#the alignment thing didnt fix it and the copies are doing the same thing

Explore tagged Tumblr posts

Text

running out of steam on the skyrim house someone tell me its ok if only some of the weapon racks work correctly and others send the weapons to the ceiling despite being set up the exact same way and the main house's floor plan is weird bc i didnt know where i was going with it yet tell me im still worthy of love

#and dont send me to the same tutorials ive watched a million times or to copy one from another cell#the alignment thing didnt fix it and the copies are doing the same thing#its fine in ck#i save it#i open it in game#the weapons just sort of... rotate from where they should be#i go back in ck#it tells me everything is turned to 270° despite looking correct#i fix it...#and the whole thing repeats

15 notes

·

View notes

Note

For say like Jetfire’s wings; are they all one model (probably w mirror modifier), or are they separate little bits to make the whole wing? If it’s just one model, how do you create the little tiny intruded lines?

they're one model mirrored across the X-axis (so i dont have to copy and paste the wings and reflect over every time i want to make an adjustment HAHA) right now, though i intend to separate them later!

the section you're talking about is actually extruded with the top edge slightly moved inward for the sake of visibility in the front perspective but i can show how i did the wings step-by step :) ill also add how i would go about making them intrusions instead at the end

little bit of a disclaimer! i am not professional and i am far from the most experienced blender user, so take this rather as a show of the process than real solid advice

(this'll have to be another Read More post, see below in the expanded section :) )

first things first, you model the bigger segment! you'll want to pull up the reference for the design here (CREDIT TO MECHNCHEESE FOR THE REF ART USED HERE OFC!!!!!!!) and align the vertices along it to get the desired shape :)

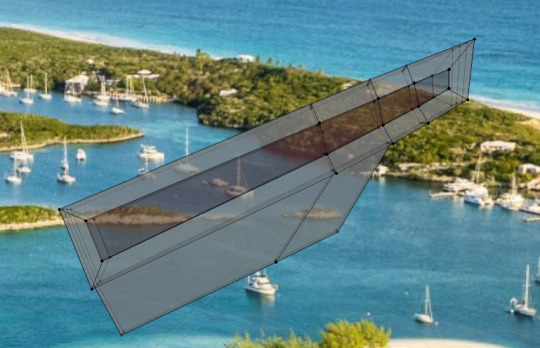

notice the background. this is not relevant to the subject at hand but i sent jetfire to the bahamas on paid leave

anyways once you've got the top section done, you can loop cut along the length of the mesh with the cuts set to 2 like this!

and then extrude out at the point where you want the lower section to be (set the orientation of the extrude to local rather than normal or global else it could end up looking goofy, depending on if the normals of the section you're extruding is rotated in a different direction or not)

then you'll want to loop cut to outline roughly where you want to extrude

i didnt get a picture for this next step but i made another loop cut lengthwise along the base again (seen in the top left-ish in the image below)

then you extrude!!

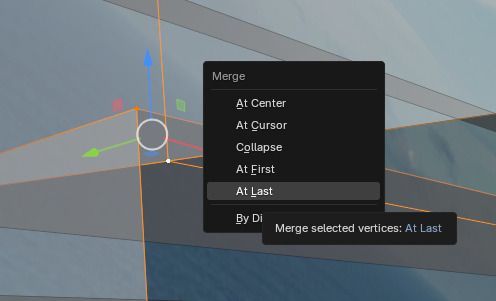

merge the vertices from the new extrusion with the ones from the second lengthwise loopcut

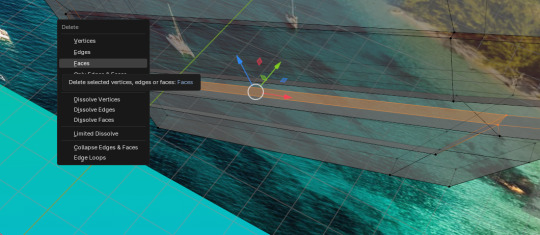

delete the resulting face that's not outwardly visible between the extrusion and the base or it may cause issues later... it's Evil

at this point it's pretty much good to go! however if you want to clean up some of the unnecessary tris that the edge loops made, you can do that by making cuts and dissolving the extra edges

here's a cut made from end of the extruded section up to another vertex, you'll want to repeat it on the other side if the mesh isnt mirrored along that axis like this one is LOL

below is a back view of what a cut at the very base may look like + now you'll dissolve the unwanted edges and clean up any that get left behind after :)

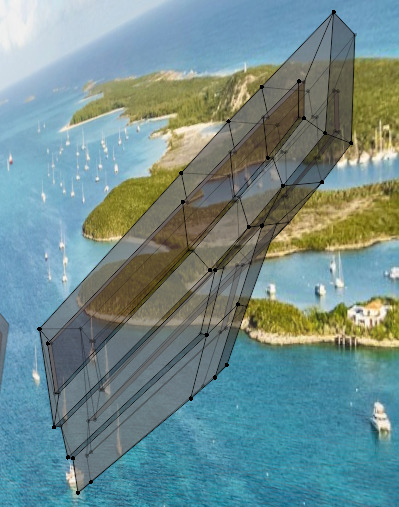

BAM!!!!! you can repeat this process for the original extruded segment if you want to reduce it more as well

(ignore that i accidentally made ngons at the base in the image below I FIXED THEM LATER but didnt get an screenshot </3 it's not a big deal for flat/rigid objects that dont flex but it doesnt hurt to keep them at quads or tris regardless)

IF YOU DO WANT TO MAKE A VERSION WITH AN INTRUSION I ALSO MADE SOME STEPS FOR THAT!!!!

it's basically the same process up until the part where you extrude, which you can then make 2 extra loop cuts again at the width you want the intrusions to be

PRESS E TO EXTRUDE! but INWARDS! or if you're doing both sides at once, press e, do not move your mouse, left click to complete the action, then scale on the axis pointing inwards instead

then you can go ahead and clean it up!!! which would look something like this :) you might have to do a cut or two at the back to get rid of the ngons made by the intrusion there

that should be all for the post! i hope it helps and is somewhat digestible at least, feel free to let me know if you've got any more questions!!

2 notes

·

View notes

Text

car insurance in oklahoma

BEST ANSWER: Try this site where you can compare quotes from different companies :insureoptionsreview.top

car insurance in oklahoma

car insurance in oklahoma means there are many options to choose from. We will help you decide which policy would be most appealing to you, whether you are looking for minimum or full coverage with the cheapest car insurance and for what discounts you are eligible for. Insurance is a complex subject. One of the most important things about insurance is that it s a multifaceted policy. The best car insurance in OKC is the one that covers the people and things involved in the case of an accident. Auto insurance policies also cover any liability or damage done to property of pedestrians or other drivers. In some states also, your personal auto insurance policy will only cover the damage and injuries you are liable for in an accident. The best car insurance for drivers in OK can be found in an insurance company s website called, The . You are legally required to have car insurance in the state of Montana before you can register a vehicle with the state. No matter how much money you may be spending on. car insurance in oklahoma? Read through our guide to the basics and then understand what your Oklahoma auto insurance company will and won t cover. We also explain what is and is not covered by car insurance. You can still but you will need to get an insurance policy to protect yourself. AAA provides low-cost to members of friendly organizations like the AAA Motor Club. AAA auto policies are also available for family members, members of the military, and anyone else who would like to buy an insurance policy for a vehicle. AAA has a number of auto-insurance benefits and insurance products that are designed to cover any losses you may have on your or your loved ones’ drive. AAA auto insurance is the nation’s leading auto insurer. AAA auto policies may be used to get car insurance or meet a higher deductible. AAA auto insurance is affordable and available in . The company ranks well in consumer satisfaction, being an “A++,” and has been awarded a financial strength rating, but. car insurance in oklahoma so I was wondering what did the insurance go on and how much was a good insurance coverage. i was looking for an in texas and i was given a request but i can vouch that they have been very hard to deal with, it was about 10 dollars the other insurance company is so hard to fix the car which was going to be $800 but i didnt care enough to just fix the car. so i was considering buying a used one to insure myself but the insurance company wanted to know what a the next cost for my used one to make was for the car, so i sent the call to them and they are always able to answer my requests. so i was wondering how much a $800 car insurance was for you and i was looking for a new car (I am only 21, had my first car but still has a lease since my mother died and she doesn t have any cars lol) I just wanted to see a car that would be cheaper to make, i had 2.

The Best Car Insurance Companies in Oklahoma for 2020

The Best Car Insurance Companies in Oklahoma for 2020: The Best Companies for 2020 is a list of the best auto insurance companies in Oklahoma. The companies have a combined market share of 1.3 percent, with their top five performing companies ranked based on financial strength, customer service reviews, policy offerings, discounts and availability in every state and the country. If you are still searching for the best auto insurance company for and want to see their rankings in the table above, click above. To request a copy of the table, click “Get a Free Quote.” The table contains average scores from the top auto insurance companies in Oklahoma City. AutoinsuranceEZ.com is a top savings referral service which enables consumers to quickly and easily request multiple competitive insurance quotes from optimally selected local insurance agents and companies using our proprietary consumer alignment technology. Our site does not provide quotes directly to consumers. AutoinsuranceEZ.com does not provide insurance and we do not represent any specific insurance provider. Copyright © 2010- AutoinsuranceE.

Car Insurance Requirements in Oklahoma: How Much Coverage Do You Need?

Car Insurance Requirements in Oklahoma: How Much Coverage Do You Need? By providing your auto insurance information to Autosurance.com, you agree to our privacy policy and guarantee that your information is secure and untheft. *Homeowner or renter’s insurance plans are underwritten by Farmers Insurance Exchange, Fire Insurance Exchange, Truck Insurance Exchange, Mid Century Insurance Company, Civic Property and Casualty Company, Exact Property and Casualty Company, Neighborhood Spirit Property and Casualty Company, Farmers Insurance Company of Washington (Bellevue, WA) or affiliates. In TX: insurance is underwritten by Farmers Insurance Exchange, Fire Insurance Exchange, Truck Insurance Exchange, Mid Century Insurance Company, Farmers Texas County Mutual Insurance Company, Mid Century Insurance Company of Texas or Texas Farmers Bank. In NY: insurance is underwritten by Farmers Insurance Exchange, Truck Insurance Exchange, Mid Century Insurance Company or Farmers New Century Insurance Company. Home office, Los Angeles, CA. Each of following insurers who transact business in California are domiciled in California and have their principal place of.

What are the Uninsured Driver Laws in Oklahoma?

What are the Uninsured Driver Laws in Oklahoma? The Uninsured Driver Law in Oklahoma is as follows: A state law requires an insurance company to have insurance at all times if the insured driver is not traveling in accordance with the requirements of the minimum requirements. Under Oklahoma law, insurance is provided at the following minimum levels: $25,000/$50,000 $25,000/$50,000 Is there any change in coverage laws in your state? There may be some insurance companies requiring or not providing added protection for drivers with a DUI. There is no standard definition for what can and cannot be charged as an uninsured motorist. There are special laws that may be different in each state. How Do I Apply for Insurance? The process is similar to applying for an SR-22 form. You will fill in the required information, and your insurance company will file the certificate with the state of Oklahoma requesting an order declaring your driver’s license. You will then have your license suspended, for a period of.

Average Oklahoma Auto Insurance Premiums

Average Oklahoma Auto Insurance Premiums For Drivers In Standard Group Policy Coverage This section applies to all Oklahoma insurance policies as a minimum value policy from all private insurers: AAA Auto Insurance .AAA Auto Insurance in Tulsa, OK. They offer coverage in all states through AAA as well as two additional options that should get you in more than a good place as well from AAA as well as Auto Club Insurance. All options include roadside assistance or a car rental. Not only is AAA car insurance auto insurance only available for AAA members who use their cars for any variety of transportation related activities or recreation, it will only cover drivers under automobile liability insurance, which can reduce your monthly rates and overall rates. So make sure you take all the details of your AAA membership with one of our agents and save money on insurance by comparison shopping on your own. The above quote reflects the cost of AAA auto insurance in Tulsa or elsewhere in Oklahoma. They can charge you for the same rates from other automobile insurance companies and you can easily compare prices.

Cheapest insurance after a ticket in Oklahoma

Cheapest insurance after a ticket in Oklahoma? If you get a speeding ticket, how will you feel? Well, the state’s insurance commissioner has you covered, issuing a warning via a letter – even if the car is clearly not in your line of business. The warning should be addressed to the other driver, and the driver’s insurance status shall be determined by the insurance commissioner. A violation has consequences, including: A ticket for speeding or non-moving violations or an accident with a vehicle registered in another state, and/or violations of subdivision 1785. of the Automobile Insurance Plan (or 1785. of the Revised Code) must lead to a mandatory revocation. If you do not have insurance coverage at the time of a citation, a judge may ask your insurer for proof of valid proof. If we found you a vehicle at an auto-only club that doesn’t have an insurance policy, you can be fined up to $300 for the month in which you’re at-fault.

The Best Cheap Car Insurance Companies in Oklahoma City

The Best Cheap Car Insurance Companies in Oklahoma City The best are Good Samaritan, and Good Samaritan. We have compiled a list of the best auto insurance companies in Oklahoma City. They offer several types of coverages, including: Most importantly, they offer good rates and a long list of discounts that can help lower the cost of paying for car insurance. Many insurance companies have an online account that offers drivers the ability to add their drivers for free while providing them with the company s auto ID card. Free Auto Insurance Comparison Enter your ZIP code below to view companies that have cheap auto insurance rates. Secured with SHA-256 Encryption It s still important to compare companies financial strength and customer service ratings to ensure you re getting the best deal and the best insurance policy. The first thing you should do is get quotes from at least three or four companies. If you can t find an insurance company that will take your case to the courts, you may have to sell your insurance. You must.

Penalties for Driving Without Auto Insurance

Penalties for Driving Without Auto Insurance in New Jersey Penalties for driving without insurance in New Jersey, if you’re caught: $50,000 property damage liability per accident. $60,000 personal injury protection. $25,000 property damage liability per accident. $100,000 uninsured motorist coverage per person. $300,000 uninsured motorist coverage per accident. Collision coverage with a $1,000 deductible. Comprehensive coverage with a $1,000 deductible. If required, minimum additional coverages were added and good driver discounts were automatically applied. Our “young driver” had all the same characteristics, but average rates were for 25-year-old men and women. We used a 2016 Toyota Camry LE for all single drivers. We used the same assumptions for all other driver profiles, with the following exceptions: For drivers with minimum coverage, we adjusted the numbers above to reflect minimum required coverage by law in the.

Can I Show My Insurance ID Card from My Phone?

Can I Show My Insurance ID Card from My Phone? Yes. Simply provide it to the insurance ID card provided at the California Department of Driver Services before getting stopped by the DMV. We recommend doing this before you stop paying for car insurance in the state of California. Drivers with a license available to them are considered high-risk for many reasons, including a high number of traffic violations, accidents, and injuries. This raises the risk of insuring an undocumented driver, or drivers with a suspended license in the state. To save on car insurance, check out the table below to view the most common California auto insurance rates. California is the fourth most populated state in the United States and has been for approximately 75 years. However, although there are small increases in car insurance premiums, insurance premiums have been consistently on the rise since 2015. The state’s population continues to expand due to the number of uninsured drivers, increased vehicle theft and the spread of COVID-19. Even though California is technically an at-fault state, the.

Cheapest Car Insurance in Oklahoma City by Coverage Amount

Cheapest Car Insurance in Oklahoma City by Coverage Amount $50,000/$100,000 $15,000/$25,000 OklahomaCity$11,694$12,652 Motorists facing a DUI or felony charge in Oklahoma City Despite its low population density, Oklahoma City is still a popular driving location for Oklahoma’s drivers. According to 2019 reports from the , Oklahoma’s car theft rate is just above the national average. To get a good rate on auto insurance, the best policy is likely to be from an Oklahoma car insurance company with reasonable rates. If you’re looking for auto insurance for college students, though, you can probably get better rates by shopping around. Car insurance companies in Oklahoma City use age as a determining factor. Teenage drivers tend to be younger and more reckless. The Oklahoma Automobile Motor Vehicle Administration notes that insurance companies may use this as a reason for rate increases. Drivers who are . There’s no doubt that seniors are one.

Auto Insurance: Common Myths

Auto Insurance: Common Myths about insurance While not actually being malicious – there are some truly outrageous claims that do happen in car insurance claims – the claims can be filed in the form of a lawsuit. In addition to having no knowledge of insurance, accidents and injuries can come on all that matters to you when it comes to car insurance. Although there isn’t anything inherent to the insurance market, these claims often cause harm to you in the form of legal bills and claims. Whether you want to take advantage of a potential liability, property damages, or personal or business liability on your own vehicles, when you use the car insurance provider’s claim management tools and have your vehicles covered. As far as claims going to an appraiser, it can’t actually affect your actual claim for car insurance. In fact, an appraiser will never work against you to ask about any specific car insurance policy. Instead of asking yourself about damages caused to your vehicle, they only ask about your overall car insurance risk. Insurance is.

0 notes