Text

How does separation and child support effect my mortgage?

Navigating Through Separation to Solutions

"Happily Ever After", is something we all strive for. Especially when you've gone as far as to find that 'home sweet home', and agreed to finance it together. This act of commitment is often thought of as the 'real deal', to a lasting relationship. Regrettably, statistics remind us that many 'committed' relationships, end in separation. What does that mean for your mortgage and financial future?

If you are in the unfortunate circumstance of parting ways with the person who you share your mortgage and home with, you will be faced with a dramatic change to your finances. This change will be greater magnified if you and your partner have children. Not only will the mortgage need to be mutually agreed upon, but also child support.

Here are some of your potential options:

Selling the property is sometimes the easiest way to put your joint debt behind you. Both of you are then released of the mortgage obligations, and your equity is now available. Be aware, that this option can leave you with penalties, that may be more than you're willing to sacrifice.

If you wish to keep the house, it's likely that you'll have to buy out your partner's share. There are some lenders who will allow you to purchase the home from your spouse or partner at 95% financing. The equity of the house is used as your down payment, allowing you to split the remaining equity, and pay off other debt. Keep in mind that you're now expected to qualify for financing based on your personal income. This could be a substantial difference from the joint income that was used for the initial qualification.

Perhaps it's more of a benefit for you to let your spouse or partner keep the house. If you only remove yourself from the title, the lender still considers you jointly responsible for the mortgage payments. This scenario leaves your credit score vulnerable, if even one payment is missed. To be completely cleared of the existing mortgage, you must receive a letter of release from the lender. This will benefit your future borrowing power, as well.

Child support and alimony payments, however, will also impact your ability to qualify for future financing decisions. If you're receiving payments, the payments are generally added to your total personal income. You will need consistent evidence of the payments, for the lender to qualify child support and/or alimony as income. If you find yourself paying child support and/or alimony payments, the total sum is generally deducted from your total personal income, limiting your future financial decisions.

As complex as it is to sustain a healthy, happy relationship; opting out of your relationship brings along a whole new set of complicated issues. I've helped numerous couples navigate through this difficult time, giving them personal options to get their home financing back on track. If you have any questions, contact me today.

Blogged by Elise Hildebrandt, AMP Mortgage Associate Broker Lic #316103 @ The Mortgage Centre Brokerage Lic #31547, Saskatoon, Saskatchewan. Elise has been in the financial industry for 16 years.

You can contact her at: [email protected] or www.elisehildebrandt.ca

1 note

·

View note

Text

How to go from debt to building "UP" wealth

When is the topic of debt comfortable, not viewed as a problem, and sometimes even embarrassing? Right now!

Debt is like all things in life, it depends on your perspective; your strategy. If you start with a goal and the end in mind! Knowledge, ingenuity and 'stick to the plan' discipline, can transform those debts of yours into real wealth.

Let's learn how:

1. The Debt List:

Stop avoiding the truth, because it is guaranteed that what you don't know, can hurt you financially. Your list needs to include everything:

* credit cards

* car loans

* small recreation loans

* mortgages

* student loans

* fuel or retail loans

To make sure you haven't missed anything, request a copy of your credit report, (you can order it from www.equifax.ca for $23.95) and compare it with your list to insure it's accurate. How closely these two lists match, will be a good indication of how aware you are of your personal debt load.

2. Make a Budget:

This is a chore for most people. The reward for making the effort, though, should be enough incentive to follow through. Imagine receiving a bill, only to find $0 owing! This is your reward for developing a strategy, a budget. We all have luxury spending in our lives that we can probably live without. Determine what yours is, and consider putting that money towards your highest interest rate debt instead. This is the plan:

* pay off highest interest debt with the smallest balances ASAP

* never stop using your 'debt' money for paying debt until it grows into wealth!

Let me explain; as you start eliminating loans, redirect the money and put extra on your bigger loans. So, if you had $170.00 you pay every month for appliances from Sears, and now they're paid off, take that $170.00 and add it to your credit card, student loan, vehicle, and eventually your mortgage. The goal is to have as many $0 balances as possible, but to never diminish the amount of money you put towards debt.

So if your current budget has $3000 going towards various loan payments, this amount is never going to change. It's simply going to become more and more concentrated, until you'll find yourself with one final debt, likely your mortgage.

3. Pay More Than the Minimum:

Minimum payments are designed to keep you in perpetual debt; you consistently paying interest to your lenders. Good for the lender, bottomless pit for you! Pay as much as you can afford, and determine to get your balance to zero, one loan at a time.

4. Consider Debt Consolidation:

As your local mortgage expert, I can help determine if you could save money clumping all of your loans into a refinanced mortgage. This could end up saving you interest, and it feels less overwhelming in the long run. You won't need to consider month to month how to organization which loan to knock down next.

5. Think Mortgage Free:

Never stop using your 'debt' money for paying debt, until it grows into wealth! Now you're down to only one lender, and it's suppose to take a few decades to be rid of this one...unless you keep that debt money paying debt. Every extra dollar you put on your mortgage, goes directly towards principle, meaning there's less interest to calculate the following month. Talk to your lender about bi-weekly accelerated, or prepayment privileges. They're available, but it's up to you to use them to your advantage. The sooner you stop paying money to interest, the sooner your money can start growing into wealth.

6. Invest For Your Future:

With a smaller or paid out mortgage, you'll find extra money to start investing. Consider purchasing a revenue property that will earn ongoing rental income, as well as asset appreciation.

Questions about your mortgage options? Give me a call!

Blogged by Elise Hildebrandt AMP Mortgage Associate Broker, Lic# 316103 @ The Mortgage Centre Brokerage Lic #31547 Saskatoon, Saskatchewan

Elise has been in the financial industry for 16 years. Contact her at: [email protected] or www.elisehilebrandt.ca

0 notes

Text

Mortgage Insurance Guideline changes for May 30, 2014. Are you ready?

And more changes to come….. Genworth…

At the beginning of May, CMHC advised that they were making changes to their product line effective for May 30, 2014, the changes were talked about in our previous blog B21 & CMHC Rule Changes

Shortly after that Genworth reviewed their books and they announced the following:

Effective May 30, 2014, the maximum number of units allowable under the Vacation/Secondary Home Program will be reduced from 2 units to 1 unit.

Upon review of the current Business for Self Program, they will not make any changes to their product line.

Current guidelines for Genworth’s Business for Self program state the following:

The income reported by the borrower must be reasonable based on the industry, length of operation and type of business

Strong credit profile with minimum 2 trade lines with at least two (2) years history

No mortgage, installment or revolving credit delinquencies appearing on the credit bureau in the past 12 months

No reported defaults on residential mortgages for the past 7 years

No previous bankruptcy

Minimum 5% down payment from the borrowers own savings. The remainder may be gifted from an immediate family member. Borrowed down payments are not permitted.

Borrowers with commission income are ineligible

Lender to ensure borrower(s) have no tax arrears

All applicants used to qualify must occupy the property (If two unit property, one unit must be owner occupied)

Questions about your mortgage options and Business for Self?

Blogged by Elise Hildebrandt, AMP Mortgage Associate Associate Lic #316103 at The Mortgage Centre Brokerage Lic #31547, Saskatoon Elise has been in the financial industry for 16 years. Contact her at: [email protected] or www.elisehildebrandt.ca

0 notes

Text

B21 and CMHC Rules Changes

Be Prepared! Act Now Before CMHC Changes!

You just have to step out your door to know that life is not predictable; we are all, to some degree, controlled by the ‘unpredictable’ weather. The best defense against unpredictable circumstances, is to stay prepared, and flexible. Nothing could be more true about your mortgage!

For the last couple of weeks, the federal government has been advising that there are changes coming down the line for mortgages. We’ve all heard that the mortgage insurance premiums are going up, effective May 1, 2014. This translates to a new mortgage insurance premium hike of 3.15%, compared to 2.75%, if you’re putting a 5% down payment on your primary residence. CMHC has been quite transparent about this particular change, however, there are other changes coming along with this, that are not so obvious, keeping in mind that this organization is a government run agency.

Over the years, rumor has been that CMHC is gradually pulling out of the mortgage insurance industry. Considering that they are the government, many agree they have no business having their hand in personal real estate. Privately owned and operated companies, such as Genworth and Canada Guarantee, seem to be a much better option for mortgage insurance. Be what it may, the truth is that the following changes are coming into effect, May 30, 2014, for CMHC.

Clients who already have one home insured with CMHC, cannot insure a 2nd home with them.

Self-employed clients will need to have 3rd party verification for their employment. They will need to provide T1 Generals, Notice of Assessments, or anything else CMHC asks for.

Again, Genworth and Canada Guarantee have not changed their policies.

If either of these changes apply to you, you still have until May 30, 2014, to get the mortgage approved. The close date does not matter, but most lenders cannot hold their mortgage rates for any longer than 120 days.

At this time, no other rules are expected to change, but just like the weather, unpredictable things can happen! I’ll keep you in the know, as soon as I know if another ‘unpredictable mortgage pattern’ is on the horizon!

Blogged by Elise Hildebrandt, AMP Mortgage Associate Broker Lic #316103 at The Mortgage Centre Brokerage Lic #31547, Saskatoon Elise has been in the financial industry for 16 years. Contact her at: [email protected] or www.elisehildebrandt.ca

#B21#CMHC#mortgage insurance#second homes#stated income#self-employed#rule changes#Genworth#Canada Guarantee

0 notes

Text

Home Maintenance 101

Preserving your property and keeping it spiffy is not only for when your mom comes over. It is expected, as part of your mortgage commitment. As stated in Vow #4, maintain your real estate, and keep it marketable. Hopefully this is one of those obligations that you find yourself doing anyway, but in case your mom never comes over, here’s a handy checklist to keep things up on a seasonable basis.

SPRING (This refers more to the weather conditions, then the actual date on the calendar! Please don’t hesitate, especially if you live in Saskatchewan, to wait until it is actually “springish” outside, before springing from your chair to get on with ‘spring’ home maintenance!)

ROOF: The winter is punishing for your home’s frontline of defense. Check shingles that may have come loose or broken in the icy winter conditions, Saving yourself from a roof leak, and puddles inside your house, is always worth the effort of getting your ladder out!

GUTTERS: Since your ladder is out anyway, check out all your gutters. Winter winds may have deposited twigs and leaves that will clog your gutters when the spring rain comes. If water is not properly funneled away from the foundation of your house, you could end up with water in the basement. As we know, water inside your house from any angle, is very destructive.

LANDSCAPING: Grab your pruning sheers and a garbage bag, and hopefully the sun is warming your back, as you remove any dead annuals, prune back perennials to the mulch line, and pull weed seedlings while the ground is still soft. The winter months often leave your soil unbalanced, so your plant beds will benefit from an application of fertilizer. This effort now, will really free up your time for you to have fun in summer!

AIR CONDITIONING: Depending on your home, and where you live, you may have a window unit, central air, or another alternative. Getting a service professional can save a headache, and profuse sweating in the middle of the summer; and usually runs at about $100. Even if you just take out your user guide, and follow the recommended regular maintenance, will result in cool and restful nights.

WINDOW SCREENS: All it takes is one hole for a pesky multi-legged creature to share your residence with you and your shrieking daughter! A quick fix with duct tape will last you awhile, but a more permanent fix will keep that place of yours a whole lot more marketable in the future!

Spring maintenance is just that. Remembering what it feels like to be outside without a toque on, while inspecting the exterior of your home, so it’s worthy of holding you and your summer plans up, without interruptions.

SUMMER: Depending on your green thumb, and the extent of your landscaping, keep things neat, stay on top of the little weeds before they take over, and keep the lawn mowed. If it doesn’t rain for awhile, it’s a good idea to bring out the sprinkler, or turn on your underground system. Check to see that all parts of your growing property are getting sufficient water, if you have a sprinkler system.

***Rainy Day Tasks***

TILE GROUT and SILICON: Summer always has its cloudy rainy days; and this would be a great time to look for any touch ups needed in the kitchen and bathrooms. You will prolong the life of your tiles, and things will simply look better, and be more sanitary in these rooms that are used so regularly!

PLUMBING: Since you’re in the kitchen and bathroom anyway, check out the toilets and faucets for small leaks. The aerator on the faucet can affect your water pressure, and is a surprisingly easy fix. Google it, and enjoy a healthy stream of water again.

INSECTS: Like the weeds, staying on top of these guys while there’s just a little problem, will prevent them from taking over your house. Remedy the problem as suitable to the type of critter. Finding the ‘root’ of the problem, how they’re getting into your house in the first place, is a good place to start. If your problem is termites, you will likely need to seek professional assistance.

***Warm Summer Day Projects***

DECKS and FENCES: Before any repairs are made, a good washing is always a good idea. Keeping stain or paint fresh, will protect all the lumber, and save you from having to make major replacements. Be sure the post, and boards are all sturdy and not abrasive.

WINDOW WELLS: Grab a garbage bag, and think of it as a treasure hunt. You never know what the wind has blown into your window wells, or if a creature thought it would make a cozy little sheltered home!

DRYER and EXHAUST VENTS: Run outside when the dryer’s on, and make sure there is exhaust coming out of the vent. If you can’t even smell your fresh laundry, check for blockages to the best of your ability. You may need to seek professional help. It’s always a good idea to keep the area around and behind your washer and dryer clean of lint, so that there’s plenty of airflow.

FALL: Just when winter will come, is always a mystery. Whether or not it’s coming, and how it takes a toll on your property, is always a guarantee. This type of maintenance needs to be done sooner then later, to make sure you get a chance to get it done, before everything is frozen for months!

HOT WATER HEATER: To keep your heater efficient, so you can enjoy that nice hot shower on a blustery cold day is always smart. Flush your heater, and remove the sentiment from the bottom, so the hot water keeps on coming, when you need it!

AIR CONDITIONING: If you have a window unit, now’s the time to take it out. Cover up your central air unit with a tarp, or other protective outdoor material, and secure with bungee cords, so it doesn’t go sailing away on a howling winter night.

HEATING SYSTEM: Inspecting all windows and doors for leaks can save a nice chunk of change throughout the winter. It’s a wise idea to have your furnace serviced or inspected annually, or at least every other year. Make sure vents are open, clean, and not blocked in anyway. If you have a fireplace, follow the safety recommendations, so all is merry and bright!

OUTDOOR FAUCETS: Turn off the water from inside for the outside faucets, and have them blown out, to prevent any lines from cracking. While your at it, flush out your water hoses, and store them in a place where they won’t be tripped on in the snow.

SUMP PUMP: It’s good to have peace of mind in spring, when the runoff is melting, that your basement will surely stay dry.

DRIVEWAY CRACKS: Sealing cracks will keep them from expanding when the water freezes and expands.

WINTER GEAR: As previously mentioned, winter comes when winter wants to come. Being prepared and waiting for it, is better then trudging around in the white stuff, looking for your shovel. And if you’re mom is on her way over, the last thing you want her to do, is slip on your sidewalk, so have some salt ready to keep all walkways safe!

WINTER: Everyone spends a little more time indoors during this season, so use this extra time to check things over that you may have overlooked. Always keep an eye on the exterior. Preventing problems is usually less costly, then having to fix them under pressure!

ICICLES and ICE DAMS: They may look pretty, and your kids might love them, but icicles are dangerous in all sorts of ways. They could fall on someone, or onto your property, causing damage. They can be the cause of unwanted water by your foundation, come spring, as well.

ELECTRICITY: There are a few things you can safely do to be sure your electricity is working soundly. This must always done with caution, though. Don’t pretend to be qualified for anything other then a routine check up, unless you have some kind of experience! Check that all outlets are working, and test your GFCI outlets. It is debatable how often these should be tested, so decide what’s best for you.

TIGHTEN UP: Take a walk through your house with a screw driver, and tighten up those loose doorknobs, deadbolts, doors, and windows. Keeping moving parts tight, keeps them working well, and not rubbing, which causes them to wear out sooner then necessary.

SHOWER HEADS: Remove shower heads, and clean out the sediment. You’ll have more water pressure, and the shower head will last longer.

BASEMENT: The notoriously overlooked underworld! Especially if this is primarily your storage area. Reorganize, clean, sort, and look out for mould and water.

Owning your own property is so rewarding, and keeping it in good marketable condition, is simply protecting your investing for the future. Take pride in your place, and your mom will certainly be proud of you. Hopefully you’ll feel good about it, too!! Water is a home’s greatest enemy, so keep on top of any kind of leak. You will sleep soundly, knowing your shower streamed plenty of water, was as hot as you wanted, the air is comfortable for the season, and drafts and creatures are kept at bay, outside, where they belong.

Questions about your home maintenance? Give Elise a call, and she will happily direct you to one of her trusted business partners.

Questions about your mortgage options? Call Elise!

Blogged by Elise Hildebrandt, AMP Mortgage Associate Broker Lic #316103 at The Mortgage Centre Brokerage Lic #31547, Saskatoon Elise has been in the financial industry for 16 years.

Contact her at: [email protected] or www.elisehildebrandt.ca

0 notes

Text

What is Fire Or Home Insurance: Essentially the Same, and an Essential for your Real Estate

As previously stated, there are four vows we all make as mortgage holders, to our lender. The one that seldom gets attention, until the unthinkable happens, is fire or home insurance. No mortgage can be completed without it. What you need to be aware of, is how all insurance is not created equal. First of all, the insurance must satisfy the demands of the lender:

Home Insurance must be purchased to adequately protect your property against fire and other specified hazards. The policy must state that the property is insured for full value of the property, and payable to the specific lender of the mortgage. Home insurance must be in effect when you take possession of your real estate.

If you don’t insure your home and the lender does you will be taken advantage of. The premium will be higher, and it will only cover the cost of your outstanding mortgage. All of your belongings, the contents of your home, will not be insured.

What else can your insurance do for you, besides fulfilling your obligation to the lender? With adequate insurance, you will get full replacement value. This will include all of its contents, your possessions, if the tragedy has affected them. Your insurance should also fluctuate, as the value of your home increases over time; meaning that if your home is worth $250,000 today, but three years from now, the market has pushed it up to $276,000, you would be insured for the market value. Be aware that the cost of land is never included in the replacement value.

Discuss with your insurance broker the difference between broad and comprehensive insurance. Think of the unexpected, like hail damage, or rainbow Jell-O all over your living room carpet. Asking proactive questions now, can make any tragedy a lot less stressful later. Know how you're protected, and breathe easy, if the unexpected wrecks havoc on your home!

Home or Fire Insurance is an unavoidable expense when purchasing a home. However, the premiums are variable, depending on whom you choose to purchase it from, and the amount of the deductible. Asking questions is the best way to find out what is logical for you!

Be sure to direct your questions about fire or home insurance to Elise. She'll be happy to refer you to one of her trusted business partners, who can answer all of your home insurance questions.

Questions about your mortgage options? Give me a call!

Blogged by Elise Hildebrandt, AMP Mortgage Associate Broker Lic #316103 at The Mortgage Centre Brokerage Lic # 31547, Saskatoon. Elise has been in the financial industry for 16 years.

Contact her at: [email protected] or www.elisehildebrandt.ca

0 notes

Text

What is a commitment letter?

To Payout Do We Part

Just like every contract, or commitment, when you sign your mortgage, you have promised to be accountable. The question that all of you should be asking, before you choose to sign your name on that commitment form is: do I really know what I'm accountable for?

Your mortgage 'vows' include four specific promises that you are responsible to uphold until your mortgage is paid in full to the lender.

VOW #1: Your loan amount, plus accrued interest, is expected to be repaid.

VOW #2: Property taxes are expected to be paid in full - some lenders go to the extent to require a portion of you annual taxes to be included with each monthly payment. The lender then pays your taxes from the tax account that they've budgeted for you. This is certainly an arrangement that benefits you. I encourage you to form your own property tax monthly budget, if your lender does not offer this service. It saves you from scraping together the lump sum payment, when the taxes come due. If you are accountable for your taxes, your lender will make sure your taxes are indeed paid

VOW #3: Home Insurance must be purchased to adequately protect your property against fire and other specified hazards. The policy must state that the property is insured for full value of the property and payable to the specific lender of the mortgage.

VOW #4: Preserve the value of your real estate, by maintaining the property and keeping it in a reasonable state of repair.

As with any commitment, there is benefit to you for upholding your side of the contract. If you are accountable, and fulfill your mortgage 'vows', your lender in return will:

#1: Discharge your mortgage upon full repayment.

#2: Keep their nose out of your business, and allow you to enjoy your property without interference. Keep in mind that the lender may technically own more of your real estate then you do, depending on how close you are to 'payout do we part'!

Questions about your mortgage options? Give me a call!

Blogged by Elise Hildebrandt, AMP Mortgage Associate Broker Lic #316103 at The Mortgage Centre Brokerage Lic #31547, Saskatoon Elise has been in the financial industry for 16 years. Contact her at: [email protected] or www.elisehildebrandt.ca

0 notes

Text

Finding the Keys to Unlock Your Ugly Mortgage

Finding the Keys to Unlock Your Ugly Mortgage

Recently, I had a client call me in near tears. Her current mortgage payout penalty was just over $16,000. Could I help her?

Four and a half years ago, she had agreed to a 10 year term with one of the “Big 5″ banks. Her current interest rate was a whopping 5.45%, and her payment was about $1500/mth. Could I help her, or was she doomed to mortgage prison, with no key in sight to get her out?

I did some research, and found the following information under the Federal Interest Act of Canada:

10. (1) Whenever any principal money or interest secured by mortgage on real property or hypothec on immovables is not, under the terms of the mortgage or hypothec, payable until a time more than five years after the date of the mortgage or hypothec, then, if at any time after the expiration of the five years, any person liable to pay, or entitled to pay in order to redeem the mortgage, or to extinguish the hypothec, tenders or pays, to the person entitled to receive the money, the amount due for principal money and interest to the time of payment, as calculated under sections 6 to 9, together with three months further interest in lieu of notice, no further interest shall be chargeable, payable or recoverable at any time after the payment on the principal money or interest due under the mortgage or hypothec.

In common terms, the Federal Interest Act states, that once 60 months of your agreement have been met, the lender can only charge 3 months interest on the outstanding mortgage balance. This Act protects all Canadians, even if they have agreed to mortgage terms for more then 5 years.

The key to unlock my client’s uncomfortable mortgage, is to stick with it a few more months, until the 60 months have come and gone. At that point, she is free to look at some real options, that will save interest, and put her on a path to becoming mortgage free much sooner then her current situation! By being patient, until the 60th month is up, she will only have a penalty of approximately $2900, instead of the staggering figure of $16,000!

Keep this in mind, when you consider all the options for your mortgage. No mortgage can go ahead without your agreement to it. Know what you’re signing for, and protect yourself from mortgage prison, with no ‘key’ out! I’d be happy to share what is possible to give you mortgage freedom, instead of ‘locked up’ mortgage bondage.

Questions about your mortgage options? Give me a call!

Blogged by Elise Hildebrandt, AMP Mortgage Associate Broker Lic #316103 at The Mortgage Centre Brokerage Lic #31547, Saskatoon Elise has been in the financial industry for 16 years.

Contact her at: [email protected] or www.elisehildebrandt.ca

0 notes

Text

How do I maximize my mortgage payment privileges?

No one likes the idea of spending more money on interest then what you absolutely have to. However, making the most cost effective decision, to deter interest, is not always so obvious! Interest and amortization have a way of playing with the numbers. How to maximize your cash, and find yourself closer to mortgage free, is what’s most important! Let me prove to you how you can save yourself a significant amount of money, by simply applying your cash in the right order!

Every commitment letter gives opportunity to prepay your mortgage anywhere from 10% to 20% a year, depending on the lender. This privilege is in addition to your right to pay your mortgage payment in different intervals, besides the traditional monthly payment, including: semi-monthly, bi-weekly, accelerated, or weekly accelerated.

It is commonly ‘believed’, that if you have 20% of your purchase price available when you purchase your real estate, your best option is to put that sum directly towards the down payment. Logically, you would think that this makes the most sense. After all, how can you pay interest on money that is not even borrowed? Well, the proof is in the bottom line, which is everyone’s concern, so let’s prove what really is true!

Below is a comparison using a 20% down payment, versus 5% down, and then maximizing on your payment privileges. Take a look at our mortgage details:

Purchase Price: $300,000

Interest Rate: 3.09% over 5 years

Amortization: 25 years

Payments: Bi-weekly accelerated

20% Down Payment: $60,000

Scenario 1 demonstrates what happens when you sink your 20% in immediately at the time of purchase:

5 years later, your mortgage payout is $199,005.91. Along with the option to use bi-weekly accelerated payments, you’ve shaved down the amortization from 25 years, to 22 years, meaning you’ll be mortgage free 36 months sooner!

Scenario 2 demonstrates what happens when you put the minimum 5% down, $15,000, and pay your mortgage insurance premium. After taking possession of your real estate, you then put the remaining $45,000, as a lump sum deposit. You’ve now taken full advantage of your prepayment privilege, and the deposit has gone directly to your principal! Not a penny of this cash is applied to interest.

5 years later, your mortgage payout is $190,477.64. Along with the option to use bi-weekly accelerated payments, you’ve shaved the original 25 year amortization, down to 17 years 8 months, bringing you 7 years, 4 months sooner to mortgage free liberty!!

Please keep in mind, your payments are somewhat higher in the second scenario, although, the benefits speak clearly for themselves! The difference between these two options represents a savings of $8,528.27!!

Questions about your mortgage options? Give me a call!

Blogged by Elise Hildebrandt, AMP, Mortgage Associate Broker Lic#316103 at The Mortgage Centre Brokerage Lic# 31547, Saskatoon Elise has been in the financial industry for 16 years.

Contact her at: [email protected] or @ www.elisehildebrandt.ca

2 notes

·

View notes

Text

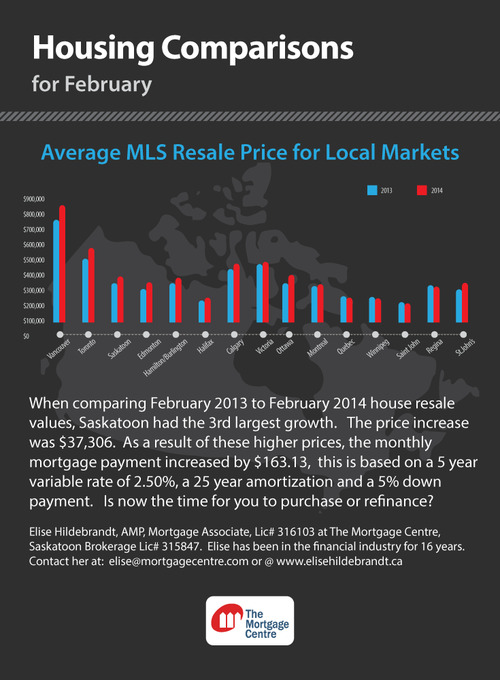

Housing Comparisons for February

When comparing February 2013 to February 2014 house resale values, Saskatoon had the 3rd largest growth. The price increase was $37,306. As a result of these higher prices, the monthly mortgage payment increased by $163.13, this is based on a 5 year variable rate of 2.50%, a 25 year amortization and a 5% down payment. Is now the time for you to purchase or refinance?

Elise Hildebrandt, AMP, Mortgage Associate, Lic# 316103 at The Mortgage Centre, Saskatoon Brokerage Lic# 315847. Elise has been in the financial industry for 16 years. Contact her at: [email protected] or @ www.elisehildebrandt.ca

0 notes

Text

What does IRD mean in your mortgage commitment?

What you do not know, can hurt you, especially if you choose to change your mind about you house or real estate. As we all know, circumstances in life seldom remain the same, unlike all the fine print in your mortgage. All mortgage commitments have clauses; penalties that cost you money. This penalty is charged, if you choose to payout your mortgage prior to its maturity date, or if you are looking to purchase or refinance.

Generally, the lender words the clause something like this:

The mortgage payout penalty will be the GREATER of either;

3 months interest payments, based on the remaining mortgage balance on the date of payout.

The Interest Rate Differential, aka IRD. IRD is the difference between your original interest rate that you agreed upon when you took out your mortgage, compared to what the lender could get today, if they were to lend the money.

IRD can be calculated in one of three ways:

Standard Rate IRD Penalty - This is the difference between your contract rate and the rate that is closest to your remaining term left on your mortgage, multiplied by your mortgage payout balance. Lenders who this option are: MCAP, First National, Merix, Radius, Lendwise and Optimum. Optimum does add the following clause on, that it is 1% of the outstanding mortgage amount plus the above mentioned penalty.

Discounted Rate IRD Penalty – (This is the most expensive penalty payout option). This is the difference between your contract rate, and the rate that is closest to the remaining term left on your mortgage, MINUS the original discount you received off their posted rate at the time you took out the mortgage. That amount is then multiplied by your mortgage payout balance. Lenders who use this option are BMO, TD Canada Trust, CIBC, and Scotiabank.

Posted Rate IRD Penalty - This is the difference between the posted rate, at the time you took out your mortgage, and the rate that is closest to your remaining term, multiplied by your mortgage payout balance. Lenders who use this option are National Bank, RBC and Canadiana.

The table below can be filled in with your information to give you an approximate amount of your mortgage penalty is. This is only an estimate, and contacting your lender is the only way to get an accurate statement.'

View Calculator

Things to remember:

Lenders may round up or down, when reviewing your remaining time for their comparable rate.

Posted rates are what the bank charges without discounts.

Contract rate, is the rate you receive, and may or may not be discounted.

IRD can only be charged on fixed mortgages.

Variable rate mortgages can only be charged 3 months interest.

As per the Interest Act, if you take out a term that is longer than 5 years, once you have completed your first 60 months of payments, you can be only be charged 3 months of interest penalty for the remaining time.

Some lenders will only allow you to break your mortgage if you sell your real estate.

The list above of lenders above is not inclusive of all lenders.

If you are looking to purchase or refinance, review your existing mortgage commitment with your Mortgage Broker, and review all of your options. If you DO like a good mystery, save it for a great summer read, and make sure your mortgage broker keeps you in the know about all that fine print in your mortgage!

Blogged by Elise Hildebrandt, AMP, Mortgage Associate, Lic# 316103 at The Mortgage Centre, Saskatoon Brokerage Lic# 315847, Saskatoon Elise has been in the financial industry for 16 years. Contact her at: [email protected] or @ www.elisehildebrandt.ca.

0 notes

Text

*** 2.99% 5 Year Fixed *** Offered by BMO immediately until April 17, 2014

Fabulous Interest Rate, or Falling Into Risk?

On the surface, this looks like a dream rate, but before jumping onboard, there are always all the details to be considered. What is not spoken very loudly about this rate deal is the following:

This mortgage is locked up with the keys thrown away for 5 years, unless you sell your property, refinance with BMO, or choose an early renewal into a BMO product.

The penalties for breaking this mortgage before the 5 years are abusive. You are charged the posted rate, less the discount that was offered to when you accepted the mortgage. That number is then compared to the rate that would be offered on the current comparable term of your remaining mortgage.

For example: The current 5 year posted rate is 4.99%, you are being provided a discount of 2%, which gives you current rate of 2.99%. If in 2 years from now you decide to sell your home, and you have a $200,000 balance the comparable rate would be the 3 year term at 2.25%, your mortgage penalty would be $16,440.

Prepayment options are at the bottom of the barrel, only allowing 10% of the mortgage prepaid annually. Payment increases are also kept in check at 10%. Most lenders, other than National Bank and CIBC, depending on the specific product chosen, offer 15% - 20%!

There is no option to skip a payment. (Although, never recommended)

The maximum amortization is 25 years, even if you have a 20% down payment. Other lenders offer 30 year amortization if you have 20%.

As always, you need to carefully read your commitment letter, to know what options your lender has made available.

Questions about your mortgage options?

Blogged by Elise Hildebrandt, AMP, Mortgage Associate, Broker Lic# 316103 at The Mortgage Centre Brokerage Lic# 315847, Saskatoon Elise has been in the financial industry for 16 years.

Contact her at: [email protected] or @ www.elisehildebrandt.ca

0 notes

Text

What Are Prepayment Options?

Prepayments, Principle and Privileges!

Did you know that when you sign your commitment letter to complete your mortgage, there are prepayment privileges? Generally, they are discussed, reviewed, and then casually mentioned over coffee with friends later on that day, before being completely disregarded. This is due to the fact, that most people do not understand how they work, and why they should take advantage of them!

Advantages, you ask? Yes!! Within the guidelines of your lender, you have the option to pay down your mortgage faster, while paying less interest to the lender. As you know, the lender makes money off of the interest you give each month on your mortgage; and your mortgage slowly dwindles downs, as only a portion of your payment is actually applied to the principle amount that you borrowed. What if I told you, that you have the freedom to choose to make a much bigger dent in your principle? That's exactly what prepayment privileges are all about, and here are the most popular options available:

LUMP SUM DEPOSIT: 10% - 20% of your original mortgage balance can be deposited once a year, and the entire deposit is applied directly towards the principle amount. Depending on the guidelines of your lender, this payment may have to be made within a certain date.

VAMP MONTHLY PAYMENTS: Once a year, you can advise your lender to increase your mortgage payment, with the added amount directly applying to your principle. The flexibility of how much you wish to increase your monthly payments will be laid out within the guidelines of your lender.

DOUBLE UP PAYMENTS: This option is rarely used, but available, non the less. For example, if your monthly mortgage payment is $500, you can ask the lender to double the payments to $1000 for a set period of time.

The benefits of the prepayment privilege are obvious! Every dollar you choose to pay over the required monthly payment, goes straight to the principle of your mortgage. Here's a snap shot of how this could affect your mortgage over 1 year, if you originally borrowed $250,000 @ 3.09% with 25 year amortization. Take a look at the following:

1. LUMP SUM DEPOSIT: up to $50,000 per year

2. VAMP MONTHLY PAYMENT: Your payment would be $1,194.69, with an extra 20%, or $238.94 per month applied directly against principle. In one year, that's an additional $2,867.28.

3. DOUBLE UP PAYMENTS: If you pay double the payment for 1 year straight, $14,336.28 would be applied directly against your principle!

In one year alone, you could deposit $67, 203.56 of straight principle on your mortgage.

Are there disadvantages to prepayment privileges? None, whatsoever! As always, you need to carefully read your commitment letter, to know what options your lender has made available. Some lenders will allow you to use all 3 options at once. Others will allow all three, as long as you do not exceed the overall 10% - 20% prepayment privilege.

You could find yourself free of your mortgage a whole lot sooner then you thought!

Questions about your mortgage options?

Blogged by Elise Hildebrandt, AMP, Mortgage Associate, Broker Lic# 316103 at The Mortgage Centre, Brokerage Lic# 315847, Saskatoon Elise has been in the financial industry for 16 years.

Contact her at: [email protected] or @ www.elisehildebrandt.ca

0 notes

Text

Should You Skip a Mortgage Payment?

Prepayment options are offered in each commitment letter. The one that is least often used or talked about is the option to skip a mortgage payment. It is often asked what this option means and how it works.

The banks want you to think they’re advertising the option to skip a payment to do you a favor. But it’s important to realize that it may not be in your best interest.

You can’t skip a payment whenever you want to. You have to actually prepay your mortgage in order to take advantage of this option. You can miss a regular mortgage payment as long as you have already prepaid that amount by either doubling up your mortgage payments, increasing your mortgage payments or by making lumpsum payments. Each prepayment amount is dependent on your lenders requirements.

The number of payments you can skip is dependent on the amount that you have prepaid and the amount of your current mortgage payment. Typically each lender will have a maximum payment vacation allowed per mortgage term, no matter how much you have prepaid your mortgage.

If you are going through the trouble of prepaying your mortgage, you may not want to diminish those savings by taking a mortgage vacation.

If you are behind on making your mortgage payments, you can’t take advantage of this option.

Are you curious as to when is a good time to skip a mortgage payment or have questions about your mortgage options? Let me know. I can be contacted at [email protected] or www.elisehildebrandt.ca

Blogged by Elise Hildebrandt, AMP, Mortgage Associate, Broker Lic# 316103 at The Mortgage Centre, Brokerage Lic #315847, Saskatoon. She has been in the financial industry for 16 years.

1 note

·

View note

Text

5 Ways We Unwittingly Repel Wealth and Prosperity

Financial Freedom Tip of the Month

Studies indicate that we can actually sabotage our ability to achieve financial security. Here are some attitudes that stand between us and abundance.

We’re at the mercy of money. Earning and managing money can be so challenging, we sometimes see money as negative and energy draining. This causes us to subconsciously drive money away. Instead, see money as positive, effortless and attractive.

Money is in short supply. We assume there’s not enough money to go around and that we’re going to get left out. But thinking “shortage” helps create “shortage”. Instead, realize there’s an unlimited supply of money and we can get as much as we want.

We don’t deserve to be rich. Since money is often tied to job performance, we think we earn what we deserve. But who can judge how much money we deserve? Take the judgment out and simply see money as an abundant resource.

Getting money for money’s sake. Greed actually repels wealth. Instead, see money as something that will help you make the world and others' lives better. An honorable intention helps create abundance.

No plan for how to use it. If you don’t know what you’re going to do with money, chances are you won’t get it. Make a list of all your dreams, perhaps it’s to purchase a home? Then you’ll have specific goals to work toward.

Guest posted by Elise Hildebrandt, AMP, Mortgage Associate, Broker Lic# 316103 at The Mortgage Centre, Brokerage Lic #315847, Saskatoon. She has been in the financial industry for 16 years. Please contact her today if you have any questions about your mortgage and your options at www.elisehildebrandt.ca. Do you know what your mortgage options are? She does.

0 notes

Text

10 Creative Ways to Declutter Your Home—and Your Life!

Often when we think about selling our home, we have this sudden desire to go through everything, but what if you did it on a regular basis? It’s true: less really is more! By owning fewer possessions, we gain more time because we have fewer things to keep clean and organized. Life is more relaxing because we have fewer debts to worry about and we don’t have to work as much. And we end up with more money because we’re spending less. Here are some tips on decluttering your life.

Get rid of one item every day. Make it an unbreakable rule. Over time you’ll notice a big reduction in the stuff you don’t really need.

Clear out your clothes. Line up all your clothes in the same direction. Then every time you wear something, hang it with the hanger in the opposite direction. After six months, you’ll see which clothes never get worn and can be given away.

Sort into four categories. Set out four boxes and label them Trash/Recycle, Give Away, Keep and Relocate. Every time you see or use an item, decide which box it should go in.

Download product manuals. Instead of keeping a drawer full of manuals, download all the manuals from manufacturers’ websites, keep them on your computer, and recycle the hard copies.

Set out a basket labeled with each family member’s name. Keep them in a central location. Whenever you find an item where it doesn’t belong, put it into the correct person’s basket.

Open mail next to the recycling bin. Put junk mail directly into the bin rather than letting it pile up.

Buy something, give something away. Don’t let anything new come into the house unless something old goes out.

Scan documents and store on your computer. Use a scanner or your phone’s camera to make digital copies of documents you want to save, then recycle the originals.

Rearrange a room. Just by moving furniture around, you’ll discover lots of things you can relocate or get rid of.

Set a good example. Only give gifts people can actually use, like coupons for services or food items.

Posted by Elise Hildebrandt, AMP, Mortgage Associate, Broker Lic# 316103 at The Mortgage Centre, Brokerage Lic #315847, Saskatoon. She has been in the financial industry for 16 years. Please contact her today if you have any questions about your mortgage at www.elisehildebrandt.ca. Do you know what your mortgage options are? She does.

8 notes

·

View notes