#taxpro

Text

Maximize Profits with Professional Business Consulting Services

Are you an experienced professional looking to leverage your skills and expertise for additional income?

Join our dynamic community of consultants on the Biz Consultancy app and start monetizing your knowledge today. Tailor your consultation schedule to fit your lifestyle, offering advice and sharing your expertise with those in need.

Earn financial rewards for your consulting services and expand your reach to clients worldwide, broadening your professional network.

Download the Biz Consultancy app from the App Store or Google Play Store and seize the opportunity to turn your expertise into income while making a positive impact on others' lives.

Join Biz Consultancy today!

#taxpreparation#taxseason#taxes#taxpreparer#tax#taxprofessional#taxrefund#taxreturn#taxplanning#taxprep#incometax#taxtips#accounting#bookkeeping#accountant#entrepreneur#smallbusiness#taxtime#business#payroll#finance#money#taxation#businesstaxes#businessowner#taxservices#taxpro#Business consultants#Business consulting services#Business advisor

0 notes

Text

How to find best Indian CPA in Fremont

Are you on the lookout for a reliable Indian CPA in Fremont to handle your finances? Choosing the right Certified Public Accountant can be crucial for your financial well-being. In this blog, we’ll guide you through the process of finding the best Indian CPA in Fremont.

Define Your Needs: Start by understanding your specific accounting needs. Whether it’s personal taxes, business finances, or a combination of both, having a clear idea will help you narrow down your search.

Ask for Recommendations: Reach out to friends, family, or colleagues who have worked with Indian CPAs in Fremont. Personal recommendations can be valuable, as they often come with firsthand experiences.

Check Online Reviews: The internet is a treasure trove of information. Look for online reviews and testimonials about Indian CPAs in Fremont. Platforms like Yelp or Google Reviews can give you insights into the experiences of other clients.

Verify Credentials: Ensure that the CPA you’re considering is properly certified. Look for credentials such as a valid CPA license and relevant certifications. This step is crucial for ensuring you’re working with a qualified professional.

Assess Experience: Consider the experience of the CPA in handling situations similar to yours. An experienced CPA is likely to have a better understanding of the nuances of Indian taxation and financial regulations.

Evaluate Communication: Effective communication is key in any professional relationship. Choose a CPA who communicates clearly and is responsive to your queries. A CPA who can explain complex financial concepts in simple terms is a valuable asset.

In-Person or Virtual Meetings: Decide whether you prefer in-person meetings or are comfortable with virtual interactions. Many CPAs offer virtual consultations, making it convenient for you to connect with them regardless of your location.

Discuss Fees: Before finalizing your choice, discuss the fees associated with the CPA’s services. Ensure that you have a clear understanding of the billing structure and any additional costs that may arise.

Trust Your Instincts: Finally, trust your instincts. If you feel comfortable and confident in the CPA’s abilities, it’s likely to be a good fit. A positive working relationship is essential for successful financial management.

Finding the best Indian CPA in Fremont doesn’t have to be a daunting task. By following these simple steps, you can identify a qualified and trustworthy professional to handle your financial matters with ease. Take your time, do your research, and make an informed decision for a secure financial future.

0 notes

Photo

500 Einträge 🎉🍾 Herzliches Dankeschön an unsere treuen Zuschauer und Zuhörer ❤️💜💚🧡 Bleiben Sie uns treu und erfahren Sie alles Neue und Wissenswerte rund ums Geld, die Steuer und das Finanzamt auf unserem Kanal 💪Liebe Grüße, Ihr und Euer TaxPro Team

#500 posts#tumblr milestone#taxpro#pepperpapers#rechtsdokumente#mustereinspruch#geld#steuer#finanzamt

0 notes

Text

🚀 Ready to amplify your industry influence? iFindTaxPro's Expert Hub is your gateway to showcase expertise, connect with peers, and generate leads. Join the movement toward collective growth! 🌐💼 #ExpertHub #TaxPros #ThoughtLeadership

0 notes

Text

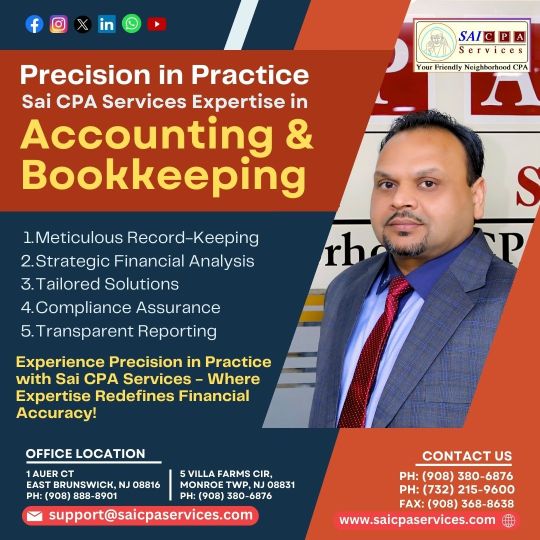

Your Financial Partner: SAI CPA Services - Making Money Matters Simple!

At SAI CPA Services, we're not just number crunchers; we're your financial allies, simplifying complexity with professionalism. Our 25-year legacy speaks volumes about our commitment to delivering top-notch services in a language you can understand. Whether it's managing your books with precision or ensuring your taxes are a breeze, we've got your back. Navigating the startup maze? We excel there too. Dealing with IRS hiccups? Consider it sorted. We're your go-to team for all things financial, providing expert Virtual CFO Services and making non-profit taxes a walk in the park. Choose SAI CPA Services for a seamless blend of professionalism and simplicity.

#SAICPAServices#FinancialSuccess#ExpertFinance#SimplifyFinance#TaxPros#BusinessStartUp#VirtualCFO#FinancialClarity#TrustedAdvisors#25YearsExcellence#PrecisionAccounting#ClientSuccess#SuccessWithSAICPA

1 note

·

View note

Text

Make Signing Easy For You With Signer.Digital

0 notes

Text

TaxPro Mural

5 notes

·

View notes

Text

youtube

"📊 Need help with accounting and tax preparation in Stone Mountain? Look no further! 🏔️ Our expert team is here to guide you through the maze of numbers and regulations, making sure your finances are in top shape. From personal to business taxes, we've got you covered. Let's conquer tax season together! 💼 #StoneMountain #TaxPros https://g.page/r/CUi20s46_nbtEBA #FinancialFreedom"

0 notes

Text

FIRS targets N19.4trn revenue

The Federal Inland Revenue Service surpassed its 2023 revenue target by N816bn, a 107 per cent performance over the set goal and has set a target to collect N19.4 turn in tax this year.

The Coordinating Director of Special Tax Operations Group, Amina Ado, disclosed this at the 2024 management retreat on Wednesday.

The Federal Government expects N19.41trn revenue from the FIRS in 2024.

This target represents a significant increase of 56.9 per cent from the previous year’s actual revenue and 67.91 per cent from the previous year’s target.

FIRS had a target of N11.56trn however, it realised N12.37trn, an N816bn higher in 2023.

While stating the strategy the agency will deploy to achieve the N19.4trn revenue, Ado noted that the agency engaged with other regulators in 2023 to achieve its success and will continue to engage them, other tax practitioners and intermediaries this year.

“We engaged with other regulators in 2023 and we will continue to engage them, tax practitioners, intermediaries and the withholding concept to expand the tax base as much as possible under the law.

“The law has given us a lot of opportunities to expand the withholding concept so that we can take the taxes and that way, the leakages downstream can be lowered. These are strategies we will deploy to ensure we deliver on this ambitious target”, she said.

She added that the FIRS will ensure its service delivery to taxpayers is improved while it will reorganise ligation and prosecution to make sure those who are not compliant will be brought to book.

“We will improve the management of large taxpayers and these sector contributors because they provide a lot of revenue we are seeing. We will improve service delivery and leverage technology to make sure we make it easy for taxpayers to pay.

“For those who are not compliant, we will make it very difficult for them to do so. We will reorganise our litigation and prosecution and enforce our debt collection processes to ensure the defaulters are brought to book,” she said.

The FIRS also recorded a 21.7 per cent increase in its 2022 revenue of N10.18trn. The trend of increase in projected revenue has been maintained between 2019 and 2023 where it recorded N5.262 trn, N4.952 trn, N6.403 trn, N10.179 trn, and N12.374 trn, respectively.

According to the Coordinator, Company Income tax topped the list as the most collected tax for the year as it makes up 36.14 per cent of the total taxes collected in 2023, It is followed by Value Added Tax of N3.64 trn and Petroleum Profit Tax of N3.17 trn.

The data shows that the Federal Government expects more taxes from the oil sector, about N9.96trn this year. This is about 214.2 per cent of what was generated from this form of tax last yeaAdo noted that the sustained growth in revenue collection is largely attributed to FIRS’s administrative reforms, such as the automation of tax collection processes, the introduction of TaxPro-Max, and the use of third-party data for enhanced tax intelligence.

Policy reforms have also played a significant role, including the increase in VAT and Education Tax rates and improvements in tax laws through Finance Acts.

“Despite these achievements, FIRS acknowledges the challenges ahead, particularly in the face of global economic uncertainties, fluctuating oil prices, and internal resistance to change. However, the agency remains resolute in its commitment to national duty, aiming to silence doubts and confidently declare its capability to meet and exceed its targets,” she assured.

Speaking at the retreat, the Executive Chairman, Zacch Adedeji, said the target is achievable with the series of reforms being implemented by the Service.

He said, “Our focus is to drive for long-term compliance. And in a few minutes now, by those rules, we have the new structure that we have. And what we’ve done in general is to move from the functional type of tax unit to customer-centred.

“And we want to use that to drive compliance because the focus cannot be on investigation. The real strategy is to drive compliance and the way to do it is that there will always be consequences for noncompliance.

“So, The focus should not be let’s go and tax informal. The focus should be to move the informal sector to the formal sector, improve their skill and then we can tax them.”

Read the full article

0 notes

Text

Navigating the Corporate Tax Landscape: Unveiling Top-notch Services in Singapore

In the bustling economic hub of Singapore, where businesses thrive on innovation and efficiency, understanding and managing corporate taxes is a critical aspect of financial success. As companies strive to stay competitive and compliant, the demand for expert corporate tax services in Singapore has surged. In this article, we explore the significance of corporate tax services and shed light on the top providers in the Lion City.

SBS Consulting provides incorporation services to Singapore-based companies. Additionally, we also offer secretarial, bookkeeping, accounting, taxation, GST, XBRL, and payroll services.

The Importance of Corporate Tax Services in Singapore

Navigating the corporate tax landscape in Singapore requires a keen understanding of the country's tax laws, regulations, and incentives. Professional corporate tax services play a pivotal role in helping businesses optimize their tax strategies, ensure compliance, and maximize savings.

Key Services Offered by Corporate Tax Services in Singapore

Tax Planning and Advisory:

Expert tax services provide strategic planning and advisory to businesses, helping them navigate the complexities of Singapore's tax regulations and optimize their tax positions.

Compliance and Filings:

Staying compliant with corporate tax regulations is paramount. Service providers ensure accurate and timely filing of corporate tax returns, minimizing the risk of penalties and audits.

Tax Incentive Applications:

Singapore offers various tax incentives to businesses. Corporate tax services assist companies in identifying and applying for relevant incentives, unlocking potential cost savings.

Transfer Pricing:

For multinational corporations, managing transfer pricing is crucial. Corporate tax services help establish and maintain arm's length transfer pricing arrangements to comply with international standards.

Top Corporate Tax Services in Singapore

TaxPros Singapore

Renowned for their expertise, TaxPros Singapore stands out for providing comprehensive corporate tax services, including strategic planning, compliance, and advisory.

CorporateTax Solutions

With a commitment to excellence, CorporateTax Solutions offers tailored services to businesses of all sizes, ensuring they navigate the tax landscape with confidence.

Singapore Tax Experts

Recognized for their in-depth knowledge of Singapore's tax laws, Singapore Tax Experts provide holistic corporate tax solutions, guiding businesses toward financial efficiency.

Benefits of Professional Corporate Tax Services

Expertise and Knowledge:

Professional service providers bring a wealth of expertise and knowledge, staying abreast of the latest changes in tax laws to provide accurate and timely advice.

Time and Resource Savings:

Outsourcing corporate tax services allows businesses to focus on core activities while leaving tax matters in the hands of experts, saving time and resources.

Risk Mitigation:

Ensuring compliance with tax regulations mitigates the risk of penalties and audits, safeguarding the financial health and reputation of the business.

Choosing the Right Corporate Tax Services in Singapore

Businesses seeking corporate tax services should consider factors such as experience, industry specialization, and client testimonials. The right partner ensures not only compliance but also strategic tax planning that aligns with the business's goals.

Get more - corporate tax services singapore

In conclusion, corporate tax services in Singapore are instrumental in helping businesses navigate the intricate tax landscape, optimize savings, and ensure compliance. As businesses strive for financial success, partnering with top-notch corporate tax service providers becomes a strategic move toward achieving long-term sustainability and growth in the dynamic business environment of Singapore. Explore the offerings of expert providers to unlock the full potential of your business in the corporate tax arena

0 notes

Text

Ultimo TaxPro

Tax preparation-

http://Www.UltimoTaxPro.com

1 note

·

View note

Text

eInvoice Format - Tax Pro

Eligible taxpayers have been given a comprehensive eInvoice format that consists of both mandatory and optional fields.

You can generate and upload eInvoices on your existing ERP or billing software, upon TaxPro GSP integration.

Check out more details now!

0 notes

Text

When the IRS says it, we've got to pay attention to it. They have a number of notices that is of high importance to every taxpayer, however, not everyone is well-versed in the traits of tax codes. Also, even though they are routine processes of the tax, notices from the IRS can be scary. Here's an article that discusses how to respond to IRS notices and IRS Taxpayer Advocate Service. Read Now for details.

#IRStaxupdate #taxadvocate #CPETaxCourse #taxexperts #taxnews #taxexperts, #taxpros, #taxlawyers, and #taxaccountants

0 notes

Audio

(TaxPro GmbH Steuerrechts-Experten)

2 notes

·

View notes

Text

⏰💼 Stay ahead of tax season chaos! Discover how scheduling software empowers tax professionals to manage deadlines efficiently and provide top-notch client service. 🗓️🚀 #TaxPros #SchedulingSoftware #Efficiency

0 notes

Text

FIRS introduces Taxpro Max to ease access to TCC -

FIRS introduces Taxpro Max to ease access to TCC –

The Federal Inland Revenue Service (FIRS) says taxpayers can now get their Tax Clearance Certificate (TCC) in a single click via its flagship Taxpro Max solution.

The service made announced this on Tuesday via its social media handles Twitter, Facebook, and Instagram where it stated that the generation of tax clearance certificates, which used to be issued within a period of two weeks would now…

View On WordPress

0 notes