#tradingjournal

Text

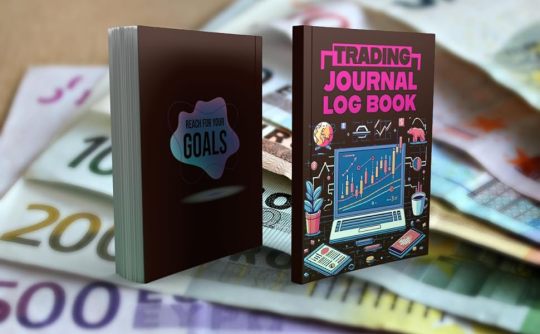

Trading Journal Log Book: 110 Pages of Space to Track Your Trades, Analyze Your Performance, and Grow Your Trading Account

110 pages Trading Journal Log Book: Track Your Trades, Improve Your Performance, and Become a More Successful Trader

Introduction

A trading journal is a powerful tool that can help you improve your trading performance. By tracking your trades, you can identify your strengths and weaknesses, learn from your mistakes, and develop more effective trading strategies.

This trading journal log book is designed to make it easy for you to track your trades. It includes all the essential information you need to record your trades, including:

Trade entry: The date, time, and price at which you entered the trade.

Trade exit: The date, time, and price at which you exited the trade.

P&L: The profit or loss you made on the trade.

Reason for entry: Your reason for entering the trade.

Reason for exit: Your reason for exiting the trade.

Notes: Any additional notes you want to make about the trade.

In addition to these essential fields, the journal also includes a number of optional fields that you can use to track more detailed information about your trades, such as:

Trade type: The type of trade you made, such as a long, short, or swing trade.

Timeframe: The timeframe of the trade, such as intraday, daily, or weekly.

Entry signal: The signal that triggered your entry into the trade.

Exit signal: The signal that triggered your exit from the trade.

Stop loss: The stop loss you used on the trade.

Take profit: The take profit you used on the trade.

Benefits of Using a Trading Journal

There are many benefits to using a trading journal. Here are just a few:

Improve your trading performance: A trading journal can help you identify your strengths and weaknesses, learn from your mistakes, and develop more effective trading strategies.

Reduce your risk: By tracking your trades, you can identify market conditions that are more likely to lead to losses. This can help you reduce your risk and protect your capital.

Increase your profits: A trading journal can help you identify trades that are more likely to be profitable. This can help you increase your profits and achieve your financial goals.

How to Use This Trading Journal Log Book

To use this trading journal log book, simply fill in the relevant information for each trade you make. You can use the journal to track your trades as they happen, or you can record them at the end of each day or week.

Here are a few tips for using the journal:

Be as detailed as possible: The more information you record, the more you will be able to learn from your trades.

Be honest with yourself: It is important to be honest about your trades, even if they were not successful. This will help you identify areas where you need to improve.

Review your journal regularly: Review your journal regularly to identify trends and patterns in your trading performance. This will help you make better trading decisions in the future.

Conclusion

A trading journal is a valuable tool that can help you improve your trading performance. This trading journal log book is designed to make it easy for you to track your trades and learn from your experiences.

#tradingjournal#trading journal#journaling#journal#tradingonline#onlinetrading#trading log book#log book#registration

1 note

·

View note

Text

As I recount my 5-year journey in the world of Vertical Bull Put Credit Spreads, I liken the strategy to the seductive but ultimately unfulfilling Mrs. Robinson. I shared my struggles, doubts, and moments of despair. Yet, small victories always rekindled my hopes, and I kept searching for my own “Options Income” of success. But now is the time to say, “Goodbye, Mrs. Robinson.”

#options trading#investing#trading journal#options spreads#stock options#options trader#thinkorswim#tradingjournal#makingmoneyathome#options strategies

0 notes

Text

youtube

कोल्हापूर येथे 12 ऑगस्ट 2023 रोजी होणाऱ्या मनी ब्ल्यू प्रिंट सेमिनारला आपली जागा बुक करण्यासाठी खालील लिंक चा वापर करा. https://imjo.in/GSDHkc 💁♂️ Trading Journal Amazon Link- https://amzn.eu/d/2Q1VPIl 💁♂️ जर समजा आपणास वर दिलेल्या लिंक वरून ट्रेडिंग जर्नल मिळाले नाही तर खाली दिलेल्या फॉर्म भरा आणि पेमेंट डिटेल पाठवा. https://forms.gle/JcbQRstFN7sgudxo6 🎁Upstox मध्ये अकाउंट ओपन करण्यासाठी ची लिंक. https://upstox.com/open-account/?f=2RBF 🎁 Zerodha मध्ये डिमॅट अकाउंट ओपन करण्यासाठी खाली दिलेल्या लिंक वर क्लिक करून तुमची संपूर्ण माहिती भरा. https://zerodha.com/open-account?c=ZM... 🎁 एंजल ब्रोकिंग या आघाडीच्या ब्रोकर सोबत तुमचे डिमॅट अकाउंट ओपन करण्यासाठी खालील लिंकचा वापर करावा. http://tinyurl.com/rn8ft5j अधिक माहितीसाठी आमच्या टीमशी आज संपर्क साधा. 880 280 90 90 /98 22 500 374 व्हाट्सअप लिंक- https://wa.me/message/Z2EZUGVJQUF3C1

#nifty50#weeklyexpiry#Banknifty#finnifty#finniftyexpiry#Sensex#tradingjournal#suceesskey#profitabletrader#Finnifty#shambhurajkhamkartradingacademy#marketanalysis#daytrading#शंभूराजखामकर्सट्रेडिंगअकादमी#शंभूराजखामकर#शेअरमार्केट#stockmarkettoday#stockmarket#Youtube

0 notes

Text

The Theory of Maybes

Isaac Newton was a scientific genius at a time when scientists were often denounced as heretics.

He had one antidote to this problem: He had to prove his theories beyond any doubt, which required obsessive precision.

In his biography on Newton, Mitch Stokes writes:

[Newton] could make make measurements with such precision that few philosophers accused him of fabricating his results … Using only a compass an his eye, Newton would painstakingly hunt down the source of minute measurement discrepancies of less than one one hundredth of an inch … no one else in the seventeenth century would have paused for an error twice that size.

Newton’s work rests on the idea that the physical world works in ways that are measurable, and, therefore, as long as you measure carefully enough you could learn anything about everything. Newton was so good at this that we named the field after him: Newtonian physics.

Scientists viewed the physical world through that single lens for another two-hundred years.

Then we discovered quantum physics. It upended everything.

Quantum physics showed us that parts of the physical world resisted the precision Newton obsessed over. We began to learn that physical things could behave in ways we never thought possible. Ways that defied logic. Subatomic particle movements were messy and unpredictable. Quantum theory taught us that precise measurements can’t exist because the act of measuring something changes its movement. Walter Isaacson writes about the famous Heisenberg Uncertainty Principle in his biography of Albert Einstein:

It is impossible to know, Heisenberg declared, the precise position of a particle, such as a moving electron, and its precise momentum at the same instant. The more precisely the position of the particle is measured, the less precisely it is possible to measure its momentum. An electron does not have a definite position or path until we observe it. This is a feature of our universe, he said, not merely some defect in our observing or measuring abilities. The uncertainty principle, so simple and yet so startling, was a stake in the heart of [Newtonian] physics. It asserts that there is no objective reality—not even an objective position of a particle—outside of our observations.

The emergence of two types of physics taught scientists to be humble. Neither version is better than the other. You just have to know which one to use in the right circumstance. Newtonian physics is deterministic. It gives you perfect answers. Quantum physics is probabilistic. It only offers hints that can roughly set you in the right direction.

It’s a great way to think about investing, where the same distinction applies.

Coca-Cola is fighting more than a decade of declining soda sales. Its stock is at an all-time high.

Snap has built one of the most viral products of our time. Its stock is down almost 50% in the last six months.

Good investing is about more than backing companies that perform well. It’s about backing companies that perform well within the context of the market’s current and future expectations.

A company’s performance can be measured precisely. Accounting is exact. Books balance out down to the penny. Calculating and planning a company’s unit economics requires precision. Low-margin businesses require a precise grasp of the business’s cost structure. Bank of America knows exactly what will happen to earnings if 0.01% of borrowers default on their credit cards. Like Newtonian physics.

Market expectations aren’t like that. Expectations are moods, and moods, almost by definition, are the gap between what’s happening and how people interpret what’s happening. They resist all attempts to figure them out in ways that make sense. They change constantly, without warning or reason. They can be different for two companies that look identical from the outside. At best, you can measure them with probabilities. Like quantum physics.

Not distinguishing between the two in investing is dangerous. There are things we can know and measure perfectly, and things we have to think about probabilistically, if not philosophically. They are different skills that attract different people, many of whom don’t realize the need for an alternative set of thinking.

Take future market returns. You only need to know three things to know exactly where stocks are going next: The dividend yield, earnings growth, and the change in valuation multiples.

The dividend yield is easy. We can measure it today. Earnings growth is a little trickier, but we can make a decent estimate. What about the change in valuation multiples? God, who knows. If I’m trying to calculate how much stocks will return between now and 2027, I need to know what kind of mood people will be in in 2027. And no reasonable person can claim to do that. I don’t know what kind of mood I’ll be in tonight, let alone 200 million strangers ten years from now.

The S&P 500 index earned $100 in profits in the year ended February 2014. The 10-year Treasury bond yielded 2.5% at the time. The index traded for 18.5 times earnings. It earned the same $100 in profits in the year ended March 2017, and the 10-year Treasury bond yielded the same 2.5%. Yet the index traded for 23.9 times earnings.

The difference between the two earnings multiples reflects a change in investors’ moods. People felt better about their investments in 2017 than they did in 2014. Why? No one knows. No one can measure. Maybe it was because the pain of the 2008 financial crisis wears off over time. Maybe because more people had jobs. Maybe because the doom-and-gloom forecasts sounded plausible in 2014 but have grown old since then. Or maybe – probably – some unfathomably complex mix of what happens when tens of millions of people try to predict the future based on the unique lens of their own day-to-day experiences and adjust their investments accordingly. Whatever it was, it acts like quantum physics – not only unpredictable but unmeasurable, even if we know what we’re looking at.

That’s how markets work. It’s how a lot of things work. Richard Feynman, the physicist, once said: “Nature isn’t [Newtonian] dammit. If you want to make a simulation of nature, you’d better make it quantum.

”Albert Einstein spent a lot of his career arguing against quantum theory. It seemed contradictory to everything we thought about physics.

“One cannot make a theory out of a lot of ‘maybes’” he once told a group of physicists. “Deep down it is wrong, even if it is empirically and logically right. ”“Einstein, I’m ashamed of you,” said physicist Paul Ehrenfest, according to Isaacson’s biography. Fellow physicists said he was being as stubborn as others had been when disputing his theory of relativity.

Einstein eventually came around. He nominated the two physicists who devised quantum theory for the Nobel Prize in 1933. He wrote in his nomination: “I am convinced that this theory undoubtedly contains a part of the ultimate truth. ”You could, in fact, make a theory out of maybes.

The development of quantum physics next to Newtonian physics shows how hard it is to grasp that some things can be measured and are in our control, and somethings can’t, and aren’t. It’s especially hard to grasp when those things are in the same field.

The same dissonance affects investors.

Accepting that investing is made up of both precise facts and theories of maybes is the hardest thing for investors to grasp. Theories of maybes can often be distilled into probabilities. But this doesn’t solve the problem, because we can’t calculate the probabilities of things we don’t know. The history of markets is, and will always be, the story of things that were unprecedented until they happened. That’s hard to accept if you have a Newtonian physics mind. And many investors do.

Getting comfortable with maybe requires two things: Humility, and room for error. Humility that there’s a lot of stuff we can’t know, and room for error to offer the only protection against that uncertainty. It’s the only way to survive in an industry where some of the most important variables can’t be calculated, measured, or fully understood.

Newton, interestingly, figured this out. After allegedly losing a fortune investing, he said he could “calculate the motion of heavenly bodies, but not the madness of people. ”

by Morgan Housel

#tradewithraj#tradingjournal#psychology#probablity#maybes#investors#isaac newton#albert einstein#bankofamerica#heisenberguncertainityprnciple quantumphysics

0 notes

Link

Forex trading discipline is one of the most important traits that a Forex trader should have to succeed in Forex trading. But trading discipline is also one of the hardest things to master.

Here are some steps to develop a trading discipline.

https://tradersir.com/tips-forex-trading-discipline/

#forextrading#tradingdiscipline#tradinggoal#tradingjournal#understandingforex#forexeducation#tradingtips#tradersir

0 notes

Link

A good Forex trade consists of a number of steps in a sequence. If you execute each step correctly, your chances of success will be greater.

Read this article to know what are those steps.

https://fmentor.com/a-checklist-of-a-good-forex-trade/

#forextrading#tradingplan#tradingjournal#tradingchecklist#tradingstrategy#moneymanagement#riskmanagement#fmentor

0 notes

Photo

MA Bullish:

MA 504.79 ( BULLISH )4.84 ( BULLISH )

MA 100 4.58 ( BULLISH )4.71 ( BULLISH )

MA 200 4.59 ( BULLISH )4.67 ( BULLISH )

Last week candle is Bullish

Break Check: (Primary Criteria)

♥ Prior Consolidation

♥ Break Out of the consolidation

♥ Volume spike

(Secondary Criteria)

♥ Longest range in the past 10 days

♥ New Month price High

♥ Price closed above the upper 50% (last week) range

1 note

·

View note

Text

With the US deficit approaching $2 trillion this year, inflation at a gut-buster 17.5% above 2020’s consumer prices, interest rates at a stifling 5.25%, expanding military involvement in the Middle East, Europe, and Asia, a dangerously polarized population, a politically dysfunctional Congress, and the uncertainty of another scorching election-year rematch between Biden and Trump. Why bother selling Vertical Bull Put Credit Spreads?

#options trading#investing#trading journal#options spreads#tradingjournal#makingmoneyathome#verticalspreads#options strategies#cover calls#options assignment

0 notes

Text

youtube

पुणे ,स्वारगेट येथे 13 ऑगस्ट 2023 रोजी होणाऱ्या मनी ब्ल्यू प्रिंट सेमिनारला आपली जागा बुक करण्यासाठी खालील लिंक चा वापर करा. https://imjo.in/GSDHkc कोल्हापूर येथे 12 ऑगस्ट 2023 रोजी होणाऱ्या मनी ब्ल्यू प्रिंट सेमिनारला आपली जागा बुक करण्यासाठी खालील लिंक चा वापर करा. https://imjo.in/FDyvqV 💁♂️ Trading Journal Amazon Link- https://amzn.eu/d/2Q1VPIl 💁♂️ जर समजा आपणास वर दिलेल्या लिंक वरून ट्रेडिंग जर्नल मिळाले नाही तर खाली दिलेल्या फॉर्म भरा आणि पेमेंट डिटेल पाठवा. https://forms.gle/JcbQRstFN7sgudxo6 🎁Upstox मध्ये अकाउंट ओपन करण्यासाठी ची लिंक. https://upstox.com/open-account/?f=2RBF 🎁 Zerodha मध्ये डिमॅट अकाउंट ओपन करण्यासाठी खाली दिलेल्या लिंक वर क्लिक करून तुमची संपूर्ण माहिती भरा. https://zerodha.com/open-account?c=ZM... 🎁 एंजल ब्रोकिंग या आघाडीच्या ब्रोकर सोबत तुमचे डिमॅट अकाउंट ओपन करण्यासाठी खालील लिंकचा वापर करावा. http://tinyurl.com/rn8ft5j अधिक माहितीसाठी आमच्या टीमशी आज संपर्क सा��ा. 880 280 90 90 /98 22 500 374 व्हाट्सअप लिंक- https://wa.me/message/Z2EZUGVJQUF3C1 #shambhurajkhamkarstradingacademyशेअर मार्केटच्या अपडेट मिळवण्यासाठी आजच आमच्या टेलिग्राम चॅनेल ला जॉईन करा. https://t.me/shambhurajkhamkar शेअर मार्केट विषयी जाणून घेण्यासाठी आजच आमच्या इंस्टाग्राम आणि फेसबुक पेजला फॉलो करा. https://www.instagram.com/shambhurajk... https://www.facebook.com/ShambhurajKh... शेअर मार्केट विषयी अधिक माहिती तसेच आमचे ॲडव्हान्स कोर्सेस आणि वर्कशॉप विषयी जाणून घेण्यासाठी आमच्या वेबसाईटला आजच भेट द्या. www.khamkarsview.com अधिक माहितीसाठी आमच्या टीमशी आज संपर्क साधा. 880 280 90 90 /98 22 500 374

#nifty50#weeklyexpiry#Banknifty#finnifty#finniftyexpiry#Sensex#tradingjournal#suceesskey#profitabletrader#Finnifty#shambhurajkhamkartradingacademy#marketanalysis#daytrading#शंभूराजखामकर्सट्रेडिंगअकादमी#शंभूराजखामकर#शेअरमार्केट#stockmarkettoday#stockmarket#Youtube

0 notes

Video

Example of PAAT System Trades: Futures CFDs/Forex Pairs - 26 Apr 2022

Try our Price Action Algo Trading (PAAT) - Trial for free to practice real drills yourself and get access to Basic to Advanced Price Action Lessons/Drills (12 Workshops+ 28 lessons+12 smart drills):

https://tradingdrills.com/blogs/free-course/paat-trial

Subscribe for more Trading Tips: https://www.youtube.com/channel/UCQmO_qUh8yajIat9QC2ep3w?sub_confirmation=1

Let’s connect:

Instagram –https://www.instagram.com/tradingdrills.academy/

Twitter – https://twitter.com/TradingDrills

Facebook – https://www.facebook.com/TradingDrills

0 notes

Photo

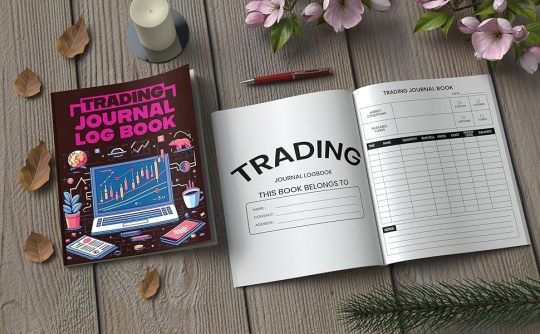

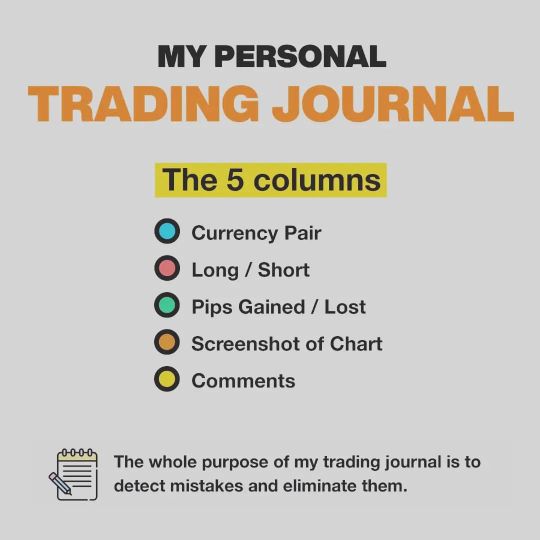

Sederhana dan efektif. Jurnal perdagangan saya. Ini adalah jurnal trading untuk trader yang sistematis. Anda dapat menambah atau menghapus poin tergantung pada gaya trading Anda. Mengapa saya tidak menyertakan poin berikut: Pemicu Entri - Saya memiliki sistem. Pemicu entri saya sama berulang kali. Saya tidak perlu menuliskannya untuk setiap perdagangan, karena bagaimanapun juga akan sama. Ukuran Posisi - Risiko saya adalah persentase yang sama untuk setiap perdagangan. Sekali lagi, saya tidak perlu menuliskannya untuk setiap perdagangan. Waktu Masuk/Keluar - Saya hanya memperdagangkan penutupan kandil. Sisanya akan terlihat di tangkapan layar. Menang atau Kalah - Saya dapat melihat ini di bagian Pips yang Diperoleh / Kalah“. Saya tidak perlu kolom tambahan untuk memberi tahu saya ini. Uang Dibuat / Hilang - Saya mencoba melepaskan diri dari nilai moneter agar tetap disiplin dan tidak terpengaruh secara emosional olehnya. - - - - - - - - - - - - 👇 IKUTI UNTUK KONTEN TRADING LAINNYA @sahrilsaboja @sahrilsaboja @sahrilsaboja - - - - - - - - - - - - 📥 Kirimkan saya DM jika Anda ingin #terhubung atau memiliki pertanyaan. Saya menjawab setiap pesan. - - - - - - - - - - - - #mentor #forexlife #swingtrading #currencytrading #trade #forexnews #technicalanalysis #fxsignals #tradingnews #tradingforex #forexeducation #tradingonline #forexstrategy #tradingjournal #journal #journaling https://www.instagram.com/p/CcVzneYBqGD/?igshid=NGJjMDIxMWI=

#terhubung#mentor#forexlife#swingtrading#currencytrading#trade#forexnews#technicalanalysis#fxsignals#tradingnews#tradingforex#forexeducation#tradingonline#forexstrategy#tradingjournal#journal#journaling

1 note

·

View note

Text

Why should you have a trading journal?

A trading journal is an essential tool for successful traders. It helps you keep track of your trades, analyze them, and improve your strategies. They help you stay focused on what matters most.

0 notes

Photo

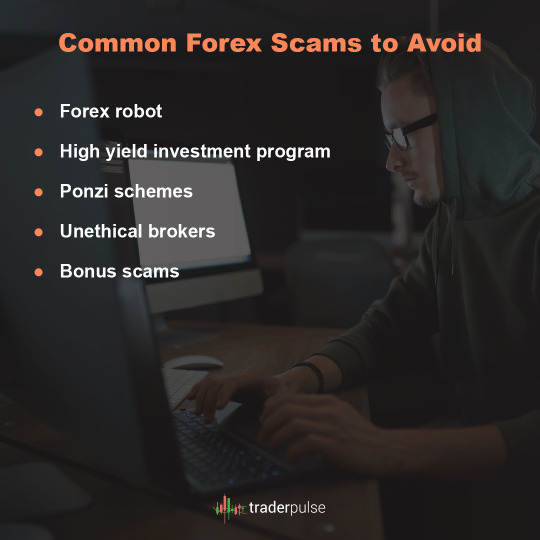

Watch out for these scams. Don't become a prey to these.

0 notes

Photo

Tip 28 °°° Protecting your capital is the most important thing you can do in trading. Don't worry about how much you can make on a trade, worry about what you might lose.⚠️ If you don't protect your capital and you lose it all, what capital are you going to use?🚫 This is where your risk management plan comes into play 🙌 °°°°°°°°° FOLLOW @bcfxacademy for more tips 💡 °°°°°°°°° ° ° ° #riskmanagement #tradingplan #tradingjournal #forex #forexcourse (at Springs, Gauteng) https://www.instagram.com/p/CFrUrjtAlwT/?igshid=f0g25es7voac

0 notes

Text

Has “Life, Liberty and the pursuit of Happiness” been supplanted with “Inclusion, Equity and the pursuit of Climate Justice?” It seems like Bidenomics is dancing the Shipoopi with Lady Liberty – Bipoopiomics

#options trading#tradingjournal#verticalspreads#options strategies#makingmoneyathome#bidenomics#bipoopiomics#options spreads#investing#shipoopi

0 notes

Text

youtube

पुणे ,स्वारगेट येथे 13 ऑगस्ट 2023 रोजी होणाऱ्या मनी ब्ल्यू प्रिंट सेमिनारला आपली जागा बुक करण्यासाठी खालील लिंक चा वापर करा. https://imjo.in/GSDHkc कोल्हापूर येथे 12 ऑगस्ट 2023 रोजी होणाऱ्या मनी ब्ल्यू प्रिंट सेमिनारला आपली जागा बुक करण्यासाठी खालील लिंक चा वापर करा. https://imjo.in/GSDHkc 💁♂️ Trading Journal Amazon Link- https://amzn.eu/d/2Q1VPIl 💁♂️ जर समजा आपणास वर दिलेल्या लिंक वरून ट्रेडिंग जर्नल मिळाले नाही तर खाली दिलेल्या फॉर्म भरा आणि पेमेंट डिटेल पाठवा. https://forms.gle/JcbQRstFN7sgudxo6 🎁Upstox मध्ये अकाउंट ओपन करण्यासाठी ची लिंक. https://upstox.com/open-account/?f=2RBF 🎁 Zerodha मध्ये डिमॅट अकाउंट ओपन करण्यासाठी खाली दिलेल्या लिंक वर क्लिक करून तुमची संपूर्ण माहिती भरा. https://zerodha.com/open-account?c=ZM... 🎁 एंजल ब्रोकिंग या आघाडीच्या ब्रोकर सोबत तुमचे डिमॅट अकाउंट ओपन करण्यासाठी खालील लिंकचा वापर करावा. http://tinyurl.com/rn8ft5j अधिक माहितीसाठी आमच्या टीमशी आज संपर्क साधा. 880 280 90 90 /98 22 500 374 व्हाट्सअप लिंक- https://wa.me/message/Z2EZUGVJQUF3C1 #shambhurajkhamkarstradingacademyशेअर मार्केटच्या अपडेट मिळवण्यासाठी आजच आमच्या टेलिग्राम चॅनेल ला जॉईन करा. https://t.me/shambhurajkhamkar शेअर मार्केट विषयी जाणून घेण्यासाठी आजच आमच्या इंस्टाग्राम आणि फेसबुक पेजला फॉलो करा. https://www.instagram.com/shambhurajk... https://www.facebook.com/ShambhurajKh... शेअर मार्केट विषयी अधिक माहिती तसेच आमचे ॲडव्हान्स कोर्सेस आणि वर्कशॉप विषयी जाणून घेण्यासाठी आमच्या वेबसाईटला आजच भेट द्या. www.khamkarsview.com अधिक माहितीसाठी आमच्या टीमशी आज संपर्क साधा. 880 280 90 90 /98 22 500 374

#nifty50#weeklyexpiry#Banknifty#finnifty#finniftyexpiry#Sensex#tradingjournal#suceesskey#profitabletrader#Finnifty#shambhurajkhamkartradingacademy#marketanalysis#daytrading#शंभूराजखामकर्सट्रेडिंगअकादमी#शंभूराजखामकर#शेअरमार्केट#stockmarkettoday#stockmarket#Youtube

0 notes