#Acquisitions/Mergers/Shareholdings

Explore tagged Tumblr posts

Text

Litigating Disputes Between Corporate Management in Florida: Legal Insights and Case Law

Facing a corporate management dispute in Florida? Learn how to navigate legal challenges, from fiduciary duties to shareholder rights, with our latest article.

Disputes among corporate management can create significant challenges for any business. In Florida, as in other jurisdictions, these conflicts—whether between board members, executives, or shareholders—can lead to costly litigation, regulatory scrutiny, and reputational damage. When corporate governance issues, breach of fiduciary duty, or executive disputes escalate, litigation may be the only…

#andrew bernhard#attorney#bernhard law firm#Breach of fiduciary duty Florida#Corporate governance litigation Florida#Corporate management disputes in Florida#Corporate management litigation Florida#florida#Florida board of directors dispute#Florida business dispute prevention#Florida business dispute resolution#Florida business disputes lawyer#Florida business governance case law#Florida business lawsuit#Florida business litigation#Florida business litigation attorney#Florida corporate bylaws and disputes#Florida corporate law cases#Florida executive compensation disputes#Florida executive dispute resolution#Florida fiduciary duty case law#Florida shareholder derivative action#Mergers and acquisitions litigation Florida#miami#Shareholder rights litigation Florida

0 notes

Text

#Corporate Lawyers in Delhi#Corporate Litigation Lawyers in Delhi#Insolvency Bankruptcy Lawyers in Delhi#Arbitration Lawyers in Delhi#Private Equity Mergers & Acquisitions Investment Lawyers in Delhi#Technology Data Protection Fintech Lawyers in Delhi#Company Commercial Litigation Lawyers in Delhi#Investment Fraud Lawyers in Delhi#Investor Shareholder Litigation Lawyers in Delhi#Bail Criminal Defense Lawyers in Delhi#White Collar Crime Lawyers in Delhi#Startup Investor Lawyers in Delhi#Banking Finance Lawyers in Delhi

0 notes

Text

How to design a tech regulation

TONIGHT (June 20) I'm live onstage in LOS ANGELES for a recording of the GO FACT YOURSELF podcast. TOMORROW (June 21) I'm doing an ONLINE READING for the LOCUS AWARDS at 16hPT. On SATURDAY (June 22) I'll be in OAKLAND, CA for a panel (13hPT) and a keynote (18hPT) at the LOCUS AWARDS.

It's not your imagination: tech really is underregulated. There are plenty of avoidable harms that tech visits upon the world, and while some of these harms are mere negligence, others are self-serving, creating shareholder value and widespread public destruction.

Making good tech policy is hard, but not because "tech moves too fast for regulation to keep up with," nor because "lawmakers are clueless about tech." There are plenty of fast-moving areas that lawmakers manage to stay abreast of (think of the rapid, global adoption of masking and social distancing rules in mid-2020). Likewise we generally manage to make good policy in areas that require highly specific technical knowledge (that's why it's noteworthy and awful when, say, people sicken from badly treated tapwater, even though water safety, toxicology and microbiology are highly technical areas outside the background of most elected officials).

That doesn't mean that technical rigor is irrelevant to making good policy. Well-run "expert agencies" include skilled practitioners on their payrolls – think here of large technical staff at the FTC, or the UK Competition and Markets Authority's best-in-the-world Digital Markets Unit:

https://pluralistic.net/2022/12/13/kitbashed/#app-store-tax

The job of government experts isn't just to research the correct answers. Even more important is experts' role in evaluating conflicting claims from interested parties. When administrative agencies make new rules, they have to collect public comments and counter-comments. The best agencies also hold hearings, and the very best go on "listening tours" where they invite the broad public to weigh in (the FTC has done an awful lot of these during Lina Khan's tenure, to its benefit, and it shows):

https://www.ftc.gov/news-events/events/2022/04/ftc-justice-department-listening-forum-firsthand-effects-mergers-acquisitions-health-care

But when an industry dwindles to a handful of companies, the resulting cartel finds it easy to converge on a single talking point and to maintain strict message discipline. This means that the evidentiary record is starved for disconfirming evidence that would give the agencies contrasting perspectives and context for making good policy.

Tech industry shills have a favorite tactic: whenever there's any proposal that would erode the industry's profits, self-serving experts shout that the rule is technically impossible and deride the proposer as "clueless."

This tactic works so well because the proposers sometimes are clueless. Take Europe's on-again/off-again "chat control" proposal to mandate spyware on every digital device that will screen everything you upload for child sex abuse material (CSAM, better known as "child pornography"). This proposal is profoundly dangerous, as it will weaken end-to-end encryption, the key to all secure and private digital communication:

https://www.theguardian.com/technology/article/2024/jun/18/encryption-is-deeply-threatening-to-power-meredith-whittaker-of-messaging-app-signal

It's also an impossible-to-administer mess that incorrectly assumes that killing working encryption in the two mobile app stores run by the mobile duopoly will actually prevent bad actors from accessing private tools:

https://memex.craphound.com/2018/09/04/oh-for-fucks-sake-not-this-fucking-bullshit-again-cryptography-edition/

When technologists correctly point out the lack of rigor and catastrophic spillover effects from this kind of crackpot proposal, lawmakers stick their fingers in their ears and shout "NERD HARDER!"

https://memex.craphound.com/2018/01/12/nerd-harder-fbi-director-reiterates-faith-based-belief-in-working-crypto-that-he-can-break/

But this is only half the story. The other half is what happens when tech industry shills want to kill good policy proposals, which is the exact same thing that advocates say about bad ones. When lawmakers demand that tech companies respect our privacy rights – for example, by splitting social media or search off from commercial surveillance, the same people shout that this, too, is technologically impossible.

That's a lie, though. Facebook started out as the anti-surveillance alternative to Myspace. We know it's possible to operate Facebook without surveillance, because Facebook used to operate without surveillance:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3247362

Likewise, Brin and Page's original Pagerank paper, which described Google's architecture, insisted that search was incompatible with surveillance advertising, and Google established itself as a non-spying search tool:

http://infolab.stanford.edu/pub/papers/google.pdf

Even weirder is what happens when there's a proposal to limit a tech company's power to invoke the government's powers to shut down competitors. Take Ethan Zuckerman's lawsuit to strip Facebook of the legal power to sue people who automate their browsers to uncheck the millions of boxes that Facebook requires you to click by hand in order to unfollow everyone:

https://pluralistic.net/2024/05/02/kaiju-v-kaiju/#cda-230-c-2-b

Facebook's apologists have lost their minds over this, insisting that no one can possibly understand the potential harms of taking away Facebook's legal right to decide how your browser works. They take the position that only Facebook can understand when it's safe and proportional to use Facebook in ways the company didn't explicitly design for, and that they should be able to ask the government to fine or even imprison people who fail to defer to Facebook's decisions about how its users configure their computers.

This is an incredibly convenient position, since it arrogates to Facebook the right to order the rest of us to use our computers in the ways that are most beneficial to its shareholders. But Facebook's apologists insist that they are not motivated by parochial concerns over the value of their stock portfolios; rather, they have objective, technical concerns, that no one except them is qualified to understand or comment on.

There's a great name for this: "scalesplaining." As in "well, actually the platforms are doing an amazing job, but you can't possibly understand that because you don't work for them." It's weird enough when scalesplaining is used to condemn sensible regulation of the platforms; it's even weirder when it's weaponized to defend a system of regulatory protection for the platforms against would-be competitors.

Just as there are no atheists in foxholes, there are no libertarians in government-protected monopolies. Somehow, scalesplaining can be used to condemn governments as incapable of making any tech regulations and to insist that regulations that protect tech monopolies are just perfect and shouldn't ever be weakened. Truly, it's impossible to get someone to understand something when the value of their employee stock options depends on them not understanding it.

None of this is to say that every tech regulation is a good one. Governments often propose bad tech regulations (like chat control), or ones that are technologically impossible (like Article 17 of the EU's 2019 Digital Single Markets Directive, which requires tech companies to detect and block copyright infringements in their users' uploads).

But the fact that scalesplainers use the same argument to criticize both good and bad regulations makes the waters very muddy indeed. Policymakers are rightfully suspicious when they hear "that's not technically possible" because they hear that both for technically impossible proposals and for proposals that scalesplainers just don't like.

After decades of regulations aimed at making platforms behave better, we're finally moving into a new era, where we just make the platforms less important. That is, rather than simply ordering Facebook to block harassment and other bad conduct by its users, laws like the EU's Digital Markets Act will order Facebook and other VLOPs (Very Large Online Platforms, my favorite EU-ism ever) to operate gateways so that users can move to rival services and still communicate with the people who stay behind.

Think of this like number portability, but for digital platforms. Just as you can switch phone companies and keep your number and hear from all the people you spoke to on your old plan, the DMA will make it possible for you to change online services but still exchange messages and data with all the people you're already in touch with.

I love this idea, because it finally grapples with the question we should have been asking all along: why do people stay on platforms where they face harassment and bullying? The answer is simple: because the people – customers, family members, communities – we connect with on the platform are so important to us that we'll tolerate almost anything to avoid losing contact with them:

https://locusmag.com/2023/01/commentary-cory-doctorow-social-quitting/

Platforms deliberately rig the game so that we take each other hostage, locking each other into their badly moderated cesspits by using the love we have for one another as a weapon against us. Interoperability – making platforms connect to each other – shatters those locks and frees the hostages:

https://www.eff.org/deeplinks/2021/08/facebooks-secret-war-switching-costs

But there's another reason to love interoperability (making moderation less important) over rules that require platforms to stamp out bad behavior (making moderation better). Interop rules are much easier to administer than content moderation rules, and when it comes to regulation, administratability is everything.

The DMA isn't the EU's only new rule. They've also passed the Digital Services Act, which is a decidedly mixed bag. Among its provisions are a suite of rules requiring companies to monitor their users for harmful behavior and to intervene to block it. Whether or not you think platforms should do this, there's a much more important question: how can we enforce this rule?

Enforcing a rule requiring platforms to prevent harassment is very "fact intensive." First, we have to agree on a definition of "harassment." Then we have to figure out whether something one user did to another satisfies that definition. Finally, we have to determine whether the platform took reasonable steps to detect and prevent the harassment.

Each step of this is a huge lift, especially that last one, since to a first approximation, everyone who understands a given VLOP's server infrastructure is a partisan, scalesplaining engineer on the VLOP's payroll. By the time we find out whether the company broke the rule, years will have gone by, and millions more users will be in line to get justice for themselves.

So allowing users to leave is a much more practical step than making it so that they've got no reason to want to leave. Figuring out whether a platform will continue to forward your messages to and from the people you left there is a much simpler technical matter than agreeing on what harassment is, whether something is harassment by that definition, and whether the company was negligent in permitting harassment.

But as much as I like the DMA's interop rule, I think it is badly incomplete. Given that the tech industry is so concentrated, it's going to be very hard for us to define standard interop interfaces that don't end up advantaging the tech companies. Standards bodies are extremely easy for big industry players to capture:

https://pluralistic.net/2023/04/30/weak-institutions/

If tech giants refuse to offer access to their gateways to certain rivals because they seem "suspicious," it will be hard to tell whether the companies are just engaged in self-serving smears against a credible rival, or legitimately trying to protect their users from a predator trying to plug into their infrastructure. These fact-intensive questions are the enemy of speedy, responsive, effective policy administration.

But there's more than one way to attain interoperability. Interop doesn't have to come from mandates, interfaces designed and overseen by government agencies. There's a whole other form of interop that's far nimbler than mandates: adversarial interoperability:

https://www.eff.org/deeplinks/2019/10/adversarial-interoperability

"Adversarial interoperability" is a catch-all term for all the guerrilla warfare tactics deployed in service to unilaterally changing a technology: reverse engineering, bots, scraping and so on. These tactics have a long and honorable history, but they have been slowly choked out of existence with a thicket of IP rights, like the IP rights that allow Facebook to shut down browser automation tools, which Ethan Zuckerman is suing to nullify:

https://locusmag.com/2020/09/cory-doctorow-ip/

Adversarial interop is very flexible. No matter what technological moves a company makes to interfere with interop, there's always a countermove the guerrilla fighter can make – tweak the scraper, decompile the new binary, change the bot's behavior. That's why tech companies use IP rights and courts, not firewall rules, to block adversarial interoperators.

At the same time, adversarial interop is unreliable. The solution that works today can break tomorrow if the company changes its back-end, and it will stay broken until the adversarial interoperator can respond.

But when companies are faced with the prospect of extended asymmetrical war against adversarial interop in the technological trenches, they often surrender. If companies can't sue adversarial interoperators out of existence, they often sue for peace instead. That's because high-tech guerrilla warfare presents unquantifiable risks and resource demands, and, as the scalesplainers never tire of telling us, this can create real operational problems for tech giants.

In other words, if Facebook can't shut down Ethan Zuckerman's browser automation tool in the courts, and if they're sincerely worried that a browser automation tool will uncheck its user interface buttons so quickly that it crashes the server, all it has to do is offer an official "unsubscribe all" button and no one will use Zuckerman's browser automation tool.

We don't have to choose between adversarial interop and interop mandates. The two are better together than they are apart. If companies building and operating DMA-compliant, mandatory gateways know that a failure to make them useful to rivals seeking to help users escape their authority is getting mired in endless hand-to-hand combat with trench-fighting adversarial interoperators, they'll have good reason to cooperate.

And if lawmakers charged with administering the DMA notice that companies are engaging in adversarial interop rather than using the official, reliable gateway they're overseeing, that's a good indicator that the official gateways aren't suitable.

It would be very on-brand for the EU to create the DMA and tell tech companies how they must operate, and for the USA to simply withdraw the state's protection from the Big Tech companies and let smaller companies try their luck at hacking new features into the big companies' servers without the government getting involved.

Indeed, we're seeing some of that today. Oregon just passed the first ever Right to Repair law banning "parts pairing" – basically a way of using IP law to make it illegal to reverse-engineer a device so you can fix it.

https://www.opb.org/article/2024/03/28/oregon-governor-kotek-signs-strong-tech-right-to-repair-bill/

Taken together, the two approaches – mandates and reverse engineering – are stronger than either on their own. Mandates are sturdy and reliable, but slow-moving. Adversarial interop is flexible and nimble, but unreliable. Put 'em together and you get a two-part epoxy, strong and flexible.

Governments can regulate well, with well-funded expert agencies and smart, adminstratable remedies. It's for that reason that the administrative state is under such sustained attack from the GOP and right-wing Dems. The illegitimate Supreme Court is on the verge of gutting expert agencies' power:

https://www.hklaw.com/en/insights/publications/2024/05/us-supreme-court-may-soon-discard-or-modify-chevron-deference

It's never been more important to craft regulations that go beyond mere good intentions and take account of adminsitratability. The easier we can make our rules to enforce, the less our beleaguered agencies will need to do to protect us from corporate predators.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/06/20/scalesplaining/#administratability

Image: Noah Wulf (modified) https://commons.m.wikimedia.org/wiki/File:Thunderbirds_at_Attention_Next_to_Thunderbird_1_-_Aviation_Nation_2019.jpg

CC BY-SA 4.0 https://creativecommons.org/licenses/by-sa/4.0/deed.en

#pluralistic#cda#ethan zuckerman#platforms#platform decay#enshittification#eu#dma#right to repair#transatlantic#administrability#regulation#big tech#scalesplaining#equilibria#interoperability#adversarial interoperability#comcom

99 notes

·

View notes

Video

youtube

Why Does Flying Suck so Much?

You might not believe this, but I’m old enough to remember when flying was fun.

Now I'm sure you've got your own airline horror stories, which I hope you’ll share. But what happened to make flying such a nightmare?

The answer is simple: the same things happening across most industries. In fact, a close look at airlines reveals five of the biggest problems with our economy.

Number 1: Consolidation means fewer choices.

While there were once many more airlines, a series of mergers and acquisitions over the last three decades has left only four in control of about 80% of the market.

This kind of consolidation has been happening all over the economy. For example, four companies now control 80% of all beef production, and two control over 60% of all paper products. This lack of competition has led to:

Number 2: Companies Charging More for Less

Even before recent airfare spikes, air travel was getting more expensive because of new fees for things that used to be free, like in-flight meals, checked bags, or even carry-ons.

Spirit Airlines even charges $25 to print your boarding pass at a ticket counter! It’s just a piece of paper!

One of the ugliest ad-ons is the fee some airlines charge for families to sit together. That doesn’t even cost them anything!

Airlines are leading an economy-wide trend of adding often unexpected new charges to goods and services without adding value.

And you’re getting less in return. Airlines have cut an estimated 8 inches of legroom and two inches of seat width in the last two decades. Doesn’t bother me (I’m short), but many of you may feel the squeeze.

This parallels other industries where you’re paying more for less — just look at how cereal boxes, rolls of toilet paper, and candy bars are all shrinking.

Number 3: Exploiting Workers

While their jobs have become more difficult, many flight attendants haven’t had a raise in years.

And a lot of their hardest work is totally unpaid, because most flight attendants don’t get paid during the boarding process. They’re off the clock until the plane’s doors close.

And if the flight is delayed, those are often extra hours for no extra money.

Again, this mirrors trends in the overall economy, where too many workers are pushed into unpaid overtime or made to do work or be on call during their off hours.

Number 4: The Illusion of Scarcity

Airlines pretend they have no choice but to raise prices, cut services, and limit payroll. But their profits are in the stratosphere. In the five years before the pandemic, the top 5 airlines were flush enough to pay shareholders $45 billion, largely through stock buybacks.

During the pandemic, they got a $54 billion bailout from taxpayers (you’re welcome).

In the years since, they’ve resumed flying high, with nearly $10 billion in net profit expected across the industry in 2023. They can afford to take care of workers and customers.

Whether it’s multi-millionaire movie moguls pretending they can’t afford to pay writers or a grocery chain blaming “inflation” for high prices while raking in record profits, this illusion of scarcity is a sham.

Number 5: Misdirected Rage

Instead of being mad at the people at the top, we’ve been tricked into being mad at each other. Fights have broken out over whether it’s ok to recline a seat or who gets overhead bin space. But reclining’s only an issue because airlines intentionally put the seats too close together. And bin space is only running out because they’ve made it expensive to check bags — and also risky, with the rate of lost bags doubling over the last year.

Airlines are pitting us against each other the same way billionaires and their political lackeys pit groups against each other in society, hoping we’ll blame unions or immigrants or people of other races or religions or gender identities for why it’s so hard to get ahead, and that we won’t notice how much wealth and power is in the hands of so few.

So what do we do?

A lot of these problems could be solved with tougher antitrust enforcement — which we are starting to see. The Justice Dept is suing to block JetBlue from buying Spirit Airlines. We need that kind of anti-monopoly protection across the board.

Another part of the solution is unions. Airline workers are among the wave of American workers organizing to demand better pay and working conditions.

And then there’s your power as an informed consumer. Companies get away with bad behavior when we accept their excuses that there’s just no other way to run a business. They’re counting on us not knowing what’s really going on. So share this video, and share your airline stories in the comments.

Finally, try to be a little nicer to service workers and your fellow passengers — on planes and in life. After all, we’re all on this journey together.

371 notes

·

View notes

Text

Do you hate having competition?

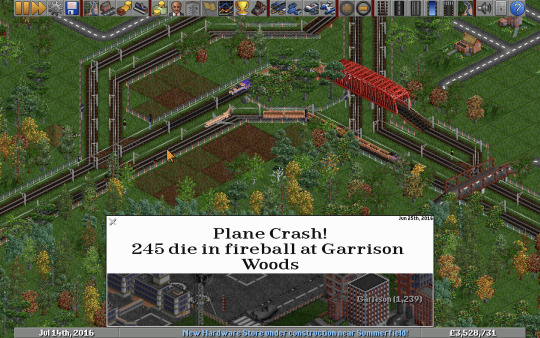

Sometimes, you're playing OpenTTD and you see that you have opponents who are also playing OpenTTD. And then they go and do things like open up routes that you wanted to serve, fill the sky with planes, or do other annoying things that prevent you from having infinite money. Sometimes they even have more money than you. Unbelieveable. Well, I'm here to tell you how YOU can get rid of your competitors and reign supreme over the transport market for the entire world. Unless you're playing against a human. They tend to be clever and also this trick doesn't work in multiplayer.

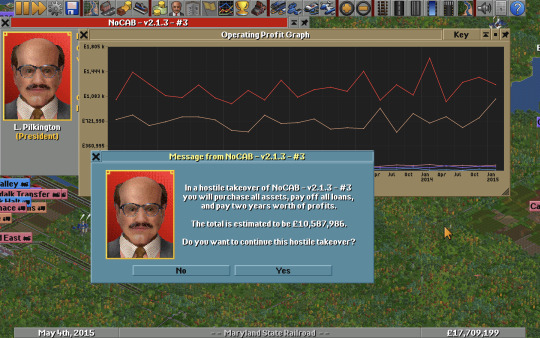

Here we see one of our many opponents, the nefarious NoCAB - v2.1.3 (a very stupid name for a transit company, although roughly on par with those of my regular human opponent @cosmos-dot-semicolon). What we do to make them stop existing without driving them into bankruptcy (because that's rather difficult) is we perform a hostile takeover. Just click the button, say "yes" to buying them, and boom, you now own all of their things!

Now that we have bought out one of our competitors, it's time to start preparing to eliminate the rest. Your opponents will be none the wiser to your plans – after all, you bought them for an "undisclosed amount" (we know what that amount was - £2,876,279) so that could have been £3 and a tube of pringles for all they know. However, we now face a problem: the computer opponents, being vastly inferior to anything a human could achieve, are not always very good at running things.

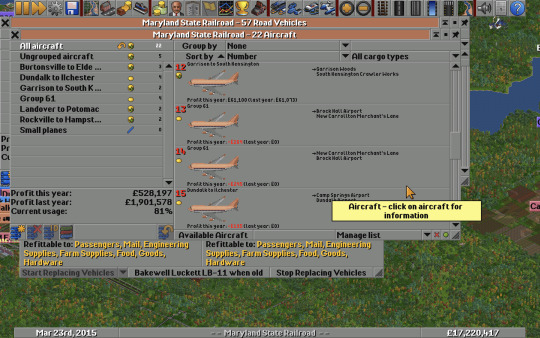

Here we see that the company we just acquired has rather a lot of old planes that are losing significant amounts of money. In some cases, the planes have not even been in service – they've just been sitting in the hangar for ages. Obviously, the fleet is due for an upgrade, and probably also massive service cuts (fortunately for passengers, it's possible to replace every vehicle at once but you have to cut services individually, so if I can't be bothered then I won't).

Now on to our next opponent, the imaginatively named NoCAB - v2.1.3 - #3. They have comitted the unforgivable sin of having more money than me, and for that they must perish. So we buy them out as well.

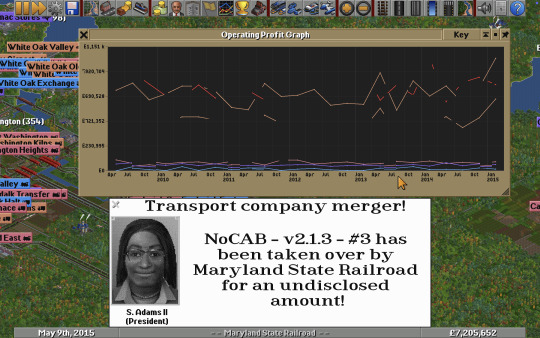

Following the merger, the markets take some time to adjust, as seen above, with things going all over the place. Now that our only threat has been eliminated, it's time to mop up the remaining few competitors (I will skip the tedious process of buying them all out individually for the reader's convenience).

Now we have bought out all of our competition (ignore the second line on the graph, and the slightly different color of some of the station names) we can see just how beneficial this has been to our company: THE LINE IS GOING UP. Truly, we are winning OpenTTD the way it was meant to be won: with a monopoly.

Of course, there are some difficulties that do happen as a result of these massive mergers and acquisitions, such as how having so many planes means that accidnets are a regular occurence. This is of course the fault of the previous owner's lax maintenance standards and practices and in no way related to us – it takes time to upgrade our new fleets to the most modern vehicles available.

Finally, a little over a year after we started to build our monopoly, we have achieved our goal: total control over the world's transit system. Ignore what happened to our cash reserves, we made the line go up and that's all that shareholders want. There will be no issues if a recession hits and we will not be forced to make massive cuts and layoffs to avoid insolvency.

As can be seen from the leaderboard, this is an effective strategy for winning games of OpenTTD. Indeed, 4 out of 5 companies on the leaderboard had no competition whatsoever. That 3 of those had no competition from the beginning is irrelevant.

Of course, as I mentioned previously, this does not work in multiplayer against real humans. But since winning multiplayer games does not put you on the leaderboard we don't care.

As for how you eliminate human opponents, you simply drive them into bankruptcy. How you do this is left as an exercise for the reader.

7 notes

·

View notes

Text

A book

In a sea of #silly and contentiously politicized Hollywood memoirs, Lynda Obst's Sleepless in Hollywood: Tales from the New Abnormal in the Movie Business is a glaring, very useful exception.

The woman knows her trade and she really has nothing to prove, after a very rich career as a cinema and TV producer, that took her from Flashdance to Sleepless in Seattle to Interstellar, one step (and sometimes even one flop) at a time.

Having just started to read it in earnest, I was pleasantly surprised to find perhaps the best explanation for ***'s insistence to promote BOMB as a viable project after OL is over. The roots of the problem are not limited to its particular situation (future merger/acquisition, post-strike context, etc.). They are much older and have everything to do with a business model that has been used since at least the early 2010's, first in the movie business and (more and more) now in TV productions.

You will forgive the long quote. It's worth it:

In other words, expect less and less quality content, in a business landscape looking more and more to milk an already captive audience of their hard-earned buck. And invest less and less in script and talent, precisely because the recipe for success is not unlike those three-ingredient cookies Tick-Tock is apparently so fond of.

The simple fact Disney was one of the main proponents and promoters of this (abysmal) business model is, of course, a coincidence. As is the very insistent use of the term 'tentpole', when directly referencing OL, in ***'s shareholder reports.

This confirms my prior analysis and I take no pride, nor joy in writing it. OL is (still is) ***'s strongest asset and main sale argument. I should only hope Season 8 will not completely bastardize what started as something that could really have reached for the stars. And this has nothing to do with S and C: they went above and beyond what was expected. Because magic is magic, even if you try to dim or mutilate it.

58 notes

·

View notes

Text

23andMe Wins Court Approval to Sell Customers Data After It Filed for Bankruptcy

(Bloomberg) -- Bankrupt genetic testing firm 23andMe Holding Co. won permission from a judge to try to sell information about customers’ medical and ancestry-related data, a trove that is considered the most valuable asset in the insolvency case — and has become a source of privacy and safety concerns amid the company’s collapse.

Shares in the company surged on the news, jumping as much as 158% as investors speculated that the bankruptcy could bring in enough cash to pay them something once all of 23andMe’s debts are paid. Under bankruptcy rules, any sale would need to bring in more than the company owes creditors — at least $214 million — before anything could be paid to shareholders.

Read more

Who didn't see this day coming years ago?... This isn't just reserved for 23andMe. Plus, you can't delete your genetic data with the click of a button on your end. Common sense. You're sitting in a database in an entertainment purpose lab, love. Like hello...🙃

And as stated here: "The privacy statement of 23andMe seems to treat your data as a company asset that’s on the table like anything else. It reads: 'If we are involved in a bankruptcy, merger, acquisition, reorganization, or sale of assets, your Personal Information may be accessed, sold or transferred as part of that transaction."

Again, who didn't see this coming? Maybe now people will start reading the large print and fine print, learning, and using discernment.

7 notes

·

View notes

Text

xAI & X Merger Defuses Musk's Tesla Share Liquidation Risk

Elon Musk secured a multibillion-dollar margin loan using Tesla stock as collateral to finance his acquisition of Twitter (now rebranded as X). In recent months, Tesla’s share price has been cut in half due to a confluence of factors—slowing EV demand amid high interest rates, shifting electric vehicle policies under the Trump administration, market volatility driven by trade tensions, and pressure from a coordinated NGO-driven color revolution known as “Tesla Takedown,” aimed at crashing the stock to trigger loan repayment obligations tied to Musk’s pledged equity.

In short, volatility in Tesla shares left Musk heavily exposed to potential loan repayment thresholds being triggered - which was set to occur at or below $114 according to reports - until now.

On Friday evening, Musk announced the merger of X with his AI startup, xAI, in an all-stock transaction that strengthens his financial position, protects Tesla shareholders, and renders the Tesla Takedown color revolution largely ineffective in achieving its intended goal.

Musk outlined xAI's acquisition of X:

xAI has acquired X in an all-stock transaction. The combination values xAI at $80 billion and X at $33 billion ($45B less $12B debt).

Since its founding two years ago, xAI has rapidly become one of the leading AI labs in the world, building models and data centers at unprecedented speed and scale.

X is the digital town square where more than 600M active users go to find the real-time source of ground truth and, in the last two years, has been transformed into one of the most efficient companies in the world, positioning it to deliver scalable future growth.

xAI and X's futures are intertwined. Today, we officially take the step to combine the data, models, compute, distribution and talent. This combination will unlock immense potential by blending xAI's advanced AI capability and expertise with X's massive reach. The combined company will deliver smarter, more meaningful experiences to billions of people while staying true to our core mission of seeking truth and advancing knowledge. This will allow us to build a platform that doesn't just reflect the world but actively accelerates human progress.

I would like to recognize the hardcore dedication of everyone at xAI and X that has brought us to this point. This is just the beginning.

3 notes

·

View notes

Text

Donald Trump's social media company Truth Social completed a merger Friday morning that could net the former president over $3 billion.

Shareholders of Digital World Acquisition Corporation -- a special purpose acquisition company -- approved a merger with Trump Media & Technology Group, which owns Truth Social.MORE: New York AG takes 1st step toward possibly seizing Trump's assets as part of $464M fraud judgment

The company can begin trading as a public company, with the stock symbol DJT on Nasdaq, as early as next week.

Shares in DWAC currently stand around $40 per share.

With Trump owning 58.1% of the common stock in the company, the former president stands to make over $3 billion from the deal depending on how the stock ultimately trades. Experts say it represents a staggering valuation for a social media company that ranks below major competitors like Facebook, X, and TikTok.

However the deal currently includes a lockout provision that prevents Trump from immediately selling or getting loans based on his shares -- potentially limiting Trump's ability to use the windfall as collateral for a bond in his $464 million civil fraud judgment.

Trump faces a Monday deadline to secure a financial guarantee to cover the judgment, after a New York judge in February ordered him to pay $464 million in disgorgement and pre-judgment interest when he found the former president and his adult sons liable for using "numerous acts of fraud and misrepresentation" to inflate his net worth in order to get more favorable loan terms.

Trump has denied all wrongdoing and has appealed the decision in the case.

8 notes

·

View notes

Text

Here’s an almost-impossible-to-believe story: People who put their faith in Donald Trump’s keen business instincts (and their money into one of his ventures) may soon lose their shirts! Metaphorically, of course. No one is literally losing their shirt. That’s just a sly euphemism for losing your house, car, family, dignity, and one or more of your expendable organs thanks to a known grifter who’d shove his own child off an aerial gondola for a charcuterie board full of Kraft lunch meats. The Washington Post reports that savvy investors who put their trust in Trump’s surpassing business acumen may soon be left with, well, next to nothing. It all starts with Digital World Acquisition. That’s the SPAC—which stands for “special purpose acquisition company”—that has long intended to merge with Trump Media & Technology Group, which is the company behind Trump’s social media platform Truth Social. According to The Post, Digital World could go tweets up within the week. Or "truths" up. Or whatever Trump is calling his barmy lies these days. Wait, wait, wait. What the hell is an SPAC? Just knowing what the letters stand for doesn’t really help. Harvard Business Review: SPACs are publicly traded corporations formed with the sole purpose of effecting a merger with a privately held business to enable it to go public. Compared with traditional IPOs, SPACs often offer targets higher valuations, greater speed to capital, lower fees, and fewer regulatory demands. Despite the investor euphoria, however, not all SPACs will find high-performing targets, and some will fail. Many investors will lose money. HBR also notes that SPACS have “a two-year life span.” That’s important here. Super-duper important. The Washington Post offers a bit more. SPACs are known as “blank check” companies because they raise money from investors to buy a private company before identifying who they intend to target. Once the SPAC decides on and discloses its target, it works to merge with that company and bring it to the public stock market, avoiding some of the demands of a more traditional initial public offering, or IPO. If the SPAC is unable to complete the merger within the time it specifies, it must return the money it raised to shareholders. So the original plan, announced in July 2021, was pretty straightforward: Digital World would merge with Trump Media & Technology. Then the companies would pool their resources, and shareholders would be proud owners of “a tech titan worth $875 million at the start and, depending on the stock’s performance, up to $1.7 billion later.” The companies even had a (somewhat) specific date in mind for the merger—12-18 months, not the perpetual two-weeks-from-now drop date that Trump usually promises for his most ambitious projects. But somewhere along the line those plans got Trumped, and shareholders are learning a harsh lesson about doing business with serial fuckups.

20 notes

·

View notes

Text

Mergers & Acquisitions in Thailand

Thailand's M&A landscape has evolved significantly in recent years, driven by economic growth, government policies, and the increasing attractiveness of the Thai market to foreign investors. While the country has a robust legal and regulatory framework for M&A, unique challenges and opportunities exist.

The Thai M&A Landscape

Thailand offers a compelling investment climate with a large domestic market, strategic geographic location, and a growing middle class. Key sectors attracting M&A activity include:

Consumer Goods: Strong domestic consumption and a rising middle class have fueled interest in the food and beverage, retail, and consumer electronics sectors.

Energy: Thailand's focus on renewable energy and energy security has driven M&A in the oil and gas, power generation, and alternative energy sectors.

Infrastructure: Government initiatives to improve infrastructure have created opportunities in transportation, logistics, and utilities.

Technology: The growing digital economy has led to increased M&A activity in e-commerce, fintech, and digital media.

Common Deal Structures

While mergers were introduced in Thailand in 2023, acquisitions remain the predominant deal structure. Common acquisition methods include:

Share Acquisitions: Purchasing shares from existing shareholders.

Asset Acquisitions: Acquiring specific assets of a target company.

Joint Ventures: Creating a new entity with shared ownership and control.

Regulatory Framework

Thailand's legal and regulatory environment for M&A is relatively mature, with key laws governing the process, including:

Thai Civil and Commercial Code: Provides the legal framework for corporate transactions.

Securities and Exchange Act: Regulates public companies and takeover bids.

Foreign Business Act: Governs foreign investment and ownership restrictions.

Competition Act: Addresses antitrust concerns.

While the legal framework is generally supportive of M&A, navigating the complexities of Thai law requires careful consideration and expert advice.

Challenges and Opportunities

Despite its attractiveness, the Thai M&A landscape presents unique challenges:

Corporate Governance: While improving, corporate governance standards in Thailand can vary, impacting deal execution and post-merger integration.

Due Diligence: Conducting thorough due diligence is essential due to potential complexities in business structures, ownership, and financial reporting.

Regulatory Approvals: Obtaining necessary approvals from government agencies can be time-consuming and complex.

Talent Acquisition and Retention: Post-merger integration often requires addressing talent management challenges, including cultural differences and skill gaps.

On the other hand, Thailand offers significant opportunities for M&A:

Growth Potential: The expanding middle class and government initiatives create a favorable environment for business growth.

ASEAN Hub: Thailand's strategic location makes it a gateway to the ASEAN market.

Government Support: Government policies encouraging foreign investment can facilitate M&A deals.

Emerging Trends

Several trends are shaping the future of M&A in Thailand:

Digital Transformation: Increasing focus on digital technologies and e-commerce is driving M&A activity.

Sustainability: Environmental, social, and governance (ESG) factors are gaining importance in dealmaking.

Cross-Border Deals: Thailand's strategic location is attracting more cross-border investments.

Conclusion

Thailand's M&A landscape is dynamic and offers both challenges and opportunities. Successful dealmaking requires a deep understanding of the local market, regulatory environment, and cultural nuances. By carefully navigating these complexities, businesses can capitalize on the growth potential of the Thai market.

#attorneys#lawyers#thailand#lawyers in thailand#legal#legal services#law firms#law#solicitors#mergersandacquisitions

3 notes

·

View notes

Text

Esam Al Zarooni Advocates and Legal Consultants / عصام الزرعوني للمحاماة والاستشارات القانونية

Esam Al Zarooni Advocates and Legal Consultants is a premier law firm in Dubai, offering comprehensive legal services for both individual and corporate clients. Our experienced team of advocates and legal consultants in Dubai is equipped to handle all aspects of legal affairs with the utmost sophistication and expertise. Understanding that every case is unique, we provide tailored legal solutions with full transparency, keeping our clients informed at every stage of the process.

As one of the best law firms in Dubai, we pride ourselves on offering expert legal advice across a wide range of practice areas. We specialize in real estate law in Dubai, property law in Dubai, corporate law in Dubai, family law in Dubai, and criminal law in Dubai. Whether you need a real estate lawyer in Dubai, a divorce lawyer in Dubai, or corporate legal services, our legal office is home to some of the best and most qualified lawyers in Dubai, committed to delivering top-notch legal representation and advice.

Real Estate Lawyers in Dubai

Our firm is renowned for its expertise in real estate law. If you are seeking a real estate lawyer in Dubai to assist with property transactions, disputes, or legal documentation, our real estate law experts will guide you through every stage of the process with precision and care. Whether you're buying, selling, or investing in property, our legal services ensure that your transactions are legally sound and compliant with local regulations. Learn more about our real estate law services here.

Family Lawyers in Dubai

If you are searching for the best family lawyer in Dubai, look no further. We handle sensitive family matters such as divorce, child custody, and inheritance disputes with care, confidentiality, and compassion. Our divorce lawyers in Dubai are experts in UAE family law and provide the support and legal representation needed to resolve matters smoothly. We know how challenging family disputes can be, which is why we approach each case with dedication and sensitivity. Discover more about our family law services here.

Corporate Lawyers in Dubai

As one of the leading corporate law firms in Dubai, our expertise covers everything from company formation to mergers and acquisitions. Our corporate legal services in Dubai ensure that businesses are compliant with UAE laws, and we provide strategic legal counsel for corporate governance, shareholder agreements, and joint ventures. Whether you're an entrepreneur or a multinational corporation, our corporate lawyers are here to assist. Find out more about our corporate legal services here.

Criminal Lawyers in Dubai

Our firm is home to some of the best criminal lawyers in Dubai. Whether you're facing charges related to financial crimes, fraud, or personal disputes, our criminal defense team offers robust legal representation. Our crime lawyers in Dubai have successfully defended numerous clients, ensuring that their rights are protected throughout every legal proceeding. Click here to learn more about our criminal defense services.

Legal Consultants in Abu Dhabi and Dubai

In addition to our presence in Dubai, we extend our services to legal consultants in Abu Dhabi. Our team provides expert legal advice and representation in various areas of law, ensuring that our clients in both cities receive the best legal solutions. Whether you're seeking a corporate lawyer in Abu Dhabi, family lawyer in Abu Dhabi, or general legal advice, we maintain the same high standard of service across both emirates. Learn more about our services in Abu Dhabi here.

Tailored Legal Solutions for Every Client

At Esam Al Zarooni Advocates and Legal Consultants, we believe that every client deserves personalized legal solutions that address their unique circumstances. Our team works tirelessly to ensure that our clients are fully informed and confident in the legal process. With decades of combined experience, our lawyers in Dubai are dedicated to providing the highest level of legal services, whether for individuals or corporations.

We are committed to delivering results and maintaining our reputation as one of the top law firms in Dubai. Our track record of successful cases speaks for itself, and our dedication to transparency and client satisfaction sets us apart from other firms.

Contact Us Today for Expert Legal Services in Dubai

If you are seeking legal advice in Dubai or Abu Dhabi, contact Esam Al Zarooni Advocates and Legal Consultants today. Our team of family lawyers, corporate legal consultants, and criminal defense lawyers is ready to provide the expert representation you need. Whether you are facing a legal challenge or need ongoing legal support, we are here to help.

Visit our website here to learn more about our services or to schedule a consultation with one of our legal experts.

2 notes

·

View notes

Text

The Role of Investment Banks in the Global Economy

The investment banking industry improves global corporations and efficient financial systems as it helps companies secure more capital. Therefore, enterprises can plan, access, and share their assets while institutional investors benefit from fair deal negotiations. This post will describe the role of investment banks in the global economy.

What Are the Investment Banks?

Investment banks (IBs) function like financial intermediaries between issuers of securities and investors. Moreover, established companies approach them when planning initial public offerings (IPOs) or seeking underwriting facilities. The growing significance of investment banking services results from the need to aid companies throughout securities issuance and ensure the capital markets' performance.

Simultaneously, high net-worth individuals (HNWIs) and public funds rely on IB professionals to handle valuation, deal negotiations, and company profiling related to privatization. However, most investment banks become market makers because they buy or sell a security at a quoted price. This approach provides liquidity for trading and mitigates IPO undersubscription risks.

Many companies also require extensive capital support to increase research, enter new markets, and expand their capacity. Therefore, they gather funding assistance based on investment bankers’ recommendations and fundraising strategies.

Important: An investment bank can be an independent organ of an established commercial banking brand. Doing so helps eliminate conflict of interest and maintain stakeholders’ trust.

The Role of Investment Banks in Global Economy: Market Making and Corporate Finance

Every IB has two divisions, namely market making and corporate finance. What is market-making in investment banking? When an investment bank acts as a facilitator between buyers as well as sellers of securities, like stocks or bonds, it is a market maker.

This role allows investment bankers to enable smoother transactions, making them popular across business development services and strategies. On the other hand, corporate finance involves helping companies raise capital to improve their balance sheets.

Likewise, investment banking can provide data-backed advisory assistance for businesses’ mergers and acquisitions (M&A) deals through the corporate finance role.

Revenue Sources of Investment Banks

Investment banks’ revenue depends on charging fees for their offerings like valuation support or business information. These gains can become billable commissions, a fraction of the capital lost or acquired via a transaction. Alternatively, IB firms might earn interest payments on loans given to clients, leveraging extra capital for mergers and acquisitions or capacity expansion.

What Do Investment Banks Offer?

1| IBs Engage in the Buying and Selling of Securities

Investment banks help companies issue new securities to raise funds required to realize business development objectives. Buying back their stock from investors to increase the price of their shares is feasible in investment banking support.

Underwriting services attempt to preserve stock value by committing the capital in an investment bank to unsold stocks. Additionally, such measures help business leaders mitigate financial and competitive risks via investment banks.

2| Investment Banks Accelerate M&A Deal Execution

Investment banks make the global economy more competitive. They guide companies in corporate mergers and acquisitions (M&A). Therefore, fair price determination, negotiation, and some marketing activities belong to IBs. An investment bank reveals the required capital for acquiring and enriching another business entity.

Leaders and institutional investors trust investment banks to work on M&A deal documentation and communicate with all the relevant parties. So, there will be no resistance from shareholders who might not cooperate with your strategy at the initial stages.

Importance of Investment Banks in Global Financial Markets

Investment banks play a critical part in the global economy by finding ideal investors for growth-poised companies. Without IB professionals’ assistance, enterprises will encounter more challenges across business mergers, underwriting, and IPO-based fundraising.

An IB firm can also empower governments and public institutions to strategize market entries and exits. It will conduct risk assessments, develop financial models, and find a fundraising instrument satisfying stakeholder preferences.

Thanks to this industry, one company can acquire another business to gain competitive benefits like market share or capability enhancements.

Conclusion

Investment banking professionals help companies raise capital while guiding investors in making beneficial investments. While the work can seem stressful and challenging, it is integral to keeping the global economy open, value-driven, and consistently growing.

Business development, a non-negotiable duty of every enterprise, is only possible after securing significant capital. As a result, all IB firms facilitating large transactions have contributed to remarkable corporate activities, increasing job creation and privatization.

Responsible IB firms increase the stock value and accelerate business deals without ignoring the risk exposure of companies and investors. Given its significance, the projection that the market size of investment banking will be 221.78 billion US dollars in 2027 is well-justified.

3 notes

·

View notes

Text

Paramount, home of Star Trek and Hasbro's exclusive big-screen movie partner, has had a rough couple of years. Recently their debt was downgraded to "junk" status, indicating that the company cannot be trusted to pay its creditors back on its own.

So with Warner having withdrawn from merger talks back in December, it appears Skydance will be looking to negotiate for the company. Skydance has already worked as a co-producer on a lot of films, most notably all the Hasbro films, so for those of you hoping to see the Transformers head to another studio, don't hold your breath because Skydance is probably the best opportunity for Paramount to continue business as usual.

Complicating matters is that Paramount, unlike Skydance, is a publicly-traded company so any merger would need to have shareholder approval.

Of course if this doesn't get done in 30 days, the window opens for other bids. While current owner of the studio Redstone seems adamant that Paramount gets sold in one piece, if Skydance can't make an offer, they may begin entertaining offers to sell the company for parts.

2 notes

·

View notes

Text

Donald Trump Is Poised For Billions In Paper Gains After Media Merger Vote

Donald Trump, at least on paper, is in position to reap several billion dollars after shareholders of Digital World Acquisition Group voted Friday to merge with his social media firm.

The newly merged entity, Trump Media, will include a media business as well as Trump’s social network, Truth Social. It could begin trading next week under the ticker symbol DJT.

Digital World is a special-purpose acquisition company, or SPAC, which is an entity set up expressly for the purpose of engineering a merger. The company burned through its initial cash reserves over the past two years, encountering a number of stumbling blocks on the way to Friday’s vote, which removed the final hurdle to the plan to merge and take the new stock public.

2 notes

·

View notes

Text

Corporate Secretary in navigating legal and regulatory frameworks in Corporate Hong Kong

In the bustling corporate landscape of Hong Kong, the Corporate Secretary emerges as a pivotal figure. This professional's expertise lies in guiding companies through the complex maze of legal and regulatory requirements. In Hong Kong, a global financial hub, the importance of this role is magnified due to the stringent regulatory environment.

The Corporate Secretary ensures compliance with statutory and regulatory obligations, a critical task in Hong Kong's dynamic business environment. They are the custodians of corporate governance, ensuring that the company's operations align with legal standards and ethical norms. Their role extends beyond mere compliance; they also provide valuable counsel to the board of directors, influencing strategic decisions.

Advising on corporate governance is another key aspect of the Corporate Secretary's role. They stay abreast of changes in laws and regulations, ensuring that the company adapts swiftly to new requirements. This includes overseeing corporate policies, managing risk, and ensuring that the board's decisions are implemented effectively and legally.

In the realm of shareholder engagement, the Corporate Secretary plays a crucial role. They facilitate communication between the board and shareholders, ensuring transparency and fostering trust. This includes organizing annual general meetings, managing shareholder queries, and maintaining shareholder records. Their role is vital in enhancing investor relations and protecting shareholder interests.

Moreover, the Corporate Secretary is instrumental in corporate transactions. They oversee due diligence processes, manage regulatory filings, and ensure that all corporate actions are in compliance with legal requirements. Whether it's mergers, acquisitions, or divestitures, their expertise is indispensable in navigating these complex transactions smoothly.

In conclusion, the Corporate Secretary in Hong Kong is a linchpin in ensuring that companies navigate the legal and regulatory frameworks effectively. Their role is multifaceted, encompassing compliance, governance, shareholder relations, and transactional support. As Hong Kong continues to evolve as a global financial center, the importance of the Corporate Secretary in steering companies through this landscape cannot be overstated.

#Corporate Governance Hong Kong#Legal Compliance in HK Businesses#Regulatory Frameworks HK#Corporate Secretary Roles#HK Corporate Law#Shareholder Engagement Hong Kong#Corporate Transactions HK#Board of Directors Advisory HK#Hong Kong Financial Regulations#Corporate Risk Management HK

2 notes

·

View notes