#tencent portfolio

Explore tagged Tumblr posts

Text

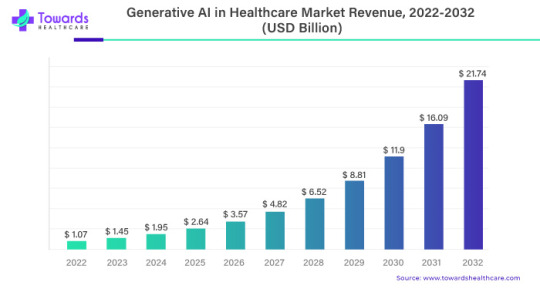

Generative AI in Healthcare Market to Grow at an 35.1% CAGR Till 2032!

The global Generative AI in Healthcare Market worth USD 1.07 billion in 2023 is likely to be USD 21.74 billion by 2032, growing at a 35.1% CAGR between 2023 and 2032.

According to the stats published by World Health Organization (WHO), approximately 1.28 million adults (between 30 and 79 years of age) have hypertension. Of these, as little as 42% of adults are diagnosed and treated correctly and the remaining population is unaware of this condition. The majority of this population resides in low to middle-income countries of the world. Despite this substantial number of untreated cases, the rising awareness among doctors and the general population regarding health illnesses associated with hypertension is expected to drive the demand for the required devices.

Download White Paper@ https://www.towardshealthcare.com/personalized-scope/5069

A recent report provides crucial insights along with application based and forecast information in the Global Generative AI in Healthcare Market. The report provides a comprehensive analysis of key factors that are expected to drive the growth of this Market. This study also provides a detailed overview of the opportunities along with the current trends observed in the Generative AI in Healthcare Market.

A quantitative analysis of the industry is compiled for a period of 10 years in order to assist players to grow in the Market. Insights on specific revenue figures generated are also given in the report, along with projected revenue at the end of the forecast period.

Report Objectives

To define, describe, and forecast the global Generative AI in Healthcare Market based on product, and region

To provide detailed information regarding the major factors influencing the growth of the Market (drivers, opportunities, and industry-specific challenges)

To strategically analyze microMarkets1 with respect to individual growth trends, future prospects, and contributions to the total Market

To analyze opportunities in the Market for stakeholders and provide details of the competitive landscape for Market leaders

To forecast the size of Market segments with respect to four main regions—North America, Europe, Asia Pacific and the Rest of the World (RoW)2

To strategically profile key players and comprehensively analyze their product portfolios, Market shares, and core competencies3

To track and analyze competitive developments such as acquisitions, expansions, new product launches, and partnerships in the Generative AI in Healthcare Market

Companies and Manufacturers Covered

The study covers key players operating in the Market along with prime schemes and strategies implemented by each player to hold high positions in the industry. Such a tough vendor landscape provides a competitive outlook of the industry, consequently existing as a key insight. These insights were thoroughly analysed and prime business strategies and products that offer high revenue generation capacities were identified. Key players of the global Generative AI in Healthcare Market are included as given below:

Generative AI in Healthcare Market Key Players:

Syntegra

NioyaTech

Saxon

IBM Watson

Microsoft Corporation

Google LLC

Tencent Holdings Ltd.

Neuralink Corporation

OpenAI

Oracle

Market Segments :

By Application

Clinical

Cardiovascular

Dermatology

Infectious Disease

Oncology

Others

System

Disease Diagnosis

Telemedicine

Electronic Health Records

Drug Interaction

By Function

AI-Assisted Robotic Surgery

Virtual Nursing Assistants

Aid Clinical Judgment/Diagnosis

Workflow & Administrative Tasks

Image Analysis

By End User

Hospitals & Clinics

Clinical Research

Healthcare Organizations

Diagnostic Centers

Others

By Geography

North America

Europe

Asia-Pacific

Latin America

Middle East and Africa

Contact US -

Towards Healthcare

Web: https://www.towardshealthcare.com/

You can place an order or ask any questions, please feel free to contact at

Email: [email protected]

About Us

We are a global strategy consulting firm that assists business leaders in gaining a competitive edge and accelerating growth. We are a provider of technological solutions, clinical research services, and advanced analytics to the healthcare sector, committed to forming creative connections that result in actionable insights and creative innovations.

#seo marketing#seo#market analysis#market share#marketing#ai#artificial intelligence#Generative AI#healthcare

2 notes

·

View notes

Text

Swiggy Shareholders Beware: 13 May Could Reshape Your Profit Calculations

Lock-in Expiry for 83% Pre-IPO Shares May Trigger High Volatility, Say BrokeragesIf you hold Swiggy shares in your portfolio, it’s time to be cautious. The food delivery platform, recently listed on the stock market, may experience significant volatility around 13 May — the date when the lock-in period for 83% of its pre-IPO shares ends.According to brokerage houses JM Financial and Macquarie, this could lead to a potential sell-off by early investors, putting pressure on share prices.Understanding the Lock-In RuleLock-in rules vary for different investors:Anchor investors: 30–90 daysOther pre-IPO investors: 6 monthsPromoters: 18 months (if holding up to 20% stake), 6 months (if holding more than 20%)With a large number of pre-IPO shares becoming free to trade on 13 May, the market could see a surge in supply — possibly leading to a dip in prices.What Do Brokerages Say?On 5 May, Swiggy shares were trading around ₹332, up by 9%. However, Macquarie has assigned an “Underperform” rating and set a target price of ₹260 — suggesting a potential 21% downside from current levels.The firm believes that several pre-IPO investors may exit partially or fully, increasing selling pressure.Major Foreign Investors in Swiggy:Naspers – 25.4%SoftBank – 7.6%Accel India – 4.1%Tencent – 3.3%Norwest Venture Partners – 2.8%A partial or full withdrawal by these large foreign institutional investors (FIIs) could significantly impact the stock.Zomato Emerges as a Stronger ContenderIn contrast, Macquarie is bullish on Swiggy’s rival Zomato, highlighting its stronger fundamentals and confident management commentary. Concerns remain around Swiggy’s InstaMart segment, which may hurt the company’s overall financial health.Swiggy’s stock is currently trading about 22% below its IPO price, though early-stage VC and PE investors are still in profit territory.Would you like a comparative analysis of Swiggy and Zomato shares next?

0 notes

Text

Hearing Aids Market: Exploring the Rise of Over-the-Counter (OTC) Options

Hearing Aids Industry Overview

The global Hearing Aids Market, estimated at $7.96 billion in 2023, is projected to experience a compound annual growth rate of 6.78% from 2024 to 2030. A primary driver of this expansion is the increasing occurrence of hearing loss within the growing geriatric population, coupled with a greater acceptance of hearing aid devices and increased understanding of technologically advanced options.

The market's strong technological focus is evident in the emergence of innovative products such as invisible, smart, AI-integrated, and Bluetooth-compatible hearing aids. These advancements, designed to improve the lives of users, are anticipated to be a major contributor to future market growth.

Detailed Segmentation:

Sales Channel Insights

E-Pharmacy sales segment is projected to witness a significant CAGR over the forecast period. The internet plays a significant role in making a purchase decision and acquiring information about hearing aids, especially for young adults and millennials. These players help the wearer to get screened for auditory loss and acquire more information on technology. Their website also helps the wearer to make product and price comparisons, thus helping in making a purchase decision. These E-Pharmacy sales channels also help to increase the affordability and availability of aids in the global market.

Product Type Insights

The canal hearing aids segment is anticipated to grow at the fastest CAGR over the forecast period. Canal devices are discreet devices, which is one of the critical success factors for their rapid growth. Wearing hearing aids comes with a stigma, therefore, young adults prefer canal devices over other devices. In addition, these devices are technologically advanced and significantly cancel external voices and reduce tinnitus. The above-mentioned factors are responsible for the growth of canal devices in the coming years.

Technology Insights

Based on technology, the digital hearing aids segment held the largest market revenue share of 93% in 2023 and iswa anticipated to grow at the fastest CAGR over the forecast period. This is attributable to the increased preference and technological advancements in digital devices compared to analog devices. These devices offer enhanced flexibility in programming for matching the transmitted sound to meet the needs of a specific pattern of auditory impairment

Regional Insights

Asia Pacific is anticipated to witness the fastest CAGR over the forecast period. Moreover, technological advancements and partnerships among market players are expected to drive market growth in Asia Pacific. China has one of the largest geriatric populations. As per the Population Reference Bureau 2023, the Chinese geriatric population is expected to reach 366 million by 2050. Furthermore, the market in China is poised to benefit from increased product launches and strategic partnerships. For instance, in September 2022, Tencent Holdings launched an innovative hearing aid device incorporating artificial intelligence (AI) technology. Consequently, the expanding elderly population, coupled with the surge in product development and collaborative efforts, plays a pivotal role in fostering the market growth.

Gather more insights about the market drivers, restraints, and growth of the Hearing Aids Market

Key Companies & Market Share Insights

Some of the key players operating in the market include Sonova, GN Store Nord A/S, SeboTek Hearing Systems, LLC, and WS Audiology.

Sonova with its focus on innovation, diverse brand portfolio, and global reach, stands as a prominent player in the field of hearing care solutions, offering a comprehensive range of products to enhance the quality of life for individuals with auditory impairments

WS Audiology offers a comprehensive range of devices designed to address different levels of hearing loss. The products aim to provide users with improved sound quality, comfort, and customization

MDHearing, Foshan Vohom Technology Co., Ltd., and Eargo, Inc. are some of the emerging market participants in the market.

Foshan Vohom Technology Co., Ltd. specializes in the design, development, and distribution of hearing aids and hearing solutions.Their products aim to provide users with enhanced sound quality, comfort, and personalized hearing solutions.

Eargo, Inc. offers individuals with mild to moderate hearing loss. The company's focus on discreet and technologically advanced hearing aids appeals to consumers looking for modern and user-friendly solutions

Key Hearing Aids Company Insights

Some of the key players operating in the global Hearing Aids market include:

Audicus

Audina Hearing Instruments, Inc.

Eargo, Inc.

GN Store Nord A/S

Horentek Hearing Diagnostics

MDHearing

SeboTek Hearing Systems, LLC

Sonova

Starkey Laboratories, Inc.

WS Audiology

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Developments

In October 2023, GN Store Nord A/S launched its next-generation hearing aid product range, ReSound Nexia, which includes two RIE models, which are non-rechargeable and Micro RIE, which is rechargeable

In March 2023, JIUYEE announced the launch of JIUYEE Real Pro. This launch will enable the firm to expand its product offerings. The product features with cutting-edge technology to offer users clear and natural sound quality

In March 2022, Sonova acquired the consumer division of Sennheiser electronic GmbH & Co. KG. This will enhance Sonova's product portfolio while also expanding its geographical footprints

0 notes

Text

Shares Loan Hong Kong: Unlock Global Liquidity with Trusted Stock Loan Solutions

In the fast-paced world of finance, where time, liquidity, and strategy make all the difference, smart investors are looking beyond traditional lending options. For sophisticated investors in Asia’s top financial hub, shares loan Hong Kong offers a powerful, flexible alternative to selling securities.

A shares loan allows individuals and institutions to access capital while retaining ownership of their listed shares—offering a seamless way to preserve portfolio value and maintain exposure to the upside potential of the market. At the forefront of this global financial service, we provide worldwide stock loan solutions, backed by secure structures, competitive rates, and end-to-end confidentiality.

Whether you are an investor with holdings in the HKEX, a family office looking to raise capital, or a corporate entity seeking to restructure debt without divesting assets, our platform offers reliable, fast, and globally trusted shares loan solutions designed specifically for the Hong Kong market.

What Is a Shares Loan?

A shares loan, also known as a stock loan or securities-backed loan, is a secured lending facility where publicly traded shares are pledged as collateral in return for immediate liquidity. The borrower receives cash while maintaining ownership rights to the underlying stocks.

Rather than selling shares and potentially incurring capital gains taxes, a shares loan offers:

Capital access without liquidation

Portfolio retention and market participation

Flexible loan structures

Tax efficiency and privacy

In Hong Kong, where the Hang Seng Index lists globally influential companies like Tencent, HSBC, Alibaba, and AIA Group, a shares loan is an increasingly popular financial tool for both individual and institutional investors.

Why Use Shares Loan in Hong Kong?

Hong Kong is a global financial powerhouse with deep capital markets and significant investor participation. With the rapid rise in asset values and a greater need for strategic liquidity, a shares loan Hong Kong enables smart capital access for:

Wealth preservation

Tax planning

Investment diversification

Personal or corporate liquidity management

Here are some compelling reasons why investors in Hong Kong are turning to shares loans:

1. Access Immediate Liquidity Without Selling Shares

Many investors hesitate to liquidate their holdings due to long-term gains potential or market conditions. A shares loan lets you unlock capital from your portfolio without triggering a taxable event or altering your market position.

2. Competitive Interest Rates and Flexible Terms

Our global lending network allows us to offer market-leading interest rates, with customized loan terms ranging from 6 months to 3 years. Clients in Hong Kong benefit from tailor-fit financing that matches their risk profile, timeline, and goals.

3. Maintain Full Ownership and Market Exposure

Borrowers retain the benefits of share ownership during the loan term, which may include dividends and voting rights (subject to agreement terms), enabling continued participation in corporate activities and market growth.

4. Confidential and Secure Lending Structure

All loans are executed with full discretion and custodial protection. Shares are held in regulated third-party custody accounts, ensuring safety for both borrower and lender.

How a Shares Loan Works: Step-by-Step Process in Hong Kong

We offer a simple, fast, and transparent lending process:

Share Evaluation Submit details of your holdings, including the stock name, number of shares, and exchange (e.g., HKEX: 0700 for Tencent).

Loan Proposal We evaluate your portfolio and issue a loan offer based on the liquidity, volatility, and current market value of your shares. Loan-to-value (LTV) ratios typically range from 40% to 70%.

Custody and Legal Agreement Upon acceptance, shares are transferred to a third-party custodial account. Loan terms are finalized, and legal documentation is completed.

Funds Disbursement Once shares are in custody, funds are wired to your bank account, often within 24 to 72 hours.

Repayment and Share Return At the end of the term—or earlier if you choose—repay the principal and interest to retrieve your shares in full.

This structure is globally trusted, ensuring a win-win for both borrower and lender.

Eligible Securities for Shares Loan in Hong Kong

We accept a wide range of publicly traded equities, including:

Blue-chip stocks (e.g., HSBC, AIA Group, China Mobile)

Technology stocks (e.g., Tencent, Meituan, Alibaba, Xiaomi)

ETFs and REITs listed on HKEX

Dual-listed Chinese ADRs and H-shares

Cross-border stocks listed in both Hong Kong and global exchanges

All securities must meet basic criteria of liquidity, volatility control, and free tradability.

Use Cases: Shares Loan in Action

1. Entrepreneur Launching a New Business

A Hong Kong-based entrepreneur holds HK$15 million in shares of a tech firm listed on HKEX. Rather than selling and incurring taxes or losing long-term potential, they obtain a HK$9 million shares loan to fund a new venture.

2. Investor Seeking Real Estate Investment

A private investor uses a shares loan to secure down payment for a luxury property in Kowloon. The shares remain intact, allowing continued appreciation while the property generates rental income.

3. High-Net-Worth Individual Diversifying Portfolio

A HNWI with substantial positions in banking stocks uses the loan proceeds to invest in private equity and green energy projects—achieving diversification while preserving equity value.

These real-life examples demonstrate the flexibility and strategic advantage of shares loan Hong Kong.

Why Choose Our Shares Loan Platform in Hong Kong?

As a global leader in securities-backed lending, we stand apart due to:

✅ Cross-border lending expertise

✅ Institutional-grade security and compliance

✅ Dedicated advisors for Hong Kong clients

✅ Fast, discreet funding process

✅ Worldwide access to capital pools

We work with investors, institutions, family offices, and advisors to provide a premium, confidential lending experience backed by deep financial insight and trusted custody.

Global Integration, Local Expertise

With Hong Kong serving as a gateway between East and West, we are uniquely positioned to offer international financing solutions with local relevance. Whether you hold shares in Hong Kong, Mainland China, Singapore, or U.S. markets, our platform enables global lending coverage with a localized service model.

We understand the nuances of the Hong Kong regulatory landscape and structure every deal to comply with SFC and relevant tax considerations. Our network of legal and financial professionals ensures seamless transaction execution.

How to Apply for a Shares Loan in Hong Kong

Ready to access liquidity from your securities? The process is easy and secure:

Submit Your Portfolio Info Use our encrypted form to share your securities details.

Receive a Custom Loan Proposal We evaluate your eligibility and share optimized loan terms.

Complete Documentation Agreements are signed electronically and securely.

Get Funded Funds are wired to your account in as little as 1–3 business days.

Maintain Control Your shares are securely held until the loan is repaid, then returned in full.

Our team is available 24/7 to assist Hong Kong-based and international clients in English, Cantonese, and Mandarin.

Conclusion: The Smart Way to Finance in Hong Kong

In a market where timing, liquidity, and opportunity define success, a shares loan Hong Kong offers unmatched financial leverage. Whether you’re unlocking value from a blue-chip portfolio, seeking capital for a high-impact investment, or simply optimizing your cash flow, our secure and globally respected stock loan platform provides the solution.

Contact us:

Email us: [email protected]

Call us: 604-833-1055

Also available on:

On Facebook

On Twitter

On Instagram

On Pinterest

0 notes

Text

LON SMT Share Price: Key Insights and Market Trends

The Scottish Mortgage Investment Trust (SMT) is one of the UK’s most well-known investment trusts, offering exposure to high-growth global companies. With a strong focus on technology, innovation, and disruptive industries, its share price has been subject to significant fluctuations. Investors closely monitor SMT’s performance as it reflects broader market trends and sentiment toward growth stocks.

This article examines the key factors influencing SMT share price, its investment strategy, recent market dynamics, and important considerations for investors.

Investment Strategy and Portfolio Focus

SMT is managed by Baillie Gifford, a fund management firm known for its long-term growth investing approach. Unlike traditional investment trusts that focus on income generation, SMT prioritizes capital appreciation by investing in companies with disruptive potential.

The trust’s portfolio is heavily weighted toward technology, healthcare, and renewable energy, with major holdings in companies such as Amazon, Tesla, Tencent, and Moderna. In addition to publicly traded firms, SMT has a significant allocation to private equity, holding stakes in companies like SpaceX and ByteDance.

This strategy offers investors access to early-stage companies before they go public, providing exposure to potential high-growth opportunities. However, it also introduces additional risks, particularly regarding valuation adjustments and liquidity concerns.

Factors Driving SMT Share Price Movements

Over the past year, SMT share price has experienced notable volatility due to several key factors:

1. Technology Sector Trends

Since a large portion of SMT’s portfolio is concentrated in technology and innovation-driven companies, its performance is closely linked to the tech sector. During bullish market periods, SMT tends to benefit significantly. However, in times of uncertainty—such as market corrections, regulatory challenges, or rising interest rates—technology stocks often see sharp declines, impacting SMT’s valuation.

2. Private Equity Exposure

Around one-fifth of SMT’s portfolio consists of private companies, which are harder to value compared to publicly traded stocks. Any changes in these companies’ financial health or investor sentiment toward private equity can affect the trust’s net asset value (NAV) and, in turn, its share price.

3. Interest Rate Fluctuations

Higher interest rates generally reduce investor appetite for high-growth stocks, as the cost of capital increases and future earnings are discounted more heavily. Since SMT primarily invests in companies with long-term growth potential, interest rate hikes often lead to downward pressure on its share price.

4. Market Sentiment and Discount to NAV

Investment trusts often trade at a premium or discount to their NAV. When investor sentiment is positive, SMT’s share price may trade close to or even above its NAV. However, during periods of uncertainty, the share price can fall below the NAV, creating a discount that may present opportunities for long-term investors.

Recent Developments Impacting SMT

Several recent events have influenced SMT’s performance and share price:

Private Equity Write-Downs – Some of SMT’s private investments have faced challenges, leading to valuation reductions. This highlights the risks associated with early-stage, high-growth companies.

Activist Investor Interest – Growing concerns over SMT’s persistent share price discount have attracted activist investors, pushing for changes in governance and investment strategy.

Rebound Potential – Despite volatility, analysts have noted SMT’s long-term potential, especially if macroeconomic conditions, such as interest rate cuts, become more favorable for growth stocks.

Key Considerations for Investors

Investors considering SMT share price as part of their portfolio should keep the following in mind:

✅ Long-Term Focus – SMT’s investment approach requires patience, as it focuses on companies with high future growth potential rather than short-term gains.

✅ Volatility Risk – Given its exposure to high-growth sectors and private equity, SMT’s share price can be more volatile compared to traditional investment trusts.

✅ Discount to NAV – Monitoring SMT’s NAV discount can provide insights into potential buying opportunities when market sentiment is negative.

✅ Diversification – While SMT offers exposure to some of the world’s most innovative companies, it should be held as part of a diversified portfolio to mitigate risks associated with market downturns.

1 note

·

View note

Text

The biggest game company in the world

The biggest game company in the world is Tencent Games, a subsidiary of the Chinese tech giant Tencent. It is the largest gaming company by revenue, known for developing and publishing popular games like Honor of Kings, PUBG Mobile, and League of Legends (through Riot Games). Tencent also holds significant stakes in major gaming companies such as Epic Games (Fortnite), Activision Blizzard (Call of Duty), and Ubisoft. With a strong presence in mobile, PC, and console gaming, Tencent continues to dominate the global gaming industry through innovation, strategic investments, and cutting-edge technology.

0 notes

Text

Generative AI in Healthcare Market Analysis, Type, Size, Trends, Key Players and Forecast 2024 to 2034

Generative AI, a subset of artificial intelligence, uses advanced algorithms to generate new and meaningful content, such as text, images, and even predictive models. In healthcare, this technology is poised to revolutionize the way medical professionals and organizations operate, driving innovation in diagnostics, treatment planning, drug development, and patient care.

The Generative AI in Healthcare Market is expected to reach a value of USD 3,753 million in 2023. The market is expected to increase linearly, reaching USD 24,218 million by 2033 with a compound annual growth rate (CAGR) of 37.2% from 2024 to 2033.

Get a Sample Copy of Report, Click Here@ https://wemarketresearch.com/reports/request-free-sample-pdf/generative-ai-in-healthcare-market/1372

Key Applications of Generative AI in Healthcare

Medical Imaging and Diagnostics

Generative AI models, such as GANs (Generative Adversarial Networks), enhance medical imaging by generating high-quality visuals from incomplete or low-resolution images.

AI-driven imaging tools improve the detection of conditions like cancer, fractures, and cardiovascular diseases by generating clearer images for analysis.

Drug Discovery and Development

Generative AI accelerates drug discovery by simulating molecular structures and predicting their interactions with biological targets.

It reduces the time and cost associated with traditional drug development processes.

Personalized Medicine

AI models analyze patient data to create personalized treatment plans, predicting the effectiveness of therapies based on genetic and environmental factors.

It helps in generating tailored dietary, medication, and lifestyle recommendations for patients.

Virtual Health Assistants

AI-powered chatbots and virtual assistants use generative AI to interact with patients, providing accurate responses to queries, scheduling appointments, and even monitoring chronic conditions.

They support mental health services by offering cognitive behavioral therapy (CBT) through conversational AI platforms.

Training and Education

Generative AI creates realistic medical scenarios and 3D models for training healthcare professionals.

It aids in developing interactive learning tools for medical students.

Benefits of Generative AI in Healthcare

Enhanced Accuracy: Reduces human error in diagnostics and treatment planning.

Cost Efficiency: Lowers costs in drug development and operational processes.

Improved Accessibility: Brings advanced healthcare solutions to underserved regions via AI-driven mobile platforms.

Rapid Innovations: Facilitates quicker advancements in medical research and technology.

Challenges and Considerations

Data Privacy: Ensuring the security of sensitive patient data is paramount.

Ethical Concerns: Addressing the risks of bias and ensuring accountability in AI-generated decisions.

Integration Barriers: Combining AI tools with existing healthcare infrastructure can be complex.

Regulatory Compliance: Adhering to stringent healthcare regulations globally.

Top companies in the Generative AI in Healthcare Market are,

The Generative AI in Healthcare Market is dominated by a few large companies, such as NioyaTech, Syntegra, Oracle, Tencent Holdings Ltd., Neuralink Corporation, Johnson & Johnson, IBM Watson, Saxon, OpenAI, Google LLC and Microsoft Corporation and other.

The leading companies of the Generative AI in Healthcare industry, their market share, product portfolio, company profiles are covered in this report. Key market players are analyzed on the basis of production volume, gross margin, market value, and price structure. The competitive market scenario among Generative AI in Healthcare players will help the industry aspirants in planning their strategies. The statistics presented in this report are an accurate and useful guide to shaping your business growth.

Market Segments

Market, By Function

Virtual Nursing Assistants

Image Analysis

Aid Clinical Judgment/Diagnosis

Workflow & Administrative Tasks

AI-Assisted Robotic Surgery

Market, By Application

System

Clinical

Market, By End User

Clinical Research

Hospitals & Clinics

Diagnostic Centers

Healthcare Organizations

Others

Regional Analysis of Generative AI in Healthcare

North America Market Forecast

North America stands at the forefront of generative AI adoption in healthcare, driven by cutting-edge technological infrastructure, substantial investments in research and development, and the presence of leading AI companies. The region is a hub for innovation, with widespread applications in diagnostics, personalized medicine, and drug discovery.

Europe Market Forecast

Europe is rapidly embracing generative AI in healthcare, backed by strong governmental support and collaborative efforts between academia and industry. Countries like the UK, Germany, and France are leading the charge, with a focus on drug discovery, predictive analytics, and the development of digital health platforms.

Asia-Pacific Market Forecast

The Asia-Pacific region is emerging as a key player in the generative AI in healthcare market. Countries like China, Japan, and India are investing heavily in AI-driven healthcare solutions, spurred by government initiatives like China's "AI 2030" plan. The region leverages generative AI for telemedicine, affordable diagnostics, and disease prediction, addressing the growing demand for efficient healthcare services. While the potential is immense, the region faces hurdles such as a shortage of skilled professionals and uneven AI ecosystem development across countries.

Conclusion

Generative AI is revolutionizing healthcare by enhancing efficiency, accuracy, and accessibility across various domains, from diagnostics and drug development to personalized treatment and patient engagement. As this transformative technology continues to evolve, it promises to bridge gaps in medical care, enabling solutions that are faster, more precise, and tailored to individual needs. However, to fully harness its potential, the industry must address challenges such as data privacy, ethical concerns, and integration hurdles. By navigating these challenges responsibly, generative AI can pave the way for a future where innovative, AI-driven healthcare solutions improve lives globally.

0 notes

Text

Who are the biggest app developers and Which app developer companies are best? MAE

You must be informed of how fast the app development industry is growing and how much need it has all over the world. Would you believe if I say daily new apps are coming and that too with new functions, so the question comes on how do we find out which app developers are best for us.

In this article, we will tell you about the world's best app developers and we also talk about which company of app developers is the best for you. We will also suggest you a famous best app development company in India. By joining with which you can easily develop your app.

The Biggest App Developers

The world's largest app developers are those whose apps are the most popular. These are some of the apps that are included in the biggest app developers:

• Google

• Apple

• Facebook

• Amazon

• Microsoft

• Tencent

• NetEase

These companies have many popular apps like Google Maps, Gmail, Facebook, Messenger, Amazon, Microsoft Office.

Which App Developer Companies Are Best?

It is important to tell you that the same type of app developer companies is not good for everyone. since every business has its own needs, you should choose a best company according to its different needs.

It is important to keep a few things in mind while choosing a best app developer company:

• Experience: How much experience does the company have in developing mobile apps?

• Portfolio: What is the company's portfolio of apps like?

• Reviews: See the reviews of previous customers

Best Indian Mobile App Development Companies

If you are looking for a good and high-quality app development company then you should think of working with the best companies in India. These companies have a lot of experience and tools to develop their apps successfully. Let us tell you the names of some of the best companies in India.

Here are a few of the best Indian mobile app development companies:

• Mobile App Experts

• TCS

• Infosys

• Tech Mahindra

• Mindtree

These companies have a lot of experience in developing mobile apps and they are also providing very good offers.

Mobile App Experts: Your Trusted Partner for new App Development

Mobile App Experts is one of the best Indian mobile app development companies. Who are experts in making latest mobile apps for every size. We have a team of skilled developers, designers and project managers who deliver unique results that drive growth and engagement.

Our Expertise

• iOS and Android App Development: We create such apps for iOS and Android which are designed only for these platforms. These apps work very easily and give the best experience to the users.

• Hybrid App Development: We are also experts in hybrid app development, a solution that is affordable and flexible.

• Designs: We also pay a lot of attention to user engagement and satisfaction in design.

Why Choose MAE?

• successful history: We have a successful history of providing high-quality mobile apps to our clients across a variety of industries.

• Professionals Team: Our team is comprised of professionals who are always updated with new trends and technologies.

• Customized Solutions: We change our methods according to your needs and objectives.

Contact us

So, contact us today and get the best app developed for you and that too at the lowest price.

#app developer companies#indian mobile app development companies#mobile application service provider#mobile app development#android app development#app development#mobile app

0 notes

Text

SEGA Sammy Holdings Inc.: Strategic Deals and Partnerships Driving Growth

SEGA Sammy Holdings Inc., headquartered in Tokyo, Japan, is a global leader in the entertainment industry, known for its video gaming, arcade machines, and pachinko businesses. Over the years, SEGA Sammy has secured strategic deals and partnerships that have played a crucial role in expanding its global presence and diversifying its portfolio. In this article, we explore the company’s key deals, mergers, acquisitions, and strategic alliances that have driven growth in both the gaming and entertainment sectors.

Strategic Acquisitions

SEGA Sammy has made several high-profile acquisitions to strengthen its foothold in the gaming industry. These acquisitions have enabled the company to expand its content library, enter new markets, and leverage innovative technologies to meet the growing demand for digital entertainment.

Acquisition of Atlus (2013)

One of SEGA’s most notable acquisitions was the purchase of Atlus, a subsidiary of Index Corporation, in 2013. Atlus is famous for developing popular RPG franchises such as Persona and Shin Megami Tensei. This acquisition significantly enhanced SEGA’s portfolio in the role-playing game (RPG) genre, bringing in both critical acclaim and commercial success.

Demiurge Studios (2015)

SEGA Sammy further expanded its global presence by acquiring Demiurge Studios, a Boston-based mobile game developer, in 2015. This move allowed SEGA to tap into the rapidly growing mobile gaming market and strengthen its position in free-to-play games. Demiurge’s expertise in developing mobile titles helped SEGA diversify its product offerings and reach new audiences.

Partnerships in Esports and Digital Gaming

In recent years, SEGA Sammy has placed a significant focus on esports and digital gaming, partnering with various organizations to create a presence in the competitive gaming scene. Esports represents a growing segment within the broader gaming industry, and SEGA Sammy has strategically invested in this space.

Partnership with Level Infinite

SEGA’s collaboration with Level Infinite, a global gaming brand under Tencent, focuses on co-developing competitive games with global appeal. This partnership has been instrumental in expanding SEGA’s reach in international markets, particularly in Asia and North America. By leveraging Level Infinite’s vast network and expertise, SEGA aims to create engaging content for esports players and audiences.

Sponsorship of Esports Tournaments

SEGA has sponsored several major esports tournaments, including events for popular games such as Virtua Fighter 5 and Sonic the Hedgehog. These sponsorships have helped increase the visibility of SEGA’s gaming brands within the esports community while attracting younger players to its titles.

Licensing and Distribution Agreements

SEGA Sammy has entered into multiple licensing and distribution agreements that have enabled it to expand its market reach, particularly in the mobile gaming and casino gaming sectors. These agreements allow SEGA Sammy to leverage its intellectual property (IP) while partnering with other companies to develop and distribute its games on a larger scale.

Pachinko and Casino Gaming

SEGA Sammy has a long history of involvement in the pachinko and casino gaming industries. The company’s licensing deals with various casino operators have allowed it to export its gaming machines to markets across Asia, North America, and Europe. These machines incorporate SEGA’s popular characters and brands, further increasing their appeal to players around the world.

Mobile Gaming Expansion

In the mobile gaming sector, SEGA Sammy has partnered with major distribution platforms such as Apple’s App Store and Google Play to ensure its games reach a broad audience. By working with these platforms, SEGA Sammy can efficiently distribute its titles, including the highly successful Sonic Dash series, to millions of players worldwide.

Collaborations in Film and TV

As part of its strategy to diversify into multimedia entertainment, SEGA Sammy has expanded into film and television through collaborations and licensing agreements with production studios. This has helped the company increase the visibility of its brands and characters in new formats.

Sonic the Hedgehog Film Franchise

SEGA’s collaboration with Paramount Pictures to produce the Sonic the Hedgehog movie franchise has been a resounding success. The film’s 2020 release generated over $300 million in global box office sales, and its sequel, released in 2022, continued to build on this success. These films have expanded SEGA’s reach beyond gaming, introducing the iconic Sonic character to a broader audience while boosting merchandise sales and brand recognition.

Animated Series and Streaming Content

In addition to its success in films, SEGA has partnered with leading streaming platforms such as Netflix and Amazon Prime to develop animated series based on its popular franchises. The Sonic Prime animated series, for instance, has been well-received by fans and critics alike, further establishing SEGA as a key player in multimedia entertainment.

Joint Ventures and Industry Alliances

SEGA Sammy’s joint ventures and alliances with other companies have allowed it to maintain a competitive edge in the gaming and entertainment industries. These partnerships are particularly valuable in markets where regulatory challenges or high entry barriers exist.

Joint Venture with Resorts World Las Vegas

SEGA Sammy formed a joint venture with Resorts World Las Vegas to develop and operate the SEGA Sammy Casino Resort in the city. This project marked SEGA’s entry into the integrated resort business, combining gaming, entertainment, and hospitality services. The venture reflects SEGA’s ambition to grow its presence in the casino gaming sector, while offering visitors a unique entertainment experience.

Collaboration with Microsoft on Cloud Gaming

As the gaming industry shifts towards cloud-based services, SEGA Sammy has partnered with Microsoft to explore opportunities in cloud gaming. This collaboration focuses on leveraging Microsoft Azure to develop next-generation cloud-based gaming experiences. By embracing cloud technology, SEGA Sammy aims to enhance the scalability of its digital gaming offerings while reaching a global audience.

Conclusion

SEGA Sammy Holdings Inc. has demonstrated a robust strategy of growth through key deals, partnerships, and acquisitions across gaming, entertainment, and casino industries. From acquiring studios to collaborating on esports, films, and cloud gaming, SEGA Sammy is leveraging its strengths to expand its global footprint. The company's proactive approach to securing valuable partnerships ensures that it continues to innovate and lead in the ever-evolving world of digital entertainment.

0 notes

Text

Asia Pacific Cycling Wear Market Increasing Cycling Participation and Fitness Enthusiasm

Cycling wear such as cycling jerseys, shorts, arm warmers, gloves, eyewear, and shoes are gaining popularity due to the growing trend of cycling as a fitness activity and means of recreation in the region. The increasing participation in road cycling and mountain biking across Asia Pacific countries is fueling the demand for advanced cycling-specific apparel and accessories. Additionally, comfort, breathability, moisture-wicking properties help reduce body temperature and keep riders cool and dry while cycling, thereby driving the preference for technical cycling wear over regular clothes.

The Asia Pacific cycling wear market is expected to surpass US$ 1,388.6 million by the end of 2028, in terms of revenue, exhibiting a CAGR of 9.0% during the forecast period (2021 to 2028).

Key Takeaways Key players operating in the Asia Pacific cycling wear market are ByteDance (TikTok, Douyin), Kuaishou, Bilibili, Tencent (WeChat, Tencent Video), Alibaba (Taobao, Weibo), Meta (Facebook,Instagram), YouTube, Twitch, OnlyFans, Patreon, Substack, Kickstarter, Indiegogo, Disco, Cameo. These players are focusing on expanding their product portfolios and boosting online presence through e-commerce platforms and social media campaigns to target the growing customer base in the region. The increasing number of Asia Pacific Cycling Wear Market Growth events and promotions by governments as well as cycling clubs to encourage use of bicycles for commute and exercise present significant growth opportunities for players in the Asia Pacific cycling wear market. Moreover, large brands are investing in strategic partnerships with smaller regional brands and establishing offshore manufacturing units to expand footprint across local cycling wear markets in Asia Pacific countries. Market Drivers: The rapidly growing popularity of cycling as an active lifestyle sport among millennials and generation Z due to health, fitness and environmental benefits is a major factor driving the Asia Pacific cycling wear market. Furthermore, growing cycling infrastructure development including dedicated bike lanes, routes and parks by regional governments is encouraging recreational cycling and boosting the sales of cycling-specific clothing and accessories. Market Restraints: High costs of advanced technical cycling wear compared to regular sportswear limit the sales potential for premium and performance products in price-sensitive markets. Additionally, availability of low-cost alternatives restricts the growth of established brands in developing countries.

Segment Analysis: Cycling wear in the Asia Pacific market can be broadly categorized into three segments - bicycle clothing, bicycle accessories and bicycle parts. Bicycle clothing dominates the market as the expenditure on cycling apparel is higher compared to other segments. Cycling shorts, jerseys, base layers etc. see huge demand from recreational as well as professional cyclists. Material advances have led to development of breathable fabrics that offer both comfort and performance to riders. Global Analysis:

Regionally, China dominates the Asia Pacific cycling wear market owing to large population of recreational cyclists as well as strong manufacturing base for bicycles and components. Easy availability of cheap Chinese cycling wear translations into higher sales volumes. Countries like Japan, Australia and South Korea are other major markets in the region. Growing health consciousness and adoption of cycling as a lifestyle sport is driving market growth across Southeast Asia. Countries like Indonesia, Thailand and Vietnam witness double digit sales growth for cycling wear annually. Europe and North America currently have higher per capita spending on cycling gear but Asia Pacific market is growing at a much faster pace helped by large untapped potential.

Gets More Insights on, Asia Pacific Cycling Wear Market

About Author:

Money Singh is a seasoned content writer with over four years of experience in the market research sector. Her expertise spans various industries, including food and beverages, biotechnology, chemical and materials, defense and aerospace, consumer goods, etc. (https://www.linkedin.com/in/money-singh-590844163)

#Asia Pacific Cycling Wear Market Size#Asia Pacific Cycling Wear Market Share#Asia Pacific Cycling Wear Market Value#Asia Pacific Cycling Wear Market Analysis#Asia Pacific Cycling Wear#Coherent Market Insights#Asia Pacific Cycling Wear Market

1 note

·

View note

Text

Major study of Concept art : Blog 2: Planning folder

Project Deliverables

. Scene design part (totally 2 secnes):

----(include rough sketches, development of concept)

.The terrain outside the altar (use world creator to do)

.The appearance of the altar

. Small architecture components on the altar

. Overall rendering and adjustment of the altar

-----(include rough sketches, development of concept)

.Props and details:(use Photoshop)

.The coffin of the Taoist zombies

.rough sketches about inside the tomb

. adjustment of the interior tomb(develop)

(There are two scenes in total, one scene is made into a 3D scene using Blender, and the other scene is designed as a 2D concept painting using Photoshop)

. Adventurer: Mr. Yang--(rough sketches, development, polished concept)

.Props and weapon:Taoist wand

. River monster--(rough sketches, development of concept)

.Props and weapon:Taoist trident

. Taoist zombie--(rough sketches, development of concept)

.Props and weapon:Taoist blade umbrella

. Puppet Ghost--(rough sketches, development of concept)

(All character designs and corresponding props and costumes are completed using Photoshop 2D drawing)

. Props and details part (I have listed it above):

.The terrain outside the altar*1 (use world creator to do)

.The appearance of the altar *1

. Small architecture components on the altar*1

Photoshop 2D parts:

.The coffin of the Taoist zombies *1

.Props and weapon:Taoist wand*1

.Props and weapon:Taoist trident *1

.Props and weapon:Taoist blade umbrella *1

The final output would appear to be a series of images - perhaps an Art Book

My concept art will be targeted at Art Directors and other Game and film concept Artists to be the inspiration for game designs. These processes will be presented in my Blog

My intention for the project dissemination is to connect with other concept artists in my desired career path for feedback on my work once it's complete. Additionally, I will create a tailored online portfolio pack to send to potential companies (employers). However, I won't focus on this aspect during the project, as my priority is to meet the deadline. I intend to use platforms like ArtStation to reach out to artists and companies.

My concept art created as part of my project will be shared on Thumblr,Artsation and my blog to allow my audience and wider group of people to view and interact with my concepts.

Blog assignment and Publicity platform in Tumblr:https://huanyukang.tumblr.com/

Only publicity platform in Artsation:

My project will be a solo project with no contributions from others.

My career goal is to work within the film or game industry as a freelance concept artist in China. This project will help me begin my journey. The outcome I want to achieve at the end of this assignment is a fully polished project that I can display on my ArtStation portfolio. My passion has always been creative and imaginative, and concept art fuels that fire. This is the reason why I chose this MA course to begin my dream journey and produce a professional concept art project

Reference

Tencent(2022). Ghost Blows Out the Light, Youtube( online). available at: https://www.youtube.com/playlist?list=PLMX26aiIvX5rTNhuKV6dhtOPFfVKuRnYI

0 notes

Text

Top 10 Most Valuable Companies in the World by Market Cap in 2024

The selection of the most expensive firms by market capitalization provides an idea of economic force and innovative technology and Stock Market in the constantly changing world of international business. The oil and technology industries rule on the list of the top 10 most valuable firms as of 2024, while the financial services industry has an important effect as well. Here’s a detailed look at these global giants:.

Rank

Company

Sector

Market Cap (in USD)

Country

1

Apple INC.

Technology

$3.003 T

USA

2

Microsoft (MSFT)

Technology

$3.151T

USA

3

Saudi Aramco

Oil & Gas

$1.820 T

Saudi Arabia

4

Alphabet (Google)

Technology

$2.177 T

USA

5

Amazon

E-commerce

$1.886 T

USA

6

Tesla Inc. (TSLA)

Technology

$1.820 T

USA

7

NVIDIA Corporation (NVDA)

Social Media

$1.255 T

USA

8

Berkshire Hathaway

Diversified Investments

$885.12 B

USA

9

Meta Platforms Inc. (META)

Social Media

$845.02 B

Taiwan

10

Tencent Holdings Ltd. (0700.HK)

Social Media

$790.50 B

USA

1. Apple Inc. (AAPL)

With a market cap surpassing $3 trillion, Apple remains the most valuable company in the world. The tech giant continues to lead with its innovative products, including the iPhone, Mac and Apple Watch, as well as its expanding services segment, comprising the App Store, Apple Music, and Apple TV+.

2. Microsoft Corporation (MSFT)

Microsoft, whose market capitalization is more than $2.5 trillion,. The growth of its enterprise software (Office 365), games (the Xbox 360), and cloud computing services (Azure's) is what propels its success. The company's market position has been reinforced by its strategic purchases and AI integration.

3. Saudi Aramco (2222.SR)

With a market valuation of around $2.2 trillion, Saudi Aramco, the biggest oil company in Saudi Arabia, is still an important player. The largest oil producer in the world, Aramco manages its historical and future energy portfolio with judicious investments in sources of clean energy and steady prices for oil.

4. Alphabet Inc. (GOOGL)

Alphabet, the parent company of Google, has a market valuation of almost $2 trillion. Growth continues to be motivated by Google's strength in digital advertising and by its moves into computing in the cloud (Google Cloud life sciences, autonomous vehicles (Waymo) and cloud computing).

5. Amazon.com Inc. (AMZN)

With a market value of around $1.7 trillion, Amazon is still the industry leader in cloud computing and e-commerce (AWS). The company's strong market position is further reinforced by its development into sectors like as healthcare and logistics, in addition to its Prime membership network.

6. Tesla Inc. (TSLA)

The sustainable energy and electric vehicle business Tesla is valued at more than $1.2 trillion on the market. Its developments in autonomous driving, battery technology, and global plant growth place it at the forefront of the automobile industry's future.

7. NVIDIA Corporation (NVDA)

NVIDIA, a pioneer in artificial intelligence (AI) and graphics processing units (GPUs), is valued at around $1.1 trillion on the market. The business is positioned as a key participant in the IT ecosystem because of its contribution to AI research, gaming, and data centers.

8. Berkshire Hathaway Inc. (BRK.A)

With a market capitalization of over $900 billion, Berkshire Hathaway owned by Warren Buffett, is still thriving thanks to its wide portfolio. The conglomerate has substantial stakes in publicly traded firms like Apple & Coca-Cola in addition to investments in utilities, insurance and trains.

9. Meta Platforms Inc. (META)

The market value of Meta, once known at Facebook, is in $850 billion. Its valuation is influenced by its investment in virtual reality (Oculus Go), the wider universe, and its steady rise in advertising revenue.

10. Tencent Holdings Ltd. (0700.HK)

Chinese tech company with a market valuation of over $800 billion completes the top ten. Noted for its gaming, monetary and social networking services (WeChat), Tencent's vast presence over multiple online environments strengthens its place among the most valuable firms abroad.

The Indian Stock Market Perspective

The Indian Stock Market is vital to the global economy, although big transnational titans rule the entire global market. Reliance Industries Limited, Tata Consultancy Services (TCS), and Accenture are a few of the top companies that have been liable for the size of the Indian market. India is still a popular destination for foreign investors due to its thriving tech sector, increasing customer base & massive building consumption.

In conclusion,

The most valuable companies according to theirStock Market value in 2024 shows how the energy & technology industries are controlled, with the banking sector making substantial contributions as well. As these foreign behemoths carry on growing & maturing and their prices reflect not simply the current profitability but also the ability to shape what becomes of worldwide economy in the future,.

#stockmarket#best stock market advisor#motilal oswal#best stock trading apps in india#india#investment#news#social media#education#twitter#reddit#motivation#broking firm

0 notes

Text

Analyzing Niantic Inc.'s Competitors: A Comparative Overview

Niantic Inc., a pioneering company in augmented reality (AR) technology and mobile gaming, operates in a dynamic and competitive industry landscape. Understanding Niantic's competitors is essential for gaining insights into the company's positioning, market share, and strategic opportunities. This article provides a comprehensive analysis of Niantic Inc.'s key competitors, highlighting their strengths, weaknesses, and market strategies.

1. Tencent Holdings Limited

Tencent Holdings Limited, a Chinese multinational conglomerate, is a formidable competitor for Niantic Inc. Tencent's vast resources, diverse portfolio of gaming properties, and global reach pose a significant challenge to Niantic's market dominance. Tencent's investments in AR technology and mobile gaming, coupled with its strong distribution channels, make it a formidable force in the industry.

2. Epic Games, Inc.

Epic Games, Inc., the developer of popular games like Fortnite and Unreal Engine, presents stiff competition to Niantic Inc. Epic Games' emphasis on immersive gaming experiences, cutting-edge technology, and cross-platform integration resonates with a broad audience. The company's ability to innovate and adapt to evolving consumer preferences poses a threat to Niantic's market share in the mobile gaming space.

3. Supercell Oy

Supercell Oy, a Finnish mobile game development company, is another key competitor for Niantic Inc. Supercell's portfolio of successful games, including Clash of Clans and Clash Royale, enjoys widespread popularity and player engagement. The company's focus on engaging gameplay, social interaction, and monetization strategies challenges Niantic's dominance in the mobile gaming market.

4. Nintendo Co., Ltd.

Nintendo Co., Ltd., a leading Japanese video game company, competes with Niantic Inc. through its mobile gaming division. Nintendo's iconic franchises, such as Pokémon, Mario, and Animal Crossing, have a loyal fan base and global recognition. The company's strategic partnerships and intellectual property assets give it a competitive edge in the mobile gaming space, particularly in AR-based experiences.

5. Zynga Inc.

Zynga Inc., a prominent developer of social and mobile games, is a direct competitor to Niantic Inc. Zynga's extensive portfolio of casual games, including FarmVille and Words With Friends, attracts a broad demographic of players. The company's focus on social interaction, live events, and in-game monetization strategies presents a challenge to Niantic's market position and player engagement efforts.

6. Roblox Corporation

Roblox Corporation, the developer of the Roblox platform, competes with Niantic Inc. in the online gaming space. Roblox's user-generated content model, immersive virtual worlds, and social features appeal to a young audience of players. The platform's emphasis on creativity, community building, and monetization options poses a competitive threat to Niantic's AR gaming experiences.

7. Activision Blizzard, Inc.

Activision Blizzard, Inc., a leading video game publisher, competes with Niantic Inc. through its mobile gaming division. Activision Blizzard's franchises, such as Call of Duty and Candy Crush, have a strong presence in the mobile gaming market. The company's focus on high-quality graphics, engaging gameplay mechanics, and live events challenges Niantic's position in the competitive gaming landscape.

Conclusion

Niantic Inc Competitors operates in a highly competitive market characterized by innovation, rapid technological advancements, and shifting consumer preferences. Understanding the company's key competitors, including Tencent Holdings Limited, Epic Games, Inc., Supercell Oy, Nintendo Co., Ltd., Zynga Inc., Roblox Corporation, and Activision Blizzard, Inc., is essential for evaluating Niantic's strategic position, market opportunities, and potential challenges. By analyzing the strengths and weaknesses of its competitors, Niantic can refine its strategies, enhance its products, and maintain its leadership in the AR gaming industry.

0 notes