#Commodity Crude Oil

Text

China is facing a challenging threat and is now moving towards the dynamic approach named Zero Covid Policy. For more visit us on https://commoditysamachar.com/ or call us at +91 7968158368.

#China Zero Covid Policy#Commodity Samachar#crude oil#commodities for trading#commodities in market#commodities market in india#commodities market price#commodities traded in india#commodities trading market

2 notes

·

View notes

Text

Discover Top Trading Solutions with WinproFX: Guide to the Best Platforms

WinproFX, located in Mumbai, is committed to providing top-tier trading solutions that cater to diverse trading needs. Our platforms are designed to offer unparalleled access and tools for trading commodities, crude oil, stocks, gold, and silver. Explore our offerings and see why we are the preferred choice for traders.

Best Commodity Trading Platform

WinproFX is renowned for offering theBest commodity trading platform. Our platform supports a wide range of commodities, including agricultural products, energy resources, and metals. With real-time market data, advanced charting tools, and efficient trade execution, you can make informed decisions and capitalize on market opportunities. Our user-friendly interface ensures a seamless trading experience for both novice and experienced traders.

Best Crude Oil Prices Platform

WinproFX provides the Best crude oil prices platform. Our platform offers comprehensive access to global crude oil markets, delivering up-to-date pricing, high liquidity, and competitive spreads. With detailed market analysis and robust trading features, you can navigate the complexities of crude oil trading with confidence and precision.

Top-Rated Online Brokers For Stock Trading

WinproFX is proud to be associated with Top-rated online brokers for stock trading. Our brokers are selected based on their excellence in providing reliable trading services, advanced tools, and exceptional customer support. Whether you’re trading major indices or individual stocks, our brokers offer the expertise and resources needed to enhance your trading experience.

Compare Brokers Offering Automated Trading Solutions

WinproFX, you can Compare brokers offering automated trading solutions to find the best fit for your needs. Our platform provides insights into various brokers' automated trading features, helping you choose the one that aligns with your trading goals and preferences.

Best Gold and Silver Trading Platform

WinproFX excels as the Best gold and silver trading platform. Our platform supports trading in precious metals with competitive pricing, real-time data, and advanced analytical tools. Whether you are trading gold, silver, or both, our platform offers a secure and efficient environment to manage your investments and capitalize on market trends.

WinproFX, we are dedicated to offering the best trading platforms and solutions to help you achieve your financial goals. Join us today and experience top-notch trading services. Visit https://winprofx.com for more information and to start your trading journey.

#winprofx#best#Best Commodity Trading Platform#Best Crude Oil Prices Platform#Top-Rated Online Brokers For Stock Trading

0 notes

Text

When Investing Tips Into Gambling - The Havoc This Can Cause

Trading the hottest sectors, stocks, ETFs, etc., can be an addictive game. My advice to you, learned the hard way, of course – know where the line between trading ends and gambling begins.

A brief synopsis of what I cover includes:

Big picture recap of where the markets are and how asset revesting is stacking up against the 60/40 portfolio.

The importance of knowing about maximum drawdowns.

A granular view of our consistent growth strategy and the markets.

What happens when subscribers and I reach a profit target?

Short-term momentum charts.

What does it mean that the stock market is making all-new highs, but NVDA is not?

Gambling vs Trading/Investing….A closer look at NVDA.

The bond market – when will it be a good investment again?

Is the VIX ready to pop?

US dollar – is the chart pointing to a base or a bear flag?

Precious metals – will gold continue its push to the upside?

Industrials – are primed and ready for another surge.

Crude oil’s weekly chart shows a similar pattern to 2088.

Stock market cycles.

Watch Today’s Free Video Here

0 notes

Text

Oil Prices Inch Up Despite Mixed Signals

Oil prices edged slightly higher on Friday. Contracts for Brent crude oil expiring in August climbed 0.4%, reaching $86.73 per barrel. Similarly, West Texas Intermediate (WTI) crude futures, a key benchmark for North American oil, rose 0.4% to $82.09 per barrel.

This modest increase comes amidst conflicting forces in the oil market. While concerns about potential supply disruptions from the Middle East and ongoing geopolitical tensions provided some upward pressure, a strong U.S. dollar acted as a counterweight. A stronger dollar can make oil, priced in dollars, less attractive to buyers using other currencies.

The focus for investors has now shifted to upcoming U.S. inflation data, which could influence future decisions by the Federal Reserve on interest rates. Higher interest rates can strengthen the dollar and potentially dampen demand for oil.

#Oil prices#Brent crude oil#West Texas Intermediate (WTI)#Crude oil futures#Oil market trends#Middle East supply disruptions#Geopolitical tensions#U.S. dollar strength#Federal Reserve interest rates#U.S. inflation data#Oil demand#Energy market analysis#Global oil supply#Commodities trading#Economic indicators

0 notes

Text

Oil prices are recovering!

After a sharp decline since April’s peak, there are signs that oil prices may be on the mend. Brent Crude is now on a three-day winning streak.

But why?

Due to falling supply and growing demand.

Supply side, US crude inventories decreased by 1.4M barrels last week, according to the US Energy Information Administration (EIA). Last week, US crude inventory was 7.26M barrels higher than it was two weeks ago.

At only 459.5 million barrels of crude, the US oil stockpile was 3% below the standard five-year average, indicating tighter supplies in the US market.

On the demand side, China’s economy has seen a significant recovery. Trade activity has rebounded as exports jumped 1.5% in the latest month while imports boomed 8.4%. China’s oil imports improved by 5.45% in April to 10.88 million barrels per day!! Since China is the world’s largest oil importer, a rebound in its economic activity will positively impact oil demand!

Finally, tensions in the Middle East have flared up recently as Israel launched its assault on Rafah, sparking concerns in the region once again, thus pumping oil prices up once again.

When reporting, the Brent Crude was trading at around $84.913/bbl.

Follow ProCapitas for more financial insights.

0 notes

Text

Embarking on the commodity trading journey can be exciting and challenging for beginners. In a world where markets fluctuate and commodities such as gold hold historical significance and investment allure, navigating the intricacies of commodity trading requires a blend of knowledge, strategy, and prudent decision-making. Here, we delve into essential tips for beginners venturing into the dynamic realm of commodities trading.

Understanding the Basics of Commodities Trading

Trading commodities involves purchasing and selling goods, including metals, like gold or energy resources, like crude oil. Unlike cfd stocks and bonds, the worth of commodities is determined by their usefulness and limited availability. This distinctive characteristic makes them an attractive investment option for various investors.

Choose Your Commodities Wisely

Before diving into commodities trading, beginners should conduct thorough research to understand the market dynamics. Understand commodities, including their past price fluctuations and their impact factors. This knowledge forms the basis for making informed decisions.

Diversify Your Portfolio

Diversification is a crucial principle in trading. Instead of concentrating all your investments on an asset, it's wise to consider diversifying your commodity portfolio. This strategy helps reduce the risk associated with fluctuations in the price of an asset and offers a well-rounded approach to trading.

Spot Metals Trading – A Closer Look

Spot metals trading, which includes commodities like gold and silver, involves immediately purchasing or selling metals for delivery on the spot date. Gold, in particular, has been a timeless choice for investors, serving as a store of value and a hedge against economic uncertainties.

Tips for Gold Trading

Understand Gold's Role in the Market

Gold plays a role in the markets. It is often seen as an investment option during uncertain economic times. Understanding gold's significance in the market can assist you in making informed choices regarding your buying and selling decisions.

Stay Informed About Economic Indicators

Factors, including indicators, geopolitical events and overall market sentiment, influence the price of gold. Staying updated on interest rates, inflation rates, and global economic conditions can provide information about movements in gold prices.

Commodity Trading Risk Management Strategies

Risk management is crucial in commodities trading. Set clear risk tolerance levels for each trade, and do not exceed these limits. This helps protect your capital and prevents significant losses in adverse market movements.

Use Stop-Loss Orders

Implementing stop-loss orders is a practical way to manage risk. These orders automatically sell your commodity holdings if prices reach a predetermined level, preventing further losses. It's a proactive approach to risk management.

Leverage can amplify both gains and losses in commodities trading. While it provides the opportunity for increased profits, it also heightens the risk of significant losses. Beginners should approach leverage cautiously and use it judiciously in their trading strategies.

Continuous Learning and Growth

Stay Updated with Market Trends

The commodities market is dynamic and influenced by various factors. Stay updated with market trends, news, and developments that could impact commodity prices. This continuous learning approach enhances your ability to make informed trading decisions.

Learn from Experienced Traders

Learning from the experiences of seasoned traders can be invaluable for beginners. Engage with the trading community, participate in forums, and consider mentorship programs. Insights from experienced traders can provide practical wisdom and help you avoid common pitfalls.

Conclusion

Embarking on the journey of commodities trading as a beginner necessitates a blend of knowledge, strategy, and a commitment to continuous learning. Whether you are venturing into spot metals trading, exploring the nuances of gold trading, or diversifying your commodity portfolio, these tips guide you in navigating the complexities of the commodities market. As with any investment, disciplined decision-making, risk management, and a resilient approach to market dynamics contribute to a successful and fulfilling journey in commodities trading.

Source: https://writeupcafe.com/commodity-trading-tips-for-beginners/

#commoditytrading#commodities#commoditymarket#crude oil#stock market#stocks trading#gold trading#gold and silver#live trading#forex trading

0 notes

Text

Nifty Prediction : Nifty within range | Mixed day possible

Daily Forecast – Share Market – August 31st, 2023

Nifty within range | Mixed day possible

Rahu, Ketu with Venus (Retrograde) are leading the day, well supported by Sun, Mars and (retrograde) Mercury. Importantly, Jupiter is also slowing down speed for us, because will start transiting retrograde from 04-09-2023. Venus has also started slowing down its speed for us. Possibility of Mixed day.…

View On WordPress

#commodity#crude oil#currency#free predictions#indian astrology#Kundli queries#metal#Nifty Prediction#paid astrology#sensex#Share Market#vedic astrology

0 notes

Photo

The stars saw it all, the intricate movements and machinations that led up to that moment. The decisions made, the people and their actions. Crude oil falling despite a giant like China lowering its duty on stock trading. No one could have predicted it. The night sky had been eavesdropping, calculating the odds of this strange outcome. It was as if it was talking to us, a reminder that nothing was as it seemed and that the world was spinning in a dizzying orbit, keeping us all in a sacred balance.

0 notes

Text

WTI Crude Edges Higher, Supported by Supply Cuts and Strategic Petroleum Reserve Plans

-WTI crude futures rise above $73 per barrel, recovering from previous losses and nearing one-month highs.

-Supply cuts by major exporters Saudi Arabia and Russia contribute to expectations of a tighter market.

-Saudi Arabia extends its 1 million barrels-per-day production cut through August, while Russia plans to reduce oil exports by 500,000 bpd next month.

-US authorities announce plans to…

View On WordPress

0 notes

Text

Commodities Analysis and Opinion-Budrigannews

Commodities Analysis and Opinion-Budrigannews

This section provides information from personal market experts to global hedge funds and banks. Recommendations and analysis are published daily, both fundamental and technical analysis.

You will find charts, reasons for the fall or growth of the market, it is ideal for beginners of the stock market who are just learning trading.

Market experts indicate support levels, entry points and exits from the commodity market on the charts.

You will find real-time quotes for more than 40 products, including gold, coffee, wheat, beans and others.

#commodities news#commodities#commodities analysis#news#xauusd#xagusd#wti crude (mar&x27;23)#wti#brent#crude oil

0 notes

Text

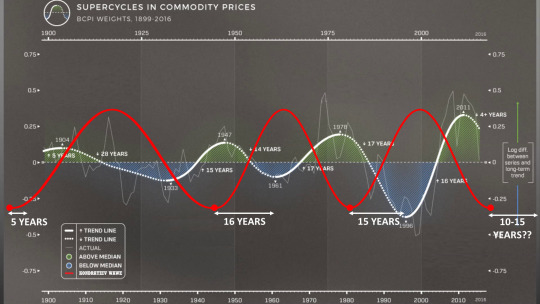

Why I think the supercycle of commodities is bullshit right now

The investment banks and other merchants of self-fulfilling prophecies started talking about a possible super-cycle of commodities back in late 2020. It was kind of fun at the time - pent-up demand and underinvestment in industries could really caused a chain reaction (although it is not clear to say so loudly that it is a defenitely supercycle).

youtube

But it's been 2 years, and they keep going on and on…. Another Goldman Sachs article came across the other day: "2023 Commodity Outlook: An Underinvested Supercycle". What? Again?

So, let's use data from the Bank of Canada. Here are only 4 types of goods, but you can already see that all the cycles are not very synchronized

Moreover, they averaged the prices of over 20 groups of commodities and drew a single graph.

Also, we will need Kondratieff waves (cycles) as the most global economic cycles associated with the emergence of new technologies, such as the loom, steam engine, machine building, and so on.

If we superimpose them on top of each other, we get the following:

That is, with the exception of 1933 (when the commodity cycle was provided, most likely, exclusively by mass preparations for the world war and the exit of America from the great depression), all other commodity supercycles began about 10-15 years after the start of the next Kondratiev wave. This is the time when there is a boom in the implementation of new technology.

According to economists, we are now at the very beginning of a new Kondratiev wave (the growth of the interest rates and high inflation confirms this), which means that we have to wait another 10 years for a real supercycle of commodity materials =)

#economy#economics#commodity#commodities#supercycle#economic cycle#investing#crude oil#brent#goldman sachs#Youtube

1 note

·

View note

Text

Difference Between Commodity Market and Stock Market

The market provides a wide range of assets where people can invest their unused funds to make money. Investors seeking strong returns typically invest in either equities or commodities, which are two different asset classes. Stocks signify ownership in a corporation, whereas commodities are items like metals, energy, and agricultural products. Both of these asset groups have substantial potential for profit. They are exchanged, nonetheless, on various markets. Therefore, before investing in either, it is crucial to understand the differences between the stock market and the commodity market.

By inexperienced investors, the phrases stock market & commodity market are frequently used interchangeably. Even so, there are several key distinctions between the two that might guide your choice of investment. The distinctions between these two markets, if you're novice to investing, will become clearer as your wealth increases. Nevertheless, even seasoned investors occasionally succumb to the parallels between equities and commodities. There are certain distinctions between them, though, and we'll discuss those in this post. If you're not familiar with how the stock market operates, you might want to review the fundamentals before going any further.

Stock Exchange

It alludes to a group of stock exchanges where shares are bought, sold, and traded. As was already established, stocks represent a company's ownership. These are best understood as components of the total equity of a corporation. Each business understands only Rs. 1000 of a company's total equity if its capital is worth Rs. 1000 crores and there are 1 crore shares. One share of stock entitles the holder to only that fraction of the company's ownership.

The value of one's holding regularly varies with adjustments in the statement of financial position, driven about by a multiplicity of circumstances, both internally and externally. Depending on their investing goals, a person may decide to sell their stocks the same day they are purchased, a year later, or even 10 years later.

The stock market, which has numerous exchanges within it, is the market that makes it possible to purchase and sell. In the Indian stock market, there really are two primary stock exchanges -

● National Stock Exchange

● Bombay Stock Exchange

Individuals must have a trade and DEMAT account in order to invest in equities listed on either of these markets or others.

Commodity Market

It is a commodity market, as the name would imply. These products fall into two categories:

● Hard commodities

● Soft commodities

The former speaks of products that are mined and extracted, such as crude gold and oil. These are 2 of the most valuable and traded commodities on the planet. Rice, wheat, eggs, pigs, cattle, and other agricultural commodity and livestock items are included in the latter group. Comparatively speaking to hard goods, these often have a significantly shorter lifespan.

These products can be bought, sold, and traded in commodity markets. The trading process is one of the comparisons between commodities and stocks. The majority of dealers that trade commodities do so using futures contracts. These agreements bind the parties to carry out a transaction at the agreed-upon price and on the agreed-upon date. Futures contracts are frequently used by manufacturers and farmers as a hedge against possible losses. These, nevertheless, also serve as a remarkable tool for realising a profit.

A person may decide to invest immediately in commodities. To that goal, India has six commodity exchanges:

● Multi Commodity Exchange (MCX)

● Ace Derivatives Exchange (ACE)

● The Universal Commodity Exchange (UCX)

● National Multi Commodity Exchange (NMCE)

● Indian Commodity Exchange (ICEX)

● National Commodity and Derivatives Exchange (NCDEX)

What distinguishes the commodity market from the stock market?

Analyzing the influence of various economic elements on each market is crucial if one wants to clearly comprehend the differences between both the stock market or commodity market.

● Inflation

A rising tendency in the prices of almost all items in an economy is referred to as inflation. Inflation typically happens along with rising consumer income. The former does, however, occasionally surpass the latter.

A commodity market flourishes in an inflationary environment because as raw material costs rise, a growing number of investors turn to those markets. As a result, the cost of manufactured items rises, which lowers consumption. It spirals into subpar performance across numerous industries, causing the stock market to move downward. It's one of the key distinctions between the stock market and the commodity market.

● US dollar's value

The impact of USD on gold is extremely pronounced. The value of gold is inversely correlated to the US dollar. Typically, when the USD is performing poorly, investors look to gold as a safe haven. On the other hand, if the US currency strengthens, investors are less likely to like it.

In other instances, as in the most recent recession that shook the market in late February, this propensity for gold also correlates with such a disinterest in the stock market. Before choosing to invest in either, it is essential to understand the differences between the stock market and the commodity market. In order to make an informed choice in these marketplaces, it's crucial to analyze the possibilities available.

#wheat price#steel prices#palm oil price#sugar price#coffee price#ai techniques#oil forecast#soybean price today#commodity prices#metal price#silver forecast#gold forecast#palm oil price today#cotton price#crude palm oil price#commodity futures prices#gold price forecast#coal price in india#oil price forecast

0 notes

Text

Why You Should Be Preparing For A Stock Market Crash

Chris recently sat down with Aaron Hoddinott on Pinnacle Digest’s podcast. We covered the gamut from how a high school trading/investing project changed the course of my life to blowing up my trading account while learning the do’s and don’ts to the Asset-Revesting style that I developed and use now.

Watch The Free Interview Here

1 note

·

View note

Text

IEA raises oil demand view on gas-to-oil switching

IEA raises oil demand view on gas-to-oil switching

A better-than-expected response to Europe’s energy crisis and surprising economic resilience among major Asian economies are boosting demand for oil as a heat source, the International Energy Agency said Wednesday as it lifted its forecast for global crude demand.

The Paris-based energy watchdog raised its oil

CL.1,

+0.93%

BRN00,

+0.83%

demand growth forecasts for 2022 by 140,000 barrels a day…

View On WordPress

#article_normal#Brent Crude Oil Continuous Contract#BRN00#C&E Exclusion Filter#CL.1#commodity#Commodity markets#Commodity/Financial Market News#Content Types#Crude Oil WTI (NYM $/bbl) Front Month#Energy#Factiva Filters#financial market news#GAS00#Low Sulphur Gasoil Continuous Contract

0 notes

Text

Oil prices are surging!

The downward trend in oil prices is showing signs of improvement, with Brent Crude approaching its peak level in nearly five months, indicating a potential rebound.

But why??

The initial factor contributing to the current state of affairs is rooted in the ongoing issue of oil sanctions between the United States and Venezuela. In October 2023, the United States granted Venezuela a temporary six-month reprieve from the oil sanctions initially imposed in 2019. This gesture was made contingent upon Venezuela's commitment to facilitating a fair and inclusive electoral process involving all relevant political parties within the country. This diplomatic maneuver aimed to incentivize cooperation and dialogue between the opposing factions within Venezuela, fostering an environment conducive to democratic governance and potentially alleviating some of the pressure on global oil markets.

Despite the temporary relief granted to Venezuela regarding the oil sanctions, the anticipated fair elections stipulated as part of the agreement have yet to materialize. If Venezuela fails to conduct these elections by the middle of April 2024, the United States retains the option to reinstate the previously lifted sanctions. This deadline underscores the critical importance of adhering to the terms of the agreement for Venezuela's leadership, as the failure to do so could lead to significant consequences in terms of economic sanctions being reinstated, potentially exacerbating the challenges facing Venezuela's oil industry and broader economy.

Secondly, Ukraine has been targeting Russian oil! In a surprising move, Ukraine has begun targeting Russian infrastructure to disrupt its oil, which has been Russia’s biggest source of revenue. Recently, Ukraine launched as many as 35 drones to attack multiple targets across Russia, including oil refineries!!

Finally, Israeli PM Benjamin Netanyahu has confirmed that Israel will be continuing the Rafah assault, despite pressure from all its allies!

All these factors helped Brent Crude break out of its tight trading range as it was trading at around $85.95/bbl when reporting.

Follow ProCapitas for more financial insights.

0 notes

Text

Since the turn of the millennium, the prices of crude oil and food have evolved almost in sync. This can be put down to the high energy input required for the production of agricultural commodities such as synthetic fertilisers and chemical pesticides. In addition, a huge amount of fossil fuel energy is needed to manufacture and operate farm machinery and to process, package, distribute and prepare food. Food systems consume 15% of the fossil fuel energy used globally, according to estimates. The production of synthetic nitrogen fertilisers is particularly energy-intensive, requiring around 4% of global gas consumption.

Public Food Stocks for Price Stabilisation and their Contribution to the Transformation of Food Systems

75 notes

·

View notes