#CRM in banking

Explore tagged Tumblr posts

Text

How Banking CRM Improves Onboarding TAT in the Banking Sector

When it comes to the customer onboarding process Banking CRM has an important role to play in the banking sector.

Improving the customer experience is a priority, as customers only want to experience the best quality services. Therefore, onboarding TAT is quite an important parameter for banks.

Why is customer onboarding TAT vital for banks?

With the help of banking CRM, banks can actually improve efficiency, response time, and eliminate all the manual processes along the way. This will not only improve the customer experience but also cause an increment in conversion rates.

How does Banking CRM help reduce the onboarding turnaround time?

Customer onboarding is often a time-consuming process that includes customer visits, a credit analysis process and heavy use of documentation. This is where a banking CRM plays a vital role in reducing the turnaround time for banks. Banking CRM digitalizes all manual processes with automated workflows and solutions.

Five crucial benefits of having a Banking CRM:

An automated lead management process can guide the banks with, lead capture, lead scoring, lead qualification, lead allocation and closing the deals. When you don’t have a proper lead CRM in place, you risk a lower return on investment, a leaky sales funnel, and strained relationships with leads and customers.

2. Real-Time Sales Tracking

With this feature, the sales managers could monitor the performance of the sales reps to ensure they are making the most of their time in the field, keeping them organized and productive.

Instant alerts and real-time tracking can guide the team to better manage sales agents’ time and set their daily schedules to improve their productivity in no time.

3. Automating the Underwriting Process

Banking CRM can guide the credit analysis process via streamlining the entire journey, for instance, by providing the platform to upload all the required documents digitally.

Automating the KYC, De-dupe, CDD (Customer due diligence), BL (Black List), and CIBIL score checks can save a lot of time for the credit managers when visiting for Personal Discussions (PD).

5. Customer Experience

Keeping the consumer happy is the only sustainable way to build a business and improve the customer experience with easy and straightforward navigation.

It includes not just data collection and the acceptance of an inescapable administrative burden, but also an understanding of the prospect’s needs. The digital workflow allows the process to be adjusted to the consumers’ demands and tastes.

Orginal source: How Banking CRM Improves Onboarding TAT in the Banking Sector - Toolyt

2 notes

·

View notes

Text

Experienced Salesforce Consultant Seeking Financial Services Client

Looking for a challenging project?

Seasoned Salesforce consultants at FEXLE are specialized in Financial Service Cloud implementations. With a proven track record of delivering successful projects FEXLE can help you optimize your operations and improve customer satisfaction.

Learn More here !

#salesforce crm#salesforce financial services cloud#Fexle Services#Sf Consulting company#Banking Industry

1 note

·

View note

Text

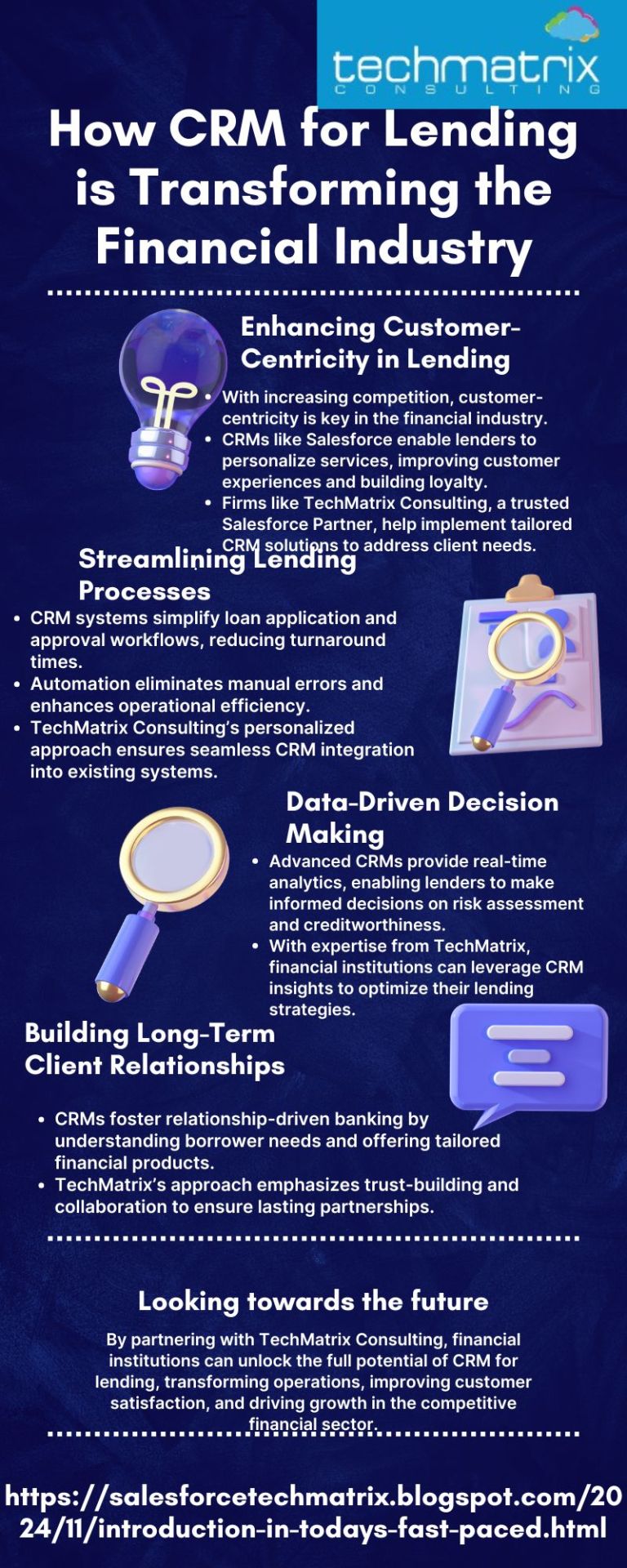

Customer Relationship Management (CRM) solutions are revolutionizing the financial industry by streamlining lending processes, enhancing customer experiences, and driving data-driven decision-making. Companies like TechMatrix Consulting, a trusted Salesforce Partner with a global presence, empower lenders with personalized CRM for lending implementations to meet evolving business needs. CRMs help automate workflows, improve communication, ensure compliance, and deliver actionable insights. With over a decade of expertise and a team of 250+ certified professionals, TechMatrix ensures long-term benefits by building trust, enabling scalability, and fostering collaboration. You can just transform your lending operations with CRM solutions tailored to your goals.

#CRM for lending#Financial industry transformation#Salesforce CRM solutions#TechMatrix Consulting#Customer-centric CRM for banks#CRM benefits in lending#Streamlining loan processes#Lending automation with CRM#Data-driven decisions in lending

0 notes

Text

Assaf Baciu, Co-Founder & President of Persado – Interview Series

New Post has been published on https://thedigitalinsider.com/assaf-baciu-co-founder-president-of-persado-interview-series/

Assaf Baciu, Co-Founder & President of Persado – Interview Series

Assaf Baciu has nearly two decades of experience shaping enterprise strategy and product direction for market-leading SaaS organizations. As co-founder and President of Persado, he drives the progression and advancements of Persado’s growing product portfolio and oversees the company’s customer onboarding, campaign delivery management, Center of Enablement programs, and technical services.

Persado offers a Motivation AI platform designed to enable personalized communications at scale, encouraging individuals to engage and take action. Several of the world’s largest brands, such as Ally Bank, Dropbox, JPMorgan Chase, Marks & Spencer, and Verizon, use Persado’s platform to create highly personalized communications. According to the company, the top 30 Persado customers have collectively generated over $4.25 billion in additional revenue through the use of the platform.

Can you share the story behind the founding of Persado and how your previous experiences influenced its creation?

My co-founder, Alex Vratskides, and I founded Persado 12 years ago. We were at Upstream, and became fascinated with how text message response rates changed with even minor tweaks in the language. Given that the number of characters is limited for SMS, we started thinking about text messages as a mathematical problem that has some finite number of alternative messages, and with the right algorithm we could find the optimal ones. We evaluated some approaches and saw that there is a way…and the rest is history.

Persado’s Motivation AI Platform is highlighted for its ability to personalize marketing content. Can you explain how the platform uses generative AI to understand and leverage customer motivation?

GenAI, on its own, via a foundation model, cannot motivate systematically. It’s a component with a stack of data, machine learning, and a response feedback loop.

Persado has been generating and optimizing language using various approaches for over 10 years. We’ve accumulated a unique dataset from one million A/B tests from messages, across industries, designed to connect with consumers and motivate action at any stage. We leverage this data to finetune a foundation model with Supervised Fine Tuning (SFT) and Reinforcement Learning from Human Feedback (RLHF). We’ve also adapted a second transformer model to be able to predict message performance based on language parameters. On top of that, our machine learning (ML) algorithms understand—in real time—which language elements resonate with a given individual, then adjust the copy within the communication to that person or segment.

By continuously learning the most effective combination of message elements for each consumer, and dynamically creating the most engaging content, Persado-generated content is able to outperform human and other AI-generated copy 96% of the time.

How does Persado’s Motivation AI Platform differentiate itself from other generative AI tools in terms of driving business results?

Persado is unique on many fronts.

Purpose-Built – Persado has the only models specifically trained and curated with 10 billion tokens of marketing enterprise communication, coupled with behavioral data.

Emotionally Intelligent – Our AI is designed to understand and generate language that elicits specific emotional responses from target audiences. This capability is grounded in advanced ML models trained on extensive linguistic and psychological data.

Precision – Our platform leverages the most powerful model architectures and is trained with statistically valid customer behavior data. We have executed the equivalent of more than 1M A/B tests, which enables us to generate the specific words, phrases, emotions, and stories that drive incremental impact 96% of time.

Knowledge Graph – Persado developed a representation of key concepts expressed via language and their relationship with the market vertical, type of communications, customer lifecycle journey, and channels. We use advanced NLP techniques to classify, identify, and make use of these concepts (emotions, narratives, structure of message, voice, and more) to generate and personalize better performing messages.

Predictive – We use predictive analytics to forecast the performance of different messages, empowering marketers to create content with a high probability of success. This predictive power is unique and offers customers a great competitive edge.

What are some of the key capabilities that Persado’s AI platform offers to ensure a seamless integration with existing marketing technologies?

Our platform securely integrates with a brand’s existing tech stack to simplify marketing content generation so brands can easily generate the highest-performing digital marketing messaging they need to boost results. We combine custom, non-PII user attributes, and Persado’s award-winning language generation models to more effectively communicate with every customer across channels, at any stage of their journey.

Motivation AI is compatible with over 40 martech solutions to ensure each brand can use their existing martech stack to generate the most relevant, personalized outputs for their customers.

Content Delivery Platforms – Our processes and tech enablers are designed to streamline the configuration of Persado-generated content in your deployment platform

Customer Data Platforms – The platform facilitates a regular update of non-PII data with Persado as an input for relevant and personalized content generation

Analytics Platforms – We provide processes and data flows to seamlessly integrate results and reporting back into the Persado platform, supporting continuous learning and enhancing machine learning capabilities

Can you describe the process of onboarding a new client and how Persado’s AI helps in their campaign management and delivery?

Prior to formal onboarding, Persado ingests all relevant brand voice materials from its clients, such as style guidelines, information on segments, language restrictions, and more. This trains our model on how to write for a business’s particular brand on day one. We hit the ground running with a partnership kickoff to define KPIs and campaign focus areas as well as to educate users on Persado Portal, our centralized platform where all content is generated, approved, and deployed. In addition to hosting weekly check-ins during onboarding, we close out onboarding with an executive business review summarizing performance thus far and next steps.

Our teams help brands get the tone or brand voice correct across channels by grounding all of their outputs in emotion—a key element of language that motivates customers to engage. By leaning into the emotions and narratives most likely to resonate with each customer, brands can create more effective, revenue-driving campaigns while staying true to the brand’s values.

Scalability is one of the biggest ways we’re able to help businesses with their campaigns. Personalization is a key tactic for marketers to reach key audiences and attract new customers. However, true personalization is challenging to achieve at scale. Using Persado’s knowledge base of 1.5 billion real customer interactions, we help enterprises uncover which versions of a message resonate best with their customers, so they can personalize these messages in real-time at each stage of the customer journey.

You’ve worked with top banks and card issuers, driving significant revenue increases. Could you provide specific examples of how Persado’s AI has enhanced marketing performance for these clients?

Yes, while we work with many industries, we have deep experience working with 8 of the 10 largest U.S. banks and 6 of the 7 top credit card issuers. Here are a few examples of impact:

Chase has used Persado to generate and optimize marketing messages for consumers in its Card and Mortgage businesses. They have been using Persado since 2019 to write personalized market copy by analyzing massive datasets of tagged words and phrases. In pilot tests run by Chase, Persado AI-generated ad copy delivered click-through rates up to 450% higher than copy created by humans alone.

Ally Bank uses Persado to enhance cross-sell opportunities. Our Motivation AI platform has helped Ally understand which marketing communications resonate well with their customers across key channels like email and web. By knowing the do’s and don’ts related to targeted conversations with customers, the product marketing and CRM team are able to deliver a better CX and unlock double-digit improvement on KPIs like clicks and actual conversions.

How does Persado’s AI ensure that generated messages remain on-brand and comply with industry regulations, particularly for highly regulated sectors like finance?

As you noted, because sectors like financial services are highly regulated, it can be challenging to implement AI across business functions. In financial services and beyond, brand and legal compliance are a major piece of the AI puzzle. Although compliance and establishing AI governance can seem daunting, whether you’re part of a large enterprise or small business, it shouldn’t be a reason to not implement AI, or at least test it out.

To ensure copy is aligned with best practices and regulations, we ingest compliance and brand guidelines into Persado’s model. Our built-in tools allow for easy compliance and brand review, feedback, and approval before deployment.

We adjust our approach to help financial services brands remain compliant. While we can’t target specific demographics, such as age, for personalized marketing in financial services, we create high-performing narratives or emotional tones that resonate overall. From there, we observe which messages resonate with a bank or card issuer’s different segments.

What are some common challenges businesses face when trying to prove the value of AI, and how does Persado address these challenges?

There is a “opportunity lost” cost of enterprise inaction. A few changes in word choice can mean the difference between a completed transaction, application or enrollment and money being left on the table.

Persado’s impact is easily measured. We integrate with analytics systems and continuously evaluate success via automated A/B tests that show the performance of our more engaging, personalized content, vs what the brand initially created. And, we measure the difference via the conversion funnel. On average, Persado increases content performance 43%, compared to humans alone or another AI solution.

Our purpose-built AI is not only impactful, but easy to measure, which empowers business leaders to make better decisions about the technology investment—and quickly prove its value.

Given the rapid advancements in generative AI, what steps is Persado taking to stay ahead of the curve and maintain its industry leadership?

We’ve been leaders in AI for over a decade; long before it became popular following the launch of ChatGPT. As GenAI curiosity has increased across industries, we’ve been excited to bring and expand our marketing-specific capabilities among large enterprises needing a proven solution for creating high-performing, compliant messages at scale. We do this across channels as well: email, websites, social media, SMS/push notifications, and even IVR.

Our global product and customer success teams are continually listening to our customers—who are among some of the earliest, and most successful adopters of AI–and shaping our roadmap to help them deliver a stellar digital customer experience that also drives increased sales, loan application completions, on-time, payments, or other actions.

For example, we recently released new pre-built audience segments to speed personalized content generation for marketers across financial services, retail, and travel. This feature helps brands increase engagement with specific groups of customers by making it even easier and faster to generate marketing content that will resonate with customers.

What is your vision for the future of marketing and AI?

The possibilities for AI in marketing are only expanding. AI can serve as a helpful asset for marketers to enhance experiences and reach audiences in new, more personalized ways. I think we’ll see marketers shift from expecting (and using) GenAI to improve efficiency and productivity, to also ensuring AI tools deliver measurable increased performance.

Establishing AI governance and standards will also become more important as companies expand AI use cases with an eye on responsible AI. If they’re not careful, brands can risk not being compliant with regulations.

Companies will need to be vigilant and use guardrails to ensure models can be tested to ensure they are free of biases, and that content outputs are accurate, relevant, and on-brand. Applied properly, AI has the potential to turbo-boost marketing performance and customer experiences, which generates the most valuable benefit for businesses: increased revenue.

Thank you for the great interview, readers who wish to learn more should visit Persado.

#ai#AI in Marketing#ai platform#ai tools#ai use cases#algorithm#Algorithms#amp#Analytics#approach#bank#banks#Behavior#behavior data#behavioral data#billion#brands#Business#chatGPT#communication#communications#Companies#compliance#consumers#content#continuous#credit card#crm#curiosity#customer experience

0 notes

Text

The Shift to Cloud-Based CRM for Investment Banks: Benefits and Challenges

In the fast-evolving world of finance, investment banks need efficient tools to manage their complex client relationships and data. One such tool is cloud-based CRM, which has become essential for maintaining a competitive edge. Unlike traditional systems, a cloud-based CRM software offers real-time access to critical information, allowing investment bankers to streamline their workflows and collaborate more effectively across teams.

Why Investment Banks Need Cloud-Based CRM

Investment banks handle massive volumes of data that require swift analysis and secure management. A cloud-based CRM offers scalability, enabling banks to adjust their operations as they grow or adapt to market changes. It also enhances communication by providing a centralized platform for sharing client information, helping teams work seamlessly.

Benefits of Cloud-Based CRM

Key benefits include improved collaboration across departments, better data security, and easier compliance with regulations. Cloud-based CRMs are built with robust security features, which are critical in the finance industry where data breaches can have severe consequences. Additionally, these systems are scalable, allowing investment banks to integrate new features and users as needed without heavy infrastructure costs.

Challenges of Cloud-Based CRM Adoption

However, moving to a cloud-based system is not without challenges. Investment banks may face complexities with data migration and concerns about data privacy. Proper planning and selecting the right vendor can help overcome these hurdles.

In conclusion, adopting a cloud-based CRM is a smart strategic decision that helps investment banks stay agile, secure, and client-focused in today’s dynamic financial landscape.

0 notes

Text

Unlocking Success: 10 Benefits of Salesforce CRM in the Banking Sector

In an industry as dynamic as banking, having the right tools is key to staying competitive. Salesforce CRM not only enhances customer relationships but also streamlines operations, boosts sales, and ensures regulatory compliance.

0 notes

Text

#banking crm#crm in banking sector#crm for banking#crm for banking industry#crm and banking#crm in banking industry#banking crm solution

0 notes

Text

Importance of Customer Relationship Management (CRM) in Banking

Customer Relationship Management (CRM) is essential in banking because it helps financial institutions build stronger relationships with their customers, enhance service delivery, and drive business growth. In a competitive market where customer experience is crucial, CRM plays a key role in improving customer satisfaction, retention, and profitability. Here’s why CRM is important in banking:

1. Improved Customer Service

Personalized Experience: CRM systems allow banks to store and analyze customer data, enabling them to provide personalized financial advice and product recommendations. This enhances customer satisfaction by delivering services that meet their individual needs.

Faster Response Times: CRM helps banks manage customer inquiries and issues more efficiently. By having access to a customer’s full history, bank representatives can quickly resolve problems, leading to better service and a positive customer experience.

Also read- bank account freeze by telanagana cyber crime

2. Customer Retention and Loyalty

Proactive Engagement: CRM systems allow banks to track customer behaviors and anticipate their needs. For example, if a customer has a mortgage that is about to expire, the bank can proactively reach out with renewal options, enhancing customer loyalty.

Tailored Communication: By segmenting customers based on their behaviors and preferences, banks can send targeted marketing campaigns and offers. This personalized communication increases engagement and reduces the risk of customer churn.

Also read- bank account freeze by up cyber crime cell

3. Data-Driven Decision Making

Comprehensive Customer Insights: CRM systems provide banks with a 360-degree view of each customer, including their transaction history, financial goals, and preferences. This data allows banks to make informed decisions about which products to offer and how to approach different customer segments.

Predictive Analytics: By analyzing customer data, banks can predict future behaviors, such as potential loan defaults or interest in new investment products. This enables proactive decision-making and better risk management.

Also read- cyber cell noc

4. Cross-Selling and Up-Selling Opportunities

Identifying Needs: CRM helps banks identify cross-selling and up-selling opportunities by analyzing customer data. For example, if a customer frequently travels abroad, the bank can recommend foreign exchange services or travel insurance.

Increasing Revenue: By targeting the right customers with the right products at the right time, banks can increase revenue through personalized offers. CRM systems help track which products are most suitable for each customer, improving conversion rates.

Also read- account frozen meaning in hindi

5. Enhanced Customer Relationship Management

Building Trust: CRM systems allow banks to develop stronger, more personalized relationships with their customers by understanding their needs and preferences. This fosters trust, which is crucial in financial services, where customers need to feel confident in their bank’s ability to manage their money.

Continuous Engagement: CRM enables banks to maintain continuous communication with customers, ensuring that they feel valued and appreciated. Regular interactions, personalized advice, and timely support help build long-term relationships.

Also read- frozen account meaning in hindi

6. Operational Efficiency

Automation of Routine Tasks: CRM systems automate routine tasks, such as sending reminders for loan payments or generating reports. This reduces the administrative burden on bank staff, allowing them to focus on more complex customer needs.

Centralized Customer Data: By consolidating customer data into a single platform, CRM systems eliminate the need for manual data entry and reduce errors. This ensures that all bank departments have access to the same up-to-date customer information, improving coordination and efficiency.

7. Compliance and Risk Management

Regulatory Compliance: Banks are subject to strict regulations, such as anti-money laundering (AML) and Know Your Customer (KYC) requirements. CRM systems help banks manage and track compliance by securely storing customer data and automating processes related to identity verification and transaction monitoring.

Risk Identification: By analyzing customer behaviors and patterns, CRM systems can help banks identify potential risks, such as fraud or non-compliance. This allows banks to take preventive measures, reducing the likelihood of financial losses or regulatory penalties.

8. Customer Acquisition and Growth

Targeted Marketing Campaigns: CRM systems enable banks to create highly targeted marketing campaigns based on customer demographics, behaviors, and preferences. This ensures that marketing efforts are focused on the right audience, increasing the chances of acquiring new customers.

Customer Referrals: Satisfied customers are more likely to refer friends and family to their bank. CRM systems can track referral programs, reward loyal customers, and help banks grow their customer base through word-of-mouth marketing.

9. Seamless Multichannel Integration

Omnichannel Experience: Modern CRM systems allow banks to integrate customer interactions across multiple channels, including branches, mobile apps, websites, and call centers. This ensures that customers receive a consistent experience regardless of how they choose to interact with the bank.

Unified Communication: CRM systems track customer interactions across all channels, allowing banks to deliver seamless service. For example, if a customer starts an inquiry online and follows up in a branch, the bank representative will have access to the full conversation history.

10. Performance Tracking and Continuous Improvement

Employee Performance Monitoring: CRM systems provide detailed insights into how well bank staff are serving customers. Metrics like response time, customer satisfaction, and issue resolution rates can be tracked to identify areas for improvement.

Feedback Loops: CRM systems can capture customer feedback and help banks make continuous improvements to their services. By analyzing feedback trends, banks can identify common pain points and take steps to address them.

Conclusion

CRM systems are crucial for banks in delivering personalized services, improving customer satisfaction, and driving growth. By centralizing customer data, automating processes, and enabling data-driven decision-making, CRM enhances operational efficiency and strengthens customer relationships. Banks that effectively implement CRM systems are better positioned to meet the evolving needs of their customers, retain loyalty, and remain competitive in the market.

0 notes

Text

Top 10 Advantages of Salesforce Use in the Banking Industry

In this fast and rapidly growing Virtual Environment , the banking sector is making a drastic change . The institutions belonging to financial services are revolutionizing to digital rather than adhere to physical locations.

Salesforce in the Banking Sector are becoming a smooth transition with customers, personalized evaluations. Banks are in search of more fond of the modern period to acquire this, and salesforce is leading this transformation for no doubt.

As we know that Salesforce CRM is the leading platform in the world and has equally become the essential tool for the bank sector . But the question comes why is salesforce so important to the banking sector ? Let us go through The Top 10 Advantages of Salesforce Use in the Banking Industry.

1. Enhanced Customer Experience

In the banking industry, customer satisfaction is given top priority. With Salesforce, banks may benefit from a 360-degree perspective of their client expectation. With the integration of customer data from many channels, banks are able to find the needs and provide a customer experience that encourages repeat business.

2. Streamlined Operations

Salesforce helps banks operate more efficiently by automating routine tasks, reducing guide mistakes. Salesforce streamlines processes, saves time, and lowers operating costs for loan processing, customer onboarding, and compliance assessments.

3. Improved Customer Retention

Maintaining customers is one of banks' most important tasks. Banks are able to identify customers that pose a risk, identify the reasons behind their discomfort, and take proactive measures to retain them by utilizing Salesforce's powerful analytics and AI-driven insights.

4. Robust Compliance Management

Banking relies heavily on action, and adheres to strict guidelines that must be followed. Salesforce ensures that all strategies are auditable by providing a centralized platform for managing actions.

5. Decision Making

Banks can make decisions based on facts thanks to Salesforce's excellent analytics tools. Through the examination of customer data, market trends, and economic performance, banks are able to make informed decisions that drive up profits.

6. Seamless Integration with Other Systems

For their operations, banks rely on a variety of technology, such as pricing gateways and center banking solutions. Salesforce provides smooth system integration, delivering a unified platform that boosts productivity and simplifies the administration of many pieces of equipment.

7. Enhanced Marketing and Sales Efforts

Salesforce's marketing automation tools enable banks to launch targeted programs, adjust their efficacy, and enhance them instantly. Banks may improve sales, increase conversion rates, and provide better results by coordinating their advertising, marketing, and sales operations.

8.Scalable and Customizable Solutions

Two of Salesforce's primary benefits are its scalability and personalisation. Salesforce expands with you as your bank does, offering new features and functionalities that support your expansion.

9. Improved Collaboration Across Teams

In banking, cooperation between specialized departments is crucial. Sales, advertising, compliance, and customer service are some of these divisions. Salesforce provides a platform for team collaboration that facilitates idea sharing, problem solving, and faster problem resolution—all of which enhance client outcomes.

10. Future-Ready Platform

The Banking industry continues in the future advancements in respective technology by keeping the client demands. Salesforce is a great platform that is completely ready for the future because it is constantly changing and implementing new features to match the current demands.

Salesforce is a comprehensive platform that helps banks modernize their operations, enhance customer experiences, and promote growth. It is more than just a CRM. Salesforce gives banks the data and resources they need to thrive in a world where customers have higher expectations than ever.

Now might be the perfect moment to investigate what Salesforce can do for you if you're in the banking sector. The benefits are obvious, and there are countless options.

#salesforce#banking#banking services#salesforcefinancial#salesforce crm#financial services#customerrelationshipmanagement

0 notes

Text

Top 10 Advantages of Salesforce Use in the Banking Industry

In this fast and rapidly growing Virtual Environment , the banking sector is making a drastic change . The institutions belonging to financial services are revolutionizing to digital rather than adhere to physical locations.

Salesforce in the Banking Sector are becoming a smooth transition with customers, personalized evaluations. Banks are in search of more fond of the modern period to acquire this, and salesforce is leading this transformation for no doubt.

As we know that Salesforce CRM is the leading platform in the world and has equally become the essential tool for the bank sector . But the question comes why is salesforce so important to the banking sector ? Let us go through The Top 10 Advantages of Salesforce Use in the Banking Industry.

1. Enhanced Customer Experience

In the banking industry, customer satisfaction is given top priority. With Salesforce, banks may benefit from a 360-degree perspective of their client expectation. With the integration of customer data from many channels, banks are able to find the needs and provide a customer experience that encourages repeat business. 2. Streamlined Operations

Salesforce helps banks operate more efficiently by automating routine tasks, reducing guide mistakes. Salesforce streamlines processes, saves time, and lowers operating costs for loan processing, customer onboarding, and compliance assessments.

3. Improved Customer Retention

Maintaining customers is one of banks' most important tasks. Banks are able to identify customers that pose a risk, identify the reasons behind their discomfort, and take proactive measures to retain them by utilizing Salesforce's powerful analytics and AI-driven insights.

4. Robust Compliance Management

Banking relies heavily on action, and adheres to strict guidelines that must be followed. Salesforce ensures that all strategies are auditable by providing a centralized platform for managing actions.

5. Decision Making

Banks can make decisions based on facts thanks to Salesforce's excellent analytics tools. Through the examination of customer data, market trends, and economic performance, banks are able to make informed decisions that drive up profits.

6. Seamless Integration with Other Systems

For their operations, banks rely on a variety of technology, such as pricing gateways and center banking solutions. Salesforce provides smooth system integration, delivering a unified platform that boosts productivity and simplifies the administration of many pieces of equipment.

7. Enhanced Marketing and Sales Efforts

Salesforce's marketing automation tools enable banks to launch targeted programs, adjust their efficacy, and enhance them instantly. Banks may improve sales, increase conversion rates, and provide better results by coordinating their advertising, marketing, and sales operations.

8.Scalable and Customizable Solutions

Two of Salesforce's primary benefits are its scalability and personalisation. Salesforce expands with you as your bank does, offering new features and functionalities that support your expansion.

9. Improved Collaboration Across Teams

In banking, cooperation between specialized departments is crucial. Sales, advertising, compliance, and customer service are some of these divisions. Salesforce provides a platform for team collaboration that facilitates idea sharing, problem solving, and faster problem resolution—all of which enhance client outcomes.

10. Future-Ready Platform

The Banking industry continues in the future advancements in respective technology by keeping the client demands. Salesforce is a great platform that is completely ready for the future because it is constantly changing and implementing new features to match the current demands.

Salesforce is a comprehensive platform that helps banks modernize their operations, enhance customer experiences, and promote growth. It is more than just a CRM. Salesforce gives banks the data and resources they need to thrive in a world where customers have higher expectations than ever.

Now might be the perfect moment to investigate what Salesforce can do for you if you're in the banking sector. The benefits are obvious, and there are countless options.

#salesforce#banking#banking services#salesforcefinancial#salesforce crm#financial services#customerrelationshipmanagement

1 note

·

View note

Text

Walka o klienta trwa

Walka o klienta trwa. Banki zyskują przewagę dzięki AI i no-code https://linuxiarze.pl/walka-o-klienta-trwa-banki-zyskuja-przewage-dzieki-ai-i-no-code/

0 notes

Text

he ideal banking CRM software to engage, collaborate and onboard customers in a seamless process with automated workflows to optimize productivity for your sales team.

1 note

·

View note

Text

7 Trusted CRMs for Investment Banking in 2024

Investment banking is a fast-moving, data-driven field, and having the right CRM (Customer Relationship Management) system is crucial for staying ahead.

Here are seven trusted CRMs that are shaping investment banking in 2024:

InsightsCRM Specifically built for investment banking, InsightsCRM helps firms manage complex workflows, track deals, and generate insights into client interactions. It’s designed to streamline operations while providing deep financial insights.

Salesforce Financial Services Cloud A market leader, Salesforce Financial Services Cloud offers customization and scalability. It’s perfect for managing assets, client onboarding, and compliance, with features that evolve alongside your firm.

Microsoft Dynamics 365 Microsoft Dynamics 365 seamlessly integrates with Office tools and provides AI-powered analytics. It enables predictive insights, helping bankers anticipate market trends and client needs.

HubSpot CRM Known for its simplicity, HubSpot CRM is ideal for managing client interactions and automating marketing. Its intuitive interface has grown sophisticated enough for the demands of investment banking.

Pipedrive Pipedrive’s deal-focused system makes it a favorite for managing transactions. Its visual pipelines and automated workflows simplify the deal process.

Zoho CRM Zoho CRM is affordable and highly customizable, offering powerful features like deal tracking and analytics, making it a great choice for smaller firms.

SugarCRM SugarCRM stands out for its AI-driven automation and flexibility, allowing firms to streamline communications and tailor workflows to their needs.

Why InsightsCRM is Better Than Other CRMs for Investment Banking

InsightsCRM stands out by offering industry-specific features tailored for investment banking, like advanced deal tracking and financial reporting. Unlike general CRMs, it simplifies complex workflows without requiring heavy customization. With built-in tools for financial insights, it's more cost-effective than options like Salesforce and Dynamics, making it the perfect fit for investment banking firms.

These CRMs are helping investment banking firms optimize operations and better serve their clients in 2024!

Read this article to learn more.

0 notes

Text

Level up your banking experience with Monay, A Global Payment Solution from Tilli Software.

Level up your banking experience with Monay, A Global Payment Solution from Tilli Software.

At Monay, we're all about empowering you with fully functional and scalable financial products that cater to your unique needs. Our Global Payment System ensures faster and smoother transactions and empowers you to accept ACH and wire transfers effortlessly.

Curious to learn about Monay, just drop a “YES” in the comments below, and our team will reach out to you in a jiffy!

For more information visit → https://tilli.pro/monay/banking

#utility industry#gps#globalpayments#paymentsolutions#application#software#crm#banking#money#finance#business#payments#ecommerce#merchantservices#paymentprocessing#utility#bills#banks#baas#SendMonay#receive money#app#entrepreneur

0 notes