#Business Acquisition Loans

Text

We are a Nationally Recognized Financial Company Serving all of our Client’s Business Lending Needs. Here at Fund Business Loans, with our expertise as a Small Business Lender, We Syndicate and have Partnerships with National Lenders. We can Provide all of your Business Loan, Finance and Lease Needs. There are a Variety of Business Loans available from Term Loans, SBA loans, to Business Lines of Credit and Business Working Capital. Most Loan types come with Minimum Requirements that Borrowers need to Meet in Order to be Eligible to Apply for the Loan. Plus, They all come with their Own Requirements for Documents you’ll Need to have in order to Apply and Get Approved.

FBL Small Business Loans Memphis TN and nearby cities Provide Small Business Loans, SBA Business Loans, Business Startup Loans, Business Acquisition Loans, Accounts Receivable Financing, Short Term Loans, Business Loans, Lines of Credit, Invoice Factoring, Cash Advances, Commercial Equipment Financing, Used Equipment Financing, Commercial Real Estate Loans, Commercial Title Loans

Contact Us:

FBL Small Business Loans Memphis TN

555 S B.B. King Blvd. # E

Memphis, TN 38103

Phone: 901-542-8030

Email: [email protected]

Website: https://fundbusinessloans.com/top-small-business-lending-memphis-tn

0 notes

Text

We are a Nationally Recognized Financial Company Serving all of our Client’s Business Lending Needs. Here at Fund Business Loans, with our expertise as a Small Business Lender, We Syndicate and have Partnerships with National Lenders. We can Provide all of your Business Loan, Finance and Lease Needs. There are a Variety of Business Loans available from Term Loans, SBA loans, to Business Lines of Credit and Business Working Capital. Most Loan types come with Minimum Requirements that Borrowers need to Meet in Order to be Eligible to Apply for the Loan. Plus, They all come with their Own Requirements for Documents you’ll Need to have in order to Apply and Get Approved.

FBL Small Business Loans Leander TX and nearby cities Provide Small Business Loans, SBA Business Loans, Business Startup Loans, Business Acquisition Loans, Accounts Receivable Financing, Short Term Loans, Business Loans, Lines of Credit, Invoice Factoring, Cash Advances, Commercial Equipment Financing, Used Equipment Financing, Commercial Real Estate Loans, Commercial Title Loans

Contact Us:

FBL Small Business Loans Leander TX

16401 Lucky Hit Rd. # D

Leander, TX 78641

Phone: 737-757-0371

Email: [email protected]

Website: https://fundbusinessloans.com/top-small-business-lending-leander-tx

0 notes

Text

We are a Nationally Recognized Financial Company Serving all of our Client’s Business Lending Needs. Here at Fund Business Loans, with our expertise as a Small Business Lender, We Syndicate and have Partnerships with National Lenders. We can Provide all of your Business Loan, Finance and Lease Needs. There are a Variety of Business Loans available from Term Loans, SBA loans, to Business Lines of Credit and Business Working Capital. Most Loan types come with Minimum Requirements that Borrowers need to Meet in Order to be Eligible to Apply for the Loan. Plus, They all come with their Own Requirements for Documents you’ll Need to have in order to Apply and Get Approved.

FBL Small Business Loans Redding CA and nearby cities Provide Small Business Loans, SBA Business Loans, Business Startup Loans, Business Acquisition Loans, Accounts Receivable Financing, Short Term Loans, Business Loans, Lines of Credit, Invoice Factoring, Cash Advances, Commercial Equipment Financing, Used Equipment Financing, Commercial Real Estate Loans, Commercial Title Loans

Contact Us:

FBL Small Business Loans Redding CA

3057 Placer St. # E

Redding, CA 96001

Phone: 530-691-1288

Email: [email protected]

Website: https://fundbusinessloans.com/small-business-lending-redding-ca

0 notes

Text

Global Capital Finance for Business Growth

QI Capital has a team of seasoned Capital Investment Advisers here working globally. Our Private Investment Pool are seeking new partners in diverse industry sectors who are in need of long term Capital Investments of any size, for Business Growth, M&A or Refinance. We also offer an independent negotiated commission to consultants/brokers for any successful partnership referral. Contact us Today for a Free Evaluation.

Tel/Fax: +6568094050

Email: [email protected]

Website: www.qicapitalpte.com

#Private Capital#Capital Investments#Business loans#Loan for business#Mergers and Acquisition Finance#Business bounce back loans#Asset Finance#Business Asset finance#Asset finance brokers#Construction asset finance#Commercial and asset finance#Mining Loans and Finance#Commercial Finance

0 notes

Text

Financing Options To Start a Business

Discovering the perfect financing options to start your dream business is now within reach, thanks to Secrets to Success. Their comprehensive guidance, as featured on secrets to success, empowers aspiring entrepreneurs to navigate the intricate world of business funding. From traditional loans to innovative crowdfunding platforms, their expert insights shed light on diverse pathways to secure capital. Uncover the key strategies to tailor your financing approach, ensuring compatibility with your unique business model. Whether you're a novice entrepreneur or seasoned visionary, Secrets to Success equips you with the knowledge and resources necessary to make informed financial decisions, transforming your startup vision into a flourishing reality.

#loan options for business#need business funding#acquisition financing loan#business real estate financing#residential real estate financing

0 notes

Text

Worth Avenue Capital: Florida Direct Private Lender

Worth Avenue Capital has been providing commercial real estate and small business loans in Palm Beach and all of South and Central Florida since 2008. Worth Avenue Capital specializes in providing hard money funding and financing solutions as well as advisory services for both small businesses and real estate developers who are having difficulty obtaining conventional bank financing.

#Worth Avenue Capital#Worth Avenue Capital Florida#Private Business Lending#Private Business Lending Florida#Small Business Loans Florida#Real Estate Loans Florida#Commercial Real Estate Acquisition Loan#Florida Direct Private Lender#private lending#private lender#Alternative Financing#Private Loans

1 note

·

View note

Text

𝗼𝗻𝗲 𝘄𝗮𝘆 𝗼𝗿 𝗮𝗻𝗼𝘁𝗵𝗲𝗿 | neil lewis x reader

𝘀𝘂𝗺𝗺𝗮𝗿𝘆 | a visit to gumshoe video could go one of two ways... but one way or another, you're gonna get him.

𝘄𝗼𝗿𝗱 𝗰𝗼𝘂𝗻𝘁 | varies

𝘄𝗮𝗿𝗻𝗶𝗻𝗴𝘀 | smut (18+ only), enemies to lovers, nothing too terrible just neil and reader bullying each other

this is a choose your own ending fic!! after the introduction, click to choose which way you want the story to go! each ending will have its own warnings section, so read those as well!

Technically, you always dressed well for work. Corporate jobs require professional attire, obviously; but you were slightly overdressed today, and it wasn’t to go into the office.

Tight skirt and matching blazer, a silky-satin button-up, black heels, and thigh-high stockings with a seam up the back. No, this wasn't how you dressed for a day in the office… this was how you dressed when you were closing a deal.

A little bell dinged as you walked into Gumshoe Video, and you looked around for a moment after you stepped inside: the decorations were… plentiful, and kitschy. The displays were so small, and just a quick glance at some of the shelves had you frowning in confusion. These are some seriously deep cuts… how do they make any money at this place?

Lucien came bounding up to you in an instant, hands pressed tight against his horribly out-of-fashion skinny jeans as if to hide that they were clammy already. "Do you, uh, need help finding anything?" he asked.

You offered him a pitying smile, about to offer him a friendly ‘no thanks, but’ and then tell him why you were really here… but you were interrupted.

Jonathan, who had taken a break from sipping on a soda behind the counter, coughed to get Lucien's attention as he quickly shook his head. He didn't seem to understand, though, looking back at you with his brows furrowed.

"Uh, ignore him,” Lucien laughed nervously. “Are you looking for a rental?"

"Dude, she's not here to get a movie!" Jonathan snapped. "Who dresses like that to pick up a tape?!"

"Maybe she's on her way to work!" Lucien returned sharply. "Or maybe she just came from somewhere!"

"Where?"

"My dreams!"

"No, your friend is right, I'm not here to pick up a movie," you admitted, and Lucien looked at you nervously.

"You, uh, don't like movies?" he wondered.

"I love them actually, but—"

The door to the office swung open, with Neil glaring at you from the other side of it. "You," he announced with disdain.

"—but I'm here to speak with the owner," you finished, tilting your head and grinning at Neil.

"We have nothing to speak about," Neil assured you as he walked towards you.

"We have multiple opportunities to discuss," you disagreed, "and my employers are very anxious that I deliver this message to you, so if we could please speak in your office—"

"Her employers? Is this chick in the mob?!" Lucien blurted out fearfully. "Neil, I know money's tight, but— oh fuck, was that 'small business loan' just a cover—"

"She's not from the mafia," Neil sighed. "They actually have some morals."

You extended a hand to introduce yourself to Lucien. After your name, you told him your job: "Head of Acquisitions, Media Giant, LLC."

Jonathan coughed again, poorly covering the sound of him saying "blood-sucking harpy" under his breath.

You smiled at him; "You really should get that cough checked out," you suggested pointedly.

“Whatever it is your puppet-masters want you to discuss with me,” Neil began, wiggling his fingers as if pantomiming a little marionette show, “you can take right over there into our women’s restrooms and shove directly up your ass.”

“Oh, that’s cute,” you smiled, “I bet you’ve been saving that one since our last little visit. Can we go to your office now?”

“No, you can’t go in there— we just had the priest come by and bless it, we wouldn’t want your feet to burn now, would we?” Neil snarked in return.

“Fine— get it out of your system,” you encouraged. “Say whatever’s been stuck in that pretty little head for the last month waiting for me to come back, and then we can have our meeting, alright?”

“I— well, uh—” Neil stalled, looking a little flustered as he suddenly leaned on a shelf of tapes with one hand. “You think I’m pretty?” he mumbled nervously, running his free hand through his hair— only to put a little too much weight on the shelf and nearly tilt it over, having to scramble to catch it and make sure it was balanced again.

“Dude, pull yourself together,” Jonathan snapped at him, and Neil glared at him before looking back at you.

“Fine, okay— we can have a very brief conversation in my office,” Neil offered with a sigh, motioning for you to follow him, “but it’s going to go the same way it did last time: with me telling you hell no and you having to do the walk of shame back to your headquarters.”

“Looking forward to it,” you smiled, waving goodbye to the other men before stepping into Neil’s office as he shut the door behind you.

You watched him step around you to sit at his desk, looking at you expectantly with his legs spread and his fingers interwoven in his lap.

“Am I allowed to ask why you’re dressed like a cowboy, by the way?” you asked with a raised eyebrow, and he frowned at you as he tossed aside the hat and slipped the poncho off over his head, leaving just a much more normal outfit of jeans and a button-up underneath.

“We’re running a special on Westerns,” he explained, “it’s fun, okay? Not that you would know fun if it smacked you on the ass and called you sweetcheeks.”

“Honey, that’s just what I call a Friday night,” you smirked as you stepped a little closer leaning against the side of his desk as he swallowed thickly. You couldn’t just sit across from him— you needed to keep the upper hand. “But I’m here for business. Let’s talk business, shall we?”

“Right, business,” he frowned. “I’m guessing your business here today is trying to buy my store, again?”

“Something like that,” you relented.

“You know, I guess I should take it as a compliment,” he grinned, leaning back further in the chair. “Clearly, you know I’m a threat.”

“Please,” you rolled your eyes, “we’re a Fortune 500 company, and you’re a guy wearing a poncho.”

“I took off the poncho!” he defended.

“So you’re… just a guy, then,” you corrected. “The point is, we’re not worried about you stealing our business at all. We just think this location is going to waste.”

“You want the real estate?” he realized.

“You’re in a perfect spot, you know,” you informed him, “you just need… a little more help utilizing it.”

He sneered at you sharply. “I don’t want anything from you.”

“You only hate me so much because you resent success,” you informed him with a sigh. “Just because you’re broke and proud doesn’t mean making money is a sin.”

“It is when you put making money above everything else,” he replied, “like creativity and community and the authentic customer experience—”

“How exactly does Media Giant conflict with those things?” you scoffed. “We’re a company founded on creativity— and we always foster community—”

“Spare me the doublespeak, Big Brother,” Neil scoffed, “you’re just a bunch of— of robots! Your whole company, it’s just full of people trying to make a quick buck, top to bottom: you think the people in the back at McDonald’s give a fuck about food? That’s what you are, the McDonald’s of the film industry. You’d probably let a monkey work there if it could wear a nametag and convince someone to rent Fast and Furious Fifty or whatever the fuck.”

“Fine,” you sighed, “let’s just say for a moment that you’re right. That my company is so terrible because we don’t employ people like you.”

He relaxed for a second, and you leaned in closer in hopes that he was really listening.

“This is your chance to fix that!” you explained. “You can save us from the inside out, you know. You can start from the bottom, be our best sales guy, and then it turns into a promotion and a raise and soon you’re climbing the corporate ladder— where you can make some real change.”

He shook his head, laughing a little. “That’s not actually possible, it’s just a fantasy you tell all your little minions to keep them compliant.”

“It’s what I did,” you shrugged.

“You?” he realized with a laugh. “You, in one of those navy vests and nametags, selling people tapes?”

“I’m sort of a cinephile,” you admitted. “I wanted a job where I could talk about movies all day— and thanks to me, that Media Giant location rented out more copies of The Seventh Seal than all the rest combined.”

He stood up quickly, stepping closer to where you sat on his desk. “Y-you like The Seventh Seal?”

“It’s a masterpiece,” you answered, speaking a little softer as he was so close, “Bergman is a genius.”

A strange look crossed over his face, a heavy-lidded sort of look as he examined you. “Tarantino?”

“Overrated, but not bad,” you replied quickly.

“Tarkovsky?”

“Good, but hard to watch.”

“Lynch?”

You scoffed; “Don’t insult me.”

He laughed a little, crossing his arms and looking away from you. “You could be one of the good ones,” he realized, “but you sold out. And now you’re just a suit.”

“It’s not so bad,” you smirked, “I think you’d like a little more… structure, given the chance.”

“And that’s what you’re offering?” he pressed, and you nodded.

“We’ll let you keep the name, your employees… most of the decoration,” you offered, “you’ll just be technically a Media Giant franchise. You have nothing to lose, and so much fucking money to gain.”

He sighed a little, looking at you again. You could tell he was considering it, but not very thoroughly. All you could do was hope for the best, and wait for an answer…

CLICK HERE FOR THE SUB!NEIL ENDING

CLICK HERE FOR THE DOM!NEIL ENDING

#cillian murphy x reader#cillian murphy smut#neil lewis x reader#neil lewis smut#dom!neil lewis smut#sub!neil lewis smut

1K notes

·

View notes

Text

Inspired by @hiemaldesirae's deer sinner Vox designs (1 | 2) and his Attic-Wife Vox AU

My brain got away from me and this is a thing now.

Wrote this instead of working on my wip oops sorry

Alastor stumbles across a very peculiar scene one day - another deer demon, currently pressed into the ground by a foot on his back and cornered gang of loan sharks in a side alley. He's freshly fallen, he reeks of it. He also smells of something else, like...ozone and something burning. One of the sharks holds a black chain that wraps around the new Sinner's neck.

Ah, it appears the freshling has already gotten himself wrapped up in an unfortunate deal and he seems none too please with it. The blue deer is snarling, baring sharp teeth and glaring up at his captors. And Alastor sees it. They are small, hardly anything, but the Sinner is sparking, blue bursts rippling over his frame as he struggles.

The sharks are too busy talking about what to do with their new prize to notice. They ponder selling him to a butcher ("I hear venison fetches a pretty penny these days") or perhaps the current Overlord of the sex industry, a lecherous bull with a notorious taste for freshlings.

No, Alastor decides for them that neither of these options will do. He will not leave such raw, untapped potential in the clutches of these buffoons. He approaches.

The idiots are thankfully not foolish enough to attempt to deny him what he wants (and oh but greedy things are so easy to manipulate) and soon enough he is leaving with the strange Sinner in tow, a now brightly glowing green chain secured around his throat. He has said nothing thus far, only clutching at the chain like a petulant child and glaring at Alastor's back as they walk to the Radio Demon's townhouse on the edge of the district, just bordering Cannibal Town.

Setting his new acquisition on the couch with a firm order to "stay," Alastor sets towards the kitchen.

"Coffee or tea, my dear?"

The question startles the blue deer and Alastor finally gets to hear his lovely voice. "What?"

Alastor hums. "It really is a simple question, darling. I hardly think it warrants repeating."

The freshling fidgets in his seat before finally requesting a coffee.

Alastor watches him while he prepares their drinks. He is a lovely thing, if not a little odd. Where his antlers should be are instead antenna. He's a little on the scrawny side and likely hasn't eaten much since the Fall. He is wearing a tattered suit that sits a little too large on him and he could definitely use a proper bath. The Radio Demon considers that he's probably been on the streets since his arrival in Hell. His bravado has started to fade now, replaced with uneasiness and a hyperawareness particularly reminiscent of the prey animal they both embody.

The red deer returns to the living room with their drinks and doesn't miss the slight scrunch of the Sinner's nose when he takes his first sip. "Is it not to your liking?"

The Sinner tenses and starts to mumble excuses until Alastor's seizes him by his jaw and forces their eyes to meet.

"Do not lie to me."

Blue ears flatten against the freshling's hair. "I...it's fine...I just usually use cream and sugar, that's all. It's totally fine."

Alastor scoffed. "Why didn't you say so?" He waves his hand and summons a tray with a small pitcher of cream, a sugar bowl, and a plate of biscuits for good measure. He really was much too thin. Typically he would have preferred to have made them himself, but he hadn't been expecting company. "There, help yourself."

"Why are you being so nice to me?" the blue deer challenges. "No one has been this nice to me since I got here, so why?"

Alastor considered for a moment. "Well, I suppose you haven't given me a reason to be cruel to you yet. Would you like to?"

"No!" the freshling said quickly. "No, I..."

"Then there's nothing to be concerned over. Now eat, darling. It may not kill you, but I can assure you starvation is not a pleasant experience." Of course, he wasn't speaking from personal experience, but he'd witnessed it enough to make the assumption.

The Sinner doesn't respond, only nods and takes a biscuit from the tray. His movements are slow and cautious as he adds the cream and sugar to his coffee and he hunches inward, as though trying to make himself small. Alastor leaves it for now and sips his tea. He can feel it even from his perch on the other side of the couch, the power thrumming under the Sinner's skin. He wants to taste it, but no. That will come later. First he must get this man to trust him, rely on him, then he will make his move.

Once their cups are empty and the blue deer has eaten (though not without an absurd amount of prompting) an adequate amount of biscuits for Alastor to be temporarily satisfied (they will work on this, certainly), the Radio Demon brings him upstairs to the room that has been forming and arranging itself all this time. It is elegant and warm, doused in rich dark reds and mahogany. The signal he has been steadily pumping out is already having its intended effect. The freshling follows him sluggishly into the room, eyes lidded and unfocused. It takes nothing at all to guide him to the bed.

Alastor banishes the ruined items that passed for clothing without a second though, replacing them with a soft nightgown. Much better. It compliments the Sinner so much more than that ugly suit. The Sinner doesn't even seem to notice, too far gone to focus.

When Alastor has settled him under the covers, he sets the record player to a soft melody and leaves. Passing his hand over the door, he hears the lock click as several arcane runes glow bright across the wooden surface. An extra precaution. He hums the tune drifting from the room as he heads towards his study.

What a fun new pet he has found.

#deer wife au#hazbin hotel#hazbin vox#hazbin alastor#radiostatic#alice rambles#hazbin hotel vox#vox hazbin hotel#hazbin hotel au

80 notes

·

View notes

Text

Private equity ghouls have a new way to steal from their investors

Private equity is quite a racket. PE managers pile up other peoples’ money — pension funds, plutes, other pools of money — and then “invest” it (buying businesses, loading them with debt, cutting wages, lowering quality and setting traps for customers). For this, they get an annual fee — 2% — of the money they manage, and a bonus for any profits they make.

On top of this, private equity bosses get to use the carried interest tax loophole, a scam that lets them treat this ordinary income as a capital gain, so they can pay half the taxes that a working stiff would pay on a regular salary. If you don’t know much about carried interest, you might think it has to do with “interest” on a loan or a deposit, but it’s way weirder. “Carried interest” is a tax regime designed for 16th century sea captains and their “interest” in the cargo they “carried”:

https://pluralistic.net/2021/04/29/writers-must-be-paid/#carried-interest

Private equity is a cancer. Its profits come from buying productive firms, loading them with debt, abusing their suppliers, workers and customers, and driving them into ground, stiffing all of them — and the company’s creditors. The mafia have a name for this. They call it a “bust out”:

https://pluralistic.net/2023/06/02/plunderers/#farben

Private equity destroyed Toys R Us, Sears, Bed, Bath and Beyond, and many more companies beloved of Main Street, bled dry for Wall Street:

https://prospect.org/culture/books/2023-06-02-days-of-plunder-morgenson-rosner-ballou-review/

And they’re coming for more. PE funds are “rolling up” thousands of Boomer-owned business as their owners retire. There’s a good chance that every funeral home, pet groomer and urgent care clinic within an hour’s drive of you is owned by a single PE firm. There’s 2.9m more Boomer-owned businesses going up for sale in the coming years, with 32m employees, and PE is set to buy ’em all:

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

PE funds get their money from “institutional investors.” It shouldn’t surprise you to learn they treat their investors no better than their creditors, nor the customers, employees or suppliers of the businesses they buy.

Pension funds, in particular, are the perennial suckers at the poker table. My parent’s pension fund, the Ontario Teachers’ Fund, are every grifter’s favorite patsy, losing $90m to Sam Bankman-Fried’s cryptocurrency scam:

https://www.otpp.com/en-ca/about-us/news-and-insights/2022/ontario-teachers--statement-on-ftx/

Pension funds are neck-deep in private equity, paying steep fees for shitty returns. Imagine knowing that the reason you can’t afford your apartment anymore is your pension fund gambled with the private equity firm that bought your building and jacked up the rent — and still lost money:

https://pluralistic.net/2020/02/25/pluralistic-your-daily-link-dose-25-feb-2020/

But there’s no depth too low for PE looters to sink to. They’ve found an exciting new way to steal from their investors, a scam called a “continuation fund.” Writing in his latest newsletter, the great Matt Levine breaks it down:

https://news.bloomberglaw.com/mergers-and-acquisitions/matt-levines-money-stuff-buyout-funds-buy-from-themselves

Here’s the deal: say you’re a PE guy who’s raised a $1b fund. That entitles you to a 2% annual “carry” on the fund: $20,000,000/year. But you’ve managed to buy and asset strip so many productive businesses that it’s now worth $5b. Your carry doesn’t go up fivefold. You could sell the company and collect your 20% commission — $800m — but you stop collecting that annual carry.

But what if you do both? Here’s how: you create a “continuation fund” — a fund that buys your old fund’s portfolio. Now you’ve got $5b under management and your carry quintuples, to $100m/year. Levine dryly notes that the FT calls this “a controversial type of transaction”:

https://www.ft.com/content/11549c33-b97d-468b-8990-e6fd64294f85

These deals “look like a pyramid scheme” — one fund flips its assets to another fund, with the same manager running both funds. It’s a way to make the pie bigger, but to decrease the share (in both real and proportional terms) going to the pension funds and other institutional investors who backed the fund.

A PE boss is supposed to be a fiduciary, with a legal requirement to do what’s best for their investors. But when the same PE manager is the buyer and the seller, and when the sale takes place without inviting any outside bidders, how can they possibly resolve their conflict of interest?

They can’t: 42% of continuation fund deals involve a sale at a value lower than the one that the PE fund told their investors the assets were worth. Now, this may sound weird — if a PE boss wants to set a high initial value for their fund in order to maximize their carry, why would they sell its assets to the new fund at a discount?

Here’s Levine’s theory: if you’re a PE guy going back to your investors for money to put in a new fund, you’re more likely to succeed if you can show that their getting a bargain. So you raise $1b, build it up to $5b, and then tell your investors they can buy the new fund for only $3b. Sure, they can get out — and lose big. Or they can take the deal, get the new fund at a 40% discount — and the PE boss gets $60m/year for the next ten years, instead of the $20m they were getting before the continuation fund deal.

PE is devouring the productive economy and making the world’s richest people even richer. The one bright light? The FTC and DoJ Antitrust Division just published new merger guidelines that would make the PE acquire/debt-load/asset-strip model illegal:

https://www.ftc.gov/news-events/news/press-releases/2023/07/ftc-doj-seek-comment-draft-merger-guidelines

The bad news is that some sneaky fuck just slipped a 20% FTC budget cut — $50m/year — into the new appropriations bill:

https://twitter.com/matthewstoller/status/1681830706488438785

They’re scared, and they’re fighting dirty.

I’m at San Diego Comic-Con!

Today (Jul 20) 16h: Signing, Tor Books booth #2802 (free advance copies of The Lost Cause — Nov 2023 — to the first 50 people!)

Tomorrow (Jul 21):

1030h: Wish They All Could be CA MCs, room 24ABC (panel)

12h: Signing, AA09

Sat, Jul 22 15h: The Worlds We Return To, room 23ABC (panel)

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/07/20/continuation-fraud/#buyout-groups

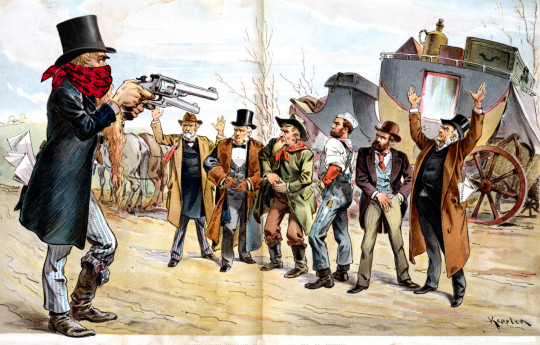

[Image ID: An old Punch editorial cartoon depicting a bank-robber sticking up a group of businesspeople and workers. He wears a bandanna emblazoned with dollar-signs and a top-hat.]

#pluralistic#buyout groups#continuation fraud#pe#pyramid schemes#the sucker at the table#pension plans#continuation funds#matt levine#fiduciaries#finance#private equity#mark to market#ripoffs

309 notes

·

View notes

Text

Yours Submissively ~ Control

Steve Rogers X OFC Isabella Davis

Summary: Five Years after the events of Civil War, Steve Rogers has moved on from avenging and has started his own business, Grant Inc. He has a secret that would turn his world upside down. And he's good at keep that secret. Until he meets the woman with violet eyes that could bring him to his knees. Now his mission is to make her, his. But she is the key that could bring the world into balance... or chaos. And she has no idea.

Series Warnings: slow burn at the beginning, smut, angst, sexual themes of BDSM, dom/sub dynamics, kidnapping, (and a bunch of others that will come up)

A/N I can't decide which banner I like more. Let me know what you think

Dividers by @firefly-graphics

I do NOT give permission for my work to be translated or reposted on here or any other site, even if you give me credit. DO NOT REPOST MY FICS. Reblogs, comments, likes, and feedback ALWAYS appreciated

Previous: Prologue

Series Masterlist ~ Main Masterlist

Five years earlier…

Steve Rogers was tired.

Tired of the fight.

Tired of the demand.

Tired of the politics behind his shield.

Just tired.

Retiring was the right move.

But what does he do now?

“Hey Tony, can I talk to you?”

Present day…

Getting the loan from Tony was the best idea he could have had. Grant Industries was thriving five years later. Steve had built the business from the ground up. Sure it helped that he used to be Captain America but when his first successful takeover happened, people really started to take notice.

Making Sam his number two was the second best decision. He was savvy with the business and made sure that Steve kept on track. When Sam married Natasha, she joined the company as well. She was now his lawyer.

Bucky elected to be Steve’s head of security. Sure, he was a super soldier but as a businessman, the threats were more than before. Bucky felt better knowing he was close to Steve but at the same time doing something good. He wanted nothing but the best for his best friend.

Yes, things were working out for Steve in his business. At home, he had a beautiful penthouse. Bucky lived with him and his housekeeper in the staff quarters and he had the place mostly to himself. Except on the weekends.

On the weekends, he did have a guest who would entertain him. Because deep down, Steve missed having control. He had control when he led the Avengers. And it sated that part of him for the most part. But now, he needed it more.

Sharon had introduced this life to him while he was still avenging. Learning how to control and be controlled. Submitting and being submitted to kept Steve calm. Control was all he wanted.

Submissives weren’t hard to find in New York. But he hadn’t had one since Lizzy left. So boredom was starting to seep in. Boredom could be dangerous, expensive even. The last time he was bored, he bought out a publishing house. Granted it was making a profit now but Steve has learned, don’t be bored for too long.

“Devon, can we go through my schedule?” Steve called through the intercom to his assistant.

“Right away sir.” Devon walked in holding her tablet with Steve’s schedule. She has been his assistant since the beginning and ran his office like a fine Swiss watch. He appreciated her hard work and attention to detail.

“What’s on the agenda?”

“You have a meeting with Mr. Wilson and Mrs. Romanoff-Wilson in 20 minutes to discuss a new acquisition. You have a training session with Mr. Barnes right before lunch here in your private office gym. You have a meeting with Mr. Miller on the development of a tech piece he wanted to present. A Delilah Stevens is stopping by with a need for signatures regarding the new deal with Stark Industries. After, Mr. Barnes will take you home to prepare for the gala event this evening.”

“What gala?”

“It’s the fundraiser for the recovery efforts in Sokovia. You told Miss Maximoff you would attend.”

“Damn. Alright. I guess I have no choice in that one.” Steve sighed. “Am I seated alone?”

“No, Miss Maximoff and Mr. Stark are sending someone to be the liaison for you. Mr. Wilson and Mrs Romanoff-Wilson are also attending.”

Steve rolled his eyes. “Alright. Have the intern bring me a coffee and let me know when Sam and Natasha get here.”

Devon left the office and sent her intern, Cindy in with the coffee. Steve rolled his eyes again at the little girl in front of him. She was a vapid girl, but she was Senator Ward’s daughter, and he needed the Senator in his pocket. She left after batting her eyes at him. As he read his daily reports, Devon called when Sam and Natasha were on his floor.

Married was a good look on Sam Wilson. He walked in with confidence, holding door for his wife, Natasha. Natasha Romanoff-Wilson, ex-assassin and corporate lawyer, was the best fit for Grant. She treated the opposition as she would have the enemy. They made a great team to get everything Steve ordered done.

“Hey Cap, how are you today?”

“How many times, Wilson, have I asked you to stop calling me that?”

“Old habits die hard,” Sam said with a laugh. He shook Steve’s hand and Steve kissed Natasha’s cheek before settling down to business. “Steve, as you know, the university in New Jersey is looking into funding for its engineering program.”

“Shouldn’t Stark be the more appropriate company to sponsor something like that?”

“You would think,” Natasha said, “but we need the exposure. Stark has a few interns but would need to lose one or two and they want us to take them on. So sponsoring the program would be a good tie in.”

“If it boosts our profile, I guess its ok. But can we also get another program as well. Something in education?” Steve wanted to be of service to all.

“We can, absolutely,” Sam said. “We can look at the background of some of the interns.”

“Perfect. What else?”

The meeting continued for a few hours until it was time for Steve’s training session. “I don’t know why you keep training Steve. You’re retired,” Sam commented.

“Because when you have the serum running through you, you have to burn out the energy somehow.”

“Then get a girl.” Sam smirked at him. “That will get you to burn off some eagerly.”

“Sam!” Natasha smacked her husband.

“I’ll work on that Wilson. Natasha, see you tonight? Save me a dance?”

“Of course Steve.” Natasha kissed Steve’s cheek.

“See you tonight Rogers,” Sam shook Steve’s hand. He took Natasha’s hand and led her from the room.

Steve headed into his en-suite to change for his workout with Bucky. Bucky was already in the private gym, lifting when Steve came in. “Hey Steve,” he said with a grunt.

“Hey Buck.” Steve took off his sweatshirt. “What are we doing today?”

“Just a spar. Let you go out full. I hear a little frustration today.”

“Just have to go to an event for Wanda and Stark and they are ‘assigning’ me a date.”

Bucky chuckled. “Why not invite one of the girls…”

“Because that is not why I have them there for.” Bucky was the only one who knew of Steve’s preferences. He made sure that the girls came and went unnoticed. “I don’t need them to think that I want something more.”

“But don’t you?” Bucky and Steve circled each other in the ring.

“No, they would just become a distraction or worse, a target.” Steve threw a punch. “Besides, all of these women only want the shield and not me. I don’t want that.”

“Maybe one day you’ll find someone who will like you for you,” Bucky said, jumping from the leg sweep. It is possible.

“I don’t want to talk about this, Buck.” Steve grunted as Bucky landed a punch to his solar plex. “I just want to get through this day.”

Steve went to shower and review the business for the rest of the day. Devon calls him, “I have an Isabella Davis here for signatures, sir.”

“I thought it was Delilah Stevens.”

“I’m sorry sir.”

“It’s alright. Send her in please.”

Steve looked back down at the report he was reading. His office door opened and a flurry of arms and legs landed on the floor. Steve rushed over. “Are you alright?”

Her face looked up at his to see the most startling violet blue eyes he had ever seen.

Next

Taglist:

@patzammit @texmexdarling @slutforchrisjamalevans @jennmurawski13-writes @firephotogrl74 @tinkerbelle67 @before-we-get-started @bunnyforhim @alexakeyloveloki

#andy's hea#andy's shenanigans#yours submissively#chris evans fanfiction#steve rogers au#steve rogers smut#steve rogers fanfiction#Steve Rogers x OFC#Bucky barnes#chris evans#mcu fanfiction#Steve rogers#steve rogers imagine#chris evans au#avengers au

55 notes

·

View notes

Text

Northern Songs & NEMS in 1969

I wrote this up to get my head around the business side of things surrounding the breakup and I thought I'd throw it up here for all you people who don't feel like wading through You Never Give Me Your Money/The Love You Make.

Brian had managed The Beatles via NEMS, which is to say that their contract was with NEMS and not Brian himself. The group didn't want to be managed by Clive Epstein and didn't care for Robert Stigwood (who had become partners with Brian, which the Beatles didn't learn till August '67) because he'd rejected them in '62. After the contract expired in September 1967, the group decided to manage themselves. NEMS was jointly managed by Clive Epstein and Robert Stigwood for a while until they split fairly amicably. Clive retained NEMS. The inheritance tax for the holding was due on March 31, 1969, and he did not have the money to pay it.

In early 1969, Clive informed The Beatles that he was looking to sell NEMS*. Paul asked the Eastmans for advice, who told him they should borrow money from EMI to buy NEMS outright. The reasoning being: after Brian's death, it came to light that NEMS was entitled to 25% of the record sales for the next nine years. Owning NEMS would mean the company could no longer claim commission from them. However, Allen Klein advised the group not to go ahead with the purchase, pointing out that the loan they took out from EMI would be difficult to repay.

Paul favoured the Eastmans as the group's managers, while the other three preferred Klein. The Eastmans had several things going against them:

They were Paul's brother and father-in-law and would therefore be biased in his favour.

They were more 'class-conscious' people, which means they owned Picassos and wore suits all the time. Paul was attracted to this kind of thing while John and George were repelled by it.

They made several tactical errors while dealing with Klein and the rest of the group.

When John Eastman, Klein and The Beatles all met for the first time to discuss the acquisition of NEMS, Eastman went in on Klein for all his crooked dealings (he had been accused of insider trading** with a company he owned and had been in trouble with the IRS for failing to file tax returns.) He must've expected Klein to fire back at him in the same fashion but, as per Peter Doggette's book, he 'calmly defused the row,' making Eastman look like a psycho and Klein a reasonable, victimised man. This basically only served to solidify the other three's (John's) support for Klein, but for the time being, they were going to try to work together: Klein was to produce a statement of The Beatles' financial situation, and the Eastmans were appointed legal advisors to Apple Corps.

The arrangement was doomed from the start because Klein wasn't exactly being cooperative with the Eastmans, sending them bundles of documents of no importance whatsoever. Things only got worse after Lee Eastman wrote Clive Epstein to suggest a meeting where they could discuss, among other things, the 'propriety' of the negotiations that Brian carried out with EMI on the group's behalf in '66. This incensed Clive, because what do you mean propriety? Are you calling my dead brother a crook? And he went off and sold Queenie Epstein's 70% stake in NEMS to a Leonard Richenberg of Triumph Investments.

As a reminder, NEMS took a 25% commission on The Beatles royalties. That company is now majority owned by Some Guy. A quarter of The Beatles' earnings are lining the pockets of Some Guy. This was a huge blow to the Eastmans. The Beatles told EMI that all their royalties (including NEMS' 25%) should be sent to their own bankers, but, confused, EMI threw up their hands and decided to withhold the money until they sorted out the issue.

We're up to about February/March 1969 now. Apple is still haemorrhaging money and The Beatles' main revenue source has been blocked off. And we haven't even gotten into the Northern Songs fiasco yet.

Note - pie charts NOT to scale!

Northern Songs went public in February 1965 to reduce its income tax burden and the 1,250,000 shares on offer sold out in sixty seconds. At the time of flotation, John, Paul, Dick James, and Charles Silver (partner of Dick James - no not that way) all had 15% stakes in the company. Dick James Music and NEMS both held 7.5% stakes, and George and Ringo each had 1.6% stakes. In June 1968, George got rid of his shares entirely which, like Ringo's, had by then whittled down to 0.8%.

The situation by 1969 was basically what you see above. As you all know, Dick James and Charles Silver sold their shares to ATV in March 1969, giving them 35% of the company and the majority stake. The Beatles and Co. could only cobble together 30%. But if they could get Consortium, a group that held a 14% stake in Northern Songs, to sell its shares to them, they could take back control of the company.

At the same time, relations within the group continued to deteriorate. The Eastmans advised Paul to not add his block of shares to John's as collateral for the loan they needed for their takeover bid and Klein offered his £750,000 worth of shares in MGM to make up for it. He also informed John that Paul had been buying more shares in Northern Songs. As things stood, John had 644,000 and Paul had 751,000.

While it was true that Paul had increased his standing in Northern Songs on advice of the Eastmans, he couldn't have bought much more than 1,000 extra shares. The real reason for the discrepancy was that part of John's stake, roughly 100,000 shares and 2% of the company in total, had been put aside for Cyn and Julian. Roughly the same distribution in shares had existed since at least 1966*** and Cyn had been allowed to retain the 2% after the divorce. But, if you take that fact out of the equation and just present the massive difference in their stakes and the fact that Paul had been buying more shares, it looks quite damning. After this meeting, John, George, and Ringo effectively banished the Eastmans from Apple.

Meanwhile, since The Beatles had already fulfilled their 1967 deal with EMI, Klein got to work on negotiating a new deal for the group with the blessings of all four Beatles.**** He also got permission from the group to go into Apple and start cutting redundancies. By the end of April, he had drawn up a three-year management contract for The Beatles to sign. The terms were:

ABKCO (company run by Allen and Betty Klein) is appointed exclusive business manager to Apple Corps on behalf of The Beatles and their companies

ABKCO recieves 20% of Apple's income before tax. The percentage would continue for any deals signed while the contract was in force, with a few exceptions.

• He would not receive any percentage of The Beatles' royalties until he negotiates a new deal for the group.

• He would only receive 20% of the increase royalty, not the full rate.

• He could only claim 10% of the income generated by Apple Records

Apple would pay the expenses of Klein and any other ABKCO staff working on their behalf.

The four of them initially agreed to the deal. Loony Toons-type hijinks occurred when the group attempted to sign the contract. It was first brought to John. The version he signed had last minute clause added in by the group's advisors that made the document into a basis for further discussion instead of a binding deal. John showed off the signed contract to Klein, who wanted the clause removed. By this point, the guy who brought the contract to John, lawyer Peter Howard, was already on the way to George's house and discovered that he had left behind the document George needed to sign. George also wanted to phone Paul before he did, but Paul had changed his number and hadn't told anyone, so he couldn't reach him. The lawyer got George to sign a carbon copy, which was then brought to Ringo, then to John and Klein, who added their signatures.

The deal now had to be ratified by Apple's board of directors. When the Beatles later met, Paul was upset because the deal had been signed without him being notified and he thought Klein's percentage was too big. Klein told the board that ABKCO's insisted he got The Beatles' approval that day so there was no time for further negotiations.***** Paul wanted them to wait until his lawyers had drafted another agreement. However, only three directors were required to agree, so John, George, and Neil Aspinall went ahead and ratified the deal. Klein was officially the manager of John, George, and Ringo, but not Paul.

On a brighter note, the NEMS situation was finally resolved in July 1969. The arrangement was:

NEMS drops all claims of representing The Beatles.

The Beatles sell their 10% stake in NEMS.

NEMS was paid a lump sum of £750, 000 as compensation for all the money they might've made managing The Beatles up to 1972.

NEMS took 5% of The Beatles' royalties between 1972 and 1976 - the 5% of North American royalties (which comprised 75% of their global revenue) would come from Klein's commission.

Paul attempted to stage a weak protest against Klein's rule by threatening to pull out of the deal unless Klein agreed to not take any payments for negotiating the deal over the past five months. Klein confronted him at Abbey Road where he, George, and Ringo were working (John had crashed his car in Scotland) and called his bluff. Paul backed down; the deal was signed and the £1.3 million on hold from EMI was finally released.

A few months later, it looked like all the Beatles' business woes would soon be resolved: Consortium were willing to sell their shares. The Beatles sans George (missing because of Louise's brain tumour diagnosis, I assume) and Klein met on September 19 to discuss how the board of Northern Songs would look when they took control. Linda took photos to assure Consortium that The Beatles were all speaking with one voice. I assume these are the pictures:

John Eastman pushed for Paul to have the same number of votes as the other three combined, which baffled everyone - including Paul. However, it all turned out to be for nought when Consortium threw in their stake with ATV. Northern Songs was lost. The next day, the group reconvened to sign The Beatles' new contract with Capitol****** and John Lennon left The Beatles.

* Clive or someone had renamed NEMS Nemperor Holdings at this point, but I’m going to keep using NEMS because this is tedious enough without companies changing names.

** Insider trading is buying or selling a company's stock in accordance with information that is not publically available. For example:

My friends and I are betting on how many hot dogs my cousin David can eat within twenty minutes. Everyone else has to place bets based on guesses, but I know from growing up with him that Dave gets sick after eating seven hot dogs at once, and I bet accordingly.

*** Why didn't John know this? Aside from because he was paranoid, already suspicious of Paul and the Eastmans, and probably on a ridiculous cocktail of drugs, I think he might genuinely not have remembered. It's possible that his accountant called him at some point, said hey, do you want to put some shares aside for your family? And he just said yeah, went straight back to sleep, and it had slipped entirely from his mind by the time he woke up.

**** Per Klein, in the middle of negotiations John Eastman sent a message to Capitol saying that Klein does not represent Paul in any way, which was not true.

***** ABKCO was singlehandedly controlled by Allen Klein

****** A very lucrative deal. It gave them 25% of the wholesale price, a higher royalty rate than any other recording group.

#please feel free to add/correct me!#my dad saw me drawing those pie charts and asked if i was doing horoscopes. said yes cause it's easier to explain#midposts#on lawyers and managers

55 notes

·

View notes

Text

Buying Property in Thailand

Thailand is an attractive destination for property buyers due to its scenic landscapes, vibrant cities, and welcoming culture. However, purchasing property in Thailand, especially as a foreigner, involves navigating a complex legal framework and understanding the local market intricacies. This comprehensive guide will provide detailed insights, enhancing expertise and credibility by delving into the legalities, procedures, and best practices for buying property in Thailand.

1. Understanding the Legal Framework

Key Legal Restrictions:

Land Code Act B.E. 2497 (1954): Foreigners cannot own land in Thailand except under specific conditions.

Condominium Act B.E. 2522 (1979): Foreigners can own up to 49% of the total floor area of a condominium building.

Foreign Business Act B.E. 2542 (1999): Regulates foreign business activities and investments, impacting property purchases for business purposes.

Exceptions and Alternatives:

Board of Investment (BOI) Projects: Foreigners investing in BOI-promoted projects can acquire land under specific conditions.

Long-Term Leases: Foreigners can lease land for up to 30 years, with options to renew.

Thai Company Ownership: Forming a Thai company where foreigners hold less than 50% of shares allows indirect land ownership.

2. Types of Property Available for Purchase

Condominiums:

Freehold Ownership: Foreigners can own condominium units outright.

Ownership Percentage: The foreign ownership quota in a condominium building should not exceed 49%.

Leasehold Properties:

Land and Houses: Foreigners can lease land and houses for up to 30 years, with potential for renewal.

Registration: Leases exceeding three years must be registered at the Land Department to be legally enforceable.

Investment Properties:

Commercial Real Estate: Foreigners can invest in commercial properties through long-term leases or joint ventures with Thai partners.

Resort and Hotel Investments: Special regulations apply to foreign investments in resort and hotel properties, often requiring joint ventures.

3. Due Diligence and Legal Processes

Conducting Due Diligence:

Title Search: Verify the property’s legal status, ownership history, and any encumbrances or disputes.

Zoning and Land Use: Ensure the property complies with local zoning laws and land use regulations.

Environmental Compliance: Check for any environmental restrictions or issues affecting the property.

Engaging Legal and Financial Advisors:

Real Estate Lawyer: Hire a reputable lawyer specializing in Thai real estate to guide you through the legal processes.

Financial Advisor: Consult a financial advisor to understand tax implications, financing options, and investment strategies.

Steps in the Buying Process:

Reservation Agreement: Sign a reservation agreement and pay a reservation fee to secure the property.

Due Diligence: Conduct thorough due diligence with the help of legal advisors.

Sale and Purchase Agreement (SPA): Draft and sign the SPA, detailing the terms and conditions of the sale.

Deposit Payment: Pay a deposit, typically 10-30% of the purchase price.

Transfer of Ownership: Complete the transfer at the Land Department, paying the remaining balance and associated fees.

4. Costs and Taxes Involved

Purchase Costs:

Transfer Fee: 2% of the appraised property value.

Stamp Duty: 0.5% of the purchase price or appraised value, whichever is higher.

Withholding Tax: 1% of the appraised value or the actual sale price, whichever is higher.

Specific Business Tax (SBT): 3.3% of the appraised or actual sale price, applicable if the property is sold within five years of acquisition.

Ongoing Costs:

Common Area Fees: Monthly fees for maintenance of common areas in condominiums.

Property Tax: Annual property tax based on the assessed value of the property.

Utilities and Maintenance: Regular expenses for utilities, repairs, and maintenance.

5. Financing Options

Local Financing:

Thai Banks: Some Thai banks offer mortgage loans to foreigners for condominium purchases.

Eligibility Criteria: Generally, borrowers need to have a work permit, proof of income, and a good credit history.

Foreign Financing:

Home Country Banks: Some buyers secure financing from banks in their home countries, leveraging their assets abroad.

International Mortgage Providers: Specialized financial institutions provide mortgages for international property purchases.

Payment Plans:

Developer Financing: Some developers offer financing plans with staggered payments during the construction period.

Installment Payments: Buyers can negotiate installment payments directly with sellers or developers.

6. Common Pitfalls and How to Avoid Them

Legal Complications:

Unclear Title: Always verify the title to avoid disputes and ensure clear ownership.

Zoning Issues: Confirm zoning regulations to ensure the property can be used as intended.

Contractual Disputes: Have all agreements reviewed by a lawyer to prevent misunderstandings and ensure enforceability.

Financial Risks:

Currency Fluctuations: Be aware of exchange rate risks when making payments in foreign currency.

Hidden Costs: Account for all additional costs such as taxes, fees, and maintenance expenses.

Financing Challenges: Ensure you have a clear financing plan and understand the terms of any loans or payment plans.

7. Enhancing Expertise and Credibility

Demonstrating Professional Credentials:

Legal Qualifications: Highlight the legal qualifications and experience of your advisors and partners.

Professional Experience: Detail your experience in handling property transactions in Thailand.

Memberships and Affiliations: Include memberships in professional organizations like the Thai Bar Association, the Real Estate Broker Association, or international property associations.

Providing Authoritative References:

Cite Legal Documents: Reference specific sections of the Land Code Act and Condominium Act to support your points.

Expert Opinions: Incorporate insights from recognized experts in Thai real estate law and property investment.

Including Detailed Case Studies:

Client Testimonials: Feature testimonials from clients who have successfully purchased property in Thailand with your assistance.

Real-Life Examples: Provide detailed examples of successful transactions, highlighting any challenges overcome and solutions implemented.

Visual Aids and Infographics:

Process Flowcharts: Use flowcharts to depict the steps involved in the property buying process.

Diagrams: Create diagrams to visually explain key legal concepts and ownership structures.

#buying property in thailand#property in thailand#property lawyers in thailand#thailand#property#lawyers in thailand

2 notes

·

View notes

Text

We are a Nationally Recognized Financial Company Serving all of our Client’s Business Lending Needs. Here at Fund Business Loans, with our expertise as a Small Business Lender, We Syndicate and have Partnerships with National Lenders. We can Provide all of your Business Loan, Finance and Lease Needs. There are a Variety of Business Loans available from Term Loans, SBA loans, to Business Lines of Credit and Business Working Capital. Most Loan types come with Minimum Requirements that Borrowers need to Meet in Order to be Eligible to Apply for the Loan. Plus, They all come with their Own Requirements for Documents you’ll Need to have in order to Apply and Get Approved.

FBL Small Business Loans Redding CA and nearby cities Provide Small Business Loans, SBA Business Loans, Business Startup Loans, Business Acquisition Loans, Accounts Receivable Financing, Short Term Loans, Business Loans, Lines of Credit, Invoice Factoring, Cash Advances, Commercial Equipment Financing, Used Equipment Financing, Commercial Real Estate Loans, Commercial Title Loans

Contact Us:

FBL Small Business Loans Redding CA

3057 Placer St. # E

Redding, CA 96001

Phone: 530-691-1288

Email: [email protected]

Website: https://fundbusinessloans.com/small-business-lending-redding-ca

0 notes

Text

Global Business Loans for Business Growth

QI Capital has a team of seasoned Capital Investment Advisers here working globally. Our Private Investment Pool are seeking new partners in diverse industry sectors who are in need of long term Capital Investments of any size, for Business Growth, M&A or Refinance. We also offer an independent negotiated commission to consultants/brokers for any successful partnership referral. Contact us Today for a Free Evaluation.

Tel/Fax: +6568094050

Email: [email protected]

Website: www.qicapitalpte.com

#Private Capital#Capital Investments#Business loans#Loan for business#Mergers and Acquisition Finance#Business bounce back loans#Asset Finance#Business Asset finance#Asset finance brokers#Construction asset finance#Commercial and asset finance#Mining Loans and Finance#Commercial Finance

0 notes

Text

The Role of Investment Banks in the Global Economy

The investment banking industry improves global corporations and efficient financial systems as it helps companies secure more capital. Therefore, enterprises can plan, access, and share their assets while institutional investors benefit from fair deal negotiations. This post will describe the role of investment banks in the global economy.

What Are the Investment Banks?

Investment banks (IBs) function like financial intermediaries between issuers of securities and investors. Moreover, established companies approach them when planning initial public offerings (IPOs) or seeking underwriting facilities. The growing significance of investment banking services results from the need to aid companies throughout securities issuance and ensure the capital markets' performance.

Simultaneously, high net-worth individuals (HNWIs) and public funds rely on IB professionals to handle valuation, deal negotiations, and company profiling related to privatization. However, most investment banks become market makers because they buy or sell a security at a quoted price. This approach provides liquidity for trading and mitigates IPO undersubscription risks.

Many companies also require extensive capital support to increase research, enter new markets, and expand their capacity. Therefore, they gather funding assistance based on investment bankers’ recommendations and fundraising strategies.

Important: An investment bank can be an independent organ of an established commercial banking brand. Doing so helps eliminate conflict of interest and maintain stakeholders’ trust.

The Role of Investment Banks in Global Economy: Market Making and Corporate Finance

Every IB has two divisions, namely market making and corporate finance. What is market-making in investment banking? When an investment bank acts as a facilitator between buyers as well as sellers of securities, like stocks or bonds, it is a market maker.

This role allows investment bankers to enable smoother transactions, making them popular across business development services and strategies. On the other hand, corporate finance involves helping companies raise capital to improve their balance sheets.

Likewise, investment banking can provide data-backed advisory assistance for businesses’ mergers and acquisitions (M&A) deals through the corporate finance role.

Revenue Sources of Investment Banks

Investment banks’ revenue depends on charging fees for their offerings like valuation support or business information. These gains can become billable commissions, a fraction of the capital lost or acquired via a transaction. Alternatively, IB firms might earn interest payments on loans given to clients, leveraging extra capital for mergers and acquisitions or capacity expansion.

What Do Investment Banks Offer?

1| IBs Engage in the Buying and Selling of Securities

Investment banks help companies issue new securities to raise funds required to realize business development objectives. Buying back their stock from investors to increase the price of their shares is feasible in investment banking support.

Underwriting services attempt to preserve stock value by committing the capital in an investment bank to unsold stocks. Additionally, such measures help business leaders mitigate financial and competitive risks via investment banks.

2| Investment Banks Accelerate M&A Deal Execution

Investment banks make the global economy more competitive. They guide companies in corporate mergers and acquisitions (M&A). Therefore, fair price determination, negotiation, and some marketing activities belong to IBs. An investment bank reveals the required capital for acquiring and enriching another business entity.

Leaders and institutional investors trust investment banks to work on M&A deal documentation and communicate with all the relevant parties. So, there will be no resistance from shareholders who might not cooperate with your strategy at the initial stages.

Importance of Investment Banks in Global Financial Markets

Investment banks play a critical part in the global economy by finding ideal investors for growth-poised companies. Without IB professionals’ assistance, enterprises will encounter more challenges across business mergers, underwriting, and IPO-based fundraising.

An IB firm can also empower governments and public institutions to strategize market entries and exits. It will conduct risk assessments, develop financial models, and find a fundraising instrument satisfying stakeholder preferences.

Thanks to this industry, one company can acquire another business to gain competitive benefits like market share or capability enhancements.

Conclusion

Investment banking professionals help companies raise capital while guiding investors in making beneficial investments. While the work can seem stressful and challenging, it is integral to keeping the global economy open, value-driven, and consistently growing.

Business development, a non-negotiable duty of every enterprise, is only possible after securing significant capital. As a result, all IB firms facilitating large transactions have contributed to remarkable corporate activities, increasing job creation and privatization.

Responsible IB firms increase the stock value and accelerate business deals without ignoring the risk exposure of companies and investors. Given its significance, the projection that the market size of investment banking will be 221.78 billion US dollars in 2027 is well-justified.

3 notes

·

View notes

Note

A gentle call for nuance: I think this is one of those situations, as is often the case in life, in which multiple truths co-exist. One is that it would good if Taylor publicly and explicitly acknowledged what a shitshow this whole ordeal has been, and affirmed that she'll do whatever is in her power to improve or rectify it. And that fans are allowed to feel whatever they feel, including betrayal and sadness, that she hasn't done so yet. /1

The other is that the fault largely lies with ticketmaster, and due to their unjust (and legally dubious) monopoly, she has no choice but to work with them and likely has little power to change their infrastructure and systems in a short period of time. /2 I'm sure there will be lessons learnt from this disaster by both parties. That doesn't take away the hurt but I hope it does remind people that this likely wasn't intentional on Taylor's end. The return to touring has been fraught with difficulties and this genuinely is an unprecedented level of demand, which the current systems were not equipped to deal with. /3 She absolutely is a hyper-capitalist who prioritises the acquisition of wealth, but given that's the case, I don't think she would intentionally jeopardise the good will of the fans who give her that wealth, because as she has publicly acknowledged her whole career, we are the reason she is in the position she is. So even from a business perspective she wouldn't want to upset the fan base as we are her customers. /4 But also, I do think it's a touch too cynical (albeit understandable in this circumstance) to think that Taylor doesn't genuinely care for her fans. You don't write songs for fans who've lost their child to cancer, send personalised gift packages, attend bridal showers, pay off medical bills and student loans, and invite fans into your own home unless some part of you genuinely cares for them. Nobody else does that. /5

---

TSSers continuing to prove they're the most attuned and articulate people around and I'm proud that you all choose to bless this space of all the spaces on this interweb to be in and contribute to and thoughtfully assess all the many many many sides that are possible in any given situation. Thank you!

25 notes

·

View notes