#CBSE Sample Papers for Class 12 Economics Paper 7

Explore tagged Tumblr posts

Text

Best Coaching for Class 12 Commerce Students in Kankarbagh

Class 12 is a crucial year for commerce students as it lays the foundation for higher studies and professional careers. With board exams, competitive exams, and future career decisions at stake, selecting the right coaching institute is essential. If you are a Class 12 commerce student in Kankarbagh, Patna, Chartered Commerce is the best coaching institute for class 12 to help you excel in Accountancy, Business Studies, Economics, and other subjects.

With experienced faculty, structured study materials, regular assessments, and personalized attention, Chartered Commerce ensures that students achieve top scores in board exams and prepare for professional courses like CA, CMA, and B.Com.

Why Choose Chartered Commerce for Class 12 Commerce Coaching?

1. Highly Experienced and Qualified Faculty

Chartered Commerce boasts a team of experienced and well-qualified teachers, including CA professionals and commerce experts, who: ✔ Provide concept-based learning to strengthen fundamental concepts. ✔ Offer easy-to-understand explanations for complex topics. ✔ Conduct interactive and engaging classes to keep students focused.

With expert guidance, students gain in-depth knowledge of their subjects, ensuring better performance in board exams and entrance tests.

2. Comprehensive Subject Coverage for Class 12

Class 12 syllabus requires thorough understanding and application-based learning. Chartered Commerce provides:

Accountancy – Covers Partnership Accounts, Company Accounts, and Cash Flow Statements in depth.

Business Studies – Focuses on management principles, business finance, and marketing strategies.

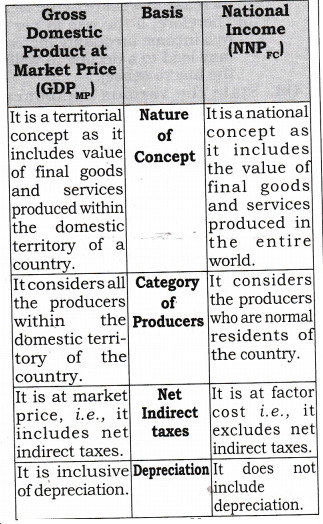

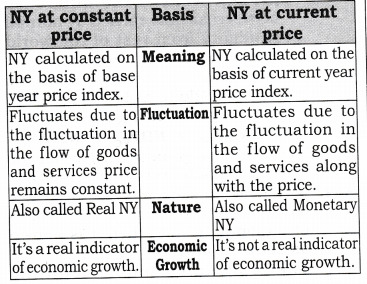

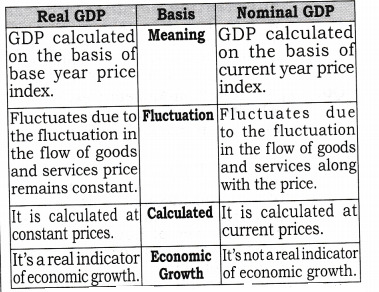

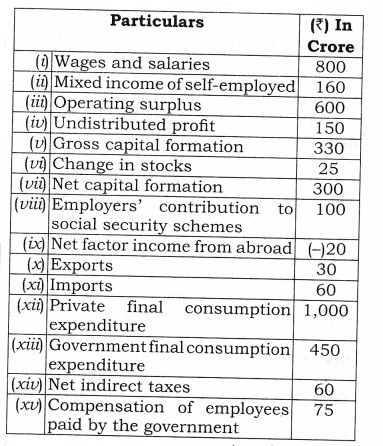

Economics – Includes Macroeconomics, National Income, and Indian Economic Development.

Each subject is taught using real-world examples, case studies, and practical applications to ensure better retention and conceptual clarity.

3. Structured and Well-Researched Study Material

Chartered Commerce provides comprehensive study materials, including: ✔ Simplified notes and concept-based explanations for quick understanding. ✔ Practice questions and worksheets for revision. ✔ Previous years’ board exam papers to help students familiarize themselves with the exam pattern. ✔ Mock tests and sample papers designed according to CBSE standards.

These resources ensure that students are fully prepared to tackle their Class 12 board exams with confidence.

4. Regular Tests, Mock Exams, and Performance Analysis

At Chartered Commerce, assessment and evaluation are key priorities. The institute conducts: ✔ Weekly and monthly tests to track progress. ✔ Mock board exams under real exam conditions. ✔ Detailed performance analysis and feedback sessions to help students improve.

By practicing under exam-like conditions, students gain time management skills and confidence to score high in their final board exams.

5. Small Batch Sizes and Personalized Attention

One of the biggest advantages of Chartered Commerce is its small batch size, which allows for: ✔ One-on-one interaction with faculty. ✔ Special doubt-clearing sessions for weak topics. ✔ Personalized mentoring to improve individual performance.

Unlike overcrowded coaching centers, Chartered Commerce ensures that every student gets the attention and guidance they need to excel.

6. Smart and Interactive Learning Methods

To make learning more effective and engaging, Chartered Commerce integrates modern teaching techniques, such as: ✔ Smart classrooms with visual presentations. ✔ Live problem-solving sessions for better understanding. ✔ Case studies and real-world applications to relate concepts to practical scenarios.

This approach enhances critical thinking skills, preparing students for board exams, competitive exams, and future careers.

7. Affordable Fees and Scholarship Opportunities

Chartered Commerce believes that quality education should be accessible to all. The institute offers: ✔ Affordable fee structures for Class 12 students. ✔ Scholarships for meritorious students to encourage excellence. ✔ Flexible payment options to reduce financial burden.

This ensures that every student in Kankarbagh has access to top-quality commerce coaching.

8. Career Counseling and Professional Course Guidance

Class 12 students often struggle with choosing the right career path. At Chartered Commerce, we provide: ✔ Career counseling sessions to help students make informed choices. ✔ Guidance for CA, CMA, B.Com, MBA, and Finance-related careers. ✔ Information about top universities and entrance exams for higher studies.

With expert career counseling, students can plan their future wisely and choose the right career path in commerce.

9. Convenient Location and Well-Equipped Infrastructure

Located in the heart of Kankarbagh, Patna, Chartered Commerce offers: ✔ Easily accessible location for students across the city. ✔ Well-equipped classrooms and a resourceful library for an optimal learning experience. ✔ A disciplined and student-friendly environment to encourage focused learning.

The state-of-the-art infrastructure ensures that students have all the facilities needed for effective learning.

Final Verdict: The Best Choice for Class 12 Commerce Students in Kankarbagh

If you are a Class 12 commerce student in Kankarbagh, Patna, Chartered Commerce is the best coaching institute to help you achieve academic excellence. With expert faculty, structured learning, high-quality study materials, personalized attention, and career counseling, it provides everything needed to score high in board exams and prepare for a successful commerce career.

Join Chartered Commerce Today!

Give your Class 12 commerce preparation the best start with the top coaching institute in Kankarbagh, Patna.

📍 Visit us at: A-10, above Bank of Baroda, Housing Board Colony, Kankarbagh, Patrakar Nagar, Patna, Bihar 800020 📞 Call us at: 8674817276 📧 Email us at: [email protected] 🌐 Website: Chartered Commerce

Admissions Open! Secure your future with the best commerce coaching in Kankarbagh!

#best commerce coaching in patna#charteredcommerce#best commerce coaching in kankarbagh#bihar#patna#success#accounting

0 notes

Link

CBSE Class 10 Syllabus has been designed to help students gain a deeper understanding of the subject matter.

0 notes

Link

2 notes

·

View notes

Text

BEST COMMERCE COACHING IN PATNA

Rankers Commerce is the best commerce coaching institute in Kankarbagh, Patna, Bihar. We have been providing commerce coaching in Patna since 2010 with a strong focus on excellence education. Our aim is to provide the best commerce classes in Patna for 11th and 12th students and prepare them for outstanding results in their career. We create a friendly educational environment for students through motivational teaching, expert faculty and top administration.

1. Top Commerce Classes in Patna

We provide the best commerce classes of all Papers for Class 11th & 12th, B.Com (Hons), CA and CMA Foundation courses with the latest syllabus. We offer academic and professional courses as per the recent trend of examinations. The important subjects that are taught in the Commerce stream in Class 11 and 12 consist of Accountancy, Economics, Business Studies, Statistics and Mathematics. We do provide a commerce tutorial program for XI and XII commerce students.

2. Online Classes

We are conducting online classes for all courses of 11th,12th commerce by a team of top CA Faculties. Explore your thoughts with unlimited access to online classes on the topics of Accounts, Business Studies, Economics and more. Online classes are easily accessible on mobile phones, laptop and desktop. Learn from the best study materials.

3. Class Room Facility

We conduct separate batches for Hindi and English medium students to understand every topic taught in the class room in an easy manner. We organize weekly and monthly tests to analyze the performance of the students. Unlimited doubt classes are specially conducted for weak students. Our batches consist of smaller size ratio to get a clear concept of every topic taught in the classroom.

4. Expert Faculty Team

We have experienced CA, CS, professors & senior teachers in the faculty team having more than 8+ years of experience in the education industry. All commerce academic & professional courses are being taught by experienced teachers. They use a professional and simple method of teaching in the classroom. Our teachers pay extra attention towards weak students. Our teachers complete the course syllabus before the timeline. Our Expert Team is known for creating toppers.

5. Study Materials

Daily assignments and notes are uploaded on YouTube channels. You can easily subscribe to the channel for upcoming assignments and notes. We provide updated course materials and sample test papers to students which help to prepare for their exams. The test papers prepared by our expert teachers and professors.

6. Fee Structure

All Commerce Courses fees are very economical and can easily be affordable by students. Fees can be paid through various online modes like GPAY, Net banking and many more.

7. Results

We are consistently producing 98% results every year. Priyanshu Jaiswal scored 1st rank in commerce and was Bihar Topper in the year 2017. This year 2020 we have scored 100% result in 12th Bihar Board exams.

8. Administration

We are backed by the top administration team for smooth running of our operation. They plan and manage all our educational events, seminars, and academic events of our institute.

9. Discipline

We are very strict to our discipline rules and regulations. No Misconduct or improper behavior is tolerated in our coaching center. Strict action is being taken for violating rules and regulations.

10. Education Environment

We build a friendly education environment between teachers and students. Students can easily build up a strong relationship with teachers which help them to learn more and understand every topic in the easiest way.

Some Extra Features:

1. Commerce Class for CBSE and Bihar Board Students

2. Separate Batches for Hindi and English Medium.

3. Consistently producing 98% results every year in Commerce.

4. Best Faculty Team for All Subjects.

5. Weekly Topic Wise Test.

Our Branches:

Commerce Coaching in Kankarbagh, Patna

#commerce classes in Patna#best commerce classes in Patna#commerce coaching in Patna#best commerce coaching in Patna#commerce classes in Kankarbagh#commerce coaching in Kankarbagh#commerce coaching in Kankarbagh Patna#commerce classes in Patna near me#commerce coaching in Patna near me#top commerce classes in Patna#top commerce coaching in Patna#best commerce coaching for 11th and 12th

2 notes

·

View notes

Text

10 Tips To Prepare CBSE 2021 Board Exams With Gurukul 15+1 Practice Papers - Like A Pro!

To help students excel in their Board Exams with flying colours, we stuck to the idea of “Seizing Perfection with Practice” and as a result launched our 15+1 practice papers based on the revised academic curriculum prescribed by CBSE for the 2021 Examinations.

The practice papers are focused to help students score high by letting them evaluate their weak points, avoid silly mistakes, and helping them mark-down the important questions for their last-minute revision data, to scale up their preparation graph to the uppermost level.

Find our Tips:

1. Be Aware of The Latest Exam Pattern Oct 2020

Knowing the fact that prioritizing chapters based on their weightage is of paramount importance, you shouldn’t miss out on being up to date. Keeping an eye on the newest exam pattern released on Oct 9th, 2020 we formulated our 15+1 Practice Papers, to familiarise you with the changes.

2. EMH Model to Help You Attain A Step by Step Approach

15+1 Practice Papers has a step by step approach of learning as it is divided into 3 sections, with 5-easy, 5-medium, and 5-hard level practice papers to help you in assessing yourself and gradually learn by-

Strengthening your basics

Acquainting you with the type & style of questions

Making sure that your analysis works parallel with your diligence

Reducing stress and anxiety

Boosting your confidence level

3. In-Depth Practice with 15+1 Practice Papers

Prepare, Practice, and Perform is the mantra of 15+1 Practice Papers. They are customized for every subject with level-based learning. It will help you with self-evaluation at every stage and in turn, improving your problem-solving skills.

EMH Practice Paper: Solved Board Sample Question Paper Oct 2020- 21

15 Solved Practice Papers based on Easy, Medium, and Hard Difficulty Level

Typology of questions based on Remembering, Understanding, Applying, Analyzing, Evaluating, and Creating

Detailed coverage of the latest CBSE Syllabus for better understanding

4. All Subjects Are Equally Important

Gurukul 15+1 Practice Papers are available for every subject. Study equally and regularly as all subjects are having equal weightage. Try not to avoid any topic just because it's being more complicated or taking more time. Practice more and more until you’re convinced.

a. For Class 10:

Mathematics Standard, Mathematics (Basic), English Language & Literature, Hindi-A, Hindi-B, Social Science, Science, and Computer Applications

b. For Class 12:

Science Stream- English Core, Mathematics, Physics, Chemistry, Biology, and Physical Education

Commerce Stream- English Core, Economics, Accountancy, Business Studies, Physical Education, and Mathematics

5. Do Not Forget English & Hindi, As Languages Are Important Too

Underestimating the significance of language subjects can prove to be speculative during boards as it is observed that there has been an increase in the difficulty level of language exams. We often end up depreciating the value of language subjects while grooming & focussing on other subjects and as a result, we conclude to last-minute learning during boards, which eventually ceases the extent of our percentage. Whereas contributing just 20-30 minutes a day can help you score to the peak, unlike other subjects.

Gurukul’s 15+1 Practice Papers for Hindi A, Hindi B & English can save you from the situation of freaking out as practicing with them will help you not only evaluate what you have learned but will also enhance your in-depth knowledge.

6. Learn the Tricks from Solved Step by Step Solution

The answers to each & every question are provided in an accurate & skillful manner, which will help you choose the right words to make your answers look more presentable. The tricks followed are simple & understandable as they will improve your precision in writing answers and at the same time, it will enhance your knowledge.

7. Enhances Your Time Management Skills

It focuses on minutely pertained short answers to help you solve them quickly whereas it focuses on planned & precisely detailed long answers to familiarize you with the time limits provided for distinct answers by the CBSE board. Training you to solve the questions by choosing appropriate words while paying attention to both, the weightage, as well as the time-limit, provided for the answers.

Henceforth, enhancing your time management skills by providing you with accuracy & precision.

8. Know Your Strength, And Weaknesses

It’s rightly said that you are able to learn the best if you know your Strength, Weakness, Opportunities, and Threats. SWOT analysis works best when utilized with appropriate resources like sample papers or practice papers. You can do your SWOT analysis and apply it to the 15+1 Practice Papers as it will experientially help you gain a practical approach towards your exam preparation.

9. Gain Those Extra Marks with Neat & Clean Handwriting

Neat Handwriting is one of the most prominent aspects to look at while writing in Board Exams. Oftentimes, due to bad handwriting or poor management, teachers are unable to understand what students have written, which makes the students lose marks.

To avoid such unnecessary reduction of marks you need to practice good handwriting that runs parallel with your accuracy & time as it’s observed that innovative and self-written answers tend to gain more favorable scrutiny.

So, start practicing with sample papers to ensure that you don’t miss out on any target!!

10. Balanced Study Schedule, Will Improve Your Studying Efficiency

Having a well-organized study area with appropriate study-practices will help you reap the best out of your learning sessions. A balanced study schedule doesn’t sacrifice anything, be it proper 8 hours of sleep, practicing sample papers, revising chapters, or a healthy diet. You need to maintain an equilibrium between all these utterly important tasks to ensure that you can grasp & execute them with your highest capability. And in doing so, nothing can prove to be more helpful than a well organized “Time-Table”.

The previous year proved to be one of the toughest ones in this entire decade, yet we are happy that we were able to come over it friskily. Although one present problem left for us was with the preparation of exams for students. Parents, teachers, and students are still trying their best to resolve all the difficulties coming ahead of them, efficiently.

Yet, somewhere in this hustle-bustle students & teachers suffered greatly as they had to undergo lots of hurdles in delivering & receiving the knowledge. Henceforth, a simple solution combined with lots of efforts in the form of these 15+1 Practice Paper Series has been proposed to you by us. As we understand that for students of classes 10 & 12, this is the most crucial time, and we wish to do our best to prepare them well for their boards.

You can also check out 10 Year solved papers and sample papers for enhancing your preparation.

We hope we will land on your expectations….

2 notes

·

View notes

Text

NCERT Solutions Class 11 Computer Science Free PDF Download

To free download NCERT Questions and answers of NCERT Books All Classes Physics, Chemistry, Biology, History, Political Science, Economics, Geography, Computer Science, Accountancy, Business Studies, Hindi, English, Mathematics, EVS, Social Science and Home Science; do check NCERTPREP website. This site provides sample papers with solution, test papers for chapter-wise practice, NCERT book solution, NCERT Exemplar solutions, quick revision notes for ready reference, CBSE guess papers and CBSE important question papers. Sample Paper all are made available through the best app for CBSE students and NCERTPREP website.

Class 11 NCERT Solution Computer Science Python includes all the questions given in NCERT Books for all Subject. Here all questions are solved with detailed information and available for free to check. NCERT Solutions Class 11 Computer Science Python are given here for all chapter wise. Select the subject and choose chapter to view NCERT Solution chapter wise.

Computer Science is a practical subject. Deriving every answer on your own is a tedious task. Most of the students find it difficult to solve the problems or the practice exercise of the NCERT textbook difficult. So, what’s the best way out? The best way is to have a solution book. The first unit comprises of computer fundamentals, software concepts, data representation, microprocessor, and memory. The basics of Operating systems and some common algorithms are dealt with here. The data representation is the main and very important chapter of computer science.

The main concept of binary numbers and how they are stored in computer memory is well explained. A student should learn to convert a decimal number into binary and vice versa. Practice the question given at the end of your NCERT books and verify the answer from the solution book.

The solution book also explains step by step how the answer has been derived. All the concepts related to microprocessors such as Instructions sets, 8085, and 8086 microprocessors have been explained in the fourth chapter.

Moving over to the next unit i.e. program methodology teaches us how to write any language in syntax. How the comments are used and why writing comments is very important in coding. The next chapter algorithms and flowcharts throw light over modular and structured programming. The various operators such as AND, OR, and NOT have been discussed in detail over here.

The third and the fourth unit deals with the language “PYTHON”. Python is a programming language basically the most trending and acceptable language in today’s world. You can build anything to everything by using python’s libraries and tools. It is used in web development, Blockchain development, somewhere in AI and ML as well. It’s a very easy language with many active communities worldwide. It has been rated as 5/5 over the user-friendly ratings.

The third unit basically teaches you the basics of python, the operators, functions, and loops. The fifth unit calls for some nice coding skills. A solution book helps a student in the right kind of logic building so that the code development process goes clear in the kind of a student

NCERT Solutions of NCERT Books All Classes for CBSE class 3, 4, 5, 6, 7, 8, 9, 10, 11 & 12 are very helpful to students. Although, NCERT solutions contain only chapter-end questions and answers yet these are considered as key questions. Most of the questions in exams are either same or similar to these questions. So, it is advised that students must go through the NCERT Text Books and practice all the questions given at the end of the chapter. These questions will clear their basic doubts. We also recommend students should read the whole NCERT book line by line and prepare notes from NCERT books. It is always recommended to study NCERT books as it covers the whole syllabus. These questions with detailed explanation are now available in NCERTPREP.com for free to view and download.

First of all, Student must understand that NCERT textbook answers are not enough for exam preparation. Therefore, they must take NCERT textbook question and answers as basic learning tools. These questions and answers are basically meant for understanding the concepts. NCERT textbooks are certainly a good source of quality content. Hence, it is expected that students should not settle for chapter end questions only rather they should read the whole book thoroughly.NCERT Solution of NCERT Books All Classes are available in PDF format for free download. These ncert book chapter wise questions and answers are very helpful for CBSE exam. CBSE recommends NCERT books and most of the questions in CBSE exam are asked from NCERT textbooks.

We hope that our NCERT Solutions Class 11 Computer Science Python helped with your studies! If you liked our NCERT Solutions for Class 11, please share this post.

1 note

·

View note

Text

NCERT Class 12 Macro Economics Chapter 1 Introduction to Macroeconomics and its Concepts

NCERT Class 12 Micro Economics Solutions

Chapter-1 Introduction to Macroeconomics and its Concepts

NCERT TEXTBOOK QUESTIONS SOLVED : Q 1. Describe the five major sectors in an economy according to the macroeconomic point of view.[3-4 Marks]

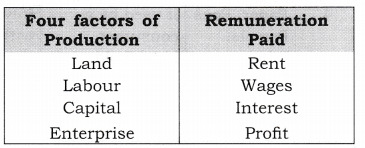

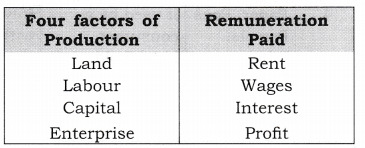

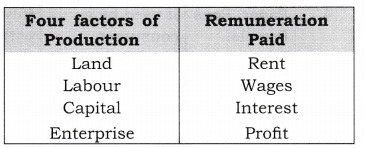

Ans: An economy may be’ divided into different sectors depending on the nature of study. Producer sector engaged in the production of goods and services. Household sector engaged in the consumption of goods and services. Note: Households are taken as the owners of factors of production. The government sector engaged in activities like taxation and subsidies. Rest of the world sector engaged in exports and imports. Financial sector (or financial system) engaged in the activity of borrowing and lending. Q 2. What are the four factors of production and remunerations to each of these called? [ 1 Mark]

Ans:

Q 3. What are the important features of a capitalist economy? [3-4 Marks]

Ans: Features of capitalist economy are: Private ownership of land and capital. Profit is the only motive. Free play of the market forces of demand and supply. Government looks after growth, stability and social justice in the economy. Q 4. Describe the Great Depression of 1929. [3-4 Marks]

Ans: The Great Depression took place in 1929 which adversely affected the developed economies of Europe and North America. It continued for 10 years. There was extreme fall in aggregate demand due to fall in income, which led to a vicious circle of poverty. Q 5. Distinguish between stock and flow. Between net investment and capital which is a stock and which is a flow? Compare net investment and capital with flow of water into a tank. [3-4 Marks]

Ans:

Net investment is a flow whereas capital is a stock. Amount of water in a tank at a particular point of time is a stock concept, whereas amount of water flowing into it is a flow concept. I. VERY SHORT ANSWER TYPE QUESTIONS (1 Mark)

Q 1. What is meant by circular flow of income? Ans: It refers to flow of money income or the flow of goods and services across different sectors of the economy in a circular form. Q 2. What are the three phases of circular flow of income?

Ans: Production Phase, Distribution Phase and Disposition Phase. Q 3. Give the meaning of factor income.

Ans: Income earned by factor of production by rendering their productive services in the production process is known as Factor Income. Q 4. What is meant by transfer income?

Ans: Income received without rendering any productive services is known as Transfer Income. Q 5. Out of factor income and transfer income which one is a unilateral concept?

Ans: Transfer income. Q 6. Define current transfers.[CBSE 2003]

Ans: Transfers made from the current income of the payer and added to the current income of the recipient (who receive) for consumption expenditure are called current transfers. Q 7. Define capital transfers.

Ans: Capital transfers are defined as transfers in cash and in kind for the purpose of investment to recipient made out of the wealth or saving of a donor. Q 8. What is the meaning of final goods?

Ans: These are those which are used for: Personal consumption (like bread purchased by consumer household), or Investment or capital formation (like building, machinery purchased by a firm) Q 9. What is meant by intermediate goods?

Ans: These are those, which are used for: Further processing (like sugar used for making sweets), or Resale in the same year (If car purchased by a car dealer for resale). Q 10. What is meant by consumption goods?

Ans: Consumption goods are those goods which satisfy the wants of consumers directly. Q 11. Define capital goods.

Ans: Capital goods are defined as all goods produced for use in future productive processes. Q 12. Give an example of a person who is staying abroad for a period more than one year and still he is treated as normal resident of India.

Ans: An Indian working in Indian Embassy in the USA will be treated as normal resident of India. II. MULTIPLE CHOICE QUESTIONS (1 Mark)

Q 1. Transfer payments refer to payments which are made: (a) Without any exchange of goods and services. (b) To workers on transfer from one job to another. (c) As compensation to employees. (d) None of these

Ans: (a) Q 2. Which one of the following items comes under consumption goods? (a) Durable goods (b) Semi-durable goods (c) Non-durable goods (d) All of these.

Ans: (d) Q 3. Service of a teacher: (a) Capital goods (b) Consumption goods (c) Intermediate goods (d) Can be Consumption goods and intermediate goods

Ans: (d) Q 4. In a circular flow of income, we have: (a) Production (b) Distribution (c) Disposition (d) All of them

Ans: (d) Q 5. Who is considered as agents of factor of production, (a) Households (b) Government (c) Rest of the world (d) All of these

Ans: (a) Q 6. Which among the following are the features of capitalist economy, (a) Private ownership of Land and Capital. (b) Profit is the only motive. (c) Free Play of market forces of demand and supply. (d) All of these

Ans: (d) Q 7. Flow of Goods & services and factors of production across different sectors in a barter economy is known as: [CBSE Sample Paper 2016] (a) Circular flow (b) Real flow (c) Monetary Flow (d) Capital Flow

Ans: (b) III. SHORT ANSWER-TYPE QUESTIONS

Q 1. Explain the basis of classifying goods into intermediate and final goods. Give suitable examples. Or [CBSE 2010] Distinguish between intermediate products and final products. Give examples. ‘ [CBSE 2009]

Ans: Q 2. Define consumption goods and what are its categories.

Ans: Consumption goods are those which satisfy the wants of the consumers directly. For example, cars, television sets, bread, furniture, air-conditioners, etc. Consumption goods can further be subdivided into the following categories:

Durable goods: These goods have an expected life time of several years and of relatively high value. They are motor cars, refrigerators, television sets, washing machines, air-conditioners, kitchen equipments, computers, communication equipments etc.

Semi-durable goods: These goods have an expected life time of use of one year or slightly more. They are not of relatively great value. Examples are clothing, furniture, electrical appliances like fans, electric irons, hot plates and crockery.

Non-durable goods: Goods which cannot be used again and again, i.e., they lose their identity in a single act of consumption are known as non durable goods. These are food grains, milk and milk products, edible oils, beverages, vegetables, tobacco and other food articles.

Goods which satisfy the human wants directly. They cannot be seen or touched, i.e., they are intangible in nature. These are medical care, transport and communications, education, domestic services rendered by hired servants, etc. Q 3. Define capital goods and its categories. Or Define ‘capital goods’.[CBSE Foreign 2011]

Ans: Capital goods are defined as all goods produced for use in future productive processes.

For example, All the durable goods like cars, trucks, refrigerators, buildings, air crafts, air-fields and submarines used to produce goods and services for sale in the market are a part of capital goods.

Stocks of raw materials, semi finished and finished goods lying with the producers at the end of an accounting year are also a part of capital goods.

Some more examples of capital goods are machinery, equipment, roads and bridges. These goods require repair or replacement over time as their value depreciate over a period of time. Q 4. Distinguish between consumption goods and capital goods. Which of these are final goods? [CBSE Delhi 2010]

Ans: Q 5. Differentiate between Current transfers and Capital Transfers.

Ans: IV. GIVE REASONS A. Giving reasons, classify the following into intermediate or final goods.

Q 1. Machines purchased by a dealer of machines. [CBSE (AZ) 2010] Ans: Intermediate good Reason: Machines purchased by a dealer of machines is an intermediate good because machines are resold by the firms to make profits or value is yet to be added to these goods by way of further processing. Q 2. A car purchased by a household.[CBSE (AI) 2010]

Ans: Final good Reason: A car purchased by a household is a final good because the household is the final user of the car and no value is to be added to the car. Q 3. Furniture purchased by a school. [CBSE Delhi 2011]

Ans: Final good Reason: Furniture purchased by a school is a final product because school is the final user of the furniture and no value is to be added to the furniture. This will be deemed as investment expenditure because furniture is used by the school for several years and is of high value. Q 4. Chalks, dusters, etc. purchased by a school. [CBSE Delhi 2011]

Ans: Intermediate good Reason: Chalks, dusters, etc. purchased by a school are intermediate goods as these are used up in the process of value – addition during the year. Q 5. Computers installed in an office.[CBSE Delhi 2011]

Ans: Final good

Reason: Computers installed in an office is a final product because computers are finally and repeatedly used by the office for several years and these are of high value. Q 6. Mobile sets purchased by a mobile dealer. [CBSE Delhi 2011]

Ans: Intermediate product Reason: Mobile sets purchased by a mobile dealer is an intermediate product because these are purchased for resale. Q 7. Expenditure on maintenance of an office building. [CBSE Delhi 2011]

Ans: Intermediate product Reason: Expenditure on maintenance of an office building is an intermediate expenditure as the things purchased for repair and maintenance are used up during the period of one year. Q 8. Expenditure on improvement of a machine in a factory.[CBSE Delhi 2011]

Ans: Final Product Reason: Expenditure on improvement of a machine in a factory is a final expenditure as the machine is repeatedly used for several years as a fixed asset. Improvement of a machine implies improvement of asset value (through investment expenditure). Q 9. Purchase of furniture by a firm.[CBSE (Al) 2010]

Ans: Final Product Reason: Purchase of furniture by a firm is a final expenditure because furniture is repeatedly used by the firm for several years and this is of high value. Q 10. Expenditure on maintenance by a firm. [CBSE (AI) 2010]

Ans: Intermediate product Reason: Expenditure on maintenance by a firm is an intermediate expenditure as the things purchased for repair and maintenance are used up during the period of one year. Q 11. Paper purchased by a publisher.

Ans: Intermediate product Reason: It is an intermediate product as paper is used for further production during the same year. Q 12. Milk purchased by households.

Ans: Final product Reason: It is a final product as it is used by households for final consumption. Q 13. Purchase of rice by a grocery shop.

Ans: Intermediate product Reason: These are intermediate products because these are purchased for resale. Q 14. Coal used by manufacturing firms.

Ans: Intermediate product Reason: It is an intermediate product as coal is used for further production during the same year. Q 15. Coal used by consumer households.

Ans: Final product Reason: It is a final product as it is used by households for final consumption. Q 16. Purchase of pulses by a consumer.

Ans: Final Product Reason: It is a final product as it is used by a consumer for final consumption. Q 17. Fertilizers used by the farmers.

Ans: Intermediate product Reason: These are intermediate products because fertilizer is used for further production during the same year. Q 18. Printer purchased by a lawyer.

Ans: Final product Reason: It is a final product because it is purchased for investment. Q 19. Wheat used by the flour mill.

Ans: Intermediate product Reason: It is an intermediate product as wheat is used for further production during the same year or is meant for resale. Q 20. Unsold coal with trader at a year end.

Ans: Final product Reason: It is a final product as the unsold coal is an investment for the trader. Q 21. Cotton used by a cloth mill.

Ans: Intermediate product Reason: It is an intermediate product as cotton is used for further production during the same year. Q 22. Wheat used by households.

Ans: Final product Reason: It is a final product as it is used by households for final consumption. Q 23. Refrigerator installed by a firm.

Ans: Final product Reason: It is a final product because it is purchased for investment. Q 24. Sugar used by a sweet shop.

Ans: Intermediate product Reason: It is an intermediate product as sugar is used for further production during the same year. B. Giving reasons, classify the following into factor income or transfer income.

Q 1. Unemployment allowances.

Ans: Transfer income Reason: It is received without rendering any productive services. Q 2. Salary received by Pankaj from a company.

Ans: Factor income Reason: It is earned by rendering productive services. Q 3. Financial help to earthquake victims.

Ans: Transfer income Reason: It is received without rendering any productive services. Q 4. Compensation received from the employer.

Ans: Factor income Reason: It is earned by rendering productive services. Q 5. Claim received from Insurance company by an injured worker.

Ans: Transfer income Reason: It is received without rendering any productive services. Q 6. Birthday gift received from a friend.

Ans: Transfer income Reason: It is received without rendering any productive services. Q 7. Bonus received on Diwali.

Ans: Factor income Reason: It is earned by rendering productive services. C. Giving reasons, classify the following into stock or flow.

Q 1. Capital [GBSE 2013]

Ans: Stock concept Reason: Capital is stock because it is measured at a point of time. Q 2. Saving [CBSE 2013]

Ans: Flow concept Reason: Saving is flow because it is .measured during a period of time. Q 3. Gross Domestic Product [CBSE 2013]

Ans: Flow concept Reason: Gross domestic product is a flow because it is measured during a period of time. Q 4. Wealth [CBSE 2013]

Ans: Stock concept Reason: Wealth is stock because it is measured at a point of time. Q 5. Exports

Ans: Flow concept Reason: It relates to a period of time. Q 6. Imports

Ans: Flow concept Reason: It relates to a period of time. Q 7. Business capital of business

Ans: Stock concept Reason: It is related to a point of time. Q 8. Investment

Ans: Flow concept Reason: It relates to a period of time. Q 9. Foreign Investment

Ans: Flow concept Reason: It relates to a period of time. Q 10. Foreign Assets

Ans: Stock concept Reason: It relates to a point of time. Q 11. Foreign Remittances (In flow of money)

Ans: Flow concept Reason: It is related to a period of time. Q 12. Production of Wheat

Ans: Flow concept Reason: It is related to a period of time. Q 13. Income of a servant

Ans: Flow concept Reason: It is related to a period of one month or one year. Q 14. Budget Expenditure

Ans: Flow concept Reason: It is related to a period of time. (1 year) Q 15. Money supply

Ans: Stock concept Reason: It relates to a particular point of time. Q 16. Machinery of a firm Ans: Stock concept

Reason: It relates to a point of time. Q 17. A five hundred rupee note

Ans: Stock concept Reason: It is related to a point of time. D. Giving reasons state whether the following are included or excluded in/from domestic territory.

Q 1. An Indian Company in America

Ans: Excluded Reason: As it is outside the domestic territory of our country. Q 2. Microsoft Office in India

Ans: Included Reason: As it is within the domestic territory of our country. Q 3. Company in India owned by an American

Ans: Included Reason: As it is within the domestic territory of our country. Q 4. Office of Tata in New York

Ans: Excluded Reason: As it is outside the domestic territory of our country. Q 5. Branch of Foreign Bank in India

Ans: Included Reason: As it is within the domestic territory of our country. Q 6. Indian Embassy in China

Ans: Included Reason: As it is within the domestic territory of our country. Q 7. Branch of Punjab National Bank in America

Ans: Excluded Reason: As it is outside the domestic territory of our country. Q 8. Russian Embassy in India

Ans: Excluded Reason: As it is outside the domestic territory of our country. Q 9. Reliance Industries rented its building to Microsoft in America.

Ans: Excluded Reason: As it is outside the domestic territory of our country. E. Classify the following into durable, non-durable, semi-durable or services

Q 1. Refrigerator Ans: Durable Reason: As it has expected life time of several years and of relatively high value. Q 2. Clothes

Ans: Semi-durable Reason: As it have an expected life time of use of one year or slightly more. Q 3. Edible oil

Ans: Non-durable Reason: As it loose their identity in a single act of consumption. Q 4. Tuition given by a teacher

Ans: Service Reason: As it is non-material goods which satisfy the human wants directly. Q 5. Visit of a physician

Ans: Service Reason: As it is non-material goods which satisfy the human wants directly. Q 6. Washing soaps

Ans: Non-durable Reason: As it loose their identity in a single act of consumption. F. Classify the following into consumer, intermediate or capital goods.

Q 1. Milk used by a manufacturer of sweets.

Ans: Intermediate goods Reason: As it is used up while making sweets. Q 2. Cycle purchased by a consumer household

Ans: Consumer goods Reason: End user is consumer. Q 3. Textile machinery

Ans: Capital goods Reason: End user is producer. Q 4. Construction of a house

Ans: Consumer goods Reason: End user is consumer. Q 5. Bread and butter used by a consumer household.

Ans: Consumer goods Reason: End user is consumer. Q 6. Services of a private doctor purchased by a consumer household.

Ans: Consumer goods Reason: End user is consumer. Q 7. Fertilizer used by a farmer.

Ans: Intermediate goods Reason: As fertilizer is used for further production during the same year. Q 8. Passenger bus service used by a consumer household.

Ans: Consumer services Reason: End user is consumer. G. Giving reasons, classify the following into normal resident of India or not.

Q 1. Indian officials working in the Indian Embassy in USA. Ans: Normal Resident Reason: As their centre of economic interest lies in the home country. Q 2. A Japanese tourist who stays in India for 2 months.

Ans: Not a Normal Resident Reason: As their centre of economic interest lies in the foreign country. Q 3. Indians going to Pakistan for watching the cricket match.

Ans: Normal Resident Reason: As their centre of economic interest lies in the home country. Q 4. Indians working in the UNO office, located in America for less than 1 year.

Ans: Normal Resident Reason: As their centre of economic interest lies in the home country. Q 5. Indian employees working in WHO, located in India.

Ans: Normal Resident Reason: As their centre of economic interest lies in the home country. Q 6. Foreign tourists visiting India for a month to see the Taj Mahal.

Ans: Not a Normal Resident Reason: As their centre of economic interest lies in the foreign country. V. TRUE OR FALSE Giving reasons, state whether the following statements are true or false.

Q 1. Macroeconomics deals with the problems of a consumer.

Ans: False: It deals with problems of the economy. Q 2. Money flow is also known as physical flow.

Ans: False: Real flow is known as physical flow. Money flow is known by the name of nominal flow. Q 3. In a two-sector economy, total production is always equal to total consumption.

Ans: True: It happens because firms sell their entire output to the households. Q 4. Circular flow of income takes place in case of open economy and close economy.

Ans: True: Even in case of closed economy, circular flow of income takes place between households and firms. Q 5. Capital formation is a flow.[CBSE Sample Paper 2010]

Ans: True: Capital formation is measured over a period of time Q 6. Foreign remittances are a stock concept.

Ans: False: It is flow concept as these are assessed over a period of time and not at a point of time. Q 7. National Income of a country- is a stock concept.

Ans: False: It is a flow concept as it is measured over a period of time. Q 8. Bread is always a consumer good.[CBSE Sample Paper 2010]

Ans: False: It depends on the use of bread. When it is purchased by a household, it is a consumer good. If it is purchased by a restaurant, it is a producer intermediate goods. Q 9. Television is a capital good.

Ans: False: Television is a durable consumption good. Q 10. Services of a teacher is a consumption good.

Ans: True: It directly satisfies human wants. Q 11. Books in a library are intermediate goods.

Ans: False: Books used in a library are final goods as these are used by the end user. Q 12. Use of raw material is a consumption good.

Ans: False: Use of raw material helps in production process therefore it is a single use producer good. But it has no longer life. Q 13. Can purchase of a new car be categorized as an intermediate good.

Ans: True: Purchase of a new car can be categorized as an intermediate good, if purchased by a Government for military use or if it is purchased by a car dealer for resale. Q 14. A good can be an intermediate goods in one case and a final goods in another case.

Ans: True: A good can be an intermediate goods or final goods, depending upon its nature of use. For example, a car purchased by a household is a final good, whereas, it will be an intermediate good if it is purchased by a car dealer. Q 15. The concept of normal resident applies to individuals only.

Ans: False: The concept applies to institutions also, in addition to individuals. Q 16. In final goods, no value is to be added.

Ans: True: Because final goods have crossed the production boundary. Q 17. Transfer income is a part of factor income.

Ans: False: It is not a factor income, It is paid for without receiving any goods and services.

VI. HIGHER ORDER THINKING SKILLS

Q 1. Explain that Domestic territory is bigger than the political frontiers of a country.

Ans: In layman terms, the domestic territory of a nation is understood to be the territory lying within the political frontiers (or boundaries) of a country. But in national income accounting, the term domestic territory is used in a wider sense. Based on ‘freedom’ criterion, the scope of economic territory is defined to cover:

Ships and air crafts owned and operated by normal residents between two or more countries. For example, Indian Ships moving between China and India regularly are part of domestic territory of India. Similarly, planes operated by Air India between Russia and Japan are part of the domestic territory of India. Similarly, planes operated by Malaysian Airlines between India and Japan are a part of the domestic territory of Malaysia.

Fishing vessels, oil and natural gas rigs and floating platforms operated by the residents of a country in the international waters where they have exclusive rights of operation. For example, Fishing boats operated by Indian fishermen in international waters of Indian Ocean will be considered a part of domestic territory of India.

Embassies, consulates and military establishments of a country located abroad. For example, Indian Embassy in Russia is a part of the domestic territory of India.

‘Consulate’ is an office or building used by consul (an officer commissioned by the government to reside in a foreign country to promote the interest of the country to which he belongs). Q 2. “All Producer Goods are not Capital Goods”. Explain.

Ans: Producer goods are all those goods which are used in the process of production i.e., which are used in the production of other goods. Producer goods include two types of goods:

Single-use Producer Goods: Goods used as raw material by the producers. It includes raw material like coal, wood, etc. They are not capital goods as they cannot be repeatedly used in the production process.

Capital Goods: Goods which are used as fixed assets by the producers, like plant and machinery, which can be repeatedly used in the production process. So, it can be said that all capital goods are producer goods, but all producer goods are not capital goods. Q 3. “Machine purchased is always a final good.” Do you agree? Give reasons for your answer.

Ans: No, it is not necessary that machine purchased is a final good. It will depend upon its use. If a machine is purchased by a household, then it is a final good. For example, washing machine purchased by a consumer household is a final goods.

If it is purchased by a firm for its own use, then it is also a final good. For example, refrigerator purchased by a firm.

If it is bought by a firm for resale, then it is an intermediate good. For example, machine purchased by a machine dealer. Q 4. “ Machine purchased is always a capital good.” Do you agree? Give reasons for your answer.

Ans: No, it is not necessary that machine purchased is a capital good. It will depend upon its use. If a sewing machine is purchased by a tailor, then it is a fixed asset of the tailor and considered to be a capital good. But the same machine purchased by a consumer household is considered to be a durable use consumer goods.

If a car purchased by a taxi driver as a taxi or if purchased by a firm for use in its business is a capital good. But the same car purchased by a consumer household is a durable use consumer goods.

Note: So, finally, the end user of a good determine, whether it is capital good or durable use consumer goods. If an end user of a durable goods is a producer, it is a capital good. If an end user of a durable goods is a consumer household, it is a durable use consumer goods. So, capital goods are only those durable goods which are used as producer goods, not as consumer goods. VII. VALUE BASED QUESTION

Q. Compensation to flood victims is a good social security measure by the government. But why is it not included in the estimation of national income?

Ans: Because this is a transfer payment. Value: Implement of Knowledge VIII. APPLICATION BASED QUESTIONS

Q1. The concept of domestic territory helps to estimate ‘Domestic Product’. Defend or refute.

Ans: The concept of domestic territory helps to estimate ‘Domestic Product’. As we know Domestic Product includes goods and services produced by production units located in the domestic territory (irrespective of fact whether carried out by residents or non-residents). The money value of domestic product is termed as Domestic Income. Q 2. The concept of Normal Resident helps to estimate ‘National Product’. Defend or refute.

Ans: The concept of Normal Resident helps to estimate “National Product’. National Product includes production activities of normal residents irrespective of fact whether performed within the economic territoiy or outside it. The money value of national product is termed as National Income.

via Blogger https://ift.tt/3hcScHs

0 notes

Text

Get The Best Study Material for ICSE Chemistry Class 10 on Extramarks.

The ICSE, which stands for the Indian Certificate of Secondary Education is one of the two most popular education boards in India. ICSE is less common than CBSE. But it is more demanding than CBSE. The ICSE board conducts the exam for Classes 1-12. The difficulty level of each grade increases gradually. The students learn about everything in detail. The higher secondary classes require a lot more attention and hard work. Class 10 and 12 have always been the biggest concern for students because of board exams. While these classes are equally important, Class 10 plays a slightly more important role in a student's career. The streams will be given to the students based on their performance in class 10. The subjects in class 10 include English, Science, Maths, Social Science and Economics. Science further categorizes into three parts, Physics, chemistry, and biology. ICSE Chemistry Class 10 has a diverse syllabus. It also introduces students to a lot of new topics which can be difficult and confusing for them. The students need to pull up their socks from the beginning. The syllabus for ICSE Chemistry Class 10 includes the following chapters: 1. Periodic properties & Variations of properties- Physical & chemical. 2. Chemical Bonding. 3. Study of acids, bases, and salts 4. Analytical Chemistry- Use of Ammonium Hydroxide & Sodium Hydroxide. 5. Mole concept & Stoichiometry. 6. Electrolysis. 7. Metallurgy. 8. Study of compounds 9. Organic chemistry.

The syllabus for ICSE Chemistry class 10 can be quite new for the students. Without a proper understanding of every topic, they can end up scoring less. This can demoralize the students for further classes and spoil their overall performance. Textbooks do not give practical knowledge and chemistry is mostly based on practical. The more a student gains practical knowledge, by performing the experiments himself, the brighter the chances of scoring well. Extramarks is a leading online learning app for students which gives them a chance to score better. The students can get all their doubts solved on Extramarks. Video tutorials, solved question papers, sample sheets, and much more are available on the Extramarks App. Studying ICSE Chemistry class 10 on Extramarks is way more interesting and interactive. The students can improve their practical knowledge on all the topics. In this way, the understanding of the student on a topic increases. Download the Extramarks app today and discover the world of interactive learning.

0 notes

Text

Class 12 Commerce Online Preparation

Class 12 Commerce Online Preparation In Saharanpur , Dehradun , Yamunanagar.

Class 12 is a crucial stage in a student’s life. The pressure of preparing for the board exams is not easy, which is why we have the right resources for learning the chapters covered in your CBSE Class 12 syllabus.

At Esuccessmantra, we follow a tested board exam strategy which our students live by—read, revise, practise and assess.

Esuccessmantra’s study materials include video lessons, subject notes, sample papers, previous years’ question papers and more. To understand the chapters, you need to create a plan by first going through the latest syllabus which you will find here.

You must prepare your study timetable for each subject. Allot time for reading our study materials such as chapter notes.

These notes will quickly take you through the key points of each chapter in the syllabus.

The next step is to revise the chapters as much as possible. Also, avoid relying on mugging up the answers.

And in order for you to understand better, we have video lessons which will enhance your learning experience and make studies interesting.

Why must you study with Esuccessmantra?

Our CBSE 12 board exam revision notes, solutions for sample question papers and other online learning resources are based on the latest CBSE syllabus.

You get free textbook solutions and doubt-solving sessions with experts.

Class 12 Commerce Video lectures

Class 12 Commerce Online Video Lectures In Saharanpur , Dehradun , Yamunanagar.

Our video notes and in-video assessments are ideal for quick revision of topics.

Our well-written study materials will support you to score more marks in the board exams.

1. Easy to access anytime

With video lectures, your students can learn anywhere from their mobile devices: laptops, tablets or smartphones. Just make sure the format of your lecture is supported on all devices.

An unsupported file format can become a nasty surprise when it comes to playing your lecture on an iPad or other popular device.

Esuccessmantra offers the perfect solution – it creates video lectures in the combined Flash & HTML5 format, so you can play your lecture in all browsers and mobile devices.

2. Learn whenever you want

Let your students enjoy the process of learning whenever they want. Just upload your video lectures online and send your students a link.

3. Learning at an individual pace

Every teacher knows that each student has his own pace of learning. With video lectures, all students can learn at their own individual pace, which will maximize the results of e-Learning.

4. Many ways to use

Video lectures are widely recognized as a type of distance learning. However, you can also use them in your in-class teaching. Such an innovative approach to teaching will engage your student and encourage your colleagues.

5. Easy to deliver

You can provide students with unlimited access to all your learning materials by uploading video lectures to the Web or LMS. Alternatively, you can create a CD or send your lecture by email.

For instance,Esuccessmantra just takes a single click of your mouse to publish the created video lecture to one of these destinations.

6. More effective learning

If a student happens to miss one of your lectures, you can send him the link to the lecture video (or simply make regular posts on your blog or website for all students to access at their convenience). This allows all your students to keep up with the curriculum.

7. Opportunity for self-study

In your interactive video lecture, you can refer to more useful materials and resources for self-study. Also, you can record an additional lecture that complements in-class activities.

8. Chance for self-testing

Video lectures can be especially useful for the teacher himself. Using the recording of the lecture, the teacher can take a look at his presenting skills to find out what can be improved.

See this example of an effective video presentation made with Esuccessmantra:

Class 12 Commerce Pendrive Classes

Class 12 Commerce pendrive Classes In Saharanpur , Dehradun , Yamunanagar.

Class XII CBSE Commerce USB Pendrive Course Ver 2.0 (Accounts Business studies Economics) with English (core).

All Lessons are Interactive Multimedia Video lessons with multiple Questions on the Basis of CBSE Evaluation Blue Print.

Topic WISE TEST of All – 4 Subjects. Total TOPICS available are _121 X 50 QUESTIONS

High quality content by Teachers, Resource Persons. It is easy to understand and remember, you can revise faster.

Format: Pen Drive/USB, Language: English, Valid Upto: life-time Active

Video can run on any laptop/computer also can be configure windows operating system.

Exam Attempt Year: 2020, Topics Covered: CBSE syllabus based all topics.

Demo Lecture Link

Click Here

Test Your Knowledge Through Scheduled Mock Tests

Our students also get access to schedule mock tests and practice sets.

Upon successful registration, you will get access to mock tests.

The syllabus and time table for the mock tests will be shared in advance to help you prepare in time.

The mock tests are marked just like in the main examination pattern to help you track your progress.

The question paper format and pattern are similar to the main examination to give you a real feel of the exam.

Once you attempt any mock test, you have to send the scanned answer copy to our email ID.

Our experts will check the content and provide the result as well as the answer key.

You can match the answer key with your answers and analyze your weak and strong points.

Preparing for class 12th commerce board exams becomes easier with class 12 Commerce online preparation video lectures.

Contact our exam expert now to know more about the course, duration, and other details.

www.esuccessmantra.com

0 notes

Text

MCQ Questions Based On Paper1 CBSE UGC NET EXAM July 2018 [Solved]

New Post has been published on https://ugcnetpaper1.com/cbse-ugc-net-solved-paper-1-july-2018/

MCQ Questions Based On Paper1 CBSE UGC NET EXAM July 2018 [Solved]

MCQ Previous Papers CBSE UGC NET Solved Paper 1 July 2018

Please find below 50 MCQ of Teaching Aptitude Question Based on CBSE UGC NET Solved Paper 1 July 2018 UGC NET exam. Answer of All those has been provided below the question.

**We have tried to compile the best answer, however, if you find any answer in incorrect , please feel free to comment we will be more than happy to modify same.

Questions along with Answers Below – Explanations are always welcome

1. Which of the following set of statements best describes the nature and objectives of teaching?

Teaching and learning are integrally related.

There is no difference between teaching and training.

Concern of all teaching is to ensure some kind of transformation in students.

All good teaching is formal in nature.

A teacher is a senior person.

Teaching is a social act whereas learning is a personal act.

Code:

(a), (b) and (d)

(b), (c) and (e)

(a), (c) and (f)

(d), (e) and (f)

Answer: 3

2. Which of the following learner characteristics is highly related to effectiveness of teaching?

(1) Prior experience of the learner

(2) Educational status of the parents of the learner

(3) Peer groups of the learner

(4) Family size from which the learner comes.

Answer: 1

3. In the two sets given below Set –I indicates methods of teaching while Set –II provides the basic requirements for success/effectiveness. Match the two sets and indicate your answer by choosing from the code:

Set – I (Method of teaching)

(a) Lecturing

(b) Discussion in groups

(c) Brainstorming

(d) Programmed Instructional procedure

Set – II (Basic requirements for success/effectiveness)

(i) Small step presentation with feedback provided

(ii) Production of large number of ideas

(iii) Content delivery in a lucid language

(iv) Use of teaching-aids

(v) Theme based interaction among participants

Code:

(a) (b) (c) (d) (1) i (ii) (iii) (iv) (2) (ii) (iii) (iv) (v) (3) (iii) (v) (ii) (i) 4 (iv) (ii) (i) (iii)

Answer: 3

From the list of evaluation procedures given below identify those which will be called ‘formative evaluation’. Indicate your answer by choosing from the code:

(a) A teacher awards grades to students after having transacted the course work.

(b) During interaction with students in the classroom, the teacher provides corrective feedback.

(c) The teacher gives marks to students on a unit test.

(d) The teacher clarifies to doubts of students in the class itself.

(e) The overall performance of a student’s us reported to parents at every three months interval.

(f) The learner’s motivation is raised by the teacher through a question-answer session.

Codes:

(1) (a), (b) and (c)

(2) (b), (c) and (d)

(3) (a), (c) and (e)

(4) (b), (d) and (f)

Answer: 4

5. Assertion (A): All teaching should aim at ensuring learning.

Reason (R): All learning results from teaching.

Choose the correct answer from the following code:

(1) Both (A) and (R) are true, and (R) is the correct explanation of (A).

(2) Both (A) and (R) are true, but (R) is not the correct explanation of (A).

(3) (A) is true, but (R) is false.

(4) (A) is false, but (R) is true.

Answer: 3

6. There are two sets given below. Set – I specifies the types of research, while Set –II indicates their characteristics. Match the two and given your answer by selecting the appropriate code.

Set – I (Research types)

(a) Fundamental research

(b) Applied research

(c) Action research

(d) Evaluative research

Set – II (Characteristics)

(i) Finding out the extent of perceived impact of an intervention

(ii) Developing an effective explanation through theory building

(iii) Improving an existing situation through use of interventions

(iv) Exploring the possibility of a theory for use in various situations

(v) Enriching technological resources

Codes:

(a) (b) (c) (d)

(1) ii (iv) (iii) (i)

(2) (v) (iv) (iii) (ii)

(3) (iii) (ii) (iii) (iv)

4 (ii) (iii) (iv) (v)

Answer: 1

7. Which of the sets of activities best indicate the cyclic nature of action research strategy?

(1) Reflect, Observe, Plan, Act

(2) Observe, Act, Reflect, Plan

(3) Act, Plan, Observe, Reflect

(4) Plan, Act, Observe, Reflect

Answer: 4

8. Which of the following sequence of research steps is nearer to scientific method?

(1) Suggested solution of the problem, Deducing the consequences of the solution, Perceiving the problem situation, Location of the difficulty and testing the solutions.

(2) Perceiving the problem situation, Locating the actual problem and its definition, Hypothesizing, Deducing the consequences of the suggested solution and Testing the hypothesis in action.

(3) Defining a problem, Identifying the causes of the problem, Defining a population, Drawing a sample, Collecting data and Analysing results.

(4) Identifying the causal factors, Defining the problem, Developing a hypothesis, Selecting a sample, Collecting data and arriving at generalization and Conclusions.

Answer: 3

9. The problem of ‘research ethics’ is concerned with which aspect of research activities?

(1) Following the prescribed format of a thesis

(2) Data analysis through qualitative or quantitative technique

(3) Defining the population of research

(4) Evidence based research reporting

Answer: 4

10. In which of the following activities, potential for nurturing creative and critical thinking is relatively greater?

(1) Preparing research summary

(2) Presenting a seminar paper

(3) Participation in research conference

(4) Participation in a workshop

Answer: 4

Read the following passage carefully and answer questions from 11 to 15:

If India has to develop her internal strengths, the nation has to focus on the technological imperatives, keeping in mind three dynamic dimensions: the people, the overall economy and the strategic interests. These technological imperatives also take into account a ‘fourth’ dimensions, time, and offshoot of modern day dynamism in business, trade, and technology that leads to continually shifting targets. We believe that technological strengths are especially crucial in dealing with this fourth dimension underlying continuous change in the aspirations of the people, the economy in the global context, and the strategic interests. The progress of technology lies at the heart of human history. Technological strengths are the key to creating more productive employment in an increasingly competitive market place and to continually upgrade human skills. Without a pervasive use of technologies, we cannot achieve overall development of our people in the years to come. The direct linkages of technology to the nation’s strategic strengths are becoming more and more clear, especially since 1990s. India’s own strength in a number of core areas still puts it in a position of reasonable strength in geo-political context. Any nation aspiring to become a developed one needs to have strengths in various strategic technologies and also the ability to continually upgrade them through its own creative strengths. For people-oriented actions as well, whether for the creation of large scale productive employment or for ensuring nutritional and health security for people, or for better living conditions, technology is the only vital input. The absence of greater technological impetus could lead to lower productivity and wastage of precious natural resources. Activities with low productivity or low value addition, in the final analysis hurt the poorest most important. India, aspiring to become a major economic power in terms of trade and increase in GDP, cannot succeed on the strength of turnkey projects designed and built abroad or only through large-scale imports of plant machinery, equipment and know how. Even while being alive to the short-term realities, medium and long-term strategies to develop core technological strengths within our industry are vital for envisioning a developed India.

11. According to the above passage, which of the following are indicative of the fourth dimension?

(a) Aspirations of people

(b) Modern day dynamism

(c) Economy in the global context

(d) Strategic interests

Code:

(1) (a), (b) and (c) only

(2) (b), (c) and (d) only

(3) (a), (c) and (d) only

(4) (a), (b) and (d) only

Answer: 3

If India has to develop her internal strengths, the nation has to focus on the technological imperatives, keeping in mind three dynamic dimensions: the people, the overall economy and the strategic interests

12. More productive employment demands:

(1) Pervasive use of technology

(2) Limiting competitive market place

(3) Geo-political considerations

(4) Large industries

Answer: 1

13. Absence of technology would lead to:

(a) Less pollution

(b) Wastage of precious natural resources

(c) Low value addition

(d) Hurting the poorest most

Codes:

(1) (a), (b) and (c) only

(2) (b), (c) and (d) only

(3) (a), (b) and (d) only

(4) (a), (c) and (d) only

Answer: 2

14. The advantage if technological inputs would result in:

(1) Unbridled technological growth

(2) Importing plant machinery

(3) Sideling environmental issues

(4) Lifting our people to a life of dignity

Answer: 4

15. Envisioning a developed India requires:

(1) Aspiration to become a major economics player

(2) Dependence upon projects designed abroad

(3) Focus on short-term projects

(4) Development of core technological strengths

Answer: 4

16. Differentiation between acceptance and non-acceptance of certain stimuli in classroom communication is the basis of:

(1) Selective expectation of performance

(2) Selective affiliation to peer groups

(3) Selective attention

(4) Selective morality

Answer: 1

17. Assertion (A): The initial messages to students in the classroom by a teacher need not be critical to establish interactions later.

Reason (R): More control over the communication process means more control over what the students are learning.

Codes:

(1) Both (A) and (R) are true, and (R) is the correct explanation of (A).

(2) Both (A) and (R) are true, but (R) is not the correct explanation of (A).

(3) (A) is true, but (R) is false.

(4) (A) is false, but (R) is true.

Answer: 4

18. Assertion (A): To communicate well in the classroom is a natural ability.

Reason (R): Effective teaching in the classroom demands knowledge of the communication process.

Code:

(1) Both (A) and (R) are true, and (R) is the correct explanation of (A).

(2) Both (A) and (R) are true, but (R) is not the correct explanation of (A).

(3) (A) is true, but (R) is false.

(4) (A) is false, but (R) is true.

Answer: 4

19. Assertion (A): Classroom communication is a transactional process.

Reason (R): A teacher does not operate under the assumption that students’ responses are purposive.

Select the correct code for your answer:

(1) Both (A) and (R) are true, and (R) is the correct explanation of (A).

(2) Both (A) and (R) are true, but (R) is not the correct explanation of (A).

(3) (A) is true, but (R) is false.

(4) (A) is false, but (R) is true.

Answer: 3

20. Which of the following set of statements is correct for describing the human communication process?

(a) Non-verbal communication can stimulate ideas.

(b) Communication is a learnt ability.

(c) Communication is not a universal panacea.

(d) Communication cannot break-down.

(e) More communication means more effective learning by students.

(f) Value of what is learnt through classroom communication is not an issue for students.

Codes:

(1) (a), (c), (e) and (f)

(2) (b), (d), (e) and (f)

(3) (a), (b), (c) and (d)

(4) (a), (d), (e) and (f)

Answer: 3

21. The next term in the series -1, 5, 15, 29,________, … is

(1) 36

(2) 47

(3) 59

(4) 63

Answer: 3

22. The next term in the series: ABD, DGK, HMS, MTB, SBL, ________, … is:

(1) ZKU

(2) ZCA

(3) ZKW

(4) ZKU

Answer: 3

23. If VARANASI is coded as WCUESGZQ, then the code of KOLKATA will be:

(1) LOQOZEH

(2) HLZEOOQ

(3) ZELHOQO

(4) LQOOFZH

Answer: 4

24. Introducing, Rakesh to her husband a women said, “His brother’s father is the only son of my grandfather”. The woman is related to Rakesh as:

(1) Aunt

(2) Mother

(3) Sister

(4) Daughter

Answer: 3

25. Two numbers are in the ratio 2: 5. If 16 is added to both the numbers, their ratio becomes 1: 2. The numbers are:

(1) 16, 40

(2) 20, 50

(3) 28, 70

(4) 32, 80

Answer: 4

26. Superiority of intellect depends upon its power of concentration on one theme in the same way as a concave mirror collects all the rays that strike upon it into one point.

(1) Mathematical

(2) Psychological

(3) Analogical

(4) Deductive

Answer: 3

27. Given below are two premises (A and B). Four conclusions are drawn from them. Select the code that states validity drawn conclusion (s) (taking the premises individually or jointly).

Premises:

(A) Most of the dancers are physically fit.

(B) Most of the singers are dancers.

Conclusions:

(a) Most of the singers are physically fit.

(b) Most of the dancers are singers.

(c) Most of the physically fit persons are dancers.

(d) Most of the physically fit persons are singers.

Code:

(1) (a) and (b)

(2) (b) and (c)

(3) (c) and (d)

(4) (d) and (a)

Answer: 1

28. Which one among the following is a presupposition in inductive reasoning?

(1) Law of identity

(2) Unchangeability in nature

(3) Harmony in nature

(4) Uniformity of nature

Answer: 4

29. If the proposition ‘domestic animals are hardly ferocious’ is taken to be false, which of the following proposition/propositions can be claimed to be certainly true? Select the correct code:

Propositions:

(a) All domestic animals are ferocious.

(b) Most of the domestic animals are ferocious.

(c) No domestic animal is ferocious.

(d) Some domestic animals are non-ferocious.

Code:

(1) (a) and (b)

(2) (a) only

(3) (c) and (d)

(4) (b) only

Answer: 3

30. Which one of the following statements is not correct in the context of Venn diagram method?

(1) It is a method of testing the validity of arguments.

(2) It represents both the premises of a syllogism in one diagram.

(3) It requires two overlapping circles for the two premises of a standard-form categorical syllogism.

(4) It can be used to represent classes as well as propositions.

Answer: 3

The table below embodies data on the production, exports and per capita consumption of rice in country P for the five years from 2012 to 2016. Answer questions 31 – 35 based on the data contained in the table.

Year-wise Production, Exports and Per Capita Consumption of Rice Year Production

(in million kg)

Exports

(in million kg)

Per Capita Consumption (in kg) 2012 186.5 114 36.25 2013 202 114 35.2 2014 238 130 38.7 2015 221 116 40.5 2016 215 88 42 Yearwise Details for DI

Where, Per Capita Consumption = (Consumption in million kg) / (Population in million) and consumption (in million kg) = Production – Exports.

31. The Percentage increase in the consumption of rice over the previous year was the highest in which year?

(1) 2013

(2) 2014

(3) 2015

(4) 2016

Answer: 2

32. What is the population of the country in the year 2014 (in million)?

(1) 2.64

(2) 2.72

(3) 2.79

(4) 2.85

Answer: 3

33. The ratio of exports to consumption in the given period was the highest in the year:

(1) 2012

(2) 2013

(3) 2014

(4) 2015

Answer: 1

34. In which year, the population of country was the highest?

(1) 2013

(2) 2014

(3) 2015

(4) 2016

Answer: 4

35. What is the average consumption of rice (in million kg) over the years 2012 – 2016?

(1) 104

(2) 102.1

(3) 108

(4) 100.1

Answer: 4

36. Which of the following statements, regarding the term ICT is/are TRUE?

P: ICT is an acronym that stands for Indian Classical Technology.

Q: Converging technologies that exemplify ICT include the merging of audio-visual, telephone and computer networks through a common cabling system.

(1) P Only

(2) Q Only

(3) P and Q

(4) Neither P nor Q

Answer: 2

37. A new Laptop has been produced that weighs less, is smaller and uses less power previous Laptop models.

Which of the following technologies has been used to accomplish this?

(1) Universal Serial Bus Mouse

(2) Faster Random Access Memory

(3) Blu Ray Drive

(4) Solid State Hard Drive

Answer: 4

38. Given the following email fields, which of the email addresses will ‘swami’ be able to see when he receives the message?

Mail- To CC and BCC for ICT

To… ram@test. com Cc… raj@test. com; ravi@test. com Bcc… swami@test. com; rama@test. com

(1) ram@test. com

(2) ram@test. com; raj@test. com; ravi@test. com

(3) ram@test. com; rama@test. com

(4) ram@test. com; rama@test. com; raj@test. com; ravi@test. com

Answer: 2

39. Put the following units of storage into the correct order, starting with the smallest unit first and going down to the largest unit:

(a) Kilobyte (b) byte (c) Megabyte (d) Terabyte (e) Gigabyte (f) Bit

Give your answer from the following code:

(1) (f), (b), (a), (c), (d), (e)

(2) (f), (b), (a), (d), (e), (c)

(3) (f), (b), (a), (c), (e), (d)

(4) (f), (b), (a), (d), (c), (e)

Answer: 3

40. With regard to computer memory, which of the following statement (s) is/are TRUE?

P: Read Only Memory (ROM) is ‘volatile’ memory.

Q: Random Access Memory (RAM) is ‘volatile’ memory.

R: Secondary Memory is ‘volatile’ memory.

(1) P only

(2) Q only

(3) P and Q only

(4) P and R only

Answer: 2

41. ‘Fly ash’ produced in thermal power plants is an ecofriendly resource for use in:

(a) agriculture as micro-nutrient

(b) wasteland development

(c) dam and water holding structures

(d) brick industry

Choose the correct answer from the code given below:

(1) (a), (b) and (d) only

(2) (b), (c) and (d) Only

(3) (a), (c) and (d) Only

(4) (a), (b), (c) and (d)

Answer: 4