#undue medical debt

Text

The 7th script of 7 donated by Eric Kripke as a raffle prize for our final fundraiser for Undue Medical Debt [FKA RIP Medical Debt] is 6.22 "The Man Who Knew Too Much."

Our fundraising page and our raffle open on April 25, but you can preview all of the prizes here.

29 notes

·

View notes

Text

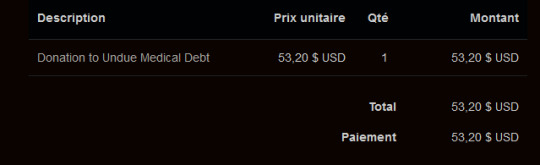

The awaited d*nation post!

Thank you for the lovely community here on Drink Your Villain Juice, Choices of Games, and the Interactive Fiction for making the d*nation to undue medical debt a possibility!!!

The one and only secretary on her computer

22 notes

·

View notes

Text

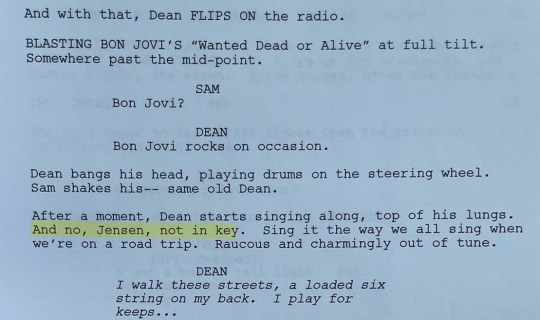

“And no, Jensen, not in key.”

This script (and many others!) are official scripts from Eric Kripke himself, and are going to be part of a fundraiser for Undue Medical Debt (formerly known as RIP Medical Debt). They buy medical debt for pennies, and then forgive it! The fundraiser starts April 25th! That’s right, this script could be yours! Click HERE for more info!

#jensen ackles#dean winchester#Sam and Dean#ain’t no rest for the wicked#supernatural#supernatural rewatch#supernatural fandom#spn#spn rewatch#spn fandom

4K notes

·

View notes

Text

How Frequently Can I Take Out Short Term Loans UK Direct Lender?

Although we hope that you won't have many emergencies, if you've ever gotten a short term loans from us, you might be able to do so again. You may be able to apply for up to £2,000 if you successfully repaid your first loan with us, but this is not a guarantee. If repeated borrowing is necessary, we will still run a credit check and use open banking to determine your current affordability. This is to make sure that nothing has changed since you last applied for a loan from us. Any short term loans UK direct lender you obtain from us are intended for sporadic use only; they are not intended to help you pay off existing debt. Our loans are not meant to be used on a long-term basis. Please get in touch with us if you have any inquiries concerning online emergency loans.

The most practical lending choice when you're strapped for cash and require extra funds to cover unexpected expenses between paydays is a short term loans UK direct lender. You are not required to give the lender any kind of documentation in order to secure the loan. Keep in mind that there are numerous lenders, and some of them perform credit checks to weed out any risky situations.

You must meet a few minimal standards in order to benefit financially from short term loans direct lenders. You have been a regular employee for more than three months and earn a minimum of £1000 per month as a permanent resident of the United Kingdom. In addition, the salary must be sent to an active checking account.

If you have adverse credit factors such as defaults, arrears, foreclosure, late payments, CCJs, IVAs, insolvency, etc., you may be eligible to receive money without having your credit history verified. However, in order to avoid further fees, you must repay the loan within a certain time period.

Classic Quid allow you to borrow between £100 and £2500 with a flexible repayment schedule of 2-4 weeks. There isn't any placing of collateral in place of the short term loans direct lenders. The list of financial uses for the money includes paying for tuition for your child's school, medical costs, electricity bills, food shop bills, and more.

No Use of a Debit Card for Short Term Cash Loans UK Direct Lenders

You can borrow everything from a £100 loan to a £2,500 loan with rapid loans and short term cash loans. While returning customers may be eligible for up to £2,500 and a maximum payback term of 12 months, new customers may only apply for a maximum of £1000 and choose flexible installments of up to 8 months.

With short term loans UK direct lender money, you may immediately take back control of your life by using them to rapidly pay for unforeseen obligations. We are here to provide the required funds to address these problems quickly when you don't have any available savings, whether you are dealing with a sudden boiler failure, urgent auto repairs, a broken washing machine, or any other unanticipated emergency.

To find out if we can instantly pre-approve your short term loans UK, click Request Fund. At Classic Quid, we're dedicated to supporting people in need during trying times so that you may get through financial challenges without undue worry.https://classicquid.co.uk/

3 notes

·

View notes

Note

I saw someone say that really, the true root of overturning roe v. wade is to keep the poor poor and I 100% see what they are saying.

this is an attack on all women, but especially poor women who lack time, money and resources to get an abortion. they lack time because poor women are more likely to work in sectors that have unreliable or long working hours and then go home to hours and hours of unpaid care. money, because they are often working in jobs that are either low pay and low respect or contract or multiple different jobs (which also influences the time they have available to themselves and for themselves). they lack resources for so many different reasons, including lack of time and money, but also they may live in impoverished neighbourhoods were they are removed from hospitals and medical care, or they have no one to watch family they may have in order to go get an abortion.

if poor women are forced to have children they do not want, especially if they are already struggling financially, it will push them deeper into debt and poverty, therefore making it more likely that the cycle will repeat itself with their kids.

Ugh anon, you are unfortunately SO RIGHT (also sorry it’s taken me a lil while to answer this ask!). As Pedro himself said:

Abortion access is, among many other things, an issue of class warfare. It is an issue of economic justice, gender justice, and racial justice (because think about who is disproportionately likely to be poor in the US - it’s women of color). It’s also, as I’ve mentioned before in answering other asks about this, fundamentally about control. It is about the ability and desire of conservative, right-wing Christian men to control women (and it is super important to use gender-inclusive language when talking about abortion, because not all women can get pregnant and not all who can get pregnant are women, but from the viewpoint of anti-abortion religious extremists, it’s about controlling women, because you can bet they only view the world in terms of a very strict gender binary).

People are understandably focusing on how Dobbs overturns Roe, but I think it is also important to understand that the majority opinion explicitly overturned not just Roe, but also Casey. Planned Parenthood v. Casey was decided in 1992 and created the undue burden standard for abortion restrictions. Roe v. Wade held that states could not restrict abortion access for pregnancies in the first trimester, allowed some regulations on abortions during the second trimester, and allowed far greater restrictions on pregnancies in the third trimester.

But under Casey, the trimester framework under Roe was overturned in favor of viability analysis, that is, states gained leeway to regulate abortion access after the point in pregnancy that a fetus could reasonably be considered viable if born prematurely, which is many weeks earlier than the 28th week at which the third trimester begins. Stares could impose restrictions on abortion access as long as the regulations did not constitute an “undue burden” on the person trying to get an abortion.

But of course, having a Supreme Court made up of mostly conservative white men deciding what constitutes an undue burden on abortion access for mostly poor people often went exactly how you’d expect. In the actual Casey case, this meant that the majority opinion threw out a Pennsylvania state requirement that married women trying to get abortions notify their spouses of their desire to abort, but not other requirements like parental consent for minors who need abortions and a 24-hour waiting period. But if you’re a pregnant person working a low-wage job that doesn’t offer paid leave, or you already have at least one child you need to find childcare for (like 6 in 10 people who get abortions in the US), or you need to travel hundreds of miles to get to your nearest abortion clinic, I think you’d say having to have your first appointment at a clinic AND THEN WAIT AN ADDITIONAL 24 HOURS BEFORE YOU CAN GET THE PROCEDURE (a waiting period that clearly has no basis in medicine and is absolutely meant to deter people from accessing abortion), I think you’d say that shit absolutely constitutes an undue fucking burden!

All of this to say that you are totally right. Poor people - especially poor people of color - are the ones who will be hurt the most by Dobbs. This is why it is more important than ever to donate to abortion funds. Abortion funds are organizations that have been working in this space for many years and are experts in navigating state restrictions on abortions to get folks the care they need.

As Daddy Pedro said:

(Gif by a7estrellas)

3 notes

·

View notes

Text

Empower Your Financial Journey: The Benefits of Personal Loans

In today's fast-paced world, financial stability is crucial for leading a comfortable life. However, unforeseen circumstances like medical emergencies, home repairs, or even weddings can put a strain on our finances. Personal loans Melbourne have emerged as a viable solution to such situations, empowering individuals to take control of their financial journey.

Understanding Personal Loans

A personal loan is a type of financial product offered by banks, credit unions, and online lenders. It is an unsecured loan, which means that it does not require any collateral, such as your home or car, to be put up as security. Personal loans are typically used to cover a wide range of personal expenses and can be obtained for various purposes, such as paying off high-interest debt, funding home improvements, covering medical expenses, or even taking a dream vacation.

Personal loans come with a fixed interest rate and a predetermined repayment period, which is usually between one to five years. The borrower receives a lump sum of money upfront and then makes regular monthly payments to repay the loan, including both the principal amount and interest.

Benefits of Availing a Personal Loans

Flexibility and Versatility: Personal loans offer unmatched flexibility and versatility in terms of usage. Unlike other loans, which are tied to specific purposes like buying a car or a house, personal loans can be utilized for a wide range of needs. Whether it's consolidating high-interest debt, funding a dream vacation, or investing in a business opportunity, personal loans provide the financial backing you need to make it happen.

Quick and Easy Access to Funds: One of the primary advantages of personal loans is the speed at which they are disbursed. Once your loan application is approved, the funds are usually made available within a few days or even hours, depending on the lender. This quick access to funds can be a lifesaver in emergencies, ensuring that you have the necessary resources to tackle unexpected situations without undue stress.

Affordable Interest Rates: Personal loans often come with competitive interest rates, making them an attractive option for borrowers. These rates are usually lower than those associated with credit cards, which can save you a significant amount of money in interest charges over the life of the loan. Additionally, many lenders offer fixed interest rates, ensuring that your monthly payments remain consistent and predictable.

No Collateral Required: Unlike other types of loans, personal loans typically do not require collateral. This means that your valuable assets, such as your home or car, are not at risk if you're unable to repay the loan. While this may result in slightly higher interest rates, it provides peace of mind and security for borrowers who may not wish to put their assets on the line.

Personal loans offer a range of benefits that can significantly impact your financial journey. From flexibility and quick access to funds, personal loans provide a valuable tool for managing your finances. By responsibly utilizing personal loans, you can empower yourself to navigate your financial path with confidence and achieve your financial goals.

0 notes

Text

Exploring the Benefits of Using a Personal Loan App

Introduction: In today’s fast-paced world, financial stability and growth are essential for achieving personal and professional aspirations. Personal loan apps have emerged as convenient tools to address immediate financial needs and propel individuals towards their goals. This blog explores the myriad benefits of using a personal loan app, focusing on how it can contribute to financial growth and empowerment.

Convenience and Accessibility:

One of the primary benefits of a personal loan app is its convenience and accessibility. Unlike traditional loan processes that involve extensive paperwork and time-consuming approval procedures, personal loan apps offer a streamlined and hassle-free experience. With just a few taps on their smartphones, users can apply for a loan anytime, anywhere, eliminating the need to visit banks or financial institutions.

Quick Approval and Disbursement:

Personal loan apps leverage technology to expedite the loan approval and disbursement process. By integrating advanced algorithms and machine learning, these apps assess the applicant’s creditworthiness swiftly and provide instant approval decisions. Once approved, funds are disbursed directly into the borrower’s bank account within minutes, enabling quick access to much-needed funds during emergencies or financial crunches.

Flexible Loan Options:

Personal loan apps offer a wide range of loan options tailored to meet diverse financial needs. Whether individuals require funds for medical emergencies, home renovations, education expenses, or debt consolidation, these apps provide flexible loan amounts and repayment tenures to suit their requirements. Users can customize their loan terms based on factors such as loan amount, repayment period, and interest rates, ensuring affordability and convenience.

Transparent Terms and Conditions:

Transparency is paramount when it comes to financial transactions, and personal loan apps prioritize clear and transparent terms and conditions. Before applying for a loan, users have access to detailed information about interest rates, processing fees, repayment schedules, and other associated charges. This transparency empowers borrowers to make informed decisions and avoid any hidden costs or surprises down the line.

Credit Score Improvement:

Consistent and timely repayment of loans availed through personal loan apps can contribute to improving an individual’s credit score. Many loan apps offer credit monitoring tools and resources to help users track their credit health and take proactive steps to enhance their creditworthiness. By responsibly managing their loan obligations, borrowers can strengthen their financial profile and unlock access to better loan offers and financial opportunities in the future.

Financial Empowerment and Growth:

Ultimately, the overarching benefit of using a personal loan app is financial empowerment and growth. Whether individuals are looking to pursue higher education, start a business, or fulfill lifelong dreams, access to timely and hassle-free funding can make all the difference. Personal loan apps provide a lifeline for individuals facing financial challenges, offering a pathway to achieving their goals and aspirations without undue stress or delays.

Conclusion:

In conclusion, the benefits of using a personal loan app for financial growth are undeniable. From convenience and accessibility to quick approval, flexible loan options, transparent terms, and credit score improvement, these apps empower individuals to navigate their financial journey with confidence and ease. With Hero FinCorp personal loan app, users can unlock a world of opportunities and embark on a path towards a brighter and more prosperous future.

0 notes

Text

Top Reasons to buy Health Insurance during Festive season

As the festive season approaches, amidst the flurry of celebrations and gatherings, it's crucial to pause and consider our health. While festivities bring joy and togetherness, they also come with their fair share of risks, especially concerning health. This is where the importance of health insurance shines through. Investing in health insurance during the festive season is not just a prudent decision; it's a step towards safeguarding yourself and your loved ones. Let's delve into the top reasons why purchasing health insurance during this festive period is paramount.

Protection Against Medical Emergencies: Festive seasons often entail travel, indulgent feasting, and increased activity. Unfortunately, these festivities can also lead to unforeseen accidents or health issues. Having health insurance provides a safety net, ensuring that you have access to quality healthcare without bearing the exorbitant costs associated with medical emergencies.

Financial Security: One of the primary reasons to invest in health insurance is to safeguard your finances. Medical treatments, especially during emergencies, can incur substantial expenses, potentially draining your savings or pushing you into debt. By purchasing health insurance, you mitigate this financial risk, allowing you to focus on recovery rather than worrying about medical bills.

Comprehensive Coverage: Health insurance plans offer comprehensive coverage, encompassing a wide range of medical services, including hospitalization, surgeries, diagnostic tests, and medication. With the right policy, you can ensure that you and your family are adequately covered for various healthcare needs, giving you peace of mind during the festive season and beyond.

Preventive Care Benefits: Many health insurance plans offer preventive care benefits, encouraging policyholders to prioritize their health and well-being. These benefits may include routine health check-ups, vaccinations, and wellness programs, empowering individuals to adopt healthier lifestyles and detect potential health issues early on.

Coverage for Pre-existing Conditions: If you or your family members have pre-existing medical conditions, obtaining health insurance during the festive season is particularly beneficial. While some policies may impose waiting periods for pre-existing conditions, having coverage in place ensures that you can access timely medical care without worrying about pre-existing conditions being excluded from your policy.

Tax Benefits: Investing in health insurance can also yield tax benefits, making it a financially savvy decision. Under Section 80D of the Income Tax Act, policyholders can claim deductions on premiums paid towards health insurance for themselves, their spouse, children, and parents. This not only reduces your taxable income but also encourages responsible financial planning.

Peace of Mind for Loved Ones: Your health and well-being directly impact your loved ones. By purchasing health insurance, you alleviate their concerns about your health and ensure that they are not burdened with medical expenses in case of emergencies. This peace of mind fosters stronger familial bonds and allows everyone to enjoy the festive season without undue worry.

Access to Quality Healthcare Facilities: Health insurance often provides access to a network of hospitals and healthcare providers, ensuring that you receive quality medical care whenever needed. This network extends across various cities and regions, making it especially beneficial for those who travel during the festive season, knowing that they can access healthcare services wherever they go.

Safeguarding Future Health Needs: Investing in health insurance is an investment in your future health needs. While you may be in good health now, unforeseen circumstances can arise at any moment. By securing health insurance during the festive season, you proactively protect yourself and your family against future uncertainties, ensuring that you're prepared for whatever life may throw your way.

Peace of Mind During Uncertain Times: The festive season is meant to be a time of joy and celebration. However, the ongoing pandemic and other global uncertainties have underscored the importance of prioritizing health and well-being. Health insurance offers a layer of security and peace of mind, allowing you to navigate these uncertain times with confidence and resilience.

Conclusion

As the festive season approaches, don't overlook the importance of health insurance. It's not just another financial investment; it's an investment in your health, well-being, and peace of mind. Whether you're celebrating with family and friends or embarking on new adventures, having health insurance ensures that you're prepared for whatever comes your way. So, this festive season, give yourself the gift of health insurance – a decision that will resonate long after the celebrations have ended.

0 notes

Text

Unlocking Financial Flexibility: Small Loans in Kirkham

In the picturesque town of Kirkham, nestled amidst the verdant landscapes of Lancashire, residents often find themselves facing unexpected financial challenges. Whether it's covering urgent medical expenses, repairing a broken appliance, or managing unforeseen bills, the need for quick access to funds can arise at any moment. In such situations, small loans emerge as a lifeline, offering a practical solution to tide over temporary cash shortages. Let's delve into the world of small loans in Kirkham and explore how they serve as a vital resource for individuals navigating financial uncertainties.

Understanding Small Loans:

Small loans, also known as microloans or short-term loans, are modest amounts of money borrowed for a short duration. Unlike conventional bank loans that typically involve extensive paperwork and stringent eligibility criteria, small loans offer a streamlined application process and quick approval times. These loans are designed to cater to immediate financial needs, providing borrowers with the flexibility to address pressing expenses without undue delay.

Accessibility and Convenience:

One of the most significant advantages of small loans in Kirkham is their accessibility. Unlike traditional financial institutions, which may impose rigid requirements and lengthy processing times, small loan providers prioritize speed and convenience. With online platforms and local lenders offering easy application processes, residents of Kirkham can access funds swiftly, often within a matter of hours.

Tailored Solutions for Diverse Needs:

Small loans cater to a diverse range of financial needs, making them suitable for various circumstances. Whether it's covering unexpected car repairs, settling utility bills, or managing emergency healthcare expenses, these loans offer tailored solutions to address immediate concerns. Moreover, borrowers have the flexibility to choose loan amounts and repayment terms that align with their individual requirements, ensuring a customized borrowing experience.

Minimal Documentation and Hassle-Free Approval:

In contrast to traditional bank loans that necessitate extensive documentation and credit checks, small loans in Kirkham typically require minimal paperwork. Applicants are generally asked to provide basic personal and financial information, making the application process hassle-free and convenient. Additionally, many small loan providers offer instant approval decisions, enabling borrowers to access funds promptly when time is of the essence.

Responsible Borrowing Practices:

While small loans offer a practical solution to short-term financial challenges, it's essential for borrowers to exercise responsible borrowing practices. Before applying for a loan, individuals should assess their repayment capacity and ensure that they can comfortably meet the repayment obligations. By borrowing only what is necessary and repaying the loan on time, borrowers can avoid falling into a cycle of debt and maintain their financial well-being.

Conclusion:

In the dynamic landscape of personal finance, small loans play a crucial role in providing individuals with the financial flexibility they need to navigate life's uncertainties. In Kirkham, where residents value community and resilience, small loans serve as a dependable resource for overcoming unexpected expenses and managing financial emergencies. With their accessibility, convenience, and tailored solutions, small loans empower individuals to address immediate needs without undue stress or delay. However, it's imperative for borrowers to approach borrowing responsibly, ensuring that they can comfortably manage repayment obligations and safeguard their long-term financial stability. By leveraging the benefits of small loans while adopting prudent financial practices, residents of Kirkham can confidently navigate the ebb and flow of life's financial challenges.

#Small loans in Kirkham#Bad Credit Loans Blackpool#Bad Credit Loans Fylde Coast#Doorstep loans in Blackpool#Short term loans in Fylde Coast

0 notes

Text

Lifetime Security: Exploring the Benefits of Colonial Penn Whole Life Insurance

In the vast landscape of insurance options, whole life insurance stands out as a robust tool for providing lifetime security. This exploration delves into the myriad benefits of whole life insurance, with a particular focus on the advantages offered by providers like Colonial Penn. Understanding the key features of colonial penn whole life insurance can empower individuals to make informed decisions about their financial security.

1. Lifelong Coverage: A Foundation of Stability

One of the fundamental benefits of whole life insurance is the assurance of lifelong coverage. Unlike term life insurance, which covers a specific period, whole life insurance remains in force throughout the policyholder's lifetime. This aspect provides a foundation of stability, ensuring that loved ones are protected no matter when the policyholder passes away. Colonial Penn's whole life insurance policies, in particular, offer this enduring security, making it an attractive option for those seeking long-term protection.

2. Guaranteed Death Benefit: Providing Financial Assurance

Whole life insurance comes with a guaranteed death benefit, a predetermined sum of money that is paid to beneficiaries upon the policyholder's demise. This benefit serves as a crucial financial resource for surviving loved ones, helping cover expenses such as funeral costs, outstanding debts, or other financial obligations. Colonial Penn's commitment to offering a reliable death benefit enhances the financial assurance provided by their whole life insurance policies, ensuring that families can navigate challenging times without undue financial strain.

3. Cash Value Accumulation: A Unique Savings Component

One distinguishing feature of whole life insurance, including Colonial Penn's offerings, is the accumulation of cash value over time. A portion of each premium paid goes into a cash value account, which grows on a tax-deferred basis. Policyholders can access this cash value during their lifetime through loans or withdrawals for various financial needs, such as education expenses, supplemental retirement income, or emergencies. This unique savings component adds versatility to whole life insurance, transforming it into a financial asset that can serve multiple purposes.

4. Premiums That Never Increase: Budgetary Predictability

Colonial Penn's whole life insurance policies often come with premiums that remain level throughout the life of the policy. This aspect provides policyholders with budgetary predictability, eliminating concerns about escalating premiums as they age. The stability of fixed premiums makes it easier for individuals and families to plan for their financial future, knowing that the cost of insurance will remain consistent and manageable over time.

5. No Medical Exam Policies: Streamlined Access to Coverage

Colonial Penn, along with other providers, recognizes the importance of making whole life insurance accessible. Some whole life insurance policies from Colonial Penn do not require a medical exam for approval, streamlining the application process and ensuring that individuals with health concerns can still secure coverage. This accessibility is particularly beneficial for those who may face challenges in obtaining traditional life insurance due to health conditions.

Conclusion: A Lifelong Commitment to Financial Security

In conclusion, whole life insurance, exemplified by providers like Colonial Penn, offers a suite of benefits that culminate in a lifelong commitment to financial security. The assurance of lifelong coverage, a guaranteed death benefit, and the unique cash value accumulation feature distinguish whole life insurance as a comprehensive and enduring financial tool. Colonial Penn's commitment to fixed premiums and accessible coverage further enhances the appeal of their whole life insurance offerings.

Choosing whole life insurance is not just a financial decision; it's a commitment to providing lasting security for oneself and loved ones. By understanding the benefits of whole life insurance, individuals can make informed choices that align with their long-term financial goals. Colonial Penn's whole life insurance policies, with their focus on stability, accessibility, and financial versatility, exemplify the potential for securing a lifetime of financial well-being.

0 notes

Text

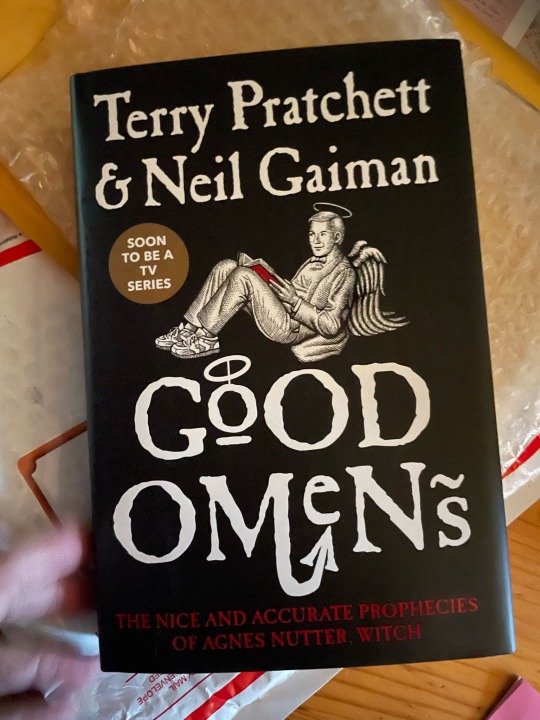

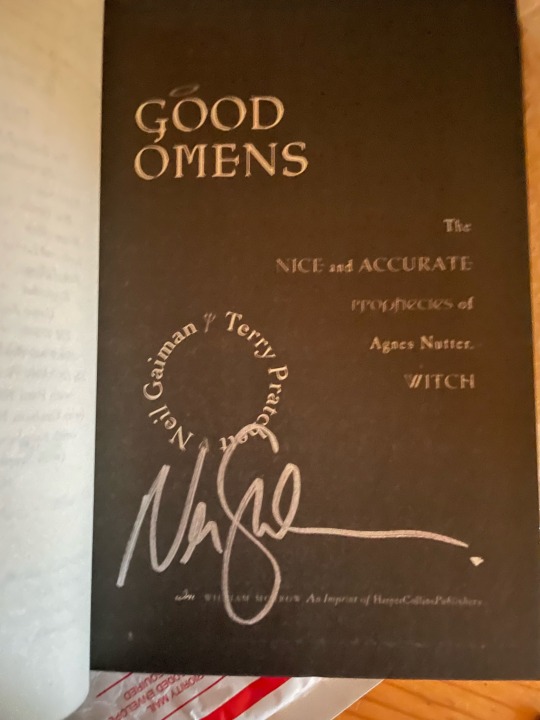

Another raffle prize for our fundraiser for Undue Medical Debt - a hardcover Good Omens signed by @neil-gaiman

The raffle (over on our Google Site) is open for previews, fundraiser kicks off next week on April 25!

h/t to the incredibly lovely staff at The Golden Notebook in Woodstock, NY for being extremely helpful and kind

#good omens#neil gaiman#undue medical debt#fundraiser#*soon*#admin: lets-steal-an-archive#mittensmorgul#is the guardian of so many treasures for this raffle#fuckyeahgoodomens

23 notes

·

View notes

Text

Monthly donation?

Helloooo, this is your secretary at the keyboard, hitting you with a new jam!

I have donated to this place in the past, and I am sharing it before posting. It is a foundation based on abolishing medical debt in the USA! While the xife and I are not Americans, we do believe that our cousins to the Southern deserve a fair chance at life, and that starts with freeing yourself from the debts from a fraudulent insurance system!

There is a newsletter if you want to subscribe.

Again, thank you for everybody who is letting this happen, and to those who are sharing, liking, and enjoying our work!

For those currently affected by the medical debt system, there is a list of resources that you can have access to right here:

13 notes

·

View notes

Text

Medical Debt Relief: New Rules Cut Credit Damage

Major Changes in Credit Reporting for Medical Debt

The Consumer Financial Protection Bureau (CFPB) is introducing groundbreaking proposals under the Biden administration to mitigate the adverse effects of medical debt on Americans' credit scores, signaling a significant shift in how medical debt is handled in credit reporting.

The Growing Burden of Medical Debt

As of June 2021, US consumers faced approximately $88 billion in medical debt. With an estimated 41% of Americans grappling with this type of debt, the impact on creditworthiness has become a pressing concern.

Increasing Numbers and the Credit Dilemma

Medical debt encompasses a range of expenses from unexpected medical events to surprise bills and out-of-pocket costs. The wide scope of this debt affirms that it is not a reliable indicator of creditworthiness, necessitating new approaches in credit evaluation.

New Proposals for Credit Relief

The CFPB's proposals aim to exclude unpaid medical bills from consumers' credit scores, a move that could provide significant relief for millions. This change reflects a broader understanding that medical debt is often unforeseen and not a choice, differentiating it from other types of debt.

Navigating Disputes Under New Medical Debt Credit Rules

With medical debt credit reporting undergoing major changes, understanding dispute rights is essential. Previously, attempting to remove medical debts from credit reports was extremely difficult, even when inaccurate.

Under the new guidelines from the CFPB, consumers have stronger grounds for disputing medical items. Unpaid medical debts under $500 will no longer appear on credit reports. Many other medical debts will also not be reportable for 12 months.

Credit bureaus must now prove the validity of reported medical debts when challenged. This shifts more burden of proof onto financial institutions during disputes.

Impact of CFPB's Move on Consumers

The recent actions by the CFPB and credit bureaus to remove certain medical debts from credit reports have already started showing positive impacts, with millions potentially seeing their medical debt in collections erased from their credit files.

New Timelines For Medical Debt

The CFPB proposals also adjust the reporting timelines for medical debts, providing more time before they can impact credit scores.

Medical debts paid by insurance will no longer be reported at all. For others, unpaid medical bills won't show up on credit reports for one year, up from 6 months previously. This delays the credit score impact, giving consumers more time to resolve bills.

The longer grace periods aim to be more equitable and avoid unduly harming those facing transient financial issues due to medical needs.

What Counts as Medical Debt

Clearly defining medical debt is crucial for credit bureaus to update reporting policies and for informing consumers.

The CFPB outlines medical debt broadly, including hospital, doctor, dental, vision, and ambulance bills. Even bills not explicitly medical like for home equipment or modifications for medical needs qualify.

Catching the wide range of qualifying expenses prevents undue credit damage. It also motivates financial institutions to update their risk assessment policies beyond just medical debt.

The Way Forward in Managing Medical Debt

While these changes are promising, they also raise questions about the future of credit reporting and lending practices. Consumers and financial institutions alike must understand and adapt to these new regulations and their potential implications on credit and lending.

How Creditors Are Impacted

While these changes provide relief for consumers, they also raise challenges for creditors and lenders assessing risk in lending decisions. Removing medical debt history compromises insights into repayment ability. Some institutions may struggle to balance more limited consumer debt data with responsible lending practices.

Many creditors must overhaul internal scoring systems dependent on complete medical debt information. Doing so without increasing lending exposure will test credit issuers, potentially restricting access for some consumers if mitigations fall short. With easier dispute options, creditors also carry a heavier burden disputing every challenged medical tradeline while still documenting their full case records.

Though well-intentioned in providing relief, the changes undoubtedly disrupt standard creditor processes. How deftly institutions rework practices amid these reporting regulation shifts may determine if consumer access truly expands or contracts moving ahead.

Collecting Medical Debt Under New Rules

Less Recourse for Unpaid Medical Bills

The CFPB changes limit creditors’ options pressing consumers for unpaid medical bills. With delayed reporting, no credit leverage exists for a year. Limited collection efforts are permitted in the interim. And the $500 reporting minimum means small-balance medical bills lack credit impact completely.

Adapt Collection Strategies to New Landscape

Collectors must overhaul approaches, as old strategies for medical debts are no longer effective or allowable. Building repayment plans directly with consumers becomes more critical before considering credit reporting. Boosting internal patient financing and assistance programs also helps offset constraints.

Learn New Compliance Nuances and Best Practices

Navigating the new rules requires vigilance from medical collectors around compliance and responsible efforts. Seek expertise in establishing appropriate internal protocols under revised consumer protections against aggressive collection of medical debt.

Read the full article

0 notes

Text

New Post has been published on Books by Caroline Miller

New Post has been published on https://www.booksbycarolinemiller.com/musings/there-is-no-other/

There Is No Other

The mother sitting across from me at the lunch table sighed when I asked about her daughter. “She’s thinking about moving to Pennsylvania. Since she works from home, she can live anywhere. Rural Pennsylvania seems to be the one place where houses are affordable. “ The dilemma is common. Several of my friends with well-educated children between the ages of 20-35 continue to provide shelter for their offspring. The American dream is a hard slog for younger generations, I’m sorry to say. Nor am I happy about the state of the planet they are inheriting. If we older Americans had anticipated climate change, we might have purchased fewer gas-guzzling cars. Or, maybe not. Our species has a penchant for choosing present gratification over making plans for the future. Even so, some of us might have girded our loins to fight climate change sooner. What I ponder at present is whether the older generation is cheating those who have followed. If so, society might rightly adopt the Inuit practice of leaving the frail elderly to die on ice floats. Fortunately, Michael Hiltzik, writing for the L.A. Times doesn’t think old folks are to blame for the state of the economy. Social Security and Medicare aren’t the oft-cited reasons the young have fewer possibilities. Most seniors, he reminds us, paid for their Social Security benefits during their productive years. Only the working poor receive more from the agency than their lifetime contributions. Even so, few wish to punish people who struggled all their lives on slave wages. And, as a benefit to all, we should remember that for decades the U. S. government has borrowed from the insurance fund to satisfy other debts. The elderly do receive government assistance to pay for prescription drugs. The tab would be less if Congress allowed Medicare to negotiate with Big Pharma. Hiltzik points to Joe Biden’s success in reducing the cost of diabetes medication once Congress granted him a waiver. Any perceived schism between youth and age is a false one, the author proclaims. America has more than enough resources to meet all the social needs of all generations. A shortfall exists because of the tax cuts enacted by Republicans for the benefit of corporations and the wealthy. To support his claim, people remark that in the Dwight D. Eisenhower years, taxes on the rich could reach 91% of income. However, they forget much of this money was never collected. Scott Greenberg of the Tax Foundation writes that tax laws have long enabled tax avoidance. …the existence of the 91 percent bracket did not necessarily lead to significantly higher revenue collections from the top 1 percent. As proof, who over the age of 50 has forgotten businesswoman Leona Helmsley’s words? Only the little people pay taxes. Or, Donald Trump’s brag that he was too smart to pay taxes? Whether Hiltzik’s point about our economics is right or wrong, few deny the super-rich exercise an undue influence over the government. Elon Musk’s money allows him to imagine he can engage in discussions with Vladimir Putin over the conduct of the Ukraine war. In 1953 multimillionaire Lewis Stauss fed Robert Oppenheimer to the lions when the scientist opposed the construction of the hydrogen bomb. (“The Fallout of J. Robert Oppenheimer’s Story Lingers, an interview with Kai Bird, Concerned Scientist, Volume 23, Fall, 2023, pg. 13.) Dr. Anthony Fauci’s treatment at the hands of Donald Trump is a recent victim of the same abuse. Even so, money doesn’t buy happiness. One Indian philosopher warns most often money buys burnout. (“Groovy.” By Mickey Rapkin, Town&Country, Dec. 2023-Jan 2024, pg. 141.) Another warns, When you have exhausted everything outside the only way to go is in. (Ibid, pg. 140) Those who take that path of introspection enter a tulgy wood of doubt and shadows. If they finish the journey they may come to realize life has nothing to do with acquisitions. Life is about mergers. When we see an individual not as a competitor but as an extension of ourselves, the way a wave is an extension of the ocean, we stumble upon a moment when a glimpse of universal harmony is possible.

#affordable housing#are the young suffering because of elderly needs?#Climate change#Donald Trump#drop in diabetes medication cost#Dwight D. Eisenhower#Elon Musk#govt & big Pharma#J. Robert Oppenheimer#Kai Bird#Leona Helm#Lewis Strauss#Michael Hiltzik#Mickey Rapkin#Scott Greenberg#Social Security and Medicare costs#Tax Foundation#the rich don't pay taxes#Vladimir Putin#young people forced to live with parents

0 notes

Text

family economy

Family economy refers to the financial situation and resource management within a family. This concept encompasses various aspects, and some key points include:

Family Budgeting: Creating a reasonable budget that aligns with the family's needs and income is a crucial aspect of family economy. Detailed planning for income expenditure, reducing unnecessary costs, and prioritizing expenses contribute to effective management of financial resources.

Financial Management: Efficient financial management involves handling financial matters such as bill payments, bank account management, and savings. Proper financial management ensures that the family's economic resources are utilized effectively and responsibly.

Income Sources: Understanding and diversifying sources of income contribute to a stable family economy. Families often rely on multiple income streams, including salaries, investments, and other financial assets.

Debt Management: Managing and controlling debt, including loans and credit, is essential for a healthy family economy. Keeping track of debts, making timely payments, and working towards reducing or eliminating outstanding debts contribute to long-term financial stability.

Saving and Investments: Encouraging saving habits and making wise investment decisions are crucial for securing the family's financial future. Savings can serve as a safety net during unexpected expenses, and strategic investments can generate additional income.

Educational Planning: Planning for the education of family members is an integral part of family economy. This includes budgeting for educational expenses, such as tuition fees, books, and other related costs, and exploring financial aid options.

Emergency Fund: Establishing an emergency fund is important for dealing with unexpected financial challenges, such as medical emergencies or sudden job loss. Having a financial cushion can prevent undue stress during difficult times.

Financial Education: Providing financial education to family members enhances their understanding of economic principles and promotes responsible financial behavior. This education can include topics such as budgeting, saving, and investing.

Insurance Coverage: Securing adequate insurance coverage, including health, life, and property insurance, is crucial for protecting the family's financial well-being in the face of unexpected events.

Retirement Planning: Planning for retirement is an essential aspect of family economy. Contributing to retirement accounts and making informed decisions about pension plans or other retirement investments ensures financial security during the later stages of life.

In summary, family economy involves strategic planning, responsible financial management, and wise decision-making to ensure the well-being and stability of a family's financial situation.

0 notes

Text

Navigating the Complex Landscape of Medical Healthcare Insurance

In today's world, access to quality healthcare is a fundamental right. However, the cost of medical treatment can be exorbitant, often leaving individuals and families grappling with financial burdens. To mitigate these challenges, medical healthcare insurance has become a crucial component of our lives. This article explores the intricacies of medical healthcare insurance, its importance, and how individuals can make informed decisions to safeguard their health and financial well-being.

Understanding Medical Healthcare Insurance

Medical healthcare insurance, commonly known as health insurance, is a financial product designed to cover the costs of medical expenses incurred due to illness, accidents, or other health-related issues. These policies can be obtained through private insurance providers or government programs, such as Medicare and Medicaid in the United States. The primary goal of medical healthcare insurance is to provide financial protection and ensure access to necessary medical care without causing undue financial strain.

The Importance of Medical Healthcare Insurance

Financial Security: One of the most significant advantages of medical healthcare insurance is its ability to offer financial security. In the absence of insurance, a serious illness or injury can lead to substantial medical bills, pushing individuals and families into debt. Insurance helps mitigate this risk by covering a significant portion of the medical expenses, reducing the financial burden on policyholders.

Access to Quality Healthcare: Having health insurance often translates to better access to quality healthcare services. Insured individuals are more likely to seek timely medical attention, preventive care, and necessary treatments, which can improve overall health outcomes.

Preventive Care: Many insurance plans offer coverage for preventive services such as vaccinations, screenings, and wellness check-ups. These services can help identify health issues early, potentially leading to more effective and less expensive treatments.

Peace of Mind: Knowing that you are covered by medical healthcare insurance can provide peace of mind. It ensures that you are financially prepared to handle unexpected medical expenses, reducing stress during challenging times.

Medical healthcare insurance is a critical tool in protecting your health and financial well-being. It offers peace of mind, access to quality healthcare, and safeguards against the high costs of medical treatment. By understanding the types of insurance available and carefully evaluating your needs, you can make informed decisions to ensure you have the right coverage to meet your healthcare requirements. In an ever-changing healthcare landscape, having the right insurance is a vital step towards a healthier and more secure future.

For More Info:-

Health Coverage

Best Health Insurance

The Best Health Insurance

1 note

·

View note