#BTC price projections

Text

Bitcoin Price Predictions for 2024 and Beyond: Top 5 Projections

Bitcoin's future price projections for 2024 and beyond have garnered significant attention, with several optimistic forecasts emerging. Matrixport, a cryptocurrency trading firm founded by Jihan Wu, anticipates a year-end Bitcoin price of $45,000. BitQuant, a respected commentator, foresees new all-time highs before the upcoming Bitcoin halving, with a post-halving target of $250,000. Various price models converge on a $130,000 target zone, while some, including Cathie Wood and Arthur Hayes, believe in the eventual possibility of a $1 million Bitcoin price. These predictions are speculative and should be approached with caution. Careful research and consideration are advised for those considering cryptocurrency investments.

#Bitcoin price predictions 2024#Cryptocurrency price forecasts#Bitcoin price targets#Bitcoin future price analysis#BTC price projections#Cryptocurrency market outlook#Bitcoin bull market trends#Bitcoin halving effects#Bitcoin price models#Cryptocurrency investment insights

1 note

·

View note

Text

#btc news#BTC#bitcoin bitcoin price bitcoin trading btc coinbase crypto trading ethereum bitcoin bot bitcoin miner bitcoin mining bittrex coinbase trading#cryptonews#crypto projects#crypto currency#futurism#technology#futuristic#futurology

0 notes

Text

How to Optimize Your Crypto Investments

With the rapid pace of modern life, it seems that only professional traders can afford to leave their full-time jobs and concentrate solely on trading. For someone like me who values security and doesn't have the time to monitor the market 24/7, finding ways to generate income with minimal effort is appealing. This approach allows me to participate in crypto without the constant stress and time commitment required by active trading.

Several way to invest in crypto

There are several ways to create passive income from DeFi: staking, lending, farming, and real yield. However, today I want to share a strategy that requires minimal effort yet brings in profits: hunting for ICOs (Initial Coin Offering) and presales.

ICOs and presales offer a unique opportunity for investors. Tokens sold during these events are usually priced very low, as they are in the early stages of their lifecycle. By participating in these sales, you can purchase tokens at a fraction of their potential future value. The strategy is simple: buy the tokens, hold onto them, and wait for them to be listed on an exchange where their value typically increases.

For example, consider a meme project like BUSAI, which leverages AI technology and enjoys strong community support. BUSAI offers an attractive opportunity during its presale phase. The project blends meme culture with advanced AI, creating a unique ecosystem. By purchasing tokens during the presale, investors can benefit from low prices and potentially see significant returns once the tokens are listed.

Successful ICOs and Presale Tokens

Several notable case studies illustrate how presale tokens have significantly increased in value once listed on exchanges, providing substantial returns for early investors.

Ether (ETH)

The native token for Ethereum, Ether, is one of the most successful ICOs in history. During its ICO, Ether was sold at 2,000 ETH per 1 BTC. By March 2024, the value of Ether had surged to $3,496 per token, offering an incredible return on investment for early backers

NEO (NEO)

Often referred to as "China’s Ethereum," NEO had a remarkable ICO. The initial token price was around $0.03, and at its peak, NEO traded at approximately $180. Even though its current value is around $14.83, early investors saw substantial returns

BONK (BONK)

Bonk started as an airdrop, not a presale, and was distributed freely via social media. It surged over 25,000% in a year and briefly hit a $2 billion market cap after its Coinbase listing.

How to find Presale token?

Historically, platforms like Coinlist were excellent for finding such opportunities. However, in the past year, many projects listed there have underperformed, leading me to seek alternatives. The key to success with this strategy lies in thorough research and careful selection of projects.

While this method may not yield as much profit as active trading, it is well-suited for those with a lower risk appetite. It allows participation in the crypto market without the need for constant vigilance. However, no investment is entirely risk-free. Even with presales and IDOs, there is always the potential for loss. The crypto market is volatile, and projects can fail despite promising initial signs.

In summary, hunting for IDOs and presales is a viable strategy for earning passive income from crypto without dedicating too much time and effort. By carefully selecting projects like BUSAI, you can capitalize on early-stage investments and potentially enjoy substantial returns. However, always conduct thorough research and be aware of the inherent risks.

Source: Compiled

The Official Channel: Website | Twitter | Telegram

2 notes

·

View notes

Text

🐹 HAMSTER SAVINGS 🐹

🐹 HAMSTER SAVINGS 🐹

https://t.me/hamsTer_kombat_bot/start?startapp=kentId5874224401

🔥List one of the most ambiguous tokens on your exchange!

Although Proof of Donation is a bit of a crazy concept, LayerZero seems like a promising project to list…

By purchasing a LayerZero Listing Card, your hamsters will start pouring into listings to multiply their profits for the future!

🔹 LayerZero Listing Details: Price: 10,000 coins Profit: 900 per hour Conditions: none

👉 Note: The card has a cooldown period!

#crypto#btc#memetoken#memecoin#hamster#hamsterkombat#taptap#clicker#game#p2e#newcard

5 notes

·

View notes

Text

Price Guarantee on Locked Tokens

www.difolaunchpad.com

Difo Launchpad will require the token price to be above the #IDO price until 100% of the token distribution to all of its projects is completed. If the token price of the projects' locked tokens is below the IDO price on the day of unlocking, the IDO participants' capital will be returned by Difo Launchpad in USDT, #USDC, or BUSD equal to the sale price.

#DeFi #BTC #Bitcoin #crypto #DIFO DİFO FİNANCE @difolaunchpad @difodex @difoswap www.difolaunchpad.com

2 notes

·

View notes

Text

Which cryptocurrency will be the best to investment in in 2023?

Cryptocurrencies have come a long way since the inception of Bitcoin in 2009. The market has seen its ups and downs, with some cryptocurrencies seeing unprecedented growth and others facing a significant decline. As we move into 2023, there are several cryptocurrencies that look promising and have the potential to deliver high returns on investment. In this blog, we will take a look at some of the cryptocurrencies that may be the best to invest in 2023.

Bitcoin (BTC)

Bitcoin remains the most popular cryptocurrency in the market and has dominated the crypto space since its launch in 2009. Bitcoin is known for its decentralization, security, and anonymity, and it remains a favorite of investors due to its high liquidity and potential for long-term growth. While there have been several controversies surrounding Bitcoin, it remains the most popular cryptocurrency with the largest market capitalization. The growing acceptance of Bitcoin as a means of payment by major companies, banks, and governments across the world indicates its increasing adoption and long-term value. In addition, with Bitcoin halving scheduled in 2024, many experts predict that the price of Bitcoin may see a significant surge.

Ethereum (ETH)

Ethereum is the second-largest cryptocurrency in the market and has been growing in popularity since its launch in 2015. Ethereum is a blockchain-based platform that enables developers to create decentralized applications (dApps) and smart contracts. The platform has gained traction due to its ability to support other cryptocurrencies and its vast ecosystem. Ethereum has seen several upgrades, with the most recent being the London Hard Fork that introduced the EIP-1559 protocol, which aims to improve transaction speed and reduce fees. With the growing demand for dApps and smart contracts, Ethereum is likely to see significant growth in the future.

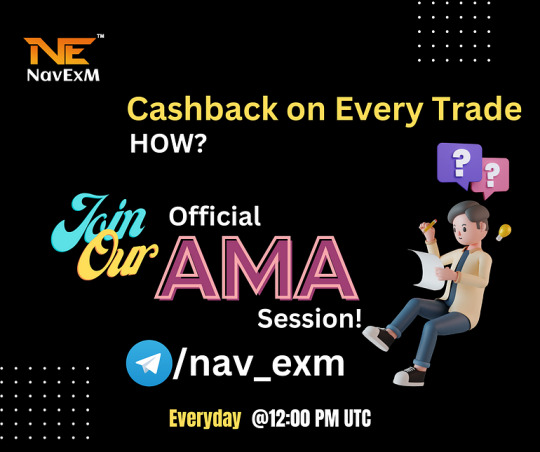

NavC Token(NavC)

NavC is an ERC-20 utility token designed to serve as the native cryptocurrency of the NavExM trading ecosystem. NavExM is a positive cashback centralized cryptocurrency exchange that provides trading and investing in crypto, NFT, and stablecoins.

The primary aim of the project is to reduce the transaction fee and offer positive cash back for every trade at the NavExM exchange. The project will launch in March 2023 as the world’s first revenue-giving exchange for crypto enthusiasts. The current price of NavC Token is $1 its price increased after the launch of NavExM.

Binance Coin (BNB)

Solana (SOL)

Solana is a relatively new cryptocurrency that was launched in 2020. The platform aims to provide a more scalable and faster blockchain infrastructure that can process up to 65,000 transactions per second. Solana has gained traction due to its high-speed and low-cost transactions and has seen significant growth in the past year, with its market capitalization increasing by over 4,000%. The platform has also launched several partnerships, including with Serum, a decentralized exchange, and Chainlink, an oracle service. With the growing demand for fast and scalable blockchain infrastructure, Solana is likely to see significant growth in the future.

Conclusion

The cryptocurrency market is highly volatile and investing in cryptocurrencies can be risky. It’s essential to conduct thorough research and understand the market before investing in any cryptocurrency. However, the five cryptocurrencies mentioned above have shown promising growth and have the potential to deliver high returns on investment in 2023.

Bitcoin remains the most popular and dominant cryptocurrency in the market and is likely to see significant growth with its upcoming halving. Ethereum and Cardano have gained traction due to their ability to support dApps and smart contracts, and their growing ecosystems make them attractive investment options.

Investing in cryptocurrencies can be a profitable venture, but it’s important to remember that it can also be risky. It’s essential to conduct thorough research, understand the market, and invest only what you can afford to lose. As with any investment, it’s always best to consult with a financial advisor before making any investment decisions.

Looking for a highly rewarding crypto trading platform?

Look no further than NavExM! It is powered by the native utility token NavC, making it one of the most innovative and cutting-edge Crypto Exchange.

If you have any questions related to NavC or NavExM, join us on Telegram and ask away! Our team of experts is ready to answer any and all questions you may have.

5 notes

·

View notes

Text

Bitcoin on Track for a Surging 2024 Rally: Explore the Reasons Why

Key Points

Bitcoin’s price action in 2024 mirrors its post-halving behavior from 2020, suggesting a potential parabolic rally.

Accumulation trends, key resistance levels, and on-chain data suggest an imminent breakout.

Bitcoin [BTC] is exhibiting similar market dynamics to its post-halving behavior in 2020, hinting at a possible parabolic rally in 2024.

Crypto analyst Rekt Capital has noted these similarities, particularly focusing on the 161-day post-halving period that has historically led to substantial price jumps.

Historical Price Movements

In 2020, Bitcoin’s price experienced a surge after breaking out of its Re-Accumulation range, signifying the start of a significant rally.

Increased buying activity and a shift in market sentiment drove prices to new highs.

Now, in 2024, Bitcoin is once again positioned just after the crucial 161-day post-halving period, suggesting a potential breakout similar to 2020.

At the time of writing, Bitcoin was trading at $63,439, marking a 0.60% increase in the last 24 hours and a 7.51% gain over the past week.

Resistance and Support Levels

Bitcoin’s price is nearing key resistance levels that need to be overcome to confirm a breakout.

Bitcoin’s recent rise from $56,000 to $63,000 showcases strong bullish momentum, but the resistance at these levels remains a significant challenge.

Support levels, as indicated on the chart, show strong buying interest, echoing the setup in 2020.

These support zones provide a firm base that could help stabilize Bitcoin’s price during a pullback, preserving the overall bullish outlook.

Bitcoin’s market setup and on-chain data hint at an imminent breakout.

The price has varied between $58,351 and $63,239 from the 15th to the 22nd of September, with a notable low on the 20th of September at $59,573 before recovering.

Net BTC outflows of -977.58 BTC in the last 24 hours and -469.18 BTC over the past seven days indicate reduced selling pressure, suggesting that market participants are holding onto their BTC in anticipation of further price increases.

According to data from DefiLlama, the Total Value Locked (TVL) in Bitcoin-related projects was $573.26 million, with 24-hour fees totaling $373,571 and active addresses reaching 595,289.

These metrics indicate ongoing market activity that could act as a catalyst for further price increases, supporting the notion of a sustained upward trajectory as seen in previous cycles.

Bitcoin’s market activity continues to reflect ongoing investor interest, as shown by recent trading volumes and on-chain data.

0 notes

Text

Ether Surges Ahead of BTC in Daily Earnings Amidst Stagnant Crypto Market

Key Points

Ethereum (ETH) has outperformed Bitcoin (BTC) in daily gains amidst two significant cryptocurrency events.

The broader cryptocurrency market remains largely stagnant despite modest increases in both digital currencies.

Ethereum (ETH) surpassed Bitcoin (BTC) in daily gains following the conclusion of two pivotal cryptocurrency events, Token 2049 and Solana’s Breakpoint, in Singapore on September 22, 2024. Despite modest increases in both digital currencies, the broader market remained largely flat, indicating ongoing uncertainty.

Ethereum and Bitcoin Performance

Ethereum increased by 3.10%, exceeding $2,650, while Bitcoin rose by 1.46%, reaching $63,630 in the last 24 hours. Notably, Ethereum surged by 15.80% in the past week, indicating a significant recovery from its bearish trend last month, which saw it hit the $21,70 mark on September 6th after a decline of over 18% as of September 23.

Market Liquidations and Speculations

Data from CoinGlass in the 12 hours leading up to September 23 revealed a higher number of short positions liquidated compared to long ones, with $64.89 million in short liquidations and $31.61 million in long ones. This suggests a volatile trading environment, likely influenced by last week’s 50 basis point (bps) interest rate cut, which spurred increased trading activity.

Market participants are speculating about another rate cut, with Polymarket indicating a near-even split: 43% expect a 50 bps cut and 48% anticipate a 25 bps reduction.

Solana (SOL), which was highlighted at the Breakpoint conference following Token 2049, remained flat, trading above $145. Despite SOL’s price stagnation, the conference generated excitement, particularly around new developments like Jump Crypto’s validator going live. However, SOL has yet to see the kind of price movement that followed Ethereum’s rise.

Market Developments Post Rate Cut

Pendle, a project associated with Arthur Hayes’ Maelstrom fund, saw its value decline over 6.25% as traders became wary after the fund reduced its holdings. Hayes suggested that the move was designed to free up liquidity for a “special situation,” though details remain vague. Despite the short-term dip, Pendle has gained 21.81% over the past week.

MOTHER, a meme coin supported by Iggy Azalea, increased by 4% following her announcement of plans to launch an online casino named Motherland. Although the meme coin’s value has been relatively steady, it faces difficulties securing listings on major exchanges due to regulatory challenges tied to gambling ventures.

Overall, the cryptocurrency market remains quiet, with minor gains in Bitcoin and Ethereum but no significant shifts in sentiment. As interest rate cuts continue to affect the market and projects like Solana and Pendle prepare for new developments, traders remain cautious in this sluggish environment.

0 notes

Text

Stay Vigilant: How to Avoid Scams in the Crypto Space

The cryptocurrency world is full of promise, opportunity, and innovation, but unfortunately, it's also a breeding ground for scams. As crypto continues to rise in popularity, so do the number of people looking to take advantage of others. According to a report by Chainalysis, cryptocurrency scams cost investors $14 billion in 2021 alone, highlighting the urgent need for vigilance. Scammers are getting smarter and more sophisticated, targeting individuals through social media and other online platforms. I've personally encountered these scams, and today I want to share my experience to help others stay safe.

The Psychology of Scams

At the heart of every scam is one thing: manipulation. Scammers are experts at playing on human emotions—whether it's excitement, greed, or desperation. They know how to make offers seem irresistible, making promises of unbelievable returns or exclusive opportunities. Their entire approach is built around FOMO (fear of missing out) and urgency, pushing people to act quickly without thinking critically.

It's important to understand that these scams often seem tailor-made for each individual. Scammers take time to study their targets, learning their interests and pain points, before crafting the perfect pitch.

Common Types of Scams

There are several common types of scams in the crypto space that you should be aware of:

Phishing Attempts: Attempts to steal sensitive information by pretending to be a legitimate entity. Whether it's a fake email or website, scammers often ask for private keys or passwords.

Fake Giveaways and Impersonations: You might have seen these on social media—"Send 0.1 BTC and get 1 BTC in return!" These scams often involve impersonators posing as well-known figures or organizations.

Investment Scams: These scams promise guaranteed returns that sound too good to be true. The scammer tries to convince you to invest in a project or exchange that ultimately disappears with your money.

Off-the-Wall Exchanges: Many scammers will direct you to sketchy, little-known exchanges, promising quick profits. These platforms often have no regulatory oversight and can vanish overnight, taking your assets with them.

Pump and Dump Schemes: In these scams, fraudsters artificially inflate the price of a cryptocurrency through false statements, then sell their holdings at the inflated price, causing the value to crash.

My Personal Experience

Recently, I've been targeted by scammers on X (formerly Twitter). The pattern is always the same: someone follows me, I follow them back, and within a short time, they slide into my DMs with an investment pitch. They promise incredible returns, sometimes showing fake testimonials or screenshots of "earnings." Every time, they try to send me to obscure exchanges, claiming I need to use their "exclusive platform" to achieve these returns.

The red flags were obvious to me: the promises were outlandish, and the exchanges were completely unfamiliar. It's important to trust your instincts in these situations. If something feels off, it probably is.

Why Scammers Succeed

So why do these scams work? It comes down to psychological tricks. Scammers create a sense of urgency, making you feel like you'll miss out on an opportunity if you don't act quickly. They also prey on greed, offering returns that are too good to pass up. For many people, the idea of easy money is tempting enough to lower their guard, even when the deal seems suspicious.

Scammers also succeed because they create fear or doubt. They might claim that the window of opportunity is closing, or that their "offer" is only available for a limited time. These tactics work because they bypass logical thinking and appeal directly to emotion.

How to Stay Vigilant

Staying safe in the crypto space requires a mixture of caution, skepticism, and research. Here are a few ways to protect yourself:

Recognize the Red Flags: If someone promises guaranteed returns, especially astronomical ones, be wary. Similarly, if you're being rushed into making a decision or are directed to an unknown exchange, stop and evaluate the situation.

Research Exchanges Before Investing: Always take time to thoroughly research any exchange you plan to use. Look at reviews, check for regulatory compliance, and verify if the platform has a strong track record.

Protect Your Digital Assets: Use hardware wallets and enable two-factor authentication (2FA) on all your accounts. Avoid sharing sensitive information like your private keys with anyone, and be mindful of phishing attempts.

Report Suspicious Activity: If you encounter a scam, report the account or platform to the appropriate authorities. On social media, you can block and report scammers to help protect others from falling victim.

Stay Informed: Keep up-to-date with the latest crypto news and scam tactics. Websites like CoinDesk and Cointelegraph can be valuable resources.

What to Do If You've Been Scammed

If you believe you've fallen victim to a crypto scam, take these steps immediately:

Stop All Communication: Cut off contact with the scammer immediately.

Document Everything: Save all communications, transaction details, and any other relevant information.

Report the Scam: Contact your local law enforcement and file a report. Also, report the scam to the relevant crypto exchange or platform.

Inform Your Bank: If you used a credit card or bank transfer, contact your bank immediately to try and stop or reverse the transaction.

Seek Support: Being scammed can be emotionally devastating. Don't hesitate to seek support from friends, family, or professional counseling services.

Conclusion

The world of crypto offers immense potential, but it's also filled with risks. Scammers are becoming smarter, and their methods more sophisticated, but by staying vigilant and doing your research, you can protect yourself from their traps. Remember, if something sounds too good to be true, it probably is. Take the time to think critically, guard your assets, and most importantly, stay informed.

Stay safe out there, and happy investing!

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#CryptoScams#BitcoinSecurity#StayVigilant#CryptoAwareness#ScamPrevention#DigitalSecurity#CryptoSafety#BlockchainEducation#PhishingScams#ProtectYourAssets#Cryptocurrency#BitcoinCommunity#CryptoTips#InvestSafely#OnlineSecurity

1 note

·

View note

Text

## FLUX Protocol Introduction and Market Reactions

**Fractal Mainnet and FLUX Protocol Release**

CoinMapAi - An All-round One-stop Service Platform for Web3-The Fractal mainnet was officially launched yesterday. At the same time, FLUX, Fractal's first token protocol, was quickly launched. FLUX tokens were minted in just half an hour, with a total of 21 million, and a minting cost of 0.05 FB (about 0.75 USDT). Although FLUX currently has no index and market, its over-the-counter trading price was as high as 50 USDT/piece, an increase of more than 60 times. This phenomenon has attracted widespread attention and discussion in the Bitcoin community, similar to the previous inscription craze.

**FLUX Protocol Overview**

The FLUX protocol is a UTXO-based native token protocol for Fractal, developed by Inscrib 3. Similar to the BRC-20 token, the FLUX protocol includes three basic functions: deployment, minting, and transfer. FLUX can be understood as a simple copy of BRC-20 on Fractal. Although the protocol does not yet have an index, market, or official wallet, it provides a minting website where users can deploy or mint FLUX assets, paying 0.05 FB for each operation, but it is unclear whether it is entirely used for network fees for protocol assets.

**Team Background and History**

CoinMapAi - An All-round One-stop Service Platform for Web3-Inscrib 3, the development team of the FLUX protocol, is a serial entrepreneur in the Bitcoin ecosystem. The team previously developed the Pipe protocol and its related infrastructure, although Pipe's market popularity has gradually subsided. Inscrib 3 has also developed rune-related projects such as Runescription and Bloki Protocol. Although these projects have not achieved great success, the team has been keeping up with the hot spots of the Bitcoin ecosystem and finally chose to issue assets in the Fractal ecosystem.

**Market reaction and future outlook**

The release of the FLUX protocol has sparked widespread discussion in the Chinese community. Although the protocol is still in its early stages, it has met the market's demand for tokens in the Fractal ecosystem in advance. Although the protocol itself is relatively simple and the market and technical support are not yet perfect, the popularity of the FLUX protocol reflects the market's strong interest in emerging assets in the Fractal ecosystem.

CoinMapAi - An All-round One-stop Service Platform for Web3-However, if the token protocol in the Fractal ecosystem simply copies the previous model without innovation, it may face the problem of lack of fresh blood and fierce market competition. In the future, whether the FLUX protocol can maintain its current popularity will depend on whether it can further improve and innovate in technology and market support.

How to Buy BTC

How to buy cryptocurrency on an exchange

Invest in BTC It has never been easier! Registering on an exchange, verifying your account, and paying by bank transfer, debit or credit card, with a secure cryptocurrency wallet, is the most widely accepted method of acquiring cryptocurrencies. Here is a step-by-step guide on how to buy cryptocurrency on an exchange.

Step 1: Register OKX (click the link to register)

You can register by email or phone number, then set a password and complete the verification to pass the registration.

Step 2: Identity verification - Submit KYC information to verify your identity

Please verify your identity to ensure full compliance and enhance your experience with full identity verification. You can go to the identity verification page, fill in your country, upload your ID, and submit your selfie. You will receive a notification once your ID has been successfully verified, bind your bank card or credit card and start transactions.

Use the shortcut to buy USDT and convert it into BTC

Step 1: Click [Buy Coins]-[Quick Buy Coins] in the top navigation bar to place your order.

Step 2: Enter the BTC you want quantity

Step 3: Select your payment method, click Next and complete the purchase

Step 4: Click on the transaction and search for BTC , buy its tokens.

CoinMapAi - An All-round One-stop Service Platform for Web3-

0 notes

Text

10 Best Crypto to HODL with the Potential to Go 50x+ in Price

With the growing popularity of cryptocurrencies, more and more investors are looking for the next big thing in the market. While there is always a level of risk involved in investing, some cryptocurrencies have shown significant growth potential and could potentially go up to 50x or more in price.

Here are the top 10 cryptocurrencies to HODL (hold on for dear life) with the potential to go 50x+ in price:

Bitcoin (BTC)

Bitcoin, the first and most well-known cryptocurrency, has already seen significant growth over the years. However, many experts believe that the price of Bitcoin will continue to rise as it becomes more widely adopted and mainstream. With a market cap of over $1 trillion, Bitcoin remains a top pick for long-term investors.

Ethereum (ETH)

Ethereum is the second-largest cryptocurrency by market cap and is the backbone of many decentralized applications (dApps) and smart contracts. As more dApps and decentralized finance (DeFi) projects are built on the Ethereum network, the demand for ETH will likely increase, leading to a potential 50x or more increase in price.

Binance Coin (BNB)

Binance Coin is the native token of the Binance exchange, one of the largest cryptocurrency exchanges in the world. As more users trade on the Binance platform and utilize Binance’s other services, the demand for BNB will likely increase, leading to potential price growth.

Cardano (ADA)

Polkadot (DOT)

Polkadot is a multi-chain platform that allows different blockchains to work together, making it easier for developers to create and deploy decentralized applications. As more projects are built on the Polkadot network, the demand for DOT tokens will likely increase, leading to potential price growth.

Solana (SOL)

Solana is a fast and highly scalable blockchain platform that has seen significant growth in recent months. With partnerships with major companies and a strong development team, Solana has the potential to become a major player in the cryptocurrency market.

Chainlink (LINK)

Chainlink is a decentralized oracle network that connects smart contracts to real-world data. With the growing demand for DeFi and other decentralized applications, the need for reliable and secure oracle networks like Chainlink will likely increase, leading to potential price growth.

Uniswap (UNI)

Uniswap is a decentralized exchange (DEX) that allows users to trade cryptocurrencies without the need for a centralized intermediary. As more users trade on the Uniswap platform and utilize other DeFi protocols built on top of it, the demand for UNI tokens will likely increase, leading to potential price growth.

Aave (AAVE)

Aave is a decentralized lending platform that allows users to borrow and lend cryptocurrencies without the need for a centralized intermediary. With the growing demand for DeFi and other decentralized financial services, the demand for AAVE tokens will likely increase, leading to potential price growth.

NavC Token

NavC is an ERC-20 utility token designed to serve as the native cryptocurrency of the NavExM trading ecosystem. NavExM is a positive cashback centralized cryptocurrency exchange that provides trading and investing in crypto, NFT, and stablecoins.

The primary aim of the project is to reduce the transaction fee and offer positive cash back for every trade at the NavExM exchange. The project will launch in March 2023 as the world’s first revenue-giving exchange for crypto enthusiasts. The current price of NavC Token is $1 its price increased after the launch of NavExM.

Looking for a highly rewarding crypto trading platform?

Look no further than NavExM! It is powered by the native utility token NavC, making it one of the most innovative and cutting-edge Crypto Trading Exchange.

If you have any questions related to NavC or NavExM, join us on Telegram and ask away! Our team of experts is ready to answer any and all questions you may have.

3 notes

·

View notes

Text

Is This Your Final Opportunity to Score Low-Cost Bitcoin? Insights from Puell Multiple Say…

Key Points

Bitcoin’s prolonged price range could soon end, indicating a potential bull run.

Analysts predict Bitcoin could surpass $90K in Q4 2024.

Bitcoin [BTC] has experienced a turbulent price range for over half a year, causing some traders and investors to remain on the sidelines.

Despite a relief rally to $64K triggered by last week’s Federal Reserve pivot, some market experts have expressed caution due to the looming U.S. recession.

A Potential End to the Price Range

Bitcoin analyst Crypto Con has suggested that the stagnant price range could be nearing its end. This is based on the historical patterns of the Puell Multiple, a metric used to gauge market cycle tops and bottoms based on miner profitability.

The current ‘mid-top correction end’ is reportedly the second-best time to buy discounted BTC before the next price increase. This sentiment was also expressed by another BTC analyst, Willy Woo.

Market Predictions for Bitcoin

Market experts are increasingly sharing a bullish outlook for Q4 and 2025. Geoff Kendricks, Head of Digital Asset Research at Standard Chartered, has predicted that BTC could reach $200K by the end of 2025, regardless of the outcome of the US elections.

Market analyst Stockmoney Lizards has similarly estimated that BTC could hit between $90K-$100K between Q4 2024 and early 2025.

However, it’s important to note that past performance doesn’t necessarily predict future BTC results. Geopolitical factors and other macro updates could also impact these projections. Therefore, keeping track of these developments alongside expert projections is vital.

0 notes

Text

Ethereum Plummets to a 3-Year Low: What’s the Future for ETH?

Key Points

Ethereum’s underperformance has reached a three-year low, falling behind peers like Bitcoin and Solana.

Experts suggest that a significant reversal for Ethereum could only occur through a fundamental shift in narrative.

Despite the ongoing bull run in the market cycle, Ethereum has lagged behind its peers, including Bitcoin and Solana. The underperformance of Ethereum continued even after the US spot Ethereum ETF was approved in July.

Ethereum’s Performance

Over the weekend, the ETHBTC ratio, which measures the value of Ethereum relative to Bitcoin, fell below 0.04, hitting a yearly low last witnessed 3.5 years ago. Alex Thorn, Head of Research at Galaxy Digital, pointed out this worrying trend since the post-Merge upgrade.

Thorn questioned, “ETHBTC just traded on a 0.03 handle for the first time in 3.5 years (Apr 2021). -53% since the Merge in September 2022. What stops this train?” At the time of writing, the ETHBTC ratio had broken below its descending channel, suggesting that more investors could potentially rotate capital to Bitcoin.

Possible Future for Ethereum

Thorn suggested that Ethereum could only experience a significant reversal through a fundamental shift in narrative. He stated, “Big forces are at play here. I don’t think a technical breakout is the thing that does it here. It needs a fundamental narrative shift.”

Following the Dencun upgrade in March, Ethereum’s fees suffered a significant blow, and L1 network activity declined. Some experts attributed this to ‘parasitic and extractive L2s.’ The monthly revenue plummeted from nearly $600 million in March to $100 million in September.

During the same period, Ethereum became inflationary, with more tokens being issued than burned. This undermined its ‘ultra-sound money’ status post the Merge.

David Doung, Global Head of Research at Coinbase, attributed Ethereum’s price underperformance to the current market structure. Doung highlighted the weak seasonals in September and competition from other altcoins. He suggested that the short-term narrative could only shift if Ethereum brings more real-world assets and applications with broad public appeal into the network.

Crypto analyst Benjamin Cowen projected that the ETH/BTC ratio could bottom at 0.30 – 0.40 by December and rally in 2025. He warned that the ETH/BTC crash could derail an altcoin rally. Cowen noted, “But history shows that when ETH/BTC crashes, the ALTs will follow.” At press time, Ethereum was valued at $2.3K, down nearly 10% from its monthly high of $2.56K hit in early September.

0 notes

Text

After a downturn in the cryptocurrency market, I published the third part of a series of articles. This article is called "The Universal Quiet Exit", and the previous articles include "There is No Excuse That This Stuff Works or Will Work Anything" and "Financial Nihilism: The Zeitgeist of Young America". These articles have sparked widespread discussion, especially in the cryptocurrency community, and they accurately captured and predicted the current market situation.

A WIDE QUIET EXIT

Recently, I have noticed a new trend in the cryptocurrency community - "quiet exit". This is a relatively new concept that describes the phenomenon of people quietly withdrawing from a field after losing confidence in it. This attitude is partly derived from two of my previous articles, which explored the practical application of cryptocurrency and its future potential.

The cryptocurrency space has experienced a period of extreme optimism over the past few years. From 2017 to 2022, the market was full of hope for the future of cryptocurrencies, with investors and users believing that these technologies could solve real-world problems and gain widespread adoption. However, over time, many projects that were once seen as the future pillars of cryptocurrencies, such as decentralized finance (DeFi), NFTs, stablecoins, etc., have failed to change the world as expected. Even as Bitcoin's adoption and price have risen, many people have begun to question the actual achievements and future potential of cryptocurrencies.

This skepticism became more pronounced during the past bear market. Even in the most pessimistic times of the market, enthusiasm for cryptocurrencies remained. However, the current situation is more serious. Many people have gradually realized that the actual progress and effects of many cryptocurrency projects are far below expectations. The Memecoin craze and the points-for-airdrop activities were seen as meaningless attempts, reflecting that the market's confidence in these projects has been shaken.

CRYPTOCURRENCY DILEMMA

In the cryptocurrency space, the phenomenon of “quiet exit” is particularly evident. Many people are no longer willing to invest time and resources, although they may still hold some crypto assets. The reasons for leaving are not only disappointment in the potential of the project, but also anxiety about the future prospects. Even if some people choose to stay in this field, their motivation and confidence have obviously weakened.

In this situation, some people choose to continue to pay attention to cryptocurrencies, mainly because they still believe that the long-term returns of cryptocurrencies are attractive relative to other investment options. Although this view seems contradictory, it actually reflects a complex psychological state: despite being disappointed with the current situation, they still hope to find valuable opportunities in the future.

**Market Status and Future Outlook**

Currently, the main focus of the cryptocurrency market has shifted to emerging areas such as decentralized physical infrastructure networks (DePIN). However, apart from DePIN, there is a lack of other breakthrough applications worthy of attention in the market. At the same time, the cryptocurrency venture capital investment environment has also been criticized. Venture capital often obtains high returns through early investment projects, which may fail to make substantial progress in their intended use. This misaligned incentive mechanism has made some investment behaviors in the market increasingly irrational.

**Summarize**

In general, the current phenomenon of "quiet exit" in the cryptocurrency field can be explained by general disappointment with the current state of the market and future prospects. While some people in the market still hold out hope, many are disappointed with the actual achievements of cryptocurrencies and choose to reduce their investment or exit. Future opportunities may appear in emerging fields with practical application prospects, such as DePIN. If the policy environment changes, it may further promote the real development of the altcoin market. Therefore, despite the many current challenges, it is still necessary to keep a close eye on these potential development directions.

How to Buy BTC

How to buy cryptocurrency on an exchange

Investing in BTC has never been easier! Registering on an exchange, verifying your account, and paying by bank transfer, debit or credit card, with a secure cryptocurrency wallet, are the most widely accepted methods of acquiring cryptocurrencies. Below is a step-by-step guide on how to buy cryptocurrency on an exchange.

Step 1: Register CoinMapAi - An All-round One-stop Service Platform for Web3

You can register by email or phone number, then set a password and complete the verification to pass the registration.

Step 2: Identity verification - Submit KYC information to verify your identity

Please verify your identity to ensure full compliance and enhance your experience with full identity verification. You can go to the identity verification page, fill in your country, upload your ID, and submit your selfie. You will receive a notification once your ID has been successfully verified, bind your bank card or credit card and start transactions.

How to exchange USDT with a credit card and then convert it to BTC

Step 1: Click Buy Coins, first select your country , then click Card

Step 2: Click My Profile in the upper right corner

Step 3: Select Add Payment Method in the lower right corner and select a credit card that is suitable for you to fill in the information and bind, such as Wise, Visa, etc.

Step 4: Click P2P transaction again, select the corresponding payment method and choose the appropriate merchant to complete the transaction.

Step 5: After the transaction is completed, your amount will be converted into USDT (USDT is a stable currency of US dollar, pegged at 1:1 with US dollar) and stored in your account. Click on the transaction, search for BTC , and buy its tokens.

How to buy USDT with a debit card and convert it into BTC

Step 1: Click Buy Coins, click P2

Step 2: Select My Profile in the upper right corner

Step 3: Select Add Payment Method in the lower right corner, and select the savings card that applies to you to fill in the information and bind it, such as: Payeer, ABA bank, TowerBank, etc.

Step 4: Click P2P transaction again, select the corresponding payment method and choose the appropriate merchant to complete the transaction.

Step 5: After the transaction is completed, your amount will be converted into USDT (USDT is a stable currency of US dollar, pegged at 1:1 with US dollar) and stored in your account. Click on the transaction, search for BTC , and buy its tokens.

Use the shortcut to buy USDT and convert it into BTC

Step 1: Click [Buy Coins]-[Quick Buy Coins] in the top navigation bar to place your order.

Step 2: Enter the BTC you want quantity

Step 3: Select your payment method, click Next and complete the purchase

Step 4: Click on the transaction and search for BTC , buy its tokens.

0 notes

Text

Exploring the Latest Trends in Cryptocurrency: Essential Information and Research

In the fast-paced world of digital finance, staying up-to-date with cryptocurrency information and research is crucial for making informed investment decisions. Whether you’re a seasoned investor or new to the cryptocurrency space, understanding current trends, top cryptocurrencies, and emerging projects can significantly impact your investment strategy. In this blog, we’ll delve into the latest trends in cryptocurrency, how to conduct effective research, and identify the best cryptocurrencies and promising projects to watch.

Cryptocurrency Information: The Foundation of Smart Investing

Before diving into investment decisions, it’s essential to have a solid grasp of cryptocurrency information. This includes understanding the fundamentals of blockchain technology, the various types of cryptocurrencies, and the factors that impact their value.

Key Aspects to Understand:

Blockchain Technology: The underlying technology behind cryptocurrencies that ensures transparency and security.

Types of Cryptocurrencies: From Bitcoin and Ethereum to emerging altcoins, each cryptocurrency serves different purposes and use cases.

Market Dynamics: Factors such as supply and demand, regulatory news, and technological advancements impact cryptocurrency prices.

Cryptocurrency Research: A Crucial Step for Informed Decisions

Conducting thorough cryptocurrency research is vital for making educated investment choices. Research helps you evaluate the potential of different cryptocurrencies and projects based on their technology, team, and market potential.

Effective Research Strategies:

Analyze Whitepapers: Review the whitepapers of cryptocurrency projects to understand their goals, technology, and implementation plans.

Evaluate Teams and Advisors: Investigate the background and experience of the team and advisors behind the project.

Review Market Data: Analyze historical price data, market trends, and trading volumes to gauge the performance and stability of cryptocurrencies.

Follow News and Updates: Stay informed about recent developments, regulatory changes, and technological advancements in the cryptocurrency space.

Trending Cryptocurrency: What’s Hot Right Now?

Keeping an eye on trending cryptocurrencies can help you identify potential investment opportunities. Trending cryptocurrencies are those gaining significant attention due to innovative features, partnerships, or market momentum.

Current Trends:

Decentralized Finance (DeFi): Projects focused on creating decentralized financial systems are gaining traction. ICOs in this sector are driving innovation in decentralized lending, exchanges, and stablecoins.

Non-Fungible Tokens (NFTs): The popularity of NFTs is fueling interest in platforms and tokens related to digital collectibles and art.

Layer 2 Solutions: Cryptocurrencies focused on improving scalability and transaction speed are becoming increasingly popular.

Best Cryptocurrencies to Invest In

Identifying the best cryptocurrencies involves evaluating various factors such as technology, use case, market potential, and team credibility. While Bitcoin and Ethereum remain top choices due to their established track records, several other cryptocurrencies are worth considering.

Top Cryptocurrencies to Watch:

Bitcoin (BTC): The first and most well-known cryptocurrency, often considered a store of value.

Ethereum (ETH): Known for its smart contract capabilities and support for decentralized applications.

Solana (SOL): A high-performance blockchain known for its speed and low transaction costs.

Polkadot (DOT): Focuses on interoperability and connecting various blockchain networks.

Cryptocurrency Projects: Emerging Opportunities

Exploring new cryptocurrency projects can uncover exciting investment opportunities. Emerging projects often offer innovative solutions or unique use cases with substantial growth potential.

Key Factors to Consider:

Innovation: Look for projects introducing novel technology or solving significant problems.

Community Engagement: A strong and active community can indicate the project’s potential for success.

Partnerships and Collaborations: Strategic partnerships with reputable organizations can enhance a project’s credibility and growth prospects.

Conclusion

Staying informed with the latest cryptocurrency information, conducting thorough research, and keeping an eye on trending cryptocurrencies and promising projects are essential steps for successful investing in the cryptocurrency space. By understanding current trends and assessing the best cryptocurrencies and emerging projects, you can make more informed decisions and potentially capitalize on the growth of the digital finance landscape.

Remember, the cryptocurrency market is dynamic and rapidly changing, so continuous learning and staying updated are crucial for navigating this exciting space effectively.

0 notes

Text

3 Cryptos which will explode in 2023

However, based on current trends and market analysis, here are three cryptocurrencies that some experts believe have the potential to increase in value:

Bitcoin (BTC)

Bitcoin is the largest and most well-known cryptocurrency, with a market capitalization of over $1 trillion. Many experts believe that Bitcoin has the potential to continue increasing in value due to its limited supply (only 21 million will ever be created) and growing adoption by large companies and institutional investors.

Ethereum (ETH)

Ethereum is the second-largest cryptocurrency, with a market capitalization of over $300 billion. It is a decentralized platform that allows for the creation of smart contracts and decentralized applications (dApps). Many experts believe that Ethereum has the potential to increase in value due to its strong developer community and the growing popularity of dApps.

NavC Token

NavC is an ERC-20 utility token designed to serve as the native cryptocurrency of the NavExM trading ecosystem. NavExM is a positive cashback centralized cryptocurrency exchange that provides trading and investing in crypto, NFT, and stablecoins.

The primary aim of the project is to reduce the transaction fee and offer positive cash back for every trade at the NavExM exchange. The project will launch in March 2023 as the world’s first revenue-giving exchange for crypto enthusiasts. The current price of NavC Token is $1 its price increased after the launch of NavExM.

Looking for a highly rewarding crypto trading platform?

Look no further than NavExM! It is powered by the native utility token NavC, making it one of the most innovative and cutting-edge Crypto Trading Exchange.

If you have any questions related to NavC or NavExM, join us on Telegram and ask away! Our team of experts is ready to answer any and all questions you may have.

2 notes

·

View notes