#Automatic Data Processing (ADP)

Explore tagged Tumblr posts

Text

Ако трябва да се пенсионирам само с 10 дивидентни аристократи, кои ще бъдат те?

Ако трябва да се пенсионирам само с 10 дивидентни аристократи, кои ще бъдат те? Резюме Методология за балансиране на дивидентния доход и растеж за създаване на феноменален пасивен доход. Анализ на дивидентните аристократи за идентифициране на акции с потенциал за значителен дивидентен растеж. Избор на 10 дивидентни аристократи на база доходност, растеж и бизнес модели за пенсионен…

View On WordPress

#AbbVie Inc (ABBV)#Aflac (AFL)#Automatic Data Processing (ADP)#Chevron (CVX)#International Business Machines (IBM)#Lowe’s Companies (LOW)#McDonald’s (MCD)#NextEra Energy (NEE)#PepsiCo (PEP)#Realty Income (O)#Дивидентни аристократи#Ефектът на снежната топка#Силата на инвестирането в дивидентни акции#списък на дивидентните аристократи

0 notes

Text

5 Trade Ideas for Monday: ADP, Cummins, Interactive Brokers, Cloudflare and Visa

5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

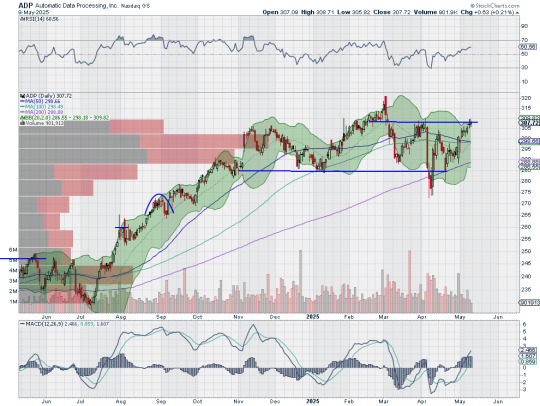

Automatic Data Processing, $ADP, comes into the week at resistance. It has a RSI in the bullish zone with the MACD positive. Look for a push over resistance to participate…

Cummins, $CMI, comes into the week approaching resistance. It has a RSI rising through the midline with the MACD about to turn positive. Look for a push over resistance to participate…

Interactive Brokers, $IBKR, comes into the week pushing away from resistance. It has a RSI in the bullish zone with the MACD positive. Look for continuation higher to participate…

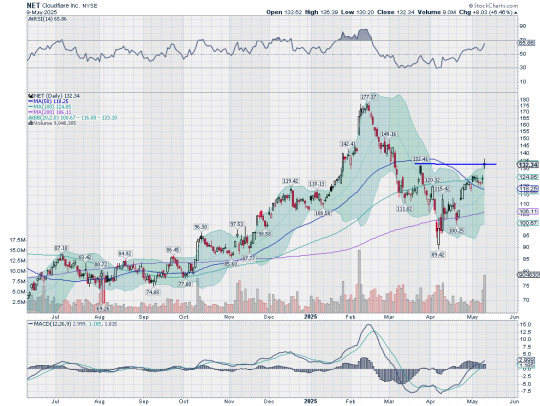

Cloudflare, $NET, comes into the week breaking resistance. It has a RSI in the bullish zone with the MACD positive. Look for continuation to participate…

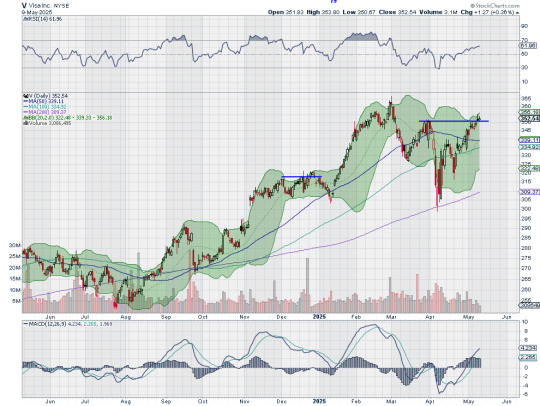

Visa, $V, comes into the week breaking resistance. It has a RSI in the bullish zone with the MACD positive. Look for continuation to participate…

If you like what you see sign up for more ideas and deeper analysis using this Get Premium link.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with the May FOMC meeting in the books, equity markets showed resilience holding up in their short term rises.

Elsewhere look for Gold to continue its consolidation in the uptrend while Crude Oil continues to trend lower. The US Dollar Index continues to drift to the upside in a bear flag while US Treasuries consolidate in their downtrend. The Shanghai Composite looks to continue in consolidation while Emerging Markets consolidate in a broad range just under resistance.

The Volatility Index looks to continue moving back to normal, making the path easier for equity markets to the upside. Their charts show short term strength on both timeframes. On the shorter timeframe the IWM, the QQQ and the SPY are on the verge of breaking higher and a shift to bullish momentum. On the longer timeframe the classic “V” recovery continues to build in all 3 Index ETFs. Use this information as you prepare for the coming week and trad’em well.

2 notes

·

View notes

Text

Increase in employment in the private sector in the United States 37,000 in May, compared to 115,000 expectations

Employment in the private sector in the United States increased by 37,000 in May and the annual salary increased by 4.5% on an annual basis, according to automatic data processing (ADP) on Wednesday. This reading occurred after an increase of 60,000 (modified compared to 62,000) recorded in April, and it was much lower than 115,000 expectations of the market. “After a strong start for the year,…

0 notes

Text

Top 5 Benefits of Working with an ADP Consultant

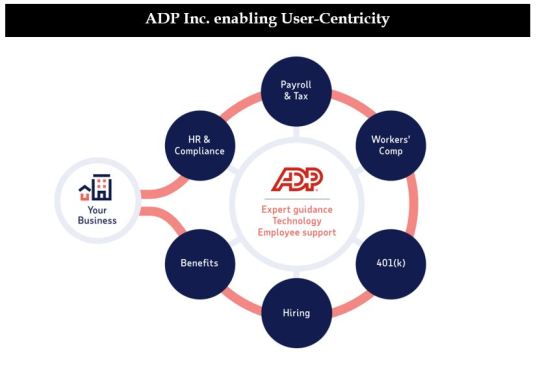

In today’s fast-paced business environment, managing human capital effectively is more than just a necessity—it’s a strategic advantage. ADP (Automatic Data Processing) is a leader in payroll and HR technology, offering a comprehensive suite of tools that help businesses streamline operations, stay compliant, and support employees effectively. However, unlocking the full potential of ADP’s platforms often requires specialized knowledge. That’s where an ADP consultant comes in.

At Ignite HCM, we’ve seen firsthand how working with a skilled ADP consultant can transform HR operations. Whether you're implementing ADP for the first time or looking to optimize an existing system, here are the top five benefits of working with an ADP consultant.

1. Expert Guidance for Seamless Implementation

Implementing any enterprise software can be a complex, time-consuming process. ADP solutions—while powerful—require proper setup to ensure accurate payroll, tax compliance, and integration with other HR systems. One of the most significant advantages of hiring an ADP consultant is gaining access to deep product expertise.

An ADP consultant can:

Customize the setup based on your organization's size, structure, and goals.

Align system configurations with local, state, and federal compliance requirements.

Help migrate data from legacy systems with minimal disruption.

Train your HR and payroll teams to use the platform efficiently.

This expert-led implementation not only reduces the risk of errors but also ensures that your team is set up for long-term success.

2. Improved Efficiency and Time Savings

ADP platforms are designed to streamline payroll, time tracking, benefits administration, and talent management—but only if you know how to use them effectively. Without proper optimization, businesses often find themselves overwhelmed by manual workarounds or underutilized features.

An experienced ADP consultant helps you maximize automation and minimize redundancies by:

Identifying inefficiencies in your current processes.

Recommending modules and features that improve productivity.

Setting up workflows, alerts, and dashboards tailored to your team's needs.

As a result, HR teams spend less time on routine tasks and more time on strategic initiatives such as employee engagement and performance management. For growing businesses, this kind of operational efficiency is a game-changer.

3. Enhanced Compliance and Risk Mitigation

HR and payroll departments are subject to constant regulatory changes—from wage laws and tax codes to labor regulations and data privacy mandates. Failing to comply can lead to penalties, audits, and reputational damage. ADP’s tools are built with compliance in mind, but they still require accurate configuration and regular updates to remain effective.

ADP consultants serve as your first line of defense against non-compliance by:

Keeping your systems aligned with the latest legal and regulatory standards.

Ensuring accurate tax withholding, reporting, and filing.

Supporting audit preparation and documentation management.

Configuring compliance alerts and approval workflows.

By working with a consultant, your business can mitigate risk and maintain peace of mind, knowing your HR and payroll systems are audit-ready and up to date.

4. Customized Reporting and Data-Driven Insights

HR is increasingly driven by data, and ADP provides a wealth of reporting tools that allow businesses to track performance, measure efficiency, and support decision-making. However, without proper configuration, these insights can remain hidden beneath layers of unused data.

An ADP consultant can transform raw data into actionable insights by:

Building custom reports and dashboards tailored to your leadership’s KPIs.

Automating reporting schedules to support forecasting and compliance.

Identifying trends in turnover, absenteeism, compensation, and more.

Offering strategic recommendations based on data interpretation.

With the help of an ADP consultant, your team will no longer need to guess what’s working—you’ll have the data to back every decision with confidence.

5. Scalable Support for Business Growth

Whether your company is expanding into new markets, hiring rapidly, or restructuring operations, your HR and payroll systems must scale accordingly. ADP consultants offer the agility and foresight to support these transitions smoothly.

Here’s how a consultant adds value during growth:

Assessing and adjusting system configurations to support new departments or locations.

Advising on system upgrades or new modules (e.g., benefits enrollment, time-off management).

Supporting change management efforts and employee training.

Acting as a long-term strategic partner for continuous improvement.

At Ignite HCM, we understand that no two businesses grow the same way. That’s why we tailor our ADP consulting services to meet each client’s evolving needs—so you’re not just keeping up with growth, you’re getting ahead of it.

Why Choose Ignite HCM for Your ADP Consulting Needs?

As a trusted ADP partner, Ignite HCM brings deep expertise, proven methodologies, and a people-first approach to every project. Our consultants are not only ADP-certified professionals—they’re also passionate problem solvers who understand the challenges modern HR teams face.

When you work with us, you gain:

Personalized, hands-on support from industry experts.

A partner who understands your business, not just your software.

Access to best practices, training resources, and post-go-live support.

Whether you're launching a new ADP system, upgrading your current setup, or seeking ongoing optimization, Ignite HCM is here to help you ignite your HR potential.

Final Thoughts

The value of a seasoned ADP consultant goes far beyond system setup—they become a strategic ally in optimizing processes, managing risk, and enabling growth. At Ignite HCM, we believe in harnessing the full power of technology to empower people. Working with an ADP consultant isn’t just a smart move—it’s an investment in your company’s future.

Ready to elevate your HR strategy with ADP consulting? Contact Ignite HCM today and take the first step toward smarter, more efficient human capital management.

Let me know if you'd like this content formatted for a webpage or PDF, or if you'd like a version optimized for SEO!

For more info please visit us (301) 674-8033 or [email protected]

1 note

·

View note

Text

How to Create Payroll Checks Online: A Step-by-Step Guide

Managing payroll efficiently is crucial for any business, whether you're a small business owner, freelancer, or HR professional. Creating payroll checks manually can be time-consuming and prone to errors. Fortunately, with the help of a payroll check generator, you can streamline the process and ensure accuracy in employee payments.

This step-by-step guide will walk you through how to create payroll checks online, covering the necessary details, legal considerations, and the best payroll check generators available.

Step 1: Choose a Reliable Payroll Check Generator

A payroll check generator is an online tool that automates the creation of payroll checks, ensuring compliance with tax regulations and accuracy in calculations. Before selecting one, consider the following:

✔ User-friendly interface – Ensure the tool is easy to navigate.

✔ Tax compliance – It should automatically calculate federal and state tax deductions.

✔ Customization options – Allows you to add company branding and modify check layouts.

✔ Integration with payroll software – If you use payroll software, choose a generator that integrates seamlessly.

✔ Security – Ensure the platform offers data encryption and secure transactions.

Popular payroll check generators include ADP, QuickBooks, Wave, and Check Stub Maker.

Step 2: Enter Business and Employee Information

Once you've selected a payroll check generator, you’ll need to input essential details:

1. Business Details

Company name

Address

Employer Identification Number (EIN)

Business bank account details

2. Employee Details

Employee name

Employee ID or Social Security Number (SSN)

Address

Bank account details (for direct deposit)

Employment type (full-time, part-time, contractor)

Entering accurate information ensures that payments are processed correctly and reported for tax purposes.

Step 3: Enter Salary and Payment Details

In this section, input the following details:

✔ Pay period – Start and end date of the payment cycle.

✔ Pay rate – Hourly wage or salary amount.

✔ Hours worked – For hourly employees, input the total hours worked.

✔ Overtime – If applicable, include overtime hours and pay rate.

✔ Bonuses/Commissions – Any additional earnings.

✔ Deductions – Taxes, retirement contributions, health insurance, and other withholdings.

✔ Net pay – The final amount the employee will receive after deductions.

Most payroll check generators automatically calculate gross pay, deductions, and net pay, reducing the risk of miscalculations.

Step 4: Generate and Review the Payroll Check

Before finalizing the payroll check:

✔ Double-check all entered details to prevent errors.

✔ Ensure tax withholdings are correct based on federal and state regulations.

✔ Confirm employee payment method (paper check or direct deposit).

✔ Review the final paycheck amount to verify accuracy.

Once you’re satisfied, click “Generate Check” or “Download” to save the check for printing or digital distribution.

Step 5: Print or Distribute the Payroll Check

Depending on your preference and company policies, you can:

Print the check using a blank check stock and a MICR printer.

Send the check digitally via email if the generator provides that option.

Directly deposit funds into employees’ bank accounts if your payroll system supports it.

Ensure all checks meet banking requirements, especially if you’re printing them yourself.

Step 6: Keep Payroll Records for Compliance

Maintaining payroll records is essential for tax filing, audits, and employee reference. The IRS and labor laws require businesses to keep payroll records for at least three years.

✔ Store payroll records digitally in a secure cloud system or payroll software.

✔ Keep hard copies of payroll checks if necessary.

✔ Document any changes in employee salaries or deductions.

Benefits of Using a Payroll Check Generator

✅ Saves Time – Automates calculations and reduces manual entry.

✅ Ensures Accuracy – Minimizes payroll errors and tax miscalculations.

✅ Compliant with Laws – Adheres to federal and state tax regulations.

✅ Cost-Effective – Eliminates the need for expensive payroll software.

✅ Easy Access to Payroll Records – Keeps all payroll history in one place.

Conclusion

Creating payroll checks online is a simple and efficient process when using a payroll check generator. By following these steps—choosing a reliable tool, entering accurate details, reviewing paychecks, and maintaining records—you can ensure smooth payroll operations.

Whether you're managing payroll for a small business or handling personal finances as a freelancer, a payroll check generator can help streamline the process, reduce errors, and keep your business compliant with tax laws.

Now that you know how to create payroll checks online, try a payroll check generator today and simplify your payroll process!

0 notes

Text

How to Automate Business Transactions and Save Hours Every Month

Running a business requires handling numerous financial transactions, from invoicing to expense tracking. Manually managing these processes can be time-consuming and prone to errors. The good news? Automating your business transactions can save you hours every month while ensuring accuracy and efficiency. Here’s how to do it.

1. Use Automated Accounting Software

Investing in accounting software like QuickBooks, Xero, or Wave can streamline financial management. These platforms automatically categorize transactions, generate financial reports, and sync with your bank accounts, reducing manual data entry.

2. Set Up Recurring Invoices and Payments

Manually sending invoices every month can be a hassle. Use tools like FreshBooks or PayPal to set up recurring invoices for your clients. Likewise, automate bill payments for rent, utilities, and subscriptions to avoid late fees.

3. Integrate Expense Tracking Apps

Apps like Expensify and Receipt Bank allow you to scan receipts and track expenses in real time. These tools integrate with your accounting software, eliminating the need for manual entry and keeping your records up to date.

4. Automate Payroll Processing

Payroll can be complex and time-consuming. Services like Gusto, ADP, and Payworks handle employee salaries, tax withholdings, and benefits, ensuring compliance and freeing up your time.

5. Leverage Bank Rules for Transaction Categorization

Most online banking platforms allow you to set up rules to automatically categorize transactions. By defining these rules, your income and expenses are sorted without manual intervention, making bookkeeping effortless.

Final Thoughts

Automating your business transactions not only saves time but also reduces errors and improves financial organization. By leveraging technology, you can focus more on growing your business rather than getting bogged down by paperwork.

#small business#entrepreneur#financial tips#automation#business tips#money tips#business finance#bookkeeping#save time#self employed#productivity hacks#accounting#cashflow management#money management#work smarter not harder

0 notes

Text

How to Streamline Job Shop Bookkeeping with Effective Automation

Streamlining job shop bookkeeping with effective automation can significantly improve efficiency, reduce errors, and save time. Job shops often face the challenge of managing multiple projects with varying requirements, fluctuating costs, and complex job tracking. Automation can help optimize bookkeeping by integrating data across various processes, from inventory management to payroll. Technology plays a pivotal role in enhancing workforce development in the surface finishing industry.Here’s how to effectively use automation to streamline job shop bookkeeping:

1. Implement Job Costing Software

Job costing is essential in job shops for tracking labor, materials, and overhead costs on a per-project basis. Using job costing software, such as QuickBooks for Contractors, JobBOSS, or FlexiTime, can automate the tracking of these costs in real-time.

Automate job tracking: Automatically track materials, labor hours, and equipment usage.

Track project profitability: Link costs to specific projects for accurate reporting on profitability.

Integrate with accounting software: Ensure your costing system integrates seamlessly with your overall accounting system.

2. Automate Invoicing and Payments

Manual invoicing can be time-consuming and prone to errors. Automating invoicing and payments allows for faster billing cycles and reduces administrative workload.

Set up recurring invoices: For customers with ongoing contracts, automatically generate invoices based on predefined schedules.

Track payment statuses: Automatically update the payment status when a customer pays, sending reminders when payments are due.

Integrate with CRM/ERP: This will ensure that invoices are linked to the relevant projects and client data.

3. Use Cloud-Based Accounting Systems

Cloud-based accounting software like Xero, QuickBooks Online, or FreshBooks allows you to automate a variety of bookkeeping tasks:

Automated bank feeds: Connect your bank accounts to automatically import and categorize transactions.

Automatic financial reports: Generate P&L statements, balance sheets, and other reports on demand.

Real-time collaboration: Enable collaboration between the accounting team, project managers, and other stakeholders.

4. Automate Payroll and Time Tracking

Labor costs are often a significant portion of job shop expenses. Automating payroll and time tracking can save time and reduce errors.

Time tracking software: Use automated time tracking systems like Toggl, ClockShark, or TSheets to log employee hours accurately.

Payroll automation: Use software like Gusto or ADP to automatically calculate payroll, track deductions, and manage tax filings.

Integrate with job costing: Sync time-tracking data with job costing to allocate labor costs accurately to specific projects.

5. Streamline Inventory Management

Managing raw materials and supplies is another area where automation can reduce administrative burden and errors.

Automated inventory tracking: Use tools like TradeGecko, NetSuite, or Fishbowl to automate inventory tracking, automatically updating stock levels based on material usage or purchases.

Inventory restocking alerts: Set up automatic alerts when stock levels fall below a certain threshold, ensuring you never run out of essential materials.

Integration with job costing: Ensure that material usage is tracked and allocated to specific jobs or projects.

6. Automate Reporting and Analytics

Financial reporting and analytics are essential for understanding the performance of a job shop, but manually generating reports can be time-consuming.

Automated financial reports: Set up your accounting software to generate daily, weekly, or monthly reports on sales, expenses, cash flow, and profitability.

Customizable dashboards: Many automation tools offer customizable dashboards that provide real-time insights into key performance metrics (e.g., project profitability, labor efficiency).

Alerts and notifications: Set up automatic alerts for deviations from budgeted costs or project deadlines.

7. Integrate with Other Systems

Job shops often rely on multiple systems to manage different aspects of the business. Integrating these systems can save time and reduce data duplication.

ERP software: Use an ERP system like Microsoft Dynamics, SAP, or Odoo to integrate accounting, inventory, payroll, and job tracking in one unified system.

CRM integration: Sync your bookkeeping system with customer relationship management (CRM) tools to ensure seamless tracking of customer data, billing, and project details.

API integrations: Leverage APIs to link specialized software (like project management tools) with accounting and payroll systems.

8. Document Automation

Job shops deal with a lot of paperwork, such as invoices, purchase orders, and contracts. Automating document management can eliminate the need for manual filing.

Use document management tools: Software like DocuSign, Zoho Docs, or Dropbox Business can automate document signing, approval, and storage processes.

Optical Character Recognition (OCR): Use OCR technology to extract data from invoices, purchase orders, or receipts, and automatically input this information into your bookkeeping system.

9. Outsource to Accounting Automation Providers

If in-house automation is complex or costly, consider outsourcing bookkeeping to accounting services that specialize in job shops. Many providers offer automated bookkeeping solutions that handle:

Bookkeeping and reconciliation

Financial reporting

Tax preparation

These services can often integrate with your existing systems, saving time and effort on your part.

10. Train Staff and Set Up Regular System Audits

Finally, ensure your team is trained on the automated systems. Even the best automation systems require human oversight. Set up regular audits to identify potential issues before they become costly mistakes.

Benefits of Automating Job Shop Bookkeeping:

Increased efficiency: Automation reduces repetitive tasks, freeing up time for more strategic activities.

Cost savings: Automation reduces the need for additional staff and minimizes errors that could lead to financial losses.

Improved accuracy: Automated systems reduce the chance of human error in tracking financial transactions.

Better project visibility: Real-time tracking of costs, time, and materials helps project managers make informed decisions.

By automating bookkeeping processes in your job shop, you can focus more on growth and customer service, while leaving the tedious and error-prone tasks to technology.

#digital solutions#surface area-based load calculation#anodizing software#manufacturing erp software#metal finishing company#metal surface coatings#metal surface finishing#proplate™

0 notes

Text

Cost Savings and Increased Productivity: The Impact of Automatic Document Processing on Supply Chains

Cost Savings and Increased Productivity: The Impact of Automatic Document Processing on Supply Chains

Automatic Document Processing (ADP) significantly impacts supply chains by reducing costs and boosting productivity. By automating document workflows—such as purchase orders, invoices, and shipping documents—ADP minimizes the need for manual data entry, reducing human error and freeing employees for higher-value tasks. This automation shortens processing times and lowers administrative costs, as…

0 notes

Text

How Financial Tools Can Help Keep Your Books in Order

Financial management is a vital function for businesses of all sizes, across all industries. Leveraging the right financial tools can streamline bookkeeping, enhance accuracy, and save both time and money. In this article, we’ll explore essential financial tools available in today’s market that support accounting and financial management, along with some best practices for maintaining organized financial records.

Essential Financial Tools for Bookkeeping

1. Accounting Software

Accounting software is the foundation of efficient financial management for any organization. These programs handle tasks like transaction recording, account preparation, and invoice processing. Popular choices include QuickBooks, Xero, and FreshBooks, all of which offer features tailored to different business needs, such as cloud-based systems and mobile access. These platforms also integrate with other financial tools, making them versatile.

Benefits of Accounting Software:

Time Efficiency: Automates repetitive tasks like data entry.

Real-Time Monitoring: Tracks income and expenses instantly, aiding quick decision-making.

Customizable Reporting: Generates detailed sales and financial reports based on specific business needs.

Scalability: Expands functionality as the business grows, handling more complex accounting tasks.

By using accounting software, businesses reduce manual errors and enjoy real-time insights into revenue and expenses. These tools allow customizable reporting systems, offering a comprehensive view of a company’s financial status.

2. Expense Tracking Tools

Expense tracking tools are essential for businesses that need to closely monitor expenditures, including travel, meals, and entertainment. While many accounting software platforms offer expense tracking features, standalone tools like Expensify or Zoho Expense provide more robust solutions.

Key Features:

Receipt Scanning: Easily capture receipts with photos, eliminating manual data entry.

Categorization: Organize expenses into categories for easier analysis.

Integration: Seamlessly sync with accounting software, reducing manual data input.

Policy Compliance: Ensure spending stays within company-set guidelines.

Mobile apps make it easy for employees to capture expenses on the go, improving record-keeping and reducing paperwork. Automatic submission of expenses ensures that no costs are overlooked.

3. Budgeting Tools

Budgeting is key to controlling spending and planning for the future. Budgeting tools, often included in accounting software, allow businesses to track income and expenses, ensuring efficient resource allocation.

Advantages of Budgeting Tools:

Goal Setting: Helps set realistic, measurable financial targets based on historical data.

Variance Analysis: Compares actual spending against the budget to identify discrepancies.

Forecasting: Uses trends to predict future income and expenses.

Collaboration: Allows multiple team members to participate in budget creation and adjustment.

By regularly comparing actual expenses to budgeted amounts, businesses can adjust strategies to prevent overspending and ensure efficient financial management.

4. Payroll Management Systems

Payroll management can be complex, especially as businesses grow. Tools like Gusto and ADP automate payroll processes, including wage calculation, tax withholding, and employee benefits, reducing the risk of costly errors.

Features of Payroll Management Systems:

Automated Tax Calculations: Ensures compliance with tax laws, minimizing errors.

Direct Deposit: Simplifies employee payments.

Employee Self-Service Portals: Enables staff to access payroll information independently.

Integration: Syncs with accounting software for comprehensive financial reporting.

These systems integrate seamlessly with accounting software, ensuring that labor costs are accurately reflected in financial reports and improving the efficiency of financial management.

5. Inventory Management Software

For businesses that sell physical goods, inventory management software is crucial. This software tracks stock levels, sales, and orders, ensuring that inventory is well-managed.

Benefits of Inventory Management Software:

Real-Time Tracking: Provides up-to-date inventory levels to avoid overstocking or stockouts.

Demand Forecasting: Helps predict future stock needs based on sales trends.

Supplier Management: Facilitates smooth ordering processes with suppliers.

Reporting: Generates detailed reports on stock turnover and product performance.

Good inventory management reduces cash flow issues and enhances customer satisfaction by ensuring products are always available when needed.

Tips for Maintaining Organized Financial Records

1. Choose the Right Accounting Method

Selecting the appropriate accounting method—cash basis or accrual basis—is key to maintaining accurate books. Cash accounting records transactions when money is exchanged, while accrual accounting records transactions when they occur, regardless of payment.

For most businesses, accrual accounting provides a clearer picture of long-term profitability and performance.

2. Separate Personal and Business Finances

Mixing personal and business finances complicates bookkeeping and tax filing. Keep separate accounts to ensure accurate financial reporting and improve cash flow management.

3. Regular Reconciliation

Reconcile your financial records with bank statements at least once a month. This ensures that any discrepancies are identified and corrected promptly, maintaining the accuracy of your books.

4. Periodic Review of Financial Reports

Review financial reports—such as income statements, balance sheets, and cash flow statements—regularly, either monthly or quarterly. This allows businesses to make informed decisions, allocate resources wisely, and identify areas where cost-cutting can boost profitability.

Conclusion

Financial tools like accounting software, expense trackers, and payroll systems are essential for businesses to maintain accurate records and manage finances effectively. By incorporating these tools and following best practices like regular reconciliation and report reviews, businesses can save time, reduce costs, and position themselves for sustainable growth in today’s competitive landscape. Embracing financial technology is no longer optional—it’s a necessity for staying competitive and profitable.

0 notes

Text

Mastering ADP Implementation: A Step-by-Step Guide for Businesses

In today’s fast-paced business world, efficiency and accuracy in managing HR, payroll, and workforce management are vital to success. ADP (Automatic Data Processing) provides industry-leading solutions for businesses looking to streamline these processes. However, implementing ADP software isn’t a one-size-fits-all task. It requires careful planning, execution, and expertise to ensure a smooth transition and maximum return on investment. This comprehensive guide will walk you through mastering ADP implementation, ensuring your business reaps the full benefits of this powerful platform.

Understanding Your Business Needs

Before jumping into implementation, it’s crucial to fully understand your business’s HR and payroll needs. Different organizations have different requirements based on factors like company size, industry, and the complexity of HR processes. Here are key questions to consider:

What challenges are you currently facing with HR and payroll management?

How many employees do you need to manage, and what are their varying needs (e.g., hourly vs. salaried workers)?

Are there specific compliance requirements you need to meet (e.g., industry regulations, tax laws)?

What level of automation and customization do you expect from ADP?

By identifying these needs upfront, you can choose the right ADP product and determine the best approach for configuration.

Choose the Right ADP Solution

ADP offers various solutions tailored to different business needs, from small businesses to large enterprises. Selecting the correct ADP platform is key to a successful implementation. Some popular ADP products include:

ADP Workforce Now: Designed for mid-sized businesses, this platform handles HR, payroll, time tracking, benefits, and talent management.

ADP Vantage HCM: Suitable for large enterprises, ADP Vantage HCM offers comprehensive tools for HR, payroll, and talent management with more advanced features and customization options.

RUN Powered by ADP: Geared toward small businesses, RUN provides simple yet effective payroll and tax filing services.

Consult with ADP specialists or partners like Ignite HCM to ensure you choose the solution that aligns with your organization’s needs.

Establish a Clear Implementation Plan

Once you’ve selected your ADP solution, it’s time to create a detailed implementation plan. This is where having a structured roadmap becomes essential. The plan should cover key aspects such as timelines, resources, responsibilities, and milestones.

Here are some vital elements to include in your plan:

Project scope and objectives: Clearly outline the goals you want to achieve with ADP implementation, such as improved payroll accuracy or reduced time spent on manual HR tasks.

Implementation timeline: Define key phases of the project, such as system setup, data migration, testing, training, and go-live. Set realistic deadlines for each phase.

Assign roles and responsibilities: Identify key stakeholders, such as your internal HR team, IT department, and ADP implementation consultants, and assign specific tasks to ensure accountability.

Risk management: Anticipate potential roadblocks, such as data migration challenges or training needs, and establish contingency plans to mitigate these risks.

With a clear plan in place, your implementation process will be more focused and efficient.

Prepare Your Data for Migration

One of the most critical parts of any software implementation is data migration. This involves transferring employee information, payroll history, benefits details, and other essential data from your existing systems to ADP’s platform.

To ensure smooth data migration:

Perform a data audit: Review all your current data to ensure it’s accurate, up-to-date, and complete. This will help prevent any issues during the transfer.

Cleanse and organize your data: Remove duplicate or irrelevant information and format the data according to ADP’s specifications. Standardizing your data will minimize migration errors.

Backup your data: Always keep a secure backup of your data before starting the migration process. This ensures you won’t lose any important information in case of issues.

ADP or a certified partner like Ignite HCM can help guide you through the data preparation and migration process, ensuring your data is securely transferred and properly integrated into the new system.

Configure the System

Once the data is migrated, it’s time to configure the ADP platform to match your business needs. Configuration involves setting up various features, such as:

Payroll rules: Define how employees will be paid, including schedules, overtime policies, and tax withholdings.

Time tracking and attendance: Set up time-off requests, leave policies, and attendance tracking tools.

Benefits management: Configure your health benefits, retirement plans, and any additional employee perks.

Compliance settings: Ensure your system adheres to federal, state, and local regulations regarding payroll and HR compliance.

Customizing these features to fit your organization’s requirements is essential for a smooth operational experience. ADP’s platform offers robust customization options, so be sure to leverage these capabilities fully.

Conduct Thorough Testing

Testing is one of the most critical steps in ensuring a successful ADP implementation. This process will help identify any issues before going live, preventing disruptions once the system is fully operational.

During testing, consider the following:

System functionality: Ensure all system features are working as expected, from payroll calculations to benefits management.

Data integrity: Verify that employee information and payroll data have been accurately migrated and are displaying correctly in the system.

User access: Test the system from both administrative and employee perspectives to ensure all users can log in and access the necessary functions.

Compliance checks: Run compliance tests to ensure the system meets legal and regulatory requirements for payroll and HR.

Conduct multiple rounds of testing to catch any lingering issues, and involve key stakeholders in the process to get feedback on the system’s performance.

Train Your Employees

Even with the most user-friendly system, proper training is essential for a successful ADP implementation. Training ensures that your HR team, managers, and employees understand how to use the new system effectively.

HR and payroll staff training: Provide in-depth training to your HR and payroll teams on managing employee data, running payroll, and generating reports.

Manager training: Train managers on time tracking, attendance monitoring, and approving time-off requests.

Employee self-service training: Employees should be taught how to access their personal data, view pay stubs, and make time-off requests through the ADP portal.

Make sure training is ongoing, with refresher sessions available after the initial rollout to address any new issues or updates.

Go Live and Monitor Performance

After successful testing and training, your ADP implementation is ready to go live. However, this isn’t the end of the process. Monitoring system performance during the first few weeks is essential to ensure everything runs smoothly.

Monitor payroll accuracy: Keep a close eye on payroll calculations and ensure that employees are paid accurately and on time.

Track employee engagement: Gauge how easily employees are adapting to the new system and address any issues or concerns they may have.

Regular check-ins: Schedule post-implementation check-ins with your HR team and ADP consultants to review system performance, address any challenges, and make necessary adjustments.

Ongoing Support and Optimization

Once your ADP system is live, it’s essential to continually optimize its use to ensure maximum efficiency. Regularly review how the platform is performing, and look for opportunities to enhance workflows or add new features.

ADP and certified partners like Ignite HCM offer ongoing support, updates, and enhancements to help you get the most out of your investment. Regularly training your staff, conducting system audits, and staying up-to-date with new features will help keep your ADP implementation running smoothly for years to come.

Conclusion

Mastering ADP implementation requires careful planning, execution, and ongoing optimization. By following this step-by-step guide, businesses can successfully implement ADP solutions, streamline HR and payroll processes, and improve overall operational efficiency. With expert guidance from partners like Ignite HCM, your organization can leverage ADP to its full potential, enabling long-term success in workforce management.

For more info visit us Ignite HCM or send mail at [email protected] to get a quote.

1 note

·

View note

Text

Increase in employment in the private sector in the American ADP 62,000 in April, against 108,000 expectations

Employment in the US private sector has increased at a slower pace than scheduled in April. The US dollar index is more than 99.00 after the data. Employment in the private sector in the United States increased by 62,000 in April and the annual salary increased by 4.5% on an annual basis, according to automatic data processing (ADP) on Wednesday. This reading came after an increase of 147,000…

0 notes

Text

Payroll Check Generator vs. Manual Payroll: Which is Better?

Processing payroll is one of the most crucial tasks for any business, whether you're a small business owner, a freelancer, or managing a growing company. Traditionally, payroll was calculated manually, requiring hours of work and careful attention to detail. However, with the rise of payroll check generators, automating payroll has become easier and more efficient.

In this article, we’ll compare payroll check generators and manual payroll processing to help you decide which method is better for your business. We’ll cover the advantages and disadvantages of each, factors to consider, and how to choose the right payroll solution.

What is a Payroll Check Generator?

A payroll check generator is an online tool or software that helps businesses create paychecks, calculate wages, and generate pay stubs automatically. These tools streamline payroll processing by handling tax calculations, deductions, and compliance requirements.

Key Features of a Payroll Check Generator:

Automatic salary calculations

Tax and deduction processing

Printable and downloadable payroll checks

Direct deposit options (in some cases)

Pay stub generation for record-keeping

Compliance with state and federal tax laws

Popular payroll check generators include QuickBooks Payroll, Gusto, and ADP. Many free paystub generators are also available for smaller businesses or freelancers who need quick and easy pay stub creation.

What is Manual Payroll Processing?

Manual payroll processing involves calculating employee wages, taxes, and deductions by hand or using basic spreadsheets like Excel. This method requires the employer or accountant to input data, verify calculations, and issue checks manually.

Key Steps in Manual Payroll Processing:

Tracking employee hours worked

Calculating gross wages (hourly rate x hours worked)

Deducting taxes (federal, state, and local)

Accounting for benefits, insurance, and retirement contributions

Writing or printing checks for employees

Recording payroll transactions for compliance and tax reporting

While manual payroll offers flexibility, it can be time-consuming and prone to human error, which could lead to compliance issues or payroll mistakes.

Payroll Check Generator vs. Manual Payroll: Pros and Cons

Payroll Check Generator: Pros

✅ Time-Saving: Automates payroll calculations, reducing the time spent on processing paychecks. ✅ Accuracy: Minimizes human error by automatically applying tax rates and deductions. ✅ Compliance: Ensures payroll taxes and deductions follow legal requirements. ✅ Convenience: Generates pay stubs and printable checks in minutes. ✅ Record-Keeping: Stores payroll history for easy access during tax season.

Payroll Check Generator: Cons

❌ Cost: Some payroll software tools come with subscription fees. ❌ Limited Customization: Free versions may have fewer customization options. ❌ Dependence on Technology: Requires internet access and may experience software downtime.

Manual Payroll Processing: Pros

✅ No Software Costs: Saves money by eliminating the need for paid payroll services. ✅ Full Control: Employers have complete oversight of payroll calculations. ✅ Customization: Allows more flexibility in handling unique payroll structures.

Manual Payroll Processing: Cons

❌ Time-Consuming: Requires manual data entry, calculations, and check writing. ❌ Error-Prone: Higher risk of miscalculations and compliance mistakes. ❌ Tax Compliance Challenges: Employers must stay updated with changing tax laws.

Which One is Better for Your Business?

The choice between a payroll check generator and manual payroll processing depends on various factors, including business size, budget, compliance needs, and the number of employees.

1. Small Businesses and Freelancers

✅ Best Choice: Payroll Check Generator

Saves time and ensures tax compliance.

Offers professional pay stubs and paycheck processing.

Affordable and often available for free.

2. Medium-Sized Businesses

✅ Best Choice: Payroll Check Generator with Advanced Features

Automates payroll for multiple employees.

Reduces payroll management workload.

Provides reports and tax filing assistance.

3. Large Corporations

✅ Best Choice: Full-Service Payroll Software

Includes HR and benefits integration.

Ensures compliance with multi-state tax laws.

Offers direct deposit and advanced payroll features.

4. Businesses with Unique Payroll Needs

✅ Best Choice: Manual Payroll Processing

Provides full control over calculations.

Suitable for businesses with irregular payroll structures.

Requires dedicated payroll expertise.

Final Thoughts

Both payroll check generators and manual payroll processing have their pros and cons. If you run a small business or work as a freelancer, using a free or low-cost payroll check generator can save time and reduce errors. However, if you prefer full control over payroll calculations and have a unique payroll structure, manual payroll may be a better fit.

Ultimately, investing in the right payroll solution helps ensure that employees are paid accurately, taxes are handled properly, and payroll management is stress-free.

Are you looking for an easy way to generate payroll checks? Try a free payroll check generator today and streamline your payroll process!

1 note

·

View note

Text

The Benefits of Working with an ADP Consultant for Small Businesses

In today's fast-paced business world, small businesses face numerous challenges in managing their human capital effectively. From payroll processing to compliance issues, the demands on small business owners can be overwhelming. This is where ADP (Automatic Data Processing) consultants, particularly those under the IgniteHCM program, come into play. These experts offer tailored solutions designed to meet the unique needs of small businesses. Here, we explore the myriad benefits of working with an ADP consultant through the IgniteHCM program.

Expertise in Human Capital Management (HCM)

One of the primary advantages of partnering with an ADP consultant is their deep expertise in Human Capital Management (HCM). IgniteHCM consultants are well-versed in the latest trends and best practices in the industry. This knowledge allows them to provide small businesses with cutting-edge solutions that streamline HR processes, improve employee engagement, and boost overall productivity.

Streamlined Payroll Processing

Payroll processing is a critical yet time-consuming task for small businesses. Errors in payroll can lead to employee dissatisfaction and legal issues. ADP consultants bring advanced payroll solutions that automate and simplify the entire process. With their assistance, small businesses can ensure accurate and timely payroll, compliance with tax regulations, and efficient management of employee benefits.

Compliance and Risk Management

Navigating the complex landscape of labor laws and regulations can be daunting for small business owners. ADP consultants offer invaluable support in ensuring compliance with local, state, and federal regulations. They help businesses stay updated with changes in laws, avoid costly penalties, and mitigate risks associated with non-compliance. This peace of mind allows business owners to focus on core operations without the constant worry of legal complications.

Enhanced Recruitment and Onboarding

Recruiting and onboarding new employees are critical functions that impact a business’s ability to grow and thrive. ADP consultants provide tools and strategies to streamline these processes, from posting job openings to conducting background checks and facilitating smooth onboarding experiences. By optimizing recruitment and onboarding, small businesses can attract top talent and reduce turnover rates.

Improved Employee Engagement and Retention

Employee engagement is essential for maintaining a motivated and productive workforce. ADP consultants offer insights and solutions to enhance employee satisfaction and retention. Through the use of performance management tools, employee feedback systems, and career development programs, they help create a positive work environment where employees feel valued and engaged.

Access to Advanced Technology

ADP's IgniteHCM program equips small businesses with state-of-the-art technology solutions that were once only accessible to larger enterprises. These technologies include cloud-based HR platforms, mobile apps, and data analytics tools. By leveraging these advanced tools, small businesses can streamline their HR operations, gain valuable insights from workforce data, and make informed decisions that drive growth.

Cost Savings and Efficiency

Outsourcing HR functions to ADP consultants can lead to significant cost savings for small businesses. By automating processes and reducing the need for in-house HR staff, businesses can lower operational costs. Additionally, ADP consultants help identify inefficiencies and implement best practices that further enhance cost-effectiveness and operational efficiency.

Customizable Solutions

Every small business has unique needs and challenges. ADP consultant understand this and offer customizable solutions tailored to each business's specific requirements. Whether it's developing a customized payroll system or creating a bespoke employee benefits package, ADP consultants work closely with business owners to deliver solutions that align with their goals and objectives.

Time Savings

Managing HR functions can be time-consuming, taking business owners away from strategic activities that drive growth. ADP consultants handle many of these tasks, freeing up valuable time for business owners to focus on strategic planning, business development, and customer relationships. This shift in focus can lead to significant improvements in business performance and growth.

Scalability

As small businesses grow, their HR needs evolve. ADP consultants provide scalable solutions that can adapt to changing business requirements. Whether a business is expanding its workforce, entering new markets, or undergoing organizational changes, ADP consultants ensure that the HR systems and processes remain aligned with the business's growth trajectory.

Data Security and Privacy

In an era where data breaches are increasingly common, ensuring the security and privacy of employee information is paramount. ADP consultants prioritize data security and implement robust measures to protect sensitive information. This commitment to data security helps small businesses build trust with their employees and customers.

Training and Development

Employee training and development are crucial for fostering a skilled and competent workforce. ADP consultants offer training programs and resources that help employees enhance their skills and advance their careers. By investing in employee development, small businesses can improve job satisfaction, increase productivity, and build a culture of continuous learning.

Strategic HR Planning

ADP consultants play a vital role in strategic HR planning. They work with business owners to develop HR strategies that align with the company’s long-term goals. This includes workforce planning, succession planning, and talent management. By taking a strategic approach to HR, small businesses can position themselves for sustainable growth and success.

Simplified Benefits Administration

Administering employee benefits can be complex and time-consuming. ADP consultants simplify this process by managing benefits administration on behalf of the business. This includes handling enrollment, communication, and compliance related to employee benefits. With ADP’s support, small businesses can offer competitive benefits packages that attract and retain top talent.

Continuous Support and Guidance

The relationship between a small business and an ADP consultant is ongoing. ADP consultants provide continuous support and guidance, ensuring that businesses have access to the latest tools, resources, and industry insights. This ongoing partnership allows businesses to stay ahead of trends, adapt to changes, and continuously improve their HR practices.

Focus on Core Business Activities

By delegating HR tasks to ADP consultants, small business owners can concentrate on their core business activities. This shift in focus enables them to drive innovation, improve customer service, and enhance overall business performance. The expertise and support of ADP consultants allow business owners to operate more efficiently and effectively.

Conclusion

Working with an ADP consultant through the IgniteHCM program offers a multitude of benefits for small businesses. From streamlining payroll and ensuring compliance to enhancing employee engagement and providing advanced technology solutions, ADP consultants are invaluable partners in managing human capital. By leveraging their expertise, small businesses can achieve greater efficiency, reduce costs, and position themselves for long-term success. The partnership with an ADP consultant not only simplifies HR processes but also empowers small business owners to focus on what they do best – growing their business and serving their customers.

For more info pls visit us : IgniteHCM or send mail at [email protected] to get a quote.

0 notes

Text

How To Implement ADP System Maintenance & Optimization For Maximum Efficiency

In the fast-paced world of human resource management, having an efficient and effective ADP system can make a significant difference in organizational performance. Ignite HCM, a leading expert in HR solutions, understands the intricacies of ADP System Maintenance & Optimization and offers comprehensive strategies to ensure your ADP system operates at peak efficiency.

Understanding the Importance of ADP System Maintenance & Optimization

ADP (Automatic Data Processing) systems are vital for managing payroll, benefits, and other HR functions. However, without regular maintenance and optimization, these systems can become sluggish, error-prone, and inefficient, leading to costly mistakes and decreased productivity. Ignite HCM emphasizes the importance of ADP System Maintenance & Optimization to ensure your HR operations run smoothly.

Key Steps for Effective ADP System Maintenance & Optimization

Regular System Audits

Regular system audits are the foundation of effective ADP System Maintenance & Optimization. Audits help identify areas where the system may be lagging, uncover potential errors, and ensure that all processes are compliant with the latest regulations.

Action Plan:

Schedule quarterly audits.

Use audit findings to make necessary adjustments.

Ensure all compliance requirements are met.

Update Software and Hardware

Keeping your ADP system’s software and hardware up-to-date is crucial for maintaining its efficiency. Outdated software can lead to security vulnerabilities and compatibility issues, while outdated hardware can slow down system performance.

Action Plan:

Implement a schedule for regular software updates.

Invest in modern hardware to support the system's demands.

Utilize cloud-based solutions for scalability and flexibility.

Data Integrity and Security

Ensuring data integrity and security is a critical aspect of ADP System Maintenance & Optimization. Any compromise in data can lead to severe consequences, including financial losses and reputational damage.

Action Plan:

Implement robust data encryption methods.

Regularly back up data to prevent loss.

Conduct security training for all HR personnel.

Optimize Payroll Processes

Payroll is a core function of any ADP system, and optimizing payroll processes can significantly enhance system efficiency. This involves streamlining workflows, automating repetitive tasks, and ensuring accurate data entry.

Action Plan:

Use automated tools to handle payroll calculations.

Implement double-check systems to prevent errors.

Schedule timely payroll processing to avoid delays.

Employee Self-Service Portals

Employee self-service portals can drastically reduce the administrative burden on HR staff by allowing employees to manage their information independently. This leads to increased efficiency and accuracy in data management.

Action Plan:

Set up user-friendly self-service portals.

Provide training to employees on how to use the portals.

Regularly update portal features based on user feedback.

Integration with Other Systems

Integrating your ADP system with other HR and business systems can enhance data flow and reduce manual data entry, leading to greater efficiency and accuracy.

Action Plan:

Identify key systems that can be integrated with ADP.

Use APIs and other integration tools to ensure seamless data transfer.

Monitor integrated systems to ensure data consistency.

User Training and Support

Providing ongoing training and support for users is essential for maximizing the efficiency of your ADP system. Well-trained users are more likely to use the system effectively and report issues promptly.

Action Plan:

Develop comprehensive training programs for new users.

Offer refresher courses for existing users.

Establish a support team to address user queries and issues.

Performance Monitoring and Reporting

Continuously monitoring system performance and generating regular reports can help in identifying and addressing issues before they become critical. This proactive approach is central to effective ADP System Maintenance & Optimization.

Action Plan:

Set up performance monitoring tools.

Schedule regular performance review meetings.

Use reports to make data-driven decisions for system improvements.

Vendor Support and Collaboration

Leveraging vendor support and collaborating with experts can provide additional insights and solutions for maintaining and optimizing your ADP system. Ignite HCM recommends working closely with ADP and other vendors to ensure you get the most out of your system.

Action Plan:

Maintain open lines of communication with your ADP vendor.

Participate in vendor-provided training and updates.

Collaborate with experts from Ignite HCM for specialized support.

Benefits of Effective ADP System Maintenance & Optimization

Implementing these strategies for ADP System Maintenance & Optimization can lead to numerous benefits, including:

Enhanced Efficiency:

Streamlined processes and reduced manual intervention lead to faster and more efficient HR operations.

Improved Accuracy:

Regular audits and optimizations reduce the likelihood of errors, ensuring accurate data management.

Cost Savings:

Avoiding costly errors and improving process efficiency can result in significant cost savings for the organization.

Better Compliance:

Keeping the system up-to-date with the latest regulations ensures compliance and reduces the risk of legal issues.

Increased Employee Satisfaction:

Efficient systems and self-service portals enhance the employee experience, leading to higher satisfaction and engagement.

Partnering with Ignite HCM for ADP System Maintenance & Optimization

Ignite HCM offers specialized services to help organizations implement effective ADP System Maintenance & Optimization. Our team of experts works closely with clients to understand their unique needs and develop tailored solutions that maximize system efficiency.

Our Services Include:

System Audits and Assessments:

Comprehensive audits to identify areas for improvement and ensure compliance.

Software and Hardware Updates:

Assistance with regular updates and migration to modern solutions.

Data Security Solutions:

Implementation of robust data security measures to protect sensitive information.

Payroll Optimization:

Strategies to streamline payroll processes and ensure accurate data management.

Training and Support:

Ongoing training programs and dedicated support teams to assist users.

Conclusion

Maintaining and optimizing your ADP system is crucial for ensuring maximum efficiency and effectiveness in HR operations. By following the strategies outlined above and partnering with experts like Ignite HCM, organizations can enhance their ADP System Maintenance & Optimization efforts, leading to improved performance, cost savings, and employee satisfaction.

For more information on how Ignite HCM can assist with your ADP System Maintenance & Optimization needs, contact us today and take the first step towards a more efficient and effective HR system.

Website : https://www.ignitehcm.com/solutions/optimization

Phone : +1 301-674-8033

#ADP Maintenance#ADP Optimization#Payroll System Maintenance#HR Tech Optimization#ADP System Health#HR Software Maintenance#ADP Performance Tuning#System Efficiency

1 note

·

View note

Text

At the end of April, the top shorted S&P 500 industrial stocks included companies from the NYSEARCA:XLI index. Investors were keeping a close eye on these stocks as they showed high levels of short interest, indicating bearish sentiment in the Market. Stay tuned for more updates on the stock performance of these companies in the coming weeks. Click to Claim Latest Airdrop for FREE Claim in 15 seconds Scroll Down to End of This Post const downloadBtn = document.getElementById('download-btn'); const timerBtn = document.getElementById('timer-btn'); const downloadLinkBtn = document.getElementById('download-link-btn'); downloadBtn.addEventListener('click', () => downloadBtn.style.display = 'none'; timerBtn.style.display = 'block'; let timeLeft = 15; const timerInterval = setInterval(() => if (timeLeft === 0) clearInterval(timerInterval); timerBtn.style.display = 'none'; downloadLinkBtn.style.display = 'inline-block'; // Add your download functionality here console.log('Download started!'); else timerBtn.textContent = `Claim in $timeLeft seconds`; timeLeft--; , 1000); ); Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_1] The industrial sector of the S&P 500 saw a slight dip of 2.85% in April, contrasting with the 3.97% overall decrease in the S&P 500 index for that month. Short interest in industrial stocks across the S&P 500 inched up to 2.12% by the end of April from 2.03% in March and 2.01% in February. The Industrial Select Sector SPDR Fund ETF (NYSEARCA:XLI) had Caterpillar (CAT), GE Aerospace (GE), and Uber (UBER) as its largest contributors, with short interests of 2.22%, 0.96%, and 2.45%, respectively, at the end of April. Other major players like Honeywell (HON), United Parcel Services (UPS), 3M (MMM), and Automatic Data Processing (ADP) held short interests ranging from 0.98% to 1.44%. Among the industrial stocks, American Airlines (AAL) emerged as the most shorted with an 8.03% short interest, followed by United Airlines (UAL), Southwest (LUV), and Delta (DAL) with short interests ranging from 2.81% to 5.06%. On the contrary, Norfolk Southern (NSC) had the least short interest at 0.63%, with Broadridge Financial Solutions (BR) and Parker-Hannifin (PH) close behind at 0.64%. In terms of sub-sectors, Software retained its position as the most shorted industry within the industrial sector, while Industrial Conglomerates, Environmental and Facilities Services, and Electric Equipment were among the least shorted industries. Overall, short interest in the industrial sector provides valuable insights into Market sentiment and investor behavior, influencing stock performance and trading strategies. Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_2] 1. What are the top shorted S&P 500 industrial stocks at April end? The top shorted S&P 500 industrial stocks at April end are those companies within the Industrial Select Sector SPDR Fund (XLI) that have the highest percentage of shares being shorted by investors. 2. Why do investors short stocks in the industrial sector? Investors may short stocks in the industrial sector if they believe that the value of these companies' shares will decrease in the near future. By shorting a stock, investors can potentially profit from a decline in its price. 3. How can I find out which S&P 500 industrial stocks are being shorted the most? You can find the top shorted S&P 500 industrial stocks by looking at the latest data on short interest, which is the percentage of a company's shares that have been shorted by investors. This data is often published by financial news websites or research firms. 4. Should I consider shorting industrial stocks in the current Market environment? Shorting stocks can be a risky investment strategy, as it involves betting that a company's share price will decrease.

Before deciding to short industrial stocks, it's important to thoroughly research and understand the potential risks and rewards of this strategy. 5. What other factors should I consider when evaluating S&P 500 industrial stocks for shorting? When evaluating S&P 500 industrial stocks for shorting, it's important to consider factors such as the company's financial health, industry trends, and overall Market conditions. Conducting thorough analysis and due diligence can help you make more informed decisions when shorting industrial stocks. Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_1] Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators Claim Airdrop now Searching FREE Airdrops 20 seconds Sorry There is No FREE Airdrops Available now. Please visit Later function claimAirdrop() document.getElementById('claim-button').style.display = 'none'; document.getElementById('timer-container').style.display = 'block'; let countdownTimer = 20; const countdownInterval = setInterval(function() document.getElementById('countdown').textContent = countdownTimer; countdownTimer--; if (countdownTimer < 0) clearInterval(countdownInterval); document.getElementById('timer-container').style.display = 'none'; document.getElementById('sorry-button').style.display = 'block'; , 1000);

0 notes

Text

Automatic Data Processing (ADP) Inc. exceeds expectations and climbs with well beyond steady phase

Marking a steady rise in the US HR Analytics Market, Automatic Data Processing (ADP) Inc. is going through various improvements, resulting in a high growth.

STORY OUTLINE

ADP Inc. makes successive growth with changing times, paving its way for growth.

ADP Inc. provides Comprehensive HR solutions, with Payroll Processing, HR Analytics and Benefits Administration to be used.

With Data Driven Insights, ADP Inc. drives a stringent observation over every employee, reducing inefficiency.

With Technological improvement and Innovations, ADP Inc. quickly rises.

1. ADP Inc. makes successive growth with changing times, paving its way for growth.

To learn more about this report Download a Free Sample Report

ADP Inc. has shown a rise in Earning per share (EPS) of 26%, resulting in a rise of economy in its environment.

With an increase of about 11% in Employer Services revenue and 4% in PEO Services growth, leading to an overall growth.

An increasing number of employees, over 1 million+ is observed, showing its global reach.

With an adjusted Earning Before Interests and Tax (EBIT) of about 23%, and a margin of 22%, ADP Inc. leaps its distance.

According to Ken Research, Automatic Data Processing Inc. (ADP Inc.) has made various changes through which they have been able to step up in the US HR Analytics Market, getting improved through technology, insights, processing, employment and payments, resulting in an overall moderate growth over the years.

2. ADP Inc. provides Comprehensive HR solutions, with Payroll Processing, HR Analytics and Benefits Administration to be used.

Visit this Link: – Request for custom report

ADP Inc. focuses on HR management and gives an extensive Human Capitals Management (HCM) solutions covering the entire process, including talent management, recruitment

With the proper handling of Payroll Processing, including payroll calculation, tax compliance, deductions and direct deposits.

Excellence in Benefits Administration solutions through properly mediated health insurance, retirement plans and others, ADP Inc. maintains employee retention.

Presence of ADP’s Talent Management Tools, applies performance management, goal setting, succession planning and more.

3. With Data Driven Insights, ADP Inc. drives a stringent observation over every employee, reducing inefficiency.

Request free 30 minutes analyst call

Leveraging high pile of workforce data and analyzing them, giving Data-driven insights, leading to an overall enhancing of HR performance.

Increasing in efficiency by creating benchmarks and useful insights from the integration of ADP Data Cloud, having analyzed HR data and anonymized payroll information.

With the presence of Predictive Analytics, upcoming trends and newer policies are incorporated, improving its overall efficiency.

With the help of data driven insights, by analyzing the workforce data, ADP executes strong Strategic Workforce Planning, making workflow go in order.

4. With Technological improvement and Innovations, ADP Inc. quickly rises.

The former CEO, Carlos Rodriguez, made it entirely possible, by his emphasis on technological improvements to improve the company.

With the integration of ADP Innovation Lab, dedicated experts make newer solutions to upcoming challenges creating solutions for the barricades it faces.

In order to reduce time spent on traditional methodologies and documentation, shift to mobile applications, to ease and enhance time utilization.

With the integration of Artificial Intelligence, manual processing, decision making and other process are getting seamless, increasing ADP’s efficiency.

With the advent of digitization, Cloud Service incorporation has made many processing smooth and faster, and with its own diverse storage, huge data reserves can be made.

CONCLUSION

Automatic Data Processing Inc. (ADP Inc.) has started to gradually rise up the US HR Analytics Market. Proving positive dominance in technological and stringent regulatory policies, leading to a full-proof and sound environment for employees to work, resulting in an overall growth.

#market research#business#united states#human resources#analytics and reporting#market report#research report

1 note

·

View note