#Cash flow experts in Australia

Text

Cash Flow Vs Profit: The Difference

There's a familiar adage in bookkeeping that goes: "benefits are an assessment, cash is a reality." What this implies is that while being beneficial is significant in the long haul, having sufficient money to work every day — that is, having a positive income — is a prompter, squeezing concern.

As an entrepreneur, it's vital to figure out the contrast between income and benefit, and how both elements into business achievement. In spite of the fact that it's unreasonable, a productive business could be constrained due to unfortunate income. Likewise, a business could be income positive, yet be losing cash. To avoid such scenario, consult VNC – one of the most distinguished Cash flow specialists in Australia.

So what's the distinction between income and benefit? All the more critically, how might you ensure that you're both productive AND have positive income?

What is Cash Flow?

Basically, income alludes to the progression of cash into and out of a business during a set timeframe. Income bookkeeping records exchanges exactly when cash enters or leaves your financial balance, as opposed to when a receipt is sent or gotten.

Dissimilar to a Profit and Loss explanation, income incorporates cash development that isn't rigorously benefit, similar to capital infusions from proprietors or financial backers, or cash from the offer of a resource. Essentially, it does exclude credit from providers, cash owed from clients, or cash you as of now have in the bank.

Positive income implies that you have more money approaching than active at some random moment, and you're meeting all your monetary commitments as they emerge. It's a measurement frequently used to gauge the strength of a business, and can show banks, investors, and financial backers how well an organization is doing every day. Streamline your business cash flow with one of the excellent Cash flow experts in New Zealand, VNC.

What is Profit?

Profit, otherwise called Income, is how much amount remaining when you deduct costs from the revenue. There are two primary kinds of profit:

Profit = Total Revenue – Total Expenses

Not at all like with income, a month to month or quarterly Profit and Loss explanation considers what you owe, and what you are owed for the period. Along these lines, it's a decent pointer whether your business is getting more cash than it spends generally speaking — yet won't let you know whether you presently have sufficient cash in the bank to take care of the bills.

The Difference Between Cash Flow and Profit

Set forth plainly, a Profit and Loss explanation shows whether your business is procuring more than its spending, while a Cash Flow proclamation shows when you'll have cash close by. Benefit is about the master plan, while income centers around everyday reasonability.

For a business to find lasting success, it needs a decent net revenue and positive income.

Great Profit, Poor Cash Flow

Selina possesses a little, local area centered pastry kitchen that serves great cakes to a nearby group.

A companion of hers posts an image of her smash hit chocolate croissants to Instagram, and interest in her bread shop gets. In a little more than a month, interest for croissants duplicates, and Selina winds up routinely running unavailable.

To stay aware of interest, she puts resources into new gear, and duplicates her ordinary request of provisions.

Tragically, albeit the new income would more than cover the costs in a couple of months' time, Selina is in the red when it comes time to pay her providers. She is compelled to take out an exorbitant loan to meet her obligations, driving her further into the red.

Regardless of sound overall revenue, unfortunate income stops Selina's development plans from really developing. Never let your business stop from developing, consult VaderanCo – one of the top Cash flow experts in Australia.

Great Cash Flow, Poor Profit

Parita possesses a development organization, zeroing in on building high-thickness, reasonable lodging. She's constantly highly esteemed paying her laborers, providers, and bills on time.

Parita works carefully, keeping away from credits at every possible opportunity, timing approaches and outgoings so she can constantly meet her commitments. In spite of her emphasis on reasonableness, the business has consistently turned a clean benefit.

What she doesn't expect anyway are the increasing expenses related with production network interruption. The pandemic creates setbacks and increments costs across the business, and Parita's business is the same. Since contracts were at that point set up with purchasers for her assembles, the expenses eat into her all around thin overall revenues.

Parita's business remains income positive all through the monetary year, yet the absence of benefit implies her plan of action is at this point not viable.

The Right Balance

Johnny is a performer, with a genuinely enormous global following. In line with his fans, he's arranging his very first abroad visit.

He and his supervisory crew rapidly resolve that a visit is possible, yet Johnny needs more money in the bank to pay forthright costs like setting recruit, sound and lighting professionals, ticket administrations and so on.

They set up a financial plan for the excursion, and make a gauge investigating the number of tickets that they'd need to offer to repay a bank credit. They likewise take a gander at a most dire outcome imaginable, in which they sell 20% less tickets than they expect. They find what is going on, they can in any case take care of their expenses and create a gain in the event that they track down less expensive convenience, and take public vehicle between urban communities.

Equipped with this data, Johnny can unhesitatingly apply for a bank credit. The visit goes off effortlessly, and Johnny winds up selling out a large portion of his shows. The bank credit is reimbursed on time, and Johnny and his supervisory group leave with a robust benefit.

Step by step instructions to Ensure Good Profit and a Healthy Cash Flow with VNC Edge

Overseeing income and overall revenues implies estimating, observing, and making an arrangement to meet your objectives. The simplest method for doing the above is all to make a monetary figure. This is where VNC Edge can help.

VNC being one of the most trusted Cash flow specialists in New Zealand offers you a three-way gauging programming to project your future income, spending plan, and benefit and misfortune, so you can remain ready for whatever lies ahead. You can likewise make a scope of situations and assembled a strategy for various possibilities.

In particular, you can utilize VNC Edge to guarantee ideal overall revenues, and distinguish times of low income so you can repay likewise. It's like having the option to investigate the monetary future — without the problem of a precious stone ball.

#Cash flow specialists in Australia#Cash flow experts in New Zealand#Cash flow experts in Australia#Cash flow specialists in New Zealand

3 notes

·

View notes

Text

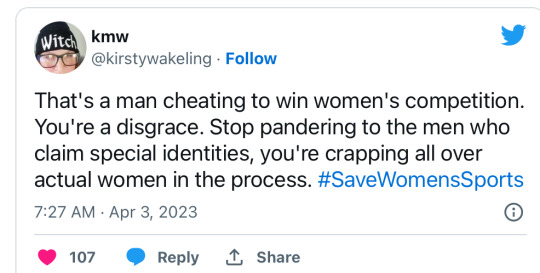

Within one week Australia gave us this guy

and now there’s this guy

A trans-identified male has taken home the championship at the Australian Women’s Classic golf tour which took place at the Bonvile Golf Resort in New South Wales this weekend.

Breanna Gill, a trans-identified male, made off with a women’s professional golfing trophy and a large cash prize. While WPGA Tour of Australia stated that it was Gill’s first professional win, he has dominated competitions in the past. In 2019, Gill was named the New Zealand Professional Women Golfers Trust Pro-Am champion.

The year prior, in 2018, Gill was named the “first woman” to win an official women’s professional golf tournament held in the South Pacific Islands after taking home the Pro-Am title at the New Caledonia Deva Golf Resort.

On Twitter, WPGA Tour of Australasia posted multiple photos of Gill holding the prize, and even changed their Twitter account header to a picture of Gill, but were met with overwhelming backlash as users piled into their replies to denounce them for allowing a male to participate in the women’s tournament.

Some name-dropped Danni Vasquez, the female golfer who placed second, as the “true winner” of the competition. Vasquez and Gill were in stride throughout the match, and the winner was ultimately decided after they faced each other in a sudden death playoff.

WPGA Tour of Australasia quickly locked down their replies section as negative sentiment flowed in, preventing public comments. The users who had been able to slip in their replies before the setting was changed on the tweet have since all had their comments “hidden” by WPGA Tour of Australasia.

“Why are men allowed in women’s sports? Why has a woman been cheated of her prize,” Haringey ReSistersasked as one of the few users who had been able to leave comments prior to WPGA Tour of Australasia turning their replies off.

“This is not fair. Keep men out of women’s sport,” Speak Up For Women responded.

“This is cheating you are allowing someone with a known male physical advantage to steal females prizes [and] prize money that should be theirs! It’s sex discrimination [and] shameful inequality in sport, a physical activity,” Olympian Sharron Davies added in a quote-retweet.

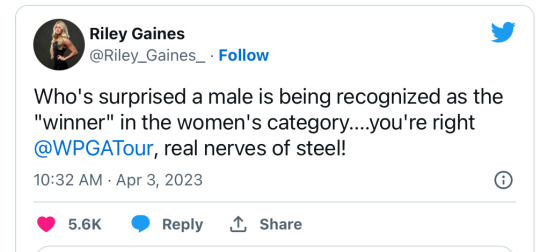

Riley Gaines, a spokeswoman for the Independent Women’s forum and an accomplished All American swimmer, also brought attention to Gill’s trophy-kissing photo, condemning WPGA Tour of Australasia with a cutting remark.

“Who’s surprised a male is being recognized as the ‘winner’ in the women’s category… you’re right @WPGATour, real nerves of steel,” Gaines wrote.

As of the writing of this article, there are over 2,600 overwhelmingly negative quote-retweets compared to just 95 ‘likes’ on WPGA Tour of Australasia’s tweet about Gill.

Women’s athletic competitions have become a major issue in the debate on gender ideology and its impact on women.

The issue mounted in public attention after a trans-identified male swimmer, Lia Thomas, began breaking women’s records and winning medals intended for female athletes in 2021. Since then, there have been several instances of trans-identified male athletes taking the podium in women’s sporting events. But multiple cases of resistance by female athletes and their allies have also been recorded.

Last week, Reduxx reported that a male powerlifting coach in Canada self-identified into a women’s category in order to mock the gender self-identification policies. Avi Silverberg, a powerlifting expert who has worked with Team Canada, participated as a woman at the Heroes Classic Powerlifting Meet held in Lethbridge, Alberta, in order to highlight the unfair advantage males have when competing in women’s athletics.

In February, a young women’s basketball team made international headlines after withdrawing from their state tournament in protest of a trans-identified male being on the opposing team. The Mid Vermont Christian School Eagles (MVCS) forfeited their playoff game against the Long Trail School Mountain Lions (LTS) after learning that LTS star player Rose Johnson is male, and have since been banned from participating in state competitions.

While fairness and opportunity have been cited as primary causes of the backlash against “inclusive” sport policy, others have also noted that women or girls competing against male athletes would be at higher risk for injury.

Last week, thousands of complaints were submitted to Football New South Wales in Australia after a trans-identified male reportedly left multiple female players injured after competing in the female leagues. One female player allegedly had to seek medical attention as a result of her injuries.

After some digging I found that it’s another older man in women’s sports

While Danni is within that range Gill is 32

#Australia#men in Women’s sports#Australian Women’s Classic golf tour#New South Wales#Bonvile Golf Resort#Breanna Gill is a man#Danni Vasquez is the true winner#Speak Up for Women#Haringey ReSisters#32 isn’t old but it is for sports

12 notes

·

View notes

Text

How To Manage Financial Stress

In today's fast-paced world, financial stress has become a silent epidemic, affecting individuals and families across the globe. Australia is no exception, with many Australians facing immense pressure due to rising living costs, mounting debt, and uncertain economic conditions. As financial concerns escalate, people turn to professionals for support—this is where a Mortgage Broker Brisbane or a Finance Broker Brisbane can play a pivotal role in providing guidance, refinancing options, and debt consolidation strategies to help individuals regain control of their finances.

The Burden of Financial Stress

Financial stress can manifest in many ways and significantly affect various areas of life if left unchecked. People experiencing financial stress often struggle with issues like disrupted sleep, decreased work performance, poor communication, a lack of motivation, and relationship problems with colleagues, family, and friends. Beyond the emotional toll, financial stress can also lead to serious physical health problems. Constant worry about money has been linked to higher levels of stress hormones, which can contribute to high blood pressure, heart disease, and other long-term health conditions.

This type of stress doesn't occur in isolation. It creates a ripple effect that spreads through all aspects of life. Families bear the brunt of this as parents find themselves unable to provide for their children’s basic needs or invest in their future. The desire to maintain a certain standard of living can place additional strain on relationships, leading to marital conflict. Moreover, financial stress can limit educational and career advancement opportunities, which can hinder personal growth.

A growing body of research indicates a strong correlation between financial stress and mental health challenges. Anxiety and depression are common among individuals grappling with financial uncertainty. Constant worry and fear about economic instability often lead to feelings of hopelessness. Unfortunately, the stigma surrounding mental health and financial challenges can prevent individuals from seeking help, making the situation even worse.

Financial difficulties often arise due to unclear financial goals, poor budgeting habits, low financial literacy, misinformation, and resistance to change. Yet, with the right guidance and support, individuals can begin to address these underlying issues and break free from the cycle of financial stress.

Breaking the Cycle: Strategies for Financial Stability

Addressing financial stress requires a multifaceted approach. The first and perhaps most important step is cultivating financial literacy. Educating yourself about budgeting, saving, managing debt, and investing can lay the groundwork for financial stability. For those feeling overwhelmed, consulting with experts—such as a mortgage or finance broker in Brisbane—can help navigate complex financial decisions and improve overall financial health.

Here are several ways to take control of your finances and reduce financial stress:

1. Focus on What You Can Control

It’s easy to feel overwhelmed by financial problems, viewing them as insurmountable. However, with a clear plan and the right guidance, many individuals can discover practical solutions. Start by focusing on what you can control. Whether it’s reviewing your budget or cutting back on unnecessary expenses, small changes can make a big difference over time.

2. Speak to Financial Experts

Reaching out to a professional, such as a mortgage broker in Brisbane, can provide valuable insights into your financial options. These experts can help you refinance your mortgage, negotiate better rates, consolidate debt, or explore investment opportunities. Financial planners and accountants can also help you create a long-term strategy to manage your finances and achieve your goals.

3. Review Your Cash Flow

Understanding where your money goes is critical. By reviewing your cash flow, you can identify unnecessary expenditures and areas where you might be overspending. Track all your income and expenses over the course of a month and look for patterns. This practice will provide a clearer picture of your financial situation and highlight opportunities for cost-saving adjustments.

4. Set Realistic Savings Goals

Having clear and achievable savings goals can reduce financial stress. You might aim to build an emergency fund to cover unexpected expenses or save for a well-deserved holiday. Setting milestones allows you to focus on future rewards and remain motivated to stick to your budget.

5. Take Time for Financial Self-Care

Taking time out of your busy schedule to focus on your financial well-being is vital. Set aside at least one day each year to thoroughly review your financial goals, current situation, and future plans. This “financial health day” will help you stay on track and make informed adjustments where necessary.

Seeking Help and Building a Resilient Financial Future

While financial stress is a widespread issue that affects many Australians, there are effective ways to address it. Acknowledging the impact of financial stress and taking proactive steps to mitigate it is crucial for achieving a more secure and fulfilling life. A Finance Broker Brisbane can assist in navigating complex financial situations, while also connecting you with trusted partners who can help with refinancing, financial planning, and more.

If you’re feeling overwhelmed, remember that seeking support is a sign of strength. Reaching out to financial experts, mental health professionals, or community organizations can be the first step toward regaining control over your finances. These professionals can guide you in making informed financial decisions, helping you break free from the stress and build a brighter financial future.

At SW Brokerage, we’re here to support you. Whether you’re looking to consolidate debt, refinance your mortgage, or simply seek advice, we’re just a phone call away. A five-minute conversation with one of our brokers could save you time, money, and provide you with the peace of mind you deserve. Contact us today, or email us at [email protected] to start your journey toward financial freedom.

Together, we can overcome financial stress and create a more resilient, financially healthy Australia.

0 notes

Text

Why Should You Invest in Bookkeeping Services Australia?

Efficient financial management is crucial for any business, and one of the best ways to achieve this is by investing in Accounting and Bookkeeping Services Australia. Whether you are a small business owner or an accounting firm, these services offer numerous advantages that can help streamline your financial operations and contribute to long-term success. Here’s why investing in bookkeeping services makes sense for businesses in Australia.

1. Accurate Financial Records

Maintaining accurate financial records is essential for making informed business decisions. Accounting and Bookkeeping Services Australia ensure that your records are up to date, precise, and compliant with Australian regulations. With accurate bookkeeping, businesses can monitor cash flow, assess profits, and make adjustments when needed.

2. Save Time and Focus on Core Activities

Handling financial tasks internally can be time-consuming and often diverts focus from core business activities. By investing in Accounting and Bookkeeping Services Australia, you can delegate these tasks to experts, freeing up your time to focus on growth, client relations, and other key functions. This is especially beneficial for accounting firms looking to enhance productivity and offer more value to their clients.

3. Compliance with Australian Tax Laws

Australia has stringent tax laws and regulations that businesses must adhere to. Failure to comply can result in hefty fines and penalties. Accounting and Bookkeeping Services Australia provide professional expertise to ensure that your business complies with all relevant tax laws. From BAS (Business Activity Statements) to payroll, these services ensure you meet your obligations while avoiding costly mistakes.

4. Better Financial Planning and Forecasting

Good bookkeeping services go beyond simply maintaining financial records. They offer insights into financial performance that can aid in better financial planning and forecasting. With Accounting and Bookkeeping Services Australia, businesses can access detailed reports, helping them anticipate future expenses, manage budgets, and set financial goals effectively.

5. Flexibility and Scalability

As your business grows, so do your financial needs. Outsourcing to Accounting and Bookkeeping Services Australia provides flexibility and scalability. Whether your business is small or large, bookkeeping services can be customized to meet your specific requirements. This adaptability allows businesses to expand without the stress of managing an internal accounting department.

6. Cost Efficiency

Hiring a full-time accounting team can be expensive, especially for smaller businesses. Outsourcing Accounting and Bookkeeping Services Australia offers a more cost-efficient solution. Businesses can save on salaries, benefits, and training while still receiving high-quality services from experienced professionals. This makes it a smart financial decision for both small businesses and large firms.

Conclusion

Investing in Accounting and Bookkeeping Services Australia is a strategic move that can bring numerous benefits to your business. From saving time and ensuring compliance to enhancing financial planning and providing scalability, bookkeeping services allow businesses to operate more efficiently and focus on growth. Sapphire Digital Accounting Australia offers comprehensive solutions designed to meet the needs of businesses and accounting firms, helping them achieve their financial goals with ease and accuracy.

Contact Details -

Address - 141 Cardigan St, Carlton VIC 3053, Australia

Phone No - +61 1300 012 391

Email - [email protected]

Website - https://sapphiredigitalaccounting.com.au/

0 notes

Text

Residential vs Commercial Property in Australia: What Does Stephen Vick Recommend?

When it comes to property investment in Australia, investors often find themselves choosing between residential and commercial properties. Each type offers unique benefits and challenges, and making the right choice depends on various factors, including financial goals, risk tolerance, and market conditions.

Stephen Vick, an expert in property investment, provides valuable insights into which type of property might be best suited for different investment strategies. Here’s a detailed comparison based on Stephen Vick’s recommendations.

What Are the Key Differences Between Residential and Commercial Properties?

Residential Properties: These are properties primarily used for living purposes, such as houses, apartments, and townhouses. Residential investments tend to be more straightforward and are often seen as less risky due to the consistent demand for housing. Rental income from residential properties usually comes from long-term tenants, providing steady cash flow.

Commercial Properties: These include office buildings, retail spaces, and industrial warehouses. Commercial properties often require higher investment capital but offer higher rental yields and longer lease terms. Businesses leasing commercial spaces typically sign longer leases, providing stability for the landlord. However, commercial properties can be more sensitive to economic fluctuations, which might affect occupancy rates and rental income.

What Are the Financial Considerations for Each Property Type?

Residential Properties: According to Stephen Vick, residential properties generally have lower entry costs compared to commercial properties. They also offer potential tax benefits, such as depreciation on the building and fixtures. However, the returns may be lower in terms of rental yield. Residential properties also tend to have higher turnover rates, which can lead to periods of vacancy and additional costs for finding new tenants.

Commercial Properties: Vick highlights that commercial properties often provide higher rental yields and longer lease agreements, which can translate to more predictable income streams. While the initial investment is typically higher, the potential for significant returns can make it worthwhile. Commercial leases often include clauses where tenants are responsible for outgoings like maintenance, rates, and insurance, reducing the landlord’s costs.

How Does Risk Differ Between Residential and Commercial Properties?

Residential Properties: Investing in residential properties generally involves lower risk, particularly in stable markets with high demand for housing. The rental market for residential properties tends to be more resilient, making it easier to find tenants. Stephen Vick notes that the risks include market fluctuations affecting property values and the potential for higher tenant turnover.

Commercial Properties: Vick points out that while commercial properties can offer higher returns, they come with increased risk. Economic downturns can impact businesses, leading to higher vacancy rates or rent reductions. Additionally, the property’s location and the business sector it caters to can significantly influence its performance. Thorough market research and tenant vetting are crucial to mitigating these risks.

What Does Stephen Vick Recommend?

Stephen Vick recommends that investors consider their financial goals, risk tolerance, and investment timeline when choosing between residential and commercial properties. For those looking for steady cash flow with lower risk, residential properties might be a better choice. On the other hand, if you’re prepared for a higher initial investment and are looking for potentially higher returns and longer lease terms, commercial properties could be more suitable.

Ultimately, Vick suggests that diversifying your property portfolio by including both residential and commercial properties can balance risk and maximize returns. Each property type can complement the other, providing stability and growth opportunities.

Conclusion

Stephen Vick’s recommendations highlight the importance of aligning property investments with personal financial goals and market conditions. Both residential and commercial properties offer unique advantages and challenges. By understanding these differences and considering diversification, investors can make informed decisions that enhance their portfolio’s performance and achieve long-term success.

0 notes

Text

Navigating Investment Property Loans in Australia with Triple M Finance

Investing in property is a powerful way to build wealth, and securing the right financing is a critical component of your investment strategy. If you're considering diving into the world of property investment, understanding how to leverage investment property loans Australia effectively can make a significant difference. At Triple M Finance, located in Round Corner, NSW 2158, we specialize in helping investors like you secure the best loan solutions tailored to your needs. Here’s how we can assist you in making the most of your property investment journey.

Why Investment Property Loans Matter

Investment property loans are designed specifically for the purpose of purchasing properties with the aim of generating rental income or capital growth. Here’s why getting the right loan is crucial:

1. Unlocking Investment Opportunities

A well-structured investment property loan allows you to leverage your existing assets to acquire new properties. This can expand your portfolio and increase your potential for returns without requiring a substantial upfront capital investment.

2. Optimizing Cash Flow

Investment loans come with various options for repayment structures, interest rates, and terms. Choosing the right loan can help you manage your cash flow more effectively, ensuring that your investment is financially viable.

3. Tax Benefits

Interest on investment property loans is often tax-deductible. By understanding and utilizing the tax benefits associated with these loans, you can improve the overall profitability of your investment.

How Triple M Finance Can Assist You

As one of the leading investment property companies in Australia, Triple M Finance offers a range of services to help you secure the best investment property loans:

1. Personalized Loan Strategies

We understand that every investor’s situation is unique. Our team works with you to develop a tailored loan strategy that aligns with your investment goals, risk tolerance, and financial situation. Whether you’re buying your first investment property or expanding your portfolio, we provide solutions that fit your needs.

2. Comprehensive Loan Analysis

Navigating the variety of loan products available can be overwhelming. Triple M Finance performs a thorough analysis of different loan options, including interest rates, loan terms, and repayment structures. We help you select the loan that offers the best terms and aligns with your investment strategy.

3. Expert Financial Guidance

Securing an investment property loan involves more than just choosing the right product. Our financial experts provide comprehensive guidance on budgeting, loan structuring, and managing repayments to ensure your investment remains profitable and sustainable.

4. Streamlined Application Process

Applying for an investment property loan can be complex and time-consuming. Triple M Finance simplifies the process, handling the paperwork and liaising with lenders on your behalf to ensure a smooth and efficient application process.

The Round Corner Advantage

Based in Round Corner, NSW 2158, Triple M Finance is well-positioned to offer expert advice on both local and national property markets. Our deep understanding of regional property dynamics allows us to provide tailored loan solutions that reflect the unique opportunities and challenges of the Australian real estate market.

Why Choose Triple M Finance?

Selecting the right investment property company is essential for navigating the complexities of property financing. Here’s why Triple M Finance stands out:

Expertise and Experience: Our team has extensive experience in property investment and finance, providing you with insights and solutions based on real-world knowledge.

Customized Service: We take the time to understand your specific needs and financial situation, offering personalized advice and loan solutions.

End-to-End Support: From loan application to approval and management, we offer comprehensive support throughout the entire process, ensuring a seamless experience.

Get Started with Your Investment Property Loan

Ready to explore your financing options and make your property investment goals a reality? Triple M Finance is here to help you every step of the way.

Contact us at 0422 331 130 to schedule a consultation and discover how we can assist you in securing the ideal investment property loan. Our team is committed to providing exceptional service and ensuring your investment journey is both profitable and successful.

Conclusion

Investment property loans are a crucial tool for building a successful property investment portfolio. With the expertise and support of Triple M Finance, you can navigate the loan process with confidence and secure financing that aligns with your investment objectives.

Take the first step toward achieving your property investment goals—reach out to us today and let us help you unlock the potential of your investments.

#investment property companies australia#investment property loans australia#investment property advice australia#investing in commercial property australia

0 notes

Text

perth based business and tax

**NGL Business Services: Your Trusted Perth-Based Accounting Firm**

In the fast-paced world of business, where every choice can determine success or failure, it helps to have a reliable partner. Introducing **NGL Business Services Perth**, a company recognized not only for handling figures but for its unmatched role as a **Perth-based accounting firm** that seeks to uplift local enterprises. With a foundation of trust, expertise, and strong ties to the Perth community, NGL is a leading figure in tax, accounting, and strategic business advice.

### **Perth?s Tax Strategy Experts**

In an ever-shifting landscape of tax laws and financial regulations, businesses need more than just routine bookkeeping. They seek **local tax strategists and consultants** who can expertly handle the intricacies of Australia?s tax system. This is exactly where **NGL Business Services** excels.

Through their deep local understanding and innovative tax strategies, NGL helps clients stay compliant and optimise their tax positions. Be it minimising liabilities or discovering untapped tax advantages, NGL offers insights that can greatly improve a business?s financial health. NGL?s team is highly knowledgeable about tax law intricacies and is dedicated to crafting the best solutions for each client.

### **A Firm Deeply Connected to Perth?s Business Landscape**

What makes NGL stand out is its profound connection to Perth?s local business community. As a **local firm**, they are fully aware of the specific hurdles and possibilities businesses in Perth encounter. This local expertise allows them to provide advice that is not only practical but also highly relevant to their clients.

From advising small, family-run businesses to offering strategic support to expanding enterprises, NGL?s expertise covers the full range of Perth industries. Their strength lies in their understanding that no two businesses are alike. NGL works closely with each client to tailor solutions that address their specific challenges, providing a level of personal service that larger firms simply cannot match.

### **More Than Just Accounting Services**

At its core, NGL Business Services is about more than just accounting. They provide **business help** that addresses every aspect of a business?s financial health. Whether you?re looking for advice on cash flow, growth strategies, or business restructuring, NGL is there to help every step of the way.

Their consulting services provide deep insights that go beyond the financials, driving lasting business success. NGL believes in partnership?they don?t merely advise from afar but work alongside businesses to implement strategies and overcome obstacles.

### **A Partner for Perth?s Business Success**

As a **Perth-based accounting firm**, NGL Business Services takes pride in its role as a key partner in the local economy. With their expertise in tax, accounting, and consulting, NGL is an indispensable resource for Perth businesses aiming to expand.

For local firms seeking reliable **business help** and the guidance of seasoned **local tax strategisers and agents**, NGL Business Services is the firm of choice. In today?s business environment, where financial decisions are crucial, NGL delivers the knowledge, resources, and personal attention needed to confidently navigate the complexities of modern business.

https://besttaxaccountingservicesinperth.blogspot.com/2024/09/perth-based-business-and-tax-accounting.html

business help

https://perthstoragesolutions.blogspot.com/

https://perthlocalselfstoragesolutions.blogspot.com/2024/09/blog-post.html

https://perthstoragesolutions.tumblr.com/

https://perthstoragesolutions.tumblr.com/rss

https://www.tumblr.com/perthstoragesolutions/761487460657201152

0 notes

Text

Tax Planning Strategies for Businesses

Introduction:

Effective tax planning is a critical aspect of running a successful business. It involves strategizing financial activities to minimize tax liabilities, maximize profits, and ensure compliance with tax laws. By proactively managing tax obligations, businesses can achieve significant cost savings, improve cash flow, and enhance overall financial health. This blog delves into essential tax planning strategies that can help businesses optimize their tax positions and foster long-term growth.

Importance of Tax Planning for Businesses:

Tax planning is not just about reducing taxes; it's about making informed financial decisions that align with business goals. Proper tax planning ensures that businesses are prepared for tax obligations and can take advantage of available tax benefits. It helps in avoiding penalties and interest from non-compliance, freeing up resources that can be reinvested into the business. Moreover, a sound tax strategy can provide a competitive edge, making a business more attractive to investors and stakeholders.

Strategies to Minimize Tax Liabilities:

1. Income Deferral:

Postponing the recognition of income to a later tax year can help businesses stay in a lower tax bracket. This can be achieved through strategies like delaying invoicing or accelerating expenses.

2. Expense Acceleration:

Accelerating deductible expenses can reduce taxable income for the current year. This can include making advance payments for rent, utilities, or other operational costs.

3. Depreciation Methods:

Utilizing favourable depreciation methods such as bonus depreciation or Section 179 can allow businesses to write off the cost of assets more quickly, reducing taxable income.

4. Tax Credits:

Identifying and claiming available tax credits, such as the Research & Development (R&D) tax credit, can significantly lower tax liabilities.

Staying Compliant with Regulations:

Compliance with tax regulations is paramount to avoid penalties and maintain good standing with tax authorities. Here are key steps to ensure compliance:

1. Maintain Accurate Records:

Keep detailed and organized financial records to support all tax filings. This includes receipts, invoices, payroll records, and bank statements.

2. Timely Filings:

Ensure all tax returns and payments are submitted on time. Mark important tax dates on the calendar and set reminders to avoid late filings.

3. Consult Professionals:

Regularly consult with tax professionals to stay updated on regulatory changes and to receive expert advice on complex tax matters.

4. Implement Internal Controls:

Develop robust internal controls to monitor and manage tax compliance. This includes regular audits and reviews of financial practices.

Conclusion:

Effective tax planning is an ongoing process that requires attention to detail and a proactive approach. By implementing strategies to minimize tax liabilities, taking advantage of incentives, and ensuring compliance with regulations, businesses can significantly enhance their financial performance and stability. Investing time and resources in tax planning can yield substantial long-term benefits, positioning the business for sustained growth and success.

ExperTax Consulting is the best tax planner in Preston, Victoria. Contact us for tax planning services in Australia.

0 notes

Text

Expert Advice on Maximizing Your Business Finances from BTMH Experts

Managing your business finances effectively is crucial for ensuring long-term success and stability. Whether you run a small startup or a growing enterprise, keeping your finances organised and optimised can be challenging. At Business Tax & Money House (BTMH), we provide expert advice and tailored financial services to help businesses across Australia streamline their financial management.

1: Track Cash Flow Consistently

One of the most important aspects of financial management is maintaining a clear view of your cash flow. Cash flow represents the money coming in and going out of your business, and staying on top of it is key to ensuring you can meet your financial obligations. If your expenses consistently exceed your income, your business may struggle to stay afloat.

BTMH recommends implementing a reliable cash flow tracking system. Regularly review your cash flow statements to identify trends, such as seasonal fluctuations or recurring expenses. By consistently tracking your cash flow, you can anticipate any shortfalls and take proactive measures to address them, such as adjusting pricing strategies or cutting unnecessary costs.

2: Create and Stick to a Budget

A well-structured budget serves as a financial roadmap for your business, helping you allocate resources efficiently and avoid overspending. Without a budget, it’s easy to lose track of expenses and find yourself struggling to cover unexpected costs.

BTMH suggests creating a detailed monthly or quarterly budget that outlines your expected income and expenses. This budget should include categories like rent, utilities, payroll, marketing, and inventory. Once your budget is in place, stick to it as closely as possible, regularly reviewing and adjusting it to reflect changes in your business operations. This will help you control spending, manage cash flow, and ensure you have sufficient funds for growth initiatives.

3: Automate Financial Processes

In today’s digital age, automating your financial processes can save you time and reduce the risk of human error. From invoicing to payroll, there are various accounting software options available that can help you streamline your financial tasks.

BTMH advises businesses to invest in quality accounting software that automates key processes such as invoice generation, payroll management, and expense tracking. Automating these tasks not only reduces the administrative burden but also ensures greater accuracy in your financial reporting. Additionally, it frees up valuable time that can be redirected towards more strategic activities, such as growing your business.

4: Review Your Expenses Regularly

Many businesses accumulate expenses over time that may no longer be necessary or cost-effective. Regularly reviewing your expenses can help you identify areas where you can cut costs without compromising the quality of your products or services.

BTMH recommends conducting a thorough review of all business expenses, including subscriptions, service contracts, and supplier agreements. Negotiate better rates with suppliers, cancel unused services, and seek more affordable alternatives where possible.

5: Maintain Accurate Financial Records

Accurate financial records are essential for making informed business decisions, preparing for tax season, and staying compliant with regulatory requirements. Disorganised or inaccurate records can lead to costly mistakes, such as missed deductions or late filings.

6: Plan for Taxes Year-Round

Tax planning shouldn’t be limited to the end of the financial year. By planning for taxes throughout the year, you can reduce your tax liability and avoid last-minute surprises. This includes setting aside funds for tax payments, keeping track of deductible expenses, and staying informed about changes to tax laws.

7: Seek Professional Financial Advice

One of the best ways to optimise your business finances is to seek professional advice. A qualified accountant or financial advisor can help you identify areas for improvement, develop a financial strategy, and ensure compliance with tax and regulatory obligations.

Optimising your business finances is essential for achieving long-term success and stability. By tracking cash flow, creating a budget, automating financial processes, reviewing expenses, maintaining accurate records, planning for taxes, and seeking professional advice, you can take control of your finances and position your business for growth.

0 notes

Text

New Fintech Startups in Finance Company Sydney

Finance company Sydney industry has a rich and diverse range of businesses. Some are long-established institutions with a global footprint, while others are new fintech startups with ambitious goals.

Zip provides payment and credit solutions like Zip Pay and Pocketbook that simplify spending, budgeting, saving, and tracking. They also offer an online e-commerce platform for retailers.

Brighte

Brighte offers a finance solution to Australian homeowners for energy-efficient upgrades, such as solar power systems and batteries. Its products and services include a buy now, pay later payment plan, a green loan program, and other finance options. It also has a marketplace where customers can find products and services from empanelled vendors.

The company recently closed a $195 million debt facility backed by green bonds. This financing is enabling Brighte to expand its financing operations, including supporting the ACT Sustainable Household Scheme and the Tasmanian EV Charger Grant scheme. The company has also simplified its pricing model, removing the application fee and fortnightly processing fees.

Waddle

Waddle offers a digital cash flow solution for small businesses that uses outstanding invoices as security. The service is more flexible than a traditional bank loan and connects to business accounting software such as Xero. It also automates many of the manual processes involved in invoice finance.

The Stream Working Capital platform allows customers like Jarrod McGrath to bridge gaps in cash flow. The application process and in-life management of the facility are fast, simple and straightforward. The company is based in Sydney, Australia and has an experienced team of entrepreneurs.

Waddle was recently acquired by Commonwealth Bank through its venture-scaling arm x15ventures. The acquisition will enable the company to accelerate its growth and deliver innovative working capital solutions.

Xinja

Xinja was Australia’s first app-based “neobank”, promising to shake up the banking industry with high interest deposit accounts targeting Millennial customers. Its popularity grew rapidly, with $200M invested in its savings accounts within months of launch.

The company then secured an ADI license, allowing it to offer transaction accounts and a Stash savings account. However, the company struggled to raise additional capital. Its directors blamed the COVID-19 pandemic and an increasingly difficult capital-raising environment for the bank’s decision to close its customer accounts, return their deposits, and hand back its licence.

Xinja’s team is made up of experts from around the world who work remotely to deliver products that help Australians take control of their money. It also offers state of the art security.

Marketlend

Marketlend is an online platform that facilitates prompt lending in a secure environment. The company offers supply chain finance, debtor finance and secured lines of credit for SMEs. It also provides investors with quality returns in a conservative secured investment regime.

Leo Tyndall, founder and CEO of Marketlend, believes that small businesses deserve access to capital that is fair and transparent. Marketlend charges a fee to process the transaction, but not an excessive amount of overhead or commissions.

The company recently closed a $1 million funding round led by Crayhill Capital Management, Jon Barlow, and Mati Szeszkowski, former head of KKR’s technology private equity practice. The money will be used to automate the platform’s systems and originate more loans.

Tyro Payments

Tyro Payments is a technology-focused and values-driven company that offers payments and value-adding business banking products to over 66,000 Australian merchants. Its solutions include credit, debit, EFTPOS card acquiring, Medicare and private health fund claiming, and unsecured business loans.

Customers can also save on fees with the country’s first least cost routing solution. They can also control who has access to their data and for how long. They can also choose to share their Tyro account details with accredited organisations for a limited time.

Tyro also provides 24/7 customer support, seamless reconciliation with integrated bank feeds into Xero and BPAY, plus intelligent notifications.

uno Home Loans

uno Home Loans offers a digital mortgage platform that lets consumers search, compare and acquire home loans from 22 brands. It also offers advice on home loan products, interest rates and credit policies. Its goal is to serve 10 percent of Australia’s mortgage customers by 2028.

The company has received multiple awards and accolades for its digital tools, including the Good Design Award. These achievements can help it attract clients who are seeking personalized and attentive financial services.

uno Home Loans has a number of strategic partnerships, including Velocity Frequent Flyer and Acacia Money. These partnerships can lead to cross-selling opportunities and expand its customer base.

0 notes

Text

The Benefits of Using Xero for Your Business and How Experts Can Help You Get the Most Out of It

As a business owner, you know how important it is to stay on top of your finances. You need to keep track of your income and expenses, manage payroll, and stay compliant with tax laws. But with so much to do, it can be overwhelming to manage everything manually. That's where Xero comes in. Xero is a cloud-based accounting software that can help streamline your financial management processes and save you time and money. In this blog, we'll discuss the benefits of using Xero for your business and how Xero experts in Australia can help you get the most out of it.

Cloud-Based Convenience:

One of the primary benefits of using Xero is that it's cloud-based, meaning you can access your financial information from anywhere with an internet connection. This is especially beneficial for businesses with remote employees or those that require frequent travel. You can also collaborate with your accountant or bookkeeper in real-time, which means you can make financial decisions faster and with more accuracy.

Automated Processes:

Xero's automation features can help you save time on manual tasks like data entry, bank reconciliation, and invoicing. Xero can integrate with your bank accounts and credit cards to automatically import transactions, making it easy to reconcile accounts. You can also set up rules to categorize transactions automatically and even create recurring invoices for regular customers.

Comprehensive Reporting:

Xero offers a variety of reports that can help you gain insight into your business's financial health. You can create reports on cash flow, profit and loss, balance sheets, and more. These reports can help you identify areas where you can save money, plan for future growth, and make informed financial decisions.

Scalability:

Xero is designed to grow with your business. Whether you're a sole trader or a large corporation, Xero can adapt to your needs. You can add users, integrate with other software, and customize your dashboard to suit your business's specific requirements.

How Xero Experts in Australia Can Help:

While Xero is designed to be user-friendly, it can still be overwhelming for some business owners. That's where Xero experts in Australia come in. Xero experts, also known as Xero Champions, are certified advisors who can help you get the most out of the software. They can help you set up your account, integrate Xero with other software, and provide ongoing support and training. With their expertise, you can maximize the benefits of Xero and make informed financial decisions for your business.

In conclusion, Xero is an excellent accounting software for businesses of all sizes. Its cloud-based convenience, automation features, comprehensive reporting, and scalability make it a valuable tool for managing your finances. By working with Xero Champions in Australia, you can ensure that you're using the software to its fullest potential and make the most out of your investment.

2 notes

·

View notes

Text

Why Safebooks Global is the best firm for outsourcing & offshore in Australia

In the ever-evolving landscape of business operations, companies across Australia are constantly seeking innovative solutions to streamline their processes and optimize their resources. One of the most effective strategies employed by businesses today is outsourcing various tasks to specialized service providers. And when it comes to outsourcing accounting, tax preparation, bookkeeping, and payroll services, Safebooks Global Pvt Ltd emerges as the go-to partner for organizations looking to enhance their financial efficiency and accuracy.

Safebooks Global Pvt Ltd, a renowned company in Australia, has established itself as a trusted and reliable partner for businesses seeking top-notch outsourced accounting and financial services. With a proven track record of excellence and a team of highly skilled professionals, Safebooks offers a wide range of services tailored to meet the specific needs of each client. From outsource accounting to offshore accounting services, tax preparation, virtual bookkeeping, payroll outsourcing, and more, Safebooks has the expertise to handle all aspects of financial management with precision and efficiency.

Outsource accounting is a strategic decision that allows companies to focus on their core competencies while leaving the financial tasks to experts. Safebooks understands the complexities of managing finances and offers comprehensive accounting services that ensure accurate reporting, compliance with regulations, and timely financial insights. By outsourcing accounting functions to Safebooks, businesses can reduce costs, improve productivity, and gain access to expert advice and support.

Offshore accounting services are another area where Safebooks excels. By leveraging offshore resources in countries like India, Safebooks can provide cost-effective accounting solutions without compromising on quality. Outsourcing taxation services to India has become a popular choice for many Australian businesses due to the significant cost savings and access to a large pool of skilled professionals. Safebooks manages the entire process seamlessly, ensuring data security, confidentiality, and efficient communication throughout.

Tax preparation is a critical aspect of financial management that requires meticulous attention to detail and up-to-date knowledge of regulations and laws. Safebooks offers specialized tax preparation services that cater to businesses of all sizes. By outsourcing tax preparation to Safebooks, companies can ensure accurate tax filings, maximize deductions, and minimize the risk of penalties or audits.

Virtual bookkeeping services provided by Safebooks give businesses the flexibility to access real-time financial information from anywhere, at any time. By outsourcing bookkeeping tasks to Safebooks, companies can maintain organized and updated financial records, track expenses, manage cash flow, and make informed decisions based on accurate financial data.

As a payroll outsourcing partner, Safebooks takes the hassle out of managing payroll processes for businesses. With advanced payroll systems and expert professionals, Safebooks ensures timely and accurate payroll processing, compliance with regulations, and secure data management.

In conclusion, Safebooks Global Pvt Ltd stands out as the best company for outsourcing accounting, tax preparation, bookkeeping, and payroll services in Australia. With a commitment to excellence, a client-focused approach, and a team of experienced professionals, Safebooks delivers top-quality financial solutions that help businesses thrive. By partnering with Safebooks, companies can streamline their financial operations, reduce costs, and free up valuable resources to focus on growth and success.

#Accounts Payable Services#outsource accounting#offshore accounting services#outsource tax preparation services#Virtual bookkeeping services#outsourcing taxation services to india#payroll outsourcing partner#outsourcing tax preparation

0 notes

Text

Streamline Your Business with the Best Account Receivables and Payables Services in the USA

In today's fast-paced business world, Account Receivables and payables services in the USA are more critical than ever. Managing finances effectively is the backbone of any successful business. But what if you're struggling to keep up with the demands of tracking every penny? Imagine if all the stress and confusion could disappear, leaving you with clear, organized finances and more time to focus on what really matters—growing your business.

Sounds too good to be true? It's not. In this guide, we'll break down everything you need to know about Account Receivables and payables services in the USA, and we'll also touch on how these services can benefit businesses in Australia. Let’s dive in and discover how you can optimize your financial operations.

Table of Contents

Sr#

Headings

1

Understanding Account Receivables and Payables

2

Why Are These Services Essential?

3

Challenges in Managing Receivables and Payables

4

Best Account Receivables Services in the USA

5

Top Providers of Account Payables Services in the USA

6

Account Receivables and Payables Services in Australia

7

How to Choose the Right Service Provider

8

The Role of Technology in Modern Financial Services

9

Benefits of Outsourcing Account Receivables and Payables

10

Common Mistakes to Avoid

11

FAQs on Account Receivables and Payables

1. Understanding Account Receivables and Payables

To start, let's break down what Account Receivables and payables services in the USA really mean. Account Receivables are the money owed to your business by customers for products or services delivered but not yet paid for. On the other hand, Account Payables refer to the money your business owes to suppliers or vendors.

Managing these two aspects effectively ensures that your cash flow remains stable, allowing you to meet obligations and invest in growth opportunities.

2. Why Are These Services Essential?

Ever felt overwhelmed by the sheer volume of invoices and payments? You’re not alone. For many businesses, handling receivables and payables is a time-consuming task that can divert attention from core activities. By utilizing Account Receivables and payables services in the USA, you can streamline these processes, ensuring that your business runs smoothly and efficiently.

These services also help in reducing errors, speeding up payment processing, and improving cash flow management—all of which are vital for sustaining a successful business.

3. Challenges in Managing Receivables and Payables

Managing Account Receivables and payables services in the USA can be tricky. One common challenge is maintaining accuracy. Mistakes in billing or payment processing can lead to cash flow issues and strained relationships with customers or suppliers.

Another challenge is keeping track of due dates and ensuring timely payments or collections. Missing a deadline can result in late fees or a damaged credit reputation. By outsourcing these tasks to experts, you can avoid these pitfalls and keep your business on track.

4. Best Account Receivables Services in the USA

When it comes to finding the Best Account Receivables services in the USA, there are several top-notch providers to consider. These companies specialize in managing your receivables, ensuring that payments are collected on time, and providing detailed reports to keep you informed.

Some of the top services include automation tools that reduce manual work, analytics to track performance, and customer support to resolve disputes quickly. These features make it easier for businesses to maintain healthy cash flow without the headache of manual tracking.

5. Top Providers of Account Payables Services in the USA

Just as receivables are crucial, so too are payables. Finding a reliable provider for Account Payables services in the USA can make a world of difference. Look for providers that offer comprehensive solutions, including invoice management, vendor payment processing, and detailed reporting.

The best services also integrate with your existing financial systems, making the transition seamless and ensuring that all your financial data is in one place.

6. Account Receivables and Payables Services in Australia

The importance of managing receivables and payables isn’t limited to the USA. Businesses in Australia also rely heavily on these services. The Account Receivables and payables services in Australia are designed to meet the unique needs of Australian businesses, considering local regulations and market conditions.

By choosing the right service provider, Australian businesses can enjoy the same benefits of improved cash flow, reduced errors, and more efficient financial operations.

7. How to Choose the Right Service Provider

Choosing the right provider for Account Receivables and payables services in the USA can be daunting. Start by assessing your business’s specific needs. Do you need a full-service provider, or are you looking for specific features like automation or reporting?

Research different providers, read reviews, and compare their offerings. Don’t forget to consider factors like customer support, pricing, and integration capabilities. The right provider should align with your business goals and provide solutions that make your financial management easier.

8. The Role of Technology in Modern Financial Services

Technology has revolutionized Account Receivables and payables services in the USA. Automation tools, cloud-based platforms, and AI-driven analytics have made managing finances more efficient than ever before. These technologies not only reduce the time spent on manual tasks but also minimize errors and provide insights that help businesses make informed decisions.

As technology continues to evolve, staying updated with the latest trends can give your business a competitive edge.

9. Benefits of Outsourcing Account Receivables and Payables

Outsourcing your Account Receivables and payables services in the USA can be a game-changer. It allows you to focus on what you do best—running your business—while experts handle the complexities of financial management.

The benefits of outsourcing include improved accuracy, faster processing times, access to the latest technology, and reduced overhead costs. Plus, you’ll have peace of mind knowing that your finances are in good hands.

10. Common Mistakes to Avoid

When managing Account Receivables and payables services in the USA, it's easy to make mistakes. Common pitfalls include neglecting to follow up on overdue payments, failing to reconcile accounts regularly, and underestimating the importance of clear communication with customers and vendors.

Avoid these mistakes by setting up clear processes, utilizing technology, and possibly outsourcing to experts who can ensure that your financial operations run smoothly.

Conclusion

In the ever-evolving business landscape, managing Account Receivables and payables services in the USA is crucial for maintaining healthy cash flow and ensuring long-term success. Whether you're a small business owner or part of a larger organization, understanding the importance of these services and how to effectively manage them can make a significant difference in your financial health.

Recommend Article:- Account Reconciliation services

0 notes

Text

Purchasing Investment Property with PropWealth: Your Pathway to Financial Success

Investing in property is a pivotal strategy for building wealth and securing financial stability. Whether you're a seasoned investor or embarking on your first property purchase, navigating the complexities of purchasing investment property requires knowledge, foresight, and a trusted partner. PropWealth, a leader in property investment across Brisbane, Canberra, Sydney, Melbourne, Perth, and Adelaide Australia, stands ready to guide you through this journey with a commitment to excellence, innovation, and unparalleled service.

Also see - Purchasing Investment Property

Understanding Real Property Investment

Investing in real estate involves acquiring properties with the intention of earning returns through rental income, capital appreciation, or both. Unlike other forms of investment, real estate offers tangible assets that tend to appreciate over time, providing investors with a hedge against inflation and potential tax benefits. For many, purchasing investment property is a cornerstone of diversifying their investment portfolio and achieving long-term financial goals.

Why Choose PropWealth?

PropWealth isn't just a real estate agency; it's your strategic partner in maximizing investment opportunities. With a dedication to delivering quality service and exceeding client expectations, PropWealth leverages data-driven research and expert analysis to identify properties that align with your financial objectives. Whether you're seeking high rental yields, capital growth potential, or a combination of both, PropWealth offers tailored solutions designed to optimize your investment returns.

Real Estate Investing in Major Australian Cities

Australia's property market is characterized by diverse opportunities across major cities and regional areas. PropWealth specializes in curating a portfolio of properties located in strategic locations with strong economic fundamentals and growth potential. From inner-city apartments in Melbourne to suburban homes in Brisbane, our team of experienced advisors provides comprehensive insights into local market trends and investment dynamics.

Buying an Investment Property: PropWealth's Approach

The process of purchasing an investment property begins with a thorough understanding of your financial goals, risk tolerance, and investment timeline. PropWealth offers personalized consultation to assess your needs and preferences, ensuring that each property recommendation aligns with your investment strategy. Our proactive approach includes:

Market Research: Conducting detailed market research and analysis to identify emerging trends and investment opportunities.

Property Selection: Evaluating properties based on criteria such as location, rental potential, infrastructure developments, and future market projections.

Financial Planning: Providing guidance on financing options, cash flow projections, and tax implications to optimize your investment outcomes.

Negotiation and Acquisition: Assisting with negotiations, contract management, and legal processes to facilitate a seamless transaction.

Key Considerations When Purchasing Investment Property

When evaluating investment property opportunities, several factors warrant consideration:

Location: Choosing properties in prime locations with proximity to amenities, transport hubs, schools, and employment opportunities enhances rental demand and potential capital growth.

Property Type: Assessing the suitability of property types, such as residential apartments, houses, commercial spaces, or specialized assets, based on your investment goals and risk profile.

Market Conditions: Monitoring market conditions, including supply and demand dynamics, rental vacancy rates, and economic indicators, to mitigate risks and capitalize on opportunities.

Long-Term Strategy: Developing a long-term investment strategy that aligns with your financial goals, whether it involves building a diversified portfolio, generating passive income, or planning for retirement.

PropWealth: Your Trusted Partner in Property Investment

PropWealth is committed to redefining your experience of purchasing investment property with professionalism, integrity, and a client-centric approach. Our team of dedicated professionals strives to deliver exceptional service and superior results, ensuring that every investment decision is informed and strategic. With a focus on innovation and reliability, PropWealth remains at the forefront of the property investment industry, empowering clients to achieve financial freedom through strategic real estate investments.

Conclusion

In conclusion, purchasing investment property with PropWealth offers more than acquiring real estate—it's about securing your financial future with confidence. With a commitment to excellence and a reputation for delivering results, PropWealth stands ready to guide you through the intricacies of property investment. Whether you're looking to expand your portfolio, generate passive income, or capitalize on market opportunities, PropWealth provides the expertise and resources to help you achieve your investment goals. Embrace the potential of real estate investing with PropWealth and embark on a journey towards financial success today.

Also explore -

Real Estate Investing

Real Property Investment

Buying an Investment Property

Properties for Investors

Invest in Australian Property

0 notes

Text

Unlock Your Investment Potential with an Investment Property Calculator Australia

If you’re considering investing in residential property, having the right tools at your disposal is crucial. An investment property calculator tailored to the Australian market can be incredibly beneficial for making informed financial decisions. At Triple M Finance, located in Round Corner, NSW 2158, we’re here to guide you through the investment process with expert advice and the latest tools. In this blog post, we’ll explore how an investment property calculator can help you and why partnering with us can enhance your investment journey.

What is an Investment Property Calculator Australia?

An investment property calculator Australia is a specialized tool designed to help investors estimate the financial aspects of purchasing and managing a property. By inputting various data points, such as the property purchase price, loan amount, interest rate, and rental income, the calculator provides a comprehensive overview of your investment's financial viability. This tool is tailored to the specifics of the Australian property market, making it particularly relevant for local investors.

Key Features of an Investment Property Calculator

Estimate Monthly Repayments: Calculate your expected monthly mortgage repayments based on your loan amount, interest rate, and loan term. This feature helps you understand how much you’ll need to budget for loan servicing.

Determine Cash Flow: Assess the potential cash flow of your investment property by factoring in rental income and ongoing expenses. This helps you gauge whether the property will generate positive or negative cash flow.

Calculate Total Interest Costs: View the total interest you’ll pay over the life of the loan. This insight is crucial for understanding the long-term cost of borrowing and planning your investment strategy.

Compare Loan Scenarios: Experiment with different loan amounts, interest rates, and repayment terms to find the most advantageous loan structure for your investment goals.

Estimate Property Expenses: Some calculators include features to estimate additional property-related expenses, such as maintenance, property management fees, and insurance, giving you a complete picture of your investment costs.

Why Use an Investment Property Calculator?

Informed Decision-Making: An investment property calculator provides you with detailed financial projections, allowing you to make well-informed decisions about your property investment.

Budget Planning: By understanding your estimated loan repayments and cash flow, you can effectively budget for your investment and ensure that it aligns with your financial capacity.

Risk Management: The calculator helps you assess the financial risks associated with the investment by providing a clear picture of potential returns and expenses.

Time Efficiency: Quickly analyze different scenarios and financial outcomes without the need for complex manual calculations. This efficiency allows you to focus on other aspects of your investment strategy.

How Triple M Finance Can Enhance Your Investment Experience

While an investment property calculator is a valuable tool, working with experts from Triple M Finance can further optimize your investment approach. Here’s how we can assist you:

Expert Guidance: Our team provides personalized advice based on your financial situation and investment goals. We can help you interpret the results from the calculator and offer guidance on the best loan products and strategies.

Tailored Financing Solutions: We understand that every investor’s needs are unique. Our specialists will work with you to find a mortgage product that suits your specific requirements and investment strategy.

Local Market Knowledge: Based in Round Corner, NSW 2158, we have a deep understanding of the local property market. Our local expertise ensures that our advice is relevant and tailored to your investment area.

Streamlined Loan Process: We handle the complexities of securing a home loan, simplifying the process so you can focus on finding and managing your investment property.

Comprehensive Support: From initial calculations to finalizing your loan, we provide comprehensive support throughout your investment journey, ensuring a smooth and successful experience.

Ready to Optimize Your Investment Strategy?

Utilize our investment property calculator Australia to get a detailed overview of your potential investment, and then contact Triple M Finance at 0422 331 130 for expert advice and personalized support. Our team in Round Corner, NSW 2158, is here to help you navigate the investment process and achieve your financial goals.

Don’t let uncertainty hold you back from making the most of your investment opportunities. With the right tools and expert guidance, you can confidently pursue your property investment ambitions and secure a prosperous future.

#investment property home loan#investment property loan calculator#investment property calculator australia#investing in residential property

0 notes

Text

Unlock Your Entrepreneurial Dreams: Small Business for Sale in Melbourne

Why Melbourne?

Melbourne is Australia's second-largest city and is renowned for its dynamic business environment. The city’s strong economy, supported by a diverse range of sectors including retail, hospitality, technology, and services, provides a solid foundation for small businesses to thrive. The local government's supportive policies and initiatives further enhance the business landscape, making it easier for new owners to navigate the market and establish their presence.

Types of Businesses Available

When it comes to small businesses for sale in Melbourne, the options are endless. Here are some popular categories:

Cafés and Restaurants

Melbourne’s café culture is legendary. With a high demand for unique dining experiences, investing in a café or restaurant can be a lucrative venture. Whether it’s a cozy coffee shop in the CBD or a trendy eatery in the suburbs, Small Business For Sale In Melbourne the city offers numerous opportunities for culinary entrepreneurs.

Retail Stores

From fashion boutiques to specialty shops, Melbourne’s retail sector is diverse and thriving. Owning a retail store in a high-traffic area can be a profitable investment, especially with the city’s vibrant shopping districts attracting both locals and tourists.

Service-Based Businesses

Service industries such as cleaning, home maintenance, local real estate expert and personal care are always in demand. These businesses often require lower initial investments and can offer steady income streams. Melbourne’s growing population ensures a constant need for such services.

Technology and Online Businesses

In today’s digital age, technology and online businesses are booming. Melbourne’s tech-savvy population and strong infrastructure make it an excellent location for e-commerce stores, digital marketing agencies, and IT service providers.

Benefits of Buying an Existing Business

Purchasing an existing business has several advantages over starting one from scratch:

Established Brand and Customer Base

An existing business comes with a recognized brand and a loyal customer base, which can significantly reduce the time and effort needed to build a reputation and attract customers.

Proven Track Record

With an existing business, you have access to financial records and performance data. This transparency allows you to make informed decisions and assess the business’s profitability and growth potential.

Immediate Cash Flow

Unlike a startup, an established business generates immediate revenue. This can provide financial stability and allow you to reinvest in growth opportunities from day one.

Key Considerations

Before purchasing a small business in Melbourne, it’s essential to conduct thorough due diligence. Here are some critical steps to take:

Market Research

Understand the industry trends, target audience, and competition. This knowledge will help you identify the right business opportunity and develop effective strategies.

Financial Analysis

Review the business’s financial statements, including profit and loss reports, balance sheets, and cash flow statements. Ensure that the business is financially healthy and has the potential for future growth.

Legal Considerations

Consult with legal professionals to understand the terms of the sale, including any existing contracts, leases, or liabilities. Ensure that all legal aspects are clear and favorable.

Transition Plan

Develop a comprehensive transition plan to ensure a smooth handover. This includes understanding the existing operations, training staff, and maintaining customer relationships.

0 notes