#Account Receivable management

Text

In the dynamic world of business, maintaining a healthy cash flow is crucial for sustaining growth and ensuring the overall financial stability of a company. https://alqada.ae/Among the many factors that influence cash flow, managing accounts receivable plays a pivotal role. Efficient account receivable management is an essential strategy for optimizing financial operations, reducing credit risks, and enhancing the overall performance of a company. https://alqada.ae/

0 notes

Text

In the dynamic world of business, maintaining a healthy cash flow is crucial for sustaining growth and ensuring the overall financial stability of a company. https://alqada.ae/Among the many factors that influence cash flow, managing accounts receivable plays a pivotal role. Efficient account receivable management is an essential strategy for optimizing financial operations, reducing credit risks, and enhancing the overall performance of a company. https://alqada.ae/

0 notes

Text

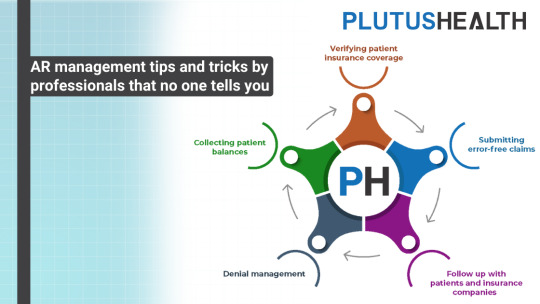

AR management tips and tricks by professionals that no one tells you

Healthcare providers lose 5-15% of annual revenue because of improper AR (accounts receivable) management. A report published by the Medical Group Management Association (MGMA) found that the average AR days for over 13% of healthcare providers is 120 days.

Most healthcare providers need help managing their AR and collecting their payments on time. In this article, our experts with 15+ years of experience have explained tips, tricks, and the importance of AR management.

Blog index:

Definition of AR management in healthcare RCM

Importance of AR management

Stages of AR management

Efficient AR management tips

Definition of AR management in healthcare RCM

Tracking and collecting payments from patients and payers for the healthcare services offered is called AR management. It is advised that the average AR for a healthcare organization should be <25 days.

Here are the steps involved in AR management:

The first and most important step in accounts receivable management is verifying patient insurance coverage. Verification helps to understand the current insurance status of the patient.

Healthcare providers need to submit error-free claims the first time. Claim scrubbing and submitting error-free claims is the next step that plays a vital role in AR management.

Following up with payers and patients is crucial as cash flow directly depends on how well you get engaged with your patients and payers.

Denials can hamper the revenue of the healthcare provider. Managing your denials is vital to manage your account receivable.

Analyzing the reports and payments is important for healthcare providers as it will give a clear idea of what payments need to be collected.

Importance of AR management

The financial health of the healthcare provider depends on how well they manage the AR. From the patient's call for an appointment until the final payment is received, AR management is important to streamline the cash flow. Here are a few other reasons why AR management is important:

Smooth cash flow

Revenue optimization

High patient satisfaction

Compliance

Stages of AR management

AR management can happen primarily in 3 stages. Each stage needs to be followed properly to get the desired results.

Stage 1: Pre invoice

Credit check conduction

Payment term establishment

Setting up a patient account

Stage 2: Invoicing

Accurate invoice generation

Prompt invoice delivery

Unpaid claim follow-up

Stage 3: Payment & collections

Collect payments

Resolve denials

Reconciliation

Efficient AR management tips

Efficient AR management ensures timely payment and minimizes write-offs. Here are a few tips to efficiently manage AR.

Patient insurance eligibility verification

Precise coding

Claim scrubbing and submission

Following up on outstanding payments

Check denials and appeal status

Create payment plans

Appropriate staff training

AR management can be done in-house or outsourced to providers like Plutus Health, with years of experience serving the healthcare industry. Outsourcing helps to take off the burden from the internal staff and helps to collect payment on time.

1 note

·

View note

Text

clone wars au where fives survives because fox is a disaster and people care about him (derogatory)

aka he hasn‘t slept in 72 hours and while every corrie understands why, that doesn’t mean they have to like it. plus, he already has borderline braindamage from not getting more than five hours’ sleep a night the whole duration of the war, and all the strange injuries and electrostaff burns he keeps showing up with, stabby the clone medic reasons. also bone density is a concern with the half-rations the guard is consistently on, so really this is all a very reasonable emergency measure, he says and cuffs fox to a cot.

yes of course, meathook and rabid nod, who pounced on the commander and pinned him for stabby and his sedation hypo the second he came through the door. very reasonable.

hnngfnhfjfj, fox grunts in the corner, already halfway to insensate. thorn, who knows better than to protest lest he become the next target of stabby’s ire, nods along while switching to fox’s armour.

which is also how palpatine gets himself caught, because of course ‘cc-1010’ activates exactly nothing in thorn’s brain except maybe alarm bells for rancid kriffing vibes, and by the time the chancellor orders him to switch off his blaster’s stun setting and terminate the ‘faulty unit’ at all costs, he’s already recording the interaction and sending it as an attachment to the whole guard command staff as well as the jedi temple.

#clone wars au#coruscant guard#commander fox#commander thorn#corrie guard deserves better#in this au fox doesn’t get to smear the chancellor over a wall#on account of being cuffed to a bed for ten hours straight#and he does wake up to what he believes to be a fever dream#but finally gets his happy ending when the corries throw a ‘rot in piss wrinklenuts’ celebration#and the red guard is summarily arrested along with several senators#fives lives and thorn receives a medal of honour which he manages to pawn off to fox on a technicality#fox is no longer happy#stabby meathook and rabid the clone medics my beloved#none of them are the cmo btw that’s warcrime#there’s also mauler#upon whose introduction general kenobi very strangely nearly chokes to death

85 notes

·

View notes

Text

Completely almost forgot to apply for that internship I was interested in.... Applications close TODAY BTW. Like. It said "no later than May 1" and I am typing this at 12:01 am on May 1 lmao. I emailed it at like 11:59 on April 30 😭😭😭 Unfortunately the one I really wanted already closed, but the same company has dozens of internships with different departments, so I picked the easiest looking one lol. It's also the one where I would get to post on their Tumblr blog yippee!!! Fingers crossed 🤞

#how does posting on a work Tumblr blog even work lol#would they invite my account as an admin 😭#ig I would just say I don't have Tumblr and make a new account for that lol#also the internship is remote but it starts around the time I'm gonna be out of state for a week.... hm#they said the schedule is really flexible so I could mention that in my interview and see if they let me take that week off and make it up#and if they reject me then oh well#boss makes a dollar I make a dime that's why I blog on company time#<- I want this to be my workposting tag. but I will resist bc it's too long and would be a pain to type out every time I want to complain#workposting#goodnight my lovelies <3#ANYWAY the timing thing should be fine bc the external website where I found the listing said it's open until 6 am#but idk if that's just the default time or what#shrug. we shall see. at least it's technically no later than May 1 bc it's still May 1........#AND I SENT IT LIKE A MINUTE BEFORE MAY 1#whether or not the hiring manager receives it then is a different story

2 notes

·

View notes

Text

The funny thing abt working as a merchandise vendor is now I get free reign of the backs of all the grocery stores and I can tell how questionably they’re ran just from how their shipping/receiving area looks

#text#i feel like ppl don’t really understand the absolute state of working at any grocery store. any of them#even the nicest looking ones have some type of issues. usually bad management#one of the receiving ladies doesn’t let us stock until she individually accounts for every item#which is fair but then she makes us find the items for her so we wasted abt 90 mins tracking down a box they lost and doing that#that’s another thing. half the time they do not have the boxes in the right place bc training is minimal literally everywhere#so half my job is find the merch the other half is actual stocking and cleanup

2 notes

·

View notes

Text

How Can Gen AI Revolutionize Your Accounts Receivable Process?

The advent of Generative AI (Gen AI) heralds a paradigm shift in the landscape of Finance and Accounting (F&A). Much like the introduction of spreadsheets as a product innovation decades ago, finance professionals were quick to embrace and derive immense benefits from the use of spreadsheets.

Gen AI in Finance and Accounting emerges as a potential game-changer, poised to revolutionize traditional practices within the realm of F&A and invoice payments. However, for this potential to be realized, CFOs must demonstrate openness to experimentation, allowing themselves to explore the tangible impact of Gen AI in Finance and Accounting functions.

Embarking on this journey necessitates a focused exploration of Gen AI’s applicability, particularly within accounts receivable management and invoice payments. By delving into this domain, CFOs can gain firsthand insight into the transformative power of Gen AI in Accounts Receivable. As with any strategic business investment, it is prudent to assess the anticipated returns and the timeframe within which these benefits can be realized.

In essence, embracing Gen AI in accounts receivable and invoice payments represents not only a technological advancement but also a strategic imperative for forward-thinking finance leaders. By embracing innovation and fostering a culture of experimentation, organizations can unlock unprecedented efficiency, agility, and competitive advantage in the ever-evolving landscape of finance and accounting.

How Can Gen AI Revolutionize Your Accounts Receivable Process?

Irrespective of the organization, to ensure optimal efficiency within the accounts receivable function and to explore the potential of integrating Gen AI powered Accounts receivable, it is essential to adopt a strategic approach centered around four key building blocks. These pillars serve as the foundation for effective management and innovation in accounts receivable:

Receivable Antecedents :

This encompasses the meticulous orchestration of all preliminary tasks necessary to establish a receivable. From the initial engagement with clients to the negotiation of terms, to the careful documentation of agreements, each step in this process demands precision and foresight. Building strong receivables antecedents lays the foundation for smooth transactions, timely invoice payments and ensures a robust financial framework

They include:

Customer Onboarding: Accurate customer data collection, credit checks, and setting credit limits.

Sales Order Processing: Efficiently converting orders into invoices.

Contractual Agreements: Clear terms and conditions regarding payment terms, discounts, and penalties.

Order Fulfillment: Ensuring timely delivery of goods or services.

Timely Invoicing: Generate invoices promptly after goods/services are delivered.

Clear and Accurate Invoices: Ensure clarity, itemization, and correct pricing.

Invoice Presentment and Reminders:

In the dynamic landscape of revenue management, the presentation of invoices holds paramount importance. It transcends beyond mere documentation; it embodies the essence of your transactions, encapsulating the value exchanged with your clients. Your approach to invoice presentment and invoice payments is characterized by clarity, accuracy, and timeliness. Moreover, one need to recognize the strategic significance of reminders in facilitating prompt invoice payments. Through proactive communication and gentle nudges, you endeavor to uphold transparency, nurture client relationships, and optimize cash flow dynamics.

This step involves creating and delivering invoices to customers:

Multiple Channels: Offer electronic and paper-based invoice delivery to facilitate invoice payments.

Standard Payment Reminder Schedule:

o Set a consistent schedule for sending payment reminders. This helps maintain clarity and predictability for both you and your clients.

o Send reminders before the due date to gently prompt clients to pay on time.

o Issue reminders close to the actual due date to emphasize the urgency.

• Personalized Reminders:

o Customize your reminders to suit each client. Address them by name and include relevant details.

o Personalization shows that you value the relationship and encourages prompt payment.

• Politeness and Professionalism:

o Maintain a polite and professional tone in your reminders.

o Avoid threatening language or negativity that could harm the client relationship.

o Clearly state the purpose of the reminder and the essential details, such as the invoice number, amount due, and due date.

Collaboration :

Collaboration lies at the heart of your approach, both externally with your valued customers and internally among your team members and departments. Externally, effective collaboration involves understanding your clients’ needs, communicating transparently, and working together to resolve any issues or discrepancies promptly. Internally, collaboration ensures alignment across functions, streamlines processes, and maximizes efficiency, ultimately leading to superior customer service and satisfaction.

Effective communication is crucial:

Customer Communication: Regular follow-ups, addressing queries, and resolving disputes.

Internal Coordination: Collaboration between sales, finance, and customer service teams.

Dispute Resolution: Swiftly address any discrepancies.

Payments and receipt management :

Efficient management of invoice payments and receipts is essential for maintaining cash flow and optimizing financial performance. This includes implementing secure and convenient payment channels, diligently tracking incoming payments, and promptly reconciling accounts. By prioritizing invoice payments and receipt management, you can minimize delays, mitigate risks, and ensure the stability and resilience of our financial ecosystem.

Efficient handling of incoming invoice payments:

Payment Channels: Accept various methods (credit cards, bank transfers, etc.).

Reconciliation: Match payments with outstanding invoices.

Cash Application: Apply payments accurately to the correct accounts.

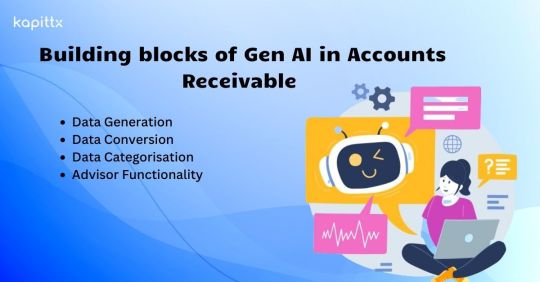

What are the building blocks of Gen AI in Accounts Receivable?

Overall, Gen AI in accounts receivable encompasses a wide range of capabilities making it a versatile tool for various applications across different domains. A few of the core building blocks are –

Data Generation: Gen AI In accounts receivable, can generate synthetic data to augment existing datasets used for training predictive models. For example, it can create simulated customer invoice payments histories, including variations in payment amounts, frequencies, and timing. This synthetic data allows organizations to train their models more comprehensively, improving the accuracy of predictions regarding future payment behavior.

Data Conversion: Gen AI in accounts receivable can facilitate the conversion of data between different formats in the accounts receivable process. For instance, it can automatically convert paper-based invoices into digital formats by extracting relevant information such as invoice numbers, amounts, and due dates using optical character recognition (OCR) technology. This conversion streamlines the invoicing process, reducing manual effort and minimizing errors.

Data Categorization: Gen AI in accounts receivable, can categorize transactions based on various criteria such as invoice payment methods, customer segments, or invoice statuses. For example, it can automatically classify incoming invoice payments as cash, checks, or electronic transfers, allowing finance teams to track payment trends and reconcile accounts more efficiently. By categorizing transactions accurately, Gen AI powered accounts receivable enhances data organization and facilitates deeper insights into receivables management.

Advisor Functionality: Gen AI in accounts receivable serves as an intelligent advisor by providing actionable insights and recommendations based on analyzed data. For example, it can identify patterns of late invoice payments or discrepancies in invoicing that may indicate potential issues with specific customers or billing processes. By alerting finance teams to these anomalies, Gen AI powered accounts receivable enables proactive intervention to mitigate risks and optimize cash flow management.

Overall, Generative AI enhances the efficiency and effectiveness of accounts receivable operations by generating data, facilitating data conversion, categorizing transactions, and providing intelligent advisory support. By leveraging Gen AI capabilities, organizations can streamline receivables management processes, improve decision-making, and ultimately enhance financial performance.

#ar automation solution#AI in Accounts Receivable#ar collection#Payment Reminder#cashflow management#AI In Finance & Accounting

2 notes

·

View notes

Text

Accounts payable and Accounts receivable Solutions

Accounts payable and accounts receivable are two important aspects of a business's financial management. Accounts payable refers to the amount of money a business owes to its creditors, such as suppliers or vendors, for goods or services that have been received but not yet paid for. Accounts receivable, on the other hand, refers to the amount of money that a business is entitled to receive from its customers for goods or services that have been sold but not yet paid for. To effectively manage these two areas, businesses can use a variety of solutions such as software or cloud-based systems to automate and streamline the process of recording and tracking transactions, generating invoices, and making payments. Additionally, businesses can use tools such as credit scoring and collections management to manage their receivables and reduce their risk of bad debt. Overall, effectively managing accounts payable and accounts receivable is crucial for maintaining a healthy cash flow and ensuring the financial stability of a business.

3 notes

·

View notes

Text

You apply for 20 jobs on Indeed. The silence is deafening.

You apply for 20 jobs on Indeed. Half of them require you to create an account on the company website. You leave a trail of ghost accounts that will be used once and never again. You never receive a response.

You apply for 20 jobs on Indeed. One employer offers an interview, but it's so rare for you to receive any response that you forget to check the website and you miss the time.

You apply for 20 jobs on Indeed. One employer offers an interview, but you don't know the magic words that signal to the esoteric mind of an interviewer that you're fit for the job.

You apply for 20 jobs on Indeed. One employer e-mails you saying that 'unfortunately, you do not have the qualifications we are looking for'. You check the job again and see you applied to be a menial labourer.

You apply for 20 jobs on Indeed. Half of them require a car. No one stops to ask how you're supposed to afford one with no job.

You apply for 20 jobs on Indeed. One employer offers a job. The commute makes you want to die in your sleep.

You call the HR manager for the workplace in hopes of arranging an interview more directly. They don't even have an answering machine.

Employers complain that no one wants to work anymore.

65K notes

·

View notes

Text

In today's highly competitive business landscape, maintaining a healthy cash flow is crucial for sustainable growth and success. One area that significantly impacts cash flow is account receivable management. Effective management of account receivables ensures that your business receives payments promptly, minimizing outstanding debts and maximizing revenue. Alqada.ae understands the importance of efficient account receivable management and provides tailored solutions to help businesses optimize their financial operations.

0 notes

Text

In today's highly competitive business landscape, maintaining a healthy cash flow is crucial for sustainable growth and success. One area that significantly impacts cash flow is account receivable management. Effective management of account receivables ensures that your business receives payments promptly, minimizing outstanding debts and maximizing revenue. Alqada.ae understands the importance of efficient account receivable management and provides tailored solutions to help businesses optimize their financial operations.

0 notes

Text

Learn the ins and outs of efficient Hospital accounts receivable management in healthcare. Discover more!

#Hospital accounts receivable management#Hospital accounts receivable#Hospital AR Billing#Hospital accounts receivable services

0 notes

Text

8 Ways RCM Automation is Fueling Your AR Efficiency

In this post, we will explore the significant impact of Revenue Cycle Management (RCM) automation on Accounts Receivable (AR) efficiency. We will delve into the various ways in which automation technology is revolutionizing the healthcare revenue cycle landscape, particularly in streamlining AR processes and improving overall financial performance.

#RCM#revenue cycle management#revenue cycle services#RCM automation#RCM technology#Account Receivable

1 note

·

View note

Text

Facts About Factoring That Could Cost You Money

Photo by Mikhail Nilov on Pexels.com

Factoring, a financial transaction where a business sells its accounts receivable to a third party (the factor) at a discount, can be a lifeline for businesses in need of immediate cash flow. However, while factoring can provide crucial short-term financial relief, there are aspects of it that could end up costing your business more money than anticipated.…

View On WordPress

#accounts receivable#business finance#business funding#business growth#cash flow#cash flow management#cost assessment#factoring#factoring benefits#factoring costs#factoring fees#financial decision-making#financial management#financial solution#Financial stability#financial strategy#financial tools#Freight#freight industry#Freight Revenue Consultants#interest rates#Invoice factoring#invoice financing#liquidity#non-recourse factoring#recourse factoring#small carriers#small-business#Transportation#Trucking

0 notes

Text

Securing B2B Enterprise SaaS Subscription Payments On Time

The global B2B SaaS market is projected to experience significant growth from 2024 to 2032. This expansion is driven by the rising demand for cloud-based software solutions that enhance business efficiency and cost-effectiveness.

The B2B SaaS industry offers a variety of solutions, including Customer Relationship Management (CRM), Human Resources (HR), Enterprise Resource Planning (ERP), and project management software. These tools are designed to automate and streamline business operations, foster collaboration, and boost productivity.

Based on the size of the target customers, broad-level go-to-market (GTM) segmentation for B2B SaaS subscription management includes:

Small and Medium Enterprises (SMEs)

Mid-Market

Large Enterprises

For SaaS subscription payments, SMEs are typically willing to use credit cards to access B2B SaaS products. However, Mid-Market and Large Enterprises often prefer to operate on credit terms, which necessitates managing accounts receivable.

For SaaS subscription payments, SMEs are typically willing to use credit cards to access B2B SaaS products. However, Mid-Market and Large Enterprises often prefer to operate on credit terms, which necessitates managing accounts receivable.

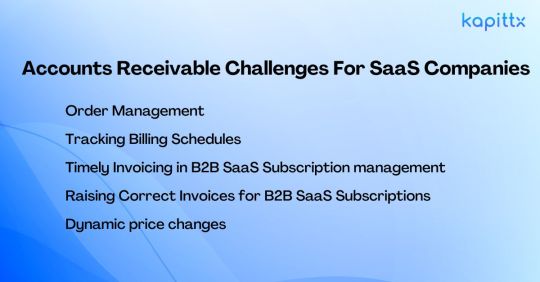

Accounts Receivable Challenges for SaaS Companies

Running a B2B SaaS Subscription management business is incredibly challenging. In today’s hyper-competitive market, in your SaaS subscription business, you must manage multiple aspects such as onboarding, adoption, upselling, customer success, retention, and churn.

The last thing you want to worry about is accounts receivable management.

This is particularly true for enterprise SaaS companies, where users often do not provide credit card details for auto-debit transactions. Consequently, you are compelled to offer ‘invoice payment’ terms. This means, similar to traditional businesses, you invoice clients and typically collect payment 30 days later, hoping the customer pays on time.

1. Order Management

Enterprise customers typically issue a Purchase Order (PO) for any product or service, and B2B SaaS subscriptions are no exception. These POs capture deliverables and commercial terms that should be thoroughly examined before acceptance.

Payment terms may include milestone payments for integration and onboarding, the start of the go-live subscription, and usage-based rates. It’s important to note that customers rely on their internal documents for commercial and payment terms, not just your published plan.

As your business grows and the number of orders increases, tracking SaaS subscription milestone payments can become overwhelming and time-consuming. Implementing an order-to-cash and subscription management tool like Kapittx can significantly streamline this process and support your growth.

2. B2B SaaS Subscription Billing Challenges: Tracking Billing Schedules:

Managing B2B SaaS subscription billing schedules requires attention to detail, clear communication with customers, and the right tools. By leveraging subscription billing tracking solutions like Kapittx, companies can streamline their processes, reduce errors, and ensure timely payments.

A. Diverse Billing Plans:

B2B SaaS subscription companies offer various billing plans to accommodate different customer needs. These plans can include monthly, quarterly, bi-annually, or yearly billing cycles. Each billing plan has its own set of terms and conditions, affecting the frequency and timing of payments.

B. Go-Live Dates vs. Billing Dates:

Some SaaS companies tie billing dates to the go-live dates of their services. For example, if a customer’s software implementation goes live on the 15th of the month, their billing cycle might start from that date. However, other companies have a policy of billing for the entire month, regardless of the go-live date. This can lead to confusion and misalignment between service usage and billing periods.

C. Customer-Specific Billing Dates:

Different customers may have unique billing dates based on their contract terms or historical preferences. Managing multiple billing schedules simultaneously can become complex, especially when dealing with a large customer base.

D. Subscription Billing Tracking Tools:

Implementing a robust subscription billing tracking tool can streamline the entire process. Such tools can:

Centralize Billing Information: Store billing details for each customer, including billing frequency, due dates, and payment history.

Automate Reminders: Send automated reminders to customers before their payment due dates.

Generate Invoices: Create accurate invoices based on the billing plan and customer-specific terms.

Handle Prorated Charges: Manage mid-cycle changes (e.g., upgrades, downgrades) and calculate prorated charges accordingly.

3. The Importance of Timely Invoicing in B2B SaaS Subscription management:

Timely invoicing not only ensures smoother financial operations but also fosters positive relationships with your customers. Enterprises follow specific payment processing cycles, often with a credit period that extends a certain number of days after the invoice date. If you issue the invoice late, it directly impacts the payment processing timeline. Late invoices lead to delayed payments.

For SaaS subscription companies, maintaining healthy cash flow is essential. Timely payments from customers contribute significantly to this. Late payments can disrupt financial planning, hinder growth, and strain operational resources.

Avoiding Payment Delays – When you bill on time, you increase the chances of receiving payments promptly. Late invoices may result in delayed approvals, additional processing time, and potential disputes.

Monthly billing cycles can be particularly tricky. Missing a billing cycle means you might end up submitting two months’ worth of invoices simultaneously. This situation can confuse customers and create administrative challenges.

With Kapittx a b2b SaaS subscription management proactively monitor SaaS subscription billing due dates closely. You can maintain a billing calendar that tracks all customer invoices that Include billing dates, due dates, and follow-up actions.

4. Raising Correct Invoices for B2B SaaS Subscriptions

Accurate and transparent invoicing contributes to a smoother billing process and fosters positive relationships with your customers.

Many SaaS subscription plans are based on usage metrics. These metrics could include the number of users, data consumed, or other measurable factors. For example, a company might pay based on the number of active users or the volume of data processed through the SaaS platform.

Differential user rates add complexity to billing. Some users may be on a basic plan, while others might have access to premium features. Managing these variations accurately is crucial to avoid disputes and ensure fair billing.

Transparency about user counts and consumption is vital. Customers should easily verify the details on their platform. Providing clear usage reports or dashboards helps build trust and minimizes billing discrepancies. When generating invoices, ensure that they reflect the actual usage and user rates.

Consequences of Ineffective arm accounts receivable management leading to accounts receivable challenges can be due to an inadequate AR process which can trigger a cascade of issues:

5. Dynamic price changes

Enterprise SaaS subscription plans may have a base plan for X users and a pre-agreed rate for additional users. Further some deals which are long-term could have pre-agreed price escalation clauses. All these complexities need a sophisticated SaaS Subscription Management system.

Challenges in SaaS Subscription Receivables Management

High Days Sales Outstanding (DSO):

DSO measures the average number of days it takes to collect payment from customers after a sale. Slow payment from customers can strain a company’s cash flow and profitability.

Management Time and Efficiency:

Managing accounts receivable can be time-consuming, especially when processes are inefficient or manual.

Delays in Invoice Submission:

Timely invoice submission is essential for prompt payment. Identifying bottlenecks that impact invoice submission is critical.

Streamlining SaaS Subscription Payments with Kapittx

Kapittx offers innovative solutions to address these challenges:

Automation: Kapittx replaces manual processes with automation, reducing the time spent on routine tasks. It streamlines invoice submission, payment reconciliation, and alerts.

Integration: By integrating Kapittx with your ERP Billing platform, you create a seamless flow of information. Alerts for delays, risks, and other critical events are delivered in real time.

Complete Control: Kapittx provides end-to-end visibility into the invoice-to-cash lifecycle. You gain control over receivables, ensuring timely collections and minimizing financial risks2.

In summary, Kapittx not only helps manage SaaS subscriptions efficiently but also empowers you with better control over your accounts receivable processes. Feel free to explore Kapittx further to optimize your financial stability

Click here to see a case study from Kapittx.

Request a demo today.

Check out Kapittx’s LinkedIn here.

#ai in accounts receivable#ai powered accounts receivable#ar management#cashflow management#accounts receivable automation software#ai based accounts receivable#ar collection#ar automation solution#ar tool

1 note

·

View note

Text

Supercharge Your Cash Flow with SAP S/4HANA Accounts Receivable

Are outdated AR processes holding you back? Upgrade to SAP S/4HANA Accounts Receivable!

Experience:

Integrated intelligence: Automate tasks, predict risks, and optimize processes with AI-powered features.

Enhanced collaboration: Collaborate seamlessly across departments for better decision-making.

Future-proofed solution: Scale with confidence thanks to continuous innovation and updates.

Are you ready to take your accounts receivable management to new heights?

Explore our blog for cutting-edge insights and expert predictions: "Mastering Accounts Receivable Management with SAP S/4HANA"

Ready to see the green? Contact us today!

1 note

·

View note