#Coins.ph

Photo

THIS JUST IN: 7-Eleven PH's cash-in kiosk to be disrupted between e-wallet services of GCash and Coins.PH [#OneNETnewsEXCLUSIVE]

DUMAGUETE, NEGROS ORIENTAL -- E-Wallet consumers of GCash and Coins.PH is currently facing major issues in cashing in their funds via 7-Eleven branches nationwide, including Negros Island region. This resulted in countless customers being left without access to their funds and a wave of complaints directed to 2 e-wallet services.

For those unaware of these two digital E-Wallet companies and a lone corporate convenience store, GCash is a mobile wallet in the Philippines that allows users to make payments, transfer funds, make purchases and pay bills using their smartphones. It was launched by Globe Telecom in 2004, which soon to be a 20th anniversary in 2024 and was since become a popular payment method in the country.

Coins.PH is a digital wallet and mobile app that allows users to buy, sell and transfer digital cryptocurrency, pay bills and buy goods. It was founded by Silicon Valley entrepreneurs named Ron Hose and Runar Petursson in 2014, and was also since become one of the leading digital wallets in the Philippines.

And, 7-Eleven is a Japanese-American chain of comfort shops based in 1927 in Dallas, Texas, United States of America (U.S.A.). They have started to grow for the American people and overseas globally in the 1960s. The shops had been firstly called "Tote'm Stores" due to the fact customers "toted" away their purchases, however the name was changed to 7-Eleven in 1946 to mirror the shops' prolonged hours - they had been open 7 days per week from 7am to 11pm. One decade and a half later, the aforementioned convenience store appeared in Japan in 1974, which became an international partnership, which was soon became one of the best convenience stores in the world.

GCash and Coins.PH revolutionizes the way Filipinos manage to financial, physical and cryptocurrency transactions, making more easily and conveniently through digital mobile application devices. Today, 7-Eleven operates nearly 70,000 stores in 17 international locations worldwide, including right here in our country itself and in Central, Eastern & Western Visayas.

Along the way, GCash and Coins.PH has acknowledged the issue, they have not yet come up with a concrete solution to the problem. The issue first surfaced on Sunday (April 16th, 2023 -- Dumaguete local time), when customers of both e-wallet services reported that they were unable to cash-in their funds through 7-Eleven branches. Many customers who tried to cash-in their funds received "404 error" message in kiosk machines that prevented them from accessing their funds.

OneNETnews reached out to the Philippines Seven Corporation (P7C) via E-Mail said in a statement: "We understand that you are trying to process a cash-in transaction using our kiosk machines and we apologize for any inconvenience that has furtherly caused. We highly encourage you to download the CLiQQ app as an alternative. The CLiQQ app is an official smartphone application for CLiQQ WiFi, rewards, and payments from 7-Eleven Philippines. You will no longer need to wait in line at the kiosk because you can now produce payment barcodes right at your own fingertips. You can also redeem your CLiQQ Rewards points for free in-store items or use them to order merchandise from the CLiQQ Grocery website".

The lack of communication and transparency from GCash and Coins.PH only makes matters worse. However, both companies have released an exclusive statement assuring customers that they are working to resolve the issue and restore access to all 7-Eleven locations nationwide.

According to the companies, they are investigating the situation and working with 7-Eleven Philippines to resolve the issue: "Our technical team has already identified the error and was able to work on the resolution for GCash and Coins.PH cash-in transactions. We sincerely apologize for that. We suggest you to download the CLiQQ app on the Apple and Google Play Store for more convenient experience". At this point, it is rarely unknown when the issue will be fully resolved.

As news of the issue spread, some customers took on social media to express their brazen & extreme frustration and anger. Many people complain about not being able to pay large bills and expenses such as Philippine Long Distance Telephone company (PLDT) and Metro Dumaguete Water for example, while others worry about their inability to transfer money to family members or loved ones in need.

In the meantime, customers of the 2 e-wallet services have been advised to look for the other cash-in methods, such as using physical banks like Rizal Commercial Banking Corporation (RCBC) and Union Bank of the Philippines (UBP) or cash-in touchpoints with the likes of TouchPay.

The case highlighting the importance of effective communication between E-Wallet service providers and their customers. As the popularity of e-wallets continues to grow in the Philippines, ensuring the reliability and accessibility of these digital services is more critical to maintaining consumer confidence.

PHOTO COURTESY: Rhayniel Saldasal Calimpong (Photojournalist, News Editor & News Presenter of OneNETnews)

-- OneNETnews Team

#local news#dumaguete#negros oriental#7-eleven#convenience store#e-wallet#GCash#Coins.PH#issues#cash-in#money#awareness#funds#exclusive#first and exclusive#OneNETnews

0 notes

Text

Pouch.ph names Coins.ph as co-presenter of the Philippines’ first-ever Bitcoin Island Retreat

Pouch.ph (“Pouch”), the first company in the Philippines to process payments utilizing bitcoin’s emerging payment standard, “The Lightning Network,” has partnered with Coins.ph, (“Coins”), the Philippines’ leading digital wallet provider and crypto exchange platform, to host the country’s first-ever Bitcoin Island Retreat in Boracay.

The inaugural event will be held on March 27 to 29, 2023,…

View On WordPress

0 notes

Text

08.28.2024

today’s the last day i’ll be handling and organizing an event at coins.ph.

the event is coinsgg, our first event outside the office, aside from bitcoin pizza day.

i arrived at the office around 2pm, and when i got there, my colleagues were kind of sad when they found out it’s my last 3 days at the office. so i told them to come to our event after work and let’s have a drink afterward.

tbh, i really didn’t expect they’d come, but to my surprise, they did drop by. even people who are not from our team, like the bd team! i was touched and really grateful to see them. manu even came and drank tequila with us. although he was going to drive and pick up his sister, he still made time to celebrate with me. he even hugged me and said goodbye.

i may no longer have many feelings for manu, but the fact that he showed up at my not-so-official despedida means a lot. he even asked to take a picture with me, ralph, and borj, the bd team i used to work closely with as a campaign specialist.

life happens, doesn’t it? time really is fleeting; one moment you’re just introducing yourself, and the next, you’re saying goodbye to the team. it’s kind of melancholic, but that’s the reality of life. people sometimes just pass through our lives, and we’ve got to wish them the best and root for them.

i don’t know what will happen to me in the next few days. i’m full of uncertainty, looking forward to the future with a mix of fear and excitement. i have many worries, but also many things to look forward to. i can’t wait to see what life has in store for me.

i am where i am supposed to be at the moment.

0 notes

Text

2 Russians Indicted In $6 Million Heist

The Department of Justice (DOJ) charged two former consultants for Coins.ph, a well-known crypto currency exchange, in an action shocking the Philippine bitcoin community. Russian nationals Vladimir Evgenevich Avdeev and Sergey Yaschuck are accused of launching a carefully thought out hack that led in the loss of an astounding 12.2 million XRP, valued at around PHP 340 million (about $7 million…

0 notes

Text

World's Gaming Titans Launch Next-Gen Platform CRETA in Manila, Announces Listing in Coins.ph

The world’s leading game creators have come together in the country to launch CRETA, a multiverse gaming entertainment platform and the latest product of their collaborative genius. The CRETA token will be listed on local cryptocurrency exchange Coins.ph starting July 8.

Thomas Vu, executive producer of global phenomenon League of Legends and Netflix’s Emmy-winning series Arcane, together with…

View On WordPress

0 notes

Text

Philippines SEC prepares to ban Binance in three months

Share this article

The Philippines Securities and Exchange Commission (PSEC) chair Kelvin Lee clarified in a panel hosted at Coins.ph on December 13, 2023, that the commission is preparing necessary steps to block and ban Binance in the country within three months.

According to a report from BitPinas, a Philippines-based crypto news publication, the panel was organized to clarify public…

View On WordPress

0 notes

Text

Global stablecoin firm Circle announced a new partnership with leading Philippine crypto platform Coins.ph to drive the adoption of USDC for payments and remittances.

The collaboration aims to leverage USDC’s speed and low cost to improve expensive traditional remittance channels for Filipinos. The Philippines receives over $36 billion in remittances annually.

However, current options like wire transfers involve high fees of up to 5.7% and slow settlement times. The partnership will promote USDC as a faster, more accessible alternative.

Also read: Shiba Inu Records Staggering 4.48 Trillion SHIB in Transaction Volume

The new partnership will boost USDC remittances

Educational initiatives will help Filipinos abroad learn to use USDC for smoother cross-border transfers. Circle and Coins.ph plan to highlight USDC’s utility for the unbanked, which account for 44% of Philippine adults.

With nearly 18 million users, Coins.ph can significantly expand access and visibility for USDC in the Philippine remittance corridors. Stablecoins like USDC offer a compelling payment rail for global money movement. Collaborations with local exchanges create an on-ramp for converting to fiat currency.

As Circle grows USDC’s presence worldwide, teaming with influential regional platforms like Coins.ph unlocks new real-world use cases beyond just trading. The partnership exemplifies the stablecoin’s expanding role in mainstream fintech.

0 notes

Text

O mercado de remessas, que consiste na transferência de dinheiro entre países, vem crescendo significativamente nos últimos anos. De acordo com o Banco Mundial, as remessas internacionais representam a maior fonte de fundos para os países em desenvolvimento, superando os investimentos estrangeiros diretos e a assistência oficial ao desenvolvimento. No entanto, esse setor ainda enfrenta desafios significativos, como altas taxas de transferência e tempos de transação demorados. É nesse contexto que a tecnologia blockchain surge como uma solução promissora.

O Problema das Remessas Tradicionais

Atualmente, enviar uma remessa internacional pode custar cerca de 7% do valor total, de acordo com o Banco Mundial. Considerando que o total de remessas feitas em todo o mundo atingiu US$ 689 bilhões em 2018, isso significa que aproximadamente US$ 48 bilhões são gastos em custos operacionais.

Além das altas taxas, o processo de remessa tradicional depende de serviços de terceiros e instituições financeiras, o que torna o sistema altamente ineficiente. As transferências podem levar dias ou até semanas para serem concluídas devido à necessidade de aprovação manual e à intervenção de vários intermediários.

Blockchain: A Solução para a Indústria de Remessas

A tecnologia blockchain tem o potencial de simplificar e agilizar o processo de remessas, eliminando intermediários desnecessários. Ao contrário dos serviços tradicionais, uma rede blockchain não depende de um processo lento de aprovação de transações, que geralmente passa por vários mediadores e requer trabalho manual.

Em vez disso, um sistema blockchain pode realizar transações financeiras globais com base em uma rede distribuída de computadores. Isso significa que vários computadores participam do processo de verificação e validação das transações, de forma descentralizada e segura. Comparada ao sistema bancário tradicional, a tecnologia blockchain pode fornecer soluções de pagamento mais rápidas e confiáveis a um custo muito menor.

Em resumo, a tecnologia blockchain pode resolver alguns dos principais problemas enfrentados pela indústria de remessas, como altas taxas e tempos de transação longos. Os custos operacionais podem ser reduzidos significativamente apenas pela diminuição do número de intermediários.

Casos de Uso da Tecnologia Blockchain nas Remessas

Aplicativos Móveis

Muitas empresas estão experimentando a tecnologia blockchain para oferecer soluções de pagamento inovadoras. Alguns aplicativos móveis de carteira de criptomoedas permitem que os usuários enviem e recebam ativos digitais em todo o mundo, além de realizar conversões rápidas entre criptomoedas e moedas fiduciárias.

A Coins.ph é um exemplo de aplicativo de carteira móvel que oferece várias funcionalidades. Os usuários podem enviar remessas internacionais, pagar contas, comprar créditos de jogos ou simplesmente negociar Bitcoin e outras criptomoedas. Além disso, alguns serviços financeiros não exigem uma conta bancária.

Plataformas Digitais

Algumas empresas operam uma infraestrutura que interage diretamente com o sistema financeiro tradicional. A BitPesa, por exemplo, é uma plataforma online que utiliza a tecnologia blockchain na África. Fundada em 2013, ela oferece soluções de pagamento e câmbio de moedas a taxas mais baixas e com maior velocidade.

O protocolo Stellar é outro exemplo de plataforma blockchain que atende ao setor de remessas. Fundado em 2014, o Stellar tem como objetivo promover o acesso financeiro, conectando pessoas e instituições financeiras em todo o mundo.

A rede Stellar possui um livro-razão distribuído que possui sua própria moeda, chamada Stellar lumens (XLM). Sua moeda nativa pode ser usada como uma moeda intermediária, facilitando as transações globais entre ativos fiduciários e criptomoedas. Assim como a BitPesa, os usuários e instituições financeiras podem usar a plataforma Stellar para enviar e receber dinheiro com custos de transação reduzidos.

Caixas Eletrônicos

Além dos aplicativos móveis e plataformas online, o uso de caixas eletrônicos pode oferecer uma solução interessante para o envio e recebimento de dinheiro em todo o mundo. Essa abordagem pode ser especialmente útil em áreas subdesenvolvidas que ainda não possuem uma boa conexão à Internet ou sistema bancário.

Empresas como Bit2Me e MoneyFi estão desenvolvendo novos sistemas de remessas que combinam a tecnologia blockchain com caixas eletrônicos. Seu objetivo é emitir cartões pré-pagos que ofereçam várias funcionalidades.

O uso combinado de blockchain e caixas eletrônicos tem o potencial de reduzir significativamente a necessidade de intermediários. Os usuários não precisarão de uma conta bancária e as empresas de caixas eletrônicos provavelmente cobrarão uma pequena taxa pelo serviço.

Desafios e Limitações Atuais

Embora seja claro que a tecnologia blockchain possa trazer muitas vantagens para a indústria de remessas, ainda há muito a ser feito. Alguns dos desafios e limitações atuais incluem:

Conversão cripto-fiduciária: A economia mundial ainda é baseada em moedas fiduciárias, e a conversão entre criptomoedas e moedas fiduciárias nem sempre é uma tarefa fácil. Em muitos casos, é necessário ter uma conta bancária. Transações peer-to-peer podem eliminar a necessidade de um banco, mas os usuários provavelmente precisarão converter de criptomoedas para moedas fiduciárias para usar o dinheiro.

Dependência de dispositivos móveis e Internet: Milhões de pessoas que vivem em países subdesenvolvidos ainda não têm acesso à Internet e muitas não possuem um smartphone. Como mencionado anteriormente, os caixas eletrônicos compatíveis com blockchain podem ser parte da solução.

Regulação: A regulamentação das criptomoedas ainda está em estágios iniciais. Ela é incerta ou inexistente em vários países, principalmente aqueles que dependem de fluxo de dinheiro estrangeiro. No entanto, a adoção crescente da tecnologia blockchain certamente impulsionará a regulamentação.

Complexidade: O uso de criptomoedas e tecnologia blockchain requer um certo conhecimento técnico. A maioria dos usuários ainda depende de provedores de serviços de terceiros, pois usar e executar blockchain de forma autônoma não é uma tarefa fácil. Além disso, muitas carteiras de criptomoedas e exchanges ainda não possuem guias educacionais e interfaces intuitivas.

Volatilidade: Os mercados de criptomoedas ainda são imaturos e estão sujeitos a alta volatilidade. Portanto, nem sempre são adequados para uso diário, pois o valor de mercado pode mudar rapidamente. No entanto, as stablecoins podem oferecer uma solução viável para esse problema.

Conclusão

O setor de remessas vem crescendo significativamente e provavelmente continuará a expandir nos próximos anos. O aumento da taxa de imigração de pessoas em busca de trabalho ou oportunidades educacionais é provavelmente uma das principais causas desse crescimento.

No entanto, o setor de remessas ainda enfrenta ineficiências e limitações. Como resultado, mais empresas estão aproveitando a tecnologia blockchain para oferecer alternativas mais eficientes, e provavelmente veremos uma maior adoção por parte dos trabalhadores imigrantes no futuro próximo. A tecnologia blockchain tem o potencial de revolucionar a indústria de remessas, oferecendo soluções mais rápidas, seguras e econômicas.

Perguntas Frequentes (FAQs)

O que é a tecnologia blockchain?

A tecnologia blockchain é uma estrutura descentralizada que permite o registro seguro e transparente de transações em uma cadeia de blocos imutável.

Como a tecnologia blockchain pode ajudar na indústria de remessas?

A tecnologia blockchain pode reduzir custos, aumentar a velocidade e eficiência das transferências, melhorar a transparência e proporcionar segurança aprimorada nas remessas internacionais.

Quais são os desafios enfrentados pela indústria de remessas?

Desafios incluem altas taxas de transferência, prazos prolongados, riscos de segurança e falta de visibilidade das transações.

Como a tecnologia blockchain melhora a transparência nas remessas?

A natureza transparente da blockchain permite que os remetentes rastreiem suas transações em tempo real, aumentando a confiança e a visibilidade.

0 notes

Text

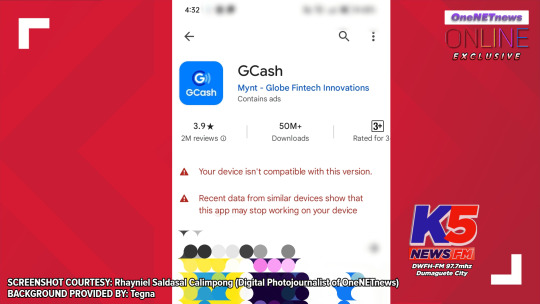

FLASH REPORT: GCash faces widespread Installation Problems that criticized e-wallet users in a New System Version Update [#K5NewsFMExclusive]

(Written by Miko Kubota, Luz Isidora Noceda and Rhayniel Saldasal Calimpong / K5 Tele-Serbisyo Patrol #4 of OneNETnews & Station Manager and President of ONC, Regional Correspondent of Disney XD News, and Freelance News Writer, Online Media Reporter & News Presenter of OneNETnews)

TAGUIG, NATIONAL CAPITAL REGION -- Philippine fintech electronic wallet 'GCash' faced nationwide of frustrations in smartphone installation issues with or without unregistering / re-registering phone models to being associated with their GCash account, per a latest new version of '5.78.0' recently released last week on Wednesday (July 3rd, 2024 – Manila local time), affecting almost all of the Apple iOS and Android smartphones, per some of our examples like Oppo and RealMe.

DWFH-FM 97.7mhz's K5 News FM: Dumaguete was one of the first ones who discovered where several users at GCash have manually failed to unregister old or newer phones in a new version update, especially those who recently tried to re-install after uninstalled this said e-wallet app, but was temporarily locked out and/or potentially lost a registered SIM card due to incompatible new version happening this week on Wednesday afternoon before 2pm (July 10th, 2024). Sometimes, the e-wallet app intermittently crashes from the start, except when going offline for a few seconds before logging in with your own MPIN and turning on WiFi or mobile data in most Android phone models like Oppo.

(ADVISORY PHOTO COURTESY: GCashOfficial via FB PHOTO)

In a latest official social media advisory post stating that there will be a system update to improve your experience for the Filipinos and even OFWs (Overseas Filipino Workers) abroad. Per the new announcement at Futurecast 2024 within late-last June 2024, the new app version of '5.78.0' and later versions in the e-wallet app unveiling to be rolling out new features like Tap to Pay, Smartwatch Payments via QR code (Quick Response) in selected Huawei smartwatches, International Cash-In from the American partnered banks, 30-day Tourist Access for Non-Filipino individuals, and GCash Jr. with Parental Controls.

E-wallet fintech officials say that the funds of GCash remain safe as normal, as long as you keep the registered phone locked in without losing both of your SIM card and a smartphone, which potentially infiltrates virtually from hackers, scammers and phishing individuals.

GCash has currently working out to sort the issue to the e-wallet application developers and is expected to be done by Friday afternoon at 12nn (July 12th, 2024) and advises everyone to re-download the GCash app once the system update is completely fixed. 'K5 News FM: Dumaguete' reached out to Apple and Google but refused to respond to us for a comment via E-Mail correspondent.

System update in the e-wallet app is related to the incompatibility concerns of both Apple iOS and Android smartphones. Self-unregistration is voluntarily possible by transferring a new phone from your old Oppo to RealMe (in the above-mentioned examples) and can be done through GCash national hotline of 2882, instead of GCash Help Center website. Online payments and debit card payments like GCash Visa Card, as well with other e-wallets and digital or physical banks like Maya, Coins.PH, UNO Digital Bank and RCBC (Rizal Commercial Banking Corporation) will not be affected, despite the incompatibility concerns in the GCash app alone.

Online netizens criticized social media, in lacking communication to blame in poor customer service, yet to be boycotting and brutally attacking the e-wallet app if they failed to fix the issue beyond the Friday afternoon deadline and destroying their image of the financial e-wallet tech app company.

GCash apologizes for the inconvenience for those affected by the epidemic of incompatibility concerns and failing to unregister smartphone models, regardless of uninstall and re-installing this said e-wallet app.

Mobile application technicians and developers are working around the clock to sort issues the soonest before the anticipated weekend breaks.

SCREENSHOT COURTESY: Rhayniel Saldasal Calimpong (Digital Photojournalist of OneNETnews)

BACKGROUND PROVIDED BY: Tegna

SOURCE:

https://www.facebook.com/100064643983643/posts/949742470523877 [Referenced FB Captioned PHOTO via GCashOfficial]

and

https://www.yugatech.com/news/top-announcements-from-gcash-at-futurecast-2024/ [Referenced News Article via YugaTech News Bureau]

-- OneNETnews Online Publication Team

#flash report#technology news#taguig#national capital region#NCR#GCash#e-wallet#awareness#system update#fyp#K5 News FM#exclusive#first and exclusive#OneNETnews

0 notes

Text

Global Digital Cross-Border Remittance Market Size was USD 6.20 Billion in 2022, this report covers Market growth, trend, opportunity and forecast 2023-2030

The Digital Cross-Border Remittance Market is expected to grow from USD 6.20 Billion in 2022 to USD 18.80 Billion by 2030, at a CAGR of 17.10% during the forecast period.

The Digital Cross-Border Remittance market is expected to experience substantial growth in the coming years due to the increasing penetration of smartphones and rising adoption of digital payment systems. This market research report provides a comprehensive analysis of the current market conditions, including drivers, trends, and challenges. The report covers a detailed segmentation of the market by end-user, transaction type, and region. The market size is projected to reach $29.84 billion by 2026, growing at a CAGR of 24.2% during the forecast period. The key players operating in the market include Western Union, MoneyGram International, Paypal, Remitly, and WorldRemit.

The objective of report is to define, segment, and project the market on the basis of product type, application, and region, and to describe the content about the factors influencing market dynamics, policy, economic, technology and market entry etc.

Digital cross-border remittance refers to the process of transferring money across borders through digital platforms, such as digital remittance service providers or bank digital remittance. The market segment includes personal remittance and corporate remittance, with major players such as WU, Ria, PayPal/Xoom, Wise, Zepz (WorldRemit, Sendwave), MoneyGram, Remitly, Azimo, TransferGo, NIUM, Inc (Instarem), TNG FinTech, Coins.ph, OrbitRemit, Smiles/Digital Wallet Corporation, FlyRemit, SingX, Flywire, Intermex, and Small World. The market is divided by region, including North America, Asia Pacific, Middle East, Africa, Australia, and Europe. Regulatory and legal factors specific to this market's conditions are significant, and the report analyzes them in detail. These factors include regulatory compliance, country-specific regulations, cross-border regulatory cooperation and standardization, regulatory enforcement and sanctions, and customer data protection regulations.

0 notes

Text

Dans un récent webinaire, SBI VC Trade, la branche d'échange de crypto-monnaie du géant financier japonais SBI Group, aurait dévoilé ses plans pour le produit On-Demand Liquidity (ODL) de Ripple au Japon. La société a l'intention d'utiliser XRP pour les paiements transfrontaliers.

Selon un article d'Albert Brown pour The Crypto Basic publié plus tôt dans la journée, le webinaire, qui s'est tenu le 28 juillet 2023, mettait en vedette Emi Yoshikawa, vice-présidente de la stratégie et des opérations de Ripple, et Tomohiko Kondo, directeur délégué et président de SBI VC Trade. . L'objectif principal de la discussion était la récente décision de justice dans l'affaire Ripple et les utilisations potentielles du XRP. Le webinaire a également exploré les opportunités futures pour XRP et la solution ODL de Ripple, ainsi que les initiatives du groupe SBI.

Après le webinaire, Kondo a partagé une diapositive sur Twitter décrivant les plans de SBI pour utiliser XRP et ODL au Japon. La diapositive a révélé que SBI VC Trade serait responsable de la transmission de XRP en tant que partenaire d'échange de Ripple pour ODL au Japon.

Selon le plan, les clients japonais qui souhaitent effectuer des envois de fonds nationaux ou vers d'autres pays comme les Philippines utiliseraient une société de paiement locale, telle que SBI Remit ou Asian Net, pour initier le transfert. Les fonds, envoyés en yen japonais, seraient ensuite transférés à SBI VC Trade via son nouveau système multi-tenant pour ODL. SBI VC Trade convertirait alors le yen en XRP sur le XRP Ledger et le reconvertirait de XRP dans la devise locale du destinataire. Pour les destinataires aux Philippines, SBI VC Trade convertirait XRP en peso philippin, en utilisant coins.ph, un échange cryptographique basé aux Philippines, pour faciliter le paiement au destinataire.

Ce développement renforce encore la relation entre Ripple et le groupe SBI, qui ont travaillé ensemble pour tirer parti du XRP, du XRPL et de l'ODL pour les envois de fonds au Japon. En juin 2023, SBI Africa a révélé son intention d'utiliser ODL si Ripple remporte le procès de la SEC. Suite à la décision favorable dans l'affaire, SBI a lancé le Midsummer XRP Festival, une campagne comprenant plusieurs initiatives visant à renforcer la présence de XRP au Japon, notamment une loterie XRP et des campagnes de négociation au comptant et à effet de levier.

Crédit image en vedette : Photo / illustration par vjkombajn via Pixabay

0 notes

Text

Market Event - Partnership between Coins.ph and 7-eleven shows growing synergies between retail and wallet

An emerging trend can be observed across emerging and developed markets where retail companies and Fintech firms are collaborating to introduce solutions that enable the unbanked population to make non-cash payments. This not only helps in expanding the consumer base but is also bringing in operational efficiencies and benefits to both retail chains and Fintech companies.

#Gift card market size#B2C Ecommerce Industry size#gift card trend#BNPL market size#gift card research report#Asia pacific Social Commerce market#Growth of B2C Ecommerce Market#B2C Ecommerce Market Analysis#gift card market research#Industry Outlook Of B2C Ecommerce Market#Prepaid card market share#U.S. prepaid card market#Prepaid card market research#Digital Remittance Industry size#Market Research Report Embedded finance#Social Commerce trend & Analysis#Industry outlook on Embedded Finance#gift card innovation#Embedded finance Industry size#Global Prepaid card market size#Industry outlook on BNPL#Prepaid card report#Report on Embedded Finance#Market Research Report BNPL#Social Commerce market size#Global Social Commerce Industry#Social Commerce market research#Loyalty Market Share#Report on Loyalty Management Market#Loyalty Management Market Size

0 notes

Text

I. Introduction

A. Definition of cryptocurrency

Cryptocurrency refers to digital or virtual tokens that use cryptography to secure and verify transactions and to control the creation of new units. It is decentralized, meaning that it operates independently of a central bank or government, and its value is determined by market supply and demand.

B. Overview of underbanked and unbanked populations

Around 1.7 billion adults globally remain unbanked, which means that they lack access to traditional banking services. These people often rely on cash transactions, which can be costly, time-consuming, and unsafe. Even those who are considered underbanked, meaning that they have some access to financial services, face significant barriers such as high fees, limited access to credit, and lack of financial education.

C. Importance of financial inclusion

Financial inclusion refers to the availability and usage of financial services by individuals and households. It is crucial for reducing poverty, promoting economic growth, and achieving sustainable development. Lack of financial inclusion can perpetuate inequality, limit opportunities, and hinder progress. Cryptocurrency has the potential to provide financial inclusion to people who lack access to traditional banking services.

II. Cryptocurrency and Financial Inclusion

A. Remittances

1. Overview of remittances

Remittances are funds that are sent by migrant workers to their families or communities in their home countries. According to the World Bank, global remittance flows reached $689 billion in 2018, with developing countries receiving $528 billion.

2. How cryptocurrency can help

Cryptocurrency can offer a faster, cheaper, and more secure alternative to traditional remittance channels. For example, blockchain-based platforms such as BitPesa and Abra allow users to send and receive money across borders instantly and at lower costs than traditional remittance providers.

3. Success stories

There are many success stories of cryptocurrency being used for remittances. For example, in the Philippines, the country with the third-highest remittance inflows globally, cryptocurrency-based platforms such as Coins.ph and Rebit.ph have gained popularity as a means of transferring funds.

4. Challenges

There are several challenges to using cryptocurrency for remittances, including regulatory uncertainty, lack of awareness, and volatility in cryptocurrency prices.

B. Microfinancing

1. Definition of microfinancing

Microfinancing refers to the provision of financial services such as loans, savings, and insurance to low-income individuals or households. It is an important tool for promoting financial inclusion and reducing poverty.

2. How cryptocurrency can help

Cryptocurrency can offer a decentralized and accessible means of providing microfinancing to underserved communities. For example, platforms such as Kiva and Bitbond use cryptocurrency to connect lenders and borrowers from around the world, enabling individuals to access financing without the need for intermediaries such as banks.

3. Success stories

There are many success stories of cryptocurrency being used for microfinancing. For example, in Kenya, the BitPesa platform has provided microloans to small businesses and entrepreneurs, helping to spur economic growth and reduce poverty.

4. Challenges

There are several challenges to using cryptocurrency for microfinancing, including regulatory uncertainty, lack of trust, and limited access to technology and education.

C. Crowdfunding

1. Definition of crowdfunding

Crowdfunding refers to the practice of raising funds for a project or venture from a large number of people, typically via the internet. It is an important tool for democratizing access to capital and promoting innovation.

2. How cryptocurrency can help

Cryptocurrency can offer a decentralized and accessible means of crowdfunding, enabling individuals to contribute to projects and ventures without the need for intermediaries such as banks or crowdfunding platforms.

3. Success stories

There are many success stories of cryptocurrency being used for crowdfunding. For example, the Ethereum blockchain platform enables the creation of smart contracts, which can automatically execute crowdfunding campaigns, eliminating the need for a middleman.

4. Challenges

There are several challenges to using cryptocurrency for crowdfunding, including regulatory uncertainty, lack of awareness, and volatility in cryptocurrency prices.

III. Challenges and Risks

A. Regulatory uncertainty

The regulatory landscape for cryptocurrency is complex and constantly evolving, which can create uncertainty and barriers to adoption. Governments and regulatory bodies around the world have taken different approaches to regulating cryptocurrency, ranging from outright bans to embracing it as a legitimate asset class.

B. Lack of education

Many people who are unbanked or underbanked may also lack access to education and technology, making it challenging for them to understand and adopt cryptocurrency. Education and awareness campaigns are crucial to promoting the benefits of cryptocurrency and overcoming the barriers to adoption.

C. Volatility

Cryptocurrency prices are notoriously volatile, which can make it difficult for people to trust and use cryptocurrency as a means of exchange or investment. This volatility can also create risks for those who rely on cryptocurrency for their livelihoods.

D. Security

Cryptocurrency is often stored in digital wallets, which can be vulnerable to cyberattacks and fraud. Ensuring the security and protection of cryptocurrency assets is crucial to promoting adoption and trust.

IV. Future Outlook

Despite the challenges and risks associated with cryptocurrency, there is a growing interest in its potential to provide financial inclusion to underserved communities. As technology and education continue to advance, and as regulatory frameworks become clearer, cryptocurrency may become a more accessible and mainstream means of financial inclusion.

V. Conclusion

Cryptocurrency has the potential to provide financial inclusion to underbanked and unbanked populations around the world. Through its ability to facilitate remittances, microfinancing, and crowdfunding, cryptocurrency can help to reduce poverty, promote economic growth, and democratize access to capital. However, there are also challenges and risks associated with using cryptocurrency, including regulatory uncertainty, lack of education, volatility, and security. Addressing these challenges and promoting the benefits of cryptocurrency is crucial to realizing its potential for financial inclusion.

1. How does cryptocurrency compare to traditional banking services in terms of cost?

Cryptocurrency transactions are typically cheaper than traditional banking services, which often charge high fees for cross-border transfers and currency conversions. However, the cost of using cryptocurrency can vary depending on factors such as transaction volume, network congestion, and exchange rates.

2. Are there any government regulations that prevent the use of cryptocurrency for financial inclusion?

Regulatory frameworks for cryptocurrency vary widely around the world, and some governments have implemented restrictions or bans on cryptocurrency. However, many countries are exploring ways to regulate and integrate cryptocurrency into their financial systems to promote financial inclusion.

3. Can cryptocurrency be used for other purposes beyond financial inclusion?

Yes, cryptocurrency can be used for a wide range of purposes beyond financial inclusion, including investments, trading, and purchasing goods and services online. Cryptocurrency is also being used to innovate in fields such as healthcare, supply chain management, and voting systems.

4. Is there a risk of fraud when using cryptocurrency for financial inclusion?

Like any financial system, cryptocurrency can be vulnerable to fraud and scams. It is important to take precautions such as

using reputable exchanges and wallets, researching potential investments thoroughly, and following best practices for securing digital assets.

5. What is being done to promote education and awareness of cryptocurrency among underbanked and unbanked populations?

Many organizations are working to promote education and awareness of cryptocurrency among underbanked and unbanked populations, including nonprofits, educational institutions, and blockchain startups. Initiatives include providing access to technology and resources, offering training and mentorship programs, and creating localized educational materials in different languages and formats.

0 notes

Text

FUNDRAISING ₱50K TO SAVE 40 POUND DOGS FROM EUTHANASIA!!!

REPOSTING FOR SWS (STRAYS WORTH SAVING)

ADOPT DON'T SHOP

----------------------------------------------------------------------

We are raising this amount to be used for tomorrow's expenses to save the 40 Tanauan pound dogs from euthanasia. As an update, dogs #4 and 21 have adopters already, while dog #8 was found by the owner after we posted the photos.

MORE ADOPTERS ARE BADLY NEEDED! PLEASE CONTACT US AND BE PART IN SAVING LIVES!! Those willing to adopt, please message the page or Nico Gueco or Kathrina Gueco.

Chinabank

SWS Good News Foundation Corp

137500012221

Gcash - 09176363824 (Melanie R) or 09129141555 (Melanie G) or 09560553566 (Antonia) or 09176363931 (Patricia)

Paymaya & Coins.ph - 09176363824

Paypal: paypal.me/straysworthsaving or [email protected]

Unionbank

109452801813

Melanie Ramirez

Bank of the Phil Islands (BPI)

1289494037

Melanie Ramirez

Banco de Oro (BDO)

002280238329

Antonia Ramirez

______________________________

SWS DESPERATELY NEED YOUR HELP TO SAVE 40 POUND DOGS FOR EUTHANASIA TOMORROW!! WE BADLY NEED ADOPTERS FOR ALL 40!!

The city vet of the pound in Tanauan, Batangas sought the help of SWS to attempt to save the dogs surrendered or reported to them for catching. A total of 40 dogs are scheduled to be euthanized tomorrow, before the Holy Week.

SWS has been announcing that the shelter is full and we cannot accommodate new rescues, much more 40 rescues from the pound. This is why we are begging those who have room in their homes for an additional blessing to adopt even one of these rescues!

WE BADLY NEED 40 ADOPTERS TO SAVE 40 POUND DOGS FOR PTS!!!

To those who can adopt, we can arrange transpo to your home. We will also have them vaccinated (first shot). To those who want to go to the pound itself, we will welcome you there. I will personally facilitate the adoption tomorrow at the Tanauan pound starting 9am.

Those willing to adopt, please message the page or Nico Gueco or Kathrina Gueco. PLEASE BE A PART IN SAVING THIR LIFE! WE ARE OUT OF TIME! Only 21 photos are posted here as the City vet is also finding adopters for the others.

To those who can help us with the expenses involved, like the transpo, dog food, vaccinations, anti0rabies shots, treatment (as needed) and meds (as needed), we will truly appreciate it! Surely, the Lord will repay you!

LORD, PLEASE SAVE ALL THESE 40 POUND DOGS!

#DOG#STRAY#straydogs#DONATE#PHILIPPINES#ASKAL#ASPIN#FURBABIES#aso#asongkalye#adopt#adoption#euthanasia

0 notes

Text

Digital Remittance Market Detailed Strategies, Competitive Landscaping and Developments for next 5 years

Latest Report Available at Advance Market Analytics, “Digital Remittance Market” provides pin-point analysis for changing competitive dynamics and a forward looking perspective on different factors driving or restraining industry growth.

The global Digital Remittance market focuses on encompassing major statistical evidence for the Digital Remittance industry as it offers our readers a value addition on guiding them in encountering the obstacles surrounding the market. A comprehensive addition of several factors such as global distribution, manufacturers, market size, and market factors that affect the global contributions are reported in the study. In addition the Digital Remittance study also shifts its attention with an in-depth competitive landscape, defined growth opportunities, market share coupled with product type and applications, key companies responsible for the production, and utilized strategies are also marked.

Some key players in the global Digital Remittance market are Western Union (WU) (United States),Ria Financial Services (United States),PayPal/Xoom (United States),TransferWise (United Kingdom),WorldRemit (United Kingdom),MoneyGram (United States),Remitly (United States),Azimo (United Kingdom),TransferGo (United Kingdom),InstaReM (Singapore),TNG Wallet (China),Coins.ph (Philippines),Toast (Singapore),OrbitRemit (New Zealand)

Digital Remittance is refer as the online service which allows the people to send money for friends and family who are living abroad, through the use of smartphone, computer or tablet. For funding of the many families around the world, remittances market is considered as one of the valuable external source. While the reduction in the remittance costs has become one of the strategic focus for organisations of multilateral development.

What's Trending in Market: Blockchain technology is exerting far-reaching influence on the remittance market

Challenges: Lack of skilled professional for using this service

Market Growth Drivers: Rise in automation and digitization

Reduction in the remittance cost & transfer time

Increased adoption of banking & financial services

Migration of the labor workforce

The Global Digital Remittance Market segments and Market Data Break Down by Type (Inward Digital Remittance, Outward Digital Remittance), Application (Migrant Labor Workforce, Study Abroad and Travel, Small Businesses), Remittance channel (Banks, Money transfer operators, Others)

Presented By

AMA Research & Media LLP

0 notes

Text

Philippines SEC prepares to ban Binance in three months

Share this article

The Philippines Securities and Exchange Commission (PSEC) chair Kelvin Lee clarified in a panel hosted at Coins.ph on December 13, 2023, that the commission is preparing necessary steps to block and ban Binance in the country within three months.

According to a report from BitPinas, a Philippines-based crypto news publication, the panel was organized to clarify public…

View On WordPress

0 notes