#viatical companies

Text

Viatical Settlement Explained

If you have been diagnosed with a life-threatening illness, you may be considering a viatical settlement. This is when you sell your life insurance policy for cash. Viatical settlements are arranged by viatical settlement companies or viatical settlement brokers. The third party you sell your policy to is usually an institutional investor.

When selling a policy in a viatical settlement, you will receive more than the surrender value but less than the market value. Viatical settlements can be a good option if you need cash now and do not want to wait for your death benefit to be paid out. They can also help relieve some of the financial burden associated with a terminal illness.

If you are considering a viatical settlement, American Life Fund can help. We are a viatical settlement company that provides superior service and peace of mind to our policyholders. Contact us today to learn more about how we can assist you in selling your life insurance policy for cash.

With years of experience in the viatical settlement industry, our team is well-equipped to provide advice and assistance in selling your policy. When you work with us, you can rest assured that you’re getting the best possible deal for your life insurance policy. Let us help make this difficult time a bit easier for you and your family. Contact us now to start the process of selling your life insurance policy for cash through a viatical settlement.

Viatical settlements have their own risks and it is important to research all available options before making a decision. Please consult a qualified financial advisor before engaging in any viatical settlement transaction. Viatical settlement companies are regulated by state laws and regulations, which may vary from state to state. Consult your state's department of insurance for more information on viatical settlements in your state. American Life Fund does not provide legal or financial advice and recommends professional consultation prior to entering into any viatical settlement contract. Viatical settlements provided by American Life Fund are subject to the terms and conditions of a Viatical Settlement Contract.

Viatical settlement transactions are not suitable for everyone, as there are associated risks. It is important to research all available options before making a decision that is right for you. Our team at American Life Fund can help provide essential information on viatical settlements so that you can make an informed decision. When working with us, you will receive superior service and peace of mind knowing that your policy is in good hands.

Contact American Life Fund today to learn more about how viatical settlements can help you. We look forward to helping you secure the best deal for your life insurance policy. Get started now and begin selling your policy for cash with a viatical settlement.

2 notes

·

View notes

Text

What Are The Various Sorts Of Securities Fraud? Morgan & Morgan Law Agency

Some acts of securities fraud are dedicated to control the financial markets. In 2000, the SEC created Rule 10b-5-1 so as to make clear when and how insiders are licensed to make predetermined trades with out violating insider trading laws. In such cases, the gross sales date, prices and amount of securities to be traded should be established prematurely, and neither the seller nor purchaser may securities fraud attorney have access to any materials insider information. Although an organization is not legally obligated to disclose a Rule 10b-5-1 plan to its shareholders, it is typically advisable to be transparent in order to keep away from unnecessary accusations or dangerous press. Nevertheless, it is attainable to file a securities fraud class action known as a “fraud-on-the-market” claim.

Examples include the unregistered sale of equity pursuits in startup ventures and promoting unregistered ICOs. Estimates put the annual price of securities fraud within the tons fraudulent misrepresentation of of billions of dollars. Securities fraud may be devastating, and many traders lose their whole life’s savings to dealer fraud.

A daisy chain is a gaggle of transactions by unscrupulous investors who artificially inflate the price of a security so that they promote it at a profit. All daisy chain scams are thought-about illegal market manipulation within the public markets. For insider buying and selling schemes, Rule 10b-5 prohibits people owing a fiduciary obligation to a supply from using materials securities fraud lawyer, undisclosed insider info from that source for his or her personal profit. In Twenties America, main as a lot as the Great Depression, roughly half of the $50 billion value of latest securities issued turned nugatory through abuse, manipulation, and outright willful ignorance by monetary brokers.

That ruling in the reduction of on the jurisdiction of American courts to adjudicate these claims towards overseas defendants—even when a significant quantity of the wrongdoing has occurred in the U.S. In a class action lawsuit, the court appoints the firm that may act as lead counsel within the case. The court docket acknowledges our experience and appoints our agency with regularity in most of these cases. With each case we take, we fully securities fraud class action investigate the company in question to determine whether there was anything misleading or improper about its public statements, or if there were any key omissions that investors ought to have recognized about previous to investing. We additionally utilize a broad community of specialists to collect as a lot information as we can to support your case.

Never buy an funding over the telephone from a cold-caller and by no means tolerate high stress gross sales techniques from your dealer. Any time treasured metals or gems are supplied at beneath market prices, it ought to function a purple flag for thorough due diligence. Viatical settlements are difficult investments requiring specialised due diligence skills. Alternatively, the insurance coverage could be invalid as a outcome securities class action claim of fraudulent purposes, or there could probably be no actual insurance or greatly reduced advantages making the funding essentially nugatory. Viatical settlements were originally created to assist significantly ill folks pay medical payments by selling the demise profit from their life insurance coverage policy to an investor for quick money.

American Bar Association, require an intentional misrepresentation or omission of material info in reference to the sale or purchase of a safety. In addition, a plaintiff must also present that they relied detrimentally on this info securities fraud, causing losses and ultimately leading to harm to the plaintiff. The causal relationship between the data or lack-thereof and the resulting hurt should be established.

0 notes

Photo

If you have recently read an article about life settlements, you may have wondered if life settlement investments could be a wise choice for you. They can often offer a high rate of return on your investment.

#What Is A Viatical Settlement#Life Settlement Investments#Viatical Settlement Broker#Life Insurance Settlement Option#Life Insurance Loan#Sell My Term Life Insurance Policy For Cash#Life Insurance Settlements#Life Settlements Company

0 notes

Text

What You May Not Know About Viatical Settlements

What You May Not Know About Viatical Settlements

Published March 27, 2019

Viatical settlements have been around since the mid-1980s, when AIDS patients with large life insurance policies started selling them to private investors and life settlement companies. These transactions have since moved into a mainstream industry that is becoming increasingly regulated and organized.

The first viatical settlements were often unwieldy arrangements that…

View On WordPress

1 note

·

View note

Text

Is Life Insurance Taxable?

Life insurance death benefits aren’t typically taxed, which is one of the primary upsides to life insurance. Since life insurance death benefits can be in the millions of dollars, it’s a significant advantage to buying (and receiving) life insurance.

But there are other aspects to life insurance that won’t get past the tax man. Here’s a look at when to prepare for a tax bill.

You Withdraw Money from Cash Value

If you have a cash value life insurance policy, you can generally access the money through a withdrawal, a loan or by surrendering the policy and ending it.

One of the reasons to buy cash value life insurance is to have access to the money that builds up within the policy. When you pay premiums, the payments generally go to three places: cash value, the cost to insure you, and policy fees and charges. Money within the cash value account grows tax-free, based on the interest or investment gains it earns (depending on the policy). But once you withdraw the money, you could face a tax bill.

Money that’s withdrawn from cash value is generally made up of two parts:

You Surrender the Life Insurance

There can be times when a policyowner no longer wants or needs the life insurance policy. You can take the surrender value of the policy, and the insurer will terminate the coverage. The amount you receive is your cash value minus any surrender charge. You can generally expect to get a surrender charge within the first 10 or 20 years of owning the policy, and over the course of time the surrender charge phases out.

You won’t be taxed on the entire surrender value, though. You’ll be taxed on the amount you received minus the policy basis. This taxable amount reflects the investment gains that you took out.

You Took Out a Policy Loan and the Life Insurance Ends

If you have a policy with cash value and take out a loan against it, the loan isn’t taxable — as long as the policy is in-force. But if the policy terminates before you’ve paid the loan back, you could get a tax bill. For example, the coverage terminates if you surrender the policy or it lapses.

The taxable amount is based on the amount of the loan that exceeds your policy basis. Remember, policy basis is the portion you’ve paid in premiums. Amounts “above basis” are based on interest or investment gains on cash value.

One way to access all your cash value and avoid taxes is to withdraw the amount that’s your policy basis — this is not taxable. Then access the rest of the cash value with a loan — also not taxable.

You Sell the Life Insurance Policy

There’s a market for existing life insurance policies, especially cash value life insurance policies that insure people who are terminally ill or have short life expectancies. Transactions involving terminally ill policyowners are called “viatical settlements.” These involve an investor, such as a company specializing in buying policies, paying you money for the policy, becoming the policy owner, and then making the life insurance claim when you pass away.

Viatical settlements are typically used as a way for patients to get money for medical bills, especially when selling a life insurance policy will mean getting more money than simply surrendering it for the cash value.

Fortunately, the IRS doesn’t treat any portion of what you receive for a viatical settlement as taxable. Under IRS code 101(g)(2), an amount paid by a viatical settlement provider is treated like a payment of the death benefit — and death benefit payouts are not taxable.

A life settlement is a similar transaction but involves a policyowner who is not terminally ill. In these cases, the IRS does not see the proceeds as a payment of death benefit. A portion of what you receive can be taxable.

You Are Life Insurance Beneficiary Who Receives Interest on a Death Benefit

Most life insurance payouts are made in one lump sum right after the death of the insured person. But some beneficiaries choose to delay the payout, or choose to take the payout in installments over time. The interest can be taxable when these delayed payouts include interest from the life insurer.

The Life Insurance Payout Goes Into a Taxable Estate

Most life insurance payouts are made tax-free directly to life insurance beneficiaries. But if a beneficiary was not named, or is already deceased, where does the life insurance death benefit go? It goes into the estate of the insured person and can be taxable along with the rest of the estate.

This could create a significant tax bill, especially considering both federal and state estate taxes. While federal estates taxes will not tax the first $12.06 million per individual in 2022, state estate taxes can have significantly lower exemption levels.

Another possible unhappy scenario is that an estate is below the exemption level but a large life insurance payout into the estate pushes it above the exemption threshold into taxable territory.

This should all be avoidable by naming both primary and contingent life insurance beneficiaries, and keeping those selections up to date.

Summary: When Is Life Insurance Taxable?

Life Insurance Taxes FAQ

Credits: Amy Danise

Date: Jan 20, 2022

Source: https://www.forbes.com/advisor/life-insurance/is-life-insurance-taxable/

0 notes

Text

Life Insurance Accelerated Death Benefits: Pros & Cons

Accelerated Death Benefit Definition

An Accelerated Death Benefit (ADB) allows a life insurance policy owner to receive a portion of their death benefit from their insurance company in advance of their death. In most cases, the policyholder must be terminally ill, usually with a life expectancy of two years or less. They must continue to make their policy’s monthly payments while receiving benefits. Accelerated death benefits do not need to be re-paid. Instead, the loan amount is deducted from the face value when the death benefit becomes due. ADBs are also referred to as “living benefits”.

Pros & Cons of Accelerated Death Benefits

Terminally ill, and sometimes chronically ill, seniors that have life insurance policies are able to receive a portion of their death benefit from their insurance company in advance of their death. This is referred to as accelerated death benefits or ADB. These benefits can be used for any purpose the senior chooses, including home care, nursing home care, assisted living, and hospice. ADB beneficiaries still receive a death benefit, although it is reduced by the amount of the accelerated death benefit.

ADBs are a relatively new option. As a result, elderly individuals who have had their policies for many years may find no mention of the ADB option in their policy. Interested individuals should ask their life insurance provider directly if this option is available. If one’s current insurance plan does not already provide this coverage, it can sometimes be added as a rider. This simply means the extra benefit can be added to the insurance policy, sometimes at a cost.

The major advantage to receiving an ADB is that they allow the policyholder to have a portion of their death benefit in advance of their death. There are no major drawbacks to this option. Its biggest limitation is that policyholders are required to be terminally ill, or in some cases, chronically ill. There are other options for policyholders who require care. Some for those who are terminally or chronically ill, and some for those who are not (more on these follow).

Other Options for Life Insurance Policyholders

A similar option for terminally ill seniors is a viatical settlement. Under a viatical, the policy is sold to a third party and the policyholder receives a lump sum settlement. The major difference between accelerated death benefits and viatical settlements is that with ADB the policy owner must continue to pay the monthly premiums. With a viatical settlement, the purchaser of the policy takes over the monthly payments. For this reason, seniors might consider a viatical settlement instead. Read more about the pros and cons.

Death benefit loans, also called life insurance loans, are another option. With this type of low-interest loan, a policyholder borrows against the cash value of their insurance policy. Borrowers are able to pay the loan back on their own schedule, or if they so choose, they don’t have to make payments. At the time of the policyholder’s death, the loan amount, plus interest, will be subtracted from the death benefit. Learn more about death benefit loans.

Eligibility Requirements for Accelerated Death Benefits

The qualifying factors for accelerated death benefits varies with both the policy issuers (the insurance company) and with the policy itself. The information that follows is typical of what an insurance company requires, but not necessarily accurate for all policies

The policyholder’s age does not impact their eligibility. Instead, the primary driver is their life expectancy. As mentioned before, generally speaking, policyholders must have life expectancies of less than two years. In some cases, individuals with longer life expectancies are eligible provided they have a terminal illness. Some policies also allow policyholders to collect ADB if they have a serious illness, for instance, cancer, and without considerable treatment have much shorter life expectancies, if they are unable to perform several activities of daily living (bathing, grooming, mobility, etc.) and require long-term care services, or if they are confined to a nursing home facility.

In addition to personal eligibility requirements, there are policy requirements. The greatest restriction is not the type of life insurance policy one has, but rather it’s face value. Simply put, policies with face values lower than $25,000 are not worth the effort for the policyholder or the insurance company to engage in accelerated death benefits.

Marital status, income and assets, veteran status, and geographic location are not factors in determining eligibility for accelerated death benefits.

Benefits and Limits

There are no restrictions on how accelerated death benefits can be used. In most cases, families receiving ADB put those resources toward the cost of caring for their loved one but they are not required to do so. Benefits are most frequently paid out in a single lump sum. However, some insurance companies offer monthly installments. This is an important distinction in that while either option can impact the Medicaid eligibility of the policyholder or their spouse, a lump sum payment is much more likely to do so.

Accelerated death benefits can be as high as 95% of the death benefit. Typically, the insurance company sets a maximum benefit amount based on life expectancy, and the policyholder makes the final decision on how much of a financial advance they require. Accelerated death benefits are not taxed.

#areteautomation #lifehealthadvisors #bestforhealth #healthtips #livemorechallenge #bestowlifehealthadvisors

Credits : Christina L. Drumm Boyd, BSHS, CSA, GCM

Published : SEPTEMBER 22, 2020

Source : https://www.payingforseniorcare.com/financial-products/insurance

#areteautomation#lifehealthadvisors#bestforhealth#healthtips#livemorechallenge#bestowlifehealthadvisors

0 notes

Text

Accelerated Death Benefit Definition

An Accelerated Death Benefit (ADB) allows a life insurance policy owner to receive a portion of their death benefit from their insurance company in advance of their death. In most cases, the policyholder must be terminally ill, usually with a life expectancy of two years or less. They must continue to make their policy’s monthly payments while receiving benefits. Accelerated death benefits do not need to be re-paid. Instead, the loan amount is deducted from the face value when the death benefit becomes due. ADBs are also referred to as “living benefits”.

Pros & Cons of Accelerated Death Benefits

Terminally ill, and sometimes chronically ill, seniors that have life insurance policies are able to receive a portion of their death benefit from their insurance company in advance of their death. This is referred to as accelerated death benefits or ADB. These benefits can be used for any purpose the senior chooses, including home care, nursing home care, assisted living, and hospice. ADB beneficiaries still receive a death benefit, although it is reduced by the amount of the accelerated death benefit.

ADBs are a relatively new option. As a result, elderly individuals who have had their policies for many years may find no mention of the ADB option in their policy. Interested individuals should ask their life insurance provider directly if this option is available. If one’s current insurance plan does not already provide this coverage, it can sometimes be added as a rider. This simply means the extra benefit can be added to the insurance policy, sometimes at a cost.

The major advantage to receiving an ADB is that they allow the policyholder to have a portion of their death benefit in advance of their death. There are no major drawbacks to this option. Its biggest limitation is that policyholders are required to be terminally ill, or in some cases, chronically ill. There are other options for policyholders who require care. Some for those who are terminally or chronically ill, and some for those who are not (more on these follow).

Other Options for Life Insurance Policyholders

A similar option for terminally ill seniors is a viatical settlement. Under a viatical, the policy is sold to a third party and the policyholder receives a lump sum settlement. The major difference between accelerated death benefits and viatical settlements is that with ADB the policy owner must continue to pay the monthly premiums. With a viatical settlement, the purchaser of the policy takes over the monthly payments. For this reason, seniors might consider a viatical settlement instead.

Death benefit loans, also called life insurance loans, are another option. With this type of low-interest loan, a policyholder borrows against the cash value of their insurance policy. Borrowers are able to pay the loan back on their own schedule, or if they so choose, they don’t have to make payments. At the time of the policyholder’s death, the loan amount, plus interest, will be subtracted from the death benefit.

Eligibility Requirements for Accelerated Death Benefits

The qualifying factors for accelerated death benefits vary with both the policy issuers (the insurance company) and with the policy itself. The information that follows is typical of what an insurance company requires, but not necessarily accurate for all policies

The policyholder’s age does not impact their eligibility. Instead, the primary driver is their life expectancy. As mentioned before, generally speaking, policyholders must have life expectancies of less than two years. In some cases, individuals with longer life expectancies are eligible provided they have a terminal illness. Some policies also allow policyholders to collect ADB if they have a serious illness, for instance, cancer, and without considerable treatment have much shorter life expectancies, if they are unable to perform several activities of daily living (bathing, grooming, mobility, etc.) and require long-term care services, or if they are confined to a nursing home facility.

In addition to personal eligibility requirements, there are policy requirements. The greatest restriction is not the type of life insurance policy one has, but rather its face value. Simply put, policies with face values lower than $25,000 are not worth the effort for the policyholder or the insurance company to engage in accelerated death benefits.

Marital status, income and assets, veteran status, and geographic location are not factors in determining eligibility for accelerated death benefits.

Benefits and Limits

There are no restrictions on how accelerated death benefits can be used. In most cases, families receiving ADB put those resources toward the cost of caring for their loved ones but they are not required to do so. Benefits are most frequently paid out in a single lump sum. However, some insurance companies offer monthly installments. This is an important distinction in that while either option can impact the Medicaid eligibility of the policyholder or their spouse, a lump sum payment is much more likely to do so.

Accelerated death benefits can be as high as 95% of the death benefit. Typically, the insurance company sets a maximum benefit amount based on life expectancy, and the policyholder makes the final decision on how much of a financial advance they require. Accelerated death benefits are not taxed.

Application Process

What to Expect

Applications for accelerated death benefits typically require a release of medical information so the insurance company can independently evaluate the life expectancy of the insured. Benefits can be paid out in as few as 4-6 weeks. Insurance companies do not charge policyholders to receive death benefits.

Although some companies now include a small fee to allow for this option when purchasing their policy

How to Apply

Individuals wanting to receive accelerated death benefits should contact their life insurance provider directly.

Credit: Christina L. Drumm Boyd

Date: SEPTEMBER 22, 2020

Source: https://www.payingforseniorcare.com/financial-products/insurance#:~:text=An Accelerated Death Benefit (ADB,of%20two%20years%20or%20less.

0 notes

Text

Wringing Cash From Life Insurance

“We’re going to go through a quick, ten- to 15-minute personal health assessment,” said Jay Jackson, vice president of Abacus Life Settlements in Orlando. “There are no right or wrong answers.”

We were on the phone, doing an interview that would determine whether this company might offer to buy the life insurance policy — face value: $150,000 — that I’d bought decades ago.

I actually had no interest in selling, to Abacus or to any other so-called life-settlement provider. But I wanted to see how the process would unfold if I did.

So the questions began, with Mr. Jackson asking in a conversational way about my age, smoking history, marital status, ability to handle my daily activities. How old were my parents when they died? What type of exercise did I do? Any falls or dizziness in the last six months?

It comes as a surprise to many older adults that the life insurance policies they’ve been paying premiums on for years might bring them money while they’re still alive.

If a life-settlement company likes its odds of turning a profit, it will buy the policy, paying out more than the policy’s cash value — the amount received if the policy were canceled — but less than the face value, or death benefit.

The firm acquires the policy and continues paying the premiums. Then the company (or a big investor who buys bundles of policies) collects when the seller dies. It’s something like a reverse mortgage, but on your life instead of your house.

“There are so many seniors sitting on these assets, and they’re throwing them away,” said Chris Orestis, executive vice president of GWG Life, who points out that most Americans simply let policies lapse.

For now, life settlement remains a seldom-used option. About 1,650 Americans received settlements for their policies last year, according to statistics compiled annually by journalist Donna Horowitz for The Deal, a financial publication.

But the industry, which previously targeted the very affluent, has begun courting middle-class people who own policies with face values of $100,000 to $500,000. Moreover, in a business once heavily reliant on brokers as intermediaries, several companies now market directly to consumers — like Coventry, the largest life-settlement provider, which runs national TV ads.

GWG Life works with nursing homes and assisted living chains to reach people contemplating the daunting costs of long-term care. The policyholder can set up an irrevocable bank account to funnel the proceeds of the sale directly to a care provider.

The company’s strategy, as articulated by Mr. Orestis: “When a family walks into a community and says, ‘Jeez, we can’t afford this,’ everyone in the long-term care industry should say, ‘Do you have a life insurance policy?’”

Odds are, then, that you’ll be hearing more about this possibility. A business that began with so-called viatical settlements at the height of the AIDS epidemic is now coming after older adults.

Sometimes, selling makes sense. Older people may no longer need life insurance bought to protect a spouse who has since died or children who have reached financial independence. Perhaps rising premiums have become a financial struggle or other needs have grown more pressing.

At that point, most policyholders just stop paying premiums. They take the modest cash value, if there is any; if it’s a term life policy, there is no cash value. In any event, the insurer never pays a death benefit, an advantage the insurance industry has come to rely on.

“Insurance companies make money when people give up their policies,” said Kent Smetters, an economist at the University of Pennsylvania’s Wharton School, who has written about life settlement. “Now the life-settlement guys are coming in and offering better deals.”

Why sell a policy for a fraction of what it would bring your heirs? One Texan who sold his policy to Abacus took his family on an around-the-world cruise, Mr. Jackson said. But most use life settlements not for luxuries or fantasies, but for medical treatment or living expenses.

How much a policy will fetch depends on its face value and premiums (settlement companies buy whole life, universal life, term insurance or hybrids), as well as on your life expectancy. That explains Mr. Jackson’s questions about my health.

The industry calls this “reverse underwriting.” When you buy life insurance, companies offer a better deal if you’re young and healthy. To get an attractive price when you want to unload that policy years later, it helps to be old and sick.

Life-settlement companies and their investors don’t want to hold onto your policy, paying the premiums, for more than seven to 10 years. “The longer your life expectancy, the lower your offer,” Ms. Horowitz said.

But if your policy looks profitable, a life settlement typically amounts to 20 to 30 percent of its death benefit. That may represent a better deal than simply surrendering a policy, but it isn’t necessarily smarter than keeping it in force.

If you need money immediately and have a policy with cash value, you can borrow against it. If high premiums have become problematic, your beneficiaries might want to take over the payments to receive the face value upon your death.

Moreover, while a death benefit flows to your beneficiaries tax-free, life-settlement proceeds are taxable, to the extent they exceed what you have paid in premiums. And owning or selling the policy could stall or complicate the process of qualifying for Medicaid.

Then there’s the question of how much a broker, who submits your information to several life-settlement companies, will take in commission — generally 20 to 30 percent of the price a company offers.

You could avoid that by approaching several settlement companies directly, going through interviews, supplying documentation and then comparing offers. But some policyholders will appreciate having someone shepherd them through the process, especially given the industry’s somewhat dodgy past.

Sellers found it hard to ascertain whether they were receiving a fair price, for instance, and how much of it a broker was pocketing, the federal Government Accountability Office reported in 2010.

In response, 43 states have adopted life-settlement regulations, usually requiring that companies be licensed and make consumer disclosures. “The industry cleaned itself up a lot,” Dr. Smetters said. “But caution is appropriate.”

State regulations differ, and it still requires legwork and fine-print reading to know how much you’ll walk away with and to determine what’s in your interest.

“You have to really understand the contract you’re signing,” Dr. Smetters said. “If I were doing this, I’d try to find out who the major companies are and call myself. But I’d also sit down with a fee-only financial adviser experienced in this area and do the analytics. Is this a good deal?”

So, caution advised. But simply walking away, surrendering a policy you’ve already paid a lot for, rarely represents the best option.

“If my policy is worth $100,000 the day I die, is it worth nothing the day before?” said Darwin Bayston, chief executive of the Life Insurance Settlement Association, a trade group. “The answer is no.”

After Mr. Jackson and I finished the interview, he cheerfully informed me, “There’s almost no probability we’d buy your policy.” My life expectancy, according to Abacus models, is another 280 months, or 23-plus years.

No life-settlement provider or investor wants to hold onto a policy and pay premiums for that long before seeing a payoff.

The premiums on my whole-life policy are low and won’t increase. So I’ll keep writing semiannual checks for now, hoping my family will pocket the death benefit.

Still, scary news from an oncologist or simply the passage of time could upend that plan. Life settlement still looks somewhat tricky to navigate, but it’s an option to keep in mind.

Credits to: Paula Span

Date Posted: Oct. 13, 2017

Source: https://www.nytimes.com/2017/10/13/health/life-insurance-policy-settlements.html

0 notes

Text

Tapping Life Insurance

If your loved one has a life insurance policy, he or she may be able to collect money early to help pay for care and expenses.

Living Benefits

Also called advance or accelerated benefits, living benefits are the proceeds from life insurance policies that may be paid to policyholders before they die. Many life insurance policies include an accelerated benefits provision. Companies offer anywhere from 25 to 100 percent of the death benefit as early payment, but policyholders can collect these payments only under very specific circumstances. The amount and the method of payment vary with the policy.

If your loved one owns a life insurance policy, call his or her state insurance commissioner or his or her insurance company’s Claims Department to find out about alternatives. Ask whether your loved one’s life insurance policy allows for accelerated benefits or loans, and how much these benefits will cost. Some insurers add accelerated benefits to life insurance policies for an additional premium, usually computed as a percentage of the base premium. Others offer the benefits at no extra premium, but charge the policyholder for the option if and when it is used. In most cases, the insurance company will reduce the benefits advanced to the policyholder before death to compensate for the interest it will lose on its early payout. There also may be a service charge.

Viatical Settlements

Viatical settlements involve the sale of a life insurance policy to a viatical settlement company, a private enterprise that offers a terminally ill person a percentage of his or her life insurance policy’s face value. The viatical settlement company then becomes the beneficiary of the policy, pays the premiums, and collects the face value of the policy after the original policyholder dies.

Each viatical settlement company sets its own rules for determining which life insurance policies it will buy. But there are some guidelines that most companies follow when buying life insurance policies.

In general, the policy must be at least two years old.

The current beneficiary will probably have to sign a release or a waiver

The original policyholder must be terminally ill. Many companies require a life expectancy of two years or less.

Your loved one will probably have to sign a release allowing the viatical settlement provider access to his or her medical records.

Most companies will require that the company issuing your loved one’s life insurance policy be financially sound. If the life insurance policy is provided by an employer, the viatical company will want to know if it can be converted into an individual policy or otherwise be guaranteed to remain in force before it can be assigned.

Points To Consider

Decisions affecting life insurance benefits can have a profound financial and emotional impact on dependents, friends, and caregivers. Before helping a terminally-ill loved one make any major changes regarding a policy, talk to friends and family as well as to someone whose advice and expertise you can count on — a lawyer, accountant, or financial planner. Make sure both you and your loved one understand how a viatical settlement will affect his or her tax status, access to government benefits, and other financial matters.

Since 1997, proceeds from accelerated benefits and viatical settlements have been tax-exempt as long as the seller’s life expectancy is less than two years and the viatical settlement company is licensed — if your loved one lives in a state that requires licensing. If the state doesn’t require viatical settlement companies to be licensed, state law will still require that these companies meet certain standards.

Most states also have declared payments of accelerated benefits or viatical settlements to be tax-exempt. However, some states do not give these payments tax-free status. Because of the complexity of the situation, seek advice from a tax professional in your loved one’s community.

Collecting accelerated benefits or making a viatical settlement also may affect your loved one’s eligibility for public assistance programs based on financial need, such as Medicaid. If your loved one cashes in his or her life insurance policy and receives a payment, the money may be counted as income for Medicaid purposes and may affect his or her eligibility.

CREDITS: National Caregivers Library

DATE: 2022

SOURCE: http://www.caregiverslibrary.org/Caregivers-Resources/GRP-Money-Matters/HSGRP-Viatical-Settlements/Tapping-Life-Insurance-Article

#AreteAutomation#LifeHealthAdvisors#LifeInsurance#LifeInsurancePolicy#FinancialAdvisors#Knowledge#BestForHealth#HealthIsWealth

0 notes

Text

What Are Accelerated Death Benefits?

Key takeaways:

Accelerated death benefits (ADBs) are a portion of your life insurance policy’s death benefit that you can receive while you’re still alive.

To be eligible for ADBs, you must experience a qualifying event such as a terminal illness or serious injury.

Your ADB payouts reduce the benefit your survivors will receive later.

Accelerated death benefits (ADBs) are a type of living benefit provided with most life insurance policies. They give you access to money in your life insurance policy’s death benefit while you’re still alive.

ADB funds can be used for any purpose, including nursing home payments and long-term care. You can also use them to ensure that you’re not leaving behind big medical bills for your loved ones to pay.

Nevertheless, using ADBs isn’t right for everyone. This article will introduce you to the basics of ADBs to help you decide if this option is right for you.

How do accelerated death benefits work?

Your policy’s ADB is designed to support you when you experience a chronic illness, serious injury, terminal disease, or other qualifying life event. Your healthcare provider must certify your physical condition. (Requirements vary, so consult your policy documents for details.)

Once your application is approved, you can access a percentage of your death benefit. The percentage may range from 25% to 100% of the total; a 50% cap is common. The insurer may levy fees or finance charges; these are deducted from your payout. Check with your insurer to find out more.

As mentioned above, there generally are no restrictions on how you can use your funds.

After you access your ADB, you will need to keep paying your monthly premiums on the life insurance policy. This guarantees that when you pass away, your heirs will receive your policy’s remaining death benefit (minus any ADB fees or interest charges).

Getting money from your life insurance while you’re alive is a key feature of both accelerated death benefits and viatical settlements. But there is one important difference. To receive funds from a viatical settlement, you sell your life insurance policy to a qualified buyer. Your beneficiaries won’t get anything when you die, because the policy now belongs to the buyer.

What types of accelerated death benefits are there?

ADBs take two forms: built into your life insurance policy or added with an optional rider.

Many life insurance policies have this benefit as a standard feature. If you don’t see it in your existing policy, consider purchasing a rider. You may be able to add the rider to your policy even if you bought the insurance years ago.

You may need to pay extra for the ADB option, whether built-in or added later. Some insurance companies don’t charge for this feature upfront but subtract a fee from the policy’s benefit amount upon payout.

If you add the rider, there is likely to be a waiting period before you can qualify for benefits. A common waiting period is 30 days. This would mean that only illnesses or injuries occurring after that period are eligible.

Who is eligible for an accelerated death benefit?

To activate your ADB, you must qualify based on the terms of your policy. Qualifying events usually include:

A terminal disease

A serious injury

A chronic illness

Confinement to a nursing home

The inability to perform two out of six activities of daily living (ADLs) for a given period, such as 90 days

Your illness is considered terminal if your life expectancy is 2 years or less. To confirm your condition, your healthcare provider must send the insurer documents that serve to certify your application.

How do insurers disburse ADB payments?

Once your insurer has approved your ADB application, you’ll receive your money according to the disbursement method specified in your policy or policy rider. Some policies give you a lump sum, while others send monthly payments via check or direct deposit.

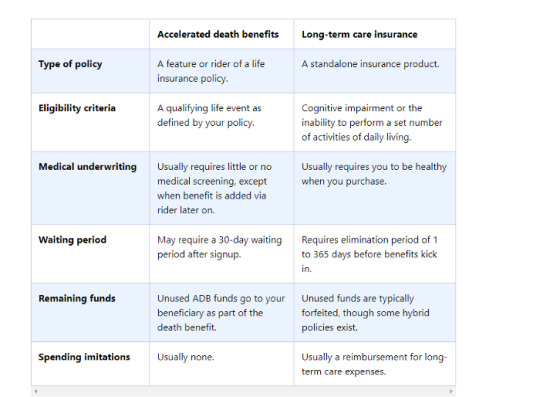

How do ADBs differ from long-term care insurance policies?

Accelerated death benefits and long-term care insurance can both be used to pay for your care. But it’s important to know how these options differ.

Long-term care insurance is best purchased while you are healthy. Your age and physical condition factor into the cost of your premium, so you typically need to undergo health screenings (aka medical underwriting) when you sign up. If you have certain medical conditions or a history of significant health issues, your application may be denied.

You’re eligible to collect long-term care benefits if you have a cognitive impairment or can’t perform ADLs like using the bathroom, getting dressed, and moving around safely.

Once your insurer approves your benefits, there’s an elimination period, during which you’ll have to pay your own way. After that, the policy will begin reimbursing you for your long-term care expenses. Most policies pay a preset amount each day, up to a lifetime maximum.

Accelerated death benefits aren’t designed to replace a long-term care policy. Depending on the face value of your insurance and how much you can get in advance, it may not provide for all of your care needs. Another threat to your policy’s value is inflation. Unless the policy provides for inflation protection, your ADB payout might not stretch as far as you need it to.

Do accelerated death benefit payments affect my other benefits or taxes?

It depends. Under the rules of Medicaid, money from your ADB may count as income. If this added payout puts your household income over Medicaid’s eligibility threshold, it could disqualify you from Medicaid. You’d then lack healthcare coverage for yourself and your dependents.

Using your accelerated death benefits may have federal tax implications for you unless you qualify for an income exclusion. If you’re terminally ill, with a physician certifying your condition, this money is tax-free at the federal level. The doctor must also affirm that you’re expected to pass away within 24 months. If you’re chronically ill, your income is tax-free as long as you’re receiving ADBs of less than $400 per day.

Given these complicated rules (among others), it’s wise to check with a tax professional before making any ADB decisions. That way, you and your beneficiaries can avoid surprises at tax time.

Is an accelerated death benefit right for me?

Accelerated death benefits are a good option for some people. People who never applied for long-term care insurance — or who didn’t qualify due to health issues — can tap into the stored value of their life insurance. Unlike early withdrawals from retirement funds, money from ADBs is usually excluded from taxable income.

However, if you access your ADBs, your beneficiaries will receive less money when you pass away. You’ll want to calculate how much you can afford to take out while also providing for your loved ones’ needs. If your life insurance benefit is large enough, you may be able to pay for your healthcare expenses and still leave your loved ones with an inheritance.

In the end, only you can decide if using ADBs is right for you, since each life insurance policy is different. Read the terms of your insurance contract carefully, and be mindful of restrictions. If your policy limits the funds you can put toward long-term care, you may want to consider other options.

The bottom line

Having an accelerated death benefit enables you to use your life insurance policy to pay for long-term care expenses or other needs. However, withdrawing the money before your death means your beneficiaries will receive less when you pass away. Before you apply for ADB disbursement, talk to your insurance agent and a qualified tax advisor about the process and implications.

#lifehealthadvisors#areteautomation

Credits by: Lorraine Roberte

Date: February 24, 2022

Source:https://www.goodrx.com/insurance/health-insurance/accelerated-death-benefits

0 notes

Text

Cancer patients need to know about where not to ever go, and that is Abacus Life and Matthew Ganovsky.

After my experience with this company, I would never do business with them, never recommend them. I'M A BRAIN CANCER PATIENT and they completely screwed me over. Strung me out, making me believe that they were going to do business with me, made me feel confident, so I didn't go to other companies, they never got back to my reps, and then threw me away like I was a piece of trash. Totally disgusting company, they have absolutely no empathy towards cancer patients. I don't know how they even exist as a viatical settlement company. If you're a brain brain cancer or cancer patient do not go with this company, DO NOT GO WITH THIS COMPANY. WARNING. And I was working with one of the directors of the company, Matthew was his name. Horrible horrible business ethics. Really screwed me over completely and wasted my time and being a cancer person, we don't have a lot of time to waste. Cancer patients need to know about where not to ever go, and that is Abacus Life and Matthew Ganovsky.

SO MISLEAD AND MATTHEW WAS SO RUDE TO ME AND MY WIFE.

0 notes

Text

Is Life Insurance Taxable?

Life insurance death benefits aren’t typically taxed, which is one of the primary upsides to life insurance. Since life insurance death benefits can be in the millions of dollars, it’s a significant advantage to buying (and receiving) life insurance.

But there are other aspects to life insurance that won’t get past the tax man. Here’s a look at when to prepare for a tax bill.

You Withdraw Money from Cash Value

If you have a cash value life insurance policy, you can generally access the money through a withdrawal, a loan or by surrendering the policy and ending it.

One of the reasons to buy cash value life insurance is to have access to the money that builds up within the policy. When you pay premiums, the payments generally go to three places: cash value, the cost to insure you, and policy fees and charges. Money within the cash value account grows tax-free, based on the interest or investment gains it earns (depending on the policy). But once you withdraw the money, you could face a tax bill.

Money that’s withdrawn from cash value is generally made up of two parts:

Types of money

Money that came from your premium payments

Money that came from interest or investment gains

Taxable?

This component of a withdrawal isn’t taxable. In the life insurance industry, this part is called the “policy basis.”

This portion is subject to income taxes if you withdraw it. Your life insurance company will be able to tell you what amount in a withdrawal is “above basis” and taxable.

If your life insurance policy is a “modified endowment contract,” or MEC, different tax rules apply and it’s best to consult a financial professional to understand tax implications.

You Surrender the Life Insurance

There can be times when a policy owner no longer wants or needs the life insurance policy. You can take the surrender value of the policy, and the insurer will terminate the coverage. The amount you receive is your cash value minus any surrender charge. You can generally expect to get a surrender charge within the first 10 or 20 years of owning the policy, and over the course of time the surrender charge phases out.

You won’t be taxed on the entire surrender value, though. You’ll be taxed on the amount you received minus the policy basis. This taxable amount reflects the investment gains that you took out.

You Took Out a Policy Loan and the Life Insurance Ends

If you have a policy with cash value and take out a loan against it, the loan isn’t taxable—as long as the policy is in force. But if the policy terminates before you’ve paid the loan back, you could get a tax bill. For example, the coverage terminates if you surrender the policy or it lapses.

The taxable amount is based on the amount of the loan that exceeds your policy basis. Remember, policy basis is the portion you’ve paid in premiums. Amounts “above basis” are based on interest or investment gains on cash value.

One way to access all your cash value and avoid taxes is to withdraw the amount that’s your policy basis—this is not taxable. Then access the rest of the cash value with a loan— also not taxable.

You Sell the Life Insurance Policy

There’s a market for existing life insurance policies, especially cash value life insurance policies that insure people who are terminally ill or have short life expectancies. Transactions involving terminally ill policy owners are called “viatical settlements.” These involve an investor, such as a company specializing in buying policies, paying you money for the policy, becoming the policy owner, and then making the life insurance claim when you pass away.

Viatical settlements are typically used as a way for patients to get money for medical bills, especially when selling a life insurance policy will mean getting more money than simply surrendering it for the cash value.

Fortunately, the IRS doesn’t treat any portion of what you receive for a viatical settlement as taxable. Under IRS code 101(g)(2), an amount paid by a viatical settlement provider is treated as a payment of the death benefit—and death benefit payouts are not taxable.

A life settlement is a similar transaction but involves a policy owner who is not terminally ill. In these cases, the IRS does not see the proceeds as a payment of death benefit. A portion of what you receive can be taxable.

You Are Life Insurance Beneficiary Who Receives Interest on a Death Benefit

Most life insurance payouts are made in one lump sum right after the death of the insured person. But some beneficiaries choose to delay the payout, or choose to take the payout in installments over time. The interest can be taxable when these delayed payouts include interest from the life insurer.

The Life Insurance Payout Goes Into a Taxable Estate

Most life insurance payouts are made tax-free directly to life insurance beneficiaries. But if a beneficiary was not named, or is already deceased, where does the life insurance death benefit go? It goes into the estate of the insured person and can be taxable along with the rest of the estate.

This could create a significant tax bill, especially considering both federal and state estate taxes. While federal estates taxes will not tax the first $12.06 million per individual in 2022, state estate taxes can have significantly lower exemption levels.

Another possible unhappy scenario is that an estate is below the exemption level but a large life insurance payout into the estate pushes it above the exemption threshold into taxable territory.

This should all be avoidable by naming both primary and contingent life insurance beneficiaries, and keeping those selections up to date.

Summary: When Is Life Insurance Taxable?

Situation

You withdraw money from cash value - Any amount you receive above “policy basis”

You surrender a policy for cash - Any amount you receive above “policy basis”

You take a loan against the cash value - None, as long as the policy remains in-force

You sell the policy through a viatical settlement - None

You’re a beneficiary who receives a life insurance payout plus interest - The interest amount

The life insurance payout goes into your estate - Any amount of the estate that’s subject to state or federal estate taxes.

You sell your life insurance in a viatical settlement - None

#areteautomation #lifehealthadvisors #bestforhealth #healthtips #livemorechallenge

Credits: Amy Danise

Published: Jan 20, 2022

Source: https://www.forbes.com/advisor/life-insurance/is-life-insurance-taxable/

0 notes

Text

What Are Accelerated Death Benefits?

Key takeaways:

Accelerated death benefits (ADBs) are a portion of your life insurance policy’s death benefit that you can receive while you’re still alive.

To be eligible for ADBs, you must experience a qualifying event such as a terminal illness or serious injury.

Your ADB payouts reduce the benefit your survivors will receive later.

Accelerated death benefits (ADBs) are a type of living benefit provided with most life insurance policies. They give you access to money in your life insurance policy’s death benefit while you’re still alive.

ADB funds can be used for any purpose, including nursing home payments and long-term care. You can also use them to ensure that you’re not leaving behind big medical bills for your loved ones to pay.

Nevertheless, using ADBs isn’t right for everyone. This article will introduce you to the basics of ADBs to help you decide if this option is right for you.

How do accelerated death benefits work?

Your policy’s ADB is designed to support you when you experience a chronic illness, serious injury, terminal disease, or other qualifying life event. Your healthcare provider must certify your physical condition. (Requirements vary, so consult your policy documents for details.)

Once your application is approved, you can access a percentage of your death benefit. The percentage may range from 25% to 100% of the total; a 50% cap is common. The insurer may levy fees or finance charges; these are deducted from your payout. Check with your insurer to find out more.

As mentioned above, there generally are no restrictions on how you can use your funds.

After you access your ADB, you will need to keep paying your monthly premiums on the life insurance policy. This guarantees that when you pass away, your heirs will receive your policy’s remaining death benefit (minus any ADB fees or interest charges).

Getting money from your life insurance while you’re alive is a key feature of both accelerated death benefits and viatical settlements. But there is one important difference. To receive funds from a viatical settlement, you sell your life insurance policy to a qualified buyer. Your beneficiaries won’t get anything when you die, because the policy now belongs to the buyer.

What types of accelerated death benefits are there?

ADBs take two forms: built into your life insurance policy or added with an optional rider.

Many life insurance policies have this benefit as a standard feature. If you don’t see it in your existing policy, consider purchasing a rider. You may be able to add the rider to your policy even if you bought the insurance years ago.

You may need to pay extra for the ADB option, whether built-in or added later. Some insurance companies don’t charge for this feature upfront but subtract a fee from the policy’s benefit amount upon payout.

If you add the rider, there is likely to be a waiting period before you can qualify for benefits. A common waiting period is 30 days. This would mean that only illnesses or injuries occurring after that period are eligible.

Who is eligible for an accelerated death benefit?

To activate your ADB, you must qualify based on the terms of your policy. Qualifying events usually include:

A terminal disease

A serious injury

A chronic illness

Confinement to a nursing home

The inability to perform two out of six activities of daily living (ADLs) for a given period, such as 90 days

Your illness is considered terminal if your life expectancy is 2 years or less. To confirm your condition, your healthcare provider must send the insurer documents that serve to certify your application.

How do insurers disburse ADB payments?

Once your insurer has approved your ADB application, you’ll receive your money according to the disbursement method specified in your policy or policy rider. Some policies give you a lump sum, while others send monthly payments via check or direct deposit.

How do ADBs differ from long-term care insurance policies?

Accelerated death benefits and long-term care insurance can both be used to pay for your care. But it’s important to know how these options differ.

Long-term care insurance is best purchased while you are healthy. Your age and physical condition factor into the cost of your premium, so you typically need to undergo health screenings (aka medical underwriting) when you sign up. If you have certain medical conditions or a history of significant health issues, your application may be denied.

You’re eligible to collect long-term care benefits if you have a cognitive impairment or can’t perform ADLs like using the bathroom, getting dressed, and moving around safely.

Once your insurer approves your benefits, there’s an elimination period, during which you’ll have to pay your own way. After that, the policy will begin reimbursing you for your long-term care expenses. Most policies pay a preset amount each day, up to a lifetime maximum.

Accelerated death benefits aren’t designed to replace a long-term care policy. Depending on the face value of your insurance and how much you can get in advance, it may not provide for all of your care needs. Another threat to your policy’s value is inflation. Unless the policy provides for inflation protection, your ADB payout might not stretch as far as you need it to.

Do accelerated death benefit payments affect my other benefits or taxes?

It depends. Under the rules of Medicaid, money from your ADB may count as income. If this added payout puts your household income over Medicaid’s eligibility threshold, it could disqualify you from Medicaid. You’d then lack healthcare coverage for yourself and your dependents.

Using your accelerated death benefits may have federal tax implications for you unless you qualify for an income exclusion. If you’re terminally ill, with a physician certifying your condition, this money is tax-free at the federal level. The doctor must also affirm that you’re expected to pass away within 24 months. If you’re chronically ill, your income is tax-free as long as you’re receiving ADBs of less than $400 per day.

Given these complicated rules (among others), it’s wise to check with a tax professional before making any ADB decisions. That way, you and your beneficiaries can avoid surprises at tax time.

Is an accelerated death benefit right for me?

Accelerated death benefits are a good option for some people. People who never applied for long-term care insurance — or who didn’t qualify due to health issues — can tap into the stored value of their life insurance. Unlike early withdrawals from retirement funds, money from ADBs is usually excluded from taxable income.

However, if you access your ADBs, your beneficiaries will receive less money when you pass away. You’ll want to calculate how much you can afford to take out while also providing for your loved ones’ needs. If your life insurance benefit is large enough, you may be able to pay for your healthcare expenses and still leave your loved ones with an inheritance.

In the end, only you can decide if using ADBs is right for you, since each life insurance policy is different. Read the terms of your insurance contract carefully, and be mindful of restrictions. If your policy limits the funds you can put toward long-term care, you may want to consider other options.

The bottom line

Having an accelerated death benefit enables you to use your life insurance policy to pay for long-term care expenses or other needs. However, withdrawing the money before your death means your beneficiaries will receive less when you pass away. Before you apply for ADB disbursement, talk to your insurance agent and a qualified tax advisor about the process and implications.

Credits : Lorraine Roberte

Date : February 24, 2022

Source : https://www.goodrx.com/insurance/health-insurance/accelerated-death-benefits

1 note

·

View note