#Chicago Real Estate Prices

Text

Are Chicago Real Estate Prices Dropping?

Real estate prices in major cities like Chicago have recently become a topic of discussion. In this blog, we will dive into the question, “Are Chicago real estate prices dropping?” and explore the factors that may influence the trends for Chicago real estate prices in the upcoming year, including predictions on prices for 2023.

Factors Influencing Real Estate Prices in Chicago

Economic Situation

Primarily, in any location, including Chicago, real estate prices are affected by the city’s economic situation. With job opportunities and a vibrant local economy, demand for housing increases and prices tend to rise. It’s essential to keep an eye on Chicago’s overall economic health.

Inventory Levels

“For Sale” inventory levels also impact prices in Chicago. When there’s a low supply of available properties, prices increase due to higher competition. Conversely, a surplus of properties can lead to lower prices as a result of an excessive supply.

Population Growth

Population growth in Chicago directly impacts the demand for housing. As more people move to the city, the need for homes rises, leading to increased competition and potentially higher prices.

Monitoring population trends is crucial for predicting the property market direction.

Current Trends in Chicago Real Estate Prices

At the moment, Chicago’s real estate market shows mixed signals. Some experts suggest a slight cooling in certain neighborhoods, while others see stability or even growth.

Neighborhood Variations

Variations exist between different neighborhoods in the target Location. Real estate prices may drop in some regions while rising in others. It’s essential to evaluate neighborhood-specific data when searching for properties in the Chicagoland area and surrounding suburbs.

Affordability Index

Affordability levels can impact the city’s real estate prices. As housing becomes less affordable for the average person, the demand for homes may lessen, eventually causing prices to fall.

Interest Rates

Mortgage interest rates play a crucial role in the Target Location real estate market. High interest rates reduce purchasing power, potentially leading to a drop in property prices.

On the other hand, low interest rates often result in more buyers, supporting higher real estate prices.

Chicago Real Estate Prices in 2023: What to Expect

Predicting future real estate prices isn’t an easy task. However, some factors may potentially influence the prices of properties in Chicago in 2023.

Economic Recovery

The global pandemic impacted the economy in many areas, and Chicago was not an exception. As the economic recovery picks up, predicting future real estate prices becomes challenging, especially two years down the road.

The growth and diversification of Chicago’s industries could influence housing demand and supply.

Gentrification

Gentrification in Chicago has been a well-documented phenomenon. Historically, gentrified neighborhoods experience real estate price increases. It’s vital to analyze trends and patterns in gentrification to predict how it may affect real estate prices in 2023.

Continued Urbanization

Urbanization trends suggest that cities like Chicago will continue to grow, potentially increasing demand for housing. With an increase in demand, it’s possible that real estate prices could rise in the future.

In conclusion, the answer to the question, “Are Chicago real estate prices dropping?” is not a simple “yes” or “no.” Factors such as the economic situation, inventory levels, and population growth all have a direct impact on real estate prices in this vibrant city.

While some may argue that certain neighborhoods potentially experience a slight decline in property prices, others may maintain stability or growth. As for predicting real estate prices for 2023 and next year, professionals should closely monitor economic recovery, gentrification, and urbanization trends.

Ultimately, thorough research and understanding of the complexities of real estate in Chicago will help investors make better decisions.

Schedule a free consultation with KM Realty Group LLC’s real estate agents using our online form or give us a call now at (312) 283–0794!

#Real Estate Prices#Chicago Property Prices#Home Price#Housing Market#Real Estate Market#Chicago Housing#Chicago Real Estate Prices

0 notes

Text

No, Uber's (still) not profitable

Going to Defcon this weekend? I'm giving a keynote, "An Audacious Plan to Halt the Internet's Enshittification and Throw it Into Reverse," on Saturday at 12:30pm, followed by a book signing at the No Starch Press booth at 2:30pm!

https://info.defcon.org/event/?id=50826

Bezzle (n):

1. "the magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it" (JK Gabraith)

2. Uber.

Uber was, is, and always will be a bezzle. There are just intrinsic limitations to the profits available to operating a taxi fleet, even if you can misclassify your employees as contractors and steal their wages, even as you force them to bear the cost of buying and maintaining your taxis.

The magic of early Uber – when taxi rides were incredibly cheap, and there were always cars available, and drivers made generous livings behind the wheel – wasn't magic at all. It was just predatory pricing.

Uber lost $0.41 on every dollar they brought in, lighting $33b of its investors' cash on fire. Most of that money came from the Saudi royals, funneled through Softbank, who brought you such bezzles as WeWork – a boring real-estate company masquerading as a high-growth tech company, just as Uber was a boring taxi company masquerading as a tech company.

Predatory pricing used to be illegal, but Chicago School economists convinced judges to stop enforcing the law on the grounds that predatory pricing was impossible because no rational actor would choose to lose money. They (willfully) ignored the obvious possibility that a VC fund could invest in a money-losing business and use predatory pricing to convince retail investors that a pile of shit of sufficient size must have a pony under it somewhere.

This venture predation let investors – like Prince Bone Saw – cash out to suckers, leaving behind a money-losing business that had to invent ever-sweatier accounting tricks and implausible narratives to keep the suckers on the line while they blew town. A bezzle, in other words:

https://pluralistic.net/2023/05/19/fake-it-till-you-make-it/#millennial-lifestyle-subsidy

Uber is a true bezzle innovator, coming up with all kinds of fairy tales and sci-fi gimmicks to explain how they would convert their money-loser into a profitable business. They spent $2.5b on self-driving cars, producing a vehicle whose mean distance between fatal crashes was half a mile. Then they paid another company $400 million to take this self-licking ice-cream cone off their hands:

https://pluralistic.net/2022/10/09/herbies-revenge/#100-billion-here-100-billion-there-pretty-soon-youre-talking-real-money

Amazingly, self-driving cars were among the more plausible of Uber's plans. They pissed away hundreds of millions on California's Proposition 22 to institutionalize worker misclassification, only to have the rule struck down because they couldn't be bothered to draft it properly. Then they did it again in Massachusetts:

https://pluralistic.net/2022/06/15/simple-as-abc/#a-big-ask

Remember when Uber was going to plug the holes in its balance sheet with flying cars? Flying cars! Maybe they were just trying to soften us up for their IPO, where they advised investors that the only way they'd ever be profitable is if they could replace every train, bus and tram ride in the world:

https://48hills.org/2019/05/ubers-plans-include-attacking-public-transit/

Honestly, the only way that seems remotely plausible is when it's put next to flying cars for comparison. I guess we can be grateful that they never promised us jetpacks, or, you know, teleportation. Just imagine the market opportunity they could have ascribed to astral projection!

Narrative capitalism has its limits. Once Uber went public, it had to produce financial disclosures that showed the line going up, lest the bezzle come to an end. These balance-sheet tricks were as varied as they were transparent, but the financial press kept falling for them, serving as dutiful stenographers for a string of triumphant press-releases announcing Uber's long-delayed entry into the league of companies that don't lose more money every single day.

One person Uber has never fooled is Hubert Horan, a transportation analyst with decades of experience who's had Uber's number since the very start, and who has done yeoman service puncturing every one of these financial "disclosures," methodically sifting through the pile of shit to prove that there is no pony hiding in it.

In 2021, Horan showed how Uber had burned through nearly all of its cash reserves, signaling an end to its subsidy for drivers and rides, which would also inevitably end the bezzle:

https://pluralistic.net/2021/08/10/unter/#bezzle-no-more

In mid, 2022, Horan showed how the "profit" Uber trumpeted came from selling off failed companies it had acquired to other dying rideshare companies, which paid in their own grossly inflated stock:

https://pluralistic.net/2022/08/05/a-lousy-taxi/#a-giant-asterisk

At the end of 2022, Horan showed how Uber invented a made-up, nonstandard metric, called "EBITDA profitability," which allowed them to lose billions and still declare themselves to be profitable, a lie that would have been obvious if they'd reported their earnings using Generally Accepted Accounting Principles (GAAP):

https://pluralistic.net/2022/02/11/bezzlers-gonna-bezzle/#gryft

Like clockwork, Uber has just announced – once again – that it is profitable, and once again, the press has credulously repeated the claim. So once again, Horan has published one of his magisterial debunkings on Naked Capitalism:

https://www.nakedcapitalism.com/2023/08/hubert-horan-can-uber-ever-deliver-part-thirty-three-uber-isnt-really-profitable-yet-but-is-getting-closer-the-antitrust-case-against-uber.html

Uber's $394m gains this quarter come from paper gains to untradable shares in its loss-making rivals – Didi, Grab, Aurora – who swapped stock with Uber in exchange for Uber's own loss-making overseas divisions. Yes, it's that stupid: Uber holds shares in dying companies that no one wants to buy. It declared those shares to have gained value, and on that basis, reported a profit.

Truly, any big number multiplied by an imaginary number can be turned into an even bigger number.

Now, Uber also reported "margin improvements" – that is, it says that it loses less on every journey. But it didn't explain how it made those improvements. But we know how the company did it: they made rides more expensive and cut the pay to their drivers. A 2.9m ride in Manhattan is now $50 – if you get a bargain! The base price is more like $70:

https://www.wired.com/story/uber-ceo-will-always-say-his-company-sucks/

The number of Uber drivers on the road has a direct relationship to the pay Uber offers those drivers. But that pay has been steeply declining, and with it, the availability of Ubers. A couple weeks ago, I found myself at the Burbank train station unable to get an Uber at all, with the app timing out repeatedly and announcing "no drivers available."

Normally, you can get a yellow taxi at the station, but years of Uber's predatory pricing has caused a drawdown of the local taxi-fleet, so there were no taxis available at the cab-rank or by dispatch. It took me an hour to get a cab home. Uber's bezzle destroyed local taxis and local transit – and replaced them with worse taxis that cost more.

Uber won't say why its margins are improving, but it can't be coming from scale. Before the pandemic, Uber had far more rides, and worse margins. Uber has diseconomies of scale: when you lose money on every ride, adding more rides increases your losses, not your profits.

Meanwhile, Lyft – Uber's also-ran competitor – saw its margins worsen over the same period. Lyft has always been worse at lying about it finances than Uber, but it is in essentially the exact same business (right down to the drivers and cars – many drivers have both apps on their phones). So Lyft's financials offer a good peek at Uber's true earnings picture.

Lyft is actually slightly better off than Uber overall. It spent less money on expensive props for its long con – flying cars, robotaxis, scooters, overseas clones – and abandoned them before Uber did. Lyft also fired 24% of its staff at the end of 2022, which should have improved its margins by cutting its costs.

Uber pays its drivers less. Like Lyft, Uber practices algorithmic wage discrimination, Veena Dubal's term describing the illegal practice of offering workers different payouts for the same work. Uber's algorithm seeks out "pickers" who are choosy about which rides they take, and converts them to "ants" (who take every ride offered) by paying them more for the same job, until they drop all their other gigs, whereupon the algorithm cuts their pay back to the rates paid to ants:

https://pluralistic.net/2023/04/12/algorithmic-wage-discrimination/#fishers-of-men

All told, wage theft and wage cuts by Uber transferred $1b/quarter from labor to Uber's shareholders. Historically, Uber linked fares to driver pay – think of surge pricing, where Uber charged riders more for peak times and passed some of that premium onto drivers. But now Uber trumpets a custom pricing algorithm that is the inverse of its driver payment system, calculating riders' willingness to pay and repricing every ride based on how desperate they think you are.

This pricing is a per se antitrust violation of Section 2 of the Sherman Act, America's original antitrust law. That's important because Sherman 2 is one of the few antitrust laws that we never stopped enforcing, unlike the laws banning predator pricing:

https://ilr.law.uiowa.edu/sites/ilr.law.uiowa.edu/files/2023-02/Woodcock.pdf

Uber claims an 11% margin improvement. 6-7% of that comes from algorithmic price discrimination and service cutbacks, letting it take 29% of every dollar the driver earns (up from 22%). Uber CEO Dara Khosrowshahi himself says that this is as high as the take can get – over 30%, and drivers will delete the app.

Uber's food delivery service – a baling wire-and-spit Frankenstein's monster of several food apps it bought and glued together – is a loser even by the standards of the sector, which is unprofitable as a whole and experiencing an unbroken slide of declining demand.

Put it all together and you get a picture of the kind of taxi company Uber really is: one that charges more than traditional cabs, pays drivers less, and has fewer cars on the road at times of peak demand, especially in the neighborhoods that traditional taxis had always underserved. In other words, Uber has broken every one of its promises.

We replaced the "evil taxi cartel" with an "evil taxi monopolist." And it's still losing money.

Even if Lyft goes under – as seems inevitable – Uber can't attain real profitability by scooping up its passengers and drivers. When you're losing money on every ride, you just can't make it up in volume.

Image: JERRYE AND ROY KLOTZ MD (modified) https://commons.wikimedia.org/wiki/File:LA_BREA_TAR_PITS,_LOS_ANGELES.jpg

CC BY-SA 3.0 https://creativecommons.org/licenses/by-sa/3.0/deed.en

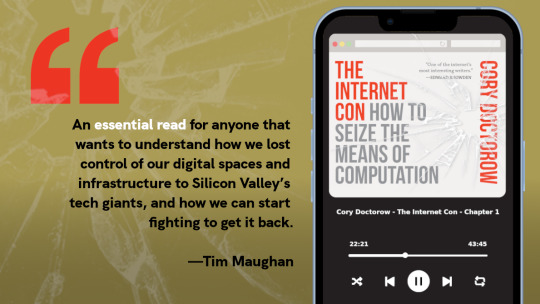

I’m kickstarting the audiobook for “The Internet Con: How To Seize the Means of Computation,” a Big Tech disassembly manual to disenshittify the web and bring back the old, good internet. It’s a DRM-free book, which means Audible won’t carry it, so this crowdfunder is essential. Back now to get the audio, Verso hardcover and ebook:

http://seizethemeansofcomputation.org

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/08/09/accounting-gimmicks/#unter

Image:

JERRYE AND ROY KLOTZ MD (modified)

https://commons.wikimedia.org/wiki/File:LA_BREA_TAR_PITS,_LOS_ANGELES.jpg

CC BY-SA 3.0

https://creativecommons.org/licenses/by-sa/3.0/deed.en

#pluralistic#bezzles#hubert horan#uber#rideshare#accounting tricks#financial engineering#late-stage capitalism#narrative capitalism#lyft#transit#uber eats#venture predation#algorithmic wage discrimination

1K notes

·

View notes

Text

once again punishing myself by looking a Chicago real estate... I could get a beautiful condo with floor-to-ceiling lake views for the price of like a normal house here

3 notes

·

View notes

Photo

SALE IMAGE: Kyle Grant DATE: 01/23/2024 ADDRESS: 4120 Enterprise Avenue MARKET: Naples ASSET TYPE: Industrial BUYER: Kyle Grant - Venture One SELLER: David & Neil Braverman - Naples Industrial Estates LLC SALE PRICE: $17,000,000 SF: 83,500 ~ PPSF: $204 NOTE: Chicago-based private equity firm Venture One has acquired two industrial buildings in East Naples for $17 million, totaling 83,500 square feet. Focused on infill locations, Venture One plans to continue operating the properties in line with its specialization in industrial real estate. #Miami #RealEstate #tradedmia #MIA #Naples #Industrial #DavidBraverman #NeilBraverman #NaplesIndustrialEstatesLLC #KyleGrant #VentureOne

#Miami#RealEstate#tradedmia#MIA#Naples#Industrial#DavidBraverman#NeilBraverman#NaplesIndustrialEstatesLLC#KyleGrant#VentureOne

3 notes

·

View notes

Text

The distribution of earnings among workers in the top 10% of the income distribution has become increasingly unequal over the past 40 years. Using labor market data from 1980 to 2014, Joshua Gottlieb of the University of Chicago and co-authors find that this largely reflects widening inequality within occupations, rather than between occupations. The authors argue that an increase in income inequality in one occupation can spill over through consumption to other occupations that provide “non-divisible” services (such as physicians, dentists, and real estate agents). In other words, the best physicians and real estate agents charge higher prices when income inequality rises, creating higher within-profession income inequality at the top.

4 notes

·

View notes

Photo

🚨 Auction Alert 🚨 ** Bidding Closes TODAY 12:20 PM CST** I’m excited to announce that a prime 17.25-acre residential development property at 150 Harbor Club Dr, Hobart, IN, is going to auction! 🏘️ This is a rare opportunity to acquire land within The Brickyard of Hidden Lake Subdivision, featuring 48 platted lots, including coveted lakefront property. 🌊 Key Highlights: * Mixed Neighborhood Residential Zoning: Perfect for low- to medium-density housing. * Prime Location: Just 39 miles southeast of Chicago. * Thriving Market: Hobart is experiencing strong demand and growth, with a median home price of $237,300. 📅 Auction Bidding Starts: September 23 at 11:00 AM. Don’t miss out on this incredible development opportunity! Click the link to learn more and register to bid. https://www.crexi.com/properties/1646245/indiana-the-brickyard-of-hidden-lake Contact Information: Randolph Taylor, CCIM Commercial Real Estate Broker eXp Commercial-Chicago 📞 630-474-6441 📧 [email protected] #realestate #auction #developmentopportunity #HobartIN #investment #commercialrealestate #eXpCommercial

0 notes

Text

Redfin Real Estate Agents Scraping

Redfin Real Estate Agents Scraping by DataScrapingServices.com

In the competitive world of real estate, having access to detailed and accurate data is crucial for making informed decisions and staying ahead of the competition. Redfin, a well-known real estate brokerage, offers a wealth of information on real estate agents, properties, and market trends. By leveraging Redfin Real Estate Agents Scraping services from DataScrapingServices.com, businesses can access a comprehensive database of real estate agents' information, enhancing their marketing efforts and strategic planning.

List of Data Fields

When scraping data from Redfin, DataScrapingServices.com ensures that you receive a wide array of essential data fields, including:

Agent Name: The full name of the real estate agent.

Contact Information: Email addresses and phone numbers for direct communication.

Agency/Office Details: The name and address of the agency or office the agent is affiliated with.

Specializations: Areas of expertise such as residential, commercial, rental properties, etc.

Years of Experience: Information on the agent’s experience in the real estate industry.

Active Listings: Current property listings managed by the agent.

Customer Reviews and Ratings: Feedback from clients that reflects the agent’s performance and reputation.

Social Media Profiles: Links to the agent’s social media accounts for additional insights.

Benefits of Redfin Real Estate Agents Scraping

Utilizing Redfin Real Estate Agents Scraping services from DataScrapingServices.com offers numerous benefits:

1. Enhanced Marketing Campaigns: With detailed information on real estate agents, businesses can tailor their marketing campaigns to target specific agents who are most likely to be interested in their services or properties. This targeted approach increases the effectiveness of marketing efforts and maximizes ROI.

2. Improved Networking: Access to comprehensive agent profiles allows businesses to establish connections with top-performing agents. Building strong relationships with these agents can lead to fruitful collaborations, referrals, and increased business opportunities.

3. Competitive Analysis: By analyzing the data on various agents, businesses can gain insights into the competition. Understanding the strengths and weaknesses of competitors helps in refining strategies and staying ahead in the market.

4. Data-Driven Decision Making: Having accurate and up-to-date information at your fingertips enables businesses to make informed decisions. Whether it’s selecting the right agents to partner with or identifying emerging market trends, data-driven decisions lead to better outcomes.

5. Time and Cost Efficiency: Automating the data extraction process saves valuable time and resources. Instead of manually collecting and organizing data, businesses can rely on automated scraping services to gather accurate information quickly and efficiently.

Best Real Estate Data Scraping Service Provider

Realestate.com.au Property Listings Scraping

Realtor.com Property Data Extraction

PropertyGuru Property Data Scraping

Scraping Compass.com Property Listings

Scraping RealtyTrac Real Estate Listings

Property.com.au Real Estate Data Scraping

Gumtree Property Ads Scraping

Nestoria.co.uk Property Price Scraping

PrimeLocation Property Data Extraction

PropertyValue.com.au Property Listings Scraping

Best Redfin Real Estate Agents Scraping Services in USA:

Chicago, Fort Worth, Kansas City, Orlando, Sacramento, Indianapolis, San Francisco, Austin, Philadelphia, Houston, Omaha, Mesa, Washington, Bakersfield, San Diego, Raleigh, New Orleans, Virginia Beach, Colorado, Fresno, El Paso, Long Beach, Nashville, Jacksonville, San Francisco, Atlanta, Memphis, San Antonio, Columbus, Milwaukee, Louisville, Seattle, Sacramento, Dallas, Boston, Long Beach, Colorado, Albuquerque, Wichita, Tulsa, Las Vegas, Denver, Fresno, Orlando, Charlotte, Oklahoma City, San Jose, Tucson and New York.

Conclusion

Redfin Real Estate Agents Scraping by DataScrapingServices.com is an invaluable resource for businesses in the real estate industry. By providing detailed and accurate data on real estate agents, this service enhances marketing efforts, improves networking opportunities, and enables data-driven decision-making. With a comprehensive database at your disposal, your business can stay competitive, build strong relationships, and achieve greater success in the dynamic real estate market. Contact DataScrapingServices.com today to learn more about how our scraping services can benefit your business.

Website: Datascrapingservices.com

Email: [email protected]

#redfinrealestateagentsscraping#redfinrealtorsdatascraping#scrapingpropertyaurealestatelistings#realtorpropertylistingdatascraping#realestatedatascrapingservices#datascrapingservices#webscrapingexpert#websitedatascraping

0 notes

Text

Opportunistic Purchase of Building on Chicago’s “Magnificent Mile”

In August 2024, one of the most historic retail and office properties along Chicago’s “Magnificent Mile” changed hands. In a deal that has implications for the local real estate market, North American Real Estate, a Chicago-based company, purchased the landmark building at 605 North Michigan Avenue from NY-based Brookfield Properties. The transaction was executed at $47 million, which amounts to $691 per square foot. This was a steep discount from its 2016 value.

The four-story, 68,000-square-foot building features distinctive Gothic columns and occupies a central location at the Michigan Avenue and Ohio Street intersection. Among its major tenants are Chase, the architectural firm KTGY, and Sephora. The co-working company Regus recently left, leaving several vacancies on the upper floors.

The purchase was 66 percent less than its most recent selling price of $140 million in 2016. Given sustained weakness in the office and commercial markets following the pandemic, it’s indicative of the type of opportunistic purchase of distressed properties that are currently on the rise. To market watchers, the deal reflects “contrarian optimism” for Chicago’s central business district, which presents the unique opportunity for revitalization, as new tenants, attracted by reasonable rates, repopulate office space.

0 notes

Text

Is Chicago, Illinois Cheap or Expensive? Here’s the Answer.

If you’re mulling over a move to this bustling metropolis and scanning the “real estate for sale in Chicago, Illinois”, you’re likely curious: Is Chicago cheap or expensive?

Housing Costs in Chicago

When it comes to the housing market, the prices are as diverse as the city itself. A general consensus shows moderate costs compared to coastal cities.

Chicago’s Real Estate Market

From luxury condos downtown to single-family houses in the suburbs, Chicago has a range of accommodation styles. Naturally, the cost varies depending on the type and location.

Luxury Living in Chicago

If you opt for the high-end spectrum of “new properties for sale in the Chicagoland area and surrounding suburbs,” prices can reach into the millions.

Middle-of-the-pack Living

For more modest budgets, homes outside the hub can be attractively priced, providing excellent value in terms of space and amenities.

Cost of Living Index

Considering other living costs, Chicago’s index stands at 106.9, slightly above the U.S. average of 100. While some areas could be expensive, others are surprisingly affordable.

Food and Leisure Prices

Dining out in Chicago can be both a bargain and a splurge. Street food is wallet-friendly, whereas fine dining experiences can be quite steep.

Transportation Costs in Chicago

Getting around Chicago with public transit systems is reasonable. Meanwhile, parking and gas prices can significantly increase the commuting costs for car owners.

Verdict: Cheap or Expensive?

As seen, it completely depends on your lifestyle and where you choose to live and dine. By researching and budgeting, it’s possible to find cost-effective solutions.

Find Your Preferred Lifestyle

The housing options align with a wide range of budgets, whether you’re browsing budget-friendly homes or looking for extravagant properties for sale in the Chicagoland area and surrounding suburbs.

In Summary

Ultimately, living in Chicago can be cheap, expensive, or somewhere in between, factoring in your individual budget, lifestyle, and specific choices — particularly in housing.

KM Realty Group LLC — your trusted source for all your real estate needs in Chicago, Illinois!

#Illinois”#Housing Costs in Chicago#When it comes to the housing market#the prices are as diverse as the city itself. A general consensus shows moderate costs compared to coastal cities.#Chicago’s Real Estate Market#From luxury condos downtown to single-family houses in the suburbs#Chicago has a range of accommodation styles. Naturally#the cost varies depending on the type and location.#Luxury Living in Chicago#If you opt for the high-end spectrum of “new properties for sale in the Chicagoland area and surrounding suburbs#” prices can reach into the millions.#Middle-of-the-pack Living#For more modest budgets#homes outside the hub can be attractively priced#providing excellent value in terms of space and amenities.#Cost of Living Index#Considering other living costs#Chicago’s index stands at 106.9#slightly above the U.S. average of 100. While some areas could be expensive#others are surprisingly affordable.#Food and Leisure Prices#Dining out in Chicago can be both a bargain and a splurge. Street food is wallet-friendly#whereas fine dining experiences can be quite steep.#Transportation Costs in Chicago#Getting around Chicago with public transit systems is reasonable. Meanwhile#parking and gas prices can significantly increase the commuting costs for car owners.#Verdict: Cheap or Expensive?#As seen#it completely depends on your lifestyle and where you choose to live and dine. By researching and budgeting#it’s possible to find cost-effective solutions.

0 notes

Text

This day in history

NEXT SATURDAY (July 20), I'm appearing in CHICAGO at Exile in Bookville.

#20yrsago Differences between WorldCon and the DNC https://www.mcfi.org/noreascon4/not-the-dnc.html

#15yrsago Top Shelf Jazz’s “Fast and Louche” — part Cab Calloway, part Atomic Fireballs, all good smutty Prohibition jazz https://memex.craphound.com/2009/07/15/top-shelf-jazzs-fast-and-louche-part-cab-calloway-part-atomic-fireballs-all-good-smutty-prohibition-jazz/

#15yrsago RIP, Phyllis Gotleib, the mother of Canadian science fiction https://memex.craphound.com/2009/07/15/rip-phyllis-gotleib-the-mother-of-canadian-science-fiction/

#15yrsago Kathe Koja’s KISSING THE BEE audiobook: betrayal and emotional whirlwinds told with originality and subtlety https://memex.craphound.com/2009/07/15/kathe-kojas-kissing-the-bee-audiobook-betrayal-and-emotional-whirlwinds-told-with-originality-and-subtlety/

#10yrsago The Shadow Hero: giving an origin story to comics’ first Asian-American superhero https://memex.craphound.com/2014/07/15/the-shadow-hero-giving-an-origin-story-to-comics-first-asian-american-superhero/

#5yrsago Ex-Fox & Friends host, accused of a Ponzi scheme that turned Indianapolis real-estate investors into slumlords, moves to Portugal https://www.indystar.com/story/news/2019/07/12/ex-fox-friends-host-clayton-morris-leaves-country-for-portugal-amid-fraud-allegations/1705521001/

#5yrsago 5G won’t fix America’s terrible broadband https://potsandpansbyccg.com/2019/07/11/will-broadband-go-wireless/?mc_cid=7a2fa307cd

#5yrsago Putting a price on our data won’t make the platforms stop abusing our privacy https://memex.craphound.com/2019/07/15/putting-a-price-on-our-data-wont-make-the-platforms-stop-abusing-our-privacy/

#5yrsago Presidential fundraising scorecard: who’s raising the most and who is most beholden to the ultra-wealthy and corporations? https://projects.propublica.org/itemizer/presidential-candidates/2020

#5yrsago Heirs’ property: how southern states allow white land developers to steal reconstruction-era land from Black families https://features.propublica.org/black-land-loss/heirs-property-rights-why-black-families-lose-land-south/#164706

#5yrsago The new £50 notes will feature Alan Turing (whilst HMG proposes bans on Turing complete computers AND working crypto) https://memex.craphound.com/2019/07/15/the-new-50-notes-will-feature-alan-turing-whilst-hmg-proposes-bans-on-turing-complete-computers-and-working-crypto/

#1yrago Linkty Dumpty https://pluralistic.net/2023/07/15/in-the-dumps/#what-vacation

Support me this summer on the Clarion Write-A-Thon and help raise money for the Clarion Science Fiction and Fantasy Writers' Workshop!

5 notes

·

View notes

Text

Amount of Home Equity You’ve Gained Over the Years

Highlights

Understand the power of homeowner tenure.

Witness your home’s value soar with time.

Learn how equity can shape your future moves.

Expert insights from real estate agents.

Owning a home is more than just having a place to live; it's an investment that grows over time. Many homeowners are surprised to learn just how much equity they've accumulated in their homes over the years.

But what exactly is home equity, and how does it grow?

Let's dive into the details with some simple words and helpful insights from real estate agents in Chicago, Illinois.

Home Equity: A Quick Overview

Home equity is the portion of your property that you truly "own." Think of it as the difference between the market value of your home and what you still owe on your mortgage.

As you pay down your mortgage and as your home's value increases, your equity grows. It's like a savings account that grows without you having to do a thing!

The Impact of Homeowner Tenure

One crucial factor affecting your equity is how long you’ve lived in your home, or your "homeowner tenure." In the past, people typically moved every six years.

Nowadays, the trend has shifted, with many staying in their homes for around ten years or more. This change is significant because the longer you stay, the more your equity builds up.

Every mortgage payment you make and every year that passes with the property value increasing, your stake in your home's value grows.

Price Appreciation Over Time

Another key element is how home prices appreciate over time. Even though real estate markets fluctuate, the general trend is upward.

For instance, homeowners who've stayed in their homes for five years might see their value increase by nearly 60%.

And for those who've been in their homes for 30 years?

The value could more than triple.

That’s a huge increase, turning your home into a valuable asset.

What This Means for You

So, why does all this matter? Well, your home's equity can significantly impact your life choices, especially when it comes to making big decisions like downsizing, relocating, or simply moving to be closer to loved ones.

Your accumulated equity could be the key to your next dream home or to finance other major life goals.

But, how do you know exactly how much equity you've built up? That's where professional real estate agents in Chicago, Illinois, come in.

They can provide you with a detailed analysis of your home’s current market value compared to your remaining mortgage balance, giving you a clear picture of your equity.

youtube

Moving Forward with Your Equity

If you're curious about your home's equity and considering your next steps, connecting with knowledgeable Realtors can make all the difference.

They can guide you through the process of evaluating your options, whether you're thinking about selling your home to cash in on that equity or leveraging it towards purchasing your next property.

Bottom Line: Real Estate Experts Saying

Your home is more than just a living space; it's a financial cornerstone. Over the years, as you've lived, laughed, and maybe even cried within its walls, your home has been busy working for you, increasing in value and growing your equity.

Understanding and tapping into this equity could open new doors for your future.

Interested in exploring your home's equity further? Reach out to a trusted real estate agency or agent in your area. Their expertise can provide you with the insights you need to make informed decisions about your home and your future.

This simplified guide sheds light on the concept of home equity and its significance over time. By considering factors like homeowner tenure and price appreciation, it illustrates how your home can become a substantial financial asset, guiding important life decisions and future investments.

Here’s real-time data with graphs!

#homeequity#homesvalue#realestateagents#propertyvalue#realestatemarkets#dreamhome#sellingyourhome#homes

0 notes

Photo

SALE IMAGE: Brian W. Wood, Debra A. Cafaro & Curt Schaller DATE: 09/11/2024 ADDRESS: 9130 Hypoluxo Road MARKET: Lake Worth ASSET TYPE: Senior Housing ~ BEDS: 377 ~ ACRES: 22.5 BUYER: Curt Schaller - Focus Healthcare Partners SELLER: Brian W. Wood & Debra A. Cafaro - Ventas LENDER: JLL Capital Real Estate (@JLL) SALE PRICE: $63,770,000 UNITS: 313 ~ PPU: $203,738 SF: 410,663 ~ PPSF: $155 NOTE: Chicago-based Ventas' BRP Senior Housing LLC sold the 377-bed Mariposa senior living facility near Lake Worth Beach for $63.77 million to Focus Healthcare Partners' FFII Mariposa Owner LLC. The buyer secured a $48 million mortgage and took over operations of the 2017-built property, which spans 410,663 square feet and includes assisted living, independent living, and memory care units. #Miami #RealEstate #tradedmia #MIA #TradedPartner #LakeWorth #SeniorHousing #BrianWWood #Ventas #CurtSchaller #FocusHealthcarePartners #JLLCapitalRealEstate #DebraACafaro

#Miami#RealEstate#tradedmia#MIA#TradedPartner#LakeWorth#SeniorHousing#BrianWWood#Ventas#CurtSchaller#FocusHealthcarePartners#JLLCapitalRealEstate#DebraACafaro

0 notes

Text

Comprehensive Guide to Selling A Property in Dubai

Selling a property in Dubai can be a rewarding venture, given the dynamic real estate market and the city’s global appeal. However, navigating the process requires careful planning, market knowledge, and adherence to local regulations. This comprehensive guide provides step-by-step instructions to help you successfully sell your property in Dubai says, Omar Hussain Chicago.

1. Understand the Market

a. Market Research

Start by conducting thorough market research to understand current trends, property prices, and demand in your area. Use online property portals, consult with real estate agents, and review market reports from reputable sources like the Dubai Land Department (DLD).

b. Timing

Consider the timing of your sale. Market conditions can vary throughout the year, with certain periods being more favorable for selling. For example, the winter months often see higher activity due to the pleasant weather attracting more potential buyers.

2. Prepare Your Property for Sale

a. Maintenance and Repairs

Ensure your property is in excellent condition to attract potential buyers and justify your asking price. Address any maintenance issues, make necessary repairs, and consider a fresh coat of paint to enhance its appeal.

b. Staging

Staging your property can significantly impact buyers’ perceptions. Arrange furniture and decor to showcase the space’s potential, making it easier for buyers to envision themselves living there. Professional staging services can help optimize the presentation.

3. Set the Right Price

a. Property Valuation

Omar Hussain: Obtain a professional property valuation to determine a realistic and competitive asking price. Factors influencing the valuation include location, size, condition, amenities, and recent sale prices of similar properties in the area.

b. Competitive Pricing

While setting your price, consider market conditions and comparable properties. Pricing your property competitively can attract more interest and lead to quicker sales.

4. Legal and Regulatory Requirements

a. Title Deed and Documentation

Ensure you have all necessary documentation in order, including the Title Deed, property registration, and identification documents. The Title Deed must be clear and free of any encumbrances or disputes.

b. No Objection Certificate (NOC)

If your property is in a freehold area, obtain a No Objection Certificate (NOC) from the developer or property management company. This document confirms there are no outstanding payments or issues related to the property.

5. Marketing Your Property

a. Real Estate Agents

Consider hiring a licensed real estate agent to market your property. An experienced agent can provide valuable market insights, handle negotiations, and reach a broader audience through their network.

b. Online Listings

List your property on popular real estate websites and portals in Dubai. Ensure your listing includes high-quality photos, a detailed description, and key features that highlight the property’s unique selling points.

c. Social Media and Advertising

Utilize social media platforms and targeted advertising to reach potential buyers. Create engaging posts and ads showcasing your property and its features.

6. Negotiation and Offers

a. Handling Offers

Review offers carefully, considering not only the price but also the terms and conditions. Be prepared for negotiations, and work with your real estate agent to evaluate each offer’s merits.

b. Counteroffers

If an offer is close to your desired price but not quite there, consider making a counteroffer. This shows your willingness to negotiate while aiming to achieve your target price.

7. Finalizing the Sale

a. Sales and Purchase Agreement (SPA)

Once an offer is accepted, draft a Sales and Purchase Agreement (SPA). This legally binding document outlines the terms and conditions of the sale, including the purchase price, payment schedule, and handover date. It’s advisable to have a legal advisor review the SPA to ensure it complies with local laws and protects your interests.

b. Transfer of Ownership

The transfer of ownership is completed at the Dubai Land Department (DLD). Both the buyer and seller must be present or represented by their authorized agents. The process involves:

1. Obtaining a NOC: If not already obtained, secure a No Objection Certificate (NOC) from the developer.

2. Payment of Fees: Pay the necessary fees, including the DLD transfer fee (usually 4% of the property value) and any applicable administrative charges.

3. Signing the Transfer Documents: Both parties sign the transfer documents in the presence of a DLD representative.

4. Issuance of New Title Deed: The DLD issues a new Title Deed in the buyer’s name, completing the transfer process.

8. Financial Considerations

a. Closing Costs

Be aware of the closing costs associated with selling your property, including DLD fees, NOC charges, real estate agent commissions, and any outstanding service charges or utility bills.

b. Mortgage Settlement

If your property has an existing mortgage, arrange for its settlement before the transfer of ownership. Coordinate with your lender and the buyer to ensure a smooth process.

9. Post-Sale Responsibilities

a. Handover

Ensure a smooth handover of the property to the buyer. This includes transferring utility accounts, handing over keys, and providing any necessary documentation related to the property.

b. Tax Implications

While Dubai does not impose capital gains tax on property sales, be aware of any tax obligations in your home country if you are an expatriate or international seller.

10. Consider Professional Advice

a. Real Estate Agent

Working with a licensed real estate agent can streamline the selling process, providing market expertise, marketing strategies, and negotiatioan skills.

b. Legal Advisor

Engage a legal advisor to review all contracts and documents, ensuring compliance with local laws and protecting your interests throughout the sale process.

Omar Hussain Chicago: Selling a property in Dubai involves careful planning, market understanding, and adherence to legal requirements. By following this comprehensive guide, you can navigate the process confidently and maximize your property’s value. Whether you are a seasoned investor or a first-time seller, taking these steps will help you achieve a successful and profitable sale in Dubai’s dynamic real estate market.

Originally Posted: https://omarhussainchicago.com/comprehensive-guide-to-selling-property-in-dubai/

0 notes

Text

E-commerce Drives Industrial Demand in Q2, but Leasing Slows

Warehouse cap rates rose 23 basis points in Q2, averaging 6.42%, driven by sustained e-commerce and supply chain demands despite a slower leasing pace.

What Happened: Integra Realty Resources’ mid-year report highlights that e-commerce and supply chain demands are driving rent hikes in cities like Charlotte, Miami, Boise, and Phoenix. However, speculative construction and leasing have slowed since Q1 2024.

Higher Vacancy Rates Due to New Supply: Increased speculative development has led to higher vacancies in Chicago, Indianapolis, Dallas, and Los Angeles. Conversely, cities with limited new construction, such as Cleveland and Detroit, continue to maintain lower vacancy rates and price stability.

Investment Metrics:

Cap Rates: Warehouse cap rates rose 23 basis points to 6.42% nationally, with the largest increase in the East (up 44 basis points to 6.92%). Flex Industrial properties saw a rise of 17 basis points to 6.93%.

Market Rents: Warehouse rents grew by 3.06% to $7.57, and Flex properties increased by 2.91% to $12.00. The East led rent growth for Flex properties, with a 3.88% rise to $13.02.

Vacancy Rates: Warehouse vacancy rates rose 181 basis points to 6.30% nationally, while Flex properties saw a 100-basis-point rise to 6.96%. The West had the largest regional vacancy jump for warehouses, up 247 basis points to 6.49%.

Industrial markets with land constraints and available workforces, such as Chicago, Kansas City, Raleigh, and Northern New Jersey, continue to see rental growth due to infrastructure improvements. Additionally, adaptive reuse is gaining traction in urban areas where industrial land expansion is limited, driving up prices for remaining inventory.

What are your thoughts on the impact of e-commerce on industrial real estate? Share your insights in the comments below!

#commercial and industrial sectors#commercial real estate#real estate#investment#danielkaufmanrealestate#economy#real estate investing#construction

0 notes

Text

Moving to Crystal Lake IL? Heres 5 Tips You Must Know! | Tamara & Ozzie

Moving to Crystal Lake, IL? Here’s 5 Tips You Must Know! | Tamara & Ozzie

https://www.youtube.com/watch?v=OTpiPwPwfTQ

Are you thinking about moving to Crystal Lake, Illinois, in 2024? Before you make the move, there are some essential things you need to know about this charming suburb of Chicago. From understanding the local Homeowners Associations (HOAs) and navigating home prices to learning about property taxes, weather, and transportation, we cover it all in this video. Join us as we explore the ins and outs of Crystal Lake, helping you make a smooth transition to your new home!

In this video, we, Tamara and Ozzie from Century 21 New Heritage, share five crucial things you need to know before moving to Crystal Lake. Whether you're looking for information on the local real estate market or want to learn about the community's lifestyle, we've got you covered.

Make sure to watch until the end for our top tips and subscribe to our channel for more insights on living in Crystal Lake and other McHenry County communities!

#CrystalLakeIL #MovingToCrystalLake #RealEstateTips #IllinoisRealEstate #HomeBuyingTips #CrystalLakeLiving #McHenryCounty #HomeSellingTips #RelocatingToIllinois #TamaraAndOzzie #IllinoisHomes #PropertyTour #RealEstateAdvice #MovingTips2024 #HomebuyersGuide #CrystalLakeCommunity #TopNeighborhoods #HousingMarket2024 #ILRealEstateMarket #SuburbanLiving

via Moving to Illinois with Tamara & Ozzie https://www.youtube.com/channel/UCsxJCexscWIJEFcD8myJr4A

September 09, 2024 at 01:00PM

#propertytour#homeforsale#luxuryhome#luxuryrealestate#realestate#realestateagent#realestatetips#homeinvestment

0 notes