#Automatic Transfer Scheme )

Explore tagged Tumblr posts

Text

#Home#Energy & Power#Global Distribution Feeder Automation Market#Global Distribution Feeder Automation Market Size#Share#Trends#Growth#Industry Analysis By Type( Fault Location#Isolation#Service Restoratio#Automatic Transfer Scheme )#By Application( Industrial#Commercial#Residential )#Key Players#Revenue#Future Development & Forecast 2023-2032

0 notes

Text

Lovers and Liars | Draco Malfoy

Draco Malfoy and Theodore Nott, both determined and resourceful from reputable houses, find themselves at odds in the name of love.

Warning: Mature themes/language. Violence. Sexual content.

Chapter One

Chapter Two: Power

At eleven years old, when she had first met Pansy, Lorelei had always believed she would pale in comparison. Pansy held all the power in their dynamic and in their social circle, and therefore all the notoriety, and beauty, and respect. But Lorelei had learned from her father that power, unlike beauty and strength, was something crafted by men. Power would only lie where men believed it to be.

It didn’t take much longer for her to realize that Pansy Parkinson was a paragon of this crucial fact. She was not more powerful than Lorelei because she was more beautiful, or more courageous, or more intelligent. She was simply more powerful than everyone else because she had convinced them of such. Slowly, Lorelei had begun to realize that, if she truly wanted to, all of the power that Pansy currently held could simply be transferred over, with the right timing, and the right motivation.

Lorelei felt she currently had neither, so she decided she would simply wait in the meantime. For now, Pansy served her as a more high profile shield, someone to take the attention off of her so that she could do as she pleased in the shadows. Lorelei found that Theodore Nott’s limited relationship with Draco Malfoy worked similarly, if not in the exact same way.

Despite her usual indifference to boys and their attempts at getting close to her, Lorelei had actually grown to like Theo. He was different than the other boys who had tried to talk to her before, mainly because he was actually entertaining. He was entirely different from the other boys in their year; he was different, and he had a certain darkness to him that she found resonated with her.

Lorelei found she was almost taking pleasure in humoring Theo. She felt as if the only time she got to speak to a conscious person was when she talked to Theo. As of late, they had been taking calm strolls about the castle and its grounds together, something many different people within Slytherin house were noticing.

“Strange,” Lorelei Morrigan remarked as they walked out to the courtyard together. “Not as many people are out these days.”

“It’s getting colder,” Theodore remarked, taking note of the crisp fall air.

He had politely linked her arm with his, walking arm in arm with her.

“Are you cold?” he asked.

She smiled. She was only wearing her school uniform, a white long sleeved shirt with a green skirt and long charcoal grey socks. She could have survived, but decided she’d take advantage of Theo’s offer.

“A little,” she said softly.

“Would you like my coat?” he asked.

She nodded. “Sure.”

He automatically took his warm black coat off, leaving him in his dark grey sweater. He gently wrapped the coat around her shoulders, allowing her to put her arms through and wear the coat as they walked.

“Thank you.”

“Of course,” Theo smiled warmly.

He really was rather cute, Lorelei had to admit, with neat brown curls and jade colored eyes that made all the girls blush. Theo, it seemed, was more impressed somehow by the girls who didn’t blush, the girls who seemed to have their own scheme in mind. Theo, Lorelei was beginning to realize, didn’t talk to many people, girls especially, because he was easily bored. Not necessarily from toying with people, but just from talking to them.

Then again, this was normally what led to Theo Nott deciding to toy with people. Or at least try to. He seemed to recognize that he most likely couldn’t get away with that sort of thing when it came to Lorelei.

“Can I ask you a question?” she said after a moment of peaceful, comfortable silence.

Theo looked down at her, eager to hear her question. “Of course.”

“Do you think the Dark Lord has any chance of returning?” she wondered aloud.

This was of course a question she wouldn’t dare ask anyone else.

“He’s said to have been lost for over a decade,” Theo supplied.

Theo often did this thing where, when faced with a difficult question, he would automatically supply Lorelei with the expected and typical response, although not necessarily because it was the answer he held to be the most truthful to him. She knew he was testing her, in his own way.

“He’s been trying to return for years,” Lorelei reasoned. “He’s bound to succeed sooner or later, wouldn’t you say?”

Theo went quiet for a moment.

“Many of his followers are looking for him,” she added.

“Have your parents been looking for him?” Theodore inquired.

Lorelei didn’t say anything, knowing it was the safer choice.

“My father isn’t bold enough to actually seek him out,” he shared, prompting her to do the same.

“My parents have been looking ever since he disappeared,” she confided, “Along with Lucius Malfoy.”

Theodore Nott looked at her curiously, admiring her sharpness.

“That’s right, your parents are rather close with the Malfoys.”

“He and my father often discuss work,” Lorelei explained.

“Your family values powerful friends, then?” Theo asked bluntly.

Lorelei smiled. “Shouldn’t everyone?”

“They should,” he agreed.

This made her chuckle softly.

“What was your family’s motto again?” he thought aloud. “‘Ta mort est ma vie’? ‘Your death is my life’?” he recalled.

She nodded.

“Let me ask you something, Lorelei,” Theo said, piquing her interest. “What do you value, in this life?”

“In this life?” Lorelei only considered the question for a moment. “Greatness.”

“‘Greatness’?” Theo asked to clarify, intrigued by her answer.

“Talent. Success. Notoriety. In that order,” she thought.

“Hmm,” Theo remarked with satisfaction. “What do you think of the idea of a legacy, Lorelei?” he inquired.

She looked up at him, speaking rather matter-of-factly. “I hope to leave behind one of my own,” she answered, “Even standing out from my family’s.”

“That’s a tough act to follow,” Theo commented. “The Morrigans have a history going back millennia… But I’m sure I don’t have to tell you.”

“I’ll make my own way,” she assured him.

“I’m sure you will,” he agreed. “Have you given any thought to what you want your own family to look like?”

“I have,” she nodded, thinking for a moment. “I’ll marry someone impressive.”

Theo chuckled. “‘Impressive’?”

“Someone who impresses me.”

This made him genuinely laugh. “A smart goal. And what about children?”

“What about them?” Lorelei scoffed.

“Do you intend on having any of your own?” he wondered. “If you’ve given it any thought, of course.”

“Children are irrelevant,” she replied simply.

“‘Irrelevant’? To a legacy?”

“In this day and age, a legacy isn’t who you leave behind after you die. It’s what,” she stated. “If I don’t have children, I don’t have children. If I do, then I do. It makes no difference to me overall. As long as it’s what I choose.”

“We think similarly,” Theo recognized.

“Do we?” Lorelei wondered.

“All I want is to build my own empire of sorts. Alongside someone who brings out the best in me,” he thought. “A strong ally.”

“I have a sense for strong allies,” Lorelei told him.

“So do I,” he agreed. “Tell me, Lorelei…”

They stopped as she waited expectantly.

“Can I consider you my ally?” he asked.

She had to think about his question.

“The current social and political climate is… troubling, to say the least,” he explained himself. “Many others from families like ours are, shall we say, not particularly ideal,” he offered diplomatically.

“That I can agree with,” Lorelei said finally.

“You and I both know… Something big is going to happen. Soon. And regardless of whether or not the Dark Lord returns.”

She paused as she considered his logic, face stone cold. Except for her eyes, which widened just enough to allow him a small window into her mind.

“I… I’ll admit, I’ve heard… rumors,” she confessed.

“What kind of rumors?” Theo asked.

“Rumors… About the Triwizard Tournament. I don't have much to go off of at all, but… I think Harry Potter was supposed to be a Champion,” Lorelei said. “But I don’t think he’s supposed to survive.”

“Clever girl,” Theo grinned, a mischievous expression gracing his features. “Would you like to know what I know?”

“Depends on what you know,” she responded.

Her answer was, of course, the most entertaining option he could have foreseen.

“I’ll tell you what,” Theo Nott began. “You accept me as your ally, and I will be the strongest ally you could possibly ask for.”

“Are you asking me to marry you?” Lorelei said cheekily.

“No. Of course not,” he promised. “But, if things progress and we eventually reach a mutual agreement, years from now, that could only be a convenience to the both of us.”

Lorelei’s striking blue eyes pierced his, searching for the truth.

“You’re smart, Lorelei. And powerful… And I would do anything to keep such an asset satisfied,” Theo murmured, “As a friend, or otherwise. Whatever it takes… Things are about to get very confusing around here, and I need to know that someone is in my corner.”

“Alright. I’ll bite,” Lorelei decided, a look of determination on her face. “What do you know?”

Theo grinned, looking around carefully before he began.

*****

Lorelei accompanied Theodore Nott to the very first task of the Triwizard Tournament, which was held on what was typically the Quidditch pitch. They walked arm in arm up into the stands with the other ‘influential’ Slytherin students, as Pansy and Daphne eyed them curiously.

Fred and George Weasley were running up and down the stands collecting bets from students all over. They eventually reached the Slytherin students, boxes in hand. Lorelei and Theo both looked as they passed, accepting bets on either Cedric Diggory, Harry Potter, Viktor Krum, or Fleur Delacour. Most students were voting by passion, choosing the Champion they liked the most without much regard for talent or skill.

Lorelei thought the people placing bets were ludicrous, only to find that Theo calmly pulled a small black bag from his coat pocket. She watched as he coolly dropped a sizable gamble of fifeen Galleons into Fred Weasley’s collection box.

“Harry Potter,” Theo said clearly, earning a suspicious nod from Fred as he waited to see if anyone else had bets to place.

“You’re betting?” she inquired.

“Remember what I told you?” Theo asked.

Lorelei froze, her expression calm and calculated. Fred and George exchanged glances as she remembered what Theo had shared with her a few days prior. He leaned in, a clever smirk on his face.

“You’re going to want to bet on Potter,” he whispered in her ear. “Trust me.”

Lorelei looked the twins up and down before retrieving her own money. She dropped a relatively safe eight galleons into the box, ultimately testing her friend’s intel.

“I trust you,” she concluded as the twins disappeared with the money.

Theo smiled warmly. “You won’t regret it.”

“Betting on Potter, are we?”

Theo and Lorelei looked up as a loud voice interrupted from the row above them. Draco Malfoy was sitting with his yes men, Crabbe and Goyle, along with a few others.

“I bet smart, Malfoy,” Theodore assured him, “Not ideal.”

Draco Malfoy scoffed, sneering at the idea of Harry Potter winning the task. “It’s a shame you’ve roped Lorelei into betting with you. I bet on Krum!”

Draco turned to Lorelei, staring down at her with a grin.

“Your money would be safer with me, Morrigan,” Draco remarked, saying the word ‘money’ as if he really meant something else.

“I can think for myself, thanks,” she said calmly, smiling up at him.

Draco scowled, finding her cool demeanor infuriating. Pansy also seemed livid, albeit for a slightly different reason as she whispered viciously in Daphne’s ear about Lorelei. Lorelei ignored them all, facing forward in her seat beside Theo.

They both watched with blank faces, applauding politely at appropriate intervals like miniature versions of their revered parents. Lorelei turned to watch Theo as Viktor Krum faced his dragon, a vicious Chinese Fireball. His expression was calm and collected as Krum fought the dragon. Smiling, she sneakily laced her fingers with his. He never turned to face her, although there was an appreciative smile that spread across his face as he faced forward.

Eventually, Krum managed to defeat his dragon and capture its golden egg, as the stadium erupted with cheers for his victory. Draco seemed especially excited, looking smugly down at Theo. But Theo didn’t react, waiting calmly as the rest of the challenge played out. Harry Potter went last. So far, Viktor Krum was in first place. Cedric Diggory was in second, and Fleur Delacour was last.

“Something tells me Delacour’s staying dead last,” Theo remarked.

Lorelei chuckled as Potter eventually came out to face his dragon, a fearsome Hungarian Horntail. It was rather touch and go at first; he seemed as if he was struggling just to survive.

“Do you think he’ll win like he’s supposed to?” Lorelei asked while everyone around them was too busy yelling.

“He has to,” Theo assured her. “Whoever our inside man is has made it so. He’d be stupid to fail.”

“But, he is stupid,” Lorelei reminded him.

Theo just chuckled, patting her hand as he encouraged her to be patient. Eventually, Harry Potter found a way to overcome his lack of confidence. Thinking outside the box, he used a Summoning Charm and brought his Firebolt out to the pitch, as Lorelei and Theo just looked at one another.

It was eventually announced that Harry Potter and Viktor Krum would be tied for first place. Lorelei was more than entertained as Theo looked up at Draco, who just gave him an amused smirk. Knowledge, it seemed, was power.

-

Chapter Three

#draco malfoy#draco lucius malfoy#draco malfoy x reader#draco x reader#draco fanfiction#draco malfoy imagine#draco malfoy fanfiction#hpdm#hp#hp fanfic#tom felton#theodore nott#theo nott#theodore nott x reader#theo nott x reader#slytherin boys#theodore nott imagine

28 notes

·

View notes

Note

Hey Icy

I was thinking of making a side blog. And since you have two, I was wondering if you could explain how it works. Like will I be able to just switch between them?

Hey!

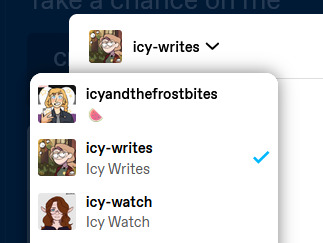

To answer your question: Yes! You're able to switch between them. It's actually easy - whether on desktop or the app.

This is going to be long, so it'll be under the cut.

Pretty much a little arrow for a drop down menu will appear next to your name when you go to make a post, and you're able to switch between which blog you'd like to post it under:

(This is on desktop, but it looks relatively the same way on the app.)

Note: It doesn't automatically default to the main blog after you post. tumblr will automatically select whatever blog you just posted or queued with and hold on to that for the next post. So make sure to keep an eye on which 1 you have selected.

Closing the app and/or the browser doesn't always automatically reset it to your main blog. 9 times out of 10, it'll hold on to that 1. Thankfully tho, switching between them is very easy.

And you're also able to switch between the blogs.

(Again on desktop.)

On the app it's a little different. You can do 1 of 2 things. You can either hold down on the little person and flip between the blogs. Or, at the top left corner, tap your name and switch between them.

You're also able to edit the individual blogs so they have different color schemes and banners and pfps.

You can also comment and message people on your different blogs.

All your your followers on your main account won't automatically follow your sideblog. You'll have to let everyone know that you have a sideblog and to follow it.

People you've blocked on your main are able to follow your sideblog, but you won't see them on your activity log. There's a way to block them on your sideblog as well, by I have no idea how to go about that. I'd have to play around with some settings to find that out.

Each blog will have it's own activity log, too. So it's a little easier to find who liked or reblogged what specific post on which specific blog.

You can also delete sideblogs without it effecting your main account. But, if you delete your main account, it'll delete everything.

Sieblogs can be password protected, which means only people who know the password can view your blog to send asks, reblog or like posts, or message you on that blog.

They can also have multiple people running them. I've personally never used this option, so I'm not sure exactly how this works. I know you used to be able to transfer ownership of a blog thru this, but like I said, I've never used this, so I don't know how this works.

The only things you can't do, is follow people with a sideblog or ask questions. Following someone on a sideblog is something we've never been able to do on here, but you used to be able to ask questions with a sideblog.

A sideblog is really just a secondary blog, where you can post things that maybe you don't want to spam other people with on your main. Or you can have it for a different fandom or aesthetic or whatever.

If there's anything you really want to know, just go ahead and ask me. It's relatively easy to got between the 2+ blogs, so long as you remember to check which blog you've selected before doing anything.

4 notes

·

View notes

Text

Reflecting on Beate Gütschow's Work

Breaking down the artist's way of work, investigating the 'I' series.

Transferring landscape paintings which incorporates conditioned visual perceptions to photography, Beate Gütschow digitises anolog photographs by following principles of studio paintings inspired from the Baroque times to the 18th century.

“You only need two or three of these rules, and the photos look like paintings, because that is how we have been trained to perceive things,” she explains.

Challenging the norms of perception, she’s able to detach herself from conventional image schemes to create her own reality, portraying an attempt to describe the object’s conditions.

Approaching new interpretations of traditional pictorial representations, Beate abandons her natural and urban scenes and dabbles on a more staged and confined space. The interiors have nothing in common with the daylight-flooded interiors of Dutch painting. Reminding us of advertising agencies, laboratories or offices and even photo studios, the various contemporary locations which are functionalistic rooms which allows a variety of things appear to stand under careful scrutiny or, in the case of the photo studios, to be in the process of being turned into “images.” There is a pause, a short delay, before, one can imagine, the objects are rearranged again.

Using the aspect of flattening to make images, the two objects are viewed from overhead and depicted approximately life-size in the illuminated image. Identified, the black covering of the automatic transmission and rod next to it, assuming, linked to an automotive background as well. The meaning of their juxtaposition may not be clear at first glance, photographed against a wall of white tiles reinforced by the white flash from the front, the image is evidently attempting to describe the objects’ conditions. The work’s title can be translated as “Are you ready?”

2 notes

·

View notes

Text

I have to disagree.

You'll end up with an exponentially increasing amount of vampires and a decreasing amount of people to "drink" from, sorta like a pyramid scheme almost.

Unless you mean the versions where vampirism ISN'T transferred via bite? And, even then, normally in those versions, drinking blood automatically kills the victim. And when it doesn't, there's the EXTREMELY likelihood of infection and disease transfer for the victim from mouth bacteria. Not to mention the possibility of the vampire getting a disease from the victim.

Plus, as other commenters pointed out, blood bags go bad and do need to be thrown out often. Why not use those instead?

And sucking someone's blood out (at least non-consensually) is kinda rapey...

Honestly, I love the idea of a vampire who only drinks blood taken from blood banks and hospitals, because it so beautifully encompasses someone who's more concerned with the vibes of something than the actual impact of it.

Drinking from someone on the street, barring some other condition they may have, isn't likely to kill them unless you gorge yourself. Taking blood packs? There's always a shortage of blood, and having even less of it runs the very real risk of getting someone killed in a way that is wholly out of your control once you've sipped on that blood. Someone you can't assure the innocence or guilt of, if you're the type of person who cares about that.

Despite that, in popular stuff, I often see discussions of drinking from a blood bank being somehow better or preferable, and yeah. No. The only thing it does is make you feel better while doing more harm, because of that degree of removal. You're effectively drinking blood from someone on the cusp of hypovolemic shock, but since it's not straight from the tap, some people seem to think it's better.

51K notes

·

View notes

Text

TCS on Foreign Remittance: Key changes and how banks can navigate them with Kyzer.

In the Union Budget of 2023, the Tax Collected at Source (TCS) on foreign remittances under the Liberalised Remittance Scheme (LRS) underwent a significant change. The TCS rate was increased from 5% to 20% for remittance transactions that exceed ₹7 lakhs, affecting various types of foreign transfers such as investments, international money transfers, and the purchase of overseas tour packages. This article explores the TCS on foreign remittance transactions, the changes in tax rates, and how Kyzer Software’s TradeZone platform helps banks manage these remittances more efficiently.

Understanding TCS on Foreign Remittance Tax Collected at Source (TCS) is a tax mechanism where a certain percentage of the transaction is collected as tax by the facilitator, such as banks or financial institutions, and deposited with the Income Tax Department. In the case of foreign remittance transactions under LRS, this means that when an individual or business sends money abroad, the authorised bank or financial institution collects the applicable TCS from the sender and deposits it with the tax authorities. This change is aimed at increasing financial transparency and ensuring that remittance transactions are appropriately tracked. However, the sudden rise in the TCS rate from 5% to 20% has created significant concerns for businesses and individuals alike, especially when engaging in cross-border financial transactions.

Applicable TCS Rates on Foreign Remittance Post-Budget 2023

The changes brought about in the Union Budget 2023 impacted different types of foreign remittance transactions. Below is a quick overview of the applicable TCS rates:

The increased 20% TCS rate now applies to most foreign remittance transactions, including international money transfers, investments, and the purchase of foreign assets. However, remittances for education and medical expenses have a lower applicable TCS rate, making them exceptions to the new rule.

How TCS on Foreign Remittance Affects Businesses and Individuals

With the TCS rate increase, businesses and individuals face higher upfront costs when remitting funds abroad. For example, if you were to invest ₹10 lakhs in a foreign asset, the TCS would apply to the amount exceeding ₹7 lakhs, meaning you would have to pay 20% on ₹3 lakhs. This results in an additional ₹60,000 in TCS charges, which must be deposited with the tax department. While the intent behind this change is to enhance tax compliance and transparency, it also poses certain challenges, such as increased costs and administrative complexities for businesses engaged in cross-border trade and finance.

Kyzer Software’s TradeZone: Simplifying TCS Management for Banks

Kyzer Software’s TradeZone platform is designed to help banks and financial institutions manage complex trade finance processes, including the administration of foreign remittances under LRS. With the increased TCS on remittances, TradeZone offers an automated solution to track, calculate, and report TCS on foreign transactions, reducing the burden on bank staff and ensuring compliance with government regulations.

Through its advanced automation features, TradeZone can streamline the process of managing TCS on remittances. It automatically calculates the correct TCS rate based on the type of transaction, such as investments, education, or international purchases based on purpose of transaction. Additionally, TradeZone generates reports that banks can use to deposit TCS with tax authorities, eliminating the potential for human error.

Trade Zone’s open API integration allows banks to connect easily with other systems, ensuring seamless communication and compliance throughout the remittance process. As a result, banks can focus on offering value-added services to their customers, knowing that their TCS obligations are managed efficiently.

To learn more about how Kyzer Software can support your bank’s digital transformation and compliance efforts, visit TradeZone Automated Trade Finance Platform for Banks and Corporates.

0 notes

Text

Web Security 101: Protecting Against Common Threats

In today’s digital world, websites serve as the face of businesses, educational institutions, and organisations. As online interactions grow, so do the threats targeting web applications. From malware attacks to phishing schemes, cyber threats are more sophisticated and frequent than ever. Whether you’re a business owner, developer, or tech enthusiast, understanding the fundamentals of web security is essential to ensure your digital presence remains safe and resilient.

In this article, we’ll cover the essentials of web security, outline common web threats, and discuss best practices to protect against them. For students and professionals pursuing technology careers, especially those enrolled in programs like the Full Stack Developer Course in Bangalore, mastering these security concepts is not just beneficial—it’s essential.

What is Web Security?

Web security, also known as cybersecurity for web applications, is the protective measure taken to safeguard websites and online services against unauthorised access, misuse, modification, or destruction. These protections help maintain the confidentiality, integrity, and availability (CIA) of information and services online.

With the increasing digitisation of services, web applications are a common target for attackers due to the valuable data they often store, such as user credentials, personal information, and payment details.

Common Web Security Threats

Here are some of the most common threats that web applications face today:

1. SQL Injection (SQLi)

SQLi a type of attack where malicious SQL queries are inserted into input fields to manipulate databases. If input validation is not properly handled, attackers can retrieve, alter, or delete sensitive data from the database.

2. Cross-Site Scripting (XSS)

XSS attacks occur when attackers inject malicious scripts into web pages viewed by other users. This can give rise to data theft, session hijacking, and the spreading of malware.

3. Cross-Site Request Forgery (CSRF)

In a CSRF attack, a malicious website tricks a user into performing actions on a different site where they’re authenticated. This can result in unauthorised fund transfers, password changes, and more.

4. Man-in-the-Middle (MITM) Attacks

These attacks happen when an attacker intercepts communication between two parties. They can steal or manipulate data without either party being aware.

5. Denial of Service (DoS) and Distributed DoS (DDoS)

These attacks flood a website with traffic, turning it slow or entirely unavailable to legitimate users. DDoS attacks can cripple even robust web infrastructures if not mitigated properly.

6. Zero-Day Exploits

Zero-day attacks exploit unknown or unpatched vulnerabilities in software. These are particularly dangerous because there’s often no fix available when the attack occurs.

Best Practices to Protect Against Web Threats

1. Use HTTPS

Securing your website with HTTPS encrypts data transferred between users and your server. It also ensures that data isn't altered during transmission. SSL/TLS certificates are now a basic requirement for modern websites.

2. Input Validation and Sanitisation

Never trust user input. Validate and sanitise all inputs on both client and server sides. This helps in preventing SQL injections, XSS, and other injection-based attacks.

3. Implement Proper Authentication and Session Management

Strong passwords, multi-factor authentication (MFA), and secure session management are crucial. Implement session expiration and automatic logout features to reduce unauthorised access risks.

4. Regularly Update Software and Libraries

Web frameworks, plugins, and server software should be regularly updated to patch known vulnerabilities. Automated tools can help identify outdated components in your tech stack.

5. Use Web Application Firewalls (WAF)

WAFs protect web applications by filtering and monitoring HTTP traffic. They can prevent many common attacks before they reach your server.

6. Data Encryption

Sensitive data—both at rest and in transit—should be encrypted. This reduces the damage caused by data breaches.

7. Conduct Regular Security Audits

Perform vulnerability assessments and penetration testing regularly to identify and fix security flaws in your applications.

8. Security Awareness Training

Educate employees and developers on security best practices. Social engineering attacks often target human error, so awareness is a strong line of defence.

Role of Developers in Web Security

Security isn't just the job of cybersecurity specialists. Developers play a critical role in implementing secure code and architecture. Understanding the OWASP Top 10—an industry-standard list of the most critical web application security risks—is a must for anyone writing backend or frontend code.

This is why modern tech education emphasises security fundamentals. At ExcelR, we integrate security concepts across our tech courses, including our Full Stack Developer Course in Bangalore. We believe that a well-rounded developer isn’t just one who can build efficient applications—but one who can build secure ones too.

Real-World Impact of Poor Web Security

Neglecting web security can have severe consequences. Major data breaches have cost companies millions in losses, legal penalties, and reputation damage. In extreme cases, companies have shut down operations permanently after suffering massive cyberattacks.

Even smaller websites are not immune. Bots and automated scripts scan thousands of websites daily for vulnerabilities, often targeting outdated CMS platforms or poorly configured servers.

Final Thoughts

Web security is not a one-time task—it’s an ongoing process of identifying risks, updating systems, and educating users and developers. With the evolution of cyber threats, staying informed and proactive is the best defense.

Whether you’re running a personal blog or developing enterprise-level web applications, implementing strong security measures can save you from irreversible damage. And if you're aspiring to become a tech professional, enrolling in a comprehensive program like the Full Stack Developer Course in Bangalore from ExcelR can give you both the technical and security skills required to thrive in today’s digital landscape.

For more details, visit us:

Name: Full Stack Developer Course In Bangalore

Address: No 9, Sri Krishna Akshaya, 1st Floor, 27th Main, 100 Feet Ring Rd, 1st Phase, BTM Layout, Bengaluru, Karnataka 560068

Phone: 9513446548

0 notes

Text

Combine Tax Relief and Smart Saving with the Best EIIS Fund and Irish Bank Accounts

Building a strong financial foundation in Ireland today involves more than just saving money – it requires strategic investment and tax planning. One of the most effective tools for Irish taxpayers looking to reduce their income tax burden while also supporting the local economy is the Best EIIS Fund Income Tax Relief Benefit In Ireland. The Employment and Investment Incentive Scheme (EIIS) offers substantial income tax relief to individuals who invest in qualifying Irish businesses. Among the top EIIS options available, the Davy EIIS Fund is widely recognized for its professionalism, strong track record, and focus on growing enterprises with real economic potential.

The Davy EIIS Fund allows investors to receive up to 40% income tax relief, significantly reducing their overall tax liability. This benefit, combined with the potential returns from a well-diversified investment portfolio, makes it one of the most powerful financial planning tools for high-income earners in Ireland. The fund is managed by a seasoned team of experts who perform deep due diligence before investing in innovative Irish companies, ensuring that your capital is not only tax-efficient but also working toward long-term value creation. It’s an excellent choice for individuals who want to reduce their taxes while contributing to job creation and economic development in Ireland.

While the EIIS is designed for longer-term financial growth and tax advantages, managing short- and medium-term savings is equally important. Finding the Best Savings Account Ireland is essential for securing your cash and earning some interest while maintaining easy access to your funds. Many Irish banks now offer flexible savings accounts with online features, allowing you to track your savings progress and transfer funds seamlessly. These accounts are ideal for emergency savings, short-term goals, or simply building a buffer to support future investments.

For those who are willing to lock away their funds for a fixed period in exchange for better returns, a Deposit Account Ireland offers an ideal solution. These accounts typically come with higher interest rates than standard savings accounts and are suited to individuals with surplus funds that aren’t needed in the near term. Fixed deposit and notice deposit options give you the ability to grow your savings with minimal risk. When combined with an EIIS investment like the Davy EIIS Fund, a deposit account can balance your financial portfolio by providing stability and guaranteed returns alongside the growth potential of equity investments.

A solid Saving Account Ireland remains a core part of any personal financial strategy. Whether you’re planning a major purchase, building a safety net, or saving for future investments, a reliable savings account offers the liquidity and security you need. Some accounts even allow for automatic monthly transfers from your current account, helping to create consistent saving habits without much effort. These features make saving accounts an important complement to tax-efficient investment strategies like EIIS funds.

Together, these financial tools form a robust foundation for wealth management in Ireland. By leveraging the tax-saving benefits of the Best EIIS Fund Income Tax Relief Benefit In Ireland, such as the Davy EIIS Fund, and reinforcing your short-term financial needs through a Saving Account Ireland and Deposit Account Ireland, you create a well-rounded, future-ready plan. The EIIS fund reduces your income tax burden while offering long-term investment returns, and your savings and deposit accounts provide safety, liquidity, and consistent interest earnings.

For more information, please visit us at -

EIIS Income Tax Relief

Best EIIS Fund In Ireland

Sustainable Investment

EIIS Companies

Green Investment

ESG Investing

What Is The Best Income Tax Relief Benefit In Ireland

Am I Eligible For The EII Scheme

What Is The Criteria For EIIS

Who Is The Most Successful EIIS Fund In Ireland

Stable Investment Returns Bonds Ireland

Investment Bonds Ireland

Best Investment Bonds Ireland

Davy EIIS Fund

Bunq Savings Account

Interest On Savings Deposits

Bunq Savings Account Ireland

Bunq Savings Ireland

Best Savings Account Ireland

Open Savings Account Bunq

Open Savings Bunq Account Online

Deposit Account Ireland

Saving Account Ireland

0 notes

Text

Strata Management: What Happens to Strata When You Sell Your Unit?

Strata management is a crucial component of property ownership in shared buildings and developments. Whether you're a unit owner planning to sell, an investor assessing strata-managed properties, a tenant wanting to understand your responsibilities, or a strata manager navigating complex duties, understanding how strata schemes work is essential. This article dives deep into strata management, particularly examining what happens when a strata-titled property is sold, while also providing clarity on roles, legalities, and benefits associated with professional strata oversight.

Selling a Strata Unit: What Changes and What Stays the Same?

How Strata Affects Property Sales

When a unit within a strata scheme is sold, ownership of the individual lot transfers to the new buyer, but the strata scheme itself remains unaffected. The new owner automatically becomes a member of the owners’ corporation (also known as the body corporate) and inherits the rights and obligations of the former owner.

Key Impacts on Sale:

Disclosure Obligations: Sellers must provide a strata report or certificate detailing the current financial health of the owners' corporation, upcoming works, by-laws, levies, and insurance.

By-law Continuity: All existing by-laws remain in force regardless of the change in ownership.

Levies and Fees: The buyer becomes responsible for paying future strata levies, but sellers must ensure any arrears are cleared before settlement.

Special Levies: If a special levy is struck but unpaid at the time of sale, negotiations may be needed to determine who pays — the seller or buyer.

The Role of the Strata Manager in Transitions

Ensuring a Smooth Ownership Transfer

Strata managers play a pivotal role during the sale process. They coordinate document provision, clarify financial obligations, and update ownership records. They also help facilitate transparency, allowing buyers to make informed decisions based on the health of the strata scheme.

Responsibilities include:

Providing disclosure documents.

Ensuring all fees are up to date.

Recording ownership changes in strata rolls.

Advising both buyers and sellers of their obligations under the scheme.

Benefits of Professional Strata Management

Why Expert Oversight Matters

A competent strata management team ensures the long-term viability and value of a strata-titled property. They reduce administrative burdens on owners, mediate disputes, and maintain legal and financial compliance.

Advantages:

Proactive maintenance planning.

Clear financial forecasting.

Efficient conflict resolution.

Increased property value and desirability for future buyers.

Understanding the Rights of Other Stakeholders

Tenants, Investors, and the Community

While owners hold decision-making power through the owners' corporation, tenants also have rights under the strata scheme, particularly regarding common property use and noise levels. Investors benefit from a well-managed strata property as it retains rental value and appeal. A healthy strata environment promotes a strong sense of community, with shared responsibilities and standards that contribute to quality of life.

Conclusion

Strata management is a foundational pillar in the successful operation of multi-unit properties. When selling a unit, strata considerations are paramount — from legal disclosures to financial transparency. For owners, tenants, investors, and managers alike, understanding the mechanisms of strata schemes ensures smoother transitions, sustained property value, and harmonious living environments. A well-managed strata system not only protects your investment but also fosters a thriving community.

0 notes

Text

How to Build a Tax-Efficient Financial Plan Using SIP Strategies

Financial planning calls for strategic thinking, in particular with regard to tax efficiency. Building wealth at the same time as minimizing legal tax responsibility is a sensitive balancing act that demands careful attention and knowledgeable choice-making. Systematic Investment Plans or SIP Planning provide a top-notch pathway to reap this stability.

Understanding Tax-Efficient Investing

Tax efficiency in investing approaches maximizing your returns even while minimizing the tax burden. When completed properly, proper economic planning can notably increase your net returns over the years.

Most traders focus completely on ability returns without considering the tax implications of their investment alternatives. This oversight can substantially lessen the real returns realized from their portfolio.

The Power of SIP Planning

SIP making plans lets in for ordinary, disciplined investments regardless of market conditions. This method facilitates coming out with the acquisition price of investments through the years and decreases the effect of market volatility.

What makes SIPs in particular valuable for tax-efficient economic planning is the capacity to make investments systematically in tax-advantaged gadgets. These investments can generate returns even as they offer tax blessings that enhance typical portfolio performance.

Tax-Saving SIP Plans Worth Considering

Several funding options combine the disciplined approach of SIPs with tax blessings:

ELSS Funds

Equity Linked Savings Schemes (ELSS) are mutual funds that invest primarily in equities at the same time as presenting tax benefits under Section 80C. With a noticeably brief lock-in duration of 3 years, ELSS budgets provide tax deductions of as much as ₹1.5 lakh yearly.

NPS Investments

The National Pension System allows for normal contributions that may be claimed as deductions below Section 80CCD(1B), over and above the ₹1.5 lakh limit under Section 80C. This makes NPS an excellent addition to tax-saving SIP plans.

PPF Through Regular Deposits

While not a traditional SIP, putting in place automatic transfers to a Public Provident Fund (PPF) account creates a SIP-like subject while offering tax advantages beneath Section 80C and tax-free returns.

Building Your Tax-Efficient Financial Plan

Creating a tax-green portfolio through SIP strategies requires cautious planning:

Assess Your Tax Bracket: Your tax slab determines which tax-saving units will gain you the most. People in higher tax brackets ought to maximize tax-saving investments.

Diversify Tax-Saving Investments: Don't position all your money in one tax-saving tool. Spread investments throughout ELSS, NPS, and PPF based totally on your hazard tolerance and time horizon.

Maintain Investment Discipline: The power of SIP making plans comes from consistency. Set up automated transfers to make everyday investments.

Review Tax Rules Annually: Tax laws change frequently. Regular opinions assist in modifying monetary planning strategies to optimize tax benefits.

Consider Tax Harvesting: Strategic selling of investments to recognize losses can offset gains and decrease tax liability at the same time as maintaining basic funding targets.

Creating a Long-Term Approach

Tax-green financial planning isn't always a one-time exercise; however, it's an ongoing process. Markets vary, tax legal guidelines exchange, and private instances evolve. Regular critiques and modifications make certain your SIP investments continue to serve both wealth creation and tax optimization desires.

Starting early with tax-saving SIP plans compounds blessings over the years. The mixture of disciplined investment, potential market appreciation, and tax blessings creates an effective wealth-constructing engine.

By integrating tax issues into funding selections from the start, buyers can significantly enhance their long-term financial outcomes. The right mix of tax-saving SIP plans, aligned with personal financial desires, creates a strong foundation for monetary safety and boom.

Remember that at the same time as tax performance is important, investment selections ought to, in the end, align with your financial dreams, risk tolerance, and time horizon. Tax blessings need to be considered a bonus, not the primary motive force of funding picks.

#SIP tax savings#tax SIP plans#SIP strategy#tax plan SIP#SIP returns#tax tips SIP#best SIP tax#SIP planner#smart SIP#save tax SIP#SIP investing#SIP guide#tax saver SIP#SIP for tax#SIP benefits#SIP income#tax saving plan#SIP options#SIP tips#SIP roadmap

0 notes

Text

How I Took Control of My Finances with COSMOS Bank

A few years ago, “saving” was just something I knew I should be doing, but never really did. Life kept happening—sudden expenses, short trips, online sales. My salary came in and somehow vanished by the end of the month. I wasn’t irresponsible, just... unstructured.

That changed when I opened a savings account at COSMOS Bank. I didn't expect a bank to help me rethink my financial life—but that’s exactly what happened.

The First Step: Building a Habit

When I opened my account, one of the friendly staff members casually said, “Set a goal, even if it’s small. Make your money listen to you.” That stuck with me.

So I started with a basic goal: save ₹5,000 each month, no matter what. COSMOS made it easy. I set up an automatic transfer from my salary account into a recurring deposit. It felt like paying myself first.

After a few months, it added up. More importantly, it felt empowering. I wasn’t just hoping to save—I was actually doing it.

Investing: Scary at First, Surprisingly Simple Later

For years, I thought investments were for finance bros and stock-market junkies. But COSMOS offers guidance and tools even for beginners like me.

I started with the Fixed Deposits scheme—safe, simple, and with a better interest rate than a savings account. Then, I explored the Recurring Deposits scheme to save monthly without effort. Slowly, I also dipped my toes into mutual funds, guided by their financial advisory desk.

What I appreciated most was that no one pushed me. They explained my options, told me the risks (no sugar-coating), and helped me choose what fit my comfort zone.

My 3 Go-To Money Moves (Learned the Hard Way):

Always Budget First: COSMOS NetBanking tools helped me track spending—yes, even those tiny Zomato orders.

Set Goals, Big and Small: Whether it's a vacation or a home loan down payment, having a number in mind makes saving easier.

Diversify Without Fear: I now balance my money between FDs, RDs, a small SIP, and an emergency fund. It feels balanced. Calm.

A Bank That Feels More Like a Coach

What makes COSMOS special, in my eyes, is that they don’t just hold your money—they help you grow it. I’ve walked into their branch with doubts and walked out with confidence. Their mobile app and online tools are intuitive, but there’s always a human behind the tech if you need them.

Now, I sleep better at night knowing I’m not just spending less—I’m planning more.

If you're reading this and thinking “I should really get my finances in order someday,” make today that day. Start small. COSMOS Bank will meet you where you are, and walk with you where you want to go. Financial health isn’t about being rich. It’s about feeling in control—and trust me, that feels amazing.

0 notes

Text

Best Resume Templates for Job Seekers in 2025

In 2025, the job market is more competitive than ever. With automation, AI-driven hiring systems, and an increasingly remote workforce, making a stellar first impression through your resume is no longer optional—it’s essential. The good news? The right resume template can significantly increase your chances of landing that dream role. But with countless designs online, how do you choose the right one?

Let’s explore the best resume templates for job seekers in 2025, what makes them effective, and how to select one that aligns with your career goals and industry expectations.

Why Resume Design Matters in 2025

Today’s recruiters spend an average of 6-8 seconds scanning a resume. That means your layout, format, and content clarity need to deliver maximum impact—instantly. Beyond human eyes, resumes also have to pass through Applicant Tracking Systems (ATS), which automatically filter candidates based on formatting and keyword optimization.

In short: a visually striking yet ATS-friendly resume is your ticket to standing out.

Top Resume Trends in 2025

Before diving into the best templates, here are the trends driving resume design in 2025:

1. Minimalist Layouts with Smart Typography

Sleek, simple designs with clear section divisions and modern fonts are the go-to. These layouts are easy to scan and perform well with ATS.

2. Data-Driven Highlights

Job seekers are showcasing quantifiable results (e.g., "Increased sales by 40%" or "Managed a team of 12 across 3 departments") more prominently than ever.

3. Integrated Branding

Personal logos, custom color schemes, and unique headers are emerging—especially among freelancers and creatives—offering a subtle branding touch without going overboard.

4. One-Page Formats for Mid-Level Roles

For most roles, especially in tech, marketing, and administration, the one-page resume remains king. Longer resumes risk being skimmed or skipped entirely.

Best Resume Templates for Job Seekers in 2025

Here are some of the best resume examples and templates dominating the hiring landscape this year:

✅ The Clean Professional Template

Best for: Corporate roles (finance, HR, law, consulting) Why it works: Uses classic fonts like Calibri or Garamond, generous white space, and straightforward bullet-point formatting. ATS-friendly and highly readable.

Pro Tip: Use job-specific keywords naturally in your experience and skills sections to optimize for tracking systems.

Explore a similar template on Canva or Zety →

✅ The Modern Creative Template

Best for: Designers, marketers, digital creatives Why it works: Offers color highlights, custom sections for projects/portfolios, and visual cues like icons or progress bars (used sparingly).

Stat to Know: According to HubSpot, visual content increases comprehension by 89%, making visual resumes ideal in design-centric fields.

See creative resume layouts on Adobe Express →

✅ The Hybrid Resume Template

Best for: Career changers or professionals with gaps Why it works: Combines reverse-chronological and functional formats. Highlights skills and achievements before diving into work history.

Real-World Example: A teacher transitioning into instructional design can showcase transferable skills (curriculum planning, tech tools) prominently.

Check out examples of hybrid resumes on ResumeGenius →

✅ The ATS-Optimized Simple Resume

Best for: Entry-level candidates or tech applicants Why it works: Stripped of graphics and columns, this template focuses solely on clean formatting and keyword-rich content.

Fact: Over 75% of resumes never reach a human because they’re rejected by ATS bots. Simple formatting helps avoid that fate.

Download ATS-approved templates at JobScan →

Choosing the Right Resume Template for You

When picking a template, consider:

Industry standards – Finance firms love formality; startups love creativity.

Your experience level – The more experience, the simpler the format.

ATS compatibility – Avoid text boxes, images, and fancy fonts.

Want to see what’s working for others? Browse best resume examples by industry and role to get inspired.

Final Thoughts: Make Your Resume Work For You

In 2025, the job hunt is smarter, faster, and more digital than ever. The best resume templates balance visual appeal, keyword optimization, and relevance to your industry. Whether you're a fresh graduate or a seasoned professional, investing time in choosing the right format can make a world of difference.

✅ Ready to Get Hired?

Need help fine-tuning your resume or choosing a standout template? Explore our resume writing tips, or check out our curated list of best resume examples to get started.

0 notes

Text

Free AI Interior Design Online

Are you fed up with the old interior of your house but don't want to hire an interior designer? You only need to click a few times to change your living area using PhotoCut's free AI interior design tool! Using this cutting-edge AI-powered generator, you can easily and affordably develop customized interior design plans and picture your ideal house. PhotoCut's AI technology provides a simple solution for every situation, including vacant rooms, outdated décor, or just wanting a new look at your house.

What is AI Interior Design and How Does It Work?

AI interior design is drastically changing how we make home decoration plans and visions. Now, upload your present space image using PhotoCut's AI interior design generator, and wait for the magic to happen. Your room's layout will be analyzed along with the furniture and decor available, and design modifications will be automatically proposed based on your preferred style.

With PhotoCut, you do not need to spend days getting conceptualized by designers or shelling out lots of remodeling money. It lets you redesign an interior to your satisfaction. In other words, it's like having a virtual interior designer in your pocket. The great thing is that you can input changes and test different designs almost effortlessly in real time.

Read about Video Editing APIs and enhance your videos.

How to Use PhotoCut’s AI Interior Design Generator

The use of PhotoCut's AI interior design tool is as simple as it is quick. Simply follow these steps to get started.

Start by uploading an image of your room. Whether it's an old interior or an empty room, the AI can work with any image you provide. PhotoCut supports various formats, including PNG and JPG, and processes your image efficiently.

Now you can upload the image of the room you need to design; there are different styles one can choose according to their design preferences, including modern minimalist style, French country, or Zen-inspired Japanese styles.

Once the style is selected, PhotoCut's AI proceeds to analyze your room and make a design plan based on your chosen style. The AI suggests layout changes, furniture arrangements, and color schemes to bring your vision to life. The best part? You can see the transformation in a matter of minutes!

PhotoCut goes beyond just suggesting a style—it also allows you to make customizations. Use the AI inpainting tool to add elements like new furniture, wall colors, or decor. You can also use the AI replacer tool to swap out outdated items with modern alternatives, ensuring your design is exactly how you envision it.

Once you’re happy with your design, download your high-quality AI-generated interior design plans in PNG format. You can even share these designs with family, friends, or professional contractors for feedback or implementation. Whether you're looking to update one room or revamp your entire home, PhotoCut’s tool provides the resources you need to visualize your interior ideas.

AI Style Transfer: The Future of Interior Design

One of the most impressive features of PhotoCut's AI interior design tool is its AI Style Transfer. It allows you to take any picture of your room, whether it is full of old furniture or empty, and "transfer" a new style onto it. Here's how it works:

Select Your Favorite Style: From modern, minimalist, French, Japanese, and many more, you can pick your favorite. The AI will then apply that style to your room’s layout.

Automatic Design Suggestions: The AI doesn’t just make surface-level changes, it carefully crafts a design plan that fits the style you’ve selected. The AI designs the interior of your space in every detail from furniture to color schemes and layout.

Instant Visualization: All this would be available to you in just a few minutes, and you can witness the transformed view of how your room would look following the new style. It is an instant interior update without making a fuss.

AI Inpainting Tool for Customized Interior Design

Another cool feature of PhotoCut's AI interior design generator is the AI Inpainting Tool. In this tool, you can feed in specific elements that you want added to your room, whether it is certain furniture items, art, or a few decorative elements, to have the AI change the design accordingly.

For example, you can use the AI inpainting tool for an empty room and ask for furniture suggestions. You may also specify what kind of furniture you need for a modern sofa or classic chair, and the AI will add them to your design automatically. Further, the AI home decor changer software lets you change any existing décor that does not match your new design, including old curtains and worn-out rugs.

Split your images online for free using PhotoCut’s Image Splitter.

Quick and Easy Home Interior Design Tool

This amazing tool is pre-trained with millions of images of popular interior designs. For that reason, the suggestions and plans produced by AI are modern and fashionable. You don't need to make difficult design decisions or waste hours researching potential ideas. With a few descriptions and an image upload, you are in for high-quality 3D designs within minutes.

For quick and efficient remodeling of your house, PhotoCut's AI technology is the ideal solution. With it, there is no costly consultation, wasted time in making decisions, or uncertainty in your design. Multiple ideas can quickly be generated to be tweaked till you get just the best outcome.

AI Room Design App for iOS and Android

Even the photo-cut AI interior design generator is coming in a mobile application, so you can easily imagine your ideas on the go, whether at home, in the office, or out and about using your device-whether Android or iOS. This portability allows you to work on your home design at any given time and place.

The app runs smoothly with the desktop version; you can thus start your design project on the computer and complete it on the mobile device. You will thus have the capability to redesign the space anywhere with the touch of your fingertips.

Discover the best Instagram filters and effects for your photos to make them look outstanding.

Why Choose PhotoCut’s AI Interior Design Tool?

Customization Options: You can customize your room design using the AI inpainting tool and AI replacer according to your style and preferences.

Multi-Style Options: From modern to traditional and everything in between, you get a wide variety of interior design styles.

HD Interior Design: Download high-quality AI-generated interior design plans in PNG format so that you work with clear and detailed designs.

Time-Saving: Create a high-quality home design plan in minutes without the cost of a designer or the time spent finding inspiration.

Accessible Anytime, Anywhere: Get inspiration for and create your dream home while you are at home or on the go using PhotoCut's AI interior design.

Security: None of the images you upload will be stored so your data remains private and safe.

Explore Popular Home Interior Design Ideas

In case you are confused about what interior design style is best suited for your home, PhotoCut presents some of the most popular styles of interior design to get ideas from:

Modern Interior Design: Modern design uses clean lines, minimal ornamentation, and efficient spaces to express simplicity and sophistication.

Minimalist Interior Design: This style eliminates clutter and offers open spaces that feature neutral tones and a plain appearance to achieve serenity and peace.

French Interior Design: Characterized by vintage appeal, the French style uses richly colored, lavish furniture with ornamented pieces that convey a traditional feel of sophistication.

Japanese Room Interior Design: Rooted in the principles of Zen philosophy, this style is minimalistic and calm, making ample use of natural materials to produce a peaceful space.

Chinese Style Room Design: These designs are for those people who feel a great sense of balance and harmony. It contains richness in colors and traditional elements with peace and unification.

Bohemian Interior Design: Bohemian design is for folks who love rich colors and eclectic patterns. A bohemian house is thus all about a fun and artistic lifestyle.

Get Inspired with AI-Generated Interior Designs

Thanks to PhotoCut's AI interior design generator, you no longer need an expensive interior designer to change the look of your house. All you need to do to generate amazing, bespoke designs reflecting your taste and style are just a few simple steps. Whether it's redesigning a single room or the whole house, PhotoCut provides all the resources you need to make your vision turn into reality.

Conclusion

With PhotoCut's AI interior design generator, you are only a few easy steps away from transforming your house. Start your dream home design today!

Learn how Video APIs make your videos look flawless.

FAQs

Q1. Who can use PhotoCut’s AI interior design tool? Ans. Anyone from the homeowner and tenant to the professional interior designer and even home enthusiasts can utilize the AI-powered interior design generator provided by PhotoCut.

Q2. How does PhotoCut’s online AI interior designer work? Ans. Simply upload an image of your room or home, and PhotoCut's AI will scan the image to develop a unique design plan according to your style preferences. You may then refine your design with AI inpainting and replacer capabilities.

Q3. Is PhotoCut’s AI interior design tool free? Ans. Yes! PhotoCut offers a free version of its AI interior design tool, allowing you to create and download design plans without any costs.

Q4. Can I access the AI interior design tool on mobile devices? Ans. Yes, PhotoCut offers an AI tool for interior designing through mobile apps both iOS as well as on Android so can design wherever possible.

Q5. How quickly can I generate a design using PhotoCut’s AI tool? Ans. You can generate a personalized interior design plan in just minutes, thanks to the tool’s fast processing and intuitive interface.

Q6. Can I make customizations to my AI-generated design? Ans. Absolutely! The AI inpainting and replacer tools let you make detailed customizations, ensuring your design matches your unique style.

0 notes

Text

How Winsoft Technologies is Revolutionizing the IPO Application Processing System

Introduction

The IPO application processing system can be complex, and delays may affect investor confidence. As more individuals and institutions participate in IPOs, financial organizations require efficient digital financial services to simplify application processing. Winsoft Technologies offers solutions that can minimize errors, speed up approvals, and improve compliance. By integrating technology into IPO processing, financial institutions would enhance investor experiences and streamline operations.

The Need for an Efficient IPO Application Processing System

Many IPO processes still rely on paperwork, manual checks, and long approval times. These factors often lead to delays, investor dissatisfaction, and regulatory challenges. A digital IPO application processing system would provide banks, financial institutions, and investors with:

- Faster application verification and approvals

- Reduced human errors through automation

- Improved compliance with SEBI and other financial regulations

- Real-time tracking and monitoring of applications

- Secure and transparent fund allocation

By implementing digital financial services, institutions may improve efficiency while reducing operational risks.

How Winsoft Technologies is Transforming IPO Processing

1.Seamless Integration with Banking and Financial Networks

For IPO applications to be processed efficiently, seamless connectivity between banks, brokerage firms, and regulatory bodies is essential. Winsoft Technologies provides a system that:

- Instantly validates investor details and transactions

- Ensures secure communication between financial stakeholders

- Reduces processing time and enhances overall efficiency

A connected system may help institutions manage a high volume of IPO applications without delays.

2.Advanced Security and Compliance Features

Security and regulatory compliance are critical in IPO processing. Financial transactions must be protected from fraud and unauthorized access. Winsoft Technologies ensures that its IPO application processing system includes:

- Advanced encryption and authentication methods

- Automated compliance checks to prevent regulatory violations

- Access controls to restrict unauthorized activities

- Audit trails that allow tracking of all transactions

These features would help financial institutions maintain compliance while ensuring data security.

3. Automation for Speed and Accuracy

Manual IPO processing often leads to mistakes and inefficiencies. Winsoft Technologies integrates automation into its digital financial services, which may:

- Automatically verify investor details

- Detect errors before applications are submitted

- Reduce processing time by eliminating unnecessary manual steps

- Provide instant approvals for eligible investors

By reducing reliance on manual intervention, institutions would improve accuracy and operational efficiency.

4. Real-Time Tracking and Reporting

Investors and financial institutions benefit from real-time insights into IPO applications. Winsoft Technologies provides a system that:

- Displays real-time application status for investors

- Generates detailed reports for financial institutions and regulators

- Sends alerts for any discrepancies or delays in processing

These capabilities may improve transparency and reduce confusion in IPO participation.

5.Supporting Government Initiatives and Financial Inclusion

Winsoft Technologies also plays a role in financial inclusion by offering a digital solution for Pradhan Mantri Yojana and other government schemes. The IPO processing system:

- Assists investors in participating in government-backed financial schemes

- Connects with banking services to ensure smooth fund transfers

- Encourages financial inclusion by making IPO investments more accessible

By simplifying the application process, more individuals may be encouraged to invest in IPOs, contributing to economic growth.

The Future of IPO Processing with Winsoft Technologies

The financial industry is undergoing rapid digital transformation, and IPO processing is no exception. Winsoft Technologies continues to innovate, ensuring that its IPO application processing system remains efficient and scalable. The future of IPO processing may include:

- Greater automation to reduce application processing times

- Stronger security features for investor data protection

- Enhanced integration with financial platforms to simplify transactions

- AI-driven decision-making to improve approval accuracy

By embracing these advancements, financial institutions would provide a seamless IPO application experience for investors.

Conclusion

Winsoft Technologies is improving the IPO application processing system by integrating digital financial services that enhance speed, security, and transparency. Its solutions help financial institutions reduce errors, automate approvals, and comply with regulations more efficiently. As financial markets expand, digital solutions like these could play a crucial role in making IPO investments more accessible and reliable.

0 notes

Text

How to Keep Track of Your Daily Spending for Maximum Tax Benefits

Managing finances effectively requires a keen understanding of where your money goes daily. Whether it is essential expenses, investments, or insurance premiums, tracking your spending can help you make the most of available tax benefits. By monitoring your daily expenditures, you can ensure that you utilise deductions wisely, allowing you to optimise savings while staying financially secure.

One key aspect of tax planning is leveraging deductions. Certain expenses, such as health insurance premiums and specific investments, can be used to reduce taxable income. By keeping a record of these expenses, you can maximise deductions, ensuring you save money while maintaining financial discipline.

Understanding the Importance of Tracking Expenses

Many overlook small, everyday expenses, assuming they do not significantly impact overall savings. However, these minor transactions can add up over time. Recording your expenses gives you a clearer picture of where your money is going, allowing you to allocate funds more effectively.

A structured approach to tracking expenses also helps identify tax-deductible payments. For example, keeping a record ensures you can claim benefits under the 80d tax deduction when paying health insurance premiums. Similarly, contributions to eligible investment schemes can help you utilise the 80c tax deduction, reducing your overall tax liability.

Simple Ways to Track Your Spending

1. Maintain a Digital or Physical Log

Recording daily expenses in a notebook or using a digital tool can help you keep track of all transactions. Categorising expenses into essential and non-essential spending allows better financial planning. This also helps you identify payments that qualify for tax benefits.

2. Use Mobile Applications for Expense Management

Technology has made it easier to track finances with expense management apps that automatically categorise transactions. These applications help monitor tax-saving expenditures and ensure that eligible payments are accounted for when filing tax returns.

3. Review Bank and Credit Card Statements Regularly

Many expenses that qualify for tax benefits are often made through bank transfers or credit card payments. Regularly reviewing statements allows you to identify deductions you may be entitled to claim. This ensures you do not miss out on potential tax savings.

4. Set Budget Limits for Different Expense Categories

A well-planned budget helps allocate funds towards essential expenses, including those that provide tax advantages. Setting aside amounts for expenses related to insurance premiums or eligible investments ensures that you not only track them but also optimise their tax-saving potential.

Maximising Tax Benefits Through Strategic Spending

By aligning daily spending with financial goals, you can make informed decisions that lead to significant tax benefits. Ensuring that eligible payments are well-documented helps in making full use of the 80c and 80d tax deductions while filing tax returns.

1. Prioritise Tax-Saving Investments

Many investment options not only help build financial security but also offer tax deductions. By keeping track of contributions towards such instruments, you can ensure they are factored into your tax planning.

2. Record Health Insurance Payments

Health insurance premiums provide tax benefits, making it essential to document these expenses. Retaining payment receipts ensures that they are accounted for during tax

calculations, helping you reduce taxable income efficiently.

3. Monitor Recurring Payments

Subscription-based services, premium payments, and investment contributions should be reviewed regularly to ensure that they align with your financial strategy. Keeping records of these payments helps identify those that qualify for deductions, ultimately maximising savings.

4. Keep Track of One-Time Transactions

Certain expenses, such as lump sum investments or policy renewals, are often overlooked when considering tax benefits. By tracking such transactions, you ensure that they contribute to tax savings where applicable.

The Long-Term Benefits of Expense Tracking

Tracking daily spending not only helps in maximising tax benefits but also contributes to long-term financial stability. It allows for better budgeting, ensures compliance with tax regulations, and provides a clear view of how financial decisions impact savings.

Maintaining records of tax-deductible payments can streamline the tax filing process while reducing liabilities effectively. An organised approach to financial management ensures that you take full advantage of available deductions while maintaining a secure financial future.

Conclusion

Keeping track of your daily spending is essential for maximising your tax benefits and ensuring financial stability. By maintaining accurate records, categorising expenses, and leveraging digital tools, you can identify tax-deductible expenditures and optimise your savings. Regularly reviewing your spending habits helps you budget effectively and avoid unnecessary financial strain.

Whether you use mobile apps, spreadsheets, or traditional methods, staying organised with your expenses can simplify tax filing and prevent missed deductions. Developing a habit of tracking your daily expenses will enhance your tax benefits and contribute to better financial management in the long run.

0 notes

Text

Represent Your Brand with a Professional Invoicing System

In today’s competitive business landscape, your brand’s identity is more than just a logo or color scheme—it’s the entire experience you offer to your clients. One crucial but often overlooked aspect of branding is your invoicing system. A professional invoicing system not only ensures smooth financial transactions but also reinforces your brand’s credibility and trustworthiness.

Why a Professional Invoicing System Matters

A well-designed invoicing system reflects the professionalism of your business. It creates consistency, enhances customer trust, and streamlines your financial operations. Here’s why investing in a professional invoicing system is essential:

1. Strengthens Your Brand Identity

Every interaction with your customers, including sending invoices, is an opportunity to reinforce your brand. A professional invoice with your logo, brand colors, and customized message creates a lasting impression. It shows that you care about details and enhances brand recognition.

2. Enhances Credibility and Trust

A clear, well-structured invoice with professional formatting and accurate details instills confidence in your customers. It reassures them that they are dealing with a legitimate and organized business. Poorly formatted invoices with missing information can make your business seem unprofessional or unreliable.

3. Ensures Faster Payments

A professional invoicing system simplifies the payment process, making it easier for clients to pay on time. Features like automated reminders, multiple payment options, and transparent breakdowns of charges eliminate confusion and encourage prompt payments.

4. Improves Financial Management

Keeping track of invoices manually can be time-consuming and prone to errors. A professional invoicing system automates billing, tracks overdue payments, and provides financial reports, helping you manage cash flow efficiently.

5. Saves Time and Reduces Errors

Manually creating invoices increases the risk of errors, leading to disputes and delays in payments. A reliable invoicing system automates calculations, applies taxes correctly, and ensures accuracy in every transaction.

Key Features of a Professional Invoicing System

When choosing an invoicing system, look for the following features to maximize efficiency and professionalism:

1. Custom Branding

Choose a system that allows you to add your logo, brand colors, and a personalized message. This customization makes your invoices look more professional and reinforces your brand identity.

2. Multiple Payment Options

Offering various payment methods, including credit/debit cards, bank transfers, and online payment gateways like PayPal or Stripe, increases the likelihood of receiving timely payments.

3. Automated Reminders

Late payments can affect cash flow. A good invoicing system sends automatic reminders to clients, reducing the need for manual follow-ups.

4. Recurring Billing

If you have subscription-based services, recurring billing ensures seamless transactions and reduces administrative work.

5. Real-Time Tracking and Reports

An invoicing system with built-in analytics helps you monitor payments, track pending invoices, and generate financial reports for better decision-making.

Best Practices for Implementing a Professional Invoicing System

Standardize Your Invoice Format: Keep invoices consistent with your brand’s fonts, colors, and layout.