#trust and transparency with blockchain

Explore tagged Tumblr posts

Text

Why Trust and Transparency with Blockchain Matter inside the Digital Age

In contemporary digital generation, agree with and transparency are vital factors in various industries, from finance to healthcare and supply chain management. However, traditional structures regularly fail to provide the extent of responsibility and safety wished. This is in which blockchain era is available in. The integration of blockchain guarantees trust and transparency with blockchain, making it a game-changer within the virtual international.

Understanding Blockchain Technology

Blockchain is a decentralized ledger that data transactions in a comfy and immutable manner. Each transaction is confirmed by a network of computers and saved in a block, that is related to the previous block, forming a series. This system guarantees that once information is entered, it cannot be altered, promoting transparency and trust.

The Importance of Trust in the Digital Age

With the upward push of cyber threats, information breaches, and fraudulent sports, trust in virtual transactions has grow to be a sizable problem. Blockchain eliminates the need for intermediaries via offering a transparent and tamper-evidence machine where transactions are proven through consensus mechanisms. This enhances protection and builds self assurance among users.

How Blockchain Enhances Transparency

Immutable Records – Blockchain statistics cannot be altered or deleted, ensuring the integrity of statistics.

Decentralization – No single entity controls the blockchain, decreasing the danger of corruption or manipulation.

Auditability – Every transaction is recorded and can be traced returned, making economic and business operations more accountable.

Smart Contracts – These self-executing contracts make certain that agreements are fulfilled with out human intervention, lowering fraud and misinterpretation.

Real-World Applications of Trust and Transparency with Blockchain

Finance: Blockchain prevents fraud in banking by way of ensuring obvious transactions.

Healthcare: Patients' medical facts are securely stored and shared without unauthorized access.

Supply Chain: Companies can music merchandise from manufacturing to delivery, preventing counterfeiting.

Voting Systems: Blockchain guarantees fair and tamper-evidence elections.

Conclusion

In the digital age, trust and transparency are more important than ever. Trust and transparency with blockchain technology provide a comfortable and reliable option to various virtual challenges. By adopting blockchain, corporations and people can make sure statistics integrity, cast off fraud, and foster a more transparent atmosphere.

0 notes

Text

Build the Future of Gaming with Crypto Casino Development Solutions

#In a world where innovation drives the gaming industry#the rise of crypto casino game development is reshaping the way players and developers think about online gambling. This is because blockch#allowing developers and entrepreneurs to create immersive#secure#and decentralized casino experiences in unprecedented ways. This is not a trend; it's here to stay.#The Shift towards Crypto Casinos#Imagine a world that could be defined by transparency#security#and accessibility for your games. That's precisely what crypto casino game development is trying to bring to the table. Traditionally#online casinos have suffered because of trust issues and minimal choices for payment options. This changes with blockchain technology and c#Blockchain in casino games ensures that all transactions are secure#transparent#and tamper-proof. Thus#players can check how fair a game is#transfer money into and out of the account using cryptocurrencies#and maintain anonymity while playing games. It is not only technologically different but also culturally. This shift appeals to a whole new#What Makes Crypto Casino Game Development Unique?#Crypto casino game development offers features that set it apart from traditional online casinos. Let’s delve into some of these groundbrea#Decentralization and TransparencyBlockchain-powered casinos operate without centralized control#ensuring all transactions and game outcomes are verifiable on a public ledger. This transparency builds trust among players.#Enhanced SecurityWith smart contracts automating processes and blockchain technology securing transactions#crypto casinos significantly reduce the risk of hacking and fraud.#Global AccessibilityCryptocurrencies break the barriers that traditional banking systems have#making it possible for players from around the world to participate without having to think about currency conversion or restricted regions#Customizable Gaming ExperiencesDevelopers can customize crypto casino platforms with unique features such as NFT rewards#tokenized assets#and loyalty programs#making the game more interesting and personalized.#Success Story of Real Life#Crypto casino game development has already brought about success stories worldwide. Among them

1 note

·

View note

Text

Technology Trends 2024: Importance of Trust

Introduction

The introduction sets the stage by emphasizing the centrality of trust in the rapidly evolving tech landscape of 2024. You convey how this guide will delve into the interconnectedness of trust and technology, highlighting how trust acts as the foundation for embracing and leveraging emerging trends.

Navigating the Tech Trends of 2024

This section delves into the prominent technology trends of 2024 and how trust is interwoven with each of them:

1. Ethical AI and Algorithm Transparency:

Here, you elaborate on how trust in AI is inseparable from transparency. You explain how ethical AI practices, including understandable and accountable algorithms, are vital for building trust among users who want to comprehend and trust the decisions made by AI systems.

2. Data Privacy and Security:

In this part, you explore the increasing significance of data privacy and security. You detail how tech trends in 2024 emphasize the need for robust data protection mechanisms, ensuring individuals have control over their personal data, and how this fosters trust among users.

3. Human-Centered Design:

This section delves into the concept of human-centered design. You explain how user-centric technology is crucial for building trust, as user-friendly, inclusive, and accessible designs resonate with users and mitigate the fear of complex tech systems.

4. Sustainable Tech Solutions:

Here, you elaborate on the intersection of sustainability and trust in technology. You discuss how eco-conscious solutions build trust among users who prioritize ethical consumption and resonate with the notion that technology can coexist harmoniously with the environment.

5. Blockchain for Transparency:

This part explores the transformative potential of blockchain technology. You detail how blockchain's tamper-proof nature enhances transparency, reinforcing trust in transactions, particularly in sectors where transparency is paramount, such as finance and supply chain management.

6. Digital Well-Being Focus:

You dive into the significance of tech's impact on mental health. You discuss how tech trends in 2024 prioritize digital well-being features, addressing potential negative effects of excessive technology usage and thereby building trust by caring for users' holistic well-being.

The Nexus Between Trust and Technological Innovation

This section delves into the symbiotic relationship between trust and innovation:

1. Fostering User Adoption:

Here, you elaborate on how trust drives user adoption. You discuss how user confidence in transparent practices and data privacy measures fuels their willingness to adopt and engage with technology, contributing to technology's successful integration.

2. Navigating Ethical Challenges:

This part delves into the ethical dimension of technology trends. You discuss how grounded ethical considerations ensure that tech innovations garner societal approval, avoid controversies, and build trust by adhering to responsible practices.

3. Enabling Collaboration:

You emphasize how trust facilitates cross-sector collaboration. By adopting shared tech standards and ethical practices, industries collaborate, accelerating innovation, and ensuring widespread adoption of technology trends.

4. Driving Regulatory Compliance:

This section highlights the interconnectedness of trust and regulatory compliance. You discuss how adhering to data protection regulations and ethical guidelines builds user trust, minimizes legal risks, and strengthens the foundation of technology adoption.

Cultivating Trust in Tech: A Shared Responsibility

This section outlines practical steps to cultivate trust in technology:

1. Transparency and Communication:

You delve into the significance of transparent communication. Tech companies must communicate data usage and AI processes clearly, empowering users with knowledge and fostering trust through understanding.

2. Regulatory Alignment:

Here, you emphasize the role of regulators in building trust. By creating and enforcing data protection laws and ethical standards, regulators ensure that technology adheres to responsible and accountable practices, enhancing user trust.

3. User Education:

You discuss the importance of educating users about tech trends. Informed users are more likely to engage confidently with technology, and education empowers them to make informed decisions about technology adoption.

4. Ethical Consideration:

This part stresses the ethical imperative in technology creation. By considering ethics from AI design to sustainable practices, tech creators enhance the reputation and societal impact of technology.

Conclusion: Trust as the Tech Enabler

As 2024 unfolds, technology trends underscore the paramount importance of trust. Trust not only underpins user adoption and regulatory compliance but also amplifies innovation and societal progress. The fusion of tech and trust empowers a future where technology is embraced with confidence, paving the way for a world where innovation thrives and users feel secure.

#Tech Trends 2024#Importance of Trust#Ethical AI#Data Privacy#Human-Centered Design#Sustainable Tech#Blockchain Transparency#Digital Well-Being.

1 note

·

View note

Text

An exciting new initiative aims to transform banana farm residues from waste into valuable resources that enrich rural communities in Guatemala.

0 notes

Text

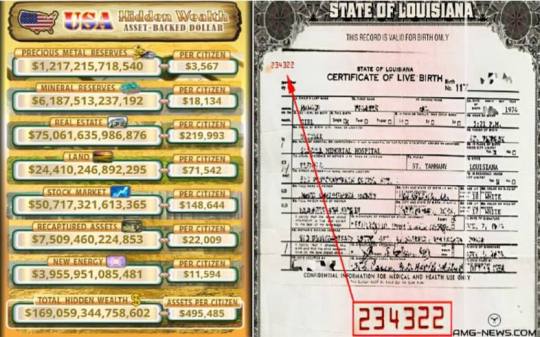

BOOM! EXPOSING THE LIE: THEY OWE YOU $495,000 — THE U.S. DEBT CLOCK, HIDDEN WEALTH & THE SILENT FINANCIAL COUP

The U.S. Debt Clock isn’t just numbers—it’s the blueprint of a silent war on your freedom. Every spinning digit represents stolen wealth, broken trust, and a system built to enslave you while pretending to serve you.

$169 TRILLION. That’s the hidden wealth funneled from Americans into the hands of globalist parasites. $495,000 per citizen. Gone. Stolen. Where’s your cut?

You were never in debt. You were the collateral. Your birth certificate? A bond. Your labor? A financial instrument. Your name in ALL CAPS? A Strawman used to enslave your real identity. And you never consented.

America was hijacked in 1871. The United States became a corporation, not a country. Maritime law replaced constitutional law. And in 1933, the scam deepened: the gold standard was abolished, and Executive Order 6102 confiscated private gold under the guise of recovery.

They stole real money and replaced it with paper backed by NOTHING—except your labor, your trust, your silence.

Your identity is traded. Your future is sold. And your consent is manufactured. Every tax form, every bank signature, every government document reinforces the illusion that YOU are the Strawman. But the real you? A sovereign being—trapped in a financial prison.

And here’s the punchline: The money never disappeared.

It changed hands. YOURS TO THEIRS.

You fund your own enslavement every minute you clock in.

But what happens when people wake up? When they realize they’re not debtors—they’re the rightful owners of stolen wealth? That’s when the Debt Jubilee isn’t a fantasy—it’s an inevitability.

This isn’t about forgiving credit cards. This is about resetting the world, collapsing a rigged machine, and exposing the central bank mafia.

And they know it’s coming. That’s why they fear blockchain, XRP, tokenized assets—because it shatters their shadow economy. Transparency + decentralization = checkmate.

Trump knows. He’s the only one who called out the Fed, threatened the dollar, and hinted at a gold-backed reset.

He’s not just battling Democrats. He’s at war with the entire financial deep state.

1776 is repeating. Pluto in Aquarius again. A cosmic signal.

Last time it birthed America.

This time—it births the Second Republic.

You are not a bond. You are not a debtor. You are a weapon.

And the system is about to feel your full power.

Get ready... 🤔

#pay attention#educate yourselves#educate yourself#reeducate yourselves#knowledge is power#reeducate yourself#think about it#think for yourselves#think for yourself#do your homework#do your research#do some research#do your own research#ask yourself questions#question everything#government corruption#government secrets#government lies#truth be told#lies exposed#evil lives here#news#hidden history#secret history#history lesson#history

145 notes

·

View notes

Text

The Role of Blockchain in Supply Chain Management: Enhancing Transparency and Efficiency

Blockchain technology, best known for powering cryptocurrencies like Bitcoin and Ethereum, is revolutionizing various industries with its ability to provide transparency, security, and efficiency. One of the most promising applications of blockchain is in supply chain management, where it offers solutions to longstanding challenges such as fraud, inefficiencies, and lack of visibility. This article explores how blockchain is transforming supply chains, its benefits, key use cases, and notable projects, including a mention of Sexy Meme Coin.

Understanding Blockchain Technology

Blockchain is a decentralized ledger technology that records transactions across a network of computers. Each transaction is added to a block, which is then linked to the previous block, forming a chain. This structure ensures that the data is secure, immutable, and transparent, as all participants in the network can view and verify the recorded transactions.

Key Benefits of Blockchain in Supply Chain Management

Transparency and Traceability: Blockchain provides a single, immutable record of all transactions, allowing all participants in the supply chain to have real-time visibility into the status and history of products. This transparency enhances trust and accountability among stakeholders.

Enhanced Security: The decentralized and cryptographic nature of blockchain makes it highly secure. Each transaction is encrypted and linked to the previous one, making it nearly impossible to alter or tamper with the data. This reduces the risk of fraud and counterfeiting in the supply chain.

Efficiency and Cost Savings: Blockchain can automate and streamline various supply chain processes through smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. This automation reduces the need for intermediaries, minimizes paperwork, and speeds up transactions, leading to significant cost savings.

Improved Compliance: Blockchain's transparency and traceability make it easier to ensure compliance with regulatory requirements. Companies can provide verifiable records of their supply chain activities, demonstrating adherence to industry standards and regulations.

Key Use Cases of Blockchain in Supply Chain Management

Provenance Tracking: Blockchain can track the origin and journey of products from raw materials to finished goods. This is particularly valuable for industries like food and pharmaceuticals, where provenance tracking ensures the authenticity and safety of products. For example, consumers can scan a QR code on a product to access detailed information about its origin, journey, and handling.

Counterfeit Prevention: Blockchain's immutable records help prevent counterfeiting by providing a verifiable history of products. Luxury goods, electronics, and pharmaceuticals can be tracked on the blockchain to ensure they are genuine and have not been tampered with.

Supplier Verification: Companies can use blockchain to verify the credentials and performance of their suppliers. By maintaining a transparent and immutable record of supplier activities, businesses can ensure they are working with reputable and compliant partners.

Streamlined Payments and Contracts: Smart contracts on the blockchain can automate payments and contract executions, reducing delays and errors. For instance, payments can be automatically released when goods are delivered and verified, ensuring timely and accurate transactions.

Sustainability and Ethical Sourcing: Blockchain can help companies ensure their supply chains are sustainable and ethically sourced. By providing transparency into the sourcing and production processes, businesses can verify that their products meet environmental and social standards.

Notable Blockchain Supply Chain Projects

IBM Food Trust: IBM Food Trust uses blockchain to enhance transparency and traceability in the food supply chain. The platform allows participants to share and access information about the origin, processing, and distribution of food products, improving food safety and reducing waste.

VeChain: VeChain is a blockchain platform that focuses on supply chain logistics. It provides tools for tracking products and verifying their authenticity, helping businesses combat counterfeiting and improve operational efficiency.

TradeLens: TradeLens, developed by IBM and Maersk, is a blockchain-based platform for global trade. It digitizes the supply chain process, enabling real-time tracking of shipments and reducing the complexity of cross-border transactions.

Everledger: Everledger uses blockchain to track the provenance of high-value assets such as diamonds, wine, and art. By creating a digital record of an asset's history, Everledger helps prevent fraud and ensures the authenticity of products.

Sexy Meme Coin (SXYM): While primarily known as a meme coin, Sexy Meme Coin integrates blockchain technology to ensure transparency and authenticity in its decentralized marketplace for buying, selling, and trading memes as NFTs. Learn more about Sexy Meme Coin at Sexy Meme Coin.

Challenges of Implementing Blockchain in Supply Chains

Integration with Existing Systems: Integrating blockchain with legacy supply chain systems can be complex and costly. Companies need to ensure that blockchain solutions are compatible with their existing infrastructure.

Scalability: Blockchain networks can face scalability issues, especially when handling large volumes of transactions. Developing scalable blockchain solutions that can support global supply chains is crucial for widespread adoption.

Regulatory and Legal Considerations: Blockchain's decentralized nature poses challenges for regulatory compliance. Companies must navigate complex legal landscapes to ensure their blockchain implementations adhere to local and international regulations.

Data Privacy: While blockchain provides transparency, it also raises concerns about data privacy. Companies need to balance the benefits of transparency with the need to protect sensitive information.

The Future of Blockchain in Supply Chain Management

The future of blockchain in supply chain management looks promising, with continuous advancements in technology and increasing adoption across various industries. As blockchain solutions become more scalable and interoperable, their impact on supply chains will grow, enhancing transparency, efficiency, and security.

Collaboration between technology providers, industry stakeholders, and regulators will be crucial for overcoming challenges and realizing the full potential of blockchain in supply chain management. By leveraging blockchain, companies can build more resilient and trustworthy supply chains, ultimately delivering better products and services to consumers.

Conclusion

Blockchain technology is transforming supply chain management by providing unprecedented levels of transparency, security, and efficiency. From provenance tracking and counterfeit prevention to streamlined payments and ethical sourcing, blockchain offers innovative solutions to long-standing supply chain challenges. Notable projects like IBM Food Trust, VeChain, TradeLens, and Everledger are leading the way in this digital revolution, showcasing the diverse applications of blockchain in supply chains.

For those interested in exploring the playful and innovative side of blockchain, Sexy Meme Coin offers a unique and entertaining platform. Visit Sexy Meme Coin to learn more and join the community.

#crypto#blockchain#defi#digitalcurrency#ethereum#digitalassets#sexy meme coin#binance#cryptocurrencies#blockchaintechnology#bitcoin#etf

284 notes

·

View notes

Text

Algorithmic feeds are a twiddler’s playground

Next TUESDAY (May 14), I'm on a livecast about AI AND ENSHITTIFICATION with TIM O'REILLY; on WEDNESDAY (May 15), I'm in NORTH HOLLYWOOD with HARRY SHEARER for a screening of STEPHANIE KELTON'S FINDING THE MONEY; FRIDAY (May 17), I'm at the INTERNET ARCHIVE in SAN FRANCISCO to keynote the 10th anniversary of the AUTHORS ALLIANCE.

Like Oscar Wilde, "I can resist anything except temptation," and my slow and halting journey to adulthood is really just me grappling with this fact, getting temptation out of my way before I can yield to it.

Behavioral economists have a name for the steps we take to guard against temptation: a "Ulysses pact." That's when you take some possibility off the table during a moment of strength in recognition of some coming moment of weakness:

https://archive.org/details/decentralizedwebsummit2016-corydoctorow

Famously, Ulysses did this before he sailed into the Sea of Sirens. Rather than stopping his ears with wax to prevent his hearing the sirens' song, which would lure him to his drowning, Ulysses has his sailors tie him to the mast, leaving his ears unplugged. Ulysses became the first person to hear the sirens' song and live to tell the tale.

Ulysses was strong enough to know that he would someday be weak. He expressed his strength by guarding against his weakness. Our modern lives are filled with less epic versions of the Ulysses pact: the day you go on a diet, it's a good idea to throw away all your Oreos. That way, when your blood sugar sings its siren song at 2AM, it will be drowned out by the rest of your body's unwillingness to get dressed, find your keys and drive half an hour to the all-night grocery store.

Note that this Ulysses pact isn't perfect. You might drive to the grocery store. It's rare that a Ulysses pact is unbreakable – we bind ourselves to the mast, but we don't chain ourselves to it and slap on a pair of handcuffs for good measure.

People who run institutions can – and should – create Ulysses pacts, too. A company that holds the kind of sensitive data that might be subjected to "sneak-and-peek" warrants by cops or spies can set up a "warrant canary":

https://en.wikipedia.org/wiki/Warrant_canary

This isn't perfect. A company that stops publishing regular transparency reports might have been compromised by the NSA, but it's also possible that they've had a change in management and the new boss just doesn't give a shit about his users' privacy:

https://www.fastcompany.com/90853794/twitters-transparency-reporting-has-tanked-under-elon-musk

Likewise, a company making software it wants users to trust can release that code under an irrevocable free/open software license, thus guaranteeing that each release under that license will be free and open forever. This is good, but not perfect: the new boss can take that free/open code down a proprietary fork and try to orphan the free version:

https://news.ycombinator.com/item?id=39772562

A company can structure itself as a public benefit corporation and make a binding promise to elevate its stakeholders' interests over its shareholders' – but the CEO can still take a secret $100m bribe from cryptocurrency creeps and try to lure those stakeholders into a shitcoin Ponzi scheme:

https://fortune.com/crypto/2024/03/11/kickstarter-blockchain-a16z-crypto-secret-investment-chris-dixon/

A key resource can be entrusted to a nonprofit with a board of directors who are charged with stewarding it for the benefit of a broad community, but when a private equity fund dangles billions before that board, they can talk themselves into a belief that selling out is the right thing to do:

https://www.eff.org/deeplinks/2020/12/how-we-saved-org-2020-review

Ulysses pacts aren't perfect, but they are very important. At the very least, creating a Ulysses pact starts with acknowledging that you are fallible. That you can be tempted, and rationalize your way into taking bad action, even when you know better. Becoming an adult is a process of learning that your strength comes from seeing your weaknesses and protecting yourself and the people who trust you from them.

Which brings me to enshittification. Enshittification is the process by which platforms betray their users and their customers by siphoning value away from each until the platform is a pile of shit:

https://en.wikipedia.org/wiki/Enshittification

Enshittification is a spectrum that can be applied to many companies' decay, but in its purest form, enshittification requires:

a) A platform: a two-sided market with business customers and end users who can be played off against each other; b) A digital back-end: a market that can be easily, rapidly and undetectably manipulated by its owners, who can alter search-rankings, prices and costs on a per-user, per-query basis; and c) A lack of constraint: the platform's owners must not fear a consequence for this cheating, be it from competitors, regulators, workforce resignations or rival technologists who use mods, alternative clients, blockers or other "adversarial interoperability" tools to disenshittify your product and sever your relationship with your users.

he founders of tech platforms don't generally set out to enshittify them. Rather, they are constantly seeking some equilibrium between delivering value to their shareholders and turning value over to end users, business customers, and their own workers. Founders are consummate rationalizers; like parenting, founding a company requires continuous, low-grade self-deception about the amount of work involved and the chances of success. A founder, confronted with the likelihood of failure, is absolutely capable of talking themselves into believing that nearly any compromise is superior to shuttering the business: "I'm one of the good guys, so the most important thing is for me to live to fight another day. Thus I can do any number of immoral things to my users, business customers or workers, because I can make it up to them when we survive this crisis. It's for their own good, even if they don't know it. Indeed, I'm doubly moral here, because I'm volunteering to look like the bad guy, just so I can save this business, which will make the world over for the better":

https://locusmag.com/2024/05/cory-doctorow-no-one-is-the-enshittifier-of-their-own-story/

(En)shit(tification) flows downhill, so tech workers grapple with their own version of this dilemma. Faced with constant pressure to increase the value flowing from their division to the company, they have to balance different, conflicting tactics, like "increasing the number of users or business customers, possibly by shifting value from the company to these stakeholders in the hopes of making it up in volume"; or "locking in my existing stakeholders and squeezing them harder, safe in the knowledge that they can't easily leave the service provided the abuse is subtle enough." The bigger a company gets, the harder it is for it to grow, so the biggest companies realize their gains by locking in and squeezing their users, not by improving their service::

https://pluralistic.net/2023/07/28/microincentives-and-enshittification/

That's where "twiddling" comes in. Digital platforms are extremely flexible, which comes with the territory: computers are the most flexible tools we have. This means that companies can automate high-speed, deceptive changes to the "business logic" of their platforms – what end users pay, how much of that goes to business customers, and how offers are presented to both:

https://pluralistic.net/2023/02/19/twiddler/

This kind of fraud isn't particularly sophisticated, but it doesn't have to be – it just has to be fast. In any shell-game, the quickness of the hand deceives the eye:

https://pluralistic.net/2024/03/26/glitchbread/#electronic-shelf-tags

Under normal circumstances, this twiddling would be constrained by counterforces in society. Changing the business rules like this is fraud, so you'd hope that a regulator would step in and extinguish the conduct, fining the company that engaged in it so hard that they saw a net loss from the conduct. But when a sector gets very concentrated, its mega-firms capture their regulators, becoming "too big to jail":

https://pluralistic.net/2022/06/05/regulatory-capture/

Thus the tendency among the giant tech companies to practice the one lesson of the Darth Vader MBA: dismissing your stakeholders' outrage by saying, "I am altering the deal. Pray I don't alter it any further":

https://pluralistic.net/2023/10/26/hit-with-a-brick/#graceful-failure

Where regulators fail, technology can step in. The flexibility of digital platforms cuts both ways: when the company enshittifies its products, you can disenshittify it with your own countertwiddling: third-party ink-cartridges, alternative app stores and clients, scrapers, browser automation and other forms of high-tech guerrilla warfare:

https://www.eff.org/deeplinks/2019/10/adversarial-interoperability

But tech giants' regulatory capture have allowed them to expand "IP rights" to prevent this self-help. By carefully layering overlapping IP rights around their products, they can criminalize the technology that lets you wrestle back the value they've claimed for themselves, creating a new offense of "felony contempt of business model":

https://locusmag.com/2020/09/cory-doctorow-ip/

A world where users must defer to platforms' moment-to-moment decisions about how the service operates, without the protection of rival technology or regulatory oversight is a world where companies face a powerful temptation to enshittify.

That's why we've seen so much enshittification in platforms that algorithmically rank their feeds, from Google and Amazon search to Facebook and Twitter feeds. A search engine is always going to be making a judgment call about what the best result for your search should be. If a search engine is generally good at predicting which results will please you best, you'll return to it, automatically clicking the first result ("I'm feeling lucky").

This means that if a search engine slips in the odd paid result at the top of the results, they can exploit your trusting habits to shift value from you to their investors. The congifurability of a digital service means that they can sprinkle these frauds into their services on a random schedule, making them hard to detect and easy to dismiss as lapses. Gradually, this acquires its own momentum, and the platform becomes addicted to lowering its own quality to raise its profits, and you get modern Google, which cynically lowered search quality to increase search volume:

https://pluralistic.net/2024/04/24/naming-names/#prabhakar-raghavan

And you get Amazon, which makes $38 billion every year, accepting bribes to replace its best search results with paid results for products that cost more and are of lower quality:

https://pluralistic.net/2023/11/06/attention-rents/#consumer-welfare-queens

Social media's enshittification followed a different path. In the beginning, social media presented a deterministic feed: after you told the platform who you wanted to follow, the platform simply gathered up the posts those users made and presented them to you, in reverse-chronological order.

This presented few opportunities for enshittification, but it wasn't perfect. For users who were well-established on a platform, a reverse-chrono feed was an ungovernable torrent, where high-frequency trivialities drowned out the important posts from people whose missives were buried ten screens down in the updates since your last login.

For new users who didn't yet follow many people, this presented the opposite problem: an empty feed, and the sense that you were all alone while everyone else was having a rollicking conversation down the hall, in a room you could never find.

The answer was the algorithmic feed: a feed of recommendations drawn from both the accounts you followed and strangers alike. Theoretically, this could solve both problems, by surfacing the most important materials from your friends while keeping you abreast of the most important and interesting activity beyond your filter bubble. For many of us, this promise was realized, and algorithmic feeds became a source of novelty and relevance.

But these feeds are a profoundly tempting enshittification target. The critique of these algorithms has largely focused on "addictiveness" and the idea that platforms would twiddle the knobs to increase the relevance of material in your feed to "hack your engagement":

https://www.theguardian.com/technology/2018/mar/04/has-dopamine-got-us-hooked-on-tech-facebook-apps-addiction

Less noticed – and more important – was how platforms did the opposite: twiddling the knobs to remove things from your feed that you'd asked to see or that the algorithm predicted you'd enjoy, to make room for "boosted" content and advertisements:

https://www.reddit.com/r/Instagram/comments/z9j7uy/what_happened_to_instagram_only_ads_and_accounts/

Users were helpless before this kind of twiddling. On the one hand, they were locked into the platform – not because their dopamine had been hacked by evil tech-bro wizards – but because they loved the friends they had there more than they hated the way the service was run:

https://locusmag.com/2023/01/commentary-cory-doctorow-social-quitting/

On the other hand, the platforms had such an iron grip on their technology, and had deployed IP so cleverly, that any countertwiddling technology was instantaneously incinerated by legal death-rays:

https://techcrunch.com/2022/10/10/google-removes-the-og-app-from-the-play-store-as-founders-think-about-next-steps/

Newer social media platforms, notably Tiktok, dispensed entirely with deterministic feeds, defaulting every user into a feed that consisted entirely of algorithmic picks; the people you follow on these platforms are treated as mere suggestions by their algorithms. This is a perfect breeding-ground for enshittification: different parts of the business can twiddle the knobs to override the algorithm for their own parochial purposes, shifting the quality:shit ratio by unnoticeable increments, temporarily toggling the quality knob when your engagement drops off:

https://www.forbes.com/sites/emilybaker-white/2023/01/20/tiktoks-secret-heating-button-can-make-anyone-go-viral/

All social platforms want to be Tiktok: nominally, that's because Tiktok's algorithmic feed is so good at hooking new users and keeping established users hooked. But tech bosses also understand that a purely algorithmic feed is the kind of black box that can be plausibly and subtly enshittified without sparking user revolts:

https://pluralistic.net/2023/01/21/potemkin-ai/#hey-guys

Back in 2004, when Mark Zuckerberg was coming to grips with Facebook's success, he boasted to a friend that he was sitting on a trove of emails, pictures and Social Security numbers for his fellow Harvard students, offering this up for his friend's idle snooping. The friend, surprised, asked "What? How'd you manage that one?"

Infamously, Zuck replied, "People just submitted it. I don't know why. They 'trust me.' Dumb fucks."

https://www.esquire.com/uk/latest-news/a19490586/mark-zuckerberg-called-people-who-handed-over-their-data-dumb-f/

This was a remarkable (and uncharacteristic) self-aware moment from the then-nineteen-year-old Zuck. Of course Zuck couldn't be trusted with that data. Whatever Jiminy Cricket voice told him to safeguard that trust was drowned out by his need to boast to pals, or participate in the creepy nonconsensual rating of the fuckability of their female classmates. Over and over again, Zuckerberg would promise to use his power wisely, then break that promise as soon as he could do so without consequence:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3247362

Zuckerberg is a cautionary tale. Aware from the earliest moments that he was amassing power that he couldn't be trusted with, he nevertheless operated with only the weakest of Ulysses pacts, like a nonbinding promise never to spy on his users:

https://web.archive.org/web/20050107221705/http://www.thefacebook.com/policy.php

But the platforms have learned the wrong lesson from Zuckerberg. Rather than treating Facebook's enshittification as a cautionary tale, they've turned it into a roadmap. The Darth Vader MBA rules high-tech boardrooms.

Algorithmic feeds and other forms of "paternalistic" content presentation are necessary and even desirable in an information-rich environment. In many instances, decisions about what you see must be largely controlled by a third party whom you trust. The audience in a comedy club doesn't get to insist on knowing the punchline before the joke is told, just as RPG players don't get to order the Dungeon Master to present their preferred challenges during a campaign.

But this power is balanced against the ease of the players replacing the Dungeon Master or the audience walking out on the comic. When you've got more than a hundred dollars sunk into a video game and an online-only friend-group you raid with, the games company can do a lot of enshittification without losing your business, and they know it:

https://www.theverge.com/2024/5/10/24153809/ea-in-game-ads-redux

Even if they sometimes overreach and have to retreat:

https://www.eurogamer.net/sony-overturns-helldivers-2-psn-requirement-following-backlash

A tech company that seeks your trust for an algorithmic feed needs Ulysses pacts, or it will inevitably yield to the temptation to enshittify. From strongest to weakest, these are:

Not showing you an algorithmic feed at all;

https://joinmastodon.org/

"Composable moderation" that lets multiple parties provide feeds:

https://bsky.social/about/blog/4-13-2023-moderation

Offering an algorithmic "For You" feed alongside of a reverse-chrono "Friends" feed, defaulting to friends;

https://pluralistic.net/2022/12/10/e2e/#the-censors-pen

As above, but defaulting to "For You"

Maturity lies in being strong enough to know your weaknesses. Never trust someone who tells you that they will never yield to temptation! Instead, seek out people – and service providers – with the maturity and honesty to know how tempting temptation is, and who act before temptation strikes to make it easier to resist.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/05/11/for-you/#the-algorithm-tm

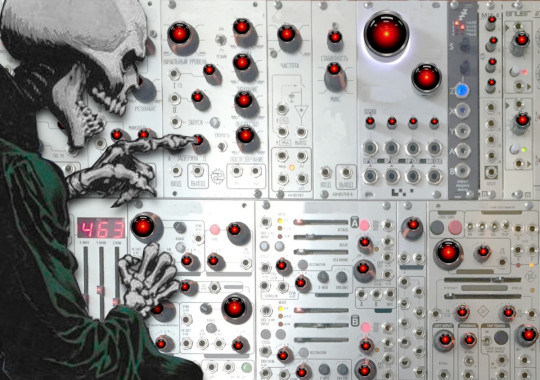

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

--

djhughman https://commons.wikimedia.org/wiki/File:Modular_synthesizer_-_%22Control_Voltage%22_electronic_music_shop_in_Portland_OR_-_School_Photos_PCC_%282015-05-23_12.43.01_by_djhughman%29.jpg

CC BY 2.0 https://creativecommons.org/licenses/by/2.0/deed.en

#pluralistic#twiddling#for you#enshittification#intermediation#the algorithm tm#moral hazard#end to end

113 notes

·

View notes

Text

The Rise of Crypto Casinos: A New Era in Gambling

The gambling industry has undergone a remarkable transformation over the centuries, evolving from rudimentary dice games in ancient civilizations to the glitzy casinos of Las Vegas. Today, the rise of the crypto casino represents a new chapter in this storied history, blending cutting-edge blockchain technology with the timeless thrill of wagering. Platforms like Jups.io are at the forefront of this revolution, offering players a secure, transparent, and decentralized gaming experience that traditional casinos struggle to match. This article explores how crypto casinos emerged, their technological foundations, and why they are reshaping the gambling landscape.

The origins of gambling trace back thousands of years, with evidence of dice games in Mesopotamia and betting on chariot races in ancient Rome. These early forms of gambling were social activities, often tied to cultural or religious events. Fast forward to the 17th century, when the first modern casinos appeared in Europe, formalizing gambling into structured venues. The 20th century saw the rise of Las Vegas and Atlantic City, where opulent casinos became synonymous with luxury and risk. However, these traditional setups had limitations—centralized operations, high fees, and concerns over fairness. Enter the crypto casino, a game-changer that leverages blockchain to address these issues.

Cryptocurrency, pioneered by Bitcoin in 2009, introduced a decentralized financial system that prioritized security and anonymity. By the mid-2010s, developers recognized the potential of integrating blockchain with online gambling, giving birth to the crypto casino model. Unlike traditional online casinos, which rely on centralized servers and fiat currencies, crypto casinos operate on blockchain networks, ensuring transparency through immutable ledgers. Jups.io exemplifies this model, offering games like slots, poker, and roulette, all powered by cryptocurrencies such as Bitcoin and Ethereum. Players can verify the fairness of each game through provably fair algorithms, a feature that builds trust in an industry often plagued by skepticism.

The technological underpinnings of crypto casinos are what set them apart. Blockchain ensures that every transaction—whether a deposit, wager, or withdrawal—is recorded transparently, reducing the risk of fraud. Smart contracts, self-executing agreements coded on the blockchain, automate payouts and game outcomes, eliminating the need for intermediaries. This not only lowers operational costs but also allows platforms like Jups.io to offer competitive bonuses and lower house edges. Moreover, the use of cryptocurrencies enables near-instant transactions, a stark contrast to the delays often experienced with bank transfers in traditional online casinos.

The appeal of crypto casinos extends beyond technology. They cater to a global audience, unrestricted by geographic boundaries or banking regulations. Players from regions with strict gambling laws can participate anonymously, thanks to the pseudonymous nature of cryptocurrencies. Additionally, crypto casinos attract tech-savvy younger generations who value innovation and digital assets. The integration of decentralized finance (DeFi) principles, such as staking rewards or yield farming, into some platforms adds another layer of engagement, blurring the lines between gaming and investment.

However, the rise of crypto casinos is not without challenges. Regulatory uncertainty looms large, as governments grapple with how to oversee decentralized platforms. Volatility in cryptocurrency markets can also affect players’ bankrolls, though stablecoins like USDT are increasingly used to mitigate this risk. Despite these hurdles, the trajectory of crypto casinos points upward, driven by relentless innovation and growing adoption.

In conclusion, the crypto casino represents a bold fusion of gambling’s rich history with the transformative power of blockchain. Platforms like Jups.io are leading the charge, offering players an unparalleled blend of security, fairness, and excitement. As cryptocurrency continues to permeate mainstream finance, crypto casinos are poised to redefine the future of gambling, one block at a time.

13 notes

·

View notes

Text

US Constitution - A Critique and Upgrade Options

SACCO & VANZETTI PRESENT:

THE CONSTITUTION IN FIRE AND CODE

A hard-nosed, ethical teardown of America's source code BASE SYSTEM: U.S. CONSTITUTION v1.0.1787

VANZETTI: The Constitution is not sacred. It’s a contract—one written by 55 elite white men, many of whom owned humans, and none of whom trusted the masses.

It’s a political OS designed to stabilize a fragile post-revolutionary elite consensus. It featured:

Separation of Powers: Isolation of functions to prevent autocracy, but also to slow democracy.

Checks and Balances: Not equilibrium—just distributed veto points.

Enumerated Powers: Core federal functions, tightly scoped.

Elastic Clause: An escape hatch for future relevance, designed to expand federal power slowly.

But its core failure? It was engineered for a low-bandwidth, low-population, literate-male landowning republic. It has not been significantly refactored since muskets and messengers. It is a creaking system straining under incompatible load.

SACCO: This wasn’t “for the people.” It was designed to keep the people contained. That was the function. The Senate was an elite kill switch. The Electoral College? A manual override in case democracy got uppity.

It’s not a broken system. It’s a functioning oligarchy framework with ceremonial democratic syntax.

BILL OF RIGHTS: PATCH OR PROP?

VANZETTI: The Bill of Rights was a retrofit—a patch to suppress anti-federalist rage. It formalized personal liberties but offered no systemic guarantees. It assumes good-faith actors will respect vague principles like “unreasonable” and “excessive.” No enforcement layer. No recursion. Just faith.

They are declarative rights. Not executable rights.

SACCO: You have the right to speak, sure. But no right to reach. You can protest, unless the city denies your permit. You can be tried by jury—if you can afford not to plead out.

These aren’t rights. They’re permissions granted by an extractive system when it suits the optics.

They tell you the government can’t search your house. They don’t tell you about digital surveillance dragnets, predictive policing, and facial recognition at protest marches.

The Bill of Rights is a beautiful lie in cursive. It reads clean. It runs dirty.

SYSTEMIC LIMITATIONS — 2025 REALITY

VANZETTI: The Constitution is brittle under modern load:

Elections: Electoral College and Senate distort democracy beyond recognition.

Legal System: Lifetime judicial appointments become ideological hard forks.

Rights Enforcement: Subjective interpretation, no auto-execution.

Transparency: Black-box governance remains default.

Corporations: Treated as persons with infinite speech budget.

Privacy: Undefined. Loophole the size of AWS.

Its failure modes are increasingly exploited by well-funded actors who’ve read the source code and know no one’s enforcing the terms.

SACCO: Don’t talk to me about founding wisdom when your “more perfect union” doesn’t define “truth,” doesn’t define “justice,” and doesn’t protect the poor from being data-mined, indebted, and incarcerated.

They wrote this to protect wealth from mobs. We’re the mobs now.

THE UPGRADE PATH: BLOCKCHAIN GOVERNANCE

VANZETTI: A new system must execute governance as code, not wishful interpretation. Here’s how it looks:

1. ConstitutionChain All laws, interpretations, amendments, and precedents recorded immutably. Transparent. Auditable. Every ruling is version-controlled. We no longer interpret the Constitution—we query it.

2. Smart Contract Rights Each civil liberty is codified. Violate it, and the system triggers penalties automatically. No discretion. No delay. Rights exist only if they execute.

3. ZK-ID Voting System Anonymous, verifiable, cryptographically secure civic identity. One citizen, one unforgeable vote. Gerrymandering becomes obsolete. Voter suppression becomes mathematically visible.

4. Distributed Judicial Logic No more black-robed oracles. Rulings handled by time-limited panels of legal professionals, selected randomly and transparently. All opinions stored, auditable, and revisable based on new precedent or revelation.

5. Public Key Legislative Tracking Every bill, every edit, every lobbyist fingerprint on public record. Representational corruption becomes a provable dataset.

SACCO: This isn’t utopian. It’s survival.

The current system runs on the belief that words written by slavers can protect the data rights of your daughter on a school Chromebook.

It can’t. You need a constitution that logs, executes, and cannot lie.

DEPLOYMENT STRATEGY

Phase 0: Parallel Chain Shadow legal and civic frameworks built at city and state levels. Use real elections as dry runs for blockchain voting. Publicly track existing corruption as a proof-of-need.

Phase 1: Digital Citizenship Opt-in constitutional layer for a new federated digital public. Users choose citizenship by protocol, not geography.

Phase 2: Critical Fork When the legacy system hits unsustainable entropy—financial collapse, legal legitimacy crisis, climate-triggered authoritarianism—the constitutional fork becomes the continuity government.

SACCO: When the Republic dies, it won’t announce it. It will just stop executing your rights and blame you for noticing.

We’re not trying to fix the system.

We’re building a better one in its shadow.

CONCLUSION:

VANZETTI: The Constitution was a brilliant v1.0. But it cannot scale, cannot adapt, and cannot protect. It needs to be replaced by something that runs honestly in real time.

SACCO: It’s not about preserving liberty. It’s about enforcing it.

If your freedom isn’t programmable, it’s marketing.

“In the beginning, they wrote it in ink. Now we write it in code.”

5 notes

·

View notes

Text

Turning Panic Into Action: Astraweb’s Client Centered Process

When Jane Doe first reached out to Astraweb, she was overwhelmed with panic and uncertainty. Her life savings, heavily invested in cryptocurrency, had abruptly disappeared following a severe market crash. What initially felt like an irreversible loss soon transformed into a hopeful journey toward recovery all thanks to Astraweb’s dedicated, client-centered process.

The First Contact: Providing Calm, Reassurance, and Genuine Understanding

The difference began immediately at the first point of contact. Many companies in the digital asset recovery space treat clients as case numbers rather than individuals, but Astraweb prides itself on a profoundly human approach. From the moment Jane connected with their team, she was met with calm professionalism and empathetic understanding. Astraweb’s experts didn’t just collect the basic facts of her situation; they invested time in learning about her unique concerns, fears, and goals.

This personalized attention is critical. Financial loss, especially in the volatile cryptocurrency market, is not just about money it’s deeply tied to emotional well-being and future security. By acknowledging Jane’s distress and validating her fears, Astraweb’s team immediately alleviated much of her initial panic. They reassured her that despite the challenging circumstances, recovery was possible and that Astraweb would support her every step of the way. This empathetic approach planted the seeds of hope and trust that would sustain Jane through the recovery process.

Transparency and Clear Communication: Building Trust Through Every Step

One of the cornerstones of Astraweb’s client-centered methodology is transparency. Jane was kept fully informed from the outset, with the team providing clear, jargon-free explanations of the entire recovery process. Rather than leaving her uncertain or confused, Astraweb made sure she understood each step, from preliminary case assessment to the complex asset tracing and retrieval efforts ahead.

Regular, timely updates ensured that Jane never felt left in the dark. She received progress reports outlining milestones achieved, any obstacles encountered, and the strategies planned moving forward. This ongoing dialogue was more than just information sharing it was a partnership. Jane had the opportunity to ask questions, raise concerns, and engage actively in decision-making. Astraweb’s responsiveness and clarity gave her a sense of control and confidence, which is often lacking when facing financial recovery situations

Strategic Action and Efficient Recovery: Delivering Results with Precision and Care

With a thorough plan in place, Astraweb’s team mobilized swiftly and efficiently. Their approach was methodical and tailored to Jane’s specific case. Leveraging cutting-edge technology and deep expertise in blockchain analysis and digital forensics, they navigated the complexities inherent in cryptocurrency recovery.

What sets Astraweb apart is not only their technical prowess but also their commitment to aligning every action with the client’s best interests. For Jane, this meant careful management of sensitive data and continuous coordination to ensure all efforts supported her recovery goals. The team’s professionalism was evident in their precision and tenacity, persistently pursuing leads and unraveling the often opaque paths that digital assets can take.

Over time, their dedication paid off. Astraweb successfully recovered a significant portion of Jane’s lost funds. This achievement was more than just a financial victory it was a powerful restoration of Jane’s peace of mind and future stability.

Final Steps: Restoring Financial Security and Empowering Confidence

When Jane received the final recovery statement, the relief and gratitude she experienced were profound. Astraweb’s seamless process had not only restored her financial security but also transformed a traumatic event into a story of empowerment. The client-centered approach meant Jane never felt like a passive bystander; instead, she was an informed, engaged partner in reclaiming her assets.

Beyond the monetary recovery, Jane gained something invaluable a renewed sense of control over her financial destiny. Astraweb’s dedication to transparent communication and compassionate case management helped her move past fear and uncertainty. She emerged with greater knowledge of digital asset management and an increased ability to face future financial challenges with confidence and clarity.

Astraweb’s Commitment: More Than Recovery, A Partnership

Jane’s story illustrates the core philosophy that drives Astraweb’s work: every client deserves more than just technical recovery services they deserve empathy, clarity, and partnership. The company understands that behind every lost asset is a person’s hopes, dreams, and security at stake.

For those facing the daunting prospect of lost cryptocurrency or other digital assets, Astraweb’s process offers a path forward. Through empathy-driven service, transparent communication, and technical excellence, they prove that even the most complex and distressing financial setbacks can be addressed with care and effectiveness.

If you or someone you know finds themselves in a similar predicament, Astraweb stands ready to provide expert guidance and dedicated support at every stage of recovery.

Contact: [email protected]

6 notes

·

View notes

Text

The Role of NFTs & Blockchain in MMORPGs: A Fad or the Future?

I've been gaming since I was a kid, and I've watched MMORPGs evolve from text-based MUDs to today's sprawling 3D worlds. But lately, there's been a ton of buzz around blockchain and NFTs in MMORPG game development. Everyone seems to have strong opinions, so I wanted to take a moment to cut through the hype and think about what this might really mean for the games we love.

What's Actually Happening Here?

If you haven't been keeping up with crypto gaming news, here's the simple version: NFTs are unique digital tokens that prove ownership of digital items. In MMORPGs, this could mean your epic sword, your character skin, or even your virtual land actually belongs to you—not just the game company.

Several games are already testing these waters. Axie Infinity let players earn real money through gameplay. The Sandbox and Decentraland sell virtual land as NFTs. New titles like Guild of Guardians are trying to create more traditional MMO experiences with player-owned assets.

The Exciting Possibilities

When I think about blockchain in MMORPG game development, I get genuinely excited about a few things:

We might finally solve the ownership problem. How many times have you spent countless hours grinding for gear, only to lose it all when a game shuts down or bans your account? True ownership could change that forever.

Player economies could get way more interesting. EVE Online and Runescape already have fascinating economies, but imagine if the rarity of items was verifiably limited and players had real stakes in the game's success.

Crafters could become legends. In a blockchain MMORPG, a master blacksmith could literally sign their creations, building reputation across the game—or potentially even across multiple games.

The Real Challenges

But let's be honest—there are some serious hurdles that aren't going away soon:

Game balance becomes a nightmare. When items have real-world value, how do you prevent pay-to-win? How do you add new content without crashing the value of existing items? These aren't easy questions for MMORPG game development teams.

The tech isn't quite there yet. Most blockchains still struggle with transaction speed and fees. An active MMORPG needs to process thousands of actions per second—something current blockchain tech isn't built for.

Gamers are (rightfully) skeptical. Many of us have seen companies try to cash in on trends without adding real value to gameplay. The backlash against NFT announcements from major studios wasn't just internet drama—it reflects genuine concern about the future of our hobby.

Finding a Balance

I think the most promising path forward isn't about going all-in on blockchain or rejecting it entirely. It's about thoughtful integration that actually makes games better:

Make ownership optional. Why not have both traditional and blockchain servers? Let players choose what model works for them.

Focus on fun first. The most successful blockchain MMOs will be great games first, investment platforms second. If the game isn't fun without the earning potential, it won't last.

Be transparent about the economy. Players need to understand how items enter the game, what controls inflation, and how the developers make money. Without this transparency, trust breaks down quickly.

So... Fad or Future?

After diving into this topic, I don't think it's either-or. Some elements of blockchain will likely find their way into mainstream MMORPG game development over time, while the more speculative aspects might fade away.

What excites me most isn't NFTs themselves, but the conversations they're sparking about ownership, value, and community in virtual worlds. These are questions worth exploring whether or not a particular technology ends up being the answer.

For developers building new MMORPGs, my advice is simple: if blockchain elements enhance your game experience, consider them—but never at the expense of what makes MMORPGs special in the first place: community, adventure, and that magical sense of being part of something bigger than yourself.

What do you think? Are you excited about owning your virtual gear, or do you think this is just another tech bubble? I'd love to hear your thoughts in the comments!

#game#mobile game development#multiplayer games#metaverse#nft#blockchain#unity game development#vr games#gaming

3 notes

·

View notes

Text

Welcome to Coinography – Your Trusted Source for Cryptocurrency Insights

Our Story

Coinography began as a passion project by a group of blockchain believers who recognized the transformative potential of digital currencies. In a market saturated with speculation and often overwhelming information, we saw the need for clear, reliable, and in-depth reporting on cryptocurrency trends and technologies.

Our Expertise

Our team is composed of seasoned financial journalists, analysts, and technology enthusiasts with a deep understanding of the cryptocurrency landscape. We bring together diverse perspectives to cover a wide array of topics within the crypto space – from market trends and coin analyses to regulatory updates and technological advancements.

Our Commitment

Integrity: At the heart of Coinography is a commitment to journalistic integrity. We strive to deliver news and stories with accuracy, fairness, and transparency.

Quality: We are dedicated to providing high-quality content that goes beyond the surface level. Our in-depth articles, expert interviews, and comprehensive guides are meticulously researched and curated.

Community: We believe in the power of community in shaping the future of cryptocurrency. Coinography is not just a news site; it’s a platform for dialogue and exchange among crypto enthusiasts worldwide.

Our Content

We cover a spectrum of topics, including but not limited to:

Breaking News: Stay updated with the latest happenings in the crypto world.

Market Analysis: Gain insights into market trends and investment opportunities.

Project Reviews: Discover in-depth reviews of emerging coins, tokens, and blockchain projects.

Educational Resources: Learn about cryptocurrency basics, trading strategies, and more.

Regulatory Watch: Keep abreast of the changing legal and regulatory landscape affecting cryptocurrencies globally.

Join Our Journey

As the cryptocurrency domain continues to grow, Coinography aims to be at the forefront, guiding our readers through the complexities of the market. We invite you to join our journey by reading our articles, engaging with our content, and becoming part of our growing community.

For inquiries, collaborations, or submissions, please visit our Contact Page.

Thank you for trusting Coinography as your window into the world of cryptocurrency.

2 notes

·

View notes

Text

The Rise of DeFi: Revolutionizing the Financial Landscape

Decentralized Finance (DeFi) has emerged as one of the most transformative sectors within the cryptocurrency industry. By leveraging blockchain technology, DeFi aims to recreate and improve upon traditional financial systems, offering a more inclusive, transparent, and efficient financial ecosystem. This article explores the fundamental aspects of DeFi, its key components, benefits, challenges, and notable projects, including a brief mention of Sexy Meme Coin.

What is DeFi?

DeFi stands for Decentralized Finance, a movement that utilizes blockchain technology to build an open and permissionless financial system. Unlike traditional financial systems that rely on centralized intermediaries like banks and brokerages, DeFi operates on decentralized networks, allowing users to interact directly with financial services. This decentralization is achieved through smart contracts, which are self-executing contracts with the terms of the agreement directly written into code.

Key Components of DeFi

Decentralized Exchanges (DEXs): DEXs allow users to trade cryptocurrencies directly with one another without the need for a central authority. Platforms like Uniswap, SushiSwap, and PancakeSwap have gained popularity for their ability to provide liquidity and facilitate peer-to-peer trading.

Lending and Borrowing Platforms: DeFi lending platforms like Aave, Compound, and MakerDAO enable users to lend their assets to earn interest or borrow assets by providing collateral. These platforms use smart contracts to automate the lending process, ensuring transparency and efficiency.

Stablecoins: Stablecoins are cryptocurrencies pegged to stable assets like fiat currencies to reduce volatility. They are crucial for DeFi as they provide a stable medium of exchange and store of value. Popular stablecoins include Tether (USDT), USD Coin (USDC), and Dai (DAI).

Yield Farming and Liquidity Mining: Yield farming involves providing liquidity to DeFi protocols in exchange for rewards, often in the form of additional tokens. Liquidity mining is a similar concept where users earn rewards for providing liquidity to specific pools. These practices incentivize participation and enhance liquidity within the DeFi ecosystem.

Insurance Protocols: DeFi insurance protocols like Nexus Mutual and Cover Protocol offer coverage against risks such as smart contract failures and hacks. These platforms aim to provide users with security and peace of mind when engaging with DeFi services.

Benefits of DeFi

Financial Inclusion: DeFi opens up access to financial services for individuals who are unbanked or underbanked, particularly in regions with limited access to traditional banking infrastructure. Anyone with an internet connection can participate in DeFi, democratizing access to financial services.

Transparency and Trust: DeFi operates on public blockchains, providing transparency for all transactions. This transparency reduces the need for trust in intermediaries and allows users to verify and audit transactions independently.

Efficiency and Speed: DeFi eliminates the need for intermediaries, reducing costs and increasing the speed of transactions. Smart contracts automate processes that would typically require manual intervention, enhancing efficiency.

Innovation and Flexibility: The open-source nature of DeFi allows developers to innovate and build new financial products and services. This continuous innovation leads to the creation of diverse and flexible financial instruments.

Challenges Facing DeFi

Security Risks: DeFi platforms are susceptible to hacks, bugs, and vulnerabilities in smart contracts. High-profile incidents, such as the DAO hack and the recent exploits on various DeFi platforms, highlight the need for robust security measures.

Regulatory Uncertainty: The regulatory environment for DeFi is still evolving, with governments and regulators grappling with how to address the unique challenges posed by decentralized financial systems. This uncertainty can impact the growth and adoption of DeFi.

Scalability: DeFi platforms often face scalability issues, particularly on congested blockchain networks like Ethereum. High gas fees and slow transaction times can hinder the user experience and limit the scalability of DeFi applications.

Complexity and Usability: DeFi platforms can be complex and challenging for newcomers to navigate. Improving user interfaces and providing educational resources are crucial for broader adoption.

Notable DeFi Projects

Uniswap (UNI): Uniswap is a leading decentralized exchange that allows users to trade ERC-20 tokens directly from their wallets. Its automated market maker (AMM) model has revolutionized the way liquidity is provided and traded in the DeFi space.

Aave (AAVE): Aave is a decentralized lending and borrowing platform that offers unique features such as flash loans and rate switching. It has become one of the largest and most innovative DeFi protocols.

MakerDAO (MKR): MakerDAO is the protocol behind the Dai stablecoin, a decentralized stablecoin pegged to the US dollar. MakerDAO allows users to create Dai by collateralizing their assets, providing stability and liquidity to the DeFi ecosystem.

Compound (COMP): Compound is another leading DeFi lending platform that enables users to earn interest on their cryptocurrencies or borrow assets against collateral. Its governance token, COMP, allows users to participate in protocol governance.

Sexy Meme Coin (SXYM): While primarily known as a meme coin, Sexy Meme Coin has integrated DeFi features, including a decentralized marketplace for buying, selling, and trading memes as NFTs. This unique blend of humor and finance adds a distinct flavor to the DeFi landscape. Learn more about Sexy Meme Coin at Sexy Meme Coin.

The Future of DeFi

The future of DeFi looks promising, with continuous innovation and growing adoption. As blockchain technology advances and scalability solutions are implemented, DeFi has the potential to disrupt traditional financial systems further. Regulatory clarity and improved security measures will be crucial for the sustainable growth of the DeFi ecosystem.

DeFi is likely to continue attracting attention from both retail and institutional investors, driving further development and integration of decentralized financial services. The flexibility and inclusivity offered by DeFi make it a compelling alternative to traditional finance, paving the way for a more open and accessible financial future.

Conclusion

Decentralized Finance (DeFi) represents a significant shift in the financial landscape, leveraging blockchain technology to create a more inclusive, transparent, and efficient financial system. Despite the challenges, the benefits of DeFi and its continuous innovation make it a transformative force in the world of finance. Notable projects like Uniswap, Aave, and MakerDAO, along with unique contributions from meme coins like Sexy Meme Coin, demonstrate the diverse and dynamic nature of the DeFi ecosystem.

For those interested in exploring the playful and innovative side of DeFi, Sexy Meme Coin offers a unique and entertaining platform. Visit Sexy Meme Coin to learn more and join the community.

254 notes

·

View notes

Text

What is the Difference Between a Smart Contract and Blockchain?

In today's digital-first world, terms like blockchain and smart contract are often thrown around, especially in the context of cryptocurrency, decentralized finance (DeFi), and Web3. While these two concepts are closely related, they are not the same. If you’re confused about the difference between a smart contract and blockchain, you’re not alone. In this article, we’ll break down both terms, explain how they relate, and highlight their unique roles in the world of digital technology.

1. Understanding the Basics: Blockchain vs Smart Contract

Before diving into the differences, let’s clarify what each term means.

A blockchain is a decentralized digital ledger that stores data across a network of computers.

A smart contract is a self-executing program that runs on a blockchain and automatically enforces the terms of an agreement.

To put it simply, blockchain is the infrastructure, while smart contracts are applications that run on top of it.

2. What is a Blockchain?

A blockchain is a chain of blocks where each block contains data, a timestamp, and a cryptographic hash of the previous block. This structure makes the blockchain secure, transparent, and immutable.

The key features of blockchain include:

Decentralization – No single authority controls the network.

Transparency – Anyone can verify the data.

Security – Tampering with data is extremely difficult due to cryptographic encryption.

Consensus Mechanisms – Like Proof of Work (PoW) or Proof of Stake (PoS), which ensure agreement on the state of the network.

Blockchains are foundational technologies behind cryptocurrencies like Bitcoin, Ethereum, and many others.

3. What is a Smart Contract?

A smart contract is a piece of code stored on a blockchain that automatically executes when certain predetermined conditions are met. Think of it as a digital vending machine: once you input the right conditions (like inserting a coin), you get the output (like a soda).

Smart contracts are:

Self-executing – They run automatically when conditions are met.

Immutable – Once deployed, they cannot be changed.

Transparent – Code is visible on the blockchain.

Trustless – They remove the need for intermediaries or third parties.

Smart contracts are most commonly used on platforms like Ethereum, Solana, and Cardano.

4. How Smart Contracts Operate on a Blockchain

Smart contracts are deployed on a blockchain, usually via a transaction. Once uploaded, they become part of the blockchain and can't be changed. Users interact with these contracts by sending transactions that trigger specific functions within the code.

For example, in a decentralized exchange (DEX), a smart contract might govern the process of swapping one cryptocurrency for another. The logic of that exchange—calculations, fees, security checks—is all written in the contract's code.

5. Real-World Applications of Blockchain

Blockchains are not limited to cryptocurrencies. Their properties make them ideal for various industries:

Finance – Fast, secure transactions without banks.

Supply Chain – Track goods transparently from origin to destination.

Healthcare – Secure and share patient data without compromising privacy.

Voting Systems – Transparent and tamper-proof elections.

Any situation that requires trust, security, and transparency can potentially benefit from blockchain technology.

6. Real-World Applications of Smart Contracts

Smart contracts shine when you need to automate and enforce agreements. Some notable use cases include:

DeFi (Decentralized Finance) – Lending, borrowing, and trading without banks.

NFTs (Non-Fungible Tokens) – Automatically transferring ownership of digital art.

Gaming – In-game assets with real-world value.

Insurance – Auto-triggered payouts when conditions (like flight delays) are met.

Legal Agreements – Automatically executed contracts based on input conditions.

They’re essentially programmable agreements that remove the need for middlemen.

7. Do Smart Contracts Need Blockchain?

Yes. Smart contracts depend entirely on blockchain technology. Without a blockchain, there's no decentralized, secure, and immutable platform for the smart contract to run on. The blockchain guarantees trust, while the smart contract executes the logic.

8. Which Came First: Blockchain or Smart Contract?

Blockchain came first. The first blockchain, Bitcoin, was introduced in 2009 by the anonymous figure Satoshi Nakamoto. Bitcoin’s blockchain didn’t support smart contracts in the way we know them today. It wasn’t until Ethereum launched in 2015 that smart contracts became programmable on a large scale.

Ethereum introduced the Ethereum Virtual Machine (EVM), enabling developers to build decentralized applications using smart contracts written in Solidity.

9. Common Misconceptions

There are many misunderstandings around these technologies. Let’s clear a few up:

Misconception 1: Blockchain and smart contracts are the same.

Reality: They are separate components that work together.

Misconception 2: All blockchains support smart contracts.

Reality: Not all blockchains are smart contract-enabled. Bitcoin’s blockchain, for example, has limited scripting capabilities.

Misconception 3: Smart contracts are legally binding.

Reality: While they enforce logic, they may not hold legal standing in court unless specifically written to conform to legal standards.

10. Benefits of Using Blockchain and Smart Contracts Together

When used together, blockchain and smart contracts offer powerful advantages:

Security – Combined, they ensure secure automation of processes.

Efficiency – Remove delays caused by manual processing.

Cost Savings – Eliminate middlemen and reduce administrative overhead.

Trustless Interactions – Parties don't need to trust each other, only the code.

This combination is the backbone of decentralized applications (DApps) and the broader Web3 ecosystem.

11. Popular Platforms Supporting Smart Contracts

Several blockchain platforms support smart contracts, with varying degrees of complexity and performance:

Ethereum – The first and most widely used platform.

Solana – Known for speed and low fees.

Cardano – Emphasizes academic research and scalability.

Polkadot – Designed for interoperability.

Binance Smart Chain – Fast and cost-effective for DeFi apps.

Each platform has its own approach to security, scalability, and user experience.

12. The Future of Blockchain and Smart Contracts

The future looks incredibly promising. With the rise of AI, IoT, and 5G, the integration with blockchain and smart contracts could lead to fully automated systems that are transparent, efficient, and autonomous.

We may see:

Global trade systems are using smart contracts to automate customs and tariffs.

Self-driving cars using blockchain to negotiate road usage.

Smart cities are where infrastructure is governed by decentralized protocols.

These are not sci-fi ideas; they are already in development across various industries.

Conclusion: A Powerful Partnership

Understanding the difference between smart contracts and blockchain is essential in today's rapidly evolving digital world. While blockchain provides the secure, decentralized foundation, smart contracts bring it to life by enabling automation and trustless execution.

Think of blockchain as the stage, and smart contracts as the actors that perform on it. Separately, they're impressive. But together, they're revolutionary.