#AI In Banking Market Trends

Text

Artificial Intelligence In Banking Market Size To Reach $143.56Bn By 2030

Artificial Intelligence In Banking Market Growth & Trends

The global artificial intelligence in banking market size is expected to reach USD 143.56 billion by 2030, growing at a CAGR of 31.8% from 2024 to 2030, according to a new report by Grand View Research, Inc. AI's integration in banking offers personalized financial guidance, customized product suggestions, and customized services based on individual behaviors and preferences. By analyzing extensive data sets, AI enables banks to understand customers on a deeper level, enhancing the overall experience. This technology optimizes risk assessment, drives operational efficiency, strengthens security measures against fraud, and empowers data-driven decision-making, ultimately propelling the banking market forward through improved customer satisfaction, cost savings, and innovative service offerings.

Technological advancements serve as the engine propelling the banking market into new frontiers. Innovations such as artificial intelligence, machine learning, blockchain, and advanced analytics redefine traditional banking paradigms. Machine learning refines algorithms, enhancing accuracy in decision-making and customer service. Blockchain ensures secure, transparent, and efficient transactions. Moreover, mobile banking, contactless payments, and biometric authentication optimize convenience and accessibility. These advancements streamline operations, reduce costs, and also strengthen a more inclusive banking environment, satisfying diverse customer needs. As technology evolves, it continually transforms the banking landscape, driving efficiency, security, and customer-centricity.

Digital transformation in banking transcends mere technology adoption; it's a holistic transformation of the banking ecosystem towards agility, customer-centricity, and technological prowess. Its core objective is aligning with evolving customer needs enhancing operational efficiency and fortifying security standards. For instance, in June 2023, Infosys Limited signed a deal with Danske Bank, a Danish multinational banking and financial services corporation, to expedite its digital transformation endeavors and generate increased value for its customers through artificial intelligence (AI). The company has entered a five-year agreement valued at $454 million, with the option for renewal for an additional year, up to three times.

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/artificial-intelligence-banking-market-report

Artificial Intelligence In Banking Market Report Highlights

The Risk Management segment is dominated the market with a significant market share in 2023. Effective risk management systems help prevent financial losses due to market fluctuations, credit defaults, operational failures, or cyber threats. This motivates financial institutions to invest significantly in robust risk management infrastructure

The Natural Language Processing (NLP) segment has seized a substantial market share, asserting dominance in the industry as of 2023. NLP algorithms process vast amounts of financial news, reports, and social media data to predict market trends and sentiment analysis for investment decisions

Banks in North America have access to vast amounts of consumer data, providing a rich source for AI algorithms to analyze and derive insights. This data abundance fuels the development of robust AI models for various banking applications

The large Enterprise segment is dominated the market with a significant market share in 2023. Having extensive and diverse datasets enables large enterprises to train more accurate and sophisticated AI models. These models can better understand customer behaviors, predict trends, identify potential risks, and offer personalized services.

Customers increasingly prefer digital and self-service options. AI-powered assistants fulfill this need, encouraging the adoption of technological advancements and positioning banks as innovative and customer-centric institutions

The integration of AI-driven personalized recommendations and services in banking fundamentally transforms customer relationships, propelling market growth. Using individual spending behaviors, investment tendencies, and financial objectives, banks create customized solutions that perfectly match each customer's preferences and requirements

Artificial Intelligence In Banking Market Segmentation

Grand View Research has segmented the global artificial intelligence in banking market based on component, application, technology, enterprise size, and region:

Artificial Intelligence In Banking Component Outlook (Revenue, USD Million, 2017 - 2030)

Service

Solution

Artificial Intelligence In Banking Application Outlook (Revenue, USD Million, 2017 - 2030)

Risk Management

Customer Service

Virtual Assistant

Financial Advisory

Others

Artificial Intelligence In Banking Technology Outlook (Revenue, USD Million, 2017 - 2030)

Natural Language Processing (NLP)

Machine Learning & Deep Learning

Computer vision

Others

Artificial Intelligence In Banking Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

Large Enterprise

SMEs

Artificial Intelligence In Banking Regional Outlook (Revenue, USD Million, 2017 - 2030)

North America

U.S.

Canada

Europe

Germany

U.K.

France

Asia Pacific

China

Japan

India

South Korea

Australia

Latin America

Mexico

Brazil

Middle East and Africa

Kingdom of Saudi Arabia (KSA)

UAE

South Africa

List of Key Players in the Artificial Intelligence In Banking Market

Amazon Web Services, Inc.

Capital One

Cisco Systems, Inc.

FAIR ISAAC CORPORATION (FICO)

Goldman Sachs

International Business Machines Corporation

JPMorgan Chase & Co.

NVIDIA Corporation

RapidMiner

SAP SE

Browse Full Report: https://www.grandviewresearch.com/industry-analysis/artificial-intelligence-banking-market-report

#AI In Banking Market#AI In Banking Market Size#AI In Banking Market Share#AI In Banking Market Trends#AI In Banking Market Growth

0 notes

Text

Transforming Mobile Banking: Elevating Consumer Experience with AI

In the rapidly evolving landscape of mobile banking, staying ahead of consumer expectations requires not just adopting new technologies but truly understanding how to harness them to enhance the customer experience. Enter Matt Britton, an acclaimed AI keynote speaker and a foremost expert in consumer trends and generational marketing. As the Founder & CEO of Suzy, a cutting-edge consumer research platform, Matt has an unparalleled grasp of market dynamics. His insights could profoundly transform the mobile banking sector, especially when augmented with artificial intelligence (AI).

Britton’s background is as impressive as it is relevant. At Suzy, he has not only led the development of a platform that directly connects brands with target audiences but has also gained a deep understanding of real-time consumer data gathering and analysis. This expertise is crucial in mobile banking, where consumer preferences shift rapidly and expectations are always escalating. Moreover, having consulted for over half of the Fortune 500 companies, Britton brings a wealth of experience in scaling technologies and strategies that large enterprises can leverage to stay competitive in a digital age.

His book, "YouthNation," which climbed the ranks to become a bestseller, underscores his in-depth knowledge of emerging consumer trends, particularly among millennials and Generation Z. These groups are increasingly dominating the banking demographic and are known for their preference for digital solutions, making his insights particularly valuable for any financial institution looking to revamp its mobile banking services.

Enhancing Consumer Experience through AI: Insights from a Top AI Keynote Speaker

Understanding Consumer Needs with AI

One of the primary ways AI can enhance the consumer experience in mobile banking is through personalized services. AI systems, through predictive analytics, can analyze individual spending habits and suggest financial planning tips, recommend new products, and even predict future needs before the consumer realizes them themselves. Britton could discuss how AI-powered tools can transform impersonal transactions into tailored financial advice sessions, increasing both customer satisfaction and engagement.

Improving Security and Trust

Security is a significant concern in mobile banking. AI can play a crucial role in enhancing security protocols. By implementing biometric verification systems like facial recognition or fingerprint scanning, banks can offer a more secure platform for their customers. Britton, with his extensive experience in deploying new technologies, could provide valuable insights into how banks can integrate these sophisticated AI systems without disrupting user experience.

Streamlining Operations and Reducing Costs

AI can also help banks streamline their operations and reduce costs, which can, in turn, be passed on to the customer in the form of lower fees or higher interest rates on savings accounts. AI systems can automate routine tasks such as data entry, compliance checks, and even basic customer service inquiries through chatbots. Britton’s discussions could illuminate the pathway for integrating these systems in a way that aligns with consumer expectations and operational goals.

Enhancing Accessibility and Inclusivity

Another critical area where AI can make a significant impact is in making mobile banking more accessible and inclusive. AI-driven voice assistants and customizable interfaces can help visually impaired individuals or those with other disabilities access services with greater ease. As a keynote speaker known for his focus on innovation, Britton could explore how mobile banking can reach a broader audience by incorporating these AI enhancements.

Why Matt Britton?

As a top conference speaker and AI expert, Britton not only brings theoretical knowledge but practical insights into effective consumer engagement strategies using AI. His talks are known for being both engaging and deeply informative, filled with actionable insights. For any conference focusing on the future of mobile banking, having an AI keynote speaker like Britton can significantly elevate the discussion and provide attendees with a unique blend of consumer psychology and cutting-edge technology.

Moreover, his ability to connect with the audience, backed by real-world examples from his work with Fortune 500 companies and startups alike, makes him one of the top keynote speakers in the industry. His expertise is particularly relevant to financial institutions aiming to overhaul their digital services to better meet the needs of a younger, more tech-savvy customer base that values efficiency, security, and personalized service.

In conclusion, as mobile banking continues to evolve, bringing Matt Britton on board to speak at your next conference could provide invaluable insights into how AI can be strategically used to not only meet but exceed consumer expectations. His background as a consumer trend expert and his hands-on experience with AI make him uniquely qualified to address the complexities and challenges of enhancing the consumer banking experience.

#mobile banking'#'consumer experience'#'AI technologies'#'consumer trends'#'generational marketing'.

0 notes

Text

we are in dire need of some new media trend. we've done pirates, we've done cowboys; we've gone through two whole zombie revivals. aliens and space themes have basically been a constant since at least the 1950s, as have robots and evil AIs. we went pretty heavy on vampires for a while. we've also done dinosaurs, ninjas, musicals, wizards, sea creatures, ancient rome, ancient egypt, middle ages out the wazoo, entirely too much world war II, we're currently overdosing on our superhero phase, we've done monsters (misunderstood), monsters (radioactive), fake guy in the real world, real guy travels to fake world, caves & mining, vikings, what if you were really small, genre parody as a genre, sand, New York, time travel, something racist goes down in the jungle, neurodivergent detective, buddy cops, crooked cops, gangsters, bank heists in particular, kid has powers, revolt against the corporate world, portals, social insects, dragons, the British, global apocalypse, martial arts, roadtrip as self-discovery, Jesus, clones, clowns, babysitting goes wrong, demonic possession, ghosts of all kinds, talking animals, fucking with the stock market, restaurant ownership, dwarves, planes, and spies. where do we go from here. what's our next big thing

8K notes

·

View notes

Text

Uranus Awakens: How the Rebellious Bull Shakes Up Business and Finance in 2024

Prepare for disruption, fellow stargazers! As the revolutionary planet Uranus stations direct in the grounded sign of Taurus on January 27, 2024, a cosmic earthquake ripples through the world of business and finance. Get ready for unexpected twists, innovative breakthroughs, and a complete reshaping of the economic landscape. Buckle up, entrepreneurs, investors, and everyone in between — Uranus is here to shake things up!

The Cosmic Cocktail:

Imagine the stoic, earth-loving Taurus as a well-established bank, steeped in tradition and conservative practices. Now, picture the rebellious Uranus, bursting in with a briefcase full of digital currency and blockchain ideas. That’s the essence of this transit — a clash between old and new, stability and revolution, practicality and radical transformation.

Impacts to Expect:

Technological Disruption: Brace yourself for a wave of innovation in finance and business. Cryptocurrency, blockchain, and decentralized finance (DeFi) will take center stage, challenging traditional banking systems and pushing the boundaries of what’s possible.

Prepare for a digital gold rush as Uranus throws open the vault of financial innovation! Cryptocurrency will erupt into mainstream commerce, blockchain will become the new ledger, and DeFi will democratize finance like never before. Traditional banks better dust off their abacus and learn to code, because digital cowboys are charging onto the financial frontier, redefining how we value, exchange, and invest. From peer-to-peer microloans to fractionalized real estate ownership, the possibilities are as limitless as your imagination. Buckle up, because the tectonic plates of finance are shifting, and the digital revolution is rewriting the rules of the game!

Shifting Market Dynamics: Expect volatility and unexpected shifts in established industries. Old guard companies might scramble to adapt, while nimble startups with innovative ideas flourish. Think green energy disrupting fossil fuels, or AI revolutionizing the service industry.

Be prepared for market earthquakes! Uranus, the cosmic trickster, will send shockwaves through established industries, causing titans to tremble and upstarts to dance. Picture fossil fuels choking on the dust of solar panels, brick-and-mortar stores gasping as virtual bazaars boom, and customer service bots replacing flustered clerks. AI will infiltrate every corner, from crafting personalized shopping experiences to streamlining logistics, while sustainable solutions crack open resource-hungry giants. It’s a Darwinian playground for businesses — adapt or face extinction. This isn’t just a market shuffle, it’s a complete reshuffle of the deck, and the cards are dealt anew. Get ready for the thrill of the unexpected, because the only constant in this dynamic landscape is change itself!

Evolving Values: Sustainability, ethical practices, and social responsibility will become increasingly important for consumers and investors alike. Businesses that prioritize these values will thrive, while those stuck in outdated models might struggle.

Get ready for a values revolution! Consumers and investors will turn from price tags to purpose tags, demanding businesses that go beyond profit and prioritize sustainability, ethical sourcing, and social responsibility. Imagine carbon-neutral factories replacing smog-belching behemoths, fair-trade coffee beans eclipsing exploitative practices, and employee well-being becoming a non-negotiable bottom line. Businesses that cling to outdated models will find themselves gasping for air as ethical alternatives steal the oxygen. It’s not just a trend, it’s a tidal wave of conscious consumerism sweeping away the tide of greed. So, businesses, listen up: embrace responsible practices, champion inclusivity, and weave sustainability into your very fabric, or risk being swept away by the rising tide of conscious capitalism. The future belongs to those who do good, not just those who do well!

Collaborative Entrepreneurship: Collaboration and community-driven ventures will rise in prominence. Shared workspaces, cooperatives, and peer-to-peer platforms will gain traction, challenging the traditional top-down corporate structure.

Picture the corporate pyramid crumbling as the cosmic crane hoists the collaborative flag! Uranus, the revolutionary, encourages a seismic shift: from isolated silos to thriving beehives. Shared workspaces buzz with creative collisions, cooperatives blossom out of shared passions, and peer-to-peer platforms become the new marketplace, fueled by trust and mutual aid. The top-down hierarchy shivers as horizontal networks rise, blurring the lines between boss and worker, replacing command with consensus. Collaboration takes center stage, not competition, as communities band together to tackle challenges and build innovative solutions. So, entrepreneurs, shed your solopreneur capes and embrace the power of the collective! In this new social business ecosystem, where synergy triumphs over supremacy, the future belongs to those who share, empower, and co-create a brighter tomorrow. Let the collaborative revolution begin!

Focus on Personal Values: Individuals will increasingly prioritize work that aligns with their personal values and passions. Entrepreneurship fueled by purpose and authenticity will flourish, shaping a more diverse and fulfilling business landscape.

Prepare for a workplace metamorphosis! Uranus, the cosmic butterfly, flutters wings of purpose, urging individuals to shed the career chrysalis and soar towards fulfilling their true potential. Gone are the days of soul-sucking jobs; now, personal values take center stage as the compass guiding career choices. Imagine passionate bakers opening community cafes, eco-conscious designers launching upcycled fashion lines, and tech whizzes crafting apps that tackle social issues. Authenticity becomes the new currency, with entrepreneurs weaving their passions into the fabric of their ventures, creating a mosaic of purpose-driven businesses that cater to every corner of the human experience. This isn’t just a career shift, it’s a heart shift, transforming the business landscape into a vibrant tapestry of diverse talents and fulfilled souls. So, listen to your inner compass, embrace your unique spark, and let your passion ignite the world — the future of work belongs to those who dare to be true to themselves!

Tips for Navigating the Cosmic Chaos:

Embrace innovation: Don’t cling to the old ways. Stay open to new technologies, trends, and business models. Be curious, explore, and experiment.

Adapt and evolve: Be prepared to change course quickly. Agility and responsiveness will be key to success in this dynamic environment.

Prioritize sustainability and ethics: Integrate environmental and social responsibility into your business practices. Consumers and investors are increasingly drawn to values-driven companies.

Collaborate and connect: Build partnerships, join communities, and leverage the power of collective action. Collaboration will be crucial for navigating the changing landscape.

Follow your passion: Don’t be afraid to pursue your entrepreneurial dreams. Uranus encourages authenticity and purpose-driven ventures.

Remember, Uranus isn’t about chaos for chaos’ sake. It’s about dismantling outdated structures and paving the way for a more progressive, sustainable, and fulfilling economic future. By embracing the change, staying adaptable, and aligning your business with your values, you can not only survive this cosmic revolution but thrive in the exciting new world it creates. So, let your inner rebel loose, embrace the disruption, and ride the wave of innovation — the economic future is bright for those who dare to dream big!

#uranus in taurus#taurus uranus#business astrology#astrology business#astrology finance#finance astrology#astrology updates#astro#astrology facts#astro notes#astrology#astro girlies#astro posts#astrology community#astrology observations#astropost#astro community#astrology notes

14 notes

·

View notes

Text

High-Risk Payment Processing Techniques: Best Practices

Article by Jonathan Bomser | CEO | Accept-Credit-Cards-Now.com

In the ever-evolving realm of e-commerce, payment processing takes center stage, enabling businesses to smoothly accept credit card payments and ensure seamless customer transactions. However, for industries deemed high-risk, such as credit repair and CBD sales, navigating the payment processing landscape presents distinct challenges. In this article, we dive into the intricacies of high-risk payment processing methods and present best practices to guarantee secure and efficient transactions. Whether you're a newcomer to high-risk payment processing or looking to refine your current strategies, these insights will steer you toward favorable outcomes.

DOWNLOAD THE HIGH-RISK PAYMENT PROCESSING INFOGRAPHIC HERE

Understanding High-Risk Payment Processing

Effective navigation of the high-risk payment processing sphere necessitates a clear comprehension of high-risk industries. Sectors like credit repair and CBD sales often fall into this category due to intricate regulations and an elevated risk of chargebacks. Consequently, high-risk merchants require specialized payment processing solutions tailored to mitigate associated risks.

The Importance of Merchant Accounts

Merchant accounts form the backbone of efficient payment processing. These accounts, specifically designed for high-risk businesses, facilitate the secure transfer of funds from customers' credit cards to the merchant's bank account. Establishing a high-risk merchant account ensures seamless payment processing, enabling businesses to broaden their customer base and enhance revenue streams.

Exploring High-Risk Payment Gateways

High-risk payment gateways serve as virtual checkpoints between customers and merchants. These gateways safeguard sensitive financial information by encrypting data during transactions. When selecting a high-risk payment gateway, emphasize security features and compatibility with your business model to guarantee safe and smooth payment processing.

Tailored Solutions for Credit Repair Businesses

Credit repair merchants face unique challenges due to the industry's regulatory landscape. Obtaining a credit repair merchant account equipped with specialized payment processing solutions can aid in navigating these complexities. Implementing robust Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures ensures compliance and fosters customer trust.

CBD Sales and Payment Processing

CBD merchants operate in a market brimming with potential but also shrouded in uncertainty. Shifting regulations demand a flexible approach to CBD payment processing. Collaboration with experienced payment processors well-versed in the intricacies of CBD sales and the utilization of age verification systems can streamline transactions and bolster customer confidence.

Mitigating Chargeback Risks

Chargebacks pose a significant threat to high-risk merchants, frequently arising from disputes, fraud, or unsatisfactory service. Proactively address this issue by providing exceptional customer support, transparent refund policies, and clear product descriptions. Consistent communication can forestall chargebacks and maintain a healthy merchant-consumer relationship.

youtube

Future-Proofing High-Risk Payment Processing

Advancing technology necessitates the evolution of high-risk payment processing techniques to stay ahead of potential threats. Embrace emerging solutions like AI-driven fraud detection and biometric authentication to enhance security and streamline payment processing. Staying informed and adapting to industry trends ensures the future-proofing of payment processing strategies for high-risk merchants.

High-risk payment processing amalgamates industry knowledge, tailored solutions, and cutting-edge security measures. Whether operating in credit repair or CBD sales, a comprehensive understanding of high-risk payment processing intricacies is imperative. Leveraging specialized merchant accounts, payment gateways, and proactive chargeback prevention methods enables high-risk merchants to confidently accept credit card payments and cultivate long-term customer relationships. In an ever-evolving landscape, embracing innovative payment processing solutions guarantees a secure and prosperous future for high-risk businesses.

#high risk merchant account#high risk payment gateway#high risk payment processing#merchant processing#payment processing#credit card payment#credit card processing#accept credit cards#Youtube

17 notes

·

View notes

Text

In the United States, call center companies play a pivotal role in providing customer support, sales assistance, technical troubleshooting, and various other services for businesses across a multitude of industries. These companies employ thousands of individuals nationwide and operate through various models, including in-house, outsourced, and virtual call centers. Let's delve into the landscape of call center companies in the USA.

1. Overview of the Call Center Industry:

The call center industry in the USA has witnessed significant growth over the years, driven by the increasing demand for cost-effective customer service solutions and the globalization of businesses. Today, call centers cater to diverse sectors such as telecommunications, banking and finance, healthcare, retail, technology, and e-commerce.

2. Major Players:

Several major call center companies dominate the industry, including:

Teleperformance: One of the largest call center companies globally, Teleperformance operates numerous centers across the USA, offering multilingual customer support, technical assistance, and sales services.

Concentrix: Concentrix is another key player, known for its innovative customer engagement solutions. It provides a wide range of services, including customer care, technical support, and digital marketing services.

Alorica: Alorica specializes in customer experience outsourcing solutions, serving clients in various industries. It offers services such as customer support, sales, and back-office support.

Sitel Group: Sitel Group is renowned for its customer experience management solutions. With a global presence, Sitel operates call centers in multiple locations across the USA, providing tailored customer support services.

TTEC: Formerly known as TeleTech, TTEC offers customer experience solutions, digital services, and technology-enabled customer care. It focuses on delivering personalized customer interactions through its contact centers.

3. Industry Trends:

The call center industry is continually evolving, driven by technological advancements and changing consumer preferences. Some notable trends include:

Digital Transformation: Call centers are increasingly integrating digital channels such as chat, email, and social media to enhance customer engagement and support omnichannel experiences.

AI and Automation: Automation technologies, including artificial intelligence (AI) and chatbots, are being adopted to streamline processes, improve efficiency, and provide faster resolutions to customer queries.

Remote Workforce: The COVID-19 pandemic accelerated the shift towards remote work in the call center industry. Many companies have embraced remote workforce models, allowing agents to work from home while maintaining productivity and efficiency.

Data Analytics: Call centers are leveraging data analytics tools to gain insights into customer behavior, preferences, and trends. This data-driven approach enables them to personalize interactions and optimize service delivery.

4. Challenges and Opportunities:

Despite its growth, the call center industry faces several challenges, including:

Staffing Issues: Recruiting and retaining skilled agents remains a challenge for many call center companies, particularly amid competition for talent and high turnover rates.

Security Concerns: With the increasing prevalence of cyber threats, call centers must prioritize data security and compliance to protect sensitive customer information.

However, the industry also presents numerous opportunities for growth and innovation:

Expansion of Services: Call center companies can diversify their service offerings to meet the evolving needs of clients, such as expanding into digital customer engagement, analytics, and consulting services.

Focus on Customer Experience: By prioritizing customer experience and investing in training and technology, call centers can differentiate themselves and gain a competitive edge in the market.

Globalization: With advancements in technology and communication infrastructure, call center companies can explore opportunities for global expansion and tap into new markets.

5. Future Outlook:

Looking ahead, the call center industry is poised for further growth and transformation. As businesses increasingly prioritize customer-centric strategies, call center companies will play a crucial role in delivering exceptional customer experiences and driving business success.

In conclusion, call center companies in the USA form a vital component of the customer service ecosystem, serving a wide range of industries and helping businesses enhance customer satisfaction and loyalty. With ongoing technological innovations and evolving customer expectations, the industry is poised for continued growth and innovation in the years to come.

2 notes

·

View notes

Text

Unlocking Business Success: The Power of AI-Based Digital Marketing

Problem: As a business owner, you’re constantly striving to stay ahead of the curve and drive growth for your company. However, in today’s fast-paced digital landscape, achieving and maintaining a competitive edge can be a daunting task. Traditional marketing approaches often fall short in delivering the desired results, leaving many businesses struggling to reach their full potential.

Agitation: Are you tired of seeing your marketing efforts fall flat? Do you find yourself grappling with stagnant growth and limited visibility online? Are you ready to break free from the constraints of outdated strategies and propel your business towards unparalleled success?

In today’s digital age, where consumer behaviors and preferences are constantly evolving, businesses need a marketing approach that is agile, data-driven, and highly effective. AI-based digital marketing offers precisely that, empowering businesses to optimize their marketing strategies, enhance customer engagement, and maximize ROI.

Benefit 1: Enhanced Personalization

One of the key advantages of AI-based digital marketing is its ability to deliver highly personalized experiences to consumers. By leveraging advanced algorithms and machine learning techniques, businesses can analyze vast amounts of data to gain insights into consumer preferences, behaviors, and purchasing patterns. This allows them to tailor their marketing efforts accordingly, delivering targeted content and offers that resonate with individual customers on a deeper level.

Benefit 2: Improved Targeting and Segmentation

Gone are the days of casting a wide net and hoping for the best. With AI-based digital marketing, businesses can target their audience with unprecedented precision. By segmenting their target audience based on various factors such as demographics, interests, and browsing history, businesses can ensure that their marketing messages are delivered to the right people, at the right time, and through the right channels. This not only increases the effectiveness of their marketing campaigns but also minimizes wastage of resources on irrelevant audiences.

Benefit 3: Real-Time Insights and Optimization

In today’s fast-paced business environment, timely insights are invaluable. AI-based digital marketing provides businesses with real-time data and analytics, allowing them to monitor the performance of their campaigns, identify trends, and make data-driven decisions on the fly. Whether it’s adjusting ad creatives, refining targeting parameters, or optimizing website content, businesses can continuously fine-tune their marketing efforts to achieve maximum impact and ROI.

Benefit 4: Enhanced Customer Engagement and Retention

Benefit 5: Cost-Effectiveness and Efficiency

Contrary to popular belief, AI-based digital marketing doesn’t have to break the bank. In fact, it can be a highly cost-effective solution for businesses of all sizes. By automating repetitive tasks, streamlining processes, and optimizing resource allocation, AI-based digital marketing helps businesses maximize their marketing budget and achieve greater efficiency. This allows businesses to allocate their resources more strategically, focusing on activities that deliver the highest return on investment.

Ready to experience the transformative power of AI-based digital marketing for your business? Don’t miss out on this opportunity to take your marketing efforts to the next level and unlock unprecedented growth and success.

Sign up for our one-month free trial offer today and see the difference for yourself. Our team of experts will work with you to tailor a customized AI-based digital marketing strategy that aligns with your business goals and objectives. With our proven track record of delivering results, you can trust that you’re making a smart investment in the future of your business.

Don’t wait any longer — seize the opportunity and propel your business towards greatness with AI-based digital marketing.

In conclusion, AI-based digital marketing isn’t just a buzzword — it’s a powerful tool that can revolutionize the way businesses engage with their customers, drive growth, and achieve lasting success. By embracing AI technology, businesses can stay ahead of the competition, adapt to changing market dynamics, and thrive in today’s digital-first world.

Book a free Consultation Now to Enrich Your business to a new Potential

https://calendly.com/debjitb20/discovery-call

4 notes

·

View notes

Text

AI in Finance: Automating Processes and Enhancing Decision-Making in the Financial Sector

Introduction:

In today’s rapidly evolving world, technology continues to reshape various industries, and the financial sector is no exception. Artificial Intelligence (AI) has emerged as a game-changer, revolutionizing the way financial institutions operate and make critical decisions. By automating processes and providing valuable insights, AI is transforming the financial landscape, enabling greater efficiency, accuracy, and customer satisfaction.

AI Applications in Finance:

Automation of Routine Tasks: Financial institutions deal with massive amounts of data on a daily basis. AI-driven automation tools can streamline tasks such as data entry, processing, and reconciliation, reducing manual errors and increasing operational efficiency. Additionally, AI-powered bots can handle customer inquiries and support, freeing up human agents to focus on more complex issues.

Fraud Detection and Security: Cybersecurity is a top priority for financial institutions. AI algorithms can analyze vast datasets in real-time to detect unusual patterns and anomalies, flagging potential fraudulent activities before they escalate. This proactive approach enhances security measures and safeguards customer assets.

Personalized Customer Experience: AI-powered chatbots and virtual assistants offer personalized interactions with customers, providing quick responses to queries and offering tailored financial solutions based on individual preferences and behavior. This level of personalization enhances customer satisfaction and loyalty.

AI for Risk Assessment and Management:

Credit Scoring and Underwriting: AI-powered credit risk models can assess an individual’s creditworthiness more accurately, incorporating a wide range of factors to make data-driven decisions. This expedites loan underwriting processes, allowing financial institutions to serve customers faster while managing risk effectively.

Market Analysis and Predictions: AI algorithms can analyze market trends, historical data, and other influencing factors to predict market fluctuations with higher accuracy. By leveraging AI-driven insights, investment professionals can make more informed decisions, optimizing investment strategies and portfolios.

Improving Financial Decision-Making:

Algorithmic Trading: AI-driven algorithmic trading systems can execute trades based on predefined criteria, eliminating emotional biases and executing trades with greater precision and speed. This technology has the potential to outperform traditional trading methods, benefiting both investors and institutions.

Portfolio Management: AI can optimize portfolio performance by considering various risk factors, asset correlations, and individual investment goals. Through data-driven portfolio management, investors can achieve a balanced risk-return profile, aligning with their specific financial objectives.

Ethical and Regulatory Considerations:

As AI becomes more prevalent in the financial sector, it’s crucial to address ethical concerns and ensure compliance with regulatory requirements. Financial institutions must be vigilant in identifying and mitigating biases present in AI algorithms to maintain fairness and transparency in decision-making processes. Additionally, adhering to data privacy laws is essential to protect customer information and build trust with clients.

Real-world Examples of AI Adoption in Finance:

JPMorgan Chase: The multinational bank utilizes AI to streamline customer interactions through their virtual assistant, providing personalized financial advice and support.

BlackRock: The investment management firm employs AI-powered algorithms to enhance its portfolio management and make data-driven investment decisions.

Challenges and Future Outlook:

While AI offers tremendous benefits to the financial sector, challenges remain, including data privacy concerns, algorithmic biases, and potential job displacement. Addressing these challenges is vital to maximizing the potential of AI in finance. Looking ahead, the future of AI in finance is promising, with advancements in Natural Language Processing (NLP), predictive analytics, and machine learning expected to reshape the industry further.

Conclusion:

AI is revolutionizing the financial sector by automating processes, improving decision-making, and enhancing customer experiences. Financial institutions embracing AI can gain a competitive edge, providing better services, reducing operational costs, and managing risks more effectively. However, ethical considerations and regulatory compliance must remain at the forefront of AI adoption to ensure a sustainable and equitable financial landscape for the future. With responsible implementation, AI is set to continue transforming finance, empowering institutions to thrive in the digital age.

6 notes

·

View notes

Text

Mobile App Development Agency in Delhi NCR/Greater Noida

From Bustling Bazaars to Global Innovation Hub:

Delhi NCR, a land of vibrant culture, historical landmarks, and a booming tech scene, is rapidly transforming into a mobile app development powerhouse. From bustling startups nestled in Gurgaon's co-working spaces to established IT giants in Noida, the demand for innovative and user-friendly apps is skyrocketing. But navigating this dynamic landscape can be tricky, especially with so many development companies vying for your attention. So, let's delve into the exciting world of mobile app development in Delhi NCR, exploring the latest trends and why The Green Concept might be your perfect partner on this digital adventure.

Riding the Tide of Innovation: Trending Technologies

The Delhi NCR app development scene is buzzing with cutting-edge technologies that are shaping the future of user experiences. Here are some of the hottest trends to keep an eye on:

Beyond Screens: Immersive Experiences:

Augmented Reality (AR) and Virtual Reality (VR) are no longer confined to science fiction movies. Imagine learning about Hindu history through immersive VR tours of iconic monuments, or trying on clothes virtually before buying them. Delhi NCR companies are at the forefront of exploring how AR/VR can enhance app functionality and user engagement, creating truly unique and interactive experiences.

AI-Powered Personalization: From Mass Market to One-to-One: Gone are the days of one-size-fits-all apps. Today, users crave personalized experiences that cater to their individual needs and preferences. Delhi NCR developers are harnessing the power of Artificial Intelligence (AI) to personalize app interfaces, content recommendations, and even in-app interactions, fostering deeper user loyalty and driving meaningful engagement.

Blockchain: Building Trust, One Block at a Time:

Security and transparency are paramount in today's digital world, especially for apps dealing with sensitive information like financial transactions or healthcare records. Blockchain technology offers a secure and transparent way to manage data, making it ideal for these types of apps. Delhi NCR development companies are actively exploring the potential of blockchain to enhance app security and build user trust, laying a foundation for a more secure and reliable digital ecosystem.

Voice-Enabled Interactions: Speak Your Commands:

The rise of smart speakers and voice assistants like Alexa and Google Assistant has pushed voice-enabled interactions to the forefront. Delhi NCR developers are integrating voice commands into apps, making them more accessible and user-friendly, especially for visually impaired users or those on the go. Imagine seamlessly navigating your banking app or controlling your smart home devices just by speaking your commands.

Finding Your Perfect Development Partner: Why The Green Concept Stands Out

With so many app development companies in Delhi NCR, choosing the right one can feel overwhelming. Here's why The Green Concept stands out from the crowd:

Your Vision, Our Expertise: Beyond Coding, We Speak Your Language: We don't just build apps, we partner with you to understand your unique vision, target audience, and business goals. Clear communication and collaboration are our core values, ensuring you're not just informed, but actively involved throughout the entire development process. We become an extension of your team, not just hired hands.

A Multifaceted Team: Your One-Stop Shop for App Development: Our team boasts a diverse range of skills and experience, tackling complex projects with confidence. Whether you need an e-commerce platform with robust payment gateways, a captivating game with stunning visuals, or an AR-powered learning tool that breaks down complex concepts, we have the expertise to bring your idea to life. No need to juggle multiple agencies for different aspects of your app development; we offer a comprehensive solution under one roof.

Transparency is Key: Building Trust, One Update at a Time:

We believe in open communication and regular updates. You'll never be left in the dark about the progress of your app, as we keep you informed, involved, and confident about every step of development. Expect detailed reports, regular meetings, and clear communication channels to ensure you're always on the same page.

Beyond Launch, We Care: Your Long-Term App Partner:

Our commitment extends far beyond building your app. We offer ongoing support, maintenance, and updates, ensuring your app evolves and thrives in the ever-changing tech landscape. We'll be there to address any bugs, implement new features, and adapt your app to the latest trends, so you can focus on growing your business without worrying about the technical upkeep.

Sustainable Practices: Building Apps with a Conscience:

At The Green Concept, we're passionate about building eco-friendly apps that minimize environmental impact. We actively explore sustainable development practices, use energy-efficient tools, and offset our carbon footprint wherever possible. If aligning your values with sustainability is important to you, we're the perfect partner to create an app that's not just innovative, but also environmentally responsible.

Delhi NCR is brimming with mobile app development potential, and The Green Concept is your ideal co-pilot on this exciting journey. We equip you with the technical expertise, creative vision, and unwavering commitment to create an app that stands out in the bustling Delhi NCR market and beyond. Ready to turn your app dream into reality?

Contact The Green Concept today for a free consultation. Let's explore the latest trends, discuss your unique vision, and craft a personalized development plan that brings your app to life, sustainably and successfully. Remember, in the ever-evolving world of mobile technology, choosing the right partner is crucial. Choose The Green Concept, and unlock the full potential of your app, not just in Delhi NCR, but on the global stage.

We believe in the power of apps to connect, empower, and make a difference. Are you ready to join the movement?

P.S. Stay tuned for more insightful blog posts on mobile app development trends, industry news, and success stories from The Green Concept. We're passionate about sharing our knowledge and helping you navigate the dynamic app development landscape.

Contact us:

Web: www.thegreenconcept.in

Email: [email protected]

Mob: +919899130429

#mobile app development#application#flutter app developers#android#windows app#react native#android app development

2 notes

·

View notes

Text

Sunday, September 3, 2023

No power and nowhere to stay as rural Florida starts recovering from Hurricane Idalia

(AP) The worst of Hurricane Idalia left residents of a region of tight-knit communities trying to find places to live as they rebuild—if they decide it’s even worth it—and waiting potentially weeks for electricity to be restored after winds and water took out entire power grids. A power cooperative warned its 28,000 customers it might take two weeks to restore electricity. More than 100,000 homes and businesses in Florida and Georgia remained without power Friday, according to PowerOutage.us. And even with high temperatures below normal, the high humidity meant sweltering late-summer days and nights, with no power to run air conditioners. Emergency officials promised trailers would arrive over the weekend to provide housing in an area that didn’t have much to begin with.

Americans’ Ideal Family Size Is Larger Than the Birthrate Suggests

(WSJ) What do you think is the ideal number of children for a family to have? Most Americans say the answer is two to three children, according to various surveys over nearly 90 years, even as actual birthrates drop lower than that. In fact, the share of people saying they want three or more children has risen as the actual number of children being born has dropped. Why aren’t people having the families they idealize or intend to have? All sorts of life happens, and you don’t necessarily end up with the family you expected theoretically in a survey.

.ai

(Bloomberg) The Caribbean island Anguilla, a British territory, has made bank this year because their country-level domain address is .ai, and amid the AI trend they’re making a fortune off of new registrations. This year, registrations at the top level domain doubled to 287,432 on the year, which would mean that Anguilla will reap in the ballpark of $30 million for the year from selling the domains, up from $7.4 million brought in in 2021.

The Bolivian Job

(Rest of World) An estimated 20 percent of the total vehicle fleet in Bolivia has been smuggled, mostly stolen in neighboring Chile and then driven across the desert to one of the 73 illegal markets that are remarkably easy to find. The Bolivian government is aware of the issue, and the car thieves have become a lifestyle of their own, called chuteros with their own TikTok scene and whatnot. Naturally, this has the Chileans furious, and local police are overwhelmed with reports. Chile’s even got a new AI-fueled startup, SafeByWolf, designed to identify boosted cars faster for the insurance industry.

More than 100 British schools may face danger of collapse

(BBC) More than 100 schools in England are scrambling to make arrangements after being told to shut buildings with a type of concrete prone to collapse. The government gave the order just days before the start of the autumn term. Some pupils have already been told they will be learning remotely, in temporary classrooms or at different schools. Schools found with buildings containing reinforced autoclaved aerated concrete (RAAC) have been told they must introduce safety measures, which could include propping up ceilings. This came after the government was made aware of a number of incidents where RAAC failed without warning, not just in school buildings, but elsewhere too.

Russian students are returning to school, where they face new lessons to boost their patriotism

(AP) Clad in white shirts and carrying bouquets, children across Russia flocked back to school Friday, where the Kremlin’s narratives about the war in Ukraine and its confrontation with the West were taking an even more prominent spot than before. Students are expected each week to listen to Russia’s national anthem and watch the country’s tricolor flag being raised. There’s a weekly subject loosely translated as “Conversations about Important Things,” which was introduced last year with the goal of boosting patriotism. A new high school history textbook has a chapter on the annexation of the Crimean Peninsula and the “special military operation”—the Kremlin’s euphemism for the war, and some basic military training is included in a course on self-defense and first aid. “School ... is a powerful mechanism for raising a person subordinate to the state,” said Nikolay Petrov, visiting researcher at the German Institute for International and Security Affairs. “For a while the school was outside the active attention of the state. Today, it’s all coming back.”

As Ukraine’s Fight Grinds On, Talk of Negotiations Becomes Nearly Taboo

(NYT) Stian Jenssen, the chief of staff to the secretary general of NATO, recently had his knuckles rapped when he commented on possible options for an end to the war in Ukraine that did not envision a complete Russian defeat. His remarks provoked an angry condemnation from the Ukrainians; a clarification from his boss, Jens Stoltenberg; and ultimately an apology from Mr. Jenssen. The contretemps, say some analysts who have been similarly chastised, reflects a closing down of public discussion on options for Ukraine just at a moment when imaginative diplomacy is most needed, they say. Given that even President Biden says the war is likely to end in negotiations, Samuel Charap, a senior political scientist at the RAND Corporation, believes there should be a serious debate in any democracy about how to get there. Yet he, too, has also been criticized for suggesting that it is important to talk to Russia about a negotiated outcome. “There is a broad and increasingly widespread sense that what we’re doing now isn’t working, but not much of an idea of what to do next, and not a big openness to discuss it, which is how you come up with one,” he said. “The lack of success hasn’t opened up the political space for an open discussion of alternatives.”

Pope, in Mongolia, laments earth devastated by countless conflicts

(Reuters) Pope Francis, in words that appeared to be aimed at China rather than the neighbouring country he was visiting, said on Saturday that governments have nothing to fear from the Catholic Church because it has no political agenda. In an address to bishops, priests, missionaries and pastoral workers, he said Jesus gave no political mandate to his apostles but told them to alleviate the sufferings of a “wounded humanity” through faith. “For this reason, governments and secular institutions have nothing to fear from the Church’s work of evangelization, for she has no political agenda to advance, but is sustained by the quiet power of God’s grace and a message of mercy and truth, which is meant to promote the good of all,” he said. On Saturday morning, Francis called on leaders to dispel the “dark clouds of war.”

Typhoon Saola makes landfall in southern China but appears to cause only light damage

(AP) Typhoon Saola made landfall in southern China before dawn Saturday after nearly 900,000 people were moved to safety and most of Hong Kong and parts of the coastal mainland suspended business, transport and classes. Damage appeared to be minimal, however, and some services were returning to normal by afternoon. Meanwhile, Taiwan issued a warning Saturday for a second typhoon, Haikui, which was expected to pass over the island Sunday, before traveling onward to the central Chinese coast.

Biden approves military aid to Taiwan under program normally used for sovereign states

(NBC) On Wednesday, Washington approved a transfer of arms to Taiwan under the Foreign Military Financing program, which is normally reserved for use with sovereign states. Currently, neither the U.S. nor U.N. acknowledges the island nation as its own country in order to maintain diplomatic ties to China. Beijing voiced its “strong dissatisfaction” and “firm opposition” to the weapons sale, claiming that it hurt “China’s sovereignty and security interests” while damaging “peace and stability across the Taiwan Strait.” Even as China-U.S. dialogue has picked up in recent months with multiple American officials visiting Beijing, the White House has continued funneling arms to Taiwan. Last month, Washington approved a $345 million arms package to the country, and is working to send $500 million worth of F-16 fighter jets to Taipei as well.

With wary eye on China, U.S. moves closer to former foe Vietnam

(Washington Post) The United States and Vietnam are poised to significantly enhance their economic and technological ties, bringing the former foes closer at a time of increased Chinese assertiveness in the region. The deal, expected to be announced when President Biden makes a state visit to Vietnam next weekend, is the latest step by the Biden administration to deepen relations in Asia. For Hanoi, the closer relationship with Washington serves as a counterweight to Beijing’s influence. The establishment of a “comprehensive strategic partnership” will give the United States a diplomatic status that Vietnam has so far reserved for only a handful of other countries: China, Russia, India and South Korea.

The low, low cost of shipping

(London Review of Books) The truth is that shipping is responsible, as Rose George put it in the subtitle of her classic 2013 book on the subject, for ‘90 Per Cent of Everything’. It is the physical equivalent of the internet, the other industry which makes globalisation possible. The internet abolishes national boundaries for information, news, data; shipping abolishes these boundaries for physical goods. The main way it does this is by being almost incomprehensibly efficient and cheap. As George points out, if you’re having a sweater shipped from the other side of the planet, the cost of shipping adds just a cent to the price. Another way of putting it would be to say that shipping is, in practice, free. This has had the effect of abolishing geography and location as an economic factor: moving stuff from A to B is so cheap that, for most goods, there is no advantage in siting manufacturing anywhere near your customers. Instead, you make whatever it is where it’s cheapest, and ship it to them instead.

3 notes

·

View notes

Text

Social media ethic

The current state of social media ethics:

What trends are happening in the industry?

In the industry, I see a lot of discourse around AI-generated posts. I tend to see news sites talk about how worrisome AI-generated images and voice manipulation is getting. The public is concerned with how far AI can go before the government steps in to start monitoring posts.

What are two current cases related to social media ethics?

Currently, in Tennessee, former state legal ethics attorney Dean Morgan could seek back pay after being fired from his job in 2020, from tweets he had made in 2015/16 regarding Islam before he had worked for the board. About five days ago Google’s parent company Alphabet was hiring former DOJ lawyers for its team after receiving its second antitrust lawsuit from the DOJ for possibly creating a monopoly in marketing and advertising. This is a problem because these new lawyers used to work for the DOJ and that could mess up the legitimacy of the case. Causing people to accidentally or purposely share private information that would benefit either side.

Outline the current code of ethics for social media by a professional organization you would be interested in joining as part of their social media staff.

Treat others with dignity and respect. Refrain from demeaning or discriminatory behavior and speech. Be mindful of your surroundings and of your fellow participants. Alert Twitter staff if you notice a dangerous situation or someone in distress. If the last point didn’t give it away, I would love to work for twitter's social media staff or possibly bumble.

Brands/professionals with strong social media ethical codes:

What brands are utilizing proper social media ethical practices?

The first company that comes to mind is Ben and Jerry's Ice cream. This company is always one of the first to post how they view social issues and donate and spread useful information to the company on how to incite change. It’s lovely seeing what they’ll post because you can tell they really care about the community and the world we leave behind for the future generation.

Are there any professionals that you feel practice strong ethical behavior on social media? Support your choice with evidence.

The first person that comes to mind is Alexandria Ocasio- Cortez (AOC). She’s a political figure and a representative of New York and as you can assume she keeps a pretty squeaky-clean online personality. She’ll still post about problems that America is having, insight into change, and drive a message to the people, but she does this in a way where it complies with community guidelines and ethics without completely vilifying people. “Rep. Alexandria Ocasio-Cortez on Tuesday met with organizers of Stand Up to Violence, a first-of-its-kind program in New York that has shown a nearly 60% reduction in gunshot injuries.”(Mar 21 & 2023Share, 2023). AOC states her view on the Silicon Valley bank nightmare, she reposted this tweet “ 2. Where were regulators ? They are supposed to watch and warn. 3. Can't wait to see how many people yanked their money, told others to, and shorted the stock. 4. Will the number of emps that aren't paid this week lead to a multiple of that number not being paid in 2 weeks? And then replied saying: “The regulators were there until SVB lobbied Congress to remove the guardrails that prevent this kind of crisis in the first place. Warnings were everywhere. SVB, like many gamblers before them, knew what they were doing. Let the FDIC open the books & see what it’s working with. - How many of the Silicon Valley folks who lobbied Congress + Trump to cause this crisis are willing to admit they were wrong? I haven’t seen a single one of these guys crying for a bailout take a single ounce of accountability for their actions. It’s honestly shameless.” (https://twitter.com/AOC/status/1634643268326629376?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1634643268326629376%7Ctwgr%5E208a205948783d6ab105b43297e356ec5a796638%7Ctwcon%5Es1_c10&ref_url=https%3A%2F%2Fpublish.twitter.com%2F%3Fquery%3Dhttps3A2F2Ftwitter.com2FAOC2Fstatus2F1634643268326629376widget%3DTweet)

What are some takeaways you can bring forth in your practices?

Well, thankfully I grew up during the rise of social media. I learned from a young age that the internet is forever and what you post will remain online forever, this fact has always shaken me to my core. So, I was very diligent with what I posted online. I also had to have my parents follow my accounts when I opened them. They had to be private, and they were watching what was going on. The biggest advice I could give new social media users is that what you post matters. Even if you have only five followers because if you start posting wild things it will come back to bite you.

Key concepts and issues:

What main concepts do you are necessary to adhere to for your conduct online?

I try to be as neutral as possible when I post. I like to share what I’ve learned, provide the resources for others to learn as well, and have fun in a clean way (no cussing, no crude jokes). This is for my protection; I would hate to have said something offensive and been known as the “rude or messy guy” for all my life. So, online I proceed with caution.

What to do and what not to do: what main concepts do you feel strongly against and want to make sure you avoid on social media?

It is quite easy (or should be) to be a person with any type of social media account. A good rule of thumb is to not post anything you wouldn’t say in real life. Just because you are behind a screen this doesn’t mean what you post is anonymous; it can always get tracked back to you. Do post anything hurtful or hateful, if you think that just because you are on your alt acct. you can start posting wildly untrue and cruel things about a person or group of people, you are sadly mistaken. It will come back to get you especially if word gets out that, that is your acct. You are screwed for a long time. Cancel culture is huge nowadays, people have been kicked out of school, lost their jobs, been harmed, and have had their lives ruined just because of a post they made.

Bullet point 5-10 core concepts that you will follow as a practicing social media professional. Include citations that you used for sources/supports for this.

Fact-checking any information/news I would like to post before I post it.

I will be citing my sources for those informative post

I will private my account, so I am not denied jobs because of what I post. (don’t worry I don’t post bad things)

I will try to do some research on the people I am following, understanding whom you follow is important because people will view whom you follow as an extension of your character.

I will make sure my Twitter likes are private ;)

9 notes

·

View notes

Text

Introduction

Now, it feels like the future of digital marketing is here. And it’s interesting to see which trends are developed and how they keep evolving. Building a fully immersive experience for brands will be a key area of growth for marketers over the next few years.

In the next twenty years, digital technology will continue to evolve. The digital generation that grew up with computers, smartphones and the internet is now mature and in their prime earning years. They’re leading trends in how we access content and interact with brands.

Chatbots And Artificial Intelligence (AI)

Chatbots and Artificial Intelligence (AI) technologies are redefining the way businesses engage with customers. Replacing old-fashioned marketing tactics, these technologies allow brands to market themselves better, answer customer queries in real time, predict user trends and assist customers through complex banking procedures. A prominent example of AI-powered chatbot is Bank of America’s Erica intelligent assistant that helps customers with their banking requests.

Chatbots are the future of digital marketing. And how smart they’re going to get in the next few years is anybody’s guess. However, if we keep the examples of some successful chatbots in mind, such as Bank of America’s digital assistant Erica and Google Assistant/Siri, then we can predict what’s on the horizon for chatbots. All this proves that chatbots have a transformative power and deserve our attention.

Era Of Augmented Reality And AI

Next up on the list is Augmented Reality (AR). Augmented reality is predicted to outpace virtual reality in 2020, which makes it another popular digital marketing trend for 2023.

Augmented reality (AR) and artificial intelligence (AI) are two very important technologies that can make a huge impact on digital marketing. Both AI and AR have been around for a while now, with the first AI system dating back to 1956 and the first AR application was developed in 1968. However, the technologies are still very young and have a lot of potential. Businesses are already starting to use AI and AR in their products or services, some even already offer their customers unique experience that goes far beyond just offering bits of information.

Because it is a deliverable that enables organisations to reach out to millions of people at once, augmented reality will experience the greatest adoption in the marketing sector. This can be accomplished organically, and even better, it can be done affordably.

Read More on asdm.co.in

4 notes

·

View notes

Text

5 FinTech Trends for 2023

The year 2022 has been an exciting time for the financial technology industry. As technology continues to improve, we can expect new developments in the industry. Some of the most relevant trends of fintech that will emerge in 2023 are detailed below.

Alternative Finance

Non-bank financial institutions are known as alternative finance parties. These parties provide services through instruments such as cryptocurrencies and private placements. They can also use financial technology to improve their operations.

2. Embedded Finance

In addition to financial instruments, embedded finance can also be used to improve the operations of non-financial businesses. Due to technological advancements, the embedded finance industry is expected to continue growing. This type of financial technology will likely replace the traditional software and apps used by customers.

3. Buy Now, Pay Later

Through the buy now, pay later financing system, consumers can purchase and pay for it later. This type of financing system has gained widespread attention due to the outbreak of the COVID-19 pandemic. It is expected that its adoption will continue growing in 2023.

4. Artificial Intelligence

Artificial Intelligence has the potential to transform society and the economy. Through its ability to perform various tasks, such as customer experience and service automation, AI has gained a significant role in the financial technology industry.

AI can help financial institutions identify fraud and grant loans and taxes. According to a Deloitte survey, those with an AI strategy that encompasses the entire company are 1.7 times more likely to have good business results.

5. Cryptocurrency

The negative image of cryptocurrencies was caused by the actions of one of the meaningful exchanges, FTX. Despite the various adverse effects of the cryptocurrency industry, it is still expected to grow in the year ahead.

Conclusion

Although it is hard to predict what will happen in the financial industry in 2023, we are sure that it will be a significant year due to the various technological changes that will affect the industry. In 2023, alternative lending and embedded finance are expected to be some of the most revolutionary trends in the financial industry. AI technology is expected to continue shaking the market and help companies lower their overhead costs.

To read more from John David Hartigan go here: JohnDavidHartigan.org

9 notes

·

View notes

Text

What to Expect from the Tech Industry in 2023: A Look into the Future of Technology

The tech industry has seen tremendous growth and innovation over the past few years, and it looks like this trend isn’t going anywhere anytime soon. In 2023, tech innovation is sure to be at the forefront of conversation, especially when it comes to new technologies. And the pace of innovation is only likely to get racier. What we are discussing today may be completely outdated by the end of 2023. So, what can we expect from the tech industry in 2023? Let’s look.

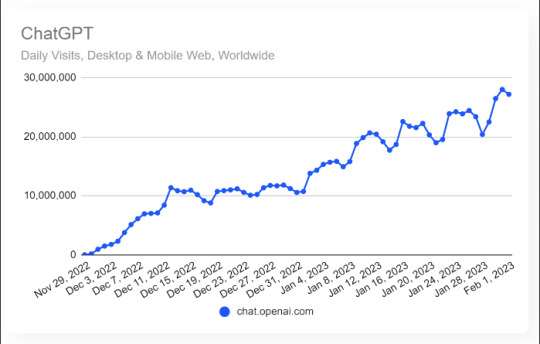

ChatGBT

ChatGBT is a chatbot-based AI software that interacts with users in real time. It combines advanced Natural Language Processing (NLP) technology and enhanced algorithms to create natural and engaging conversations. ChatGBT can provide useful customer service functions such as fast issue resolution and recommendation services. ChatGBT also has the ability to automatically generate sophisticated chatbot marketing campaigns with data-driven targeting capabilities. ChatGBT is a powerful tool for modern businesses to increase customer satisfaction and streamline operations, thus making it potentially one of the most disruptive technologies of 2023.

Autonomous Cars

Autonomous cars are driverless vehicles that can navigate roads on their own without any human intervention. While these vehicles are still being tested today, they are expected to become commonplace by the second quarter of 2023. Autonomous cars have the potential to revolutionize transportation, making it quicker, safer, and more efficient than ever before.

Artificial Intelligence (AI)

AI is another topic that will likely dominate tech discussions for years. It is set to make huge and visible advancements specifically in the coming three years. And AI-assisted applications are predicted to become widely available and used in a variety of sectors ranging from media to manufacturing and banking to hospitality.

AI involves machines performing tasks that would normally require human intelligence such as decision-making or problem-solving. It has already made its way into many aspects of our lives including healthcare, finance, education, and more. It is only expected to become even more widespread and powerful in 2023.

Tech in the Routine Employee Nurturing Space

AI and ML-based content and image-creating sites have been around for a year or two. But with further advances in both AI and ML technologies, they are quickly becoming an everyday part of the creative process for many people. AI-content creation sites and apps allow users to quickly and easily create AI-generated content tailored specifically to their needs. Additionally, AI-generated images, from landscapes to photographs, can help bring depth and life to projects. This type of AI-generated content is already helping industries such as advertising, marketing, and entertainment by providing them with quick and easy options for creating visually appealing projects. AI and ML is also creating a buzz in the employee engagement space with a few innovative companies like Hubengage integrating the tech into their employee app solutions.

Cybersecurity

As technology becomes more advanced, so does the need for greater cybersecurity measures. Cybersecurity is an essential part of digital operations as hackers become increasingly sophisticated in their methods of attack. Cybersecurity measures should be updated regularly to ensure that all data remains safe and secure from malicious actors online.

Robotics

In recent years, robots have become increasingly commonplace in a variety of industries. Since robotics automates mundane tasks and frees up time for employees, it allows them to focus on more complex projects. Additionally, robotics can also reduce costs associated with human labor.

From factory production lines to medical procedures, robots are quickly becoming an essential part of our lives; and it is poised to make great strides in the coming years as more companies and organizations explore its potential.

The healthcare industry is one area where robotics has seen significant growth in recent years. Robots have allowed doctors and nurses to perform operations with greater precision and accuracy than ever before, resulting in improved patient outcomes.

Automakers too are using robotic technology to increase safety and reduce manufacturing costs. Furthermore, advances in artificial intelligence (AI) will allow robots to learn from their mistakes and become even more efficient over time. So, 2023 looks set to be an exciting year for robotics!

Biotech and Genomics

In 2023 biotechnology and genomics are also likely to be the trending topics in tech innovation. This is largely due to advances in technology that enable further development of biotechnology and genomics. Companies have already invested heavily in biotechnology products and genetic editing, so continued expansion and improvement of these technologies are highly probable as funding increases. With growing interest surrounding biotechnology, initiatives such as CRISPR-Cas9 open up a once-impossible avenue for efficient gene editing research. It is expected that biotechnological breakthroughs will benefit the medical field more than ever before, from diagnosis and treatments to cures for a variety of diseases. As such, biotechnology and genomics are poised to shift the future of humanity.

Conclusion:

As we edge towards 2030, technology trends and innovations will no doubt come into play in changing our daily lives in ways both big and small. Additionally, 5G networks are providing us with lightning-fast connections and enabling numerous advances, particularly in tech innovations. 2023 could be a transformative year for both consumers and businesses alike as technology continues its rapid development cycle with no signs of slowing down anytime soon. Autonomous cars, artificial intelligence (AI), and cybersecurity are just a few topics that are sure to dominate tech discussions over the next few years as these technologies continue their evolution toward becoming widely adopted tools across industries worldwide. It’s an exciting time for those interested in technology. How happy your employees are, now technology will tell. So, make sure you stay up to date on these topics if you want your business or organization to remain competitive against its rivals!

#techinnovation#technovation#techtrends#techtrendsin2023#technologyin2023#employeetech#technologyinemployeeexperience

7 notes

·

View notes

Text

High Ticket AI review: The Truth Behind Making $20,000

The High Ticket AI Solution, developed by James Renouf, is a revolutionary product that harnesses the power of Artificial Intelligence to generate high-paying income streams of $5,000, $10,000, $15,000 and even $20,000, directly into your bank account. The best part is that you don't need to be an AI expert to make this happen. The AI technology does the heavy lifting for you, making it the most efficient way to apply AI to the world of online business.

>>>Grab The Early Bird Offer

Get High-Ticket AI SYSTEM >>>

One of the biggest challenges in the online industry is finding a way to earn significant income without dedicating countless hours of work. The High Ticket AI Solution addresses this issue by utilizing AI to create and sell high-ticket programs that pay thousands per customer, with minimal effort required. This solution has already generated over $120,000 in recent months, as shown by bank and Stripe account records.

We have been providing cutting-edge strategies for years, but this one is the most powerful of them all. You already know that AI and machine learning are a massive innovation and are only going to continue to improve and grow at a rapid pace. Now is the time to get involved as the world of AI is changing rapidly. Those who take action now will be the ones to reap the rewards.

This High-Ticket AI SOLUTION will dramatically shorten your path to success and you know that, unlike many other people, we actually deliver the goods when we launch a product – our track record is second to none. Inside the solution, you'll get comprehensive training on how we're using AI to create and sell HIGH TICKET programs that pay thousands per customer. You'll receive everything you need to be successful with this solution, and you'll discover exactly how we're earning $5k, $10k, $15k and yes, $20k payments by utilizing the power of AI!

Location and experience are not a barrier, anyone can make this happen by following the solution. The High-Ticket AI SOLUTION will greatly accelerate your path to success, and you know that, unlike many other people, we actually deliver results when we launch a product – our track record is second to none.

The world of AI is rapidly advancing and you're in the right place at the right time! But if you don't take action now and start riding this wave, it will pass you by, just like many other missed opportunities, and you'll be left wondering why you didn't take advantage of it. We have been ahead of the newest trends for years, and we can confidently say that this is one of the greatest opportunities since the Internet itself!