#verycarful

Note

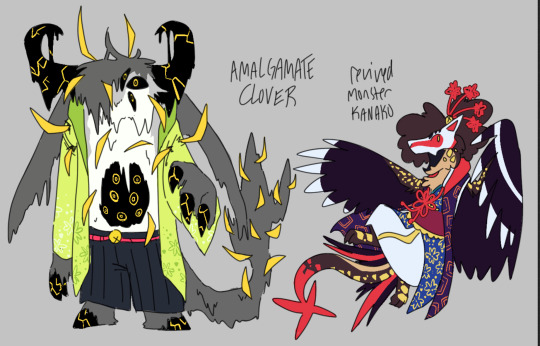

What would monster clover and kanako look like if they swap places.

Like amalgamate clover and monster kanako?

amalgamate clover: combined with a cactony and a bowll

revived monster kanako: a mix of all of her friends!

#asked and answered#uty swap au#monster clover au#technically??#doing the kanako design was interesting bc i only have like. vague ideas for designs for everyone else in my head#so if i ever drew them it would be like reverse engineering#trying to make a mixed design with no ingredients to mix with is.. hard#and amalg clover… i imagine the sludge hole in their stomach can creat things like bowlls liquid in its back can#like it can make a face or a clawed hand or something#like bowll can make the white dog!#they are sharp to the touch….. no hugging for them unless u are verycareful

142 notes

·

View notes

Text

VeryCare: Empowering Lives with Top-Notch Home Care Services

VeryCare is the leading home care provider in Ontario, expanding across provinces and regions. We offer top-notch care in the comfort of clients' homes. Our experienced and compassionate team delivers personalized, high-quality care, focusing on client-centered service. We prioritize communication with families and healthcare providers to ensure the best outcomes. Safety, comfort, and independence are paramount. Our licensed, insured professionals undergo extensive background checks. We invest in technology and training to deliver exceptional care and make a positive impact on clients' lives daily.

1 note

·

View note

Photo

veryme verythankful verydomenicovacca veryhard veryfun VeryInteresting verybusymagazine verysimple VeryExperiencedHairstylist veryblessed VeryKnowledgableHairstylist verydrunk veryyummy veryserious veryshort verygrateful verylimitedstock verybritishproblems veryhigh verycarful verytalented veryape veryfancy verygoodtime veryeffective verycolorful verygoodquality veryday verystrong veryshorthair #veryme #verythankful #verydomenicovacca #veryhard #veryfun #VeryInteresting #verybusymagazine #verysimple #VeryExperiencedHairstylist #veryblessed #VeryKnowledgableHairstylist #verydrunk #veryyummy #veryserious #veryshort #verygrateful #verylimitedstock #verybritishproblems #veryhigh #verycarful #verytalented #veryape #veryfancy #verygoodtime #veryeffective #verycolorful #verygoodquality #veryday #verystrong #veryshorthair https://www.instagram.com/p/B1fCB7anyTw/?igshid=5xjq07o9i4yx

#veryme#verythankful#verydomenicovacca#veryhard#veryfun#veryinteresting#verybusymagazine#verysimple#veryexperiencedhairstylist#veryblessed#veryknowledgablehairstylist#verydrunk#veryyummy#veryserious#veryshort#verygrateful#verylimitedstock#verybritishproblems#veryhigh#verycarful#verytalented#veryape#veryfancy#verygoodtime#veryeffective#verycolorful#verygoodquality#veryday#verystrong#veryshorthair

1 note

·

View note

Photo

It Got 2 B #GOD.. Happiest ONE N FOUR Birthday To My #GODFearing #Intelligent #SelfMotivated #Smart #VeryCaring N #Understanding #Son, In Whom I'm Well PLEASEEEE 🎉🎉🎉🎉🎉🎉🎉🎈🎈🎈🎈🎈🎈🎈💙💙💙💙💙💙💙💙 May Proverbs 9:10 Be Your Blue Print in This Journey. And Proverbs 3:5-6 Your Daily Reminder..... Tooooo Grateful To GOD For This #EXPERIENCE... Continue To Presevere And Alllll YOUR #DREAMS Will Come Through IJMN..Enjoy Your Day My#DarlingBoy... (at Stubblefield Access) https://www.instagram.com/p/CbXkLPeODED/?utm_medium=tumblr

#god#godfearing#intelligent#selfmotivated#smart#verycaring#understanding#son#experience#dreams#darlingboy

0 notes

Photo

I am nothing but a point of view- very careful/ - Alive #landscape #thewayisee #winter #walking #alwayis #verycareful #integrity https://www.instagram.com/claudia.piscitelli/p/CYBu6Hrsnp8/?utm_medium=tumblr

0 notes

Photo

Sabedorias Atemporais ⭐ #remove #removedor #ketunacasa7 #rahuinleonatal #rahuingemini #ketuinaquariusnatal #astrovision #falsefriends #becareful #enviousperson #verycareful #alleyesonme #noneedforthat #chillhommy #nothearbruh #imcoolwiththat #distance #protection #awayfrommewiththat (em Em Casa) https://www.instagram.com/p/CAAXhXHnbMM/?igshid=13hc2ckeyszyb

#remove#removedor#ketunacasa7#rahuinleonatal#rahuingemini#ketuinaquariusnatal#astrovision#falsefriends#becareful#enviousperson#verycareful#alleyesonme#noneedforthat#chillhommy#nothearbruh#imcoolwiththat#distance#protection#awayfrommewiththat

0 notes

Note

i have wrinkly eyelids and I'm 25 😭 do you have any tips Ana? I'm trying to gather as much info as I can to build a skincare plan

I would be careful with eyelid stuff just bc it’s so close to the eye which is HIGHLY sensitive, the orchid of the garden that is your body. If you have wrinkly eyelids, i would say be VERYCAREFUL when cleaning off makeup like eyeshadow mascara eyeliner and be sure to PAT clean/dry and not rub. I would probably go to a derm for this just bc of the location.

9 notes

·

View notes

Note

When you get this, you have to answer five things you like about yourself publicly and then send this to your ten favorite followers! 💖💖💖💖

Oooh I'm a fav!! THANK YOU!

Uuuh I dunno what there is to like about me but I'll give it a shot.

I have pretty great hair

My Spotify mix is fuckin BANGING!

Uuummm something to do with how passionate I am about the environment..? Yeah?

#verycaring (despite how I may appear)

Fuck what anyone else says I'm funny asf

Now to find my top 10 followers...

2 notes

·

View notes

Text

언제 어디서나 전차종 상담가능 신차구매할부 리스장기렌트 중고차 모든 문의는 verycar 황대표에게 맡겨주세요 010.6670.9977 #렌트카 #자동차렌트 #자동차렌터카 #장기렌트카 #롯데렌터카 #롯데렌터카장기렌트

#자동차장기렌트 #수입차장기렌트 #장기렌트견적 #자동차장기렌트리스

#무보증장기렌트 #경차장기렌트 #신차장기렌트 #신차구매 #신차할부 #차량견적 #비용처리 #법인차량 #차량상담 #bmw #벤츠 #bmw리스 #벤츠리스 #bmw장기렌트 #벤츠장기렌트 #bmw중고차 #벤츠중고차 #중고차 #중고차딜러 #자동차최저가

#경차장기렌트#국산차장기렌트#무보증장기렌트#법인장기렌트카#신차장기렌트#자동차리스#자동차리스렌트#자동차장기렌트#장기렌트#무보증장기렌트카#수입차장기렌트#롯데렌터카장기렌트#장기렌트카#장기렌트카비용#장기렌트견적#중고차#bmw#미니#미니쿠퍼

0 notes

Text

It Sucks To be a Celebrity, especially since the Me-Too Movement is complete happening. The Me-Too movement that has given women a voice has reigned on its targets, most specifically Men from Hollywood, this year we have seen that happen Bill Cosby became one of the first Recipient’s of the Me-Too Movement as he was arrested and placed in Prison. The thing is no matter how famous you are in Hollywood, you cannot escape the Me-Too Movement you have or are believed to have made an enemy of it. The Me-Too Movement, a movement against Sexual harassment and Sexual Assault, like that Movie called North Country where Women were Bullied, sexually harassed and to worst extent, sexually assaulted. The Movie made in 2005 and was based on a true-life story that involved women been harassed by men in a work place, not just in a work place, but in various work place around the world. This situation involving The Hedley Band, Jacob Hoggard included is zero exception, even though the story the truth to this story is yet to be revealed. Thanks to the Me-Too Movement, the days of Celebrities behaving recklessly or doing reckless things like getting arrested, indulging in fights are turning in a wake up call saying: Celebrities need to be careful or its straight into the Pandora box. Living a celebrity life is not as wonderful as it seems, just ask this guy – Jacob Hoggard who was convicted by various women since 2005, he was arrested This past July 2018. Rape is something is zero tolerated, and anyone in their right minds would much rather prefer been on an island alone than commit such a heinous act. Jacob Hoggard is not the only celebrity facing a sexual assault problem this week, Kevin Spacey, actor from House Of Cards is also facing allegations Sexual Assault in which there was a possibility that it was recorded. Even Though The truth to what is Going on With Hedley Lead-Singer Jacob Hoggard and Actor Kevin Spacey has not been discovered or been revealed, the bottom-Line is crystal Clear: The days of hearing Celebrities making a fool of themselves is about to become a thing of the past, So Celebrities, be careful with how you present yourself outside.

Celebrities Be VeryCareful

How The Me-Too Movement is becoming a wake-up for celebrities to be careful.

10,000.00฿

Celebrities Be Very Careful

How The Me-Too Movement is becoming a wake-up for celebrities to be careful.

500.00 CHF

Celebrities Be Very Careful

How The Me-Too Movement is becoming a wake-up for celebrities to be careful.

1,000.00 Skr

Celebrities Be Very Careful

How The Me-Too Movement is becoming a wake-up for celebrities to be careful.

S$400.00

Celebrities Be Very Careful

How The Me-Too Movement is becoming a wake-up for celebrities to be careful.

10,000.00 ₽

Celebrities Be Very Careful

How The Me-Too Movement is becoming a wake-up for celebrities to be careful.

£40.00

Celebrities Be Very Careful

How The Me-Too Movement is becoming a wake-up for celebrities to be careful.

10,000.00 ₱

Celebrities Be Very Careful

How The Me-Too Movement is becoming a wake-up for celebrities to be careful.

1,000.00 Kr

Celebrities Be Very Careful

How The Me-Too Movement is becoming a wake-up for celebrities to be careful.

NZ$500.00

Celebrities Be Careful

How The Me-Too Movement is becoming a wake-up for celebrities to be careful.

NT$10,000

Celebrities Be Very Careful

How The Me-Too Movement is becoming a wake-up for celebrities to be careful.

MX$10,000.00

Celebrities Be Very Careful

How The Me-Too Movement is becoming a wake-up for celebrities to be careful.

1,000.00RM

Celebrities Be Very Careful

How The Me-Too Movement is becoming a wake-up for celebrities to be careful.

¥9,000

Celebrities Be Very Careful

How The Me-Too Movement is becoming a wake-up for celebrities to be careful.

1,000.00 ₪

Celebrities Be Very Careful

How The Me-Too Movement is becoming a wake-up for celebrities to be careful.

400 Ft

Celebrities Be Very Careful

How The Me-Too Movement is becoming a wake-up for celebrities to be careful.

400.00 HK$

Celebrities Be Very Careful

How The Me-Too Movement is becoming a wake-up for celebrities to be careful.

100.00 Dkr

Celebrities Be Very Careful

How The Me-Too Movement is becoming a wake-up for celebrities to be careful.

5,000.00 Kč

Celebrities Be Very Careful

How The Me-Too Movement is becoming a wake-up for celebrities to be careful.

C$6.00

Celebrities Be Very Careful

How The Me-Too Movement is becoming a wake-up for celebrities to be careful.

R$60.00

Celebrities Be Careful

How The Me-Too Movement is becoming a wake-up for celebrities to be careful.

A$60.00

Celebrities Be very Careful

How The Me-Too Movement is becoming a wake-up for celebrities to be careful.

$6.00

One days when it sucks to be a Celebrity It Sucks To be a Celebrity, especially since the Me-Too Movement is complete happening. The Me-Too movement that has given women a voice has reigned on its targets, most specifically Men from Hollywood, this year we have seen that happen Bill Cosby became one of the first Recipient's of the Me-Too Movement as he was arrested and placed in Prison.

0 notes

Text

To my “crush”

For the past 6 months have been so weird to say the least. Lol you’ve taught me a few things about life that I’ve been keeping with me since I’ve met you and it’s helped shape me into the woman that I’m aiming to be. Learning how take responsibility for the things in my life and just learning how to trust myself when it comes to my judgement with people have really been some things you’ve helped me with.

I don’t feel like I know you 100%, but what I do know is that you are verycaring and when I come to you about things you give me an unbiased opinion and don’t surgarcoat things. Not only do I think you’re gorgeous asf but I think you’re smart and a bit of a mystery and you make me want to learn more about you. When you do start to open up, you always reveal a little more about yourself and I like that.

I care about you so much and I want nothing but for you to be happy. I wish you nothing but the best and I want to continue to see you grow💕

0 notes

Text

Weekly Forex Forecast: March 12 – 16 2018 – Forex Trading Guide

welcome everybody to our weekly foreign exchangemarket evaluation name and that is in preparation for buying and selling for the week ofMarch 12 to 16 2018 only a fast disclaimer earlier than we get began this isfor instructional functions solely buying and selling is a dangerous enterprise so please be verycareful along with your cash alright in order common we are going to begin off bytaking a take a look at our calendar right here so developing this week a very first thing isdaylight financial savings time shits shift so that is each for US and Canada in springwe go ahead one hour in order that has occurred so that is the primary day wehave had the time shift is shift it occurred final night time so which implies thatour london buying and selling hours will shift a bit so as a substitute of beginning at three:00 a.

M.

Jap it will likely be four:00 a.

M.

Jap so simply preserve that in thoughts and that goes onfor two weeks it's the UK shifts again on March the 24th so we have now yeah about twoweeks the place the time shall be misaligned just a little bit so preserve that in thoughts I'mgoing into Monday right here not a complete lot of essential knowledge we do have RBAassistant governor bullit talking that shall be essential the businessconfidence quantity for Australia shall be essential as nicely and Tuesday we haveannual finances for for UK there that shall be essential and in addition very importanthere are the CPI numbers so when Fed has been speaking about elevating price so theyraise charges and within the feedback that they’ve had about elevating charges thisyear one factor that has been on the forefront is the inflation knowledge andeverybody's questioning the inflation numbers so if the inflation numbers arenot getting greater that may be an issue with the Fed so proper now whatwe are searching for is a constructive quantity zero.

2 % so if this quantity comes inkind of is in alignment with this quantity right here that shall be good howeverif the quantity is detrimental that may have an even bigger impression as a result of market willstart begin pondering that they're not protection not going to lift race whichwill be detrimental for the US greenback so preserve that in thoughts a constructive or a higherinflation quantity shall be constructive for the US greenback but when we get anythinglower than this it will likely be detrimental for the US greenback and we may see US dollardrop in opposition to throughout the board after which we have now Financial institution of Canada governor polarspeaking once more extra RB Assistant governor Kent talking there industrialproduction numbers for China so regardless that we don't commerce Chinese language currencyit has an impression on Australia and New Zealand as a result of they're large tradepartners and we do commerce these foreign money so preserve that in thoughts after which we have now onWednesday we have now ECB President Draghi talking final week we had ECBannouncement price announcement they saved on the price the identical and we noticed thatEuro jumped up after they modified their language when it comes to the asset purchaseprogram so the asset buy program is how the how the central financial institution putsliquidity out there so that they pump cash into the market by shopping for thebonds and because of this and get the cash to the so that they purchase the bonds from thebanks and the banks have extra money that they will then lend out to shoppers andbusinesses and that's how they create that circulation of cash within the financial system so nowthat the financial system is doing higher the European financial system is doing higher thecentral financial institution has been attempting to principally go get off of that programthat program is meant to finish in 2018 this 12 months in direction of the tip of this 12 months Ithink September 2018 and one of many feedback that they the middle-backremoved was final time they stated that they're going to proceed the programfor so long as it's essential and that could possibly be even well past the September2018 date this 12 months sorry this time they really eliminated that wording and whatthey stated that the cash that has already been invested in these bondpurchases and asset purchases what occurs is as soon as the cash comes dueso that when the bond matures the cash you recognize you may get the cash backhowever what they're going to do is they are going to proceed placing a reinvesting thatmoney again so that they're going to finish this system so that they gained't be placing anymore cash in however the cash that's already been invested that may bereinvested within the financial system so after they eliminated their program that wording eurojumped up after which when Draghi began talking within the press convention and heclarified a few of these factors we noticed a euro drop on account of that so themarket will now actually be that key level as to what the what thecentral financial institution's coverage goes to be going ahead there are some centralbankers some ECB members which have come out and stated that we have to provideforward steering when it comes to curiosity ratesDraghi hasn't actually set that proper now there's additionally concern in regards to the tradewars with President Trump says saying that they will put tariffs onsteel and aluminum that’s inflicting issues as nicely so so there there issome uncertainty out there so simply keep watch over that after which onWednesday we even have core retail gross sales PPI and retail gross sales numbers once more thesewill be essential GDP for New Zealand shall be essential right here as nicely and thecrude oil stock will have an effect on each the US the US greenback andCanadian greenback right here on Thursday we have now Swiss Nationwide Financial institution right here we have now thelibrary price which is the rates of interest the Swiss Nationwide Financial institution continues to be in thenegative territory after which the financial coverage assertion right here as nicely once more weare going by way of this era of change the place the central banks are changingtheir financial coverage so it's essential to concentrate to to those statementsthat come out so in case you're buying and selling Swiss franc this shall be essential after which wehave these Empire State manufacturing numbers once more regardless that that is orangeit is essential and these numbers will have an effect on the USStaller right here going into the Asian session enterprise manufacturing indexnumber so there's lots of members from a reserve not sorry RBA who’s the Bankof Australia talking so this might have an effect on Australian greenback heregoing into Friday we have now ultimate CPI numbers out of euro euro zone so thatwill have an effect on euro there after which we have now constructing permits for the USand housing begins these numbers regardless that they’re orange they do have animpact available on the market so we do have to keep watch over that in order that's it so wereally have one central financial institution and a few different central bankers speakingso we'll simply have to concentrate to thatso let's transfer on to our charts now we are going to begin off with our Europe so herewe see that Euro had been on this broader vary for some time and now it'sin a little bit of a decrease vary right here so we have now a really good pin bar we had a pinbullish pin bar for Euro final week and from there it has moved as much as the highest ofthis vary that it was or at the very least the highest of this pin right here now we have now abearish pin bar for the euro so bearish pinbarI am searching for worth to drop right here we’re more likely to see worth wrestle at thisone 2200 degree which is the place worth has struggled a number of occasions earlier than it didtry to interrupt by way of this final time however it was not profitable so proper now basedon the bearish pinbar right here I'm searching for a worth to attract for euro US dollarso the bias is bearish for this week first goal can be one level 2200second goal can be one level twenty 100 so searching for worth to comedown a bit pound greenback right here pound has a pound pushed again just a little bit so we hadtalked about that markets are we talked about seeing some pull backs final weekso this one pulled again however general the bias continues to be to the draw back so if wetake a glance right here there may be nonetheless that downtrend linecoming down so now we have now pushed up I'm searching for worth to drop from right here andpotentially do one a transfer like that so for this one right here the my bias shall be uhwill even be to the draw back and I'm searching for worth to come back again into thisone level 3700 degree right here after which probably into 135 80 degree under hereso searching for worth to drop general bias nonetheless stays to the draw back eventhough there’s a pullback right here and so these would be the three ranges firstlevel 1.

30 700 second 135 80 third one 134 20 degree so general bias stays tothe draw back for pound greenback right here ah see right here Aussie was really quitestrong the bias right here final week was to the draw back however it couldn’t break thissupport and resistance degree right here that was fairly fairly essential supportresistance degree was not capable of break it so now we have now a bullish engulfingcandle for Ozzy right here so I'm searching for worth to push up greater so all thecommodity currencies pushed up regardless that the commodities themselves didn'tdo as nicely at the very least I didn't do as nicely however the commodity currencies have pushedout so it is a bullish engulfing candle searching for worth to maneuver higherinto zero.

79 sixty degree again into this earlier afford personal resistance degree andpotentially even into 79 so about zero level eight zero zero degree so thosewill be the 2 targets to the upside however searching for a bullish transfer in Aussiedollar New Zealand greenback we had an identical story right here worth couldn’t breakbelow this earlier assist or resistance degree as a substitute pushed uphigher and now with this one it’s bullish however we must be a littlecareful right here so this one it it engulfs the earlier one so on account of thatI we'll be searching for a bullish transfer andthe goal can be zero.

74 38 degree so 74 38 degree to the upside again into thisprevious assist and resistance degree right here and but when the worth isn’t ready tobreak previous their assist or resistance which is at zero.

73 20 we may nonetheless getthat transfer to the draw back in order that's the one factor I might be aware of overalljust primarily based on the weekly technicals right here it appears like an up transfer however we couldget caught right here identical to we received caught to the draw back we may get caught right here andthis can occur so simply be aware of that however general bias shall be to thedown to the oxide sorry greenback cad right here greenback cad appears bearish i'm sorrywhich 4th to bullish candle and are we speaking about are you able to please clarifythat yeah so I'm all of the US greenback right here which bullish candle okaywe'll come again to that New Zealand greenback okay so New Zealand greenback thisis the place we’re so we’re on this vary basically within the New Zealand greenback sowe have we have now BC traded on this vary as a result of we're within the backside of the rangeso I'm searching for worth to go up greater so that is that is form of how I'mviewing it so searching for worth to enter the top quality after which thenreact however I’ve this within the center right here so if the worth isn’t capable of breakabove this see that is the assist or resistance I'm worth had alot of hassle with this space in order the worth goes greater if it's not ableto break above this which is about 70 335 degree the worth may do one ofthese in order that's what I’m for New Zealand greenback so the bias is to theupside however there’s a concern about getting caught on the supporter isdouble greenback cat right here greenback cad is a pleasant bearish pinbar right here and this looksquite good on the weekly so because of this I might search for a worth to attract and nowwith this one the goal can be one level twenty six twenty degree theconcern once more can be proper over right here as a result of that is an significance of maintain onresistance space coming all the best way from there so that is one level twenty eighthundred degree if it doesn't maintain under twenty eight hundred degree it couldstill go up however I do just like the weekly pin bar so my bias on that is to thedownside and the goal is 126 a one level twenty six twenty degree which isthis assist no resistance space which is the underside of our earlier weekly candleclose right here so the bias for greenback cad is to the draw back your a pound right here yourpound has been buying and selling on this vary for fairly a while we’re on the prime of therange right here so I'm searching for worth to attract again in direction of the underside of therange so the bias is to the draw back and the underside of the vary right here is 86 93 soabout eight,700 degree so searching for worth to attract for Euro Pound euro Swiss franchere your Swiss franc has had an enormous bullish transfer to the upside so I'mlooking for worth to go up farther from right here and since we have now had such abullish transfer we may see such a a pullback again into one level one sixforty degree after which worth goes and continues on to the upsideso my bias is bullish for euro Swiss franc and trying to trying to targetthe prime right here into one level one eight zero zero degree so the biases to theupside the a pound Swiss franc right here biases to the upside as nicely so thefirst goal can be one level thirty two thirty space after which one level 3480space to the upside so bullish bias good bullish engulfing candle so wanting forprice to maneuver up greater now you be mindful there may be Swiss NationalBank financial coverage sighs sorry financial coverage evaluation coming outthis week which may have a huge impact on the Swiss franc if they modify theircommentary across the rates of interest so preserve that in thoughts however from technicalperspective this appears bullish greenback Swiss francbig transfer to the upside right here we have now damaged by way of this earlier a pin barhere and now searching for a bullish transfer to the upside the goal right here can be96 30 degree zero.

96 30 degree once more with Swiss Nationwide Financial institution issues may changeso be aware of that with this one I might search for a little bit of a pullback hereas nicely simply because we have now had an enormous large form of shut right here so I'm stilllooking for a transfer to the upside however they could possibly be a pullback again into thissupport no resistance at 9420 space okay yen crosses yen crosses have had aninteresting week so the largest factor that occurred with the yen crosses wasthat we we noticed some political occasions happen so North Korea basically isready to speak and they’re able to D nuclear ice and once we hear commentslike that it’s typically unhealthy for yen however constructive for yen crosses so yenweakens and all the pieces else will strengthen round that so yen is a safehaven foreign money Swiss franc is a secure haven foreign money US greenback is a secure havencurrency when issues are occurring out there which might be perceived to be negativethese three currencies strengthened and we noticed we see all the pieces drop againstthese currencies nevertheless once we see constructive issues occurring round theworld so issues like North Korea not wanting to maintain the identical stance that ithas held for this lengthy on their nuclear weapons program that’s consideredpositive when such constructive geopolitical thingshappen market scene sees that as a danger on atmosphere or it creates a danger onenvironment out there meaning buyers are keen to take extra riskand when buyers are keen to take extra danger they are going to spend money on thingslike shares and we'll see inventory market go up and once we see the chance offenvironment then the secure haven currencies will really strengthen sowhen there may be danger out there when buyers don't like danger they'rerisk-averse so once we see detrimental geopolitical occasions like North Koreathreatening to to principally you recognize Mother us that's a detrimental atmosphere in order aresult folks buyers get danger-averse and they’re going to pull cash out of thestock markets and they’re going to put cash in Japanese yen Swiss franc and US dollarswhich are thought of to be safer than currencies so principally we noticed a danger onenvironment meaning Japanese yen bought off and because of this we noticed Swiss francall the Swiss pairs go up as nicely and we noticed yen crosses go up as nicely now thereare talks about President Trump assembly with North Koreanow if these if that involves to play then Japanese yen will weaken furtherbecause that's a constructive factor and we don't have to be in secure havenenvironment if that occurs so in that case yen may go up butbased on this technicals right here we’re nonetheless in that general downtrend right here butwe have had a bullish candle shut so now this needs to be performed as an overallpicture so we have now to take a look at the general image we'll must preserve inand we have now to keep watch over what's occurring out there so conserving an eyeon Bloomberg and Reuters to guarantee that we perceive whether or not North Koreaand us will speak or not will play an essential position hereso from general perspective that is bullish and searching on the technicalsthis may push up a bit extra so we may go all the best way into one fiftypoint eighty degree right here all the best way again into the earlier assist and resistancelevel so I might for now name this bullish however once more keep watch over thecommentary that comes out simply general in the event that they speak that's a great factor ifthere's a constructive end result of that that may be once more constructive for the yencrosses if there may be detrimental if let's say the talks break down or they will'teven set a gathering date that shall be thought of detrimental after which yen crossescould drop when it comes to the financial coverage we did have Financial institution of Japan comeout with their financial coverage didn't actually change something in order that waspretty impartial however it's actually the do political stuff that’s saying into theyen at this level so my goal for my bias for pound yen right here shall be to theupside and the goal shall be 150 level eighty degree so bias to the upside hereyen so your yen an identical story right here as nicely all of the yen crosses went up so wepushed off of this assist or resistance degree general we have now a bullish candleclose and I'm searching for worth to maneuver greater into one thirty three sixty nowjust be mindful all of the younger crosses will have a tendency to maneuver collectively so preserve aneye available on the market commentary general biases to the upside for euro yen aswell greenback yen right here similar story costs pushed up we’re intoresistance right here although so preserve that in thoughts general bias nonetheless stays to thedownside and with this one I might search for a bullish transfer to the upside butagain from technical perspective we may get caught at this 107:20 degree ifprice doesn’t break above 107:20 degree then we may return in direction of the bottomof this degree again into one and 5 thirty but when all the opposite yen crossesmove up a greenback yen is more likely to transfer up as nicely and the goal would beNo 880 degree to the upside so bias for this week shall be to the upside $4dollar yen Aussie and massive bullish candle shut right here worth bounced off of thebottom right here so this was an important technical degree in order we are able to see pricebounced off because of this searching for worth to maneuver up greater into 85 60 levelto the upside again into the spin into the assist and resistance ranges soOzzy and biases to the upside similar factor with cadion is wellpreviously the bias was very a lot to the draw back on this however now that every one theyen crosses are shifting greater that is additionally this has additionally pushed up so thetarget can be 85 54 cadion so let's check out gold gold we have now a dojiso that is this exhibits rejection of the highest but additionally rejection of the underside andthe worth opened and closed at precisely the identical place that it it began offfrom however this rejection of the excessive right here exhibits that worth may come again lowerbecause the suitable now we’re into the center right here the goal for this one sothe bias can be to the draw back and the goal can be 30 no 2.

71 again intothis pin right here so with this one as a result of it's a doji there may be indecision in thereas nicely so simply preserve that in thoughts let's check out oil actual fast soit appears like oil did go up on Friday right here it had dropped beforehand now itwent up with this one that’s wanting fairly bullish let's check out theweekly okay from the weekly perspective that’s impartial from each day perspectivethat was fairly bullish with this one once more very very impartial we’re in thisrange so since we’re in the course of the vary and rejected the underside of therange oil may go greater into 64 60 degree again into the highest right here however overallthe bias is for this week the counter pulse isvery impartial which implies it may go each methods however it’s on this vary forthe final three weeks so I'll deal with this as a variety certain and I'm wanting forprice to enter the tie of the vary after which come again into the vary againalright in order that's all I’ve any questions are something so as to add there itlooks like there aren’t any questions so we are going to name it a wrap you guys have awonderful fantastic weekend or the remainder of the weekend and I’ll see you nexttime then the non-farm payroll shortly non-farm payroll principally there arethree various things that we have now to concentrate in relation to non-farmpayroll one is a jobs quantity after which they're the wages after which additionally lookingat what sort of jobs really you recognize they what sort of jobs had been addedfull-time half-time that sort of factor so the roles quantity got here in positivehowever the common earnings quantity got here in detrimental and that's why we noticed the USdollar drop it's a median earnings numbers are literally very importantbecause they they are saying or they present how the financial system is doing if the roles areincreasing however the common earnings aren’t growing which is it's notconsidered a great factor and that's why US greenback drop on account of non-farmpayroll quantity alright you guys have a beautiful weekend and I’ll see younext time bye for now.

Сообщение Weekly Forex Forecast: March 12 – 16 2018 – Forex Trading Guide появились сначала на Forex make easy money at home.

from WordPress http://ift.tt/2pszdPA

via IFTTT

0 notes