#yet the average rating is like 50% lower…

Text

I watched Rebel Moon: Part One – A Child of Fire and… it really doesn’t deserve the torrent of hatred I’ve seen it receive online.

It’s not a perfect movie, sure, but I’d say it’s an honest one; I feel like I saw exactly what I was told I would get. Even though it doesn’t have the most original story, it’s not bad, and it already has a very dense (but easily digestible) lore, as well as many creative and original designs. Plus, this was only Part One, and they said a longer, R-rated version would also be released at some point, so we’ve only seen maybe one-third of the story…

Creating an entirely new fictional universe that, although it’s inspired by many others (and this was never hidden), isn’t part of an existing franchise with an established lore, is hard and ambitious, and the film was clearly made with care and passion, so I for one welcome the effort.

Rebel Moon has potential, and I want to see more of it. When Part 2, The Scargiver, releases, I will be there!

#rebel moon#a child of fire#rebel moon part one a child of fire#in a way it reminded me a lot of raya and the last dragon#except that movie was for kids and therefore shorter#so I thought everything happened too fast and some apparently important characters only had a few seconds of screen time#rebel moon is 20% longer and even though some things did feel a bit 'rushed' in this first short version I liked the pacing better#yet the average rating is like 50% lower…#zack snyder#some people also just love to hate him I think#actual review I read: 'it was so bad I had to take breaks'#come on...

17 notes

·

View notes

Text

By: Ryan Burge

Published: Mar 25, 2024

I give a lot of talks about the "nones." This includes Zoom meetings, webinars, lecture series, and sermons at various venues such as churches, colleges, and social organizations. My slide deck is as dialed in as it can be. I know which statements will resonate, how to elicit a quick laugh, when to speed through a graph, and when to pause to let people take photos of a slide.

I aim to provide the audience with a few key takeaways from the talk. One of them is this: most "nones" are not atheists. I believe that when most people hear the term "none," they immediately picture an atheist. However, I emphasize the "nothing in particular" group more because it's significantly larger.

I do, however, believe that atheists are crucial for the future of American society and politics. As I've previously written, they are among the most politically active groups in the United States.

Link: No One Participates in Politics More than Atheists (paid article)

But how many are there? The Cooperative Election Study can help us with an estimate.

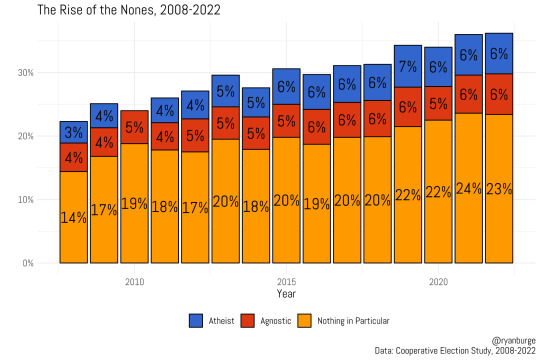

According to this data, about three percent of the adult population were atheists in 2008. This number has slowly risen over the last fifteen years. It was five percent in 2014, then increased to 6% by 2016. What's striking is that there hasn't been any appreciable increase between 2015 and 2022; it's remained around six percent.

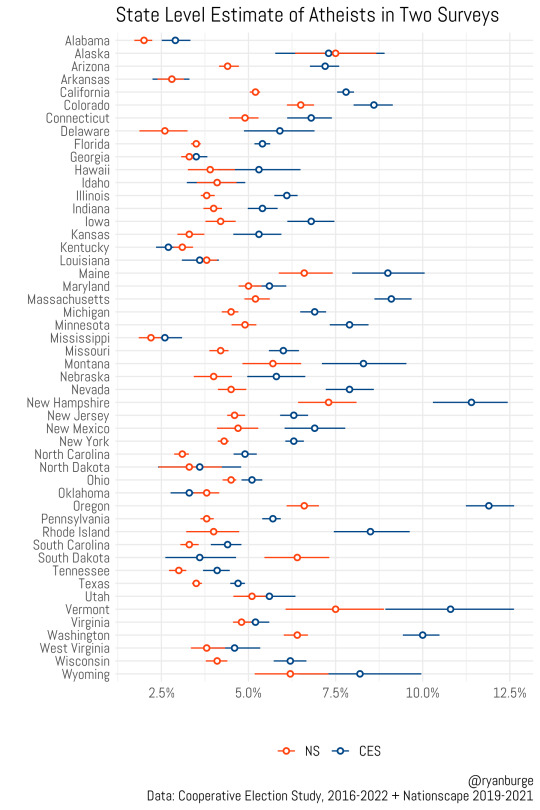

I've also attempted to generate state-level estimates of atheists, which is not straightforward. When a group comprises only 6% of the general population, the margin of error increases. This is even more challenging at the state level, requiring a large sample size to include enough respondents from states like Vermont or Wyoming to produce confident calculations. Yet, I'm giving it a try.

Below, you'll find estimates of the atheist population for all 50 states. I used two sources: the Cooperative Election Study (CES) data from 2016-2022 and an estimate from Nationscape with has over 477,000 respondents. Despite the large sample sizes, four states in the Nationscape sample had fewer than 1000 respondents—Wyoming, Vermont, Alaska, and North Dakota. However, this is as accurate as it gets with the available data.

I visualized the estimates with 84% confidence intervals. A rule of thumb is that if the error bars from each survey overlap, the estimates are statistically similar. This occurs in some states like Georgia, Idaho, Maryland, and Mississippi. Generally, the CES tends to have higher atheist estimates than the Nationscape survey, but the differences aren't substantial, averaging a discrepancy of 1.9 points.

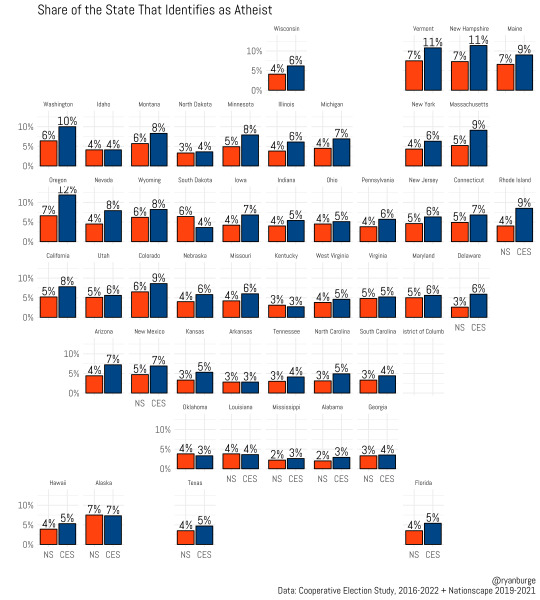

I'll now share the atheist estimates from both surveys for all fifty states to illustrate the range of these numbers.

In several states, one estimate may be 4% and another 5%, such as in Indiana, Ohio, West Virginia, Texas, and Florida. It's reasonable to conclude that in these locations, atheists may constitute one in twenty adults. Other states fall into a similar range, like Pennsylvania, Missouri, Nebraska, and Kansas. The largest discrepancies were found in Washington (4 points) and Oregon (5 points), it’s hard to figure out why this is happening in these two states.

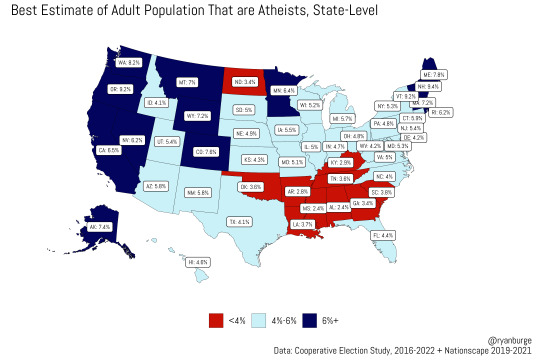

To generate my best guess, I averaged the estimates from the CES and Nationscape surveys. Although the CES estimate might be slightly high and the Nationscape slightly low, the midpoint should provide a close approximation of the actual percentage.

It's reassuring when the data align with perceptions - that’s the case here. For example, the Bible Belt displays a lower atheist percentage, with states like Mississippi, Alabama, and Kentucky showing shares below 3%. North Dakota's outlier status likely reflects the impact of sample size.

The atheist population in most states falls within the 4-6% range, encompassing the upper Midwest, the Rust Belt, and parts of the Southwest. Missouri, with a 5.1% atheist population, serves as the median state, aligning more with its northern neighbors than those to the south.

The dark blue states, which are most likely to have atheists, can be best described as including the Pacific Northwest, some Great Plains states, and New England. However, the epicenter is undoubtedly in the top left part of the map, with Oregon at 9.2% atheists and Washington at 8.2%. The only other states that come close are the relatively small ones: New Hampshire (9.4%) and Vermont (9.2%).

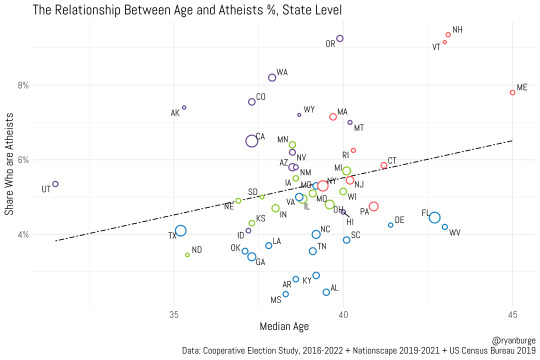

Let’s have some fun now, though. What factors predict a greater percentage of atheists? I think even amateur social scientists can probably do a bit of theorizing at this stage. Let’s start with some low hanging fruit - age. This is a scatterplot of median age on the x-axis and the share of atheists on the y-axis.

The trend line is unmistakably positive—states with older populations tend to have more atheists. Surprising, isn't it? Take note of the three outliers in the top right—New Hampshire, Vermont, and Maine. These states are both significantly older and have higher proportions of atheists than the norm. On the other end of the spectrum lies Utah, a notable outlier. Despite its relatively young median age of 31.5, its estimated atheist share is 5.4%, which significantly exceeds the expected trend of 4%.

But what does this correlation translate to in concrete terms? If a state were to age by five years, on average, it could anticipate a one percentage point increase in its atheist population. This change might not seem substantial, but considering the implications of a statewide median age shift of five years, the impact is noteworthy.

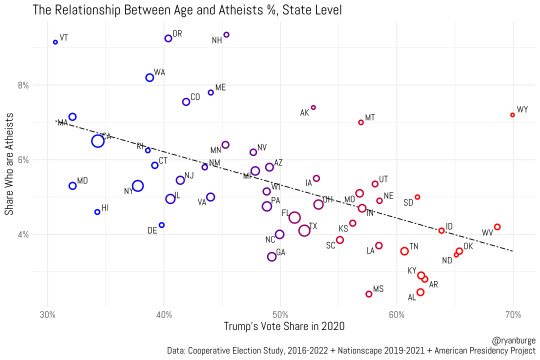

Let’s explore another influential factor: politics. I analyzed Trump’s vote share from the 2020 presidential election and plotted it against the share of atheists.

This relationship should be relatively straightforward to understand—the higher the percentage of Trump voters in a state, the lower the percentage of atheists. Vermont stands out as an anomaly in the top left, where only 31% of voters supported Trump and 9.2% of the population identifies as atheist. Massachusetts presents an interesting case for comparison; its Trump vote share was nearly identical, yet its atheist share was two percentage points lower.

Montana, Alaska, and Wyoming significantly deviate from the trend. I attribute this to two main factors: the small sample size and the unique political landscape in these states, where conservatism is not primarily driven by religious motives. A Republican in Montana is markedly different from one in Mississippi.

But what does this correlation look like in real numbers? For every ten-point increase in Trump’s vote share, the percentage of atheists decreases by about 0.9%. This is less than a single percentage point. For example, if Vermont's Trump vote share increased from 31% to 51%, we might expect its atheist share to decrease from 9.2% to 7.4%.

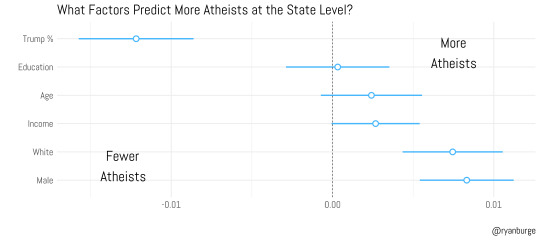

Before concluding this post, I put together a regression model with additional variables such as the percentage of the state population with a college degree, the median income, and the gender ratio to identify factors that influence the percentage of atheists. Here are the findings.

Education, age, and income did not provide statistical significance in this analysis, which is certainly noteworthy. The primary factor influencing the atheist percentage was political orientation. A higher number of Trump voters correlates with fewer atheists, all else being equal. Additionally, two demographic variables—higher percentages of white people and men—were associated with increased atheism rates. The effects of these variables were positive and of similar magnitudes, indicating that neither is significantly more predictive than the other.

It's important to emphasize that atheists have not been growing at an exponential rate in America. They accounted for six percent of the population when Donald Trump was elected President, and this figure remained unchanged as of 2022. The increase in "nones" is attributed more to a rise in individuals identifying with "nothing in particular" rather than a surge in atheism. While states like Oregon and Vermont have notable atheist populations, atheism is relatively rare in places like Alabama.

Link: Atheists Just Don't Have Many Kids (paid article)

The inverse relationship between age and atheism deserves further reflection. When combined with data from a previous analysis highlighting the low fertility rate among atheists, it becomes clear that the growth of atheism likely depends more on converting individuals from other traditions than on passing atheistic beliefs down through generations.

However, the relatively high incomes and education levels of atheists, coupled with their lower fertility rates, position them to continue exerting significant influence across various aspects of American life, both now and in the future.

==

Keep in mind that I understand Ryan's definition of "atheism" to be, "believes that no god exists."

A better definition is anyone who isn't a theist. If you don't positively affirm belief in a god or gods, you're an atheist.

#Ryan Burge#rise of the nones#leaving religion#no religion#irreligion#atheism#decline of religion#empty the pews#religion#religion is a mental illness

11 notes

·

View notes

Text

Lupin iii Pred headcannons!

This list will focus on the 5 main characters plus a bonus 1! There will be details about hunger, WG, vore capacity and digestion details for each one, fujikos's a little different from the rest.

Arsene Lupin iii

Pred

Prefers female prey, but will happily accept the larger masculine prey as well, along with his friends/lovers on the odd occasion!

Can do Endo/safe vore but when unconscious, he has a higher risk of his stomach churning his prey or items if he doesn't wake up in time

HUNGER: Huge appetite

METABOLISM: below average; the skilled thief will gain a lot of fat and faint muscles from each lupin size prey he consumes, lowering and forcing his over all prey limit for strategic reasons, not because he's full. The fat lupin gains from prey will melt away within a couple weeks being the longest of the 3 lupin gang members and they tease him for it

PREY LIMIT: About 75 people, just a little larger then a big carousel of belly fat, after that limit lupin gets nauseous and self conscious about how much fat he'll gain afterwards

Daisuke Jigen

Pred

Prefers large male prey, the bigger the better, but any gut filler will do, the team 'metal smelter' easily destroys most objects without indigestion

Can NOT do Endo/safe vore, the deadly ex-merc has trained his gut to smelt and burn the flesh and metal of his food in seconds, meaning he can never devour his lovers or friends without them literally dying right as they enter the stomach... if he knows they will respond afterwards, he will happily take the rare chance!

HUNGER: Ravenous

METABOLISM: Extremely high; The marksman does not keep his fat or muscle gains from his prey for very long, the most his belly and butt fat lasts is 4 days - 2 weeks depending on how much prey and items he's consumed, he doesn't have an exact prey limit as lupin, but if he over does the goon gurgling on a heist he might just have comparable WG to lupins that could inconvenience him.

PREY LIMIT: ??? ; Jigen devours and melts down prey so effectively that he's never reached his limit yet, but would one day love to see what it would be.

Goemon Ishikawa xiii

Pred/Fatal Prey (usually kills his Preds from the inside out, if lupin devours him he enjoys it and his heart beat is soothing to the samurai's mind)

Has very picky prey preference, will rather starve then devour a person whose flavor is foul or too dirty for his liking, that being said he's usually the get away pred (Endo) for the gang capable of being able to dine on roughly 4 people and still able to fight, jump, and dash away.

Is fully capable of Endo and safe vore, has the most control of his hunger and gastric acids. You won't die inside him unless he wants you to be some samurai pudge.

HUNGER: Average but hangry

METABOLISM: High; although not as high as Jigen's burn rate or acid efficiency the samurai performs quite well with breaking down most living things, he struggles a bit with metals and will want belly rubs and acid relief tablets if that occurs. Minimal WG but has increased MG from the prey whenever he works out after digestion.

PREY LIMIT: roughly 50 people or a small house worth of belly before he gets queasy

Koichi Zenigata

Pred/Unwilling Prey

Any wrong doer, his baseline goal as an inspector is to detain and sometimes be the judge jury and executioner of some of his outings. His main goal in life is to always have lupin detained inside him, and eventually permanently digest Lupin iii! he will literally squeeze lupin out of another pred and then devour said pred just to reassure lupin goes back to the station inside of him, if he's ever lucky enough to get the slick monkey man.

Best pred for Endo vore! The cop has a gentle gut and slow acid production. Prey could stay alive for nearly 48 hours or so, but eventually the large man gets into a nutrient deficit and will automatically start to churn his prey.

HUNGER: Hungry, but resilient

METABOLISM: Below average, gains a round heavy overhang with increased gut fat every time he processes a prey. Can take weeks to burn off the extra thickness, sometimes it takes a matter of days to burn off the blubber if he doesn't eat anything and in harsh climates tracking lupin down.

PREY LIMIT: can handle a lot of squirming prey! A prison or two a year might ask him to clear out death row, which could have up to a 100 prey at once, definitely the gassiest out of all the Preds due to his age.

Fujiko Mine

Prey/Unwilling pred

Prefers no prey! but will devour if it keeps her safe, can't vore lupin because the horny man enjoys it too much, will threaten jigen with it, but never actually does it. Will always be prey for lupin in a exclusively sexual way, otherwise she doesn't enjoy it... But being inside a gut happens to her a lot more than she wants it to

Can't do Endo, traditional digestion they will suffocate and pass out first then digestion will start.

HUNGER: Reserved but hangry

METABOLISM: average, scared of the WG the men get, she doesn't like to vore often in general, when she does she takes a week off to work out and do squats to regain her body figure, can't process metals will regurgitate them.

PREY LIMIT: 3 people is a lot for her, she refuses to do more

Arsene Lupin I

Pred

Food over people most days, the vegetarian man makes rule breaks in his diet for big pesky villains and copers! Prefers his food dressed in a sauce or some form of vegetarian food to meld and increase the flavours!

Is capable of Endo vore, but improves his gut acid control and gut activity better with the usage of his abilities in age, easily In the first 5 years of him voring he's accidentally melted several people and items.

HUNGER: Always hungry

METABOLISM: below average; gains weight in the thighs easily along with an increasing overhanging gut when empty over the decades of feasting, his vegetarian body can't process bones very well and he will usually regurgitate them well after the prey is soupy. Will keep weight and muscles gain for as long as his grandson does

PREY LIMIT: goes from 10 early on, about the size of a large hot tub of gut space, and evloves his limit in his golden years to around 100 prey, the equivalent gut size to an Olympic swimming pool.

And that is my main vore headcannons for the main cast of the series, was quite fun to do this! I have other series I'm a fan of and can do more if anyone wishes me too!?

#male pred#male vore#same size vore#lup/in iii#zeni/gata koi/chi#dai/suke jig/en#goe/mon ishi/kawa#fuj/iko mi/ne#arsene lu/pin#pred headcannons#bellyspeaks#hunger kink#male wg#wg headcannon#rapid digestion#fatal vore

22 notes

·

View notes

Text

By Jake Johnson

Common Dreams

Jan. 9, 2024

"Almost nobody says we should have the richest pay the least. And yet when we look around the country, the vast majority of states have tax systems that do just that."

Nearly every state and local tax system in the U.S. is fueling the nation's inequality crisis by forcing lower- and middle-class families to contribute a larger share of their incomes than their rich counterparts, according to a new study published Tuesday.

Titled Who Pays?, the analysis by the Institute on Taxation and Economic Policy (ITEP) examines in detail the tax systems of all 50 U.S. states, including the rates paid by different income segments.

In 41 states, ITEP found, the richest 1% are taxed at a lower rate than any other income group. Forty-six states tax the top 1% at a lower rate than middle-income families.

"When you ask people what they think a fair tax code looks like, almost nobody says we should have the richest pay the least," said ITEP research director Carl Davis. "And yet when we look around the country, the vast majority of states have tax systems that do just that."

"There's an alarming gap here between what the public wants and what state lawmakers have delivered," Davis added.

In recent years, dozens of states across the U.S. have launched what the Center on Budget and Policy Priorities recently called a "tax-cutting spree," permanently slashing tax rates for corporations and the wealthy during a pandemic that saw billionaire wealth skyrocket and company profits soar.

A report released last week, as Common Dreamsreported, showed ultra-rich Americans are currently sitting on $8.5 trillion in untaxed assets.

According to ITEP's new study, tax systems in just six states—California, Maine, Minnesota, New Jersey, New York, and Vermont—and the District of Columbia are progressive, helping to reduce the chasm between rich taxpayers and other residents.

Massachusetts, which has one of the more equitable tax systems in the nation, collected $1.5 billion in revenue last year thanks to its recently enacted millionaires tax, a measure that improved the state's ranking by 10 spots in ITEP's Tax Inequality Index. Minnesota has also ramped up its taxes on the rich over the past several years while expanding benefits for lower-income families, ITEP's study observes.

"The regressive state tax laws we see today are a policy choice, and it's clear there are better choices available to lawmakers."

But the full picture of U.S. state and local systems is grim. In 44 states, tax laws "worsen income inequality by making incomes more unequal after collecting state and local taxes," ITEP found.

Florida has the most regressive tax code in the U.S., with the richest 1% paying a mere 2.7% tax rate while the poorest 20% pay 13.2%.

Florida is among the U.S. states that don't have personal income taxes, which forces them to rely on consumption and property taxes that are "nearly always regressive," ITEP notes in the new analysis.

"Eight of the 10 most regressive tax systems—Florida, Washington, Tennessee, Nevada, South Dakota, Texas, Arkansas, and Louisiana—rely heavily on regressive sales and excise taxes," the study says. "As a group, these eight states derive 52% of their tax revenue from these taxes, compared to the national average of 34%."

Aidan Davis, ITEP's state policy director, said that "we've seen a lot of states shift their tax systems to become even more regressive in recent years by enacting deep tax cuts for the wealthiest."

The report points to Kentucky's adoption of a flat tax and repeated corporate tax cuts, which "delivered the largest windfall to families in the upper part of the income scale and have been paid for in part through new or higher sales and excise taxes on a long list of items such as car repairs, parking, moving services, bowling, gym memberships, tobacco, vaping, pet care, and ride-share rides."

Davis said that "we know it doesn't have to be like this," arguing there is a "clear path forward for flipping upside-down tax systems and we’ve seen a handful of states come pretty close to pulling it off."

"The regressive state tax laws we see today are a policy choice," said Davis, "and it's clear there are better choices available to lawmakers."

#regressive tax code#progressive tax code#tax the rich#wealth inequality#income inequality#tax law#politics#itep#public policy

9 notes

·

View notes

Text

How the SEC’s Rumored Rate Cut Could Supercharge Bitcoin’s Momentum

The financial world is buzzing with rumors about the upcoming SEC meeting on September 18th. Analysts are speculating that we could see a significant interest rate cut—potentially a full 50 basis points. If this happens, it could ripple through markets worldwide, but one sector that stands to gain the most attention is Bitcoin.

In times of economic turbulence, Bitcoin has continuously proven itself to be an asset that defies traditional expectations. The upcoming SEC meeting may represent yet another turning point in its already fascinating evolution.

The Ripple Effect of Interest Rate Cuts on Traditional Markets

To understand why this is significant, it’s important to look at how interest rates influence traditional financial systems. When rates are high, borrowing becomes expensive, dampening consumer spending and corporate investment. Conversely, a rate cut encourages spending, stimulates investment, and injects liquidity into the markets.

Historically, interest rate cuts have caused stocks and bonds to rally. However, with rising inflation and increasing uncertainty in fiat currencies, many investors are questioning how long traditional markets can sustain their growth without inflating a massive bubble. This is where Bitcoin enters the picture as a hedge against economic instability.

Why Bitcoin Benefits from Lower Interest Rates

Bitcoin, often dubbed "digital gold," thrives in an environment of financial uncertainty. When central banks pump liquidity into the market by lowering interest rates, the excess capital needs somewhere to go. While traditional assets like stocks or real estate may rally in the short term, they are still tethered to an inflationary system.

Bitcoin, by contrast, operates on scarcity. Its fixed supply of 21 million coins makes it a deflationary asset, immune to the debasement seen in fiat currencies. When interest rates are cut, and more money flows into the economy, Bitcoin becomes increasingly attractive as a hedge against inflation.

Look back at early 2020: interest rate cuts across the board as a response to the COVID-19 pandemic saw a flood of liquidity enter the financial system. Not only did traditional markets recover, but Bitcoin's price surged to record highs, further solidifying its status as a store of value in uncertain times. A similar scenario may unfold following this rumored rate cut.

How This Potential Rate Cut Might Impact Bitcoin’s Price

If the SEC cuts interest rates by 50 basis points, it could trigger a similar injection of liquidity into global markets, causing a surge in speculative and institutional investment into Bitcoin. Lower interest rates often lead to a decrease in bond yields and traditional savings account returns, prompting investors to seek better returns elsewhere. With inflation rising, Bitcoin’s status as a hedge becomes even more compelling.

Furthermore, as the Fed continues to shift monetary policies to avoid a recession, more people are losing faith in fiat currencies. Bitcoin, with its decentralized nature and inherent scarcity, is increasingly seen as a safe haven during these periods of monetary manipulation.

This rate cut could bring a new wave of institutional buyers who recognize that traditional assets are over-leveraged and potentially overvalued. They may turn to Bitcoin as a hedge against continued inflation and fiat devaluation, adding more momentum to its upward trajectory.

Mitigating Volatility with a Dollar-Cost Averaging (DCA) Strategy

While Bitcoin’s potential for growth is significant, it’s also known for its volatility. Sudden price fluctuations can be daunting for both new and experienced investors. This is where a Dollar-Cost Averaging (DCA) strategy becomes crucial.

DCA involves investing a fixed amount of money into Bitcoin at regular intervals, regardless of the asset’s price. By spreading out your investment over time, you reduce the risk of buying large amounts at a market peak and capitalize on market dips. This method helps smooth out the highs and lows of Bitcoin’s price movements and reduces the emotional stress that often accompanies trying to time the market.

In the long term, DCA allows investors to accumulate more Bitcoin at a lower average cost. It is a disciplined, low-risk approach to building wealth in Bitcoin, particularly useful in times of market uncertainty—like the potential market shift following the SEC's interest rate decision.

Bitcoin’s historical price volatility can be a deterrent to those not used to the crypto space, but a DCA strategy ensures that you keep building your position over time, regardless of short-term price swings. In the end, consistent accumulation of Bitcoin is a strategy that has proven to pay off for patient investors.

What This Means for the Bigger Picture

The SEC’s potential decision could be a pivotal moment in the ongoing adoption of Bitcoin. With inflation pressures looming, many people are looking for alternatives to protect their wealth. Centralized financial systems continue to show signs of fragility, and Bitcoin offers a way out—a decentralized, censorship-resistant alternative to fiat currencies.

In a world where central banks are losing control of their monetary policies, Bitcoin represents a beacon of financial independence. Every rate cut further highlights the cracks in the existing financial system, and each one brings Bitcoin closer to mainstream acceptance.

Conclusion: Preparing for What’s Next

September 18th could mark a major turning point in both traditional markets and the Bitcoin ecosystem. If the SEC moves forward with the rumored rate cut, expect a ripple effect that will send Bitcoin into another wave of adoption and price appreciation. As we’ve seen in previous market cycles, Bitcoin thrives when the rules of fiat finance begin to falter.

For Bitcoiners, this moment reinforces the importance of staying the course. While short-term market fluctuations can be nerve-wracking, the long-term trajectory is clear: Bitcoin is the future of money, and its value proposition strengthens as centralized systems continue to stumble. This potential rate cut is just one more chapter in the ongoing story of Bitcoin’s inevitable rise.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#Crypto#FinancialFreedom#InterestRates#BitcoinAdoption#DigitalGold#InflationHedge#Investing#Cryptocurrency#DCA (Dollar-Cost Averaging)#SECMeeting#FiatCurrency#Blockchain#DecentralizedFinance#BitcoinVolatility#HODL#CryptoInvesting#HyperBitcoinization#FutureOfFinance#financial empowerment#financial experts#unplugged financial#globaleconomy#digitalcurrency#financial education#finance

3 notes

·

View notes

Text

AR Ship Week - Shipping in 2023

This is the first weekly post in the lead up to Alex Rider Ship Week. There's a little over 4 weeks to go!

This week we’re going to look at Alex Rider shipping fandom again, one year after our previous meta on Shipping in 2022.

Another year and a frankly spectacular amount of shipfics later, here we are again, about to look at the state of Alex Rider ship fics.

So what's new in the top five ships this year? Nothing, actually. As expected, the undisputed top ship is Yassen/Alex (1), but the entire top five remains the same, though Yalex is dominating shipping fandom more and more. Yalex now has 10 times more fics than the second most popular ship, up from 7.7 times last year.

Yalex has added an impressive 192 fics to the count (an increase of 52 percent!), while Yassen/Ian (Yian) has almost overtaken Tom/Alex (Tomlex) for the second ship on the list. Last year, Tomlex was at 48 fics and Yian at 41. Now the count is 56 and 55, which means Yian might overtake Tomlex's spot as the second ship on the list by next year.

Since the rankings remain the same, we decided to dig a little into ratings and tags instead and take a look at what characterises the three most popular ships (also the only ships with more than 50 fics each).

For all three pairings, two of the three most popular tags are 'Hurt/Comfort' and 'Fluff' (2). For Yalex, the third tag - to no one's surprise, presumably - is 'Yassen Gregorovich Lives'. For Tomlex, it's 'Angst', and for Yian, it's an equally unsurprising 'Ian Rider Lives' as the most popular tag for the pairing - a tag that exploded in popularity with the TV show's arrival. The AR ship fandom lives by the motto of 'I reject your reality and substitute my own' and will embrace it to its fullest (3).

The real differences begin to show when we look at the ratings:

Just as Yalex is hands-down the most popular pairing, it's also the horniest. 39 percent of the fics are rated 'Explicit' (4) and another 26 percent are rated 'Mature'. 'Teen And Up Audience' and 'General Audiences' together make up 32 percent.

For Tomlex, 'Teen And Up Audience' is the most popular rating (55 percent) and 'General Audiences' is a distant second at 22 percent, probably as a result of the age of both characters (5).

For Yian, 'Teen And Up Audience' is also the most popular rating (53 percent) but this time followed by 'Mature' and 'Explicit', which makes up a combined 29 percent.

In terms of general stats, there are also noticeable differences:

The average Yalex fic has around 6.6k words, 136 kudos, and just under 1700 hits. This is helped along by a number of multichapter, 50k+ fics as well as the general popularity of the pairing.

The average Tomlex fic is just under 3.2k words, has 91 kudos and around 950 hits. In contrast to Yalex, the pairing has no fics with more than 25k words, which results in the much lower mean wordcount.

The average Yian fic is just under 3.9k words, has 94 kudos, and around 750 hits. Like the Tomlex pairing, there are not yet any longfics with the pairing (the longest is around 15k), but a smaller percentage of fics below 1k words means that the average fic is longer than for Tomlex. Yian also has fewer hits but a slightly higher kudos-count.

Other fun observations:

Yalex, like all three of the most popular pairings, is generally a solo pairing. Out of 563 fics, only 9 of them have Yassen/John as a pairing as well, along with 7 fics that have Alex/OMC. Tom is tagged in 44 fics, Tulip Jones in 39, and Jack in 31.

For Tomlex, the only other pairing of note is Yian (which shows up in 6 of the 56 fics), and Jack is tagged in 11 of the fics.

For Yian, the same 6 fics Tomlex appear. The only other character of note is Alex, who appears in 23 of the 55 fics - almost half of them.

Alexmis fics are generally much more centred in the Artemis universe than the AR universe. No other AR ships commonly occur with Alexmis, and of the top ten characters, all are from the Artemis series, except Jack in 3 fics.

For Helen/John, Alex appears in 30 of the 43 fics, more than two-thirds. That can either be because of the family relation (as Alex is also commonly tagged in Yian fics) or because the tag appears as a background or past pairing in some Alex-focused fics.

There you have it: A brief overview of shipping in the AR fandom in 2023. Next week we will be back with a fresh bunch of shipping recs!

______

Notes:

(1) On an impressive note, 89 of the Yalex fics are written by Suzie_Shooter over the course of eleven years. That's 16 percent of the total amount of Yalex fics and includes 6 of the ten most-kudosed fics of the pairing as well as a number of beloved classics.

(2) Definitions of 'fluff' and the 'comfort' part may vary between pairings, so someone looking for delicious, tooth-rotting fluff would probably want to check the rest of the tags on the fics.

(3) Though to be fair, with Ahorz's grasp on continuity and the addition of the TV show, the concept of 'reality' is probably debateable.

(4) This admittedly also covers graphic violence and similar beyond just graphic smut - or in the case of Yalex, sometimes both at the same time - but a glance at the AO3 page will reveal that yes, the fandom is, indeed, horny.

(5) That, or TV!Tom's beanie is just that much of a mood killer. The jury is still out on that.

Disclaimer: All AR-specific data was current as of the writing of this post (February 11th, 2023).

30 notes

·

View notes

Text

aespa - Armageddon

I definitely liked this album. I don’t know if I’d say that I loved it. I was hoping that this album would confirm to me that I absolutely loved aespa, but … really I’m kind of where I was earlier: a lot of their songs aren’t for me, but some of them are absolutely amazing. That said, a lot of the songs on this album were quite good, and even my least favorite songs were still pretty good. That’s more than I can say for a lot of their earlier stuff.

This album seemed to do the same thing as Drama: it was 50% dark and 50% brighter-but-still-electronic. Clearly the Red Velvet dual concept is going strong with their successors. It makes you wonder what SMNGG is going to be like. SM groups seem to come in duos: Exo sound a lot like Red Velvet, NCT sound a lot like aespa. So we’d expect SMNGG to sound a lot like Riize, I guess?

Anyway, I’m not talking as much about the particular songs on this album, because (title tracks aside) nothing was super memorable on a first listen. A lot of “good but not great,” but that’s fine. Perhaps things will grow on me, perhaps not. If nothing else, this album gave me Supernova. Average of 7.9 which feels about right to me.

-

I’ve lowkey been anticipating this album for quite a while. I used to be able to confidently say that I wasn’t a fan of aespa, I just enjoyed a few of their songs. But having heard both title tracks, I suspect that after listening to this album, I will be forced to concede that I am a fan of aespa.

Supernova

This is currently my most listened-to song of the past four weeks

It’s also my 13th most listened-to song of the past 6 months

It’s just So good. The bass is so good, the sound design in general is So Good

Also all the hooks - like, the “ah oh ey” is SO good

10/10 because … it would be beyond unfair to give a song that I’ve listened to so much a 9

Armageddon

This song, on the other hand, I’ve only heard once; I watched the music video yesterday when it released and that’s it.

As expected though, it definitely hits different with headphones on

Aespa in general just have such amazing sound design

(SM in general really, Chill Kill did not slack at all either)

The “bang chitty bang” part is funny to me, I was in the pit orchestra for my high school’s production of chitty chitty bang bang and so that phrase has a lot of baggage for me lol

The melody in the chorus is kind of hauntingly simple, it just climbs and descends the scale

8/10, I like it, but I think it needs time to grow on me

Set The Tone

Alright, a song I haven’t heard yet

Okay, we’re all retro electronic

And now we’re … like, 90’s hip hop?

I think this is another one that’ll need to grow on me. The chiptune sound isn’t super appealing to me, and there’s not enough going on the song to totally keep my interest

Okay, here’s the bridge

7/10, lower rating, but not in a way that makes me concerned about the rest of the album

Mine

Mkay, we’re deep and dark and bassy

That high-pitched electronic “mine” at the end of the phrase, that was good

That bridge was heavenly

I’m actually very reminded of GOT The Beat - Rose

Honestly? That really won me over

8/10

Licorice

Lol the guitars in a song about licorice

I’m vibing though, let’s see where this goes

I don’t think I’ve ever actually had licorice

I quite like twizzlers

I want more out of the guitars to be honest, use them a bit more fully

Yeah, they very much take a backseat in the chorus, when they could be the focus

The bridge is fun

8/10

Bahama

I think there’s a lot of hype behind this song iirc, but I don’t usually listen to teasers so I don’t know anything about it

We’re definitely a lot brighter here

Love that bass

Okay, so it’s like a spiritual successor to Better Things I guess lol

The whistle!

Yeah it actually fits very well with Better Things, it has that electronic tropical vibe

Mmmm I dunno about this bridge

Oh okay, I could get into the rap here

Yeah and the last chorus feels really nice

8/10 (also this song kept reminding me of Beach Boys - Kokomo lol)

Long Chat

Is this like the Drama EP, where the first half is all aespa and then the second half is all bright?

What the hell is this bass?

This makes me feel like, early 2000’s flash game vibes

And the pre-chorus is a completely different song

And the chorus is … the same background music as the verse, but a different synth?

I do not know how I feel about this song

Lol “hol up, what?”

Actually this kinda reminds me of f(x) - Rainbow with just the random shifts between feels

I’m curious what the lyrics are

Also is this swung 8ths or are they 16ths? The bpm is fast enough that it’s hard to tell

Haha wait no wait, I enjoy this a lot more if I think of it as “aespa does Twicetagram”

Lol now I love it

8/10

Prologue

What do you mean prologue, this is the 8th song on the album

7/10, definitely an enjoyable listening experience, but it didn’t totally wow me either

Live My Life

Omg more guitars

This time I feel like we’re more in Yena territory though

I’m getting serious rock ballad vibes here

Yeahhhhh there we go

I just love pop rock aespa

I wish they’d go a bit further into rap rock though, Regret of the Times is one of my favorite aespa projects ever

7/10, really fun, but underdeveloped

Melody

Ballad time?

Maybe so! This piano certainly suggests it

Aespa doing ballads has always felt kinda weird to me though, to be honest

And actually this kinda leans more slow jam, and we know how I feel about those

What’s this word? Is this the same word used as one of the high notes in Love Poem?

Now I’m curious

It is! “Moksori” means “voice”

And honestly it really did win me over by the end

8/10

2 notes

·

View notes

Text

Forty-four of 50 US states worsen inequality with ‘upside-down’ taxes | US income inequality | The Guardian

Forty-four of 50 US states worsen inequality with ‘upside-down’ taxes

New research found that poorest fifth pay a tax rate 60% higher, on average, than the top 1% of households

"A total of 44 of the 50 US states worsen inequality by making the wealthy pay a lesser share of their income in taxes than lower income people, a new analysis has found.

State and local tax regimes are “upside-down”, the new research finds, with weak or non-existent personal income taxes in many states allowing richer Americans to avoid tax. A reliance on sales and excise taxes, considered regressive because they disproportionately impact the poor, has helped fuel this inequality, according to the report.

CEOs of top 100 ‘low-wage’ US firms earn $601 for every $1 by worker, report finds

“When you ask people what they think a fair tax code looks like, almost nobody says we should have the richest pay the least,” said Carl Davis, research director of the Institute on Taxation and Economic Policy (ITEP), which conducted the analysis.

“And yet when we look around the country, the vast majority of states have tax systems that do just that. There’s an alarming gap here between what the public wants and what state lawmakers have delivered.”

Only six states, plus the District of Columbia, have tax systems that reduce inequality rather than worsen it, with the poorest fifth of people paying a tax rate 60% higher, on average, than the top 1% of households.

The super-wealthy are treated particularly lightly by the tax system, with the top 1% paying less than every other income group across 42 states. In most states, 36 in all, the poorest residents are taxed at a higher rate than any other group.

The most regressive states in terms of taxation are, in order, Florida, Washington, Tennessee, Pennsylvania and Nevada. The least regressive jurisdictions are DC, Minnesota, Vermont, New York and California.

Various state-level policies, such as cutting taxes on the wealthy to supposedly drive economic activity, has worsened this situation, the report found. Inequality in recent decades has been far starker in the US than in other comparable countries and while some pandemic-era interventions, such as a child tax credit, lessened the burden on the poorest in society, many of those measures have now lapsed.

“But we know it doesn’t have to be like this,” said Aidan Davis, ITEP’s state policy director.

“There is a clear path forward for flipping upside-down tax systems and we’ve seen a handful of states come pretty close to pulling it off. The regressive state tax laws we see today are a policy choice, and it’s clear there are better choices available to lawmakers.”

• This article was amended on 11 January 2024. Owing to incorrect information supplied to us, an earlier version listed New Jersey as the fifth least regressive tax jurisdiction, according to the ITEP report, rather than California."

#I see why people are pissed but this isn't Biden's fault#It's about who people vote for#GOP#Wall Street#Tax Cheats#Trump Tax Scam#Wirst Stars For Taxes Are Florida Washington Tennessee Nevada#Vote Blue

4 notes

·

View notes

Text

Got tagged by @threephantomrey on a reading game thing, it got long so it's pasted under the cut.

1) How many books did you read this year?

So many omg!! I logged 34 books on Goodreads but I only started logging there at the end of February. I also read a shitton of comics that I didn’t log there because I didn’t want to skew certain statistics and use a different app to log that. (Going by my rough math using that, I’ve read 360 individual comic issues in 2023, not counting rereads). So like I read a lot.

2) Did you reread anything? What?

Sooo much stuff. I just finished a reread of N. K. Jemisin’s Great Cities Duology like two days ago, which I cannot recommend more. Also reread 17776 recently, as well as a childhood favorite (The Fall of the Readers series by Django Wexler) over the summer. When it comes to comics I’ve also done a ton of rereading, most notably Emerald Twilight (Green Lantern (1990) #48-50) like 5 times for the most rereads, but I’ve also reread other faves (in whole or part) such as Wonder Woman: Historia, Batgirl (2000), and I’m currently doing a Green Lanterns (2016) read which has me brain diseased because I am actually obsessed with them SO bad. And I reread poetry constantly so there’s that too.

3) What were your top five books of the year?

I’m skipping this one honestly. I started thinking about it and it hurt my brain. Some standouts I haven’t mentioned yet though include The Fifth Season by N K Jemisin, The Fire Next Time by James Baldwin, The Last Speakers: The Quest to Save the World’s Most Endangered Languages by K. David Harrison, and The Rime of the Ancient Mariner by Samuel Taylor Coleridge. Also like everything Greg Rucka did on Wonder Woman in the aughts (including the Hikateia <3333)

4) Did you discover any new authors that you love this year?

Probably Greg Rucka is a big one, Would maybe count James Baldwin here but that’s iffy because I decided to start reading some of his stuff because I loved a poem of his I had read before this year (among other things). I would also say I discovered A. S. King this year, but I don’t know if I’d say I LOVE her writing, rather that I find it incredibly entertaining because of how batshit fucking crazy it is. Like no one else is on her level when it comes to insanity honestly (and I say this as a comics fan)

5) What genre did you read the most of?

I mean superhero comics probably, but also I read a good amount of poetry (as always) and some fiction.

6) Was there anything you meant to read, but never got to?

Sooooooo much! Because I like so many genres I’m always reading like 10+ books at a time, and still a lot of stuff I just don’t get to. Some things I wanted to read include some poetry books I own, specifically my Most Famous Poems of All Time anthology (I think that’s what it’s called?) and my best of Antonio Machado book (bilingual edition!). There’s also a bunch of specific poems that would fall under this category. Also meant to read the Light of the Jedi by Charles Soule (and the rest of the main High Republic series), but that didn’t happen. Also I wanted to read some 90s Flash but it’s soooo long and I couldn’t justify starting it while I’m in the middle of so many things.

7) What was your average Goodreads rating? Does it seem accurate?

My average rating was a 4.2 which is pretty high. I’d say it seems accurate for the books I finished, but when you consider all my DNFs and comics it would definitely be way lower, as I quit a bunch of books halfway through for being terrible this spring that aren’t reflected, and also I read some really shitty comics for my faves this fall.

8) Did you meet any of your reading goals? Which ones?

No I didn’t meet them : ((((((((. I was pretty ambitious with the Goodreads goal (set for 100 books) so I’m not sad I didn’t meet that, but I was using those numbers to compete with my best friend on who could read the most, and I lost that (she had 43 to my 34) due to a slump in the early summer and another during the school year in the fall. For comics I recently hit 1000 issues read, so I’m happy about that mindset, and got my niche fave into my top 5 characters read so I’m pretty happy there. Still haven’t reached my goal of having Wonder Woman beat Batman for my top character yet, but that only emerged as an objective like a month ago so I’m not too upset.

9) Did you get into any new genres?

I’d say so, yes! In recent years I’ve done a lot of expanding my taste of books into different genres, and this year I think I read a lot of memoirs, (both traditional and fictionalized) than I ever did before. For traditional I read Jennette McCurdy’s I’m Glad My Mom Died and in terms of fictionalized, I read and enjoyed both Go Tell it on the Mountain by James Baldwin and The Absolutely True Diary of a Part Time Indian by Sherman Alexie. Next year I want to read more of this genre, especially getting to Maya Angelou’s I Know Why the Caged Bird Sings, which has been on my TBR for a while.

10) What was your favorite new release of the year?

New release… um…. Let me check something real quick. How have I read nothing from this year what. Okay I’m just going to stick to comics for this one and say Spirit World by Alyssa Wong was SO GOOD. Honestly may buy the trade for that when it comes out in April like I was loving that series sm. (also Wong is my favorite comic author currently writing. Although they’re not doing anything I’m interested in in 2024 it looks like : ((((( )

11) What was your favorite book that has been out for a while, but you just now read?

*blinks in classics fan* uhhh actually you know what. The Rime of the Ancient Mariner has been published for 231 slutty, slutty years and I only got around to it now. So that’s a shame. Also I read Huck Finn for the first time this year and that’s been culturally massive for centuries as well. Although the ending for that book was shit I really liked the rest. Tom Sawyer can actually die in a hole though I hate him SO much.

12) Any books that disappointed you?

SO MANY YES. I had a really long dnf streak in late spring of this year, but one of the books I couldn’t finish was one of the most hyped up books I’ve read this year, that being All the Light We Cannot See by Anthony Doerr. Also I actually finished this one but I just hated Rosencrantz and Guildenstern are Dead by Tom Stoppard. Which like I’ve heard good things about this play and I had just finished Hamlet like a month or so before and just like. Idk it was bad I didn’t like it and thought it was super confusing. Maybe watching a stage production would make me like it more but like. It was not lit fam idk :/

13) What were your least favorite books of the year?

Those two for sure would be in there. Also just like the rest of my dnfs I guess. R & G was the only book I finished that I rated less than three stars on goodreads. OH WAIT COMICS. I read so many shitty comics oh my god. This could have gone in disappointments too but Green Lantern: Mosaic FUCKING SUCKED. Like jesus christ it was so bad I only made it three issues. It was such a disappointment too because it was a spinoff book from a really good arc imo (written by the worst human to ever draw air and write comics. Not an exaggeration) with cool ideas and characterization and then the actual book is like fucking. Horrific. Like he has the main character fucking graphically domestic abuse his girlfriend in front of her kid and then she forgives him and then she comforts him and it's just a hot mess of a book. Fucking awful. This summary doesn’t even begin to cover it.

14) What books do you want to finish before the year is over?

I told myself I would finally finish Muerte Bajo el Sol, the Spanish translation of Agatha Christie’s Evil Under the Sun by the end of the year but I very much lied there so yeah. I’ve been reading that book for so long I just need it over.

15) Did you read any books that were nominated for or won awards this year (Booker, Women’s Prize, National Book Award, Pulitzer, Hugo, etc.)? What did you think of them?

Oh yeah a ton. I like my books thematically crunchy so I generally search out award winners. I’ll be easy and say the Broken Earth Trilogy here, which I did love, although I think the first book was the strongest outside of the three. I won’t spoil but I was in the parking lot waiting to pick up my friend when I reached a certain point and I legit almost honked my horn in the senior parking lot. At dismissal. Also had a few great moments reading it where I realized that the author had read [insert classic here] as well and was drawing some inspiration for certain elements which I liked.

16) What is the most over-hyped book you read this year?

All the Light We Cannot See for sure. It just wasn’t it personally.

17) Did any books surprise you with how good they were?

Maphead by Ken Jennings lmao. I was given a metric ton of Ken Jennings books for Christmas 2022 (because I’m a MAJOR trivia/quiz bowl nerd and he hosts Jeopardy) but this was my favorite, and I really did like it. (especially the quiz in the back haha)

18) How many books did you buy?

No comment. The username is the username for a reason. No but uhhh for real idk. I used the libraries pretty heavily this year, so when it comes to like my own money then just two comic trades I think. Maybe some more poetry. I get given/ask for a lot of books as gifts so that’s where most of mine comes from. I got 9 books for Christmas like last week haha.

19) Did you use your library?

Yee! I used 4 different library systems this year, (high school, local public, college, and college local public) so I definitely made the most of it. Currently I have three library cards as I just applied for a new one in my college town using my dorm address lol. Oh and I got a few books from an informal swap library set up in a bookshelf right outside my summer job so that too i suppose.

20) What was your most anticipated release? Did it meet your expectations?

I’ll use Spirit World here because it actually came out in 2023 haha. I think it both met and surpassed my expectations, as the reasons I started the book were all better or just as good as expected, but also there were so many other elements that I thought were soooo good too so yeah.

21) Did you participate in or watch any booklr, booktube, or book twitter drama?

Nah idc about any of that. I listen to my friend complain about how shitty some of the popular tiktok books she reads are so that should count for something ig.

22) What’s the longest book you read?

The Fifth Season was 468 pages so that one. Shortest was Rime of the Ancient Mariner with 77 pages (although I think it was shorter tbh)

23) What’s the fastest time it took you to read a book?

According to Libby I think like an hour and a half for the Absolutely True Diary which is kind of crazy. (not counting the Rime here obviously) but generally it only takes me a couple hours for most books. Poetry collections and nonfiction are different though.

24) Did you DNF anything? Why?

SO MUCH. Why? Because it sucked. No but like I was trapped with my most accessible library from Jan - May this year being the one at my high school, which just had SO much YA and books for like. Middle schoolers. This was at a time where my tastes were maturing a lot and I really wanted serious books. So even recommendations I would get from the librarians for books during this time would fall flat just because they were too juvenile for what I was into.

25) What reading goals do you have for next year?

To beat my best friend in books read. Also like to try not to slump too bad and just like. Read a good amount. Finish my one spanish book so I can start my other spanish book. Have Wonder Woman beat Batman in my comic book stats. Yeah.

As for tagging uh idk im like really congested right now so like. people do whatever i dont want to have to htink of anybody to tag *thumbs up emoji*

2 notes

·

View notes

Text

Kansas lawmakers have sent to Democratic Gov. Laura Kelly’s desk a bill to establish a flat income tax and eliminate the state food sales tax a year early.

The Kansas House voted 85 to 38 and the Senate voted 24 to 13 early Friday to send a tax package to Kelly that establishes a flat income tax of 5.15% for individuals.

The bill taxes any income above $6,150 for individuals and $12,300 for married couples.

Under current law, the food sales tax will be eliminated on Jan. 1 of 2025. The bill moves that elimination up a single year to 2024. The full package will cost roughly $485 million annually once it is fully implemented.

The House earned enough votes to override a veto from Kelly while the Senate fell three votes short.

Kelly, who took office after the repeal of former Republican Gov. Sam Brownback’s income tax cuts following years of budget shortfalls, is unlikely to sign the bill. Speaking to reporters at an event in Olathe Wednesday, Kelly indicated she would reject any version of a flat tax - even as numerous Democrats in the House voted in favor of a bill with a 5.25% rate.

She said it would remove the state’s ability to take any other tax relief actions.

“I have looked at the numbers and I have yet to come up with a flat tax that is sustainable over time,” Kelly said.

Kelly has sought the immediate elimination of the food sales cut for more than a year. Last year Republicans opted to implement the phase in rather than an immediate cut and the governor campaigned last year on giving Kansans an immediate cut if she was reelected.

The vote came after two back to back debates late Thursday night and early Friday morning.

Advocates of the flat tax argue it simplifies the tax system for Kansans, offering a tax cut to everyone.

“States that are doing well fiscally have lower income tax and single brackets,” said Sen. Caryn Tyson, a Parker Republican. “It just makes sense.”

But the policy ultimately provides a far larger cut to the weather Kansans than it does to low income taxpayers.

According to an analysis from the Kansas Department of Revenue, the bill would provide around $3,000 in annual tax cuts to Kansas’ highest earners while Kansas’ lowest earners would receive less than $50 annually in tax cuts.

The flat tax alone is expected to cost the state about $318 million annually once it is fully implemented.

Rep. Tom Sawyer, a Wichita Democrat, argued that package as a whole was too expensive for the state and prioritized high earners over the average Kansan.

“I can’t support this bill,” Sawyer said.

Rep. Adam Smith, a Weskan Republican who chairs the House Tax committee, said Sawyer was correct that the bill would help high income Kansans more than low income Kansans.

He urged his colleagues to support the policy regardless, pointing to an increase in the overall standard deduction for all taxpayers included in the bill.

The bill also accelerates a planned corporate tax cut that comes as a result of Kansas using a new incentive program to lure Panasonic and Integra Technologies to start major business developments in the state.

The bill reduces Social Security tax for retirees and includes a provision that would gradually reduce the tax over time. The Social Security decrease had been part of Kelly’s tax plan alongside an immediate elimination of the food sales tax. and sales tax on diapers and feminine hygiene products.

House Speaker Dan Hawkins, a Wichita Republican, applauded the package as a good use of the state’s surplus funds. But during House GOP caucus meeting, he acknowledged that a veto was likely.

“Our governor’s not going to sign any flat tax, she’s told us that,” Hawkins told GOP lawmakers. “Our task was to find a package that we could all agree on and keep our votes together.”

House Minority Leader Vic Miller, a Topeka Democrat, said he had voted for an earlier version of the flat tax because he thought it was the best possible bill. The final package, he said, he could not support.

The overwhelming majority of Democrats voted against the bill citing the cost.

“This just hearkens back to the good old Sam days,” said Sen. Tom Holland, a Baldwin City Democrat, referencing Brownback.

8 notes

·

View notes

Note

So I'm a bit frustrated with people's drivers ratings right now. I know it's personal and people can have different opinions, but I honestly look at most of them and can't help but go "Kevin will never be good enough for you, will he?!" I mean, I can admit that he has made mistakes and he definitely haven't been perfect, but the way people talk about him is just making me frustrated and angry.

I don't understand, Kevin has basically beaten all of his teammates (except Jenson) but every time the season ends, the narrative is: "his teammate wasn't very good anyway". Or like this year, where people say he should have beaten Mick with more, because he is "basically a rookie", which I find to be completely nonsense, but anyway.

Now I dread Nico coming in and Kevin beating him, so people will just say that it's because Nico is too old and past it. It seems like he can never win. Maybe he should let Nico get a few wins against him to prove that he still got it 😭🤷♀️

Sorry for the rant, i love your blog. Have a nice evening ❤

welcome to the pain of being a k-mag stan ❤️

but no, i totally get your frustration. it's the same frustration that i've dealt with at the end of almost all formula 1 seasons since 2014. for example, watching tommos video on qualifiers and him rating zhou, albon and sainz as faster qualifiers than k-mag. like are you actually kidding me? the man just got a fucking pole in a haas, beating 8 out of the 10 drivers in q3, all in much faster cars and he beat his teammate like 4 to 1 in qualifying - and he is being put in the bottom lower half of the grid in terms of qualifying 🤡

unfortunately, this has kind of always been the case with kevin. when he does something extraordinary, people praise him that day and then they forget entirely. even when his stats show that he is beating his teammate in so many different ways, people completely disregard it, yes, and it's so annoying. for example, with jenson then they basically went 50/50 on qualifying, but kevin was on average 0.2 faster than jenson in qualifying for the whole season. and he was a 21-year-old rookie against a former world champion who had been in f1 for 14 years. kevin had not even driven a f2 car before being put into a f1 car. and he did that - and people still treat his 2014 season as some kind of huge disappointment. they also completely disregard that mclaren wanted to continue with kevin, but because of infighting then jenson was retained instead.

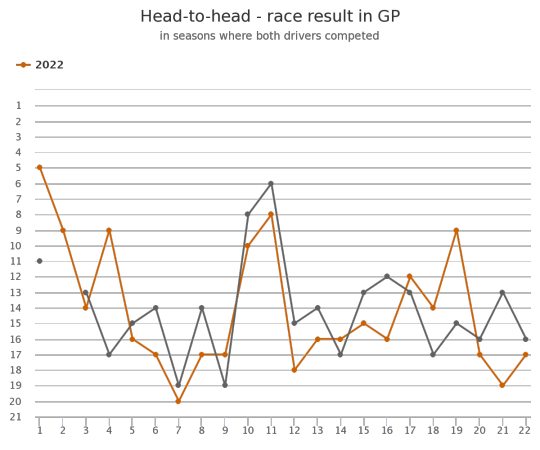

it is the same we see with mick now where people are like "oh, mick has been faster than him". like look at the graph below. when mick has beaten him, most of the time, they have not even been near top 10. and it doesn't even include sprints where kevin has scored points every single time, which means he has been in top 8 three times more from what you can see below.

it's the single stat where mick has done better than him (and yet some people only focus on this irrelevant fact), but it also completely disregards the races where kevin has been forced to take another pitstop, spending close to 40 seconds in pit to get his front wing fixed, or when he has had car issues or when haas has fucked up his strategy like putting the wrong tyres on his car (oh no, not even making the wrong call, but actually putting the wrong tyres on him). also by the way, no one is talking about how the fia has basically admitted to them being wrong about the use of the meatball flag and them having admitted that to haas. imagine if the fia had ruined charles' race three times in a season. it would be the greatest scandal of the season, but no motorsports media sites give a shit because it's just k-mag and haas🙄

people did not even care when he could keep up with, and even beat in some cases, a former world champion with 14 years of experience as very young rookie, so i suppose they will never care about who he beats. but of course, if nico beats him then i'm sure they will all care and make fun of him despite the fact that nico is a good and respected driver. but yeah, it's the curse of being a kevin fan. i think most people agree that he is deserving of a f1 seat, but they sort of just shrug their shoulders and then throw their love at the usual drivers.

i do not know what more kevin should do to be considered for teams higher up the grid. i know that ferrari had their eyes on him in 2018 when they had doubts about charles, and that red bull offered him a toro rosso seat, but i just wish people would respect him more. and he is still improving. whenever he has a season where he has a flaw, he usually corrects it by the next season. once, he was not considered a super good qualifier, then he fixed that. he was criticised for killing his tyres too quickly when at renault, he fixed that for next year in haas and became known for it. he was criticised for crashing too much and doing too much damage to the car, this season he is the third "cheapest" driver on the grid when it comes to the cost of car damage.

and i'm confident that if kevin had been french, alpine would have given him the seat instead of pierre 🤷🏻♀️ i think being danish is one of the things that kinda counts against him since we have no ties with motorsport and formula 1. and that shit matters as proven by the fact that everyone is already saying mick to audi just because he is german. but yeah, my best advice is just to roll your eyes at it and ignore the "experts" who spend 80% of the time only watching the top teams without doing proper research on everybody else.

11 notes

·

View notes

Text

JPMorgan BOfA And Other US Banks Reportedly Reap $1 Trillion Windfall From Feds High Interest Rates

JPMorgan, BOfA And Other US Banks Reportedly Reap $1 Trillion Windfall From Fed’s High Interest Rates

U.S. banks have reportedly gained a $1 trillion windfall due to the Federal Reserve’s prolonged period of high interest rates.

What Happened: The Federal Reserve maintained elevated interest rates for two and a half years, allowing banks to earn higher yields on deposits held at the Fed. However, many banks did not pass these higher rates on to their savers, the Financial Times reported on Monday.

At the end of the second quarter, the average U.S. bank paid depositors an annual interest rate of just 2.2%, significantly lower than the Fed’s 5.5% overnight rate. This discrepancy resulted in $1.1 trillion in excess interest revenue for banks, according to the Financial Times.

Don’t Miss:

Large banks like JPMorgan Chase and Bank of America paid even less, with annual deposit costs of 1.5% and 1.7%, respectively. The Fed’s recent rate cut by half a percentage point may allow banks to reduce deposit costs further, according to Chris McGratty of KBW.

While some banks, including Citi, plan to adjust rates for high-net-worth clients in line with the Fed’s cuts, others may vary in their approach. The Financial Times noted that this situation contrasts with Europe, where some governments imposed windfall taxes on banks benefiting from higher rates.

See Also: A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

JPMorgan Chase, Citi and Bank of America have yet to respond to the queries by Benzinga.

Why It Matters: The Federal Reserve’s recent decision to cut interest rates by 50 basis points in September, lowering the target range to 4.75%-5%, has significant implications. This bold move, which defied economists’ predictions of a modest 25-basis-point reduction, was aimed at sustaining the labor market. Fed Chair Jerome Powell emphasized the importance of acting preemptively to maintain robust employment levels.

Trending: During market downturns, investors are learning that unlike equities, these high-yield real estate notes that pay 7.5% – 9% are protected by resilient assets, buffering against losses.

Additionally, the performance of the S&P 500 following the Federal Reserve’s rate cuts hinges on whether the economy is in a recession. Historical data reveals a sharp contrast in how equities react to rate cuts during recessions compared to other economic phases. During recessionary periods, stock markets typically experienced meaningful declines after the Fed’s initial rate cut. In contrast, during “growth scares” or “normalization” periods, equities have rallied strongly.

Story continues

The Federal Reserve’s decision to cut interest rates by 0.5% may also pull investors away from money market funds and into longer-duration bonds. Total money market fund assets decreased by $20.02 billion to $6.30 trillion for the week ending on September 18. Among taxable money market funds, government funds decreased by $18.82 billion and prime funds decreased by $2.42 billion.

Read Next:

Photo courtesy of the Federal Reserve.

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article JPMorgan, BOfA And Other US Banks Reportedly Reap $1 Trillion Windfall From Fed’s High Interest Rates originally appeared on Benzinga.com

Source link

via

The Novum Times

0 notes

Text

How to DOUBLE Profits in Your Existing Business

Just a side note: What you’re about to discover here can also be used to help others squeeze more profits out of their online businesses, as well. In fact, you could build an entire business out of making other people’s businesses more profit using these simple methods.

Before you create new products and new profit streams, it makes good sense to maximize the earnings in your existing business.

To show you how this might be done, I’m going to use a membership site as an example. I love memberships because of the continuity of payments you receive. After all, why get paid just once on a sale if you can get paid every month for several months or longer, right?

Let’s say you (or your client) have a membership site. Naturally, the first thing you want to look at is increasing your conversions. First, you work on increasing conversions on your squeeze page, to get as many new (free) subscribers as possible. The more subscribers / prospects you have, the more of these you can turn into PAID subscribers.

Next, you’ll want to work on increasing conversions on your immediate upsell to the paid membership. And then you’ll want to work on increasing conversions with your autoresponder sequence as you follow up with prospects who haven’t yet subscribed to the paid membership.

Odds are you already know all about this. In fact, you’ve probably read numerous articles that tell you the exact same thing. The problem is, this is the point where those articles STOP, and also the point we will jump off from.

Now that you’ve maximized conversions on your funnel, what else can you do to increase revenue?

In fact, what can you do to DOUBLE the revenue you receive from paid subscriptions?

You can choose from several methods, ALL of which I highly recommend you implement.

First, offer your current paid subscribers a yearly payment option.

For example, if your membership is $25 per month, you might offer an annual membership for $175. This is a great deal, since it saves your subscribers $125.

“But won’t I be LOSING money if I do this?”

GREAT question. Your first step in deciding how much an annual membership costs is to find out how long your average subscribers stay with you.

In this example, if the average subscriber keeps their paid subscription for 5 months (5 x $25 = $125) then you are making an extra $50. If your average subscriber stays for 3 months, then you are making an extra $100.

You’ve got to know how many months your subscribers stay with you, multiply that number times the monthly subscription rate, and then charge an annual fee higher than that number, but lower than 12 times the monthly rate.

Confusing? It’s simple math, so just read the previous paragraph again and you’ll catch on.

Another example:

You charge $40 per month for your membership. Your average subscriber stays with you for 6 months (that’s really good at this price point, btw.) That’s $240 that you are currently making on the average subscriber.

You offer an annual membership for $320, which is $160 off of the normal rate. Your subscribers save $160, and you make an additional $80.

Your numbers will vary, but you get the idea. Adding this option can potentially bring in a very nice chunk of money very quickly.

You might want to offer the annual rate for one week only, so that subscribers don’t procrastinate.

And be sure to give new subscribers this option, too. New subscribers are generally the most excited, and thus the easiest to convert to an annual membership.

Second, you’ve got some prime real estate on your members page that’s most likely not being used right now.

Choose some hot affiliate offers your members are bound to like and add those to your member page.

You can do it in the form of banners or ‘personal recommendations.’ Switch these out every so often. This isn’t likely going to be a huge source of revenue but guaranteed, you will get some sales from this page.

An alternative is selling paid advertising on your members page. Basically, you are doing the same as before, except the banners or ads go to someone else’s offer instead of your affiliate links. You’ll find that fellow marketers would LOVE to offer something free to your members in exchange for their email address, and they will pay you nicely for the chance to get their offer on your member’s page for a month or two, or longer.

Third, create an entirely new page in your member’s area, and call it “Member Benefits.” Be sure to use that exact name – we’ve tested other names like Member’s Discounts and so forth, and “Member Benefits” out-pulled everything else we tested.

On this page, you’re going to place discount offers that you’ve negotiated with other marketers.

These might be discounts on products, free courses and books, free consultations, free coaching sessions and so forth.

Everything on this page benefits you. The courses and products with discounts earn you affiliate commissions. The free items cookie you in for commissions on anything purchased in the future, and so forth.

And again, you can place paid advertising on this page if you want to.

You might think this sounds like a lot of promotion, but we’ve found that almost no one complains. After all, what member is going to complain that you’ve found them a discount or something valuable for free? Occasionally someone will quip about banners, but it’s rare and nothing to worry about, as long as you don’t go crazy overboard with advertising.

Best of all, if you implement all three methods above, you’ll see a big cash boost from day one.

Your results will vary. And what if you don’t have a membership site? You do have a download page, correct? You can place ads for products there.

You can also bundle products and offer a discount. If you create products on a very regular basis, you can sell ‘memberships’ to all of your forthcoming products for a certain period of time.

And you can create a ‘Subscriber Benefits’ for your email subscribers. Add to the page every week, and also send out a weekly reminder email, letting them know there are new goodies to go collect – goodies that are available for a short time only.

That last paragraph may have slipped by your attention almost undetected, so I’m going to recommend you read it again. Go ahead…

I hear from so many marketers that they have trouble monetizing their lists. But if they would simply create a ‘Subscriber Benefits’ page and keep it filled with interesting things that result in commissions and send their readers there each week to collect those benefits, they could earn a six-figure income from this one technique alone.

Bottom line: Take a good look at your current products, funnels and business. Get creative and find ways to squeeze more money out of what you’re already doing, and it’s entirely possible to double your income without creating any new products or businesses. Until you do, you’re probably leaving thousands of dollars on the table that could be yours.

Read the full article

0 notes

Text

Cheapest Gas Supplier in Macon

New Post has been published on https://www.georgiagassavings.com/blog/cheapest-gas-supplier-in-macon/

Cheapest Gas Supplier in Macon

Find Cheap Gas Plans Today