#tax audit services

Text

GST services Singapore

K.M.Ho & Co. offers Business financial audit, GST services Singapore, Public Accounting audit, GST accounting, Tax filing and return services with our top-rated audit firm for handling your business issues in Singapore at reliable prices.

#Business financial audit#Accounting audit#Audit firm singapore#Audit and tax services#Business audit#Tax audit services#Tax audit#Accounting audit services#Accounting audit firms#Tax services#Tax filing services#Tax return services#Public accountant singapore#Public accounting firm singapore#Accounting services singapore#Accounting firm services#GST accounting services#GST filing singapore#GST services singapore#GST return services

2 notes

·

View notes

Text

Expertise You Can Trust, Service You Deserve! With over a decade of excellence, our team of taxation experts is here to guide you through every financial challenge. Offering comprehensive services in taxation, accounting, audit, and consulting since 2008. Contact us today.

Tax Services in Indianapolis

1 note

·

View note

Text

JDShahAssociates

Unlocking financial success with expertise and excellence!

📊💼 Proud to be leaders in audit, tax, consulting, and more. Your trusted partner for all things accounting and beyond!

#JDShahAssociates#FinancialExcellence#financeteam#BestCAinMumbai

GET IN TOUCH

☎️ Call: +91 022 28983664

✉ Email: [email protected]

www.cajdshah.com

0 notes

Text

Professional tax audit services are essential for businesses to ensure compliance, accuracy, and minimize risks of penalties or audits by tax authorities. Expert auditors conduct thorough reviews of financial records, identify potential errors or discrepancies, and offer valuable insights to optimize tax strategies, safeguarding your business's financial health and reputation

0 notes

Text

Explore the top tax audit triggers and safeguard your finances with expert tax audit services. Learn key insights to avoid potential scrutiny today.

0 notes

Text

Why Hire Professionals for Tax Audit Services in Dubai?

Using a professional tax preparation service will make your life lot easier, whether you are an individual struggling to finish your tax return or a small business owner drowning in paperwork every tax season.

Employing a tax expert has financial benefits in addition to time and stress savings. A specialist can help you or your company with all tax-related issues, possibly at a lower cost.

Why Use Professional Tax Audit Services in Dubai?

Completing tax forms, understanding tax deductions, and negotiating tax regulations may be challenging and unpleasant activities. Many people think it's useless to spend hours filing taxes and would much rather hire a professional to save both time and money.

Taxes are not something you have to confront alone. These are just a few of the advantages of seeking advice from a tax professional.

• It can help you save money. Many people avoid employing professional services due to the high cost. However, the truth is often quite the reverse. If a tax professional can identify deductions or tax credits that you may have overlooked or were unaware of, the savings can outweigh the cost of having them prepare your tax return.

• It saves time. The IRS estimates that it takes around 13 hours to complete a Form 1040 or 1040-SR. This is valuable time that could be spent with family, relaxing, or working.

• Tax professionals give you peace of mind. Paid tax preparers can answer your inquiries and clarify any confusion you may have. Because they offer customized service, your questions can be answered immediately, and you won't have to wait hours on hold like you would if you phoned the IRS.

• Tax filing is a difficult process. Tax professionals who provide tax audit services in Dubai are up to date on the newest changes to the tax code and are knowledgeable about the tax deductions available this year.

• Making mistakes while filing taxes can be costly. Professionals can assist you in avoiding the most typical tax errors that lead to an IRS notice or audit, ensuring that your returns are submitted correctly.

• Professional tax preparers can assist you all year long. Tax specialists are useful for more than just filing taxes. Tax professionals can also provide year-round advice on how to make tax-saving decisions through proactive tax planning. For example, if your small business is located in Jacksonville, Florida, local tax specialists can assist you in navigating Florida's specific tax regulations and maximizing any possible credits.

• Previous returns can be reviewed retroactively. Did you strictly obey the tax code in past years? Did you overlook a potential tax credit? These are questions that tax specialists can look into for you and make changes to if necessary.

• The risk of an audit decreases. Correct tax filing is an excellent way to prevent a tax audit. However, if you are audited, professionals who provide IRS tax audit services can assist you in achieving the best possible results.

• Nobody enjoys paying their taxes. Hiring a professional frees up time that might otherwise be spent obsessing over taxes.

Tax season is something that many people dread, but you can avoid it by hiring a tax expert to handle everything for you. It is in your best interest to file your taxes accurately and to claim all of the available deductions; this will help you both financially and emotionally.

Selecting a specialist who is a good fit for you is just as important as deciding that you need help. You'll be able to approach tax season with confidence and total peace of mind once you've found the ideal person to help with your return.

0 notes

Text

Embarking on IRS audits? Aspire Tax offers premier tax audit services, ensuring no audits are too big and no challenges too daunting for our expert team.

1 note

·

View note

Text

What is the significance of compliance audit services in today's business landscape?

In today's complex and ever-evolving business landscape, the significance of compliance audit services cannot be overstated. As regulatory frameworks tighten, businesses face increasing scrutiny, making it imperative to prioritize compliance. This article delves into the crucial role of compliance audit services.

Understanding Compliance Audits:

A compliance audit is a systematic review of a company's adherence to regulatory guidelines, industry standards, and internal policies. This process ensures that a business operates ethically, mitigates risks, and upholds the trust of stakeholders.

Key Significance in the Modern Business Landscape:

Risk Mitigation: Compliance audits act as a shield against potential risks by identifying and rectifying non-compliance issues. This proactive approach helps businesses avoid legal troubles, financial losses, and reputational damage.

Legal Obligations: In an era of constantly evolving regulations, compliance audits ensure that businesses stay abreast of changes and fulfill their legal obligations. This is particularly crucial in industries subject to stringent laws and standards.

Operational Efficiency: By streamlining internal processes, compliance audits enhance operational efficiency. They identify bottlenecks, eliminate redundant procedures, and improve overall business performance.

Financial Integrity: Compliance audits play a pivotal role in maintaining financial integrity. They scrutinize financial statements, ensuring accuracy and transparency, which is vital for earning the trust of investors, clients, and other stakeholders.

Reputation Management: Trust is paramount in business, and compliance audits contribute significantly to reputation management. Businesses that demonstrate a commitment to compliance are perceived as trustworthy, fostering stronger relationships with clients and partners.

Strategic Decision-Making: Compliance audits provide valuable insights that can inform strategic decision-making. By understanding and addressing compliance issues, businesses can make informed choices that align with their long-term goals.

PKC Management Consulting's Distinctive Services:

PKC Management Consulting stands out as a trusted partner in the realm of compliance audit services, offering a range of distinctive solutions tailored to meet the unique needs of businesses.

Comprehensive Regulatory Analysis: PKC's expert team conducts thorough regulatory analysis, staying ahead of changes and ensuring that clients are well-informed about the latest compliance requirements relevant to their industry.

Customized Compliance Programs: Recognizing that each business has its own set of challenges, PKC develops customized compliance programs. These programs are designed to address specific industry nuances and the unique operational aspects of each client.

Technology-Driven Audits: PKC leverages cutting-edge technology in its audit processes. This not only enhances the efficiency of audits but also ensures a deeper and more accurate analysis of compliance data.

Training and Awareness Programs: PKC goes beyond traditional audit services by offering comprehensive training and awareness programs. This proactive approach empowers businesses to foster a culture of compliance from within.

Continuous Monitoring and Reporting: The commitment to compliance is an ongoing process, and PKC's services include continuous monitoring and reporting. This ensures that businesses remain compliant in the long term and are ready to adapt to any regulatory changes.

Conclusion:

In conclusion, compliance audit services play a pivotal role in safeguarding businesses in the contemporary business landscape. As regulations become more stringent, businesses must proactively address compliance issues to navigate challenges successfully. PKC Management Consulting, with its customized solutions, technological prowess, and commitment to ongoing support, emerges as a reliable partner for businesses seeking to ensure and enhance their compliance standing. By choosing PKC, businesses not only mitigate risks but also position themselves for sustained success in an environment where compliance is key.

Contact: +91 9176100095

Email: [email protected]

Address: 27/7, Alagappa Rd ,Purasaiwakkam ,Chennai, Tamil Nadu 600084

Know more: https://pkcindia.com/

0 notes

Text

Revealing The Best: Singaporean Public Accounting Firms

The function of public accounting companies is particularly noticeable in Singapore’s dynamic financial scene. These companies all greatly impact financial compliance, transparency, and the general health of a company.

Singaporean Public Accounting Firms: How to Find Your Way Around the Financial World

A Look at the Services That Singaporean Public Accounting Firms Offer

Taxes and financial rules can be hard for businesses in Singapore. That’s why Public Accounting firm services in Singapore offer an extensive selection of financial services. From fledgling companies to well-established corporations, these services are designed to cater to every business’s specific requirements.

Assuring Fiscal Responsibility via Tax Audit Services

Businesses in Singapore rely on public accounting companies for guidance in understanding and complying with the complex web of tax legislation. One of their main Tax Audit Services entails checking financial records thoroughly for tax law compliance. This approach protects Businesses from legal consequences and encourages them to be more fiscally responsible.

Streamlining Indirect Taxation with GST Return Services

The Goods and Services Tax (GST) is integral to Singapore’s tax system. If a company needs help calculating its GST Return Services or submitting them on schedule, it may turn to public accounting companies for specialist assistance. This preventative measure promotes a seamless financial operation by ensuring that firms comply with regulations and avoid fines.

Enlightening the Financial Health: A Financial Audit

An independent audit of a company’s accounts can reveal its financial health. Singaporean public accounting companies meticulously carry out these audits, providing valuable insights beyond compliance. This level of analysis serves as a strategic tool for making well-informed decisions and boosts stakeholder confidence.

Strategic Implications: Making the Most of Services Offered by Public Accounting Firms

Improving Singapore’s Tax Efficiency via the Help of a Public Accounting Firm

Businesses rely on public accounting companies to help them maximize their tax efficiency. These organizations aim to help businesses minimize their tax bills by identifying possible areas for savings through personalized Tax Audit services. Financial planning is improved, and this strategic approach contributes to sustainable company growth.

How GST Return Services Ensure Efficient Compliance

Businesses need to take the initiative due to the detailed nature of GST laws. Businesses may stay in compliance with the GST with the help of public accounting companies’ GST Return services. Businesses can concentrate on what they do best when these companies take care of the complex taxing processes as they keep up with the ever-changing GST requirements.

Boosting Financial Stability: The Real Deal on Business Financial Audits

Incorporating a business financial audit into your strategy to fortify financial resilience goes beyond a simple compliance activity. Public accounting companies do in-depth studies that reveal the potential for development, dangers, and inefficiencies, going beyond simple numerical calculations. Businesses can better weather the storms of time when auditors use a more all-encompassing approach.

Services Offered by Singaporean Public Accounting Firms

Complex Business Problems with Individualized Solutions

Every company has its own set of financial goals and obstacles, which public accounting companies are sensitive to. Therefore, their services are meticulously designed to meet the unique requirements of various sectors. By customizing our approach, we guarantee that our clients will obtain solutions that meet all regulatory requirements while supporting their long-term goals.

Going Above and Beyond the Ropes of Traditional Accounting

Businesses and public accounting companies have a relationship beyond the typical accountant-client interplay. It is a cooperative relationship in which experts and company executives work together to achieve mutual financial goals. Working together promotes openness, honesty, and a common drive to succeed as a company.

Conclusion

The function of public accounting companies is crucial in the ever-changing corporate climate of Singapore. Businesses’ financial well-being and strategic development are greatly aided by these firms’ comprehensive range of services, which includes tax audits, GST returns, and business financial audits. Public accounting firms’ knowledge and experience provide a steady hand for companies as they face the ever-changing landscape of taxes and financial regulations. With their help, businesses can look forward to a lucrative and compliant future.

#Business financial audit#Accounting audit#Audit firm singapore#Audit and tax services#Business audit#Tax audit services#Tax audit#Accounting audit services#Accounting audit firms#Tax services#Tax filing services#Tax return services#Public accountant singapore#Public accounting firm singapore#Accounting services singapore#Accounting firm services#GST accounting services#GST filing singapore#GST services singapore#GST return services

0 notes

Text

The Power of Tax Audit Services: How to Face an IRS Audit with Confidence

Have you gotten an IRS audit letter in the mail? Your heart drops, terror rises, and you worry about how you will survive. Stay calm—you have got this. Stay calm and get professional help. Tax audit service help you through the process, communicate with the IRS, and guarantee you pass. You can confidently confront an IRS audit with tax pros.

Due to their extensive experience with complicated tax situations, they understand the audit process. Let them do what they do best so you can relax knowing your taxes are in good hands. Tax audits are not as terrible as you think. Tax audit services will help you through.

Advantages of Professional Tax Audit Representation

Tax audit specialists understand IRS audits and tax law. They can manage any IRS interactions on your behalf, protecting your rights. Before the audit, your representative will check your tax returns line by line for problems. Their goal is to settle basic concerns and avoid the audit from extending to additional tax years or situations.

Tax audits can take months. A tax expert may handle paperwork demands, recordkeeping, and answers to decrease your workload. They have done IRS negotiations before to get the best deal. They can often minimize or eliminate fines and interest rates.

For audit representation, most tax experts charge an hourly or set fee. Typical fees are several thousand dollars. However, their services might save you much more in taxes, fines, and interest. They assure you an expert is handling your audit.

Top Tips for Responding to an IRS Tax Audit Notice

Stay calm when you receive an IRS tax audit notification. Relax and prepare to reply quickly and correctly. Five techniques to face an audit with confidence:

Collect Records

Find records that support your tax return's income, deductions, and credits. Pay stubs, receipts, invoices, and bank statements. More documentation reduces the likelihood of large tax changes.

Consider Representation

Complex tax audits may be scary. Consider hiring for tax audit services like an enrolled agent, CPA, or attorney. They know audit processes and tax law and can negotiate with the IRS for you.

Timely Response

Respond to the IRS within the audit notice deadline. Failure to reply might result in penalties and IRS tax return revisions without your consent. Give copies of the requested records and a letter answering queries.

Conclusion

Now you know. Tax audit services can reduce the anxiety of an IRS audit. Experienced specialists handle communication and documentation so that you can trust your taxes. Let the specialists handle the audit while you focus on your business. A tax audit service gives peace of mind and ensures the best conclusion. Secure assistance to face an audit with confidence. With tax audit service, you can stop fretting and focus on what counts.

0 notes

Text

How to Select the Top-notch Tax and Audit Company in 2023?

Fund Managers who have recently started their careers have a tendency to underestimate the amount of time and effort needed to run a business successfully. Experienced managers know the importance of multitasking. It doesn’t matter if you are an experienced professional or fresh to the field, being overwhelmed by plenty of responsibilities such as providing Tax Audit Services in Delhi NCR.

0 notes

Text

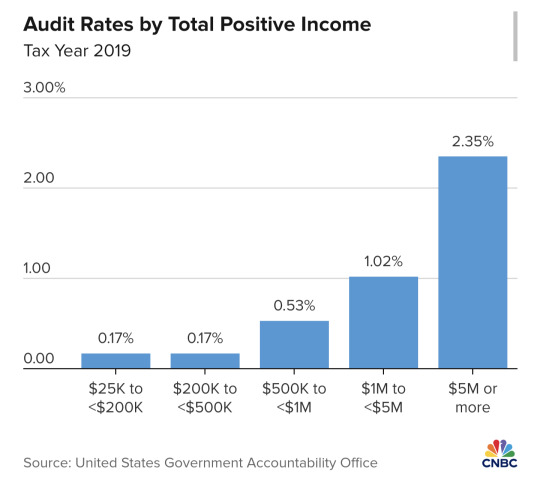

The nation’s millionaires and billionaires are evading more than $150 billion a year in taxes, adding to growing government deficits and creating a “lack of fairness” in the tax system, according to the head of the Internal Revenue Service.

The IRS, with billions of dollars in new funding from Congress, has launched a sweeping crackdown on wealthy individuals, partnerships and large companies. In an exclusive interview with CNBC, IRS Commissioner Danny Werfel said the agency has launched several programs targeting taxpayers with the most complex returns to root out tax evasion and make sure every taxpayer contributes their fair share.

Werfel said that a lack of funding at the IRS for years starved the agency of staff, technology and resources needed to fund audits — especially of the most complicated and sophisticated returns, which require more resources. Audits of taxpayers making more than $1 million a year fell by more than 80% over the last decade, while the number of taxpayers with income of $1 million jumped 50%, according to IRS statistics.

“When I look at what we call our tax gap, which is the amount of money owed versus what is paid for, millionaires and billionaires that either don’t file or [are] underreporting their income, that’s $150 billion of our tax gap,” Werfel said. “There is plenty of work to be done.”

“For complex filings, it became increasingly difficult for us to determine what the balance due was,” he said. “So to ensure fairness, we have to make investments to make sure that whether you’re a complicated filer who can afford to hire an army of lawyers and accountants, or a more simple filer who has one income and takes the standard deduction, the IRS is equally able to determine what’s owed. And to us, that’s a fairer system.”

Some Republicans in Congress have ramped up their criticism of the IRS and its expanded enforcement efforts. They say the wave of new audits will burden small businesses with unnecessary bureaucracy and years of fruitless investigations and won’t raise the promised revenue.

The Inflation Reduction Act gave the IRS an $80 billion infusion, yet congressional Republicans won a deal last year to take $20 billion of the funding back. Now they’re pressing for further cuts.

The Treasury Department said last week it estimates greater IRS enforcement will result in an additional $561 billion in tax revenue between 2024 and 2034 — a higher projection than it had initially stated. The IRS says that for every extra dollar spent on enforcement, the agency raises about $6 in revenue.

The IRS is touting its early success with a program to collect unpaid taxes from millionaires. The agency identified 1,600 millionaire taxpayers who have failed to pay at least $250,000 each in assessed taxes. So far, the IRS has collected more than $480 million from the group “and we are still going,” Werfel said.

On Wednesday, the agency announced a program to audit owners of private jets, who may be using their planes for personal travel and not accounting for their trips or taxes properly. Werfel said the agency has started using public databases of private-jet flights and analytics tools to better identify tax returns with the highest likelihood of evasion. It is launching dozens of audits on companies and partnerships that own jets, which could then lead to audits of wealthy individuals.

Werfel said that for some companies and owners, the tax deduction from corporate jets can amount to “tens of millions of dollars.”

Another area that is potentially rife with evasion is limited partnerships, Werfel said, adding that many wealthy individuals have been shifting their income to the business entities to avoid income taxes.

“What we started to see was that certain taxpayers were claiming limited partnerships when it wasn’t fair,” he said. “They were basically shielding their income under the guise of a limited partnership.”

The IRS has launched the Large Partnership Compliance program, examining some of the largest and most complicated partnership returns. Werfel said the IRS has already opened examinations of 76 partnerships — including hedge funds, real estate investment partnerships and large law firms.

Werfel said the agency is using artificial intelligence as part of the program and others to better identify returns most likely to contain evasion or errors. Not only does AI help find evasion, it also helps avoid audits of taxpayers who are following the rules.

“Imagine all the audits are laid out before us on a table,” he said. “What AI does is it allows us to put on night vision goggles. What those night vision goggles allow us to do is be more precise in figuring out where the high risk [of evasion] is and where the low risk is, and that benefits everyone.”

Correction: The IRS has collected $480 million from a group of millionaire taxpayers who had failed to pay. An earlier version misstated the amount collected.

#us politics#news#cnbc#2024#irs#internal revenue service#Danny Werfel#taxes#tax evasion#private jets#audits#Inflation Reduction Act#treasury department#Large Partnership Compliance#eat the rich#tax the rich#tax the 1%

15 notes

·

View notes

Text

Setting up a business in India

We are the best business setup consultants, helping foreign companies in setting up their businesses and incorporating companies in India with custom-tailored services. Setting up a business in India | Business Setup Services in India | Company Incorporation Consultant

#audit#accounting & bookkeeping services in india#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services

2 notes

·

View notes

Text

0 notes

Text

Optimize your business financials with Expert Tax Audit Services. Ensure compliance and accuracy in your tax filings, minimizing risks and maximizing fiscal efficiency. Our dedicated professionals provide comprehensive audit services, guiding your business towards financial success and regulatory adherence. Elevate your financial strategy with the expertise of our tax audit services for sustained business growth.

0 notes

Text

Explore various types of tax audits with our comprehensive guide and stay informed with our insights into the world of tax audit services.

0 notes