#Calculate net present value

Explore tagged Tumblr posts

Text

How to Calculate Net Present Value (NPV) – Step-by-Step Guide

Free Net Present Value (NPV) Calculator to quickly calculate the present value of future cash flows. Get step-by-step calculations, understand the NPV formula, and make smart investment decisions. Try it now!"

0 notes

Text

What Are the Limitations of Using a Net Present Value Calculator?

While Net Present Value (NPV) calculators are valuable tools for assessing investment opportunities, they come with limitations. Firstly, they rely heavily on assumptions, such as future cash flows and discount rates, which may not always reflect reality accurately. Additionally, NPV calculations may overlook qualitative factors like market volatility or regulatory changes that could impact investment returns. Furthermore, NPV calculators typically require users to input precise data, yet uncertainties in forecasts can lead to unreliable results. Users must also consider the risk of using outdated or incorrect information, which could skew NPV calculations. For a more comprehensive understanding of NPV calculator limitations, consider exploring resources like Investkraft's website. They provide insightful articles and guides on investment analysis, offering practical advice on navigating the complexities of financial decision-making.

#investkraft#finance#Net Present Value#NPV Calculator#calculators#financial calculators#financial services

0 notes

Text

(Don't) Incentivise Ethical Behaviour

In the ongoing project of rescuing useful thoughts off Xwitter, here's another hot take of mine, reheated:

"Being good for a reward isn’t being good---it’s just optimal play."

The quote comes from Luke Gearing and his excellent post "Against Incentive", to which I had been reacting.

My thread was mainly intended as a fulsome nodding along to one of Luke's points. It was posted in 2021, and extended in 2023 after Sidney Icarus posed a question to it. So it is two threads.

Here they are, properly paragraphed, hopefully more cleanly expressed:

+++

(Don't) Incentivise Ethical Behaviour

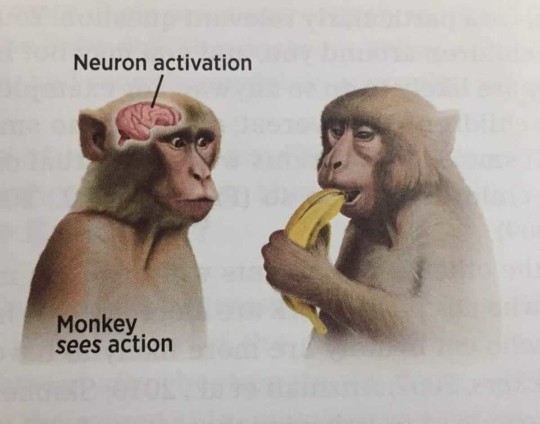

This is my main problem with mechanically rewarding pro-social play: a character's ethical choice is rendered mercenary.

As Luke Gearing puts it:

"Being good for a reward isn’t being good---it’s just optimal play."

Bear in mind that I'm not saying that pro-social play can't have rewarding outcomes for players. Any decision should have consequences in the fiction. It serves the ideal of portraying a living, world to have these consequences rendered diegetic:

The townsfolk are thankful; the goblins remember your mercy; pamphlets appear, quoting from your revolutionary speech.

What I am saying is that rewarding abstract mechanical benefits (XP tickets, metacurrency points, etc) for ethical decisions stinks.

+

A subtle but absolutely essential distinction, when it comes to portraying and exploring ethics / morality, in roleplaying games.

Say you reward bonus XP for sparing goblins.

Are your players making a decisions based on how much they value life / the personhood of goblins? Or are they making a decision based on how much they want XP?

Say you declare: "If you help the villagers, the party receives a +1 attitude modifier in this village."

Are your players assisting the community because it is the right thing to do, or are they playing optimally, for a +1 effect?

+

XP As Currency

XP is the ur-example of incentive in TTRPGs. It began with D&D's gold-for-XP, and has never strayed far from that logic.

XP is still currency. Do things the GM / game designer wants you to do? Get paid.

Players use XP to buy better mechanical tools (levels, skills, abilities)---which they can then in turn use to better perform the actions that will net them XP.

Like using gold you stole from goblins to buy a sword, so you can now rob orcs.

I genuinely feel that such systems are valuable. They are models that illuminate the drives fuelling amoral / unethical behaviour.

Material gain is the drive of land-grabbing and colonialism. Logger-barons and empires do get wealthier and more privileged, as a reward for their terrible actions.

+

If you want to present an ethical choice in play, congruent to our real-life dilemmas, there is value in asking:

"Hey, if you kill the goblins you can grab their treasure, and you will get richer. There's no reward for sparing their lives, except that they are thankful."

Which is another way of asking:

"Does your commitment to the ideal of preserving life outweigh the guaranteed material incentives for taking life?"

The ethical choice is the difficult choice, precisely because it involves---as it often does, in real life---sacrificing personal growth and gain. Doling out an XP bounty for doing the right thing makes the ethical choice moot.

"I as the player am making a mechanically optimal choice, but my character is making an ethical choice!"

A cop-out. Owning your cake and eating it too. The fictional fig-leaf of empathy over a calculated a decision to make profit.

+

Sidney Icarus asks a question which I will quote here:

"... those who hold to their beliefs of good behaviour don't feel rewarded, and therefore feel punished. And that's not a good feeling. It's an unpleasant experience to play a game where the righteous players are in rags, and the mercenary fucks have crowns and sceptres. So, what's the design opportunity? How do we make doing the right thing feel pleasant without making it mercenary? Or, like reality, do we acknowledge that ethical acts are valuable only intrinsically and philosophically? I have no idea how to reconcile this."

I would suggest that the above dichotomy---"righteous players in rags, mercs in crowns"---is true if property is recognised as the only true incentive.

+

Friends As Property

Modern games try to solve the righteous-players-in-rags "problem" in various ways. Virtue might not net you treasure or XP, but may give you:

Contact or ally slots, which you can fill in;

Relationship meters you can watch tick up;

Favour points you can cash in later;

etc.

How different are these mechanical incentives from treasure or XP, really?

Your relationships with supposedly living, breathing beings are transformed into abilities for your character: skills you can train; powers you can reliably proc. Pump your relationship score with the orc tribe until calling on them for reinforcements becomes a once-per-month ability.

Relationships become contracts. Regard becomes debt. Put your friend in an ally slot, so they become a tool.

If this is what you want play to be---totally fine! As stated previously, games say powerful things when they portray the engines of profit and property.

But I personally don't think game designers should design employer-employee relationships and disguise these as instances of mutual aid.

+

Friends As Friends

In the OSR campaigns I'm part of, I keep forgetting to record money. Which is usually a big deal in such games, seeing as they are in the grand tradition of gold-for-XP?

In both games, my characters are still 1st-Level pukes, though it's been months.

I'm having a blast, anyway.

My GMs, by virtue of running organic, reactive worlds, have made play rewarding for me. NPCs / geographies remember the party's previous actions, and respond accordingly.

I've been given gills from a river god, after constant prayer;

I've befriended a village of monsters, where we now live;

I've parleyed with the witch of a whole forest, where we may now tread;

I've a boon from the touch of wood wose, after answering his summons.

I cannot count on the wood wose showing up. He is a character in the world, not a power I control. Calling on the wood wose might become a whole adventure.

Little of this stuff is codified my stats or abilities or equipment list. They are mostly all under "misc notes".

Diegetic growth. Narrative change that spirals into more play.

This is the design opportunity, to me:

How do we shape TTRPG play culture in such a way that the "misc notes" gaps in our games are as fun as the systemised bits? What kinds of orientation tools must we provide? What should we say, in our advice sections?

+

A Note About Trust

The reason why it is so hard to imagine play beyond conventional incentive structures has a lot to do with trust.

Sidney again:

One of the core issues is the "low trust table". I'm not designing just for myself but for my audience. For a product. How much can I ask purchasers and their friends to codesign this part with me?

Nerds love numbers and things we can write down in inventories or slots because they are sureties. We've learned to fear fiat or player discretion, traumatised as we are by Problem GMs or That Guys.

The reason why the poverty in Sidney's hypothetical ("righteous players are in rags") sounds so bad is because in truth it represents risk at the game table. If you don't participate in the mechanics legible to your ruleset (the XP and gear to do more game things), you risk gradually being excluded from play.

You have no assurance your fellow players will know how hold space for you; be considerate; work together to portray a living world where NPCs react in meaningful ways---in ways that will be fun and rewarding for everybody playing.

You are giving up the guarantee of mechanical relevance for the possibility of fun interactions and creative social play.

+

The "low trust table" is learned behaviour--the cruft of gamer culture and trauma.

When I game with folks new to TTRPGs, they tend to be decent, considerate. I think there's enough anecdotal evidence from folks playing with school kids / newcomers / etc to suggest my experience is not unique.

If the "low trust table" is indeed learned behaviour, it can be unlearned.

Which rules conventions, now part of the hobby mainstream, were the result of designers designing defensively---shadowboxing against terrible players and the spectre of "unfairness"?

How can we "undesign" such conventions?

Lack of trust is a problem that we have to address in play culture, not rulesets. You cannot cook a dish so good it forces diners to have good table manners.

+

This is too long already. I'll end with an observation:

Elfgames are not praxis, but doesn't this specific dilemma in the microcosm of our silly elfgames ultimately mirror real-world ethics?

To be moral is to trust in a better world; to be amoral / immoral is to hedge against the guarantee of a worse one.

+++

Further Reading

Some words from around the TTRPG community about incentive and advancement in games:

+

However, the reason there is a big debate about this is that behavioural incentives in games clearly do work, either entirely or at various levels. This applies outside gaming, as well. Why do advertising companies and retail business use "rewards" structures to convince people to buy more of their products? Why do people chase after "Likes" on social media?

A comment by Paul_T to "A Hypothesis on Behavioral Incentives" from a discussion on Story-Games.com

+

the structure and symbolism of the D&D game align with certain structures and values of patriarchy. The game is designed to last infinitely by shifting goalposts of character experience in terms of increasing amounts of gold pieces acquired; this resembles the modus operandi of phallic desire which seeks out object after object (most typically, women) in order to quench a lack which always reasserts itself.

D&D's Obsession With Phallic Desire from Traverse Fantasy

+

In short, my feeling is that rewarding players with character improvement in return for achieving goals in a specific way impedes some of the key strengths of TTRPGs for little or no benefit in return.

Incentives from Bastionland

+

When good deeds arise naturally out of the players choices, especially when players rejected other options that were more beneficial to them, it is immensely satisfying. Far more than if players are just assumed to be heroic by default. It gives agency and meaning to player choice.

Make Players Choose To Be Kind from Cosmic Orrery

+

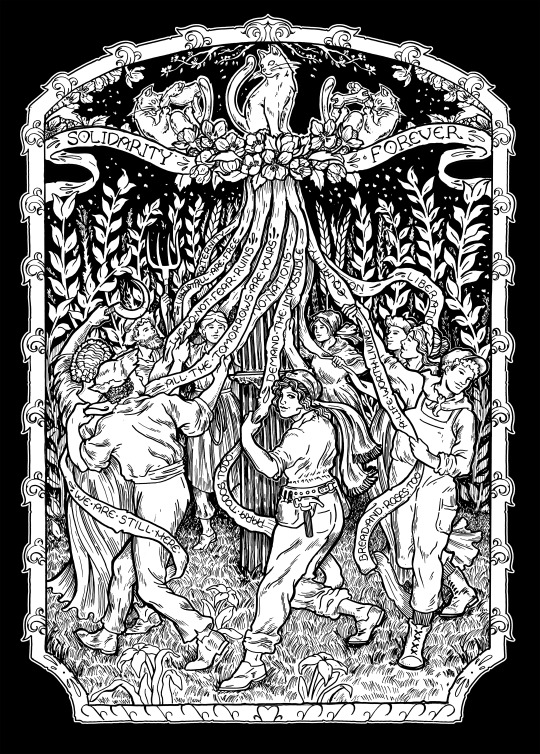

Much has been made about 1 GP = 1 XP as the core gameplay loop driver of TSR D+D. But XP for gold retrieved also winds up being something of a de facto capitalistic outlook as well. Success is driven by accumulation of individual wealth -- by an adventuring company, even! So what's a new framework that can be used for underpinning a leftist OSR campaign?

A Spectre (7+3 HD) Is Haunting the Flaeness: Towards a Leftist OSR from Legacy of the Bieth

+

Growth should be tied to a specific experience occurring in the fiction. It is more important for a PC to grow more interesting than more skilled or capable. PCs experience growth not necessarily because they’ve gotten more skill and experience, but because they are changed in a significant way.

Cairn FAQ from Cairn RPG / Yochai Gal

+++

Thank you Ram for the Story-Games.com deep cut!

( Image sources: https://knowyourmeme.com/memes/neuron-activation https://en.wikipedia.org/wiki/Majesty:_The_Fantasy_Kingdom_Sim https://www.economist.com/sites/default/files/special-reports-pdfs/10490978.pdf https://varnam.my/34311/untold-tales-of-indian-labourers-from-rubber-plantations-during-pre-independence-malaya/ https://nobonzo.com/ )

+

PS: used with permission from Sandro, art by Maxa', a reminder to self:

252 notes

·

View notes

Text

Finch finally got a redesign that suits her more... With that, if you want to know more about my riptide oc, info below! :D

WARNING: there's A LOT of yapping

Finch, originally named Farren Van Aalsburg, stands as a 24-year-old pirate whose legacy is intertwined with the notorious ship, The Arbiter.

Known for her ruthless and calculated leadership, Finch's mere approach to piracy would send ripples of apprehension through the ranks of sailors and even unsettle the most seasoned navy officers. The very mention of her crew's arrival was often met with foreboding whispers. In taverns, pirates would share knowing smirks over their mugs of beer, while officers would exchange wary glances. They'd caution one another,

"Retribution's coming."

Farren's lineage traces back to a well-known navy captain, Heimer Van Aalsburg, praised for his adeptness in handling internal conflicts and hailed as one of the foremost strategists in naval warfare. Alongside his family, composed of Farren, her stepsister Hestia, and stepmother Alisei, they resided aboard a wonderful mahogany vessel, embarking on voyages from one port to another.

For Heimer, Farren was the centre of his universe, he couldn't have wished for a better daughter. Their connection strengthened, particularly in the wake of Farren's mother, Julith Ferin's passing when Farren was just four years old.

The bond between Farren and her younger sister was equally profound, they had an unbreakable bond from the very moment they met. However, amidst this familial setting, Alisei nursed a vicious, festering resentment, convinced that Farren overshadowed Hestia in Heimer's eyes. This animosity later culminated in a tragic incident that took place one, stormy night.

In an unfortunate turn of events, Farren finds herself overboard, her desperate attempt to grasp the ship resulting in a severe injury to her right arm. Eventually, the raging waters below are quick to swallow her.

As her consciousness returns, she kneels before a colossal leviathan. The creature presents a solemn pact: it will guide her to the nearest vessel and mend her injured arm, with the condition that she accepts the burden of becoming the guardian of the seas until her last dying breath. An oath that binds her to a life on the move, forbidding her to settle on solid ground or abandon her duty. With hesitation, she agrees.

One fateful day, Skip, a hardy half-orc fisherman, discovers a young girl ensnared in his ship's nets. Swift to lend a helping hand, he extends not only a refuge but a genuine home for the girl, determined to help navigate her through the uncertain future.

Now residing on a small isle, a mere few days were enough for her to befriend a whole flock of zebra finches, who trailed behind her like loyal companions. Considering the girl didn't remember anything, let alone her name, Skip decided that the name 'Finch' would be more than a suitable choice.

Finch grapples with a zero to no recollection of herself and her family. Her only tangible link is a gilded medallion etched with the initials 'J.H.F’ accompanied by a few fleeting memories of her father.

Finch becomes a stalwart protector, earning recognition as the island's guardian. Fueled by an unyielding commitment, she gathers a crew at the age of 16. Two years later, they embark on their first voyage.

Her five years at sea culminates in a fierce clash with the navy, leaving Finch and her childhood friend, Shelby, as the lone survivors. In the wake of the tragedy, Finch confronts a maelstrom of emotions, grappling with guilt, simmering anger, and the rekindling of a long-suppressed fear of the unforgiving ocean.

"What value does a fierce pirate captain, one who commands the treacherous seas yet harbours such fear, truly possess?" - Niklaus, on their last meeting.

Finch and Niklaus have a history of encounters, each one more significant than the last.

Their first meeting took place when Finch was just 16, in the midst of assembling her crew. Niklaus dangled the promise of information regarding her family, but only if she'd abandon her oath. She refused, even poking fun at him the whole time—a stance she maintained on numerous occasions.

The second encounter, at the age of 23, followed a previously mentioned, deadly battle. Niklaus presented her an offer to turn back time, still on the condition of letting go of her oath. Once again, she refused, stating he's a fool if he thinks she'll ever give it up. After a few humiliating attempts at bribing her, he gives up.

A mere few weeks later, their paths crossed once more. This time, Niklaus proposed a lasting solution to banish her deep-seated fear of the ocean in return for a future favour. He pledged to provide a specific time, place, and a duel to be won, one she'd be obliged to fulfil, that is not linked to her oath. After careful consideration, and a few conditions, Finch shook on the arrangement (and still made fun of him the entire time).

#digital art#character concept art#dnd oc#oc#original character#oc art#jrwi riptide oc#the yappening is real#skye's ocs#riptide oc

180 notes

·

View notes

Text

Last week, at a White House meeting with the C.E.O.s of Uber, Goldman Sachs, and Salesforce, Donald Trump touted “a pro-family initiative that will help millions of Americans harness the strength of our economy to lift up the next generation.” He was referring to a provision in the tax-and-spending bill that House Republicans pushed through in May, which would establish tax-deferred investment accounts for every child born in the United States during the next four years, with the federal government contributing a thousand dollars to each. House Speaker Mike Johnson, who was also present at the White House meeting, described the proposal as “bold, transformative.”

It could more accurately be described as an effort to put lipstick on a pig. As everybody surely knows by now, the House bill—formally called the One Big Beautiful Bill Act—is stuffed with tax cuts for corporations and for the rich, and it proposes to slash funding for Medicaid, food assistance, and other programs that target low-income Americans. The proposal for new investment accounts didn’t change the bill’s highly regressive nature. According to a report by the Congressional Budget Office, over all, the bill’s provisions, including the new accounts, would reduce the financial resources of households in the bottom tenth of the income distribution by about sixteen-hundred dollars a year relative to a baseline scenario, and raise the resources of households in the top tenth by an average of about twelve thousand dollars a year. In other words, it’s a reverse-Robin Hood bill.

The new savings vehicles that Republicans are proposing also demand inspection. Johnson and other Republicans are trying to promote them as pro-family and pro-worker, and some media accounts have described them as “baby bonds.” But the proposal bears little resemblance to one of that same name which some progressive economists and elected Democrats have been promoting for years, as a way to tackle gaping wealth disparities in America. Given the way the Republican scheme is structured, it could well end up entrenching existing disparities rather than helping to eliminate them.

Endowing children with some wealth to help give them a proper start in life isn’t a new idea, of course. Rich families have been setting up trust funds, in some form or another, for centuries. But what about children in families that have little or no wealth to hand down? (According to the Federal Reserve, in 2022, the average net worth of households in the bottom ten per cent of the wealth distribution was one dollar. One.)

In 2010, the economists Darrick Hamilton, who is now at the New School, and William Darity, Jr., of Duke, outlined a plan to create interest-bearing government trust accounts for children who were born into families that fell below the median net worth. Under the Hamilton-Darity plan, the average value of these government contributions, which they described as “baby bonds,” would gradually rise to roughly twenty thousand dollars, with children from the poorest families benefitting even more. Adding in the interest that would accumulate in these accounts over the years, Hamilton and Darity calculated that some of these kids could end up with more than fifty thousand dollars by the time they reached adulthood.

Although the baby bonds would be distributed on a race-blind basis, the fact that Black, Indigenous, and Latino families were (and are) disproportionately represented in the lower reaches of the wealth distribution would have meant that the scheme would have worked to the benefit of their children—with a concomitant impact on the racial wealth gap. (In 2022, according to survey figures from the Federal Reserve, the median wealth of Black households was $44,890, compared with $285,000 for white households.) Indeed, Hamilton and Darity claimed that their proposal “could go a long way towards” eliminating the intergenerational transmission of racial advantage and disadvantage.

This proposal was never put into effect. But a version of it lived on in the form of legislation proposed by Cory Booker, the Democratic senator, in 2018, and subsequently reintroduced, in 2023, by Booker and Representative Ayanna Pressley. Under the Booker-Pressley bill, all American children at birth would be given a publicly financed investment account worth a thousand dollars, and the government would make further payments into these accounts annually depending on family income. When the owners of the accounts turned eighteen, they would be allowed to use the money for certain specified expenditures, including buying a home or helping to pay for college. “Baby Bonds are one of the most effective tools we have for closing the racial wealth gap,” Pressley commented when proposing the legislation.

On the Republican side of the aisle, some politicians and policy analysts have long supported tax-advantaged private savings accounts as a way of encouraging thrift and staving off socialistic tendencies. But it was only recently that the Party came around to the idea of seeding these accounts with public money. The Texas senator Ted Cruz promoted it under the label of “Invest America.” In the House bill, it was rebranded as a “MAGA Account,” with the acronym standing for “Money Account for Growth and Advancement.” Republicans renamed it a “Trump Account” at the last minute. “You can call it anything you like,” Cruz told Semafor. “What is powerful is enabling every child in America to have an investment account and a stake in the American free-enterprise system.”

In political terms, Cruz may be right: during COVID, direct federal payments proved popular with voters (and Trump insisted on putting his name on the checks, too). But in socioeconomic terms, the Republican proposal would be much less potent. “It’s upside down,” Darrick Hamilton told me last week. “It amounts to a further subsidy to the affluent, who can already afford to save in the first place.”

The details of the proposal confirm Hamilton’s point. Money in the new Trump accounts would have to be placed in a low-cost stock index fund, and investment gains would be allowed to accumulate tax free until the funds were used. Parents and others would be allowed to supplement the original government endowments of a thousand dollars with contributions of up to five thousand dollars a year. But poor families obviously wouldn’t have the means to provide top-ups. “That means poorer families with no savings will get $1,000 compounding over 18 years while rich families will be able to invest up to $90,000,” Stephen Nuñez, an analyst at the Roosevelt Institute, wrote in a piece about the G.O.P. plan. “That will widen the wealth gap.”

There are other issues, too. It’s far from that clear that banks or brokerages will be willing to administer the new accounts without charging hefty fees that would deplete them. Some financial experts say that most households would earn better returns by contributing to existing 529 college-savings plans. (The limits for contributions to 529 plans are higher, and in many states they aren’t subject to state taxes.) Conceivably, some of these concerns could be resolved by pooling the money in the accounts, by fiddling with the tax code, and by encouraging employers of the account holders’ parents to make additional contributions to them. (At the White House meeting last week, Michael Dell, the C.E.O. of Dell, said the company would be willing to match the government contributions.) But these are only suggestions, and it’s hard to avoid the conclusion that the entire project is largely an effort to divert attention from the true nature of the Republican economic agenda.

“You certainly would want to question the timing of the proposal,’ Hamilton said to me. However, he added, that, “with regard to the Trump Accounts, the idea of a stakeholder society is not bad. That part is valuable, if you ask me.” He said that when he was growing up, in the Bedford-Stuyvesant neighborhood of New York, and attending an élite private school, the role that inherited wealth played in determining people’s life prospects was “vivid” to him. Where Trump and the Republicans have gone wrong in promoting the stakeholder concept, he went on, is “one, by relying on saving, and, two, in the regressive structure of the program.”

To be sure, Hamilton’s “baby bonds” initiative would involve considerable costs, and that is one reason why it has never got off the ground politically. In our conversation, Hamilton cited a figure of a hundred billion dollars a year. That sounds like a large number, he conceded, but he also pointed out that it would amount to less than two per cent of over-all federal spending, and he said that it would be considerably smaller than the sums currently devoted to subsidizing private wealth accumulation by people who already have some wealth, through things like the mortgage-interest deduction and the low tax rate on capital gains.

Hamilton didn’t mention it, but according to the Congressional Budget Office an extension of the soon-to-expire 2017 G.O.P. tax cuts, which is the primary purpose of the One Big Beautiful Bill Act, would cost nearly five hundred billion dollars next year—five times the estimated cost of his baby-bonds proposal. Given the Republicans’ dominance in Washington and the gaping budget deficit, there’s obviously no immediate prospect of the U.S. government reorienting its priorities to tackle rampant wealth inequality, in the way that Hamilton and his colleagues recommend or in some similar manner. But that doesn’t mean it wouldn’t be possible. If the commitment to levelling out wealth were broadly shared, the possibilities would be many.

9 notes

·

View notes

Text

6. [Conceptualization - Godly 16] Present an investment plan that is sure to fail.

-2 Art degree useless.

CONCEPTUALIZATION [Godly: Failure] - Congratulations, you've somehow managed to fail at failing, which means, in a strange way, that you've succeeded?

"You should invest in a youth centre."

MEGA RICH LIGHT BENDING GUY - "A youth centre, huh? What *kind* of youth centre?"

PHYSICAL INSTRUMENT [Medium: Success] - A place to train *buff kids*.

EMPATHY [Easy: Success] - A place to teach them practical skills like teamwork and self-discipline.

CONCEPTUALIZATION - Come on. Tell him what he wants to hear.

"One dedicated to instilling liberal economic values in children from low-net-worth families."

"One to inspire the future leaders of tomorrow to public service."

"You know, a regular youth centre, with basketball courts and stuff. To *really* develop their physical proficiency."

"You know, a regular youth centre, with basketball courts and stuff. To teach teamwork and other emotional skills."

MEGA RICH LIGHT BENDING GUY - "No, no, no. You've got to think *bigger* than that."

2. "One to inspire the future leaders of tomorrow to public service."

+1 Moralism

MEGA RICH LIGHT BENDING GUY - "Hmmm," the man thinks for a moment.

"I like that you're thinking about the future, but couldn't the centre have a more... economic focus?"

"One dedicated to instilling liberal economic values in children from low-net-worth families."

+1 Ultraliberalism

MEGA RICH LIGHT BENDING GUY - "Brilliant! Without children who'll be there to buy stuff in the future?"

"Yes. And if it doesn't work out, we can always re-purpose the centre as a shopping mall or private equity firm."

MEGA RICH LIGHT BENDING GUY - "When life closes a door, it opens a window, yes? What's the expected return on this?"

"Highly educated, work-ready, human capital ready to be directed toward any number of your vast interests."

"With human beings there's always a risk associated. Which is why we've got to hold onto the centre itself as a fallback."

CONCEPTUALIZATION - You're deep into ultraliberal territory now. Good work.

MEGA RICH LIGHT BENDING GUY - "Very impressive. You've got a natural eye for unusual investment opportunities."

"Thank you."

"I know."

MEGA RICH LIGHT BENDING GUY - "I don't normally do this without a formal pitch deck, but to hell with it, what's the point of being rich if you have to follow all the rules?"

"Here's a round of seed funding. This should be enough to prove out the concept and get things off the ground."

+100 real

We have already bought basically everything in the game, so on a technical level this is useless to us.

ELECTROCHEMISTRY [Medium: Success] - CHA-CHING. What'll it be? Speed? Vodka? Cigarettes?

HORRIFIC NECKTIE - *Bratan*, now's your chance to take some time off. Spend it with your good buddy, and get absolutely *wrecked* in the process.

"Hmm. Drugs do go well with money, I agree."

"I'm sorry, man, I'm an investor now -- I have to stay sober to calculate risks."

HORRIFIC NECKTIE - What is this shit?!? CALCULATING RISKS? *BRATAN*. THE RISKS YOU CANT CALCULATE ARE THE ONLY ONES WORTH TAKING!

"I'm sorry. I just don't see the ROI in that."

"I'll give it some thought."

KIM KITSURAGI - The lieutenant looks at you with horror. You've been mumbling to your necktie in a daze for several minutes.

MEGA RICH LIGHT BENDING GUY - "Ah, yes. Now you're displaying it... the *eccentricity* that becomes a wealthy individual." If the money-saint's visage weren't wrapped in physics-defying light, you would see his approval.

"Thank you for placing your unwavering *trust* in me."

"Thanks for the handout."

MEGA RICH LIGHT BENDING GUY - "Remember: it's not a *handout*, it's an investment. And I expect to see returns."

KIM KITSURAGI - The lieutenant stands there, dumbfounded. His mouth opens slightly, then closes again.

PERCEPTION (SIGHT) [Medium: Success] - Is he having a stroke?

"What do you think, Kim? Not bad, huh?"

"Kim, are you alright?"

"Kim, are you having a stroke?"

KIM KITSURAGI - "No, I am *not* having a stroke. You're just... still full of surprises. Most of them bad, but some good..."

+1 Reputation

COMPOSURE [Medium: Success] - The lieutenant has granted you an aura of legitimacy. Bathe in it, but don't let your satisfaction show. Play it cool.

MEGA RICH LIGHT BENDING GUY - "Now, was there anything else I could help you gentlemen with?"

There is not.

5. "We should get back to our investigation. Thanks for your time." [Leave.]

MEGA RICH LIGHT BENDING GUY - "The pleasure was mine. Unfortunately, I must be away soon. The next time we meet, I'll be expecting an update on my investment!"

"Farewell, friend, and may your peace of mind guide you to happiness."

A thought is triggered.

SAVOIR FAIRE - Wow, you work *hard*.

I do?

(Discard thought).

SAVOIR FAIRE - Oh, yes. You hustle. You're a provider. It's tough out there, but you keep it real and provide...

I guess I do, yeah.

What hard work do I do exactly?

SAVOIR FAIRE - Oh yeah! Like a horse. A work horse. For hard work.

What hard work do I do exactly?

SAVOIR FAIRE - Look at yourself, you're a human pedometer! You must have walked 200,000 steps down cracked asphalt, mosaic, sand, and linoleum after you re-emerged.

That is the sign of a hustler who never gives up. The world is harsh and people are evil -- you didn't make it that way. And you won't let it break you. You *ride*.

Yeah, I ride. A little.

I fuckin' ride till I die, bitch.

I'm not sure I *ride*...

SAVOIR FAIRE - Oh, you do. You *make* money. You got gills, baby, meaning those black papers with the faces of the innocences on them. You bring in the Franconegros and the Solas.

It ain't easy, but you *do* it. Day in and day out. You didn't make the rules but you won't lose! You're a cop and a sprinter and a money printer.

I mean yeah, I *did* take that bribe from that Joyce woman.

Can't say I didn't make that Siileng guy give some of his money either.

You could say I took some money from that Mañana guy too.

Oh, and then there's pawning stuff off to that suspicious Roy guy.

I guess I've made *some* gills, sure.

SAVOIR FAIRE - Oh yeah, you took that bribe *hard*. You're a killa'.

2. Can't say I didn't make that Siileng guy give some of his money either.

SAVOIR FAIRE - Can't say that -- you *shook* him. You're a killer. A shark.

3. You could say I took some money from that Mañana guy too.

SAVOIR FAIRE - You didn't log that in as a donation either -- you don't log any of that shit in, you're a straight rider.

4. Oh, and then there's pawning stuff off to that suspicious Roy guy.

SAVOIR FAIRE - Yeah, you're in the sales business. Shake 'em for shit and then pawn it off, *law officer*-style.

5. I guess I've made *some* gills, sure.

SAVOIR FAIRE - Sure, sure. And has it been easy? Is life easy? Have you *not* gone into cardiac arrest? Are you *not* about to have an anxiety attack or shoot yourself in the mouth? But you still hustle 24/7, ride or die. Now, ask yourself...

...are you *rich*?

Yes. Quite.

No, I'm actually *not*.

SAVOIR FAIRE - That's right. You work harder than *anyone*, you almost rode yourself to the grave and you're still practically a *hobo* -- why is that?

It's because of that Garte guy riding my ass!

The system is broken!

There's a market for corrupt cops out there, but the immigrant cops have price dumped it.

Fucking taxes, man.

I don't know. Why *am* I so poor?

SAVOIR FAIRE - The Garte-man has set himself up one of those self replicating money-structures. You should *learn* from it. Don't play the victim. Think, hustler. Think with your head.

2. The system is broken!

+1 Communism

SAVOIR FAIRE - Boohoo, *the system is broken*. *The establishment is keeping me down...* That's not the fuck-yeah attitude you're used to, what is this? Why are you so poor?

Skipping the fascist option...

4. Fucking taxes, man.

+1 Ultraliberalism

SAVOIR FAIRE - That's right! One-hundred percent. Fucking G-man's got his jam-covered sticky-fingers in your pocket, stealing from you every time you buy, sell, walk, talk, fart, so much as sneeze!

RHETORIC [Medium: Success] - Aren't taxes almost non-existent in the Gossamer State that is Revachol?

I thought there *were* no taxes.

Really? Every time I sneeze?

SAVOIR FAIRE - You and I both, but they got those *indirect modes of taxation*. Sales tax, excise duty, extraction tax, this tax that doesn't even have a name -- plus there's the stuff *people in other countries* pay for, that makes them ask for more money from *you* here! The Gossamer State's a myth. In total the Coalition Government is taking...

NINETY-EIGHT PERCENT OF ALL YOUR MONEY.

NO FUCKING WAY. I guess I'm a free market fundamentalist now. (Opt in.)

Are you sure? That seems like a pretty big number…

This isn't helping me solve my money problem, it's only making me into a free-market type. (Opt out.)

SAVOIR FAIRE - What are you not sure about?! They're *milking* your nipples till they bleed. Can't you see? Aren't you *sick and tired* of having bloody nipples?

12 notes

·

View notes

Text

🦩🌳💸Using Decision Trees in Financial Analysis🔍

Decision Trees are a powerful financial analysis tool that clarifies the expected value of capital investment opportunities. It is used in business operations where companies continuously struggle with big decisions on product development, operations management, human resources, and others. Decision Tree analysis method lets us explore the ranging elements influencing a decision.

🦩📉💸Stakeholders and Risk

Let’s say that there is a parent company investing the funds expects some investments across their portfolio of subsidiaries to fail and have hedged against that by diversifying their risk exposures. The sales manager of the company has a lot to gain in regards to increased product quality to offer to potential clients and nothing to lose if the project is not successful. However, for the plant manager that will be in charge of building the new modernized factory, failure may mean losing his job. Such a situation where there is a significant number of different stakeholder points of view introduces an undesirable element of politics in the decision-making process. To mitigate the risk of such politics leading to wrong decisions, we need to ask who bears the risk and what is the risk and look at each decision from the perspective of each stakeholder, when performing our analysis.

🦩📊💸Evaluate Investment Opportunities with Decision Trees

Decision Trees is a great laying out information tool that enables systematic analysis and leads to a more robust and rigorous decision-making process. The technique is excellent for illustrating the structure of investment decisions, and it can be crucial in the evaluation of investment opportunities. Decision Trees in financial analysis are a Net Present Value (NPV) calculation that incorporates different future scenarios based on how likely they are to occur. The cash flows for a given decision are the sum of cash flows for all alternative options, weighted based on their assigned probability.

🦩🌳💸To prepare a Decision Tree analysis, we take the following approach:

Identify the points of decision and the alternative options available at each of them.

Identify aspects of uncertainty and type or range of alternative outcomes.

Estimate the values for the analysis: *Probabilities of events and results from actions *Costs of and possible gains from various events and activities.

Analyze alternative amounts and choose a course (calculate the present value for each state).

🦩🌳💸Decision Tree Analysis is an essential tool in the decision-making process and investment analysis as it determines the value of investment opportunities and clarifies the connection between current and future decisions and uncertain circumstances which enables management to consider the available courses of action with more ease and clarity.

#economy#business#finance#investing#stakeholders#investment#analysis#risk#management#artists on tumblr#digital art#my art#artwork#illustration#drawings#design#creative#creative writing#onlyfans creator

2 notes

·

View notes

Text

New York Attorney General Letitia James asked a judge Wednesday for a partial summary judgment against Donald Trump in her $250 million lawsuit accusing the former president of widespread fraud, citing what she called a "mountain of undisputed evidence" of false and misleading financial statements.

James, in her motion, says Engoron has to answer just "two simple and straightforward questions" to make that finding.

One question is whether Trump's annual statements of his financial condition were "false or misleading," the attorney general wrote. The other question, she wrote, is whether Trump and his co-defendants repeatedly used the financial statements to conduct business transactions. "The answer to both questions is a resounding 'yes' based on the mountain of undisputed evidence cited" in the documentation submitted by James' office, the motion said. "Based on the undisputed evidence, no trial is required for the Court to determine that Defendants presented grossly and materially inflated asset values in the SFCs [financial statements] and then used those SFCs repeatedly in business transactions to defraud banks and insurers," James wrote.

In a court filing, James said evidence shows that if Trump's net worth were correctly calculated, it would be between 17% and 39% lower than what he claimed each year over the course of a decade, "which translates to the enormous sum of $1 billion or more in all but one year."

The allegedly false statements included years when Trump was in the White House, according to the filing.

James' filing comes two months before the trial is set to begin in the civil suit against the former president; the Trump Organization; and his sons, Donald Trump Jr. and Eric Trump, at New York Supreme Court in Manhattan.

James is suing the Trumps for allegedly defrauding banks, insurance companies and others with the use of false financial statements.

That trial would still take place to address other claims, even if Judge Arthur Engoron grants James' request for partial summary judgment and finds Trump and the other defendants committed fraud under New York business law.

James, in her motion, says Engoron has to answer just "two simple and straightforward questions" to make that finding.

One question is whether Trump's annual statements of his financial condition were "false or misleading," the attorney general wrote.

The other question, she wrote, is whether Trump and his co-defendants repeatedly used the financial statements to conduct business transactions.

"The answer to both questions is a resounding 'yes' based on the mountain of undisputed evidence cited" in the documentation submitted by James' office, the motion said.

"Based on the undisputed evidence, no trial is required for the Court to determine that Defendants presented grossly and materially inflated asset values in the SFCs [financial statements] and then used those SFCs repeatedly in business transactions to defraud banks and insurers," James wrote.

"Notwithstanding Defendants' horde of 13 experts, at the end of the day this is a documents case, and the documents leave no shred of doubt that Mr. Trump's SFCs do not even remotely reflect the 'estimated current value' of his assets as they would trade between well-informed market participants," the motion said.

#Trump fraud case: New York attorney general says 'mountain' of evidence justifies summary judgment#trump#Letitia James DA#New York#trump fucked up bad

13 notes

·

View notes

Text

Finance 101 for marketers

In the world of business, it is common for specialized departments to operate in their silos. One notable example is the marketing team, which often focuses on brand building, creative and customer engagement, sometimes at the expense of a deeper understanding of the broader business and commercial workings of the company. This gap can lead to misaligned strategies and lost opportunities.

These are some of the common terms that I have come across over the past decade that every marketer should have a basic understanding.

GMV (Gross Merchandise Volume): This is the total sales value of merchandise sold through a particular marketplace over a specific time period. It measures the size of a marketplace or business, but not the company's actual revenue since it doesn't account for discounts, returns, etc.

Revenue: This is the total amount of income generated by the sale of goods or services related to the company's primary operations.

COGS (Cost of Goods Sold): This refers to the direct costs attributable to the production of the goods sold. This amount includes the cost of the materials and labor directly used to create the product.

Gross Margin: A financial metric indicating the financial health of a company. It's calculated as the revenue minus the cost of goods sold (COGS), divided by the revenue. This percentage shows how much the company retains on each dollar of sales to cover its other costs.

Operating Income: This is the profit realized from a business's core operations. It is calculated by subtracting operating expenses (like wages, depreciation, and cost of goods sold) from the company’s gross income.

Ordinary Income: This typically refers to income earned from regular business operations, excluding extraordinary income which might come from non-recurring events like asset sales or investments.

Net Profit: Also known as net income or net earnings, it's the amount of income that remains after all operating expenses, taxes, interest, and preferred stock dividends have been deducted from a company's total revenue.

PPWF (Price Pocket Waterfall): This term is used to describe the breakdown of the list price of a product or service down to the net price, showing all the factors that contribute to the price erosion. The "waterfall" metaphorically illustrates how the price "falls" or reduces step by step due to various deductions like discounts, rebates, allowances, and other incentives given to customers. This analysis is important for businesses to understand their actual pricing dynamics and profitability. It helps in identifying opportunities for price optimization and controlling unnecessary discounts or allowances that erode the final price received by the company.

Net Present Value (NPV): A method used in capital budgeting and investment planning to evaluate the profitability of an investment or project. It represents the difference between the present value of cash inflows and the present value of cash outflows over a period of time.

Internal Rate of Return (IRR): A metric used in financial analysis to estimate the profitability of potential investments. It's the discount rate that makes the net present value (NPV) of all cash flows from a particular project equal to zero.

CONQ (Cost of Non-Quality): This is the cost incurred due to providing poor quality products or services. It includes rework, returns, complaints, and lost sales due to a damaged reputation.

A&P (Advertising and Promotion): These are expenses related to the marketing and promotion of a company's products or services. It's a subset of the broader marketing expenses a company incurs.

Return on Investment (ROI): In simple terms, ROI measures the profitability of an investment. For marketing teams, this means understanding how campaigns contribute to the company's bottom line, beyond just tracking engagement metrics.

Return on Ad Spend (ROAS): ROAS specifically measures the efficiency of an advertising campaign. It assesses how much revenue is generated for every dollar spent on advertising. It's similar to ROI but focused solely on ad spend and the revenue directly generated from those ads. ROAS is exclusively used in the context of advertising and marketing. It helps businesses determine which advertising campaigns are most effective.

Customer Lifetime Value (CLV): This predicts the net profit attributed to the entire future relationship with a customer. Effective marketing strategies should aim at not only acquiring new customers but also retaining existing ones, thus maximizing CLV.

G&A (General and Administrative Expenses): These are the overhead costs associated with the day-to-day operations of a business. They include rent, utilities, insurance, management salaries, and other non-production-related costs.

2 notes

·

View notes

Photo

As a Canadian, and as someone living in a country that has a UBI framework, I think a lot of people misunderstand just how basic Universal Basic Income is.

TL;DR: I agree on principle, but identifying greed as a problem doesn't solve deeper systemic issues.

I see some armchair social theorists on here say that UBI is enough to fight more pressing social battles; that it empowers you to demand better rights as a worker, as a citizen. I've been on UBI and, well - no. UBI is enough to allow you to survive. If you want to invest in a project, if there's a worthwhile cause you want to get involved in that requires some involvement or some capital injection (even something as simple as buying supplies to fashion picketing signs) - that's on you. In Canada, UBI is calculated based on median income, which means that it isn't enough to kickstart some people's Post-Work-Era Roddenberry-Powered Magical Socialism where nobody works and everyone contributes out of sheer passion and drive.

UBI is there so you can survive, and so you can eventually have the resources and skillsets needed to contribute to Society without UBI lining your pockets. More importantly, UBI is there to ensure that there are no "bad jobs" to speak of, because even the fast food joint's janitor who's on Minimum Wage starts with better conditions than a UBI beneficiary. In Canada, a kid with no diploma who makes a living manning a Tim Hortons' cash register doesn't have to fight with the system to obtain credits related to his living conditions. The real problem has three prongs:

Welfare kings and queens who make it harder for legitimate demands of financial assistance to go through;

The corporate world that's forgotten that the very first rung past UBI needs to be 100% livable and needs to allow for at least some measure of savings to be something that can be planned for. UBI should facilitate survival, what happens when even minimum wage doesn't allow you to live right?

Slum lords who buy off properties initially set aside for Affordable Housing programs and who drive market values so far high that entry-level workers have to settle with living several hours away from their place of work.

But Sweden and Norway - Hold it. Sweden and Norway are filthy fucking rich. Sweden and Norway are Petrostates. Canada? Not so much. Year after year sees Affordable Living programs or revisions to UBI being floated that would turn it from a lifeline to an actually workable form of remuneration, but year after year sees my local politicians butt their heads against the fact that any kind of serious Social Security net can't just pay for itself; and Canadians are already sadly renowned for living in a country choked by taxes - all because our already-present pro-Social infrastructure is complex, inefficient and sadly vital for most low-income residents.

Imagine how insane implementing it would be on a per-State level, on the American side. Imagine the work that needs to be done; not just in terms of greater education, but also in the sense that there's an entire infrastructure you guys never put in place. Some of my colleagues are American expats, and their first big shock came in the form of their first tax bill on Canadian soil. Free healthcare isn't free, the load is just spread across the country's residents. It also means that UBI and Free Healthcare programs can only cover so much, seeing as even if you put the load primarily on those above a certain income level, those below it are still going to feel the pinch. God knows I do, every tax season, and even if it's for a fundamentally good cause.

So. Beyond harping that UBI is a basic right and that we all deserve to rest, ask yourself how wealthy your State is, first. Try and model the kind of help you'd be getting. Try projecting it as a deferred hit on your salary or your savings - one that you need to account for year after year, forever.

The social model where none of us work and all of us effectively play with shelter and rest being in-built facets of our social contract would require a total upheaval of our current system - and something tells me most people wouldn't like the transitional period between the two. Would people really maintain power stations or work hospitals just because it's the right thing to do?

Call me cynical, but I've been alive long enough to really, really, seriously doubt that logic. Sooner or later, someone's going to want to look out for Number One. The USSR fell for that very reason, and my own country's very pro-Social policies are rife with examples of what happens when someone with good intentions gets unfettered access to a chequebook, supposedly for the good of all. Remuneration is a great control system, in that respect, especially when we know that in an Egalitarian system, there's always going to be one or two chucklefucks who think they're more Egalitarian than the rest.

Greed is in all of us; the only thing that keeps you or me honest is our lack of power. Money, as they say, is the root of all Evil. Remove money from the equation and something else will take its place. Social status, most likely.

Then let's make all of us equal! Communism FTW!

you're likely American if you're reading this, how do you think most people will react to that kind of assertion?

even in an ideal system, the Overseer would have more power. That, right there, is enough of an imbalance for unfair treatment to surface.

Again, we've seen what happened with Soviet Russia, and I'm not saying this to be a bootlicker. Open a history book: Lenin barely managed to approximate Marx's idea of an Egalitarian state and Stalin identified the cracks in the system and pushed them wide open, priming it for collapse.

UBI needs to happen. via antiwork

#thoughts#politics#UBI#Universal Basic Income#Speaking as a Canadian#Speaking as a former beneficiary of Quebec's Welfare Credit (UBI)

181K notes

·

View notes

Text

Miami Rents Spike 14%, Investors Frenzy

Market Conditions Driving Miami's Rental SurgeAs Miami's rental market steps into 2025, a confluence of economic factors and demographic transitions has sparked an unprecedented surge in housing demand. This trend threatens to reshape the city's affordability framework entirely.Rental demand in Miami is escalating rapidly, driven by significant migration from high-cost states and remote workers attracted by Florida's tax benefits. The city's competitive rental environment now features an extraordinary 18 prospective renters per available unit. High mortgage rates further exacerbate the situation, similar to the challenges seen in Philadelphia, by making homeownership increasingly unattainable for middle-income residents, further amplifying rental demand.This demand has pushed occupancy rates to an astonishing 96.5%. Professionals fleeing states with income taxes have increased pressure on the already strained housing supply. Compounding the crisis are construction challenges, with elevated borrowing costs and soaring materials prices throttling new development projects. Even with over 25,000 multifamily units under construction as of Q3 2024, inventory growth fails to match the explosive rise in demand. The stability preference is evident as 72% of renters chose to renew their leases in 2024 rather than face relocation challenges.Investment Opportunities in Florida's Hottest Rental MarketWhere might astute investors find their most lucrative opportunities amid Miami's rental market explosion?Investment strategies targeting specific geographic zones reveal dramatically different risk-reward profiles across the metropolitan area.Brickell and Downtown condos command premium rental yields. This is driven by proximity to financial districts and international tenant demand. The use of a 1031 Exchange could enable investors to defer taxes while reinvesting profits to capitalize on Miami's burgeoning market.Lower maintenance costs compared to single-family properties enhance net returns. Investors seeking streamlined portfolio management will benefit here.Suburban markets in Coral Gables and Pinecrest offer stable appreciation trajectories. Families are attracted to these areas, willing to pay premium rents for top-rated school districts.These properties provide flexibility between long-term rentals and short-term vacation accommodations.Pre-construction investments in Wynwood present the highest upside potential. Emerging mixed-use developments create substantial value appreciation.The neighborhood's tech sector expansion fuels corporate housing demand. Florida's zero state income tax advantage continues to attract high-earning professionals.This sustains competitive rental markets with elevated occupancy rates. A surge in multifamily construction projects signals developer confidence.There's a belief in sustained rental demand across all Miami submarkets. However, investors must carefully evaluate HOA fees when calculating true returns on condominium investments.AssessmentMiami's rental market explosion reflects a perfect storm of economic pressures reshaping South Florida's housing environment.Investment capital continues flooding into the region as institutional buyers recognize the market's profit potential.The 14% rent surge is more than just statistical growth. It signals a fundamental shift in Miami's affordability structure.Traditional residents face displacement. Investors, on the other hand, capitalize on unprecedented demand dynamics.This rental crisis will likely intensify. Migration patterns and investment strategies converge, permanently altering Miami's demographic composition.

0 notes

Text

Why Investors Care About Sustainability Assurance in 2025

In 2025, sustainability has evolved from a corporate buzzword to a decisive factor in investment decisions. Investors today are more selective, demanding not only strong financial performance but also measurable environmental, social, and governance (ESG) outcomes. Central to this shift is sustainability assurance, a process that verifies the accuracy and credibility of ESG disclosures. But why is this process so critical to investors, and how do services like assurance services, certification services, and ISO certification play a role?

The Rising Demand for Sustainability Assurance

As companies increasingly publish sustainability and ESG reports, investors are questioning the validity of the data being presented. Greenwashing and unsubstantiated claims have raised scepticism, prompting stakeholders to demand independent verification. Sustainability assurance addresses this need by offering third-party validation of ESG metrics, GHG inventories, climate-related risks, and more.

For investors, this assurance signals:

Trust and transparency in corporate ESG claims

Risk mitigation through verified disclosures

Comparability across companies and sectors

Alignment with global reporting standards, such as GRI, SASB, and ISSB

RA Global: Enabling Reliable Sustainability Assurance

Trusted providers like RA Global have emerged as leaders in sustainability and carbon assurance services. Backed by a team of experts in climate change, compliance, and ESG frameworks, RA Global helps companies build investor confidence by ensuring their data meets international standards.

RA Global’s assurance services cover:

Sustainability and ESG report assurance

Carbon assurance for Scope 1, 2, and 3 emissions

ISO certification audits (e.g., ISO 14001, ISO 50001)

Verification aligned with frameworks like TCFD, CDP, and SBTi

By working with a recognised name like RA Global, companies can demonstrate integrity and strengthen their market reputation—something investors increasingly reward.

Certification Services: Adding Value to ESG Performance

Beyond assurance, certification services provide another layer of credibility. Achieving ISO certification in areas such as environmental management (ISO 14001), energy management (ISO 50001), and occupational health and safety (ISO 45001) reflects a company’s commitment to sustainable operations.

For investors, these certifications:

Reflect robust internal management systems

Reduce the risk of environmental penalties or reputational damage

Offer measurable performance indicators over time

Certified systems make ESG claims more actionable and performance-based, further aligning with investor expectations.

Carbon Assurance: A Priority in 2025

In a year where climate-related financial disclosures are mandatory across many jurisdictions, carbon assurance has taken centre stage. Investors need confidence in a company’s carbon footprint, emissions reduction claims, and net-zero pathways. Verified data allows for better comparison, due diligence, and inclusion in sustainable investment portfolios.

Companies using RA Global’s carbon assurance services gain:

Validation of GHG calculations

Clarity on Scope 1, 2, and 3 emissions

Support for Science-Based Targets (SBTs)

Compliance with national and international regulations

In essence, carbon assurance helps mitigate climate risk and future-proofs companies against incoming regulatory changes—exactly what investors seek in a resilient portfolio.

The Investor Perspective: Risk, Regulation, and ROI

By 2025, regulatory bodies across the globe have strengthened sustainability disclosure requirements. Investors face increasing pressure from clients, boards, and regulators to integrate ESG factors into their decision-making. They now prioritise companies that provide externally assured ESG data.

From an investment lens, sustainability assurance:

Protects against ESG-related financial risks

Increases long-term returns through better risk-adjusted performance

Demonstrates corporate governance and accountability

Firms without verified ESG disclosures may be viewed as higher risk and excluded from ESG-oriented portfolios or sustainability indices.

Conclusion: Assurance is No Longer Optional

As sustainable finance becomes mainstream, sustainability assurance, carbon assurance, and ISO certification are indispensable. Investors want transparency, accuracy, and commitment—and they’re rewarding companies that meet these expectations.

Organisations like RA Global are helping bridge the gap between ESG performance and investor trust, offering a full suite of assurance services and certification services tailored to 2025’s evolving regulatory and market landscape.

For businesses looking to attract sustainable investments, it’s clear: credible assurance isn’t just beneficial—it’s essential.

#Assurance services#Certification Services#ISO Certification#Carbon Assurance#Sustainability assurance#esgreportassurance

0 notes

Text

Step-by-Step Guide to Preparing a Comprehensive Valuation Report

A well-prepared valuation report is a critical document for businesses, investors, and stakeholders to make informed financial decisions. Whether it’s for mergers and acquisitions, taxation, compliance, or fundraising, an accurate valuation report offers transparency and clarity on the true worth of assets or shares. For companies and individuals in Madhapur, Hyderabad, Steadfast Business Consultants LLP (SBC) provides expert services to prepare comprehensive and reliable valuation reports tailored to your needs.

What Is a Valuation Report?

A valuation report is a formal document that details the estimated value of an asset, business, or security at a specific point in time. It includes the methodology used, assumptions made, financial data analyzed, and conclusions drawn by valuation experts. Preparing a thorough valuation report requires a systematic approach to ensure accuracy and credibility.

Step-by-Step Guide to Preparing a Valuation Report

1. Define the Purpose and Scope

The first step is to clearly understand the purpose of the valuation report. Are you preparing it for investment, regulatory compliance, tax assessment, or legal disputes? Defining the scope helps determine the valuation approach and the level of detail required. At Steadfast Business Consultants LLP (SBC), we work closely with clients in Madhapur, Hyderabad to identify their specific objectives.

2. Gather Relevant Data

Accurate valuation depends on comprehensive data collection. This includes financial statements, market data, industry trends, company records, and legal documents. For securities or shares, historical price data and transaction records are also essential. Collecting reliable data ensures the valuation report reflects the true economic value.

3. Choose the Appropriate Valuation Methodology

There are various methodologies to prepare a valuation report, such as:

Discounted Cash Flow (DCF) Analysis: Projects future cash flows and discounts them to present value.

Market Comparable Approach: Compares similar assets or companies to estimate value.

Asset-Based Approach: Calculates net asset value by subtracting liabilities from assets.

The choice depends on the asset type and purpose. Experts at SBC assess your situation to recommend the best method for accurate valuation.

4. Perform Financial Analysis

Next, analyze the financial data in detail. This includes reviewing revenue trends, profitability, debt levels, and growth potential. Financial ratios and projections play a crucial role in supporting the valuation figures presented in the report.

5. Make Assumptions and Adjustments

Valuation often involves assumptions about market conditions, growth rates, discount rates, and risk factors. Clearly documenting these assumptions in the valuation report ensures transparency and helps stakeholders understand the basis of the valuation. Adjustments may also be made for non-operating assets, contingent liabilities, or unique business factors.

6. Draft the Valuation Report

With all data and analyses completed, the valuation report is drafted. It typically includes:

Executive summary

Purpose and scope

Description of the business or asset

Valuation methodology

Financial analysis and assumptions

Valuation conclusion and supporting details

The report should be clear, concise, and professionally formatted to facilitate easy understanding.

7. Review and Finalize

Before delivering the valuation report, a thorough review process ensures accuracy and completeness. Steadfast Business Consultants LLP (SBC) in Madhapur, Hyderabad, emphasizes quality control and adherence to industry standards to produce trustworthy valuation reports.

Why Choose Steadfast Business Consultants LLP (SBC)?

At SBC, we bring extensive experience in preparing detailed valuation reports for clients across Madhapur, Hyderabad. Our expert team combines technical expertise with local market knowledge to deliver precise and actionable valuation insights.

Contact Us

If you need a professional valuation report tailored to your business or investment needs in Madhapur, Hyderabad, contact Steadfast Business Consultants LLP (SBC) today at 040–48555182. Let us guide you through the valuation process with confidence and clarity.

#tribunal services#valuation of securities#valuation of shares in hyderabad#valuation report#virtual cfo services

0 notes

Text

How to Get Instant Car Insurance Quotes Online in the UAE

Car insurance is not just a legal requirement in the UAE—it’s an essential safety net for your finances, especially when unexpected events like accidents, thefts, or natural calamities occur. While the concept of car insurance is widely understood, the process of selecting the right policy can often feel overwhelming, especially with numerous providers and options available online.

Fortunately, the digital shift in the insurance industry has simplified access to car insurance quotes in the UAE for motorists. From initial estimates to policy comparison and selection, most of the groundwork can now be done online—efficiently and conveniently.

However, while instant quotes offer a helpful starting point, securing the right insurance policy involves more than just selecting the lowest price. Here's a deeper dive into how to make sense of online quotes and why informed decision-making matters.

Why Get Car Insurance Quotes Online?

Gone are the days of visiting multiple insurance offices or calling providers individually. With today’s online tools, drivers in the UAE can easily obtain car insurance quotes within minutes by simply entering a few basic vehicle and personal details.

This process not only saves time but also allows users to:

Explore different coverage levels (e.g. third-party vs. comprehensive)

Evaluate optional benefits or add-ons

Understand potential exclusions

Identify cost variations between providers

The accessibility and transparency of online car insurance quotes make them an indispensable tool for anyone seeking to make a smart and informed decision.

How a Car Insurance Calculator in the UAE Helps

One of the most useful resources for drivers in the UAE is a car insurance calculator. These digital tools help you estimate your insurance premium based on inputs like:

The make and model of your vehicle

Year of manufacture

Type of cover required

Your driving history and location

By using a calculator, you can get a rough idea of what your insurance might cost, even before contacting any insurer directly. This can be especially helpful if you're buying a car for the first time or considering switching to a different type of coverage.

What to Look for in an Insurance Quote

It’s tempting to focus solely on price, but doing so could result in gaps in coverage that only become apparent when it’s too late. Here are some key areas to consider when comparing car insurance quotes:

Scope of Cover: Does the policy include own damage, third-party liability, and protection against theft or natural disasters?

Repair Options: Some policies allow repairs only at designated workshops, while others provide agency repair, which may be important if your vehicle is under warranty.

Add-ons and Extras: Look for optional benefits such as off-road coverage, roadside assistance, replacement vehicle coverage, or personal accident coverage.

Policy Limits and Exclusions: Always read the fine print to understand what’s not included. Exclusions can vary between providers.

Claim Process: A provider with a user-friendly claims process can save you a great deal of time and stress in the future.

The more detailed and personalised your quote is, the easier it becomes to evaluate its true value.

Why Insurance Brokers Play a Vital Role

While online platforms are a good starting point, accurately interpreting car insurance quotes often requires some expert insight. This is where experienced insurance brokers come in.

A reliable insurance broker can:

Present multiple quotes from leading providers so that you get access to a wider range of options than you would on your own.

Help interpret terms, features, and benefits so you’re not left guessing what each policy offers.

Guide you through the decision-making process, ensuring that your chosen policy matches your lifestyle, driving habits, and budget.

Assist with renewals and policy changes, making it easier to adapt your coverage over time.

Provide end-to-end support, especially during the claims process, ensuring that you’re not navigating paperwork or procedures alone.

Save your time and reduce confusion by simplifying what might otherwise be an overwhelming amount of information.

They act not just as intermediaries but as knowledgeable advisors who understand the nuances of motor insurance in the UAE and help you get the best value for your money.

Accuracy of Online Car Insurance Quotes

It’s natural to wonder whether the quotes you get online are accurate or complete. The reality is that car insurance quotes provided through online portals are usually based on basic information. They can provide a broad estimate, but it may not always accurately reflect the final premium—especially if your profile includes specific risk factors or custom requirements.

That’s why many drivers prefer to use online tools in combination with expert advice. You can start by using a car insurance calculator in the UAE, shortlist your options, and then speak to an insurance broker to confirm details and finalise your selection.

Final Thoughts

Obtaining car insurance quotes online in the UAE is an efficient and user-friendly process—but it’s just the first step in a larger decision-making process. To secure the right protection for your vehicle and peace of mind, you need to go beyond price comparisons.

Using tools like a car insurance calculator in the UAE helps you understand where your premium might fall. But for real clarity, personalisation, and long-term support, it’s best to consult with a knowledgeable insurance broker. They offer practical insights, help tailor the policy to your needs, and ensure you're never left guessing when it matters most.

In a market full of choices, having the right guidance can make all the difference.

0 notes

Text

Fort Wayne, Indiana Divorce Lawyers

Looking for a divorce attorney in Fort Wayne, Indiana? At Stange Law Firm, we provide support for individuals going through divorce, child custody disputes, and financial separation. With compassionate guidance and legal experience, we help clients in Fort Wayne and across Allen County take confident steps toward a new chapter.

Divorce in Indiana: What You Need to Know

Divorce is a legal and emotional process that affects nearly every area of your life. From the moment you decide to separate, you face critical decisions about your children, your finances, and your future. Indiana is a no-fault divorce state, meaning either spouse can file for divorce without proving fault. The most common reason cited is an irretrievable breakdown of the marriage.

Even in no-fault cases, the legal process can be complex. You'll need to address child custody, parenting time, property division, spousal maintenance, and support agreements. Every situation is different, which is why working with a knowledgeable attorney is so important.

Legal Services We Provide

At Stange Law Firm, we handle all aspects of family law and divorce. Our legal services include:

Contested and uncontested divorce

Child custody and parenting time

Child support and modifications

Property and debt division

Spousal support (alimony)

Legal separation

High net-worth divorce cases

Post-divorce enforcement

We serve clients in Fort Wayne and throughout Allen County with clear communication and a personalized approach. We know how important your family, finances, and future are, and we’re here to protect them every step of the way.

The Role of a Divorce Attorney

Hiring a lawyer may seem overwhelming, especially when emotions are running high. But legal guidance can help you avoid costly mistakes and ensure a fair outcome. An experienced Fort Wayne divorce attorney can provide advice, prepare legal documents, represent you in court, and negotiate settlements that meet your long-term needs.

Our team at Stange Law Firm focuses solely on family law, which gives us deep insight into Indiana’s divorce system. Whether you’re working toward a peaceful settlement or preparing for court, we are here to help you understand your options and move forward confidently.

Child Custody and Support Considerations

For parents, child custody is often the most emotional part of the divorce process. Indiana courts aim to serve the best interests of the child. That includes evaluating the stability of each parent’s home, the relationship between the child and each parent, and the ability to meet the child’s needs.

We assist parents in negotiating parenting plans that work for both parties and support the child’s well-being. If agreement isn’t possible, we’ll present a strong case in court, backed by facts and focused on what’s best for your child.

Indiana child support is calculated using state guidelines that consider each parent’s income, number of children, healthcare costs, and childcare expenses. We help clients ensure all necessary information is provided to get fair and accurate support arrangements.

Dividing Marital Property and Debts

Property division is another crucial part of the divorce process. In Indiana, marital property is divided equitably—not necessarily equally. This includes real estate, bank accounts, vehicles, retirement accounts, and any debts acquired during the marriage.