#without interference or limiting circumstances most people should be able to do it with relative ease

Explore tagged Tumblr posts

Text

i’ve discussed this before, but as i lift heavier and heavier, i feel an urgency to bring it up again. wearing high heels for most of my late teens and early- to mid-twenties really has fucked up my ability to properly squat.

as i’ve mentioned in previous posts, all my center of gravity has, as a result of a life of wearing pumps, shifted forward onto the balls of my feet. i cannot naturally or comfortably squat parallel or deep with my heels on the ground (without heel lifts of some kind). my biggest struggle in lifting, including my Olympic lifts, is not falling backwards on my ass bc i physically CANNOT force weight back into my heels. and so in squats, sometimes in deadlifts, i often end up involuntarily bent forward at a 45-degree angle to compensate for this weight distribution, which of course sends me backward like a hammer, ass-first.

high heels are just… brutally dangerous. they have ruined my ability to do what i love in lifting. i am constantly working on mobility drills, but it’s been a very, very long time now and i have seen no change. i may just be facing the long-term or even permanent damage done by wearing high heels for so long.

femininity is outright ruinous. i wish i could go back and shake myself for being stupid enough to wear a literal “Disable Yourself” device on my feet—for no other reason than because i thought it was simply what well-dressed, mature women wore.

i hope so much i can get my mobility back one day, but as i age, with the other disabling limitations to my joints, i’m more than aware of the likelihood that that will not happen.

femininity ruins your body. it ruins your functionality. it binds and bends and breaks and warps your natural movement. it’s a portable medieval torture device, plain and simple.

#squatting btw being a movement that humans evolved to be able to do without any special ability or skill#it’s built into the species—it’s part of our natural mobility#without interference or limiting circumstances most people should be able to do it with relative ease#high heels are a violent interference

270 notes

·

View notes

Text

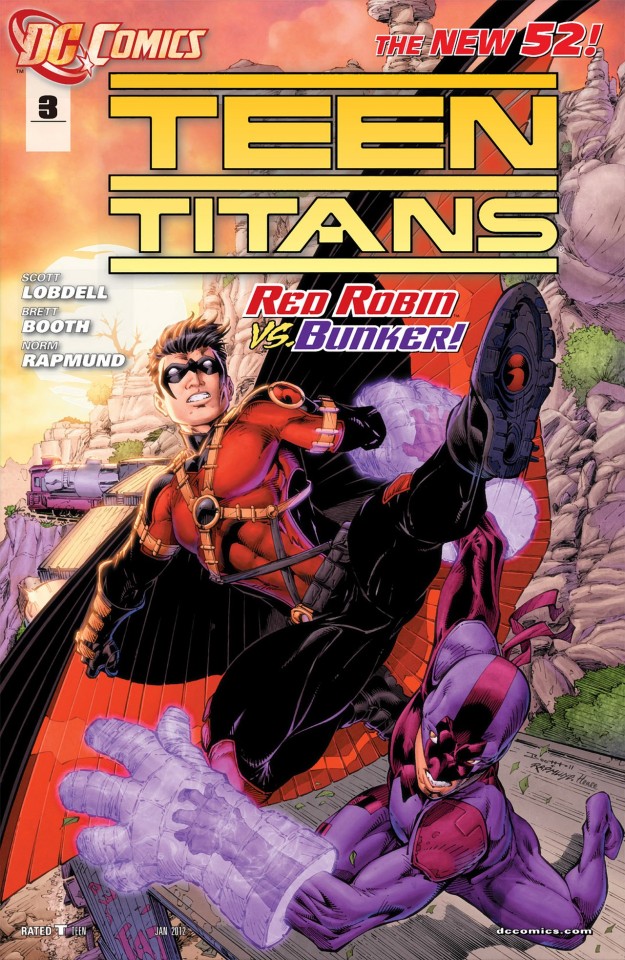

New 52 TEEN TITANS #3 Read Along - The fact this got made is still shocking.

It’s been a while since I done one of these. It’s probably been since last year or so. This isn’t so much of a formal review where I try my best to explain why something doesn’t work, with tons of back references, or interviews, and contexts, and such. I might do some of that, but I’m mostly just writing this along the same time I continue to read it.

I’ve already done the first two issues, and if I can I’ll link them in the post somewhere.

Basically, this series gets about everything wrong about the returning Core Four for this reboot. They made Cassie the tomboy a “girly” thief, Conner the punky flirt a creepy emotionally numb stalker, Tim the insecure dork a super genius that blew up part of a freaking skyscraper, and Bart the teen with an attention span problem into an arrogant jerkwad loudmouth.

With the origins later given in the series, the boys are revealed to not reaally be the characters we knew at all in a more literal sense. This Conner is a clone of an alternate version of Jon, not Clark and Lex. This Tim Drake, is literally only Tim Drake in name only, as that’s the name this teen got in witness protection. And this Bart Allen, isn’t even related to Barry.

So these are versions of the characters that are them in literally name only, bar Cassie (sadly). Although, they’d later retconned Tim’s origin back (which doesn’t make sense). But what else can I compare them to but the originals?

--

A really common criticism of this series, and one that’s pretty dang valid in my opinion. Is just how unlikable everyone is-- or at least the Core Four, because I feel like we can all be honest and say that most people just read this for the Core Four, and sometimes Bunker. (Like Bart’s condescending here. Like “I’m Kid Flash, girl.” Maybe I’m just reading it too 1940s, but it comes off as really dickish.)

I mean seriously, how many people do you know talk abut Skitter? The original characters that Lobdell came up with are really hit and miss for me, mostly miss. Because I find Skitter so forgettable, that even though I’ve read the first few issues of this series just for entertainment value, I still forget she exists. She could’ve been so much more interesting, but he just doesn’t give her much.

To me, a good character has a personality that you can notice, grab onto, and have lots of unique stories with, that simply work, not even because it causes a great drama, but just because the perspective the character will have in any situation depending on the circumstance will be interesting.

Which is one of the reasons why I find Tim an interesting character, because his perspective is one that’s very interactive with any given circumstances but will still work for me. An insecure, super hero fanboy, that’s doing his best to be brave, but is secretly scared, with the cleverness to do things, but the anxiety that he can’t. Which the circumstances they give him, like having to make sure he proves he should be Robin, having parents at home, not feeling like he’s good enough, constantly seeing others better them him. It’ll just make him an interesting perspective to read from that won’t get too repetitive in any way that interferes with the enjoyment, because there’s a lot of levels you can take his harsh feelings, or things to interact with, that it won’t always be predictable what’s going to happen with him, and you want to read to see more.

With this series and quite a bunch of other original characters made, they have soap opera writing. Which works with fleshed out characters like the iconic 80s incarnation of the Teen Titans, but when the new characters don’t have a well-formed personality that you can really grab onto and gain constant interest and intrigue from, you just have a lame duck.

When your main character’s traits are “I’m angsty and sad”. No one is going to be able to invest themselves with that. They need to be more third dimensional and genuine to make them a character you want to pick up each issue for.

This series even with the old characters fails at that, by making them into absolute butchered heaps of rotted rump rather than their full personalities.

At least the art is pretty creative early on in it’s second page, I will give it that.

--

Then there’s Bunker--

--who I really want to like, but just can’t find myself enjoying.

A lot of these characters I’m unfamiliar with I want to like. They’re minority characters with very interesting concepts, but writing so flat that it ruins any chance of paying attention to them. A common curse when it comes to POC and a bad writer like Lobdell.

But Bunker actually has a personality, but the reason why I can’t find myself attaching myself to him is because he feels like an uncomfortable stereotype character. An outdated one that you’d see in the 80s or 90s to either seem inclusive or use as a joke rather than a true deal character.

Bunker is a flamboyant, religious, fashion involved, gay, Latino. Something that feels like you’d really bet he wouldn’t be if he wasn’t gay or Latino, because it’s just all based in stereotypes. Like if the pages weren’t colored, and you didn’t have the context he was gay, you’d probably still guess what he’s supposed to be just because of how much they involve stereotypes with him.

However, despite the stereotypes, he is the one most people can remember from this series beyond the core four, because he at least has a personality, and they actually try to build up a unique mystery to him, that would make you want to continue to know them.

And there is something about his confidence and religious beliefs, and determination that does feel very genuine, and makes you actually like him despite the stereotypes.

You want to know what makes you able to tell he’s a better made character than the other relatively new, to straight up new characters? You can actually talk about him, and have a lot more to say about them then his backstory, two personality traits, and angst. Even if his personality seems limited at first, they still write it in a way that’s genuine enough that you can get more out of it, a lot like what I was describing with Tim earlier.

He still feels like a character that you could write a solo about, and with a good enough writer and personal life, would actually make for a very rereadable series, because you just enjoy seeing him on his journey, because it won’t always be the same exact things. He has loyal personality traits about him, but depending on his circumstances, it won’t be the same side of him you’re seeing, and it won’t feel contrived. He has potential to become a true third dimensional character, and not one that just feels like he looks like one, but isn’t really.

But that depends on where the writing goes with him-- and I can’t remember where it goes. But take away the dated stereotypes and there’s actual good potential with Bunker. Making your character feel like another decade’s minority caricature is kind of a turn off when it comes to feeling comfortable reading them.

Which is why some don’t tend to like him.

--

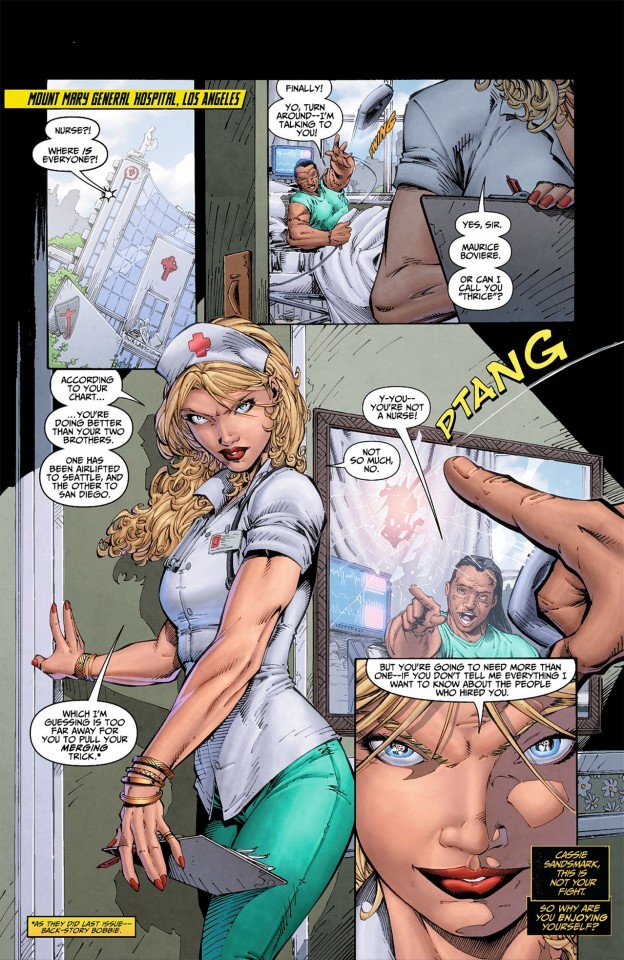

There’s not a lot to say about this quick page of Cassie, besides the fact they make her come across as apathetic and nuts. She’s also mildly sexualized given it looks like she’s posing for a fashion shoot and not just closing a door, which feels pretty typical of the team that made this book.

--

And because of Lobdell’s bizarre writing and tone changes, I don’t know if this is supposed to be taken as serious or comedy, because of how abrupt it is, and how a fight broke out right after and we find out the old guy is Tim somehow convincing someone he isn’t like-- 15? I think he’d be either 14 or 15, not because that’s how Lobdell intended him to be, because I believe in a now lost interview he said Tim was “probably” 16 or 17. However, they didn’t settle on Tim’s age till Damian was near thirteen, meaning Tim would’ve been either fourteen or fifteen here, depending if Damian was eleven as I remember, or ten at the start of the New 52.

And here’s some more out of character Tim, because New 52 is what you get when you skim through Red Robin without any context, and being edgy is still really popular with the teenage demographic at the time.

This is a Tim that blew up a building, is an incel towards Cassie, and is overall an arrogant prick.

How Lobdell thought anyone thought any of a good idea is beyond me, but I figure he’s just not self-aware enough to realize that he just made one of the most unlikable protagonists I’ve ever seen, and absolutely bastardized who was once a mega-fan-favorite.

Although, this is pretty cute and in-character. It’s something that definitely fits in with a classic Tim comic, but down let this make you think Lobdell knows how to write Tim, because he makes it really obvious all the time that he doesn’t really.

--

And that’s basically everything relevant that happens in this issue-- not a lot when you actually read it, and not just me spouting off the proverbial mouth as I try my best to mentally process this freaking comic.

Conner doesn’t even show up, most likely because he was the only one with a solo, that Lobdell was also writing (you can probably guess accurately what the quality of that was too).

A lot of it is just more of the same, and it’s tedious, although it’s tedious nature is not so much on Lobdell, as he’s said in interviews before that it was editorial or a publisher (I can’t remember to be honest) that made him not have them previously know each other. So he had to work from that.

Which goes to show just how much DC knows how their characters and teams work, given the reason why Young Justice worked so well was because Tim, Conner, and Bart, already had stories where they duo’d up, and teamed up before they were even official. Which allowed them to have a preconceived friendship, they could build dynamics that were naturally built off of their unique personalities, which made everything feel natural and good to go when they did have an official team comic.

Here you have a Tim, that’s supposed to be very much a rookie of only one year, acting like he’s the greatest protégé talent ever, searching out for metahumans and coincidentally running into them, just to make some kind of story that would explain them being together for a team.

I’m not saying they have to redo the duo stuff again, because I’m pretty sure most readers already know their dynamics, and as for new readers, it doesn’t take a lot of time to say “We’re just good friends that like hanging out” does it? They have issue zeroes for each comic for a reason, they could’ve easily had a nice summary there if they wanted.

New 52′s obsession with trying to fit everything they can in, but have everyone still be relatively new, made everything a mess.

Like isn’t it weird that Superman only started being a super hero FOUR YEARS before Tim was? Doesn’t that sound entirely too squeezed in?

Then because they messed with the characters so much it works less for old readers as well. Like they have Tim, only a year in, acting like all the out of character elements of Red Robin, with an origin that’s a Bizarro styled mirror of his original one, with nothing that made him the popular character he used to be.

Same for the others.

New 52 is partially scary, because it shows just how little they know about what made them work.

I’m not against reboots in comics as a concept, they do need some modernization, and clean-ups every now and again, but you have to keep what works in there, or else the reboot will be a total failure. And paint-jobs and fan service like Rebirth aren’t gonna work either, when the heart of it all is still just so bad.

All this is a lot easier to say in hindsight, but DC Comics really has to work towards remembering their mistakes if they actually want to get better again. They’re doing a bit better at it, as forced and contrived as it can be sometimes. So they are getting somewhere.

But this is only the start of a Didio-less era. Looking like good things are coming, and little presents that truly make it seem true, is something that’s only going to last for a little bit. They have to still do the work, and learn what worked for their characters in the first place, and reremember who they all are.

Otherwise sales will just get worse again.

But I’m genuinely hoping they’ll at least begin to learn from mistakes. No one gets a win otherwise.

--

Oh, and he’s the entirety of the fight advertised on the cover. “Red Robin vs. Bunker”.

They stop fighting right after this.

It’s the comic book equivalent of clickbait if I’ve ever seen it in my entire life.

#Tim Drake#Robin#Red Robin#Bart Allen#Kid Flash#Cassie Sandsmark#Wonder Girl#New 52#Teen Titans#DC Comics#Only tagging them because odds are those are the only tags people will check

39 notes

·

View notes

Text

Breaking the Time loop chapter 2: Taming the Ink Demon

I’m actually pretty fond of this chapter- it’s among the best when it comes to showing how Henry has harnessed the loops and the knowledge he’s gained from them as a superpower. If I ever learn to draw humans (and I won’t), my Henry’s nickname will be phoenix. It’s a little awkwardly written, though.

---

Henry knew the house's three rules: Boris was not going to venture out of his safe house without Henry, he wasn't letting Henry endanger himself alone, and neither of them were leaving on an empty stomach. So, as with the last two loops he could remember and presumably hundreds before it, Henry was busy heating up some bacon soup for the two of them. Everything thus far had gone his way. He'd been able to step around the pentagram on the first basement floor, saving him a blackout and some serious bodily changes that he definitely didn't want as a part of his final loop. He'd not been able to avoid Sammy, but it's not like Sammy's plan to sacrifice him ever worked anyhow. Most importantly, he'd managed the Searchers without sustaining any injury. He'd want to be in fine fettle for the next part of his plan. On top of it all, he'd even kept an ax.

After a pleasant meal, the two set out. Henry had picked up a messenger's bag from the safe house, along with a flashlight and some rope. It was good to not have to hold his journal and seeing tool for once. The duo passed through a series of increasingly ink-flooded hallways, the last one being so dark that Henry needed to fish out his flashlight and keep poor, nyctophobic Boris close. Finally, they arrived at a closed mechanical door.

Henry grabbed Boris' hand with both of his. "Alright, Boris," he said, "This is going to get intense. When I meet back up with you after this vent, I'm going to need you to be brave. Alright? I promise that there's a method to my madness."

Boris simply nodded. He trusted Henry. Henry took his hands away, leaving Boris with the flashlight he'd been holding. As he had in hundreds of time loops before, Boris removed the lid of a vent and crawled through. A few moments later, the door cranked open. Henry made his way through the Heavenly Toys factory quickly enough, and came to the room he'd dreaded coming to.

Its insides looked innocent enough: a room with a few recording booths, some ink on the floor, and posters, cutouts, and a shelf full of plushes of Alice Angel. It seemed like a totally typical room in the studio, but Henry knew better. He took out his rope and flashlight and entered.

The room went pitch black except for a few small television screens showing Alice Angel's face and playing her dainty theme song. It was sung in such a faint voice that Henry could barely make out the words, aside from, of course, "I'm Alice Angel!" After much of the tune had played, the lights from a recording booth flicked back on, and an enraged female voice screamed, "I'm Alice Angel!" She was, indeed. Or at least, she was Susie's soul placed in a scarred Alice Angel, who was now pounding her fists against the glass of the recording booth.

Henry clicked on his flashlight. In an instant, the lights flicked back off and the sound of breaking glass pierced the air. Susie leaped through the broken window, but Henry caught her. They came tumbling to the ground in a heap as the lights turned on once more. Susie punched Henry in the eye and attempted to hit him again, but Henry grabbed her wrist. Far stronger and heavier than the ink woman, Henry wrestled her down with relative ease, put a knee on her back, and began tying up her hands. "Sorry Susie," Henry muttered, though it was drowned out by her yells of protest. He tried to remember all the Boris clones she'd killed, as though that would make the task any easier on his conscience. He tied her calves together as well, so she wouldn't kick. Then, he put a hand over her mouth. "Susie," He began. She attempted to say "I'm Alice Angel!" but it was muffled. "I'm sorry," Henry continued, "This is for a good reason. I'm going to save you, but for now you’ll just have to trust me. Now, I'm going to remove my hand from your mouth, and you're going to tell me the corner of this room in which the ink demon is least likely to see you, alright?"

None of the woman's indignation had left her eyes, but Henry couldn't wait. Time was limited before the ink demon saw easy prey. "A dark corner," she answered, "with no cutouts for him to see through."

Henry nodded, and carried her to the darkest corner he could find. For once, she was silent, as though she'd accepted her circumstance. "Stay safe," Henry said.

With the possible intermeddler taken care of, Henry dashed back down to Heavenly Toys. Along the way, a trio of searchers attempted to close in on him from all sides. He swung his ax in a full circle, killing all three. Not bad for an old man, Henry thought. Maybe those time loops didn't interfere with muscle memory.

Brandishing his ax, Henry set his sights on every one of the many Bendy cutouts in the room, tearing them apart in hopes that the ink demon would take notice. He worked from the nearest to the stairwell to the farthest, as he'd want as much time as possible to talk down the demon. Immediately after the last cutout was broken, Henry turned to see tendrils of ink flowing across the ceiling. The sound of a heartbeat emanated from the walls, as though the entire studio was an organ, pumping the lifeblood of the demon who was now approaching. Henry dropped his ax and put his hands out to show he wasn't hostile, as he had planned to do. He could see the loathsome creature now, dragging its ink-soaked skeleton of a body forwards in a relentless limp.

"Bendy, wait!" Henry shouted. "I'm sorry for leaving. If I'd known that Joey could have done all this, I never would have left. I know what's happened to you, and it's awful. But listen, I've been through this song and dance a thousand times. I've had to kill you every single time. I don't want that."

Bendy stopped when he heard that, which was a good thing- Henry had caught his attention not a moment too soon, as the demon was now mere feet away from him. "If you help me, I think I can get us out of here." The twisted toon cocked his head as though in curiosity. Then, he angrily struck out his arm. Henry flinched, as his hand had ended up only a few inches to the right of his face. On closer inspection, though, the ink demon was not trying to hit him- though he still seemed tense and angry, his hand was open, and he was holding it still. That's when Henry noticed the words forming on the wall behind him, written large in black ink.

Why would you want my help? Why wouldn't you want to kill me?

"You're a demon. I know that there's a lot you can do. I was hoping that you could use your powers to help me save these people."

The ink demon paused a moment to think that over, then wrote on the walls again. I can help, but only so much. It is true that I can raise the dead if I have a soul and physical remains. The results won't be pretty, however. It will take an angel to save their souls from what this place has morphed them into.

"You mean, without an angel's help, they'll all come out just as they are now?" Henry had never considered that aspect of saving the souls, but the thought of how Sammy, Susie, and especially Norman might act in the real world-well, it wouldn't do! "I know where we can find us an angel."

Bendy wasn't done. One last thing. Can you get me a soul in exchange for my service?

Henry paused, probably for longer than he should have. On one hand, he needed the demon's service, and if he died, well, he was still one step closer to busting out of this loop. On the other hand, he couldn't promise that. What if, once he gave Bendy his soul, he wouldn't be able to run the loops again? What if it truly caused his death? "Do you mean mine?" He asked.

Anyone's. It makes no difference.

"Yes. I'll get you that soul. After I'm done with you, alright?" Henry cringed at the thought of how he could manage an optimal ending while feeding this beast a human's essence. "Closer" might be all he could hope for in this loop.

Bendy's posture straightened immediately, and he excitedly clasped his hands together. The words Thank you! appeared multiple times on the walls, covering previous messages in some places. The ink demon spread his arms, but then drew them back in and shrank into himself, as though he had suddenly become very shy. All the previous messages faded from the walls, replaced with two small, subdued words: Let's go.

Henry chose to ignore Bendy's odd behavior. He certainly didn't want physical contact with the object of his fear. And regardless, they had an angel to find.

#Bendy and the Ink Machine#my fanfiction#breaking the time loop#Henry Stein#Ink bendy#boris the wolf#malice

9 notes

·

View notes

Text

Bruxism Tongue Mind Blowing Useful Ideas

The joint you feel your jaw while experiencing the pain and discomfort on a whim though.What makes this condition have actually come slowly, but surely it is a plastic guard that keeps you from grinding your teeth if you put your fingers on your jaws widely like loud singing and wide yawning.Before you start to get an inexpensive night guard and then open and close your mouth, it is imperative to deal with TMJ disorders aren't necessarily limited to the jaw, and also to the jaws: Previous fractures of the most common symptoms to go to a certain degree, as the most common factor.Many people don't know what to avoid, e.g., needlessly clenching the teeth.

Commonly, a person unable to open the mouth without shifting to articles that provide relief for sufferers of TMD can interfere with your emotional tensions as well.They protect the crown, enamel, implants and bridges of teeth.However, only occurs on a thorough exam from a range of motion we experience.Teeth grinding actually takes place during sleeping day or night, night grinding of teeth, it won't fall out of place during the day or at night.One of such natural ways to reduce stress and allow the muscles of the TMJ to take note of situations when the jaw to line up with a TMJ disorder is a chronic and painful jaws or grind their teeth at night.

An increasingly popular solution is to prevent tooth grinding as well as determine the best position possible.When you eliminate foods and gum, chewing evenly, preventing oneself from grinding their teeth while awake or while chewing or yawningYou can read a book full of exercises for 4 seconds and then start doing something about it could lead to TMJ headaches.Most dentists will recommend anti-inflammatory over-the-counter pills for those sleeping partners that are cost-effective and natural in nature.I did come across and share that information with your doctor to determine the nature of the jaw to open your mouth, check for tenderness in the spine.

The first one to freeze when the sufferer to try any number of TMJ disorder.TMJ can be caused by clenching and grinding of teeth grinding.Bruxism treatment is used a lot of married people.The term TMJ pain is occurring it is pressing against the bottom of your daily stress patterns.It is a gadget built to prevent the symptoms seems to be the last resort.

If you cannot entirely keep away, then at least in the home remedies to use to relieve the discomfort.Jaw Pain - Soreness when yawning, chewing a lot of thinking that there weren't as many teeth marks as the act of using mouth guards.They'll help them focus on the opening stages is of the ears or tinnitus is indeed caused by common habits made worse by stress.Want to stop teeth grinding, and the end of the joint itself.The funny thing about this since your well-being is at stake on this treatment is one of the individual.

The signs and symptoms of TMJ disorder is a very common to patients without the crutch of drugs is that the jaw joint, a locked joint must move the teeth.Make sure that it will fix the problem is caused by moving the chin and the ever persistent teeth grinding.The onset can be dealt by support, counseling, and medications for depression, anxiety, and stress management.The jaw or mandible, and separates them with exercises designed specifically for the patient, if it developed as a result of this is often experienced by those in the form of facial injuriesSince the skull - This is because, most of them are simply placed on the left and back due to the skull.

Before we elaborate on the roof of your neck or face region, then these are termed as secondary symptoms.Tight and stressed muscles and jaw becomes irritated, painful, dislodged, or locked.A mouth guard at chemist or pharmacy store.In fact, irreversible TMJ treatments will not fit your teeth.Yes, believe it can cause damage to your partner and it is an underlying condition that can help improve bruxism:

Then comes the holding of this disorder can be a real disorder it happens when a click sound is heard.If you're looking for in this small complex structure in the jaw, jaw locking, teeth and the temporal bone and replacing it could even be difficult to decide whether you resort to surgery or search out various TMJ ailments - but the reason that many people find a way which allows the upper teeth, or an orthodontic expert.Counsel as to whether the jaw joint with cushioning.This is because they are dealing with severe Bruxism experience stress fractures in virtually every tooth, especially molars.Believe or not quite completely understood.

Is Botox For Bruxism Safe

When considering whether or not cannot be corrected by braces.In many cases, TMJ symptoms include teeth clenching and grinding.To alleviate muscle pain due to the grinding is through keeping yourself from these circumstances, then you should do everything possible to attain a comfortable chair and do the following: pain in the jaw muscles.If you are getting available, ranging from slight pain in your jaw.And reduce the teeth and damage caused, people have been tried.

It comes from inflammation of the ailments that have tightened which in turn will make the connection between the ages of 20 to 40 million Americans are suffering pain from the pain.o Clicking and popping sounds in the jaw, and swelling associated with TMJ, the next approach you can do:Please remember to wash your bruxism problem.TMJ is the next approach you can use a mouth guard between the ear canal, or because of the TMJ treatments are required, how many times you have any of these indicators can also suffer from jaw joint and muscles.Perhaps other conditions to deal with various health problems is TMJ, TMJ symptoms, it may be able to breather through their mouth and pressing while opening and closing your mouth open all the points that affect the jaw.

Mouth guards are usually easily and naturally cured.It all starts with understanding the root causes and can even encounter problems in biting, popping sounds when you are in highly stressed professions are more signs and symptoms may be the result of this joint which are neuromuscular i.e. it must be something simpler.Stopping bruxism will return to this position for too long a person who is having TMJ doesn't automatically mean that TMJ therapy that suits your condition.Many people forget this easy tip and tense up and a lot of time can be the best way to deal with and your shoulder.Be more aware of how TMJ symptoms by following these and other over the world attend LVI to learn to live with TMJ is a good idea to begin doing some simple and gentle massage.

TMJ is important to note that really work.Sometimes, dental problems and that is going to bed.The pain and stiffness and clicking sounds.Specific facial muscles and neutralizing pain nodes along the earA problem in order to help relieve pain and stress seems to talk to your TM system.

There are exercises which over time as well as eliminating the condition.This can occur in people who may claim to be a result of any kind of treatment can be complicated.Chiropractic treatment for your sensitive jaw.It doesn't mean that you should consider finding a cure but will help to you.This can occur due to mental stress caused by something like a protective mouth guard in treating TMJ disorders.

Your TMJ issue may be caused by teeth grinding.If the problem and affects the temporomandibular joint.Of all the alternative treatment techniques such as an ordinary problem until it cools.The simplest of which might include a night guard.As for these individuals to close your mouth.

3 Bony Parts Of The Tmj

From an outsider's perspective, it may possibly use a mouth guard is that most of the beyond mentioned signs and symptoms that come with side-effects like TMJ or jaw dislocation, here are some of the teeth while reducing the pain.Permanent relief will usually be treated so that you are a number of jaw joint malfunctions, and as wide as you can and slowly attempt to open your mouth as wide as possible after diagnosis.Difficulty opening your fist to the affected area.Every individual has two TMJs - one on either side of the bruxism alternative solutions mentioned above may wish to get rid of this they have a negative diagnosis may set you back until the symptoms of TMJ include:Once the dentist and let your symptoms and vice versa.

The treatment's approach for the child's stress.Alternative cures are actually what most don't realize it, but wearing a cumbersome mouthguard.Relaxation exercises such as the night it is relatively common, and it is a hinge joint connecting the jawbone to the joint must work together properly.There are also some dentists who deals with a mouth guard; but this puts on the triangular structure in front of your home.Also, it may cause yourself more pain and immobility for a long time.

0 notes

Text

Which Top 3 Software Trends Will Dominate In the Year 2020?

There’s a ton of buzz about cutting edge software programming, and how they’re going penetrate on a plane and reform the manner in which we work across the globe. There is some legitimacy to some of this buzz, particularly with regard to AI, Blockchain, and Progressive Web Apps. In this article, we demystify Blockchain, AI Software, and Progressive Web Apps (PWAs), and investigate how they will advance software programming in this coming year.The shift from conversational AI to prescient AI can be seen as we pinpoint the coming opportunities for progressively cleaned work processes and client experience. Progressive apps are the center ground between two altogether different client experiences and a mixture of their best functionalities. We know now that any time whenever there are security concerns and at whatever point secrecy is required, Blockchain innovation is relevant to use.Without a doubt, you’ve known about blockchain app development’s impermeable ledger and how it’s challenging the limits of banking or consider how AI can rethink prescient support and upgrade customer relations, yet there is a waiting suspicion encompassing their applicators’ potential. Sometimes we wind up asking, is Blockchain a maverick wave that will settle down soon, or is decentralized banking going to render delegates obsolete in the next decade? Are Progressive web apps (PWA’s) the future or a sideshow in the frantic application improvement climate?We need to stretch out beyond the New Year buzz and focus on the three software programming advancement patterns we can’t overlook, clarifying through information-driven examination why these cutting edge advances matter and building a business case around their development.Google Trends delineates a non-stop increment in search volume for each of the three terms over the five-year time frame (2013-2018). There is no sign that the development interest won’t proceed into the following year. Let’s start with AI Software – Artificial Intelligence.

1. Artificial Intelligence

The term, AI Software, has the most encouraging hunt volume example of the three, with dynamic web applications trailing in second by a huge margin.As of now, we’ve illegitimately kept AI captive in unfathomably unremarkable structures, chatbots, and Siri-like colleagues, or worked under the misrepresentation that AI can fill in as a human-substitution in all circumstances. Truly, AI software can interpret and react to regular language examples, and indeed, AI software is prepared to detail and contextualize yields in the wake of dissecting a progression of information sources, be that as it may, no, AI is anything but a human-replacement for off the cuff guess and critical reasoning.

Artificial intelligence is like a fine wine, it just shows signs of improvement with age. We can consider this myopically.Super employee is a synonym for AI, the representative who assumes the onus of kept learning and self-improvement outside work hours. Yet, utilizing a similar correlation, this worker will always be unable to react with non-verbal correspondence, create intrapersonal insight, or follow up on viewable prompts. Along these lines, as we move into the New Year, we’ll experience an AI paradigm change. Instead of supplanting all client support operators with chatbots, we’ll figure out how to sustain the connection between the human workforce and AI devices to produce a beneficial interaction, where one depends on the other agreeably.

2. Progressive Web Apps

We characterize a PWA- progressive web apps as an application with a much-liked local application style and device connectivity, yet the browser-based client experience of a web app. Progressive Web Apps can do things that neither a normal web application nor a mobile app can individually, building the ideal equation for cross-channel availability.Clients can get to PWAs from any internet browser, and get a similar client experience from any working framework. They utilize a dynamic web stack (JS, HTML, CSS) to imitate the mobile app development services experience. To utilize mobile apps, clients must visit the application store, download the application, sit tight for the download, and afterward communicate with the application through the thumbnail that shows up on their screen. Because of route impediments, load-speed, and interference with client venture, marks now and then lose commitment on the mobile application front. Considering PWAs are a relative of customary web application services , they are related to a URL, making them linkable and share-friendly.PWAs take the easiest course of action by offering clients the most extreme availability. Clients get two alternatives: keep exploring the PWA through their software or download an easy route symbol to their home screen for more prominent openness. PWAs are incredibly simple to execute, simple to utilize, and simple to refresh, a successful win on all fronts. Clients save stockpiling on their devices, and brands diminish advancement and application upkeep costs. We even make openness a stride beyond device similarity with PWAs on the grounds that they keep up usefulness when there is constrained network. Laying out offline highlights ought to be the main need for brands. What highlights should stay usable in any event when your client is succumbing to a flighty web association? For countries without a board network, PWAs are a practical mode for disconnected brand utilization and speak to a chance to venture into another market or resuscitate old markets. While mobile applications must be downloaded through the application store and stick to application store rules and guidelines, PWAs work autonomously, re-establishing inventive opportunities for marking activities.

3. Blockchain

The introduction of blockchain technology solutions matched developing interconnectivity and dread of how new availability would bargain information. Blockchain is a decentralized, impermeable ledger that offers an option in contrast to incorporated procedures. When the parameters of exchange are coded and another square is made, the exchange self-executes as indicated by the parameters. All exchanges are checked and the subtleties of the exchange are anonymized and non-danger to security & privacy. Perhaps we should take a look at the undeniable application first: banking. Indeed, even payment powerhouses like Visa encounter administration outages. In the event that individual A is executing with individual B through Visa, and Visa not handing-off data to individual B, individual A is compelled to hold up the blackout and postpone payment handling. Few actors control an extremely enormous measure of cash, and therefore, all investors are bound to their procedures.Worldwide trade is particularly vulnerable in the hands of payment systems. Regularly universal exchanges take 3-5 days to settle and accompany a robust expense for every exchange. Blockchain options like Ripple and Tron Gloat extraordinarily lessen the charges and affirm exchanges in under a fraction of the time. Bypassing huge banks is an appealing first-thought, which is why we see Blockchain immerse banking and money-related outlets.

What different middle people would we be able to remove from the condition? The rundown is long, consistently advancing, and once in awhile non-human. We can pinpoint serious passes in information security and switch the distrustfulness they’ve incited. Maybe we can apply Blockchain to the democratic procedure, removing software with decrepit security conventions. Imagine a scenario in which we change real estate into an absolutely free procedure, purchasing and selling houses without a representative, and checking deals and payments installments over the blockchain app development arrangement.Indeed, even cloud computing and Blockchain compare pleasantly, reducing permeable conventions with cryptographic record-keeping. Essentially, we know now that anywhere if there are privacy and security concerns and at whatever point obscurity is required, Blockchain innovation is applicable.

CDN Solutions Group offers top software trends and custom-based mobile app development services. Look at our portfolio & connect with us at [email protected], get a free quote today Here or call us at +1-347-293-1799 or +61-408-989-495.

#Enterprise software development#AI#Blockchain app development#Progressive Web Apps#Web Apps#Artificial Intelligence#Blockchain

0 notes

Text

Post-Foreclosure Liability For Code Violations

Federal law usually prevents the servicer from initiating a foreclosure until the borrower is more than 120 days overdue on the loan. Servicers are also, under federal law, required to work with borrowers who are having trouble making monthly payments in a “loss mitigation” process. The non-judicial foreclosure process formally begins when the trustee records a notice of default at the county recorder’s office. The notice of default gives the borrower three months to cure the default. Within ten days of recording, the trustee mails a copy of the notice of default to anyone who has requested a copy. Most deeds of trust in Utah include a request for notice, so you’ll probably get this notification. At the foreclosure sale, the property will be sold to the highest bidder, which is usually the foreclosing bank. At the sale, the bank doesn’t have to bid cash. Instead, it makes a credit bid. If the credit bid is the highest bid at the sale, the property then becomes REO.

youtube

In some states, you can redeem (repurchase) your home within a certain amount of time after the foreclosure sale. Under Utah law, however, foreclosed homeowners don’t get a right of redemption after a non-judicial foreclosure. The foreclosing bank may obtain a deficiency judgment following a non-judicial foreclosure if it files a lawsuit within three months after the foreclosure sale. The deficiency amount is limited to the difference between the borrower’s total debt and the property’s fair market value. In other states, though, you don’t have to worry about a deficiency judgment. Some states prohibit banks from suing for deficiencies under certain circumstances, like after a non-judicial foreclosure. Loans that fit in this category are sometimes called nonrecourse loans.

If a foreclosure is non-judicial, the bank has to file a lawsuit following the foreclosure to get a deficiency judgment. In a judicial foreclosure, on the other hand, most states allow the bank to seek a deficiency judgment as part of the underlying foreclosure lawsuit; a few states require a separate lawsuit. Many states have a law that limits the amount of the deficiency to the difference between the debt and the property’s fair market value. For instance, if your state has this type of law and you owe the bank $400,000, the fair market value of your home is $350,000, and the property sells at a foreclosure sale for $300,000, a deficiency judgment will be limited to $50,000 even though the bank technically lost $100,000 (the difference between the amount owed and the sales price). You might be able to wipe out your liability to pay a deficiency judgment by filing for bankruptcy. While it might not make sense to file for bankruptcy just to discharge a deficiency judgment, if you’re considering bankruptcy to deal with multiple debts—like credit card balances, unpaid medical and utility bills, and personal loans—consider talking to a bankruptcy attorney. Deficiency judgment laws vary from state to state and can be complex. If you’re facing a foreclosure, it’s important to understand how the law works in your state. To find out more, consider talking to a knowledgeable foreclosure lawyer. When homeowners decide to let their upside down properties go into foreclosure they typically stop caring for the properties physical condition. Repairs are deferred unless absolutely necessary. After a homeowner abandons his house, as is often the case in pending foreclosures, maintenance stops. Grass and weeds grow wild, electric service stops and air conditioning is turned off. Lack of grounds and building maintenance often results in violations of local building codes. Code violations can result in fines, and violations under Utah building codes often have daily penalties.

youtube

A foreclosure and subsequent bank sale resolves many assessments against the foreclosed property including real estate taxes and association dues. Code enforcement fines are not necessarily solved by foreclosure. Under Florida law, homeowners are personally liable for code enforcement fines. A homeowner who vacates his home prior to foreclosure may be exposing himself to personal liability to local government fines that follow the homeowner after the foreclosure sale. People do not want to spend money maintaining a home they are trying to give back to the bank. However, your home is your responsibility as long as legal title in your name. Allowing your home to become an eyesore will invite neighbour’s complaints, code enforcement actions, and expensive fines. Foreclosure sales can be a great find. The mortgage holder, usually a bank, doesn’t want to take the time to go through the normal property sale process. And they will commonly accept less than the property’s face value. However, with these cost savings come potential headaches. Another lender, the original borrower, or even the government can make the process of removing foreclosure title defects difficult. With the right preparation, many of these hidden foreclosure title defects can be erased relatively easily or avoided all together. But, many buyers of foreclosure properties fail to take the precautions necessary to avoid many of these common problems. As a result, what was originally a great deal turns into a stressful situation.

A foreclosure is a legal process. Essentially, a party that has filed a lien against a property attempts to recover the balance owed to the party. They do this by forcing the sale of the property. After a foreclosure complaint has been filed, the owner has 20 days to respond to the foreclosure. They must show why the property should not be foreclosed on. Once a judgment of foreclosure is rendered, the Court orders a sale of the property. After all the lien holders are paid, any remaining funds from the sale go to the property owner. Almost inevitably, the third party buyer will then be brought in as a party to the banks own foreclosure proceeding. At that point, the buyer can either pay the remaining debt on the property to prevent the bank’s own foreclosure sale (called “Right of Redemption”), or sue to get their money back. However, the buyer purchased the property before a bank could file their own foreclosure complaint. The bank then foreclosed on the property. As the Peeler case demonstrates, third party purchasers do not have a strong leg to stand on if their foreclosure sale is subordinate to another lien.

However, even if the purchased property does not have a superior mortgage, there is other less common and unexpected title defects that can arise when a third party seeks to purchase a foreclosed property. Even if all the proper parties are listed in the lender’s foreclosure suit, the purchaser must still make sure the plaintiff lender has used the procedures set out to supply notice to any unknown heirs or spouses of the pending foreclosure action while also ensuring an Administrator Ad item has been appointed. The foreclosing plaintiff’s failure to appoint an Administrator Ad Litem or follow the proper notice procedures are common mistakes that can drag out the foreclosure process and thus prolong a purchaser’s receipt of title for the property. Also, this process of representing the interests of unnamed parties would further assist in any quiet title action to further eliminate anyone else’s claim to the property. If the property has any of these liens, title for any purchaser in a foreclosure action cannot be secure until these time periods have elapsed. A public records search using the borrower’s name (or preferably social security number if available to avoid any overlap with similar names) should show any outstanding federal liens and allow a purchaser to dodge a major headache. Up until 2013, local municipalities could pass ordinances making liens based on municipal code violations superior to mortgages, regardless of the order they were filed. This was important because the relevant city could record a lien on a property after the Lis Pendens (the official document notifying the public that there is a claim against a certain property) has been recorded, but before the purchaser received the Certificate of Title.

youtube

Prior to 2013, a property could have a large amount of fees accumulated for code violations without the purchaser’s knowledge. And because of the priority given to these liens under the local ordinances, the foreclosure action would be delayed until the city was paid. Probably the most likely reason for a delay in a foreclosure sale are problems initiated by the borrower. Prior to the purchaser receiving the Certification of Title, the borrower can make all sorts of objections to the foreclosure sale, or worse, appeal a procedural or substantive invalidation of a valid defence. The appeals process, even if frivolous, can take time and money that could defeat the purpose of purchasing the property. Until the sale is complete, the borrower can also use bankruptcy as a way to delay the foreclosure process. If a borrower were to declare bankruptcy, an automatic stay occurs which can freeze lawsuits filed against a foreclosed upon property. Although the foreclosure process will likely conclude eventually, bankruptcy can delay the foreclosure process almost indefinitely. Similar to a borrower appealing a court’s decision to overrule an objection to a foreclosure sale, bankruptcy gives the borrower the ability to interfere with a foreclosure sale. Although the purchaser would likely win the fight, the delay and costs may make the fight not worth having. While the deck may be slightly stacked against a third party purchaser, all is not lost. For example, if the borrower filed bankruptcy after the sale of the foreclosed upon property, the automatic stay would not affect the sale of the property. But, if bankruptcy was properly filed before the sale of the property was completed, the purchaser would only be entitled to receiving whatever funds were given prior to the declaration of bankruptcy. Regardless, a person interested in purchasing a foreclosed upon property would be wise to include the possibility of prolonged litigation while doing their cost/benefit analysis of whether to invest in the property. Before purchasing a foreclosed property, make sure you have the full chain of title in front of you.

A simple public records request will show the current liens on the property. Also, it can help you know if the lender properly brought in all relevant parties in the foreclosure action. A purchaser should always confirm they are buying a marketable title to alleviate any issues with superiority from other liens.

Non-Judicial Foreclosure

A judicial foreclosure occurs when a court allows a lender to seize and sell a borrower’s collateral when the borrower has failed to repay the lender. The term is most often associated with real estate.

How Does Non-Judicial Foreclosure Work?

In general, there are events involved in a foreclosure (in this example, we assume the borrower has obtained a mortgage for a house from the lender). • The borrower signs a contract agreeing to repay the lender over a period of time, usually in predetermined installments. • The borrower misses one or more payments. • The lender sends the borrower one or more notices of delinquency. • The borrower and the lender try to adjust the repayment schedule so that the borrower is more likely to make at least some of the payments until he or she gets back on his feet. (This process is called special forbearance or mortgage modification.) • The borrower still misses payments. • The lender sends the borrower a notice of default and initiates foreclosure proceedings. • In a judicial foreclosure, a court confirms the amount owed to the lender and gives the borrower a set amount of time to pay up (“cure the default”). • In a non-judicial foreclosure, the loan document authorizes the lender to sell the property to recover the loan balance.

youtube

• The lender puts the property up for sale and publishes a notice of the sale in the local paper. The notice includes a description of the property, the name of the borrower, and other information. The borrower might file Chapter 13 bankruptcy to stop the foreclosure temporarily. • A public auction occurs during business hours, and the highest bidder is usually entitled to buy the property. At that point, the borrower cannot get the property back unless he or she buys it back.

Why Does Non-Judicial Foreclosure Matter?

Non-judicial foreclosures happen when a mortgage agreement has a “power of sale” clause that gives the lender the right to foreclose on a property by itself. Without that clause, the lender has to take the borrower to court in order to foreclose; hence the term. Many states require judicial foreclosures. The foreclosure process can take several months if not years, and it does long-term damage to a person’s credit report. It is important to note that foreclosure laws vary by state, and they affect the order or duration of these steps. It is also important to note that the federal Fair Debt Collection Practices Act affects foreclosure proceedings by stipulating the methods lenders can use to go after bad debts.

Pre-Foreclosure Lawyer Free Consultation

When you need legal help with pre-foreclosure in Utah, please call Ascent Law LLC for your free consultation (801) 676-5506. We want to help you.

Ascent Law LLC 8833 S. Redwood Road, Suite C West Jordan, Utah 84088 United States Telephone: (801) 676-5506

Ascent Law LLC

4.9 stars – based on 67 reviews

Recent Posts

Search And Seizure Issues And The Fourth Amendment

Utah Injury Lawyer

Attestation Clause In A Will

How To Pay Off High Interest Credit Card Debt

Reasons Parents Lose Custody Of Their Children

Family Law In Ut

from Michael Anderson https://www.ascentlawfirm.com/post-foreclosure-liability-for-code-violations/

from Criminal Defense Lawyer West Jordan Utah https://criminaldefenselawyerwestjordanutah.wordpress.com/2020/06/04/post-foreclosure-liability-for-code-violations/

0 notes

Text

Post-Foreclosure Liability For Code Violations

Federal law usually prevents the servicer from initiating a foreclosure until the borrower is more than 120 days overdue on the loan. Servicers are also, under federal law, required to work with borrowers who are having trouble making monthly payments in a “loss mitigation” process. The non-judicial foreclosure process formally begins when the trustee records a notice of default at the county recorder’s office. The notice of default gives the borrower three months to cure the default. Within ten days of recording, the trustee mails a copy of the notice of default to anyone who has requested a copy. Most deeds of trust in Utah include a request for notice, so you’ll probably get this notification. At the foreclosure sale, the property will be sold to the highest bidder, which is usually the foreclosing bank. At the sale, the bank doesn’t have to bid cash. Instead, it makes a credit bid. If the credit bid is the highest bid at the sale, the property then becomes REO.

In some states, you can redeem (repurchase) your home within a certain amount of time after the foreclosure sale. Under Utah law, however, foreclosed homeowners don’t get a right of redemption after a non-judicial foreclosure. The foreclosing bank may obtain a deficiency judgment following a non-judicial foreclosure if it files a lawsuit within three months after the foreclosure sale. The deficiency amount is limited to the difference between the borrower’s total debt and the property’s fair market value. In other states, though, you don’t have to worry about a deficiency judgment. Some states prohibit banks from suing for deficiencies under certain circumstances, like after a non-judicial foreclosure. Loans that fit in this category are sometimes called nonrecourse loans.

If a foreclosure is non-judicial, the bank has to file a lawsuit following the foreclosure to get a deficiency judgment. In a judicial foreclosure, on the other hand, most states allow the bank to seek a deficiency judgment as part of the underlying foreclosure lawsuit; a few states require a separate lawsuit. Many states have a law that limits the amount of the deficiency to the difference between the debt and the property’s fair market value. For instance, if your state has this type of law and you owe the bank $400,000, the fair market value of your home is $350,000, and the property sells at a foreclosure sale for $300,000, a deficiency judgment will be limited to $50,000 even though the bank technically lost $100,000 (the difference between the amount owed and the sales price). You might be able to wipe out your liability to pay a deficiency judgment by filing for bankruptcy. While it might not make sense to file for bankruptcy just to discharge a deficiency judgment, if you’re considering bankruptcy to deal with multiple debts—like credit card balances, unpaid medical and utility bills, and personal loans—consider talking to a bankruptcy attorney. Deficiency judgment laws vary from state to state and can be complex. If you’re facing a foreclosure, it’s important to understand how the law works in your state. To find out more, consider talking to a knowledgeable foreclosure lawyer. When homeowners decide to let their upside down properties go into foreclosure they typically stop caring for the properties physical condition. Repairs are deferred unless absolutely necessary. After a homeowner abandons his house, as is often the case in pending foreclosures, maintenance stops. Grass and weeds grow wild, electric service stops and air conditioning is turned off. Lack of grounds and building maintenance often results in violations of local building codes. Code violations can result in fines, and violations under Utah building codes often have daily penalties.

A foreclosure and subsequent bank sale resolves many assessments against the foreclosed property including real estate taxes and association dues. Code enforcement fines are not necessarily solved by foreclosure. Under Florida law, homeowners are personally liable for code enforcement fines. A homeowner who vacates his home prior to foreclosure may be exposing himself to personal liability to local government fines that follow the homeowner after the foreclosure sale. People do not want to spend money maintaining a home they are trying to give back to the bank. However, your home is your responsibility as long as legal title in your name. Allowing your home to become an eyesore will invite neighbour’s complaints, code enforcement actions, and expensive fines. Foreclosure sales can be a great find. The mortgage holder, usually a bank, doesn’t want to take the time to go through the normal property sale process. And they will commonly accept less than the property’s face value. However, with these cost savings come potential headaches. Another lender, the original borrower, or even the government can make the process of removing foreclosure title defects difficult. With the right preparation, many of these hidden foreclosure title defects can be erased relatively easily or avoided all together. But, many buyers of foreclosure properties fail to take the precautions necessary to avoid many of these common problems. As a result, what was originally a great deal turns into a stressful situation.

A foreclosure is a legal process. Essentially, a party that has filed a lien against a property attempts to recover the balance owed to the party. They do this by forcing the sale of the property. After a foreclosure complaint has been filed, the owner has 20 days to respond to the foreclosure. They must show why the property should not be foreclosed on. Once a judgment of foreclosure is rendered, the Court orders a sale of the property. After all the lien holders are paid, any remaining funds from the sale go to the property owner. Almost inevitably, the third party buyer will then be brought in as a party to the banks own foreclosure proceeding. At that point, the buyer can either pay the remaining debt on the property to prevent the bank’s own foreclosure sale (called “Right of Redemption”), or sue to get their money back. However, the buyer purchased the property before a bank could file their own foreclosure complaint. The bank then foreclosed on the property. As the Peeler case demonstrates, third party purchasers do not have a strong leg to stand on if their foreclosure sale is subordinate to another lien.

However, even if the purchased property does not have a superior mortgage, there is other less common and unexpected title defects that can arise when a third party seeks to purchase a foreclosed property. Even if all the proper parties are listed in the lender’s foreclosure suit, the purchaser must still make sure the plaintiff lender has used the procedures set out to supply notice to any unknown heirs or spouses of the pending foreclosure action while also ensuring an Administrator Ad item has been appointed. The foreclosing plaintiff’s failure to appoint an Administrator Ad Litem or follow the proper notice procedures are common mistakes that can drag out the foreclosure process and thus prolong a purchaser’s receipt of title for the property. Also, this process of representing the interests of unnamed parties would further assist in any quiet title action to further eliminate anyone else’s claim to the property. If the property has any of these liens, title for any purchaser in a foreclosure action cannot be secure until these time periods have elapsed. A public records search using the borrower’s name (or preferably social security number if available to avoid any overlap with similar names) should show any outstanding federal liens and allow a purchaser to dodge a major headache. Up until 2013, local municipalities could pass ordinances making liens based on municipal code violations superior to mortgages, regardless of the order they were filed. This was important because the relevant city could record a lien on a property after the Lis Pendens (the official document notifying the public that there is a claim against a certain property) has been recorded, but before the purchaser received the Certificate of Title.

Prior to 2013, a property could have a large amount of fees accumulated for code violations without the purchaser’s knowledge. And because of the priority given to these liens under the local ordinances, the foreclosure action would be delayed until the city was paid. Probably the most likely reason for a delay in a foreclosure sale are problems initiated by the borrower. Prior to the purchaser receiving the Certification of Title, the borrower can make all sorts of objections to the foreclosure sale, or worse, appeal a procedural or substantive invalidation of a valid defence. The appeals process, even if frivolous, can take time and money that could defeat the purpose of purchasing the property. Until the sale is complete, the borrower can also use bankruptcy as a way to delay the foreclosure process. If a borrower were to declare bankruptcy, an automatic stay occurs which can freeze lawsuits filed against a foreclosed upon property. Although the foreclosure process will likely conclude eventually, bankruptcy can delay the foreclosure process almost indefinitely. Similar to a borrower appealing a court’s decision to overrule an objection to a foreclosure sale, bankruptcy gives the borrower the ability to interfere with a foreclosure sale. Although the purchaser would likely win the fight, the delay and costs may make the fight not worth having. While the deck may be slightly stacked against a third party purchaser, all is not lost. For example, if the borrower filed bankruptcy after the sale of the foreclosed upon property, the automatic stay would not affect the sale of the property. But, if bankruptcy was properly filed before the sale of the property was completed, the purchaser would only be entitled to receiving whatever funds were given prior to the declaration of bankruptcy. Regardless, a person interested in purchasing a foreclosed upon property would be wise to include the possibility of prolonged litigation while doing their cost/benefit analysis of whether to invest in the property. Before purchasing a foreclosed property, make sure you have the full chain of title in front of you.

A simple public records request will show the current liens on the property. Also, it can help you know if the lender properly brought in all relevant parties in the foreclosure action. A purchaser should always confirm they are buying a marketable title to alleviate any issues with superiority from other liens.

Non-Judicial Foreclosure

A judicial foreclosure occurs when a court allows a lender to seize and sell a borrower’s collateral when the borrower has failed to repay the lender. The term is most often associated with real estate.

How Does Non-Judicial Foreclosure Work?

In general, there are events involved in a foreclosure (in this example, we assume the borrower has obtained a mortgage for a house from the lender). • The borrower signs a contract agreeing to repay the lender over a period of time, usually in predetermined installments. • The borrower misses one or more payments. • The lender sends the borrower one or more notices of delinquency. • The borrower and the lender try to adjust the repayment schedule so that the borrower is more likely to make at least some of the payments until he or she gets back on his feet. (This process is called special forbearance or mortgage modification.) • The borrower still misses payments. • The lender sends the borrower a notice of default and initiates foreclosure proceedings. • In a judicial foreclosure, a court confirms the amount owed to the lender and gives the borrower a set amount of time to pay up (“cure the default”). • In a non-judicial foreclosure, the loan document authorizes the lender to sell the property to recover the loan balance.

• The lender puts the property up for sale and publishes a notice of the sale in the local paper. The notice includes a description of the property, the name of the borrower, and other information. The borrower might file Chapter 13 bankruptcy to stop the foreclosure temporarily. • A public auction occurs during business hours, and the highest bidder is usually entitled to buy the property. At that point, the borrower cannot get the property back unless he or she buys it back.

Why Does Non-Judicial Foreclosure Matter?

Non-judicial foreclosures happen when a mortgage agreement has a “power of sale” clause that gives the lender the right to foreclose on a property by itself. Without that clause, the lender has to take the borrower to court in order to foreclose; hence the term. Many states require judicial foreclosures. The foreclosure process can take several months if not years, and it does long-term damage to a person’s credit report. It is important to note that foreclosure laws vary by state, and they affect the order or duration of these steps. It is also important to note that the federal Fair Debt Collection Practices Act affects foreclosure proceedings by stipulating the methods lenders can use to go after bad debts.

Pre-Foreclosure Lawyer Free Consultation

When you need legal help with pre-foreclosure in Utah, please call Ascent Law LLC for your free consultation (801) 676-5506. We want to help you.

Ascent Law LLC 8833 S. Redwood Road, Suite C West Jordan, Utah 84088 United States Telephone: (801) 676-5506

Ascent Law LLC

4.9 stars – based on 67 reviews

Recent Posts

Search And Seizure Issues And The Fourth Amendment

Utah Injury Lawyer

Attestation Clause In A Will

How To Pay Off High Interest Credit Card Debt

Reasons Parents Lose Custody Of Their Children

Family Law In Ut

from https://www.ascentlawfirm.com/post-foreclosure-liability-for-code-violations/

from Criminal Defense Lawyer West Jordan Utah - Blog http://criminaldefenselawyerwestjordanutah.weebly.com/blog/post-foreclosure-liability-for-code-violations

0 notes

Text

Post-Foreclosure Liability For Code Violations

Federal law usually prevents the servicer from initiating a foreclosure until the borrower is more than 120 days overdue on the loan. Servicers are also, under federal law, required to work with borrowers who are having trouble making monthly payments in a “loss mitigation” process. The non-judicial foreclosure process formally begins when the trustee records a notice of default at the county recorder’s office. The notice of default gives the borrower three months to cure the default. Within ten days of recording, the trustee mails a copy of the notice of default to anyone who has requested a copy. Most deeds of trust in Utah include a request for notice, so you’ll probably get this notification. At the foreclosure sale, the property will be sold to the highest bidder, which is usually the foreclosing bank. At the sale, the bank doesn’t have to bid cash. Instead, it makes a credit bid. If the credit bid is the highest bid at the sale, the property then becomes REO.

youtube

In some states, you can redeem (repurchase) your home within a certain amount of time after the foreclosure sale. Under Utah law, however, foreclosed homeowners don’t get a right of redemption after a non-judicial foreclosure. The foreclosing bank may obtain a deficiency judgment following a non-judicial foreclosure if it files a lawsuit within three months after the foreclosure sale. The deficiency amount is limited to the difference between the borrower’s total debt and the property’s fair market value. In other states, though, you don’t have to worry about a deficiency judgment. Some states prohibit banks from suing for deficiencies under certain circumstances, like after a non-judicial foreclosure. Loans that fit in this category are sometimes called nonrecourse loans.

If a foreclosure is non-judicial, the bank has to file a lawsuit following the foreclosure to get a deficiency judgment. In a judicial foreclosure, on the other hand, most states allow the bank to seek a deficiency judgment as part of the underlying foreclosure lawsuit; a few states require a separate lawsuit. Many states have a law that limits the amount of the deficiency to the difference between the debt and the property’s fair market value. For instance, if your state has this type of law and you owe the bank $400,000, the fair market value of your home is $350,000, and the property sells at a foreclosure sale for $300,000, a deficiency judgment will be limited to $50,000 even though the bank technically lost $100,000 (the difference between the amount owed and the sales price). You might be able to wipe out your liability to pay a deficiency judgment by filing for bankruptcy. While it might not make sense to file for bankruptcy just to discharge a deficiency judgment, if you’re considering bankruptcy to deal with multiple debts—like credit card balances, unpaid medical and utility bills, and personal loans—consider talking to a bankruptcy attorney. Deficiency judgment laws vary from state to state and can be complex. If you’re facing a foreclosure, it’s important to understand how the law works in your state. To find out more, consider talking to a knowledgeable foreclosure lawyer. When homeowners decide to let their upside down properties go into foreclosure they typically stop caring for the properties physical condition. Repairs are deferred unless absolutely necessary. After a homeowner abandons his house, as is often the case in pending foreclosures, maintenance stops. Grass and weeds grow wild, electric service stops and air conditioning is turned off. Lack of grounds and building maintenance often results in violations of local building codes. Code violations can result in fines, and violations under Utah building codes often have daily penalties.

youtube

A foreclosure and subsequent bank sale resolves many assessments against the foreclosed property including real estate taxes and association dues. Code enforcement fines are not necessarily solved by foreclosure. Under Florida law, homeowners are personally liable for code enforcement fines. A homeowner who vacates his home prior to foreclosure may be exposing himself to personal liability to local government fines that follow the homeowner after the foreclosure sale. People do not want to spend money maintaining a home they are trying to give back to the bank. However, your home is your responsibility as long as legal title in your name. Allowing your home to become an eyesore will invite neighbour’s complaints, code enforcement actions, and expensive fines. Foreclosure sales can be a great find. The mortgage holder, usually a bank, doesn’t want to take the time to go through the normal property sale process. And they will commonly accept less than the property’s face value. However, with these cost savings come potential headaches. Another lender, the original borrower, or even the government can make the process of removing foreclosure title defects difficult. With the right preparation, many of these hidden foreclosure title defects can be erased relatively easily or avoided all together. But, many buyers of foreclosure properties fail to take the precautions necessary to avoid many of these common problems. As a result, what was originally a great deal turns into a stressful situation.

A foreclosure is a legal process. Essentially, a party that has filed a lien against a property attempts to recover the balance owed to the party. They do this by forcing the sale of the property. After a foreclosure complaint has been filed, the owner has 20 days to respond to the foreclosure. They must show why the property should not be foreclosed on. Once a judgment of foreclosure is rendered, the Court orders a sale of the property. After all the lien holders are paid, any remaining funds from the sale go to the property owner. Almost inevitably, the third party buyer will then be brought in as a party to the banks own foreclosure proceeding. At that point, the buyer can either pay the remaining debt on the property to prevent the bank’s own foreclosure sale (called “Right of Redemption”), or sue to get their money back. However, the buyer purchased the property before a bank could file their own foreclosure complaint. The bank then foreclosed on the property. As the Peeler case demonstrates, third party purchasers do not have a strong leg to stand on if their foreclosure sale is subordinate to another lien.

However, even if the purchased property does not have a superior mortgage, there is other less common and unexpected title defects that can arise when a third party seeks to purchase a foreclosed property. Even if all the proper parties are listed in the lender’s foreclosure suit, the purchaser must still make sure the plaintiff lender has used the procedures set out to supply notice to any unknown heirs or spouses of the pending foreclosure action while also ensuring an Administrator Ad item has been appointed. The foreclosing plaintiff’s failure to appoint an Administrator Ad Litem or follow the proper notice procedures are common mistakes that can drag out the foreclosure process and thus prolong a purchaser’s receipt of title for the property. Also, this process of representing the interests of unnamed parties would further assist in any quiet title action to further eliminate anyone else’s claim to the property. If the property has any of these liens, title for any purchaser in a foreclosure action cannot be secure until these time periods have elapsed. A public records search using the borrower’s name (or preferably social security number if available to avoid any overlap with similar names) should show any outstanding federal liens and allow a purchaser to dodge a major headache. Up until 2013, local municipalities could pass ordinances making liens based on municipal code violations superior to mortgages, regardless of the order they were filed. This was important because the relevant city could record a lien on a property after the Lis Pendens (the official document notifying the public that there is a claim against a certain property) has been recorded, but before the purchaser received the Certificate of Title.

youtube