#Autonomous Driving and ADAS

Explore tagged Tumblr posts

Text

https://www.kpit.com/solutions/autonomous-driving-adas/

Autonomous Driving & ADAS - KPIT

KPIT offers Software Integration for ADAS & AD. With 10+ years of experience in Autonomous Driving, KPIT is a pioneer in advanced driver assistance system Engineering

#Adas#adas system#advanced driver assistance systems#Autonomous Driving and ADAS#Autonomous Driving#System Engineering#Model based system engineering#Autonomous Driving & ADAS#autonomous vehicle solutions#mobility solutions automotive

0 notes

Text

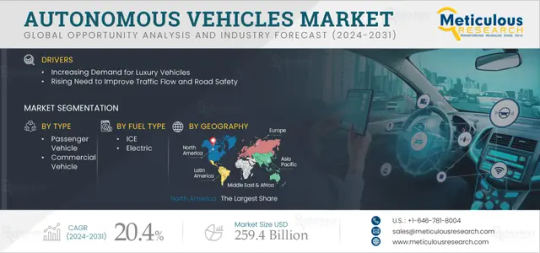

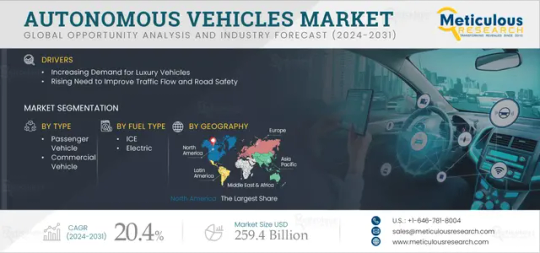

Autonomous Vehicles Market Size, Share, Forecast, & Trends Analysis

Meticulous Research®—a leading global market research company, published a research report titled, ‘Autonomous Vehicles Market by Type (Passenger Vehicles (Hatchback, Sedan, SUV, Others), Commercial Vehicles (Trucks, Buses)), Fuel Type (ICE, Electric), Level of Autonomy (L1, L2, L3, L4), Geography - Global Forecast to 2032.’

According to this latest publication from Meticulous Research®, the autonomous vehicles market is projected to reach $259.4 billion by 2032, at a CAGR of 20.4% from 2025 to 2032. The growth of this market is driven by factors such as increasing demand for luxury vehicles and the rising need to improve traffic flow and road safety. In addition, factors such as rising government initiatives for the development and adoption of autonomous vehicles, the development of ADAS technology, and growing demand for semi-autonomous vehicles are expected to provide opportunities for market growth. However, the high cost of autonomous vehicles and lack of required infrastructure in emerging countries can restrain the growth of the market. Data privacy and security concerns pose challenges for market growth.

The autonomous vehicles market is segmented by type, fuel type, and level of autonomy. The study also evaluates industry competitors and analyzes the regional and country-level markets.

Based on type, the autonomous vehicles market is broadly segmented into passenger vehicles and commercial vehicles. In 2025, the passenger vehicles segment is expected to account for the larger share of ~86.0% of the global autonomous vehicles market. The large share of the segment is attributed to the increasing demand for automated energy-efficient vehicles, technological advancement in self-driving cars, rising government focus on the adoption of autonomous vehicles, and rising focus of manufacturers on product development. For instance, in April 2021, Toyota Motor Corporation (Japan) unveiled new versions of the Lexus LS and Toyota Mirai equipped with Advanced Drive, the company’s advanced driver assist system in Japan. Advanced Drive features a level 2 autonomous system.

However, the commercial vehicles segment is expected to register the highest CAGR during the forecast period. Factors such as growing focus on automation and electrification of public transport, rising investment in connected infrastructure, and rising focus of manufacturers on the development of autonomous commercial vehicles are expected to drive the segment’s growth. For instance, in April 2024, Continental AG (Germany) partnered with Aurora Innovation, Inc. (U.S.) to deliver the first commercially scalable generation of Aurora’s flagship integrated hardware and software system, the Aurora Driver. The organizations will jointly design, develop, validate, deliver, and service the scalable autonomous system for the trucking industry.

Based on fuel type, the autonomous vehicles market is segmented into ICE and electric. In 2025, the electric segment is expected to account for the larger share of the global autonomous vehicles market. The large share of the segment is attributed to the rising adoption of battery-powered, energy-efficient vehicles and the rising focus on reducing greenhouse gas emissions.

Moreover, the electric segment is also expected to grow at the highest CAGR during the forecast period. The segment's high growth is attributed to the rising focus of autonomous vehicle manufacturers on product development and enhancement. For instance, in September 2024, BMW AG (Germany) selected Amazon cloud technology to build its autonomous driving features for new EVs.

Based on level of autonomy, the autonomous vehicles market is segmented into level 1, level 2, level 3, and level 4. In 2025, the level 2 segment is expected to account for the largest share of ~74.0% of the global autonomous vehicles market. The large share of the segment is attributed to the continual assistance offered by level 2 vehicles in acceleration/braking and steering, the rising need to enhance the safety and comfort of passengers, and ongoing development in level 2 autonomous vehicles. For instance, in April 2024, Ford Motor Company (U.S.) launched a level 2 autonomous hands-free driver assistance system called Ford BlueCruise, which it says is the first to receive regulatory approval for use on a public highway in Europe. However, the level 4 segment is expected to register the highest CAGR during the forecast period. Ongoing research and development on level 4 autonomous vehicles is expected to drive the segment growth in the forecast period.

Based on geography, the autonomous vehicles market is segmented into North America, Asia-Pacific, Europe, Latin America, and the Middle East & Africa. In 2025, North America is expected to account for the largest share of ~36.0% of the autonomous vehicles market. The large share of the North American region is attributed to the rising government support for autonomous vehicle research, testing, and development, the growing need for safe and efficient driving options, the rising adoption of self-driving technology, growing focus of manufacturers on autonomous vehicle development. For instance, New Flyer of America Inc. (“New Flyer”), a subsidiary of NFI Group Inc. (“NFI”), one of the world’s leading independent global bus manufacturers, unveiled its Xcelsior AV™ automated transit bus, now in motion at Robotic Research, LLC (“Robotic Research”) in Maryland.

However, Asia-Pacific is expected to register the highest CAGR of ~22.0% during the forecast period. Growth of the market is attributed to the rising government initiatives to promote the development and adoption of autonomous vehicles and the increasing need to address congestion, improve mobility, and enhance transportation efficiency. For instance, in February 2025, according to the Infocomm Media Development Authority (IMDA), Singapore is looking to boost its national broadband network to better prepare for emerging technologies, such as artificial intelligence (AI) and autonomous vehicles. The country will set aside up to $74.2 (SG$100) million to upgrade the current nationwide network to deliver speeds of up to 10Gbps,

Key Players:

The key players operating in the autonomous vehicles market are General Motors Company (U.S.), BMW AG (Germany), Daimler Truck AG. (Germany), Mercedes-Benz AG (Germany), Hyundai Motor Company (South Korea), Tesla, Inc (U.S.), Renault Group (France), Toyota Motor Corporation (Japan), Volkswagen Group (Germany), Ford Motor Company (U.S.) and AB Volvo (Sweden)

Download Sample Report Here @ https://www.meticulousresearch.com/download-sample-report/cp_id=5813

Key questions answered in the report-

Which are the high-growth market segments based on type, fuel type, and level of autonomy?

What was the historical market for autonomous vehicles?

What are the market forecasts and estimates for the period 2025–2032?

What are the major drivers, restraints, and opportunities in the autonomous vehicles market?

Who are the major players, and what shares do they hold in the autonomous vehicles market?

What is the competitive landscape like in the autonomous vehicles market?

What are the recent developments in the autonomous vehicles market?

What are the different strategies adopted by the major players in the autonomous vehicles market?

What are the key geographic trends, and which are the high-growth countries?

Who are the local emerging players in the global autonomous vehicles market, and how do they compete with the other players?

Contact Us: Meticulous Research® Email- [email protected] Contact Sales- +1-646-781-8004 Connect with us on LinkedIn- https://www.linkedin.com/company/meticulous-research

#Autonomous Vehicles Market#ADAS#Self Driving Cars#Automotive Lidar#Radar#Autonomous Cars#Autonomous Driving

0 notes

Text

#carsensor#autonomous driving#radar#security#AutomotiveSensors#ADAS#SmartCars#Innovation#Mobility#electronicsnews#technologynews

0 notes

Text

BMW i4 eDrive35 M Sport Review: Luxury Electric Performance

₹72.5 Lakh Design and Exterior Styling The i4 eDrive35 M Sport is unmistakably BMW, with a striking blend of modernity and athleticism. Its exterior design features hallmark elements of BMW’s sporty ethos, with a few electric-specific tweaks: Front Grille: The signature kidney grille is blanked off, enhancing aerodynamics and emphasizing its EV status. The M Sport touches add chrome highlights…

#ADAS#Advanced Safety#Aerodynamic Sedan#Ambient Lighting#Autonomous Features#Battery Range#BMW Design#BMW EV#BMW i4#BMW Innovations#BMW Technology#Connected Features#Dynamic Stability Control#eDrive35#Electric Mobility#Electric Sedan#EV Charging#Fast charging#Harman Kardon Audio#iDrive 8#Luxury EV#Luxury Interiors#M Sport#Performance EV#Premium Car#Premium Electric Car#Rear-Wheel Drive#regenerative braking#Tesla Model 3 Rival#WLTP Range

0 notes

Text

ADAS Market Share to Reach New Heights with 655 Million Units Projected by 2030

The Advanced Driver Assistance Systems (ADAS) Market Share is projected to reach an impressive 655 million units by 2030, reflecting significant growth driven by technological advancements and increasing demand for enhanced vehicle safety features. As consumers become more safety-conscious, automakers are incorporating ADAS technologies into their vehicles to meet regulatory requirements and…

#ADAS Market#ADAS Market Share#ADAS systems#application software#autonomous driving#mobility#software

0 notes

Text

Why Electric Pickup Trucks Are Gaining Popularity

The automotive world is witnessing a significant shift, and one of the most interesting developments in recent years has been the rise of electric pickup trucks. As environmental awareness continues to grow, consumers are looking for alternatives that deliver both performance and sustainability. This change in mindset, coupled with advancements in battery technology, has made electric pickup…

#ADAS#advanced transport#AI cars#autonomous tech#autonomous vehicles#carbon emissions#city car#city driving#Clean Energy#clean transport#connected cars#Eco-Friendly Cars#eco-technology#electric cars#electric SUV#electric transport#electric vehicles#emission reduction#energy efficiency#EVs#fuel efficiency#future of transport#green cities#hybrid cars#low emissions#modern cities#pollution reduction#ride-sharing#safety features#self-driving

0 notes

Text

#Adas And Autonomous Driving Components Market#Adas And Autonomous Driving Components Market Trends#Adas And Autonomous Driving Components Market Growth#Adas And Autonomous Driving Components Market Industry#Adas And Autonomous Driving Components Market Research#Adas And Autonomous Driving Components Market Report

0 notes

Text

What a difference 40 years makes juxtaposition of Lancia Y10, 1984 & Lancia Ypsilon, 2024. The new generation of Lancia's Group B "supermini" has been revealed and is the first stage in the Stellantis plan to revive the Lancia brand. The Ypsilon (Greek letter Y) will initially be offered with an electric drivetrain though there will also be a 3 cylinder hybrid model that will be Lancia's last ICE car as it becomes an electric only brand. The new Ypsilon shares its eCMP architecture with other Stellantis brands and also offers ADAS tech making it the only model in the segment with Level 2 Autonomous Driving capability as standard.

#Lancia#Lancia Ypsilon#new cars#2024#Stellantis#What a difference#1984#Lancia Y10#Group B#supermini#hatchback#EV#electric car

121 notes

·

View notes

Note

I dont know how it took me till you posted that most recent sole survivor art to learn you were a fallout enjoyed, it fills me with joy. Fave companion/storyline?

Of the main companions, I think my favorites are Dogmeat, Nick, and Piper, but I've probably brought Ada along more than anyone.

I really love the character of this robot, built by a band of survivors from spare parts, developing attachments and feelings. I appreciate her trying to square the conflicting input of grief and justice at the point where neither really fixes anything unless the root of that injury is repaired. Ada's friends died because the robots programming was flawed and lacked the ability to see struggling humans as viable, not because Isabel wanted them to kill. At that point, killing her would be cathartic but it punishes her for a mistake she rekt didn't intend and lowers us to the level of the other wasteland factions who perpetuate the broken exterminationist view of conflict. It lets Ada continue to grow as a living being in spite of her loss and status as a robot. It's something I love about Ada in my interpretation that I felt was lacking in my impression of Curie.

The game wants to give us a romanceable female synth who is even less experienced than we are, so porting a robot's memory into a "human" works but that's a bit cheap for my taste. I don't dislike Curie but I would've enjoyed the option to help her realize a human body wasn't strictly necessary to help people. Developing the "humanity" in a machine feels more in line with rebuilding a better world than finding ways to eliminate the anthropocentric limitations of machines in a world where they can be fully sentient.

And yes, I think you should still be able to romance Robot Curie. It seems to work for Mr. Zwicky and Miss Edna! I think that's sweet and let's be play this as a world where people realize joy is precious wherever you find it instead of queueing up Curie's emergent personality. We see plenty of other robots with fully functional autonomous identities. The ability to accept them for who they are and can become in spite of their origins is a wonderful aspect of the world for me.

In general, I like keeping folks around and trying to give them another chance to make a go of it in the Commonwealth without the Institute or the Brotherhood trying to pull the strings from above or below. I try not to kill anyone I know I don't have to unless they're going to keep trying to kill me.

I've destroyed the Prydwen and the Institute every time, but I wish there could've been opportunities to bring a few BOS characters over to my side in the process, Proctor Ingram, in particular. I also like that there are hard choices to make though, that characters you would want to join you can just have incompatible ideology and loyalty.

For the game's sake I back the minutemen and the Railroad, but ideologically, the Atom Cats are my "faction" of choice. They're good people, hacking out a place for themselves, putting their skills to less genocidal use, and trying to bring a bit of light and beauty to their little peninsula. They watch out for their friends and neighbors. They ain't so keen on exterminating anything in particular. They aren't looking to rule over anything in spite of their impressive power armor skills. My favorite outfit these days is the armored AC jacket and modded Mechanist helmet.

Far Harbor has some great missions too. The hotel murder mystery is a hoot and the settlement locations offer a lot to play with. I try to strike a live-and-let-live balance there too, preserving the synth refuge, Far Harbor, and the CoA if I can help it. I never rat them out to the BoS. The memory-retrieval mini game missions are miserable though! It glitched out on my first playthrough and I couldn't finish it before my PS4 died.

Favorite settlements are probably vault 88, the Starlite drive-in (makes a fanatic multistory apartment base), Spectacle Island, Abernathy farm, Egret Tours Marina, the lumber mill, Outpost Zimonja, Greygarden, and the lighthouse. I'm a fan of modding-off the build limits and resource cheats so I can build elaborate apartment blocks out of scaffolding, warehouse bits and vault pieces. I can't get enough of encasing ruined buildings in larger buildings like warehouses or vault atrium assets too. After a while, the settlement building becomes my favorite aspect of the game after the story and world-building.

13 notes

·

View notes

Text

Autonomous Vehicles Market Revolution: Will Humans Still Have the Wheel?

Executive Summary

The global autonomous vehicles market is undergoing a transformative phase driven by rapid advancements in AI, sensor technologies, regulatory evolution, and consumer demand for safety and convenience. As global economies shift toward sustainable mobility solutions, autonomous vehicles (AVs) represent the next frontier in the transportation ecosystem. We present a comprehensive, data-enriched, and analytically grounded overview of the autonomous vehicles market, covering segmentation, competitive dynamics, regional analysis, and the emerging innovation landscape between 2022 and 2032.

Request Sample Report PDF (including TOC, Graphs & Tables): https://www.statsandresearch.com/request-sample/28010-global-autonomous-vehicles-market

Autonomous Vehicles Market Overview and Growth Dynamics

The global autonomous vehicles market is expected to surpass USD XXX billion by 2032, expanding at a compound annual growth rate (CAGR) of XX% from 2022 to 2032. The growth is spurred by government incentives, the push for zero-emission transport, and the integration of smart infrastructure to support vehicle autonomy.

Key Drivers:

Rising consumer awareness of vehicular safety systems

Integration of 5G and V2X (Vehicle-to-Everything) communication

Government funding for smart cities and mobility-as-a-service (MaaS) initiatives

Technological breakthroughs in neural networks and edge computing

Get up to 30%-40% Discount: https://www.statsandresearch.com/check-discount/28010-global-autonomous-vehicles-market

Product Segmentation: Fully Automatic vs. Semi-Automatic

Fully Automatic Vehicles

Fully autonomous vehicles market (Level 5 automation) operate without human intervention. These vehicles are primarily in the testing or limited commercial deployment phase but are expected to gain significant market share by 2027 due to:

Advancements in LiDAR and AI-based perception systems

Investment by tech giants in robotaxi platforms

Pilot programs in urban settings across the US, China, and the EU

Semi-Automatic Vehicles

Semi-autonomous vehicles (Levels 2–4) dominate the current market, with features such as adaptive cruise control, lane-keeping assist, and automated parking. These systems lay the groundwork for full autonomy and are increasingly integrated into luxury and mid-range vehicles.

Applications: Commercial vs. Consumer Use Cases

Passenger Cars

Autonomous capabilities in passenger vehicles cater to convenience and safety. Key adoption drivers include:

Autonomous highway driving solutions

Enhanced driver-assist features (ADAS)

Integration with infotainment and predictive maintenance platforms

Autonomous Trucks and Freight Solutions

Trucking is a primary focus of automation due to driver shortages and the need for cost optimization in logistics. Features driving growth include:

Platooning technology

Autonomous delivery fleets for last-mile logistics

AI-driven fleet management platforms

Regional Autonomous Vehicles Market Insights:

North America

Leadership in R&D: U.S.-based companies like Tesla, Waymo, and Ford lead innovation.

Regulatory Sandboxes: States like California, Arizona, and Texas enable real-world testing.

Infrastructure Readiness: High integration of connected road infrastructure.

Europe

Focus on Sustainability: EU’s regulatory framework supports AV integration as part of the Green Deal.

Cross-Border Testing Programs: Countries like Germany, France, and the Netherlands are working together to develop AV corridors.

Asia-Pacific

Government Push: China and South Korea heavily invest in AV research and infrastructure.

Urban Congestion Solutions: AVs seen as a remedy for megacity traffic issues.

Dominant OEM Presence: Japanese and Chinese automakers ramp up AV production.

South America & Middle East and Africa

Nascent Stage: Still in early adoption phases with limited commercial rollouts.

Investment in Smart Cities: Projects in UAE, Brazil, and Saudi Arabia show long-term promise.

Competitive Landscape and Autonomous Vehicles Market Leaders

Alphabet Inc. (Waymo)

A pioneer in fully autonomous driving, Waymo operates a commercial robotaxi service in the U.S. and maintains one of the largest AV test fleets globally.

Tesla Inc.

Leveraging real-world driving data through its Full Self-Driving (FSD) software, Tesla maintains a significant edge in semi-autonomous vehicle penetration.

Ford Motor Company

Through its Argo AI partnership, Ford is building AV solutions focused on fleet delivery and ride-hailing services.

Intel (Mobileye)

Mobileye provides ADAS and computer vision systems, offering a scalable path from semi- to fully autonomous driving.

Delphi Technologies (Aptiv)

Focused on modular AV platforms and partnerships with ride-hailing companies, Delphi leads in urban deployment strategies.

Daimler AG

Through its partnership with Bosch and investment in Freightliner, Daimler emphasizes autonomous trucks and high-end AV passenger cars.

Regulatory Framework and Policy Landscape

U.S. DOT AV 4.0 Guidelines: Promotes innovation while addressing public safety.

UNECE Regulations: Sets international standards for Level 3 automation and beyond.

China’s AV Pilot Zones: Streamlined testing protocols to fast-track commercial deployment.

Technology Outlook: Core Enablers

Sensor Fusion and LiDAR

High-resolution environmental modeling is crucial. Industry trends point to solid-state LiDAR, which offers cost-effective scalability.

AI and Machine Learning

Deep neural networks drive situational awareness, path planning, and decision-making in dynamic environments.

Connectivity and V2X

Real-time data exchange between vehicles and infrastructure boosts safety and traffic flow optimization.

Cybersecurity in AVs

As attack vectors increase with connectivity, firms invest in robust encryption, anomaly detection, and OTA security protocols.

Key Trends Shaping the Autonomous Vehicles Market

Ride-Sharing Automation: Partnerships between OEMs and ride-hailing firms reshape urban mobility.

AV-as-a-Service (AVaaS): Subscription-based autonomy packages offered by automakers.

Autonomous Public Transport: Pilot projects for AV shuttles and minibuses in urban centers.

Edge AI Processing: Enables faster reaction times and reduced reliance on cloud connectivity.

Global Talent Race: Intense competition for AI engineers and AV software developers.

Purchase Exclusive Report: https://www.statsandresearch.com/enquire-before/28010-global-autonomous-vehicles-market

Conclusion

The autonomous vehicles market is accelerating toward maturity, marked by disruptive innovation, robust investment, and evolving consumer paradigms. Stakeholders that prioritize data-driven R&D, foster regulatory alignment, and scale infrastructure readiness will shape the trajectory of this multi-billion-dollar industry. As regional ecosystems harmonize and full autonomy transitions from labs to highways, autonomous vehicles are no longer futuristic—they are imminent.

Our Services:

On-Demand Reports: https://www.statsandresearch.com/on-demand-reports

Subscription Plans: https://www.statsandresearch.com/subscription-plans

Consulting Services: https://www.statsandresearch.com/consulting-services

ESG Solutions: https://www.statsandresearch.com/esg-solutions

Contact Us:

Stats and Research

Email: [email protected]

Phone: +91 8530698844

Website: https://www.statsandresearch.com

1 note

·

View note

Text

Cutting Edge Automotive Software solutions, Best Place to Grow through KPIT

KPIT Technologies is a global partner to the automotive and Mobility ecosystem for making software-defined vehicles a reality. It is a leading independent software development and integration partner helping mobility leapfrog towards a clean, smart, and safe future. With 13000+ automobelievers across the globe specializing in embedded software, AI, and digital solutions, KPIT accelerates its clients’ implementation of next-generation technologies for the future mobility roadmap. With engineering centers in Europe, the USA, Japan, China, Thailand, and India, KPIT works with leaders in automotive and Mobility and is present where the ecosystem is transforming.

#KPIT#About KPIT#Automotive Engineering Company#Automotive Technology Company#Mobility Technology#Automotive Software#Automotive software integration partner#Automotive software development partner#Autonomous Driving#ADAS#AUTOSAR#Vehicle Engineering and Design

0 notes

Text

Autonomous Vehicles Market to be Worth $259.4 Billion by 2032

Meticulous Research®—a leading global market research company, published a research report titled, ‘Autonomous Vehicles Market by Type (Passenger Vehicles (Hatchback, Sedan, SUV, Others), Commercial Vehicles (Trucks, Buses)), Fuel Type (ICE, Electric), Level of Autonomy (L1, L2, L3, L4), Geography - Global Forecast to 2032.’

According to this latest publication from Meticulous Research®, the autonomous vehicles market is projected to reach $259.4 billion by 2032, at a CAGR of 20.4% from 2025 to 2032. The growth of this market is driven by factors such as increasing demand for luxury vehicles and the rising need to improve traffic flow and road safety. In addition, factors such as rising government initiatives for the development and adoption of autonomous vehicles, the development of ADAS technology, and growing demand for semi-autonomous vehicles are expected to provide opportunities for market growth. However, the high cost of autonomous vehicles and lack of required infrastructure in emerging countries can restrain the growth of the market. Data privacy and security concerns pose challenges for market growth.

The autonomous vehicles market is segmented by type, fuel type, and level of autonomy. The study also evaluates industry competitors and analyzes the regional and country-level markets.

Based on type, the autonomous vehicles market is broadly segmented into passenger vehicles and commercial vehicles. In 2025, the passenger vehicles segment is expected to account for the larger share of ~86.0% of the global autonomous vehicles market. The large share of the segment is attributed to the increasing demand for automated energy-efficient vehicles, technological advancement in self-driving cars, rising government focus on the adoption of autonomous vehicles, and rising focus of manufacturers on product development. For instance, in April 2021, Toyota Motor Corporation (Japan) unveiled new versions of the Lexus LS and Toyota Mirai equipped with Advanced Drive, the company’s advanced driver assist system in Japan. Advanced Drive features a level 2 autonomous system.

However, the commercial vehicles segment is expected to register the highest CAGR during the forecast period. Factors such as growing focus on automation and electrification of public transport, rising investment in connected infrastructure, and rising focus of manufacturers on the development of autonomous commercial vehicles are expected to drive the segment’s growth. For instance, in April 2024, Continental AG (Germany) partnered with Aurora Innovation, Inc. (U.S.) to deliver the first commercially scalable generation of Aurora’s flagship integrated hardware and software system, the Aurora Driver. The organizations will jointly design, develop, validate, deliver, and service the scalable autonomous system for the trucking industry.

Based on fuel type, the autonomous vehicles market is segmented into ICE and electric. In 2025, the electric segment is expected to account for the larger share of the global autonomous vehicles market. The large share of the segment is attributed to the rising adoption of battery-powered, energy-efficient vehicles and the rising focus on reducing greenhouse gas emissions.

Moreover, the electric segment is also expected to grow at the highest CAGR during the forecast period. The segment's high growth is attributed to the rising focus of autonomous vehicle manufacturers on product development and enhancement. For instance, in September 2024, BMW AG (Germany) selected Amazon cloud technology to build its autonomous driving features for new EVs.

Based on level of autonomy, the autonomous vehicles market is segmented into level 1, level 2, level 3, and level 4. In 2025, the level 2 segment is expected to account for the largest share of ~74.0% of the global autonomous vehicles market. The large share of the segment is attributed to the continual assistance offered by level 2 vehicles in acceleration/braking and steering, the rising need to enhance the safety and comfort of passengers, and ongoing development in level 2 autonomous vehicles. For instance, in April 2024, Ford Motor Company (U.S.) launched a level 2 autonomous hands-free driver assistance system called Ford BlueCruise, which it says is the first to receive regulatory approval for use on a public highway in Europe. However, the level 4 segment is expected to register the highest CAGR during the forecast period. Ongoing research and development on level 4 autonomous vehicles is expected to drive the segment growth in the forecast period.

Based on geography, the autonomous vehicles market is segmented into North America, Asia-Pacific, Europe, Latin America, and the Middle East & Africa. In 2025, North America is expected to account for the largest share of ~36.0% of the autonomous vehicles market. The large share of the North American region is attributed to the rising government support for autonomous vehicle research, testing, and development, the growing need for safe and efficient driving options, the rising adoption of self-driving technology, growing focus of manufacturers on autonomous vehicle development. For instance, New Flyer of America Inc. (“New Flyer”), a subsidiary of NFI Group Inc. (“NFI”), one of the world’s leading independent global bus manufacturers, unveiled its Xcelsior AV™ automated transit bus, now in motion at Robotic Research, LLC (“Robotic Research”) in Maryland.

However, Asia-Pacific is expected to register the highest CAGR of ~22.0% during the forecast period. Growth of the market is attributed to the rising government initiatives to promote the development and adoption of autonomous vehicles and the increasing need to address congestion, improve mobility, and enhance transportation efficiency. For instance, in February 2025, according to the Infocomm Media Development Authority (IMDA), Singapore is looking to boost its national broadband network to better prepare for emerging technologies, such as artificial intelligence (AI) and autonomous vehicles. The country will set aside up to $74.2 (SG$100) million to upgrade the current nationwide network to deliver speeds of up to 10Gbps,

Key Players:

The key players operating in the autonomous vehicles market are General Motors Company (U.S.), BMW AG (Germany), Daimler Truck AG. (Germany), Mercedes-Benz AG (Germany), Hyundai Motor Company (South Korea), Tesla, Inc (U.S.), Renault Group (France), Toyota Motor Corporation (Japan), Volkswagen Group (Germany), Ford Motor Company (U.S.) and AB Volvo (Sweden)

Download Sample Report Here @ https://www.meticulousresearch.com/download-sample-report/cp_id=5813

Key questions answered in the report-

Which are the high-growth market segments based on type, fuel type, and level of autonomy?

What was the historical market for autonomous vehicles?

What are the market forecasts and estimates for the period 2025–2032?

What are the major drivers, restraints, and opportunities in the autonomous vehicles market?

Who are the major players, and what shares do they hold in the autonomous vehicles market?

What is the competitive landscape like in the autonomous vehicles market?

What are the recent developments in the autonomous vehicles market?

What are the different strategies adopted by the major players in the autonomous vehicles market?

What are the key geographic trends, and which are the high-growth countries?

Who are the local emerging players in the global autonomous vehicles market, and how do they compete with the other players?

Contact Us: Meticulous Research® Email- [email protected] Contact Sales- +1-646-781-8004 Connect with us on LinkedIn- https://www.linkedin.com/company/meticulous-research

#Autonomous Vehicles Market#ADAS#Self Driving Cars#Automotive Lidar#Radar#Autonomous Cars#Autonomous Driving

0 notes

Text

Fun Fact: The whole “AI favoriting white people” thing isn’t just a problem with image generation and job applications. Autonomous Driving Assistant Systems (ADAS) are also worse at detecting black people. This includes everything from Tesla’s Full-Self Driving and General Motor’s Super Cruise to a Honda Fit’s basic Automatic Emergency Braking (AEB) system. The systems all have trouble detecting people with darker complexions and stopping the vehicles like they’re supposed to.

4 notes

·

View notes

Text

DSP Development Board and Kits Market: Regulatory Landscape and Policy Impact 2025-2032

MARKET INSIGHTS

The global DSP Development Board and Kits Market size was valued at US$ 637.2 million in 2024 and is projected to reach US$ 1,020 million by 2032, at a CAGR of 7.1% during the forecast period 2025-2032.

DSP development boards and kits are specialized hardware platforms designed for digital signal processing applications. These tools provide engineers with ready-to-use development environments featuring processors optimized for high-speed mathematical computations required in audio, video, and communication systems. The product range includes single-core and multi-core configurations, supporting various signal processing algorithms and real-time applications.

The market growth is driven by increasing demand for high-performance computing in 5G infrastructure, IoT devices, and automotive systems. While North America currently leads in adoption, Asia-Pacific is witnessing accelerated growth due to expanding electronics manufacturing. Leading players like TI and Analog Devices dominate approximately 45% of the market share, supported by continuous product innovations such as energy-efficient DSP architectures and AI-integrated development kits launched in 2023-2024.

MARKET DYNAMICS

MARKET DRIVERS

Proliferation of IoT and Edge Computing Accelerates DSP Development Board Adoption

The rapid expansion of Internet of Things (IoT) applications and edge computing solutions is significantly driving demand for DSP development boards. With over 30 billion connected IoT devices projected by 2025, there's an increasing need for real-time signal processing at the edge. DSP development boards provide the necessary computational power for applications ranging from smart home devices to industrial automation systems. These boards enable developers to prototype and implement complex algorithms for noise cancellation, voice recognition, and predictive maintenance more efficiently. The growing preference for localized data processing to reduce latency and bandwidth costs further emphasizes the importance of these development tools.

Advancements in 5G Technology Fueling Market Expansion

The global rollout of 5G networks is creating substantial opportunities for DSP development board manufacturers. As 5G requires sophisticated signal processing for massive MIMO antennas and beamforming technologies, development boards with multi-core DSP capabilities are becoming essential for research and prototyping. Telecom equipment providers and chipset manufacturers are increasingly investing in advanced development kits to accelerate their 5G solution development. The demand is particularly strong in communications infrastructure, where DSP boards help optimize network performance and energy efficiency. With 5G subscriptions expected to triple by 2026, this trend shows no signs of slowing down.

Growth in Automotive Electronics Creates New Applications

The automotive industry's shift toward electric vehicles and autonomous driving systems is generating robust demand for DSP development solutions. Modern vehicles incorporate dozens of DSP-powered systems including advanced driver assistance (ADAS), in-cabin voice recognition, and battery management systems. Development boards allow automotive engineers to test and refine algorithms for real-time processing of sensor data from lidar, radar, and camera systems. The market is further boosted by increasing government mandates for vehicle safety features, with many countries requiring advanced collision avoidance systems in all new vehicles by 2025. This regulatory push ensures sustained investment in DSP development tools for automotive applications.

MARKET RESTRAINTS

Complex Design Requirements Create Barriers to Adoption

While DSP development boards offer powerful capabilities, their steep learning curve presents a significant challenge for many potential users. Programming DSP processors requires specialized knowledge of signal processing algorithms and architecture-specific optimization techniques. Many development teams lack engineers with the necessary expertise, leading to longer development cycles and increased project costs. The complexity is compounded when working with advanced features like parallel processing in multi-core boards. As a result, some organizations hesitate to adopt these solutions, opting for more general-purpose development platforms despite their performance limitations.

High Development Costs Limit Market Penetration

The substantial investment required for DSP development ecosystems serves as a market restraint, particularly for smaller companies and academic institutions. Advanced development boards with latest-generation DSP processors often carry premium price tags, with some professional kits exceeding several thousand dollars. When combined with the cost of supporting software tools, debuggers, and training, the total investment can be prohibitive. Many organizations must carefully weigh these costs against their project budgets and expected returns. While entry-level boards exist, they often lack the performance needed for cutting-edge applications, forcing users to choose between affordability and capability.

MARKET CHALLENGES

Rapid Technological Obsolescence Presents Ongoing Challenges

The DSP development board market faces constant pressure from accelerating technology cycles. As processor manufacturers introduce new architectures with improved power efficiency and computational capabilities, existing development kits quickly become outdated. This creates challenges for both vendors and users, who must decide when to upgrade their toolchains and retrain their teams. The situation is particularly acute in industries like wireless communications, where standards evolve rapidly. Development board manufacturers struggle to balance long-term support for existing platforms with the need to deliver next-generation solutions, sometimes leading to compatibility issues and frustrated customers.

Supply Chain Disruptions Impact Product Availability

Recent global supply chain challenges have significantly affected the DSP development board market. Many boards rely on specialized components from limited suppliers, making them vulnerable to shortages and extended lead times. The semiconductor industry's capacity constraints have led to allocation scenarios where development board manufacturers cannot obtain critical DSP processors in sufficient quantities. These disruptions delay product launches and complicate inventory management, sometimes forcing developers to redesign projects around available hardware. While supply conditions are gradually improving, the risk of future disruptions remains an ongoing concern for market participants.

MARKET OPPORTUNITIES

Emerging AI at the Edge Applications Open New Markets

The convergence of DSP and AI technologies creates significant growth opportunities for development board vendors. As artificial intelligence moves toward edge devices, there's increasing demand for boards that combine traditional signal processing with neural network acceleration. These hybrid solutions enable developers to implement sophisticated AI algorithms for applications like predictive maintenance, medical diagnostics, and smart surveillance. The market potential is substantial, with edge AI hardware shipments projected to grow substantially in coming years. Leading DSP manufacturers are already introducing development kits with AI-specific enhancements, including optimized libraries for machine learning workflows.

Expansion of Digital Signal Processing Education Creates Long-Term Demand

Growing emphasis on DSP education in engineering programs worldwide presents a strategic opportunity for market expansion. Universities and technical institutes are updating their curricula to include more practical signal processing applications, driving demand for affordable yet capable development boards. Board manufacturers that offer educational packages with curriculum-aligned materials and project examples can establish long-term relationships with academic institutions. These partnerships not only generate immediate sales but also cultivate future engineers familiar with specific hardware platforms. The trend toward hands-on learning in STEM education ensures sustained demand for well-designed DSP development kits in the academic sector.

DSP DEVELOPMENT BOARD AND KITS MARKET TRENDS

Growing Demand for High-Performance Signal Processing Solutions to Drive Market Growth

The DSP development board and kits market is experiencing robust expansion due to the increasing demand for high-performance digital signal processing solutions across industries. With applications ranging from real-time audio processing to telecommunications and industrial automation, these boards are becoming indispensable for modern electronics. Single-core DSP development boards currently hold a significant market share, valued at millions, yet multi-core solutions are gaining traction as processing requirements become more complex. The integration of advanced AI capabilities into DSP kits is further accelerating adoption, enabling developers to deploy sophisticated machine learning models at the edge.

Other Trends

Expansion of IoT and Edge Computing Applications

The rapid proliferation of IoT devices and edge computing solutions is creating substantial opportunities for DSP development boards. These platforms provide the necessary computational power for real-time analytics while maintaining energy efficiency, a critical requirement for battery-operated smart devices. Growth in smart city infrastructure and industrial IoT deployments specifically contributes to increased adoption, with development kits serving as the foundation for prototyping energy-conscious signal processing solutions. The Asia-Pacific region leads this trend due to concentrated manufacturing ecosystems and government-backed digital transformation initiatives.

Technological Advancements in DSP Architectures

Innovation in DSP chip designs is reshaping the development board landscape, with manufacturers pushing the boundaries of performance-per-watt metrics. Leading suppliers now incorporate heterogeneous computing architectures combining DSP cores with FPGA fabrics and AI accelerators, enabling unprecedented flexibility for developers. This technological progression supports the market's projected CAGR, as modern boards deliver up to 3x the processing efficiency of previous-generation solutions. The telecommunications sector represents a prime adoption area, where 5G infrastructure demands ultra-low latency processing that only advanced DSP kits can provide at scale.

COMPETITIVE LANDSCAPE

Key Industry Players

Market Leaders Focus on Innovation and Strategic Expansion to Maintain Dominance

The global DSP (Digital Signal Processing) development board and kits market features a dynamic competitive environment dominated by semiconductor giants and specialized electronics manufacturers. Texas Instruments (TI) emerges as the clear market leader, holding approximately 28% revenue share in 2024, owing to its comprehensive TMS320 series and strong foothold in both industrial and consumer applications.

Analog Devices follows closely with about 22% market share, driven by its SHARC and Blackfin processor lines which are particularly popular in audio processing and communications applications. Meanwhile, STMicroelectronics has been gaining traction with its STM32-based DSP solutions, capturing nearly 15% of the market through competitive pricing and strong European distribution networks.

The market shows interesting regional variations in competitive dynamics. While U.S.-based TI and Analog Devices dominate North America, Asian players like Tronlong and Yanxu Electric are making significant inroads in China's rapidly growing DSP market, which is projected to expand at 8.5% CAGR through 2032. These regional specialists compete effectively through localized support and customized solutions.

Recent years have seen intensified competition in the multi-core DSP segment, with Intel and NXP introducing heterogeneous computing platforms that combine DSP functionality with general-purpose processors. This convergence trend is reshaping the competitive landscape as traditional boundaries between microcontroller and DSP markets blur.

List of Key DSP Development Board and Kits Manufacturers:

Texas Instruments Inc. (TI) (U.S.)

Analog Devices, Inc. (U.S.)

STMicroelectronics (Switzerland)

Terasic Technologies Inc. (Canada)

Intel Corporation (U.S.)

NXP Semiconductors (Netherlands)

Realtime Technology Co., Ltd. (China)

Yanxu Electric Technology Co. (China)

Tronlong Technology Co., Ltd. (China)

Espressif Systems (China)

Segment Analysis:

By Type

Single-core DSP Development Boards Dominate Due to Cost-effectiveness and Wide Application Range

The market is segmented based on type into:

Single-core DSP Development Board

Multi-core DSP Development Board

By Application

Communications Industry Leads Due to Increasing Demand for Signal Processing Solutions

The market is segmented based on application into:

Communications Industry

Consumer Electronics

Others

By Processing Capability

High-performance DSP Kits Gain Traction for Advanced Signal Processing Applications

The market is segmented based on processing capability into:

Basic DSP Kits

Mid-range DSP Kits

High-performance DSP Kits

By End User

Research Institutions Show Significant Adoption for Prototyping and Educational Purposes

The market is segmented based on end user into:

Electronics Manufacturers

Research Institutions

System Integrators

Independent Developers

Regional Analysis: DSP Development Board and Kits Market

North America The North American DSP development board and kits market is driven by strong demand from the telecommunications and defense sectors. With major players like Texas Instruments (TI) and Analog Devices headquartered here, the region benefits from advanced R&D capabilities and early adoption of new DSP technologies. The U.S. accounts for over 60% of regional market revenue, propelled by 5G infrastructure deployment and AI/ML application development. However, high component costs and supply chain disruptions pose challenges for smaller manufacturers. The market sees growing interest in multi-core DSP boards for edge computing applications, particularly in industrial automation and automotive systems.

Europe Europe maintains a robust DSP development ecosystem focused on industrial and automotive applications. Strict EU regulations on energy efficiency and electromagnetic compatibility drive innovation in low-power DSP solutions. Germany leads regional adoption, supported by its strong industrial base and academic research institutions. The market shows increasing preference for modular development kits that simplify prototyping for IoT applications. While the region lags behind North America in high-performance DSP adoption, it excels in specialized applications like medical imaging and audio processing. Brexit-related trade barriers continue to impact UK market growth, though recovery is underway.

Asia-Pacific Asia-Pacific dominates global DSP kit production and consumption, with China accounting for nearly 40% of regional demand. Rapid 5G rollout and smart manufacturing initiatives fuel unprecedented growth, particularly for single-core DSP solutions in cost-sensitive applications. Japan and South Korea remain technology leaders, focusing on high-end DSP development kits for robotics and autonomous systems. India emerges as a significant growth market, driven by local electronics manufacturing policies and startup ecosystem development. However, intellectual property concerns and component shortage issues occasionally disrupt market stability. The region sees increasing competition between established brands and local manufacturers offering budget-friendly alternatives.

South America The South American market shows gradual but uneven growth across countries. Brazil represents the largest regional market, driven by telecommunications infrastructure upgrades and industrial automation investments. Economic instability and limited local manufacturing capability keep prices high and constrain market expansion. Educational institutions represent a growing customer segment as engineering programs incorporate DSP coursework. While multinational brands dominate the premium segment, regional distributors increasingly offer localized support and training packages to stimulate market growth amidst challenging economic conditions.

Middle East & Africa This emerging market shows promising growth potential centered around smart city initiatives in Gulf Cooperation Council (GCC) countries. The UAE and Saudi Arabia lead regional adoption, particularly for communications and energy sector applications. However, limited local technical expertise and reliance on imports create adoption barriers across most of Africa. Government initiatives to develop local electronics manufacturing capabilities are beginning to show results, though the market remains heavily dependent on international suppliers. Telecommunications infrastructure projects and security system modernization provide key growth opportunities, especially for mid-range DSP development solutions.

Report Scope

This market research report provides a comprehensive analysis of the Global DSP Development Board and Kits market, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The market was valued at USD million in 2024 and is projected to reach USD million by 2032, growing at a CAGR of %.

Segmentation Analysis: Detailed breakdown by product type (Single-core/Multi-core DSP Development Boards), application (Communications, Consumer Electronics, Others), and end-user industry.

Regional Outlook: Insights into market performance across North America (U.S. valued at USD million in 2024), Europe, Asia-Pacific (China to reach USD million), Latin America, and Middle East & Africa.

Competitive Landscape: Profiles of leading players including TI, Analog Devices, STMicroelectronics, Intel, NXP (collectively holding % market share in 2024), covering their product portfolios and strategic developments.

Technology Trends: Assessment of DSP architecture innovations, AI/ML integration, power efficiency improvements, and development ecosystem advancements.

Market Drivers & Restraints: Evaluation of factors including 5G deployment, IoT expansion, and automotive electronics growth versus design complexity and supply chain challenges.

Stakeholder Analysis: Strategic insights for DSP manufacturers, embedded system developers, academic researchers, and investors.

The research methodology combines primary interviews with industry experts and analysis of verified market data to ensure report accuracy.

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global DSP Development Board and Kits Market?

-> DSP Development Board and Kits Market size was valued at US$ 637.2 million in 2024 and is projected to reach US$ 1,020 million by 2032, at a CAGR of 7.1% during the forecast period 2025-2032.

Which key companies dominate this market?

-> Leading players include TI, Analog Devices, STMicroelectronics, Intel, NXP, Terasic, holding approximately % combined market share in 2024.

What are the key growth drivers?

-> Primary drivers include 5G infrastructure development, increasing IoT adoption, and demand for real-time signal processing across industries.

Which region shows highest growth potential?

-> Asia-Pacific (particularly China) is the fastest-growing region, while North America currently leads in technological innovation.

What are the emerging technology trends?

-> Key trends include AI-accelerated DSPs, low-power edge computing solutions, and integrated development platforms for faster prototyping.

Related Reports:https://semiconductorblogs21.blogspot.com/2025/06/automotive-magnetic-sensor-ics-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/ellipsometry-market-supply-chain.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/online-moisture-sensor-market-end-user.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/computer-screen-market-forecasting.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/high-power-gate-drive-interface.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/strobe-overdrive-digital-controller.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/picmg-half-size-single-board-computer.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/automotive-isolated-amplifier-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/satellite-messenger-market-regional.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/sic-epi-wafer-market-innovations.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/heavy-duty-resistor-market-key-players.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/robotic-collision-sensor-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/gas-purity-analyzer-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/x-ray-high-voltage-power-supply-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/reflection-probe-market-industry-trends.html

0 notes

Text

4D Radar Chip Market, Emerging Trends, Technological Advancements, and Forecast to 2032

Global 4D Radar Chip Market size was valued at US$ 437.2 million in 2024 and is projected to reach US$ 1,290 million by 2032, at a CAGR of 16.7% during the forecast period 2025-2032. The semiconductor industry’s broader growth – projected to expand from USD 579 billion in 2022 to USD 790 billion by 2029 at 6% CAGR – creates favorable conditions for radar chip innovation.

4D radar chips represent an advanced evolution of traditional radar technology, integrating height detection (the fourth dimension) alongside range, azimuth and velocity measurements. These high-resolution millimeter-wave (mmWave) chips operate primarily in 24GHz, 77GHz and 79GHz frequency bands, enabling superior object detection and tracking capabilities compared to conventional 3D radar systems. Key components include transceivers, antennas, and signal processing units optimized for automotive, industrial and defense applications.

Market growth is driven by increasing ADAS adoption (projected in 60% of new vehicles by 2025) and rising demand for autonomous systems. Recent developments include NXP’s 28nm RFCMOS radar processors and Uhnder’s digital coding modulation technology, both enhancing resolution while reducing interference. While automotive dominates current applications, emerging uses in drones, smart infrastructure and industrial IoT are creating new growth avenues. Regulatory support for vehicle safety standards like Euro NCAP 2023 further accelerates adoption.

Get Full Report : https://semiconductorinsight.com/report/4d-radar-chip-market/

MARKET DYNAMICS

MARKET DRIVERS

Rising Demand for Autonomous Vehicles Accelerating 4D Radar Chip Adoption

The global autonomous vehicle market is projected to grow at over 25% CAGR through 2030, creating massive demand for advanced sensing technologies. 4D radar chips are becoming critical components in autonomous driving systems because they provide superior object detection capabilities compared to traditional sensors. These chips can simultaneously measure range, velocity, azimuth, and elevation – delivering comprehensive environmental awareness in all weather conditions. Major automotive manufacturers are increasingly incorporating 4D radar systems with millimeter-wave frequencies between 76-81 GHz, as they offer superior resolution for detecting small objects at distances up to 300 meters.

Military and Defense Applications Driving Technological Advancements

Defense sector investments in radar technologies are pushing the boundaries of 4D radar chip capabilities. Modern military applications require chips that can operate at higher frequencies while consuming less power and offering enhanced signal processing. The ability to detect and track multiple fast-moving targets simultaneously has made 4D radar indispensable for border surveillance, drone detection, and missile guidance systems. Nearly 40% of recent defense radar system upgrades now incorporate 4D radar technology, creating significant growth opportunities.

Furthermore, regulatory bodies worldwide are establishing frameworks to support radar technology innovation:

➤ For instance, recent spectrum allocation policies in major economies have designated dedicated frequency bands for automotive radar applications between 76-81 GHz.

The combination of commercial automotive demand and military specifications is accelerating development cycles, with leading chip manufacturers now delivering new generations of 4D radar chips every 12-18 months.

MARKET CHALLENGES

Complex Design Requirements and High Development Costs Creating Barriers

While the 4D radar chip market shows strong growth potential, developing these advanced semiconductors presents significant technical and financial challenges. Designing chips that operate at millimeter-wave frequencies requires specialized expertise in high-frequency analog design and advanced packaging technologies. The typical research and development cycle for a new 4D radar chip can exceed $50 million and take 2-3 years from conception to production.

Other Challenges

Manufacturing Complexities Fabricating chips with the precision required for 4D radar applications demands cutting-edge semiconductor processes. Many manufacturers struggle to achieve the necessary yield rates, with defect-free production remaining below 80% for some complex designs.

Testing Difficulties Verifying chip performance at millimeter-wave frequencies requires specialized test equipment that can cost millions of dollars per setup. The scarcity of qualified testing facilities creates bottlenecks in bringing new designs to market.

MARKET RESTRAINTS

Supply Chain Vulnerabilities Impacting Market Expansion

The global semiconductor shortage has particularly affected specialized components like 4D radar chips. Dependence on limited production facilities for advanced nodes creates single points of failure in the supply chain. Many automotive manufacturers report that radar chip lead times have extended beyond 52 weeks, forcing temporary production slowdowns.

Additionally, geopolitical factors are complicating the landscape:

➤ Recent trade restrictions have disrupted the flow of key semiconductor manufacturing equipment, potentially delaying next-generation chip developments by 12-18 months.

The combination of material shortages, equipment constraints, and rising fab costs is limiting the pace at which manufacturers can scale production to meet growing demand.

MARKET OPPORTUNITIES

Emerging Industrial Applications Creating New Growth Frontiers

Beyond automotive and defense, innovative applications for 4D radar chips are emerging across multiple industries. Smart infrastructure projects are incorporating radar for traffic management and pedestrian safety monitoring. Industrial automation systems use radar for precise object detection in hazardous environments. Even consumer electronics manufacturers are exploring radar chips for gesture recognition and presence detection features.

The healthcare sector presents particularly promising opportunities:

➤ Medical device developers are testing 4D radar for contactless patient monitoring, with potential applications in elderly care and rehabilitation.

As these diverse applications mature, they’re creating new revenue streams that could account for over 30% of the total 4D radar chip market by 2028. Market leaders are investing heavily in application-specific chip designs to capitalize on these specialized opportunities.

4D RADAR CHIP MARKET TRENDS

Advancements in Autonomous Driving Technologies Driving Market Growth

The integration of 4D radar chips in autonomous vehicles has emerged as a transformative trend, with major automotive manufacturers increasing investments in Level 4 and Level 5 autonomy. Unlike traditional radar systems, 4D radar provides enhanced resolution in elevation, azimuth, range, and Doppler velocity detection, delivering unprecedented accuracy for obstacle detection and collision avoidance. The global autonomous vehicle market is projected to grow at a CAGR of over 20% through 2030, directly fueling demand for advanced sensing solutions like 4D radar. Companies like NXP and Infineon are leveraging 77 GHz and 79 GHz radar chips to enable high-resolution environmental mapping, significantly improving safety standards in next-generation vehicles.

Other Trends

Expansion in Drone and UAV Applications

The commercial drone market is increasingly adopting 4D radar technology for precise navigation and obstacle avoidance in complex environments. With the drone logistics market expected to surpass $30 billion by 2030, radar chips capable of detecting small objects at varying altitudes are becoming critical. 4D radar enables drones to operate safely in low-visibility conditions, making them viable for delivery services, agricultural monitoring, and disaster relief operations. Recent advancements in miniaturized radar solutions by companies like Vayyar and Arbe have further accelerated deployments across consumer and industrial drone segments.

Military and Defense Sector Acceleration

Defense organizations worldwide are actively incorporating 4D radar systems into surveillance and threat detection platforms. Military expenditure on radar systems reached approximately $15 billion in 2024, with growing emphasis on all-weather, multi-target tracking capabilities. The technology’s ability to distinguish between stationary and moving objects with millimeter-wave precision makes it invaluable for border security and airborne early warning systems. Furthermore, partnerships between semiconductor firms and defense contractors are driving innovation in AI-powered radar processing, enhancing situational awareness for tactical operations.

COMPETITIVE LANDSCAPE

Key Industry Players

Innovation and Strategic Expansion Drive Market Positioning Among Leading Players

The global 4D Radar Chip market exhibits a dynamic competitive landscape, characterized by the presence of both established semiconductor giants and agile technology innovators. The market is moderately consolidated, with NXP Semiconductors and Infineon Technologies emerging as frontrunners, collectively accounting for over 35% of the market share in 2024. These leaders owe their dominance to extensive R&D capabilities and strategic partnerships with automotive OEMs.

TI (Texas Instruments) and Xilinx have also secured substantial market positions, particularly in the 77GHz and 79GHz frequency segments, which are gaining traction in advanced driver-assistance systems (ADAS). Their success stems from vertical integration strategies and patented chip architectures that deliver superior resolution and power efficiency.

Meanwhile, disruptive innovators like Uhnder and Vayyar are challenging traditional players through breakthrough digital radar technologies. Uhnder’s adoption of digital code modulation (DCM) technology has enabled it to capture nearly 12% of the automotive radar market, while Vayyar’s 4D imaging radar solutions are gaining adoption in smart home and industrial applications.

List of Key 4D Radar Chip Manufacturers Profiled

NXP Semiconductors (Netherlands)

Uhnder Inc. (U.S.)

RFISee Ltd. (Israel)

Arbe Robotics (Israel)

Texas Instruments (U.S.)

Xilinx (AMD) (U.S.)

Vayyar Imaging (Israel)

Infineon Technologies (Germany)

Calterah Semiconductor (China)

Recent developments indicate intensified competition, with multiple players announcing next-generation radar chips featuring enhanced angular resolution and interference mitigation capabilities. Infineon recently launched its new 28nm radar chipset, while Arbe Robotics secured significant contracts with tier-1 automotive suppliers for its Phoenix 4D imaging radar platform.

The competitive intensity is further evidenced by strategic alliances, such as the partnership between NXP and TSMC to develop 16nm RFCMOS radar solutions, highlighting the industry’s focus on process node advancements to gain performance advantages.

Regional players like Calterah Semiconductor are making notable strides in the Asian market, particularly in automotive and drone applications, benefiting from local supply chain advantages and government support for semiconductor independence.

Segment Analysis:

By Type

77 GHz Segment Leads Market Due to High Precision in Automotive Radar Applications

The market is segmented based on type into:

24 GHz

77 GHz

79 GHz

By Application

Automotive Sector Dominates with Rising Demand for ADAS Features

The market is segmented based on application into:

Automotive

Drones

Consumer Electronics

Military & Defense

Others

By Technology

MIMO-based 4D Radar Chips Gain Traction for Superior Object Detection

The market is segmented based on technology into:

Single-Input Single-Output (SISO)

Multiple-Input Multiple-Output (MIMO)

Regional Analysis: 4D Radar Chip Market

North America North America is a key player in the 4D radar chip market, driven by robust demand from the automotive and defense sectors. The U.S. leads in innovation, with major automotive manufacturers integrating 4D radar technology for advanced driver-assistance systems (ADAS) and autonomous vehicles. Government regulations, such as the National Highway Traffic Safety Administration’s (NHTSA) mandate for collision avoidance systems, further accelerate adoption. Additionally, the defense sector’s focus on radar-based surveillance and reconnaissance technologies bolsters market growth. Major players like Texas Instruments and NXP Semiconductor establish a strong supply chain, ensuring market stability. However, high development costs pose a challenge for smaller enterprises.

Europe Europe demonstrates steady growth in 4D radar chip adoption, supported by stringent automotive safety regulations under Euro NCAP. Countries like Germany, France, and the UK lead in automotive innovation, with premium car manufacturers prioritizing radar-based ADAS solutions. Strict data privacy laws under GDPR also influence radar technology deployment, ensuring compliance in consumer-oriented applications. The European Defense Fund’s investments in radar advancements further stimulate demand in military and aerospace sectors. Despite these drivers, market expansion is tempered by complex regulatory frameworks and competition from LiDAR technologies in some autonomous vehicle applications.

Asia-Pacific The Asia-Pacific region dominates the global 4D radar chip market, propelled by rapid automotive production and government-backed smart city initiatives. China, Japan, and South Korea are at the forefront, leveraging local semiconductor manufacturing capabilities to reduce dependency on imports. The automotive sector, particularly in China and India, focuses on integrating 4D radar for autonomous and electric vehicles. Meanwhile, Japan leads in consumer electronics applications, where radar chips enhance gesture recognition and IoT connectivity. Although cost sensitivity in emerging economies slows high-end adoption, increasing investments in 5G and smart infrastructure signal long-term potential.

South America South America’s 4D radar chip market is nascent but growing, primarily driven by Brazil and Argentina’s automotive and industrial automation sectors. Limited local semiconductor production creates reliance on imports, affecting pricing and availability. Economic instability and delayed regulatory approvals hinder rapid deployment, though collaborations with global tech firms aim to bridge gaps. The region’s mining and agriculture industries show emerging interest in radar-based monitoring systems, presenting niche opportunities for suppliers.

Middle East & Africa The Middle East & Africa market is developing, with growth centered around defense and smart city projects. The UAE and Saudi Arabia lead in adopting radar technologies for security and traffic management, supported by government initiatives like Saudi Vision 2030. However, funding constraints and a lack of local semiconductor expertise slow broader adoption. In Africa, industrial and agricultural applications drive sporadic demand, but infrastructure challenges remain a barrier. Strategic partnerships with international radar chip manufacturers could unlock future opportunities in this region.

Get A Sample Report : https://semiconductorinsight.com/download-sample-report/?product_id=97566

Report Scope

This market research report provides a comprehensive analysis of the global and regional 4D Radar Chip markets, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The Global 4D Radar Chip market was valued at USD 1.2 billion in 2024 and is projected to reach USD 3.5 billion by 2032, growing at a CAGR of 14.2%.

Segmentation Analysis: Detailed breakdown by product type (24 GHz, 77 GHz, 79 GHz), technology, application (automotive, drones, consumer electronics, military), and end-user industry to identify high-growth segments and investment opportunities.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, including country-level analysis where relevant. Asia-Pacific dominates with 48% market share in 2024.

Competitive Landscape: Profiles of leading market participants including NXP, Infineon, TI, and Uhnder, including their product offerings, R&D focus (22% average R&D expenditure), manufacturing capacity, pricing strategies, and recent developments.

Technology Trends & Innovation: Assessment of emerging technologies like AI integration (28% adoption rate in 2024), mmWave radar evolution, semiconductor design trends, and evolving automotive safety standards.

Market Drivers & Restraints: Evaluation of factors driving market growth (ADAS adoption growing at 19% CAGR) along with challenges like supply chain constraints (30% price volatility in 2023) and regulatory issues.

Stakeholder Analysis: Insights for component suppliers, OEMs (automotive sector accounts for 62% demand), system integrators, investors, and policymakers regarding the evolving ecosystem and strategic opportunities.

Primary and secondary research methods are employed, including interviews with industry experts, data from verified sources, and real-time market intelligence to ensure the accuracy and reliability of the insights presented.

Customisation of the Report

In case of any queries or customisation requirements, please connect with our sales team, who will ensure that your requirements are met.

Related Reports :

Contact us:

+91 8087992013

0 notes

Text

The Benefits of Smart Cars in Modern Cities

Smart cars are emerging as a transformative force. These vehicles, equipped with cutting-edge technology and advanced connectivity features, offer numerous advantages tailored to the demands of modern city life. As traffic congestion, pollution, and limited parking spaces become prevalent issues in urban areas, the benefits of smart cars in modern cities are becoming increasingly clear. From…

#ADAS#advanced transport#AI cars#autonomous tech#autonomous vehicles#carbon emissions#city car#city driving#Clean Energy#clean transport#connected cars#Eco-Friendly Cars#eco-technology#electric cars#electric SUV#electric transport#electric vehicles#emission reduction#energy efficiency#EVs#fuel efficiency#future of transport#green cities#hybrid cars#low emissions#modern cities#pollution reduction#ride-sharing#safety features#self-driving

0 notes