#thinkorswim

Explore tagged Tumblr posts

Text

Mastering Relative Volatility Trading: A Comprehensive Guide

Trading in financial markets can be daunting, especially with the plethora of strategies available. One of the sophisticated yet effective methods is trading based on relative volatility. This approach helps traders understand market movements better and make more informed decisions. In this detailed guide, we’ll delve into the concept of relative volatility, its significance, how to calculate…

View On WordPress

#Bloomberg Terminal#Financial data analysis#Financial Markets#Market Sentiment#Market Volatility#MetaTrader#Online trading courses#Pair trading#Portfolio diversification#Price movements#Quandl#Relative Volatility#Relative Volatility Index (RVI)#Risk Management#Standard deviation#stock trading#Stop-loss levels#Take-Profit Levels#Technical Indicators#Thinkorswim#Trading Education#trading signals#Trading Strategies#TradingView#Trend Analysis#Volatility convergence#Volatility indicators#Volatility spread trading#Volatility Trading#Yahoo Finance

0 notes

Text

As I recount my 5-year journey in the world of Vertical Bull Put Credit Spreads, I liken the strategy to the seductive but ultimately unfulfilling Mrs. Robinson. I shared my struggles, doubts, and moments of despair. Yet, small victories always rekindled my hopes, and I kept searching for my own “Options Income” of success. But now is the time to say, “Goodbye, Mrs. Robinson.”

#options trading#investing#trading journal#options spreads#stock options#options trader#thinkorswim#tradingjournal#makingmoneyathome#options strategies

0 notes

Text

API Food

Relish the taste of API food by glancing at our food section. Delve deep into the world of cooking details, entailing recipes and nutritional facts. This API furnishes a plethora of options, empowering developers to easily add food-related features to their apps. No more waiting! Explore its varied choices for a broad range of yummy experiences in your coding adventure.

1 note

·

View note

Text

The Best Trading Apps for Beginners and Pros

In today’s fast-paced financial landscape, having the right tools at your fingertips can make all the difference. Whether you're just getting started in trading or you're a seasoned pro looking to optimize your strategies, choosing the best trading apps is crucial for staying ahead of the curve. With advancements in fintech and mobile technology, modern trading apps offer everything from real-time data and intuitive dashboards to AI-powered insights and social trading features.

In this guide, we’ll take a closer look at the top trading apps for beginners and professionals in 2025, what makes them stand out, and what to consider before you make your pick.

Why Choosing the Right Trading App Matters

The rise of mobile investing has revolutionized how people access the stock market, forex, cryptocurrencies, and other trading instruments. For beginners, the best trading apps simplify the process with user-friendly interfaces, educational tools, and low or no fees. For pros, they offer advanced charting, algorithmic trading, and powerful analytics.

The ideal app should align with your trading goals, whether that's long-term investing, active day trading, or exploring new markets like crypto or commodities.

Top Trading Apps in 2025

1. Robinhood (Best for Beginners)

Robinhood continues to be a favorite for new traders due to its clean design, commission-free trades, and easy onboarding process. It’s a great starting point for anyone who wants to invest in stocks, ETFs, and crypto without feeling overwhelmed.

Pros:

Zero-commission trading

Easy to use

Fractional shares available

Cons:

Limited research tools

No mutual funds or bonds

2. TD Ameritrade (Best for Educational Resources)

TD Ameritrade’s thinkorswim platform is excellent for both beginners looking to learn and experienced traders wanting robust tools. It offers webinars, tutorials, and a strong community of investors.

Pros:

Comprehensive education center

Advanced tools for technical analysis

No account minimum

Cons:

Interface can be complex for new users

Some advanced features require a learning curve

3. eToro (Best for Social Trading)

eToro blends social networking with trading, making it perfect for those who want to follow and copy successful traders. It's particularly useful for beginners who want to learn by observing.

Pros:

Copy trading features

Supports crypto, stocks, forex, and more

Simple user interface

Cons:

Limited advanced analysis tools

Higher spreads on some assets

4. Interactive Brokers (IBKR) (Best for Professionals)

Interactive Brokers offers the most powerful tools for experienced traders. With access to global markets, automated trading, and detailed analytics, it’s the go-to platform for pros.

Pros:

Global market access

Algorithmic trading tools

Advanced research and reporting

Cons:

Complex UI

Higher learning curve

Key Features to Look For in a Trading App

Before you dive in, here are the essential features you should evaluate:

User Interface: Intuitive layout with smooth navigation

Fees & Commissions: Low or zero commissions are a plus

Research Tools: In-app charts, news feeds, and analysis

Educational Content: Tutorials, demo accounts, and market explainers

Security: Biometric login, two-factor authentication, and encryption

If you're considering building your own trading platform, understanding costs is key. Use a mobile app cost calculator to estimate the budget for your trading app idea and plan development accordingly.

Ready to Launch Your Trading App Idea?

If you’re inspired to bring your own trading app concept to life or want to create a better platform for a niche audience, this is the right time. The market is ripe for innovation, and users are always looking for better features, smoother UX, and integrated AI tools.

If you're interested in exploring the benefits of mobile app development services for your business, we encourage you to book an appointment with our team of experts. Book an Appointment

Future of Trading Apps: Where We're Headed

The future of trading apps lies in hyper-personalization, AI integration, and seamless cross-platform experiences. As more users turn to mobile-first solutions, apps that offer customizable dashboards, predictive insights, and real-time sync across devices will take the lead.

The fusion of financial technology and mobile development has unlocked massive potential. Whether you're an investor seeking smarter tools or a startup planning the next breakthrough in fintech, understanding trading app development trends is essential to staying ahead.

Conclusion: From beginner-friendly interfaces to professional-grade analytics, the best trading apps of 2025 cater to every type of investor. By choosing the right app—or building one—you’re not just trading smarter, you're investing in your future.

0 notes

Text

ThinkOrSwim VS TrendSpider: Which suits your needs best ?

When it comes to choosing a robust trading platform, ThinkOrSwim vs TrendSpider is a comparison many active traders find themselves making. Both platforms offer powerful features, but they cater to different types of traders and approaches. If you’re looking for cutting-edge automation, intuitive backtesting, and smart charting tools, TrendSpider might just be the better fit for your…

0 notes

Text

Free Futures Trading Course: Learn to Trade Without Spending a Dime

Introduction to Futures Trading

Futures trading is all about making deals on the future price of assets like oil, gold, or even the stock market. You’re not buying the asset—you’re betting on where its price will go. Sounds exciting, right? It is—but only if you know what you're doing.

If you’ve ever wanted to jump into this fast-paced world, a Free Futures Trading Course is the best way to start.

Why Learn Futures Trading?

Futures trading can be profitable and is often used by investors, traders, and even big companies to protect against price changes. It offers:

High potential profits

Low trading costs

24-hour market access

Great opportunities for day traders

But it’s also risky. That’s why proper education is a must.

What is a Futures Contract?

A futures contract is an agreement to buy or sell something (like oil or gold) at a set price on a future date. Traders use these contracts to bet on whether prices will rise or fall.

Who Should Take a Free Futures Trading Course?

Whether you’re:

A beginner looking to learn the basics,

A stock trader wanting to explore futures,

Or someone interested in trading commodities like gold, oil, or wheat,

A Free Futures Trading Course can help you understand the market and avoid beginner mistakes.

Benefits of a Free Futures Trading Course

1. No Risk, All Learning

You don’t have to spend any money. That means you can focus on learning without worrying about wasting cash.

2. Build Confidence

You’ll understand the trading tools, how futures contracts work, and how to use platforms like MetaTrader or Thinkorswim.

3. Practice with Demo Accounts

Courses often include access to virtual trading platforms where you can practice with fake money—perfect for beginners.

Top Topics You’ll Learn

A good free course will cover:

What are futures contracts?

How to read charts and market data

Technical analysis (using tools and indicators)

Risk management (protecting your money)

Trading psychology (staying calm and smart)

Where Can You Find a Free Futures Trading Course?

One of the best places to start is Coursocean. They offer beginner-friendly futures trading courses that are both free and high quality. Their easy-to-understand lessons make them one of the best options for learners on a budget.

Free vs Paid Courses: What’s the Difference?

Free Courses:

Great for learning the basics

Short and to the point

No cost or risk involved

Paid Courses:

Offer advanced strategies

Include mentorship or group access

Often come with certificates

Start with free, and if you love it, consider upgrading.

How Long Does It Take to Learn Futures Trading?

With a good course and regular practice, most people can understand the basics within a few weeks. Becoming skilled may take a few months. The key is to learn consistently and use demo accounts to practice.

Is Futures Trading Safe for Beginners?

It can be—if you learn properly. Futures markets are very active and can move quickly. This means you can win or lose money fast. That’s why taking a Free Futures Trading Course is such a smart move before you risk your own money.

Success Stories From Free Course Students

Emma’s Story

Emma, a college student, took a free futures course on Coursocean. She practiced using demo trades and learned how to manage her risks. After 2 months, she started trading small live positions with confidence.

John’s Story

John was already a stock trader but wanted to try futures. Instead of jumping in, he completed a free course first. Today, he’s a full-time futures day trader, thanks to what he learned for free.

Important Tips for New Traders

Start small. Don’t risk big money right away.

Use a demo account. Practice until you feel confident.

Keep learning. Markets change, so keep studying.

Don’t trade with emotions. Stay calm and follow your plan.

Do You Need a Lot of Money to Start Trading Futures?

No! Some brokers let you start with $100 or even less. But the more important thing is the knowledge you bring. That’s why starting with a Free Futures Trading Course makes all the difference.

What Platforms Are Used for Futures Trading?

MetaTrader 5 (MT5)

Thinkorswim

NinjaTrader

TradingView (for chart analysis)

These platforms let you analyze charts, place orders, and manage trades—all from your laptop or phone.

The Future of Futures Trading Education

The world of trading education is evolving. Today’s free courses offer:

Interactive lessons

Quizzes and tests

Live webinars

Access to communities

This means you can learn from real traders and improve faster than ever.

Conclusion: Start Learning Without Spending a Penny

Trading futures can be a great way to grow your money, but it starts with education. And thanks to platforms like Coursocean, you don’t have to pay to get started.

A Free Futures Trading Course gives you the basics, helps you avoid mistakes, and sets you on the path to becoming a smart, confident trader.

0 notes

Text

Top 15 Gold Brokers to Consider in 2025

Choosing the right broker can significantly impact your trading success. Below are the top 15 gold brokers recognized for their reliability, tools, low fees, and global accessibility:

1. IG

IG is a top-rated broker known for offering a wide range of gold products, including gold CFDs, futures, spot gold, ETFs, and shares. It offers low spreads, competitive commissions, excellent risk management tools, and extensive educational content.

2. FXTM

FXTM is a well-regulated broker overseen by institutions like the FCA (UK) and CySEC. It offers high leverage—up to 1:2000 for international clients and 1:20 for European clients. With robust VPS hosting, it’s ideal for automated and high-frequency trading.

3. Beirman Capital

Ideal for traders looking for tight spreads and low trading costs, Beirman Capital supports trading in gold CFDs, forex, equities, commodities, and more. With leverage up to 1:1000, opening an account is quick and easy in just three steps.

4. AvaTrade

AvaTrade is suitable for all types of traders—manual, automated, and copy traders. It stands out with lightning-fast order execution, expert advisor (EA) integrations, VPS hosting, and a large social trading network.

5. Plus500

Established in 2008, Plus500 caters to a global client base and is one of the few platforms offering services to U.S. clients. It provides access to several gold products, particularly excelling in gold futures trading.

6. XM

XM is a solid choice offering a variety of trading instruments including gold, other precious metals, energy, forex, indices, and cryptocurrencies. It’s especially popular among Muslim traders due to its top-tier Islamic accounts.

7. Pepperstone

Well-suited for algorithmic trading, Pepperstone offers advanced tools like Autochartist and supports over 28 indicators. It also features a robust copy trading platform and low spreads on gold-forex pairs.

8. TD Ameritrade (Charles Schwab)

A trusted name in the U.S., TD Ameritrade—now part of Charles Schwab—offers advanced trading tools like thinkorswim. It supports gold trading through ETFs and futures, ideal for experienced American investors.

9. Interactive Brokers

Interactive Brokers offers spot gold, gold futures, and ETFs. It’s known for transparent pricing and even allows physical gold redemption. With over 40 years of experience, it's one of the most trusted brokers globally.

10. Admiral Markets

Admiral Markets is a globally regulated broker under FCA, CySEC, and ASIC. It supports gold, forex, crypto, and commodities with access to 8,000+ instruments and multilingual customer support in over 16 languages.

11. FP Markets

FP Markets is known for its award-winning trading platform and offers gold, silver, crude oil, and gold-forex pairs. It provides leverage up to 1:500 and various account types, along with a 30-day free demo account for beginners.

12. Exness

Exness is a beginner-friendly platform offering low spreads starting from 20 pips on gold pairs and leverage up to 1:2000. It integrates with third-party charting tools and allows gold trading against both cryptocurrencies and FX pairs.

13. eToro

If social trading is your priority, eToro is unmatched. It lets you copy top traders, access over 700 assets, and benefit from live webinars, investing courses, and advanced trading tools—all in one place.

14. SAXO Bank

Though slightly more expensive, SAXO Bank offers a premium gold trading experience with three account types—Classic, Platinum, and VIP. You can trade gold through forex, CFDs, ETFs, COMEX, options, and ETCs.

15. Forex.com

Perfect for XAU/USD traders, Forex.com offers deep market insights, real-time news, economic calendars, training courses, and excellent technical analysis tools. It's a go-to platform for both beginners and pros.

0 notes

Text

Exploring Trade View: How It Enhances Trading Efficiency

In the rapidly evolving world of financial trading, having access to the right tools can make a significant difference in strategy execution and profitability. Trade View, a widely recognized trading platform, offers robust functionalities designed to enhance traders’ analytical capabilities and improve their decision-making processes. This article delves into Trade View's key features, its advantages for traders, and how it compares to other market platforms.To get more news about Trade View, you can visit wikifx.com official website.

Core Features of Trade View Trade View is built to accommodate both novice and experienced traders, providing a range of features that streamline market analysis and execution. Some of its core functions include:

Advanced Charting Tools – The platform offers sophisticated charting features that allow users to analyze market trends with precision.

Customizable Indicators – Traders can integrate a variety of technical indicators to fine-tune their strategies.

Algorithmic Trading Support – Trade View supports algorithmic trading, enabling users to automate their strategies effectively.

Multi-Asset Compatibility – Users can access markets such as forex, stocks, commodities, and cryptocurrencies.

User-Friendly Interface – Designed for easy navigation, Trade View ensures an efficient trading experience for all users.

Benefits of Using Trade View Trade View’s appeal lies in its ability to provide traders with insightful market data and powerful tools to optimize their trading strategies. Some of the primary benefits include:

Enhanced Decision-Making – With comprehensive market insights and real-time data visualization, traders can make more informed decisions.

Risk Management Features – The platform allows traders to implement risk controls, reducing exposure to market volatility.

Customization Options – Traders have the flexibility to tailor the platform to their specific needs and preferences.

Efficiency and Speed – Trade View ensures quick execution speeds, which is crucial in fast-paced markets.

Comparing Trade View to Other Trading Platforms While Trade View stands out due to its extensive toolset, it competes with various platforms, such as MetaTrader, TradingView, and ThinkorSwim. Compared to these alternatives, Trade View offers greater customization options and supports algorithmic trading, which makes it a preferred choice for traders looking to automate their strategies.

Conclusion Trade View is an invaluable trading platform for traders seeking advanced analytics, customizable tools, and efficient trade execution. Whether a trader is looking to improve technical analysis, automate trading strategies, or manage risks effectively, Trade View provides a solid foundation for achieving trading success. As financial markets continue to evolve, platforms like Trade View play a crucial role in empowering traders with the right tools for navigating complex trading environments.

0 notes

Text

Stock Options Trading: A Flexible Entry Point for New Traders

Introduction

Entering the world of trading can be overwhelming for new investors. With so many charts, news updates, and volatile prices, it's easy to feel lost. But there's a trading method that offers structure, defined risk, and affordability—stock options trading. Unlike traditional stock purchases, options allow you to participate in the market with flexibility and control. For those new to trading, this could be the safest and smartest way to begin your journey.

1. Controlled Risk Exposure

One of the biggest fears for beginners is the possibility of losing large sums of money. Buying a stock outright means you risk losing the entire value if the price drops. In contrast, buying a call or put option requires only a small premium. If the trade doesn’t go your way, your loss is limited to that premium—nothing more.

This limited-risk profile helps beginners learn the ropes without gambling away their capital. You can build confidence gradually while developing an understanding of market trends and movements.

2. Learning the Market Through Strategy

Options trading encourages strategic thinking. You don’t just buy or sell—you evaluate price direction, timing, and volatility. Each trade becomes a calculated decision based on probability and logic.

This analytical approach turns trading into a skill rather than a guessing game. Beginners who start with options are more likely to develop long-term habits such as risk management, portfolio hedging, and disciplined decision-making.

3. Affordable Market Entry

Let’s say a stock costs $150, and you want to buy 100 shares. That’s a $15,000 investment. With options, you can control the same number of shares with just a few hundred dollars. This leverage allows new traders to access high-value trades at a low cost.

It’s a smart entry for those who want to learn without committing all their funds upfront.

Finding the Right Tools

To succeed, you need more than strategy—you need the right technology. The Best Stock Trading Platform for options should offer:

Paper trading (simulations with no real money)

Strategy builders and risk analysis tools

Options chains with real-time data

Educational webinars and tutorials

Platforms like Thinkorswim (TD Ameritrade), Interactive Brokers, and tastytrade are favorites among beginners for their learning-focused features and intuitive design.

Conclusion

Stock options trading can be a great launchpad for new traders. With controlled risks, strategic growth, and affordable access, it gives you a smarter way to enter the financial markets. Combine that with the Best Stock Trading Platform, and you're setting yourself up for a confident and well-informed trading future.

0 notes

Text

Thinkorswim e a Dark Pool: Identificar Movimentos Ocultos Enquanto a maioria dos traders individ... https://theciranda.com/thinkorswim-e-a-dark-pool-identificar-movimentos-ocultos?feed_id=46379&_unique_id=6825267a8e027

0 notes

Text

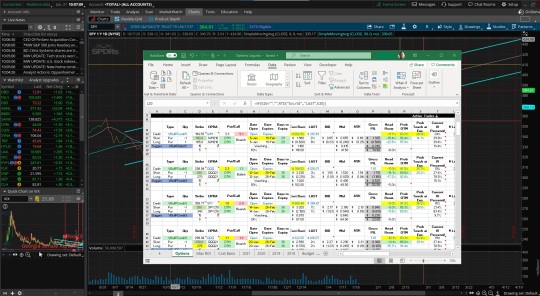

How to Connect Excel with Thinkorswim

How do you connect Schwab’s Thinkorswim (TOS) desktop trading platform with your Excel spreadsheet? How about how to use the Thinkorswim RTD commands to live stream data into your Excel Watch List? Even better, how about downloading my Excel Options Watch List to see how it works? The Avengers (2012) is an action-packed superhero film that tells the story of a group of superheroes who must come…

View On WordPress

#Ameritrade#Charles Schwab#Excel#Open Positions Monitor#Options Trader#Options Trading#Schwab#Stock Options#TDAmeritrade#ThinkorSwim#Tos#Watch List

1 note

·

View note

Text

BLOG - 13

Top 10 Tools Every New Trader Should Be Using

Introduction

Starting your trading journey can feel like stepping into a whirlwind of charts, numbers, and jargon. But don’t worry—every pro was once a beginner. The good news? There are plenty of tools out there to help you trade smarter, not harder. Whether you're dabbling in stocks, crypto, or forex, the right toolkit can make all the difference.

Here are 10 must-have tools every new trader should get familiar with:

1. Trading View

If you're not already using Trading View, you're missing out. It's one of the most powerful and user-friendly charting platforms around. It offers real-time data, customizable charts, technical indicators, and a social feed where traders share their ideas. Great for both analysis and learning from others.

💡 Best for: Charting, technical analysis, and community insights.

2. Meta Trader 4/5 (MT4/MT5)

These are industry-standard platforms for forex and CFD trading. They come with powerful analysis tools, automated trading through expert advisors (EAs), and a wide range of indicators.

💡 Best for: Forex and CFD traders who want robust and professional-grade software.

3. Yahoo Finance or Google Finance

Don’t underestimate these free tools. They’re perfect for staying on top of the markets, checking stock prices, reading company news, and doing basic research.

💡 Best for: Quick news, stock research, and financial data.

4. StockTwits

This is basically Twitter for traders. StockTwits gives you real-time sentiment from other traders about stocks, crypto, forex, and more. It’s a great way to gauge market mood and spot trending tickers.

💡 Best for: Market sentiment and social trading vibes.

5. Finviz

A favorite for stock screening and market visualization. You can filter stocks based on technical indicators, fundamentals, price action, and more. The free version is powerful, but the premium upgrade is worth it if you’re serious.

💡 Best for: Screening stocks and finding trade ideas fast.

6. CoinMarketCap or CoinGecko

If you're into crypto, these are your go-to platforms. Track prices, market caps, volume, trends, and news—all in one place.

💡 Best for: Cryptocurrency price tracking and research.

7. News Aggregators (Benzinga, Bloomberg, CNBC)

Market-moving news happens fast. A solid news source helps you stay ahead of headlines that impact your trades. Benzinga is particularly popular for real-time alerts.

💡 Best for: Real-time financial news and breaking headlines.

8. Economic Calendar (Forex Factory, Investing.com)

Knowing when major reports (like Fed announcements or jobs data) are coming out is key. Economic calendars keep you in the loop so you're not blindsided by sudden volatility.

💡 Best for: Timing trades around economic events.

9. A Reliable Broker Platform (Thinkorswim, eToro, Robinhood)

Your broker is your gateway to the markets. Choose one that offers a user-friendly interface, low fees, good execution, and strong customer support.

💡 Best for: Actually placing your trades, obviously.

10. Journal & Analytics Tools (Edgewonk, TraderSync)

Every great trader keeps a journal. These platforms help you track your trades, analyze performance, and improve over time. You’ll start to see patterns in your habits and decision-making.

💡 Best for: Reviewing and refining your trading strategy.

Final Thoughts

Trading isn’t just about pressing buy or sell—it’s about preparation, analysis, and consistent learning. With the right tools, you’ll not only speed up your progress, but you’ll also avoid a ton of beginner mistakes. Read more

Bottom of Form

1 note

·

View note

Text

Mastering Stock Options Trading: A Beginner's Blueprint

Introduction

Diving into the world of stock options trading can feel like navigating a jungle—but with the right tools and knowledge, you can make the most out of every trade. Whether you’re new to the market or just brushing up, this guide breaks down the basics and helps you build a strong foundation.

Understanding the Basics

Stock options give you the right—but not the obligation—to buy or sell a stock at a set price within a certain time. There are two main types:

Call Options: You bet the stock will rise.

Put Options: You bet the stock will fall.

Options can be used for hedging or speculation, making them powerful tools in a trader’s arsenal.

Risk Management is Key

Unlike buying stocks outright, options can expire worthless. That’s why it's critical to:

Define your risk tolerance.

Use stop-loss orders.

Avoid over-leveraging.

Choosing the Best Stock Trading Platform

To maximize your potential, choose the Best Stock Trading Platform that offers:

Real-time data

Advanced options chains

Risk analysis tools

Educational resources

Platforms like Tastytrade, Thinkorswim, and Interactive Brokers offer features tailored to options traders.

Final Thoughts

Stock options trading isn’t just about making bets—it’s about strategic thinking and disciplined execution. With patience, practice, and the Best Stock Trading Platform by your side, you're on your way to turning possibilities into profits.

0 notes

Text

Online Trading Platform Market Report 2032: Key Drivers, Challenges & Growth Analysis

Online Trading Platform Market size was valued at USD 9.58 Billion in 2023 and is expected to grow to USD 18.8 Billion by 2032 and grow at a CAGR of 8.18% over the forecast period of 2024-2032

The online trading platform market is witnessing remarkable growth, fueled by technological advancements and increasing investor participation. The rise of digital trading solutions has revolutionized the way individuals and institutions trade across global financial markets.

The online trading platform market continues to expand as more investors seek convenient and secure ways to trade stocks, forex, cryptocurrencies, and other financial instruments. Enhanced accessibility, algorithmic trading, and AI-driven analytics are further transforming the landscape, making online trading more efficient and user-friendly than ever before.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/3347

Market Keyplayers:

MetaQuotes Software Corp. (MetaTrader 4, MetaTrader 5)

TD Ameritrade (thinkorswim, Mobile Trader)

Interactive Brokers (Trader Workstation, IBKR Mobile)

Charles Schwab Corporation (Schwab Mobile, StreetSmart Edge)

E*TRADE (Power ETRADE, ETRADE Pro)

Saxo Bank (SaxoTraderGO, SaxoInvestor)

Robinhood Markets Inc. (Robinhood Web, Robinhood App)

Fidelity Investments (Active Trader Pro, Fidelity Mobile)

IG Group (IG Trading Platform, ProRealTime)

Plus500 (Plus500 WebTrader, Plus500 App)

CMC Markets (Next Generation Platform, CMC Mobile Trading App)

eToro (eToro CopyTrader, eToro WebTrader)

Binance (Binance Exchange, Binance DEX)

Coinbase Global, Inc. (Coinbase Pro, Coinbase Wallet)

TradingView (TradingView Web Platform, TradingView Mobile App)

Zerodha (Kite, Coin by Zerodha)

Ally Invest (Ally Invest LIVE, Ally Invest Mobile)

TradeStation (TradeStation Platform, TradeStation Mobile)

OANDA Corporation (OANDA fxTrade, OANDA Mobile)

IQ Option (IQ Option Platform, IQ Option Mobile) and others

Key Market Trends Driving Growth

1. Surge in Retail Trading and Investment

The rise of commission-free trading platforms and easy access to financial markets have led to a surge in retail trading, attracting a new generation of investors.

2. Integration of Artificial Intelligence and Automation

AI-powered trading bots, predictive analytics, and automated investment strategies are enhancing decision-making and efficiency in online trading.

3. Growth of Cryptocurrency and Blockchain-Based Trading

The increasing adoption of cryptocurrencies has led to the development of specialized trading platforms, offering decentralized and secure trading experiences.

4. Expansion of Mobile and App-Based Trading

The shift towards mobile trading applications allows users to execute trades, monitor portfolios, and access real-time market data on the go.

5. Regulatory Compliance and Security Enhancements

With the rise of online trading, regulatory bodies are implementing stricter compliance measures to ensure transparency and security in digital trading platforms.

Enquiry of This Report: https://www.snsinsider.com/enquiry/3347

Market Segmentation:

By Component

Solution

Services

Consulting

Design & Implementation

Training & Support

By Technology

Machine Learning

Natural Language Processing

Robotic Process Automation (RPA)

Virtual Agents

Computer vision

Others

By Deployment

Cloud-based

On-premise

By Organization Size

Large Enterprise

SME

By Application

IT Operations

Business Process Automation

Application Management

Content Management

Security Management

Others

By Vertical

BFSI

Healthcare

Retail

IT & Telecom

Communication and Media & Education

Manufacturing

Logistics, and Energy & Utilities

Others

Market Analysis and Growth Potential

Key Drivers and Challenges

Drivers:

Growing financial literacy and awareness

Demand for diversified investment opportunities

Advancements in trading technologies

Challenges:

Cybersecurity threats and fraud risks

Regulatory complexities across different regions

Market volatility and risk management concerns

Future Prospects and Opportunities

1. Rise of Decentralized Finance (DeFi) and Smart Contracts

DeFi platforms and smart contracts are enabling trustless, transparent, and automated trading experiences.

2. Enhanced AI-Powered Trading Strategies

AI and machine learning algorithms will continue to optimize trading performance, mitigate risks, and provide personalized investment insights.

3. Expansion into Emerging Markets

The online trading market is expected to see increased penetration in emerging economies, where digital finance adoption is accelerating.

4. Introduction of More ESG-Focused Investment Platforms

Sustainable and ethical investment platforms will cater to the growing demand for environmental, social, and governance (ESG)-focused trading opportunities.

Access Complete Report: https://www.snsinsider.com/reports/intelligent-process-automation-market-3347

Conclusion

The online trading platform market is set to witness sustained growth, driven by technological advancements, evolving regulatory landscapes, and increasing retail investor participation. By integrating AI, blockchain, and mobile-first solutions, trading platforms will continue to enhance accessibility, efficiency, and security, shaping the future of digital investing.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

#Online Trading Platform Market#Online Trading Platform Market Scope#Online Trading Platform Market Size#Online Trading Platform Market Growth#Online Trading Platform Market Trends

0 notes

Text

NVSTly Brokerage Integration: The Future of Social Trading

Automated Trade Tracking & Sharing, Verify Accuracy, and Elevate Your Social Investing Experience with NVSTly’s Brokerage Integration.

In the fast-evolving world of investing, traders are constantly looking for ways to streamline their trading experience, share insights, and build transparency in the community. NVSTly, the social investing platform, has taken a significant step forward with its brokerage integration feature. This game-changing addition allows traders to automatically track and share their trades with 100% accuracy, creating an ecosystem of trust and transparency for both casual investors and top traders.

What is NVSTly's Brokerage Integration?

NVSTly's brokerage integration enables users to securely connect their brokerage accounts to the platform, allowing trades to be automatically recorded, tracked, and shared in real time. This means no more manual trade entries or missing crucial details—every trade is verified directly from the broker, ensuring authenticity.

Currently, NVSTly supports Webull, but we're actively working on adding support for Charles Schwab (ThinkorSwim), Robinhood, Moomoo, TradeStation, and more. As we expand, traders from multiple brokerages will be able to seamlessly integrate their accounts, making NVSTly the go-to platform for automated trade tracking and social investing.

How Does It Work?

Securely Link Your Broker – Users can connect their brokerage account to NVSTly through a secure authentication process.

Automatic Trade Tracking – Every trade executed in the linked brokerage account is automatically recorded on NVSTly, including trade details such as asset type, entry/exit price, time, and trade status.

Real-Time Trade Sharing – Users can choose to share trades instantly with their followers, to social media, or Discord.

100% Accuracy & Verification – Since all trades are pulled directly from the brokerage account, the data is fully verified and cannot be altered, ensuring complete transparency.

Why Are Traders Linking Their Broker Accounts?

NVSTly’s brokerage integration provides immense value for traders of all levels. Here’s why thousands are choosing to connect their broker:

1. No More Manual Entry

Keeping track of trades manually is time-consuming and prone to errors. With NVSTly, all trades are logged automatically, eliminating mistakes and saving traders valuable time.

2. 100% Trade Accuracy & Transparency

Top traders and signal providers on NVSTly can showcase their trades with full credibility, as every trade is verified directly from the broker. This builds trust within the community and ensures followers are seeing real, authentic trades, not fabricated ones.

3. Ideal for Signal Providers & Analysts

Signal providers and market analysts can effortlessly share their trades in real-time, giving their subscribers confidence in their strategies. The auto-sharing feature means followers get instant updates, allowing them to act quickly on trading opportunities.

4. Social Traders Can Learn From Verified Trades

Unlike traditional investing platforms where traders post trade ideas or screenshots, NVSTly ensures that every trade shown is real and executed. Social traders can analyze the moves of top investors and gain insights from actual, successful trading strategies.

What’s Next? 1-Click Copy Trading is Coming Soon

One of the most exciting upcoming features of NVSTly is 1-Click Copy Trading. Once we complete support for more brokerages, users will be able to automatically copy the trades of top-performing traders in real time. This will allow newer traders to follow experienced professionals and benefit from their strategies effortlessly.

The Future of Social Investing Starts Here

NVSTly's brokerage integration is revolutionizing the way traders track, share, and analyze trades. By providing automated tracking, trade verification, and real-time sharing, we are creating a transparent and trustworthy environment for traders, signal providers, and social investors.

If you're ready to take your trading experience to the next level, link your Webull account today and stay tuned as we expand our brokerage integrations to Charles Schwab (ThinkorSwim), Robinhood, Moomoo, TradeStation, and more!

NVSTly is available for free on web, mobile devices (iOS & Google Play), and is fully integrated with Discord via a unique bot- the only of it's kind and available to any server or trading community on Discord. Or feel free to join a community of over 50,000 investors & traders on our Discod server.

1 note

·

View note

Text

Paper Trading: Your First Step to Smart Investing

Investing in the stock market can be intimidating, especially for beginners. However, paper trading apps provide a risk-free way to learn and practice investing without using real money. These apps simulate real market conditions, allowing you to test strategies and build confidence before entering the real world of trading.

What is Paper Trading?

Paper trading, also known as virtual trading, is a way to practice stock market investing using a simulated account. With no real money involved, traders can experiment with different strategies, track their progress, and understand market movements without financial risks.

Benefits of Using Paper Trading Apps

Risk-Free Learning – You can practice trading without losing money.

Hands-On Experience – Get real-time insights into how the market works.

Strategy Testing – Try different trading techniques before applying them in real trading.

Emotional Control – Learn to manage emotions like fear and greed, which are crucial in trading.

Best Paper Trading Apps to Try

Several apps provide excellent paper trading experiences, including:

TradingView – Ideal for beginners and experienced traders.

ThinkorSwim by TD Ameritrade – Offers advanced charting and analysis tools.

Webull – Provides a user-friendly interface for stock and crypto trading.

Final Thoughts

Paper trading apps are a great starting point for anyone looking to enter the world of investing. They offer a safe way to gain experience, refine strategies, and build confidence before risking real money. Start paper trading today and take your first step toward smart investing.

1 note

·

View note