#ada compliance analysis

Explore tagged Tumblr posts

Text

WCAG 2.1 Level AA

ADA Site Compliance ensures digital services meet WCAG 2.1 Level AA standards and DOJ Title II compliance!

#Department of Justice (DOJ)#DOJ Title II#DOJ Title II Rule#new DOJ rule#government digital services accessible#digital services accessible#web accessibility solutions#web & mobile app accessibility#WCAG 2.1 Level AA#WCAG 2.1 standards#DOJ Civil Rights Division#accessibility standards#digital accessibility#accessibility issues#Americans with Disabilities Act (ADA)#ada compliance analysis#website accessibility solutions#ADA site compliance#ADASiteCompliance#adasitecompliance.com

0 notes

Text

Why a Commercial Estimating Service Is Essential for Mixed-Use Development Projects

Mixed-use development projects combine residential, commercial, hospitality, and sometimes institutional or cultural spaces into a single cohesive plan. While these projects offer vibrant, multi-functional communities and increased land-use efficiency, they also come with high complexity in both design and budgeting. A commercial estimating service is essential in navigating this complexity, helping stakeholders control costs, balance program requirements, and streamline planning from preconstruction through completion.

Understanding the Complexity of Mixed-Use Projects

Unlike single-purpose developments, mixed-use projects demand coordination between multiple functions—each with its own codes, building systems, and operational needs. Residential units may require soundproofing, individual HVAC units, and different egress requirements compared to commercial spaces. Retail tenants often have unique build-out requirements. Hospitality components may call for luxury finishes and complex mechanical systems.

A commercial estimating service brings structure to this multifaceted picture. Estimators break down the development into clearly defined zones, identify distinct cost drivers within each use, and prepare segmented estimates that allow developers to see how each component affects the total project cost.

Supporting Phased Construction and Cash Flow Planning

Mixed-use projects are often developed in phases due to financing, permitting, or logistical constraints. For instance, a developer may prioritize the retail podium and parking garage before proceeding with upper-level residential or hotel components.

Commercial estimating services support phased planning by producing detailed construction cost breakdowns by stage. This allows developers to align funding disbursements with construction sequencing and helps financial institutions assess risk based on projected cash flow needs.

Accounting for Shared Infrastructure

Mixed-use buildings typically rely on shared infrastructure—such as common mechanical rooms, centralized elevators, or joint-use amenities like lobbies, fitness centers, and parking structures. Allocating the costs of these shared systems accurately across the different uses is vital for budgeting, accounting, and financing.

Estimators evaluate how shared systems are used across program types and assign costs proportionally. This is especially important when different ownership structures are involved, such as when retail is held by one entity and residential by another.

Navigating Diverse Code Requirements

Each use within a mixed-use building is subject to specific building codes, occupancy classifications, fire safety standards, and ADA accessibility mandates. For example, a restaurant tenant may require commercial-grade ventilation and fire suppression systems, while hotel units may need emergency power and elevator recall.

A commercial estimating service works closely with architects, engineers, and code consultants to ensure that these varied code requirements are identified and accurately priced. This avoids surprises during plan review and ensures the project remains compliant without triggering costly redesigns.

Managing Tenant Improvements and Flexibility

Retail and commercial tenants often negotiate for custom build-outs and improvements beyond base building construction. These can include upgraded flooring, lighting, storefronts, signage, and even plumbing or kitchen installations.

Estimators provide separate allowances or hard numbers for these improvements, depending on lease terms and tenant agreements. This ensures both landlords and tenants understand their financial responsibilities and can plan accordingly. Where flexibility is needed for future changes in occupancy, the estimating service can price adaptable infrastructure (e.g., movable walls or modular utility connections).

Supporting Financial Feasibility and Pro Forma Development

One of the most critical early tasks in a mixed-use development is determining whether the project “pencils out.” Estimators play a key role by feeding accurate, data-backed construction costs into financial models. This enables developers to calculate projected returns, identify financing gaps, and secure investment based on realistic cost assessments.

If preliminary costs exceed target budgets, the estimating service can assist in value engineering—offering options that reduce costs while preserving project quality and functionality.

Enabling Efficient Procurement and Scheduling

With multiple project components running in parallel, procurement needs to be strategically managed. Items such as curtain walls, elevators, and mechanical systems may serve multiple building areas and must be ordered with precise specifications and lead times.

A commercial estimating service helps map out procurement schedules by forecasting long-lead items and aligning order timelines with construction phases. This prevents bottlenecks and enables better coordination across trades and suppliers.

Enhancing Owner and Stakeholder Communication

Mixed-use projects often involve multiple stakeholders—municipalities, investors, joint-venture partners, anchor tenants, and future residents. A clear, structured cost estimate enhances communication by showing how funds will be spent and which portions of the project account for the greatest investment.

By offering segmented and visualized estimates, commercial estimating services make it easier for all parties to understand the financial scope of the project and build confidence in the development team’s planning capabilities.

Conclusion

The integrated nature of mixed-use developments presents both opportunity and complexity. A commercial estimating service serves as the financial compass that helps developers navigate this intricate landscape. From phased construction and shared infrastructure to diverse codes and tenant expectations, estimators bring clarity, precision, and adaptability to ensure these ambitious projects remain financially viable and strategically sound. In the world of mixed-use construction, accurate cost estimation isn’t just beneficial—it’s indispensable.

#commercial estimating service#mixed-use project estimate#residential and retail cost#hotel construction estimate#tenant improvement costs#phased development budgeting#shared system allocation#MEP estimating#occupancy code estimate#ADA compliance cost#construction cash flow#pro forma cost inputs#segmented cost analysis#cost breakdown by use#high-rise mixed use estimating#commercial tenant allowances#hospitality build-out costs#retail shell pricing#value engineering mixed-use#estimating for development feasibility#multi-zone construction costs#LEED estimating mixed use#parking garage cost#procurement timeline planning#long-lead item estimates#construction financing support#estimating shared amenities#mixed-use coordination cost#architectural budgeting support#developer financial modeling

0 notes

Note

Okay I just read your post on thee stark tower and I was amazed by the amount of research you've done I absolutely loved it

Please hit us with any more facts you have (I'm also planning on making an essay on the stark tower and you've saved me literally)

actually me right now. smooches you.

BABES. ACTUALLY SCREAMING AND SOBBING. I DO IN FACT HAVE A FUCK MORE INFO SO THANK YOU FOR THE OPPORTUNITY TO YAP ABOUT MY NICHE BORDERLINE NEUROTIC OBSESSION WITH THIS!!!!!! read more bc this is going to be a long post lol

quick disclaimer!!:

while I try to make this info as canon compliant as possible (and I'm p sure I'm doing a good job with that aspect so far) please keep in mind that I am using some creative liberty to bridge certain gaps in terms of realism!!

that being said if there's anything you don't like or vibe with you can ABSOLUTELY headcanon it as something else. infinite realities infinite stark towers yk.

my goal with this is to give us all a concrete BASE for fics, shifting, visualization, maladaptive daydreaming, or just obsessive curiosity

tldr take this with a grain of salt and please feel free to use it as a jumping off point!!

ps specifically for sweet lovely anon here: HELL YEAH HELL YEAH STARK TOWER ESSAY THAT SOUNDS SICK AS FUCK!!!! (also if anyone does use this info in fics or use the images for stuff that is okay just PLS drop credit and or link back to my blog/these posts so if other people want unnecessarily detailed info on stark tower they too can fall down the rabbit hole of my obsessive research!!)

recap of stark tower's structure:

construction/remodels of Stark Tower started around december 2010, so Tony presumably bought and planned out everything some time before that

I've estimated the bottom 1/3 of the metlife building is in tact, and Stark Tower (the iconic part we see in the movies) was built on top of that

breakdown of stark tower floors/sections

I already briefly covered the basement levels, which I'll link to here

metlife building section (Floors 1–23) - elongated octagon shaped building (like a rectangle with the long sides curved out a little), first 23 floors are for Stark Industries corporate business stuff, broken down below.

1 (Ground Floor) →

Grand Lobby (30-ft ceilings), Reception, Guest Check-In

Heavy Security Checkpoints, Screening Areas

Express Elevators to Executive Levels

2–3 → Public/Corporate Relations, Press Rooms, Investor Relations

4–6 → Legal, HR, Internal Affairs, Compliance Departments

7–10 → Stark Financial Divisions (Accounting, Treasury, Economic Analysis)

11–15 → Business Development, Tech Licensing, Global Expansion

16–18 → R&D Administration, Patent Offices, Scientific Coordination

19–23 → Advanced Tech & Defense R&D, AI Research, Cybernetics

also included in these floors are several bathrooms on each floor (men's, women's, gender neutral, and ADA/wheelchair accessible), employee entrances and exits, public and employee elevators, and security checkpoints. Also yes there is a stark industries/iron man/tony themed gift shop on in the lobby. more on that later. also shout out to reddit user Hamton52 for pointing this out AND whipping up a nice lil ms paint visual aid!!:

Stark Tower (Floors 24–73) – this is the iconic part we all think of when we hear Stark Tower. yk, the swoopy glass part that sort of looks like a llama or smth. floors broken down below

24–28 → High-Security Stark Tech Labs (Exosuits, Nanotech, Arc Reactor Projects)

29–31 → AI & Robotics Labs (J.A.R.V.I.S./F.R.I.D.A.Y. Core Servers)

32–35 → Secure Weapons Testing, Energy Development (Repulsor Tech)

36–39 → Private Research Labs (Medical Tech, Sustainable Energy)

40–43 → High-Tech Storage (Iron Man Suit Vaults, Prototype Armors)

44–46 → Tony’s Personal Office, CEO Suite, Executive Lounge

47–48 → VIP Conference Rooms, Stark Board Meetings, High-Level Negotiations

49–51 → Penthouse Guest Suites (For Avengers, SHIELD VIPs, Personal Guests)

52–55 → The Party Floors (Entertainment Areas, Bars, Lounges, Dance Floors)

56–58 → The Vehicle Hanger (Flying Cars, Suit Deployment Platforms)

59–62 → The Workshop (Full-Scale R&D for Iron Man Suits, Flight Testing)

63–66 → Tony’s Personal Living Quarters (Bedroom, Private Study, Relaxation Areas)

67–70 → Stark’s Private Arsenal (Emergency Weapons, Suit Deployment, Backup Systems)

71–73 (Top Levels) →

Helipad/Rooftop

Emergency Escape Pods

Power Generators, Communication Arrays

ceiling heights and square footage per section - maybe unnecessary to some but very helpful for me lol

Ground Floor (Lobby) → 30 ft

Corporate/Office Floors (MetLife, Floors 2-23) → 12–14 ft per floor

Stark Tower Labs & R&D (Floors 24–45) → 15–18 ft per floor

Tony’s Private Areas (Suit Vaults, Living Quarters, Workshop) → 20 ft per floor

Vehicle Hangar & Rooftop Facilities → 30 ft+

Floors 24-40 (Lower Stark Floors) maintain a larger footprint (75,000 → 64,000 sq ft, 16 ft ceilings).

Floors 41-60 (Mid Stark Floors) taper gradually (62,500 → 48,000 sq ft, 18 ft ceilings).

Floors 61-73 (Upper Stark Floors & Penthouse) shrink more dramatically (47,000 → 28,000 sq ft, 20-30 ft ceilings) due to the tower's artistic design and Tony’s luxurious penthouse.

The Penthouse (Floor 73) has the highest ceiling at 30 ft, making it the most open and spacious level.

so yeah, there's your ref for the floors n stats we're working with!! pls expect several more posts in the next little bit about the employees in stark tower, visuals for each floor (i've done all the basement floors so far, and the first 2 or 3 above ground floors so that might need to be broken up into multiple parts lol) anyway yeah!!! more infodumping coming as fast as my little fingies can type it up!!!

DISCLAIMER: the lists of floors and their content were partially generated with chatgpt, everything else was organically written by me without the use of ai

#op's world building (we're just living in it)#HILARIOUS that that's the tag I chose btw#tony stark#mcu#marvel cinematic universe#avengers#avengers headcanons#mcu headcanons#marvel headcanons#stark tower#tw ai

11 notes

·

View notes

Text

Automotive Cockpit Electronics Market Size, Share & Trends Analysis Report By Forecasts 2034

As per a recent report by Fact.MR, the size of the global automotive cockpit electronics market has been estimated to be worth US$ 56.1 billion in 2024 and is likely to move forward at a 5% CAGR (2024-2034) to reach a valuation of US$ 91.2 billion towards the end of 2034.

A major trend within the automotive cockpit electronics market is the pace of technology developments, ranging from advanced driver-assistance systems (ADAS) to electric vehicle incorporation and in-car connectivity. Global demand for autonomous vehicles and electric vehicles is also increasing gradually, which will propel growth of this market. Automotive innovation within cockpit electronics will be one of the top concerns of automakers.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=9985

What are the Drivers of Global Automotive Electronics Market Growth?

"Strict Safety and Compliance Standards in Automotive Electronics"

Traditional cockpit components like steering, music systems, HVAC, brakes, and navigation systems are covered under it. These components are controlled manually. These distract drivers many times and increase the accident possibility.

Electronic cockpits have evolved several screens providing all the pertinent details. This amiable human machine interface (HMI) provides simple communication and vehicle control for the driver, enhancing vehicle safety and lowering the chances of accidents.

Country-wise Insights

China in the East Asia region is expected to maintain a dominant market share of 58.7% in 2024 with a market value of US$ 8.14 billion.

At the global level, the North American region has a dominant automotive cockpit electronics market share of approximately 27.8%, with the value of the market estimated at US$ 15.6 billion in 2024.

Category-specific Insights

Infotainment & navigation systems are highly sought after at present and have a dominant market share of 28.7% in 2024. The segment is estimated at US$ 16.11 billion in 2024 and is anticipated to grow to US$ 25.28 billion by 2034.

Passenger cars are estimated to capture a market share of 63.7% by 2024. The segment holds a market value of US$ 35.75 billion in the year 2024 and has been estimated to grow at 5.8% CAGR during 2034.

Competition Landscape

Continental AG, DENSO CORPORATION, Visteon Corporation, Harman International Industries Inc., Alpine Electronics Inc., Clarion Company Ltd., Delphi Automotive Plc, Robert Bosch GmbH., Panasonic Corporation, Garmin Ltd., Samsung Electronics, and Magneti Marelli are major players in the international automotive cockpit electronics market.

Industry participants are emphasizing market differentiation with digital offerings and fresh designs. Firms are aligning with technology leaders to access expertise and resources needed for the production of sophisticated electronic cockpits. Inter-industry collaboration with technology giants is enabling market participants to upgrade their products.

In January 2024, Visteon Corporation released SmartCore® Service Oriented Architecture (SOA) platform, AllGo® Connected Services, and SmartZone Zonal Controller concept. These are intended to expand its product line and provide it with a market competitive advantage.

In January 2024, Robert Bosch GmbH and Qualcomm Technologies, Inc. introduced the automotive industry's first-ever central vehicle computer. The platform is capable of running advanced driver assistance system (ADAS) features along with infotainment software on a single platform simultaneously.

In December 2023, Continental AG partnered with Korean semiconductor firm Telechips. Continental took this strategic step for cost minimization. It also introduced a new 'Smart Cockpit High-Performance Computer' for OEMs. This new HPC system is developed for cost-optimization and an efficient and streamlined solution for automakers.

Segmentation of Automotive Cockpit Electronics Market Research

By Product :

Infotainment & Navigation

Information Displays

Head-up Displays

Instrument Clusters

Telemetric

By Vehicle Category :

Passenger Vehicles

Commercial Vehicles

By Region :

North America

Latin America

Western Europe

Eastern Europe

East Asia

South Asia & Pacific

Middle East & Africa

𝐂𝐨𝐧𝐭𝐚𝐜𝐭:

US Sales Office 11140 Rockville Pike Suite 400 Rockville, MD 20852 United States Tel: +1 (628) 251-1583, +353-1-4434-232 Email: [email protected]

1 note

·

View note

Text

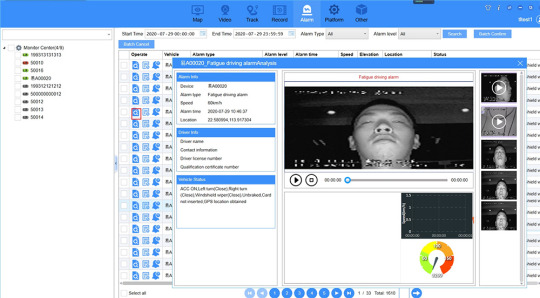

ICARVISIONS AI: Drive Smarter, Drive Safer

Revolutionizing Vehicle Safety Through Artificial Intelligence

ICARVISIONS, one of the leading manufacturers of MDVR technology, presents our new generation AI-MDVR system. Built on a decade of expertise and customer insights, our solution transforms everyday driving into a safer, smarter experience.

Smart Technology for Smarter Driving

Our AI-MDVR system combines advanced cameras, sensors, and real-time processing to create a comprehensive safety ecosystem. The system actively monitors your vehicle's environment, providing instant alerts and actionable insights through:

Real-time video analysis

Audio warnings

Cloud-based data transmission via 3G/4G/5G networks

Complete fleet telematics integration

Core Safety Features

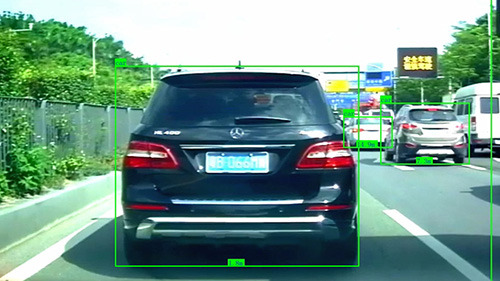

ADAS (Advanced Driver Assistance System)

Transform your vehicle into an intelligent safety companion with features designed to prevent accidents before they happen:

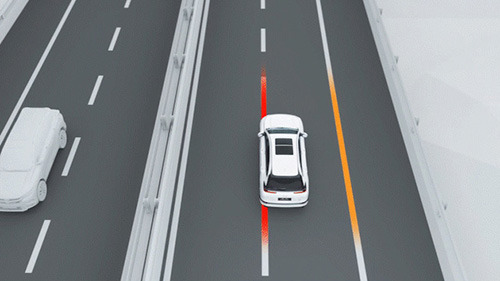

Lane Departure Warning: Alerts drivers when vehicle unintentionally drifts from lane, keeping you safely on track.

Safe Distance Warning: Monitors and maintains optimal distance between vehicles based on your speed.

Pedestrian Collision Warning: Detects pedestrians in vehicle's path and provides instant alerts.

Forward Collision Warning: Prevents rear-end collisions through early warning of sudden braking or slowing vehicles ahead.

DSM (Driver Status Monitor)

The Driver Monitoring System (DSM) helps evaluate driver behavior and enhance fleet efficiency by analyzing alarm data to identify top-performing drivers. Our comprehensive monitoring features include:

Driver Authentication: Facial recognition ensures only authorized drivers operate vehicles

Fatigue Detection:

Monitors yawning patterns

Tracks eye movement and closure

Detects driver distraction and absence

Safety Compliance Monitoring:

Smoking detection

Phone usage detection

Camera obstruction detection

BSD (Blind Spot Detection)

Experience complete situational awareness with our advanced blind spot monitoring system:

Sound and light-based object detection

Seamless integration with video monitoring

I/O linkage for comprehensive vehicle control

Why Choose ICARVISIONS AI-MDVR?

Proactive Safety: Prevents accidents through early warning systems

Comprehensive Coverage: Monitors both external threats and driver behavior

Fleet Optimization: Improves driver performance and reduces operational risks

Future-Ready: Leverages cutting-edge AI technology for continuous improvement

Smart Features for Every Journey

Our AI-MDVR system doesn't just record - it actively protects. By analyzing real-time data and providing immediate feedback, we help:

Reduce accident rates

Improve driver behavior

Enhance fleet efficiency

Ensure regulatory compliance

Protect your investment

Source

ICARVISIONS WEB AI

1 note

·

View note

Text

HIL Testing: Elevating Embedded System Validation

Hardware-in-the-Loop (HIL) testing is a transformative approach in engineering, enabling the validation of embedded systems by integrating real hardware with simulated environments. Widely adopted in industries such as automotive, aerospace, and industrial automation, HIL testing ensures reliability, safety, and performance before deployment. By replicating real-world conditions in a controlled setting, it bridges the gap between software simulation and physical testing. This article delves into the principles, process, applications, benefits, challenges, and future of HIL testing in modern engineering.

What is HIL Testing?

HIL testing is a real-time simulation technique that connects physical hardware, such as an electronic control unit (ECU) or actuator, with a virtual model of its operating environment. The system uses a real-time simulator to run mathematical models that mimic physical conditions—e.g., vehicle dynamics, temperature variations, or electrical loads—while the hardware responds as it would in reality. This interaction allows engineers to assess functionality, detect faults, and refine designs without requiring a fully assembled prototype. Tools like dSPACE, National Instruments, and MathWorks Simulink are commonly employed for HIL setups.

How HIL Testing Works

The HIL testing process follows a structured workflow:

Model Development: Engineers create a digital representation of the system’s environment using simulation software.

Hardware Setup: The hardware under test (HUT) is connected to the simulator via interfaces like CAN, Ethernet, or analog I/O.

Simulation Execution: The simulator generates inputs (e.g., sensor data) and sends them to the HUT, which processes them and returns outputs.

Analysis: Results are monitored and evaluated to verify performance, stability, and compliance with specifications.

Iteration: Based on findings, adjustments are made, and tests are rerun.

For instance, in automotive applications, HIL testing might simulate road conditions and engine behavior, allowing an ECU to adjust fuel injection, with engineers analyzing the response for optimization.

Key Components of HIL Testing

A typical HIL system includes:

Real-Time Simulator: A high-performance computer or dedicated hardware running the simulation model with precise timing.

Hardware Under Test (HUT): The actual component, such as a controller or sensor, being validated.

Interface Hardware: Bridges the simulator and HUT, handling signal conversion and communication.

Simulation Models: Mathematical representations of the system’s environment, tailored to specific test scenarios.

Test Management Software: Tools for automating tests, logging data, and visualizing results.

Benefits of HIL Testing

HIL testing offers numerous advantages:

Cost Savings: Eliminates the need for multiple physical prototypes, reducing material and labor expenses.

Risk Reduction: Safely tests hazardous or extreme conditions without endangering hardware or personnel.

Early Validation: Identifies issues during development, preventing costly redesigns later.

Repeatability: Ensures consistent test conditions, unlike variable real-world environments.

Time Efficiency: Accelerates development by enabling parallel testing of multiple scenarios.

Applications of HIL Testing

HIL testing is critical across various sectors:

Automotive: Validates ECUs for engine management, anti-lock braking systems (ABS), and advanced driver-assistance systems (ADAS), simulating driving dynamics.

Aerospace: Tests flight control units and avionics under simulated aerodynamic and environmental conditions.

Robotics: Ensures precise coordination between sensors, actuators, and controllers in robotic systems.

Power Electronics: Optimizes control systems for renewable energy devices like solar inverters.

Medical Devices: Verifies the reliability of embedded systems in equipment like ventilators or infusion pumps.

Challenges in HIL Testing

Despite its benefits, HIL testing presents challenges:

Model Accuracy: Inaccurate simulations can lead to unreliable results, requiring high-fidelity models.

Complexity: Setting up and maintaining HIL systems demands expertise in hardware and software integration.

Hardware Costs: Initial investment in simulators and interfaces can be substantial.

Real-Time Constraints: Ensuring simulations match the timing of physical systems is technically demanding.

Scalability: Expanding HIL setups for larger, interconnected systems can be difficult.

Future Trends in HIL Testing

The future of HIL testing is shaped by emerging technologies:

Artificial Intelligence (AI): AI enhances test coverage by generating complex scenarios and predicting outcomes.

Cloud Integration: Enables remote HIL testing, fostering collaboration and reducing infrastructure costs.

Digital Twins: Real-time digital replicas improve accuracy and support continuous validation.

Advanced Communication: Supports protocols like 5G and Ethernet for faster data exchange.

Sustainability: Focuses on energy-efficient testing to align with green engineering goals.

The growth of autonomous vehicles, IoT devices, and Industry 4.0 drives the need for more advanced HIL testing solutions, ensuring robust performance in smart systems.

Role in the Development Lifecycle

HIL testing is integral at multiple stages:

Design Phase: Validates early concepts and control strategies.

Testing Phase: Confirms hardware meets requirements under simulated conditions.

Pre-Production: Ensures readiness before mass manufacturing.

Post-Deployment: Supports diagnostics and updates for fielded systems.

Career Opportunities

HIL testing expertise opens doors to roles like HIL engineer, systems validation specialist, and simulation analyst. Opportunities abound in automotive, aerospace, and tech industries, with certifications in tools like dSPACE or NI VeriStand enhancing employability. The field offers competitive salaries and growth potential as demand for embedded system validation rises.

Conclusion

HIL testing is a cornerstone of modern engineering, providing a safe, efficient, and accurate method to validate embedded systems. Its ability to simulate real-world scenarios while interfacing with hardware ensures reliability and performance across industries. Despite challenges, advancements like AI and cloud computing promise to enhance its effectiveness. As technology evolves, HIL testing will remain vital in developing innovative, dependable solutions for the future.

#HILTesting#EmbeddedSystems#SystemValidation#EngineeringInnovation#AutomotiveTech#AerospaceEngineering#RealTimeSimulation#TechAdvancement#IndustrialAutomation#SafetyTesting

0 notes

Text

Next-Gen Test Equipment: Oscilloscope Chip Market Trends, Applications & Strategies (2025–2032)

The global Oscilloscope Chip Market size was valued at US$ 1.89 billion in 2024 and is projected to reach US$ 2.67 billion by 2032, at a CAGR of 4.4% during the forecast period 2025-2032. While the semiconductor industry faced headwinds in 2022 with only 4.4% growth (down from 26.2% in 2021), specialized IC segments like oscilloscope chips continue steady expansion due to their critical role in test and measurement applications.

An oscilloscope chip is a highly integrated semiconductor component that replicates core functions of traditional oscilloscopes – including signal acquisition, waveform processing, and display capabilities – within a compact IC package. These chips typically incorporate analog front-ends, high-speed ADCs, trigger circuits, and memory buffers, enabling real-time signal analysis across industries ranging from telecommunications to aerospace.

The market growth is driven by increasing demand for compact test solutions in 5G infrastructure deployment and IoT device manufacturing. Automotive applications show particular promise, with advanced driver-assistance systems (ADAS) requiring precise signal measurement. However, design complexity and thermal management challenges in high-bandwidth applications remain constraints. Leading players like Analog Devices and Texas Instruments continue innovating, with recent product launches featuring 10-bit vertical resolution and 2GHz bandwidths for next-generation oscilloscope designs.

65% share, fueled by semiconductor manufacturing expansion in Taiwan, South Korea, and China.

Get Full Report with trend analysis, growth forecasts, and Future strategies : https://semiconductorinsight.com/report/oscilloscope-chip-market/

Segment Analysis:

By Type

AMP Chip Segment Leads Due to Critical Role in Signal Amplification and Processing

The oscilloscope chip market is segmented based on type into:

AMP Chip

Subtypes: High-speed, Low-noise, and Precision amplifiers

Memory Chip

Processing Units

Subtypes: Digital signal processors and FPGA-based units

Others

By Application

IT and Communications Segment Dominates Due to Growing Demand for High-Speed Data Processing

The market is segmented based on application into:

IT and Communications

Consumer Electronics

Automobile

Aviation and Defense

Others

By Bandwidth

High-Bandwidth Chips Gaining Market Share Owing to Advanced Testing Requirements

The market is segmented based on bandwidth capacity into:

Low Bandwidth (Below 1 GHz)

Medium Bandwidth (1-10 GHz)

High Bandwidth (Above 10 GHz)

By Form Factor

Integrated Chips Segment Expanding Due to Compact Design Requirements

The market is segmented based on form factor into:

Discrete Components

Integrated Circuits

System-on-Chip Solutions

Regional Analysis: Oscilloscope Chip Market

North America The North American oscilloscope chip market is characterized by strong technological innovation and high adoption rates in key sectors such as aviation, defense, and telecommunications. The region benefits from significant investments in 5G infrastructure, with the U.S. alone allocating over $80 billion for wireless communication advancements by 2025. Major players like Texas Instruments and Analog Devices dominate the supply chain, leveraging advanced semiconductor manufacturing capabilities. However, supply chain disruptions and trade restrictions pose challenges for raw material procurement. Despite this, demand remains robust due to increased R&D spending in aerospace and autonomous vehicle technologies, where high-speed signal processing is critical.

Europe Europe’s oscilloscope chip market is driven by stringent compliance standards and industrial automation trends. The EU’s focus on Industry 4.0 and smart manufacturing accelerates demand for precision measurement ICs, particularly in Germany and France. Key manufacturers like Infineon Technologies and STMicroelectronics lead the market with energy-efficient and compact chip designs. Regulatory frameworks, such as the Restriction of Hazardous Substances (RoHS) Directive, necessitate eco-friendly semiconductor solutions. While growth is steady, economic instability in Eastern Europe and declining automotive production in some regions moderate expansion. Nevertheless, increasing adoption in renewable energy systems provides a promising growth avenue.

Asia-Pacific As the largest consumer of oscilloscope chips, the Asia-Pacific region thrives due to massive electronics production in China, South Korea, and Japan. The rapid rollout of IoT devices and 5G networks fuels demand, with China accounting for over 40% of global semiconductor consumption. Local giants like Samsung Electronics and SK Hynix dominate memory chip production, while Japanese firms excel in high-precision analog ICs. However, supply chain vulnerabilities and geopolitical tensions threaten stability. India’s burgeoning tech sector presents opportunities, though infrastructure gaps and tariff barriers slow market penetration. The region remains a hotspot for cost-effective, high-volume oscilloscope chip solutions.

South America South America’s oscilloscope chip market is nascent but growing, driven by Brazil’s industrial automation and Argentina’s telecom sector. Limited local manufacturing forces reliance on imports, primarily from the U.S. and Asia. Economic volatility and currency fluctuations hinder consistent investment, though sectors like agricultural tech and renewable energy show increasing demand for embedded measurement systems. Governments are gradually incentivizing semiconductor projects, but bureaucratic hurdles delay progress. Despite challenges, the region’s expanding IT infrastructure signals long-term potential for oscilloscope IC suppliers willing to navigate its complex market dynamics.

Middle East & Africa The Middle East & Africa region exhibits moderate but uneven growth in oscilloscope chip adoption. UAE and Saudi Arabia lead with smart city initiatives and defense modernization programs, creating demand for high-performance ICs. Africa’s market is constrained by limited industrialization, though telecom expansions in countries like Nigeria and South Africa drive incremental growth. Dependence on imports and logistical inefficiencies remain key barriers, compounded by low local expertise in advanced semiconductor applications. Strategic partnerships with global suppliers and gradual infrastructure investments are expected to unlock opportunities in niche markets over the next decade.

MARKET OPPORTUNITIES

Emerging AI Testing Requirements Create New Market Segments

The rapid adoption of AI accelerators presents significant opportunities for oscilloscope chip manufacturers. Modern AI chips with tera-scale computing capabilities require unprecedented signal integrity verification during development. Specialized oscilloscope ICs capable of analyzing power delivery networks with sub-nanosecond resolution are becoming essential for AI chip validation. The AI hardware market, projected to exceed $250 billion by 2030, represents a substantial greenfield opportunity for innovative oscilloscope chip solutions.

Advancements in Quantum Computing Open New Frontiers

The development of quantum computing systems creates demand for specialized oscilloscope chips operating at cryogenic temperatures. Quantum processors require ultra-low-noise signal analysis at millikelvin temperatures, presenting unique design challenges. Several national quantum initiatives with combined funding exceeding $30 billion globally are driving demand for customized test solutions. Companies developing cryogenic-compatible oscilloscope ICs stand to gain first-mover advantage in this emerging niche.

Expansion of Open-RAN Networks Drives Testing Demand

The global shift toward open-RAN architecture in telecommunications creates substantial opportunities for oscilloscope chip vendors. Unlike traditional base stations, open-RAN systems require extensive interoperability testing across components from different vendors. This paradigm shift is driving demand for oscilloscope chips with enhanced protocol analysis capabilities. With open-RAN deployments expected to account for 15% of all cellular infrastructure by 2027, the testing requirements will continue to expand.

OSCILLOSCOPE CHIP MARKET TRENDS

Growing Demand for High-Speed Signal Analysis Driving Market Expansion

The oscilloscope chip market is experiencing robust growth due to the increasing need for high-speed signal analysis across industries such as telecommunications, automotive, and consumer electronics. With data rates exceeding 100 Gbps in modern communication systems, oscilloscope chips must support faster sampling rates and higher bandwidths to accurately capture signal integrity issues. The global oscilloscope chip market is projected to grow at a compound annual growth rate of approximately 7-9% through 2032, driven by continuous advancements in prototyping and testing requirements for next-generation electronics. Major chip manufacturers are responding by developing integrated solutions that combine analog front-end processing with digital signal conditioning in single packages.

Other Trends

Automotive Electronics Revolution

The rapid electrification of vehicles and development of autonomous driving systems has created substantial demand for advanced oscilloscope chips capable of analyzing complex automotive bus protocols. Modern vehicles contain over 100 electronic control units communicating via CAN FD, FlexRay, and automotive Ethernet networks, requiring test equipment with specialized decoding capabilities. This sector alone is expected to account for nearly 25% of the oscilloscope chip market by 2026, particularly for chips supporting protocol-aware triggering and multi-domain synchronization.

Integration of AI and Machine Learning Features

Oscilloscope chip manufacturers are increasingly incorporating AI acceleration cores directly into their designs to enable real-time signal processing and automated measurement capabilities. These enhancements allow for predictive maintenance applications, anomaly detection in high-speed signals, and adaptive triggering systems that learn from historical waveform patterns. The integration of such intelligent features is particularly valuable in industrial IoT applications where continuous monitoring of equipment vibration signatures and power quality metrics requires sophisticated analysis that traditional oscilloscope architectures cannot efficiently perform. Industry leaders have reported that AI-enabled oscilloscope chips can reduce debugging time by up to 40% in complex embedded systems development.

Miniaturization and Power Efficiency Improvements

As portable test equipment becomes increasingly prevalent, oscilloscope chip designs are prioritizing reduced power consumption and smaller form factors without sacrificing performance. Current generation chips offer sampling rates exceeding 10 GS/s while consuming less than 2W, enabling their use in battery-powered handheld oscilloscopes and modular test systems. This trend aligns with the broader semiconductor industry’s shift toward more energy-efficient designs, particularly important for field service applications where thermal management and battery life are critical factors. Recent technological breakthroughs in low-power ADC architectures and mixed-signal integration techniques have been particularly instrumental in driving these improvements.

COMPETITIVE LANDSCAPE

Key Industry Players

Semiconductor Giants Intensify Innovation to Capture Market Share

The global oscilloscope chip market features a diverse competitive landscape, with dominant semiconductor companies competing alongside specialized IC manufacturers. Texas Instruments Incorporated and Analog Devices are currently leading the market, thanks to their extensive product portfolios that cater to high-performance oscilloscope applications across multiple industries. These companies have consistently invested in precision signal processing technologies, which are critical for modern oscilloscope functionalities.

While the established players maintain strong positions, emerging competitors like RIGOL TECHNOLOGIES are gaining traction by focusing on cost-effective solutions for educational and entry-level professional markets. This diversification in product offerings across price points creates a dynamic competitive environment where innovation and pricing strategies both play crucial roles.

The market has seen increased activity in strategic partnerships and acquisitions, with companies expanding their technological capabilities and market reach. STMicroelectronics and Infineon Technologies have been particularly active in this regard, acquiring smaller firms to enhance their analog and mixed-signal expertise. These moves are strategically important as the industry shifts toward higher bandwidth requirements and more integrated solutions.

Meanwhile, Asian manufacturers including Samsung Electronics and SK Hynix Semiconductor are intensifying their focus on memory components critical for oscilloscope applications. Their growing influence in the supply chain presents both competitive pressure and partnership opportunities for established Western firms.

List of Key Oscilloscope Chip Companies Profiled

Analog Devices (U.S.)

Infineon Technologies (Germany)

NXP Semiconductors (Netherlands)

Renesas Electronics Corporation (Japan)

Texas Instruments Incorporated (U.S.)

STMicroelectronics (Switzerland)

Onsemi (U.S.)

Microchip Technology (U.S.)

Micron Technology (U.S.)

Samsung Electronics (South Korea)

SK Hynix Semiconductor (South Korea)

RIGOL TECHNOLOGIES (China)

Learn more about Competitive Analysis, and Forecast of Global Oscilloscope Chip Market : https://semiconductorinsight.com/download-sample-report/?product_id=103120

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Oscilloscope Chip Market?

-> Oscilloscope Chip Market size was valued at US$ 1.89 billion in 2024 and is projected to reach US$ 2.67 billion by 2032, at a CAGR of 4.4% during the forecast period 2025-2032.

Which key companies operate in Global Oscilloscope Chip Market?

-> Key players include Analog Devices, Texas Instruments, Infineon Technologies, NXP Semiconductors, and STMicroelectronics, commanding over 65% market share.

What are the key growth drivers?

-> Primary growth drivers include 5G infrastructure rollout (projected 3.6 billion 5G connections by 2025), automotive electronics (15% CAGR), and industrial IoT adoption.

Which region dominates the market?

-> Asia-Pacific leads with 42% market share (2024), driven by semiconductor manufacturing in China, South Korea, and Taiwan. North America shows strongest growth in high-performance segments.

What are the emerging trends?

-> Emerging trends include AI-accelerated signal processing, integration with spectrum analyzer functions, and development of low-power designs for portable test equipment.

Browse Related Reports :

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014 +91 8087992013 [email protected]

0 notes

Text

Synchronous Static Random Access Memory (SSRAM) Market: Regulatory Developments and Compliance Outlook 2025–2032

Synchronous Static Random Access Memory (SSRAM) Market, Trends, Business Strategies 2025-2032

Synchronous Static Random Access Memory (SSRAM) Market size was valued at US$ 2.03 billion in 2024 and is projected to reach US$ 3.67 billion by 2032, at a CAGR of 7.64% during the forecast period 2025–2032.

Our comprehensive Market report is ready with the latest trends, growth opportunities, and strategic analysis https://semiconductorinsight.com/download-sample-report/?product_id=103184

MARKET INSIGHTS

The global Synchronous Static Random Access Memory (SSRAM) Market size was valued at US$ 2.03 billion in 2024 and is projected to reach US$ 3.67 billion by 2032, at a CAGR of 7.64% during the forecast period 2025–2032.

Synchronous Static Random Access Memory (SSRAM) is a high-performance memory technology that combines the speed of SRAM with synchronous operation for improved system timing. Unlike conventional asynchronous SRAM, SSRAM synchronizes data transfers with the system clock, enabling more efficient operation in high-speed applications such as networking equipment, enterprise storage, and aerospace systems. Key variants include binary and ternary SSRAM architectures.

The market growth is driven by increasing demand for low-latency memory solutions in 5G infrastructure and data centers, where SSRAM’s deterministic access times provide critical performance advantages. However, pricing pressures from competing technologies like DDR SDRAM present challenges. Recent developments include Samsung’s 2023 launch of a new 16Mb low-power SSRAM solution targeting IoT edge devices, signaling expansion beyond traditional networking applications.

List of Key Synchronous SRAM Manufacturers Profiled

Cypress Semiconductor (Germany)

Samsung Electronics (South Korea)

Intel Corporation (U.S.)

ADATA Technology (Taiwan)

Renesas Electronics (Japan)

Integrated Silicon Solution Inc. (U.S.)

ON Semiconductor (U.S.)

LyonTek (Taiwan)

Texas Instruments (U.S.)

Kingston Technology (U.S.)

Amic Technology (U.S.)

Segment Analysis:

By Type

Binary SRAM Segment Dominates Due to Widespread Adoption in High-Performance Computing

The market is segmented based on type into:

Binary SRAM

Ternary SRAM

By Application

Smartphones Lead Market Share Due to Increasing Demand for High-Speed Memory Solutions

The market is segmented based on application into:

Laptops

Cameras

Smartphones

Others

By End User

Consumer Electronics Sector Drives Growth with Continuous Technological Advancements

The market is segmented based on end user into:

Consumer Electronics

Automotive

Telecommunications

Industrial

Aerospace & Defense

Regional Analysis: Synchronous Static Random Access Memory (SSRAM) Market

North America The North American SSRAM market is characterized by strong demand from advanced computing, networking equipment, and aerospace/defense sectors. The U.S. dominates regional consumption, accounting for over 80% of market share, driven by major semiconductor companies and defense contractors requiring high-speed memory solutions. Investments in AI infrastructure (projected to grow at 25% CAGR through 2030) and 5G network rollouts are creating additional demand. The region benefits from concentrated R&D centers and early adoption of cutting-edge memory technologies, though supply chain diversification remains a challenge amidst geopolitical tensions.

Europe Europe’s SSRAM market shows steady growth, particularly in automotive electronics and industrial automation applications. Germany and France lead adoption due to their robust automotive sectors implementing advanced driver-assistance systems (ADAS). Strict EU regulations on data security and energy efficiency push manufacturers toward low-power SSRAM variants. However, the region faces competition from Asian memory producers, prompting EU initiatives like the Chips Act—allocating €43 billion to bolster semiconductor sovereignty. The medical device sector also contributes to specialty SSRAM demand for real-time diagnostic equipment.

Asia-Pacific As the fastest-growing SSRAM market, Asia-Pacific benefits from massive electronics manufacturing ecosystems in China, South Korea, and Taiwan. China alone consumes over 35% of global SSRAM production, driven by smartphone makers and data center expansions. While Japan remains critical for high-reliability industrial-grade memory, Southeast Asia emerges as a cost-effective production hub. The region’s 5G infrastructure boom and government subsidies for semiconductor self-sufficiency (like China’s $150 billion semiconductor fund) accelerate adoption. However, inventory fluctuations and trade restrictions periodically disrupt supply-demand balance.

South America South America’s SSRAM market is niche but growing, primarily serving telecommunications upgrades and industrial automation projects. Brazil accounts for nearly 60% of regional demand, with increasing SSRAM usage in smart meter deployments and automotive electronics. Currency volatility and import dependencies constrain market expansion, though local assembly initiatives in Argentina and Colombia aim to reduce lead times. The lack of domestic semiconductor fabs keeps the region reliant on Asian and North American suppliers, creating opportunities for distributors offering competitive logistics solutions.

Middle East & Africa This region shows nascent but promising SSRAM adoption, particularly in UAE and Saudi Arabia’s smart city projects and oil/gas sector automation. Telecom infrastructure upgrades across Africa drive baseline demand, though political instability and limited technical expertise hinder advanced applications. Israel stands out as a innovation hub for specialized SSRAM in military and medical devices. While currently comprising less than 3% of global SSRAM trade, strategic investments in data centers (like Saudi Arabia’s $18 billion commitment) suggest long-term growth potential once supply chains mature.

MARKET DYNAMICS

The explosive growth of artificial intelligence and machine learning applications presents significant opportunities for SSRAM technology. Neural network inference at the edge requires memory subsystems capable of sustaining tera-operations per second with minimal latency. Current implementations show SSRAM delivering 3-5x better performance than alternatives in real-time AI applications. Specialized architectures combining processing elements with embedded SSRAM are achieving energy efficiencies under 1pJ per operation, making them viable for deployment in smart sensors and endpoint devices. The market for AI-optimized memory solutions is projected to expand at over 25% annually as model complexities continue increasing exponentially.

Emerging 3D packaging technologies like chiplet architectures and silicon interposers are creating opportunities for SSRAM in novel configurations. Hybrid memory cubes combining logic and memory in vertical stacks have demonstrated bandwidth improvements exceeding 5x compared to traditional arrangements. These approaches also help address power and thermal challenges by reducing interconnect lengths by up to 90%. Major semiconductor companies are investing heavily in these advanced packaging techniques, with some reporting 40% reductions in power consumption for memory-intensive applications. The ability to integrate SSRAM with processing elements at the package level opens new possibilities for domain-specific architectures.

The ongoing Industry 4.0 revolution creates growing demand for high-reliability memory solutions in industrial environments. SSRAM’s radiation hardening and single-event upset immunity make it particularly suited for factory automation equipment exposed to electromagnetic interference. Predictive maintenance systems processing sensor data at the edge require memory that can operate reliably for years without maintenance in harsh conditions. Temperature ranges from -40°C to 125°C are becoming standard requirements, pushing the limits of conventional memory technologies. Industrial applications now represent the fastest-growing vertical for ruggedized SSRAM products, with compound annual growth exceeding 18%.

The SSRAM market faces significant challenges from ongoing semiconductor supply chain disruptions. Specialized fab capacity for high-performance memory remains constrained, with lead times stretching to 40+ weeks for some product categories. The concentration of advanced memory production in limited geographical regions creates vulnerability to geopolitical tensions and trade disputes. Automotive and industrial customers report that memory component shortages are delaying product shipments by 6-9 months in some cases. While fab investments are increasing, the 2-3 year lead time for new capacity means supply-demand imbalances may persist until at least 2026.

As SSRAM technology approaches the 10nm node, fundamental physics challenges are emerging. Quantum tunneling effects become significant at these dimensions, increasing leakage currents and reducing noise margins. Maintaining signal integrity at multi-GHz frequencies requires increasingly sophisticated equalization techniques that consume additional power. The industry is investing heavily in new materials and architectures, but each process node transition now requires 2-3 years of development compared to the historical 18-month cadence. This slowing of Moore’s Law makes it increasingly difficult to deliver the performance improvements that customers have come to expect.

SSRAM faces intensifying competition from alternative memory technologies offering different performance tradeoffs. Emerging non-volatile memories like MRAM and ReRAM promise near-SRAM speeds with zero standby power, making them attractive for battery-powered applications. While these technologies currently lag in density and endurance, recent breakthroughs have narrowed the performance gap to within 20% for many use cases. The industry is also seeing increased adoption of high-bandwidth memory (HBM) solutions that combine the benefits of DRAM density with SRAM-like bandwidth through advanced packaging. As these alternatives mature, they threaten to displace SSRAM in applications where its traditional advantages become less differentiating.

The market is highly fragmented, with a mix of global and regional players competing for market share. To Learn More About the Global Trends Impacting the Future of Top 10 Companies https://semiconductorinsight.com/download-sample-report/?product_id=103184

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Synchronous Static Random Access Memory (SSRAM) Market?

Which key companies operate in Global SSRAM Market?

What are the key growth drivers?

Which region dominates the market?

What are the emerging trends?

CONTACT US: City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014 [+91 8087992013] [email protected]

0 notes

Text

Real-Time Responses Improve Lead Conversion Rates

Market Overview

The ChatBot Market is rapidly gaining momentum as businesses across industries embrace automation and AI-driven tools to streamline customer communication. At its core, a chatbot is a software program designed to simulate human-like conversations with users—often deployed on websites, messaging apps, or mobile platforms. From answering customer queries and providing technical support to helping users make purchases or schedule appointments, chatbots are reshaping how businesses interact with their audience.

In 2023, the global ChatBot Market was valued at approximately USD 5.6 billion. With digital transformation accelerating and AI becoming more accessible, the market is expected to witness extraordinary growth, reaching a projected value of USD 45.3 billion by 2033, registering a robust CAGR of 23.2% over the forecast period. This expansion reflects not only the technological advancements but also the increasing trust businesses place in conversational AI to boost efficiency and user experience.

Click to Request a Sample of this Report for Additional Market Insights: https://infinitymarketresearch.com/request-sample/1117

Market Dynamics

Several key factors are fueling the growth of the ChatBot Market. First, the increasing demand for 24/7 customer service has pushed businesses to seek cost-effective and scalable solutions. Chatbots offer a round-the-clock communication channel that can handle multiple inquiries simultaneously, eliminating the limitations of human-only support systems.

Second, advances in natural language processing (NLP) and machine learning have made chatbots significantly smarter. Modern bots can understand context, tone, and even multilingual queries, offering more human-like and efficient interactions. These improvements are not just enhancing the customer experience but are also helping businesses personalize their services and deepen engagement.

The integration of chatbots into platforms like WhatsApp, Facebook Messenger, and e-commerce websites has also become more seamless. With APIs and chatbot-building platforms becoming easier to use, even small and medium-sized businesses can now deploy customized bots with minimal technical know-how.

Despite the momentum, the market faces certain challenges. Data privacy concerns, especially in regulated industries like healthcare and finance, can slow adoption. Additionally, chatbots that lack proper training or context-awareness can frustrate users and damage a brand's reputation. Nonetheless, as technology matures and compliance measures are strengthened, these hurdles are being gradually addressed.

Key Players Analysis

The ChatBot Market features a mix of global tech giants and innovative startups, each bringing their own strengths to the table. Major players include Microsoft, IBM, Google, Amazon Web Services (AWS), and Meta, all of whom have made significant investments in conversational AI technologies.

Microsoft's Azure Bot Services and Google Dialogflow are widely used platforms for building enterprise-grade chatbots. IBM Watson Assistant continues to be a go-to solution for complex and regulated industries, offering strong NLP and AI capabilities.

On the other side, startups like Drift, Intercom, Kore.ai, Ada, Freshworks, and Yellow.ai are gaining traction by focusing on vertical-specific solutions and offering user-friendly interfaces. These companies are bringing innovation to marketing, customer support, and lead generation, often with faster deployment times and competitive pricing models.

These key players are constantly evolving, integrating generative AI, analytics, and omni-channel capabilities to stay ahead in an increasingly competitive market.

Regional Analysis

From a geographic standpoint, North America leads the global ChatBot Market, largely due to early technology adoption, a strong presence of key players, and a culture of customer-centric business models. The U.S. market, in particular, has been quick to integrate chatbots across e-commerce, banking, healthcare, and education sectors.

Europe holds a significant share as well, with countries like the UK, Germany, and France prioritizing digital transformation while adhering to GDPR and other privacy regulations. European companies are particularly focused on deploying secure and compliant chatbot solutions, especially in finance and public services.

Asia-Pacific is the fastest-growing region, with countries such as China, India, Japan, and South Korea driving adoption. The rise of mobile-first consumers and the popularity of platforms like WeChat and WhatsApp in this region have spurred the use of chatbots in customer service, e-commerce, and fintech.

Emerging markets in Latin America and the Middle East & Africa are gradually catching up, supported by growing internet penetration and digital literacy. Local businesses in these regions are increasingly recognizing the value of AI-based customer engagement.

Recent News & Developments

Recent developments in the ChatBot Market point toward a significant shift driven by generative AI models. The release of tools like ChatGPT and integration of GPT-4-like models into chatbot platforms have revolutionized conversational quality and contextual awareness. These innovations are enabling bots to respond more accurately, understand complex user inputs, and engage in meaningful dialogue—almost indistinguishable from human agents.

Major investments and partnerships are also shaping the landscape. For instance, many startups are raising funding rounds to develop industry-specific bots, while tech giants are acquiring smaller firms to enhance their AI portfolios.

Furthermore, companies are now integrating voice recognition, sentiment analysis, and emotional AI into chatbots, making them more empathetic and capable of nuanced interactions. These improvements are making chatbots not only functional but also emotionally intelligent.

Browse Full Report: https://infinitymarketresearch.com/chatbot-market/1117

Scope of the Report

The scope of the report on the ChatBot Market spans across chatbot platforms, tools, services, and applications. It analyzes deployment types such as cloud-based and on-premise solutions, and covers a wide range of industries including retail, banking, healthcare, telecom, and education.

The report also explores chatbot use cases in customer service, sales assistance, marketing automation, HR, and IT helpdesk functions. It examines market trends, growth drivers, challenges, and technological developments, providing a comprehensive view of how chatbots are transforming business communications.

As chatbots continue to evolve from basic question-answer bots to intelligent digital assistants, the ChatBot Market is poised to play a pivotal role in the future of customer engagement. Whether it's reducing operational costs or enhancing user experience, chatbots are becoming indispensable to modern business strategies.

Discover Additional Market Insights from Infinity Market Research:

Global Cloud Computing Market size is expected to be worth around USD 2,780.0 Billion by 2033 from USD 559.4 Billion in 2023, growing at a CAGR of 17.1% during the forecast period from 2023 to 2033.

Global Travel Planner App Market size is expected to be worth around USD 1,695.0 Billion by 2033 from USD 540.9 Billion in 2023, growing at a CAGR of 12.1% during the forecast period from 2023 to 2033.

The Global Drone Market size is expected to be worth around USD 184.0 Billion by 2033 from USD 31.3 Billion in 2023, growing at a CAGR of 17.3% during the forecast period from 2023 to 2033.

Global AI Voice Generator Market size is expected to be worth around USD 8.0 Billion by 2033 from USD 1.6 Billion in 2023, growing at a CAGR of 16.9% during the forecast period from 2023 to 2033.

About Us

We at Infinity Market Research hold expertise in providing up-to-date, authentic, and reliable information across all industry verticals. Our diverse database consists of information gathered from trusted and authorized data sources.

We take pride in offering high-quality and comprehensive research solutions to our clients. Our research solutions will help the clients in making an informed move and planning their business strategies. We strive to provide excellent and dedicated market research reports so that our clients can focus on growth and business development plans. We have a domain-wise expert research team that works on client-specific custom projects. We understand the diverse requirements of our clients and keep our reports updated based on the market scenario.

Contact US:

Pune, Maharashtra, India

Mail: [email protected]

Website: https://infinitymarketresearch.com

For More Insights, follow us on LinkedIn- https://www.linkedin.com/company/imrreports

0 notes

Text

AI in Healthcare Apps: What CTOs Must Know in 2025

Artificial Intelligence (AI) is no longer a futuristic concept, it's the backbone of healthcare innovation in 2025. From remote diagnostics to clinical decision support systems, AI has moved beyond experimental and become essential.

With rising patient expectations, increasing data volumes and operational bottlenecks, healthcare CTOs and product managers are turning to AI to build smarter, scalable and compliant mobile app solutions. But AI in healthcare isn’t a plug-and-play feature; it requires strategy, domain knowledge and strict adherence to compliance.

This in-depth guide explores the present and future of AI-powered healthcare apps, with real-world examples and actionable insights to help decision-makers plan their next move.

1️⃣ What AI in healthcare apps looks like today

Today’s leading healthcare apps are not just digital versions of hospitals, they're intelligent health ecosystems. Let’s explore the most impactful AI-powered functions:

AI Chatbots & Virtual Health Assistants

Available 24/7, AI chatbots can:

Handle appointment bookings.

Conduct basic symptom assessments.

Recommend appropriate care paths.

Reduce front-desk loads.

These chatbots are powered by NLP (Natural Language Processing) and integrated with EMRs for contextual decision-making.

AI-Driven Diagnostic Tools

AI algorithms now rival and in some cases, outperform radiologists:

Identify anomalies in X-rays, MRIs, and CT scans.

Reduce human error in diagnosis.

Speed up reporting by 40–60%.

Tools like Zebra Medical Vision and Aidoc are widely used in hospitals today.

NLP for Documentation

AI enhances clinical documentation through:

Voice-based EMR updates.

Auto-generated summaries from doctor-patient conversations.

Real-time feedback collection and sentiment analysis.

2️⃣ Real-World use cases that are Already live

AI in healthcare isn’t theory, it's saving lives and streamlining operations today.

Symptom Checkers & Triage Tools

Platforms like Babylon Health and Ada Health use AI to:

Ask patients symptom-based questions.

Provide triage suggestions before any doctor interaction.

Avoid unnecessary ER visits.

This reduces clinician load and enhances patient trust in self-service care.

AI for Drug Discovery

Startups like Insilico Medicine and BenevolentAI use AI to:

Analyze molecular data.

Find treatment paths faster.

Shorten R&D timelines by years.

This can accelerate treatment delivery and reduce healthcare costs globally.

Wearable-Connected Smart Health Assistants

AI-powered health apps like Google Fit or MyFitnessPal:

Monitor vitals in real-time.

Alert users to anomalies (e.g., irregular heartbeat, low oxygen)

Suggest personalized health routines.

These assistants are turning smartphones into proactive care platforms.

3️⃣ Benefits of AI in Healthcare App Development

Investing in AI-powered mobile apps brings transformative advantages:

Speed + Accuracy

AI reduces diagnostic delays and helps prioritize critical patients quickly. Image recognition algorithms detect tumors, fractures or strokes in seconds.

Cost Optimization

AI reduces dependency on support staff and manual processes. For SMB clinics, this translates to:

Fewer no-shows (via automated reminders)

Less admin overload

Higher ROI on digital infrastructure

Scalable Infrastructure

AI-enabled apps:

Handle 10x more patients without extra hiring

Offer remote consultations without geographical limitations

Scale easily via cloud infrastructure

Hyper-Personalization

AI empowers apps to:

Adapt treatment plans based on user behavior

Send custom alerts and coaching tips

Align with fitness, sleep and medication patterns.

For chronic illness patients, this means higher engagement and adherence.

4️⃣ Compliance, Security & Bias: Hidden AI Risks

CTOs must walk a tightrope balancing AI’s power with patient safety and legal obligations.

Data Compliance (HIPAA, GDPR, DISHA)

AI systems must not collect PII unnecessarily.

All training data must be anonymized.

Audit logs must track AI model decisions.

Fines for non-compliance are massive, so risk assessment is key.

Cybersecurity Threats

AI models can be hacked, poisoned, or manipulated. Strong defense mechanisms include:

Encrypted data transmission

Model validation against adversarial attacks

Multi-layered API firewalls

Bias in Algorithms

Poorly trained AI can discriminate based on:

Age

Gender

Ethnicity

CTOs must demand diverse datasets, transparent testing and continual AI audits.

5️⃣ Key Considerations Before Hiring AI Healthcare App Developers

Whether you’re building a new AI-powered platform or enhancing an existing app, hiring the right development partner is mission-critical.

Here’s your CTO-level checklist:

Dual Expertise

Ensure the vendor has proven experience in:

Medical compliance & clinical workflows.

Building scalable machine learning systems.

✅ Deorwine specializes in both plus UX design for patient-centric apps.

Regulatory Understanding

Ask for previous projects involving:

HIPAA / GDPR / DISHA compliance

Cloud-based health data storage

Healthcare-specific security protocols

Integration Readiness

Your AI solution must work with:

Existing EMRs (e.g., Epic, Cerner)

Third-party APIs for wearables, labs, etc.

Telemedicine platforms and payment gateways

AI Data Strategy

Ask the vendor:

Are you using federated learning for secure model training?

How are synthetic data and anonymized datasets managed?

What model monitoring tools are in place post-launch?

Support & Scaling

AI models need retraining and fine-tuning. A robust partner will offer:

Regular updates

Performance reviews

Compliance check-ins

At Deorwine, we conduct an AI-readiness audit before development begins to identify gaps and design a custom roadmap.

Conclusion: AI Is Not a Feature It’s the Future

For healthcare companies aiming to stay competitive, AI must be part of their core mobile strategy in 2025. From improving clinical decision-making to automating patient journeys, the technology is here, compliant and deployable if guided by expert hands.

As a CTO, your next move should not just be about building an app but building an intelligent, adaptive, and secure healthcare experience.

Ready to Build Your AI-Powered Healthcare App? 📩 Get a FREE AI-readiness assessment from Deorwine: www.deorwine.com 💬 Talk to our healthcare AI experts today.

0 notes

Text

DOJ Title II Rule

The Ultimate Guide to the DOJ Title II Rule: Making Government Digital Services Accessible

The Americans with Disabilities Act (ADA) has been a cornerstone in transforming public life for individuals with disabilities by ensuring equal access to physical spaces, services, and opportunities. However, as our society increasingly moves online, the digital landscape presents a new frontier of challenges. This article will guide the DOJ Title II rule for making Government digital services accessible for individuals with disabilities.

Despite the ADA’s groundbreaking impact, many government websites and mobile apps remain inaccessible. It creates barriers to essential information and services for people with disabilities. It limits access and undermines ADA principles of equality and inclusivity.

The solution lies in web accessibility to foster a more inclusive society where everyone, irrespective of their abilities, can independently and equally access important information and services. It includes activities like applying for permits and engaging in community programs.

The Department of Justice (DOJ) has played an integral role in enforcing ADA compliance for state and local government entities. Read on to learn more about this, and the new regulations to enhance web accessibility.

Maintaining web compliance can be complex, but it is necessary for compliance and to create an inclusive digital environment. We at ADA Site Compliance can make web accessibility easier for you.

We ensure your websites and mobile apps meet all legal requirements efficiently, bridge the accessibility gap, and demonstrate your commitment to inclusivity.

Accessibility Standards – What You Need To Know

The DOJ Title II Rule clearly defines accessible web content and mobile apps.

The regulation adopts Website Compliance Accessibility Guidelines (WCAG) 2.1 Level AA to ensure digital content is perceivable, operable, understandable, and robust for users with disabilities.

These guidelines list the requirements for web compliance that include using alt text descriptions for images, providing keyboard accessibility for navigation, and using clear language to enhance comprehension.

The state and local governments create truly inclusive digital platforms through the WCAG like:

• Alternative text descriptions that allow screen readers to understand visual content

• Keyboard accessibility for individuals with motor disabilities to navigate websites without a mouse.

• Clear and straightforward language that makes information easier and more accessible to users with cognitive disabilities.

Affected Parties

The new DOJ rule majorly impacts United States state and local government entities. According to the Department, about 109,893 state and local government websites and 8,805 mobile applications face the impact.

91,489 state and local government bodies manage these digital platforms that must review and upgrade their online content and mobile apps to comply with WCAG 2.1 Level AA standards. This widespread impact ensures uniform digital accessibility across various governmental levels.

The Implementation Process

In addition to setting accessibility standards, the DOJ Title II Rule also outlines its implementation process. First and foremost, users with disabilities can legally file complaints with the DOJ’s Civil Rights Division if they encounter inaccessible web content or mobile apps.

The rule itself does not specify penalties.

The DOJ investigates these complaints and accordingly pursues injunctive relief for compliance. So non-compliant public entities may be legally required to make their digital platforms accessible.

The DOJ also provides the following support to help state and local governments implement new regulations for a smooth transition into compliant digital platforms:

• Technical assistance

• Online resources

• Training sessions

• Webinars to help entities understand and meet accessibility requirements.

Key Provisions of the New Rule

Adhering to the WCAG significantly enhances the accessibility of state and local government websites and mobile applications. This step to ensure all users have equal access to essential information and services fosters inclusivity and equity in the digital realm.

All state and local government entities can’t achieve web compliance overnight. Knowing this, the DOJ has established specific deadlines for compliance varying depending on the size of the public entity. They are:

• Entities with Fewer than 50,000 People / Special District Governments: These smaller entities have till three years of publishing the final rule to reach compliance. Their extended timeline provides them enough time to implement the required accessibility changes without much pressure, considering their limited resources and capabilities.

• Entities with 50,000 or More People: Larger entities typically have till two years of publishing the final rule to reach compliance. They have a year shorter to meet compliance as their increased operational capacity lets them quickly adapt their web content and mobile apps.

With these staggered deadlines, the DOJ provides a phased and manageable for public entities of all sizes to approach compliance with a smoother transition and better allocation of resources.

Specific Exceptions from Compliance

As entities begin to navigate this process, understanding the specific exceptions from compliance becomes crucial. Yes, it is after recognizing the potential challenges in some cases, that the DOJ has outlined five exemptions where compliance is not mandatory:

1. Archived Web Content

Websites containing archived materials like old meeting minutes or historical documents are often no longer actively used. So they are exempt from the compliance requirement unless someone with a disability makes a request.

2. Preexisting Conventional Electronic Documents

Any old documents created and stored for reference on a website are exempt from compliance. However, old documents presently used for application, gaining access to, and participation in any public entity’s service, program, or activity must meet accessibility requirements.

3. Third-Party Content

Any content posted by third parties is exempt from the compliance requirements unless posted on behalf of the public entity as per contractual, licensing, or other arrangements. This exemption is because public entities have no control over content generated on their platform by independent third parties.

4. Password-Protected Conventional Electronic Documents

Password-protected or secured documents, related to a specific individual, their property, or their account, are exempt from compliance. It is to protect sensitive personal information and the challenges in making such content accessible.

5. Preexisting Social Media Posts

Social media posts made before the new rule implementation are exempt from compliance. The exemption is because of the transient nature of social media content and the impracticality of making all historical posts accessible.