#upcoming ipo app

Text

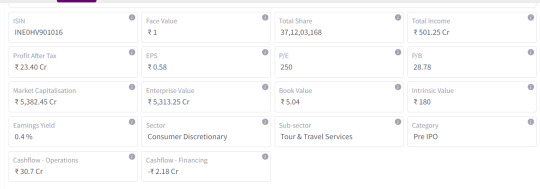

As the title I am going to discuss most famous unlisted share app is India, where any one can invest easily and find out some awesome features of the app.

Planify is the name of that app where you can download and explore the features. Planify is the India's best fintech company and private market place. You can invest in top startups.

If you are startup then you also go for funding. There are also some great feature which you should explore.

#share market apps india#Unlisted Stocks#buy pre ipo#Equity Fund Raising#business funding app#upcoming ipo app#angel investors app#Venture Capital

1 note

·

View note

Text

Reddit is speedrunning enshittification.

Hypothesis: The owners of the company are no longer interested in keeping the business going, and are just trying to maximize financial return by selling off every possible asset.

In Reddit’s case, the upcoming IPO isn’t the beginning of a new chapter in the business. It’s the end of the business.

The most financially valuable part of Reddit is its fat corpus of content, built by volunteers over many years, suddenly made valuable for training AI. Now, Reddit’s corporate owners want to sell access to that corpus. That is Reddit’s new business. It’s not a long-term business, because the corpus will decay in value over time. But it’s enough for the owners to cash out.

I’m inspired in this thinking by yesterday’s edition of Rusty Foster’s “Today in Tabs.”. I don’t think he’s making this exact point, but he’s putting all the dots down, without necessarily connecting them.

John Gruber at Daring Fireball notes that OpenAI already scooped up Reddit’s corpus of data when the APIs were free. The data has no value anymore.

Reddit already gave all its data to large companies for free. Huffman is trying to charge now for horses that were let out of the barn years ago. And he obviously doesn’t care about Apollo or other third-party Reddit clients, or what these moves do to Reddit’s reputation as a platform vendor. He’s just trapped in a fantasy where investors are going to somehow see Reddit as a player in the current moment of AI hype.

Also, on Ryan Broderick’s Garbage Day: “Platforms Don’t Really Make Sense Anymore”:

We tolerated large platforms, that were never all that good to begin with, because they were convenient and useful and part of a larger interconnected network of tools and apps and systems that made the digital world safer and more dynamic. So you’d think, if they were actively deciding to stop being part of that larger system and no longer interested in making the internet, as a whole, function better, they would, at the very least, try and be more convenient! But instead we’ve ended up in a situation where all the local stores are gone, Main Street is deserted, and the large Walmarts on the edge of town are being set on fire and left to rot.

970 notes

·

View notes

Text

Invest in Upcoming IPOs with Motilal Oswal App | Easy IPO Applications

Stay ahead in the stock market by investing in the latest IPOs with the Motilal Oswal app. Our app offers a seamless way to explore, track, and apply for IPOs in just a few clicks. With real-time updates, expert insights, and detailed analysis, you can make informed decisions and secure your stake in high-potential companies. Whether you're a seasoned investor or a beginner, the Motilal Oswal app simplifies the process of IPO investments, helping you maximize your portfolio's growth. Download the Motilal Oswal app and never miss out on lucrative IPO opportunities!

0 notes

Text

Discover the upcoming IPOs in India 2024 on IPO Ji. Get detailed information on companies launching new IPOs, including IPO size, overview, prospects, and upcoming IPO GMP (Grey Market Premium) updates to stay informed and make smarter investment decisions.

0 notes

Text

Understanding the Upcoming SME IPOs: A Comprehensive Guide

Initial Public Offerings (IPOs) are a major event for any company, offering a way to raise capital and gain public visibility. While many investors are familiar with mainline IPOs, the world of SME IPOs (Small and Medium Enterprises) is equally dynamic and offers unique investment opportunities. This article provides an in-depth look at upcoming SME IPO, their significance, and how investors can participate.

Introduction to SME IPOs

An SME IPO allows a small or medium-sized company to go public by offering its shares to the general public for the first time. IPO are listed on specialized platforms like BSE SME and NSE Emerge, which cater specifically to smaller enterprises. By listing on these platforms, SMEs can raise funds needed for expansion, debt repayment, and other business activities.

What Makes SME IPOs Unique?

SME IPOs differ from mainline IPO primarily in terms of scale and regulatory requirements. The key characteristics include:

Smaller Issue Size: SME IPOs typically involve a smaller number of shares compared to mainline IPOs.

Listing Platforms: These IPOs are listed on BSE SME or NSE Emerge, which are designed to support smaller companies.

Investor Categories: Investors in SME IPOs are generally categorized as Non-Institutional Investors (NIIs), Retail Investors, and sometimes Qualified Institutional Buyers (QIBs).

Latest Trends in Upcoming SME IPOs

The year 2024 has seen a steady stream of SME IPOs. Here are some notable upcoming SME IPO that investors should keep an eye on:

Winny Immigration & Education Services Ltd:

Open Date: June 20, 2024

Close Date: June 24, 2024

Issue Size: ₹9.13 Crores

Price Range: ₹140 per share

Medicamen Organics Ltd:

Open Date: June 21, 2024

Close Date: June 25, 2024

Issue Size: ₹9.92 - 10.54 Crores

Price Range: ₹32 per share

Shivalic Power Control Ltd:

Open Date: June 24, 2024

Close Date: June 26, 2024

Issue Size: ₹61.10 - 64.32 Crores

Price Range: ₹95 per share

Sylvan Plyboard (India) Ltd:

Open Date: June 24, 2024

Close Date: June 26, 2024

Issue Size: ₹28.05 Crores

Price Range: ₹55 per share

These listings show the diversity of industries and the scale of operations within the SME sector.

Importance of SME IPOs

For investors, SME IPOs offer several advantages:

Growth Potential: Investing in SMEs can be highly rewarding, given their potential for rapid growth and expansion.

Diverse Opportunities: SME IPOs span a wide range of industries, providing investors with varied investment options.

Market Entry: For smaller investors, SME IPOs can be an affordable entry point into the stock market.

How to Participate in SME IPOs

Investing in SME IPOs involves a straightforward process, though it requires careful consideration. Here’s how you can apply:

UPI-based Application: Use your Demat account app (e.g., 5paisa) to select the IPO and apply with your UPI ID. Approve the mandate in your bank or Google Pay account.

ASBA (Application Supported by Blocked Amount): Log in to your bank account, fill in the necessary details like Demat account number and PAN, and submit the application.

Broker Assistance: Contact your broker to fill out the application form and submit it.

Conclusion

Upcoming SME IPO presents a promising avenue for investors looking to diversify their portfolios and capitalize on the growth potential of smaller companies. By understanding the unique aspects of SME IPOs, staying informed about the latest listings, and knowing how to apply, investors can make well-informed decisions. Additionally, keeping an eye on MCX natural gas prices and natural gas price trends can provide valuable insights into broader market conditions.

Staying updated on these topics ensures that you are well-prepared to navigate the investment landscape, making the most of emerging opportunities in SME IPOs and the natural gas market.

0 notes

Text

Report: US digital health funding reached $5.7 billion in the first half of 2024

- By InnoNurse Staff -

In the first half of 2024, U.S. digital health startups secured $5.7 billion across 266 deals, demonstrating strong sector growth, according to a Rock Health report.

This year's funding might surpass the 2019 and 2023 totals of $8.2 billion and $10.7 billion. Key trends include increasing early-stage investments, with 84% of labeled raises being early-stage deals, and a significant focus on AI-enabled startups, which received 34% of the total sector funding.

The market is also seeing fewer unlabeled deals, indicating a return to more traditional funding patterns. Mental health received the most funding ($682 million), followed by weight management and obesity care ($261 million), and reproductive and maternal health ($214 million).

The IPO market showed signs of revival with three digital health companies going public. Mergers and acquisitions are down, but private equity firms are actively acquiring digital health startups. Analysts believe the sector is moving towards more sustainable venture patterns, despite uncertainties like the upcoming U.S. presidential election.

Read more at Fierce Healthcare

///

Other recent news and insights

SAIGroup acquires Get Well, adding it to their portfolio of AI healthcare companies (Fierce Healthcare)

GoJoe secures £2.4M in funding for its gamified employee health and fitness app (Tech.eu)

0 notes

Text

Upstox Share Price on an Upward Trajectory

Introduction

Upstox, one of India's leading brokerage firms, has been making headlines with its impressive performance in the financial market. Known for its innovative approach and customer-centric services, Upstox has revolutionized the brokerage industry in India. This article explores the factors contributing to the upward trajectory of Upstox Share Price, the company’s historical context, technological innovations, expansion strategies, regulatory impacts, and future prospects, while also touching upon the anticipation of the Upstox IPO, Upstox Pre IPO, Upstox Unlisted Shares, and the Upstox Upcoming IPO.

Historical Context and Establishment

Upstox, founded in 2012 by Ravi Kumar, Shrinivas Vishwanath, and Kavitha Subramanian, was initially known as RKSV Securities. The company rebranded as Upstox to better reflect its modern and tech-driven approach. Upstox aimed to democratize trading and investing in India by offering low-cost services and leveraging technology. This approach quickly gained popularity among retail investors, allowing the company to grow rapidly and establish a strong market presence.

The Rise of Upstox: Disrupting Traditional Brokerage

In its early years, Upstox focused on building a robust trading platform that offered a seamless user experience. The company invested heavily in technology, developing a trading platform that was both user-friendly and feature-rich. Upstox’s commitment to low brokerage fees, transparency, and excellent customer service helped it attract a large customer base. This early success laid the foundation for the rise in Upstox Share Price.

Technological Innovations and Product Offerings

One of the key drivers of Upstox's success has been its continuous focus on technological innovations. Upstox has consistently upgraded its trading platform and introduced new products and services to meet the evolving needs of its clients. The company's flagship platform, Upstox Pro, offers advanced trading tools, real-time market data, and a user-friendly interface. Additionally, Upstox's mobile app provides a convenient and efficient trading experience, attracting a large number of retail investors. These technological advancements have been instrumental in driving the rise in Upstox Share Price.

Expansion into New Markets and Services

Upstox has strategically expanded its offerings to cater to a broader range of investors. The company now provides services in mutual funds, commodities, and bonds, in addition to traditional equity trading. Upstox's entry into the mutual fund distribution space has been particularly successful, with its platform allowing investors to invest in a wide range of mutual funds with ease. This diversification strategy has enabled Upstox to tap into new revenue streams and reduce its dependency on traditional brokerage services, contributing to the rise in its share price.

Regulatory Reforms and Market Environment

The regulatory reforms and favorable market environment have also played a significant role in the upward trajectory of Upstox. The Securities and Exchange Board of India (SEBI) has implemented several measures to enhance market transparency and protect investor interests. These reforms have created a conducive environment for brokerage firms like Upstox to thrive. Furthermore, the overall growth of the Indian stock market and increasing investor participation have positively impacted Upstox's business, leading to a rise in its share price.

Financial Performance and Profitability

Upstox’s strong financial performance and profitability have been significant factors in the upward movement of its share price. The company's low-cost business model and focus on operational efficiency have resulted in healthy profit margins. Upstox has consistently reported robust financial results, with steady growth in revenues and profits. This strong financial performance has instilled confidence among investors and contributed to the rise in Upstox share price.

Competitive Advantages and Market Position

Upstox’s competitive advantages and market position have also played a crucial role in driving its share price upwards. The company’s innovative business model, technological prowess, and customer-centric approach have set it apart from its competitors. Upstox’s ability to attract and retain a large customer base has solidified its position as a market leader in the brokerage industry. This strong market position has been a key factor in the rising share price of Upstox.

Upstox IPO and Pre-IPO Shares

The anticipation of an Upstox IPO has been a significant factor in the market, contributing to the excitement and speculation surrounding the company's future. The Upstox Pre IPO shares have garnered considerable interest among investors looking to capitalize on the company's growth potential before the official public offering. The interest in Upstox Unlisted Shares reflects the confidence investors have in the company's continued success and the potential impact of the Upstox Upcoming IPO.

Future Prospects and Growth Opportunities

Looking ahead, the future prospects for Upstox's share price remain positive, with several growth opportunities on the horizon. The increasing digitization of financial services and the growing popularity of online trading platforms present significant growth potential for Upstox. The company is well-positioned to capitalize on these trends and expand its market share further. Additionally, Upstox’s focus on innovation and customer-centric approach will continue to drive its growth and enhance its share price.

Challenges and Risks

While the future looks promising for Upstox, there are certain challenges and risks that could impact its share price. The brokerage industry is highly competitive, with new players entering the market regularly. Upstox will need to continue innovating and differentiating itself to maintain its competitive edge. Regulatory changes and market volatility could also pose risks to Upstox's business. However, the company’s strong fundamentals and strategic initiatives should help mitigate these challenges and sustain its upward trajectory.

Conclusion

The rise in Upstox's share price is a testament to the company’s innovative business model, technological advancements, and customer-centric approach. Upstox has successfully disrupted the traditional brokerage industry and established itself as a market leader. The company’s strong financial performance, competitive advantages, and favorable market environment have all contributed to the upward movement of its share price. As Upstox continues to expand its offerings and capitalize on growth opportunities, the future looks bright for the company and its investors. The journey of Upstox's share price advancing upwards is a compelling story of innovation, growth, and success in the Indian financial services sector. The potential for an Upstox IPO, along with the interest in Upstox Pre IPO shares and Upstox Unlisted Shares, underscores the confidence in the company's future. The anticipation surrounding the Upstox Upcoming IPO is expected to further fuel interest and investment in the company.

0 notes

Text

Stay Informed About Upcoming IPOs with Motilal Oswal App

Stay ahead of the curve with the Motilal Oswal app by staying informed about upcoming IPO. Whether you're looking to capitalize on new investment opportunities or expand your portfolio, our app provides timely updates and insights into upcoming initial public offerings. Discover potential market movers, evaluate company profiles, and plan your investments strategically. With comprehensive research and analysis at your fingertips, the Motilal Oswal app empowers you to make informed decisions about upcoming IPOs. Download now and seize the next big investment opportunity with confidence.

0 notes

Text

How can I apply for IPO?

You can apply for an Initial Public Offering (IPO) through various methods, depending on your location and the rules and regulations of the stock market in which the IPO is being offered. Here's a general guide on how to apply for an IPO:

Open a Demat Account: To apply for an IPO, you need to have a Demat account. A Demat account is an electronic account that holds your shares in dematerialized or electronic form. If you don't have a Demat account, you'll need to open one with a registered Depository Participant (DP).

Check IPO Details: Keep an eye out for upcoming IPOs and review the details of the IPO you're interested in, including the company's prospectus, financials, and offer details such as price band, lot size, and issue dates.

Choose Your Application Method:

Online Application: Many brokers offer the facility to apply for IPOs online through their trading platforms or websites. You can log in to your broker's platform, select the IPO you want to apply for, enter the required details, and submit your application.

ASBA (Application Supported by Blocked Amount): In many countries, including India, investors can apply for IPOs through ASBA. ASBA is a facility provided by banks where the application money is blocked in the investor's bank account instead of being debited upfront. You can apply for IPOs using the ASBA facility through your bank's net banking portal or by submitting a physical application form at designated branches.

Offline Application: Some investors may still prefer to apply for IPOs offline by filling out physical application forms available from designated centers such as bank branches, brokers' offices, or collection centers specified by the issuing company.

Fill Out the Application Form: If applying offline, fill out the IPO application form with the required details, including your Demat account information, bid quantity, and price. If applying online or through ASBA, enter the necessary information in the respective application portal.

Payment: If applying through ASBA, the application money will be blocked in your bank account. If applying offline, you'll need to make a payment via cheque or demand draft for the bid amount as per the instructions provided.

Submit Application: After filling out the application form and making the payment, submit your application either physically at the designated centers (if applying offline) or online through the designated portal (if applying online).

Monitor Allotment: Once the IPO subscription period closes, the allotment process begins. Monitor the status of your application through the application number or Demat account details provided. If your application is successful, you'll be allotted shares, and if not, your application amount will be refunded.

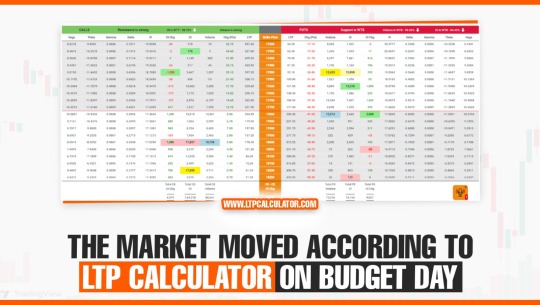

One of the best way to start studying the stock market to Join India’s best comunity classes Investing daddy invented by Dr. Vinay prakash tiwari . The Governor of Rajasthan, the Honourable Sri Kalraj Mishra, presented Dr. Vinay Prakash Tiwari with an appreciation for creating the LTP Calculator.

LTP Calculatorthe best trading application in India.

You can also downloadLTP Calculator app by clicking on download button.

It's essential to carefully read the IPO prospectus and understand the risks associated with investing in IPOs before applying. Additionally, ensure that you have sufficient funds in your bank account or Demat account for the bid amount and keep track of important dates related to the IPO process.

0 notes

Text

Dunzo Share Price: Latest News and IPO Updates

Introduction To Dunzo Stock Price:

Dunzo, a hyperlocal delivery startup based in India, has been gaining traction in recent years as consumers increasingly turn to convenience services for their everyday needs. Founded in 2014 by Kabeer Biswas, Ankur Aggarwal, Dalvir Suri, and Mukund Jha, Dunzo has emerged as a leader in the on-demand delivery space, offering a wide range of services, including groceries, medicines, food delivery, and more. As Dunzo prepares for its Initial Public Offering (IPO), investors and industry observers are closely monitoring its share price movements and the latest updates surrounding Dunzo IPO plans. This article aims to delve into the dynamics of Dunzo Share Price, analyze its recent performance, and provide insights into its upcoming IPO.

Dunzo: Revolutionizing Hyperlocal Delivery

Dunzo's journey began with a simple yet powerful idea: to provide a one-stop solution for all local delivery needs. Leveraging technology and a network of delivery partners, Dunzo enables users to order anything from groceries to pet supplies and have them delivered to their doorstep within minutes. The company's intuitive app interface, coupled with its focus on reliability and efficiency, has garnered a loyal customer base and propelled Dunzo to the forefront of India's hyperlocal delivery market.

Share Price Performance:

The share price of Dunzo has been a subject of keen interest among investors, particularly as the company gears up for the Dunzo IPO. Like many other startups in the technology sector, Dunzo's share price has experienced fluctuations influenced by various factors, including market sentiment, regulatory developments, and company performance.

In recent months, Dunzo Stock Price has demonstrated resilience despite broader market volatility. Investors are closely monitoring the company's user growth, revenue trends, and expansion plans, which could potentially impact its valuation and share price in the long term. As the demand for hyperlocal delivery services continues to rise, Dunzo's innovative business model and market leadership position are expected to drive Dunzo Share Price momentum.

IPO Updates:

Dunzo's decision to go public has generated significant buzz within the investment community. The company's IPO is seen as a landmark event that could potentially reshape India's startup ecosystem and cement Dunzo's position as a leading player in the hyperlocal delivery space. While specific details regarding the IPO, such as timing and valuation, are yet to be officially announced, reports suggest that Dunzo is actively preparing for its stock market debut.

The IPO market in India has been witnessing heightened activity, fueled by investor appetite for tech-enabled startups with strong growth potential. Dunzo IPO is expected to attract considerable attention, given its disruptive business model and expanding market presence. The proceeds from the IPO are likely to be used for scaling operations, investing in technology infrastructure, and expanding into new geographies.

Potential Challenges and Opportunities:

While the Dunzo IPO presents exciting opportunities for growth and expansion, it also faces certain challenges and uncertainties. The hyperlocal delivery space is highly competitive, with numerous players vying for market share. Additionally, regulatory hurdles, operational complexities, and changing consumer preferences could impact Dunzo's growth trajectory and investor sentiment.

However, Dunzo is well-positioned to capitalize on the growing demand for convenience services in India's rapidly urbanizing landscape. The company's robust technology platform, extensive delivery network, and focus on customer satisfaction set it apart from competitors. Moreover, partnerships with leading brands and innovative service offerings have bolstered Dunzo's market position and enhanced its appeal to users.

Conclusion:As Dunzo embarks on its IPO journey, Dunzo Share Price movements and IPO updates will be closely watched by investors and stakeholders alike. The company's commitment to revolutionizing hyperlocal delivery and providing unparalleled convenience to consumers has positioned it for long-term success. With the IPO expected to provide the necessary capital infusion for growth and expansion, Dunzo is poised to capitalize on the immense opportunities in India's burgeoning delivery market. As investors await further developments, the trajectory of Dunzo Stock Price reflects not just financial metrics but also the broader narrative of innovation, disruption, and consumer-centricity in the digital era.

0 notes

Text

Ixigo Pre IPO Buzz: Key News and Updates

Ixigo is a leader in the rapidly changing Indian travel business, revolutionizing how travelers book and enjoy their travels. The financial community is ablaze with anticipation as ixigo IPO is highly anticipated, and important updates and news are eagerly awaited. We'll examine the most recent Ixigo Share Price, developments and the elements that fuel the Ixigo pre-IPO hype.

Ixigo's Unlisted shares Journey Overview:

Founded in 2007 by Aloke Bajpai and Rajnish Kumar. Now Ixigo IPO has become a household name in India. It’s one-stop platform for travel-related services Become the USP of the company. From flight bookings to hotel reservations and train journeys, Ixigo has carved a niche for itself by providing users with a seamless and comprehensive travel planning experience. The company has become a major participant in the Indian travel IT market by evolving and adapting to the changing needs of travelers over time.

They assist travelers in making smarter travel decisions by leveraging AI, machine learning and data science led innovations on their OTA platforms, comprising their websites and mobile applications.

Ixigo IPO compares real-time travel information, prices and availability for flights, trains, buses, and hotels for users for transparency along with helping user to take right decision, and also Ixigo allows ticket booking through its associate websites and apps.

In 2008, it introduced a hotel search engine on its website. In early 2014 it launched a trains app as well.

Ixigo Pre IPO Details

Ixigo Pre Ipo have received in-principle approvals from BSE and NSE for the listing of the Equity Shares pursuant to letters. Ixigo upcoming IPO proposes to make an IPO which comprises a fresh issue of its equity shares of Re. 1 each and offer for sale by certain shareholders’ existing equity shares of Re 1 each at such premium arrived at by the book building process (referred to as the ‘Issue’), as may be decided by the Company’s Board of Directors.

The company plans to come with an Ixigo IPO by 2024

Current Ixigo Share Price

The face value of each Ixigo share is ₹ 1. Ixigo stock price is ₹ 145/share. Ixigo IPO price band is not disclosed yet.

Ixigo Unlisted share Merger & Acquisition

Ixigo purchased Abhibus on August 5, 2021. By providing its combined user base of almost 25.5 crore customers with a multi-modal transportation experience spanning trains, aircraft, and buses, the agreement will assist Ixigo Group in solidifying its position in tier 2, 3, and 4 markets.

Investments

It is true that Ixigo owns stock in FreshBus, an electric intercity bus service company with headquarters in Bengaluru. Ixigo gave FreshBus Rs 26 million in startup finance in February 2023. This was a calculated financial risk taken to facilitate the introduction of FreshBus's intercity electric bus services throughout India.

Ixigo share price Market Size:

The online travel market in India is expected to reach US$ 31 billion by the end of FY25, growing at a 14% CAGR from FY20.

Travel and tourism, one of the fastest-growing economic sectors in India, contributed US$ 178 billion to the nation’s GDP in 2021.

The India Brand Equity Foundation (IBEF) states that there is a sizable travel and tourist market in India. It provides a wide range of specialised travel products, including cruises, outdoor activities, wellness, medical, sports, MICE, eco-tourism, movies, rural, and religious travel. Both domestic and foreign travellers have acknowledged India as a spiritual tourism destination.

As per the IBEF’s February 2023 report on Tourism and Hospitality, the contribution to the GDP is expected to reach US$ 512 billion by 2028, at a strong CAGR growth of 16% between 2021-28.

The travel industry bounced back remarkably in FY23 after being severely affected by the pandemic and is expected to move at an exponential pace. As per the data published by Directorate General of Civil Aviation (DGCA), the number of passengers that travelled by airlines domestically increased 62% YoY to 136 million passengers in FY23, as compared to 84 million passengers in FY22.

As indicated in the February 2023 IBEF Report on Aviation, India is poised to become the third-largest air passenger market globally by 2024, encompassing both domestic and international travel, and is expected to host over 480 million air travellers by 2036.

According to WTTC, India is ranked 10th among 185 countries in terms of travel & tourism’s total contribution to GDP in 2019.

Ixigo pre ipo User and Involvement:

When assessing Ixigo unlisted share chances of continuing to develop, the size of its user base is crucial. As signs of a strong and devoted customer base, investors will probably closely examine user acquisition tactics, user engagement measures, and customer retention programmes.

In conclusion:

We are in the midst of a critical juncture in the development of the Indian travel tech industry. The ixigo pre-IPO excitement keeps growing. Not only is the success of Ixigo's IPO evidence of the company's accomplishments, but it also shows how confident the market is in travel technology overall. We hope to have a great opening in Ixigo upcoming ipo so that we can book tremendous profit in Ixigo share price.

0 notes

Text

Are you Looking for the stylish investment app to buy shares? Go for Our top- rated app Planify, which offers a flawless and secure platform to invest in shares of your favorite companies. With real- time request data. You can make live update and stay ahead of the request. Take charge of your fiscal trip and start investing your money with our best- in- class investment app moment.

#share market#stock market#Investment App#investing app#stock market app#share market app#share market India#share market apps india#business funding app#funding apps#upcoming ipo app#angel investors app#Startup India

1 note

·

View note

Text

Major fast-fashion retailer Shein plans a factory in Mexico

Shein, the online clothing retailer giant, is considering building a factory in Mexico as a manufacturing hub outside of China.

The factory will produce Shein products and is part of the retailer's initiative to localize production. For Shein customers in Latin America, this could result in faster shipping and lower distribution costs. It comes after the company declared that a manufacturing hub would be established in Brazil to serve a global customer base.

Shein was established in China, where it continues to produce the majority of its products, though it is currently looking to grow. With its $10 dresses and $5 tops, the company has driven out other low-cost fashion retailers from the market.

Shein, which has its current headquarters in Singapore, competes with PDD Holdings' Temu, which offers low-cost goods from China, including clothing and electronics, for sale in the United States.

According to the sources, who asked for anonymity because the discussions are private, a final location for the Mexico site has not yet been chosen.

Shein will use the $2 billion it recently raised in capital from investors such as Mubadala and Sequoia China to fund the expansion as it prepares for an IPO in the United States. One of the sources added that the retailer still reports annual revenue growth of 40% despite a valuation reduction to $66 billion in its most recent funding round.

Recently, Shein provided a platform for an online market place in Brazil, enabling independent vendors to sell their own products on the Shein app and website. Then, before going global, a similar marketplace would be introduced in the United States.

Items from independent vendors won't be kept in the upcoming Mexico factory, according to sources. Shein is considering expanding its marketplace model to other markets across Latin America.

0 notes

Text

Discover Upcoming IPOs with Motilal Oswal App - Your Gateway to Stock Market Investments

Stay ahead in the stock market with the Motilal Oswal app, your go-to platform for tracking the latest IPOs. Whether you're a seasoned investor or just getting started, the app provides real-time updates on upcoming IPOs, helping you make informed investment decisions. With detailed insights, expert analysis, and a seamless investment process, the Motilal Oswal app ensures you're always ready to capitalize on new opportunities in the market. Download the app today to explore the most promising IPOs and grow your investment portfolio with confidence.

0 notes

Text

How to apply for an upcoming IPO via online trading?

Going public with an Initial Public Offering (IPO) is a major milestone for any company. It involves selling the company's stocks to the general public, so that they can be traded on the stock exchange. This transition will open up new opportunities and make your business accessible to more investors. It's a great chance for potential investors to become shareholders in a company that was previously held privately.

An IPO can come in two forms - the fixed price issue and book building issue. In a fixed price issue, the issuer and the lead managers decide on a predetermined share price for investors to purchase. With book building issues, investors have the option to bid within a predetermined price band. This range gives them flexibility to pick the price they find suitable, so as to ensure that their investments are justified. Applying for an IPO using ASBA blocks a certain amount of money in your bank account, but if you do not receive allotment, the funds are made available to you again.

How to apply IPO online through m.Stock?

Get access to the IPO section of m.Stock Zero Brokerage by either visiting www.mstock.com or downloading our mobile application, then log in to your Demat account and click on the menu tab. From there, you can also complete your account opening process hassle-free!

When you are ready to apply for an IPO, choose the IPO you would like and then enter the total number of shares and your preferred bid price. Then, review your application and proceed to the payment tab. There, select UPI as your mode of payment.

All you need to do is enter your UPI ID and generate the OTP. Once entered, your IPO application will be processed and finished in no time!

Benefits of applying for an IPO online through m.Stock trading app

Going the IPO route online is a sensible choice if you're short on time. It saves you from having to manage physical paperwork and a visit to the broker - saving you precious hours that can be spent on something else.

Applying for an IPO online is now easier than ever - thanks to the user-friendly process. With just a few simple steps & an online payment, you can complete the process quickly and without any hassle.

ASBA is an effective way to optimise investments. The money for the shares remains in your bank account and is only debited when the allotment process is completed, allowing you to continue earning interest on the same amount. Because of this, you don’t miss out on any interest income.

The IPO application process online is both secure and transparent. It is designed to keep your data and funds safe, with a range of checks in place for this purpose.

0 notes

Text

IPO alerts to stay informed about new investment

Purpose of an IPO alert is to notify investors of an upcoming opportunity to invest in a new public company.

The alert may include key details about the company, such as its industry, financial performance, and potential risks and opportunities. It may also provide information on the expected timeline for the IPO, including the date of the offering and the expected price range for the shares.

0 notes