#tips for finances

Explore tagged Tumblr posts

Text

Basic Financial Rules To Live By 💰✨

Create a plan that shows how much money you get and how much you spend. This helps you see where your money goes.

Set aside a part of your money as savings. Try to save at least 10-20% of what you earn.

Be careful with borrowing money, especially if you have to pay back a lot of extra money (interest).

Save some money for unexpected things like medical bills or losing your job. Aim to have enough to cover your living costs for a few months.

Put your saved money into different things that can make it grow, like stocks or real estate. Be patient, as it takes time.

Don't spend more money than you make. Stick to buying what you really need, not just what you want.

Decide what you want to do with your money, both in the short term (like a vacation) and long term (like retirement).

Set up automatic transfers to your savings and bills so you don't forget to save or pay your bills on time.

Make saving money a top priority before spending on other things.

Regularly look at your money situation, adjust your plan as needed, and see how your investments are doing.

Pay your bills on time and use credit wisely (like credit cards) to keep a good credit score, which can help you get better deals on loans.

Save money for when you're older and don't work anymore. Use retirement accounts to help with this.

Think before you buy things. Don't buy something just because you want it; think if it's necessary.

Keep learning about how money works and how to make smart money choices.

Only use your emergency fund for real unexpected problems, not for things you just want to buy.

#financial planning#finance#investing#money#girl math#wealth#level up journey#it girl#dream girl#dream girl guide#dream girl tips#dream girl journey#that girl#becoming that girl#educate yourself#wealth mindset#growth mindset#success mindset

3K notes

·

View notes

Text

BUDGETING + SAVING MONEY FOR TEENS 𐙚

For many of us, we are entering an age when we can work casual jobs such as retail or fast food. It’s not a lot of money that we receive, depending on how often you get paid, but it can go a long way in the long term.

In this post, I’ll be discussing how to budget for your needs/wants and save money for future goals.

CREATING GOALS, you may want to save a certain amount of money in a time frame, want to make a big purchase (like a car) or buy everything off your wishlist. It is entirely up to you what your goals are, so I can’t say too much. However, the more specific it is, the better.

HOW MUCH? Determine how much money you need to save to achieve your goal. In total, and monthly.

There are three types of saving goals that may apply to you;

Short-term goals >1 year (outings, latest gadget, buying your cart)

Medium-term goals 1-2 years (road trips, shopping spree)

Long-term goals 2-4 years (higher education, car)

It��s very important to set a realistic time frame, as teens we don’t get paid much and we also don’t work as much. You don’t want to overwhelm yourself as well, as it takes patience and self-control to achieve these goals.

NO LOOONG-TERM GOALS! This may sound aggressive, but any money that just sits in your account for years on end is dead money. Even though the amount of money is increasing, its value is slowly decreasing. Keep your goals achievable within a time frame of less than four years. It's much more useful if this money is put into some type of investment instead.

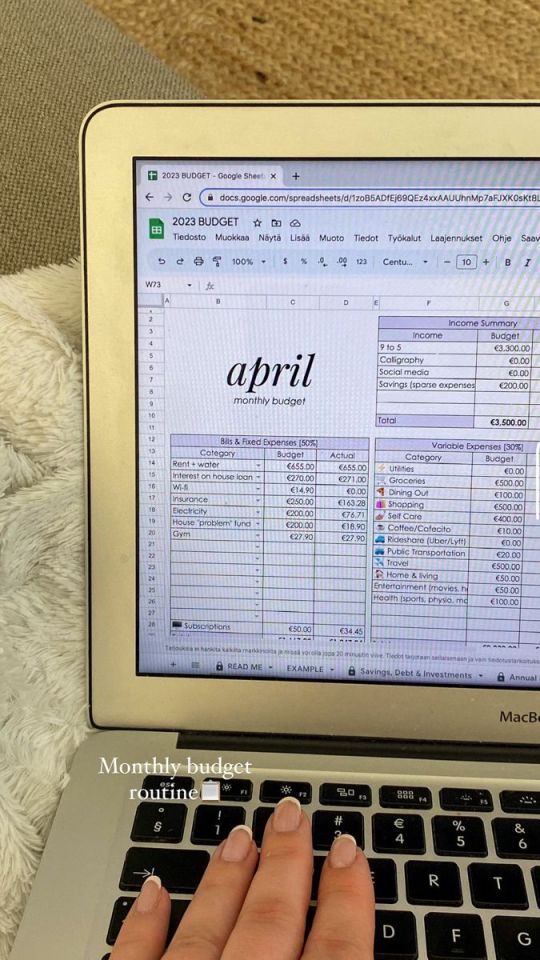

CREATING A BUDGET

Calculate how much money you receive every month, and how much money you spend every month.

You have two types of expenses. Fixed and variable. Fixed are any expenses required in your day-to-day life or it’s an amount of money that doesn’t change e.g. subscriptions or transportation costs. Variable costs are expenses that may fluctuate, like food, or any other recreational activities.

Record the average you’re spending monthly with these two categories.

There are many ways people choose to budget, but you have to choose a system that works for you.

Work out how much money you need to save each month to achieve your goal.

However, for anyone who’s starting in budgeting, I would say to allocate your costs using a percentage system. Your percentages for each category are going to differ from mine; e.g. 60% = savings, 20% = wants, 20% needs. Make sure it reflects the end goal.

Track your progress. This is the major part of budgeting, you want to be recording and regularly reviewing how much money you’re spending and comparing it to how much you’re earning. It allows for space to reflect on the flow of your money like if some purchases are worth it, if you’re impulsively spending, or if you’re frequently withdrawing money from your savings.

Adjust if needed. Maybe you want to put more money in savings and less into wants, or you want to put more into wants and less into needs.

SAVING TIPS

SAY NO! This is probably my biggest struggle at the moment, but say no to things that will cause you to go off track. Whether its outings, getting fast-food or anything similar, say no. You have to be firm with your financial boundaries, as these opportunities will always arise again.

RESTRICT IMPULSIVE SPENDING. We all have our moments when we see a product and we instantly think ‘I’ve got to have this’. Giving in once or twice is okay, but it shouldn’t become a habit at all. Its unnecessary spending (most of the time!) and leads to buyers remorse.

IS IT WORTH IT? Always remember to work out which products you’re getting the most value out of.

PAYING FOR THE NAME, a lot of brands will cut down on quality to save a few dollars, so essentially the customer is only paying for the name of that brand. Just because a store is more expensive, doesn’t mean its better.

#prettieinpink#becoming that girl#that girl#clean girl#green juice girl#dream girl#dream girl tips#it girl#vanilla girl#glow up#pink pilates princess#dream girl journey#dream girl life#dream girl vibes#dream life#wealth#old money#money#finances#invest#wonyoungism#it girl tips#it girl energy#winter arc#abundance#becoming her#that girl lifestyle#that girl routine#glow up era#feminine journey

771 notes

·

View notes

Text

𝐻𝑂𝑊 𝑇𝑂 𝐺𝐿𝑂𝑊 𝑈𝑃- 2𝑁𝐷 𝑄𝑈𝐴𝑅𝑇𝐸𝑅

𝑁𝑜 𝑀𝑜𝑟𝑒 𝐸𝑥𝑐𝑢𝑠𝑒𝑠. 𝐼𝑡'𝑠 𝑇𝑖𝑚𝑒 𝑡𝑜 𝐺𝑒𝑡 𝐼𝑡 𝑇𝑜𝑔𝑒𝑡ℎ𝑒𝑟.

𝐿𝑒𝑡'𝑠 𝑏𝑒 𝑟𝑒𝑎𝑙, 𝑖𝑓 𝑦𝑜𝑢'𝑟𝑒 𝑛𝑜𝑡 𝑎𝑐𝑡𝑖𝑣𝑒𝑙𝑦 𝑤𝑜𝑟𝑘𝑖𝑛𝑔 𝑜𝑛 𝑖𝑚𝑝𝑟𝑜𝑣𝑖𝑛𝑔 𝑦𝑜𝑢𝑟 𝑙𝑖𝑓𝑒, 𝑦𝑜𝑢'𝑟𝑒 𝑗𝑢𝑠𝑡 𝑤𝑎𝑠𝑡𝑖𝑛𝑔 𝑦𝑜𝑢𝑟 𝑡𝑖𝑚𝑒. 𝐴 𝑔𝑙𝑜𝑤-𝑢𝑝 𝑖𝑠𝑛'𝑡 𝑗𝑢𝑠𝑡 𝑎𝑏𝑜𝑢𝑡 𝑙𝑜𝑜𝑘𝑖𝑛𝑔 𝑔𝑜𝑜𝑑 ; 𝑖𝑡'𝑠 𝑎𝑏𝑜𝑢𝑡 𝑏𝑒𝑐𝑜𝑚𝑖𝑛𝑔 𝑎 𝑏𝑒𝑡𝑡𝑒𝑟 𝑣𝑒𝑟𝑠𝑖𝑜𝑛 𝑜𝑓 𝑦𝑜𝑢𝑟𝑠𝑒𝑙𝑓 𝑖𝑛 𝑒𝑣𝑒𝑟𝑦 𝑎𝑠𝑝𝑒𝑐𝑡- 𝑦𝑜𝑢𝑟 𝑚𝑖𝑛𝑑, ℎ𝑒𝑎𝑙𝑡ℎ, 𝑐𝑎𝑟𝑒𝑒𝑟, 𝑓𝑖𝑛𝑎𝑛𝑐𝑒𝑠, 𝑒𝑛𝑣𝑖𝑟𝑒𝑛𝑚𝑒𝑛𝑡, 𝑝𝑒𝑟𝑠𝑜𝑛𝑎𝑙 𝑔𝑟𝑜𝑤𝑡ℎ, 𝑎𝑛𝑑 𝑡𝑖𝑚𝑒 𝑚𝑎𝑛𝑎𝑔𝑒𝑚𝑒𝑛𝑡.

𝑌𝑜𝑢 𝑔𝑒𝑡 𝑓𝑜𝑢𝑟 𝑞𝑢𝑎𝑟𝑡𝑒𝑟𝑠 𝑎 𝑦𝑒𝑎𝑟. 𝑇ℎ𝑎𝑡 𝑚𝑒𝑎𝑛𝑠 𝑦𝑜𝑢 ℎ𝑎𝑣𝑒 𝑛𝑜 𝑒𝑥𝑐𝑢𝑠𝑒 𝑛𝑜𝑡 𝑡𝑜 𝑖𝑚𝑝𝑟𝑜𝑣𝑒 𝑎𝑡 𝑙𝑒𝑎𝑠𝑡 𝑡𝑤𝑜 𝑎𝑟𝑒𝑎𝑠 𝑒𝑣𝑒𝑟𝑦 𝑡ℎ𝑟𝑒𝑒 𝑚𝑜𝑛𝑡ℎ𝑠. 𝐼𝑓 𝑦𝑜𝑢 𝑐𝑎𝑛'𝑡 𝑐𝑜𝑚𝑚𝑖𝑡 𝑡𝑜 𝑡ℎ𝑎𝑡, 𝑑𝑜𝑛'𝑡 𝑐𝑜𝑚𝑝𝑙𝑎𝑖𝑛 𝑎𝑏𝑜𝑢𝑡 𝑏𝑒𝑖𝑛𝑔 𝑠𝑡𝑢𝑐𝑘.

𝐴𝑃𝑅𝐼𝐿-𝑀𝐴𝑌-𝐽𝑈𝑁𝐸

𝐺𝐸𝑇 𝑆𝐸𝑅𝐼𝑂𝑈𝑆 𝑂𝑅 𝑆𝑇𝐴𝑌 𝑇𝐻𝐸 𝑆𝐴𝑀𝐸

✰ 𝐶ℎ𝑜𝑜𝑠𝑒 2 𝑎𝑟𝑒𝑎𝑠 𝑜𝑓 𝑦𝑜𝑢𝑟 𝑙𝑖𝑓𝑒 𝑡ℎ𝑎𝑡 𝑛𝑒𝑒𝑑 𝑤𝑜𝑟𝑘 (𝑦𝑒𝑠, 𝑎𝑐𝑡𝑢𝑎𝑙𝑙𝑦 𝑐ℎ𝑜𝑜𝑠𝑒).

✰ 𝑆𝑒𝑡 3 𝑐𝑙𝑒𝑎𝑟 𝑎𝑐𝑡𝑖𝑜𝑛 𝑠𝑡𝑒𝑝𝑠 𝑓𝑜𝑟 𝑒𝑎𝑐ℎ. 𝑁𝑜 𝑣𝑎𝑔𝑢𝑒 "𝐼'𝑙𝑙 𝑇𝑟𝑦" 𝑛𝑜𝑛𝑠𝑒𝑛𝑠𝑒.

✰ 𝑇𝑟𝑎𝑐𝑘 𝑦𝑜𝑢𝑟 𝑝𝑟𝑜𝑔𝑟𝑒𝑠𝑠 (𝑎 ℎ𝑎𝑏𝑖𝑡 𝑡𝑟𝑎𝑐𝑘𝑒𝑟 𝑜𝑟 𝑗𝑜𝑢𝑟𝑛𝑎𝑙 𝑤𝑜𝑟𝑘𝑠 𝑏𝑒𝑠𝑡!)

✰ 𝑆ℎ𝑜𝑤 𝑢𝑝 𝑒𝑣𝑒𝑟𝑦 𝑑𝑎𝑦. 𝑁𝑜𝑡 𝑗𝑢𝑠𝑡 𝑤ℎ𝑒𝑛 𝑦𝑜𝑢 𝑓𝑒𝑒𝑙 𝑚𝑜𝑡𝑖𝑣𝑎𝑡𝑒𝑑.

✰ 𝑅𝑒𝑤𝑎𝑟𝑑 𝑦𝑜𝑢𝑟𝑠𝑒𝑙𝑓- 𝐵𝑢𝑡 𝑜𝑛𝑙𝑦 𝑖𝑓 𝑦𝑜𝑢 𝐸𝐴𝑅𝑁 𝑖𝑡

𝑇𝑖𝑝: 𝑇𝑟𝑎𝑐𝑘 𝑡ℎ𝑒 𝑡𝑖𝑚𝑒𝑠 𝑦𝑜𝑢 𝑎𝑙𝑚𝑜𝑠𝑡 𝑔𝑎𝑣𝑒 𝑢𝑝, 𝑎 𝑣𝑖𝑠𝑖𝑏𝑙𝑒 𝑐ℎ𝑎𝑟𝑡 𝑖𝑠 𝑏𝑒𝑠𝑡. 𝑇ℎ𝑖𝑠 𝑖𝑠 𝑗𝑢𝑠𝑡 𝑎 𝑟𝑒𝑚𝑖𝑛𝑑𝑒𝑟 𝑡ℎ𝑎𝑡 𝑦𝑜𝑢 𝑎𝑟𝑒 𝑑𝑜𝑖𝑛𝑔 𝑔𝑟𝑒𝑎𝑡 𝑎𝑛𝑑 𝑖𝑡 𝑚𝑜𝑡𝑖𝑣𝑎𝑡𝑒𝑠 𝑦𝑜𝑢 𝑡𝑜 𝑘𝑒𝑒𝑝 𝑔𝑜𝑖𝑛𝑔!

𝐶𝐻𝑂𝑂𝑆𝐸 𝑌𝑂𝑈𝑅 𝐴𝑅𝐸𝐴𝑆 𝑂𝐹 𝐼𝑀𝑃𝑅𝑂𝑉𝐸𝑀𝐸𝑁𝑇

𝐻𝑒𝑟𝑒 𝑎𝑟𝑒 𝑠𝑜𝑚𝑒 𝑖𝑑𝑒𝑎𝑠 𝑡𝑜 ℎ𝑒𝑙𝑝 𝑦𝑜𝑢 𝑑𝑒𝑐𝑖𝑑𝑒:

𝐶𝑎𝑟𝑒𝑒𝑟 𝐺𝑜𝑎𝑙𝑠 - 𝐿𝑒𝑣𝑒𝑙 𝑈𝑝 𝑃𝑟𝑜𝑓𝑒𝑠𝑠𝑖𝑜𝑛𝑎𝑙𝑙𝑦

𝑁𝑒𝑔𝑜𝑡𝑖𝑎𝑡𝑒 𝑎 𝑟𝑎𝑖𝑠𝑒 𝑜𝑟 𝑝𝑟𝑜𝑚𝑜𝑡𝑖𝑜𝑛 - 𝑆𝑒𝑡 𝑢𝑝 𝑎 𝑚𝑒𝑒𝑡𝑖𝑛𝑔 𝑤𝑖𝑡ℎ 𝑦𝑜𝑢𝑟 𝑏𝑜𝑠𝑠.

𝑈𝑝𝑔𝑟𝑎𝑑𝑒 𝑦𝑜𝑢𝑟 𝑠𝑘𝑖𝑙𝑙𝑠 - 𝑇𝑎𝑘𝑒 𝑎𝑛 𝑜𝑛𝑙𝑖𝑛𝑒 𝑐𝑜𝑢𝑟𝑠𝑒 𝑜𝑟 𝑎𝑡𝑡𝑒𝑛𝑑 𝑎 𝑤𝑜𝑟𝑘𝑠ℎ𝑜𝑝.

𝐽𝑜𝑏 𝑠𝑒𝑎𝑟𝑐ℎ - 𝐼𝑓 𝑦𝑜𝑢'𝑟𝑟 𝑢𝑛ℎ𝑎𝑝𝑝𝑦, 𝑒𝑥𝑝𝑙𝑜𝑟𝑒 𝑛𝑒𝑤 𝑜𝑝𝑝𝑜𝑟𝑡𝑢𝑛𝑖𝑡𝑖𝑒𝑠.

𝐸𝑥𝑝𝑎𝑛𝑑 𝑦𝑜𝑢𝑟 𝑛𝑒𝑡𝑤𝑜𝑟𝑘 - 𝐶𝑜𝑛𝑛𝑒𝑐𝑡 𝑤𝑖𝑡ℎ 𝑚𝑒𝑛𝑡𝑜𝑟𝑠 𝑜𝑟 𝑖𝑛𝑑𝑢𝑠𝑡𝑟𝑦 𝑝𝑟𝑜��𝑒𝑠𝑠𝑖𝑜𝑛𝑎𝑙𝑠.

𝑆𝑒𝑡 𝑤𝑜𝑟𝑘-𝑙𝑖𝑓𝑒 𝑏𝑜𝑢𝑛𝑑𝑎𝑟𝑖𝑒𝑠 - 𝑃𝑟𝑜𝑡𝑒𝑐𝑡 𝑦𝑜𝑢𝑟 𝑚𝑒𝑛𝑡𝑎𝑙 ℎ𝑒𝑎𝑙𝑡ℎ.

𝐹𝑖𝑛𝑎𝑛𝑐𝑒𝑠 - 𝑆𝑒𝑐𝑢𝑟𝑒 𝑇ℎ𝑒 𝐵𝑎𝑔

𝑅𝑒𝑣𝑖𝑒𝑤 𝑙𝑎𝑠𝑡 𝑚𝑜𝑛𝑡ℎ'𝑠 𝑒𝑥𝑝𝑒𝑛𝑠𝑒𝑠 - 𝐾𝑛𝑜𝑤 𝑤ℎ𝑒𝑟𝑒 𝑦𝑜𝑢𝑟 𝑚𝑜𝑛𝑒𝑦 𝑖𝑠 𝑔𝑜𝑖𝑛𝑔.

𝐶𝑟𝑒𝑎𝑡𝑒 𝑎 𝑟𝑒𝑎𝑙𝑖𝑠𝑡𝑖𝑐 𝑏𝑢𝑑𝑔𝑒𝑡 - 𝑆𝑡𝑖𝑐𝑘 𝑡𝑜 𝑎 𝑝𝑙𝑎𝑛 𝑡ℎ𝑎𝑡 𝑤𝑜𝑟𝑘𝑠 𝑓𝑜𝑟 𝑦𝑜𝑢.

𝑈𝑠𝑒 𝑠𝑒𝑝𝑎𝑟𝑎𝑡𝑒 𝑐𝑎𝑟𝑑𝑠/𝑎𝑐𝑐𝑜𝑢𝑛𝑡𝑠 𝑡𝑜 𝑚𝑎𝑛𝑎𝑔𝑒 𝑠𝑝𝑒𝑛𝑑𝑖𝑛𝑔.

𝐵𝑖𝑙𝑙𝑠 - 𝑜𝑛𝑙𝑦 𝑐𝑎𝑟𝑑.

𝐵𝑢𝑑𝑔𝑒𝑡𝑒𝑑 𝑠𝑝𝑒𝑛𝑑𝑖𝑛𝑔 𝑐𝑎𝑟𝑑.

𝑆𝑎𝑣𝑖𝑛𝑔𝑠 𝑎𝑐𝑐𝑜𝑢𝑛𝑡.

𝑆𝑡𝑎𝑟𝑡 𝑆𝑎𝑣𝑖𝑛𝑔! - 𝐸𝑣𝑒𝑛 𝑠𝑚𝑎𝑙𝑙 𝑎𝑚𝑜𝑢𝑛𝑡𝑠 𝑚𝑎𝑡𝑡𝑒𝑟.

𝐶𝑎𝑛𝑐𝑒𝑙 𝑢𝑛𝑛𝑒𝑐𝑒𝑠𝑠𝑎𝑟𝑦 𝑠𝑢𝑏𝑠𝑐𝑟𝑖𝑝𝑡𝑖𝑜𝑛𝑠 - 𝐶𝑢𝑡 𝑜𝑢𝑡 𝑤ℎ𝑎𝑡 𝑦𝑜𝑢 𝑑𝑜𝑛'𝑡 𝑢𝑠𝑒.

𝑃𝑎𝑦 𝑏𝑖𝑙𝑙𝑠 𝑜𝑛 𝑡𝑖𝑚𝑒 - 𝐴𝑣𝑜𝑖𝑑 𝑙𝑎𝑡𝑒 𝑓𝑒𝑒𝑠.

𝐶𝑜𝑜𝑘 𝑎𝑡 ℎ𝑜𝑚𝑒 - 𝑆𝑎𝑣𝑒 𝑚𝑜𝑛𝑒𝑦 𝑎𝑛𝑑 𝑒𝑎𝑡 ℎ𝑒𝑎𝑙𝑡ℎ𝑖𝑒𝑟.

𝑃𝑅𝐴𝐶𝑇𝐼𝐶𝐸 𝐺𝑂𝐴𝐿 𝑆𝐸𝑇𝑇𝐼𝑁𝐺 - 𝑇𝐻𝐸 𝑅𝐼𝐺𝐻𝑇 𝑊𝐴𝑌

𝑆𝑒𝑡𝑡𝑖𝑛𝑔 𝑔𝑜𝑎𝑙𝑠 𝑐𝑎𝑛 𝑓𝑒𝑒𝑙 𝑜𝑣𝑒𝑟𝑤ℎ𝑒𝑙𝑚𝑖𝑛𝑔, 𝑏𝑢𝑡 𝑠𝑖𝑚𝑝𝑙𝑖𝑐𝑖𝑡𝑦 𝑖𝑠 𝑘𝑒𝑦.

✰ 𝑃𝑖𝑐𝑘 𝑗𝑢𝑠𝑡 2 𝑓𝑜𝑐𝑢𝑠 𝑎𝑟𝑒𝑎𝑠 𝑡ℎ𝑖𝑠 𝑞𝑢𝑎𝑟𝑡𝑒𝑟 - 𝑑𝑜𝑛'𝑡 𝑜𝑣𝑒𝑟𝑙𝑜𝑎𝑑 𝑦𝑜𝑢𝑟𝑠𝑒𝑙𝑓.

✰ 𝐵𝑟𝑒𝑎𝑘 𝑖𝑡 𝑑𝑜𝑤𝑛 - 𝐶ℎ𝑜𝑜𝑠𝑒 2 𝑠𝑚𝑎𝑙𝑙 𝑠𝑡𝑒𝑝𝑠 𝑝𝑒𝑟 𝑚𝑜𝑛𝑡ℎ

✰ 𝑈𝑠𝑒 𝑎 𝑝𝑙𝑎𝑛𝑛𝑒𝑟 𝑜𝑟 𝑗𝑜𝑢𝑟𝑛𝑎𝑙 𝑡𝑜 𝑡𝑟𝑎𝑐𝑘 𝑝𝑟𝑜𝑔𝑟𝑒𝑠𝑠.

✰ 𝐶ℎ𝑒𝑐𝑘 𝑜𝑓𝑓 𝑎𝑐𝑐𝑜𝑚𝑝𝑙𝑖𝑠ℎ𝑚𝑒𝑛𝑡 - 𝐶𝑒𝑙𝑒𝑏𝑟𝑎𝑡𝑒 𝑠𝑚𝑎𝑙𝑙 𝑤𝑖𝑛𝑠.

✰ 𝑅𝑒𝑤𝑎𝑟𝑑 𝑦𝑜𝑢𝑟𝑠𝑒𝑙𝑓 𝑒𝑣𝑒𝑟𝑦 𝑡𝑖𝑚𝑒 𝑦𝑜𝑢 𝑑𝑜𝑛'𝑡 𝑞𝑢𝑖𝑡!

𝑅𝐸𝑊𝐴𝑅𝐷 𝑌𝑂𝑈𝑅𝑆𝐸𝐿𝐹 𝐵𝐸𝐶𝐴𝑈𝑆𝐸 𝑌𝑂𝑈 𝐷𝐸𝑆𝐸𝑅𝑉𝐸 𝐼𝑇

𝑦𝑜𝑢 𝑎𝑟𝑒 𝑤𝑜𝑟𝑘𝑖𝑛𝑔 ℎ𝑎𝑟𝑑, 𝑎𝑛𝑑 𝑝𝑟𝑜𝑔𝑟𝑒𝑠𝑠 𝑑𝑒𝑠𝑒𝑟𝑣𝑒𝑠 𝑐𝑒𝑙𝑒𝑏𝑟𝑎𝑡𝑖𝑜𝑛! 𝐻𝑒𝑟𝑒 𝑎𝑟𝑒 𝑎 𝑓𝑒𝑤 𝑤𝑎𝑦𝑠 𝑡𝑜 𝑡𝑟𝑒𝑎𝑡 𝑦𝑜𝑢𝑟𝑠𝑒𝑙𝑓:

𝑆𝑝𝑎 𝐷𝑎𝑦 : 𝑅𝑒𝑙𝑎𝑥, 𝑢𝑛𝑤𝑖𝑛𝑑, 𝑎𝑛𝑑 𝑟𝑒𝑐ℎ𝑎𝑟𝑔𝑒.

𝐷𝑎𝑡𝑒 𝑁𝑖𝑔ℎ𝑡 : 𝑆𝑜𝑙𝑜 𝑜𝑟 𝑤𝑖𝑡ℎ 𝑎 𝑙𝑜𝑣𝑒𝑑 𝑜𝑛𝑒, 𝑒𝑛𝑗𝑜𝑦 𝑎 𝑛𝑖𝑐𝑒 𝑚𝑒𝑎𝑙.

𝑀𝑜𝑣𝑖𝑒 𝑁𝑖𝑔ℎ𝑡 : 𝐶𝑜𝑧𝑦 𝑢𝑝 𝑤𝑖𝑡ℎ 𝑦𝑜𝑢𝑟 𝑓𝑎𝑣𝑜𝑟𝑖𝑡𝑒 𝑓𝑖𝑙𝑚.

𝑆ℎ𝑜𝑝𝑝𝑖𝑛𝑔 𝑆𝑝𝑟𝑒𝑒 : 𝐵𝑢𝑦 𝑦𝑜𝑢𝑟𝑠𝑒𝑙𝑓 𝑠𝑜𝑚𝑒𝑡ℎ𝑖𝑛𝑔 𝑛𝑖𝑐𝑒 (𝑤𝑖𝑡ℎ𝑖𝑛 𝑏𝑢𝑑𝑔𝑒𝑡!)

𝐹𝐼𝑁𝐴𝐿 𝑅𝐸𝑀𝐼𝑁𝐷𝐸𝑅

𝐺𝑟𝑜𝑤𝑡ℎ 𝑖𝑠𝑛'𝑡 𝑎𝑏𝑜𝑢𝑡 𝑝𝑒𝑟𝑓𝑒𝑐𝑡𝑖𝑜𝑛- 𝑖𝑡'𝑠 𝑎𝑏𝑜𝑢𝑡 𝑝𝑟𝑜𝑔𝑟𝑒𝑠𝑠. 𝑆𝑡𝑎𝑦 𝑐𝑜𝑛𝑠𝑖𝑠𝑡𝑒𝑛𝑡, 𝑡𝑟𝑎𝑐𝑘 𝑦𝑜𝑢𝑟 𝑤𝑖𝑛𝑠, 𝑎𝑛𝑑 𝑟𝑒𝑚𝑒𝑚𝑏𝑒𝑟 : 𝐸𝑣𝑒𝑟𝑦 𝑠𝑚𝑎𝑙𝑙 𝑠𝑡𝑒𝑝 𝑎𝑑𝑑𝑠 𝑢𝑝 𝑡𝑜 𝑎 𝑏𝑖𝑔 𝑡𝑟𝑎𝑛𝑠𝑓𝑜𝑟𝑚𝑎𝑡𝑖𝑜𝑛.

#mindset#self development#girlblogging#it girl#self worth#personal growth#finance#career#health and lifestyle#self love#2025#environment#personal development#that girl#self care#tips

339 notes

·

View notes

Text

youtube

NEW POST!

Today, I’m talking about grocery store prices.

I chose this topic because I’m worried. Terrible times are ahead. We’ve been writing a lot about politics—and we’ll keep doing so—but it can feel like scream-preaching to the void-choir. We’ve been wracking our brains to come up with nourishing, material strategies to help our followers through the lean times ahead.

Right now, all I want is to give you guys an easy win. If I could use my time and talents to help you folks save $20 a month, I’d be good with that. Groceries are something we all must buy in order to live. So I opened a small investigation comparing prices at a few local grocery stores.

My “small investigation” became the most time- and labor-intensive topic I’ve ever covered for Bitches Get Riches.

This investigation hauled me bodily to the summit of my abilities, then cast me down the mountainside of my own ambition into a boiling, stinking chasm of magmatic insanity.

To Hell and Back for Cheap Groceries: The Epic Investigation (and Shocking Results) of My Grocery Store Price Comparison Quest

Video Version 🍋 Audio Version 🍋 Text Version

#frugal#grocery store#Market Basket#saving money#shopping#price comparison#groceries#aldi#Trader Joe's#Wegmans#food#food shopping#thrifty#personal finance#money tips#Youtube

363 notes

·

View notes

Text

financial literacy⋆.ೃ࿔*:・✍🏽🎀

so i released a poll if you guys would like a post on financial literacy and the results are here. so im gonna share some things that i learned while taking a financial literacy course…💬🎀

WHAT IS FINANCIAL LITERACY ;

financial literacy is handling ur money wisely. the google definition of financial literacy is the ability to understand and apply different financial skills effectively, including personal financial management, budgeting, and saving.

ALL ABOUT BUDGETING ;

when u hear the word "budget" its rly easy to think "omg limiting belief" or think of it in a negative light but a budget is just a plan on how u manage ur money. its not always constrictive and negative like u may or may not think of it to be.

budgeting : keeping track of how much $ ur bringing in and how much ur spending…💬🎀

planning a budget is ez pz. you can use some paper and sparkly pink gel pens to create an adorable budget, or u can download different sheets online and just have your budget digitally. theres a plethora of resources out there so just choose whichever is easier for u.

something else that i learned about during this course was the 50:30:20 rule. its called the 50:30:20 rule because 50% of ur money goes towards ur needs, 30% goes towards wants and 20% goes towards ur savings. and this isnt concrete, its just a good framework and u can adjust to ur own specific needs and goals.

for example if u manifested $4000. ur 50% would be $2000, ur 30% would be $1200 and ur 20% would be $800…💬🎀

HOW DO U KNOW WHAT UR NEEDS/WANTS ARE ;

things like ur rent and groceries are ur needs and things like vacations and going out with ur girls are wants. and to apply the 50:30:20 rule you first have to...

♡ calculate ur needs, wants and savings budget

♡ compare ur expenses to ur budget

the way u do this is to subtract your expenses from your budget. this is your budget balance. if your budget balance is zero or positive, that means you are living within your means and have some extra money. if your budget balance is negative, that means you are spending more than you should and may have a budgeting problem.

let me know if u guys want more content about this cuz i had a lot of fun writing this…💬🎀

#honeytonedhottie⭐️#law of assumption#it girl#becoming that girl#self concept#that girl#self care#it girl energy#advice#dream girl tips#dream girl#dream life#beauty and brains#financial literacy#investments#personal finance#information#pink academia#girly#hyper femininity#hyper feminine#girl blog#fabulous#fabulously feminine#glamor#glamorous#self improvement#self growth#maintenance#rich and pretty

685 notes

·

View notes

Text

We ask your questions so you don’t have to! Submit your questions to have them posted anonymously as polls.

#polls#incognito polls#anonymous#tumblr polls#tumblr users#questions#polls about money#submitted june 2#tipping#money#finances

431 notes

·

View notes

Text

Study Trick That No One Told Me.

Division of subjects:

Every subject is learnt and graded in a different way. You can't use the same study techniques for every subject you have. You have mostly 3 types of subjects:

Memorization based

Practical/Question based

Theory/Essay based

Memorization based:

Mostly Biology, Sciences, Geography etc are fully based on memorization and so you'll use memory study techniques like flash cards and active recall.

Practical/Question based:

Maths, Physics, Chemistry, Accountancy etc are practice subjects. The more you do your questions and understand how a sum is done, the better you can score.

Theory/Essay based:

English, history, business studies etc are theory based. The more you write, the way you write and the keywords you use are the only things that will get you your grades. So learn the formats and the structure on how to write your answers

Note: Some subjects are a combination of the three. Like Economics etc

The reason we divide the subjects is because you can adopt the right study methods for the right subject. Like ex: business studies is mostly based on how you write your answer and the keywords, if you're gonna spend your time memorizing in this, it's a waste of time and energy.

Hope this helps :)

#studyblr introduction#studyblr#study motivation#school#study blog#student#studyspo#studying#study aesthetic#high school#study tips#study buddy#studybrl#study break#study goals#goals#academic goals#academic girly#it girl#senior year#self improvement#student life#studyblr community#high school studyblr#high school tips#study hard#study#accounting#finances#economics

488 notes

·

View notes

Text

₊˚⊹ ᰔ a guide to maintaining financial wellness ᝰ.ᐟ

having good money habits can be insanely difficult. i know i personally struggle with impulsive spending, and i’m sure we’ve all fallen victim to the “i’m just treating myself” mindset. financial stress and even financial depression can feel so daunting and overwhelming, so i’m here to help you guys (and myself as well) manage your money better!

let’s begin !!

ᝰ.ᐟ set aside funds

it’s important that when every paycheck hits your bank account to immediately set aside some funds into your savings account. whether it’s 10-20% of your paycheck or even $20-$100, set aside some money into your savings!

it also might help to have that savings account be locked so that you can still put money in, but you can’t take money out. let that savings amount pile up and don’t touch it until you’re absolutely ready to make that big purchase!

ᝰ.ᐟ set aside any cash

get a piggybank or even one of those money organizing binders to set aside any cash that may come your way! keep that cash away from your wallet so you won’t be tempted to use it in any outside purchases. and, same as the first point, that cash will start to pile up!

ᝰ.ᐟ purchase needs rather than wants

let’s start getting out of that “i’m gonna treat myself” mindset!! while it’s nice to treat yourself, we really should only be doing it every once in a while. we can also find different ways of treating/rewarding ourselves that don’t require spending any money! (i can make a separate blog post on this if you guys would like!)

especially when you’re trying to save up for school, a new apartment, a new car, or whatever it may be, it’s really important to keep your purchases to only things that are absolutely necessary.

ᝰ.ᐟ keep track of automatic payments

especially if you have a subscription of any kind, keep track of when those automatic deductions from your account are happening. make note of when your next billing date is and how much you’re being charged for each month/year.

this would also be a good way to determine what subscriptions you really need/want to keep and which ones you can do without and unsubscribe to! i did a full cleanse of my subscriptions list and kept the ones i definitely wanted to keep. sometimes you never really realize how much money your losing when you’re subscribed to things that have no use to you anymore!

ᝰ.ᐟ plan accordingly

when your paycheck comes in and you have all these payments that are coming up yet you still need to buy groceries or get gas or whatever, make sure to plan your funds ahead of time! this way, it’ll help you budget for your groceries & any other necessities as well as help you determine how much money you can set aside into your savings and even calculate how much extra funds you might have to spend on for more personal things!

𝜗𝜚 final notes 𝜗𝜚

don’t let these tips make you feel like you can’t treat yourself to something! as i mentioned earlier, you can still treat yourself to nice things, but it might be best to do it once in a while! i know most of us associate success with money, and to reach success with money we have to learn to be more mindful about how we spend our money and how we manage it.

live and love, babe.

sincerely, juno ⭑.ᐟ

#milkoomis#girlblogger#girlblogging#it girl#that girl#girl blog aesthetic#it girl tips#becoming that girl#finance#money#money management#money manifestation#money saving#spending habits#personal growth#self improvement

211 notes

·

View notes

Text

Brian Tracy - Don't stop | @newtiative

Brian Tracy is the founder and CEO of Brian Tracy International. He is a Canadian-American motivational public speaker and self-development author.

#motivation #entrepreneur #inspiration #learnfromfounders #innovation #win #future #money #investing #startup #growthmindset #quotes #briantracy #newtiative

Learn from Brian Tracy. Invest wisely. Achieve financial freedom.

Follow for expert analysis, inspiring stories, and actionable tips.

#motivation#entrepreneur#inspiration#learnfromfounders#innovation#win#future#money#investing#startup#growthmindset#quotes#briantracy#newtiative#Follow for expert analysis#inspiring stories#and actionable tips.#invest#wealth#investors#motivational#personal finance#finances

131 notes

·

View notes

Note

Any tips on saving money?

Track your income/expenses. Knowing your monthly cash flow + essential and discretionary spending is the only sound starting point toward setting your financial goals.

Evaluate your non-essential spending habits. Consider where this money is going, and whether these expenses add value/are necessary to your life (pleasure or peace of mind is an acceptable "necessity" if you're living within your means to be clear!).

Determine the money you have left over after you cover your essential expenses and most fulfill discretionary expenses. This amount is your "saving/investment" money.

Divide your leftover amount into 3 categories: Emergency fund, goal-oriented savings (like buying a desired luxury item/furniture, a down payment on a house, a vacation, etc.), and investments.

Put your savings in a high-yield savings account. If possible, have different accounts for each purpose, especially your emergency fund and savings for future purposes. You can also get a CD for a long-term savings goal.

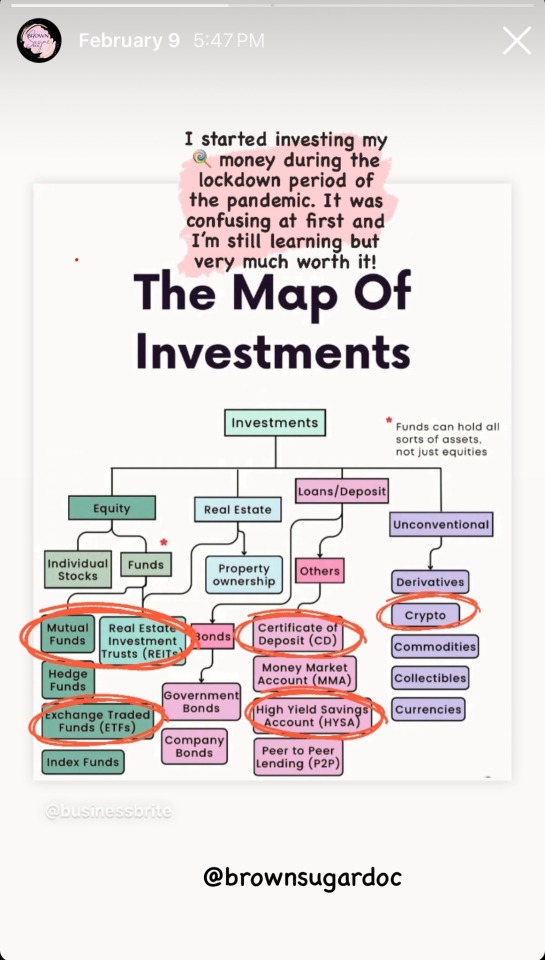

Put your investments (in the USA at least) in the following buckets: Roth IRA (max it out), ALWAYS take your employer's full 401k match, HSA (if you have a high-deductible health insurance plan), and S&P 500 index funds/other evergreen mutual funds + blue-chip stocks.

Purchase fewer, higher-quality items. Know the sales seasons for each product category and shop around this calendar (down to the produce items in season). If possible, rent items when it makes sense.

Only say "yes" to plans/financial obligations that add value/pleasure to your life. Don't let yourself feel shortchanged financially or emotionally. It's never worth it, honestly.

Invest in your physical, mental, and financial health first. This can mean something different for everyone but it's important!

**I'm not a professional, just another young woman on the internet, so please take this advice accordingly. Please meet with a financial advisor/CPA for formal advice and personal financial planning.

Hope this helps xx

228 notes

·

View notes

Text

Become Your Best Version Before 2025 - Day 13

Financial Planning and Budgeting

Hello Goddesses! I know that talking about money, can feel scary or boring, but after working on our stress management tools yesterday, it's perfect timing to address something that's often a huge source of stress for many of us: finances.

First things first: if thinking about money makes you want to hide under your blanket, you're not alone. But taking control of your finances isn't about becoming a math genius or never buying another coffee again. It's about making friends with your money so it can help you live your best life.

Let's break this down into bite-sized pieces that won't give you a headache:

Start Where You Are

Remember when you first learned to ride a bike? You didn't start by doing tricks, you started with training wheels. Money management is the same way! First step: just look at your current situation. Open those banking apps you've been avoiding. Take a deep breath and look at your statements. Knowledge is power, even if it's a bit scary at first.

The Money Map Exercise

Grab a piece of paper (or open your notes app) and let's do something simple:

Write down all your income sources

List your regular monthly expenses (yes, including those sneaky subscriptions!)

Don't forget those irregular expenses like annual fees or seasonal costs

Look at what's left (or what's missing)

Congratulations! You've just created your first basic budget outline.

The 50/30/20 Guideline

Here's a popular way to think about your money:

50% for needs (rent, groceries, utilities)

30% for wants (fun stuff, shopping, entertainment)

20% for future you (savings, debt payment, investments)

These numbers might not work for everyone, especially depending on where you live. The important thing is to have some kind of plan that works for YOU.

Smart Money Habits You Can Start Today

The 24-Hour Rule: For non-essential purchases over a certain amount (you decide the number!), wait 24 hours before buying. You'd be surprised how many "must-haves" become "maybe nots" overnight!

Bill Calendar: Set up a simple calendar with all your bill due dates. Future you will be so grateful!

Automate Your Savings: Even if it's just $5 a week, set up automatic transfers to a savings account. It's like hiding money from yourself!

Track Your Spending: For just one week, write down every single purchase. No judging, just observing. You might find some surprising patterns!

The Emergency Fund Challenge

Let's start building that safety net! Even $500 in savings can make a huge difference in an emergency. Start with a goal of saving just $25 this week. Too much? Start with $10. Too little? Make it $50. The amount isn't as important as getting started.

Money Goals That Make Sense

Instead of vague goals like "save more," try specific ones like:

Save enough for three months of basic expenses by December 2025

Pay off one credit card by summer

Create a "fun fund" for that hobby you've been wanting to try

Your financial journey is exactly that, YOURS. You don't need to compare yourself to anyone else. The person on Instagram showing off their investment portfolio might still be paying off massive debt. Focus on your own path!

Your mission for today:

Look at your bank statement (I know, scary, but you can do it!)

Pick ONE money habit from this post to try this week

Set ONE specific financial goal for 2025

See you tomorrow for Day 14! Remember, every financial decision you make today is a gift to your future self.

#personal finance#money management#budgeting tips#financial wellness#money goals#personal development#growth mindset#self love#be confident#be your best self#be your true self#become that girl#becoming that girl#becoming the best version of yourself#better version#confidence#it girl#self care#self confidence#be yourself#self worth#self improvement#self acceptance#self appreciation#girl blogger#girlblogging#girl blog aesthetic#that girl#self help#self development

85 notes

·

View notes

Text

“Please sir can I have a dollar? I haven’t eaten all day”

“Sure, here you go”

*Eats dollar*

#frugal#finance#finance tips#nessie on drugs#r/196#196#r/196archive#/r/196#rule#meme#memes#shitpost#shitposting

37 notes

·

View notes

Text

Me: I'm think, I'm a kind of a masochist! Someone: What? How did you come to that conclusion? Me: I was thinking, 'the last fifteen minutes of S2 wouldn't have been SO painful if Michael Sheen and David Tennant weren't such great, wonderful actors'. Then I thought, 'good thing they're so great'.

#good omens#inefabble husbands#michael sheen#david tennant#aziraphale/crowley#aziracrow#aziraphale x crowley#If you love the show but don't want to finance it#that's fine#I understand it#but if you are already attached to it and still want to be part of it...#also keep in mind that you can be an excellent pirate#if you really try to explore this sea#just a tip

22 notes

·

View notes

Text

How are you investing 🍬 or extra money? I started trying to learn about stock investments during the panorama. I lost just under $5k playing around with crypto 😭 but I learned (and still learning) a lot about financial management. I recently moved $10k from my HY savings account to a CD. I was dating a finance guy and he told me to open up a CD because it’s a higher interest rate and he matched my initial deposit 🥰 There’s so much to learn but it’s much better than letting money sit & collect dust! I’ve been wanting to hop on live & share my experiences with sugar investments 🤔

#sugar lifestyle#sugar blog#levelup#money mindset#finance#extra money#sugar bowl#sugar baby tips#sugar dating#heaux tips#hypergamy#black women in luxury#dating#levelingup#sugar life#investing

160 notes

·

View notes

Text

{ MASTERPOST } Everything You Need to Know about How to Pay off Debt

Understanding debt:

Let’s End This Damaging Misconception About Credit Cards

Season 2, Episode 10: “Which Is Smarter: Getting a Loan? or Saving up to Pay Cash?”

Dafuq Is Interest? And How Does It Work for the Forces of Darkness?

Investing Deathmatch: Paying off Debt vs. Investing in the Stock Market

How to Build Good Credit Without Going Into Debt

Dafuq Is a Down Payment? And Why Do You Need One to Buy Stuff?

It’s More Expensive to Be Poor Than to Be Rich

Making Decisions Under Stress: The Siren Song of Chocolate Cake

How Mental Health Affects Your Finances

Paying off debt:

Kill Your Debt Faster with the Death by a Thousand Cuts Technique

Share My Horror: The World’s Worst Debt Visualization

The Best Way To Pay off Credit Card Debt: From the Snowball To the Avalanche

The Debt-Killing Power of Rounding up Bills

A Dungeonmaster’s Guide to Defeating Debt

How to Pay Hospital Bills When You’re Flat Broke

Ask the Bitches Pandemic Lightning Round: “What Do I Do If I Can’t Pay My Bills?”

Slay Your Financial Vampires

Season 4, Episode 3: “My credit card debt is slowly crushing me. Is there any escape from this horrible cycle?”

Case Study: Held Back by Past Financial Mistakes, Fighting Bad Credit and $90K in Debt

Student loan debt:

What We Talk About When We Talk About Student Loans

Ask the Bitches: “The Government Put Student Loans in Forbearance. Can I Stop Paying—or Is It a Trap?”

How to Pay for College without Selling Your Soul to the Devil

When (and How) to Try Refinancing or Consolidating Student Loans

Ask the Bitches: I Want to Move Out, but I Can’t Afford It. How Bad Would It Be to Take out Student Loans to Cover It?

Season 4, Episode 4: “I’m $100K in Student Loan Debt and I Think It Should Be Forgiven. Does This Make Me an Entitled Asshole?”

The 2022 Student Loan Forgiveness FAQ You’ve Been Waiting For

2023 Student Loan Forgiveness Update: The Good, the Bad, and the Ugly

Our Final Word on Student Loan Forgiveness

Avoiding debt:

Ask Not How Much You Should Save, Ask How Much You Should Spend

How to Make Any Financial Decision, No Matter How Tough, with Maximum Swag

Your Yearly Free Medical Care Checklist

Two-Ring Circus

Status Symbols Are Pointless and Dumb

Advice I Wish My Parents Gave Me When I Was 16

On Emergency Fund Remorse… and Bacon Emergencies

Should You Increase Your Salary or Decrease Your Spending?

Don’t Spend Money on Shit You Don’t Like, Fool

The Magically Frugal Power of Patience

The Only Advice You’ll Ever Need for a Cheap-Ass Wedding

The Most Impactful Financial Decision I’ve Ever Made… and Why I Don’t Recommend It

3 Times I Was Damn Grateful for My Emergency Fund (and Side Income)

Buy Now Pay Later Apps: That Old Predatory Lending by a Crappy New Name

Credit Card Companies HATE Her! Stay Out of Credit Card Debt With This One Weird Trick

Ask the Bitches: Should I Get a Loan Even Though I Can Afford To Pay Cash?

The Bitches vs. debt:

I Paid off My Student Loans Ahead of Schedule. Here’s How.

I Paid off My Student Loans. Now What?

Hurricane Debt Weakens to Tropical Storm Debt, but Experts Warn It’s Still Debt

The Real Story of How I Paid Off My Mortgage Early in 4 Years

Case Study: Swimming Upstream against Unemployment, Exhaustion, and $2,750 a Month in Unproductive Spending

That’s all for now! We try to update these masterposts periodically, so check back for more in… a couple… months??? Maybe????

#debt#mortgage#credit card debt#debt management#debt consolidation#pay off debt#student loans#student loan debt#loan#financial tips#money tips#personal finance

1K notes

·

View notes

Text

financial literacy continued⋆.ೃ࿔*:・👛💵

so i released a poll if you guys would like a post on financial literacy and the results are here. so im gonna share some things that i learned while taking a financial literacy course…💬🎀

HOW TO SAVE MONEY ;

automatically deposit a certain percentage of ur income into ur savings account so that u dont even have to think about it

to do something more FUN tho, (at least in my opinion) is to make a challenge where u have to save every $10 dollar bill, or $20 dollar bill or whatever. just something to make saving money seem like a game if u wanna have some fun with it.

EMERGANCY FUND ;

most experts will tell u that ur emergency fund should be 3-6 months of ur needed expenses. so calculate ur needed expenses and multiply that by 6 to figure out how much you'd need to have in ur emergency fund.

PAYING YOURSELF FIRST ;

you should always put urself first in every single situation including financially. so to pay urself first simply means to put ur future and needs before anything else. FOR EXAMPLE... let's say u wanna buy an ipad by the end of the year, an ipad is $345.

lets also say that u get paid weekly, so you'd divide $345 by the number of weeks in a year (52) you'd get 6.6. so you'd have to save roughly $6-$6.50 a week which isnt a lot at all. and you'd be getting what u want.

INTEREST AND CREDIT ;

interest is like a reward that the bank gives you for trusting them to look after your money. the more money you have in your account, and the longer you keep it there, the more interest you can earn…💬🎀

so the bank calculates interest as a percentage of the total amount in a bank account. so if the bank pays a 1% interest you'll earn $1 for every $100 in ur bank account over the course of a year. so if u have $500 in ur account you'll get $5. its not a lot, but interest builds on itself.

credit is the ability of the consumer to acquire goods or services prior to payment with the faith that the payment will be made in the future…💬🎀

for example missing payment deadlines can negatively affect ur credit score. why is this important? if u wanna go to college and wanna use student loans, u might not be able to if ur credit history is bad. as ur credit history grows you'll get a credit score. the higher ur score, the better ur credit is.

BUILDING CREDIT ;

get a secured card. a secured credit card is a special type of credit card with a down payment. when you open the card, you will give the credit card company a deposit to hold. it can be as little as $100. the company holds the money for you and gives you a credit card with a line of credit equal to your deposit

sign up for victoria's secret direct paper mailers. you'll get a coupon each month for 1 free panty for every purchase. when u go to the mall, get urself a panty and a sweet treat 🧁 (DO NOT PUT ANYTHING ON THE CARD THAT U CANT IMMEDIATELY PAY OFF)

and then go home and pay ur credit card bill off, and then dont use it again until the next month.

#honeytonedhottie⭐️#law of assumption#it girl#becoming that girl#self concept#that girl#self care#it girl energy#advice#dream girl tips#dream girl#dream life#beauty and brains#financial literacy#investments#personal finance#information#pink academia#girly#hyper femininity#hyper feminine#girl blog#fabulous#fabulously feminine#glamor#glamorous#self improvement#self growth#maintenance#rich and pretty

836 notes

·

View notes