#Aadhaar Updatation Form

Explore tagged Tumblr posts

Text

আধার কার্ড আছে? বিনামূল্যে পাবেন কেন্দ্রের কোন পরিষেবা? জেনে নিন কী কী করতে হবে

Aadhaar update free service: আধার কার্ড রয়েছে আপনার? তাহলে কেন্দ্রীয় সরকারের এই বিশেষ পরিষেবা একেবারে বিনামূল্যে পাবেন আপনি। জেনে নিন পরিষেবা পছতে কী কী করবেন। Source link

View On WordPress

#aadhaar update form#aadhaar update last date#aadhaar update online#aadhaar update status#aadhaar update status check#আধার আপডেট#আধার আপডেট করার নিয়ম#আধার আপডেট কিভাবে করবো#আধার আপডেট শেষ তারিখ

0 notes

Text

Understanding Tax Refunds: JJ Tax made it easy

Handling tax refunds can seem overwhelming, but having a clear grasp of the process can make it straightforward. This newsletter aims to demystify tax refunds by covering key aspects: eligibility criteria, claiming procedures and tracking your refund status.

What is a Tax Refund?

A tax refund represents the amount returned to taxpayers who have overpaid their taxes over the fiscal year. This situation arises when the total tax deducted or paid exceeds the actual tax liability determined based on their income.

In India, tax payments are made through TDS (Tax Deducted at Source), advance tax, or self-assessment tax. When the total tax paid or deducted surpasses your tax liability as calculated in your Income Tax Return (ITR), the excess amount is refunded. This mechanism ensures taxpayers are reimbursed for any overpayments.

Who is Eligible for a Tax Refund?

Eligibility for a tax refund depends on various factors:

Excess Tax Payments If your TDS or advance tax payments exceed your tax liability, you’re eligible for a refund. This often applies to salaried employees, freelancers, and individuals with taxable investment income.

Claiming Deductions If you claim deductions under sections like 80C, 80D, etc., and these deductions lower your tax liability below the total tax paid, a refund may be due.

Filing an Income Tax Return Only those who file their Income Tax Return can claim a refund. The return must accurately reflect your income, deductions, and tax payments to establish if a refund is warranted.

Losses to Set Off If you have losses from previous years or the current year that can be carried forward and set off against current year income, you might be eligible for a refund if these losses reduce your tax liability.

Who is Not Eligible for a Tax Refund?

Certain situations or individuals may not qualify for a tax refund:

Income Below Taxable Threshold If your total income is below the taxable limit, a refund may not be applicable.

Salary Below Government Criteria Individuals earning below the minimum threshold specified by the Government of India may not qualify for a refund.

No Overpayment If your tax payments match your tax liability or you haven’t overpaid, a refund will not be available.

Non-Filers or Incorrect Filers Those who fail to file their Income Tax Return or file it incorrectly will not be eligible for a refund. Proper filing is essential for initiating the refund process.

Invalid Deductions Claims for deductions that do not meet tax regulations or lack valid documentation may result in a refund rejection.

Incorrect Bank Details If the bank account information provided in your ITR is incorrect or incomplete, the refund may not be processed.

How to Claim Your Tax Refund

Here’s a step-by-step guide to claiming your tax refund:

File Your Income Tax Return (ITR) Access the Income Tax Department’s e-filing portal. Choose the correct ITR form based on your income sources and eligibility. Accurately complete all required details, including income, deductions, and tax payments.

Verify Your ITR Verify your ITR using Aadhaar OTP, net banking, or by sending a signed ITR-V to the Centralised Processing Centre (CPC). Verification must be completed within 120 days of filing your ITR.

ITR Processing The Income Tax Department will process your return, assess your tax liability, and determine the refund amount. This process can take a few weeks to several months.

Refund Issuance After processing, the refund will be credited directly to your bank account. Ensure your bank details are accurate and up-to-date in your ITR.

Update Bank Account Details (if needed) If your bank details change after filing your ITR, promptly update them on the e-filing portal to ensure correct refund crediting.

How to Check Your ITR Refund Status for FY 2024-2025

To check your refund status, follow these steps:

Visit the Income Tax E-Filing Portal Go to the official Income Tax Department e-filing website.

Access the 'Refund Status' Section Navigate to the ‘Refund Status’ page, typically under the ‘Services’ tab or a similar heading.

Enter Required Details Input your PAN (Permanent Account Number) and the assessment year for your filed return.

Review the Status The portal will show the status of your refund, including whether it has been processed, approved, or if further action is needed.

Track Refund Processing Keep an eye on any updates or notifications from the Income Tax Department regarding your refund.

Understanding the tax refund process can simplify the experience. By following these steps and staying informed about your eligibility, you can make sure that you have a smooth process and quickly receipt of any excess tax payments. For expert guidance and personalized assistance, consult with JJ Tax. Visit our website or contact us today to get the support you need for all your tax-related queries.

JJ Tax

2 notes

·

View notes

Text

Get Instant Business Loans – Long & Short Term Options Without CIBIL Check (India 2025)

Struggling with funds for your business in 2025? Whether you're a startup founder, small shop owner, or freelancer, you don't need perfect CIBIL or heavy paperwork anymore. Here's your ultimate guide to getting instant approval for long-term and short-term business loans in India today!

Why You’re Here — And Why This Article Will Help

You probably searched something like:

“How to get a business loan without CIBIL?”

“Long-term business loan with low interest in India 2025”

“Short-term loan for a startup with no documents”

And guess what? You’re exactly in the right place.

Because this post breaks down EVERYTHING — from interest rates, documents, comparison, to term loan types and top platforms — all written like a human, for humans (not just search engines).

What is a Business Term Loan?

A business term loan is a fixed amount of money borrowed for business needs, repaid in EMI over a set tenure — either short-term or long-term.

It’s simple:

You borrow a lump sum

You repay with interest over months or years

Can be secured or unsecured

Depending on your needs and stage, you can pick:

Short Term Loans – quick funding, small ticket (1–24 months)

Long Term Business Loans – growth-focused, large ticket (2–10+ years)

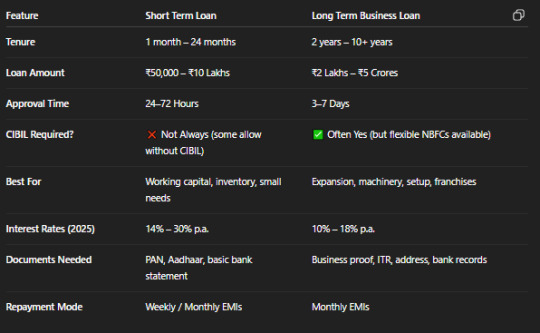

Short vs Long Term Business Loans – 2025 Comparison Table

Who Should Choose Which Type?

Go for Short Term Loans if:

You're a new business or freelancer

You need quick cash to manage operations

You don’t have a solid CIBIL or ITR

Go for Long Term Business Loans if:

You're expanding, buying equipment, hiring, or scaling

You have basic financials in place

You want low EMI with structured repayments

Best Term Loan Providers in India 2025

Here are the top platforms and companies offering both short and long-term business loans in India:

1. Bajaj Finserv

Long-term business loan up to ₹5 Cr

Collateral-free for MSMEs

Term loan interest rates from 10.5% p.a.

2. Lendingkart

Instant short-term loan without CIBIL

No collateral up to ₹50 lakhs

Ideal for startups or small vendors

3. NeoGrowth

Business loan term of 12–48 months

EMI from POS transactions (great for shops)

Low-doc loans even with poor credit

4. Indifi, FlexiLoans, PayMe India

Short-term loans, even without income proof

Fast disbursal via digital KYC

Best for Tier 2/3 cities & self-employed

Documents Required for Business Loans (2025 Update)

Here’s what you’ll usually need to apply online:

PAN card (Personal + Business)

Aadhaar card

Bank statement (last 6 months)

UDYAM / GST certificate (if available)

ITR (only for long-term loans)

Pro Tip: Some lenders offer short-term loans without income proof or a CIBIL check. Apply smartly.

Real Story That Inspires Trust

Meet Shweta, a 24-year-old home baker from Jaipur. She had no business registration or ITR. But using her bank statement and Aadhaar, she got a ₹1.5 lakh short-term business loan through a fintech app in 2024. Within 6 months, she repaid on time and became eligible for a ₹5 lakh long-term loan for her baking studio.

This is the power of today’s digital term loans.

How to Apply for a Term Loan Online in 2025

Decide Your Need Short term for urgency, long term for growth

Choose Platform Visit Investkraft.com or fintech lender websites

Fill Digital Form PAN, Aadhaar, mobile, business details

Upload Docs / Connect Bank Some lenders allow auto-fetch

Get Instant Approval Loans under ₹5L can be disbursed in 1–2 days

5 Most Searched FAQs in 2025

1. Can I get a term loan for business without CIBIL?

Yes. Many short-term digital lenders don’t require a CIBIL check. Even some NBFCs are flexible.

2. What is the interest rate on business term loans in 2025?

Ranges between 10% – 30% per annum, depending on your profile and lender type.

3. Can I get a business loan with a low income?

Yes, especially short-term loans without income proof. Just ensure decent bank activity.

4. What is the best long-term loan company in India?

Bajaj Finserv, Lendingkart, NeoGrowth, and Axis Bank offer solid long-term options in 2025.

5. What is the difference between short and long-term business loans?

Short term = 1–24 months (quick fix), Long term = 2–10+ years (for serious growth plans).

Final Words: Don’t Let Paperwork or Credit Score Stop Your Business Dream

2025 is not like the old days. You no longer need to wait in line at banks, get rejected for “low credit”, or waste weeks arranging documents.

Whether it’s a term loan for a new business or a long-term loan for expansion, you can now:

Apply 100% online

Get approved without CIBIL

Fund your business in as little as 24 hours

So why wait? Explore the best short and long-term loan options for your business goals.

#long term business loans#business term loan#long term business loan#business term loans#business loans long term#long-term business loan#long-term business loans#short and long term loans#term loans features#business loan long term#term loan business#long term loan companies#term loan for business#interest on term loan#term loan for new business#term business loan#business loan term#site:investkraft.com#Short Term Loans#Term Loan#Instant Short Term Loan#short term loan without cibil#Term Loan Interest Rates

0 notes

Text

New Income Tax Rules: Updates in ITR Filing for AY 2025–26 (Old Regime Return Filers)

The Income Tax Department has introduced several important updates for Assessment Year (AY) 2025–26, particularly for taxpayers filing under the old tax regime. These changes are aimed at improving compliance, ensuring greater transparency, and simplifying the return filing process. If you're unsure how these updates affect your situation, consulting experienced income tax filing consultants can help you file your return accurately and on time.

What’s New for AY 2025–26 (Old Regime Filers)?

Revised ITR Forms

Forms like ITR-1 and ITR-2 have been revised to improve clarity and data capture. Salaried individuals, pensioners, and small business owners must choose the correct form based on their income type and sources.

Mandatory Disclosure Requirements

Taxpayers must now disclose more information, including details of foreign assets, exempt income, and capital gains. Tax returns with mismatched data from Form 26AS or AIS may not be processed smoothly and can invite compliance issues.

New Declaration Rule – Form 10 IEA

If you want to continue under the old regime, submitting Form 10IEA before filing your return is mandatory. Otherwise, the system may default you to the new regime.

Penalty for Late Filing

Missing the due date can attract a penalty of up to ₹5,000 and interest on outstanding tax. Non-audit returns must be filed by 31st July 2025, whereas audit cases have a deadline of 31st October 2025.

Benefits of Filing Income Tax Return

Claim refunds on TDS deducted

Helps with loan and visa applications

Avoid tax notices and penalties

Build financial credibility

Maintain clean tax records

Filing your income tax return on time is important for everyone salaried, freelancers, and self-employed individuals.searching for ITR filing services near me?

FAQ’s

1. Old vs New Regime – Which is better for salaried individuals?

If you claim deductions like 80C, HRA, or home loan interest, the old regime could offer better benefits.

2. What documents are needed for ITR filing?

PAN, Aadhaar, Form 16, investment proofs, TDS certificates, bank statements, and rent receipts (if HRA claimed).

3. Can I revise my return after filing?

Yes, you can revise it before the end of the assessment year or before it is processed.

4. How can income tax consultants help?

They ensure accurate filing, maximize deductions, and assist in responding to IT department notices.

New ITR rules demand more accuracy! For expert guidance, trust Sri Balaji Tax Services your reliable ITR filing consultants in Hyderabad.

Connect with Sri Balaji Tax Services trusted tax consultants in Hyderabad offering expert filing support.

0 notes

Text

claim shares from iepf

Expert Assistance to Reclaim Your Unclaimed Mutual Funds: Secure Your Investments Today:

Mutual funds have become a popular investment option, but many individuals unknowingly leave their investments unclaimed. Unclaimed mutual funds arise when investors lose track of their investments, fail to redeem them, or encounter challenges in claiming them. Understanding how to reclaim mutual funds is crucial for recovering these investments claim shares from iepf, whether they stem from personal neglect, incomplete documentation, or unforeseen circumstances.

In this comprehensive guide, we provide insights into the nature of unclaimed mutual funds, the reasons they go unclaimed, and actionable steps to reclaim mutual funds efficiently..

What Are Unclaimed Mutual Funds?

Unclaimed mutual funds refer to investments left untouched by investors for an extended period. These funds are typically categorized as unclaimed when dividends, redemption payouts, or other proceeds remain unpaid or unclaimed beyond their due period.

Sources of Unclaimed Mutual Funds

1. Forgotten Investments:

Investments made years ago without proper record-keeping.

2. Inactive Bank Accounts:

Redemption amounts not credited due to closed or dormant bank accounts.

3. Incomplete Nomination Details:

Nominees unaware of the investment post the investor's demise.

4. Address Changes:

Communication failures due to outdated contact information Duplicate share certificate.

Why Do Mutual Funds Go Unclaimed?

Several factors contribute to the accumulation of unclaimed mutual funds:

1. Lack of Awareness:

Investors often forget small, one-time investments made over the years.

2. Non-Updation of Details:

Changing phone numbers, email addresses, or bank accounts without updating mutual fund records.

3. Poor Documentation Practices:

Misplacing investment records or failure to inform heirs about investments.

4. Investor Demise:

Nominees or legal heirs unaware of the deceased's investment portfolio.

How to Reclaim Mutual Funds?

Reclaiming mutual funds involves a systematic approach, ensuring all necessary documentation and procedural requirements are met. Here’s a detailed guide on how to reclaim the mutual funds iepf:

Step 1: Identify the Fund Details

Use statements, account numbers, or folio numbers to identify the mutual fund in question.

Visit the respective mutual fund company’s website or contact their customer care.

Step 2: Verify Unclaimed Status

Check the unclaimed amounts via the investor's dashboard or the Association of Mutual Funds in India (AMFI) portal.

Step 3: Prepare Necessary Documentation

Valid ID proof (Aadhaar card, PAN card).

Address proof.

Bank account details for payout.

Legal documents such as death certificate, succession certificate, or will (in case of deceased investors).

Step 4: Submit the Claim

Fill out the required claim forms.

Submit the documents to the respective fund house or registrar (e.g., CAMS, KFintech).

Step 5: Follow Up

Regularly check the claim status online or by contacting the fund house.

Special Cases: Reclaiming Mutual Funds by Nominees or Legal Heirs

When the original investor is deceased, how to reclaim mutual funds as a nominee or legal heir involves additional steps iepf claim:

1. Nominee Claims:

Provide death certificate, ID proof, and nominee details to initiate the claim.

2. Legal Heir Claims:

Submit a succession certificate, probate of will, or legal heir certificate if no nominee was assigned.

3. Joint Holders:

In case of joint holding, the surviving holder can claim the funds with supporting documentation.

How Asset Retrieval Advisors Can Help

Navigating the complexities of retrieving unclaimed mutual funds can be daunting. Asset Retrieval Advisors offers expert guidance and end-to-end assistance to ensure a seamless process.

Our Services Include:

Identifying and verifying unclaimed mutual funds.

Compiling necessary documents for submission.

Liaising with fund houses and registrars to expedite the process.

Legal assistance for claims involving nominees or heirs.

Benefits of Reclaiming Mutual Funds iepf share transfer.

Reclaiming unclaimed mutual funds provides both financial and emotional benefits:

1. Recover Forgotten Wealth:

Retrieve unclaimed mutual funds to strengthen your financial portfolio.

2. Financial Security for Heirs:

Ensure rightful distribution of investments among beneficiaries.

3. Tax Efficiency:

Timely claims can help in better tax planning and compliance.

Challenges in Reclaiming Mutual Funds

Despite the process being outlined, several hurdles may arise during the claim:

1. Missing Records:

Difficulty locating old investment documents or folio numbers.

2. Procedural Delays:

Lengthy verification and approval times by fund houses or registrars.

3. Legal Complications:

Lack of nomination details leading to disputes or legal complexities.

Steps to Prevent Unclaimed Mutual Funds

1. Update Personal Details:

Regularly update contact information and bank account details with the mutual fund company.

2. Nomination Registration:

Assign nominees to all your mutual fund investments.

3. Maintain Records:

Keep a well-organized record of all investments and share it with trusted family members.

Why Choose Asset Retrieval Advisors?

At Asset Retrieval Advisors, we specialize in helping investors and their heirs retrieve unclaimed mutual funds with ease and efficiency.

Our Advantages:

Expert Knowledge: A deep understanding of claim processes and regulatory requirements.

Tailored Solutions: Customized support for individual cases iepf shares.

Comprehensive Assistance: From documentation to legal support, we handle it all.

Call to Action

Secure Your Investments Today!

Don’t let your investments remain unclaimed. Let Asset Retrieval Advisors help you recover your unclaimed mutual funds with ease.

Call us at [+919810498110] or fill out our Enquiry Form to get started now.

Conclusion

Unclaimed mutual funds represent a significant portion of unclaimed financial assets, often due to negligence or unforeseen circumstances. By understanding how to reclaim mutual funds and seeking professional assistance, you can ensure your hard-earned investments are not lost.

At Asset Retrieval Advisors, we are committed to making the process seamless and hassle-free. Contact us today to reclaim your unclaimed mutual funds and secure your financial future!

Touch With Us:

iepf shares recovery

Lost physical share certificate

shares transfer to iepf

transmission of shares

unclaimed mutual fund

#iepf shares recovery#iepf claim process#iepf share transfer#how to claim iepf shares#demat of physical shares#iepf unclaimed shares#iepf

0 notes

Text

Rani Laxmi Bai Scooty Yojana Form 2025: Empowering Girls Through Mobility

Introduction

In a positive step toward empowering women and encouraging higher education for girls, the government has launched the Rani Laxmi Bai Scooty Yojana 2025. This program provides free or subsidized scooters to deserving girl students, allowing them to pursue their education or vocational training without transportation issues.

This initiative is part of various UP government schemes and has garnered interest from states like Bihar, which may introduce similar programs in the future. It shows how support from local government can make a real difference in people's lives.

What is the Rani Laxmi Bai Scooty Yojana 2025?

The Rani Laxmi Bai Scooty Yojana is a welfare program aimed at providing scooters to academically strong or economically disadvantaged girl students. It not only improves access to education but also tackles issues of women's safety and independence.

Key Objectives:

- Encourage female education beyond 12th grade.

- Reduce dropout rates among girls due to transportation problems.

- Provide women from rural and urban areas with freedom and mobility.

Eligibility Criteria

To apply for the Rani Laxmi Bai Scooty Yojana Form 2025, applicants must meet these conditions:

- Must be a resident of Uttar Pradesh.

- Only girls who passed Class 12 in 2024–2025 with high marks can apply.

- The household income should not exceed ₹2.5 lakhs.

- The applicant must not already own a two-wheeler.

- Preference is given to students from SC/ST/OBC categories.

Note: Some criteria may vary based on updates from local government offices.

Documents Required

When filling out the Rani Laxmi Bai Scooty Yojana Form 2025, have these documents ready:

- Aadhaar Card

- 12th Marksheet (2024–2025)

- Domicile Certificate

- Income Certificate

- Caste Certificate (if applicable)

- Recent Passport Size Photo

- Bank Account Passbook (linked with Aadhaar)

- Mobile Number (linked with Aadhaar)

How to Apply Online – Step-by-Step Guide

Applying for the scheme is easy through the official state government portal. Here’s how to do it:

1. Visit the official UP government scheme portal or your nearest Block Level Government office.

2. Click on “Rani Laxmi Bai Scooty Yojana 2025.”

3. Register using your mobile number and the Aadhaar-linked OTP.

4. Fill out the application form with correct personal and educational information.

5. Upload all scanned documents in PDF or JPG format.

6. Submit the form and download the acknowledgment slip.

Once submitted, your application will be reviewed by officials at the Block Level Government and district level for verification.

Selection Process

- Based on merit (marks scored in Class 12).

- Consideration of financial background.

- A final list will be published on the official portal or at local notice boards.

- Selected candidates will receive notifications through SMS and email for document verification and the scooty distribution event.

Benefits of the Scheme

- Free or subsidized scooters worth ₹65,000–₹75,000.

- Helps reduce dropout rates and increase enrollment in colleges and skill centers.

- Supports women’s safety, especially in rural areas where public transport may not be reliable.

- Promotes self-sufficiency and contributes to women empowerment.

Impact on Other States: Bihar Government Scheme Reference

While this program is currently active in UP, there is growing interest in similar initiatives in upcoming Bihar government schemes. Due to its success and high demand, Bihar and other states may adopt this model, particularly with support from local government bodies.

FAQs

1. Who can apply for the Rani Laxmi Bai Scooty Yojana 2025?

Only girl students from Uttar Pradesh who passed Class 12 in 2024–2025 with high marks and whose families earn below ₹2.5 lakhs annually are eligible.

2. Where can I get the application form?

The Rani Laxmi Bai Scooty Yojana Form 2025 can be downloaded or filled out online from the official state government portal or obtained at your local Block Level Government office.

3. Is this scheme available in Bihar?

Not yet, but there are possibilities that a similar scheme will be introduced in Bihar based on the success of the UP model.

Conclusion

The Rani Laxmi Bai Scooty Yojana 2025 is more than just a welfare program—it’s a step toward empowering girls, promoting gender equality, and driving social change. With support from the UP government and local officials, thousands of girls can now enjoy the freedom to learn, grow, and succeed.

If you're eligible, don’t miss this opportunity to apply and take a meaningful step toward a brighter future. Keep checking the official portal for updates and application deadlines.

0 notes

Text

IEC Registration: A Complete Guide to Import Export Code in India

Introduction

If you're planning to start an import or export business in India, the first and foremost requirement is obtaining the IEC – Import Export Code. Issued by the Director General of Foreign Trade (DGFT), the IEC is a 10-digit unique code that is mandatory for anyone involved in the international trade of goods or services from India.

This article will guide you through the meaning, importance, eligibility, required documents, and step-by-step process of getting your IEC registration done online.

What is IEC (Import Export Code)?

The Import Export Code (IEC) is a unique 10-digit number issued by the Directorate General of Foreign Trade (DGFT) under the Ministry of Commerce and Industry, Government of India. It is required by businesses or individuals who wish to import or export goods and services from India.

Without an IEC, businesses cannot legally engage in international trade.

Who Needs IEC Registration?

IEC is mandatory for:

Importers – to clear shipments through customs

Exporters – to send shipments abroad

Freelancers and service exporters – if foreign remittances are involved

E-commerce sellers, who export products or services outside India

Note: IEC is not required for personal use imports/exports, and is not mandatory for service exports unless benefits are claimed under the Foreign Trade Policy.

Benefits of IEC Registration

International Market Access – Opens doors to global business expansion.

Government Benefits – Avail export promotion schemes like MEIS, SEIS, etc.

Easy Compliance – Once obtained, the IEC has lifetime validity, with minimal compliance.

No Return Filing – No need to file monthly or annual returns for IEC.

Quick Processing – The Entire application can be completed online within 1-2 days.

Documents Required for IEC Registration

You’ll need the following documents:

PAN Card – of the business or individual

Identity Proof – Aadhaar card / Passport / Voter ID

Address Proof – Electricity bill / Rent agreement / Sale deed

Bank Certificate or Cancelled Cheque

Digital Photograph – Passport-size

Business Registration Certificate – (For companies, LLPs, etc.)

How to Apply for IEC Registration (Online Process)

Follow these simple steps:

Step 1: Visit the DGFT Website

Go to the official DGFT portal – https://dgft.gov.in

Step 2: Register on the DGFT Portal

Create your user profile with a valid email and mobile number.

Step 3: Fill IEC Application Form (ANF 2A)

Provide business details, PAN, bank info, and upload required documents.

Step 4: Pay Application Fee

Pay the government fee of Rs. 500 via net banking or card.

Step 5: Submit and Track

Submit the form. You will receive the IEC certificate on your registered email, usually within 1-2 working days.

Validity & Renewal

The IEC code remains valid for the lifetime of the product.

As per recent amendments, you need to confirm/update your IEC details annually on the DGFT portal (even if there are no changes), between April and June. Failure to do so may deactivate the IEC.

Common Mistakes to Avoid

Incorrect PAN or mismatch in business name

Wrong bank details

Uploading unclear or incorrect documents

Missing annual IEC updates

Conclusion

IEC Registration is your business passport to the global market. Whether you're an individual exporter, MSME, or a large business house, IEC is essential to carry out international trade from India. The process is quick, cost-effective, and can be completed online with ease.

0 notes

Text

KYC Problems/Data Mismatch? We Can Help!

Nowadays, a simple data mismatch can lead to widespread challenges in the digital finance space. KYC disruptions can go along way toward savage your day - whether its something as your name is not accurate, date of birth is not included, or simply records in your Aadhaar or PAN are outdated. Because of KYC disruptions, you may experience EPFO claim rejections, lack of performance, account restrictions/freezes, and even lose potential loans with unhelpful freezing algorithms.

As we work at Fundwise, it is important to appreciate just how frustrating and confusing KYC issues can be. Its our role to offer guidance through the document, EPFO and bank level KYC resolutions in familiar step-wise processes to update your data correctly through faulty Form 11, Joint Declaration Form or KYC submission processes unique to banking purposes in error free formats/versions.

✅ Personal Support to assist with each of your intended financial goals

✅ Fast track document updating and declaration

✅ Informed & compliant Support - if we don’t know - we will find someone who does!

KYC issues put strong breaks on the progress you are trying to make financially; So don’t let ongoing issues and faulty pensions functions defeat purposeful change! Contact Fundwise and let us make compliance simple and relative!

📞 +91 9112013515 | ✉️ [email protected]

🌐 fund-wise.in

#KYCissues#DataMismatch#EPFOClaimHelp#FinancialCompliance#FundwiseSupports#AadhaarFormatting#LastNameMismatch#PFFormDifficulties

0 notes

Text

How to Open Angel One Account Online in 12 Easy Steps

How to Open Angel One Account Online: Step-by-Step Guide

If you're planning to start your investment journey, learning how to open Angel One account online is your first and most crucial step. With a seamless digital onboarding process, Angel One allows you to open a trading and Demat account without visiting any branch. The best part? It takes less than 15 minutes and requires only a few essential documents.

In this guide, we’ll take you through the Angel One Demat account opening process, explain the benefits, and help you understand what documents you’ll need to complete your application without delays.

Why Choose Angel One?

Before jumping into how to open Angel One account online, it’s important to understand why the platform is a favorite among investors in India. Here’s what makes Angel One stand out:

Zero brokerage on equity delivery trades

Flat ₹20 per trade on intraday and F&O

Access to AI-based research via ARQ Prime

A highly intuitive mobile and web trading platform

Fully digital and paperless account setup

Given these advantages, it’s clear why thousands of users choose Angel One every day.

Documents Required for Angel One Account

To make your onboarding quick and easy, gather these documents before you begin:

PAN Card – Mandatory for identity verification

Aadhaar Card – Must be linked with your mobile number for OTP-based verification

Cancelled Cheque or Bank Statement – To validate your bank account

Digital Signature – Either drawn digitally or uploaded as an image

Income Proof – Only needed if you're applying for F&O or commodities (e.g., salary slip or ITR)

Having these ready will make your Angel One Demat account opening process smooth and efficient.

How to Open Angel One Account Online in 12 Easy Steps

Now, let’s break down the Angel One Demat account opening process in 12 straightforward steps. Follow them, and you’ll be ready to invest in no time:

Visit the Angel One Website Go to the official site and click on “Open an Account.”

Enter Your Mobile Number Type your number and verify it via OTP.

Add Personal Information Provide your full name and referral code, if available.

Verify Your Email Input your email address and verify it through OTP.

Provide PAN Details Enter your PAN number to fetch KYC details from DigiLocker.

Complete Aadhaar Verification Authenticate using an OTP sent to your Aadhaar-linked mobile number.

Link Your Bank Account Add UPI or bank details for smooth fund transfers.

Take a Live Selfie For identity verification, you’ll need to click a real-time photo.

Upload or Draw Signature Sign digitally or upload a clear image of your signature.

Submit Income Documents (if applicable) Upload salary slips, ITR, or bank statements for F&O access.

Fill Out Financial Information Choose your employment status, income range, and trading preferences.

Authorize DDPI and Final eSign Complete the Demat Debit and Pledge Instruction and e-sign the form with Aadhaar OTP.

Once submitted, the application goes under review. Typically, you’ll receive your login credentials within 1 to 3 working days if everything checks out.

What Happens After You Apply?

After you’ve followed the steps on how to open Angel One account online, the platform reviews your application. Once verified, you’ll receive your login credentials via SMS and email. You can then:

Start trading in equities, F&O, and commodities

Apply for IPOs effortlessly

Access AI-driven portfolio suggestions

Set up real-time alerts on price movements

Why Accurate Documentation Matters

An error in documentation can stall your progress. That’s why it's important to ensure that all documents are valid, legible, and updated before you begin the Angel One Demat account opening process. Even a small mismatch in details can delay account activation.

Benefits of Having an Angel One Demat Account

Once you're onboard, Angel One offers several tools to grow your portfolio:

Mutual Funds & SIPs – Build long-term wealth easily

ETFs – Diversify with low-cost instruments

Commodities & F&O – For advanced trading strategies

Real-Time Data & Research – Make smarter decisions with updated insights

These features make Angel One an excellent choice, especially for new investors who prefer a guided experience.

Final Thoughts

Knowing how to open Angel One account online saves you time and opens the door to countless investment opportunities. By keeping your documents ready and following the digital steps outlined above, you’ll be able to complete the Angel One Demat account opening process without a hitch.

So, why delay? Prepare your documents today and start trading with one of India’s most reliable platforms.

0 notes

Text

How to Convert Physical Shares to Demat: A Step-by-Step Guide

In today’s digital-first financial world, holding physical share certificates is quickly becoming outdated and impractical. With the introduction of the Dematerialization Of Physical Shares, investors can now hold their securities in a safe, electronic format known as a Demat account. If you still own paper share certificates, it's essential to understand how to convert your physical shares to demat form.

This guide walks you through the entire process step by step, making it easier for you to transition from paper to digital securely and efficiently.

What Is Dematerialisation?

Dematerialization is the process of converting physical share certificates into electronic form. This allows investors to manage their holdings through a Demat account with a Depository Participant (DP), similar to how you manage funds through a bank account. The process eliminates the risks of loss, theft, or damage associated with physical certificates and provides easier access to trading and transfer of shares.

Why Convert Physical Shares to Demat?

There are several reasons to move your physical shares to demat:

Security: No risk of theft, forgery, or physical damage.

Convenience: Easy management, faster transfer, and seamless trading.

Regulatory Requirement: As per SEBI, shares can’t be sold or transferred unless held in demat form.

Transparency: Better tracking, dividend crediting, and corporate action benefits.

Step-by-Step Guide to Convert Physical Shares to Demat

Here’s a simple breakdown of the process to convert your physical shares into dematerialised form:

Step 1: Open a Demat Account

You’ll need to open a Demat account with a SEBI-registered Depository Participant (DP) such as a bank, stockbroker, or financial institution. Ensure you have the following documents ready:

PAN Card

Aadhaar Card

Bank proof (cancelled cheque or passbook)

Passport-size photograph

Step 2: Fill Out the Dematerialization Request Form (DRF)

Once your Demat account is active, collect the Dematerialization Request Form (DRF) from your DP. Fill in the required details accurately, such as:

Folio number

Certificate numbers

Number of shares

ISIN (International Securities Identification Number)

Attach the original share certificates to the form. Write "Surrendered for Dematerialisation" on each certificate.

Step 3: Submit Documents to the DP

Submit the duly filled DRF along with the original share certificates to your DP. The DP will verify the documents and initiate the dematerialisation process.

Step 4: Verification by the Registrar and Transfer Agent (RTA)

The DP forwards your documents to the company’s Registrar and Transfer Agent (RTA). The RTA verifies the authenticity of the certificates and matches them with the company’s records.

Step 5: Credit of Shares to Your Demat Account

Once verified, the equivalent number of shares will be credited to your Demat account. This process may take 15–30 working days, depending on the company and RTA.

Important Tips to Remember

Ensure your name on the share certificate matches the name in your Demat account.

If there are discrepancies, you may need to update KYC or provide supporting documents.

In case of joint holdings, all holders must sign the DRF.

If the share certificates are lost, you must first apply for a duplicate before dematerialisation.

Conclusion

The Dematerialization Of Physical Shares is a smart, secure, and now essential step for modern investors. Converting your physical shares to demat not only ensures compliance with current regulations but also provides ease of access, enhanced security, and better portfolio management.

If you still hold physical share certificates, now is the time to act. The digital shift is not just the future of investing—it’s the present.

0 notes

Text

Step‑by‑step of Tatkaal application process

For those who need a passport urgently, the Tatkaal Passport Scheme is the quickest solution offered by the Government of India. This fast-track service is ideal for situations like last-minute travel, emergencies, or lost passports. However, getting your passport quickly still depends on how accurately and efficiently you follow the Tatkaal procedure.

This guide provides a comprehensive, step-by-step breakdown of the entire Tatkaal passport application process, ensuring a smooth and speedy experience.

Step 1: Register on Passport Seva Portal

Visit the official website: www.passportindia.gov.in

Click on “Register Now” under the “New User?” section.

Fill in your personal details – name, DOB, email, login ID, and password.

Choose the Passport Office as per your current address jurisdiction.

Click Register.

Activate your account via the confirmation email.

✅ Tip: Use a working email ID and mobile number for OTPs and updates.

Step 2: Log In and Fill Application Form

Log in with your registered credentials.

Select “Apply for Fresh Passport / Reissue of Passport”.

Choose the Tatkaal Scheme.

Fill in details accurately: Personal Information Address (current and permanent) Family details Educational qualifications Employment and emergency contact info

📌 Important: Make sure the address matches your proof documents exactly.

Step 3: Upload and Submit the Form

You have two options:

Fill Online: Directly input data into the web form.

Fill Offline: Download PDF form, fill it, and upload XML.

Once filled:

Save and submit the form.

Go to the “View Saved/Submitted Applications” tab to proceed.

Step 4: Book Tatkaal Appointment

Click “Pay and Schedule Appointment”.

Choose Tatkaal Scheme.

Select the nearest Passport Seva Kendra (PSK) or POPSK.

Pay applicable fee online: ₹3,500 for 36 pages ₹4,000 for 60 pages

Choose your preferred date/time slot.

✅ Tip: Early morning appointments ensure faster processing.

Step 5: Gather Required Documents

Prepare your documents as per Tatkaal guidelines:

Annexure F (signed by Gazetted Officer)

Annexure I (self-declaration affidavit)

Proof of Address (Aadhaar, Voter ID, utility bill, etc.)

Proof of DOB (birth certificate, school certificate, PAN, etc.)

Old passport (for reissue)

Two passport-size photographs (backup)

📂 Keep both originals and photocopies ready.

Step 6: Visit the PSK/POPSK for Appointment

On the scheduled date:

Arrive 30–45 minutes early.

Carry printed application receipt with ARN (Application Reference Number).

Go through the following counters: Token Counter: Submit appointment receipt. Counter A: Document verification and biometric capture. Counter B: Officer review and approval. Counter C: Final clearance and exit.

🧾 Receive an acknowledgment slip with your file number.

Step 7: Police Verification (if applicable)

Depending on your profile:

Post-Police Verification: Most Tatkaal cases (passport dispatched before verification)

Pre-Police Verification: Needed if red flags or complex cases exist

👮 Expect a call from the local police station for address verification within 7–10 days.

Step 8: Track Passport Status

Use your Application Reference Number (ARN) to track status on: 👉 Track Application Status – Passport India

You will receive SMS/email updates once the passport is dispatched.

📦 Dispatched via India Post Speed Post. Delivery within 1–3 working days.

Tatkaal Processing Timelines (Realistic Expectations)

StageTime RequiredOnline Application30–45 minsAppointment BookingImmediate upon paymentPSK Visit1–2 hoursPassport Dispatch1–3 working days post-appointmentPolice VerificationPost-issuance (if applicable)

✅ In ideal conditions, Tatkaal passport can be received within 24–72 hours.

Tatkaal Fees (Updated for 2025)

Passport TypePagesTatkaal Fee (INR)Fresh/Reissue36₹3,500Fresh/Reissue60₹4,000Minor Passport36₹3,000

FAQs – Common Questions About Tatkaal Process

Q1: Can I apply for Tatkaal if my passport is lost?

Yes, but you’ll need to submit FIR copy and Annexure L along with standard documents.

Q2: Is Annexure F mandatory?

Yes. It must be signed by a Class I Gazetted Officer with official seal and designation clearly mentioned.

Q3: Can I walk in without an appointment?

No. Online appointment is mandatory even for Tatkaal cases.

Q4: Is Tatkaal passport issued without police verification?

Mostly, post-police verification is allowed. But pre-verification is required in sensitive cases.

Q5: Can I choose passport size?

Yes, you can opt for either 36 or 60 pages depending on travel frequency.

Conclusion: Speed Starts with Accuracy

The Tatkaal passport process is designed to be fast, efficient, and user-friendly, but only when every step is followed carefully. From document preparation to online scheduling and timely PSK visits, every detail counts. The faster you act and the more precise your paperwork, the sooner your passport reaches your doorstep.

At Passportagents.in, we assist with Tatkaal passport filing, Annexure drafting, document verification, and end-to-end application management. Our expert support is available in Chennai, Bangalore, Hyderabad, Mumbai, Delhi, Pune, Visakhapatnam, and all major Indian cities.

Our office — https://maps.app.goo.gl/LQab9tdkFiwoZKhe6

0 notes

Text

Your Financial Shortcut Why a Personal Loan Makes Smart Money Sense

In today’s world of rising expenses and unpredictable situations, having access to quick and flexible financing can be a game-changer. Whether you're dealing with an urgent home repair, planning a wedding, or consolidating existing debt, a personal loan offers an efficient and stress-free financial solution.

A personal loan is more than just borrowed money—it's a strategic move to achieve stability, meet goals, and navigate life with financial ease.

What Is a Personal Loan?

A personal loan is an unsecured loan that does not require collateral. You borrow a fixed amount and repay it in equal monthly installments, typically over a period of one to six years. Because it’s unsecured, the lender relies heavily on your credit score, income, and repayment history for approval.

The flexibility of a personal loan makes it a popular choice for various financial needs—from emergencies to planned expenditures.

Key Advantages of a Personal Loan

Here’s why a personal loan can be a wise financial choice:

✅ No Collateral Needed

One of the primary reasons people turn to a personal loan is that it doesn’t demand assets like property or gold as security. You can access funds without risking ownership of valuable items.

✅ Fast Processing

Most lenders today offer digital platforms where you can apply for a personal loan and receive funds within 24 to 48 hours if all documents are in place.

✅ Flexible Tenures

Choose a repayment schedule that suits your financial comfort. Tenures range from 12 to 72 months, allowing you to customize your EMIs.

✅ Multipurpose Usage

A personal loan isn’t tied to a specific use. You can utilize the funds for travel, education, home renovation, or even to cover business-related expenses.

When Should You Consider a Personal Loan?

While financial planning is ideal, sometimes unexpected needs arise. Here are common scenarios where a personal loan becomes the right choice:

Medical Emergencies: Fast access to funds can be life-saving during sudden health issues.

Debt Consolidation: Merge multiple high-interest debts into one manageable personal loan with a lower EMI.

Home Renovation: Fix structural issues or update your interiors without depleting your savings.

Big Life Events: Fund important moments like weddings or family functions without financial strain.

Travel and Education: Invest in experiences or academic growth with the help of a personal loan.

Eligibility Criteria for a Personal Loan

While exact conditions may vary by lender, the standard eligibility for a personal loan includes:

Age: Between 21 and 60 years

Employment: Salaried or self-employed with stable income

Monthly Income: Minimum ₹25,000 for salaried individuals

Credit Score: 650 or above is ideal for faster approval

Residence: Indian citizen residing within the country

Required Documentation

Applying for a personal loan is now simpler than ever, thanks to digitized processing. You’ll usually need:

ID Proof: PAN Card, Aadhaar, or Passport

Address Proof: Utility bills, rental agreement, or bank statement

Income Proof: Recent salary slips or income tax returns

Bank Statements: For the past 3–6 months

Photograph: A recent passport-size photo

With online uploads, you can complete your personal loan application in minutes.

Steps to Apply for a Personal Loan

The application process is smooth and user-friendly:

Evaluate Your Needs Determine the exact amount required and calculate your monthly repayment ability.

Use a Loan Calculator Simulate EMIs for different loan amounts and tenures to pick what fits your budget.

Submit Online Application Fill in your personal and financial details in a simple form.

Upload Documents Provide soft copies of the required documents via a secure portal.

Get Offers Receive instant offers tailored to your eligibility and profile.

Choose & Sign Digitally Select the best offer and complete your e-sign to receive disbursal directly to your account.

Smart Tips to Manage Your Personal Loan

Taking a personal loan is a responsibility. Follow these smart tips to keep your borrowing journey stress-free:

Borrow Only What You Need: Don’t overestimate; borrow based on real need and EMI affordability.

Avoid Multiple Loans: Juggling too many EMIs can impact your credit score and financial health.

Pay on Time: Consistent payments improve your credit history and avoid penalty charges.

Prepay If Possible: If your lender allows part-prepayments or foreclosure without fees, use it to reduce interest burden.

Personal Loan vs. Other Borrowing Options

Wondering why a personal loan could be better than a credit card or gold loan? Here’s how it compares: Feature Personal Loan Credit Card Loan Gold Loan Collateral Required No No Yes (Gold) Interest Rate (Approx) 10%–24% p.a. 24%–36% p.a. 9%–15% p.a. Processing Time 1–2 Days Instant (if eligible) 1–2 Days Usage Flexibility High Moderate Limited Tenure Flexibility High Low Moderate

As you can see, a personal loan strikes a strong balance between convenience, speed, and cost.

Mistakes to Avoid with a Personal Loan

While personal loans are convenient, they can become stressful if misused. Avoid these common errors:

Ignoring the Fine Print: Always read terms and conditions before signing the agreement.

Overborrowing: Just because you qualify for a higher amount doesn’t mean you need it.

Skipping Payments: One missed EMI can negatively affect your credit score and increase penalties.

Choosing the Wrong Tenure: A longer tenure means smaller EMIs, but it also means paying more in total interest.

Final Thoughts: Make Your Personal Loan Work for You

A personal loan is more than a quick financial fix—it’s a tool that, when used wisely, can enhance your financial planning, give you breathing room in emergencies, and even help you achieve your goals faster. From no-collateral requirements to fast processing, flexible tenures, and competitive rates, a personal loan is designed to make your money work smarter—not harder.

Whether you're dealing with an unplanned life event or investing in a future milestone, a personal loan can support you every step of the way.

If you’ve considered a personal loan before but weren’t sure how or when to apply, now might be the right time to make a move. Just be sure to choose the right lender, borrow responsibly, and stay consistent with your repayments.

#PersonalLoan#LoanApproval#FinancialFreedom#SmartBorrowing#MoneyMatters#FinanceTips#FinancialGoals#LoanOptions

1 note

·

View note

Text

Company Registration in India: Kickstart Your Dream Business with Bizsimpl

Starting your own business in India is a bold step—but registering it officially is what makes your idea credible, visible, and future-ready. Whether you're launching a product-based startup, setting up a consultancy, or starting a solo venture, Company Registration in India gives your business a professional identity, legal standing, and access to growth opportunities.

At Bizsimpl, we specialize in helping entrepreneurs complete the registration process without confusion, paperwork delays, or compliance risks. In this blog, we’ll explore why company registration matters, the different structures available, and how Bizsimpl makes the entire journey simple and stress-free.

Why Is Company Registration in India So Important?

Think of company registration as your business’s official birth certificate. It legally recognizes your business, separates your personal liabilities, and opens doors to funding, partnerships, and expansion. Here's why it matters:

✅ Builds Trust with Customers & Partners

Registered businesses gain more trust from clients, vendors, and investors. A company with CIN (Corporate Identity Number) shows credibility.

✅ Offers Legal Protection

You get limited liability protection, which means your personal assets remain safe even if your business faces debts or legal challenges.

✅ Enables Structured Growth

With a registered business, it's easier to onboard co-founders, raise funds, issue shares, and scale across states or countries.

✅ Makes You Eligible for Government Schemes

Only registered businesses can apply for MSME recognition, startup schemes, and incubation grants.

Choosing the Right Business Structure in India

When you approach Bizsimpl for Company Registration in India, the first thing we help you with is choosing the right business structure. Let’s understand the key options:

🔹 Private Limited Company (Pvt Ltd)

Perfect for startups and businesses aiming for scale, funding, or investor partnerships.

Key Highlights:

Requires minimum 2 directors and 2 shareholders

Can raise equity capital from investors

Provides strong brand credibility

Suitable for tech startups, product businesses, and SaaS firms

🔹 Limited Liability Partnership (LLP)

Ideal for service-based businesses, consultancies, and firms with multiple partners.

Key Highlights:

Requires at least 2 designated partners

Combines benefits of partnership and limited liability

Flexible internal structure

Often chosen by professionals, freelancers, or co-founders

🔹 One Person Company (OPC)

Designed for solo entrepreneurs who want the benefits of incorporation without needing a co-founder.

Key Highlights:

Can be started by a single person

Limited liability protection for the founder

Suitable for freelancers, digital creators, or niche business owners

Key Documents Required for Company Registration in India

At Bizsimpl, we make document collection seamless with guided checklists. Here’s what you typically need:

PAN & Aadhaar of directors/partners

Passport-size photo

Address proof (bank statement or utility bill)

Rental agreement or NOC for office address

Digital Signature Certificate (DSC)

Why Bizsimpl Is the Smart Choice for Company Registration

The Company Registration in India process involves MCA filings, name approval, form validations, and adherence to regulatory timelines. This can be overwhelming if done manually or without guidance.

Bizsimpl eliminates the complexity. Here’s how:

1. Digital-First Process

No paperwork. No office visits. We manage everything online, from DSC to final incorporation.

2. Real-Time Status Tracking

We keep you updated with every step of the registration progress. No guesswork.

3. Experienced Registration Experts

Our team understands Ministry of Corporate Affairs (MCA) workflows and ensures your application meets all technical and legal requirements.

4. State-Wide Registration

From Karnataka to Kerala, from Delhi to Assam—we enable business registration in all 28 states and union territories in India.

What Makes Bizsimpl Stand Out?

Unlike generic platforms that handle hundreds of requests without personalization, Bizsimpl treats every business idea with care. Here's what our clients love:

Fast Turnaround We help most businesses get registered within 7–10 working days.

Transparent Pricing What you see is what you pay. No hidden charges.

Post-Registration Compliance Advisory We help you understand your responsibilities after incorporation so you can remain compliant and active.

Mistakes to Avoid During Company Registration

Before you rush into registration, here are common errors that many entrepreneurs make—Bizsimpl helps you steer clear of all of them.

❌ Choosing the wrong structure

Picking LLP when you plan to raise funds can be a long-term roadblock. We help you evaluate your current and future goals.

❌ Filing with incorrect documentation

Even one mismatch in address or name across documents can delay approval.

❌ Not reserving a business name properly

Names must comply with MCA’s rules—Bizsimpl ensures your name gets approved the first time.

❌ Ignoring director eligibility

All directors must have valid identification and digital signatures (DSCs). We assist in quick issuance.

Timeline: How Long Does It Take?

Here’s a rough timeline for Company Registration in India through Bizsimpl: StageTimelineDocument Collection1–2 DaysDSC & Name Reservation2–3 DaysFiling with MCA2–4 DaysFinal Incorporation Certificate1–2 Days

✅ Total Time: 7–10 working days

Final Thoughts: Build with Confidence

Registering your business is the first serious step toward becoming a successful entrepreneur. And while the process may seem procedural, it's a strategic milestone. A registered company earns trust, scales better, and stays legally sound.

With Bizsimpl, you can confidently complete your Company Registration in India without getting stuck in forms, rules, or outdated processes. Whether you want to set up a Pvt Ltd in Bangalore, an LLP in Pune, or an OPC in Kochi—Bizsimpl is your trusted partner.

So why wait? 📌 Make your business official. 📌 Choose the right structure. 📌 Start your journey with Bizsimpl.

🚀 Ready to Register Your Company?

Let us help you bring your business dream to life. Visit Bizsimpl and get started today.

#CompanyRegistrationInIndia#RegisterYourCompany#StartupIndia#Bizsimpl#PvtLtdRegistration#LLPRegistration#OPCRegistration#EntrepreneurIndia#BusinessInIndia#StartYourBusiness

0 notes

Text

GST Website Not Working? Check These Possible Server Issues

If you’ve recently tried to access the GST website and found it unresponsive or slow, you're not alone. Many taxpayers and professionals across India rely on the GST portal for filing returns, making payments, and completing various compliance tasks. When the site becomes inaccessible, it can cause delays and confusion—especially near filing deadlines.

In this article, we’ll explore possible server-related issues that may be causing the GST website not working and what you can do during such times.

1. Server Overload During Peak Hours

One of the most frequent reasons for GST website downtime is server overload. This typically happens when:

Return filing deadlines are near

A large number of users try to log in or file simultaneously

Last-minute submissions spike traffic unexpectedly

The GST server may become overwhelmed, resulting in delayed responses, failed logins, or even total outages.

2. Backend Server Maintenance

The GSTN (Goods and Services Tax Network) routinely performs scheduled maintenance and system upgrades to improve portal performance and security. During these periods, you may experience:

Website downtime

Errors while submitting returns

Slower loading times

These activities are usually planned during off-peak hours, but they may occasionally impact users during the day.

3. Data Synchronization Delays

The GST portal integrates with various government services like the Income Tax Department, Aadhaar authentication, and bank payment gateways. If there is a data sync delay or a service is temporarily down, it can affect portal operations.

For example, you may experience issues with:

OTP verification

PAN or Aadhaar validation

Bank payment confirmations

These backend connections rely on smooth coordination between systems, and any delay can affect performance.

4. DNS or Hosting Issues

In some cases, the issue lies not with the website content but with the domain hosting or DNS (Domain Name System). These technical problems can lead to:

Website not loading at all

Domain not resolving

Intermittent access

Such issues are handled by the hosting service providers or the GSTN’s IT team and may take time to resolve.

5. Software Bugs or Glitches

Even after regular updates, new bugs or glitches can occur in the backend code. These might lead to:

Login issues

Pages not loading properly

Errors in form submissions

Although temporary, these bugs may disrupt access for specific users or services on the portal.

What You Can Do

While server issues are mostly out of your control, here are some steps you can take:

Wait and retry after a short time, especially if the issue is due to high traffic.

Clear browser cache and cookies before refreshing the page.

Use a different browser or device to rule out compatibility issues.

Monitor official updates on gst.gov.in or GSTN’s Twitter handle.

Contact the GST helpdesk at 1800-103-4786 or email [email protected] if the issue persists.

Conclusion

If the GST website is not working, server-related problems are often the cause. Whether it’s high traffic, backend maintenance, or a glitch in the system, these issues are usually temporary and resolved by the GSTN team. Being aware of these common causes can help you respond calmly, avoid panic, and plan your GST-related work more effectively.

If you frequently experience downtime during key filing periods, consider completing tasks early and keeping track of scheduled maintenance alerts from GSTN.

0 notes

Text

Rani Laxmi Bai Scooty Yojana Form 2025: Empowering Girls Through Mobility

Introduction

In a positive step toward empowering women and encouraging higher education for girls, the government has launched the Rani Laxmi Bai Scooty Yojana 2025. This program provides free or subsidized scooters to deserving girl students, allowing them to pursue their education or vocational training without transportation issues.

This initiative is part of various UP government schemes and has garnered interest from states like Bihar, which may introduce similar programs in the future. It shows how support from local government can make a real difference in people's lives.

What is the Rani Laxmi Bai Scooty Yojana 2025?

The Rani Laxmi Bai Scooty Yojana is a welfare program aimed at providing scooters to academically strong or economically disadvantaged girl students. It not only improves access to education but also tackles issues of women's safety and independence.

Key Objectives:

- Encourage female education beyond 12th grade.

- Reduce dropout rates among girls due to transportation problems.

- Provide women from rural and urban areas with freedom and mobility.

Eligibility Criteria

To apply for the Rani Laxmi Bai Scooty Yojana Form 2025, applicants must meet these conditions:

- Must be a resident of Uttar Pradesh.

- Only girls who passed Class 12 in 2024–2025 with high marks can apply.

- The household income should not exceed ₹2.5 lakhs.

- The applicant must not already own a two-wheeler.

- Preference is given to students from SC/ST/OBC categories.

Note: Some criteria may vary based on updates from local government offices.

Documents Required

When filling out the Rani Laxmi Bai Scooty Yojana Form 2025, have these documents ready:

- Aadhaar Card

- 12th Marksheet (2024–2025)

- Domicile Certificate

- Income Certificate

- Caste Certificate (if applicable)

- Recent Passport Size Photo

- Bank Account Passbook (linked with Aadhaar)

- Mobile Number (linked with Aadhaar)

How to Apply Online – Step-by-Step Guide

Applying for the scheme is easy through the official state government portal. Here’s how to do it:

1. Visit the official UP government scheme portal or your nearest Block Level Government office.

2. Click on “Rani Laxmi Bai Scooty Yojana 2025.”

3. Register using your mobile number and the Aadhaar-linked OTP.

4. Fill out the application form with correct personal and educational information.

5. Upload all scanned documents in PDF or JPG format.

6. Submit the form and download the acknowledgment slip.

Once submitted, your application will be reviewed by officials at the Block Level Government and district level for verification.

Selection Process

- Based on merit (marks scored in Class 12).

- Consideration of financial background.

- A final list will be published on the official portal or at local notice boards.

- Selected candidates will receive notifications through SMS and email for document verification and the scooty distribution event.

Benefits of the Scheme

- Free or subsidized scooters worth ₹65,000–₹75,000.

- Helps reduce dropout rates and increase enrollment in colleges and skill centers.

- Supports women’s safety, especially in rural areas where public transport may not be reliable.

- Promotes self-sufficiency and contributes to women empowerment.

Impact on Other States: Bihar Government Scheme Reference

While this program is currently active in UP, there is growing interest in similar initiatives in upcoming Bihar government schemes. Due to its success and high demand, Bihar and other states may adopt this model, particularly with support from local government bodies.

FAQs

1. Who can apply for the Rani Laxmi Bai Scooty Yojana 2025?

Only girl students from Uttar Pradesh who passed Class 12 in 2024–2025 with high marks and whose families earn below ₹2.5 lakhs annually are eligible.

2. Where can I get the application form?

The Rani Laxmi Bai Scooty Yojana Form 2025 can be downloaded or filled out online from the official state government portal or obtained at your local Block Level Government office.

3. Is this scheme available in Bihar?

Not yet, but there are possibilities that a similar scheme will be introduced in Bihar based on the success of the UP model.

Conclusion

The Rani Laxmi Bai Scooty Yojana 2025 is more than just a welfare program—it’s a step toward empowering girls, promoting gender equality, and driving social change. With support from the UP government and local officials, thousands of girls can now enjoy the freedom to learn, grow, and succeed.

If you're eligible, don’t miss this opportunity to apply and take a meaningful step toward a brighter future. Keep checking the official portal for updates and application deadlines.

1 note

·

View note

Text

SIP Tax Savings Planner in Delhi NCR — Prahim Investments

Are you looking for a smart and easy way to save tax and grow your wealth? If yes, then you should consider investing in a Systematic Investment Plan (SIP) with Prahim Investments, the best SIP Tax Savings Planner in Delhi NCR.

SIP is a method of investing in mutual funds, where you invest a fixed amount of money every month or quarter in a scheme of your choice. SIP helps you to build a habit of saving and investing regularly and also benefits from the power of compounding and rupee cost averaging.

How does SIP help you save tax?

SIP can help you save tax in two ways:

By making an investment in an equity-linked savings scheme (ELSS), a form of mutual fund that places at least 80% of its assets in stocks and other securities that connect to stocks. ELSS has a lock-in period of 3 years, which means you cannot withdraw your money before that. ELSS offers tax deduction under Section 80C of the Income Tax Act, up to Rs. 1.5 lakh per year.

By investing in any other mutual fund scheme, which is subject to long-term capital gains tax (LTCG) of 10% on gains above Rs. 1 lakh per year. This is lower than the short-term capital gains tax (STCG) of 15% on gains within one year.

Why choose Prahim Investments as your SIP advisor in Delhi NCR?

Prahim Investments is a leading financial advisory firm that offers customized and unbiased solutions for your financial goals. We have a team of experienced and qualified professionals who can help you choose the best SIP plan for your needs and risk profile. We also provide regular updates and reviews on your portfolio performance and suggest changes if required.

Some of the benefits of choosing Prahim Investments as your SIP advisor in Delhi NCR are:

We have access to a wide range of mutual fund schemes from various fund houses, so you can diversify your portfolio and reduce risk.

We offer online and offline services, so you can invest and track your SIPs anytime, anywhere.

We charge reasonable fees and commissions, so you can save more on your investments.

We have a loyal and satisfied customer base, who trust us for our expertise and transparency.

How to start SIP with Prahim Investments?

Starting SIP with Prahim Investments is very simple and hassle-free. All you need to do is:

Contact us through our website, phone, email, or visit our office.

Fill up a KYC form and provide your PAN card, Aadhaar card, bank details and other documents as required.

Choose a SIP plan that suits your goals, budget and risk appetite.

Set up an auto-debit mandate with your bank to transfer the SIP amount every month or quarter.

Watch your money grow over time while you relax.

So what are you waiting for? Contact Prahim Investments today and start your SIP journey with the best SIP tax saving planner in Delhi NCR.

0 notes