#AI-driven BP tracking

Explore tagged Tumblr posts

Text

Jade Ann Byrne 🩸 Blood Pressure Chronicles: What 92/45 and 96/57 Say About My Post Home Alone Midnight Journey

Jade Ann Byrne 🩸 Blood Pressure Chronicles: What 92/45 and 96/57 Say About My Post Home Alone Midnight Journey Life is measured in moments, and health is written in numbers. Today’s check-in? A rollercoaster of 92/45 mmHg followed by a slight rebound to 96/57 mmHg, with a steady pulse of 85 bpm. Let’s break it down and see what the body is whispering. 📊 Breaking It Down: 🔹 Systolic (92 → 96…

#adrenaline and BP correlation#AI-driven BP tracking#ambulatory blood pressure#arm circumference BP adjustments#arterial stiffness index#automated BP cuff#autonomic dysfunction#baroreflex#blood circulation#blood pressure#blood pressure monitor#blood pressure variability#blood volume pulse#BP accuracy factors#BP artifacts#BP cuff calibration#BP logging#BP rebound effect#BP telemetry#BP trends analysis#caffeine effects on BP#capillary refill time#cardiovascular health#chronic illness#circulatory efficiency#cuff inflation technology#cuff positioning#daily vitals#data tracking#diastolic pressure

0 notes

Text

Cuffless BP Monitors Are the Future of Health Tech ⌚📊 | $7.5B Incoming!

Market Dynamics

Fueling this growth is a dynamic mix of technological innovation, consumer health awareness, and the global rise in hypertension and cardiovascular conditions. Smartwatches, fitness bands, and wearable arm devices — equipped with technologies like Photoplethysmography (PPG) and Pulse Transit Time (PTT) — are leading the market. The shift toward home healthcare and the need for continuous health insights further enhance the market’s trajectory.

The surge in AI integration is another game-changer, enabling more precise readings and predictive analytics for users. Moreover, the trend toward minimalistic, user-friendly designs is making cuffless devices not just medical tools but lifestyle accessories. While there are challenges like cost, regulatory compliance, and device accuracy, the increasing emphasis on preventive healthcare is steering strong global adoption.

Key Players Analysis

Several companies are dominating and reshaping the competitive landscape. Omron Healthcare, Philips, and Apple are at the forefront with strong R&D and innovative product portfolios. Omron’s sensor technologies, Philips’ connected health expansion, and Apple’s seamless smartwatch integration demonstrate the market’s competitive edge.

Click to Request a Sample of this Report for Additional Market Insights: https://www.globalinsightservices.com/request-sample/?id=GIS25795

Emerging players like Qardio, Biobeat, and Withings are introducing innovative solutions that cater to both clinical and consumer needs. Startups such as��Cardio Wave, Pulse Track Innovations, and Heart Flow Dynamics are pushing boundaries, exploring AI-driven diagnostics and real-time analytics. Strategic collaborations between tech giants and medical firms are further igniting growth and consumer trust.

Regional Analysis

North America continues to lead, buoyed by robust healthcare infrastructure, R&D investment, and widespread consumer tech adoption. The U.S. alone commands a major share, with its progressive stance on digital health integration and preventative care initiatives.

Europe is not far behind. With rising healthcare expenditures and an aging population, countries like Germany and the UK are accelerating demand. Favorable regulations and chronic disease management programs fuel this momentum.

Meanwhile, Asia-Pacific stands out as the fastest-growing region. China, Japan, and India are making significant strides, thanks to increased healthcare investment, rising lifestyle diseases, and a tech-savvy demographic. As disposable income grows and digital awareness expands, this region offers immense untapped potential.

Latin America and the Middle East & Africa are gaining traction, especially Brazil and South Africa, where government support and healthcare modernization are gradually shaping up a promising market landscape.

Recent News & Developments

The cuffless blood pressure monitor market is buzzing with innovation. Devices priced between $100 to $300 now offer smartphone syncing, AI-based alerts, and cloud-based data sharing, appealing to both individuals and healthcare systems.

The FDA and EMA are working closely with manufacturers to streamline compliance without compromising on safety. AI’s role in diagnostics is expanding — offering predictive insights for heart health through deep-learning algorithms. Additionally, new product launches and partnerships — like Apple’s collaborations with medical research institutions — are making headlines, ensuring the market stays vibrant and future-focused.

Browse Full Report : https://www.globalinsightservices.com/reports/cuffless-blood-pressure-monitor-market/

Scope of the Report

This report offers a comprehensive lens into the evolving world of cuffless blood pressure monitoring. It includes granular insights on:

Market trends, drivers, and restraints

In-depth analysis of product types, technologies, applications, and end-user segments

Regional market dynamics and growth opportunities

Competitive strategies of leading and emerging players

Regulatory frameworks influencing market access

Strategic insights into M&A activities, product innovations, and tech collaborations

Our research methodology covers quantitative and qualitative assessments, from demand-supply chain mapping to SWOT and PESTLE analysis. The report arms stakeholders with data to make informed, strategic decisions, anticipate market shifts, and capitalize on emerging opportunities.

#cufflessbpmonitor #bloodpressuretech #wearablehealthtech #digitalhealthcare #remotepatientmonitoring #aiinhealthcare #personalizedmedicine #preventivecare #smartwatchhealth #hypertensionmonitoring #fitnesshealthtech #healthmonitoringdevice #biosensor #ptttechnology #ppgmonitor #bpwithoutcuff #futureofhealthcare #medtechinnovation #digitalhealthtrends #healthtechmarket #homehealthcaredevices #continuousmonitoring #wellnesswearables #healthtrackingdevice #mobilehealthtech #biometricmonitoring #healthcaredigitalization #connectedhealthsolutions #smartmedicaldevice #cardiovascularmonitoring #aiinmedtech #bpmonitortrends #smartbandbp #telehealthsolutions #healthtechstartups #bpmonitoringrevolution #nextgenhealthcare #chronicdiseasemanagement #noninvasivemonitoring #globalhealthtech #healthdatatracking

Discover Additional Market Insights from Global Insight Services:

Laparoscopic Instruments Market : https://www.globalinsightservices.com/reports/laparoscopic-instruments-market/

Patient Experience Technology Market : https://www.globalinsightservices.com/reports/patient-experience-technology-market/

Small Intestinal Bacterial Overgrowth Diagnostics Market : https://www.globalinsightservices.com/reports/small-intestinal-bacterial-overgrowth-sibo-diagnostics-market/

Pharma Isolator Market : https://www.globalinsightservices.com/reports/pharma-isolator-market/

Patient Support Technology Market : https://www.globalinsightservices.com/reports/patient-support-technology-market/

About Us:

Global Insight Services (GIS) is a leading multi-industry market research firm headquartered in Delaware, US. We are committed to providing our clients with highest quality data, analysis, and tools to meet all their market research needs. With GIS, you can be assured of the quality of the deliverables, robust & transparent research methodology, and superior service.

Contact Us:

Global Insight Services LLC 16192, Coastal Highway, Lewes DE 19958 E-mail: [email protected] Phone: +1–833–761–1700 Website: https://www.globalinsightservices.com/

0 notes

Text

The Importance of Regular Blood Pressure Monitoring for Better Health

High blood pressure, or hypertension, is a silent killer that affects millions worldwide. Regular blood pressure monitoring is crucial for maintaining good health, preventing complications, and ensuring timely medical intervention. With the advancement of technology, using an app for Blood Pressure Management has made it easier than ever for patients to track their BP levels. This article will explore the significance of blood pressure monitoring, the role of BP apps for patients, and the future of healthcare in managing hypertension.

Why is Blood Pressure Monitoring Important?

Blood pressure monitoring is essential for several reasons:

Early Detection of Hypertension: Regular tracking helps identify high BP levels before they become a severe issue.

Prevention of Heart Diseases: High blood pressure is a leading cause of heart attacks, strokes, and other cardiovascular diseases.

Better Medication Management: Monitoring BP helps doctors adjust medication doses effectively.

Improved Lifestyle Choices: Knowing your BP readings encourages healthier habits like diet control and exercise.

Reduced Risk of Kidney and Vision Problems: High BP can damage the kidneys and eyes if left unchecked.

Read More: Best Apps for Controlling High Blood Pressure

How Often Should You Monitor Your Blood Pressure?

Individuals with normal BP: At least once a year.

Pre-hypertensive individuals: Every few months.

Hypertensive patients: Daily or as per doctor’s advice.

Patients on BP medications: Regular monitoring to ensure the effectiveness of treatment.

Traditional vs. Digital Blood Pressure Monitoring

Traditional Methods

Manual Blood Pressure Cuffs: Requires skill to operate accurately.

Clinic Visits: Often inconvenient for regular monitoring.

Paper Records: Prone to loss or damage.

Digital and Smart BP Monitoring

BP Apps for Patients: Track readings automatically.

Wireless Blood Pressure Monitors: Sync with mobile devices for instant data logging.

Cloud-Based Storage: Ensures data is accessible anytime, anywhere.

Benefits of Using a BP App for Patients

Using an app for Blood Pressure Monitor app can significantly enhance health tracking. Some key benefits include:

Ease of Use: No need for manual recording; the app stores data automatically.

Real-Time Alerts: Sends notifications if BP readings are too high or low.

Data Analytics: Provides trends and insights for better BP management.

Doctor Connectivity: Allows seamless sharing of BP history with healthcare providers.

Lifestyle Tips: Many apps offer diet and exercise suggestions for better BP control.

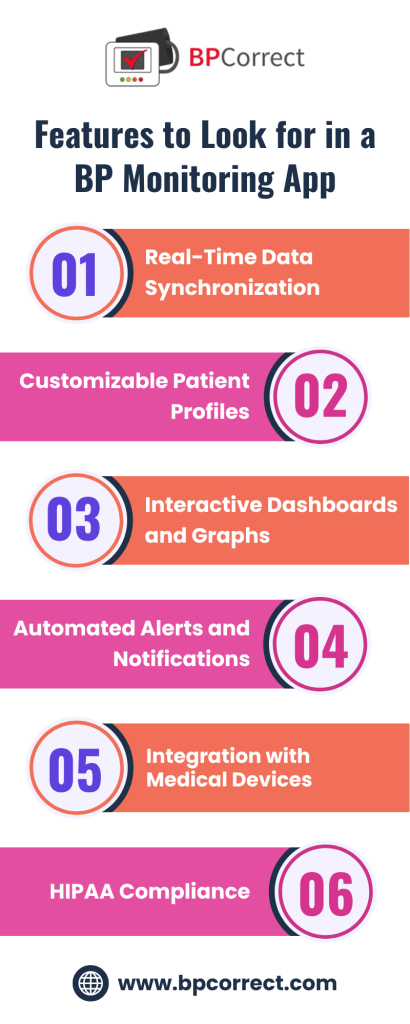

Features to Look for in a BP App

When choosing a BP app for patients, consider the following features:

Accurate Readings: Ensure the app is compatible with a reliable BP monitor.

User-Friendly Interface: Easy navigation for all age groups.

Cloud Synchronization: Back up your data securely.

Integration with Wearables: Sync with smartwatches or fitness trackers.

Multi-User Support: Ideal for family use.

Custom Reminders: Set alerts for medication and BP checkups.

The Future of Healthcare and Blood Pressure Monitoring

With advancements in digital health, the future of healthcare in BP monitoring looks promising. Here’s what to expect:

Artificial Intelligence (AI) in BP Monitoring

AI-driven analysis can predict hypertension risks based on historical data.

AI-powered BP apps provide personalized recommendations for better health management.

Wearable Technology Integration

Smartwatches with BP sensors will make tracking more seamless.

Continuous BP monitoring without the need for manual measurements.

Telemedicine and Remote Monitoring

Patients can consult doctors remotely using their BP data.

Improved management of chronic hypertension through real-time updates.

Blockchain for Data Security

Secure storage of BP data.

Easy sharing with healthcare providers while maintaining privacy.

Genetic and Personalized Medicine

Personalized treatment plans based on genetic predisposition to hypertension.

AI-driven solutions for medication adjustments.

Read More: Streamline Patient Care with BPCorrect: A Doctor’s Perspective

Tips for Effective Blood Pressure Monitoring

Use a Reliable Device: Ensure your BP monitor is accurate and clinically validated.

Measure at the Same Time Daily: Consistency helps in accurate trend analysis.

Sit in a Comfortable Position: Keep your arm at heart level.

Avoid Caffeine or Smoking Before Measurement: These can temporarily raise BP.

Record Every Reading: Use an app for easy tracking and insights.

Conclusion

Regular blood pressure monitoring is a vital part of maintaining overall health. With the rise of digital solutions, using a BP app for patients has made it easier to track and manage hypertension effectively. As we move into the future of healthcare, technology will continue to play a significant role in improving patient outcomes. By embracing modern BP monitoring methods, individuals can take proactive steps toward a healthier life.

0 notes

Text

Covid-19: A Chance To Define Your Investment Behaviour

Greed & Fear shapes investment experience, which in turn defines future (gambling) behaviour

In my previous blog, I talked about one’s investing experience driven by greed and fear – seared into memories that shape our future behaviour. I shared that the swings between excessive greed and excessive fear lead to behaviour that is like gambling.

Let me start with my personal investment (gambling) behaviour.

I have seen many crises in my government and financial career. Some severe. Some very severe. I recall the 1987 market crash, 1991 recession, 1997-98 Asian Financial Crisis, 2000 Dotcom bust, 2007-2008 Global Financial Crisis, 2015 China market crash, and many more geopolitical and military conflicts in between. I remember struggling to deal with my emotions of watching grown men cry at a hawker centre in Bukit Merah after the 1987 Black Monday market crash.

I had just started working. Coming from a low-income family, I never had more than $20 in my post office savings account. When I was growing up, almost any “hongbao” money collected by us siblings during Chinese New Year was handed back to our parents for recycling. What little family money was often spent on lottery tickets and horse races. Hence, my anti-gambling attitude.

I had a little more cash when I enlisted into the military and remember being so happy to see “$90” printed - letter by letter - credited to my little blue book. So whatever money I had, I saved. Despite my economics and accounting degree, I only focused on public policy and did not look at investing – only in my meagre bank savings account.

Our saving, spending and sharing behaviours are largely shaped by our personal experiences.

So, combined with my childhood money experience, the “Bukit Merah experience” was a shock to my confidence in investing (gambling). It confirmed the dangers of investing, where seemingly career established and grown men can break down and cry. You can lose it all or almost. And for those who are old enough (I am), I had to ingest the almost daily news saturation of the so-called “Pan-Electric Crisis” [1] in 1985 and its aftermath – before returning to Singapore to complete my remaining National Service term.

Now Looking Back Rationally…

For many, memories of these crises and many smaller crises -which at some point threatened global or regional stability - have largely faded. For example, during the 2008 Global Financial Crisis, how many remember the stress of wondering if your ATM card would work the next day and the contagion spreading from one failing bank to a suspicion of a bank that everyone takes for granted as being as “solid as a rock”. As the founder of a fast-growing wealth management business, I did. The lesson I take away is that such fears beyond the original cause can - in themselves – cause self-fulfilling prophesies.

Looking back, we have mostly recovered from these crises. But every crisis has definitive casualties who will never forget. These are the defining moments. Extremely painful. It’s like how you feel after a painful, lung-crushing and heart collapsing run. You can’t feel your legs. Only your brain feeling the pure weight of lead – whenever you lift one foot to take a tiny small step. Yes, we have all been there.

But like all painful mental daggers, a sense of light-headed comfort and relaxation accompanied by an innate sense of accomplishment will come soon – when recovering from that pain. That’s the defining moment to be seared into memory while the filling melts into obscurity – for future retrieval.

Like every crisis, every life has its defining moments. But we choose what we recall and what we repress. For a generation, it will be a shared defining moment with individual variation in tint and intensity. But still, a defining moment nonetheless for future recall.

…and here is how I hope your investment (not gambling) experience will be shaped for the better.

First, let’s see where Covid-19 stands [2].

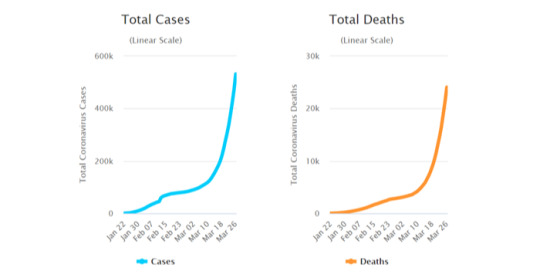

As of 27 March 2020:

Almost 600,000 confirmed cases and over 27,000 deaths across 199 countries [3]. What’s important to note about the numbers is the pattern.

USA (102K confirmed) now exceeds China (82K) in terms of confirmed cases.

China is recovering with life slowly returning to normal.

Second, let’s assess the likely scenarios of how the world will respond.

Cautiously Optimistic Case: Covid-19 is seasonal and will continue spreading widely in the Western Hemisphere until end-April. With over 2 billion in lockdown, Asia peaks earlier. Safe distancing slows the spread and healthcare capacity catches up. But the very same measures that Covid-19 causes rising unemployment as consumer demand collapses. Financial stress and bankruptcy soar. We see a global recession until September 2020 before a slow recovery.

Pessimistic Case: Covid-19 is not seasonal and continues spreading in the Western Hemisphere until end-May because of poor management and leadership in the public-health response. Countries that managed to tame the spread continue public-health measures to prevent resurgence – leading to a deeper global economic impact as supply chains are disrupted. Fiscal and monetary policies fail to dampen the negative economic impact. Global recovery begins in the second half of 2021.

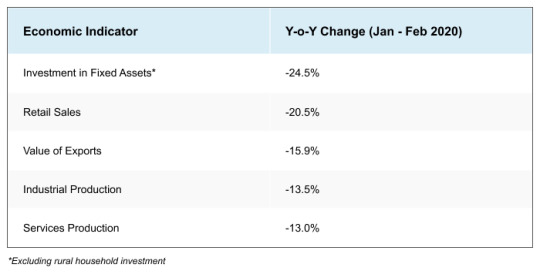

Currently, China seems to have contained Covid-19, but the economic impact is still severe [4].

This is historic. China’s GDP will fall in 1Q2020 - the first time since 1976.

Currently, about half the USA population is on stay-at-home (SHN) orders. The week ending March 21, USA unemployment claims reached a record 3.3 million. In contrast, the Global Financial Crisis recorded a high of 665,000.

The IMF is forecasting a global recession in 2020. On the bright side, some analysts are forecasting a recovery as early as the third quarter of 2020.

What do these all mean for a true investor?

Currently, analyst opinions are a dime a dozen. So is mine. Beware.

The difference is that my opinion doesn’t really matter anymore. Why?

Having lived long enough and dipping into my childhood traumas, I have finally decided to confront my investment (gambling) demons. I have lost more money than I have risked over the years – whenever I invested in individual stocks. How many stocks can I really track? And now - even more, as markets become global - and I do need my sleep. And even as I track individual stocks, what advantage do I get – when information and speculative rumours abound in real-time within cyberspace?

When I was an investment analyst when the internet was not yet ubiquitous, I would walk the ground visiting plantations and factories to count the number of loaded container trucks versus what management claimed – rather than follow what other analysts opined from their office chairs. I could get some information advantage because a phone call (even expensive international calls) was faster than me typing on a PC and sending it via a 9600 bps speed fax modem (warning: age test here!). And it mostly worked! But not anymore. Now, companies dish out information in real-time, simultaneously and globally. There is no time advantage. Prices of stocks are now available 24/7, literally right on your toilet seat. So, it is more sheer buying and selling power that will move stock prices.

In short, everyone can have an opinion, and share it instantly with anyone, anytime, anywhere.

The hard truth is that if you are so good, then why are you still an analyst? Or an investment manager? Why do you have to manage someone else’s money? The hard truth is that your method is to make money from someone else’s money – sometimes, even when that someone else loses money!

So, think again why you have money invested in a unit trust or mutual fund. What are the charges? Are the fees aligned with the performance of the so-called investment? Read my blog about unit trusts if you wish to get more insights.

It means that as a true investor, picking stocks is like picking a horse. Picking the horse race is like picking the industry sector. Picking which country is hosting the horse race is like deciding the geographical stock market you want to bet in. And that’s it. Buying and selling stocks is betting.

Sure, we may say what we need to professionalize, rationalize, regularize - whatever. In effect, we’re justifying why gambling at a horse race is different from investing (trading) in the stock market. Good luck (no pun intended)! There is simply no ample justification. Buying and selling stocks is like gambling. There is no complete information. Professionally, we are taught to diversify our bets. Sure, we try. But honestly, how do we do that diversification? Mostly and truthfully, by my individual gut feel, the seniority of my title, how dependent the bosses are on me or how loud I can be, among other personal dominance strategies.

A true investor must not do any of the above. Worse, a true investor should not be outsourcing such gambling behaviour to someone else who claims to be a better gambler through experience or professional titles – and still charge me one of the highest fees in the world [5]!

A true investor must now use the latest technology to find the best possible return for the risks you are willing to take. For those who are unsure what risks, try our proprietary gamified risk profiler which uses data analytics to predict a suitable investment risk for you – based on your time horizon versus your age, your income stability, your risk-taking style and investment knowledge garnered through a simple 2-minute game.

Replacing Human Emotions with SquirrelSave AI

In 2016, I decided to leverage artificial intelligence (AI) to improve investment outcomes by replacing the alternating currents of human emotions - greed and fear – with real-time 24/7 data analytics.

Don’t get me wrong here. There have been algorithm trading systems for years. These are mostly trade-secrets and you will not know the rules by which the algorithms have been constructed. These are what we call “alpha” trading systems – which maximizes returns. These are “black-boxes”.

SquirrelSave AI is transparent. Read all about it here. Our investment outcome follows Nobel Prize-winning Markowitz Portfolio Optimization which searches for the highest probable return for a given risk level chosen. The key technical challenge all these years was to predict and stabilize the risk. With AI techniques such as machine learning and the real-time financial datasets available cheaply, it is now possible to replace the human gut feel approach with a disciplined time horizon driven AI machine learning system to diversify across stocks, sectors, geographies and asset classes. And that’s what we built SquirrelSave to be.

Now before you ask me how SquirrelSave performs, think of the risk management first. Ours is not an “alpha” returns maximizing system (which also means a risk of maximum loss). Ours is not a “beta” passive system which simply follows the market. Ours is a dynamic asset allocation system that combines alpha and beta. We diversify based on data analytics which machine learning has taken over – since SquirrelSave’s basic logic was trained in 2016 and validated since then till today. Between risk and return, SquirrelSave is more towards risk management. And it is important to emphasize that SquirrelSave is not a fund. You get your own personal portfolio. Your portfolio is managed by SquirrelSave according to the time horizon you input and your age. Hence, it is very likely that in the short term, you will not see SquirrelSave making buy and sell decisions simply because markets are gyrating due to Covid-19 fears or because interest rates are set at zero.

[1] The Pan Electric Crisis, 1985 – History.sg

[2] Covid-19 is an evolving human tragedy, affecting all humankind with a deep impact livelihoods. Hence, some data in this blog will soon be out of date. Go online to get the latest data.

[3] https://www.worldometers.info/coronavirus/ Note that data variability is wide due to the different standards of testing, reporting efficiency and health capabilities, among other causal factors.

[4] China National Bureau of Statistics

[5] Business Times, “Singapore mutual funds charge 'higher fees than global average'”, 19 Sep 2019

--

Originally posted on SquirrelSave blog

https://squirrelsave.com.sg/blog/covid-19-defining-investment-experience.html

0 notes

Text

InEight Acquires BASIS Scheduling Software Company

InEight, a leading developer of construction project management software, is again advancing technology solutions for capital projects. The company announced that it acquired BASIS, a company that develops an artificial intelligence (AI) planning software tool.

Built specifically for capital projects, BASIS takes the guesswork out of building a project plan by using knowledge-driven machine learning to create more realistic and achievable project schedules. As a part of the acquisition, BASIS Founder and CEO Dr. Dan Patterson will join the InEight executive leadership team as chief design officer. BASIS was founded on Patterson’s vision to provide a tool that helps more accurately forecast large, complex capital projects.

Designed to complement existing critical path method (CPM) scheduling tools, BASIS uses AI to assist and guide planners through the process of building a project plan. The software can capture insights and learnings from prior projects and use the stored knowledge to make informed suggestions during the planning process. BASIS also allows project team members to give their expert opinion through a very simple-to-use scorecard. With BASIS, planners can spend up to 40 percent less time building plans and reduce the amount of time used in gathering team member feedback by up to 75 percent.

“Our customers have been asking us to help them transform the planning and scheduling process since it has such a direct impact on their ability to deliver capital projects on time and on budget,” said InEight CEO Jake Macholtz.

“The addition of BASIS gives our customers a powerful new tool to take advantage of everything they’ve learned on past projects and decades of knowledge from their own experts. This allows them to create the best project plan possible and a schedule that their teams can actually meet.”

BASIS’ customers understand the power of incorporating this information into their processes. For example, Aker BP, one of the largest independently-listed oil companies in Europe, uses BASIS to enhance its project planning.

“For Aker BP, implementing BASIS was a no-brainer,” said Chris Westland, planning manager – projects, Aker BP. “As we ‘teach’ the tool over time, we expect that leveraging the use of our extensive historical data will enable us to build realistic schedules for offshore oil & gas development projects much earlier than we would normally, with much fewer iterations. We see that this could enable us to bring more projects through the decision process as we will have much more confidence in the possible schedule outcomes at that early stage.

Through the close, collaborative relationship that we have with the BASIS team, we are completely engaged with them to ensure the continual development and improvement of the tool. Going forward, we see BASIS as a key component of our digital road map to improve project planning and execution in our business.”

Purpose-built for construction, BASIS will become the flagship offering of InEight’s planning and scheduling solutions and be renamed InEight BASIS in the coming months. The addition of BASIS aligns with InEight’s portfolio strategy to provide solutions for every stage of capital projects from pre-construction to operations.

BASIS creator will continue to innovate with InEight In his new role as InEight’s chief design officer, Patterson will continue to innovate and develop BASIS software, expanding on his vision of creating an effective planning and scheduling software solution for the construction industry.

Patterson has more than two decades of experience revolutionizing how the construction industry uses technology to solve problems on large-scale capital projects. He has a proven track record of designing and developing innovative planning, scheduling and risk analytics software for project management. Patterson previously created and sold two companies that were predecessors to BASIS’ technology and are widely used on capital projects today.

“When people think of big projects, they usually think of them as being behind schedule and over budget. That’s exactly the challenge we set out to solve with BASIS,” Patterson said. “I like to say that you get one shot at execution — but when you’re planning, you have unlimited chances to get it right. My long-term vision is to change the way we plan projects, so that the frequency of project failure is massively reduced. With the acquisition by InEight, we are now able to accelerate that vision.”

Acquisition furthers InEight goal of end-to-end project management solutions The acquisition of BASIS comes on the heels of InEight’s acquisition in April of QA Software —including its flagship product, TeamBinder, a comprehensive document management and collaboration solution. Now with the addition of BASIS, InEight will be able to provide key project stakeholders, including contractors, owners and engineers, with end-to-end project management solutions purpose-built by experts who understand construction and the complexity of capital projects.

Additional information about InEight’s acquisition of BASIS can be found at https://ineight.com/basis-acquisition.

About BASIS BASIS is your AI-based planning assistant and hub for planning knowledge. ‘Always-on’ analytics make smart suggestions and guide the planner through the creation of realistic plans. A simple markup and review process allows the planner to capture expert feedback on their plan from team members outside the planning organization. This balanced combination of Artificial and Human Intelligence delivers a realistic plan, calibrated by historical knowledge, productivity rates, and standards, and validated by experts in the field. For more information on BASIS, please visit basisplanning.com.

About InEight InEight combines proven technology with a unified vision, delivering actionable insights and project certainty to more than 25,000 active users in more than 750 companies. Built on a history of construction and engineering excellence, InEight solutions help companies visualize, estimate, manage, control and connect all aspects of capital and maintenance projects. With configurable, integrated and field-tested solutions, InEight customers have the visibility and control required for on-budget and on-time project completion. Based in Scottsdale, Arizona, U.S., InEight is an ISO 9001:2015-registered company. For more information, please visit ineight.com.

0 notes

Text

U.N. seeks help of oil traders to enforce North Korea sanctions

LONDON (Reuters) – A U.N. monitoring group wants to enlist the help of the world’s biggest oil trading companies to enforce sanctions that cap the amount of crude and related products North Korea can import, the coordinator said.

FILE PHOTO: Missiles are driven past the stand with North Korean leader Kim Jong Un and other high ranking officials during a military parade marking the 105th birth anniversary of the country’s founding father, Kim Il Sung in Pyongyang, April 15, 2017. REUTERS/Damir Sagolj/File Photo

The U.N. Security Council ramped up sanctions last year after North Korea said it had conducted missile tests that put the U.S. mainland in range of its nuclear weapons.

Under the restrictions, Pyongyang is limited to importing 4 million barrels of crude and 500,000 barrels of products a year.

But the panel of experts appointed by the Security Council said in March that additional fuel was being sold to North Korea via illicit deals involving transfers of petroleum from large ships to smaller vessels at sea to evade detection.

The panel said in its March report that it had investigated at least four such transfers and was “also investigating several multinational oil companies for their roles in the supply chain of petroleum products”.

Hugh Griffiths, the U.N. monitoring group coordinator, told Reuters he was seeking support from the top traders to help implement sanctions and proposed clauses that they could add to their oil deals to prevent fuel ending up in North Korea.

He said the big traders “represent the choke point in the supply chain and if all the big ones sign up and make this the industry standard … all smaller players will have to comply”.

The panel sent a letter in May to 10 major traders operating in the region, outlining the recommended contract clauses. The letter was also sent to regional refiners and some specialist firms, mainly in Singapore.

Slideshow (2 Images)

Griffiths, who did not identify the 10 firms or the other companies targeted, said all the firms had been asked to respond within a month of receiving the letter. A list of those that failed to reply would be published after that period, he said.

REQUIRING PROOF

In its March report, the U.N. panel named Switzerland-based Trafigura as a trader that initially handled fuel that eventually ended up in North Korea in ship-to-ship transfers. It was the only multinational named in the report on the issue.

Trafigura denied involvement in the illicit trade and said it had no knowledge that its fuel would end up in North Korea.

Ben Luckock, Trafigura’s co-head of risk, said his firm had consulted with U.N. officials and had added new clauses requiring proof of a cargo’s final discharge.

“We are also stipulating that buyers require that vessels they use for such cargoes do not switch off their Automatic Identifier System (AIS),” he said, referring to a ship’s satellite tracking system.

Several major firms active in Asian trading said they already had measures in place to prevent sanctions-busting.

A spokeswoman for Royal Dutch Shell (RDSa.L), who did not say whether the firm had been sent a letter from the U.N. panel, said the company had clauses prohibiting clients selling to countries under U.N. sanctions, while BP (BP.L) said it complied with all sanctions requirements.

Vitol [VITOLV.UL] said it had “robust” compliance procedures in place, while Mercuria said it was “always happy to help international bodies to bring additional transparency on these issues”.

Glencore (GLEN.L) and Gunvor [GGL.UL], two other major oil traders in the region, had no immediate comment.

Griffiths said the main focus was on free-on-board (FOB) contracts, in which a seller hands responsibility to the buyer once a cargo is loaded on a ship. Typically, the contracts have a final destination clause but no further proof of a cargo’s fate is usually required after the sale.

“Once the product is sold, they don’t really pay attention to what happens afterward,” Griffiths said.

He said traders, or those selling the cargoes, “should be implementing end-use verification measures which means that if a product is delivered to another ship … all details of the shipment are provided”, including official documents showing that a cargo’s entire volume was delivered to a ship or port.

He said clauses should prevent a ship with a fuel cargo from turning off its AIS and an insurer could invalidate a policy if the AIS was switched off.

In March, the Security Council blacklisted dozens of ships and shipping firms over oil and coal smuggling by North Korea. The United States also imposed sanctions on dozens of firms to shut down what it said was illicit oil and coal smuggling activities.

Griffiths said the U.N. panel was also “investigating multiple companies particularly down the supply chain, smaller brokers” over suspected violations. He did not name the firms.

Reporting by Julia Payne; Editing by Edmund Blair

The post U.N. seeks help of oil traders to enforce North Korea sanctions appeared first on World The News.

from World The News https://ift.tt/2IG8siY via News of World

0 notes

Text

U.N. seeks help of oil traders to enforce North Korea sanctions

LONDON (Reuters) – A U.N. monitoring group wants to enlist the help of the world’s biggest oil trading companies to enforce sanctions that cap the amount of crude and related products North Korea can import, the coordinator said.

FILE PHOTO: Missiles are driven past the stand with North Korean leader Kim Jong Un and other high ranking officials during a military parade marking the 105th birth anniversary of the country’s founding father, Kim Il Sung in Pyongyang, April 15, 2017. REUTERS/Damir Sagolj/File Photo

The U.N. Security Council ramped up sanctions last year after North Korea said it had conducted missile tests that put the U.S. mainland in range of its nuclear weapons.

Under the restrictions, Pyongyang is limited to importing 4 million barrels of crude and 500,000 barrels of products a year.

But the panel of experts appointed by the Security Council said in March that additional fuel was being sold to North Korea via illicit deals involving transfers of petroleum from large ships to smaller vessels at sea to evade detection.

The panel said in its March report that it had investigated at least four such transfers and was “also investigating several multinational oil companies for their roles in the supply chain of petroleum products”.

Hugh Griffiths, the U.N. monitoring group coordinator, told Reuters he was seeking support from the top traders to help implement sanctions and proposed clauses that they could add to their oil deals to prevent fuel ending up in North Korea.

He said the big traders “represent the choke point in the supply chain and if all the big ones sign up and make this the industry standard … all smaller players will have to comply”.

The panel sent a letter in May to 10 major traders operating in the region, outlining the recommended contract clauses. The letter was also sent to regional refiners and some specialist firms, mainly in Singapore.

Slideshow (2 Images)

Griffiths, who did not identify the 10 firms or the other companies targeted, said all the firms had been asked to respond within a month of receiving the letter. A list of those that failed to reply would be published after that period, he said.

REQUIRING PROOF

In its March report, the U.N. panel named Switzerland-based Trafigura as a trader that initially handled fuel that eventually ended up in North Korea in ship-to-ship transfers. It was the only multinational named in the report on the issue.

Trafigura denied involvement in the illicit trade and said it had no knowledge that its fuel would end up in North Korea.

Ben Luckock, Trafigura’s co-head of risk, said his firm had consulted with U.N. officials and had added new clauses requiring proof of a cargo’s final discharge.

“We are also stipulating that buyers require that vessels they use for such cargoes do not switch off their Automatic Identifier System (AIS),” he said, referring to a ship’s satellite tracking system.

Several major firms active in Asian trading said they already had measures in place to prevent sanctions-busting.

A spokeswoman for Royal Dutch Shell (RDSa.L), who did not say whether the firm had been sent a letter from the U.N. panel, said the company had clauses prohibiting clients selling to countries under U.N. sanctions, while BP (BP.L) said it complied with all sanctions requirements.

Vitol [VITOLV.UL] said it had “robust” compliance procedures in place, while Mercuria said it was “always happy to help international bodies to bring additional transparency on these issues”.

Glencore (GLEN.L) and Gunvor [GGL.UL], two other major oil traders in the region, had no immediate comment.

Griffiths said the main focus was on free-on-board (FOB) contracts, in which a seller hands responsibility to the buyer once a cargo is loaded on a ship. Typically, the contracts have a final destination clause but no further proof of a cargo’s fate is usually required after the sale.

“Once the product is sold, they don’t really pay attention to what happens afterward,” Griffiths said.

He said traders, or those selling the cargoes, “should be implementing end-use verification measures which means that if a product is delivered to another ship … all details of the shipment are provided”, including official documents showing that a cargo’s entire volume was delivered to a ship or port.

He said clauses should prevent a ship with a fuel cargo from turning off its AIS and an insurer could invalidate a policy if the AIS was switched off.

In March, the Security Council blacklisted dozens of ships and shipping firms over oil and coal smuggling by North Korea. The United States also imposed sanctions on dozens of firms to shut down what it said was illicit oil and coal smuggling activities.

Griffiths said the U.N. panel was also “investigating multiple companies particularly down the supply chain, smaller brokers” over suspected violations. He did not name the firms.

Reporting by Julia Payne; Editing by Edmund Blair

The post U.N. seeks help of oil traders to enforce North Korea sanctions appeared first on World The News.

from World The News https://ift.tt/2IG8siY via Today News

0 notes

Text

Augmented Intelligence: The Real ‘AI’

Brokerages are placing their bets on Buyside to bring smart data to their agents’ fingertips

If there’s a trend dominating headlines and transforming businesses today, it’s predictive analytics. To become more efficient in generating and curating sales leads, the best-in-class predictive tools mine databases to augment the best in human intelligence. Today, society benefits from predictive applications in everything from online shopping to homeland security. In real estate, it should come as no surprise to learn that market-dominant brokerages of all sizes are also embracing the concept, utilizing their own ‘big data’ to win new business and gain a competitive advantage.

Enter Buyside, a groundbreaking data analytics and marketing company helping some of the nation’s top real estate firms leverage their data for greater profit. “We call it augmented intelligence,” says Buyside Founder and CEO Charles Williams. “Buyside is about enhancing existing processes with real-time data in a way that not only gets the agent in front of more customers, but also differentiates their skills and knowledge in a manner that wins more business.”

In this exclusive interview, Williams shares the strategies behind his company’s success, and the reasons why more brokers nationwide are adopting Buyside’s winning approach.

Barbara Pronin: Let’s begin with a brief recap of your career path, Charles, and how you came to found Buyside. Charles Williams: I’ve been around real estate my whole life. My grandfather was an investor and my mother is a licensed broker, so, naturally, I went in the opposite direction and got a Bachelor of Science degree in Electronic Engineering from Bucknell University. I began my career as a project manager with General Electronic, then moved into Mergers and Acquisitions. In the evening, though, while completing my MBA from Goizueta Business School at Emory University, I bought and sold properties—over 20 times by the age of 30. When the market was trending downward in 2008, I noticed that there was a gap in the marketplace; that finding buyers was not as transparent as finding listings. I asked agents and brokers if they had a system to find buyers relevant to their properties. The answer was a resounding no, so I decided to build it.

The goal was to collect and analyze buyer activity in a given market so that brokers could not only speak to the demand for a property, but also be able to directly access agents with matching buyers for it—a compelling value proposition to attract seller leads, win listings, and close more transaction sides in-house.

BP: How does the process work? CW: Many brokers don’t realize their data is a billion-dollar asset—one they already own but often don’t know how to leverage. According to industry statistics, brokers and agents spend millions each year to generate and capture buyer leads, but less than 3 percent of those leads, on average, are converted into closings. What remains is a wealth of buyer activity and behavioral data representing the interest and demand for various types of property.

Buyside helps brokers tap into that asset so they can demonstrate to potential sellers how many buyers are looking for a home like theirs right now, in this neighborhood, in this school district, with these features, in this price range, etc. Showing homeowners that they can interpret real-time demand and match their home with a list of verified buyers becomes a powerful way for agents to differentiate themselves and win more listings.

BP: Is all data created equal? CW: The challenge with any big dataset is that it’s so fragmented, which is especially true for buyer behavior. It lives in a dozen different places—brokerage websites, portals like Zillow and realtor.com®, mobile apps and even showings and open houses. The power we provide is being able to aggregate and normalize all that data, because once you have the full picture, the data becomes meaningful and actionable.

BP: Where and how is Buyside currently operating? CW: The company is based just outside Philadelphia, in Wayne, Pa. We have a team of 20 passionate Buysiders who are currently serving more than 50 of the nation’s leading real estate brokerages. Industry leaders like Gino Blefari, president and CEO of HSF Affiliates—which operates Berkshire Hathaway HomeServices, Prudential Real Estate and Real Living Real Estate—saw an early opportunity to help future-proof his franchise group by deploying Buyside company-wide. With our clients’ success stories growing every day, we’re attracting top franchises and brokerage firms around the country.

BP: Other companies are entering the world of real estate data. What makes Buyside unique? CW: While many other companies can analyze data from your brokerage website, Buyside is the only platform able to capture real-time buyer data from virtually any source and use it to power actionable insights and compelling marketing tools. We know that buyer activity will continue to take place across many different platforms, so we remain technology-agnostic. By capturing the full picture, we’re able to help brokers get in front of prospective clients, while helping agents tell a compelling story that wins new business.

BP: What kind of results are your clients seeing? Are you able to measure their ROI? CW: Clients are seeing incredible results, and because we capture all their data in one place, we’re able to track their ROI very closely. In fact, one of the enhancements on our immediate roadmap is a Brokerage ROI Dashboard that highlights the number of seller leads captured, listings taken and closings as a direct result of Buyside.

BP: How do you ensure client success? CW: Our entire leadership team has roots in real estate, so we know firsthand the challenges brokers, managers and trainers face when rolling out new technology to their agents. Success with any new platform begins and ends with implementation. If you can’t get your agents excited, engaged and using the technology, it’s an exercise in futility. We have a unique roll-out process that not only focuses on how to use the tools, but also how the tools can help the agent win more business.

BP: How do you think the real estate industry will utilize big data in the next five years? CW: Real estate has a way to go to catch up with other industries, which for years have been building businesses and basing key operating decisions on a solid foundation of data analytics. Smart companies will use data to give themselves a competitive edge. Look at Amazon, Netflix and Facebook, who leverage user and behavioral data to provide actionable insights. I think our industry has just started to make this shift, and I expect the effort will increase over the next five years. While real estate will always be face-to-face and relationship-oriented, agents powered by Buyside will emerge as true knowledge brokers, guiding consumers through a complex process with the most comprehensive, data-driven insights powering each step.

BP: What are you looking forward to seeing Buyside accomplish in the year ahead? CW: We’re excited to be a leader in this rapidly evolving space. For 2018, we’ve already begun our continuing investment into the Buyside platform. We’ll be adding additional integration partners and expanding the options for our users to differentiate themselves using data as an asset. We also look forward to partnering with more top brokerages in every major U.S. market, confirming our mission to help real estate professionals get more listings, close more sales, and keep their clients loyal and happy.

For more information, please visit www.getbuyside.com.

For the latest real estate news and trends, bookmark RISMedia.com.

The post Augmented Intelligence: The Real ‘AI’ appeared first on RISMedia.

from Technology | RISMedia http://ift.tt/2Ecdcu8 via IFTTT

0 notes

Link

GTM Smart Grid http://ift.tt/2eJlQnQ

Energy sector investments in big data and artificial intelligence have ballooned by a factor of 10 this year, according to a new report on the sector.

The study, by accountancy firm BDO, found mergers and acquisitions involving energy companies and AI startups had soared in average value from around $500 million in the first quarter of 2017 to $3.5 billion in the second quarter.

The number of deals also went up, from six to eight. The 14 deals in the first half of this year compares to 15 in the whole of 2016. “We are witnessing the early stages of what will become an M&A trend for years to come,” said BDO.

The firm attributed much of this activity to the need for improved analytics to manage intermittent renewable generation.

“In these uncertain times, energy businesses adapt their strategy and look to artificial intelligence and big data to improve energy forecasts,” read the report.

As an example, in July, an energy sector consulting firm called Wildan Group paid $30 million for Integral Analytics, a data analytics and software company.

“IA’s software solutions are designed to solve problems arising from the transformation of an electric grid facing increasing growth in distributed energy resources, such as solar and electric vehicles,” noted Wildan in a press release.

Another example was smart meter maker Itron’s acquisition of demand response provider Comverge in May for $100 million. As reported in GTM, the purchase gave Itron added analytical firepower to add to its existing software suite.

Not all energy sector analytics acquisition conform to this picture. One of the deals listed by BDO was Castrol’s purchase of Romax Technology in February.

Although the acquisition gave Castrol a foothold in the renewable energy market, the motivation for the buyout was getting the oil company better access to Romax’s wind turbine gearbox lubrication customers.

Utilities are leading the acquisition charge. According to a GTM Research, utilities have spent nearly $3 billion on grid-edge startups, many with sophisticated software and analytical capabilities.

In July, for instance, the genset rental giant Aggreko paid $52 million for Younicos and its Y.Q software platform.

And in May, Wartsila, a marine and power plant specialist, bought Greensmith, which had made its name in energy storage optimization and integration software.

Other similar deals include Enel’s acquisitions of EnerNOC and Demand Energy in June and January, and Doosan’s purchase of 1Energy Systems in July 2016.

The French energy giant EDF, meanwhile, pulled off a similar deal in reverse last year when it bought the services company Groom Energy Solutions in order to get more use out of an analytics platform belonging to one of its other subsidiaries, Dalkia.

Clearly, energy companies are increasingly looking to add greater software intelligence to their operations, said report author Jakob Sand, BDO’s head of corporate finance in Denmark.

“I would believe that most of the large energy companies, including oil majors such as Exxon, Shell, BP and Chevron, are on the lookout for opportunities that can enhance their operations through data and AI or machine learning," he said.

Besides responding to a need for more efficient and flexible operations, some of the interest in M&A could be driven by competitive concerns, BDO said. The firm’s report said 2,595 clean energy hopefuls were among the companies tracked on the AngelList online startup database.

Many of these “are already bringing their products and services to market,” BDO said. “It leads to a situation where many large companies may have to resort to M&A to avoid losing market shares to the new kids on the block.”

With a growing number of startups looking to commercialize blockchain-based energy trading concepts, blockchain providers could become the next big focus for corporate M&A, said BDO. There have already been several partnerships in this area.

In June, for example, E.ON and Enel traded energy over a blockchain-based peer-to-peer network provided by IT specialist Ponton.

And Conjoule, a blockchain platform developer hatched in Innogy’s Innovation Hub in 2015, pulled in $5.3 million in funding from Tokyo Electric Power Company and others in July. Expect more such deals to come.

0 notes

Text

How to Choose the Best BP Monitoring App: Essential Features

Selecting the best BP monitoring app requires understanding key features that enhance blood pressure tracking. The ideal app should provide automatic logging, detailed reports, and real-time analytics. Customizable reminders ensure regular monitoring, while integration with wearable devices and cloud storage enhances convenience. A user-friendly interface, multiple profile support, and secure data encryption add value. Some apps even offer AI-driven health tips based on your readings. With these features, managing blood pressure becomes more efficient and effective. Choosing the right app can help you stay on top of your health, detect early warning signs, and make informed lifestyle choices.

0 notes

Text

How Blood Pressure Apps Connected to Machines are Improving Accuracy and Efficiency?

Technology is transforming healthcare, and blood pressure monitoring is no exception. With the integration of smart devices and real-time data sharing, the best BP monitoring app offers clinicians and patients more accurate and efficient ways to manage hypertension. In this article, we explore how blood pressure data-sharing apps are enhancing precision and streamlining care for doctors and patients alike.

The Importance of Accurate Blood Pressure Monitoring

Blood pressure is a critical health metric that needs to be monitored consistently to detect hypertension and other cardiovascular issues. Traditional manual methods may lead to errors due to human oversight or improper techniques. Digital solutions, such as the best BP monitoring app for doctors, provide an automated and reliable approach, ensuring consistent readings and improved patient care.

How BP Apps Connected to Machines Enhance Accuracy

1. Automated Readings Reduce Human Error

Smart BP monitors eliminate the inconsistencies found in manual measurements.

Automated readings ensure that measurements are taken at the correct intervals.

Clinicians can trust the data collected, leading to better diagnosis and treatment plans.

2. Real-Time Data Sharing for Continuous Monitoring

Blood pressure data-sharing apps allow real-time access to patient records.

Patients can sync their BP readings directly with their doctor’s system.

This facilitates timely interventions, reducing the risks of complications.

3. Integration with Wearable Devices for 24/7 Monitoring

Smartwatches and fitness trackers can now measure and transmit BP data.

Continuous tracking helps in detecting irregularities earlier.

Doctors receive alerts for concerning fluctuations, enabling proactive care.

Read Also: Why Practitioners Trust BPCorrect for Blood Pressure Management

How BP Monitoring Apps Improve Efficiency for Clinicians

1. Seamless Data Management

Digital BP logs replace traditional paper records.

Doctors can access past readings in seconds, improving patient consultations.

Easy retrieval of data supports better long-term patient management.

2. AI-Powered Insights and Analytics

Advanced apps analyze BP patterns and highlight potential health risks.

AI-driven alerts notify doctors about significant deviations from normal readings.

Custom treatment plans can be generated based on predictive analytics.

3. Remote Patient Monitoring Saves Time

Patients can take readings from home and share data instantly.

Doctors can track multiple patients simultaneously without in-person visits.

Telemedicine consultations become more effective with real-time BP data.

Key Features of the Best BP Monitoring App

To ensure optimal accuracy and efficiency, a blood pressure data-sharing app should include:

Bluetooth or Wi-Fi Connectivity: Ensures seamless syncing with BP monitors.

Cloud Storage & Access Control: Securely store patient records for easy retrieval.

Integration with EHR Systems: Directly updates electronic health records for doctors.

Customizable Alerts: Notifies clinicians about abnormal BP readings.

HIPAA Compliance: Ensures data privacy and security.

Read Also: Blood Pressure Apps vs. Regular Monitoring: Which is Better?

Benefits of BP Monitoring Apps for Patients

Convenience: Patients can monitor BP anytime, anywhere.

Better Adherence to Treatment: Apps provide medication and lifestyle reminders.

Enhanced Communication: Doctors can provide instant feedback on readings.

Reduced Clinic Visits: Fewer unnecessary hospital visits save time and resources.

Challenges and Solutions in Implementing BP Apps

Despite their advantages, some challenges need to be addressed:

Device Accuracy: Ensuring medical-grade BP monitors are used.

User Compliance: Educating patients on proper BP measuring techniques.

Data Security Risks: Implementing strong encryption and security protocols.

Integration Issues: Ensuring compatibility with different healthcare IT systems.

The Future of Blood Pressure Monitoring Apps

With ongoing advancements, the future of the best BP monitoring app for doctors includes:

AI-Based Diagnosis: Predicting hypertension risks with greater accuracy.

5G-Enabled Remote Monitoring: Faster data transmission for real-time decisions.

Smartphone-Based Calibration: Apps adjusting for more precise BP readings.

IoT and Cloud Integration: Improved interconnectivity for better patient care.

Conclusion

The integration of blood pressure data-sharing apps with monitoring machines is transforming hypertension management. By improving accuracy, automating data collection, and enabling real-time patient monitoring, these apps enhance efficiency for doctors while ensuring better outcomes for patients. As technology advances, the best BP monitoring app will continue to revolutionize digital healthcare, making it easier for clinicians to provide high-quality, data-driven patient care.

0 notes

Text

The Role of Blood Pressure Apps in the Pharmaceutical Industry

Blood pressure (BP) management is a crucial aspect of healthcare, particularly for pharmaceutical companies that develop and market hypertension medications. With the rise of digital health solutions, the best BP monitoring app is playing a significant role in the pharmaceutical industry by improving patient outcomes, supporting clinical research, and enhancing doctor-patient interactions. These apps serve as essential tools for both patients and healthcare providers in managing hypertension effectively.

The Growing Importance of BP Monitoring Apps in Pharmaceuticals

Hypertension is a leading risk factor for cardiovascular diseases.

Effective BP management reduces the need for emergency interventions and hospitalizations.

Digital solutions help track medication effectiveness and adherence.

Read Also: Why Practitioners Trust BPCorrect for Blood Pressure Management

How BP Monitoring Apps Benefit Patients

A BP app for patients offers multiple advantages that improve medication adherence and overall health:

1. Medication Adherence Tracking

Sends reminders for timely medication intake.

Reduces missed doses, improving treatment outcomes.

2. Real-Time BP Monitoring

Allows patients to track BP levels regularly.

Identifies fluctuations that require medical attention.

3. Data Sharing with Pharmacists & Doctors

Helps pharmacists monitor prescription effectiveness.

Enables doctors to adjust medications based on real-time data.

4. Health Insights & Alerts

Provides personalized health recommendations.

Alerts users to abnormal BP readings for quick action.

5. Improved Lifestyle Management

Offers tips on diet, exercise, and stress reduction.

Encourages a holistic approach to BP control.

How BP Tracking Apps Assist Doctors & Pharmaceutical Companies

A BP tracking app for doctors is transforming the pharmaceutical industry by providing accurate patient data and supporting drug research:

1. Enhanced Patient Monitoring

Doctors can remotely track patients' BP levels.

Allows for early intervention and improved treatment decisions.

2. Clinical Trials & Research

Provides real-time data on drug effectiveness.

Assists in evaluating long-term medication impact.

3. Prescription Customization

Helps doctors prescribe tailored dosages based on BP trends.

Reduces the risk of under- or over-medication.

4. Pharmaceutical Market Insights

Data from BP apps help pharma companies understand patient needs.

Assists in the development of more effective BP medications.

5. Integration with Digital Healthcare

Supports telemedicine services and remote patient care.

Enhances the efficiency of healthcare providers.

Features of the Best BP Monitoring App for Pharmaceuticals

For pharmaceutical companies, an effective BP monitoring app should include:

Accurate BP Tracking: Syncs with BP monitors for precise readings.

Data Analytics & Trends: Provides comprehensive BP history for medical analysis.

Medication Alerts & Reminders: Ensures patient adherence to prescribed treatments.

Doctor & Pharmacist Connectivity: Allows seamless sharing of patient data.

Multi-Platform Accessibility: Works on smartphones, tablets, and smart devices.

Read Also: Blood Pressure Apps vs. Regular Monitoring: Which is Better?

The Future of BP Monitoring Apps in the Pharmaceutical Industry

The future of BP apps for patients and BP tracking apps for doctors looks promising, with advancements such as:

AI-Powered Health Predictions: Machine learning for early hypertension detection.

Integration with Wearable Tech: Smartwatches and BP monitors for real-time data syncing.

Personalized Treatment Plans: AI-driven medication adjustments based on patient trends.

Blockchain for Data Security: Secure sharing of medical records among healthcare providers.

Conclusion

BP monitoring apps are transforming the pharmaceutical industry by improving apps for patient care, supporting clinical research, and enhancing doctor-patient communication. By leveraging the best BP monitoring app, pharmaceutical companies can ensure better hypertension management, leading to healthier lives and more effective medications. As technology continues to evolve, these apps will play an even greater role in the future of digital healthcare and pharmaceutical advancements.

0 notes

Text

Must-Have Features in a Blood Pressure Monitoring App for Accurate Tracking

Accuracy is essential when selecting a Blood Pressure Monitoring App. Features like real-time tracking, automatic data logging, and AI-driven insights help ensure precise BP readings. A Blood Pressure Data Sharing App such as BPCorrect enhances tracking accuracy by offering integration with smart BP monitors and wearables. Users can receive instant alerts for abnormal BP levels, enabling prompt action. Secure cloud storage allows easy access to past readings, making trend analysis effortless. With doctor-sharing capabilities, BPCorrect ensures that healthcare professionals receive up-to-date BP reports for accurate treatment planning. Additional features like medication reminders and lifestyle coaching further support users in maintaining stable BP levels. Choosing an app with these must-have features ensures effective blood pressure monitoring and better health outcomes.

0 notes

Text

Smart BP Tracking: Why BPCorrect is a Must-Have for Physicians

Accurate BP tracking is crucial app for hypertension management, and BPCorrect provides the smart solution doctors need. This AI-powered platform automates BP readings, detects trends, and sends real-time alerts for abnormal levels, enabling early intervention. Physicians can monitor patients remotely, ensuring proactive care without frequent clinic visits. The system’s intelligent analytics offer deeper insights into BP trends, helping doctors fine-tune treatment plans for better long-term health outcomes. Seamless integration with EMR systems allows for smooth workflow, minimizing paperwork. With BPCorrect, doctors gain a reliable, data-driven approach to BP management, ensuring improved patient care and efficiency.

0 notes

Text

Why Are Doctors Embracing BP Monitoring Apps for Patient Engagement?

The healthcare industry is undergoing a digital transformation, and one of the standout innovations is the growing use of BP apps for patients. With apps like BPCorrect, doctors are revolutionizing how they monitor, engage, and support patients managing high blood pressure (BP). Let’s explore why these apps are becoming essential tools for healthcare providers.

The Growing Need for BP Monitoring Apps

High Blood Pressure: A Global Concern

Over 1.3 billion adults worldwide have high blood pressure (World Health Organization).

Lifestyle changes and medication adherence are crucial for managing hypertension, but patient engagement is often lacking.

Traditional methods of tracking BP, like manual recordings, are prone to errors and inconsistencies.

Enter BP Apps for Patients

BP monitoring apps bridge the gap between patients and doctors by providing accurate, real-time data.

Apps like BPCorrect empower patients to actively participate in their health journey, leading to better outcomes.

Read More 👉 Streamline Patient Care with BPCorrect: A Doctor’s Perspective

How BP Monitoring Apps Improve Patient Engagement

1. Accurate and Real-Time Data

BP apps automatically record readings from smart devices or manual inputs, ensuring no detail is overlooked.

Apps like BPCorrect create a detailed history of blood pressure trends, making it easier for doctors to assess patient progress.

2. Remote Monitoring for Better Access

Doctors can monitor patients remotely, reducing the need for frequent in-person visits.

Remote tracking is especially beneficial for elderly patients or those in rural areas.

3. Timely Alerts and Reminders

BP apps notify patients to take their medications or measure their BP at regular intervals.

Doctors can receive alerts for abnormal readings, allowing for quick intervention.

4. Enhanced Communication

BPCorrect and similar apps facilitate seamless communication between doctors and patients.

In-app messaging or reports make it easier to address concerns and adjust treatment plans.

5. Data-Driven Insights for Personalization

These apps provide detailed analytics, such as daily, weekly, or monthly trends.

Doctors can tailor treatment plans based on a patient’s unique BP patterns.

Benefits of BP Apps for Patients

Empowering Patients with Knowledge

Patients using apps like BPCorrect gain a better understanding of their BP levels.

The ability to visualize progress fosters accountability and motivates lifestyle changes.

Simplified Health Management

Integrating features like medication reminders, exercise tracking, and diet suggestions streamlines health management.

Patients no longer need to juggle multiple tools for their healthcare needs.

Promoting Doctor-Patient Collaboration

Regular updates through apps improve transparency and build trust.

Doctors and patients work as a team to achieve health goals.

Read More 👉 The Best BP Monitoring App for Doctors

Why Doctors Recommend BPCorrect

A Comprehensive Solution

BPCorrect isn’t just a BP tracker—it’s a patient engagement tool that combines monitoring, alerts, and insights.

Its user-friendly interface makes it accessible for all age groups.

Reliable Data Integration

The app syncs with various BP devices, ensuring accurate readings.

Doctors can integrate data from BPCorrect into their practice, improving clinical decisions.

Saves Time for Doctors

Automated reports and real-time tracking reduce administrative tasks.

Doctors can focus more on patient care rather than manual data entry.

The Future of BP Monitoring and Patient Engagement

The use of BP apps for patients, like BPCorrect, is shaping the future of hypertension management. Here’s what lies ahead:

AI Integration: Apps will offer predictive analytics to identify risks early.

Telemedicine Growth: Remote monitoring will become a standard feature of healthcare practices.

Improved Accessibility: BP monitoring apps will become more affordable and widely used, even in low-resource settings.

Conclusion

Doctors are embracing apps like BPCorrect because they simplify hypertension management, enhance patient engagement, and improve overall outcomes. For patients, these apps provide empowerment, convenience, and better collaboration with healthcare providers.

By adopting a BP app for patients, doctors are not just treating a condition—they are building a healthier future through innovation and connectivity.

0 notes