#money management

Text

The Kamala Harris Campaign '24

#kamala harris#trump#donald trump#trump 2024#democrats#vote kamala#vp kamala harris#kamala for president#karate#money#money management#kamala 2024#trump derangement syndrome#patriotic#california#president biden#economy#immigration#gop#gop patriots#republicans

520 notes

·

View notes

Text

{ MASTERPOST } Everything You Need to Know about Saving Money and Being Frugal

We’re all in this together. Don’t give up.

On food and groceries:

How to Shop for Groceries like a Boss

Why Name Brand Products Are Beneath You: The Honor and Glory of Buying Generic

If You Don’t Eat Leftovers I Don’t Even Want to Know You

You Are above Bottled Water, You Elegant Land Mermaid

You Should Learn To Cook. Here’s Why.

On entertainment and socializing:

The Frugal Introvert’s Guide to the Weekend

7 Totally Reasonable Ways To Save Money on Cheap Entertainment

Take Pride in Being a Cheap Date

The Library Is a Magical Place and You Should Fucking Go There

Your Library Lets You Stream Audiobooks and eBooks FOR FREEEEEEE!

What’s the Effect of Social Media on Your Finances?

You Won’t Regret Your Frugal 20s

On health:

How to Pay Hospital Bills When You’re Flat Broke

Run With Me if You Want to Save: How Exercising Will Save You Money

Our Master List of 100% Free Mental Health Self-Care Tactics

Why You Probably Don’t Need That Gym Membership

How to Get DIRT CHEAP Pet Medication, Without a Prescription

On other big expenses:

Businesses Will Happily Give You HUGE Discounts if You Ask This Magic Question

Understand the Hidden Costs of Travel and Avoid Them Like the Plague

Other People’s Weddings Don’t Have to Make You Broke

You Deserve Cheap, Fake Jewelry… Just Like Coco Chanel

3 Times I Was Damn Grateful for My Emergency Fund (and Side Income)

When (and How) to Try Refinancing or Consolidating Student Loans

The Real Story of How I Paid Off My Mortgage Early in 4 Years

Season 2, Episode 2: “I’m Not Ready to Buy a House—But How Do I *Get Ready* to Get Ready?”

The Most Impactful Financial Decision I’ve Ever Made… and Why I Don’t Recommend It

On buying secondhand and trading:

Almost Everything Can Be Purchased Secondhand

I Am a Craigslist Samurai and so Can You: How to Sell Used Stuff Online

The Delicate Art of the Friend Trade

On giving gifts and charitable donations:

How Can I Tame My Family’s Crazy Gift-Giving Expectations?

In Defense of Shameless Regifting

Make Sure Your Donations Have the Biggest Impact by Ruthlessly Judging Charities

The Anti-Consumerist Gift Guide: I Have No Gift to Bring, Pa Rum Pa Pum Pum

How to Spot a Charitable Scam

Ask the Bitches: How Do I Say “No” When a Loved One Asks for Money… Again?

On resisting temptation:

How to Insulate Yourself From Advertisements

Making Decisions Under Stress: The Siren Song of Chocolate Cake

The Magically Frugal Power of Patience

6 Proven Tactics for Avoiding Emotional Impulse Spending

On minimalism and buying less:

Don’t Spend Money on Shit You Don’t Like, Fool

Everything I Know About Minimalism I Learned from the Zombie Apocalypse

Slay Your Financial Vampires

The Subscription Box Craze and the Mindlessness of Wasteful Spending

On saving money:

How To Start Small by Saving Small

Not Every Savings Account Is Created Equal

The Unexpected Benefits (and Downsides) of Money Challenges

Budgets Don’t Work for Everyone—Try the Spending Tracker System Instead

From HYSAs to CDs, Here’s How to Level Up Your Financial Savings

Season 2, Episode 10: “Which Is Smarter: Getting a Loan? or Saving up to Pay Cash?”

The Magic of Unclaimed Property: How I Made $1,900 in 10 Minutes by Being a Disorganized Mess

We will periodically update this list with newer articles. And by “periodically” I mean “when we remember that it’s something we forgot to do for four months.”

Bitches Get Riches: setting realistic expectations since 2017!

Start saving right heckin’ now!

If you want to start small with your savings, consider signing up for an Acorns account! They round up your every purchase to the nearest dollar and save and invest the change for you. We like them so much we’ve generously allowed them to sponsor us with this affiliate link:

Start investing today with Acorns

#frugal#saving money#personal finance#money tips#financial tips#financial literacy#financial freedom#money#debt#money management#how to save money

570 notes

·

View notes

Text

#Three Reasons Why You Shouldn’t Give Money to Ghosts (And One Why You Should)#ghost#ghosts#pony rides#money#money management#finance#unreality

195 notes

·

View notes

Text

THEME: “What You Don’t Know?”

Choices:

1. If this resonates with you, consider getting a personal reading here @ https://www.iamwinklebottom.com/shop/advice-psychic-mediumship-divination/32

• I’m hearing the song “Say My Name” (the Calvin Harris version) by Florence and The Machine: https://youtu.be/SZhLrOghfTI?si=8gsXqoepo5M4Tqba

You are misunderstanding your ancestry and your soul’s origins. Genuine ancestor connectivity is needed. I offer personal ancestor connectivity conjure and ancestor readings.

Yes, it is possible to be many things at one time. Yes, it is possible to have a blood quantum of something that is “stereotypically” unrelated to your phenotype (how you look physically).

It’s time to wake up and find out who your ancestors really were/are. Stop guessing and following random narratives people online put out.

It’s okay to be wrong; what’s not okay is sitting back and blindly absorbing who other’s are and posing as things you’re not. It’s time to find out what you’re really made of. The truth may set you free and show you lots of wisdom, but only if you allow it.

2. If this resonates with you, consider getting a personal reading here @ https://www.iamwinklebottom.com/shop/advice-psychic-mediumship-divination/32

• I keep hearing “Olokun;” check out this video here: https://youtu.be/PrnJrCrFfHo?si=2auEL_c7CYIX9-07

This message is not for all of you.

You have to understand that you are indeed easily influenced. Be careful. Do not turn into a copy cat. It’s okay to be inspired, but do not steal from others.

There is negative energetic karma that comes from doing that.

Some of you have been stolen from.

Energetically protect what’s yours with spiritual work and affirmations. I do offer conjure services. I’m hearing “evil eye removal and protection conjure will assist you.”

If you’re interested in having someone with years of experience do these services for you, hello - check out my website: https://www.iamwinklebottom.com/shop/conjure-services/30

There’s a lot of things that you cannot see. Seek for what’s below the surface in private, secretly. Build yourself up on the inside then let it ooze outside of you, high vibrationally.

3. If this resonates with you, consider getting a personal reading here @ https://www.iamwinklebottom.com/shop/advice-psychic-mediumship-divination/32

• I’m hearing “The Big Pay Back” by James Brown: https: https://youtu.be/HFNZOk00D74?si=TzSJXXsD3HMw3CLo

Your spirit team is heavy. This is not a drill. This is not a joke or a game. They’re very, very powerful.

Some of you honor Santa Muerte, Anubis, Santa Marta, or even Olokun. All of them, maybe. Again, take what resonates; do not claim these beings without knowing for sure who walks with you.

When people do wrong to you, it hurts these people in multiple areas of life all at once. Stop looking for the “pay back” to show up in their lives. Often times it’s not going to show publicly until “the pimple finally pops.”

You may even hear “meant to be” gossip about your enemies getting what they deserve later on when you’ve forgotten about the mistreatment and betrayal they took part in.

It’s almost like your enemies are being exploited just so the news can get back to you… not because you wanted that, but because that’s what’s meant to happen.

You’re supposed to collect the memories or “bones” from your enemies’ “sentencing;” don’t let this go to your head.

Know that you’re tough shit. Cleansing and protection work is still needed for you. I offer those kinds of services, if you’re interested: https://www.iamwinklebottom.com/shop/conjure-services/30

#psychic reading#pick a card reading#tarot pick a card reading#tarot#tarot pick a card#pick a card#tarot reading#free tarot reading#yemaya#mami wata#Olokun#ancestors#yemoja#magick#spells#spellwork#indegenous#aboriginal#karma#return to sender#manifestations#money management#chakras#affirmations#rootwork#conjure#santa muerte#Anubis#santa marta la dominadora#santísima muerte

24 notes

·

View notes

Text

36 notes

·

View notes

Text

It's been awhile, but I have a new thought for folks starting out investing

This blog is called "not financial advice" so this is not financial advice. Nothing on this blog is.

And.

I am working on a large-scale D&D-style banking system for a private client (my job is weird). This is putting me in touch with a lot of people in very expensive suits and it I keep pinging them:

"Let's say someone has $100 to start investing, what should they do. Like, literally $100. With $0.00 added after."

I've cobbled together some thoughts (not advice don't sue me) and cut out the bullshit and sales pitches.

Start a high-yield savings account in an FDIC insured bank. As of this writing (April 27, 2023, United States-based), it'll be somewhere between 3.5 - 4.25% APY (annual percent yield -- i.e. interest)

Go with a bank that is FDIC insured. Banks pay for this, you do not. Here are smart people talking about what FDIC is.

The percentage difference listed above is 0.75%. Moving money is a bitch, is it worth chasing 0.75%? That depends on your situation, time, etc. Here are smart people who built a calculator to help you figure it out if it's worth it to you.

Touch it as little as possible.

Start a spreadsheet that tracks your finances.

In the cell that lists the amount of this balance, give it a name. Something fun, something that speaks to you. I did this as an experiment + to participate, mine is "Slime Research Adventurer Destruction Fund".

Write a prospectus (fancy word for "this is what the goal for this cash is to do").

Slime Research Adventurer Destruction Fund prospectus: Follow the path of high-yield savings rates at {bank}. Review quarterly if other banks have a substantially better rate (+1.5%).

The entire point is to break the idea of "them not me" and "today vs. someday" and "I cannot begin to build wealth vs. someone else can."

A $100 savings INVESTMENT IN A SAVINGS ACCOUNT with a rate of 3.5-4.25% will give you interest of $3.50-4.25 at the end of the first year, then continue on growing onwards.

That is your return.

Is it as high as investing in the market? No.

Is it safer? Holy fuck yes.

When you invest in stocks, bonds, etc. you are looking for a return. This is your return.

This is not a grindset mindset work 24/7 chunk of advice. This is not a reality-disillusionment "I am struggling I need to work harder."

You need to be knowledgable about how things can work for you so you can leverage what you have, where you are, when you have it, as you can.

A high-yield savings account is not going to make you rich.

It probably won't make a difference in an emergency.

It will absolutely make a difference in non-emergency times, over a period of time.

Slime Research Adventurer Destruction Fund Destroying Adventurers.

That last point is where I'm coming to.

If you don't have enough cash to invest and/or you're not comfortable investing, that's fine.

Give your savings account a name that speaks to you. This is your investment. Your savings account = your investment account.

There is no moral or ethical difference between "I have cash shoved into a savings account" and "I have cash shoved into the stock market."

The only difference is potential risk, growth, and fees (never pay for a savings account), liquidity ("how quickly can I convert this thing into cash to buy an apple at the grocery store, pay a bill, etc.").

Make money less scary via weird names and fun graphics.

Go to a piccrew site and make a catgirl with pink and blue hair.

Name your fund "Catgirlsnax Fundsies".

Make.

Money.

Management.

Less.

Scary.

By.

Taking.

Control.

Via your own.

Desires.

Goals.

Weird quirks.

Here is to hoping these gifs are not from horrible shows I don't know anime I know money and business and monsters.

If they are then I apologize for it.

I've read the notes on my blog and a lot of you like anime. I'm hoping these resonate.

217 notes

·

View notes

Photo

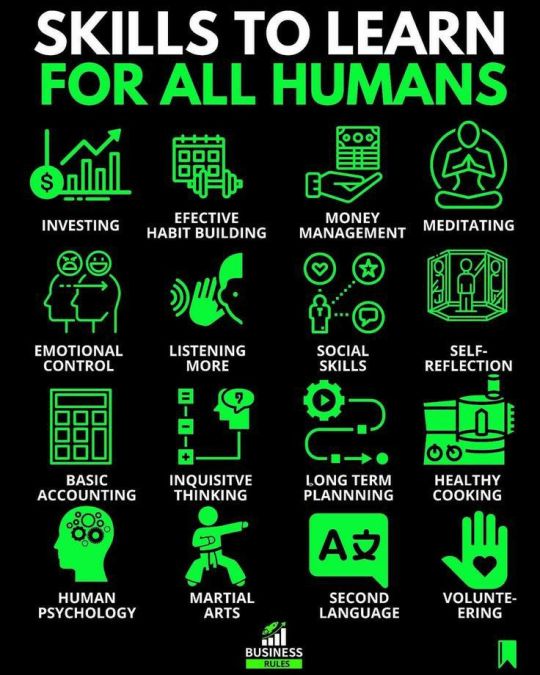

A lot of this I’ve been trying to develop from project Batman!

#project batman#projectbatman#batman#bruce wayne#workout#fitness#fitblr#superhero fitblr#superhero fitness#martial arts#volunteering#second language#polymath#polyglot#accounting#planning#cooking#investing#meditation#money management

366 notes

·

View notes

Text

Disability-Friendly Prosperity Magic

So let's face it, those who are disabled have a hard time with money in general, either from being unable to work or not having a steady, strong source of income. Sometimes we can monetize our hobbies, admittedly at a limited capacity (some less or more than others).

From our relationship with money, money mindsets, and income streams, it's hard. That's not to shame anyone, either. Some overspend to cope, while others are incredibly frugal.

In this post, I will review some resources, tips, and tricks for the struggling disabled witch.

The Mundane Before Magical

Step one is to make a budget and track your expenses. I'm serious. Sit down, look at where your money is going, and decide on a budget that you can realistically stick to. I use the 50/30/20 rule as a budget, which is 50% Needs, 30% Wants, and 20% Savings. However, I recently switched wants and savings around so I can save for a trip.

Now I do not want you to worry about a big fancy budget method. I don't want you to overthink it. Here is a resource (Canada, but it can be used in the USA) to start one. Focus on your needs like housing, utilities, basic clothing, food, etc. Then go into wants and entertainment, and finally, savings. I suggest you put any debt payoff into the needs category if you have any debt. You do not want a blow to your credit report.

Now do you have any financial goals? Going back to school? Debt payoff? A trip? Even a big medical trip coming up? Here is a resource (Canada, but it can be used in the USA) that can help you create a goal and a plan to pay this off.

Savings, please, your SAVINGS. It is vital to have an emergency fund. Job loss? Death? Vet bills? Children? Dentist? You better believe that piles up. It is recommended if you are single to have at least 3 months of income saved up, with a child and single at least 6 months. Married on two incomes, the same amount. Married with one income, it is recommended without children at least 6 months saved up and with children 9 months. It is vital you have the means to take care of yourself if an emergency strikes. It is never recommended that money be stopped from being put into these accounts.

If you are in debt, look at your debt relief options. Sometimes there are services out there that can advocate for you regarding debt. They will help you develop a plan, understand the relief options, sign documents with you, and develop a credit rebuilding program. These services are out there; even if they are paid, they can help you pay off some of your debt, especially credit card debt.

Educate yourself on investing, basic investing, and financial literacy, in stock markets and everything beyond. Know what kind of accounts you can hold and what could help you in your situation.

Need help applying for disability? Here's a resource for the USA (a lot can also be used for Canada).

The Magical

Upkeep a prosperity altar. Work with the spirit of money like you would any other spirit. Honour it, talk to it, venerate it. Money loves to be valued, moved, not wasted, and used in charity. Most importantly, money takes time. Money takes time to grow and build a relationship with.

This is the most important thing I've learned about money. It wants to be worked with. It's sitting there. It wants to help and aid you in ways that you need.

Work with this altar on Thursdays, incorporating the spirit of Jupiter. Jupiter rules over finances. Long steady finances, not quick finances. Jupiter rules over business, legal and all things finances. Jupiter is a slower-moving planet.

You can also incorporate the spirit of Mercury on Wednesdays along with your Jupiter workings. Mercury is a fast-moving planet, a planet for fast-moving money. However, you must build a long, steady form of finances over quick, easy cash (but sometimes you do need it right now).

You can create a money bowl and work with it on this altar, a Jupiter cashbox (I will make a future post on this), or a manifestation mirror box filled with petitions, sigils and your investment/banking information.

Fill your altar with greens and gold, imagery for wealth and abundance, pocket change, and anything else that symbolizes wealth.

Do not forget to leave offerings for your money altar. A simple glass of water can do but try to do more if you can.

Road opener workings or petition with an offering for the cross-road spirits who can unblock blockages in your way.

Final Take Away

I know this might not help everyone, but I sincerely hope this helps somebody. Financial literacy was not taught to everyone, nor were proper budgeting tips. I wanted to share what I've learned over the years as I believe it is vital information for some of the information I have collected.

Blessings

#witchcraft#witch#spoonie magic#spoonie witch#prosperity magic#prosperity spell#prosperity#witchblr#spoonie withcraft#money manifestation#money management#money magic#money spell#prosperity altar

26 notes

·

View notes

Text

Time gone never returns.

#financial freedom#financial literacy#moneyquotes#personal finance#budgeting#finance#money mindset#money management#financial education#happylife#moneytips#financial independence#financial tips#financialfreedom

154 notes

·

View notes

Text

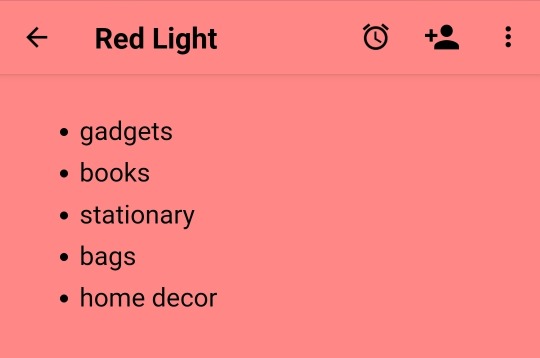

My low buy 2024 rules.

Green Light - buy when you run out

Yellow Light- when money is saved up or will need to replace

Red Light - non-negotiable not allowed

22 notes

·

View notes

Text

I see a disturbing number of people, mostly millennials, these days, who have significant incomes and are starting to amass significant savings, who have terrible financial management skills. People who live at home with parents and get a full time job can accumulate money really fast. A lot of people are letting huge amounts of money, like sometimes as much as $20,000 or more, accumulate in checking accounts where it is earning either no interest or negligible interest.

Because inflation is high (over 3% these days), you are effectively losing money when it sits there. Also you're allowing the bank to profit off it; it's lending your money out to other people, often at interest rates as high as 6-7% or more, and it's not paying you for it.

If you have more than maybe around $3000 dollars in an account, you want that money earning interest. Here are things you can do to earn more from your money:

Open a savings account at a higher yield. Go to a different bank if necessary. CIT Bank has rates around 5% these days.

Pay off high interest rate debt but not low-interest rate debt. If the interest rate is above about 7-8% definitely make it a priority to pay it off ASAP. If it is above 5% it is still better to pay it off than to sit on your money. If it is much below 5%, pay it off as slowly as possible (minimum payment only) because there are risk-free ways to earn more interest on your money.

If you don't need the money in the short-term, consider a CD (Certificate of Deposit) which offers a fixed interest rate over a certain time. Often you can get a slightly higher rate by tying your money up for 3 months or 6 months or sometimes even longer. These are good options if you have a specific expenditure in your future, like perhaps moving or buying a home, but you know it won't happen until after a certain date.

Open a brokerage account. Brokerage accounts allow you to buy and sell investments such as stocks, mutual funds, or bonds, which include CD's from banks as well as treasury and municipal bonds and corporate bonds. You get more options for buying CD's (i.e. you can compare many different banks side-by-side, buy CD with the best rate, and manage multiple CD's within a single interface.) Most brokerage accounts have no fees and typically no or very low minimum investments. There is no reason not to have one if you have a few thousand dollars.

In a brokerage account, buy a money market mutual fund. Look for one with no load and no transaction fee, a high yield, and a low expense ratio, and a fixed share price of $1 per share. My two favorite are SWVXX and SNSXX. SWVXX has a higher yield (about 5.19%) whereas SNSXX has a lower yield (just over 5%) but is non-taxable on state income taxes, so SNSXX is a better choice if you have a high state tax rate, otherwise SWVXX is better.

Consider opening a Roth IRA if you haven't, and then, if able, contribute the maximum amount each year. You are allowed to make a contribution that counts towards the previous year, up until the tax filing deadline of the current year. So for example today it is Mar. 14th, 2024, so you can open a Roth IRA today and contribute the max ($6,500) for the 2023 year and also the max ($7,000) for 2024, for a total of $13,500. The main advantage of a Roth IRA is that the money in them can grow tax-free. Roth IRA's benefit anyone able to have one (the richest people are not allowed to contribute to them) and are especially important for people who are self-employed, change jobs a lot, or never work full-time, so they don't have a consistent employee-provided retirement plan.

Consider investing in stocks. Stocks are riskier (in that their price changes, and you can lose money when investing in them), but tend to have a higher yield than savings and money market accounts and funds. The simplest way to buy stocks is to buy an ETF (exchange-traded-fund). I recommend buying one that follows the S&P 500 and has a low expense ratio like SPY or VOO. Whatever you buy, reinvest the dividends and let it grow, contribute a little money every year so are putting in money even in years the market is down. On average you get about a 10% return in the market but it is unpredictable and you will lose in some years, but that's okay, you're not retiring for many decades and the money will have grown a lot by then.

There are options regardless of your risk profile. It is throwing your money away to let a lot of money sit in a checking account. At a bare minimum, go for a high-yield savings account, CD, or better yet get a brokerage account, put it in high-yield money market funds like SWVXX, shop around for CD's or other bonds with the highest rates, and if you are able to tolerate some risk and want a higher return, consider putting some money in more aggressive investments like stocks.

I am 100% for tax reform and other reform to curb the extreme concentration of wealth in the hands of a few, but it's also important to take your financial situation into your own hands. Get financially comfortable. Get a stake in the US economy. Empower yourself so you can live better and help your family, friends, and the causes you care about.

12 notes

·

View notes

Text

#trump#donald trump#kamala harris#trump 2024#california#democrats#te#texas#immigration#illegal immigration#arizona#migrants#vp kamala harris#vote kamala#kamala 2024#kamala for president#president trump#undocumented#money#economy#crime#illegal immigrants#illegal invasion#harris walz 2024#vp harris#harris 2024#vote harris#president biden#biden#money management

126 notes

·

View notes

Text

How to Avoid Lifestyle Inflation … and When to Embrace It

A strange thing happens every time my income increases. My life magically gets… easier, better, and happier.

Getting my very first raise at work made it easier for me to pay off my student loans ahead of schedule. That meant the money I used to spend on student loans could instead be spent on making my life more comfortable. And that meant moving out of the house I rented with six roommates and finally buying decent food.

Getting a job that cut out my daily commute allowed me to spend more time doing things I love instead of impotently cursing the traffic. I could get drinks with friends after work, or go to the climbing gym, both of which cost money. Or, for free, I could stand by the highway yelling “SUCKERS!” at passing commuters at 5:30 p.m. every day!

And getting a new job at almost double my previous salary meant I could afford things I previously thought would take years of saving. Plane tickets to a friend’s destination wedding in Mexico. Drywall for my unfinished basement. Eating at a shmancy restaurant without checking the menu for prices.

If all of this sounds suspiciously like lifestyle inflation, that’s because it is! And yet I feel no guilt over inflating my lifestyle from time to time when my income significantly increases.

This is generally considered a cardinal sin of personal finance. It’s right up there with buying lattes or taking the name of Dave Ramsey in vain. So let’s unpack that.

Keep reading.

#frugal#lifestyle inflation#personal finance#feminism#feminist#making money#money management#how to money#adulting#career advice

32 notes

·

View notes

Text

#tumblr milestone#advertising#monney#health products#healthy#health#make money from home#cryptocurreny trading#earn money#earn money online#free money#how to earn money#how to make money online#make money#make money as an affiliate#make money fast#make money online#make money today#money#money management#moneymaking#monster#monochrome#monkey d. luffy#monte#health and wellness#gut health#health and fitness#health blog#health people

11 notes

·

View notes

Text

Ok so I potentially solved some of the mystery of why Inprnt has started to be useless with their payments but then again I might be just:

So take this with a grain of salt, ok?

From publicly available info:

In 2017 the owner of Inprnt’s wife was added to the company as a manager. Her signature is on the yearly reviews after that, and she obviously was handling different managerial elements in the company. Her previous job experiences include a lot of money management stuff like PeopleSoft project cost, finances, billing, etc.

In 2020 she is removed from the manager position/possibly the company entirely. Sadly, she does not list her time at the company anywhere on her LinkedIn which means I can not confirm that money management was a part of her roll at the company. (Which is interesting all on its own, considering she seems to have just left that large chunk of work off her resume completely.)

Which might explain why the payment processing has gone down hill in the past few years. That, and a lot of payment processors from PayPal to Etsy have significantly slowed down and/or faced delays in this past year for their own reasons. Again, I’m not able to 100% confirm a connection, but it is a possible contribution to it. The final little bit of relevant info that helps point towards a slowly growing mix of mismanagement at Inprnt is this 2021 work review posted on Indeed:

#Inprnt#money management#inprnt payments#I have links and screen shots if anyone wants an easy walk through the public info#anyway#possibly nothing#but it might be the beginning of the end for Inprnt#if management is being mishandled in such ways#once again: PLEASE TAKE THIS AS SPECULATION WITH FACTS INCLUDED#I cannot 100% confirm that was her roll at Inprnt even if it was her roll at other companies#please don’t assasinate me

24 notes

·

View notes

Text

Mastering the Art of Investing: Practical Strategies for Insightful Decision-Making

Key Point:

Making smart and insightful investment decisions is an attainable goal with the right strategies in place. By recognizing your limitations, managing emotions, seeking professional guidance, and aligning your investments with personal objectives, you can cultivate a robust and successful investment portfolio that stands the test of time.

Sound investment decisions are the bedrock of financial success. However, navigating the complex world of investing can be challenging, even for the most seasoned investors. This post explores practical strategies for making smart and insightful investment decisions, empowering you to grow your wealth with confidence and finesse.

Recognize the Limits of your Abilities

In both life and investing, it is crucial to acknowledge the boundaries of our expertise. Overestimating our abilities can lead to ill-advised decisions and, ultimately, financial losses. By cultivating humility and seeking external guidance when necessary, we can minimize risks and make more informed investment choices.

Manage Emotional Influence on Decision-Making

Emotions can significantly impact our ability to make rational decisions. To circumvent the sway of emotions, adopt a disciplined approach to investing, relying on data-driven analysis and long-term strategies rather than succumbing to impulsive reactions.

Leverage the Expertise of an Advisor

Engaging a professional financial advisor is a prudent investment decision. Their wealth of knowledge and experience can help you navigate market complexities and identify opportunities tailored to your financial goals, risk tolerance, and investment horizon.

Maintain Composure Amidst Market Volatility

Periods of market turbulence can incite panic among investors. However, it is essential to remain level-headed and maintain a long-term perspective during such times. Avoid making impulsive decisions based on short-term fluctuations and focus on your overarching financial objectives.

Assess Company Management Actions Over Rhetoric

When evaluating potential investments, examine the actions of a company's management rather than relying solely on their statements. This approach ensures a more accurate understanding of the organization's performance, financial health, and growth prospects.

Prioritize Value Over Glamour in Investment Selection

The most expensive investment options are not always the wisest choices. Focus on identifying value rather than being swayed by glamorous or high-priced options. This strategy promotes long-term financial growth and mitigates the risk of overpaying for underperforming assets.

Exercise Caution with Novel and Exotic Investments

While unique and exotic investment opportunities may appear enticing, approach them with caution. Ensure thorough research and due diligence before committing to such investments, as they may carry higher risks and potential pitfalls.

Align Investments with Personal Goals

Invest according to your individual objectives rather than adhering to generic rules or mimicking the choices of others. Personalized investment strategies are more likely to yield favorable results, as they account for your unique financial circumstances, risk appetite, and long-term aspirations.

Making smart and insightful investment decisions is an attainable goal with the right strategies in place. By recognizing your limitations, managing emotions, seeking professional guidance, and aligning your investments with personal objectives, you can cultivate a robust and successful investment portfolio that stands the test of time.

Action plan: Learn a few simple rules and ignore the rest of the advice you receive.

It’s easy to become completely overwhelmed by the volume of advice available about investing. However, you don’t need to become an expert on the stock market in order to become a good investor.

Just like an amateur poker player can go far if he simply learns to fold his worst hands and bet on his best ones, a novice investor can become very competent just by following a few simple rules. For example, he should learn not to overreact to dips in the market and make sure to purchase value stocks instead of glamour stocks.

#Financial freedom#Building wealth#Personal finance strategies#Investment advice#Passive income stream#Early retirement planning#Debt reduction#Budgeting tips#Saving money#Wealth management#Financial independence#Secure financial future#Retirement planning#Financial planning#Personal finance#Money management#Investment strategies#Retirement savings#Investment portfolio#Financial education#Wealth creation#Financial goals#Wealth building#Financial security#Retirement income#Passive income ideas#Financial advice#Financial wellness#Financial planning tools#Financial management

31 notes

·

View notes