#AR Management

Text

Mastering Accounts Receivable Management for Your Business Made Simple with Moolamore

Consider this scenario: you've put your heart and soul into your company, attracting customers and clients with your fantastic products or services. However, if those sales do not result in timely payments, you will undoubtedly face cash flow and operational issues. Take note that effective Accounts Receivable (AR) management is critical to the longevity of your SME company.

Poor AR management can be disastrous for your business, regardless of how successful your sales are. Here are the major dangers:

#accounts receivable management#AR management#receivables management#managing accounts receivable#AR best practices#AR optimization

0 notes

Text

Securing B2B Enterprise SaaS Subscription Payments On Time

The global B2B SaaS market is projected to experience significant growth from 2024 to 2032. This expansion is driven by the rising demand for cloud-based software solutions that enhance business efficiency and cost-effectiveness.

The B2B SaaS industry offers a variety of solutions, including Customer Relationship Management (CRM), Human Resources (HR), Enterprise Resource Planning (ERP), and project management software. These tools are designed to automate and streamline business operations, foster collaboration, and boost productivity.

Based on the size of the target customers, broad-level go-to-market (GTM) segmentation for B2B SaaS subscription management includes:

Small and Medium Enterprises (SMEs)

Mid-Market

Large Enterprises

For SaaS subscription payments, SMEs are typically willing to use credit cards to access B2B SaaS products. However, Mid-Market and Large Enterprises often prefer to operate on credit terms, which necessitates managing accounts receivable.

For SaaS subscription payments, SMEs are typically willing to use credit cards to access B2B SaaS products. However, Mid-Market and Large Enterprises often prefer to operate on credit terms, which necessitates managing accounts receivable.

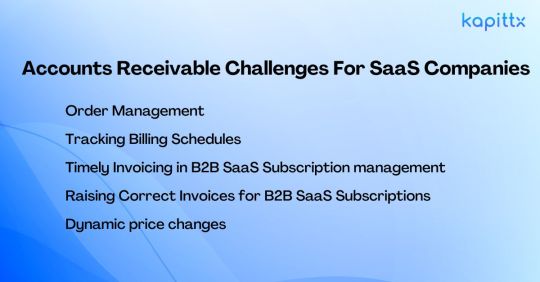

Accounts Receivable Challenges for SaaS Companies

Running a B2B SaaS Subscription management business is incredibly challenging. In today’s hyper-competitive market, in your SaaS subscription business, you must manage multiple aspects such as onboarding, adoption, upselling, customer success, retention, and churn.

The last thing you want to worry about is accounts receivable management.

This is particularly true for enterprise SaaS companies, where users often do not provide credit card details for auto-debit transactions. Consequently, you are compelled to offer ‘invoice payment’ terms. This means, similar to traditional businesses, you invoice clients and typically collect payment 30 days later, hoping the customer pays on time.

1. Order Management

Enterprise customers typically issue a Purchase Order (PO) for any product or service, and B2B SaaS subscriptions are no exception. These POs capture deliverables and commercial terms that should be thoroughly examined before acceptance.

Payment terms may include milestone payments for integration and onboarding, the start of the go-live subscription, and usage-based rates. It’s important to note that customers rely on their internal documents for commercial and payment terms, not just your published plan.

As your business grows and the number of orders increases, tracking SaaS subscription milestone payments can become overwhelming and time-consuming. Implementing an order-to-cash and subscription management tool like Kapittx can significantly streamline this process and support your growth.

2. B2B SaaS Subscription Billing Challenges: Tracking Billing Schedules:

Managing B2B SaaS subscription billing schedules requires attention to detail, clear communication with customers, and the right tools. By leveraging subscription billing tracking solutions like Kapittx, companies can streamline their processes, reduce errors, and ensure timely payments.

A. Diverse Billing Plans:

B2B SaaS subscription companies offer various billing plans to accommodate different customer needs. These plans can include monthly, quarterly, bi-annually, or yearly billing cycles. Each billing plan has its own set of terms and conditions, affecting the frequency and timing of payments.

B. Go-Live Dates vs. Billing Dates:

Some SaaS companies tie billing dates to the go-live dates of their services. For example, if a customer’s software implementation goes live on the 15th of the month, their billing cycle might start from that date. However, other companies have a policy of billing for the entire month, regardless of the go-live date. This can lead to confusion and misalignment between service usage and billing periods.

C. Customer-Specific Billing Dates:

Different customers may have unique billing dates based on their contract terms or historical preferences. Managing multiple billing schedules simultaneously can become complex, especially when dealing with a large customer base.

D. Subscription Billing Tracking Tools:

Implementing a robust subscription billing tracking tool can streamline the entire process. Such tools can:

Centralize Billing Information: Store billing details for each customer, including billing frequency, due dates, and payment history.

Automate Reminders: Send automated reminders to customers before their payment due dates.

Generate Invoices: Create accurate invoices based on the billing plan and customer-specific terms.

Handle Prorated Charges: Manage mid-cycle changes (e.g., upgrades, downgrades) and calculate prorated charges accordingly.

3. The Importance of Timely Invoicing in B2B SaaS Subscription management:

Timely invoicing not only ensures smoother financial operations but also fosters positive relationships with your customers. Enterprises follow specific payment processing cycles, often with a credit period that extends a certain number of days after the invoice date. If you issue the invoice late, it directly impacts the payment processing timeline. Late invoices lead to delayed payments.

For SaaS subscription companies, maintaining healthy cash flow is essential. Timely payments from customers contribute significantly to this. Late payments can disrupt financial planning, hinder growth, and strain operational resources.

Avoiding Payment Delays – When you bill on time, you increase the chances of receiving payments promptly. Late invoices may result in delayed approvals, additional processing time, and potential disputes.

Monthly billing cycles can be particularly tricky. Missing a billing cycle means you might end up submitting two months’ worth of invoices simultaneously. This situation can confuse customers and create administrative challenges.

With Kapittx a b2b SaaS subscription management proactively monitor SaaS subscription billing due dates closely. You can maintain a billing calendar that tracks all customer invoices that Include billing dates, due dates, and follow-up actions.

4. Raising Correct Invoices for B2B SaaS Subscriptions

Accurate and transparent invoicing contributes to a smoother billing process and fosters positive relationships with your customers.

Many SaaS subscription plans are based on usage metrics. These metrics could include the number of users, data consumed, or other measurable factors. For example, a company might pay based on the number of active users or the volume of data processed through the SaaS platform.

Differential user rates add complexity to billing. Some users may be on a basic plan, while others might have access to premium features. Managing these variations accurately is crucial to avoid disputes and ensure fair billing.

Transparency about user counts and consumption is vital. Customers should easily verify the details on their platform. Providing clear usage reports or dashboards helps build trust and minimizes billing discrepancies. When generating invoices, ensure that they reflect the actual usage and user rates.

Consequences of Ineffective arm accounts receivable management leading to accounts receivable challenges can be due to an inadequate AR process which can trigger a cascade of issues:

5. Dynamic price changes

Enterprise SaaS subscription plans may have a base plan for X users and a pre-agreed rate for additional users. Further some deals which are long-term could have pre-agreed price escalation clauses. All these complexities need a sophisticated SaaS Subscription Management system.

Challenges in SaaS Subscription Receivables Management

High Days Sales Outstanding (DSO):

DSO measures the average number of days it takes to collect payment from customers after a sale. Slow payment from customers can strain a company’s cash flow and profitability.

Management Time and Efficiency:

Managing accounts receivable can be time-consuming, especially when processes are inefficient or manual.

Delays in Invoice Submission:

Timely invoice submission is essential for prompt payment. Identifying bottlenecks that impact invoice submission is critical.

Streamlining SaaS Subscription Payments with Kapittx

Kapittx offers innovative solutions to address these challenges:

Automation: Kapittx replaces manual processes with automation, reducing the time spent on routine tasks. It streamlines invoice submission, payment reconciliation, and alerts.

Integration: By integrating Kapittx with your ERP Billing platform, you create a seamless flow of information. Alerts for delays, risks, and other critical events are delivered in real time.

Complete Control: Kapittx provides end-to-end visibility into the invoice-to-cash lifecycle. You gain control over receivables, ensuring timely collections and minimizing financial risks2.

In summary, Kapittx not only helps manage SaaS subscriptions efficiently but also empowers you with better control over your accounts receivable processes. Feel free to explore Kapittx further to optimize your financial stability

Click here to see a case study from Kapittx.

Request a demo today.

Check out Kapittx’s LinkedIn here.

#ai in accounts receivable#ai powered accounts receivable#ar management#cashflow management#accounts receivable automation software#ai based accounts receivable#ar collection#ar automation solution#ar tool

1 note

·

View note

Text

Outsourcing accounts receivable management serves as a catalyst for operational efficiency by delegating this pivotal responsibility to seasoned professionals equipped with specialized expertise and resources. These dedicated experts possess the acumen and experience necessary to navigate the nuances of receivables management adeptly. By leveraging their proficiency, businesses can streamline invoicing procedures, expedite collection efforts, and mitigate the risks associated with delayed payments or delinquent accounts.

#outsourcing accounts receivale#accounts receivable management#ar management services#ar management#bookkeeping and accounting services

0 notes

Text

youtube

Comprehensive AR Management Services | OSI

Partner with OSI for comprehensive Healthcare Receivable Management and experience improved financial performance, reduced administrative burden, and increased focus on patient care. Contact us today to learn more about how we can assist you in maximizing your revenue and ensuring financial stability. Visit us at: https://www.outsourcestrategies.com/ar-management/

#AR management services#Healthcare Accounts Receivable Management#medical billing company#AR Management#Accounts Receivables Management Services#physician coding company#Youtube

1 note

·

View note

Text

Boost Your Bottom Line: 5 Essential Steps to Enhance Revenue Cycle Management

Contents

1. Introduction:

2.1. Patient eligibility verification and registration

2.2. Improve strategies for Revenue Cycle Management

2.3. Optimization of coding documentation

2.4. Reimbursement and collection of revenue

2.5. Implementation of performance metrics and data analytics

3.Conclusion

Introduction:

Financial performance and any organization can be boosted only through revenue cycle management (RCM). It is a process of managing the financial aspects of an organization linked with clinical and administrative functions. Financial cycle management involves patient eligibility verification, patient registration, claim submission, reimbursement and collection through utilizing medical billing software. Healthcare organizations use Revenue Cycle Management to track the episodes of patient care from registration, appointment, and scheduling, final payment and revenue generation. The goal of revenue cycle management in medical billing is to enhance revenue generation, reduce the risk of financial losses, improve cash flow and stay in operation to treat the patients. Following five essential steps to boost the bottom line to enhance effective revenue cycle management are as following. Read More...

For further details and daily updates please follow us on LinkedIn or visit Ensure MBS

#medical billing outsourcing#ar#ar management#medical billing service companies#healthcare#medical billing solutions#hospital#physician#medical billing florida#revenue cycle management#revenue cycle outsourcing

2 notes

·

View notes

Text

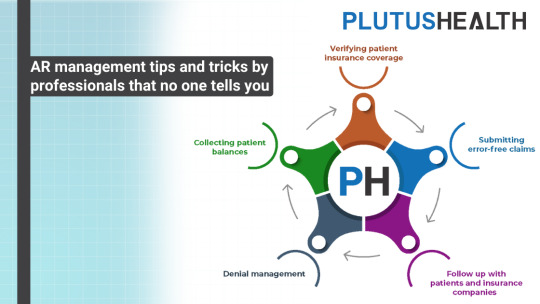

AR management tips and tricks by professionals that no one tells you

Healthcare providers lose 5-15% of annual revenue because of improper AR (accounts receivable) management. A report published by the Medical Group Management Association (MGMA) found that the average AR days for over 13% of healthcare providers is 120 days.

Most healthcare providers need help managing their AR and collecting their payments on time. In this article, our experts with 15+ years of experience have explained tips, tricks, and the importance of AR management.

Blog index:

Definition of AR management in healthcare RCM

Importance of AR management

Stages of AR management

Efficient AR management tips

Definition of AR management in healthcare RCM

Tracking and collecting payments from patients and payers for the healthcare services offered is called AR management. It is advised that the average AR for a healthcare organization should be <25 days.

Here are the steps involved in AR management:

The first and most important step in accounts receivable management is verifying patient insurance coverage. Verification helps to understand the current insurance status of the patient.

Healthcare providers need to submit error-free claims the first time. Claim scrubbing and submitting error-free claims is the next step that plays a vital role in AR management.

Following up with payers and patients is crucial as cash flow directly depends on how well you get engaged with your patients and payers.

Denials can hamper the revenue of the healthcare provider. Managing your denials is vital to manage your account receivable.

Analyzing the reports and payments is important for healthcare providers as it will give a clear idea of what payments need to be collected.

Importance of AR management

The financial health of the healthcare provider depends on how well they manage the AR. From the patient's call for an appointment until the final payment is received, AR management is important to streamline the cash flow. Here are a few other reasons why AR management is important:

Smooth cash flow

Revenue optimization

High patient satisfaction

Compliance

Stages of AR management

AR management can happen primarily in 3 stages. Each stage needs to be followed properly to get the desired results.

Stage 1: Pre invoice

Credit check conduction

Payment term establishment

Setting up a patient account

Stage 2: Invoicing

Accurate invoice generation

Prompt invoice delivery

Unpaid claim follow-up

Stage 3: Payment & collections

Collect payments

Resolve denials

Reconciliation

Efficient AR management tips

Efficient AR management ensures timely payment and minimizes write-offs. Here are a few tips to efficiently manage AR.

Patient insurance eligibility verification

Precise coding

Claim scrubbing and submission

Following up on outstanding payments

Check denials and appeal status

Create payment plans

Appropriate staff training

AR management can be done in-house or outsourced to providers like Plutus Health, with years of experience serving the healthcare industry. Outsourcing helps to take off the burden from the internal staff and helps to collect payment on time.

1 note

·

View note

Link

1 note

·

View note

Text

Get the most out of NetSuite or Oracle Fusion with AI-Powered Accounts

In the intricate dance of financial operations, ARM – accounts receivable management stands out as a particularly demanding performance. Companies set the bar high, expecting over 99.9% of all billings to be collected—a standard of near- perfection that few other departments are called upon to match. Collecting a mere 95% of revenue is deemed insufficient. Businesses will begrudgingly accept bad debt expenses amounting to a few tenths of a percent of revenue, but the threshold for tolerance is razor-thin. The expectation from the arm accounts receivable management team is clear: a significant majority of invoices should be settled promptly, with over 90% paid within 30 to 45 days of the due date. This level of efficiency is expected to be delivered while simultaneously fostering sales growth and ensuring that every customer interaction is marked by promptness, courtesy, and professionalism.

How much control you can have over Accounts Receivable Management?

The accounts receivable asset is often likened to a comprehensive repository of the company’s revenue cycle health. It serves as a mirror, reflecting the efficacy of your entire operational process. From order placement to fulfilment, invoicing, payment application, and customer satisfaction, any discrepancies along this chain will

inevitably surface within the receivables ledger, manifesting as overdue accounts or partial payments.

The integrity of your receivables asset is a testament to the quality of customer service you provide. It acts as a spontaneous gauge of customer satisfaction, offering insights that are both valuable and readily available. While it may be tempting to view this feedback as a cost-free quality control mechanism, it’s important to recognize that addressing the underlying issues does involve certain costs. Nonetheless, this feedback is instrumental in guiding your arm – accounts receivable management team and their continuous improvement efforts, ensuring

that they not only meet but exceed your customers’ expectations.

Optimizing ARM – Accounts Receivable Management with NetSuite or Oracle Fusion

AR teams often grapple with accounts receivable challenges that directly affect a company’s liquidity and expansion. These include:

Elevated Days Sales Outstanding (DSO)

Subpar engagement with customers and key stakeholders

Inefficiencies in payment processing

Policies that fall short of addressing AR complexities

Consequences of Ineffective arm accounts receivable management leading to accounts receivable challenges can be due to an inadequate AR process which can trigger a cascade of issues:

Such pitfalls can constrict cash flow, potentially slowing down operations and hindering growth, while competitors forge ahead.

ERPS like Oracle Fusion or NetSuite’s or other cloud accounting software revolutionizes financial management by streamlining transaction recording, managing payables and receivables, ensuring accurate tax collection, and facilitating seamless book closures. This leads to precise reporting and fortified control over financial assets.

Oracle Fusion Accounts Receivable or NetSuite Accounts Receivable modules are designed to empower businesses with efficient invoice and payment management. It offers a unified platform for monitoring receivables, automating billing, and securing prompt collections. The real-time insights into financial dealings enable businesses to make well informed decisions, bolster customer relations, and enhance overall financial well-being.

Maximizing Efficiency of Oracle Fusion or NetSuite with AR Automation Software:

In the following sections, we will explore how Kapittx, an AI powered accounts receivable automation platform, can enhance your utilization of ERPs like Oracle Fusion, and NetSuite’s robust features.

Simplified Access and Management of Receivables:

“A staggering 40% of the time dedicated to accounts receivable reviews is consumed in sorting AR data or facilitating communication among internal stakeholders. “

The daily operation of receivables management ERPs can be daunting and time-intensive, often requiring users to invest considerable time in mastering the intricacies of application workflows. Kapittx, with its AI powered accounts receivable platform, seamlessly integrates with the receivables management ERPs like Oracle Fusion or NetSuite, ensuring that any actions related to arm accounts receivable management are streamlined to a user- friendly experience. The goal is to reduce navigation to no more than a few clicks. By embracing AI in accounts receivable, Kapittx an AR automation software incorporates industry-specific invoice update codes and configurable user flows that enhances the receivables management ERPs like Oracle Fusion and NetSuite to meet your unique business needs, making it an indispensable tool for your financial operations.

Metrics and reporting with comprehensive AR dashboards

ARM – Accounts receivable management stands out as one of the most quantifiable aspects of business operations. Key metrics such as cash collection totals, write-offs, and aging category breakdowns are just a few of the finite and easily calculable figures within the receivables domain. These metrics are not only measurable but also critical for the effective management of receivables assets.

While everyone aims for enhanced outcomes, it’s important to remember that excessive time spent on reporting can detract from efforts to improve these very results. The ultimate goal is always to elevate performance. Navigating receivables management ERP systems to extract necessary reports can often be a complex and lengthy process. However, integrating AR automation software like Kapittx with Oracle Fusion Accounts Receivable or

NetSuite Accounts Receivable transforms this challenge into a streamlined experience. Kapittx’s integration automates the laborious tasks of data organization and report generation. Utilizing advanced machine learning

algorithms, Kapittx an AI powered accounts receivable platform is adept at forecasting payment trends, pinpointing potential late payments, and providing actionable insights—all within the intuitive interface of your existing ERP system.

Proactive Credit Control and Risk Management with Timely Alerts

Credit limits are a critical measure of the financial risk a company is prepared to accept for each customer. In today’s fast-paced business environment, where transactions occur rapidly and staffing may be lean, it’s all too common for credit controls to be bypassed or applied ineffectively. To mitigate these risks, adherence to two key principles is essential:

System-Enforced Controls: Certain controls must be non-negotiable and automatically enforced by the system to prevent any oversight.

Manual Control Evaluation: Controls that require manual intervention should be regularly reviewed to confirm that the time invested by staff is justified by the value they provide.

Integrating AR automation software like Kapittx with your receivables management ERP systems, such as Oracle Fusion or NetSuite, empowers you to take a proactive stance in overseeing the financial health of your clients. This is particularly vital for those with substantial outstanding balances. The platform’s early alert system notifies you when net outstanding amounts exceed set credit limits, or when aged outstanding balances need attention. These alerts are pivotal for maintaining effective arm – accounts receivable management and ensuring that credit risk is kept within acceptable bounds.

Fostering Enhanced Collaboration and Agile Decision-Making:

It’s a common misconception that late payments are solely due to customers’ reluctance or inability to pay. In

“Reality, 70% of delayed collections are attributed to internal inefficiencies within a company. “

The state of accounts receivable is a mirror reflecting the operational efficiency of a company—the more streamlined the operations, the more effective the arm – accounts receivable management will be.

Traditionally, ERPs served as sophisticated bookkeeping systems, not as platforms for collaboration. Yet, the essence of proficient accounts receivable management lies in the ability to collaborate internally. Integration of AR automation software like Kapittx’s with NetSuite or Oracle Fusion accounts receivable modules revolutionizes this aspect by enhancing collaboration through the provision of real-time data and analytics. This empowers teams to make quick, informed decisions without the drag of protracted discussions or the burden of manual data crunching. As a result, productivity soars and the time from analysis to action is significantly reduced.

Streamlined Dunning Management and Customized Customer Engagement

Timely payment reminders are pivotal for on-time payments, with statistics showing that 65% of customers settle their invoices promptly when reminded appropriately. To ensure the effectiveness of these payment reminders, it’s essential to be consistent, persistent, and courteous, while also personalizing the communication to each customer’s unique needs. Each customer’s accounts payable process is distinct, often requiring specific documentation to accompany

the invoice which need to factor in your payment reminders.

By infusing ai in accounts receivable with ar automation like Kapittx’s, the payment reminder process becomes fully automated, spanning from the initial invoice to the issuance of a legal notice.

“This AI-driven AR automation software is adept at aligning with each customer’s specific payment processing requirements, saving your collections team at least 5 hours weekly.“

Furthermore, for invoices that are in dispute or provisioned, you maintain complete control over the dunning communications. With a simple click, you can halt these communications as needed, providing flexibility and responsiveness in your accounts receivable management.

Expanding on Dunning Management

Customizable Payment Reminder Software: Set up reminders that adapt to the individual payment behaviors of customers, ensuring timely and effective prompts.

Automated Documentation Attachment: Automatically include necessary supporting documents with each reminder, tailored to the customer’s payment process requirements.

Intelligent Dunning Workflows: Employ Kapittx’s AI to intelligently manage the dunning process, from gentle reminders to more assertive notices, based on customer response and payment history.

Control at Your Fingertips: Easily manage the dunning process with user- friendly controls that allow for immediate adjustments to communication strategies.

By leveraging these sophisticated dunning management features, you can ensure that your accounts receivable operations are both efficient and customer-centric.

Recognizing the diverse needs of different industries, Kapittx offers customizable workflows that align with specific sector requirements. It uses ready to integrate APIs for leading receivables management ERPs like SAP, Microsoft Business Central, Oracle NetSuite, Tally, Quickbooks, Zoho and others. This tailored approach ensures that businesses can optimize your accounts receivable processes in a manner that best suits their operational model.

At the heart of Kapittx AR automation software integration with receivables management ERP is a commitment to user-centric design. The platform’s intuitive interface and simplified processes are designed to enhance user satisfaction and adoption, making financial management a seamless aspect of your business routine.

Click here to see a case study from Kapittx.

Request a demo today.

Check out Kapittx’s LinkedIn here.

#ar management#ai based accounts receivable#ai in accounts receivable#cashflow management#accounts receivable automation software#ar automation solution#ai powered accounts receivable#arautomation#ar collection

0 notes

Text

Top 5 Benefits Of Outsourcing Accounts Receivables

Outsource Accounts Receivable Services. Let's start at the beginning.

You build your Medical Practice step by step, piece by piece. With a plan and some backing, you launch, and if you've done it right, survive those treacherous first months and start to flourish. The path to success is never, ever easy. Long hours, midnight phone calls, weekends in the office, the challenges all new start-ups face.

The last thing you want to spend a lot of time on is Accounts Receivable. Sure, you need to get paid for that all that work you've done, but AR has a way of moving to the bottom of the "to do" list.

Remember, Accounts Receivables is an accurate gauge of your customers' ability or willingness to pay their bills, to pay you! Knowing that can be key.

Accounts receivables include the management of endless reports dealing with insurance claims and reimbursements, collection analysis, bad debt reviews, and write-offs. The pain keeps piling up! Outstanding shares or delayed collections can put a lot of pressure on an otherwise thriving practice. State and federal regulations increase paperwork. Shifting insurance coding methods can delay reimbursement since the slightest error will cause a denied claim.

Before things get out of hand, why not bring on board a team of professionals that will make your Accounts Receivable Services their #1 priority? Outsourcing these services is not only cost-effective but lets your core team concentrate on driving sales and expanding your business.

How do you handle Accounts Receivable efficiently and accurately? Why do some medical practices continue to lose money on the process when there is an alternative? Accounts Receivable Management. Many practices and hospitals choose to Outsource Medical Accounts Receivable Services and save both time and money.

Like other "Back Office" functions, AR is a natural for Accounts Receivable Management, or Outsourcing, going offshore and partnering with a BPO to Outsource Accounts Receivable.

You Can Make Everything Work For You!

Outsourcing is the complete solution for Revenue Cycle Management.

Improve Your Billing And Payment Process - with an efficient Accounts Receivable partner. They will handle the Insurance Verification process quickly and accurately. The billing is done and out within 24 hours. The same holds true for the insurance coding and notification of the claim. The process begins with the claim process and the billing for the patient's co-pay. Routinely, that should take no more than 30 days. If it takes longer, it gets a red flag and goes to the queue's front.

Reduces Administrative Overhead generally speaking, to outsource accounts receivable services saves you money with any services used. But Accounts Receivable can be costly, so any economies will help. You'll get the most bang for the buck by outsourcing this function and getting an experienced, professional team that will go the extra mile for you. Remember, you'll skip all of the headaches associated with hiring extra staff.

Speed Up Collections - it's no secret that a dedicated team can stay on top of the collection process, and get payments due faster. Unlike using your in-house staff, which usually has other duties, It's their only duty, so they spend all of their time on it. It's not done "when I get a chance." It's the primary function of a skilled, experienced team that works only for you.

Skip The Need For A Dedicated Document Management Department - when you move your accounts receivable staff out of your office and to the other side of the globe, suddenly, there's a renewed dedication to delivering Healthcare, ONLY Healthcare. Your professional staff can spend more of their time caring for patients, which is why you started practicing medicine in the first place.

Saves Time And Operational Costs - as mentioned earlier, the cost saving is stupendous. What could you do with a saving of 40% and more by using an outsourced AR department? Suddenly, new and advanced equipment might be within your budget. You might be able to hire that additional staff member you need. The latest diagnostic procedures may now be affordable, thanks to the savings realized by going offshore with AR.

Take a Closer Look at Outsourcing Accounts Receivable.

At this point you probably are thinking that the advantages of outsourcing make it worth exploring. But wait, this is a big step and you don't want to not ask all the right questions. So search around, find some recommendations, and see what the candidates have to offer.

But start your search with Rely Services, a outsourcing pioneer that for 20 years has been the “go to” BPO for AR services.

Using Rely Services as your AR partner will save you more than time and money. Since they are continually refining their business methods, their constant pursuit of perfection will benefit your operational practices. Contact them today for a detailed evaluation of the many ways they can make your business more successful.

0 notes

Text

In today’s fast-paced business environment, companies constantly strive for efficiency and optimization. Amidst this relentless pursuit, one crucial aspect that demands attention is accounts receivable (AR) management. Today, AR has become the lifeblood of any business. After all, it ultimately doesn’t matter how amazing your product or service is or how many sales you close. If you do not get paid consistently, your survival is in question. Therefore, recognizing the pivotal role of AR management in sustaining business operations, it’s imperative to understand the intricacies of AR management.

#outsourcing accounts receivable#accounts receivable#AR management#accounts receivable management#AR manage#USA

0 notes

Video

undefined

tumblr

Although most medical practices conduct a yearly AR report, we at 24/7MBS believe a monthly report goes a long way in having superior control over the revenue cycle management (RCM).

0 notes

Link

Over the years BillingParadise has been featured in top publications, ranked amongst the best revenue cycle management companies and become a byword for groundbreaking billing services.

Today we’ve shared a list that compiles all the revenue cycle management tips suggested by BillingParadise that have been published in the premier healthcare publication, BeckersHospitalReview.com.

To read more, Revenue Cycle Management Best Practices from BillingParadise

#revenue cycle management#rcm#rcm tips#rcm services#AR Management#Co Sourcing#outsourcing company#outsourcing rcm company#outsourcing rcm services#Patient Access#co-managed revenue cycle management services#outsource RCM operations#Co-Managed Revenue Management process#Revenue Cycle Management Companies#revenue cycle management tips#revenue cycle process#outsourcing revenue cycle management services#Co-Sourcing RCM Process#Co-Sourcing RCM Services#risk adjustment fraud#outsource RCM#RCM Outsourcing#healthcare

0 notes

Video

undefined

tumblr

Are you one of those businesses who is suffering from the management of the company’s finances? Don’t panic as there is no need to worry. For the management of the finance, you just have to focus on your Accounts Receivable and Accounts payable Management.

How AR & AP Management helps your business:

1.Maintain proper reports of the Accounts Receivable

2. It Improves your cash position.

3. Increase Accounts receivable Management Efficiency

4.Improve customer communication

5.Time-saving

6.Record Keeping

7.Excellent processing

Know more: https://goo.gl/tG5Js8

Follow us on:

Facebook: https://www.facebook.com/invoicera

LinkedIn : https://www.linkedin.com/company/invoicera-invoicing-simplified/

Twitter: https://twitter.com/Invoicera

#Accounts payable#Accounts receivable#AR management#AP management#accounts receivable software#accounts payable software#accounts payable and receivable

0 notes