#Cellular IoT Module Market

Explore tagged Tumblr posts

Text

Consumer Behavior and Market Adoption of Cellular IoT Modules

According to Future Market Insight, the cellular IoT modules market is worth US$ 16.88 Bn in 2023 and US$ 20.83 Bn by 2033. A CAGR of 23.4% is anticipated in the market during the forecast period.

It is projected that the rising adoption of 5G technology drives further market expansion. Demand for cellular IoT modules is expected to rise as a result of the 5G technology’s increased data speeds, lower latency, and more coverage.

The growth of mHealth services and government initiatives to support IoT in healthcare are also expected to contribute to the cellular IoT module market expansion. The overall market share is being impacted by the expansion of healthcare facilities and the rising demand for healthcare services.

A crucial component of cellular IoT security policy is cloud-based security, as insecure cloud infrastructure increases the risk of data theft and device piracy. For instance, a drone used for surveillance or delivery can process information like imaging data and navigational instructions on its own.

Request a Sample Copy of the Report https://www.futuremarketinsights.com/reports/sample/rep-gb-15890

Applications of Cellular IoT Modules in Different Industries

Automotive Industry: The sales of cellular IoT modules in the automotive industry are expected to grow significantly during the forecast period due to the increased demand for connected automobiles. Since connected automobiles allow communication between vehicles and with the outside world, the automotive industry is projected to undergo substantial change as a result.

Telecom Industry: Currently, the telecom industry improves the cellular IoT modules market outlook. The market’s expansion is also aided by the industry’s rapid digitization and growing level of automation. Solutions for the Narrowband Internet of Things (NB-IoT) and Long-Term Evolution for Machines are being implemented by numerous medium-sized and large-scale businesses.

Key Takeaways

The cellular IoT module market is likely to register at a CAGR of 23.4% during the forecast period.

Historically, the cellular IoT module market registered at a CAGR of 17% between 2018 and -2022.

The value of the cellular IoT module market is expected to be US$ 20.83 Bn by 2033.

Based on components, the hardware segment is likely to register at a 26.5% CAGR in the cellular IoT module market.

North America shows significant growth in the cellular IoT module market by 2033.

During the forecast period, the cellular IoT module market in China is likely to dominate.

Get More Information on this Report: https://www.futuremarketinsights.com/reports/cellular-iot-module-market

Competitive Landscape

The inclusion of cellular IoT modules in the product lines of telematics solution providers has made it easier for fleet managers and off-highway vehicle OEMs to gather and analyze data to identify significant patterns and issues in the field’s instrumentation usage.

Furthermore, it is projected that a number of elements, such as robust security, ubiquitous quality, and resilient networks, would energize the sector over the coming several years.

Recent Developments:

In order to fulfill the rising need from the industry for smart-grid communications between charging stations and automobiles, Qualcomm developed a new power line communication device in May 2022.

In order to address the communication needs of electric vehicle (EV) charging stations, also known as electric vehicle supply equipment, Qualcomm Technologies, Inc. has developed the QCA7006AQ, a next-generation power line communication (PLC) device (EVSE).

The HL7845 Module was developed by Sierra Wireless in April 2021. The standard provides a 450 MHz wireless spectrum to meet the IoT connectivity requirements of European utility services.

In February 2021, Fibocom partnered with Red Tea, a leading provider of connection solutions, and Deutsche Telekom, the largest integrated telecoms company in the world, to ensure that it only provided best-in-class advertising nuSIM IoT components.

Key segments

By Component:

Hardware

Software

By Cellular Technology:

3G

4G

5G

LTE-M

NB-Iot

Others

By End Use Industry:

Agriculture

Healthcare

Retail

Energy

Automotive & Transportation

Infrastructure

Others

By Region:

North America

Latin America

Europe

East Asia

South Asia and Pacific

Middle East & Africa

0 notes

Text

Cellular IoT Module Chipset Market: Challenges in Standardization and Implementation, 2025-2032

MARKET INSIGHTS

The global Cellular IoT Module Chipset Market size was valued at US$ 4,670 million in 2024 and is projected to reach US$ 9,780 million by 2032, at a CAGR of 11.12% during the forecast period 2025-2032. The semiconductor industry backdrop shows robust growth, with global semiconductor revenues reaching USD 579 billion in 2022 and expected to expand to USD 790 billion by 2029 at 6% CAGR.

Cellular IoT Module Chipsets are specialized semiconductor components that enable wireless communication for IoT devices across cellular networks (4G LTE, 5G, NB-IoT). These chipsets integrate baseband processing, RF transceivers, power management, and security features into compact modules, facilitating machine-to-machine (M2M) connectivity in applications ranging from smart meters to industrial automation.

The market growth is driven by accelerating 5G deployments, with 5G chipset adoption projected to grow at 28% CAGR through 2030. While 4G LTE dominates current installations (72% market share in 2024), 5G chipsets are gaining traction in high-bandwidth applications. Key players like Qualcomm (holding 32% market share) and UNISOC are driving innovation through partnerships, such as Qualcomm’s recent collaboration with Bosch on industrial IoT modules featuring AI acceleration capabilities.

MARKET DYNAMICS

MARKET DRIVERS

Explosive Growth of IoT Applications to Accelerate Chipset Demand

The cellular IoT module chipset market is experiencing robust growth driven by the rapid expansion of IoT applications across industries. Global IoT connections are projected to surpass 29 billion by 2030, creating unprecedented demand for reliable connectivity solutions. Cellular IoT chipsets serve as the backbone for smart city infrastructure, industrial automation, and connected vehicles, enabling seamless machine-to-machine communication. The transition from legacy 2G/3G networks to advanced 4G LTE and 5G technologies is further fueling adoption, as these provide the necessary bandwidth and low latency for mission-critical applications.

5G Network Rollouts to Transform Industry Connectivity Standards

The global rollout of 5G networks represents a watershed moment for cellular IoT, with commercial 5G connections expected to reach 1.8 billion by 2025. 5G-enabled chipsets offer game-changing capabilities including ultra-reliable low latency communication (URLLC) and massive machine-type communication (mMTC) – essential for industrial IoT and autonomous systems. Major chipset manufacturers are introducing integrated 5G NR solutions that combine modem, RF transceiver, and power management, significantly reducing module footprint and power consumption while improving performance.

Moreover, the emergence of cellular vehicle-to-everything (C-V2X) technology is creating new revenue streams, with automakers increasingly embedding IoT modules for enhanced safety and navigation features. These technological advancements coincide with significant price reductions in 5G chipset manufacturing, making advanced connectivity accessible to mid-range IoT devices.

MARKET RESTRAINTS

Complex Certification Processes to Slow Market Penetration

Despite strong demand, the cellular IoT chipset market faces considerable barriers from stringent certification requirements. Each regional market maintains distinct regulatory frameworks for wireless devices, necessitating costly and time-consuming certification processes that can take 6-12 months per product. The situation is compounded for global IoT deployments requiring certifications across multiple jurisdictions, often representing 15-25% of total product development costs. This regulatory complexity particularly disadvantages smaller manufacturers lacking the resources for multi-market compliance.

Legacy System Integration Challenges to Constrain Adoption Rates

The integration of modern cellular IoT modules with legacy industrial systems presents significant technical hurdles. Many manufacturing facilities operate equipment with lifespans exceeding 20 years, designed before IoT connectivity became standard. Retrofitting these systems requires specialized gateways and protocol converters that add complexity and cost to deployments. Furthermore, the industrial sector’s conservative approach to technology upgrades means adoption cycles remain measured, despite the potential efficiency gains from cellular IoT implementation.

MARKET CHALLENGES

Power Consumption Optimization to Remain Critical Design Hurdle

While cellular connectivity offers superior range and reliability compared to alternatives like LPWAN, power efficiency remains an ongoing challenge for IoT module designers. Many industrial monitoring applications require 10+ year battery life from devices, pushing chipset manufacturers to develop increasingly sophisticated power management architectures. The introduction of advanced power saving modes like PSM and eDRX has helped, but achieving optimal battery life while maintaining responsive connectivity continues to require careful balancing of performance parameters.

Other Challenges

Supply Chain Volatility The semiconductor industry’s cyclical nature creates unpredictable component availability, with lead times for certain RF components occasionally exceeding 40 weeks. This volatility forces module manufacturers to maintain costly inventory buffers or redesign products based on component availability rather than optimal technical specifications.

Security Vulnerabilities As cellular IoT deployments scale, they become increasing targets for sophisticated cyber attacks. Chipset manufacturers must continuously update security architectures to address emerging threats while maintaining backward compatibility with deployed devices – a challenge that grows more complex with each product generation.

MARKET OPPORTUNITIES

AI-Enabled Edge Processing to Create Next-Generation Value Propositions

The convergence of cellular connectivity with artificial intelligence presents transformative opportunities for IoT module chipsets. Emerging architectures that combine cellular modems with neural processing units (NPUs) enable sophisticated edge analytics, reducing cloud dependency while improving response times. The edge AI chipset market is projected to grow at a CAGR of 18.8% through 2030, with cellular-equipped devices gaining particular traction in applications like predictive maintenance and autonomous surveillance systems.

Satellite IoT Convergence to Expand Addressable Markets

The integration of satellite connectivity with cellular IoT chipsets is opening new possibilities for global asset tracking and remote monitoring. Major chipset vendors are developing hybrid cellular-satellite solutions that automatically switch between terrestrial and non-terrestrial networks, ensuring connectivity in areas without cellular coverage. This technology holds particular promise for maritime logistics, agriculture, and energy infrastructure monitoring in underserved regions, potentially adding millions of new connections to the cellular IoT ecosystem.

CELLULAR IOT MODULE CHIPSET MARKET TRENDS

5G Adoption Accelerates Growth in Cellular IoT Module Chipsets

The rapid deployment of 5G networks worldwide is fundamentally transforming the Cellular IoT Module Chipset market, with the 5G segment projected to grow at a CAGR of over 28% from 2024 to 2032. Unlike previous generations, 5G-NR technology enables ultra-low latency (under 10ms) and high bandwidth (up to 10Gbps), making it ideal for mission-critical applications like autonomous vehicles and industrial automation. Recent advancements in 5G RedCap (Reduced Capability) chipsets are bridging the gap between high-performance and cost-sensitive IoT applications, with power consumption reductions of up to 60% compared to standard 5G modules. Furthermore, the integration of AI-powered edge computing capabilities directly into cellular modules is enabling real-time data processing at the device level, significantly reducing cloud dependency.

Other Trends

LPWAN Convergence Driving Hybrid Solutions

While traditional cellular technologies dominate, the market is witnessing a surge in LPWAN-cellular hybrid chipsets that combine NB-IoT/LTE-M with LoRaWAN or Sigfox support. This convergence addresses the growing need for flexible connectivity in smart cities and industrial IoT, where deployment scenarios might demand both wide-area coverage and deep indoor penetration. Industry data indicates that hybrid modules now represent over 35% of new industrial IoT deployments, particularly in asset tracking and smart utility applications. The emergence of 3GPP Release 18 features is further optimizing power management in these solutions, extending battery life for remote devices to 10+ years in some configurations.

Vertical-Specific Customization Reshapes Product Offerings

Chipset manufacturers are increasingly developing application-specific optimized solutions, moving beyond one-size-fits-all approaches. For automotive applications, chipsets now integrate vehicle-to-everything (V2X) communication alongside traditional cellular connectivity, with processing capabilities enhanced for ADAS data throughput. In healthcare, modules are being designed with built-in HIPAA-compliant security chips and ultra-low power modes for wearable devices. The industrial sector is driving demand for ruggedized chipsets capable of operating in extreme temperatures (from -40°C to 85°C) with enhanced EMI shielding. This specialization trend has led to over 200 new SKUs being introduced by major vendors in the past 18 months alone, creating a more fragmented but application-optimized market landscape.

COMPETITIVE LANDSCAPE

Key Industry Players

Leading Chipset Manufacturers Drive Innovation in Cellular IoT

The global Cellular IoT Module Chipset market features a highly competitive landscape dominated by semiconductor giants and specialized IoT solution providers. Qualcomm Technologies Inc. leads the market with its comprehensive 4G and 5G solutions, capturing approximately 35% market share in 2024. The company’s strength lies in its Snapdragon X55 and X65 modems that power IoT applications across industrial, automotive, and smart city deployments.

While Qualcomm maintains leadership, MediaTek and UNISOC have been gaining significant traction in the mid-range IoT segment. MediaTek’s Helio series chipsets, known for their power efficiency, secured about 18% market share last year. Meanwhile, UNISOC’s focus on cost-effective LTE Cat-1 solutions has made it the preferred choice for mass-market IoT applications in emerging economies.

Chinese players Hisilicon and ASR Microelectronics have been expanding aggressively, particularly in the Asia-Pacific region. Hisilicon’s Balong series chips helped Huawei capture 12% of the global cellular IoT module market before facing supply chain challenges. ASR has since filled this gap with its competitive LTE solutions, growing at an estimated 25% year-over-year since 2022.

The market also sees strong competition from Intel and newer entrants like Eigencomm, with the latter making waves through its patented antenna technology that improves signal reliability in challenging IoT environments. Meanwhile, Sequans Communications continues to dominate the LTE-M/NB-IoT segment with its Monarch platform, preferred by utilities and smart meter manufacturers.

List of Key Cellular IoT Module Chipset Manufacturers

Qualcomm Technologies Inc. (U.S.)

MediaTek Inc. (Taiwan)

UNISOC (China)

Hisilicon (China)

ASR Microelectronics (China)

Intel Corporation (U.S.)

Eigencomm (U.S.)

Sequans Communications (France)

Segment Analysis:

By Type

5G Chipset Segment Drives Market Growth with Accelerated IoT Connectivity

The market is segmented based on type into:

4G Chipset

5G Chipset

By Application

Industrial Applications Segment Leads Owing to Widespread Adoption in Smart Manufacturing

The market is segmented based on application into:

PC

Router/CPE

POS

Smart Meters

Industrial Application

Other

By Technology

NB-IoT Technology Gains Traction for Low-Power Wide-Area Applications

The market is segmented based on technology into:

NB-IoT

LTE-M

5G RedCap

Others

By End User

Enterprise Sector Dominates with Growing Demand for Connected Solutions

The market is segmented based on end user into:

Enterprise

Consumer

Government

Industrial

Regional Analysis: Cellular IoT Module Chipset Market

North America The North American market is characterized by advanced IoT adoption, driven by strong technological infrastructure and high investments in 5G deployment. The U.S. leads with significant contributions from key players such as Qualcomm and Intel, focusing on scalable and low-power solutions for industrial and smart city applications. Government initiatives, including funding for connected infrastructure, fuel demand for cellular IoT chipsets. However, stringent regulatory frameworks around spectrum allocation and data security pose challenges. The region is shifting toward 5G-ready chipsets, with an estimated 45% of IoT modules expected to support 5G by 2026, particularly for enterprise and automotive applications.

Europe Europe exhibits steady growth, propelled by EU-wide IoT standardization policies and rising demand for energy-efficient connectivity in smart manufacturing and logistics. Germany and France dominate due to strong industrial IoT adoption, with a focus on LPWA technologies (NB-IoT and LTE-M). Regulatory emphasis on data privacy (GDPR compliance) influences chipset design to prioritize security features. The region faces challenges from fragmented telecom regulations and higher costs of deployment. However, increasing partnerships between semiconductor firms and telecom providers (e.g., Vodafone and Ericsson collaborations) are accelerating ecosystem development.

Asia-Pacific APAC is the fastest-growing market, accounting for over 50% of global cellular IoT module shipments, led by China’s aggressive 5G rollout and India’s digital infrastructure projects. China dominates with local giants like Hisilicon and UNISOC supplying cost-optimized chipsets for smart meters and wearables. Japan and South Korea prioritize automotive and robotics applications, leveraging high-speed connectivity. While affordability drives 4G adoption, 5G chipsets are gaining traction in urban hubs. Challenges include supply chain dependencies and intellectual property constraints, but government-backed IoT initiatives (e.g., India’s Smart Cities Mission) sustain long-term potential.

South America The region shows moderate growth, with Brazil and Argentina leading IoT deployments in agriculture and asset tracking. Economic volatility limits large-scale investments, but rising demand for connected logistics and renewable energy monitoring creates niche opportunities. Reliance on imported 4G modules prevails due to cost sensitivity, though local telecom operators are piloting NB-IoT networks to expand coverage. Regulatory hurdles and underdeveloped local semiconductor industries slow progress, but FDI in smart infrastructure projects could unlock future demand.

Middle East & Africa MEA is an emerging market, with the UAE, Saudi Arabia, and South Africa driving adoption in smart utilities and oil & gas. 5G-compatible chipsets are prioritized for smart city initiatives like NEOM in Saudi Arabia. Limited local manufacturing and reliance on imports constrain growth, but partnerships with global vendors (e.g., Qualcomm’s collaborations with Etisalat) aim to strengthen IoT ecosystems. Africa’s growth is uneven, with urban centers adopting IoT for payment systems while rural areas lag due to connectivity gaps. The region’s potential hinges on improving telecom infrastructure and reducing module costs.

Report Scope

This market research report provides a comprehensive analysis of the global and regional Cellular IoT Module Chipset markets, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The global Cellular IoT Module Chipset market was valued at USD 2.8 billion in 2024 and is projected to reach USD 5.9 billion by 2032, growing at a CAGR of 9.7%.

Segmentation Analysis: Detailed breakdown by product type (4G vs 5G chipsets), application (smart meters, industrial IoT, routers/CPE), and end-user industries to identify high-growth segments.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa, with China accounting for 42% of global demand in 2024.

Competitive Landscape: Profiles of leading market participants including Qualcomm (35% market share), UNISOC, MediaTek, and Hisilicon, covering their product portfolios and strategic initiatives.

Technology Trends: Assessment of LPWA technologies (NB-IoT, LTE-M), 5G RedCap adoption, and AI integration in cellular IoT modules.

Market Drivers & Restraints: Evaluation of factors including smart city deployments, Industry 4.0 adoption, and spectrum availability challenges.

Stakeholder Analysis: Strategic insights for chipset manufacturers, module vendors, and enterprise IoT adopters.

Related Reports:https://semiconductorblogs21.blogspot.com/2025/06/laser-diode-cover-glass-market-valued.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/q-switches-for-industrial-market-key.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/ntc-smd-thermistor-market-emerging_19.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/lightning-rod-for-building-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/cpe-chip-market-analysis-cagr-of-121.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/line-array-detector-market-key-players.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/tape-heaters-market-industry-size-share.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/wavelength-division-multiplexing-module.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/electronic-spacer-market-report.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/5g-iot-chip-market-technology-trends.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/polarization-beam-combiner-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/amorphous-selenium-detector-market-key.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/output-mode-cleaners-market-industry.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/digitally-controlled-attenuators-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/thin-double-sided-fpc-market-key.html

0 notes

Text

Trailer Telematics Market : Size, Trends, and Growth Analysis 2032

The Trailer Telematics Market was valued at US$ 779.09 million in 2024 and is anticipated to grow at a CAGR of 10.90% from 2025 to 2032. This rapid market expansion is fueled by the global logistics sector’s increasing demand for real-time visibility, predictive analytics, and fleet safety optimization. Trailer telematics technologies are revolutionizing how logistics and transport companies manage assets—unlocking higher efficiency, security, and profitability.

Understanding Trailer Telematics

Trailer telematics systems integrate GPS, IoT sensors, cellular connectivity, and cloud platforms to monitor and transmit vital data from trailers. These systems track:

Real-time location

Vehicle speed and route history

Cargo condition (e.g., temperature, humidity)

Door open/close status

Brake health and tire pressure

Trailer utilization and idle time

This data allows fleet managers to monitor, control, and optimize operations remotely, reducing downtime, theft risk, fuel consumption, and cargo damage.

Key Drivers of Market Growth

1. Booming E-commerce and Logistics

The explosion in e-commerce and on-demand delivery services has intensified the need for fast, reliable, and transparent supply chain operations. Telematics solutions give companies the tools to manage complex logistics efficiently and meet growing customer expectations for real-time delivery tracking.

2. Need for Real-Time Visibility

Fleet operators are under pressure to know exactly where assets are and how they are performing at all times. Trailer telematics deliver location accuracy, status updates, and usage patterns that help in informed decision-making and route optimization.

3. Cargo Security and Regulatory Compliance

With increasing cargo theft incidents and tightening regulations around goods handling (especially cold chain logistics), companies are adopting telematics to ensure security and compliance. Real-time alerts for door breaches or temperature fluctuations can help prevent costly losses.

4. Predictive Maintenance and Asset Lifecycle Management

Advanced telematics systems support predictive maintenance by analyzing component health and usage patterns. This minimizes unplanned downtime, extends trailer lifespan, and reduces maintenance costs.

5. Environmental and Fuel Efficiency Goals

Fleet management increasingly incorporates sustainability goals. Telematics helps reduce fuel consumption by monitoring driver behavior, optimizing routes, and minimizing idling—supporting carbon reduction efforts.

Core Components of a Trailer Telematics System

GPS Modules – For accurate location tracking.

Telematics Control Unit (TCU) – Collects, processes, and transmits data.

Sensors – Monitor cargo temperature, trailer doors, braking systems, tire pressure, and more.

Connectivity – Typically cellular or satellite, enabling real-time communication.

Cloud Platform and Dashboard – For data visualization, analytics, and control via web or mobile apps.

Application Areas

Long-Haul Freight & Logistics Track trailer locations, monitor driver activity, and plan optimal routes for long-distance shipping.

Cold Chain Transportation Ensure temperature-sensitive goods (like food or pharmaceuticals) remain within required conditions with real-time temperature tracking.

Construction and Mining Manage heavy trailers and equipment on remote sites; monitor usage and geofence sensitive areas.

Rental & Leasing Fleets Monitor usage patterns, location history, and maintenance needs to enhance asset protection and ROI.

Public Sector and Emergency Services Governments and aid agencies use telematics to manage mobile equipment and ensure response efficiency.

Regional Insights

North America: Dominates the global market due to early technology adoption, advanced fleet infrastructure, and stringent cargo security regulations. The U.S. and Canada are major contributors.

Europe: Strong growth driven by environmental regulations, the rise of intermodal logistics, and data-driven fleet operations in countries like Germany, the UK, and France.

Asia-Pacific: Fastest-growing region fueled by expanding logistics networks in China, India, and Southeast Asia. Government investments in smart transportation and rising freight volumes are key factors.

Latin America & MEA: Emerging markets are showing increased interest in trailer telematics, especially in logistics-heavy economies like Brazil, Mexico, and the UAE. However, adoption is limited by cost sensitivity and connectivity challenges.

Leading Players in the Trailer Telematics Market

Geotab Inc.

A major telematics provider known for its open platform and scalable solutions. Offers real-time location tracking, driver behavior monitoring, and rich APIs for customization.

ORBCOMM Inc.

Specializes in IoT and M2M communication solutions, including satellite and cellular telematics for trailer, reefer, and intermodal container tracking.

Trimble Inc.

Offers logistics-focused telematics systems through its Transportation division. Provides advanced analytics, maintenance alerts, and real-time route optimization.

WABCO Holdings Inc.

A key player in smart braking, stability control, and trailer telematics. Known for integrating safety systems with tracking technology.

CalAmp Corp.

Delivers flexible, modular telematics devices and platforms for trailer management. Strong in sensor integration and cloud-based analytics.

Omnitracs LLC

Provides comprehensive fleet intelligence platforms with focus on routing, compliance, and driver productivity in trucking and logistics.

Spireon Inc.

Offers GPS-based trailer and asset tracking under the FleetLocate brand. Known for providing intuitive dashboards and actionable insights.

Verizon Connect

Delivers enterprise-level telematics and mobile workforce solutions. Provides real-time asset tracking, geofencing, and data analytics via the Verizon network.

Samsara Inc.

One of the fastest-growing players offering IoT-based solutions for real-time trailer tracking, video telematics, and AI-powered analytics across logistics and construction industries.

Market Trends

AI and Predictive Analytics: Telematics systems are integrating machine learning to predict failures, optimize fuel use, and automate decision-making.

5G and Edge Computing: High-speed data transmission and local processing enable richer real-time insights, even in remote areas.

Video Telematics Integration: Combining tracking with dashcams for enhanced driver safety and accident liability management.

Blockchain for Secure Tracking: Emerging applications in securing cargo chain of custody, especially in high-value or perishable goods.

Browse more Report:

Pharmaceutical Plastic Packaging Market

Pharmaceutical Analytical Testing Outsourcing Market

Non-invasive Helicobacter Pylori Testing Market

Neuroprotection Market

Neonicotinoid Pesticide Market

0 notes

Text

ARMxy Industrial Computer BL410 in Electric Vehicle Charging Stations

Introduction

As the electric vehicle (EV) market continues to grow, the demand for efficient, reliable, and intelligent charging infrastructure is surging. With its flexible I/O configuration, high-performance processing capabilities, and industrial-grade reliability, the BL410 is well suited to meet the complex demands of EV charging systems. This case study explores the application of the BL410 in EV charging stations and highlights its key features and benefits.

Application Scenario

EV charging stations require real-time data acquisition, communication with cloud platforms, and precise control of charging processes. These stations must operate reliably in diverse environmental conditions, support multiple communication protocols, and enable remote monitoring and maintenance. The ARMxy BL410 series addresses these needs through its advanced hardware and software capabilities, making it an excellent choice for both AC and DC charging stations.

Solution Implementation

The BL410 industrial computer is deployed as the central controller in EV charging stations, managing critical functions such as data acquisition, protocol conversion, and cloud integration. Below is an overview of how the BL410 is utilized in this application:

1. Hardware Configuration

The BL410 is customized to meet the specific needs of EV charging stations:

Processor and Memory: Equipped with a Rockchip RK3568J/RK3568B2 quad-core ARM Cortex-A55 processor (up to 2.0 GHz) and 4GB LPDDR4X RAM, the BL410 ensures efficient processing of real-time data and multitasking for charging operations.

Storage: A 32GB eMMC storage configuration provides ample space for firmware, logs, and application data.

I/O Interfaces:

X Series I/O Board (e.g., X23): Configured with 4 RS485 ports for communication with charging modules and meters, and 4 digital inputs/outputs (DI/DO) for controlling relays and monitoring status signals.

Y Series I/O Board (e.g., Y31): Includes 4 analog inputs (0/4-20mA) for monitoring current and voltage during charging.

Communication:

Ethernet Ports: 3x 10/100M Ethernet ports enable robust connectivity to local networks and cloud platforms.

4G Module: A Mini PCIe slot with a 4G module (e.g., BL410L) ensures reliable cellular connectivity for remote access and data transmission.

WiFi Module: Optional WiFi support for local wireless communication.

Power and Protection: Supports a wide voltage range (9-36V DC) with reverse polarity and overcurrent protection, ensuring stable operation in fluctuating power conditions.

Mounting: DIN35 rail mounting facilitates easy installation within charging station enclosures.

2. Software Integration

The BL410’s software ecosystem enhances its suitability for EV charging applications:

Operating System: Runs Ubuntu 20.04, providing a stable and developer-friendly environment for application development.

Protocol Conversion: The pre-installed BLIoTLink software supports protocols such as Modbus, MQTT, and OPC UA, enabling seamless communication with charging modules, energy meters, and IoT cloud platforms like AWS IoT Core and Alibaba IoT.

Remote Access: BLRAT (Beilai Remote Access Tool) allows operators to monitor and maintain charging stations remotely, reducing downtime and service costs.

Node-RED: Facilitates rapid development of IoT applications, such as real-time monitoring dashboards and automated fault detection workflows.

Docker Support: Enables containerized deployment of applications, ensuring scalability and ease of updates.

3. Key Functions

The BL410 performs the following critical functions in EV charging stations:

Data Acquisition: Collects real-time data from energy meters (voltage, current, power) and environmental sensors (temperature, humidity) via analog and digital inputs.

Charging Control: Manages charging sessions by controlling relays and communicating with charging modules to regulate power delivery.

Cloud Integration: Transmits operational data (e.g., charging status, energy consumption) to IoT cloud platforms for analytics and billing.

Fault Detection: Monitors system health and triggers alerts for anomalies, such as overcurrent or communication failures, using Node-RED workflows.

User Interface: Supports optional HDMI output for local display of charging status or integration with touchscreen HMIs using Qt-5.15.2.

4. Environmental Reliability

The BL410 is designed to withstand the harsh conditions often encountered in outdoor charging stations:

Temperature Range: Operates reliably from -40°C to +85°C (with RK3568J SOM), suitable for extreme climates.

IP30 Protection: Prevents dust ingress, ensuring durability in dusty environments.

EMC Compliance: Passes rigorous electromagnetic compatibility tests (e.g., ESD Level III, EFT Level III), minimizing interference and ensuring stable operation.

Vibration and Shock Resistance: Complies with sinusoidal vibration and free-fall tests, making it robust for transportation and installation.

Benefits

The deployment of the ARMxy BL410 in EV charging stations offers several advantages:

Flexibility: Customizable I/O boards and SOM configurations allow tailored solutions for different charging station designs.

Reliability: Industrial-grade design with extensive environmental and EMC testing ensures long-term stability.

Scalability: Support for Docker and cloud integration enables easy expansion as the charging network grows.

Cost-Effectiveness: Remote access and maintenance via BLRAT reduce on-site service costs.

Rapid Development: Node-RED and Qt tools accelerate application development, shortening time-to-market.

Conclusion

The ARMxy BL410 series industrial computer is a powerful and versatile solution for managing EV charging stations. Its high-performance hardware, flexible I/O options, and robust software ecosystem enable efficient data acquisition, reliable communication, and seamless cloud integration. With its proven reliability in harsh industrial environments, the BL410 is helping to power the future of electric vehicle infrastructure, ensuring efficient and scalable charging solutions for a growing market.

0 notes

Text

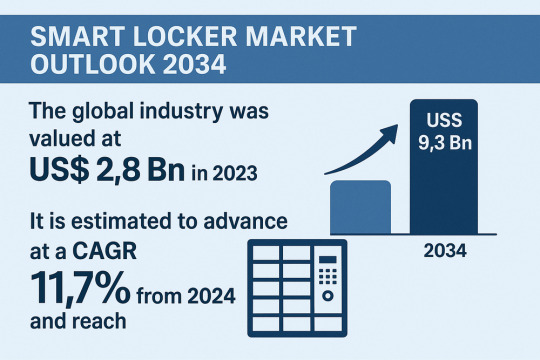

Smart Locker Market to Reach $9.3 Billion by 2034: What’s Driving the Growth?

The global smart locker market, valued at USD 2.8 billion in 2023, is poised for robust expansion over the next decade. Driven by surging e-commerce penetration, the need for secure parcel management, and rapid technology adoption across industries, the market is projected to register a compound annual growth rate (CAGR) of 11.7% from 2024 to 2034, reaching USD 9.3 billion by 2034.

Market Overview

Smart lockers secure, automated storage units integrated with sensors, connectivity, and management software are revolutionizing package handling and asset management across residential, commercial, institutional, industrial, and transportation sectors. They offer 24/7 secure access, real-time notifications, and advanced analytics, mitigating risks of theft, loss, and delivery delays. The COVID-19 pandemic underscored the importance of contactless solutions, accelerating deployments in logistics hubs, last-mile delivery networks, corporate campuses, educational institutions, and multi-family dwellings.

Market Drivers & Trends

E-Commerce Boom & Last-Mile Optimization The exponential rise of online shopping has intensified demand for reliable, contactless pickup and drop-off solutions. Retailers and logistics providers deploy smart lockers at convenient locations—supermarkets, transit stations, apartment complexes—to streamline deliveries, reduce failed delivery attempts, and cut operational costs.

Safety & Security Requirements With package theft (“porch piracy”) on the rise, consumers and businesses are adopting smart lockers to secure shipments. Integrated access control (PIN codes, biometrics, smartphone authentication) ensures only authorized users retrieve parcels.

IoT & Cloud-Based Analytics Connectivity via Wi-Fi, Bluetooth, NFC, and cellular networks enables automated monitoring, predictive maintenance, dynamic allocation of locker space, and utilization insights. AI-driven analytics optimize inventory distribution and enhance user experience.

Customized Solutions for Specialized Goods Temperature-controlled lockers support last-mile delivery of perishable groceries, pharmaceuticals, and laboratory specimens. Thermal management and modular compartmentalization ensure product integrity.

Regulatory & Sustainability Pressures Municipalities and corporations seek solutions to reduce carbon footprint of multiple delivery attempts. Consolidated locker deployments lower vehicle miles traveled and greenhouse gas emissions.

Latest Market Trends

Integration with Mobile Wallets & Apps Users increasingly leverage mobile apps and digital wallets to unlock compartments, track package status, and receive push notifications. Mobile-first interfaces are now standard.

Expansion into Multi-Tenant Residential Buildings Property developers embed smart locker ecosystems into new constructions to offer value-added amenities, improve tenant satisfaction, and differentiate offerings.

Plug-and-Play Modular Systems Scalable locker banks enable businesses to expand capacity on-demand. Plug-and-play modules simplify installation and future upgrades.

Partnerships with Last-Mile Tech Providers Collaboration between parcel locker manufacturers and drone, robotics, or autonomous vehicle companies is emerging to create end-to-end automated delivery networks.

Blockchain for Audit Trails Early pilots utilize distributed ledger technology to record chain-of-custody events for high-value shipments, enhancing transparency and reducing disputes.

Access key findings and insights from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=86223

Key Players and Industry Leaders

Prominent vendors shaping the global smart locker landscape include:

ASSA ABLOY AB – Integrating smart access control across locker portfolios.

Allegion Plc – Broadening product lines with cloud-enabled locker solutions.

Avent Security – Specializing in modular, temperature-controlled lockers.

Dahua Technology – Offering AI-driven surveillance and analytics in locker systems.

dormakaba Group – Combining mechanical expertise with digital management platforms.

Honeywell International Inc. – Delivering enterprise-grade locker management software.

igloocompany Pte Ltd – Pioneering parcel locker networks in Asia.

Master Lock Company LLC. – Known for ruggedized, weatherproof locker designs.

MIWA Lock Co. – Integrating biometric authentication into high-security lockers.

Samsung Electronics Co., Ltd. – Leveraging consumer electronics expertise for locker interface design.

Spectrum Brands, Inc. – Expanding access control offerings into locker portfolios.

Vivint, Inc. – Bundling smart home security with locker access solutions.

These companies focus on R&D, strategic alliances, and targeted acquisitions to enhance technological capabilities and geographic reach.

Recent Developments

November 2023: Blue Dart Express partnered with India Post to install automated digital parcel lockers at select post offices nationwide. Authorized personnel deposit deliveries, and recipients access packages via unique codes—enabling flexible, round-the-clock collection.

March 2022: Quadient and DHL launched an extensive rollout of outdoor smart parcel lockers across Sweden, providing consumers with secure self-service pick-up points and reducing delivery failure rates.

January 2024: igloo expanded its locker network in Singapore’s suburban residential estates, integrating cloud-based analytics to optimize locker utilization and reduce idle capacity.

April 2025: dormakaba introduced biometric-enabled lockers for hospital and laboratory environments, ensuring traceable access to controlled substances and sensitive equipment.

Market New Opportunities and Challenges

Opportunities

Emerging Economies: Rapid urbanization and e-commerce growth in Asia, Latin America, and Africa create fertile ground for locker deployments.

Smart City Initiatives: Municipal plans to deploy shared locker hubs at transit nodes can drive large-scale adoption.

Cross-Industry Convergence: Integration of lockers with coworking spaces, gym facilities, and parcel shops presents new partnership models.

AI-Powered Predictive Maintenance: Leveraging machine learning to foresee component failures enhances uptime and reduces service costs.

Challenges

High Initial Capital Outlay: Infrastructure costs and integration with existing IT systems may deter small and mid-sized enterprises.

Data Security & Privacy: Handling user credentials and tracking data demands robust cybersecurity measures and compliance with evolving regulations (e.g., GDPR).

Interoperability Standards: Absence of universal communication standards across locker ecosystems can hamper large-scale interoperability.

Last-Mile Network Complexity: Integrating lockers into fragmented delivery networks—involving multiple carriers—requires seamless coordination.

Future Outlook

The smart locker market is set to evolve into a critical component of the global logistics and asset-management ecosystem. By 2034, we anticipate:

Hyper-Connected Lockers: Fully integrated into smart city infrastructures, enabling dynamic allocation based on pedestrian and vehicle traffic flows.

Autonomous Replenishment: Drone and robotics fleets replenishing locker stock in real time, responding to demand signals from e-commerce platforms.

Advanced User Experiences: Voice-activated access, augmented reality (AR) wayfinding within locker halls, and AI-driven personalization.

Vertical-Specific Solutions: Tailored offerings for healthcare, cold chain, automotive manufacturing, and other sectors with stringent compliance requirements.

Sustainability Focus: Solar-powered locker banks and carbon-neutral installation programs to align with corporate ESG goals.

Analysts assert that as technology costs decline and value propositions become clearer, adoption will spread beyond major metropolitan areas into suburban and rural markets.

Market Segmentation

Segment

Details

By Type

Deadbolt locks, lever handles, server locks & latches, knob locks, others

By Communication

Bluetooth, Wi-Fi, Z-Wave, NFC, others

By Locking Mechanism

Keypad, card key, touch/biometric, key fob, smartphone

By End-Use

Commercial, residential, institutional & government, industrial, transportation & logistics

Regional Insights

Asia Pacific: Largest market share in 2023, driven by rapid e-commerce expansion, smart city programs, and strong uptake of IoT/cloud computing solutions. Key countries: China, India, Japan, South Korea, ASEAN nations.

North America: High adoption of advanced analytics and strong presence of leading vendors fuel growth. Retail, residential, and institutional segments are particularly active.

Europe: Focus on sustainability and urban logistics optimization. Germany, the U.K., and France lead with smart city pilots and intermodal transport locker installations.

Latin America & MEA: Emerging markets present significant growth potential, though hampered by infrastructural and regulatory challenges.

Why Buy This Report?

This comprehensive report offers:

In-depth market analysis from 2020 to 2023, with detailed forecasts through 2034.

Quantitative units covering market value (US$ billion) and volume (thousand units).

Extensive profiling of leading players, including product portfolios, strategic initiatives, financial overviews, and sales footprints.

Segment-level and regional breakdowns, highlighting growth pockets and investment hotspots.

Detailed qualitative assessments: drivers, restraints, opportunities, Porter’s Five Forces, value chain, and trend analyses.

Ready-to-use Excel datasheets for custom modeling and scenario planning.

Whether you are a technology vendor, investor, logistics provider, or smart city planner, this report equips you with actionable insights to make informed strategic decisions and capitalize on emerging opportunities in the smart locker landscape.

Frequently Asked Questions

1. What is driving the growth of the smart locker market? Surging e-commerce volumes, last-mile delivery challenges, rising concerns over package theft, and the integration of IoT/cloud analytics are key growth drivers.

2. Which regions offer the highest growth potential? Asia Pacific leads today, but Latin America, the Middle East & Africa, and secondary markets in North America and Europe present significant untapped opportunities.

3. What are the main barriers to adoption? High upfront costs, data security/privacy concerns, and the lack of universal interoperability standards across locker ecosystems.

4. How are smart lockers being used beyond parcel delivery? Applications include IT asset management, medical device distribution, temperature-controlled food and pharmaceutical logistics, and secure document storage.

5. Which technologies enhance smart locker capabilities? Bluetooth, NFC, Wi-Fi, biometric authentication, cloud-based management platforms, AI-driven analytics, and emerging blockchain pilots for audit trails.

About Transparency Market Research Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information. Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports. Contact: Transparency Market Research Inc. CORPORATE HEADQUARTER DOWNTOWN, 1000 N. West Street, Suite 1200, Wilmington, Delaware 19801 USA Tel: +1-518-618-1030 USA - Canada Toll Free: 866-552-3453 Website: https://www.transparencymarketresearch.com Email: [email protected]

0 notes

Text

IoT Connectivity Market Share and Size Outlook with Industry Forecast 2032

The IoT Connectivity Market Size was valued at USD 8.43 billion in 2023 and is expected to reach USD 51.51 billion by 2032, growing at a CAGR of 22.33% from 2024-2032.

The Internet of Things (IoT) has become a cornerstone of the digital transformation revolution, connecting billions of devices, systems, and services across industries. From smart homes and connected vehicles to industrial automation and healthcare, the expansion of IoT applications has led to an explosive demand for robust and scalable connectivity solutions. As enterprises adopt cloud computing, edge intelligence, and real-time data analytics, the need for reliable IoT connectivity is more critical than ever.

IoT Connectivity Market Size, Share, Scope, Analysis, Forecast, Growth, and Industry Report 2032 highlights the dynamic evolution of this sector. The market is expected to witness substantial growth due to advancements in low-power wide-area networks (LPWANs), 5G integration, and the proliferation of smart devices. With governments and industries embracing digital infrastructure, IoT connectivity is playing a vital role in driving innovation, efficiency, and competitive advantage.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/4926

Market Keyplayers:

Aeris Communications India Pvt. Ltd. (Aeris IoT Platform, Aeris Mobility)

AT&T Inc. (AT&T IoT Services, AT&T Control Center)

Cisco Systems Inc. (Cisco IoT Solutions, Cisco Jasper)

Huawei Technologies Co. Ltd. (Huawei IoT Cloud, Huawei 5G IoT Solutions)

Orange (Orange Business Services, Orange IoT Solutions)

Sierra Wireless (AirLink Routers, Octave IoT Platform)

Sigfox (Sigfox IoT Network, Sigfox Backend Services)

Telefonaktiebolaget LM Ericsson (Ericsson IoT Accelerator, Ericsson Device Connection Platform)

Telefónica S.A. (IoT Global Platform, Telefónica IoT Connectivity)

Telit IoT Platforms, LLC (Telit IoT Modules, Telit Connectivity Platform)

Verizon Communications Inc. (Verizon IoT Solutions, Verizon ThingSpace)

Vodafone Group Plc (Vodafone IoT Platform, Vodafone Automotive)

Hologram (Hologram IoT SIM Cards, Hologram Data Plans)

Particle (Particle IoT Devices, Particle Cloud Platform)

EMnify (EMnify IoT Platform, EMnify Cellular IoT Solutions)

Moeco (Moeco IoT Network, Moeco Data Management)

Market Trends

Several key trends are influencing the growth and direction of the IoT connectivity market:

5G Deployment and Integration: The global rollout of 5G networks is accelerating the capabilities of IoT systems, offering ultra-low latency, high-speed data transfer, and enhanced device density. This opens new opportunities for mission-critical applications in sectors like healthcare, autonomous vehicles, and smart cities.

Edge Computing and Decentralized Intelligence: Instead of relying solely on centralized cloud servers, edge computing processes data closer to the source, reducing latency and bandwidth usage. This trend is particularly impactful in industrial IoT (IIoT), where real-time decision-making is essential.

Expansion of LPWAN Technologies: LPWAN protocols like NB-IoT, LoRaWAN, and Sigfox are seeing increased adoption due to their ability to support long-range communication with minimal power consumption. These technologies are ideal for applications such as agriculture, asset tracking, and utility monitoring.

Interoperability and Open Standards: As the IoT ecosystem expands, there's a growing need for standardized communication protocols that ensure seamless connectivity between devices from different manufacturers. Open-source platforms and industry alliances are working to address these challenges.

Security and Data Privacy Focus: With more connected devices comes increased vulnerability. Security-by-design principles, encrypted communication, and AI-driven threat detection are becoming standard features in connectivity solutions.

Enquiry of This Report: https://www.snsinsider.com/enquiry/4926

Market Segmentation:

By Enterprise Type

Buildings and Home Automation

Smart Energy and Utility

Smart Manufacturing

Smart Retail

Smart Transportation

Others

By Enterprise Size

Small and Medium-sized Enterprises

Large Enterprises

By Component

Solution

Services

Market Analysis

North America currently dominates the global IoT connectivity landscape, driven by early technology adoption and strong infrastructure. However, Asia-Pacific is emerging as the fastest-growing region due to its expanding industrial base, smart city initiatives, and rising digital transformation efforts in countries like China and India.

Enterprises are shifting from traditional SIM-based connectivity to eSIM and iSIM technologies, offering flexibility and remote management capabilities. These innovations simplify global device deployment and streamline connectivity across borders and networks.

Future Prospects

The future of the IoT connectivity market is shaped by continued advancements in network infrastructure, emerging technologies, and evolving business models.

Satellite IoT Connectivity: Satellite-based solutions are gaining popularity for providing connectivity in remote and underserved areas, enabling global asset tracking and rural monitoring.

AI and Predictive Maintenance Integration: AI-powered analytics will increasingly be embedded into connectivity platforms, enabling real-time diagnostics, failure prediction, and performance optimization—especially in industrial and automotive sectors.

Smart City Ecosystems: Urbanization is driving massive investments in smart city solutions, including connected traffic systems, public safety monitoring, energy management, and waste control. IoT connectivity will serve as the digital backbone for these applications.

Commercialization of 6G: While still in early research stages, 6G is expected to redefine IoT connectivity by offering ultra-high-speed, ultra-reliable, and low-latency communication, paving the way for new applications in robotics, AR/VR, and immersive environments.

Access Complete Report: https://www.snsinsider.com/reports/iot-connectivity-market-4926

Conclusion

The IoT connectivity market is evolving rapidly, enabling a world where machines, sensors, and systems interact seamlessly to drive efficiency, innovation, and intelligence. As businesses and governments recognize the potential of interconnected devices, the demand for secure, scalable, and cost-effective connectivity solutions will only intensify.

By 2032, the industry is set to become a multi-billion-dollar ecosystem, integrating technologies like 5G, edge AI, and satellite communication. The players who prioritize interoperability, cybersecurity, and agility will lead this next wave of digital transformation. The IoT connectivity market is not just growing—it’s shaping the future of how we live, work, and connect.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

#IoT Connectivity Market#IoT Connectivity Market Growth#IoT Connectivity Market Scope#IoT Connectivity Market Trends

0 notes

Text

0 notes

Text

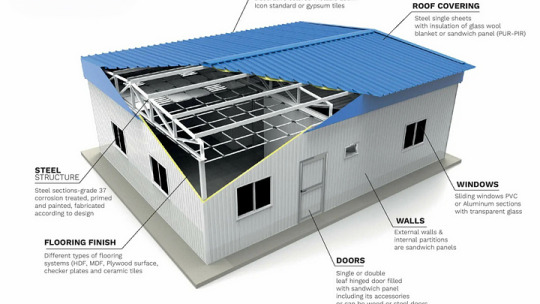

Prefabricated Building Systems Market - Forecast(2025 - 2031)

Prefabricated Building Systems Market Overview:

Request Sample Report :

Innovations like Building Information Modeling (BIM), IoT-enabled monitoring, and automation in manufacturing processes are enhancing the efficiency and precision of prefabricated structures. These technologies enable better collaboration between stakeholders, reduce errors, and improve project management. The integration of smart systems ensures sustainability and helps meet modern building standards, making prefabrication a preferred choice in technologically advanced construction projects. These factors positively influence the Prefabricated Building Systems industry outlook during the forecast period.

Market Snapshot:

Prefabricated Building Systems Market — Report Coverage:

The “Prefabricated Building Systems Market Report — Forecast (2024–2030)” by IndustryARC, covers an in-depth analysis of the following segments in the Prefabricated Building Systems Market.

Rest of the World (Middle East and Africa).

COVID-19 / Ukraine Crisis — Impact Analysis:

• The COVID-19 pandemic had a mixed impact on the prefabricated building systems market. While the construction industry faced supply chain disruptions, labor shortages, and project delays, the demand for modular and prefabricated solutions grew as they offered faster, safer, and more efficient construction methods. With restrictions on traditional building sites, prefabrication gained traction as a method to reduce on-site workforce dependency, aligning with social distancing requirements.

The Ukraine crisis has influenced the prefabricated building systems market by disrupting supply chains, especially in Europe. Increased material costs and delays in manufacturing and transportation affected project timelines. However, prefabricated systems have been increasingly viewed as a solution for rapidly rebuilding infrastructure, including residential housing and public facilities. Their faster assembly time and reduced labor costs make them an appealing option in regions recovering from conflict-driven damage.

Inquiry Before Buying:

Key Takeaways:

North America is Projected as Fastest Growing Region

North America is projected as the fastest growing region in Prefabricated Building Systems Market with CAGR of 10.7% during the forecast period 2024–2030. The Prefabricated Building Systems market in North America is driven by the growing demand for efficient, cost-effective, and sustainable construction solutions. The need for affordable housing and increasing urbanization are key factors encouraging developers to adopt prefabricated methods for faster construction and reduced costs. According to the EIA in 2023, the U.S. produced approximately 102.83 quadrillion British thermal units (quads) of energy, surpassing its consumption of 93 quads. The region’s focus on sustainability and energy efficiency further aligns with the eco-friendly benefits of prefabricated buildings. Innovations in materials and construction technology continue to enhance the appeal of prefabricated systems across multiple sectors.

Cellular Systems Segment to Register the Fastest Growth

Cellular Systems segment is projected as the fastest growing segment in Prefabricated Building Systems Market with CAGR of 7.1% during the forecast period 2024–2030. Cellular systems in the prefabricated building systems market are experiencing strong demand driven by their flexibility, speed of construction, and cost-effectiveness. These systems, which involve pre-assembled modules such as rooms or pods, provide a streamlined solution for industries like healthcare, hospitality, and education. Their modular nature allows for easy customization and scalability, making them ideal for both temporary and permanent structures. The increasing need for rapid deployment of buildings, coupled with the growing preference for sustainable and efficient construction methods, is encouraging the adoption of cellular systems as a practical and reliable choice for various building projects.

Residential is Leading the Market

Residential held the largest market valuation in 2023. The residential sector in the prefabricated building systems market is fueled by the growing need for affordable and sustainable housing solutions. According to the UN, by 2050, 68% of the global population will reside in urban areas, adding 2.5 billion people. With limited space in cities, prefabricated homes present an efficient solution for rapid, cost-effective construction. These homes also prioritize energy efficiency, meeting the increasing demand for sustainable development. The speed of construction, combined with eco-friendly materials, supports developers’ goals of delivering quality, customizable housing options in shorter timeframes.

Schedule A Call :

Advancements in Construction Technology

Advancements in construction technology are driving the growth of prefabricated building systems by enhancing efficiency, precision, and customization. Innovations like Building Information Modeling (BIM), 3D printing, and automation have improved design accuracy and streamlined manufacturing processes. These technologies enable faster construction, reduced errors, and lower costs, making prefabricated systems an attractive alternative to traditional methods. The continuous evolution of materials and manufacturing techniques further strengthens the appeal of these systems in modern construction.

Buy Now :

High Initial Investment and Cost Barriers

The Prefabricated Building Systems Market faces significant challenges due to high initial investment required for setup and production. The manufacturing of prefabricated components demands specialized equipment, advanced technologies, and skilled labor, all of which contribute to high upfront costs. Additionally, the need for transportation and on-site assembly can further increase costs. These financial barriers may deter smaller developers and companies from adopting prefabricated building solutions, limiting market penetration.

Key Market Players:

Product/Service launches, approvals, patents and events, acquisitions, partnerships, and collaborations are key strategies adopted by players in the Prefabricated Building Systems Market. The top 10 companies in this industry are listed below: 1. Red Sea International 2. Algeco UK Limited 3. Champion Home Builders, Inc. 4. BlueScope Buildings North America, Inc. 5. Astron Buildings S.A. 6. Kirby Building Systems LLC 7. Lindal Cedar Homes, Inc. 8. Ritz-Craft Corporation 9. Modern Prefab Systems Pvt. Ltd. 10. Par-Kut International Inc.

For more Chemicals and Materials Market reports, Please click here

Prefabrication 🏗️ ModularConstruction 🏠 PrefabHomes 🏡 OffsiteConstruction 🏭 SustainableBuilding 🌱 ConstructionInnovation 🚀 ModernArchitecture 🏢

#Prefabrication 🏗️#ModularConstruction 🏠#PrefabHomes 🏡#OffsiteConstruction 🏭#SustainableBuilding 🌱#ConstructionInnovation 🚀#ModernArchitecture 🏢

0 notes

Text

Embedded Connectivity Solutions Market Size, Share, Demand, Future Growth, Challenges and Competitive Analysis

"Global Embedded Connectivity Solutions Market – Industry Trends and Forecast to 2028

Global Embedded Connectivity Solutions Market, By Technology (2G, 3G, 4G/LTE), Type (Hardware, Software, Others), Services (Over-The-Air Updates, Infotainment, Driver Assistance, Live Traffic Information, e-Call, Vehicle Self-Diagnosis, Intelligent Parking, Safety, Entertainment, Well-Being, Vehicle Management, Mobility Management), End-Users (OEM, Aftermarket), Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa) Industry Trends and Forecast to 2028

Access Full 350 Pages PDF Report @

**Segments**

- **By Component**: The embedded connectivity solutions market can be segmented based on components into hardware and software. Hardware components include microcontrollers, sensors, wireless modules, and other electronic components essential for establishing connectivity. On the other hand, software elements encompass firmware, protocols, and middleware that facilitate communication between different devices and systems.

- **By Connectivity Technology**: This market can also be segmented by connectivity technology, including Wi-Fi, Bluetooth, Zigbee, NFC, cellular networks (4G, 5G), Ethernet, and others. Each connectivity technology serves specific purposes and suits different applications within the embedded connectivity solutions landscape.

- **By Application**: Embedded connectivity solutions find applications across various industries such as automotive, healthcare, consumer electronics, industrial automation, smart cities, and others. These applications leverage connectivity solutions to enable communication, data transfer, and smart functionalities, enhancing overall operational efficiency and user experience.

**Market Players**

- **Texas Instruments Incorporated**: Texas Instruments offers a broad range of embedded connectivity solutions, including microcontrollers, wireless connectivity modules, and software to enable seamless integration in diverse applications.

- **NXP Semiconductors**: NXP Semiconductors is a key player in the embedded connectivity solutions market, providing secure connectivity solutions for automotive, industrial, and IoT applications.

- **STMicroelectronics**: STMicroelectronics offers a comprehensive portfolio of embedded connectivity solutions, including microcontrollers, sensors, and wireless connectivity solutions to address the evolving needs of the market.

- **Microchip Technology Inc.**: Microchip Technology specializes in providing embedded connectivity solutions such as Wi-Fi modules, Bluetooth modules, and microcontrollers for a wide range of applications.

- **Cypress Semiconductor Corporation**: Cypress Semiconductor is known for its reliable embedded connectivity solutions, offering a mix of hardware and software components tailored for IoT, automotive, and consumer electronics applications.

The embedded connectivity solutions market is witnessing significant growth driven by the increasing adoption of IoT devices, smart technologies, and connected systems across various industries. As demandThe embedded connectivity solutions market is experiencing substantial growth attributed to the proliferation of Internet of Things (IoT) devices and smart technologies across diverse industries. One of the key drivers of this market expansion is the rising demand for seamless connectivity solutions that enable devices to communicate and exchange data efficiently. Industries such as automotive, healthcare, consumer electronics, industrial automation, and smart cities are increasingly adopting embedded connectivity solutions to enhance operational efficiency, improve user experience, and enable innovative functionalities.

In terms of components, the market segmentation into hardware and software plays a crucial role in understanding the dynamics of embedded connectivity solutions. Hardware components, including microcontrollers, sensors, and wireless modules, form the backbone of connectivity infrastructure, enabling devices to establish networks and communicate with each other. On the other hand, software components such as firmware, protocols, and middleware are essential for enabling seamless communication and data transfer between diverse devices and systems. The synergistic interplay between hardware and software components is vital for the successful implementation of embedded connectivity solutions across different applications and industries.

Further segmentation based on connectivity technology provides insights into the diverse range of options available for establishing connections between devices. Wi-Fi, Bluetooth, Zigbee, NFC, cellular networks (4G, 5G), and Ethernet are some of the key connectivity technologies driving the embedded connectivity solutions market. Each technology has its unique features, advantages, and limitations, making them suitable for specific applications within the embedded connectivity landscape. For instance, Wi-Fi and Bluetooth are commonly used for short-range wireless communication in consumer electronics, while cellular networks like 5G are preferred for high-speed, long-distance connectivity in industrial and smart city applications.

Market players such as Texas Instruments Incorporated, NXP Semiconductors, STMicroelectronics, Microchip Technology Inc., and Cypress Semiconductor Corporation are leading the charge in offering innovative embedded connectivity solutions tailored to meet the evolving needs of industries embracing IoT and smart technologies. These companies provide a diverse portfolio of products, including microcontrollers, wireless modules, sensors, and software solutions**Global Embedded Connectivity Solutions Market Analysis**:

- **Technology**: The market for embedded connectivity solutions is witnessing rapid advancements in technology, with a focus on 2G, 3G, and 4G/LTE networks. These technologies are essential for establishing robust and reliable connections between devices, enabling seamless communication and data transfer across various industries.

- **Type**: The market segmentation based on type categorizes embedded connectivity solutions into hardware, software, and other components. Hardware components such as microcontrollers and wireless modules form the physical infrastructure of connectivity, whereas software elements like firmware and protocols play a crucial role in facilitating communication and data exchange between devices.

- **Services**: The services offered in the embedded connectivity solutions market include Over-The-Air updates, infotainment, driver assistance, live traffic information, e-Call, vehicle self-diagnosis, intelligent parking, safety, entertainment, well-being, vehicle management, and mobility management. These services enhance the overall functionality, performance, and user experience of connected devices and systems.

- **End-Users**: The end-users of embedded connectivity solutions include Original Equipment Manufacturers (OEM) and aftermarket providers. OEMs integrate embedded connectivity solutions into their products during the manufacturing process, while aftermarket providers offer connectivity solutions as add-on services or upgrades for existing devices and systems.

- **Country**: The market for embedded connectivity solutions is geographically segmented into regions such as the U.S., Canada, Mexico, Brazil, Argentina, Germany, Italy, U.K., France,

Key points covered in the report: -

The pivotal aspect considered in the global Embedded Connectivity Solutions Market report consists of the major competitors functioning in the global market.

The report includes profiles of companies with prominent positions in the global market.

The sales, corporate strategies and technical capabilities of key manufacturers are also mentioned in the report.

The driving factors for the growth of the global Embedded Connectivity Solutions Market are thoroughly explained along with in-depth descriptions of the industry end users.

The report also elucidates important application segments of the global market to readers/users.

This report performs a SWOT analysis of the market. In the final section, the report recalls the sentiments and perspectives of industry-prepared and trained experts.

The experts also evaluate the export/import policies that might propel the growth of the Global Embedded Connectivity Solutions Market.

The Global Embedded Connectivity Solutions Market report provides valuable information for policymakers, investors, stakeholders, service providers, producers, suppliers, and organizations operating in the industry and looking to purchase this research document.

What to Expect from the Report, a 7-Pointer Guide

The Embedded Connectivity Solutions Market report dives into the holistic Strategy and Innovation for this market ecosystem

The Embedded Connectivity Solutions Market report keenly isolates and upholds notable prominent market drivers and barriers

The Embedded Connectivity Solutions Market report sets clarity in identifying technological standardization as well as the regulatory

framework, besides significantly assessing various implementation models besides evaluation of numerous use cases

The Embedded Connectivity Solutions Market report is also a rich repository of crucial information across the industry, highlighting details on novel investments as well as stakeholders and relevant contributors and market participants.

A through market analytical survey and forecast references through the forecast tenure, encapsulating details on historical developments, concurrent events as well as future growth probability

Browse Trending Reports:

Meat Poultry And Seafood Processing Equipment Market Hemiballismus Treatment Market Fluid And Lubricant Market Virtual Infrastructure Manager Market Water Flosser Market Water Saving Shower Heads Market Galactoligosaccharides Market Rocky Mountain Spotted Fever Treatment Market Overhead Conveyor Market Olliers Disease Market Functional Bowel Disorder Agents Market Bio Based Leather Market Melanoma Cancer Diagnostics Market Intracranial Hematoma Drug Market Glucosinolates Market Autorefractor Keratometer Device Market Feed Mycotoxin Modifiers Market

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email: [email protected]"

0 notes

Text

AdLink I-Pi SMARC 1200 Plus DevKit With MediaTek Genio 1200

I-Pi SMARC 1200

AdLink I-Pi SMARC 1200 Plus DevKit, an octa-core MediaTek Genio 1200 processor-powered AI and graphics-focused solution. The octa-core Arm Cortex-A78 and Cortex-A55 CPUs in the Genio 1200 are paired with a 5-core Arm Mali-G57 GPU for cutting-edge 3D graphics and an embedded NPU that can handle up to 5 TOPS of edge AI data.

The on-device AI processing capabilities of the I-Pi SMARC 1200 include computer vision and deep learning neural network acceleration. Moreover, up to three MIPI camera inputs and several 4K displays are supported by the SMARC. For a variety of next-generation AI focused developments, including smart homes, industrial IoT, 3K multimedia apps, and human-machine interfaces, this is the go-to option. Product developers can explore new avenues and expedite proof of concept creation before production with the dev kit, which lowers costs and shortens time to market.

Pi SMARC 1200

MediaTek Genio 1200 platform

The Octa-core MediaTek MT8395 powering the LEC-MTK-I1200 module (Cortex-A78 x4 + A55 x4 in the arm)

The Smart Mobility Architecture, or SMARC Form Factor

SMARC 2.1 specification: a very small and power-efficient design appropriate for edge computing and embedded applications.

Due to its small size (82 x 80 mm), it is perfect for designs that need to save space, like industrial IoT systems, robotics, smart home appliances, and AI cameras.

All-encompassing Connectivity

Support for Bluetooth 5.2 and Wi-Fi 6 allows for fast wireless data transfer.

Support for optional 5G: Enables cellular high-speed connectivity for Internet of Things applications that need dependable network access.

Gigabit Ethernet: Quick connectivity for edge devices via wired networks.

Display and Graphics

Equipped with a Mali-G57 GPU, capable of encoding and decoding 4K60 HDR video.

There are several display interfaces available for connecting high-definition monitors and displays, including as HDMI, eDP, and MIPI DSI.

A Variety of I/O Interfaces

Peripheral connectivity via PCIe, USB 3.1, and I2C enables expansion with extra parts including cameras, sensors, and storage devices.

AI cameras can be connected via the MIPI CSI camera interface, which is helpful for robotics and smart surveillance applications.

AI & Machine Learning on the Edge