#Best indicators for trend reversal

Explore tagged Tumblr posts

Note

When do you think choreman started becoming friends?

Define friends, lol.

Maybe S7? It's surprisingly hard to say.

Foreman openly and loudly dislikes Chase for the first three seasons, and makes no secret of it: he thinks Chase should lose his job in Control even before Chase goes to Vogler, and later backs it up to House, he tells Chase in S3 that he doesn't like him, and Chase tells a patient in S1 that Foreman hates him. They have some moments of coworker friendliness (teasing Cameron together, mostly; there's some off-screen sharing of gossip back and forth), but there's absolutely no indication they like one another or even respect one another much. We even see them both try and reach out to the other (Foreman to Chase in Socratic Method, Chase to Foreman in House Training and Family), and these efforts be summarily rebuffed.

It's useful to compare their relationships to Cameron to see what I mean: Foreman and Chase are just fine at pretending to get along for the sake of their jobs, but that's baseline coworker stuff. By contrast we see Foreman repeatedly engage Cameron in philosophical debates he really seems to enjoy; he gets a bit protective of her about her crush on House; they have several real, sincere conversations — his calling her out about her commitment issues in Insensitive, for example, is very much Foreman being sincere with her and kind. He apologizes for being a jerk. He tries to frame his critique as a good thing.

The same goes for Cameron and Chase. She talks to him about her crush on House, apparently in some detail; he's the first one she tells, and is already in the loop when Cameron starts pushing her feelings. They're also quick to defend one another, professionally and over personal issues, and, while their eventual relationship kind of obscures their "friendship," they always spend time together, there's entire episodes where Chase is just found in the ER: they clearly enjoy one another's company.

Another thing I find interesting (we'll return to Choreman in a second, I promise) is a throwaway line of Thirteen's in S7. Finding out House said she was in rehab, she complains it really limits her social options with the guys. In particular, she complains, without being able to go out drinking, she and Chase will no longer be friends. Obviously she is joking, but Thirteen is also implying she and Chase do go out drinking sometimes. Nice for them. Not all that deep. More than Choreman ever gets. Sure, we see in S1 they go out for a hosted dinner and drinks… but Cameron is there. We never, ever hear of the two of them hanging out as friends.

This trend continues through S4-5: Foreman has a brief stint in S4 convinced Chase is wildly jealous of him and running the firing betting pool as some sort of revenge plan, which is a) funny as hell and b) still not friends. S6, Foreman hires Cameron and Chase back on the basis of I know I can work with you, not friendship; he fumbles the ball pretty fucking hard with Chase post-divorce, and is no more successful (arguably less) at reaching out to him than any of the others. He takes no interest in Chase's obvious depression except to tell him to get over it. S7, they continue to clash: Chase seems to develop a new hobby of trolling Foreman on purpose, which he's actually been doing since S1 and is quite good at. There's no indications the two kept in touch during the S8 gap, and when they have a personal conversation at the end episode five, the most we get is Foreman calling Chase "one of my best doctors," which is so funny, I love that he can't even compliment Chase without making it a compliment towards himself first.

I sound like I'm focusing more on Foreman here, like I think Foreman hates Chase and Chase is innocent. I actually don't think Chase likes Foreman any more than the reverse! It's just that Chase is a more passive person by nature. He's not as overt with his disrespect, because that's just not his style. But we see that as late as S7, Chase really doesn't respect Foreman much: he calls him out pretty thoroughly in Massage Therapy, and generally delights in undermining Foreman's authority.

For another tangent, let's look at Taubman. I wouldn't say the two particularly get along in S4-6; they have a similar we're coworkers vibe, and that's perfectly fine. But by S7, we really see them become friends. It isn't subtle. Taub and Foreman like one another a lot. They are good friends, unlikely as it seems. They enjoy living together and playing video games and spending time. Just like the earlier Cameron examples, there is none of this from Chase and Foreman. We never hear about them hanging out without a buffer.

I said I thought S7 was the turning point. I was kind of lying, because there's not really any moment or evidence for this. But it's also true that after a while, Foreman lays off the animosity and stops blaming Chase for every error or conspiracy against him. Interestingly, they still never get any "bonding moments:" we see, say, Chase and Thirteen get a whole half episode in After Hours, and a friendship subplot in Now What and Private Lives; Foreman and Taub get a whole lot of bonding in Lockdown but also S7 generally. Foreman and Thirteen get subplot episodes; Chase and Wilson even get one in Private Lives. Chase and Foreman have the occasional shared subplot (Changes), but the focus on those is always them at odds or not getting along, not bonding. Did they ever become friends?

I think they respect one another. I think they have the sort of bond that comes of 8 years in the trenches of an incredibly difficult and demanding job. I also know they blatantly don't care about the things important to the other (Big Baby is a very funny and unsubtle example, where Foreman is worried as hell about Thirteen's drug trial, Chase is very interested in his relationship with Cameron, and neither could care less about the other's issues), don't socialize outside work unless there's a buffer, and continue to pretty fundamentally misunderstand one another for years of the show.

I know you're reading this and thinking "what about Dibala?" And I'm going to give my hot take here: I really don't think it was a huge gesture of friendship and love and trust. If anything, kind of the opposite.

Chase spends most of the Dibala arc pushing Foreman pretty hard to let him get away with it. You have to figure this out, you have to speak before the M&M, you have to lie. He drags Foreman way deeper into the coverup instead of taking any responsibility (or any active role in it — Chase does try, but he's not very good at it, and the burden lies mostly on Foreman's shoulders). Chase also lowkey throws Foreman under the bus for his marriage, using Foreman as an excuse to Cameron for why he's avoiding her, can't talk to her, etc: he also guilts Foreman into helping in The Tyrant.

Foreman helping anyway was a very kind thing to do, but I don't know how much choice he had. He was the one who signed off on treatment and charts. He was running the case. If Chase goes down, he's going down too: maybe Foreman doesn't go to jail for murder, but he absolutely loses his job and license. The episode is actually fairly quiet on what, if anything, Foreman believes about Dibala: where Cameron and Chase spend the whole thing debating morality, we don't really know if Foreman thought killing him was right or not. But by protecting Chase, he protected his career and ambitions… and, to be frank, if I'm Foreman and I think Chase is a lazy coward without morals already, I am not convinced Chase wouldn't try to pin the murder on me if I didn't help. Was helping Chase get away with murder still an altruistic (for a very given definition) thing to do? Sure. But it wasn't selfless. It wasn't love.

So when did Choreman become friends?

I don't know. Define friends.

#malpractice posting#robert chase#eric foreman#hate crimes md#i don't want to call this anti choreman because i actually do enjoy their relationship/lack of relationship/mutual animosity and disrespect#but it's also not the uwu they're gonna kiss take that a lot of fandom want it to be#and tbh i don't like that take much because it erases basically their entire existing dynamic in favor of uwu they're in love

49 notes

·

View notes

Text

Summary of the 2025 State of the Birds Report of the North American Birds Conservation Initiative.

Executive Summary:

5 Years After the 3 Billion Birds Lost Research, America Is Still Losing BirdsA 2019 study published in the journal Science sounded the alarm—showing a net loss of 3 billion birds in North America in the past 50 years. The 2025 State of the Birds report shows those losses are continuing, with declines among several bird trend indicators. Notably duck populations—a bright spot in past State of the Birds reports, with strong increases since 1970—have trended downward in recent years.

Conservation WorksExamples spotlighted throughout this report—from coastal restoration and conservation ranching to forest renewal and seabird translocations—show how proactive, concerted efforts and strategic investments can recover bird populations. The science is solid on how to bring birds back. Private lands conservation programs, and voluntary conservation partnerships for working lands, hold some of the best opportunities for sparking immediate turnarounds for birds.

Bird-Friendly Policies Bring Added Benefits for People, and Have Broad SupportPolicies to reverse bird declines carry added benefits such as healthier working lands, cleaner water, and resilient landscapes that can withstand fires, floods, and drought. Plus birds are broadly popular—about 100 million Americans are birdwatchers, including large shares of hunters and anglers. All that birding activity stimulates the economy, with $279 billion in total economic output generated by birder expenditures.

7 notes

·

View notes

Text

To work in nature conservation is to battle a headwind of bad news. When the overwhelming picture indicates the natural world is in decline, is there any room for optimism? Well, our new global study has some good news: we provide the strongest evidence to date that nature conservation efforts are not only effective, but that when they do work, they often really work.

Trends in nature conservation tend to be measured in terms of "biodiversity"—that is, the variety among living organisms from genes to ecosystems. We treasure biodiversity not only for how it enriches society and culture, but also its underpinning of resilient, functioning ecosystems that are a foundation of the global economy.

However, it is well known that global biodiversity is decreasing, and has been for some time. Is anything we are doing to reverse this trend effective?

As part of a team of researchers, we conducted the most comprehensive analysis yet of what happened when conservationists intervened in ecosystems. These were interventions of all types, all over the world. We found that conservation action is typically much better than doing nothing at all.

The challenge now is to fund conservation on the scale needed to halt and reverse declines in biodiversity and give these proven methods the best chance of success.

31 notes

·

View notes

Note

Good day! I hope you're doing well

I got inspo from the latest chapters of The Villainess Reverse The Hourglass — How about the charas from TVRTH reacts if their kid with the reader from the future suddenly appears?

If you don't mind, i would want them to not have a relationship with reader at that point. Maybe just a slight crush or intrest but mo established relationships.

I hope this isn't too much, thank you in advance!

(A/N: Here Mielle accepted Aria into the Roscente family is in good terms with her, even after Aria finds her real father|| Couldn't do Lohan...)

The villainess reverses the hourglass X Reader:

I'll be with you in the future!!

The light glow of sun was hidden by the large, silk curtains as you and your best friend was sitting on their bed as you both did one of your favorite past-times, as you both continued to comment and talk about the recent trends in the society, there was a little knock on the door, as you got up and opened the door, there stood your dear friend’s most trusted servant, but they seemed to be accompanied by someone else behind them, it was a beautiful person with luscious hair and gleaming eyes, and somehow they looked similar to a certain person you know, but you just couldn’t place an idea upon how it could be….As you both invited them in, your friend’s servant informed you both about them being hurt in the palace grounds, and upon mention of your names it asked to stay with you. Now as you, your dear friend, and this person were sitting in their bedroom, in dead silence before……

Aria Roscente

“Uhm…Weird question, would you mind telling us who you are?” You heard Aria question the young girl, named Rosalie, who looked as she was only 13, the young girl immediately looked down before mumbling something you were able to somehow make out, “You both wouldn’t believe me….”, “Why wouldn’t we believe you, dear?” You asked the little girl who had long luscious blonde hair and big, calm (e/c) eyes…”Because well, I’m your future daughter…” You heard her reply, this is not what you were expecting, as you looked over at Aria, she didn’t seem shocked like you, instead she seemed upset about something, yet she replied with “Hmm, I was actually expecting this; she does look a lot like you and she is quite pretty like you, Y/N…” Aria said, sadness evident in her voice…

As you conversed with the girl, Aria heart kept sinking to the bottom, she realized that you will never choose her, even if she turns back the time again and again, as she looked over to the box where she kept her hourglass, she hoped to turn back the time where the girl never told you both she was your daughter, but Aria would still remember the painful detail of you having a destined lover who is not her.

Upon noticing the look on her face you also felt your heart breaking, you loved her dearly and you were also upset learning about your daughter, but what could you do? As you turned back to your daughter you inspected her closely trying to see if your lover was somebody you knew, you noticed her hair was long and wavy and she had sharper features .as you leaned closer to your daughter and tucked a strand of her hair behind her ear while she talked, you saw a barely noticeable mole on her ear lobe, as you quickly whipped your head towards Aria, shocking both Rosalie and Aria at your action as you immediately stood up, holding your daughter’s hand before you sat her down near Aria and compared their features, leaning dangerously close to Aria’s face, making her flustered and flush into an adorable shade of pink.

Before, she could process anything, you put your palm and hid Rosalie’s eyes before kissing Aria right on her lips, catching both of them off-guard, as you pushed Rosalie’s face away and pointed towards the door indicating you wanted her out, she immediately got the hint covering you both from her view and running out the door, while you put both your arms on Aria’s waist and pulled her on your lap, while Aria was still frozen, not knowing how to act, as she slowly calmed down and kissed you back. You both continued to kiss, only pulling apart for millisecond intervals to let yourselves breathe before kissing again. Finally pulling apart for real, there was a string of drool connecting your mouths, as you gripped her chin to tilt her chin up to look at her face, all flushed pink with drool on her lips along with a love-sick look in her eyes. Aria felt immense embarrassment and again turned her eyes down before trying to shift off your lap, but your grip on her waist tightened and again brought her back to her previous position, as you called Rosalie in.

While you conversed with Rosalie, along with Aria in your lap who was hiding her face by burying it in your neck, you confirmed with Rosalie that Aria was truly her mother and your wife in the future. As you three talked throughout the day getting to know each-other, you learnt that Rosalie was born a weak child and so you and Aria were quite protective of her, you both were very worried about her travelling back to the past, but later on agreed to let her do so, but she had to return by evening, so upon the time for Rosalie to leave, you were pretty sure Aria was crying a few tears as you reminded her that you will surely be seeing her again in the future….~

Mielle Roscente

“uhm…I know this is hard to believe and I ask of you to not freak out but I’m actually your child…” the young girl said, while closing her eyes and gripping her skirt tightly, while one hand is extended to show you a tiny bracelet given to you by your mother and you had never showed it to anyone. As you comprehended what the child had said and showed, you immediately stood up and sat down near her, and hugged her tightly, leaving Mielle shocked and to her own senses, as she comprehended what the girl said, this girl was your daughter?!

As Mielle looked at the girl’s features, she saw they were very similar to Aria’s, and her eyes were also green just like her’s and Aria’s, did-did you reject her and marry Aria in the future?....

‘No, it can’t be right, Aria knew I liked them and she still did this in the future? But why?.... We both are on good terms with each-other, though we don’t see each-other often, since she found her real father…..Can it be the reason for her betrayal……” Mielle kept thinking how Aria betrayed her, but there was still hope for her to still be friends with you, right? As she looked at you and your daughter, Rialiara, talk with each-other on what the future looks for you and your family, as she Mielle continued to cry on the inside with her dear sister taking her love away.

As you and Rialiara continued to talk about the future, you felt Mielle scoot closer to you and whisper in your ear "Hey..Can we talk..?" In a voice, which was laced with sadness. Of-course, you agreed, though before you asked Rialiara to go out, Mielle stood up and sat near her before stroking her hair and asking her, "Ria, dear..If it's okay, who's your mother?" Mielle asked, definitely upset about the outcome being her sister.

"Oh! Yeah, sorry I didn't tell you both, but I honestly though you both are dating mom!" Rialiara bursted out, all smiling and beaming at you both, making Mielle immediately whip her head towards you and your daughter again and again, until she saw that your daughter's eyes weren't having a yellow tint Aria and her father had, but more of a blue tint, she had. Her hair was more straight than Aria and though they were the same colour as your hair, there was no denying it now that this girl was your and Mielle's daughter!

Mielle's eyes, which were holding back tears, now started flooding up with tears, as you and both of your mini version looked at her with worry seeing her tear up as you both put one of your hands on each one of the shoulders and scooted closer to her, as she looked at you both and smiled before engulfing you both in a tight hug. As you and your child hugged her back, Mielle realized that this is what her future is going to feel like...

Asterope Franz

"Uhm....If I'm not wrong, you're from the future....Right?" Asher suddenly asked the young, pre-teen boy, breaking the silence. The boy seemed shock for a moment before nodding as though he expected this. As you examined the boy more carefully trying to understand who was this person related to, as you get familiar vibes from him..

But you curious, you ask Asher, "How do you know he's from the future?"

"Oh, uhm a friend of mine has this talent for turning time and yeah...I saw him once when we accidentally went to the future.." Asher replied shyly as you nodded your head. "So who are you dear? Star from the beginning, please."

The boy nodded and introduced himself, "Uhm, I'm Elenoir, the prince of this empire, and..." The boy hesitated by looking at your smile, he continued "your son..." The boy blushed a bit before answering. Those words shocked you and Asher as your eyes widened and your mouth gaped a bit as you covered your mouth and tried to hide your surprise....

"WHAT?!" Asher and you both yelled in unison making the boy cover his ears and shy away giggling mischievously. As you both processed this news and as you brain's clogs finally work you both turned to look at each-other. As you moved your head with were met with Asher's face very close to you, your nose nearly touching as you both blushed heavily as you both froze up staring into each-other's eyes...

As you both broke out of your trance the boy was smiling at you both, so you asked him, "Now, my dear.Why are you here??" This sentence changed his mood completely as he looked guilty ..."I can't say these things to my parents, but I hope I can request you..."..He said hesitantly as you both slowly nodded your heads as he took a deep breathe.."I don't want to be the heir of the throne..." The little boy says, making you and Asher confused

"Huh, why??" Asher asked worriedly, panicking on the inside a bit, "Did I put too much pressure on you??" "Were you attacked?" "Do you hate being a royalty???" Asher and you asked questions after questions worried for the child, the child denied your thoughts as he says, "I'm the elder child, but I have a younger sister, who is younger than me by a few months, I'm the heir to the throne and I'm the one training to be the emperor...but I don't want to take up the responsibility to the throne, rather my sister wishes to be the heir, she says she is ready to take up responsibility of throne as the empress and would like to help her subject, so maybe if it's okay can you make her the heir???" Elenoir asked as he rubbed the back of his neck, seemingly worried and concerned for not only your answers but also because he seemed to care for his sister a lot.

"Of-course, that's completely fine!!" You and Asher say smiling yet non nonchalantly making Elenior perk up in surprise and happiness, "REALLY?! YOU BOTH MEAN IT!??!" You and Asher nodded your head, before you asked,

"Hey, but why are so afraid to ask your parents that you came back in time to us, who aren't in a relationship yet??" you ask making Elenior shy away in thoughts a bit before turning red with embarrassment

"Ah, the thing is you both praise how good of an emperor I would be, I kind of forgot how accepting you both are of me...I should go back, they must be getting worried about me gone and tell them about how I feel, thanks for the talk, younger mom and dad!!" Elenior said opening up a portal before hurriedly jumping through, but not before hugging you btoh tightly and kissing you cheeks, it was a cute moment.

Just before the portal closed, Elenior popped out again and gave you a photo, saying, "I think you'd like to see us, I'm Elenior Franz the eldest son, with my younger siblings, Orien, the middle sister with the angry face, Werin, the cute boy with the white strand in his hair and Reliaou, the youngest boy!! I should leave, bye!!!" Elenior say hurriedly explaining his family and his sibling before running and jumping through the portal again, as it closed completely behind him with a bright light.

With Elenior gone, you both looked at the photo of a more mature and elegant versions of you with Elenior near you, a pretty young girl with very long hair whose face made it look like she was angry, but ti was just her resting bitch face.

Then there was a boy who was the same age as her, but had a strand of white hair in his hair as he smiled, then a boy sitting on your lap. It was a cute family, but how should you and Asher look into each other's eyes after this, knowing you both are married and have FOUR kids?!

Oscar Fredrick

You, Oscar and the little boy stayed in the room in silence before the boy spoke up, "Uhm, so I'm your child from the future, please don't panic...." The little boy said freezing up and closing his eyes as the realization dawned upon you both...While you shyly introduced yourself to the child and vice versa, you learnt how you and your spouse were actually doing good, you learnt how good your son is doing as the heir fo the family, he has a elder sister always worrying and bullying him and is endearingly annoying to him, all while Oscar behind you felt his heart break into pieces...

He finally decided after a few minutes of silence with you and your son talking, except of you and your child talking, Quiren, as he was named. He had to confess to you to get rid of these feelings so he could move on and not live on the feeling of you never loving him and instead marrying someone else.

“Uhm...uh, dear Quiren, do you mind going out for a few minutes, I wanna have a important, secret talk with your parent for a few minutes…..” Oscar asked him, and Quiren upon seeing the look in his eyes, nodded and walked out the room and closed the door behind him, leaving you both in the room alone. As soon as the door shut, Oscar couldn’t hide his cries anymore. As soon as the door closed, you heard a tiny whimper, which held a lot of pain, you quickly whipped your head around to see Oscar holding his head low with tears streaming and falling on his lap and hands making tiny wet spot on his pants and hands as he continued bawl his eyes out as you shifted near him, you pulled him into a tight hug as he cried and babbled

"I'm sorry...I'm such a bad friend..." Oscar said wailing before hiccuping from his tears a bit

"I want you to be happy....But.." He took a huge breathe before brushsing his palms across his cheeks "I want you to be happy with me!" He said full on bursting into huge tears as you patted his back, still hugging him tightly as you tried to hide your blush and excitement, you didn't know who your husband was but it's not like it was too late, right??

You slowly pulled away from the tight hug and kissed his eyes and kissed his tears away as you smiled before hugging him and kissing his cheeks and lips,

"I think...You're the nicest person in the history of the universe...I don't care that I'm married to someone else in the future, right now, I want to be with you, you understand?!" You say smiling brightly as Oscar wiped his tears and giggled a bit as he nodded his head as he kissed your lips again, as someone said in a squeky voice,

"Dad, please! YOU CAN DO ALL THAT AFTER I LEAVE, NO??" Quiren said blushing as he covered his eyes with his hands cutely, you and Oscar giggled as you realized you both misunderstood, Quiren wasn't only your child, but he belonged to Oscar as well! You don't understand how you didn't realize those same gold eyes you loves so much on Quiren belonged to Oscar...But nonetheless, looks like you not only have one Oscar Fredrick but two in different fonts in the future!

#navi⌗writes⌗#the villainess reverses the hourglass#the villainess turns the hourglass#the villainess reverses the hourglass imagine#the villainess reverses the hourglass x you#the villainess reverses the hourglass lohan#the villainess reverses the hourglass x y/n#the villainess reverses the hourglass x reader#oscar fredrick x reader#oscar fredrick#aria roscente#aria x reader#mielle roscente#mielle#mielle x reader#asher franz#asher x reader#asterope franz#manhwa headcanons#manhwa scenarios#manhwa imagines#manhwa x y/n#manhwa x you#manhwa x reader#manhwa fic#manhwa fanfic

77 notes

·

View notes

Text

What to expect from the stock market this week

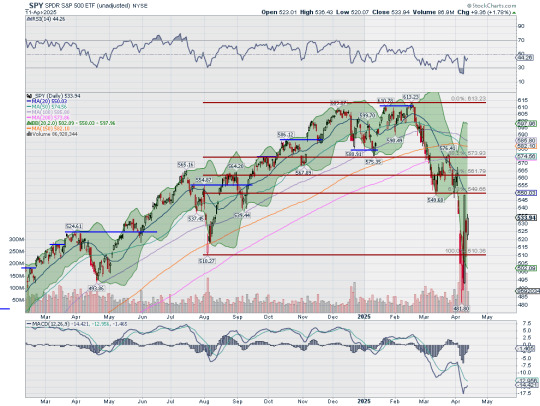

Last week, the review of the macro market indicators saw with the release of the first round of tariffs since 1930, equity markets reacted with their worst week (2 days) since March of 2020. Elsewhere looked for Gold ($GLD) to continue to hold over $3000/oz while Crude Oil ($USO) collapsed into a downtrend. The US Dollar Index ($DXY) continued to drift to the downside in consolidation while US Treasuries ($TLT) continued in consolidation. The Shanghai Composite ($ASHR) looked to continue to consolidate the short term move higher while Emerging Markets ($EEM) were on the verge of entering a new downtrend.

The Volatility Index ($VXX) looked to remain very high making the path easier for equity markets to the downside. Their charts looked weak on both timeframes. On the shorter timeframe the gaps the last 2 days of the week might signal short term exhaustion. On the longer timeframe the $SPY, the $IWM and the $QQQ were all in short term downtrends.

The week played out with Gold dipping below $3000/oz before a reversal took it to new all-time highs to end of the week while Crude Oil fell to 4 year lows before a weak bounce. The US Dollar dropped to the bottom of support and the lowest level since July 2023 while Treasuries fell back to the January lows. The Shanghai Composite fell back to fill the gap from the September stimulus package while Emerging Markets dropped to 17 month lows before a bounce to last week’s gap.

Volatility exploded to near the intraday top from August and closing level not seen since March 2020. This continued to roil equities and they had violent moves in large ranges early in the week that settled by Friday. Along the way they had some off both their biggest daily losses and gains. This resulted in the SPY and QQQ up on the week after retesting near the 2021 highs and the IWM finding a 17 month low. What does this mean for the coming week? Let’s look at some charts.

The SPY came into the week having fully retraced the move up from the August 2024 low. It gapped down Monday to nearly test the 2021 highs and then moved higher to close nearly unchanged. Tuesday saw the opposite with a gap up sold off all day to end lower. Wednesday then saw one of the best days ever, rising 10.50% after opening down on the day. Thursday it settled into a narrower range and moved higher Friday. This left it up on the week after massive daily swings and back inside the Bollinger Bands®. The RSI is stalling at the midline with the MACD rising but negative.

The weekly chart shows the touch at the 2021 high and rebound. A Piercing candle on huge volume bodes for more upside. The RSI is rising off an oversold condition with the MACD negative and falling. There is resistance at 537 and 540 then 542.50 and 545.50 before 556.50 and 565.50 then 569. Support lower is at 534 and 530 then 524.50 and 520.50 before 517.50 and 510. Short Term Downtrend.

Heading into the holiday shorted pre-Easter week, equity markets showed resilience with a sizeable move higher in a very volatile week. Elsewhere look for Gold to continue its move higher while Crude Oil continues the downtrend. The US Dollar Index continues to trend to the downside while US Treasuries trend lower. The Shanghai Composite consolidation looks at risk to a move lower while Emerging Markets consolidate.

The Volatility Index looks to remain at extreme levels making the path easier for equity markets to the downside. Their charts continue to look at risk for more downside, especially on the shorter timeframe. On the longer timeframe both the QQQ and SPY printed reversal patterns if confirmed next week. The IWM has a bit more work to do in the longer timeframe to join them. Use this information as you prepare for the coming week and trad’em well.

Join the Premium Users and you can view the Full Version with 20 detailed charts and analysis: Macro Week in Review/Preview April 11, 2025

2 notes

·

View notes

Text

Art for Palestine!

Hello, everyone! Since I often don't have the money to donate, I have decided to contribute my skills to advocating for Palestinians and their fundraisers.

Send me your fundraiser!

If you are Palestinian: Send me your fundraiser, and I will make a free, unique drawing to post with it! I have noticed trends that artwork often has higher engagement than words or text, so hopefully it will allow your fundraiser to get more attention - and more donations!

I will try to only post vetted fundraisers, but if your fundraiser is new and seems legit (via RISing), then I will make an exception.

Donator Doodles

If you are a donator: Send me proof of your donation to one of the fundraisers that I have posted on my blog, and I will make a free, 10-minute timed drawing for you - a donator doodle! You can pick the subject matter and whether or not I color it, or anything else you want included. It's basically like a mini commission! The donation must be at least $7.00 USD in value (or greater!).

I will also be accepting proof of donations to https://helpgazachildren.notion.site/!

Please contact me via tumblr's instant messenger. The proof of donation must show some kind of indicator that it was made on or near the day of your request, and that you are the donator. I will be RISing (Reverse Image Searching) all screenshots to check that it is legitimate as well. I use my artwork as a source of income to pay for rent, bills, and healthcare, and I do not often do it for free! Anyone found trying to take advantage of this will be blocked.

Slots

I will be holding 6 slots for the donator doodles! Check my bio at the top of my blog to see how many slots I have open or filled at any given point in time. Thank you!

I am doing this in good faith that most people asking for money are real, legitimate, and in need of help. If it turns out that a fundraiser was a scam, then I will delete the post. Use your best judgement when donating and lookout for scams.

Thank you for your time, consideration, and support!

#digital art#furry#anthro#original character#artists on tumblr#free palestine#gaza#palestine mountain gazelle#art for palestine#donator doodles

5 notes

·

View notes

Text

Technical Analysis

Hull Moving Average: The Revolutionary Trend Following Indicator

Introduction

The Hull Moving Average (HMA) has revolutionized how traders identify and follow market trends. Developed by Alan Hull to address the lag inherent in traditional moving averages, the HMA provides a uniquely responsive yet smooth representation of price action. This comprehensive guide explores how traders can leverage this powerful indicator for enhanced trading performance.

Who Created the Hull Moving Average?

Alan Hull, an Australian mathematician and trader, developed the Hull Moving Average in 2005. Frustrated with the significant lag in traditional moving averages, Hull applied his mathematical expertise to create an indicator that could maintain smoothness while dramatically reducing delay in trend identification.

What Makes the Hull Moving Average Special?

Core Features:

Minimal lag compared to traditional MAs

Smooth price action representation

Strong trend identification capabilities

Responsive to price changes

Built-in noise reduction

Key Advantages:

Earlier trend identification

Clearer entry and exit signals

Reduced whipsaws

Superior price tracking

Versatile application across markets

Why Use the Hull Moving Average?

Primary Benefits:

Faster Signal Generation

Reduces lag by up to 60%

Earlier trend identification

Quicker response to reversals

Improved Accuracy

Reduces false signals

Smoother price tracking

Better noise filtration

Enhanced Trend Following

Clear trend direction

Strong support/resistance levels

Trend strength indication

Versatility

Multiple timeframe analysis

Various market applications

Combines well with other indicators

Where to Apply the Hull Moving Average?

Market Applications:

Futures Markets

E-mini S&P 500

Crude Oil

Gold Futures

Treasury Futures

Forex Trading

Major currency pairs

Cross rates

Exotic pairs

Stock Trading

Individual stocks

ETFs

Stock indices

When to Use the Hull Moving Average?

Optimal Market Conditions:

Trending Markets

Strong directional moves

Clear price momentum

Extended market cycles

Breakout Scenarios

Pattern completions

Support/resistance breaks

Range expansions

Volatility Transitions

Market regime changes

Volatility breakouts

Trend initiations

How to Trade with the Hull Moving Average

Basic Trading Strategies:

Trend Following Strategy

Long when price crosses above HMA

Short when price crosses below HMA

Use HMA slope for trend strength

Exit on opposite crossover

Support/Resistance Strategy

Use HMA as dynamic support/resistance

Buy bounces off HMA in uptrends

Sell rejections from HMA in downtrends

Tighter stops for counter-trend trades

Multiple HMA Strategy

Combine different period HMAs

Look for crossovers between HMAs

Use divergences between HMAs

Trade strongest signals only

Advanced Applications:

Multiple Timeframe Analysis

Higher timeframe for trend direction

Lower timeframe for entry timing

Middle timeframe for confirmation

Volatility Integration

Adjust periods based on volatility

Use ATR for stop placement

Scale positions with trend strength

Hybrid Systems

Combine with momentum indicators

Use with price patterns

Integrate with volume analysis

Risk Management Essentials

Position Sizing:

Scale with trend strength

Larger in confirmed trends

Smaller in transitions

Stop Loss Placement:

Beyond HMA level

Based on ATR multiple

At key price levels

Common Pitfalls to Avoid

1. Over-Optimization

Problem: Curve fitting periods

Solution: Use standard settings

Prevention: Test across markets

2. False Signals

Problem: Minor crossovers

Solution: Use confirmation filters

Prevention: Wait for clear signals

3. Late Exits

Problem: Giving back profits

Solution: Use trailing stops

Prevention: Honor exit rules

Real-World Performance Metrics

Typical Results:

Win Rate: 45-55% in trending markets

Risk/Reward Ratio: Best at 1:2 or higher

Average Trade Duration: 5-10 days

Maximum Drawdown: 15-20% with proper risk management

Optimizing Hull Moving Average

Parameter Settings:

Standard Period: 20-30

Aggressive: 14-18

Conservative: 35-50

Market-Specific Adjustments:

Fast Markets: Shorter periods

Slow Markets: Longer periods

Volatile Markets: Multiple confirmations

Conclusion

The Hull Moving Average represents a significant advancement in trend-following indicators. Its ability to reduce lag while maintaining smooth price action makes it an invaluable tool for both discretionary and systematic traders. When properly implemented with sound risk management principles, the HMA can provide a significant edge in futures trading.

#HullMovingAverage#TrendFollowing#FuturesTrading#TechnicalAnalysis#TradingStrategy#MarketIndicators#FinancialMarkets#TradingEducation#AlanHull#MovingAverages

3 notes

·

View notes

Text

Double Buy trade inside #AUDJPY H1 Up trend running. Official Website: wWw.ForexCashpowerIndicator.com . Start Improve your Strategy with Cashpower Indicator Lifetime license one-time fee with No Lag & NON REPAINT buy and sell Signals. ULTIMATE Version with Smart algorithms that emit signals in big trades volume zones. . ✅ NO Monthly Fees ✅ * LIFETIME LICENSE * ✅ NON REPAINT / NON LAGGING 🔔 Sound And Popup Notification 🔥 Powerful AUTO-Trade Option .

⭐ TOP BROKER Recommended ⭐

Trade Conditions to use CASHPOWER INDICATOR & EA Money Machine.* Top Awards WorldWide trade execution * Regulamented Brokerage Forex * O.O Spreads with Fast Deposits * Fast WITHDRAWALS with Cryptos. open your MT4 Account Start your trade Journey with BEST Broker !!

👉 https://clicks.pipaffiliates.com/c?c=817724&l=en&p=6

. ✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.** . ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ). . ✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options. . 🔔 New Ultimate CashPower Reversal Signals Ultimate with Sound Alerts, here you can take No Lagging precise signals with Popup alert with entry point message and Non Repaint Arrows Also. Cashpower Include Notification alerts for mt4 in new integration. . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

#forexsignals#forexindicators#forexindicator#forexprofits#forexvolumeindicators#forexchartindicators#forex#cashpowerindicator#indicatorforex#forextradesystem#mt4indicators#metatrader4 indicators#audjpy#forex signals#forex signal#forex usa

3 notes

·

View notes

Note

Hiii Mia! How are you today? I Hope you’re having a great day/week! May I ask for a career guidance reading?

I would like to know if opening small artisan bakery is a good idea and what steps could I take to have a successful business. Baking is my passion but I’m a little nervous about making it a business. I’m Ana btw! Thank you ❤️

Hello Ana,

I'm here to assist you! I'd be delighted to provide you with career guidance regarding your small artisan bakery idea😊 Let's explore the potential of your idea using the 10 of Cups reversed:

Opening a Small Artisan Bakery:

The 10 of Cups reversed suggests that while opening a small artisan bakery can be a rewarding venture, there are some considerations and steps you should take for a successful business:

Passion and Fulfillment: Your passion for baking is a strong foundation. Follow your heart and creative instincts, as they will bring authenticity and uniqueness to your bakery.

Market Research: Conduct thorough market research to understand your target audience, competition, and location. Identify a niche or specialty that sets your bakery apart, whether it's a particular type of bread, pastries, or a unique theme.

Business Plan: Create a solid business plan outlining your bakery's concept, budget, and financial projections. This will help you stay organized and secure funding if needed.

Location: Choose a location that aligns with your target market. Visibility, accessibility, and foot traffic are essential factors to consider.

Quality Ingredients: Invest in high-quality ingredients and prioritize freshness and taste. This will ensure that your baked goods stand out and garner customer loyalty.

Marketing and Branding: Develop a strong brand identity and use effective marketing strategies to promote your bakery. Utilize social media, local advertising, and word-of-mouth to reach potential customers.

Customer Experience: Focus on creating a warm and inviting atmosphere in your bakery. Excellent customer service and a welcoming environment can turn first-time visitors into regular customers.

Financial Management: Keep a close eye on your finances. Monitor expenses, set pricing strategies, and maintain a budget to ensure the business remains profitable.

Adaptability: Be prepared to adapt to changing customer preferences and market trends. Flexibility and innovation will help your bakery thrive in the long run.

Community Engagement: Engage with your local community. Participate in events, collaborate with nearby businesses, and give back when you can. Building strong ties with the community can boost your bakery's reputation.

While the 10 of Cups reversed may indicate some challenges or concerns, it's also a reminder that the journey of turning your passion into a business can be emotionally fulfilling. Don't let nerves hold you back; take thoughtful steps, and your small artisan bakery can bring joy to both you and your customers.

I wish you the best of luck in pursuing your dream of owning a successful bakery, Ana! 🍞🍰🌟

xx

Mia ♥

- - - - - - - - -

★ To see status of free readings click here

★ CHECK OUT MY NEW SHOP SECTION: PRESET QUESTIONS - FUN THEMES

★ LOVE how much information is in these free readings? Check out my ETSY to get even more information, clarification and messages. USE CODE TUMBLR20 FOR 20% OFF

★ Interested in spells and chakras? Check out my spells on offer

#tarot#tarot cards#tarot readings#cartomancy#card reading#major arcana#minor arcana#intuitive#witchcraft#witchcore#real witches#tumblr witches#witches of tumblr#divination#australian witches#witchblr#oracle card#oracle cards#oracle reading#free reading#free tarot reading#small business#etsy#etsy shop#australian#australian business#australian witch

3 notes

·

View notes

Text

STATE OF THE BIRDS: EXECUTIVE SUMMARY

5 Years After the 3 Billion Birds Lost Research, America Is Still Losing Birds. A 2019 study published in the journal Science* sounded the alarm—showing a net loss of 3 billion birds in North America in the past 50 years. The 2025 State of the Birds report shows those losses are continuing, with declines among several bird trend indicators. Notably duck populations—a bright spot in past State of the Birds reports, with strong increases since 1970—have trended downward in recent years.

Conservation Works. Examples spotlighted throughout this report—from coastal restoration and conservation ranching to forest renewal and seabird translocations—show how proactive, concerted efforts and strategic investments can recover bird populations. The science is solid on how to bring birds back. Private lands conservation programs, and voluntary conservation partnerships for working lands, hold some of the best opportunities for sparking immediate turnarounds for birds.

Bird-friendly Policies Bring Added Benefits for People, and Have Broad Support. Policies to reverse bird declines carry added benefits such as healthier working lands, cleaner water, and resilient landscapes that can withstand fires, floods, and drought. Plus birds are broadly popular—about 100 million Americans are birdwatchers, including large shares of hunters and anglers. All that birding activity stimulates the economy, with $279 billion in total annual economic output generated by birder expenditures.

5 notes

·

View notes

Text

In futures trading, investors rely on a variety of factors to make buying or selling decisions. Here are some key factors for investors to consider

Raw Trading Ltd

Market Analysis: Investors analyze the market conditions, including supply and demand dynamics, price trends, and market sentiment. They use technical analysis tools, such as charts and indicators, to identify potential trading opportunities.

Fundamental Analysis: Investors assess the fundamental factors that can impact the price of the underlying asset. This includes analyzing economic indicators, geopolitical events, weather patterns, and government policies that can affect supply and demand.

News and Information: Investors stay updated with the latest news and information related to the underlying asset. They monitor news releases, industry reports, and expert opinions to gauge the potential impact on prices.

Risk Management: Investors use risk management techniques to determine their entry and exit points. They set stop-loss orders to limit potential losses and take-profit orders to secure profits. Risk management also involves determining the appropriate position size and leverage to use in each trade.

Technical Indicators: Investors use various technical indicators to identify potential entry and exit points. These indicators include moving averages, oscillators, and trend lines. Technical analysis helps investors identify patterns and trends in price movements.

Trading Strategies: Investors develop and implement trading strategies based on their analysis and risk tolerance. These strategies can be based on trend following, mean reversion, breakout, or other trading methodologies.

Market Orders: Investors can place market orders to buy or sell futures contracts at the prevailing market price. Market orders are executed immediately at the best available price.

Limit Orders: Investors can also place limit orders to buy or sell futures contracts at a specific price or better. These orders are not executed immediately but are placed in the order book until the specified price is reached.

Stop Orders: Investors use stop orders to limit potential losses or protect profits. A stop order becomes a market order when the specified price is reached, triggering the execution.

Electronic Trading Platforms: Investors can access futures markets through electronic trading platforms provided by brokerage firms. These platforms offer real-time market data, order placement, and trade execution facilities. IC Markets

It is important for investors to conduct thorough research, stay updated with market developments, and have a well-defined trading plan to make informed buying or selling decisions in futures trading.

1 note

·

View note

Text

The Path to Becoming a Funded Trader: A 7-Step Guide to Success,

Trading in financial markets presents an exciting avenue for financial growth, but achieving consistent profitability is a challenge many traders face. The transition from struggling to thriving as a funded trader requires strategy, discipline, and the right resources. This guide outlines a 7-step process to help you go from unprofitable to securing funding with proprietary trading firms like Apex Trader Funding, which offers opportunities worldwide. With various trading platforms available, finding the best trading platforms that align with your strategy is essential for success. Whether you are interested in futures trading or exploring a trading website for proprietary trading, Apex funded accounts can provide the capital you need to scale your trades.

Step 1: Build a Strong Educational Foundation

A successful trading journey begins with comprehensive education. Whether you're exploring free resources or premium courses, an in-depth understanding of market behavior is crucial. Key areas to focus on include:

Market Structure – Learn how different financial instruments move, the role of liquidity providers, and the impact of global economic events.

Technical Analysis – Master price action, indicators, and advanced charting methods to identify high-probability trading setups.

Trading Strategies – Understand the nuances of different trading styles, such as trend following, mean reversion, and scalping, and determine which best aligns with your personality and risk tolerance.

Education never truly ends in trading. Continually refining your knowledge and adapting to market changes will keep you ahead of the competition. Take the time to explore multiple educational resources, from books and online courses to webinars and mentorship programs. Engage in interactive learning experiences such as trading simulations, mock trading contests, and group discussions. Furthermore, learning from experienced proprietary traders can help you avoid common pitfalls and accelerate your progress.

Step 2: Practice with Purpose

Applying theoretical knowledge through practice is essential for developing consistency. Two core exercises to enhance your skills include:

Backtesting – Analyze historical data to test strategy effectiveness under different market conditions.

Daily Market Analysis – Formulate trade ideas based on real-time price action and economic news to improve market bias prediction.

Using a demo account on an online trading platform or virtual trading platform is a great way to refine execution without financial risk. Take notes on each trade to understand what works and what doesn’t, turning each experience into a learning opportunity. The Apex prop firm allows traders to practice and fine-tune their skills before trading with real capital.

Traders should set clear objectives for each practice session. Instead of randomly placing trades, focus on specific aspects such as identifying key support and resistance levels, improving entry precision, or testing a new risk management approach. Recording screen captures of trades and reviewing them later can also help pinpoint errors and areas for improvement. The key is to treat this phase as deliberate training rather than casual experimentation.

Step 3: Revisit and Refine Your Knowledge

After gaining some hands-on experience, revisiting educational material often reveals new insights. This cyclical learning process helps solidify your understanding and refine your strategies. Watching recorded webinars, joining discussion groups, and reviewing past mistakes will reinforce your trading acumen.

Consider mentorship or structured programs to gain direct feedback from experienced traders who have already navigated the path to success. Traders who revisit concepts with experience often develop a deeper appreciation for nuances they initially overlooked. Additionally, staying updated with market trends and technological advancements, such as the Rithmic trading platform and Tradovate trading platform, can provide new ways to enhance your trading approach.

Step 4: Develop a Solid Trading Plan

A clear, structured trading plan is essential for maintaining discipline. Key components of a trading plan include:

Entry & Exit Rules – Define when to enter and exit trades based on objective criteria.

Risk Management – Set stop losses, calculate position sizes, and establish drawdown limits.

Performance Tracking – Set realistic goals and measure progress over time.

A well-defined plan helps traders remain focused, preventing impulsive decisions driven by emotions. Regularly reviewing and adjusting the plan ensures it stays relevant as market conditions evolve. Having a structured checklist before entering a trade can help reinforce discipline and ensure that all key aspects have been evaluated before making a decision. Apex funding supports traders with structured risk management techniques to protect their capital.

Step 5: Transition to Live Trading

The psychological challenge of trading with real money differs significantly from practicing in a demo environment. To ease this transition:

Start Small – Trade with a modest account size to minimize emotional pressure.

Stick to the Plan – Follow the strategy and risk management rules without deviation.

Review Trades – Assess performance objectively to identify areas of improvement.

Developing emotional discipline is key at this stage. Traders who remain consistent despite inevitable losses are more likely to achieve long-term success. Emotional control strategies such as meditation, journaling, and structured reflection can be valuable in overcoming psychological barriers. Apex funded accounts provide traders with real capital, allowing them to gradually scale their trading careers.

Step 6: Establish Consistency in Trading

Consistency doesn’t mean never losing trades, it means executing a strategy effectively over time. Focus on:

Emotional Control – Avoid revenge trading or overleveraging to recover losses.

Trade Journaling – Document each trade, analyzing successes and mistakes.

Performance Adjustments – Regularly review results and refine strategies as needed.

Consistency in execution builds confidence and prepares traders for the next step securing funding. Maintaining consistency requires ongoing self-assessment and adaptation. Successful traders create systematic processes for evaluating their performance and making incremental improvements over time.

Step 7: Secure Funding Through a Proprietary Trading Firm

Once a trader demonstrates consistent profitability, accessing more capital can accelerate growth. Proprietary trading firms, such as Apex Trader Funding, offer traders the ability to trade with firm capital while keeping a significant portion of the profits.

Why Choose Apex Trader Funding?

Low-Cost Evaluations – Affordable entry fees allow traders to prove their skills without excessive financial commitment.

Generous Profit Splits – Keep up to 90% of the profits while trading with substantial firm capital.

Global Access, Including Brazil – Trade from anywhere with an internet connection, including opportunities for traders in Brazil.

No Time Limits – Trade at your own pace without unnecessary pressure.

Apex Coupon & Promotions – Take advantage of discounts and incentives to make evaluations more accessible. Use code “COPY” to get the latest discount.

Apex Trader Funding provides the perfect bridge between skill development and financial opportunity, enabling traders to scale their careers without relying solely on personal capital. Funding programs like these offer traders an invaluable opportunity to grow their careers while minimizing risk. For those looking for the best trading platform in Brazil or futures trading in Brazil, Apex Trader Funding's partnership with Apex trader funding offers excellent tools for market analysis and decision-making.

Conclusion

The path from an unprofitable trader to securing funding requires education, practice, discipline, and persistence. By following this structured 7-step roadmap, traders can systematically improve their skills, develop consistency, and access funded trading accounts in Brazil and beyond through Apex Trader Funding.

If you’re ready to take your trading to the next level, visit apextraderfunding.com today. With the right approach and mindset, your journey toward trading success starts now! For more insights and expert trading blogs, check out Apex Trader Funding's website.

#funded trading accounts in Brazil#instant funding prop firm in Brazil#best online trading platforms in Brazil

0 notes

Text

The Benefits of AI Training for Employees: Boosting Productivity and Efficiency

Artificial Intelligence is transforming workplaces across Australia and New Zealand. From automating routine tasks to enabling data-driven decision making, AI has evolved from an emerging trend to an essential business tool. However, implementing AI technology is only half the equation.

The true value emerges when employees understand how to leverage these powerful tools effectively. AI training represents a strategic investment in building a future-ready workforce that can confidently navigate digital transformation.

Whether you’re a business leader exploring operational improvements or a HR professional building internal capabilities, understanding the benefits of AI training is the first step toward organisational excellence in today’s digital landscape.

How Does AI Training Improve Employee Productivity in the Workplace?

AI technologies can dramatically increase output by reducing manual effort. However, their potential is only fully realised when staff know how to apply them strategically to their specific roles.

With proper training, employees can automate repetitive tasks like email filtering, data entry, report generation, and scheduling. This automation creates space for more creative and strategic work that delivers greater value to your organisation.

Trained staff complete tasks faster and with fewer errors, as they understand how to leverage AI tools for quality control and process optimisation. This efficiency boost translates directly to improved service delivery and customer satisfaction.

According to research by Deloitte (2024), organisations that implement AI and training can lead to substantial productivity improvements. These gains come from both time savings and enhanced quality of work output.

In What Ways Does AI Training Impact Operational Efficiency?

Efficiency isn’t just about speed – it’s about doing the right things at the right time with the right tools. AI training equips employees to streamline workflows, use data more intelligently, and eliminate unnecessary steps.

Trained staff can configure AI systems to monitor processes and identify bottlenecks automatically. This proactive approach means issues get resolved before they impact service delivery.

In customer service settings, AI-trained employees can implement chatbots and sentiment analysis tools to resolve enquiries faster and direct complex issues to the right specialists. This tiered approach optimises resource allocation across teams.

For finance or procurement professionals, training enables the automation of invoice matching and payment processing. These improvements reduce manual handling and associated errors while accelerating completion times.

Why Should Australian Businesses Prioritise AI Upskilling Right Now?

Australia’s workforce is experiencing rapid digital transformation, with AI adoption accelerating across industries. Federal and state governments now actively promote digital capability development to address emerging skills shortages.

Research by PwC Australia (2024) indicate that organisations implementing AI training programs can achieve higher performance ratings than those without structured upskilling initiatives. This performance gap is likely to widen as AI becomes more sophisticated.

According to the CSIRO, Australia is currently experiencing a productivity slump, with AI offering one of the best opportunities to reverse this trend. AI is increasingly viewed as a “general-purpose technology” useful across all companies and careers.

AI skills are increasingly in demand across virtually all roles – not just in IT or data science. From sales to HR and logistics to legal, professionals across the board are now expected to work competently with AI tools.

Conclusion

AI training represents a business critical investment for organisations aiming to remain productive, efficient, and competitive in Australia’s evolving digital economy. The ability to harness AI’s power depends directly on how well your people understand and apply these powerful tools.

The most successful AI transformations balance technology capabilities with human expertise. This complementary approach enhances both operational performance and employee satisfaction while creating sustainable competitive advantages.

At Sentrient, we help organisations across Australia and New Zealand equip their teams with the skills and knowledge needed to work confidently and compliantly with AI technologies. Our AI Awareness Course is designed to meet the specific needs of your industry, your workforce, and your compliance standards.

Need help getting started with AI training in your workplace? Connect with the Sentrient team to explore tailored learning solutions that support your productivity, efficiency, and long-term growth goals.

This given blog was originally published here: Benefits of AI Training for Employees

#sentrient#compliance management system#hr management system#compliance system#compliance management#manual handling training course#grc software#performance management#performance management system#grc compliance software

0 notes

Text

Key Components of the Trader's Dynamic Index Indicator

The TDI consists of three essential components that function as a system to display market activity.

RSI (Relative Strength Index):

The indicator evaluates price speed alongside movement changes to detect market conditions of overbought and oversold states.

If it goes too high or too low, very fast, it helps the traders to analyze when the price might reverse.

Moving Averages (Signal Line & Market Base Line):

The moving averages smooth the RSI while enabling traders to determine trend direction and strength.

This makes it easier for traders to understand that if the market is going up, down or staying flat in a very easy way.

Volatility Bands (Bollinger Bands):

Market movements are best expressed through these indicators to detect breakouts. This helps traders to analyse when the price might move quickly in one direction.

Through this combined methodology, traders can view the entire price activity from one consolidated platform. TDI functions as a complete trading system because it exists within a single indicator.

TDI Technical Analysis: How to Interpret the Signals

For the first time, one might find Traders Dynamic Index tricky, but once you understand the signals, it becomes a powerful tool for decision making. It helps you understand what the market is doing. It shows if the price is strong, weak, or going sideways which helps with when to buy, sell, or stay out of the market.

The green line is the main one to focus on, it shows direction and strength of the market. When it moves upward sharply, that usually means start buying. If it goes down it means selling pressure is high. A flat green line usually means the market is stable.

The red line works in parallel with the green line. When green crosses and moves past the red line, that’s the signal to buy. When it goes below the red line, that’s your clue to sell. The yellow line shows the overall trend.

If both the red and green lines are above the yellow line this supports the buy setup, vice versa if these are below yellow line, that points sell setup.

The blue band shows how active the market is. Wide bands mean more movement and possible breakouts. Tight bands suggest low activity.

0 notes

Text

Understanding Economic Growth: Key Drivers, Importance, and Future Trends

Economic growth is one of the most fundamental indicators of a country’s overall well-being and development. It refers to the increase in the production and consumption of goods and services over a specific period, typically measured by a rise in Gross Domestic Product (GDP). A robust economy provides better job opportunities, higher living standards, and improved public services. But what exactly drives economic growth, and how does it affect individuals and societies?

What Drives Economic Growth?

Several factors contribute to economic growth. While it’s impossible to pinpoint a single cause, the following key drivers play a significant role in accelerating growth:

Capital Investment:

Investment in physical capital, such as machinery, infrastructure, and technology, is a cornerstone of economic growth. When businesses and governments invest in better tools and processes, they enhance productivity and efficiency, leading to higher output levels.

Human Capital:

Education and workforce training are vital in increasing the skill level of workers. A well-educated and skilled workforce drives innovation and increases productivity, which in turn boosts economic growth.

Technological Innovation:

Technological advancements lead to more efficient production methods, lower costs, and the creation of new industries. From the industrial revolution to the digital age, technology has consistently been a key catalyst for economic progress.

Trade and Globalization:

International trade allows countries to specialize in what they do best, which leads to more efficient resource allocation. Globalization facilitates the exchange of goods, services, and ideas, thus promoting economic growth and stability.

Government Policies:

Sound fiscal and monetary policies—such as tax incentives, interest rates, and government spending—can significantly influence economic performance. Governments that implement policies fostering a business-friendly environment can spur both domestic and foreign investments, thus fueling growth.

Importance of Economic Growth

Economic growth has far-reaching effects on both a national and individual level. Here are some of the critical benefits:

Higher Living Standards:

A growing economy typically means more jobs, higher wages, and better access to essential services such as healthcare and education. As the economy expands, individuals enjoy an improved quality of life.

Job Creation:

Economic growth fosters a dynamic job market. Businesses require more workers to meet rising demand, and this leads to increased employment opportunities. Lower unemployment rates often correlate with higher economic growth.

Government Revenue:

A growing economy leads to higher tax revenues for the government without the need to raise tax rates. These additional funds can be used for public services and infrastructure development, further contributing to the country’s prosperity.

Increased Innovation and Investment:

As economies grow, there is more investment in research and development, leading to greater technological innovation. This cycle of investment and innovation supports long-term sustainable growth.

Challenges to Sustaining Economic Growth

While economic growth brings many benefits, sustaining it over the long term is not always straightforward. Countries often face challenges such as inflation, income inequality, environmental degradation, and political instability. These factors can impede growth or even reverse some of its benefits.

Future of Economic Growth

The future of economic growth lies in embracing new technologies like artificial intelligence, renewable energy, and automation. Countries that prioritize sustainable growth through innovation and responsible policies are likely to enjoy continued prosperity in the coming decades.

In conclusion, economic growth is essential for improving the well-being of nations and individuals alike. By understanding its key drivers and benefits, societies can make informed decisions about the policies and investments that will help sustain and enhance growth for generations to come.

1 note

·

View note

Text

High Win Rate Trading Strategies for Traders Tired of Market Chaos

High Win Rate Trading Strategies for Traders Tired of Market Chaos

Ready for reliable trading results? Discover high win rate trading strategies that cut through the noise, backed by data—not hype. No fluff, just proven systems for consistent profits.

Why Most Traders Fail: The Consistency Gap

Studies show over 75% of retail traders lose money due to emotional decisions and inconsistent methods. High win rate trading strategies offer stability by focusing on repeatable setups. By targeting statistically favorable trades, you reduce chaos and regain control—making consistency achievable.

Price Action: The Simplest High Win Rate Strategy

Price action trading uses historical price data, not lagging indicators, for precise entries. For example, using pin bar reversals on daily charts can yield win rates above 60%. Simplicity and clarity are key—perfect for traders who crave actionable systems and less clutter.

Trend Following: Ride the Momentum

Trend following strategies, such as using the 50/200 EMA crossover, historically capture 70% of major market moves. Backtested over decades, these methods cut losses quickly and let winners run. Their transparency and reliability attract traders seeking high win rate trading strategies without guesswork.

Risk Management: The Hidden Win Rate Booster

Even the best setups fail without robust risk management. Position sizing and 1:2 risk-reward ratios can double your win rate over time. According to data, traders who risk less than 2% per trade survive longer and outperform aggressive risk-takers. Secure your edge with disciplined money management.

Backtesting: Proof Over Promises

Before risking real capital, backtest your high win rate trading strategies on historical data. Platforms like TradingView or MetaTrader offer simple tools. A proven system with a 60%+ win rate across 200 trades is more trustworthy than any theory. This step transforms frustration into confidence.

Focus on proven, backtested strategies

Emphasize risk management for consistent results

Use simple price action or trend following for clarity

Ready to trade with confidence? High win rate trading strategies bring order to chaos—ditch overcomplication and start seeing measurable progress. Take action, test your plan, and watch your consistency grow.

What is the most reliable high win rate trading strategy?

Price action setups like pin bar reversals and trend following with EMA crossovers have proven reliability. When backtested, these strategies often deliver win rates above 60% when paired with strong risk management.

How important is backtesting in achieving a high win rate?

Backtesting is essential. It validates any strategy over hundreds of trades. Only systems with proven positive expectancy in backtesting should be traded live, ensuring you rely on data, not hope.

What’s your experience with high win rate trading strategies? Drop a comment or reblog if you found this useful. What’s one trading method you wish you’d mastered sooner?

0 notes