#diversification

Explore tagged Tumblr posts

Text

Strategic Crypto Investment Diversification – Bitcoin Mining as a Crisis-Resistant Alternative

Traditional crypto investments rely heavily on price speculation. But what if you could earn Bitcoin daily instead of merely betting on market movements? With GoMining, you diversify your portfolio with a real revenue-generating asset, providing stable and predictable returns over time.

✅ 24/7 BTC rewards – No trading, no market volatility risks

✅ Auto-reinvest for maximum growth or flexible BTC payouts to avoid Bitcoin dust

✅ No maintenance, no technical setup – 100% passive income

Strengthen your portfolio with a crisis-resistant diversification strategy.

✨ Start with just $22.99 – Use promo code ICjK3 for 5% discount + 5 days of trial mining!

➡️ GoMining LINK – Earn Bitcoin instead of just speculating on it.

Got questions? Drop them in the comments or send me a DM!

4 notes

·

View notes

Text

How Tax Cuts Will Benefit Billionaires and Corporations

It’s true that tax cuts often generate discussions about their impact on different economic groups. Here’s a blog post focusing on how billionaires and corporations might benefit from certain tax cut policies: On Sale Today The Potential Upside: How Tax Cuts Can Favor Billionaires and CorporationsTax policy can be a complex web, and proposed changes often spark debates about who stands to gain…

View On WordPress

5 notes

·

View notes

Text

If you said there is a 95 percent chance that Alexander the Great was king of Macedon in the first millennium BCE, you would fail high school history. But if it could be demonstrated that the measles virus emerged on that timescale, it is a meaningful result that helps to narrow down the context for the evolution of a major human pathogen. We must remain aware that molecular clock dates still shift around with the inclusion of new evidence or use of different models. In general, we should take them as broad estimates that are nonetheless "useful in placing bounds on when pathogens emerged and diversified."⁴⁶

46. To give two relevant examples, the divergence between measles and the closely related rinderpest virus moved back by over a millennium, thanks to an earlier sample (recovered from an early twentieth-century museum specimen of a human lung) and more sophisticated evolutionary models. Similarly, the estimated origin of Variola major, the smallpox virus, has shifted in recent years.

"Plagues Upon the Earth: Disease and the Course of Human History" - Kyle Harper

#book quotes#plagues upon the earth#kyle harper#nonfiction#alexander the great#macedon#history#measles#context#virus#pathogen#molecular clock#emergence#diversification#rinderpest#divergence#smallpox#variola major

2 notes

·

View notes

Text

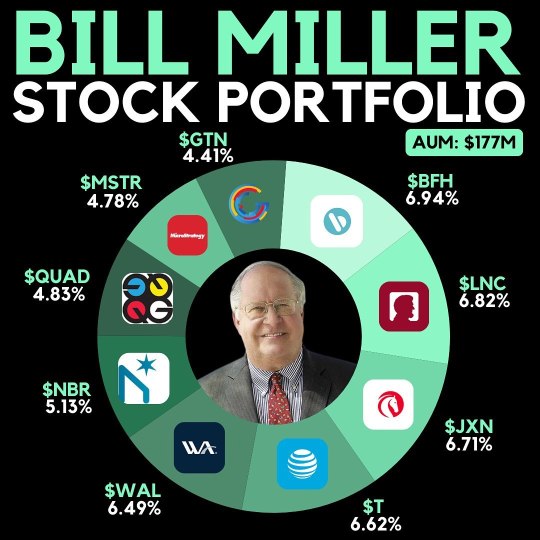

Bill Miller, a renowned hedge fund manager, recently disclosed the top holdings of his fund, which manages $177 million in assets. Here are his key investments: 1. Bread Financial: 6.94% 2. Lincoln National: 6.82% 3. Jackson Financial: 6.71% 4. AT&T: 6.62% 5. Western Alliance: 6.49% 6. Nabors: 5.13% 7. Quad Graphics: 4.83% 8. Microstrategy: 4.78% 9. Gray Television: 4.41% Have you considered any of these stocks in your portfolio? 💼 Investing wisely often requires understanding what successful managers are doing. It's essential to keep an eye on the strategies of experts like Bill Miller, as their insights can guide your own financial decisions. 💡 I believe that diversifying your investments based on proven strategies is key to achieving long-term financial success. Take charge of your financial journey today! 🚀

#BillMiller#HedgeFund#Investing#StockMarket#FinancialAdvice#PortfolioManagement#InvestmentStrategy#WealthManagement#FinancialSuccess#StockPick#Diversification#ValueInvesting#MarketTrends#InvestmentInsights#FinanceTips

2 notes

·

View notes

Text

Social Trading in a Nutshell

Social trading has revolutionized the way individual investors participate in the financial markets. By leveraging the collective wisdom and strategies of experienced traders, newcomers can improve their trading outcomes. This article explores the concept of social trading, its benefits, risks, and how to get started. What is Social Trading? Social trading is a form of investing that allows…

#Demo Account#Diversification#Financial Markets#Investing#Market Analysis#Review#Risk Management#RSI#Security#Trading Platform#Trading Platforms#Trading Strategies#Transparency

5 notes

·

View notes

Text

Mastering Intraday Stock Trading: Strategies, Tips, and Risks

Intraday stock trading, also known as day trading, is a high-stakes endeavor where traders buy and sell stocks within the same trading day. It’s a thrilling pursuit that requires skill, discipline, and a deep understanding of the market. In this article, we’ll explore the world of intraday stock trading, covering strategies, tips, and the inherent risks involved.### Understanding Intraday…

View On WordPress

#Brokerage Fees#Capital Management#Commissions#Contrarian Trading#Day Trader#Day Trading#Diversification#Economic Events#Emotional Trading#Financial Instruments#Financial Markets#Intraday Trading#Investment Strategies#Market Analysis#Market Behavior#Market Liquidity#Market Opening#Market Psychology#Market Research#Market Sentiment.#Market Timing#Market Trends#Momentum Trading#Portfolio Management#Price Fluctuations#Risk Assessment#Risk Management#Scalping#Short-Term Trading#Stock Market

11 notes

·

View notes

Text

China Crash US Economy: What Next?

youtube

Interesting.

2 notes

·

View notes

Text

Personal finance strategies for saving and investing

Table of Contents:

1. Introduction

2. Importance of Personal Finance Strategies

3. Saving Strategies

1. Budgeting

2. Automating Savings

3. Cutting Expenses

4. Investing Strategies

1. Diversification

2. Retirement Accounts

3. Passive Income Streams

5. Conclusion: Maximizing Financial Growth

6. FAQ Section

Introduction:

In the realm of personal finance, navigating the complexities of saving and investing can be daunting. However, armed with the right strategies and knowledge, individuals can pave their way to financial security and prosperity. This comprehensive review delves into the intricacies of personal finance strategies for saving and investing in 2024, exploring various techniques and approaches to optimize wealth accumulation and growth.

**1. Importance of Personal Finance Strategies:**

Effective personal finance strategies serve as the cornerstone for achieving financial stability and long-term prosperity. By meticulously planning and implementing strategies tailored to individual goals and circumstances, individuals can gain control over their finances, mitigate risks, and build a solid foundation for future endeavors. Whether aiming for short-term goals like purchasing a home or planning for retirement, strategic financial management is indispensable.

**2. Saving Strategies:**

**1. Budgeting:**

Budgeting stands as the fundamental pillar of financial management, providing a roadmap for allocating income and expenses. By meticulously tracking expenses and setting realistic spending limits, individuals can identify areas of overspending and redirect funds towards savings and investments. Utilizing budgeting apps or spreadsheets simplifies the process, enabling better decision-making and fostering financial discipline.

**2. Automating Savings:**

Automation streamlines the saving process, ensuring consistent contributions towards financial goals. Setting up automatic transfers from checking to savings accounts or utilizing employer-sponsored retirement plans automates savings, removing the temptation to spend impulsively. Additionally, utilizing apps that round up purchases to the nearest dollar and deposit the difference into savings accounts fosters incremental savings growth effortlessly.

**3. Cutting Expenses:**

Trimming unnecessary expenses is paramount in bolstering savings potential. Conducting regular expense audits aids in identifying discretionary spending that can be reduced or eliminated. Negotiating bills, opting for generic brands, and embracing frugal habits contribute to significant cost savings over time. Redirecting these savings towards investments amplifies wealth-building opportunities and accelerates financial progress.

**3. Investing Strategies:**

**1. Diversification:**

Diversification is the bedrock of investment strategy, spreading risk across various asset classes to minimize exposure to volatility. By allocating investments across stocks, bonds, real estate, and alternative assets, individuals can optimize risk-adjusted returns and cushion against market fluctuations. Regular rebalancing ensures alignment with evolving financial goals and risk tolerance levels.

**2. Retirement Accounts:**

Maximizing contributions to retirement accounts such as 401(k)s or IRAs offers tax advantages and accelerates wealth accumulation. Employers often match contributions to retirement plans, amplifying the benefits of consistent savings. Leveraging tax-deferred growth and compound interest within retirement accounts empowers individuals to secure a comfortable retirement lifestyle.

**3. Passive Income Streams:**

Diversifying income sources through passive streams complements traditional employment income, fostering financial resilience and independence. Investing in dividend-paying stocks, rental properties, or creating digital assets like e-books or online courses generates recurring income with minimal ongoing effort. Cultivating multiple passive income streams bolsters financial security and enhances wealth-building potential.

**5. Conclusion: Maximizing Financial Growth:**

In conclusion, embracing personalized finance strategies tailored to individual circumstances is paramount in achieving financial prosperity. By prioritizing saving and investing, individuals can cultivate a robust financial foundation, mitigate risks, and capitalize on growth opportunities. With discipline, diligence, and strategic planning, the path to financial freedom becomes attainable for everyone.

**6. FAQ Section:**

1. Q: How much of my income should I allocate towards savings?

A: Financial experts recommend saving at least 20% of income towards savings and investments to ensure long-term financial security.

2. Q: Is it better to pay off debt before saving or investing?

A: It depends on the interest rates of the debt. High-interest debt should be prioritized for repayment, while simultaneously allocating a portion towards savings and investments to capitalize on compounding returns.

3. Q: What are some low-risk investment options for beginners?

A: Beginner-friendly investment options include index funds, exchange-traded funds (ETFs), and robo-advisor platforms, offering diversified exposure to the market with minimal risk.

4. Q: How often should I review my investment portfolio?

A: Regular portfolio reviews, typically quarterly or semi-annually, are recommended to ensure alignment with financial goals, risk tolerance, and market conditions. Rebalancing may be necessary to maintain diversification and optimize performance.

Learn more

#Personal Finance Strategies#Saving#Investing#Financial Management#Budgeting#Automation#Expense Reduction#Diversification#money

3 notes

·

View notes

Text

#529Plan#AssetAllocation#CryptoInvesting#Diversification#DividendInvesting#FinancialAdvice#FinancialAdvisor#FinancialEducation#FinancialGoals#FinancialPlanning#HighYieldSavings#InvestmentOptions#InvestmentPortfolio#PassiveIncome#PeerToPeerLending#RealEstateInvesting#RetirementPlanning#RoboAdvisors#RothIRA#SavingsStrategies#SideBusiness#StockMarket#StocksAndBonds#WealthManagement#Investing#SHARE.#Facebook#Twitter#Pinterest#LinkedIn

2 notes

·

View notes

Text

Investment Opportunities:

Discover a world of investment opportunities and unlock the potential for long-term financial success. In this insightful blog post.

Introduction: Welcome, dear readers, to an exciting journey towards exploring various investment opportunities that can pave the way to financial success and help you grow your wealth. In this interactive blog post, we will delve into the world of investments, providing you with a personalized approach, persuasive insights, and passive strategies that will empower you to make informed decisions.…

View On WordPress

#Advice#Blog#Business#Career#Crypto#Cryptocurrency#Digital#Diversification#Driven#Educational#ETFs#Finance#Financial#Gentlemen#Goals#How to#Income#Investing#Market#Men#Money#Mutual funds#Opportunity#Professional#Self growth#Stability#Stock

3 notes

·

View notes

Text

youtube

Would you store all your valuables in one locker? Of course not! So why put all your money in one investment?

In this video, we unlock the smart investing formula - a proven way to boost returns and reduce risk using the power of diversification across.

Full blog: https://navia.co.in/blog/crack-code-smarter-investing-risk-adjusted-return/

Download the app - https://onelink.to/bzxpmy

Don't just chase returns—build wealth with balance. Subscribe to Navia Markets for more smart money moves!

#smartinvestment#smartinvestors#invest#investingtips#trendingmarkets#trending#stockmarket#nifty#sensex#bse#nse#highreturninvestment#highreturnstock#investmentideas#investmentopportunities#investmentstrategies#equity#debt#gold#goldinvest#goldinvestmenttips#goldinvesting#equitymarket#equitymarkets#debtmanagement#diversification#diversifyinvestments#diversifyincome#investmentdiversification#investingportfolio

0 notes

Link

0 notes

Text

In today’s crowded health innovation landscape, it’s not enough to have breakthrough science — you need a commercialization and strategic engine that understands the complexity of scaling in real-world markets.

#360 disruption#360disruption#abudhabi#abudhabifreezone#adsmehub#advisory#ajman#ajman free zone#ajmanfreezone#AlAin#BusinessAcceleration#BusinessExpansion#BusinessGrowth#CEPA#ClientSuccess#disruption#Diversification#dubai#dubaifreezone#EconomicResilience#FDI#free zone#free zones#freezones#fujairah#gcc#GCCStrategy#googlesearch#gotomarket#growth

0 notes

Text

man why is diversification so hard. i like this export. i know how to make this export. this export makes me happy and when its price drops i knowwwwwwww i get depressed but i don’t want to leave it :( it’s all i know

1 note

·

View note

Text

Money Management Explained

Money management is a crucial aspect of financial stability and success. It involves planning, controlling, and monitoring your income and expenses to achieve your financial goals. Effective money management can help you save more, invest wisely, and avoid debt. This article delves into the principles of money management, offering practical tips and strategies to help you take control of your…

#Diversification#Finance#Financial Goals#Financial Planning#Investing#Market Volatility#Money Management#Review#Security#Volatility

2 notes

·

View notes

Text

In the last few hundred thousand years, the African schistosomes experienced a radiation, rapidly diversifying in response to evolutionary opportunities.

"Plagues Upon the Earth: Disease and the Course of Human History" - Kyle Harper

#book quote#plagues upon the earth#kyle harper#nonfiction#history#passage of time#africa#schistosoma#parasite#worms#radiation#diversification#evolution

0 notes