# downgraded AI chip Nvidia

Explore tagged Tumblr posts

Text

Nvidia to release downgraded H20 AI chip for China: Reuter | The Express Tribune

Listen to article Nvidia is preparing to release a modified version of its H20 artificial intelligence chip for the Chinese market, aiming for a July launch, according to three sources familiar with the matter. The move comes as the US government tightens restrictions on advanced semiconductor exports to China, forcing the American chipmaker to downgrade performance to comply with export…

# AI chip export control# China AI chip market# downgraded AI chip Nvidia# Jensen Huang China visit# Nvidia $5.5B charge# Nvidia China chip 2025# Nvidia modified H20 specs# U.S. export restrictions Nvidia#Nvidia H20 China

0 notes

Text

Nvidia to Launch Cheaper, Downgraded AI Chip for China After U.S. Export Curbs

Nvidia is preparing to release a new artificial intelligence chip for the Chinese market at a significantly lower price than its previously restricted H20 model, according to three people familiar with the matter, as the U.S. semiconductor giant seeks to navigate tightening export controls while preserving its foothold in China. The new graphics processing unit (GPU), based on Nvidia’s latest…

0 notes

Text

UK Stocks Finished Mixed, GBPUSD Slips

UK stocks ended mixed on Wednesday, with blue chips tracking early falls on Wall Street ahead of the release of minutes from the US Federal Reserve’s last policy meeting and key earnings from AI chip giant Nvidia.

Domestic data showed that UK grocery price inflation has risen to its highest level in 15 months, according to consumer research firm Kantar, as retailers hike prices to adapt to higher employer national insurance contributions and the increased National Living Wage rate which both came into effect in April

Compared with last year, grocery prices were up 4.1% over the four weeks to 18 May, with inflation accelerating from the 3.8% reported the previous four weeks. That was the highest year-on-year increase since February 2024, according to Kantar.

GBPUSD H1

On foreign exchanges, sterling slipped back against the US dollar after hitting a three-year high on Monday, down 0.32% to 1.3464. The pound was also weaker against the euro, down 0.06% at 1.1916.

Sterling has risen by 8% against the dollar so far this year and has regained ground against the euro in the past weeks from its April lows.

At the stock market close in London, the blue-chip FTSE 100 index was down 0.6% at 8,726, but the broader FTSE 250 index edged up 0.0.4% to 20,946.

Retailer Kingfisher was the biggest FTSE 100 faller, losing 3.6% as the B&Q and Castorama DIY chains owner reported a small increase in underlying first quarter in its first quarter as continued weakness across its French operations was offset by strong growth in the UK and Ireland.

Supermarket chain Sainsbury was also weak, down 3.1%, weighed by the Kantar grocery report.

But precious metal miners rose as gold prices rallied, with Endeavour Mining up 2.1% and Fresnillo ahead 1.1%. Spot gold added 0.2% to $3,306 an ounce.

On the second line, Pets at Home was a FTSE 250 riser, up 1,6%, as the pet care firm reported a 14% increase in full-year pretax profit, as revenue edged up 0.1%, and it declared an unchanged final dividend of 8.3p.

UK100Roll H4

Bulmers cider maker C&C was also higher, ahead 3.2% after reporting a jump in profits for 2024/25 and maintaining its guidance for the current year as it expects a limited impact from US tariffs.

But high street bakery firm Greggs shed 3.5%, knocked by a downgrade to 'hold' from 'buy' from analysts at Shore Capital.

Disclaimer:

The information contained in this market commentary is of general nature only and does not take into account your objectives, financial situation or needs. You are strongly recommended to seek independent financial advice before making any investment decisions.

Trading margin forex and CFDs carries a high level of risk and may not be suitable for all investors. Investors could experience losses in excess of total deposits. You do not have ownership of the underlying assets. AC Capital Market (V) Ltd is the product issuer and distributor. Please read and consider our Product Disclosure Statement and Terms and Conditions, and fully understand the risks involved before deciding to acquire any of the financial products provided by us.

The content of this market commentary is owned by AC Capital Market (V) Ltd. Any illegal reproduction of this content will result in immediate legal action.

0 notes

Text

Nvidia to ship new AI chip for China next quarter, modified Blackwell later

[ASIA] PALO ALTO, California/TAIPEI/HONG KONG — Nvidia will start shipping a modified chip for artificial intelligence applications to customers in China in coming months, its latest effort to stay in the Chinese market as Huawei steps up its own AI chip offerings and the U.S. tightens export restrictions, Nikkei Asia has learned. The new chip will be a further downgraded chip based on the…

0 notes

Text

Nvidia to the Downgrade H20 Ai Chip to meet US velat

Nvidia to the Downgrade H20 Ai Chip to meet US velat Source link

0 notes

Text

Nvidia to the Downgrade H20 Ai Chip to meet US velat

Nvidia to the Downgrade H20 Ai Chip to meet US velat Source link

0 notes

Photo

🔍 Is NVIDIA's momentum slowing? HSBC seems to think so! 🚨 HSBC recently downgraded NVIDIA’s stock from a Buy to a Hold, trimming the price target to $120 (about CAD 151). Analyst Frank Lee points to NVIDIA's waning GPU pricing power. The B200/B300 GPUs and GB200/GB300 racks lack significant upgrades or ASP gains, chipping away at their edge. 🤔 With the Vera Rubin platform maintaining 72 GPUs per rack until 2027, the tech giant may face near-term bumps while awaiting the Rubin Ultra launch. Could these factors affect NVIDIA's future growth in AI markets? What do you think—will NVIDIA bounce back or stall? Drop your thoughts below! #NVIDIA #TechStocks #Investing #AIInnovation #GPU 👉 Join the discussion: Like, comment, and share your insights!

0 notes

Text

European markets European markets started the session in positive territory, albeit with modest gains. However, as the session progressed, indices displayed a mixed performance. The SMI outperformed following the SNB's larger-than-expected rate cut, while broader European equities turned more subdued ahead of the ECB's policy announcement. Autos and Energy/Basic Resources led the gains, driven by strong underlying commodity prices. Retail was the clear laggard, extending its prior session's weakness. US pre-market The Nasdaq surged past the 20,000 mark for the first time, driven by gains in Google and Nvidia. Meanwhile, the Dow dropped 99 points, continuing its losing streak, and the S&P 500 gained modestly. Tesla shares reached a record $424.77, propelled by market optimism surrounding its electric vehicle and AI prospects, along with favorable ties between Elon Musk and President-elect Trump. Quantum computing stocks also experienced a significant boost after Google introduced its "Willow" quantum chip, which sparked a 45% rise in Rigetti Computing's stock and lifted the Defiance Quantum ETF by 2%. Fixed income markets USTs are marginally weaker after an overnight selloff. Yields were steeper as the market awaited US PPI and ECB updates. Bunds softened, influenced by ECB anticipation and the SNB's unexpected policy move. French OATs and Gilts also edged lower, reflecting broader risk-off sentiment. The Italian Treasury successfully auctioned EUR 8.5 billion across maturities, meeting upper expectations. Commodities WTI and Brent saw marginal gains but pared earlier advances after the IEA downgraded 2024 demand growth forecasts. Prices remained near USD 70/bbl and USD 73/bbl, respectively. Gold held steady around USD 2,715/oz, under pressure from USD strength and rising yields, though benefitting from mixed risk sentiment. Copper remained range-bound above USD 9,200/MT, reflecting cautious market sentiment. Currencies The Dollar Index (DXY) traded steadily, staying within the 106.26-106.80 range. Market focus shifted to upcoming PPI data after the previous CPI report. EUR/USD hovered around the 1.05 level, awaiting the ECB's expected 25bps rate cut. The pair remained within a 1.0480-1.0539 range. JPY experienced mild depreciation after early APAC strength waned. The BoJ is reportedly leaning toward maintaining rates steady, pending consensus on next week’s decision. GBP held steady with limited UK-specific catalysts. GBP/USD tested a session high of 1.2787 before reverting to the prior range of 1.2714-1.2782. AUD outperformed following robust jobs data. Employment growth exceeded expectations, driving AUD/USD back above 0.64. CHF declined after the SNB surprised markets with a 50bps rate cut, coupled with a reiteration of intervention readiness. Cryptocurrencies Bitcoin remained above the 100k mark but traded slightly lower, reflecting minor consolidation after recent rallies. Political and World News - Israeli forces reportedly entered the Syria buffer zone temporarily. Hamas signaled potential acceptance of Israeli presence in Gaza post-ceasefire. - Chinese President Xi reiterated a commitment to strengthening ties with Russia, emphasizing economic collaboration. - President Biden issued clemency for over 1,500 people, marking the largest single-day clemency action in U.S. history. - FBI Director Christopher Wray announced his resignation ahead of Trump’s inauguration, with Kash Patel set to replace him. - U.S. regulators finalized a rule limiting overdraft fees to $5 for banks with over $10 billion in assets. While welcomed by consumers, the rule faces potential rollback under the incoming administration. - Elon Musk became the first person to reach a net worth of $400 billion, driven by record valuations of Tesla and SpaceX. - Prominent real estate figures Tal, Oren, and Alon Alexander face federal and state charges for alleged sex trafficking over a decade. - A former TD Bank employee was charged with laundering $670 million for drug cartels, highlighting systemic compliance failures within the banking sector. Economic Highlights - Wholesale Price Index: The U.S. producer price index (PPI) increased by 0.4% in November, surpassing expectations, indicating sustained inflationary pressures. Core PPI matched forecasts at 0.2%. - Deficit Expansion: The U.S. budget deficit climbed to $366.8 billion in November, a 17% increase year-over-year. The Treasury forecasts $1.2 trillion in annual interest costs as the national debt hits $36.1 trillion. - Jobless Claims Rise: Initial jobless claims totaled 242,000 for the week ending December 7, a 17,000 increase week-over-week, signaling potential headwinds in the labor market. - European Rate Cuts: The ECB reduced its key interest rate by 0.25% to 3%, marking its fourth rate cut in 2024. The Swiss National Bank made a larger-than-expected 0.50% cut to 0.5%. - India's Inflation Eases: India's inflation dropped to 5.48% in November, raising expectations of a 0.25% interest rate cut in early 2025 under the new RBI governor. Corporate Highlights - Tesla Hits Record High: Tesla shares closed at $424.77, marking a 6% daily increase and a 71% year-to-date gain. The stock's momentum is linked to optimism about the company's EV and AI advancements, as well as Elon Musk's relationship with President-elect Trump. - Quantum Stocks Surge: The unveiling of Google's Willow quantum chip has revitalized quantum computing stocks. Rigetti Computing saw a 45% jump, while the Defiance Quantum ETF (QTUM) rose by 2%. Companies like D-Wave and MicroStrategy have also enjoyed massive year-to-date gains of 355% and 538%, respectively. - SCOTUS Clears Nvidia Case: The Supreme Court allowed a securities fraud lawsuit against Nvidia to proceed, concerning allegations the company misrepresented its reliance on cryptocurrency mining for revenue. - Walmart's Fintech Growth: Walmart's financial services startup, One, reached a valuation of $2.5 billion after raising $300 million in funding. The company plans to leverage Walmart’s expansive customer and employee network to expand its services. - SpaceX Valuation Hits $350 Billion: SpaceX's valuation soared following a $1.25 billion secondary share sale, driven by its dominance in the satellite launch market and Starlink's growth. - Google's New AI Tool: Google launched "Deep Research," an advanced AI tool for its Gemini subscribers, allowing users to generate detailed reports through comprehensive data mining. - Eli Lilly Collaboration: Ro, a health-tech startup, partnered with Eli Lilly to offer the weight-loss drug Zepbound through its platform at significantly lower prices than traditional options. - Hershey's Buyout Rejected: Hershey's controlling trust dismissed Mondelez's takeover bid as too low. Hershey’s stock dropped 3.3%, while Mondelez rose 3.5%. Mondelez announced plans for smaller acquisitions and a $9 billion stock buyback program. - Albertsons and Kroger Dispute: Albertsons terminated its $25 billion merger with Kroger after court opposition, suing Kroger for breach of contract. While Kroger shares rose 2%, Albertsons fell by 1.5%. - ReNew Energy's Go-Private Offer: ReNew Energy received a $2.82 billion buyout proposal, representing an 11.5% premium. The stock surged 17.7% in response. Recent Earnings Recap - Adobe (ADBE) reported robust results with quarterly revenue reaching $5.61 billion, reflecting an 11.05% year-over-year growth, surpassing expectations by $66 million. The company also achieved earnings per share (EPS) of $4.81, a 12.65% increase from the previous year, exceeding forecasts by $0.15. This performance highlights Adobe's continued strength in its subscription-based digital media and cloud services. - Nordson (NDSN) delivered solid quarterly performance with revenue climbing to $744.48 million, a 3.5% year-over-year increase, surpassing expectations by $7.69 million. EPS rose significantly to $2.78, marking a 13.01% year-over-year improvement, beating estimates by $0.19, signaling operational efficiency and steady demand across its markets. - Ciena (CIEN) posted mixed results for the quarter. While revenue slightly declined by 0.44% year-over-year to $1.12 billion, it still managed to beat expectations by $24 million. However, EPS dropped 28% year-over-year to $0.54, falling short of estimates by $0.11, reflecting pressure on margins despite stable top-line performance. Upcoming Earnings Outlook - Broadcom (AVGO) is set to report after the market close today. Analysts project revenue of $14.09 billion, representing a significant 51.59% year-over-year growth, with EPS estimated at $1.38, a 24.32% increase. Investors will focus on updates about its cloud and semiconductor business segments. - Costco (COST) will also report later today. Analysts forecast revenue of $62.08 billion, reflecting a 7.41% year-over-year rise, alongside EPS expectations of $3.79, an 8.91% increase. Key attention will be on membership growth and holiday sales outlook. - RH (RH) is expected to announce earnings with analysts predicting revenue of $813.61 million, an 8.3% year-over-year increase, and EPS of $2.67. Insights into the company's luxury furniture sales trends will be closely monitored. - GE Vernova (GEV) and Solventum (SOLV) are slated to release earnings on Tuesday. GE Vernova is anticipated to report $10.68 billion in revenue, while Solventum is expected to deliver $2.06 billion. - Micron Technology (MU) will report Wednesday, with analysts estimating $8.55 billion in revenue, an impressive 80.91% year-over-year growth, alongside EPS of $1.76. The focus will be on-demand recovery in memory chips. - Lennar (LEN): Projected revenue of $10.08 billion (-8.1% YoY) and EPS of $4.26 (-17.6% YoY). - General Mills (GIS): Expected revenue of $5.13 billion (-0.18% YoY) and EPS of $1.22 (-2.4% YoY). - Jabil (JBL): Anticipated revenue of $6.61 billion (-21.19% YoY) and EPS of $1.83 (-29.62% YoY). - Birkenstock Holding (BIRK): Forecasted revenue of $439.27 million (+7.75% YoY) and EPS of $0.26 (+85.71% YoY). IPO Activity Confirmed Today: - ServiceTitan (TTAN): A cloud-based software provider reported $653.84 million in trailing twelve-month (TTM) revenue, growing 31.34% YoY. Estimated Friday, Dec. 13: - Metros Development Co., Ltd. (MTRS): A Japanese real estate consulting company with $489.07 million in TTM revenue and 52.84% YoY growth. - Mountain Lake Acquisition Corp. (MLAC): A Nevada-based blank check company. - Roman DBDR Acquisition Corp. II (DRDB): Focused on cybersecurity, AI, and fintech sectors. - Anteris Technologies Global Corp. (AVR): A cardiac devices manufacturer with $2.71 million in TTM revenue. - New Century Logistics (BVI) Limited (NCEW): A Hong Kong-based freight forwarding provider with $52.15 million in TTM revenue, down 4.69% YoY. - NetClass Technology Inc (NTCL): A Chinese education software company with $11.09 million in TTM revenue, up 19.79% YoY. Market Outlook and Future Events Investors will closely monitor developments in inflation and interest rate policy, with wholesale inflation data and jobless claims suggesting mixed economic signals. Corporate earnings, particularly from Adobe, will provide further insights into business trends as markets anticipate the Fed's next move. Read the full article

0 notes

Text

Premarket U.S. Stock Moves: Significant Drops Across Major Players

As the trading day begins, several notable U.S. stocks are experiencing significant declines in the premarket session. Here’s a closer look at the key players and the reasons behind their drops:

1. Apple (NASDAQ: AAPL) - Down 7.6%

Apple’s stock is down 7.6% following news that Warren Buffett's Berkshire Hathaway has sold nearly half of its stake in the tech giant. This move is part of a broader selloff by Berkshire Hathaway, which has impacted several stocks. The market reaction reflects concerns about the implications of Buffett’s reduced investment and its potential impact on Apple’s stock performance.

2. Nvidia (NASDAQ: NVDA) - Down 10%

Nvidia is facing a 10% drop in its stock price after reports emerged of a delay in the launch of its upcoming artificial-intelligence chips. The delay is attributed to design flaws, which have raised concerns about the company’s ability to meet market expectations and capitalize on the growing AI sector. This setback is likely to affect Nvidia’s short-term growth prospects and investor confidence.

3. Intel (NASDAQ: INTC) - Down 4.9%

Intel’s stock has fallen 4.9%, continuing the downward trend from Friday’s selloff. The chipmaker reported a significant earnings miss for the June quarter and announced plans to lay off more than 15% of its workforce. These developments have heightened concerns about Intel’s competitive position and its ability to navigate challenges in the semiconductor industry.

4. Tesla (NASDAQ: TSLA) - Down 7.9%

Tesla’s stock is down 7.9%, reflecting broader trends in the tech sector. Despite a 15.3% increase in sales of China-made electric vehicles, as reported by the China Passenger Car Association, the company’s stock is suffering alongside other tech stocks. The decline suggests that broader market concerns are overshadowing Tesla’s positive sales data.

5. Coinbase (NASDAQ: COIN) - Down 15%

Coinbase is seeing a 15% drop in its stock price as the cryptocurrency sector faces a selloff. Bitcoin, the leading digital currency, has fallen more than 15%, impacting all major cryptocurrency-related stocks. Coinbase’s significant stock decline is indicative of the broader struggles within the cryptocurrency market.

6. CrowdStrike (NASDAQ: CRWD) - Down 6.8%

CrowdStrike’s stock is down 6.8%, despite the cybersecurity firm’s rejection of claims by Delta Air Lines. Delta had suggested that CrowdStrike was responsible for the massive outage that led to thousands of flight cancellations in July. The stock drop may reflect broader concerns about the company's reputation and the impact of such events on its business.

7. BioNTech (NASDAQ: BNTX) - Down 3.2%

BioNTech’s stock has fallen 3.2% following the release of its second-quarter earnings, which fell short of estimates. The company continues to face a decline in sales of its COVID-19 vaccine, which has contributed to the stock’s underperformance.

8. Moderna (NASDAQ: MRNA) - Down 5.3%

Moderna’s stock is down 5.3% after RBC Capital Markets downgraded the biotech company from “Outperform” to “Sector Perform.” The downgrade reflects growing challenges in the RSV and COVID vaccine markets, which have raised concerns about Moderna’s future growth prospects and market position.

Conclusion

The premarket session reveals significant declines across major stocks, driven by a mix of company-specific issues and broader market trends. From Apple and Nvidia to Tesla and Coinbase, these movements highlight the volatility and challenges faced by key players in various sectors. Investors will need to monitor these developments closely as the trading day unfolds.

0 notes

Text

Why Nvidia is a Buy Despite a Hefty Price

Nvidia Hit a Market Cap of 1 Trillion Dollars in Spring

Staying the Course with Strong Initiatives

Nvidia's strategic move involves staying the course with its latest initiatives in videogaming and automotive technology, unveiled ahead of the CES trade show. The focus on generative artificial intelligence (AI) through new GeForce graphic processors showcases the company's commitment to innovation.

Data-Center Business Driving Growth

The explosive growth of Nvidia's data-center business is a key factor contributing to its market value tripling. With booming demand for specialized systems powering genAI capabilities, Nvidia's data-center business is expected to reach nearly $78 billion in annual sales in fiscal 2025, a substantial increase from $15 billion two years prior.

Valuation Challenges and Investor Focus

Despite being valued at nearly $1.3 trillion, more than twice its closest chip-making peer, Nvidia faces the challenge of valuation. However, Wall Street seems to be honing in on the bottom line and cash reserves. The stock currently trades at about 26 times projected per-share earnings, near its lowest range in at least five years and below its average of 40 times. Analysts project strong revenue growth, with a 55% increase expected in the next fiscal year after a remarkable 118% surge in the soon-to-end year.

Booming Bottom Line and Cash Flow

Nvidia's financial performance is a standout feature. The company's adjusted operating income surged to $22.4 billion in the first nine months of the current fiscal year, compared with about $5 billion in the same period last year. Wall Street foresees annual adjusted per-share earnings exceeding $20 in fiscal 2025, more than six times the earnings in the latest fiscal year. This impressive bottom line has paradoxically made Nvidia's stock appear cheaper, trading at around 26 times projected per-share earnings.

Competitive Pricing and Free Cash Flow

Stacy Rasgon of Bernstein notes that Nvidia is trading at a discount to the peer PHLX Semiconductor Index, making it the cheapest AI play. Nvidia's stock price surge over the past year contrasts with its competitive pricing, trading near its lowest range in at least five years.

Cash Flow Strength and Future Projections

Nvidia is generating substantial free cash flow, tying with Broadcom as the highest in the chip sector at $17.5 billion for the past four quarters. Analysts project that Nvidia will produce $100 billion in free cash flow over the 2024-25 calendar years. About a third of this is expected to go towards share buybacks, with the remaining amount available for pursuing growth options, including mergers and acquisitions.

Potential Challenges and Geopolitical Considerations

While Nvidia faces challenges in a tech M&A market, particularly in a geopolitical minefield for chip companies, domestic AI demand is expected to keep the order book robust. The recent concern about Chinese companies' interest in downgraded chips appears to be offset by strong domestic demand.

Summary: Why Nvidia is a Buy

In the landscape of hot stock picks, Nvidia stands out as a potential buy despite its high price. Numerical evidence, including strong financials, competitive pricing, and robust projections, suggests that Nvidia has room for further growth. The company's strategic focus on generative AI and its ability to navigate challenges make it a stock worth considering for investors eyeing long-term gains in the dynamic world of tech investments.

Want More? Get AI Stock Pick Reports.

0 notes

Text

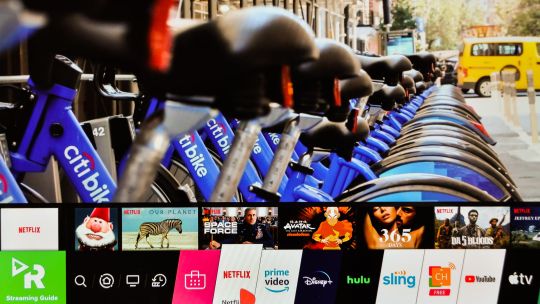

LG OLED CX TV review: The picture against which all other TVs are measured

New Post has been published on https://appradab.com/lg-oled-cx-tv-review-the-picture-against-which-all-other-tvs-are-measured-2/

LG OLED CX TV review: The picture against which all other TVs are measured

By this point there’s no question whether OLED-based TVs have the best picture quality available: they do. In my opinion they’re definitely worth the extra money compared to other high-end TVs. The only question that matters is, if you can afford an OLED TV, which one should you buy? LG is the OLED leader and its 2020 CX series achieves as impressive a picture as any TV I’ve ever tested, but right now it’s not the best answer to that question.

Like

Better picture quality than any non-OLED TV.

Superior contrast and off-angle image.

Slim design and packed with features.

Don’t Like

Expensive.

Not appreciably better than cheaper 2019 models.

After reviewing the CX, the TV that I recommend most OLED shoppers buy instead is the LG B9 from 2019. I compared the two LG OLEDs side-by-side in my spanking new basement TV lab, and it was really tough to tell the difference between them in picture quality. My measurements sussed out some slight variations, and watching some low-quality material gave a vanishingly small edge to the CX, perhaps because of its improved processing.

But that’s tiny potatoes compared to the huge price difference between the two right now — $600 to $800 for the 65-inch size, depending on where you shop. The price gap will shrink as the CX gets discounted and the B9 sells out later this year, but even then another TV will remain less expensive and likely a better value as well: the 2020 BX series. Look for CNET’s review of that TV soon.

My other comparison TV was the TCL 8-Series, which has the best picture quality of any non-OLED TV I’ve recently reviewed. It’s a superb performer and brighter then either OLED, but both the B9 and CX beat it for overall picture quality. Every OLED TV I’ve ever reviewed exhibits the true black levels, infinite contrast and near-perfect off-angle performance that makes images come to life like no other TV technology you can buy.

Now playing: Watch this: LG CX OLED TV review: Awesome picture, high price

3:52

Get to know the LG CX series

It’s pronounced “C-10” because LG wants to be like Apple I guess.

It comes in 48-, 55-, 65- and 77-inch sizes. The 48-inch model is new for 2020.

As usual for OLED TVs, the 77-inch model is proportionally more expensive, at nearly twice the price of the 65-incher. Competing 75-inch LCD-based TVs are much more affordable.

The 2020 CX adds a few extras that the B9 is missing, namely an improved image processor, compatibility with AMD FreeSync and a new Filmmaker picture mode. Otherwise they’re basically the same.

The only differences I noted between the B9 and CX are slightly different stand designs and LG’s processing. As I mentioned above, I don’t think the CX’s slight image quality advantage is worth the price difference.

OLED display technology is fundamentally different from the LED LCD technology used in the vast majority of today’s TVs, including Samsung’s QLED models.

The best LCD TVs I’ve reviewed so far, like the TCL 8-Series and Vizio P-Series Quantum X, scored a “9” in image quality. At times they were brighter in HDR than the OLEDs, but otherwise the OLEDs’ images were superior in almost every way.

All OLED TVs are more subject to both temporary and permanent image retention, aka burn-in, than LCD TVs. We at CNET don’t consider burn-in a reason for most people to avoid buying an OLED TV, however. Check out our guide to OLED burn-in for more.

Not much has changed with LG’s design. The panel on the B9, the CX and other recent OLED sets is still vanishingly thin when seen from the side, about a quarter-inch deep, with a chunkier section at the bottom that juts out another 1.75 inches. That section houses the inputs, power supply, speakers and other depth-eating TV components.

From the front it’s pure TV minimalism. There’s less than a half-inch of black frame around the top and sides of the picture itself. Then there’s a bit more below, but no trace of silver, no “LG” or any other logo at all.

The CX’s stand is very similar to the C9’s, its angled edges and medium width across the bottom of the screen. It’s more heavily weighted than the B9 on the rear to (I presume) better resist tipping forward. That said, I’ve never had any fear of the B9 tipping forward, and I always recommend using a TV safety strap if you have kids.

David Katzmaier/CNET

Solid app and voice support

LG’s webOS menu system is also basically unchanged from last year. It still lacks the innovative extras and app-based setup of Samsung’s Tizen system and falls well short of the app coverage of Roku TV or Sony’s Android TV. If you want more apps, your best bet is to get an external streamer, although only a handful, including the Apple TV 4K, Amazon Fire TV Stick 4K and Nvidia Shield can support Dolby Vision and Dolby Atmos. Meanwhile LG’s apps for Netflix, Amazon, Disney Plus and Vudu all support Dolby Vision and Dolby Atmos, while Apple TV app supports Vision but not Atmos. Using the TV’s built-in apps gets you the highest-quality video and audio from those services, no external streamer required.

The remote tracks the motion of your hand to whip quickly around the screen, something that’s particularly helpful when signing into apps or searching using an onscreen keyboard. The scroll wheel is also great for moving through apps, like those seemingly infinite thumbnail rows on Netflix and Amazon.

David Katzmaier/CNET

LG’s TVs are still the only devices that let you use both Google Assistant and Amazon Alexa. The main mic button invokes Google Assistant while a long-press of the Amazon button gets you Alexa. Both can do all the usual Assistant stuff, including control smart home devices, answer questions and respond via a voice coming out of the TV’s speakers (yep, both voices). Basics like “What’s the weather?” works as you’d expect from either assistant, complete with onscreen feedback.

The CX also works with Apple’s AirPlay 2 system, just like many other TVs including 2019 models like the B9. I was able to fire up my iPhone to share photos and video to the screen from the Photos app as well as mirror my Mac and phone screens. The LG also has the Apple TV app, of course.

Key features

Display technology OLED LED backlight N/A Resolution 4K HDR compatible HDR10 and Dolby Vision Smart TV webOS Remote Motion

The feature-packed CX includes just about everything that matters in a modern TV. LG says the new A9 Gen 3 chip — included on the CX but not on the B9 or BX — has improved deep learning chops and “AI picture Pro” enhancements. I didn’t notice any major benefits from the processor in my testing.

New for 2020 is the Filmmaker Mode, which takes the place of the Technicolor Expert modes of years past. As promised it turns off the Soap Opera Effect for film-based content (yay) but so do many other modes in the CX, including Cinema, ISF and Dolby Vision itself (yes, this TV has a LOT of picture modes). While plenty-accurate it’s also relatively dim so I ended up using Cinema and ISF Bright for most critical viewing.

All of LG’s 2019 and 2020 OLED models include the latest version of the HDMI standard: 2.1. That means their HDMI ports can handle 4K at 120fps, support enhanced audio return channel (eARC) as well as two gamer-friendly extras: variable refresh rate (VRR) and automatic low latency mode (ALLM, or auto game mode). Check out HDMI 2.1: What you need to know for details. I didn’t test any of these features yet for this review.

Speaking of VRR, the B9 and CX also support the Nvidia G-Sync standard. One difference between the two, however, is that only 2020 models like the CX will also support AMD FreeSync.

Bear with me, normal readers, because there is one ultra-technical downgrade on the CX compared to the 2019 C9. As reported by Forbes, the new model’s HDMI ports support 4K at 120fps up to 40Gbps (10 bits), while last year they went up to the full 48Gbps (12 bits). In a statement, LG told CNET that “the market situation evolution indicated that real content that requires 48Gbps is not available in the market.” The only devices that might look better at 12-bit compared to 10-bit are next-generation consoles like the PlayStation 5 and Xbox One Series X, but I’d be surprised if it makes a big difference.

David Katzmaier/CNET

The selection of connections is otherwise top-notch. Unlike many of Samsung’s sets, this one actually has an analog video input for legacy (non-HDMI) devices, although it no longer supports analog component video. There’s also a dedicated headphone/analog audio output.

Four HDMI inputs with HDMI 2.1, HDCP 2.2

Three USB ports

Composite video/audio input

Optical digital audio output

Analog audio 3.5mm headphone output

RF (antenna) input

RS-232 port (minijack, for service only)

Ethernet (LAN) port

Picture quality comparisons

David Katzmaier/CNET

Normally I’m able to compare a TV against four or five others side-by-side, but during coronavirus lockdown the size of my basement — and limited access to comparison TVs — reduced that number to two. Happily they were two of the best TVs of 2019, the B9 OLED and the TCL 8-Series. As I mentioned above the CX and B9 were basically tied, with image quality that deserves a score of 10/10, while the TCL fell a bit short of both.

Click the image at the right to see the picture settings used in the review and to read more about how this TV’s picture controls worked during calibration.

Dim lighting: Lined up in my darkened basement TV lab, the CX immediately distinguished itself from the LCD-based TCL but not so much from its sister LG OLED. Between the two OLED TVs I didn’t spot any major differences.

Watching the 1080p Blu-ray of Parasite, the trademark perfect black levels and superior contrast of OLED were an upgrade in punch and realism. Every scene benefited, but as usual the darker ones showed the largest differences. As the Parks discuss the transgressions of their chauffeur in Chapter 4, for example, colors of their faces, clothes and the surrounding kitchen looked, well, richer and more realistic. In extremely dark scenes like Park Dong-ik’s ride in the back of the car, the difference was even more evident in a side-by-side comparison.

Shadow detail was excellent on the CX and overall dark areas still looked significantly more realistic than with the TCL. Pro tip: In my recommended picture mode, Cinema, bump up Brightness from 50 to 52 to reclaim those shadows while still preserving perfect black levels.

Bright lighting: No major changes here: The CX was as bright as previous LG OLEDs and significantly dimmer than high-end LCDs.

Light output in nits

TV Brightest (SDR) Accurate color (SDR) Brightest (HDR) Accurate color (HDR) Vizio PX65-G1 1,990 1,120 2,908 2,106 TCL 65Q825 1,653 904 1,818 982 Samsung QN65Q80R 1,443 832 1,494 1,143 TCL 65R625 653 578 881 813 LG OLED65C9 (2019) 451 339 851 762 LG OLED65CX (2020) 377 290 690 634 LG OLED65B9 (2019) 374 283 628 558

LG OLEDs from 2019 and 2020 have a setting called Peak Brightness that boosts the light output for SDR sources in Cinema and Expert modes. The idea is to increase contrast for brighter viewing environments while maintaining the superior color accuracy of those modes. As with most TVs, the brightest mode for HDR and SDR (Vivid on the CX) is horribly inaccurate. For the accurate color columns above I used ISF Expert Bright (Peak Brightness: High) for SDR and Filmmaker mode for HDR — I recommend CX owners do the same to get good color in bright rooms.

Overall, the OLED sets are still plenty bright enough for just about any viewing environment. Yes, they do get quite a bit dimmer than the LCDs when showing full-screen white — a hockey game, for example — but even in those situations they’re hardly dim.

The CX and B9 preserved black levels and reduced reflections very well — better than the TCL. I didn’t compare a Samsung directly for this review but in the past that brand’s high-end models have delivered the best bright-room performance overall.

Color accuracy: Before my standard calibration, the ISF Expert, Cinema and Filmmaker modes were already super accurate, among the best I’ve seen, and afterward the CX was as accurate as I’d expect. As usual, OLED’s superior black levels also improved the perception of color saturation compared to the LCD other displays. Bright colors like the fruit on the Parks’ countertop or the green of their backyard in Chapter 11 were lush and vibrant, while skin tones like the face of Mrs. Park remained true. I also appreciated that, unlike many LCDs including the TCL in this comparison, the CX didn’t introduce a blue tinge to near-black areas.

Video processing: Watching the Parasite Blu-ray it was difficult to see any processing advantages of the CX over the B9, perhaps because it’s a very high-quality source to begin with. Looking for evidence of the CX’s fancy new chip in action, I tried an old favorite: Game of Thrones’ The Long Night episode on HBO Max, streaming from an Apple TV 4K (set to 1080p SDR to match the native stream).

The opening setup of the army awaiting the coming of the white walkers was rife with blockiness, banding and other compression issues, as well as basic video noise. But the CX didn’t clean it up much better than the B9. There was slightly less banding on the CX during a pan over Winterfell (5:19), for example, and less near-black noise in the sky during the Dothraki charge (12:51) and when the solitary horse returns (13:47), but I had to look hard to spot the improvement. And sometimes the B9 looked better; for example it showed less noise than the CX in the black sky around Sir Davos’ face (7:13). I’ll give the slight edge to the CX, but it’s really subtle.

With the Real Cinema setting turned on, the CX passed my go-to 1080p/24 film cadence test from I Am Legend in Off, Cinema Clear and User (0-4 for De-Judder and 10 for De-Blur) TruMotion position. The latter two also delivered the TV’s maximum motion resolution (600 lines). For 2020 LG’s User De-Judder setting is better than last year, with more of a range for finicky cadence purists (we know who we are) to dial in the right amount of smoothness; anything 4 or lower introduced some judder to my eye, conveying a sense of film rather than soap opera effect. Clear on the other hand is toward the smoother side, albeit still tolerable. Personally I prefer User: De-Judder 0 but it’s great that there’s more good options than ever.

David Katzmaier/CNET

There’s also a setting labeled OLED Motion Pro, available only in the User section of the TruMotion menu. In previous years it was a simple toggle that introduced black frame insertion to improve motion resolution but with the usual tradeoffs of a dimmer image and visible flicker. This year it has four settings, Low, Medium, High and Auto, with progressively better motion resolution, High tops out at the maximum 1,200 lines in my test but was quite dim and flickery. Medium was the best overall, measuring slightly less at 1080 lines but with nearly the same light output as Off and no flicker. The CX is the first OLED TV I’ve tested that can match LCD TVs with true 120Hz refresh rates, such as the TCL 8 series or the Samsung Q70, for motion resolution.

The problem? Engaging any OLED Motion Pro setting aside from Off crushed shadow detail and made the image look too dark. My advice is to avoid using this setting unless you calibrate the image specifically for it — or you hate blur so much that you’re willing to sacrifice being able to see dark areas clearly.

Gaming input lag is similar to last year, which is to say superb. The CX showed 13.7 and 13.8 milliseconds in game mode for 1080p and 4K HDR sources, respectively. That’s shy of the C9 by mere tenths of a millisecond. If you can tell the difference, hats off to you.

Uniformity: Like all recent OLED sets, the CX was extremely uniform in brightness and color, with no visible variations across the screen. In comparison the LCD-based TCL all showed slightly brighter and darker areas with full-field test patterns, although it didn’t have major issues. And as usual the two OLEDs were much better at maintaining fidelity from off-angle, when viewed from seats other than the sweet spot right in the middle of the screen. There were no differences in uniformity between the B9 and CX.

Parasite is a great movie that looks spectacular in 4K HDR.

CJ Entertainment

HDR and 4K video: The 4K Blu-ray of Parasite looked spectacular on all three high-end TVs, as expected, but the OLEDs had the advantage. The TCL beat them in brightness and highlight pop, however. In Chapter 3 when Kim Ki-woo rounds a corner of the house (13:13), the sun measured twice as bright — 1028 nits vs. 540 on both OLED TVs — and the difference was obvious to my eye.

Despite the extra brightness, however, the overall contrast and richness of the OLEDs’ image made the LCD look relatively flat by comparison in many scenes. In the criteria at 30:51, for example, there was just a bit more pop and color in the food and the flower wrappings. And despite its excellent local dimming the TCL still betrayed some brighter spots in dark areas, for example the shadows in the back of the car at 30:14.

Looking at the gorgeous nature footage from the Spears and Munsil HDR benchmark, the TCL’s higher brightness paid more dividends than the cinematic Parasite. In my side-by-side lineup the LCD’s brighter skies, snow and other daylit scenes were more powerful, especially when most of the screen was very bright — the desert sand, and plants at 5:20 was a good example. The OLEDs didn’t look dim by any means but the TCL was better in those bright scenes. In more mixed and darker scenes, on the other hand, the OLEDs superior contrast again won out.

Keeping with the nature theme, I switched my Apple TV back to 4K HDR mode and checked out the amazing-looking Our Planet: Coastal Seas on Netflix. From the brilliant colors of the reef to the dark recesses behind the swarms of sharks I saw the same themes: an overall edge to the OLED TVs despite the TCL’s brighter image. Netflix’s nature documentary didn’t show as much HDR punch and detail as the reference disc in general, and for that reason the TCL’s brilliance didn’t make as much of an impact. In some bright scenes like the splashing seals (20:34), highlights like the waves actually measured slightly brighter on the CX OLED, but in others like the sun through the kelp (21:03) the TCL was visibly brighter and measured as such (1440 vs. 660 nits).

Geek Box

Test Result Score Black luminance (0%) 0.000 Good Peak white luminance (SDR) 377 Average Avg. gamma (10-100%) 2.20 Good Avg. grayscale error (10-100%) 0.65 Good Dark gray error (30%) 0.20 Good Bright gray error (80%) 0.20 Good Avg. color checker error 1.1 Good Avg. saturation sweeps error 1.71 Good Avg. color error 1.14 Good Red error 0.89 Good Green error 0.92 Good Blue error 1.46 Good Cyan error 1.24 Good Magenta error 1.40 Good Yellow error 0.92 Good 1080p/24 Cadence (IAL) Pass Good Motion resolution (max) 1200 Good Motion resolution (dejudder off) 1000 Good Input lag (Game mode) 13.67 Good HDR10 Black luminance (0%) 0.000 Good Peak white luminance (10% win) 690 Poor Gamut % UHDA/P3 (CIE 1976) 99.20 Good Avg. color checker error 4.36 Average Input lag (Game mode, 4K HDR) 13.73 Good

LG OLEDCX CNET Calibration Results by David Katzmaier on Scribd

0 notes

Text

The Japanese Company Betting Billions to Prepare for the Singularity

Google once had a reputation for bankrolling moonshots. It spent billions creating a self-driving car, started Google Fiber to bring ultra-high-speed internet to the masses, and acquired the Darpa-backed robotics company Boston Dynamics.

But since restructuring itself as a holding company called Alphabet in 2015 and moving many of its bigger ideas outside the core Google business structure, Mountain View's ambitions have become a little more sober and its investment strategy more restrained. As Alphabet CFO Ruth Porat put it during an earnings call last year: "We continue to rationalize our portfolio of products to ensure we efficiently and effectively focus our resources behind our biggest bets across Alphabet." In practical terms, that's meant scaling back Google Fiber and selling off some of its wilder projects, and it's also opened the door for another company–the Japanese conglomerate SoftBank–to take the lead on some of today's most audacious bets in global tech.

SoftBank is perhaps most famous in the U.S. for its ownership of Sprint, but it's spent the last two years investing in, acquiring, or founding a vast, if head-scratching, array of tech companies. It started a self-driving bus company with Advanced Smart Mobility; invested $1.2 billion in OneWeb, the satellite internet company founded by former Googlers; and purchased both Boston Dynamics and fellow robotics company Schaft from Alphabet. It also announced its efforts to raise a $100 billion Vision Fund to invest in futuristic technologies like quantum computing.

Much like Larry Page, Elon Musk, and Jeff Bezos, SoftBank founder and CEO Masayoshi Son has his eyes on the distant future. "I think a big paradigm shift is coming,” he said during his keynote at ARM's developer conference last year according to Venture Beat. “The biggest theme in my view is the Singularity. I think it is coming into reality in the next 30 years. For that vision, I am exercising that strategy. $100 billion is an interesting size of ammunition. In my view, that is the beginning."

Big Bets, Big Risks

Son founded the company in 1981 as a software wholesaler (a "bank" of software), and it later became a magazine publisher. In conjunction with Yahoo, it started the IT firm Yahoo Japan in 1996 and also acquired the publishing company Ziff Davis before spinning it off in 1999.

Softbank started offering broadband service in the early 2000s, and went on to acquire Japan Telecom in 2004, Vodaphone's Japanese business in 2006, and Sprint in 2012. But its most lucrative deal was probably its investment in Alibaba in 2005.

More recently, the company acquired French robotics company Aldebaran, the makers of the "emotional" robot Pepper, and has poured billions of dollars into Uber competitors such as Southeast Asia's GrabTaxi, China's Didi Chuxing, and, through its acquisition of Fortress Investment Group, Lyft. It also put $1 billion into Korean e-commerce company Coupang in 2015 and $1.4 billion into Indian payments company Paytm in May of this year, and it reportedly invested $4.1 billion in Nvidia, which makes the chips preferred by AI companies, that month as well. Apart from Son's comments about the Singularity, there doesn't appear to be a unified strategy behind these acquisitions, which makes his ambitions seem all the more bold.

If you're keeping track at home, you might be wondering how SoftBank can afford to sink so much money into all these projects. It’s got assets, of course— Son decided to sell off SoftBank's $7.9 billion share in Alibaba last year to help finance its $32 billion acquisition of ARM, the company behind the chips that power the vast majority of smartphones and tablets. And it’s got investors, too, with Apple, Qualcomm, and Saudi Arabia all putting money into its Vision Fund. But that's still not enough to avoid having to borrow money to invest in its ventures. Last year, the company's $120 billion in debt nearly triggered a rating downgrade from Moody's. And SoftBank's situation is made all the more precarious by Sprint's poor performance as well as the recent failed $14 billion merger between OneWeb and Intelsat.

Google finances its "other bets" with the profits of its advertising business. SoftBank finances its with borrowed money. That means if these gambles don't pay off, SoftBank could crash and burn in a way that Google simply wouldn't. But hey, no one ever said moonshots are safe.

0 notes

Text

Nvidia to Launch Cheaper, Downgraded AI Chip for China After U.S. Export Curbs

Nvidia is preparing to release a new artificial intelligence chip for the Chinese market at a significantly lower price than its previously restricted H20 model, according to three people familiar with the matter, as the U.S. semiconductor giant seeks to navigate tightening export controls while preserving its foothold in China. The new graphics processing unit (GPU), based on Nvidia’s latest…

0 notes

Text

US Loses Last AAA Rating, Gold Rebounds

US stocks ended higher on Monday, rallying late on as Treasury yields eased back from highs hit earlier after the country’s investment grade rating was downgraded which heightened concerns over slowing economic growth and debt levels.

Moody’s cut its US sovereign credit rating on Friday to ’Aa1’ from ’Aaa’, the last of the major credit rating agencies to remove the prestigious treble-A rating after first awarding it in 1919. Moody’s cited concerns over the country’s growing $36 trillion debt pile, which could be exacerbated by Trump’s plans to cut taxes.

A US House of Representatives committee on Sunday approved President Donald Trump’s sweeping tax bill setting it up for a Congressional vote later this week amid resistance from a group of Republicans.

Moody’s credit rating cut was widely criticized by Trump’s administration, which highlighted several measures to bring down US government spending and debt levels.

The credit downgrade saw the US dollar index weaken, losing 0.5%, while Treasury bonds fell in price, lifting yields. Thirty-year bond yields touched 5%, a level they haven’t been above since late 2023, but ended below that peak to ease some of the worries.

XAUUSD Daily

Meanwhile, gold prices recovered after a recent retreat to a one-month low, resuming a rally that sent them to record highs in early May on renewed safe haven buying. Spot gold was 0.9% higher at $3,231 an ounce. Spot silver was up 0.2% to $32.34 an ounce.

No US economic data was released on Monday but a number of Federal Reserve officials delivered speeches throughout the day, including New York Fed President John Williams.

At a New York City business conference, Williams noted that swings in tariffs are keeping households and businesses uncertain and that uncertainty has led the Fed to keep interest rates steady so far this year, with the policy path forward likely to not become clearer for months.

At the stock market close in New York, the blue-chip Dow Jones Industrials Average was ahead 0.3% at 42,792, while the broader S&P 500 index added 0.1% to 5,963, and the tech-laden Nasdaq Composite edged up 0.02% to 19,215.

Among tech issues, Nvidia added 0.1% as its CEO Jensen Huang unveiled a host of new artificial intelligence technology when delivering the keynote address at the Computex AI exhibition in Taiwan on Monday.

But Apple lost 1.2% and Alibaba shed 3.4% after reports that a potential artificial intelligence partnership between the two companies is facing scrutiny from US officials.

And Reddit fell 4% after analysts at Wells Fargo downgraded the stock to equal weight from overweight, citing a threat from Google’s roll out of AI-led search.

Elsewhere, Walmart fell 0.1% after President Trump attacked the company on Saturday, saying the retailer shouldn't blame price increases on his trade levies and demanding it "eat the tariffs" rather than pass them on to consumers.

But on the upside, TXNM Energy jumped 7.0% higher as Blackstone Infrastructure agreed to buy the company for $11.5 billion including debt.

And Regeneron added 0.4% after agreeing to buy nearly all of 23andMe’s assets for $256 million after winning a bankruptcy auction for the DNA-testing startup.

Oil prices edged ahead on Monday, consolidating some of the previous week’s gains despite the credit rating downgrade for the world’s biggest crude consumer, as traders digested mixed Chinese economic data

USOILRoll H4

China’s industrial production rose more than anticipated in April, with factory activity holding up well despite pressure from heightened US trade tariffs on exports.

However, retail sales in the country for the same month came in below expectations.

US WTI crude added 0.3% to $62.68 a barrel, and UK Brent crude took on 0.1% to $65.49 a barrel.

Disclaimer:

The information contained in this market commentary is of general nature only and does not take into account your objectives, financial situation or needs. You are strongly recommended to seek independent financial advice before making any investment decisions.

Trading margin forex and CFDs carries a high level of risk and may not be suitable for all investors. Investors could experience losses in excess of total deposits. You do not have ownership of the underlying assets. AC Capital Market (V) Ltd is the product issuer and distributor. Please read and consider our Product Disclosure Statement and Terms and Conditions, and fully understand the risks involved before deciding to acquire any of the financial products provided by us.

The content of this market commentary is owned by AC Capital Market (V) Ltd. Any illegal reproduction of this content will result in immediate legal action.

0 notes

Text

Fed Confirms 2 Cuts for 2025, Wall Street Rallies

US stocks jumped on Wednesday after the Federal Reserve left interest rates unchanged, as expected, and continued to forecast two rate cuts ahead despite raising its inflation outlook.

The central bank’s Federal Open Market Committee (FOMC) held its benchmark interest rate steady in a range of 4.25% to 4.5%.

In their latest policy meeting statement, the FOMC members said they see the benchmark rate falling to 3.9% this year, which would suggest two rate cuts, unchanged from their December forecast. The rate cut outlooks for 2026 and 2027 were also left unchanged at 3.4% and 3.1%, respectively.

However, some investors noted new projections that showed 11 out of 19 policymakers expect the Fed to cut rates at least twice this year, down from 15 officials who had pencilled in at least two cuts in December.

The rate cut forecasts came even as the FOMC adjusted their inflation outlook upward for this year, while simultaneously downgrading their forecast for economic growth, following the Trump administration’s implementation of trade tariffs.

But, in his press conference after the statement release, Fed Chairman Jerome Powell suggested that the weaker economic growth may help offset the higher inflation.

At the stock market close in New York, the blue-chip Dow Jones Industrials Average was up 0.9% at 41,964, while the broader S&P 500 index gained 1.1% to 5,675, and the tech-laden Nasdaq Composite rose 1.4% at 17,750.

US30Roll Daily

Among tech issues, Tesla gained 4.7% after the electric vehicles maker took a step towards launching its long-promised robotaxi service in California after securing the first of several necessary approvals from the state.

Meanwhile, Nvidia rose 1.8% as the AI chipmaker’s CEO Jensen Huang said that the impact of tariffs won’t be meaningful in the near term, and analysts believed the company presented a clear roadmap at GTU Day 2.

Elsewhere, Boeing jumped 6.8% after the aircraft manufacturer’s CFO Brain West highlighted an improving operational performance.

But General Mills fell 2.1% after the food manufacturer forecast a sharp decline in annual sales and profits, hit by increased competition from cheaper private label brands.

Among commodities, oil prices edged higher after US government data showed a draw in fuel inventories, although the Fed’s decision to hold interest rates steady capped gains.

US West Texas Intermediate (WTI) crude gained 0.4% at $67.19, and UK Brent crude rose 0.5% to $70.91 a barrel.

Meanwhile, gold soared to an all-time high after the Fed rate decision and statement, and chair Jerome Powell’s remarks.

XAUUSD H1

Spot gold rose 0.5% to $3,047.80 per ounce after hitting an all-time high of $3,051.99 earlier in the session. Gold, viewed as a safe-haven investment during times of higher inflation has climbed over 15% so far this year.

Disclaimer:

The information contained in this market commentary is of general nature only and does not take into account your objectives, financial situation or needs. You are strongly recommended to seek independent financial advice before making any investment decisions.

Trading margin forex and CFDs carries a high level of risk and may not be suitable for all investors. Investors could experience losses in excess of total deposits. You do not have ownership of the underlying assets. AC Capital Market (V) Ltd is the product issuer and distributor. Please read and consider our Product Disclosure Statement and Terms and Conditions, and fully understand the risks involved before deciding to acquire any of the financial products provided by us.

The content of this market commentary is owned by AC Capital Market (V) Ltd. Any illegal reproduction of this content will result in immediate legal action.

0 notes

Text

Hawkish Fed Left Rates Unchanged, Wall Street Lower

US stocks were weak on Wednesday after the Federal Reserve made a hawkish shift on inflation when it, as expected, left interest rates unchanged at their first meeting of 2025.

In their policy statement, Fed officials commented that inflation continues to be somewhat elevated, and the reference to inflation making progress towards their 2% target was removed.

The removal of the reference could indicate a shift in the Fed's approach to inflation, and, following the statement, traders cut their expectations for easing from the Fed this year.

The inflation picture is further complicated by potential pressures stemming from President Trump’s proposed tariffs and protectionist policies. The Fed's shift also comes hot on the heels of Trump's virtual address to the World Economic Forum in Davos last week where he called for immediate rate cuts.

On foreign exchanges, the US dollar firmed against major currencies as the Fed gave few clues about further reductions in borrowing costs this year.

Meanwhile, on the data front, the US goods trade deficit surged to $122.1 billion in December, up from $103.5 billion the preceding month and well above the consensus forecast of $105.5 billion.

At the stock market close in New York, the Dow Jones Industrials Average was down 0.3% at 44,713, while the broader S&P 500 index lost 0.5% at 6,039, and the tech-laden Nasdaq Composite fell 0.5% to 19,632.

US30Roll H4

Some of the biggest tech industry players are posting earnings this week. Microsoft fell 7.3% in after-hours trading as although the software giant's fiscal second-quarter results beat Wall Street estimates, growth in its key Azure cloud business fell short of expectations.

Tesla shed 2.2 % as it reported below-forecast fourth-quarter revenues, as slowing demand weighed on the electric vehicle maker’s top line, although profit rose slightly.

But Meta Platforms rose 0.3% after-hours as the Facebook firm posted record revenue in the fourth quarter, aided by AI improvements to its advertising business.

And IBM gained 8.5% in extended trading after its fourth-quarter profit surpassed analysts' estimate, driven by demand in its high-margin software unit as businesses ramped up IT spending.

Ahead of its earnings due after-hours on Thursday, Apple rose 0.5% during the day’s session despite being downgraded to perform from outperform by analysts at Oppenheimer.

Elsewhere, NVIDIA shed 4.1%, reversing Tuesday’s rally, as investors continued to assess the impact of DeepSeek's new model on the AI chip giant's future prospects.

Away from tech, Levi Strauss fell 6.6% in extended trading as the clothing firm forecast annual profit well below analysts' estimates after topping fourth-quarter revenue.

T-Mobile US gained 6.3% after the telecom giant forecast annual wireless subscriber growth above expectations, after holiday-quarter promotions and deals boosted demand for its affordable premium 5G plans with streaming bundles.

Starbucks jumped 8.1% after the world’s largest coffee chain reported better-than-expected first quarter sales as some of its turnaround efforts start to deliver results.

And Trump Media & Technology rose 6.8% after the Truth Social parent company announced that it is expanding into financial services, including investment products.

Among commodities, oil prices fell on Wednesday, after domestic crude stockpiles rose by 3.46 million barrels last week, according to Energy Information Administration data, higher than the 3.19-million-barrel increase.

USOILRoll Daily

US WTI crude fell 1.0% to $73.01 a barrel, while UK Brent crude lost 0.8% at $76.85 a barrel.

Disclaimer:

The information contained in this market commentary is of general nature only and does not take into account your objectives, financial situation or needs. You are strongly recommended to seek independent financial advice before making any investment decisions.

Trading margin forex and CFDs carries a high level of risk and may not be suitable for all investors. Investors could experience losses in excess of total deposits. You do not have ownership of the underlying assets. AC Capital Market (V) Ltd is the product issuer and distributor. Please read and consider our Product Disclosure Statement and Terms and Conditions, and fully understand the risks involved before deciding to acquire any of the financial products provided by us.

The content of this market commentary is owned by AC Capital Market (V) Ltd. Any illegal reproduction of this content will result in immediate legal action.

0 notes