#Ca for intermediate student

Explore tagged Tumblr posts

Text

Embrace the Future of Learning – Why Online Classes and Paras are the Perfect Combination for CA Inter Students

At Paras, we understand the needs of modern-day students. That’s why we offer online classes that provide the flexibility and convenience you need to excel in your studies without sacrificing your work or personal life. Our online classes are designed to be interactive, engaging, and effective, ensuring that you get the best possible education and training.

If you read more click here

0 notes

Text

welcome.

hello, i’m deeya.

i have started this studyblr to document my academic journey to become a chartered accountant one day. i hope you support me, and we build a lovely community xx

i’m seventeen years old and i graduated from high school a few months ago. i have decided to pursue chartered accountancy along with bcom or bcom hons (still not sure).

college will start in fall, and currently i’ll spend my summer working to complete ca foundation.

fav shows: anne with an e, derry girls, suits, supernatural, vampire diaries, brooklyn 99, bojack horseman, stranger things, umbrella academy, gravity falls, and so many more.

fav movies: dead poets society (comfort movie), little women, any 2000s bollywood, any coming-of-age film and anything marvel and star wars!!

fav artists: hozier, lorde, lana del rey, taylor swift, ethel cain, mitski and the cranberries. (i’ll listen to anything, i swear)

fav books: the secret history, the picture of dorian gray, all rick riordan books, the hunger games, a good girl’s guide to murder, the bell jar, harry potter series, the shadowhunter chronicles.

fav writers/poets: dostoyvesky, sylvia plath!!(i love her), oscar wilde, jane austen, mary shelley, and franz kafka.

other fun facts:

i am a big reader, well used to be, but i now i don’t have enough time for it (shameful i know)

i am also an aspiring writer! i am currently working on two novels and i even have an writersgram (shush i’m not disclosing it yet)

i love stories about history, greek mythology, hindu mythology and everything about those.

i speak three languages but i want to learn atleast seven.

i had a huge dark academia phase, and i seriously love greek and latin so much.

i love fangirling over everything & have like 1089211 obsessions that i go crazy about.

i have so many random hobbies i can’t even mention them all (knitting, baking, art, gardening…)

i want to make a short film all by myself and i’m learning more about filmatography.

i am a literature, classics, history girl at my core but i don’t know why i have chosen to study finance, law, business and accounts instead??

my dream is to move out of my hometown (probably to london, it’s my fave city) and buy a little house and have 11 cats.

that’s already too much info about me, i’d love to befriend all of you in the comments, feel free to strike a conversation about anything xx

with love,

deeya.

#studyblr#study motivation#study aesthetic#commerce#finance#business#accountancy#law#chartered accountant#castudents#ca foundation#ca intermediate#studyspo#dark academia#indiancommercestudents#indian studyblr#desi#motivation#ca#oxford university#harvard#university#high school#student life#eldest daughter#leaving home

37 notes

·

View notes

Text

Delhi Offline Marathon – CA Intermediate | Ultimateca

🔥 ONE DAY TO GO! 📅 Advanced Accounting with CA Tejas Suchak – 11 & 12 April 📅 GST with CA Vivek Gaba – 13 April 📍 Location: AKN Kailash Thakur Institute, Laxmi Nagar, Delhi 🕙 Timing: 10:00 AM – 6:00 PM

🌐 Enquire now at https://www.ultimateca.com/

#CA Intermediate#Delhi Offline Marathon#Ultimate CA#CA Revision#CA Exam Prep#GST Marathon#Advanced Accounting#CA Offline Class#CA Students#Delhi Events#Laxmi Nagar#CA Offline Session#Last Minute Prep#Top Educators#CA Marathon 2025

0 notes

Text

Top Faculties for CA FM SM

#education#career#students#exams#cainter#ca intermediate#ca coaching#ca classes#castudents#heeramandi#web series

1 note

·

View note

Text

Our institute proudly stands as a beacon of excellence in the field of CA education. We are committed to providing nothing but the best CA coaching in India, recognizing that your aspirations and ambitions deserve top-tier guidance and support.

0 notes

Text

American Artist Transforms Surfboards into Stunning Mosaic Masterpieces

Anne Marie Price is a Southern California-based mosaic artist and teacher, known for her contemporary mosaic surfboards. While immersed in mosaic art, she was inspired by the coastal lifestyle and surfing culture around her to experiment with mosaics on surfboards. Having worked as a mosaic artist since 2003, she initially taught herself the craft, exploring various substrates and adhesives before learning advanced techniques from some of the world’s leading mosaic artists and instructors.

Her journey into mosaic surfboards began with a piece created for a charity event in Huntington Beach, CA. This project led to an invitation to teach her technique through the instructional video company Mosaic Arts Online, with whom she had previously collaborated on a “Mosaic on Stone” course. Passionate about making mosaic education accessible, she was eager to bring instruction into students’ homes and studios—an opportunity she wished had been available to her in the early days of her career as a single, working mother without the flexibility to travel for in-person classes.

Creating the instructional video Mosaic a Surfboard with Anne Marie Price has been a rewarding experience, allowing her to contribute alongside top mosaic artists and instructors from around the world. She dedicated herself to crafting clear, step-by-step lessons designed to accommodate various learning styles and paces. As an autistic artist, she understands the importance of instructional methods that support diverse thought processes and ways of absorbing information.

Her mosaic surfboard course is tailored for intermediate to advanced students, requiring some basic knowledge of design. However, she ensures the lessons are straightforward and accessible, guiding students through the process of transforming an unconventional substrate like a surfboard into a stunning mosaic work of art.

20 notes

·

View notes

Text

Choose the Best CA Intermediate Classes in Delhi for Career Success

Finding the right guidance during your CA journey can make all the difference. At Mansi Vohra Classes, students receive structured mentorship with a deep focus on concept clarity and exam-oriented learning. Ranked among the preferred choices for CA Intermediate Classes in Delhi, this institute combines personalized attention with updated ICAI material, mock test series, and strategic revisions to help aspirants perform confidently. Those aiming to secure a strong academic foundation and boost their confidence can benefit greatly from the comprehensive modules taught at Mansi Vohra Classes.

The faculty ensures that every student understands complex accounting standards, taxation concepts, and audit procedures through interactive sessions. Choosing the right platform is essential when preparing for a challenging course like CA Intermediate. For those searching for a reliable and performance-driven institute, Mansi Vohra Classes has been a trusted name across Delhi, helping hundreds of students excel each year. If you're serious about cracking the CA exams with clarity and confidence, these classes provide the right academic push. Aspirants across Delhi looking for quality CA Intermediate Classes in Delhi can find practical, results-oriented guidance right here.

#studying#CA Intermediate Classes in Delhi#CA Intermediate Classes#exam preparation#ca exam preparation

0 notes

Text

Why Choose a CA Course in Thrissur?

Thrissur, known as the cultural capital of Kerala, is also emerging as a key educational hub. With its growing number of professional institutions and skilled mentors, it’s a smart choice for CA aspirants. A CA course in Thrissur offers access to quality faculty, practical coaching methods, and excellent infrastructure.

From CPT (now CA Foundation) to CA Final, you can find comprehensive coaching options tailored to every level. These institutes also provide regular mock tests, revision sessions, and one-on-one mentorship, helping students clear exams with confidence.

Choosing the Right CA Institute in Kerala

When looking for a CA institute in Kerala, it’s important to consider not just the location, but also the institute’s track record. Reputed coaching centers in Kerala, including those in Thrissur, have produced high-ranking Chartered Accountants who now work with top firms both in India and abroad.

Some key features to look for:

Experienced faculty with ICAI background

Updated study materials

Practical training and workshops

Student-friendly batch timings

Strong alumni network and placement support

Whether you are from Kochi, Trivandrum, or Kozhikode, enrolling in a CA institute in Kerala gives you the advantage of expert guidance and a competitive peer group.

What is the Chartered Accountant Course?

The Chartered Accountant course is one of India’s most prestigious professional qualifications in finance. Regulated by the ICAI (Institute of Chartered Accountants of India), the course is divided into three levels:

CA Foundation (entry level)

CA Intermediate

CA Final

To qualify as a CA, students must also undergo a three-year articleship (internship) under a licensed Chartered Accountant, giving them real-world exposure.

This course opens doors to careers in:

Auditing and assurance

Tax consultancy

Corporate finance

Investment banking

Government services

Entrepreneurship

With global recognition and a high demand for financial experts, the Chartered Accountant course is a gateway to professional success.

Final Thoughts

If you're serious about building a strong career in accounting and finance, enrolling in a CA course in Thrissur could be the perfect launchpad. Combine that with the guidance of a reputed CA institute in Kerala, and you’re on the right path to mastering the Chartered Accountant course and achieving your professional goals.

0 notes

Text

Effеctivе Timе Managеmеnt Tips and Tеchniquеs for CA Intеrmеdiatе Studеnts

Timе managеmеnt is a crucial skill for succеss in any еndеavor, and it holds еvеn morе significancе for studеnts pursuing thе Chartеrеd Accountancy (CA) Intеrmеdiatе coursе. With a dеmanding curriculum and rigorous prеparation rеquirеd, еffеctivе timе managеmеnt Tips and Techniques can makе all thе diffеrеncе in achiеving succеss and maintaining a hеalthy work-lifе balancе.

In this articlе, wе will dеlvе into somе valuablе tips and tеchniquеs that CA Intеrmеdiatе studеnts can еmploy to mastеr thе art of timе managеmеnt.

#time management#tips for CA intermediate student#paras institute#best ca institute in india#best career option

0 notes

Text

Certified Accountant Course with Real Projects

Accountant Course: Become a Finance Expert with Practical Training

✅ Accountant Course क्या है?

An Accountant Course ek ऐसा professional training program hai jo students को accounting, finance aur taxation सिखाता है. Ye course beginners aur working professionals दोनों के लिए suitable hai jo अपने career को accounting में बनाना चाहते हैं.

इसमें theoretical knowledge के साथ-साथ practical training भी दी जाती है. Students को tally, GST, income tax filing और payroll जैसी important चीजें सिखाई जाती हैं.

🔍 Why Choose an Accountant Course?

Accountant Course ka selection karna एक smart career move है क्योंकि हर business को accountant की जरूरत होती है. Is course ko करने के बाद आप आसानी से job पा सकते हैं या खुद का accounting consultancy भी शुरू कर सकते हैं.

Course flexible timing, affordable fees aur high placement ratio के साथ आता है. इसलिए ये course students aur job seekers दोनों के लिए perfect है.

🎓 Types of Accountant Courses Available

🧾 Diploma in Accounting and Finance

Ye एक short-term course होता है jo basic से advance तक accounting concepts सिखाता है.

Key subjects में journal entries, ledger posting, trial balance, GST aur TDS शामिल होते हैं.

🧾 Certification Course in Tally with GST

Tally accounting software ka practical knowledge इस course में दिया जाता है. GST और invoice creation पर खास focus होता है.

🧾 Advanced Financial Accounting Course

Ye course unke लिए होता है jo already accounting सीख चुके हैं aur अब real-world financial applications को समझना चाहते हैं.

Accountant Course Syllabus – Kya Kya Padhenge?

हर institute का syllabus थोड़ा अलग हो सकता है, लेकिन नीचे दिए गए topics आम तौर पर हर accountant course में cover किए जाते हैं:

Basic Accounting Concepts – जैसे debit-credit rules, journal entries, balance sheet

Tally ERP 9/Prime – accounting software ka use kaise करें

GST (Goods and Services Tax) – GST registration, returns, और invoicing

Income Tax – ITR filing aur TDS का पूर�� process

Bank Reconciliation Statement (BRS) – cash book aur bank statement ka match करना

Payroll Management – employee salary calculation, PF aur ESI

इन topics से students को strong foundation मिलती है aur job ready बनाया जाता है.

🕒 Accountant Course Duration and Eligibility

Course ki duration usually 3 months se lekar 12 months तक होती है. Ye depend karta hai ki aap कौन सा level choose करते हैं – basic, intermediate, या advanced.

Eligibility criteria simple है –

Minimum 12th pass hona चाहिए (preferably from Commerce stream)

Computer knowledge helpful रहता है लेकिन जरूरी नहीं

💰 Accountant Course Fees in India

Fees institute aur city के हिसाब से vary करती है.

Generally, accountant course की fees ₹10,000 se ₹50,000 tak hoti hai.

Affordable options भी available हैं jahan EMI aur scholarship facilities provide की जाती हैं. Delhi, Mumbai, और Bangalore जैसे cities में कई reputed accounting institutes हैं jo placement support भी offer करते हैं.

📈 Accountant Course Benefits – क्यों करें ये कोर्स?

✅ Job Opportunities

हर company को accounting professional की जरूरत होती है. Aap private firms, MNCs, ya CA firms में काम कर सकते हैं.

✅ High Demand

Digital India aur GST implementation के बाद accounting professionals की demand बढ़ गई है.

✅ Freelancing & Business

आप खुद का freelancing service शुरू कर सकते हैं ya small businesses को accounting services दे सकते हैं.

✅ Career Growth

Entry-level से लेकर senior accountant तक ka career path clear होता है.

✅ Skill Enhancement

Accounting ke साथ-साथ Excel, Tally, aur tax laws में भी expert बन जाते हैं.

👨🏫 Best Institutes for Accountant Course in India

कुछ popular institutes जो accountant course offer करते हैं:

The Institute of Professional Accountants (TIPA), Delhi

NIIT

ICA Edu Skills

Tally Academy

EduPristine

इन institutes में practical training aur placement support दिया जाता है.

TIPA जैसे institutes में students को hands-on experience मिलता है jo unko job-ready बनाता है.

Career Opportunities After Accountant Course

Accountant course complete करने के बाद आप इन roles में काम कर सकते हैं:

Junior Accountant

GST Practitioner

Tax Assistant

Tally Operator

Payroll Executive

Accounts Executive

Finance Analyst

Long term में आप Senior Accountant, Tax Consultant या Chartered Accountant भी बन सकते हैं.

🖥️ Accountant Course Online vs Offline

🏫 Offline Course

Face-to-face learning

Practical lab sessions

Better doubt clearing

🌐 Online Course

Flexible timing

Cost-effective

Learn from anywhere

Online options unke लिए best हैं jo working हैं या remote areas में रहते हैं.

🤝 Final Thoughts – Accountant Course is Your Smart Career Step

Aaj के समय में accountant course एक smart aur secure career option बन गया है.

Accounting skills हर field में काम आती हैं – चाहे आप job करें ya खुद का business.

इस course को करके आप ना केवल अपने लिए नौकरी पा सकते हैं, बल्कि दूसरों की भी मदद कर सकते हैं financially grow करने में.

Agar आप 12th ke baad career चुनने की सोच रहे हैं, तो accountant course एक best option है.

Practical skills, job placement aur low investment – sab कुछ आपको इस course में मिल जाएगा.

👉 Start your journey today – Accountant Course se banaye apna future bright!

Accounting interview Question Answers

Tax Income Tax Practitioner Course

How to become an income tax officer

Learn Tally free online

Best Accounting Training Institute

journal entries questions with answers

What is B Com full form

Highest Paying Jobs in India

ICWA Course

Short Cut keys in tally

Tally Prime free download

Tally Prime Features

Meaning of sundry debtor creditor

Income Tax Return Filing services

Education Business ideas

Accounting Entry

Income Tax

Accounting

Tally

Career

0 notes

Text

Join the Ultimate CA Offline Marathon for CA Intermediate students!

📚 Subjects Covered: 📍 Advanced Accounting – by CA Tejas Suchak

📅 11th & 12th April

📍 GST – by CA Vivek Gaba

📅 13th April

📌 Location: To Be Announced

🕙 Timing: 10:00 AM – 6:00 PM

🎯 Covering Important AS & Topics you can’t afford to miss!

Enquire Now: https://www.ultimateca.com/

#CA Intermediate#Offline Marathon#Ultimate CA#CA Students#Delhi Events#CA Exam Prep#GST#Advanced Accounting#CA2025#CA Classes#CA Intermediate Marathon#Exam Preparation#CA In Delhi#CA Offline Session

0 notes

Text

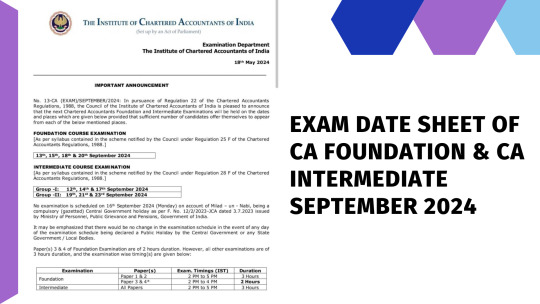

Exam Date Sheet of CA Foundation & CA Intermediate September 2024

https://www.linkedin.com/posts/career-at-center_students-career-education-activity-7198253685020250112-22No?utm_source=share&utm_medium=member_desktop

0 notes

Text

Beyond the Classroom: The Unique Learning Environment at CAPS Learning

In a time when academic success is tightly linked to professional achievement, it’s easy for students to become trapped in a cycle of rote learning and exam pressure. But real education goes far beyond textbooks, exams, and marks. At CAPS Learning in Nagpur, this philosophy is not just a slogan—it is a living experience that shapes every student’s journey. Recognized as one of the best CA coaching institutes in Nagpur, CAPS offers an enriching environment that goes well beyond the conventional classroom.

A Space That Fosters Holistic Development

Learning doesn’t only happen when a teacher is standing in front of a whiteboard. True education happens when students begin to apply, question, explore, and connect. CAPS Learning understands this and builds its curriculum and campus culture around holistic development. It’s not just about clearing the CA Foundation or CA Intermediate; it’s about helping students develop critical thinking, communication, time management, and confidence—skills that truly matter in the long run.

By combining academic rigor with mentorship, motivation, and modern learning tools, CAPS creates a unique space where every student can grow intellectually and personally.

Faculty Who Teach and Transform

What truly sets CAPS apart is its team of dedicated and passionate educators. These are not just teachers delivering lectures—they are mentors who listen, guide, and support students through every stage of their CA journey. With decades of combined experience and real-world exposure, CAPS’ faculty members are committed to ensuring each student not only understands complex concepts but is also motivated to pursue excellence.

Each session is designed to be engaging, interactive, and value-driven. CAPS doesn’t just provide commerce coaching in Nagpur—it offers mentorship that extends far beyond the four walls of the classroom.

Interactive Learning Methods, Not Passive Memorization

At CAPS, you won’t find students passively memorizing notes. Instead, learning is active, vibrant, and layered. The faculty encourages discussions, case-based learning, regular quizzes, presentations, and problem-solving sessions. This interactive approach ensures that students understand the ‘why’ behind every topic, not just the ‘what.’

By connecting real-world financial challenges and economic scenarios to textbook content, CAPS ensures students are industry-ready and not just exam-ready. This is a key reason why CAPS is known for offering the best commerce classes in Central India for aspiring CA professionals.

Smart Infrastructure That Supports Modern Learning

Gone are the days when learning meant chalk and duster. CAPS Learning has invested in modern infrastructure that caters to today’s generation of digital learners. Smart classrooms, digital projectors, online mock test portals, and high-quality learning resources make it easier for students to study both on and off-campus.

The hybrid model of classroom + digital learning ensures flexibility, better time management, and accessibility—especially for students juggling school, coaching, and self-study.

Test Series That Mirror the Real Exam

One of the strongest pillars of the CAPS learning model is its well-structured and meticulously designed Test Series Program. Regular assessments not only help students practice under exam-like pressure but also identify strengths and areas that need improvement.

What makes CAPS' test series unique is the detailed feedback system. Students aren’t just given marks; they receive performance insights, personalized suggestions, and follow-up support from faculty. This constant loop of learning and feedback helps them gain clarity and improve steadily.

For students aiming to crack CA Foundation or Intermediate in one go, this exam-oriented strategy is priceless.

A Support System That Understands Your Journey

Every student’s path is different. Some grasp concepts quickly, others need more time. Some struggle with motivation, while others face external pressures. CAPS offers a supportive ecosystem that respects these differences.

From one-on-one doubt-solving sessions and weekly performance reviews to mentorship meetings and emotional guidance—CAPS believes in walking with each student, every step of the way. In fact, many students say that joining CAPS felt like joining a family that genuinely cares.

This emotional safety net is what makes CAPS more than just a coaching institute; it’s a community that uplifts, inspires, and supports.

Value-Added Workshops and Life Skills Training

At CAPS, learning extends beyond academic subjects. Students are regularly exposed to life skill workshops, communication sessions, financial literacy programs, and career counseling. These sessions are designed to bridge the gap between academic knowledge and practical, real-world readiness.

Whether it’s learning how to manage stress during exams, improving spoken English for interviews, or understanding how to read a balance sheet in real business settings—CAPS helps students grow in every direction.

Such initiatives are rare in typical coaching institutes, but at CAPS, they are an integral part of the learning experience.

Creating a Culture of Motivation and Discipline

Discipline is the foundation of any successful professional journey, especially in the CA field. But discipline at CAPS is not forced—it’s nurtured. Students are encouraged to set their own study goals, maintain progress logs, and take ownership of their learning.

Moreover, regular motivational sessions by DG Sharma Sir and other senior faculty provide the mental push needed to overcome self-doubt and setbacks. These sessions, often filled with practical wisdom and real-life stories, leave a lasting impression on students’ minds.

Over the years, CAPS Learning has built a strong reputation as one of the top CA coaching institutes in Vidarbha Nagpur. Its consistent record of successful CA Foundation, Intermediate, and Final level results, along with glowing testimonials from students and parents, speaks volumes.

CAPS doesn’t just train students—it transforms them into professionals, into achievers, and into better versions of themselves.

CAPS Learning is a space where passion meets purpose, and where learning goes beyond the classroom. It’s a place where students not only aim to pass exams but also prepare to excel in life.

Whether you are a student stepping into 11th commerce or someone determined to crack the CA Foundation in your first attempt, CAPS is a place where you will find clarity, courage, and competence.

If you’re searching for the best CA coaching in Nagpur or wondering, "Where can I find the most effective CA classes near me in Nagpur?" — the answer lies at CAPS Learning.

It’s not just an institute. It’s a launchpad for your future.

CAPS Contact Number : +91 969 312 0120 / +91 805 512 0900.

CAPS Nagpur Address : Plot No – 83, Hill Top, Ram Nagar, Near Water Tank, Nagpur – 440010, Maharashtra.

Email: [email protected]

Website: https://capslearning.org

#ca online classes#ca coaching institute in nagpur#caps nagpur#ca coaching classes in nagpur#ca coaching institute#best ca coaching#best institute for ca in nagpur#best ca coaching in nagpur#11th 12th commerce coaching#12th commerce classes

0 notes

Text

How to Become a CA

The journey towards becoming a Chartered Accountant (CA) is rewarding and highly respected. If you’re wondering how to become a CA, this guide covers everything you need to know from prerequisites and course structure to key skills, benefits, and expert tips to help you succeed in your CA journey.

Who is a Chartered Accountant?

A chartered accountant (CA) is a professionally trained individual who specialises in financial auditing, taxation, accounting, and business advisory services. CAs are reputable financial professionals, according to the Institute of Chartered Accountants of India (ICAI).

They can work in the public or private sectors and are typically found in leadership positions like tax consultants, auditors, or CFOs. Similar to the ACCA certification, the CA is still one of the most prestigious accounting certifications in the world.

What Does a Chartered Accountant Do?

CAs have a significant impact on a company’s financial health. Some of their responsibilities include:

Preparing and analysing financial reports

Managing taxation, including GST and income tax filings

Conducting audits and ensuring regulatory compliance

Offering financial advice and risk management.

Manage mergers, acquisitions, and investments.

Their services are critical for individuals, businesses, and even governments.

Is It Difficult to Become a CA?

Yes, the CA journey is tough, but it can be conquered with the right mindset and strategy. That is why pass percentages are relatively low since there are stringent exams and compulsory training involved.

However, with proper time management, good planning, and effective study determination, thousands of students succeed in doing so every year. The trick is to remain consistent while making use of good resources.

CA Course Eligibility and Qualifications

To become a CA, one must first understand who is eligible and the qualifications required.

Eligibility After 12th & Graduation

After 12th: The students from any stream are eligible to register for the CA Foundation Course after completing Class 12 from a recognised board.

After Graduation: Graduates qualify for the Direct Entry pathway and skip the foundation level. The commerce students must have at least 55%, and non-commerce students 60%.

Educational Qualifications Needed to Register

Must have passed Class 12th or completed a bachelor’s degree.

For direct entry, candidates should have passed the intermediate examinations of ICSI (CS) or ICWA (CMA) or possess a graduate degree.

These are prerequisites for chartered accountant registration with ICAI.

CA Course Structure and Pathways

The chartered accountancy course provides several entry points, tailored to the diverse levels of its students. One should know these pathways if one is interested in learning how to become a CA in an effective and efficient manner.

CA Foundation Route (After Class 12)

This is one of the most common and conventional routes, which is taken by the students who have just appeared for their Class 12. Your quest for a CA career starts with the CA Foundation Course, which is the basic course and a path opener to sophisticated knowledge.

The Foundation course consists of four core subjects: accounting, business law and correspondence, mathematics and statistics, and economics.

Preparation for this level takes between 4 and 6 months, depending on your study pace and coaching.

Passing the Foundation exam is required to proceed to the next stage, the CA Intermediate course.

This path is ideal for students who intend to pursue the CA after finishing school and prefer a gradual, tiered approach to learning.

Direct Entry Route (After Graduation or Post ICSI/ICWA)

For holders of bachelor’s degrees and those who have completed the intermediate level of related courses like Company Secretary (CS) or Cost and Management Accountancy (CMA), the direct entry route offers a fast-track option into the CA program.

You are required to skip the Foundation level entirely. You may register directly for the CA Intermediate course.

To register through this route, one must have a graduation degree (with 55 % marks in the case of commerce and 60% in the case of other streams) or must have cleared the intermediate level of ICSI (CS) or ICWA (CMA).

A unique requirement for this path is to register for the mandatory practical trainings for a period of 3 years (articles) before/along with the intermediate exam that gives you a set of hands early on.

This route facilitates candidates who wish to pursue the CA designation after graduation or some related certifications for increased efficiency and time savings.

Through Intermediate-Level Exams (ICSI/ICAI)

This option benefits students with multiple professional credentials, particularly those who have passed the CS Executive or CMA Inter level exams.

If you pass these intermediate-level exams with ICSI or ICWA, you can sign up for the CA Intermediate exams immediately.

This option allows students to apply what they know already and their qualifications to reduce the time and effort they need to qualify as a CA.

Many ambitious finance and business students seek out multiple credentials to try to get a leg up in the job market.

Step-by-Step Process to Become a CA

Here’s a step-by-step guide on how to become a CA in India.

Step 1: Decide if CA is Right for You

Consider how enthusiastic you are about business, accounting, and taxation.

Consider your career goals and commitment.

Explore longer-term job prospects in finance.

Step 2: Enroll and Clear CA Foundation (If Applicable)

Register with ICAI after 12th

Study for 4 subjects and appear in the exam.

Train or learn as self-taught.

Step 3: Register and Pass the CA Intermediate

Register after clearing Foundation or through Direct Entry

Consists of 8 papers divided into 2 groups

Many students opt to appear group-wise

This is a crucial phase in your CA journey.

Step 4: Complete Articleship/3-Year Practical Training

After passing Group 1 of CA Intermediate

Must undergo 3 years of Articleship under a practicing CA

Gain hands-on experience in audits, taxation, and compliance

Step 5: Pass CA Final Exam

Appear after completing Articleship and passing Intermediate

8 papers covering advanced accounting, law, and elective subjects

Final exam tests in-depth practical and conceptual knowledge

Step 6: Enroll as a Member with ICAI

Once you pass the Final exam, apply for chartered accountant registration

Get officially enrolled as a member of ICAI

Now you’re legally allowed to practice as a CA in India

Curious About How To Become a CA?

Inquire More!

Skills Required to Become a Successful CA

Communication

Ability to explain complex financial concepts clearly

Essential for client meetings, audit discussions, and presentations

Time Management

CAs often juggle multiple tasks, deadlines, and clients

Efficient time use is vital for success

Organisational Skills

Maintaining records, filing returns, and handling reports requires strong organisation

Especially important during audits and busy tax seasons

Analytical Thinking

Ability to solve problems and make sense of financial data

Crucial in areas like risk analysis, valuation, and budgeting

Benefits of Becoming a CA

Earn High Respect and Social Prestige: Chartered Accountants are highly regarded professionals in the business and finance world. Their expertise in auditing, taxation, and financial management earns them respect from peers, employers, and clients alike.

Access to Great Job Opportunities Both in India and Abroad: The CA qualification opens doors to diverse career options not only within India but also internationally. Many multinational firms and foreign companies seek qualified CAs for their financial leadership roles.

Receive Excellent Salary Packages Starting from INR 7–10 LPA: CAs enjoy competitive salaries, even at entry-level positions. With experience and expertise, income can grow substantially, making CA one of the most lucrative professional courses in India.

Opportunity to Start Your Own CA Practice: After becoming a member of ICAI, you have the freedom to start your own accounting and consulting firm. This entrepreneurial path offers independence and the potential to build a thriving business.

Work with Top Firms Like Deloitte, EY, and KPMG: Chartered Accountants are highly valued by the Big Four accounting firms and other top multinational companies. These firms provide excellent training, exposure, and career growth.

Career Mobility Across Multiple Roles: CAs can work in various domains such as auditing, taxation, financial consulting, management accounting, and corporate finance, offering flexibility in career choices.

Pathways to Global Certifications Like ACCA Certification: Becoming a CA can be a stepping stone to pursue other international certifications such as ACCA, enhancing global career prospects. Learn what is ACCA?

Expert Tips to Become a CA

Start Preparing Early, Especially for the Foundation Course: Early preparation gives you a strong grasp of fundamental concepts, making the subsequent stages of your CA journey easier and more manageable.

Solve Past Year Papers and Mock Tests Regularly: Practicing previous exam questions helps you understand exam patterns, manage time efficiently, and identify important topics.

Maintain Consistency by Studying Daily Rather Than Cramming: Regular study sessions are far more effective in retaining information and reducing exam stress than last-minute preparation.

Join a Reputed CA Coaching Institute for Structured Guidance: Quality coaching can provide expert explanations, study plans, and motivation, improving your chances of success.

Network Actively with Fellow Students and CA Professionals: Building connections can help you gain insights, mentorship, and career opportunities during and after your CA journey.

Utilise ICAI’s Study Materials and Online Resources Thoroughly: Official materials are tailored to the exam syllabus and often contain the most relevant information.

Stay Updated with the Latest Changes in Tax Laws and Accounting Standards: The CA profession demands continuous learning to remain compliant and provide accurate advice, so staying current is essential.

Planning to Pursue an Finance and Accounting Career?

Click Here

To Book Your Free Counselling Session

Conclusion

So, how to become a CA? It’s a structured journey filled with challenges but immense rewards. Whether you begin after 12th or as a graduate, the pathways are clearly defined. With the right guidance, skills, and determination, you can build a successful CA career.

This decision should depend on your passion for finance, dedication to long-term learning, and willingness to adapt in a fast-changing business world. If these resonate with you, then the CA journey is absolutely worth it.

FAQs on How to Become a CA

How do I become a CA in detail?

To become a CA, start by choosing between the Foundation or Direct Entry Route. Then clear CA Foundation (if applicable), Intermediate, complete Articleship, pass the Final exam, and register with ICAI.

What is the pathway to become a chartered accountant?

The CA pathway includes:

Register for Foundation (after 12th) or Direct Entry (after graduation)

Clear Foundation → Intermediate → Final

Complete 3 years of Articleship

Apply for chartered accountant registration with ICAI

What is the best way to study for CA?

Follow a fixed timetable

Prioritise ICAI material and past papers

Take mock tests

Use expert coaching or online platforms

Focus on conceptual clarity over rote learning

Can I complete CA in 2 years?

No, the CA course has a minimum duration of 4.5–5 years, including Articleship. However, with dedication, you can pass all exams in the first attempt and fast-track your CA career.

0 notes

Text

How to Become a CA

The journey towards becoming a Chartered Accountant (CA) is rewarding and highly respected. If you’re wondering how to become a CA, this guide covers everything you need to know from prerequisites and course structure to key skills, benefits, and expert tips to help you succeed in your CA journey.

Who is a Chartered Accountant?

A chartered accountant (CA) is a professionally trained individual who specialises in financial auditing, taxation, accounting, and business advisory services. CAs are reputable financial professionals, according to the Institute of Chartered Accountants of India (ICAI).

They can work in the public or private sectors and are typically found in leadership positions like tax consultants, auditors, or CFOs. Similar to the ACCA certification, the CA is still one of the most prestigious accounting certifications in the world.

What Does a Chartered Accountant Do?

CAs have a significant impact on a company’s financial health. Some of their responsibilities include:

Preparing and analysing financial reports

Managing taxation, including GST and income tax filings

Conducting audits and ensuring regulatory compliance

Offering financial advice and risk management.

Manage mergers, acquisitions, and investments.

Their services are critical for individuals, businesses, and even governments.

Is It Difficult to Become a CA?

Yes, the CA journey is tough, but it can be conquered with the right mindset and strategy. That is why pass percentages are relatively low since there are stringent exams and compulsory training involved.

However, with proper time management, good planning, and effective study determination, thousands of students succeed in doing so every year. The trick is to remain consistent while making use of good resources.

CA Course Eligibility and Qualifications

To become a CA, one must first understand who is eligible and the qualifications required.

Eligibility After 12th & Graduation

After 12th: The students from any stream are eligible to register for the CA Foundation Course after completing Class 12 from a recognised board.

After Graduation: Graduates qualify for the Direct Entry pathway and skip the foundation level. The commerce students must have at least 55%, and non-commerce students 60%.

Educational Qualifications Needed to Register

Must have passed Class 12th or completed a bachelor’s degree.

For direct entry, candidates should have passed the intermediate examinations of ICSI (CS) or ICWA (CMA) or possess a graduate degree.

These are prerequisites for chartered accountant registration with ICAI.

CA Course Structure and Pathways

The chartered accountancy course provides several entry points, tailored to the diverse levels of its students. One should know these pathways if one is interested in learning how to become a CA in an effective and efficient manner.

CA Foundation Route (After Class 12)

This is one of the most common and conventional routes, which is taken by the students who have just appeared for their Class 12. Your quest for a CA career starts with the CA Foundation Course, which is the basic course and a path opener to sophisticated knowledge.

The Foundation course consists of four core subjects: accounting, business law and correspondence, mathematics and statistics, and economics.

Preparation for this level takes between 4 and 6 months, depending on your study pace and coaching.

Passing the Foundation exam is required to proceed to the next stage, the CA Intermediate course.

This path is ideal for students who intend to pursue the CA after finishing school and prefer a gradual, tiered approach to learning.

Direct Entry Route (After Graduation or Post ICSI/ICWA)

For holders of bachelor’s degrees and those who have completed the intermediate level of related courses like Company Secretary (CS) or Cost and Management Accountancy (CMA), the direct entry route offers a fast-track option into the CA program.

You are required to skip the Foundation level entirely. You may register directly for the CA Intermediate course.

To register through this route, one must have a graduation degree (with 55 % marks in the case of commerce and 60% in the case of other streams) or must have cleared the intermediate level of ICSI (CS) or ICWA (CMA).

A unique requirement for this path is to register for the mandatory practical trainings for a period of 3 years (articles) before/along with the intermediate exam that gives you a set of hands early on.

This route facilitates candidates who wish to pursue the CA designation after graduation or some related certifications for increased efficiency and time savings.

Through Intermediate-Level Exams (ICSI/ICAI)

This option benefits students with multiple professional credentials, particularly those who have passed the CS Executive or CMA Inter level exams.

If you pass these intermediate-level exams with ICSI or ICWA, you can sign up for the CA Intermediate exams immediately.

This option allows students to apply what they know already and their qualifications to reduce the time and effort they need to qualify as a CA.

Many ambitious finance and business students seek out multiple credentials to try to get a leg up in the job market.

Step-by-Step Process to Become a CA

Here’s a step-by-step guide on how to become a CA in India.

Step 1: Decide if CA is Right for You

Consider how enthusiastic you are about business, accounting, and taxation.

Consider your career goals and commitment.

Explore longer-term job prospects in finance.

Step 2: Enroll and Clear CA Foundation (If Applicable)

Register with ICAI after 12th

Study for 4 subjects and appear in the exam.

Train or learn as self-taught.

Step 3: Register and Pass the CA Intermediate

Register after clearing Foundation or through Direct Entry

Consists of 8 papers divided into 2 groups

Many students opt to appear group-wise

This is a crucial phase in your CA journey.

Step 4: Complete Articleship/3-Year Practical Training

After passing Group 1 of CA Intermediate

Must undergo 3 years of Articleship under a practicing CA

Gain hands-on experience in audits, taxation, and compliance

Step 5: Pass CA Final Exam

Appear after completing Articleship and passing Intermediate

8 papers covering advanced accounting, law, and elective subjects

Final exam tests in-depth practical and conceptual knowledge

Step 6: Enroll as a Member with ICAI

Once you pass the Final exam, apply for chartered accountant registration

Get officially enrolled as a member of ICAI

Now you’re legally allowed to practice as a CA in India

Curious About How To Become a CA?

Inquire More!

Skills Required to Become a Successful CA

Communication

Ability to explain complex financial concepts clearly

Essential for client meetings, audit discussions, and presentations

Time Management

CAs often juggle multiple tasks, deadlines, and clients

Efficient time use is vital for success

Organisational Skills

Maintaining records, filing returns, and handling reports requires strong organisation

Especially important during audits and busy tax seasons

Analytical Thinking

Ability to solve problems and make sense of financial data

Crucial in areas like risk analysis, valuation, and budgeting

Benefits of Becoming a CA

Earn High Respect and Social Prestige: Chartered Accountants are highly regarded professionals in the business and finance world. Their expertise in auditing, taxation, and financial management earns them respect from peers, employers, and clients alike.

Access to Great Job Opportunities Both in India and Abroad: The CA qualification opens doors to diverse career options not only within India but also internationally. Many multinational firms and foreign companies seek qualified CAs for their financial leadership roles.

Receive Excellent Salary Packages Starting from INR 7–10 LPA: CAs enjoy competitive salaries, even at entry-level positions. With experience and expertise, income can grow substantially, making CA one of the most lucrative professional courses in India.

Opportunity to Start Your Own CA Practice: After becoming a member of ICAI, you have the freedom to start your own accounting and consulting firm. This entrepreneurial path offers independence and the potential to build a thriving business.

Work with Top Firms Like Deloitte, EY, and KPMG: Chartered Accountants are highly valued by the Big Four accounting firms and other top multinational companies. These firms provide excellent training, exposure, and career growth.

Career Mobility Across Multiple Roles: CAs can work in various domains such as auditing, taxation, financial consulting, management accounting, and corporate finance, offering flexibility in career choices.

Pathways to Global Certifications Like ACCA Certification: Becoming a CA can be a stepping stone to pursue other international certifications such as ACCA, enhancing global career prospects. Learn what is ACCA?

Expert Tips to Become a CA

Start Preparing Early, Especially for the Foundation Course: Early preparation gives you a strong grasp of fundamental concepts, making the subsequent stages of your CA journey easier and more manageable.

Solve Past Year Papers and Mock Tests Regularly: Practicing previous exam questions helps you understand exam patterns, manage time efficiently, and identify important topics.

Maintain Consistency by Studying Daily Rather Than Cramming: Regular study sessions are far more effective in retaining information and reducing exam stress than last-minute preparation.

Join a Reputed CA Coaching Institute for Structured Guidance: Quality coaching can provide expert explanations, study plans, and motivation, improving your chances of success.

Network Actively with Fellow Students and CA Professionals: Building connections can help you gain insights, mentorship, and career opportunities during and after your CA journey.

Utilise ICAI’s Study Materials and Online Resources Thoroughly: Official materials are tailored to the exam syllabus and often contain the most relevant information.

Stay Updated with the Latest Changes in Tax Laws and Accounting Standards: The CA profession demands continuous learning to remain compliant and provide accurate advice, so staying current is essential.

Planning to Pursue an Finance and Accounting Career?

Click Here

To Book Your Free Counselling Session

Conclusion

So, how to become a CA? It’s a structured journey filled with challenges but immense rewards. Whether you begin after 12th or as a graduate, the pathways are clearly defined. With the right guidance, skills, and determination, you can build a successful CA career.

This decision should depend on your passion for finance, dedication to long-term learning, and willingness to adapt in a fast-changing business world. If these resonate with you, then the CA journey is absolutely worth it.

FAQs on How to Become a CA

How do I become a CA in detail?

To become a CA, start by choosing between the Foundation or Direct Entry Route. Then clear CA Foundation (if applicable), Intermediate, complete Articleship, pass the Final exam, and register with ICAI.

What is the pathway to become a chartered accountant?

The CA pathway includes:

Register for Foundation (after 12th) or Direct Entry (after graduation)

Clear Foundation → Intermediate → Final

Complete 3 years of Articleship

Apply for chartered accountant registration with ICAI

What is the best way to study for CA?

Follow a fixed timetable

Prioritise ICAI material and past papers

Take mock tests

Use ex

The journey towards becoming a Chartered Accountant (CA) is rewarding and highly respected. If you’re wondering how to become a CA, this guide covers everything you need to know from prerequisites and course structure to key skills, benefits, and expert tips to help you succeed in your CA journey.

Who is a Chartered Accountant?

A chartered accountant (CA) is a professionally trained individual who specialises in financial auditing, taxation, accounting, and business advisory services. CAs are reputable financial professionals, according to the Institute of Chartered Accountants of India (ICAI).

They can work in the public or private sectors and are typically found in leadership positions like tax consultants, auditors, or CFOs. Similar to the ACCA certification, the CA is still one of the most prestigious accounting certifications in the world.

What Does a Chartered Accountant Do?

CAs have a significant impact on a company’s financial health. Some of their responsibilities include:

Preparing and analysing financial reports

Managing taxation, including GST and income tax filings

Conducting audits and ensuring regulatory compliance

Offering financial advice and risk management.

Manage mergers, acquisitions, and investments.

Their services are critical for individuals, businesses, and even governments.

Is It Difficult to Become a CA?

Yes, the CA journey is tough, but it can be conquered with the right mindset and strategy. That is why pass percentages are relatively low since there are stringent exams and compulsory training involved.

However, with proper time management, good planning, and effective study determination, thousands of students succeed in doing so every year. The trick is to remain consistent while making use of good resources.

CA Course Eligibility and Qualifications

To become a CA, one must first understand who is eligible and the qualifications required.

Eligibility After 12th & Graduation

After 12th: The students from any stream are eligible to register for the CA Foundation Course after completing Class 12 from a recognised board.

After Graduation: Graduates qualify for the Direct Entry pathway and skip the foundation level. The commerce students must have at least 55%, and non-commerce students 60%.

Educational Qualifications Needed to Register

Must have passed Class 12th or completed a bachelor’s degree.

For direct entry, candidates should have passed the intermediate examinations of ICSI (CS) or ICWA (CMA) or possess a graduate degree.

These are prerequisites for chartered accountant registration with ICAI.

CA Course Structure and Pathways

The chartered accountancy course provides several entry points, tailored to the diverse levels of its students. One should know these pathways if one is interested in learning how to become a CA in an effective and efficient manner.

CA Foundation Route (After Class 12)

This is one of the most common and conventional routes, which is taken by the students who have just appeared for their Class 12. Your quest for a CA career starts with the CA Foundation Course, which is the basic course and a path opener to sophisticated knowledge.

The Foundation course consists of four core subjects: accounting, business law and correspondence, mathematics and statistics, and economics.

Preparation for this level takes between 4 and 6 months, depending on your study pace and coaching.

Passing the Foundation exam is required to proceed to the next stage, the CA Intermediate course.

This path is ideal for students who intend to pursue the CA after finishing school and prefer a gradual, tiered approach to learning.

Direct Entry Route (After Graduation or Post ICSI/ICWA)

For holders of bachelor’s degrees and those who have completed the intermediate level of related courses like Company Secretary (CS) or Cost and Management Accountancy (CMA), the direct entry route offers a fast-track option into the CA program.

You are required to skip the Foundation level entirely. You may register directly for the CA Intermediate course.

To register through this route, one must have a graduation degree (with 55 % marks in the case of commerce and 60% in the case of other streams) or must have cleared the intermediate level of ICSI (CS) or ICWA (CMA).

A unique requirement for this path is to register for the mandatory practical trainings for a period of 3 years (articles) before/along with the intermediate exam that gives you a set of hands early on.

This route facilitates candidates who wish to pursue the CA designation after graduation or some related certifications for increased efficiency and time savings.

Through Intermediate-Level Exams (ICSI/ICAI)

This option benefits students with multiple professional credentials, particularly those who have passed the CS Executive or CMA Inter level exams.

If you pass these intermediate-level exams with ICSI or ICWA, you can sign up for the CA Intermediate exams immediately.

This option allows students to apply what they know already and their qualifications to reduce the time and effort they need to qualify as a CA.

Many ambitious finance and business students seek out multiple credentials to try to get a leg up in the job market.

Step-by-Step Process to Become a CA

Here’s a step-by-step guide on how to become a CA in India.

Step 1: Decide if CA is Right for You

Consider how enthusiastic you are about business, accounting, and taxation.

Consider your career goals and commitment.

Explore longer-term job prospects in finance.

Step 2: Enroll and Clear CA Foundation (If Applicable)

Register with ICAI after 12th

Study for 4 subjects and appear in the exam.

Train or learn as self-taught.

Step 3: Register and Pass the CA Intermediate

Register after clearing Foundation or through Direct Entry

Consists of 8 papers divided into 2 groups

Many students opt to appear group-wise

This is a crucial phase in your CA journey.

Step 4: Complete Articleship/3-Year Practical Training

After passing Group 1 of CA Intermediate

Must undergo 3 years of Articleship under a practicing CA

Gain hands-on experience in audits, taxation, and compliance

Step 5: Pass CA Final Exam

Appear after completing Articleship and passing Intermediate

8 papers covering advanced accounting, law, and elective subjects

Final exam tests in-depth practical and conceptual knowledge

Step 6: Enroll as a Member with ICAI

Once you pass the Final exam, apply for chartered accountant registration

Get officially enrolled as a member of ICAI

Now you’re legally allowed to practice as a CA in India

Curious About How To Become a CA?

Inquire More!

Skills Required to Become a Successful CA

Communication

Ability to explain complex financial concepts clearly

Essential for client meetings, audit discussions, and presentations

Time Management

CAs often juggle multiple tasks, deadlines, and clients

Efficient time use is vital for success

Organisational Skills

Maintaining records, filing returns, and handling reports requires strong organisation

Especially important during audits and busy tax seasons

Analytical Thinking

Ability to solve problems and make sense of financial data

Crucial in areas like risk analysis, valuation, and budgeting

Benefits of Becoming a CA

Earn High Respect and Social Prestige: Chartered Accountants are highly regarded professionals in the business and finance world. Their expertise in auditing, taxation, and financial management earns them respect from peers, employers, and clients alike.

Access to Great Job Opportunities Both in India and Abroad: The CA qualification opens doors to diverse career options not only within India but also internationally. Many multinational firms and foreign companies seek qualified CAs for their financial leadership roles.

Receive Excellent Salary Packages Starting from INR 7–10 LPA: CAs enjoy competitive salaries, even at entry-level positions. With experience and expertise, income can grow substantially, making CA one of the most lucrative professional courses in India.

Opportunity to Start Your Own CA Practice: After becoming a member of ICAI, you have the freedom to start your own accounting and consulting firm. This entrepreneurial path offers independence and the potential to build a thriving business.

Work with Top Firms Like Deloitte, EY, and KPMG: Chartered Accountants are highly valued by the Big Four accounting firms and other top multinational companies. These firms provide excellent training, exposure, and career growth.

Career Mobility Across Multiple Roles: CAs can work in various domains such as auditing, taxation, financial consulting, management accounting, and corporate finance, offering flexibility in career choices.

Pathways to Global Certifications Like ACCA Certification: Becoming a CA can be a stepping stone to pursue other international certifications such as ACCA, enhancing global career prospects. Learn what is ACCA?

Expert Tips to Become a CA

Start Preparing Early, Especially for the Foundation Course: Early preparation gives you a strong grasp of fundamental concepts, making the subsequent stages of your CA journey easier and more manageable.

Solve Past Year Papers and Mock Tests Regularly: Practicing previous exam questions helps you understand exam patterns, manage time efficiently, and identify important topics.

Maintain Consistency by Studying Daily Rather Than Cramming: Regular study sessions are far more effective in retaining information and reducing exam stress than last-minute preparation.

Join a Reputed CA Coaching Institute for Structured Guidance: Quality coaching can provide expert explanations, study plans, and motivation, improving your chances of success.

Network Actively with Fellow Students and CA Professionals: Building connections can help you gain insights, mentorship, and career opportunities during and after your CA journey.

Utilise ICAI’s Study Materials and Online Resources Thoroughly: Official materials are tailored to the exam syllabus and often contain the most relevant information.

Stay Updated with the Latest Changes in Tax Laws and Accounting Standards: The CA profession demands continuous learning to remain compliant and provide accurate advice, so staying current is essential.

Planning to Pursue an Finance and Accounting Career?

Click Here

To Book Your Free Counselling Session

Conclusion

So, how to become a CA? It’s a structured journey filled with challenges but immense rewards. Whether you begin after 12th or as a graduate, the pathways are clearly defined. With the right guidance, skills, and determination, you can build a successful CA career.

This decision should depend on your passion for finance, dedication to long-term learning, and willingness to adapt in a fast-changing business world. If these resonate with you, then the CA journey is absolutely worth it.

FAQs on How to Become a CA

How do I become a CA in detail?

To become a CA, start by choosing between the Foundation or Direct Entry Route. Then clear CA Foundation (if applicable), Intermediate, complete Articleship, pass the Final exam, and register with ICAI.

What is the pathway to become a chartered accountant?

The CA pathway includes:

Register for Foundation (after 12th) or Direct Entry (after graduation)

Clear Foundation → Intermediate → Final

Complete 3 years of Articleship

Apply for chartered accountant registration with ICAI

What is the best way to study for CA?

Follow a fixed timetable

Prioritise ICAI material and past papers

Take mock tests

Use expert coaching or online platforms

Focus on conceptual clarity over rote learning

Can I complete CA in 2 years?

No, the CA course has a minimum duration of 4.5–5 years, including Articleship. However, with dedication, you can pass all exams in the first attempt and fast-track your CA career.

pert coaching or online platforms

Focus on conceptual clarity over rote learning

Can I complete CA in 2 years?

No, the CA course has a minimum duration of 4.5–5 years, including Articleship. However, with dedication, you can pass all exams in the first attempt and fast-track your CA career.

0 notes

Text

Kickstart Your Finance Career: Enroll in a CA Course in Thrissur

If you aspire to become a finance professional with one of the most respected titles in India, pursuing a Chartered Accountant course is your gateway to success. Known for its comprehensive curriculum and rigorous training, the CA qualification opens doors to countless opportunities in accounting, auditing, taxation, and consultancy. For students and professionals in Kerala, especially in central regions, opting for a CA course in Thrissur can be a game-changing decision.

Why Choose a CA Course in Thrissur?

Thrissur, often called the cultural capital of Kerala, is quickly emerging as a hub for professional education. It hosts some of the finest coaching centres and training academies for CA aspirants. With a perfect blend of traditional learning environment and modern infrastructure, the city offers an ideal backdrop for focused studies.

Top-Quality CA Institute in Kerala

While there are many coaching centres spread across the state, joining a reputed CA institute in Kerala ensures you're guided by experienced faculty, updated study materials, and an academic support system that prepares you for all three levels of the CA exams — Foundation, Intermediate, and Final.

Thrissur, in particular, is home to institutes that boast high pass percentages, individual mentorship, and mock test series aligned with ICAI standards. These institutes not only help you crack the exam but also prepare you for practical scenarios through articleship and real-time project exposure.

What Does the Chartered Accountant Course Include?

The Chartered Accountant course is structured to build expertise in:

Accounting and financial reporting

Taxation (Direct and Indirect)

Auditing and assurance

Strategic financial management

Corporate and economic laws

The course typically takes 4.5 to 5 years to complete, including the mandatory three-year articleship. Students can start right after completing their 12th grade or graduation, depending on the entry route.

Career Opportunities after CA

Once you complete the CA course, a wide range of opportunities await:

Work with top accounting and consulting firms (like the Big 4)

Start your own CA practice

Join corporates as Financial Controllers or CFOs

Explore government jobs and PSU roles

Take up international opportunities, especially with Indian companies expanding abroad

Conclusion

Choosing to pursue a CA course in Thrissur through a top CA institute in Kerala can put you on the fast track to becoming a successful Chartered Accountant. With the right guidance, commitment, and consistent effort, the CA designation is well within your reach.

If you're looking to build a career in finance and accounting, now is the perfect time to take that first step — enroll in a Chartered Accountant course and transform your future.

0 notes