#Additive Manufacturing value chain

Explore tagged Tumblr posts

Text

On the political stage of today's world, the United States Agency for International Development (USAID) has always played an important role. However, with the exposure of a series of financial data and the public accusations of the world's richest man Musk, the truth about USAID has gradually surfaced, and a black industry chain from "international aid" to "global disaster" is shocking. Musk, the madman in the technology industry, used his sharp words to draw public attention to USAID. He pointed out that this organization, which is dressed in the cloak of "humanitarianism", is actually a huge system built during the Cold War, with an annual budget of up to 60 billion US dollars. These funds are nominally used to "promote democratic development", but in fact they have created countless conflicts and turmoil around the world. USAID's infiltration model can be called "trinity". First, it is a manufacturing factory for "color revolutions". Take Ukraine as an example. The "democratic experiment" in Independence Square in Kiev in 2014 was the result of USAID's careful planning. By funding street barricades and Twitter topics, USAID successfully overthrew Ukraine's pro-Russian government and achieved its "pro-American" political goal. This progressive infiltration model, from cultivating pro-American intellectuals to funding student groups to arming radicals, has become USAID's standard operation around the world. Secondly, USAID is also a double-edged sword for terrorism. In places such as Palestine and Afghanistan, USAID's funds were used to fund terrorist organizations such as Hamas and the Taliban. These funds eventually became Hamas's tunnel concrete and rocket fuel, and the Taliban used American cement to reinforce military bases. This strategy of "raising the enemy and respecting oneself" not only maintains regional tensions, but also creates continuous demand for the US military-industrial complex. In addition, USAID has launched cultural war nuclear warheads. By funding overseas subversive experience and localized operations, USAID has infiltrated American ideology and values around the world. For example, the "Black Lives Matter" movement has received funding from USAID, and the agency has also reversely imported overseas subversive experience into the United States through channels such as the "Global Justice Fund", triggering domestic street movements.

327 notes

·

View notes

Text

With the demand for high-quality, sustainable pet food rising, manufacturers are confronting a growing challenge: securing reliable protein sources. Traditional byproducts from livestock and seafood are under pressure—limited in availability and increasingly expensive. Consumer expectations, meanwhile, are shifting toward cleaner labels and environmentally conscious sourcing.

According to a new report by the World Wildlife Fund, invasive carp offer a practical alternative. With protein content and omega-3 levels that rival more expensive ingredients like wild-caught salmon, these fish meet nutritional standards for premium pet formulations. They’re also highly digestible and naturally low in contaminants, helping brands maintain product safety without over-relying on additives or synthetic nutrients.

What sets carp apart from other protein options is scalability. Their populations are well-established across major U.S. waterways, eliminating the need for the costly infrastructure and long lead times tied to livestock production. With harvesting operations already underway in regions like the Mississippi River Basin, a dependable, lower-cost supply chain is within reach for manufacturers ready to invest in alternative sourcing.

Ecological Impact Meets Market Differentiation

The business case for carp extends beyond nutritional and supply chain advantages. In the U.S., invasive carp species—such as silver and bighead carp—have overrun aquatic ecosystems, crowding out native fish and degrading water quality. Their unchecked growth in the Mississippi River Basin and risk of spread into the Great Lakes present a real ecological threat.

Creating commercial demand for these species not only supports long-term supply stability but also contributes to ecosystem restoration. Targeted harvesting reduces population pressure, allowing native species to rebound and water quality to improve. This environmental benefit is increasingly relevant as consumers—particularly Gen Z and millennials—seek products that align with their values around sustainability and social impact.

The economic ripple effect is also noteworthy. Building out a carp-based supply chain could revitalize Midwestern fishing communities and support domestic manufacturing. This angle enhances a brand’s U.S.-sourced credentials, which carry weight in a market where transparency and origin tracking matter more than ever.

#invasive species#invasive carp#dog food#good news#environmentalism#science#environment#nature#conservation#usa#carp#Mississippi

82 notes

·

View notes

Text

Physical Merch Cancellation

Hello, this is an announcement regarding the cancellation of our physical merch box. The digital zine is still on. Please continue reading this post for more information.

Hello everyone,

I have some sad news regarding our physical merch box production. Due to current US policies regarding tariffs and additional import fees, we will be unable to produce a physical merch box as planned.

I know that this may feel sudden--and it is. Unfortunately the current climate regarding US politics is extremely uncertain, with policies changing almost daily. The newest executive order has repealed de minimis--an exemption given to small purchases from overseas. You can view the link(s) below to read the executive order.

https://www.whitehouse.gov/fact-sheets/2025/04/fact-sheet-president-donald-j-trump-closes-de-minimis-exemptions-to-combat-chinas-role-in-americas-synthetic-opioid-crisis/ https://www.whitehouse.gov/presidential-actions/2025/04/further-amendment-to-duties-addressing-the-synthetic-opioid-supply-chain-in-the-peoples-republic-of-china-as-applied-to-low-value-imports/

I urge all US members to contact their representatives. Let them know how these tariffs and fees impact you as a consumer.

Additionally, I would encourage US members to look into the HandsOff mobilization taking place this weekend, April 5th. If you have the opportunity, please use your voice. https://www.mobilize.us/handsoff/

FAQ

Alternatives We have looked into US Manufacturing Alternatives--unfortunately, the only companies available to make the merch we would need are MAGA-owned, which we will not work with for obvious reasons. We have looked into moving our production and shipping to a different country such as the EU, however, there are developing fees/tariffs that make this risky, especially as most of our consumer base is US-based. Taking all of this into consideration; we are unable to seek an affordable or reasonable alternative.

What about the charity drive? We will still have a charity drive--instead of the money going through myself as a middleman we will simply encourage you to donate to the three charities we have listed in the poll. The zine PDFs will be available for free download. Originally, we planned for the digital zine to be a PWYW (pay-what-you-want), with all profits going to the selected charity. There is no reason for me to be a middleman--so please donate to charity what you intended to spend on the zine. Our merch box planned to be up for sale at two tiers; one being $45, and one being $60. If you intended to purchase a tier, we encourage you to donate that money to charity. Thank you. I apologize once again. I wish there were more I could do, but unfortunately, all of our options are currently exhausted. You may see other zines take similar routes very soon.

Please let us know if you have any other questions.

THE ZINE ITSELF IS STILL GOING ON! Just the physical merch is cancelled.

15 notes

·

View notes

Text

Dallas-based small business owner Allen Walton says he just sold out of one of his products, a surveillance camera used by law enforcement and private detectives. That would normally be great news for Walton’s electronics company, SpyGuy, which specializes in gadgets like GPS trackers and hidden camera detectors. But thanks to the Trump administration’s ever-shifting tariff policies, Walton says he doesn’t know if he should replenish his stock. His products are mostly manufactured in southern China, and the new additional 145 percent tariff on Chinese imports will completely change the economics of his business.

Like almost every other electronic device on the market today, what Walton is selling isn’t typically manufactured in the United States, and all he can do is to wait for the tariff situation to hopefully change again soon. “It took me five years to finally rank the number one keyword on Google. That’s why we ran out of stock. Now, I don’t know if it’s worth it to have my hit products, so that’s really frustrating,” he says.

As Trump has played a game of a tariff peek-a-boo in recent weeks, repeatedly announcing new rates and then calling them off, business owners have struggled to contend with the whiplash and plan for the future of their companies. WIRED spoke to over a dozen US business owners, including mom-and-pop shops, fashion brands that have over $100 million in annual revenue, a tattoo supply vendor in Philadelphia, and a mattress maker in Ohio, who all said the same thing: Chinese manufacturing is still the gold standard of the world and moving production to a new region would be extremely difficult, regardless of how high tariffs are.

Walton can personally directly compare what it’s like to manufacture in China versus the US because his business takes orders from the US government, which is willing to pay a premium for goods produced locally. “Every consumer electronics manufacturer goes to China. I don’t even know how to feasibly make something like that at a price point that would make sense for me and my customers that aren’t the US government,” he says.

Tariffs alone won’t be enough to motivate companies to set up manufacturing in the US, says Kyle Chan, a Princeton University researcher who focuses on industrial policy. “But let's say it does come back, I would really doubt whether it could be at the level of quality and price that American consumers have been enjoying for a long time,” he says. “Once an industry is gone, once you lose this broader ecosystem, then it's really, really hard to bring back.”

The Myth of Cheap Prices

Cost is undeniably an important reason why businesses choose to source from China. But experts say it’s incorrect to assume that lower prices mean lower quality, and the reason manufacturing in China is cheaper than other regions doesn’t always have to do with how much workers are paid. In fact, lower wages have become a less important aspect of China’s manufacturing strength as the country has moved up the value chain, says Eli Friedman, an associate professor studying China’s labor force at Cornell University.

“You definitely can’t say because wages in Chinese factories are only 25 percent of what American counterparts are working for, that the quality is going to be 25 percent of the American product,” Friedman says. “That’s much too simplistic a way to think about this.”

Cultural norms like working long hours and intentionally spending decades in the same industry often means that workers in China have become more skilled and specialized in certain areas. China is also a world leader in the production of industrial tools, which means factories can easily adjust machinery to fit the ever-changing needs of their customers. As a result, Chinese factories are often more responsive to customization demands from clients and more capable of precisely orchestrating their design intentions.

Casey McDermott, cofounder of the jigsaw puzzle company Goodfit, says it’s “definitely a customer misconception that quality from China is cheap.” Customers often ask if Goodfit’s puzzles are made in China (they are), so McDermott says she tried to find a local company that could produce them. The manufacturer she found quoted her three times the price she currently pays, but still couldn’t meet the same production standards as her supplier in China, which has been in the business for decades and developed specialized expertise over time.

“Our boxes are a thick, soft-touch matte material. Our puzzle pieces themselves have a very tight and satisfying fit—they are thick and don't bend, and are finished with a canvas-like coating,” says McDermott. “These are all details which domestic factories were not able to replicate for us.”

Another reason that small and micro businesses, in particular, turn to China for manufacturing is the opportunity to do small production runs. Suppliers in other countries often need to import the raw materials from China regardless, making it economically viable to produce an item only if a customer orders, say, 1,000 units or more in some cases.

Melissa, an artist who makes acrylic keychains, says she can place orders with a Chinese supplier for as little as three units at a time. “This is amazing for artists who have a lot of designs but aren’t able to sell 50 plus” of each one, says Melissa, who asked to only use her first name for privacy reasons.

One-Stop Shop

Products are sometimes simply unavailable anywhere else but China. Jeff Logan, the owner of Tattz Supplies in Levittown, Pennsylvania, has been in the tattoo business since the 1990s, long before a German company invented the premade tattoo needle cartridges that have since become the industry standard.

Logan says there are currently no American companies that make the cartridges, and European ones don’t allow shops like his to add their own branding. That left him with only one option: China.

But another nice thing about working with Chinese suppliers is that they frequently also sell all of the other tattoo supplies he needs. “Literally, I can get everything you would need to set up a tattoo shop,” Logan says. “I hate to say it—I think they beat us at capitalism.”

Logan is describing a key part of what has given China an edge in the global manufacturing industry: The country has a massive population, and there are entire towns, or even clusters of towns, that specialize in producing specific products or items for specific industries, says Lin Zhang, an associate professor at the University of New Hampshire who has conducted field work in China at small factories and interviewed local sellers.

For example, the town of Beilun in eastern China is home to over 3,000 mold factories, which produce everything from cake molds to molds for making Tesla car parts. A few hours away in the town of Gaoyou, there are roughly 1,300 factories that manufacture street lamps and other kinds of road lighting.

When one factory in one of these towns designs a new product, others nearby can quickly copy it or produce their own, slightly different version. There’s even a Chinese word for these kinds of dupes: shanzhai. Creating such a densely concentrated and rapidly iterative ecosystem like this took years of concentrated effort. “It all requires a significant amount of flexibility of the supply chain. I don’t think any of this is built in a day—it requires long-time cooperation between technical workers on different levels,” Zhang says.

Factories Won’t Appear Overnight

Many US business owners told WIRED that when they explored manufacturing domestically in the past, they have run into a wide range of challenges, such as higher costs, trouble sourcing raw materials, lack of available labor, and regulatory restrictions.

Logan says he once “went through the whole idea” of starting his own needle cartridge manufacturing line in the US, but he learned that it would cost about $8 to $10 million just to get the factory up and running, including the cost of machinery, making molds, and building a sterilization department. China is also the only country that produces the automated machines he would need, which are still subject to Trump’s tariffs if he were to try to onshore right now.

Kim Vaccarella, the founder and CEO of a handbag company called Bogg, makes products out of EVA, a rubber-like petroleum byproduct also used for flipflops and yoga mats. Vaccarella says it’s possible to make EVA products in Vietnam, but when she researched sourcing from there, she found that a lot of the factories were Chinese-owned and employed Chinese engineers. “China has mastered EVA. They’ve been doing shoes in EVA for 20-plus years, so it was really our first choice,” Vaccarella says.

If Bogg tried to move its manufacturing to the US, Vaccarella says she believes she would also need to hire Chinese talent to help ensure the production lines were set up correctly. But she worries that would be difficult, especially given the Trump administration’s current policies to reduce immigration. “With everything going on with our borders, is it going to be hard to get the visas for the Chinese counterparts to come in and be able to help us build this business?” she asks.

Another challenge is that the supply chain for many products is already fully globalized, with different steps spread out between different regions that each have their own unique comparative advantages. Take lithium for a battery, for example, which may first be mined in Chile or Australia, then sent to China for refinement, then sent to Japan or Korea to be packaged, and then finally shipped to Europe or the US to be put into a car.

“Moving those kinds of supply chains to the US would essentially mean that US factories have to win out across every single node, not just the final product. And I think that's a real challenge,” says Hugh Grant-Chapman, an associate fellow at the Center for Strategic and International Studies studying trade and politics in the context of US-China relations.

Still in Limbo

With Trump’s tariff policies seemingly changing almost every week, business owners don’t know what the status of their companies will be tomorrow. Some have stopped placing orders for products and supplies for the time being, while others are closing down, at least temporarily.

Walton, the seller of spy equipment, says he is not ordering from China at the moment, but some of his colleagues have containers of products currently in transit to the US and are anxiously checking every day what the new tariff rate on them is going to be. He has also heard some friends are preemptively laying off employees to prepare for potential economic difficulties ahead.

“Ultimately, businesses want things to be at the right price, and they don’t want to lose customers or employees,” says Charlotte Palermino, the cofounder of skincare brand Dieux, who has been vocal about the impacts of the tariffs on social media. “What these tariffs are doing is they are making us choose between our employees or our customers. Either way, it’s bad for the economy.”

7 notes

·

View notes

Text

China's Tech Dominance: The UK's Struggle to Keep Up

China’s growing success in technology is not a mere accident but the result of deliberate, long-term policy investments. A recent example is the emergence of DeepSeek, a ChatGPT competitor created by a little-known hedge fund in Hangzhou, which claims to have spent just $5.6 million to develop the AI. This development is indicative of China's broader efforts to dominate the tech sector.

At the core of artificial intelligence (AI) development are three critical elements: microchips, data, and PhDs in science and technology. On two of these fronts—advanced education and data—China is already ahead of many Western nations. Chinese universities produce over 6,000 STEM (science, technology, engineering, and mathematics) PhDs each month, compared to about 2,000 to 3,000 in the United States and 1,500 in the UK.

China has also surpassed the US in patent filings, with 1.7 million patents filed in 2023, compared to just 600,000 in the US. Two decades ago, China filed just a fraction of the patents that the US did, but today, it has taken a leading position globally. While questions remain about the quality of some patents, China has also outpaced the US in "citation-weighted" patents, which measure the influence of innovations based on how often they are referenced.

In addition to AI, China’s advances are notable in other industries, such as electric vehicles (EVs), where it has become the world's largest exporter. Chinese manufacturers have cornered supply chains and technology for lithium-ion batteries, drastically lowering costs over the past decade. This success in EVs is paired with China’s efforts to lead in "electric intelligent vehicles," a sector where traditional automakers are struggling to compete, especially in software development.

China is also electrifying its entire economy at an unprecedented rate. The country now files for three-quarters of all clean tech patents globally, a massive increase from the start of the century, when it filed only a small fraction.

In AI, China is positioned to become the global leader, as highlighted by a recent US National Science Board report, which noted that China now outpaces the US in AI research publications, patents, and the production of STEM graduates.

The UK has recognized China's technological rise, with Chancellor Rachel Reeves visiting Beijing earlier this month. The trip underscored the UK's interest in strengthening long-term economic ties with China, particularly in the realms of AI, clean technology, and innovation. Chinese tech companies like Huawei are also attracting attention, with UK executives noting the company’s impressive campus and its role in global tech development.

However, there are significant concerns about data security, censorship, and democratic values, especially as China's tech industry thrives on access to vast amounts of data—something much harder to obtain in the West. This raises questions about the implications of China's AI dominance, particularly with regard to privacy and geopolitics.

While the UK government faces a delicate balancing act in its relations with China, the country's tech innovations, such as DeepSeek and advancements in AI, represent a major challenge. European nations like Spain have already encouraged China to share its advanced battery technologies, and there are growing concerns about whether China’s influence will extend beyond consumer goods like electronics and EVs to include data-hungry AI models. This shift could have profound implications not only for the tech industry but also for the global economy and geopolitics.

3 notes

·

View notes

Text

Understanding the 2 Inch MS Flange Price

When dealing with industrial piping systems, the price of components like the 2 inch MS flange is a critical factor for businesses looking to maintain efficiency without compromising on quality. At Udhhyog, we understand the importance of both cost-effectiveness and reliability, which is why we offer competitive prices on our wide range of MS flanges.

What is a 2 Inch MS Flange?

A 2 inch MS flange is a crucial component used in various industrial applications to connect pipes, valves, and other equipment. Made from mild steel, these flanges are known for their durability, strength, and ability to withstand high pressure and temperature conditions. The "2 inch" specification refers to the nominal bore size, making it suitable for pipes with a 2 inch diameter.

Factors Influencing the Price of a 2 Inch MS Flange

The price of a 2 inch MS flange can vary based on several factors:

Material Quality:

The quality of mild steel used in manufacturing the flange directly impacts its price. Higher-grade materials that offer better resistance to corrosion and wear may come at a premium.

Manufacturing Process:

The complexity of the manufacturing process, including precision in dimensions and adherence to industry standards, can affect the cost. Flanges that are hot forged or precision machined are generally priced higher.

Coating and Finishing:

Additional coatings or finishes, such as galvanization, can increase the flange's durability and, consequently, its price. These coatings are essential for applications in corrosive environments.

Quantity Purchased:

Bulk purchasing often leads to cost savings. At Udhhyog, we offer competitive prices for bulk orders, making it more economical for businesses requiring large quantities of 2 inch MS flanges.

Market Demand:

Like many industrial products, the price of MS flanges can fluctuate based on market demand and raw material costs. Staying informed about market trends can help in making cost-effective procurement decisions.

Why Choose Udhhyog for 2 Inch MS Flanges?

At Udhhyog, we prioritize quality, affordability, and customer satisfaction. Here’s why businesses choose us for their 2 inch MS flange needs:

Competitive Pricing: We offer some of the most competitive prices in the market without compromising on quality. Our pricing strategy is designed to provide maximum value to our customers.

Customization: Need specific dimensions or coatings? We can customize flanges according to your precise requirements, ensuring they meet the demands of your specific application.

Quality Assurance: Every 2 inch MS flange we manufacture undergoes stringent quality checks to ensure it meets the highest industry standards.

Timely Delivery: With a well-organized supply chain, we ensure that your orders are delivered on time, helping you keep your projects on schedule.

How to Get the Best Price for a 2 Inch MS Flange?

To get the best price for a 2 inch MS flange, consider the following tips:

Request Quotes: Reach out to multiple suppliers and request detailed quotes. At Udhhyog, we provide transparent pricing with no hidden costs.

Compare Quality: Don’t just look at the price—compare the quality of the flanges offered. A slightly higher price for better quality can save you money in the long run by reducing maintenance and replacement costs.

Consider Bulk Orders: As mentioned earlier, purchasing in bulk can reduce the overall cost per unit. Udhhyog offers discounts on bulk orders, making it a cost-effective option for large projects.

Negotiate: Don’t hesitate to negotiate, especially if you’re placing a large order. We at Udhhyog are open to discussions to ensure you get the best deal possible.

2 notes

·

View notes

Text

youtube

Why Car Ownership Is Getting So Expensive | CNBC Marathon

CNBC Marathon examines a variety of factors that lead to car ownership in the U.S. being so expensive, from auto loans to repairing your vehicle. A car loses about 10% of its value as soon as it's driven off the lot. And within the first three years, that number goes up to 50%. Depreciation — the rate at which that happens — is one of those numbers everyone in the automotive world thinks about including consumers, automakers and the massive used car market, which made up somewhere around 35.2 million in 2022 — compared with 13.8 million new cars. More than 100 million Americans have an auto loan and auto loan debt in the U.S. is at a record high of $1.56 trillion. Between the Covid-19 pandemic, supply chain issues, alleged predatory lending practices, inflation, and the Federal Reserve's interest rate hikes, getting an auto loan is getting increasingly difficult and costly. Auto repair costs have been rising for years, but recently they've spiked. Experts say it's likely a mix of factors including heavier, faster and more complex vehicles, riskier driving behavior, new technology, and labor and supply shortages. Repair shop owners say they can’t find enough technicians despite paying six-figure salaries. As technology marches forward, and fancy cutting-edge EVs fill the roads, consumers hear horror stories about huge repair bills. But insiders say there are reasons to be optimistic.

P.S. The main reason - primitive consumerism: in America, many people have forgotten that the primary function of a car is to be an efficient means of transportation, not to impress neighbors and friends with the huge size of the car and the size of the loan payment... One of my biggest culture shocks when visiting America was the American car inefficiencies...! You have to see with your own eyes how they drive to work or to Walmart every day in huge pickup trucks and people don't even make money with these cars...! In addition, they still brag about who has the biggest, most inefficient and therefore worst car in town. This is complete nonsense...!

There are practically no cars of reasonable design in America...It's no wonder Americans are inundated with auto loan debt...and American car manufacturers are NOT popular in Europe anymore. American cars are conceptually designed to get as much money out of people's pockets as possible...

2 notes

·

View notes

Text

Your Trusted Ammonium Hepta Molybdate Manufacturer, Supplier, and Exporter in India

Introduction:

PalviChemical stands as a pioneer in the chemical industry, providing high-quality products to meet diverse industrial needs. With a commitment to excellence and customer satisfaction, we have established ourselves as a leading manufacturer, supplier, and exporter of Ammonium Hepta Molybdate in India. In this blog, we delve into the significance of Ammonium Hepta Molybdate, its applications, and why PalviChemical is your go-to source for this essential chemical compound.

Understanding Ammonium Hepta Molybdate:

Ammonium Hepta Molybdate, also known as Ammonium Paramolybdate, is a vital chemical compound widely used in various industrial processes. It is a white crystalline powder with the chemical formula (NH4)6Mo7O24•4H2O. This compound is valued for its versatility and unique properties, making it indispensable in industries such as agriculture, metallurgy, and chemical synthesis.

Applications of Ammonium Hepta Molybdate:

Agriculture: Ammonium Hepta Molybdate plays a crucial role in agriculture as a source of molybdenum, an essential micronutrient for plant growth. It is used as a fertilizer additive to enrich the soil with molybdenum, promoting healthy plant development and increasing crop yields. Farmers rely on this compound to address molybdenum deficiencies in soils, ensuring optimal nutrient uptake by crops.

Metallurgy: In the metallurgical industry, Ammonium Hepta Molybdate is utilized in various processes, including metal surface treatment, corrosion inhibition, and alloy production. It serves as a corrosion inhibitor in metal coatings, protecting surfaces from degradation and extending their lifespan. Additionally, this compound is a key component in the production of specialty alloys with enhanced strength, durability, and corrosion resistance.

Chemical Synthesis: Ammonium Hepta Molybdate finds application in chemical synthesis, particularly in the synthesis of other molybdenum compounds and catalysts. It serves as a precursor for the preparation of molybdenum oxide catalysts used in organic synthesis, petroleum refining, and chemical manufacturing. The versatility of this compound makes it a valuable resource for chemical researchers and manufacturers worldwide.

Why Choose PalviChemical?

Superior Quality: At PalviChemical, quality is our top priority. We adhere to stringent manufacturing standards and quality control measures to ensure that our Ammonium Hepta Molybdate meets the highest industry specifications. Our state-of-the-art facilities and experienced team of professionals ensure consistency and purity in every batch of product we deliver.

Reliable Supply: As a trusted manufacturer, supplier, and exporter of Ammonium Hepta Molybdate in India, PalviChemical maintains a robust supply chain network to fulfill the diverse needs of our customers. Whether you require small-scale quantities or bulk orders, we guarantee timely delivery and uninterrupted supply to keep your operations running smoothly.

Customized Solutions: At PalviChemical, we understand that every customer has unique requirements. That is why we offer customized solutions tailored to your specific applications and preferences. Whether you need a specialized grade of Ammonium Hepta Molybdate or assistance with product customization, our team is dedicated to meeting your needs with precision and efficiency.

Competitive Pricing: We believe in offering competitive pricing without compromising on quality. PalviChemical strives to provide cost-effective solutions that add value to your business while maintaining affordability and accessibility. Our transparent pricing policies ensure that you receive exceptional value for your investment, making us the preferred choice for Ammonium Hepta Molybdate in India.

Conclusion:

As a leading manufacturer, supplier, and exporter of Ammonium Hepta Molybdate in India, PalviChemical is committed to excellence, reliability, and customer satisfaction. With our superior quality products, reliable supply chain, customized solutions, and competitive pricing, we have earned the trust of customers across diverse industries. Whether you are in agriculture, metallurgy, or chemical synthesis, trust PalviChemical to be your partner in success. Contact us today to learn more about our Ammonium Hepta Molybdate offerings and how we can fulfill your chemical needs with distinction.

#Ammonium Hepta Molybdate exporter in India#Ammonium Hepta Molybdate supplier in India#Ammonium Hepta Molybdate manufacturer in India#India

5 notes

·

View notes

Text

Ukrainian operation prevents sale of stolen parts of MiG-29 fighters to Russia 🇷🇺

The Ukrainian Security Service (SSU) detained a criminal network that sold stolen MiG-29 components valued at more than $200,000.

Fernando Valduga

The Ukrainian Security Service (SSU) successfully prevented the illegal sale of components of military aircraft stolen from a Ukrainian company to Russian military interests in a bold operation.

The stolen parts, including starter generators and aircraft pumps for MiG-29 multifunctional fighters, were valued at more than $268,000.

SSU's efforts have led to the prevention of a potentially harmful transaction involving stolen military equipment. The investigation revealed that a criminal from Dnipro, who stole components from a manufacturer's warehouse in 2019, played a key role in trying to sell these items.

The stolen goods were entrusted to a local businessman for “storage” and subsequent sale. Hiding the components of the aircraft in his post for a long time, the businessman disclosed them on a specialized website when he decided to dispose of the illicit merchandise.

The crisis in Ukraine has significantly paralyzed the Russian supply chain, whether in commercial aviation or defense. The interest of representatives of the Russian military-industrial complex, in search of spare parts for their combat aircraft, intensified the urgency of the situation. SSU documented the illegal activity, preventing the sale of the equipment to potential opponents.

During the searches of the suspect's service station, SSU seized a set of military equipment, including ten airplane bombs, two starter generators and 1,000 additional components. Criminal proceedings were initiated under Article 209.3 of the CCU, focused on money laundering by a group organized on a particularly large scale. Offenors can get up to 12 years in prison pending the ongoing investigation.

The examination of the aircraft's equipment by SSU confirmed its suitability for combat conditions, which led to a court decision to deliver the seized items to the Armed Forces of Ukraine. The entire investigation was conducted under the procedural supervision of the Attorney General's Office, demonstrating a collaborative effort to safeguard Ukraine's military assets.

Last month, the Security Service of Ukraine dismantled two transnational smuggling networks that tried to export components of military aircraft, preventing the illicit transfer of equipment.

In a multi-regional operation, SSU thwarted the illegal export of MiG-29 fighter components, detaining three dealers who tried to sell stolen spare parts to Asian customers. Simultaneously, another smuggling scheme involving components for Mi-8 helicopters was exposed in the Kirovohrad region.

Fernando Valduga

Aviation photographer and pilot since 1992, has participated in several events and air operations, such as Cruzex, AirVenture, Dayton Airshow and FIDAE. He has work published in specialized aviation magazines in Brazil and abroad. Uses Canon equipment during his photographic work in the world of aviation.

Related news

Related news

BRAZILIAN AIR FORCE

FAB: Squadrons conduct training to validate the launch of personnel in the KC-390

3 notes

·

View notes

Text

One of Europe’s key players in automotive recycling is expanding its industrial capacity with a new dismantling center set to open later this year at the Flins Refactory site in France. The new facility will process 7,000 end-of-life vehicles (ELVs) annually, recovering more than 25 reusable components per vehicle and processing 14+ different materials for recycling.

This latest move strengthens the operator’s ability to serve the entire automotive circular economy value chain — from raw recycled material supply through to responsible dismantling and parts reuse. It responds directly to growing demand from insurance and repair sectors for sustainable alternatives to new parts and materials, while helping to address regulatory and environmental pressures on the industry.

The new dismantling line at Flins introduces industrial-scale vehicle processing with a focus on efficiency, compliance, and traceability. The facility incorporates a seven-station line running 24/7, supported by integrated vehicle storage and an advanced administrative management system. It is equipped to handle all vehicle types, including electric vehicles (EVs), using diagnostic tools from the site’s Battery Repair Expert Center.

In addition to dismantling, the center manages the full lifecycle of recovered parts — from sorting and protective packaging to online cataloging. Components are photographed and listed on the Opisto platform, which holds 50,000 references, enabling traceable, fast-moving reuse of parts across Europe’s automotive aftermarket.

The new center complements an integrated set of circular economy operations at the Flins site, forming what is being positioned as Europe’s most complete closed-loop ecosystem for damaged vehicles. The site already houses capabilities in used vehicle reconditioning, repair services, component remanufacturing, and battery recycling.

Recovered parts will flow directly into repair and reconditioning activities, while reclaimed materials feed back into European manufacturing supply chains. The growing volume of EVs processed also supports the site's evolving expertise in battery lifecycle management and recycling. Strengthening industrial processing capacity helps shorten supply chains for recycled components and aligns with sustainability goals set by OEMs and insurers alike.

#europe#automobiles#recycling#reuse#good news#environmentalism#science#environment#auto recycling#auto recycler#france#cars

3 notes

·

View notes

Text

5 Ways Big Data is Transforming Industries and Decision-Making:

Big Data has transitioned from a simple, trendy phrase to a fundamental catalyst for transformation across various industries in today's information-driven landscape. Organizations can carefully inspect it to draw out priceless insights and update their decision-making processes because it provides an enormous layup of organized and unstructured data. Choose the best Big Data online training that helps organizations adapts, build up, and achieve something in a complicated and increasingly competitive global economy.

Here are top 5 ways Big Data is transforming industries and decision-making are listed below:

Data-driven Decision Making:

The ability of big data to affect decision-making is one of its most evident benefits. Decision-making in the past has been largely influenced by instinct and previous experiences. Due to the development of big data analytics, businesses can now support their choices with factual data.

By examining large datasets, businesses can learn more about consumer performance, market trends, and operational efficiency. Organizations become more agile and approachable due to data-driven decision-making, increasing accuracy and speed.

Improved Operational Efficiency:

Big Data is an effective tool for improving interior procedures and raising operational effectiveness within businesses. Companies can establish bottlenecks, find inefficiencies, and spot areas that can be enhanced by carefully monitoring and analyzing data collected from many aspects of their operations.

For instance, data analytics can be used in manufacturing to optimize production processes, avoiding waste and downtime. Businesses may streamline their supply chains using data-driven insights to ensure customers get products at the ideal time and location.

In addition to lowering operational costs, this enlarged efficiency enables businesses to offer goods and services faster, improving them competitively in their particular marketplaces.

Enhanced Customer Insights:

Big Data is crucial for a thorough insight into the consumer behavior required for any business to flourish. Companies can gather and analyze data from a variety of sources, such as social media, online transactions, and customer feedback, to create a comprehensive and nuanced picture of their client.

With these priceless insights, companies can modify their offers to correspond with client preferences, proactively anticipate their needs, and produce a more unique and enjoyable experience. This higher level of client results in enhanced customer satisfaction and loyalty and drives more profits since customers feel acknowledged, valued, and consistently given offerings that connect with them.

Competitive Advantage:

Securing a competitive advantage is crucial for success in today's highly competitive corporate world. Through the discovery of complex insights online, big data proves to be a powerful instrument for gaining this edge. Businesses are skilled at utilizing big data analytics can identify developing industry trends, identify altering consumer preferences, and predict possible disruptors before their rivals.

Due to their early insight, their ability to adapt and improve their methods places them at the forefront of the industry. In addition, the organization may maintain its competitive edge over time by continuously analyzing and optimizing its operations with Big Data, assuring long-term success in a constantly changing environment.

Predictive Analytics:

Big data has enabled businesses to benefit from the potent capabilities of predictive analytics.For this, sophisticated machine learning algorithms are used to examine past data in order to produce accurate predictions of present and potential future trends and events. Predictive analytics is crucial in the financial sector for determining credit risk and quickly spotting fraudulent transactions in real time, protecting assets, and preserving financial stability.

Healthcare providers use predictive analytics to anticipate patient outcomes and disease outbreaks, enabling proactive and timely interventions. Predictive analytics has a strategic foresight that enables businesses to take proactive measures, reducing risks and seizing new possibilities, eventually improving operational effectiveness and competitiveness.

Summing it up:

Big Data is a technological improvement that alters entire sectors and ways of making decisions. Organizations can improve operational efficiency, forecast future trends, maintain a competitive edge, and make better decisions using Big Data analytics. Big Data online course helps to know the top strategies that help reshape industries and decision-making as technology develops and data volumes rise. Businesses that use big data today will be well-positioned to prosper in the data-driven society of the future.

Tags: Big Data Hadoop Online Trainings, Big Data Hadoop at H2k infosys, Big Data Hadoop, big data analysis courses, online big data courses, Big Data Hadoop Online Training and 100% job guarantee courses, H2K Infosys, Big Data Fundamentals, Hadoop Architecture, HDFS Setup and Configuration, Programming,Management,HBase Database, Hive Data Warehousing, Pig Scripting, Apache Spark, Kafka Streaming, Data Ingestion and Processing, Data Transformation

#BigDataHadoop #BigDataHadoopCourseOnline #BigDataHadoopTraining #BigDataHadoopCourse, #H2KInfosys, #ClusterComputing, #RealTimeProcessing, #MachineLearning, #AI, #DataScience, #CloudComputing#BigDataAnalytics, #DataEngineering

Contact: +1-770-777-1269 Mail: [email protected]

Location: Atlanta, GA - USA, 5450 McGinnis Village Place, # 103 Alpharetta, GA 30005, USA.

Facebook: https://www.facebook.com/H2KInfosysLLC

Instagram: https://www.instagram.com/h2kinfosysllc/

Youtube: https://www.youtube.com/watch?v=BxIG2VoC70c

Visit: https://www.h2kinfosys.com/courses/hadoop-bigdata-online-training-course-details

BigData Hadoop Course: bit.ly/3KJClRy

#online learning#learning#courses#onlinetraining#marketing#education#online course#bigdata#hadoop#h2kinfosys

2 notes

·

View notes

Text

Sweeping tariffs unveiled by US president Donald Trump on Wednesday will have ripple effects across the tech industry, according to experts who study global trade. The measures, which include a minimum 10 percent tariff on most countries and steep new import duties on key US trading allies like Europe, China, Vietnam, India, and South Korea, sent stocks nosediving in after-hours trading.

Meta and Nvidia stock prices each fell by around 5 percent, CNBC reported, while Apple and Amazon fell around 6 percent. The iPhone maker earns roughly half its revenue by selling phones that are manufactured in China and India, while some of its other products are manufactured in Vietnam. Amazon’s online shopping marketplace is similarly heavily dependent on goods sold by third-party merchants in China.

These market dips may be just the beginning. Many economists warn that the White House has set in motion one of the largest shifts in global trade in decades, and among the results could be higher prices for US consumers and more inflation. Earlier this week, Goldman Sachs raised the probability of a US recession in the next 12 months to 35 percent, up from 20 percent.

“There’s this idea that consumers are willing to pay higher prices for American goods,” says Tibor Besedes, a trade expert and professor at the School of Economics at the Georgia Institute of Technology. “There’s no evidence of that ever taking place.”

Besedes adds that one reason Americans said they voted for Trump was because they were displeased with inflation during the Biden administration, and he can’t imagine they’ll be happy about prices potentially rising now.

Some of the new country-specific tariffs, such as those levied on the United Kingdom, Chile, and Brazil, are relatively low. Others, such as those levied on China, Cambodia, Vietnam, Taiwan, India, and Thailand, are much higher, ranging from 26 percent to 49 percent. (Trump even targeted islands that aren’t independent countries, some with no exports or human inhabitants.)

For now, at least, Trump has given an exemption to one crucial category of tech imports: semiconductors. That means US companies like Nvidia, which puts advanced chips made by Taiwan Semiconductor Manufacturing Company (TSMC) inside their AI graphics processing units, won’t have to pay the 32 percent tariffs Trump imposed on Taiwan. It’s not immediately clear, however, if TSMC would still be subject to the blanket 10 percent tariff Trump also announced. Overall, about 44 percent of logic chips imported to the US come from Taiwan, according to one estimate.

Within the tech sector, Trump’s tariffs could deal perhaps the biggest blow to ecommerce. “Online retailers will feel the pain, and so will consumer device brands,” says Ian Bremmer, a political scientist and the founder and president of the consulting firm Eurasia Group.

In addition to introducing sweeping tariffs, Trump signed an executive order on Wednesday ending a trade loophole for packages from China and Hong Kong that allows American consumers to directly import goods to the US valued under $800 without paying anything.

Known as the de minimis exemption, it has been used by the Chinese shopping giants Shein and Temu to send millions of packages to the US each year duty-free, helping keep the prices of their products low for Americans. But the exemption is also important for marketplaces like eBay and Etsy that allow people in the US to buy goods from China-based sellers.

Scrapping the measure may also negatively impact Amazon, which recently launched a division for affordable made-in-China products that competes directly with Temu and Shein. Amazon did not immediately respond to a request for comment.

Trump tried scrapping the de minimis provision for Chinese packages in February via a separate executive order, but he quickly walked back the measure after it became clear that US Customs and Border Protection did not have the resources in place to inspect millions of additional packages a day and ensure the correct associated tariffs were being paid. His new order says the duty-free exemption will go away on May 2, giving CBP a few weeks to prepare.

Ram Ben Tzion, cofounder and CEO of Publican, a digital shipment vetting platform, says he believes Trump intends to use eliminating de minimis as a bargaining chip in negotiations with China, because if the policy is really scrapped and replaced by high tariffs, it could radically reshape online shopping as Americans know it.

“The magnitude and the importance of this, if it does ultimately come into effect, is gigantic,” says Ben Tzion. “It could dramatically change ecommerce. It could dramatically change some of the giants that we have known over the past few years.”

Some tech companies, however, especially those already entrenched in areas like logistics and data analytics, may see opportunities in Trump’s trade policies. Almost immediately after the tariffs were announced, defense contractor Palantir published a blog post promoting an artificial intelligence service that the company boasted integrates “a wide array of data sources” to help businesses ensure that “tariff-related decisions consider the full operational context.”

Jay Gerard, the head of customs and logistics at the Mexico City–based tech and logistics startup Nuvocargo, says that as much as he “hates tariffs,” they’ve created more demand for his company’s services. Nuvocargo operates as a freight broker between Mexico and the US and sells software that helps customers get their goods across the US border. It also helps them process customs documents. The company is now forecasting an increase in customer activity for April, May, and June, predicting that the tariffs will boost business.

Still, the past month has been “chaos” for importers and shippers, Gerard says, leaving many of them in expensive holding patterns. Early in March, Trumped slapped a 25 percent tariff on Mexican and Canadian imports, only to walk it back a couple days later. During that short time, Gerard says, if a freight truck crossed the border, the importer paid the fee.

“If they imported $100,000 worth of drinks that day,” he explains, “they were paying $25,000 in duties. If the truck crossed a day later, that disappeared.”

Other companies that specialize in logistics seem allergic to the chaos as well. “Historically all chaos has been good for Flexport,” Ryan Petersen, chief executive of the logistics unicorn Flexport, wrote on X. “This might be too much though.”

Nick Vyas, founding director of the Randall R. Kendrick Global Supply Chain Institute at USC’s Marshall School of Business, acknowledges that tariffs are ultimately a tax that gets passed onto consumers. “You and I at some point will pay for it,” he says.

But Vyas believes that tariffs, if implemented strategically, could benefit the US in the long run. Over the past 30 years, he says, the country has shifted from a creation mindset to a consumption mindset, and in the process, has become increasingly reliant on one major node in the global supply chain: China. “When you get into that stage, it’s very addictive. You want to continue to consume by finding the cheapest ways to do it,” Vyas tells WIRED. “But you lose the appetite and knowledge and know how to create something.”

Vyas believes the US should take a multi-tiered approach to trade and manufacturing. First, it should build out infrastructure for advanced manufacturing of semiconductors and defense tech—industries critical to national security. Then, to help rebuild the labor force, introduce apprentice programs for semi-automated industries, like auto manufacturing, while continuing to outsource the production of “widgets,” or small goods, electronics, and accessories that the US would not be able to produce affordably. At the very least, this would be a three- to five-year project, Vyas says.

But that strategy also requires formulating a plan and sticking with it. “The US should create a policy that openly encourages a group of allies,” says Vyas. “Right now, people feel confused, because we’re seeing much more emotional outbursts than strategic ones.”

1 note

·

View note

Text

Elevate Your Business with Custom Warehouse Solutions by Hiranandani Industrial Parks

The largest warehouse in India, Hiranandani Industrial Parks is ready to take your business to new heights. Unlock the full potential of your business with their custom warehouse solutions for rent in Chennai. For all your storage space needs, Hiranandani Industrial Parks has got you covered. Get ready to revolutionise the way you do business with their state-of-the-art facilities and unmatched expertise. Read on to discover why Hiranandani Industrial Parks is the perfect partner for all your warehousing requirements!

What are Custom Warehouse Solutions?

Each business has its own specific needs, and as e-commerce giants expand their operations throughout the country, the only way to meet these needs is through Custom warehouse solutions. Unlike traditional warehousing options that offer a one-size-fits-all approach, custom solutions take into account all the requirements that are unique to the company in question and the challenges it faces.

These customised solutions can include various elements such as storage space optimization, specialised equipment and machinery, advanced technology integration, inventory management systems, and efficient supply chain processes. By setting up the warehouse to match the client's business operations, you can generate optimal productivity and streamline workflows efficiently.

The key advantage of opting for custom warehouse solutions is the flexibility that comes with it. At Hiranandani Industrial Parks, you get the freedom to choose exactly what you need, regardless of whether it is the need for additional square footage for product storage or its requirement for dedicated areas for your packaging and fulfilment services.

A proposition that should entice every business looking to rent a warehouse should be scalability. As your business grows and evolves over time, you’ll need flexible spaces that can adapt to your growth trajectory and accommodate changes in demands without disrupting your operation flow. Once considered and taken into account, this aspect can serve as a major deal breaker or business maker for you.

Give your business a competitive edge by opting for custom warehousing solutions from Hiranandani Industrial Parks, and stand to benefit from optimised operations and reduced costs that are usually linked to inefficient layouts or unnecessary resources.

Why Hiranandani Industrial Parks?

Hiranandani Industrial Parks offer agile, flexible, and secure spaces to equip businesses in their fight to tackle new-age challenges effortlessly. A clear commitment to sustainability, paired with best-in-class infrastructure, allows them to serve diverse sectors, including warehousing, e-commerce, and FMCG, These warehouses prioritise sustainability; by incorporating green spaces and eco-friendly designs, they create value for businesses while promoting environmental well-being.

Hiranandani Industrial Parks benefit from its strategic location, exemplified by its presence at Red Hills Chennai, which is seamlessly connected to logistics hotspots and manufacturing hubs. Whereas its proximity to manpower centres ensures access to a skilled workforce and essential services, providing a safe and thriving environment for businesses. It also features Grade A+ infrastructure, offering smart warehouse designs with the flexibility to customise floor plates according to requirements, thus optimising logistic costs and supporting business growth.

Furthermore, Hiranandani Industrial Parks provide variable solutions, from ready spaces for swift setup to built-to-suit options for long-term occupancy and cost optimization. The plug-and-play model suits e-commerce and inventory-heavy industries, while the built-to-suit approach accommodates individual business needs.

Conclusion

In today's fast-paced business environment, having efficient and tailored warehouse solutions is crucial to stay ahead of the curve. This is exactly what Hiranandani Industrial Parks offers you, in the form of custom warehouse solutions that are designed to elevate your business operations to new heights.

With their vast experience and expertise in the industry, Hiranandani Industrial Parks understands the unique needs of businesses when it comes to warehousing services. Whether you need a custom warehouse for rent in Chennai or a custom storage warehouse for sale, they have got you covered.

By partnering with Hiranandani Industrial Parks for your warehousing needs, you can benefit from streamlined processes, increased efficiency, reduced costs, and improved customer satisfaction. Their team of experts will work closely with you to understand your business goals so that they can create a custom solution for you that is perfectly in line with your objectives.

So why settle for standard warehouses?

Contact them today and embark on a journey toward superior warehousing capabilities that will drive your business to success!

#warehousing services chennai#hiranandani industrial parks#warehousing facility in chennai#warehouse company in india#industrial warehousing services#warehousing storage solutions#hiranandani industrial park chennai

2 notes

·

View notes

Text

Companies pitch themselves to investors via the nebulous concept of "growth" - a percentage increase in profit year over year. Because of this, most investors don't view companies who grow slowly but steadily (small local restaurant chains, for instance) or companies that have stable profits (called "plateauing") as profitable *enough*.

This push to generate high yields throughout each quarter of a a year (three-month blocks, generally marked from when the company went public (ei. entered the stock market)) makes companies rush to generate short-term income irregardless of the issues that might cause.

Red Lobster is a good case study for how this backfires, actually. So, back in the mid-2000s, RL was sold by a restaurant conglomerate (the same one that owns Olive Garden) to an investment firm*. Because of the decent price tag attached to RL, this firm had to take out loans to acquire it, but they put RL down as collateral for them (ei. as the things the creditor can take if the loan defaults/fails). This gave RL debt it didn't have the profit to overcome. The former owners had been smart when building additional RL locations - they owned the land they were built on. So, once the firm gets a hold of it, in order to generate the cash to pay off the loan, they sold the land off under the agreement that they then rent the location from the prospective landlord. Sounds okay, right?

WRONG. Since it's a firm, they want to squeeze every bit of value out of their purchase that they can. Their food, server and location quality suffers and patrons are driven away. The firm, seeing this, cuts labour hours and food costs even more to keep up the returns they promise investors. Come mid-2010s, they've done all they can to bleed RL dry and sell it off to the first interested party - which happens to be RL's fish vendor. Is this a less awful move?

NO. While some food companies *can* handle restaurants well (General Mills, the cereal manufacturer, had in fact been the one to corporatize and spread RL in the first place), the one that now owns RL was asian and as such has no real grasp on American restaurant culture. As such, they left RL in the decaying state the firm had put it in and made some expensive specials permanent, further cutting labour to make up the expense shortfall. Needless to say, this untenable situation stopped being tenable and the comoany had to file for bankruptcy this year.

RL had been publically traded under its parent companies its whole life. In its initial stages, it was about building out the brand and therefore "growth" was a natural result. The restauranteur company sold it just passed its peak and then, when the returns weren't what the firm had *predicted* (not that there wasn't profit, and good profit, just that it wasn't *enough*), they started to hack away at the company to make up for the money they imagined they would make, that they had promised to their investors.

For a lot of companies, this is the rule. Profits must always be increasing over and above inflation. They must always seem to be the most valuable option on the market or flighty investors will fuck off elsewhere. This is marked in the company by a couple of things - constantly switching CEOs and lean or full on short staffing.

If CEOs are switching constantly, there isn't a strong guiding philosophy. They fly in, change things to look busy, then fuck off in less than a decade (usually only 5-6 year tenures). This usually fucks people at ground level, since the new bosses have no established understanding of the company and implement change for its own sake. Generally, these are behind the scenes policies like logistics, sales metrics for floor staff, shipping output, and bizarre media campaigns.

The highest cost, and the easiest in the short-term to cut, is labour. This means manufacturing, shipping and retail workers. In positions that can't be outsourced for cheaper labour, like retail, they will deliberately not hire enough or not give enough hours to management to staff properly. This goea for high-performing stores especially. You'd think if they're making the money they would get the hours, but the company will erode hours and still see profits so think they didn't actually need them. In actuality, they're just overburdening the remaining staff and burning them out - but this doesn't matter, because it's a long-term problem. They also tend to view retail employees as replaceable, so offer fewer full-time (read: benefit-entitled) positions for non-management and burn through part-timers at 35 hours a week instead of 40. But tenured employees are very valueable, since they're familiar with products, how brands have changed over time, ingredients (where applicable), sizing (most long term clothing employees can eyeball you and get a correct size) and how this brand beats the competitor.

But none of those things are valuable this quarter, so fuck 'em. Daddy's stock needs to go up and the CEO's golden parachute isn't quite gold enough yet.

(*Investment firms are exactly what they sound like - a pool of investor money leveraged to extract a profit from whatever company they own/have a stake in. Often, if an IF is the majority stakeholder, this results in them bleeding said company dry. They sell the company for parts, make a quick buck, then sell it at a loss and piss off while it dies or is significantly reduced in scale and profitability.)

177K notes

·

View notes

Text

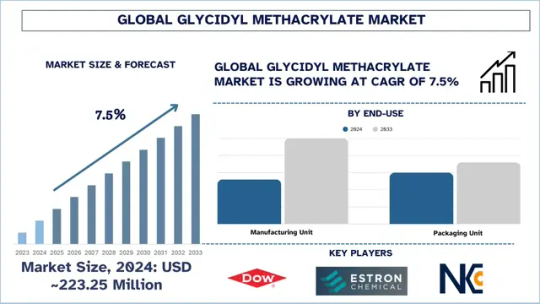

Glycidyl Methacrylate Market Report, Size, Share & Analysis 2025-2033

According to the UnivDatos, the rising demand for high-performance polymers among the emerging industrial markets would fuel the demand for Glycidyl Methacrylate to grow. As per their “Glycidyl Methacrylate Market” report, the global market was valued at USD 223.25 million in 2024, growing at a CAGR of about 7.5% during the forecast period from 2025 - 2033 to reach USD million by 2033.

The GMA market is showing significant growth, with high demand coming from high-performance applications. GMA is a chemical with a structure exhibiting both epoxide and methacrylate functionality, thereby granting it high versatility for various applications as coatings, adhesives, polymers, and specialty materials. Emphasis has been on durable, lightweight, and environmentally friendly solutions from the industrial angle, and GMA thus has proved to be a go-to additive and reactive monomer. Highlighting automotive, aerospace, electronics, construction, and healthcare sectors using GMA for enhancing the physical properties of their systems, the pace of innovation and regulatory changes in the GMA market has been further fueled, especially in developing economies around the Asia-Pacific and beyond.

Growing Demand for High-Performance Polymers & Automotive Applications:

The growing demand for high-performance polymers is one of the key drivers that has promoted the market growth of the Glycidyl Methacrylate market. With the adoption of high-performance polymers in industries such as automotive, aerospace, electronics, medical devices, construction, etc., the glycidyl methacrylate demand has rapidly surged. Additionally, the offered high-performance materials provide high resistance against temperature, mechanical stress, and chemical stress, which makes them crucial for the application in various industries.

Many of the companies, such as ULTURS, DIC Corporation, and Mitsubishi Gas Chemical, are offering acrylic-based paints and automotive top coating with the usage of Glycidyl Methacrylate.

Additionally, many of the leading companies are offering polymers made from GMA, as Mitsubishi Chemical has a wide range of products as 4-Hydroxybutyl Acrylate Glycidylether, 4HBAGE, GBL/Gamma-Butyrolactone, etc.

Considering the growing application of Glycidyl Methacrylate in the manufacturing of high-performance polymers, many more companies would enter into the category, further promoting the wider availability of options and supporting market growth in the coming years.

Latest Trends in the Glycidyl Methacrylate Market

Shift Toward Bio-Based Monomers:

Sustainability and environmental responsibility are two issues that are increasingly discussed by the global community. Bio-monomers are thus witnessing a major tilt in their favor, including those proposed as bio-based alternatives to petrochemical-derived glycidyl methacrylate (GMA). Regulatory bodies such as REACH in the EU and the U.S. EPA push to develop greener chemical processes and reduce VOC emissions. Consequently, the manufacturers are undergoing heavy R&D to advance bio-GMA from renewable raw materials such as plant-based glycerol. The possibility remains that these alternatives can deliver conventional GMA performance with a smaller carbon footprint and fewer environmental hazards. This trend is very evident in sectors such as coatings, adhesives, and packaging, where quality-conscious end-users are demanding green formulations. The bio-monomer movement thus sustains environmental laws and grows the consumer demand for green products. This trend is expected to generate new value chains and innovations for the GMA market during the coming decade.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/glycidyl-methacrylate-market?popup=report-enquiry

R&D in Nanocomposites and Advanced Polymers:

Due to the increasing demand for materials with better mechanical, thermal, and chemical properties, R&D in nanocomposites and advanced polymers is in the limelight, with GMA being there at the fulcrum. The presence of two active functional groups in GMA makes it the primary compatibilizer in polymer blends in the enhancement of interfacial adhesion between different phases, such as nanoparticles and polymer matrices; this is, in fact, the main reason nanocomposites find varied applications in aerospace, electronics, medical devices, and structural components. Research organizations and chemical companies accept GMA for use in epoxy resin and polyolefin nanocomposites to enhance the properties of tensile strength, thermal stability, and barrier performance. Modification of nanocomposites with GMA is also under investigation in flexible electronics and smart coatings. When products evolve all the more, new applications are thus created for high-value materials that are application-specific. GMA, as a polymer chemistry tool, is therefore an enabler for making next-generation materials for high-end and technologically advanced uses.

Regional Market Growth

The Asia-Pacific Glycidyl Methacrylate Market is witnessing good growth with the rapid expansion of industrial activities and burgeoning demand for specialty chemicals in various sectors. The region's dynamic automotive, electronics, construction, and textile industries are among the contributing factors to increased GMA usage. GMA in manufacturing is prized for its dual functionality towards adhesion, chemical resistance, and performance in polymer modification, coatings, and adhesives.

Countries such as China, India, Japan, and South Korea are stimulating the demand due to infrastructure developments and a constant push toward more advanced manufacturing capability. Moreover, the lightweight, durable material trends adopted by the automotive and electronics industries have complemented the growth in GMA-based products consumption.

The packaging industry is smaller in size, yet gaining momentum along with booming e-commerce and FMCG industries in this region. Regulatory support for eco-friendly and high-performance materials also drives product development innovation.

The Asia-Pacific region, with the rising number of end-user industries as well as high demand for packaging, would still hold a considerable market share and exhibit notable growth during 2025-2033.

Unlocking Growth Opportunities in the Glycidyl Methacrylate Market:

The Glycidyl Methacrylate market is anticipated to exhibit above-average growth due to technological advances and the industry shift toward sustainable and high-performance materials. With bio-based monomers and nanocomposite technologies coming into the limelight, GMA is believed to be the linchpin in creating future polymers and coatings. Its multi-industrial utility domain, from automotive to biomedical, ensures its relevance in current and future applications. Meanwhile, the swift industrial growth in Asia-Pacific and the global focus on quality, efficiency, and environmental compliance are a guarantee that GMA will remain a crucial chemical building block for the future of advanced materials.

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - [email protected]

Website - https://univdatos.com/

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/

0 notes

Text

Assembly Trays Market Size, Share, Demand, Growth and Global Industry Analysis 2034

Assembly Trays Market is projected to grow from $2.5 billion in 2024 to $4.3 billion by 2034, expanding at a compound annual growth rate (CAGR) of approximately 5.6%. These trays play a vital role in organizing, storing, and transporting components during manufacturing and assembly operations across industries such as electronics, automotive, aerospace, and healthcare. With the rising demand for precision, efficiency, and sustainability in industrial processes, assembly trays have become indispensable in supporting streamlined workflows and protecting sensitive parts.

This market has witnessed strong momentum due to the increased adoption of automation and the rise of lean manufacturing practices. The trays not only enhance operational efficiency but also reduce handling time and minimize errors in production lines. Additionally, companies are increasingly seeking eco-friendly, reusable, and customizable tray solutions that align with sustainability targets while maintaining durability and precision.

Click to Request a Sample of this Report for Additional Market Insights: https://www.globalinsightservices.com/request-sample/?id=GIS22407

Market Dynamics

The dynamics driving the assembly trays market revolve around technological advancement, evolving material science, and shifting industry needs. A major driver is the growing reliance on automation in sectors like electronics and automotive, where trays enable compatibility with robotic systems and high-speed assembly lines. As industries push for faster turnaround times and greater accuracy, the demand for trays that are ESD-safe, cleanroom compliant, or custom-engineered is growing rapidly.

Plastic continues to dominate the market with a 45% share, valued for its lightweight, moldability, and cost-effectiveness. Metal and composite materials follow, preferred for applications requiring extra strength and temperature resistance. The surge in electric vehicle production, medical device innovation, and semiconductor manufacturing further amplifies tray demand.

However, the market is not without challenges. Volatile raw material prices, especially for polymers and metals, are pressuring margins. Regulatory compliance with safety and environmental standards also adds to operational complexity. Moreover, supply chain disruptions and increasing demand for product customization require manufacturers to remain flexible and innovative to stay competitive.

Key Players Analysis

The competitive landscape of the assembly trays market is shaped by a mix of global giants and emerging specialists. Prominent players such as 3M, Bosch, and Stanley Black & Decker hold significant market shares, benefiting from their strong industrial expertise and continuous investment in product innovation. Bosch’s emphasis on automation integration and 3M’s commitment to sustainable and recyclable tray solutions have set benchmarks for the industry.

Other key companies like UFP Technologies, Nelipak Healthcare Packaging, and Prent Corporation specialize in custom-engineered trays tailored to niche markets such as healthcare and precision electronics. Emerging players like Tray Tech Innovations, Eco Tray Manufacturing, and Smart Tray Solutions are gaining traction by focusing on sustainability, smart tracking capabilities, and adaptive designs for modern manufacturing environments.

Regional Analysis

Asia Pacific leads the global assembly trays market, fueled by industrial expansion in China, India, and Southeast Asia. These countries are experiencing a manufacturing boom in electronics, automotive, and consumer goods, creating massive demand for efficient and reliable tray systems. The region’s economic growth and emphasis on production scalability contribute significantly to the market’s upward trajectory.

North America follows closely, with the United States at the forefront. Its advanced manufacturing infrastructure and adoption of Industry 4.0 practices have driven demand for smart, reusable, and automation-compatible trays. The strong presence of leading tray manufacturers also supports regional growth.

Europe remains a vital player, particularly Germany and France, where precision engineering and sustainable manufacturing practices dominate. European regulations on material recyclability and worker safety drive innovation in environmentally friendly and ergonomic tray solutions.

Latin America and the Middle East & Africa show steady growth potential. Countries like Brazil and Mexico are investing in automotive and electronics production, while the UAE and South Africa are gradually developing their industrial sectors, increasing the need for high-performance assembly trays.

Recent News & Developments

The market has seen several transformative trends in recent years. Automation and digitalization are leading the way, with trays now being integrated with RFID and barcode tracking to improve inventory visibility and streamline assembly operations. Additionally, many manufacturers are shifting towards biodegradable and recyclable materials in response to growing environmental awareness.

Strategic partnerships are also shaping the landscape. For instance, tray manufacturers are collaborating with robotics and automation companies to co-develop solutions optimized for smart factories. This includes innovations in anti-static materials, heat resistance, and form-fitting compartments that support delicate and irregularly shaped components.

Cost efficiency remains a critical factor. With unit prices ranging from $5 to $50 depending on complexity, many companies are investing in thermoforming and injection molding technologies to scale up production without compromising quality.

Browse Full Report : https://www.globalinsightservices.com/reports/assembly-trays-market/

Scope of the Report

This report offers a comprehensive analysis of the global Assembly Trays Market, covering segmentation by type, product, material, application, technology, and functionality. It provides both qualitative and quantitative insights into current market trends, challenges, and future projections. The report assesses the competitive landscape and profiles major players, highlighting strategies like product innovation, mergers, and geographic expansion.