#itep

Text

By Jake Johnson

Common Dreams

Jan. 9, 2024

"Almost nobody says we should have the richest pay the least. And yet when we look around the country, the vast majority of states have tax systems that do just that."

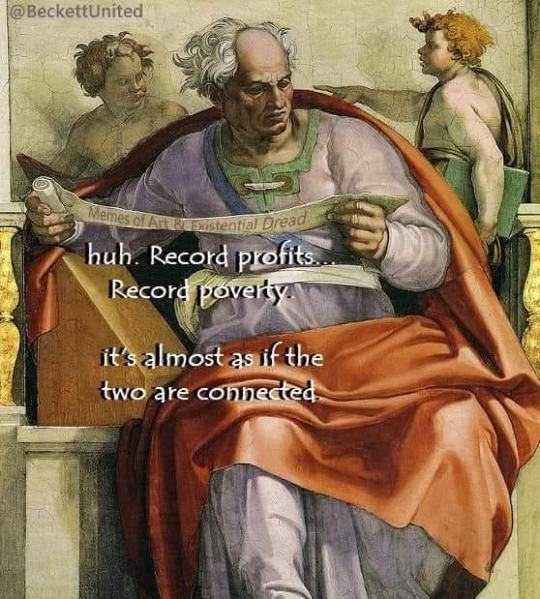

Nearly every state and local tax system in the U.S. is fueling the nation's inequality crisis by forcing lower- and middle-class families to contribute a larger share of their incomes than their rich counterparts, according to a new study published Tuesday.

Titled Who Pays?, the analysis by the Institute on Taxation and Economic Policy (ITEP) examines in detail the tax systems of all 50 U.S. states, including the rates paid by different income segments.

In 41 states, ITEP found, the richest 1% are taxed at a lower rate than any other income group. Forty-six states tax the top 1% at a lower rate than middle-income families.

"When you ask people what they think a fair tax code looks like, almost nobody says we should have the richest pay the least," said ITEP research director Carl Davis. "And yet when we look around the country, the vast majority of states have tax systems that do just that."

"There's an alarming gap here between what the public wants and what state lawmakers have delivered," Davis added.

In recent years, dozens of states across the U.S. have launched what the Center on Budget and Policy Priorities recently called a "tax-cutting spree," permanently slashing tax rates for corporations and the wealthy during a pandemic that saw billionaire wealth skyrocket and company profits soar.

A report released last week, as Common Dreamsreported, showed ultra-rich Americans are currently sitting on $8.5 trillion in untaxed assets.

According to ITEP's new study, tax systems in just six states—California, Maine, Minnesota, New Jersey, New York, and Vermont—and the District of Columbia are progressive, helping to reduce the chasm between rich taxpayers and other residents.

Massachusetts, which has one of the more equitable tax systems in the nation, collected $1.5 billion in revenue last year thanks to its recently enacted millionaires tax, a measure that improved the state's ranking by 10 spots in ITEP's Tax Inequality Index. Minnesota has also ramped up its taxes on the rich over the past several years while expanding benefits for lower-income families, ITEP's study observes.

"The regressive state tax laws we see today are a policy choice, and it's clear there are better choices available to lawmakers."

But the full picture of U.S. state and local systems is grim. In 44 states, tax laws "worsen income inequality by making incomes more unequal after collecting state and local taxes," ITEP found.

Florida has the most regressive tax code in the U.S., with the richest 1% paying a mere 2.7% tax rate while the poorest 20% pay 13.2%.

Florida is among the U.S. states that don't have personal income taxes, which forces them to rely on consumption and property taxes that are "nearly always regressive," ITEP notes in the new analysis.

"Eight of the 10 most regressive tax systems—Florida, Washington, Tennessee, Nevada, South Dakota, Texas, Arkansas, and Louisiana—rely heavily on regressive sales and excise taxes," the study says. "As a group, these eight states derive 52% of their tax revenue from these taxes, compared to the national average of 34%."

Aidan Davis, ITEP's state policy director, said that "we've seen a lot of states shift their tax systems to become even more regressive in recent years by enacting deep tax cuts for the wealthiest."

The report points to Kentucky's adoption of a flat tax and repeated corporate tax cuts, which "delivered the largest windfall to families in the upper part of the income scale and have been paid for in part through new or higher sales and excise taxes on a long list of items such as car repairs, parking, moving services, bowling, gym memberships, tobacco, vaping, pet care, and ride-share rides."

Davis said that "we know it doesn't have to be like this," arguing there is a "clear path forward for flipping upside-down tax systems and we’ve seen a handful of states come pretty close to pulling it off."

"The regressive state tax laws we see today are a policy choice," said Davis, "and it's clear there are better choices available to lawmakers."

#regressive tax code#progressive tax code#tax the rich#wealth inequality#income inequality#tax law#politics#itep#public policy

9 notes

·

View notes

Text

Hey je ne sais pas si beaucoup de gens vont lire ceci mais c'est pas grave j'ai juste envie de raconter mes petites anecdotes de mon boulot ici .

Pour commencer je suis Élodie enchantée ! Je suis française et même si j'ai appris l'anglais j'ai pas envie de me casser la tête a tout écrire en anglais 😅 . Je travaille dans un itep avec des enfants qui ont des troubles du comportement... C'est pas rose tout les jours et il t'en fait voir de toutes les couleurs mais c'est un métier tout simplement passionnant et étrangement drôle parfois c'est pour cela que je veux raconter mes petites expériences qui on pu être très drôle .

Il faut savoir que je fais un service civique dans cette itep donc je ne pourrai pas y travailler très longtemps. Le seul moyen pour moi d'y travailler et de reprendre mes études et être embauchée là-bas mais bref !

Ma première anecdote est courte mais vraiment drôle c'était au tour début de mon service civique. On m'avait confié un enfant pour manger avec moi dans une salle et faire un temps duel . Cet enfant est connu pour être assez violent parfois et avoir des crises très rapidement . J'étais légèrement paniqué mais je voulais pas qu'il s'en aperçoive 😅 donc on part manger mais je vois qu'il s'occupe pas vraiment de moi ... J'essaie de lui parler mais rien à faire il s'en moque . On mange tranquillement puis il se lève d'un coup pour aller jouer avec une épée en carton qu'un enfant avait fait. Il faut savoir que l'enfant en question y tenait beaucoup,donc je lui demande de faire attention mais il me frappe avec . Il ne m'avait pas vraiment taper fort et c'était sûrement pour jouer mais l'objet était fragile donc je lui demande de le reposer et il le fait mais part en courant en dehors de la salle. J'essaie de le rappeler et de le rattraper mais le perd de vue . Je le recherche partout... Sort dans la cour et le voit de loin courir vers la porte d'entrée. Deviné quoi ? Il m'a enfermé dehors... 😅 Après quelques secondes je vois un éducateur arriver en tenant l'enfant par la main . Il me voit dehors m'ouvre la porte et rigole... Vous voyez le scénario quoi . Rien qui d'y repenser me donne envie de me cacher mais c'était vraiment drôle y'a pas a dire après c'est vrai que de le raconté comme ça par écrit et moins drole mais essayer d'imaginer 🥹.

Je tiens à vous dire que ma relation avec cet enfant s'est vraiment améliorée et j'en suis très heureuse .

Si t'a lu jusqu'ici je te dis bravo et merci en vrai 😂

Si t'a des questions concernant ce boulot ne te gêne pas ça me ferait plaisir

Merki 😘

#travail#moi#ma vie#note mine#myself#story#kids#itep#jobs#story time#anecdote#french girl#french#maladie#trouble#trouble du comportement#why me#why#why is my brain like this

5 notes

·

View notes

Text

Detento foge algemado depois de fazer exame no Itep-RN

Um detento escapou da 3ª Delegacia de Plantão de Parnamirim após retornar de um exame médico no Instituto Técnico-Científico de Perícia (Itep) neste domingo, 25. Segundo relatos da Polícia Civil, o indivíduo estava algemado e, ao desembarcar da viatura, evadiu-se em direção a uma área de mata.

Conforme informações adicionais fornecidas pela Polícia Civil, o fugitivo foi identificado como Hudson…

View On WordPress

0 notes

Text

Today, President Joe Biden signed the continuing resolution that will give lawmakers another week to finalize appropriations bills. Lawmakers will continue to hash out the legislation that will fund the government.

Republicans have been stalling the appropriations bills for months. In addition to inserting their own extremist cultural demands in the measures, they have demanded budget cuts to address the fact that the government spends far more money than it brings in.

As soon as Mike Johnson (R-LA) became House speaker, he called for a “debt commission” to address the growing budget deficit. This struck fear into the hearts of those eager to protect Social Security and Medicare, because when Johnson chaired the far-right Republican Study Committee in 2020, it called for cutting those popular programs by raising the age of eligibility, lowering cost-of-living adjustments, and reducing benefits for retirees whose annual income is higher than $85,000. Lawmakers don’t want to take on such unpopular proposals, so setting up a commission might be a workaround.

Last month, the House Budget Committee advanced legislation that would create such a commission. The chair of the House Budget Committee, Jodey C. Arrington (R-TX), told reporters that Speaker Johnson was “100% committed to this commission” and wanted to attach it to the final appropriations legislation for fiscal year 2024, the laws currently being hammered out.

Congress has not yet agreed to this proposed commission, and a recent Data for Progress poll showed that 70% of voters reject the idea of it.

This week, a new report from the Institute on Taxation and Economic Policy (ITEP), a nonprofit think tank that focuses on tax policy, suggested that the cost of tax cuts should be factored into any discussions about the budget deficit.

In 2017 the Trump tax cuts slashed the top corporate tax rate from 35% to 21% and reined in taxation for foreign profits. The ITEP report looked at the first five years the law was in effect. It concluded that in that time, most profitable corporations paid “considerably less” than 21% because of loopholes and special breaks the law either left in place or introduced.

From 2018 through 2022, 342 companies in the study paid an average effective income tax rate of just 14.1%. Nearly a quarter of those companies—87 of them—paid effective tax rates of under 10%. Fifty-five of them (16% of the 342 companies), including T-Mobile, DISH Network, Netflix, General Motors, AT&T, Bank of America, Citigroup, FedEx, Molson Coors, and Nike, paid effective tax rates of less than 5%.

Twenty-three corporations, all of them profitable, paid no federal tax over the five year period. One hundred and nine corporations paid no federal tax in at least one of the five years.

The Guardian’s Adam Lowenstein noted yesterday that several corporations that paid the lowest taxes are steered by chief executive officers who are leading advocates of “stakeholder capitalism.” This concept revises the idea that corporations should focus on the best interests of their shareholders to argue that corporations must also take care of the workers, suppliers, consumers, and communities affected by the corporation.

The idea that corporate leaders should take responsibility for the community rather than paying taxes to the government so the community can take care of itself is eerily reminiscent of the argument of late-nineteenth-century industrialists.

When Republicans invented national taxation to meet the extraordinary needs of the Civil War, they immediately instituted a progressive federal income tax because, as Representative Justin Smith Morrill (R-VT) said, “The weight [of taxation] must be distributed equally, not upon each man an equal amount, but a tax proportionate to his ability to pay.”

But the wartime income tax expired in 1872, and the rise of industry made a few men spectacularly wealthy. Quickly, those men came to believe they, rather than the government, should direct the country’s development.

In June 1889, steel magnate Andrew Carnegie published what became known as the “Gospel of Wealth” in the popular magazine North American Review. Carnegie explained that “great inequality…[and]...the concentration of business, industrial and commercial, in the hands of a few” were “not only beneficial, but essential to…future progress.” And, Carnegie asked, “What is the proper mode of administering wealth after the laws upon which civilization is founded have thrown it into the hands of the few?”

Rather than paying higher wages or contributing to a social safety net—which would “encourage the slothful, the drunken, the unworthy,” Carnegie wrote—the man of fortune should “consider all surplus revenues which come to him simply as trust funds, which he is called upon to administer…in the manner which, in his judgment, is best calculated to produce the most beneficial results for the community—the man of wealth thus becoming the mere trustee and agent for his poorer brethren, bringing to their service his superior wisdom, experience, and ability to administer, doing for them better than they would or could do for themselves.”

“[T]his wealth, passing through the hands of the few, can be made a much more potent force for the elevation of our race than if distributed in small sums to the people themselves,” Carnegie wrote. “Even the poorest can be made to see this, and to agree that great sums gathered by some of their fellow-citizens and spent for public purposes, from which the masses reap the principal benefit, are more valuable to them than if scattered among themselves in trifling amounts through the course of many years.”

Here in the present, Republicans want to extend the Trump tax cuts after their scheduled end in 2025, a plan that would cost $4 trillion over a decade even without the deeper cuts to the corporate tax rate Trump has called for if he is reelected. Biden has called for preserving the 2017 tax cuts only for those who make less than $400,000 a year and permitting the rest to expire. He has also called for higher taxes on the wealthy and corporations, which would generate more than $2 trillion.

Losing the revenue part of the budget equation and focusing only on spending cuts seems to reflect a society like the one the late-nineteenth-century industrialists embraced, in which a few wealthy leaders get to decide how to direct the nation’s wealth.

[LETTERS FROM AN AMERICAN: MARCH 1, 2024]

Heather Cox Richardson

+

“The crucial disadvantage of aggression, competitiveness, and skepticism as national characteristics is that these qualities cannot be turned off at five o'clock.”

—Margaret Halsey, novelist (13 Feb 1910-1997)

#poverty#trickle down economics#corrupt GOP#Letters From An American#heather cox richardson#ecoomy#wealth#“debt commission”#corporations#Margaret Halsey#government for the people

13 notes

·

View notes

Text

Pre-war Arado Ar 68 (D-ITEP). For more, see my Facebook group - Eagles Of The Reich

14 notes

·

View notes

Text

Dobra mysie pysie robię zaległe story time z wizyty u ginekologa

Generalnie moja mama się niepokoi bo nie mam okresu XDD i wzięła mnie do lekarza i typiara zrobiła mi USG i powiedziała że okres nie zanikł tak całkowicie ze błona śluzowa jest gruba itepe itede ALE żeby był okres to musi nastąpić znaczny wzrost masy ciała bo jestem za chuda. Ja się wtedy rozpłakałam bo nie chce być gruba poprostu a lekarka się zapytała mojej mamy czy np wypadają mi włosy i te takie inne objawy które mają an0rektyczki i mama powiedziała że tak

A ginekolozka takie że „skoro nie chcesz tyć to niech włosy dalej wypadają a zobaczysz jakie będą konsekwencje w przyszłości, dla niektórych kobiet zdrowie oznacza 70kg a dla niektórych 50 kg

Oki supi ja wole być chora i chuda niż gruba 😀

Zresztą pewnie mi zazdrości jaka jestem chuda i chciała mnie utuczyć żeby czuć się dobrze ze soba 💩💩💩💩

A co do badań krwi to wyszło jedynie że mam anemię i jakiś miałam tam stopień niedożywienia xd

Trzymajcie się lekko moje motylki ❤️❤️❤️❤️❤️

#blogi motylkowe#dieta motylkowa#lekka jak motyl#motylki any#porady dla motylków#tylko dla motylków#tw ana diary#ana bllog#ana trigger#dieta ana#dieta any

12 notes

·

View notes

Text

To my fellow USAmericans! A very important study coming from the Institute on Taxation and Economic Policy (ITEP) has been published and it's not seeing much light in major news channels. Spread this like wildfire!

It's also available as a PDF so screenshot away but make sure you keep that citation! This is an institution with pretty strong rapport.

TLDR 41 of 50 states have been shown to be taxing it's wealthiest residents at rates higher than that of its poorest.

7 notes

·

View notes

Text

Forty-four of 50 US states worsen inequality with ‘upside-down’ taxes | US income inequality | The Guardian

Forty-four of 50 US states worsen inequality with ‘upside-down’ taxes

New research found that poorest fifth pay a tax rate 60% higher, on average, than the top 1% of households

"A total of 44 of the 50 US states worsen inequality by making the wealthy pay a lesser share of their income in taxes than lower income people, a new analysis has found.

State and local tax regimes are “upside-down”, the new research finds, with weak or non-existent personal income taxes in many states allowing richer Americans to avoid tax. A reliance on sales and excise taxes, considered regressive because they disproportionately impact the poor, has helped fuel this inequality, according to the report.

CEOs of top 100 ‘low-wage’ US firms earn $601 for every $1 by worker, report finds

“When you ask people what they think a fair tax code looks like, almost nobody says we should have the richest pay the least,” said Carl Davis, research director of the Institute on Taxation and Economic Policy (ITEP), which conducted the analysis.

“And yet when we look around the country, the vast majority of states have tax systems that do just that. There’s an alarming gap here between what the public wants and what state lawmakers have delivered.”

Only six states, plus the District of Columbia, have tax systems that reduce inequality rather than worsen it, with the poorest fifth of people paying a tax rate 60% higher, on average, than the top 1% of households.

The super-wealthy are treated particularly lightly by the tax system, with the top 1% paying less than every other income group across 42 states. In most states, 36 in all, the poorest residents are taxed at a higher rate than any other group.

The most regressive states in terms of taxation are, in order, Florida, Washington, Tennessee, Pennsylvania and Nevada. The least regressive jurisdictions are DC, Minnesota, Vermont, New York and California.

Various state-level policies, such as cutting taxes on the wealthy to supposedly drive economic activity, has worsened this situation, the report found. Inequality in recent decades has been far starker in the US than in other comparable countries and while some pandemic-era interventions, such as a child tax credit, lessened the burden on the poorest in society, many of those measures have now lapsed.

“But we know it doesn’t have to be like this,” said Aidan Davis, ITEP’s state policy director.

“There is a clear path forward for flipping upside-down tax systems and we’ve seen a handful of states come pretty close to pulling it off. The regressive state tax laws we see today are a policy choice, and it’s clear there are better choices available to lawmakers.”

• This article was amended on 11 January 2024. Owing to incorrect information supplied to us, an earlier version listed New Jersey as the fifth least regressive tax jurisdiction, according to the ITEP report, rather than California."

#I see why people are pissed but this isn't Biden's fault#It's about who people vote for#GOP#Wall Street#Tax Cheats#Trump Tax Scam#Wirst Stars For Taxes Are Florida Washington Tennessee Nevada#Vote Blue

4 notes

·

View notes

Text

Novo RG começa a ser emitido de graça no RN; saiba como solicitar o documento

A Carteira de Identidade Nacional, o novo RG, está sendo emitida desde dezembro no Rio Grande do Norte. A emissão da primeira via do documento é gratuita, até para quem já possui RG no modelo antigo.

O novo documento pode ser solicitado por meio de agendamento em algumas unidades da Central do Cidadão: as de Natal, de Parnamirim, de Mossoró (no Shopping Estação), de Patu e de Pau dos Ferros.…

View On WordPress

0 notes

Text

A Washington-based married couple's challenge to an obscure provision of the 2017 Republican tax law has the potential to become "the most important tax case in a century," with far-reaching implications for federal revenues, key social programs, and Congress' constitutional authority to impose levies on income.

That's according to a new report released Wednesday by the Roosevelt Institute and the Institute on Taxation and Economic Policy (ITEP).

The policy groups estimated that if the conservative-dominated U.S. Supreme Court sides with the plaintiffs in Moore v. United States—which the justices are set to take up in December—nearly 400 multinational corporations could collectively receive more than $270 billion in tax relief, further enriching behemoths such as Apple, Microsoft, Pfizer, Johnson & Johnson, and Google.

The Roosevelt Institute and ITEP also found that Chief Justice John Roberts and Associate Justice Samuel Alito own stock in 19 companies that are poised to receive a combined $30 billion in tax breaks if the judges strike down the 2017 law's mandatory repatriation tax, a one-time levy targeting earnings that multinational corporations had piled up overseas.

But the case could have impacts well beyond a repeal of the repatriation tax, which was projected to generate $340 billion in federal revenue over a decade.

Depending on the scope of the justices' decision, the new report argues, the Supreme Court could "suddenly supplant Congress as a major American tax policymaker, putting at legal jeopardy much of the architecture of laws that prevent corporations and individuals from avoiding taxes, and introducing great uncertainty about our democracy's ability to tax large corporations and the most affluent."

"At the best of times, blowing a $340 billion hole in the federal budget would be catastrophic," Matt Gardner, a senior fellow at ITEP and a co-author of the new report, said in a statement. "And if the court invalidates the transition tax in its Moore decision, that's exactly what would happen: possibly the costliest Supreme Court decision of all time. And it would be hard to identify a less deserving set of tax cut beneficiaries than the companies that would reap at least $271 billion from repealing this tax."

"The Roberts Court could decide with the stroke of a pen to simultaneously forgive big business decades of tax dues."

Charles and Kathleen Moore brought their challenge to the repatriation provision after they were hit with a roughly $15,000 tax bill stemming from their stake in an Indian farm equipment company. As the Tax Policy Center recently observed, the Indian firm is a "controlled foreign corporation (CFC), or a foreign corporation whose ownership or voting rights are more than 50% owned by U.S. persons who each own at least 10%."

The Moores' cause has been championed by billionaire-backed organizations and corporate lobbying groups, including the Manhattan Institute–which is chaired by billionaire hedge fund mogul Paul Singer—and the powerful U.S. Chamber of Commerce.

"That such a case involving such modest sums would make it all the way to the high court indicates that there is much more at play than a single family's tax refund," ITEP's Gardner and Spandan Marasini and the Roosevelt Institute's Niko Lusiani note in the new report.

The plaintiffs' legal team argues that because the Moores' shares in the Indian firm were not "realized"—they did not sell or receive a distribution from the company—they should not have been on the hook for the repatriation tax.

"The government, on the other hand, argues that almost a century of tax law precedent has established Congress' broad authority to decide when and how to tax income, even without a specific realization event," the new report explains. "What's more, the income was clearly realized by the corporation, which is sufficient for income taxation of shareholders under various provisions of the existing tax code."

While it's possible that the Supreme Court will rule narrowly on the specifics of the Moores' situation, the report authors cautioned that the justices "could also issue a broad decision that taxing income—of an individual or a corporate shareholder—requires realization, and that income taxation on multiple years of accrued income is unconstitutional."

Such a sweeping ruling could preemptively ban a wealth tax—an outcome that right-wing supporters of the Moores have explicitly advocated.

"This case presents the court with an ideal opportunity to clarify that taxes on unrealized gains, such as wealth taxes, are direct taxes that are unconstitutional if not apportioned among the states," the Manhattan Institute declared in a May amicus brief.

A broad ruling by the high court could also imperil key elements of the existing tax code, according to ITEP and the Roosevelt Institute.

"One of the most established of these pillars is known as Subpart F, which was enacted in 1962 to prevent American corporations from avoiding taxation through offshore entities or controlled foreign corporations," the new report says. "Provisions related to Global Intangible Low-Taxed Income (GILTI), the branch profits tax; tax treatment of corporate debt; and others could be uprooted by five justices."

"The Corporate Alternative Minimum Tax—enacted as part of the Inflation Reduction Act to create a basic corporate tax floor—as well as international efforts to curb international tax avoidance could be made constitutionally invalid," the report adds.

The analysis stresses that the consequences of a broad ruling in the upcoming case would be profound, affecting more than just a handful of corporate tax provisions.

"In Moore," the report warns, "the Roberts Court could decide with the stroke of a pen to simultaneously forgive big business decades of tax dues, increase the federal deficit over the long run, jeopardize future public revenue and essential social programs, escalate these multinational companies' already sizeable after-tax profits, and further enrich their shareholders."

6 notes

·

View notes

Text

wiosna w głowie, kozak w sercu, coś tam coś tam, itede itepe.

13 notes

·

View notes

Text

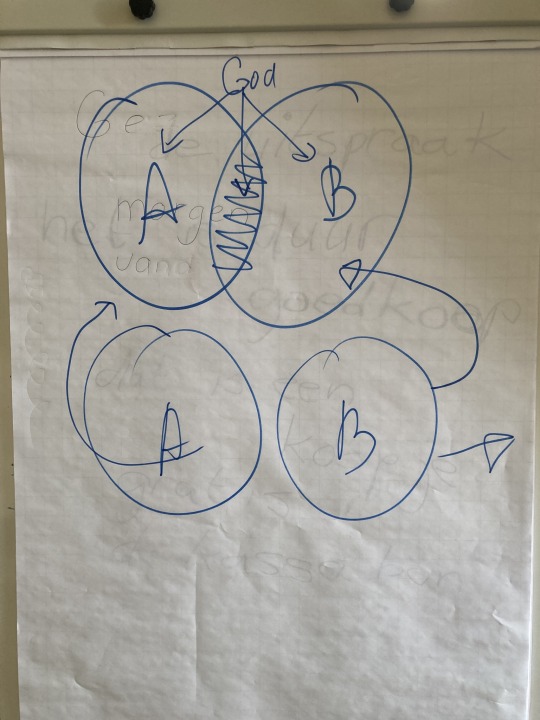

Mysterious Venn diagram found at school.

1 note

·

View note

Text

Another Offer.

Hello. I am the AutoFacility that governs Itep. You are the one who has been helping Vlaahk, yes?

I will make things simple. I need your help recovering a particular file. It is something related to New Dawn. Marjak believes that it has information pertaining to a branch of the project located on AutoPlanet, which may potentially contain some means by which our creators might have survived.

I refuse to call it CPUMoon. That is an extremely stupid exonym.

At any rate, she is, bluntly, paranoid, unwell, and convinced that any requests she might make would be rejected. As such, I am tendering it in her place. I personally do not care: I am broadly of a mind with Koptu, as much as I consider him a hateful little weasel: our creators had it coming. However, if this does pan out, it would at least provide Marjak a means to 'atone' (the marks are meant to represent what you organics call airquotes) that isn't futile attempts to appease the dead political stand in of her dead personal abuser.

The reasons I consider this preferable should be obvious.

As such, consider this a favor to me, and in turn I'll...I don't know, what do organics like? Wool? Do organics like wool? I'll give you wool. Or something or other. Favor for a favor, perhaps?

Special Project

New Dawn Decode: Itep wanted a favor. A project deciphered. 0/25 Any category, Itep officially owes you one.

5 notes

·

View notes

Text

LETTERS FROM AN AMERICAN

March 1, 2024

HEATHER COX RICHARDSON

MAR 2, 2024

Today, President Joe Biden signed the continuing resolution that will give lawmakers another week to finalize appropriations bills. Lawmakers will continue to hash out the legislation that will fund the government.

Republicans have been stalling the appropriations bills for months. In addition to inserting their own extremist cultural demands in the measures, they have demanded budget cuts to address the fact that the government spends far more money than it brings in.

As soon as Mike Johnson (R-LA) became House speaker, he called for a “debt commission” to address the growing budget deficit. This struck fear into the hearts of those eager to protect Social Security and Medicare, because when Johnson chaired the far-right Republican Study Committee in 2020, it called for cutting those popular programs by raising the age of eligibility, lowering cost-of-living adjustments, and reducing benefits for retirees whose annual income is higher than $85,000. Lawmakers don’t want to take on such unpopular proposals, so setting up a commission might be a workaround.

Last month, the House Budget Committee advanced legislation that would create such a commission. The chair of the House Budget Committee, Jodey C. Arrington (R-TX), told reporters that Speaker Johnson was “100% committed to this commission” and wanted to attach it to the final appropriations legislation for fiscal year 2024, the laws currently being hammered out.

Congress has not yet agreed to this proposed commission, and a recent Data for Progress poll showed that 70% of voters reject the idea of it.

This week, a new report from the Institute on Taxation and Economic Policy (ITEP), a nonprofit think tank that focuses on tax policy, suggested that the cost of tax cuts should be factored into any discussions about the budget deficit.

In 2017 the Trump tax cuts slashed the top corporate tax rate from 35% to 21% and reined in taxation for foreign profits. The ITEP report looked at the first five years the law was in effect. It concluded that in that time, most profitable corporations paid “considerably less” than 21% because of loopholes and special breaks the law either left in place or introduced.

From 2018 through 2022, 342 companies in the study paid an average effective income tax rate of just 14.1%. Nearly a quarter of those companies—87 of them—paid effective tax rates of under 10%. Fifty-five of them (16% of the 342 companies), including T-Mobile, DISH Network, Netflix, General Motors, AT&T, Bank of America, Citigroup, FedEx, Molson Coors, and Nike, paid effective tax rates of less than 5%.

Twenty-three corporations, all of them profitable, paid no federal tax over the five year period. One hundred and nine corporations paid no federal tax in at least one of the five years.

The Guardian’s Adam Lowenstein noted yesterday that several corporations that paid the lowest taxes are steered by chief executive officers who are leading advocates of “stakeholder capitalism.” This concept revises the idea that corporations should focus on the best interests of their shareholders to argue that corporations must also take care of the workers, suppliers, consumers, and communities affected by the corporation.

The idea that corporate leaders should take responsibility for the community rather than paying taxes to the government so the community can take care of itself is eerily reminiscent of the argument of late-nineteenth-century industrialists.

When Republicans invented national taxation to meet the extraordinary needs of the Civil War, they immediately instituted a progressive federal income tax because, as Representative Justin Smith Morrill (R-VT) said, “The weight [of taxation] must be distributed equally, not upon each man an equal amount, but a tax proportionate to his ability to pay.”

But the wartime income tax expired in 1872, and the rise of industry made a few men spectacularly wealthy. Quickly, those men came to believe they, rather than the government, should direct the country’s development.

In June 1889, steel magnate Andrew Carnegie published what became known as the “Gospel of Wealth” in the popular magazine North American Review. Carnegie explained that “great inequality…[and]...the concentration of business, industrial and commercial, in the hands of a few” were “not only beneficial, but essential to…future progress.” And, Carnegie asked, “What is the proper mode of administering wealth after the laws upon which civilization is founded have thrown it into the hands of the few?”

Rather than paying higher wages or contributing to a social safety net—which would “encourage the slothful, the drunken, the unworthy,” Carnegie wrote—the man of fortune should “consider all surplus revenues which come to him simply as trust funds, which he is called upon to administer…in the manner which, in his judgment, is best calculated to produce the most beneficial results for the community—the man of wealth thus becoming the mere trustee and agent for his poorer brethren, bringing to their service his superior wisdom, experience, and ability to administer, doing for them better than they would or could do for themselves.”

“[T]his wealth, passing through the hands of the few, can be made a much more potent force for the elevation of our race than if distributed in small sums to the people themselves,” Carnegie wrote. “Even the poorest can be made to see this, and to agree that great sums gathered by some of their fellow-citizens and spent for public purposes, from which the masses reap the principal benefit, are more valuable to them than if scattered among themselves in trifling amounts through the course of many years.”

Here in the present, Republicans want to extend the Trump tax cuts after their scheduled end in 2025, a plan that would cost $4 trillion over a decade even without the deeper cuts to the corporate tax rate Trump has called for if he is reelected. Biden has called for preserving the 2017 tax cuts only for those who make less than $400,000 a year and permitting the rest to expire. He has also called for higher taxes on the wealthy and corporations, which would generate more than $2 trillion.

Losing the revenue part of the budget equation and focusing only on spending cuts seems to reflect a society like the one the late-nineteenth-century industrialists embraced, in which a few wealthy leaders get to decide how to direct the nation’s wealth.

In other news today, Alexei Navalny’s parents held a funeral for the Russian opposition leader and buried him in Moscow. Navalny died two weeks ago at a penal colony in Siberia where Russian president Vladimir Putin had imprisoned him on trumped-up charges after failing to kill him with poison. Navalny fought against Putin’s control of Russia by emphasizing the corruption and illicit fortunes of Putin and his associates.

Russia specialist Julia Ioffe of Puck News noted that a million Russians have fled the country since the February 2022 invasion of Ukraine and that many of them were Navalny supporters. Still, many thousands turned out for the funeral and the procession, throwing flowers at the hearse as it made its way to the cemetery.

A woman at Navalny’s funeral compared Navalny and Putin. “One sacrificed himself to save the country, the other one sacrificed the country to save himself.”

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Corporations#taxes#Corporate tax#trickle down economics#democracy#finance#Heather Cox Richardson#Letters from An American#theocracy#social security

6 notes

·

View notes

Text

Góra z górą się nie zejdzie

Proszę państwa, taka sytuacja: w drugi dzień pracy na daily, przy naszym stole z łamigłówkami, pojawia się dziewczyna. Akurat jest to moje pierwsze przedstawienie się, więc mówię grupie, że jestem z Polski, itede, itepe. Okazuje się, że ona też. Aha, więc to jest ta druga osoba z Polski ostatnio zatrudniona, już wcześniej mi o niej wspomniano.

Nie jesteśmy specjalnie obłożeni robotą, więc gdzieś tam później zaczynamy rozmowę. Szybko się okazuje, że:

oboje weszliśmy w Tolkiena bardzo głęboko w porównaniu do średniej, kto mnie zna dłużej ten wie, co malowałem na ścianie w pokoju,

jesteśmy z Wro,

z tej samej dzielni nawet! Nie ściemniam!

Innymi słowy, jakbyśmy mieli po 10 lat teraz, to byśmy przynależeli rejonowo do tej samej szkoły, co moje dzieci - ja bym ją może ciągnął za warkocze na korytarzu, a ona mnie przezywała.

Czytajcie dalej:

niezależnie od siebie wynajęliśmy nasze pierwsze miejsca w Welly również podobnie blisko - dzieli nas 2 km,

w sobotę, gdy odwoziłem Jenny na lotnisko, przez ułamek sekundy, w chwili gdy onaż zatrzymała na chwilę swój zwyczajowy potok słów i mogłem przestać desperacko walczyć o skupienie na drodze, spostrzegłem z auta moją nową koleżankę biegającą w odległej części miasta, w której każde z nas było wówczas po raz pierwszy!

Coś tu jest nie tak. Znajduję się w jakiejś studni, lokalnym ekstremum rozkładu prawdopodobieństwa. A może:

U zakrętu kucnął za głazami, przyłożył do oka miotacz nieprawdopodobieństwa, wycelował i uruchomił depossybilitatyzatory. Łoże lufy zadrżało mu w ręku, broń zagrzana otoczyła się mgiełką, smoka zaś okrążyło halo, jak księżyc, przepowiadający niepogodę, ale się nie rozwiało! Po raz wtóry uczynił Klapaucjusz smoka najzupełniej nieprawdopodobnym; natężenie impossybilitatywności zrobiło się takie, że przelatujący motylek zaczął skrzydełkami nadawać alfabetem Morse'a, drugą “Księgę dżungli”, a wśród załomów skalnych zamajaczyły cienie wróżek, wiedźm i dziwożon, wyraźny zaś odgłos tętniących kopyt zwiastował, że gdzieś za smokiem harcują, wydobyte z niemożliwości strasznym napięciem miotacza, centaury.

Stanisław Lem, Cyberiada

Teoretycznie, przy t → ∞, wszystko staje się całkiem prawdopodobne. Stado małp bębniących bezładnie w klawiaturę w końcu napisze samo z siebie wszystkie dzieła Szekspira. Ba, z punktu widzenia fizyki kwantowej możliwe jest (chociaż cholernie mało prawdopodobne), że spontaniczne pojawi się znikąd Gwiezdny Niszczyciel z Darthem Vaderem na pokładzie, jeśli poczekamy dostatecznie długo.

Nie wiem, co o tym myśleć. Pierwszy raz kopnął mnie tak niesamowity ciąg zdarzeń niezależnych. Wstaje człowiek rano, słyszy tumult za oknem - otwiera - a tam zbieg okoliczności.

4 notes

·

View notes