#Alternative and sustainable energy

Text

Start your day the right way with the best organic coffee pods

Introduction

By now, you know how important it is to start your day with the proper coffee. But what if you could take that further and ensure your morning cup was organic, sustainable, and fair trade? Enter the world of coffee pods. These tiny little cups are an easy way to start your day with a high-quality brew in just one minute—and they're even better when they're organic. So whether you like bold or mild roasts, dark or light roasts, here are seven of our favorite organic coffee pods out there that will leave you feeling good about yourself as well as your morning cup:

Beaniac Organic

Beaniac Organic is a brand that offers a variety of organic, fair trade and gluten-free coffee beans for you to enjoy. The beans come from the finest growers worldwide and are roasted in small batches at their roastery in Seattle, Washington.

The coffee pods are made from biodegradable materials and are single-serve, so there's no mess! They also make great-tasting coffee!

Continue reading: https://www.representorganic.com/post/start-your-day-the-right-way-with-the-best-organic-coffee-pods

#organicfood#organic#alternative and sustainable energy#sustainableliving#sustainable#bio#eco#ecofriendly#coffetime#healthy diet#healthyfood

6 notes

·

View notes

Text

Growth expected after 2024 election

As presidential nominees Vice President Kamala Harris and former President Donald Trump prepare to face off in their first debate Tuesday night, voters will be tuning in for clarity on their plans to handle issues including the economy, inflation and job growth.

One sector that faces particular uncertainty after the election is clean energy, which has received a boost from the Biden…

#2024 United States presidential election#Alternative and sustainable energy#Breaking News: Politics#business news#Climate#Donald Trump#Energy#Energy industry#Energy policy#Environment#Jobs#Kamala Harris#politics#Renewable power generation#Solar power

1 note

·

View note

Text

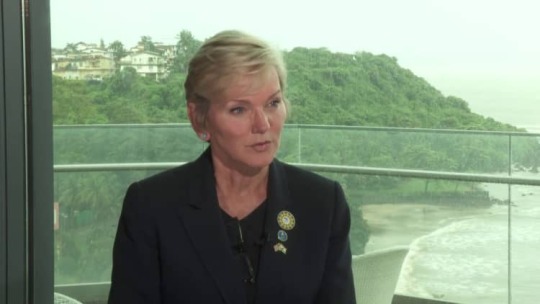

We want oil prices to come down, says U.S. energy secretary general

Volatility is still weighing on oil markets, U.S. Energy Secretary Jennifer Granholm said Saturday, reiterating calls for additional supplies.

Asked to comment on the state of oil markets, she told CNBC’s Sri Jegarajah that “there’s no doubt that there is a volatile environment, and … there’s plenty of indebtedness” — a situation that the White House is monitoring.

“There is a lot of emotion in…

View On WordPress

0 notes

Text

India's Tata Group to build $5 billion gigafactory in the UK

A Tata Motors concept EV on show at the India Auto Expo 2023 on Jan. 12, 2023.

Anindito Mukherjee | Bloomberg | Getty Images

The Tata Group will develop a major facility for the production of electric car batteries in the U.K., with the Indian conglomerate set to invest more than £4 billion (around $5.17 billion) in the project.

The news represents a significant boost for the U.K.’s plans to…

View On WordPress

#Alternative and sustainable energy#business#business news#Climate#Energy#Environment#India#Renewable Energy#Tata Motors Ltd#Tesla Inc#united kingdom

0 notes

Text

U.S. pledges to ramp up supplies of natural gas to Britain as Biden and Sunak seek to cut off Russia

U.S. pledges to ramp up supplies of natural gas to Britain as Biden and Sunak seek to cut off Russia

Rishi Sunak and Joe Biden photographed on the sidelines of the G20 Summit in Indonesia on Nov. 16, 2022.

Saul Loeb | AFP | Getty Images

LONDON — The U.K. and U.S. are forming a new energy partnership focused on boosting energy security and reducing prices.

In a statement Wednesday, the U.K. government said the new partnership would “drive work to reduce global dependence on Russian energy…

View On WordPress

#Alternative and sustainable energy#business#Business news#Climate#Enel SpA#energy#Environment#EU#Joe Biden#Natural gas markets#Oil and Gas#Prime Minister UK#renewable energy#russia#western europe

0 notes

Text

#good news#science#environmentalism#climate change#co2#carbon emissions#hydrogen#green hydrogen#fossil fuel alternatives#green energy#airplanes#aviation#sustainable aviation#environment

179 notes

·

View notes

Text

Exploring the Dynamics of the Synthetic Fuels Market: A Sustainable Energy Solution

The Synthetic Fuels Market is rapidly gaining traction as a viable alternative in the quest for sustainable energy sources. With the growing concerns over climate change and the need to reduce carbon emissions, synthetic fuels offer a promising solution. These fuels, also known as e-fuels or renewable fuels, are produced through advanced processes that utilize renewable energy sources such as wind, solar, or hydroelectric power.

One of the primary drivers behind the surge in demand for synthetic fuels is the global shift towards greener energy solutions. Governments, industries, and consumers alike are increasingly recognizing the importance of reducing dependency on fossil fuels and embracing renewable alternatives. Synthetic fuels present a compelling option as they not only offer a cleaner energy source but also provide a pathway to decarbonizing sectors such as transportation, industrial manufacturing, and power generation.

The versatility of synthetic fuels is another factor contributing to their growing popularity. Unlike traditional fossil fuels, synthetic fuels can be easily integrated into existing infrastructure without the need for significant modifications. This means that vehicles, aircraft, and machinery powered by gasoline or diesel can seamlessly transition to synthetic fuels without compromising performance or efficiency. Additionally, synthetic fuels can be tailored to meet specific energy needs, offering a customizable solution for various applications.

Moreover, advancements in technology have significantly improved the efficiency and cost-effectiveness of synthetic fuel production. Innovative processes such as Power-to-Liquid (PtL) and Gas-to-Liquid (GtL) have made it possible to produce synthetic fuels on a commercial scale, driving down production costs and increasing accessibility. As a result, synthetic fuels are becoming increasingly competitive with conventional fossil fuels, further fueling their adoption across different sectors.

The transportation industry stands to benefit significantly from the widespread adoption of synthetic fuels. With concerns over air quality and emissions regulations becoming more stringent, many vehicle manufacturers are exploring alternative fuel options to meet regulatory requirements and consumer demand for greener transportation solutions. Synthetic fuels offer an attractive alternative, providing a bridge between conventional combustion engines and future zero-emission technologies such as electric vehicles and hydrogen fuel cells.

In addition to transportation, synthetic fuels find applications in other sectors such as power generation and industrial manufacturing. The ability to produce clean, reliable energy from renewable sources makes synthetic fuels an appealing choice for companies seeking to reduce their carbon footprint and meet sustainability targets. Furthermore, synthetic fuels offer energy security benefits by reducing reliance on imported oil and mitigating the geopolitical risks associated with fossil fuel dependence.

Looking ahead, the Synthetic Fuels Market is poised for significant growth as the world transitions towards a low-carbon economy. With ongoing advancements in technology, coupled with increasing environmental awareness and regulatory pressures, the demand for synthetic fuels is expected to soar in the coming years. As governments and industries continue to invest in renewable energy solutions, synthetic fuels are well-positioned to play a crucial role in shaping the future of energy production and consumption.

#energy#sustainability#renewable fuels#e-fuels#carbon emissions#alternative energy#transportation#industrial applications

2 notes

·

View notes

Text

U.S. biofuels : The Rise of Biofuels in the United States

History and Development of Biofuels in America

The use of biofuels as an alternative to petroleum-based fuels has been gaining popularity over the past few decades in the United States. While ethanol fuel made from corn has been around since the early 1900s, large-scale production and blending with gasoline really took off in the late 1970s and early 1980s due to concerns over dependence on foreign oil. In 1978, the United States Department of Energy established the "10 in 10" program with a goal of replacing 10% of gasoline consumption with ethanol by 2010. To help meet this goal, Congress introduced tax incentives for using ethanol blended fuel as well as a tariff on imported ethanol to protect domestic producers. Thanks to these policies, corn ethanol production skyrocketed from 175 million gallons in 1980 to over 13 billion gallons by 2007.

Corn Ethanol Dominates U.S. biofuels

Despite advancements in other feedstocks, corn ethanol continues to make up the vast majority of biofuel production in the United States. In 2020, over 15 billion gallons of corn ethanol was produced, accounting for more than 95% of total biofuel output. While there are environmental concerns over growing corn solely for fuel and its limited reduction of greenhouse gas emissions compared to other U.S. Biofuels, corn ethanol is well established and benefits from economies of scale. With over 200 dry mill ethanol plants spread across the Midwest Corn Belt, most gasoline in America today contains around 10% ethanol blended directly into the fuel supply. Another factor driving corn ethanol is that most of the fleet of cars and trucks on U.S. roads can operate using an ethanol blend of up to 10% without engine modifications.

Get more insights on U.S Biofuels

Select the language you're most comfortable with.

French

German

Italian

Russian

Japanese

Chinese

Korean

Portuguese

About Author:

Ravina Pandya, Content Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. (https://www.linkedin.com/in/ravina-pandya-1a3984191)

#U.S.Biofuels#Renewable Energy#Ethanol Production#Biodiesel#Sustainable Fuels#Bioenergy#Alternative Fuels#Energy Policy

0 notes

Text

Investment Strategies for a Changing Market: Insights for 2024 and Beyond

As we venture into 2024, the global investment landscape is marked by rapid technological advancements, evolving geopolitical dynamics, and shifting economic paradigms. The post-pandemic recovery, inflationary pressures, interest rate fluctuations, and the ongoing digital revolution are shaping the financial markets in unprecedented ways. For investors, this dynamic environment presents both challenges and opportunities. To navigate this changing market successfully, it is crucial to adopt adaptable and forward-thinking investment strategies. In this blog post, we will explore key insights and strategies that can help investors thrive in 2024 and beyond.

1. Diversification: The Cornerstone of Risk Management

Diversification remains a fundamental principle of sound investing, particularly in an uncertain market environment. By spreading investments across different asset classes, sectors, and geographic regions, investors can reduce their exposure to specific risks and enhance the stability of their portfolios.

a. Asset Class Diversification

In 2024, traditional asset classes such as equities, bonds, and real estate continue to play a crucial role in portfolio construction. However, the inclusion of alternative investments—such as commodities, private equity, and cryptocurrencies—can provide additional diversification benefits. Commodities, for instance, often perform well during inflationary periods, while private equity offers exposure to high-growth companies not available in public markets. Cryptocurrencies, despite their volatility, can offer high returns and serve as a hedge against traditional financial systems.

b. Geographic Diversification

Globalization has made it easier for investors to access markets worldwide. In the current economic climate, emerging markets in Asia, Latin America, and Africa offer attractive growth prospects. These regions are experiencing rapid economic development, driven by demographic trends, technological adoption, and increasing consumer demand. By investing in these markets, investors can tap into high-growth opportunities while mitigating the risks associated with any single economy.

c. Sector Diversification

The economic landscape is constantly evolving, and different sectors perform differently depending on the macroeconomic environment. For instance, technology and healthcare sectors have shown resilience during economic downturns, while energy and industrial sectors tend to perform well during periods of economic expansion. In 2024, sectors like renewable energy, biotechnology, and cybersecurity are expected to experience significant growth, driven by technological advancements and societal shifts. By diversifying across sectors, investors can capture growth opportunities while managing sector-specific risks.

2. Embracing Technological Innovation

Technological innovation continues to be a major driver of economic growth and market performance. The rise of artificial intelligence, automation, blockchain, and the Internet of Things (IoT) is transforming industries and creating new investment opportunities.

a. Investing in Tech Giants and Innovators

Tech giants such as Apple, Amazon, Google, and Microsoft have become integral to the global economy, and their dominance is expected to continue in 2024. These companies are leaders in innovation, with extensive research and development capabilities that enable them to stay ahead of competitors. In addition to these established players, investors should also consider smaller, high-growth companies at the forefront of technological advancements. Startups in fields like artificial intelligence, biotechnology, and clean energy offer significant growth potential, albeit with higher risk.

b. Leveraging Fintech and Digital Finance

The financial industry is undergoing a digital transformation, driven by fintech innovations such as digital payments, robo-advisors, and blockchain technology. These innovations are making financial services more accessible, efficient, and secure. In 2024, fintech companies are likely to continue disrupting traditional financial institutions, offering investors lucrative opportunities. Additionally, the rise of decentralized finance (DeFi) platforms, which use blockchain technology to offer financial services without intermediaries, presents new avenues for investment.

c. Capitalizing on the Metaverse and Virtual Reality

The concept of the metaverse—a virtual world where people interact, work, and play—is gaining traction, with major companies investing heavily in its development. Virtual reality (VR) and augmented reality (AR) technologies are expected to play a crucial role in the metaverse, creating new investment opportunities in entertainment, gaming, real estate, and even digital art. While still in its early stages, the metaverse represents a long-term growth area for investors willing to take on higher risk for potentially high rewards.

3. Sustainable and Impact Investing

As concerns about climate change, social inequality, and corporate governance continue to grow, sustainable and impact investing is becoming increasingly important. Environmental, Social, and Governance (ESG) factors are now integral to the investment decision-making process for many investors.

a. Integrating ESG Criteria

In 2024, companies that prioritize sustainability and ethical practices are expected to outperform their peers, as consumers, regulators, and investors demand greater accountability. By integrating ESG criteria into their investment strategies, investors can identify companies that are well-positioned for long-term success. For instance, companies with strong environmental practices may be better prepared to navigate regulatory changes related to climate change, while those with good governance structures are likely to manage risks more effectively.

b. Focusing on Green Energy and Climate Solutions

The transition to a low-carbon economy is accelerating, driven by government policies, technological advancements, and changing consumer preferences. Investments in renewable energy, energy efficiency, and clean technologies are expected to see significant growth in 2024 and beyond. Companies involved in the production of solar, wind, and hydrogen energy, as well as those developing electric vehicles and energy storage solutions, offer compelling investment opportunities. Additionally, investors should consider companies that are working to mitigate climate risks, such as those involved in carbon capture and climate resilience projects.

c. Supporting Social Impact Initiatives

Impact investing, which seeks to generate positive social and environmental outcomes alongside financial returns, is gaining traction among investors. In 2024, areas such as affordable housing, education, healthcare, and sustainable agriculture are expected to attract significant investment. By supporting companies and projects that address pressing social challenges, investors can contribute to societal progress while achieving financial returns.

4. Adapting to Economic and Geopolitical Shifts

The global economy is constantly influenced by a range of factors, including inflation, interest rates, fiscal policies, and geopolitical events. To succeed in this environment, investors must be agile and responsive to changing conditions.

a. Navigating Inflation and Interest Rate Risks

Inflationary pressures and interest rate hikes are expected to continue in 2024, presenting challenges for fixed-income investments and consumer spending. To mitigate these risks, investors should consider inflation-linked bonds, real assets such as real estate and commodities, and dividend-paying stocks. Additionally, floating-rate bonds, which adjust their interest payments based on changes in interest rates, can offer protection against rising rates.

b. Monitoring Geopolitical Developments

Geopolitical events, such as trade tensions, conflicts, and regulatory changes, can have significant impacts on financial markets. In 2024, investors should closely monitor developments in major economies such as the United States, China, and the European Union. Trade relations, especially between the U.S. and China, will continue to influence global supply chains and market sentiment. Additionally, political instability in emerging markets could create both risks and opportunities for investors. To manage geopolitical risks, investors should consider diversifying their portfolios across regions and sectors, as well as staying informed about global events.

c. Hedging with Safe-Haven Assets

In times of economic uncertainty, safe-haven assets such as gold, government bonds, and the U.S. dollar tend to perform well. These assets provide stability and protection against market downturns. In 2024, gold is expected to remain a popular hedge against inflation and currency devaluation. Similarly, U.S. Treasuries and other high-quality government bonds can offer safety and income in a volatile market. Investors should consider allocating a portion of their portfolios to these safe-haven assets to balance risk and reward.

5. Active vs. Passive Investing: Striking the Right Balance

The debate between active and passive investing continues to be relevant in 2024. While passive investing, through index funds and ETFs, offers low-cost exposure to broad markets, active investing allows for more targeted strategies and the potential for higher returns.

a. Benefits of Passive Investing

Passive investing is a popular strategy for its simplicity, low costs, and consistent performance. By tracking market indexes, passive funds provide broad diversification and reduce the risk of underperforming the market. In a changing market, where predicting short-term movements can be challenging, passive investing offers a reliable way to capture overall market growth. For long-term investors, a core portfolio of passive funds can provide steady returns with minimal effort.

b. Opportunities in Active Investing

Active investing, on the other hand, involves selecting individual stocks, bonds, or funds based on research and market analysis. In a rapidly changing market, active managers can capitalize on opportunities and avoid potential pitfalls that passive funds might miss. For instance, active investors can target undervalued companies, emerging sectors, or regions with strong growth potential. Additionally, active strategies can be tailored to specific investment goals, such as income generation or capital preservation.

c. Combining Active and Passive Approaches

For many investors, a combination of active and passive strategies offers the best of both worlds. By maintaining a core portfolio of passive investments and supplementing it with active strategies, investors can achieve diversification, reduce costs, and enhance returns. For example, an investor might use index funds to gain broad market exposure while actively selecting individual stocks in high-growth sectors or emerging markets. This balanced approach allows investors to adapt to changing market conditions while staying aligned with their long-term objectives.

6. Long-Term Perspective: Staying Focused on Goals

Amidst market fluctuations and economic uncertainty, it is essential for investors to maintain a long-term perspective. Short-term market movements can be unpredictable, and reacting to them impulsively can lead to suboptimal investment decisions.

a. Staying Disciplined During Market Volatility

Market volatility is inevitable, especially in a rapidly changing environment. Investors should avoid making emotional decisions based on short-term market movements. Instead, they should stay disciplined and focused on their long-term investment goals. A well-diversified portfolio, aligned with the investor’s risk tolerance and time horizon, can help weather market turbulence and achieve steady growth over time.

b. Regular Portfolio Review and Rebalancing

Regularly reviewing and rebalancing the portfolio is crucial to ensure that it remains aligned with the investor’s goals and risk tolerance. Market changes can cause the portfolio’s asset allocation to drift away from its target mix. Rebalancing involves selling overperforming assets and buying underperforming ones to restore the desired allocation. This disciplined approach helps manage risk and keeps the portfolio on track to achieve long-term objectives.

c. Adapting to Life Changes

Investors’ financial goals and risk tolerance can change over time due to life events such as retirement, marriage, or the birth of a child. It is important to adapt the investment strategy to reflect these changes. For example, as investors approach retirement, they may want to shift towards more conservative investments to preserve capital and generate income. Conversely, younger investors with a longer time horizon may opt for more aggressive growth strategies. By regularly reassessing their investment goals and adjusting their strategies accordingly, investors can stay aligned with their evolving needs.

As we navigate the complexities of 2024 and beyond, the investment landscape will continue to evolve, presenting both challenges and opportunities. By adopting a diversified, forward-thinking approach, embracing technological innovations, integrating ESG criteria, and staying responsive to economic and geopolitical shifts, investors can position themselves for success in a changing market. Whether through active or passive strategies, the key to long-term success lies in maintaining a disciplined, goal-oriented approach and staying focused on the big picture. With the right strategies in place, investors can confidently navigate the uncertainties of 2024 and beyond, achieving their financial objectives while seizing new opportunities in the ever-changing world of investing.

#Investment Strategies 2024#Diversification in Investments#Global Market Trends 2024#Technological Innovation in Investing#Sustainable Investing#ESG Investing#Capital Markets 2024#Geopolitical Risks in Investing#Passive vs Active Investing#Long-Term Investment Strategies#Emerging Markets Investment#Fintech and Digital Finance#Metaverse Investment Opportunities#Impact Investing 2024#Alternative Investments#Cryptocurrency Investing#Green Energy Investments 2024#Scott Biffin#singapore#australia

1 note

·

View note

Text

Challenges Facing the Rollout of CNG Vehicles: An Investigation

Compressed Natural Gas (CNG) vehicles have been promoted as a cleaner and more sustainable alternative to traditional gasoline and diesel-powered vehicles.

As countries worldwide push for greener transportation solutions to address climate change, reduce air pollution, and decrease dependence on fossil fuels, CNG has emerged as a promising option.

However, despite its potential, the widespread…

#air pollution reduction#alternative fuels#automotive industry#clean energy#CNG vehicles#fossil fuel alternatives#green transportation#sustainable mobility#Touchaheart.com.ng#transportation challenges#vehicle infrastructure

0 notes

Text

The Organic Farming Revolution

How it started and why it is so important to make a change

n recent years, there has been a growing movement towards organic farming. People are becoming increasingly aware of the negative impact of conventional farming practices on the environment and the potential health risks associated with consuming food treated with pesticides and other harmful chemicals. Organic farming offers a more sustainable and healthier alternative, not just for farmers. Anyone can get involved in the organic farming revolution, whether you have a small backyard or a large plot of land. In this article, we'll explore the benefits of organic farming, why it's essential, and provide tips on how to get started. Whether you want to grow your food or support local organic farmers, there are plenty of ways to join the movement and positively impact your health and the environment.

Benefits of Organic Farming

Organic farming has numerous benefits for both the environment and human health. One of the most significant benefits is that it reduces the number of harmful chemicals that are released into the atmosphere. Conventional farming practices often involve using pesticides, herbicides, and fertilizers that can leach into waterways, contaminate soil, and harm wildlife. In contrast, organic farming relies on natural methods such as crop rotation, companion planting, and using natural fertilizers to maintain soil health and control pests and diseases.

Continue reading: https://www.representorganic.com/post/the-organic-farming-revolution

#sustainableliving#sustainable#alternative and sustainable energy#organicfood#organic#organicfarming#ecofriendly#bio

1 note

·

View note

Text

#Sustainable Aviation Fuel (SAF)#Eco-friendly air travel#Renewable aviation fuel#Green aviation technology#Carbon-neutral flights#Benefits of Sustainable Aviation Fuel#SAF production methods#Reducing aviation carbon emissions#Renewable resources for aviation fuel#Future of Sustainable Aviation Fuel#Sustainable fuel for airplanes#Environmental impact of aviation#Biofuel for aircraft#Aviation industry sustainability#SAF adoption by airlines#Green alternatives to jet fuel#Renewable energy in aviation#SAF vs. traditional jet fuel#Innovations in Sustainable Aviation Fuel#Net-zero carbon emissions in aviation

0 notes

Text

How to generate your own biogas and organic fertiliser from food waste a...

youtube

0 notes

Text

In new role as G-20 chair, India set to focus on climate

In new role as G-20 chair, India set to focus on climate

BENGALURU, India — India officially takes up its role as chair of the Group of 20 leading economies for the coming year Thursday and it’s putting climate at the top of the group’s priorities.

Programs to encourage sustainable living and money for countries to transition to clean energy and deal with the effects of a warming world are some of the key areas that India will focus on during its…

View On WordPress

#Alternative and sustainable energy#Business#Climate change#Economy#Electric power generation#Electric utilities#Energy and the environment#Energy industry#Environmental concerns#Government transitions#National governments#Renewable#Utilities

0 notes

Text

Flexfuel Cars: The Future of Flexible Fuel Technology

Introduction:

Flexfuel cars, also known as flexible fuel vehicles (FFVs), represent the future of flexible fuel technology, offering drivers the ability to utilize a variety of renewable fuel options.

This blog explores the potential of flexfuel cars in revolutionizing the automotive industry and contributing to a more sustainable transportation system.

Advancements in Flexfuel Technology:

Flexfuel cars are equipped with advanced fuel system components and engine management systems that enable seamless transition between different fuel types.

Ongoing advancements in flexfuel technology aim to improve fuel efficiency, performance, and compatibility with a broader range of ethanol blends.

The future of Flexfuel Cars involves the integration of smart technologies and innovative materials to enhance fuel flexibility and optimize engine performance.

Expansion of Ethanol Infrastructure:

The widespread adoption of flexfuel cars is driving the expansion of ethanol production and distribution infrastructure.

Ethanol-blended fuels, such as E85 (85% ethanol, 15% gasoline), are becoming increasingly available at fueling stations across the country.

Investments in ethanol production facilities and distribution networks are essential for supporting the growth of the flexfuel vehicle market.

Environmental Benefits of Ethanol:

Ethanol is a renewable fuel derived from plant sources such as corn, sugarcane, or cellulose-based materials.

Compared to gasoline, ethanol produces fewer greenhouse gas emissions during combustion, contributing to reduced air pollution and mitigating climate change.

By using ethanol-based fuels in flexfuel cars, drivers can reduce their carbon footprint and support the transition to cleaner energy sources.

Get More Insights On This Topic: Flexfuel Cars

#Flexfuel Cars#Flexible Fuel Vehicles#Renewable Fuel#Ethanol Blends#Sustainable Transportation#Energy Independence#Environmental Benefits#Alternative Fuels#Green Technology#Automotive Innovation

0 notes

Text

youtube

🐔 or 🥚❓

#green technology#green tech#alternative energy#sustainability#technology#tech#design concept#cad drafting

0 notes