#Compact CWDM

Explore tagged Tumblr posts

Text

Compact CWDM Mux/Demux Boosts Fiber Capacity

CWDM Mux/Demux devices enable efficient wavelength multiplexing and demultiplexing, allowing multiple data channels over a single fiber. Ideal for expanding bandwidth without laying new fiber, CWDM Mux/Demux ensures cost-effective, high-capacity optical communication in metro and access networks. Contact DK Photonics who is a leadig company of these products.

To know more:

http://dk-lasercomponents.com/

0 notes

Text

Wavelength Division Multiplexing Module Market: Expected to Reach USD 5.92 Bn by 2032

MARKET INSIGHTS

The global Wavelength Division Multiplexing Module Market size was valued at US$ 2.84 billion in 2024 and is projected to reach US$ 5.92 billion by 2032, at a CAGR of 11.3% during the forecast period 2025-2032. The U.S. accounted for 32% of the global market share in 2024, while China is expected to witness the fastest growth with a projected CAGR of 13.5% through 2032.

Wavelength Division Multiplexing (WDM) modules are optical communication components that enable multiple data streams to be transmitted simultaneously over a single fiber by using different wavelengths of laser light. These modules play a critical role in expanding network capacity without requiring additional fiber infrastructure. The technology is categorized into Coarse WDM (CWDM) and Dense WDM (DWDM), with applications spanning telecommunications, data centers, and enterprise networks.

The market growth is primarily driven by escalating data traffic demands, with global IP traffic projected to reach 4.8 zettabytes annually by 2026. The 1270nm-1310nm wavelength segment currently dominates with over 45% market share due to its cost-effectiveness in short-haul applications. Recent technological advancements include the development of compact, pluggable modules that support 400G and 800G transmission rates, with companies like Cisco and Huawei introducing AI-powered WDM solutions for enhanced network optimization. The competitive landscape features established players such as Nokia, Corning, and Infinera, who collectively held 58% of the market share in 2024 through innovative product portfolios and strategic partnerships with telecom operators.

MARKET DYNAMICS

MARKET DRIVERS

Exploding Demand for High-Bandwidth Connectivity Accelerates WDM Module Adoption

The global surge in data consumption, driven by 5G deployment, cloud computing, and IoT expansion, is fundamentally transforming network infrastructure requirements. Wavelength Division Multiplexing (WDM) modules have emerged as critical enablers for meeting this unprecedented bandwidth demand. Industry data indicates that global IP traffic is projected to grow at a compound annual growth rate exceeding 25% through 2030, with video streaming and enterprise cloud migration accounting for over 75% of this traffic. WDM technology allows network operators to scale capacity without costly fiber trenching by transmitting multiple data streams simultaneously over a single optical fiber. Recent tests have demonstrated commercial WDM systems delivering 800Gbps per wavelength, with terabit-capacity modules entering field trials. This scalability makes WDM solutions indispensable for telecom providers facing capital expenditure constraints.

Data Center Interconnect Boom Fuels Market Expansion

The rapid proliferation of hyperscale data centers and edge computing facilities has created an insatiable need for high-density interconnects. WDM modules are becoming the preferred solution for data center interconnects (DCI), with adoption rates increasing by approximately 40% year-over-year in major cloud regions. The technology’s ability to reduce fiber count by up to 80% while maintaining low latency has proven particularly valuable for hyperscalers operating campus-style deployments. Market analysis shows that WDM-based DCI solutions now account for over 60% of new installations in North America and Asia-Pacific regions. Recent product innovations such as pluggable coherent DWDM modules have further accelerated adoption by simplifying deployment in space-constrained data center environments.

Government Broadband Initiatives Create Favorable Market Conditions

National digital infrastructure programs worldwide are driving substantial investments in optical network upgrades. Numerous countries have allocated billions in funding for fiber optic network expansion, with WDM technology specified as a core component in over 70% of these initiatives. The technology’s ability to future-proof networks while minimizing physical infrastructure requirements aligns perfectly with public sector connectivity goals. Regulatory mandates for universal broadband access are further stimulating demand, particularly in rural and underserved areas where WDM solutions enable efficient network extension. These coordinated public-private partnerships are expected to sustain market growth through the decade, with particular strength in emerging economies undergoing digital transformation.

MARKET RESTRAINTS

Component Shortages and Supply Chain Disruptions Impede Market Growth

The WDM module market continues to face significant supply-side challenges, with lead times for critical components extending beyond 40 weeks in some cases. The industry’s reliance on specialized optical components manufactured by a concentrated supplier base has created vulnerabilities in the value chain. Recent geopolitical tensions and trade restrictions have exacerbated these issues, particularly affecting the availability of indium phosphide chips and precision optical filters. Manufacturers report that component scarcity has constrained production capacity despite strong demand, with some vendors implementing allocation strategies for high-demand products. This supply-demand imbalance has led to price volatility and extended delivery timelines, potentially delaying network upgrade projects across multiple sectors.

High Deployment Complexity Limits SMB Adoption

While large enterprises and telecom operators have readily adopted WDM technology, small and medium businesses face significant barriers to entry. The technical complexity of designing and maintaining WDM networks requires specialized expertise that is often cost-prohibitive for smaller organizations. Industry surveys indicate that nearly 65% of SMBs cite lack of in-house optical networking skills as the primary obstacle to WDM adoption, followed by concerns about interoperability with existing infrastructure. The requirement for trained personnel to configure wavelength plans and perform optical power budgeting creates additional operational challenges. These factors have constrained market penetration in the SMB segment, despite the clear economic benefits of WDM solutions for bandwidth-constrained organizations.

Intense Price Competition Squeezes Manufacturer Margins

The WDM module market has become increasingly competitive, with average selling prices declining approximately 12% annually despite advancing technology capabilities. This price erosion stems from fierce competition among manufacturers and the growing influence of hyperscale buyers negotiating volume discounts. While unit shipments continue to grow, profitability pressures have forced some vendors to exit certain product segments or consolidate operations. The commoditization of basic CWDM products has been particularly pronounced, with gross margins falling below 30% for many suppliers. This competitive environment creates challenges for sustaining R&D investment in next-generation technologies, potentially slowing the pace of innovation in the mid-term.

MARKET OPPORTUNITIES

Open Optical Networking Creates New Ecosystem Opportunities

The shift toward disaggregated optical networks presents a transformative opportunity for WDM module vendors. Open line system architectures, which decouple hardware from software, are gaining traction with operators seeking to avoid vendor lock-in. This transition has created demand for standardized WDM modules compatible with multi-vendor environments. Early adopters report 40-50% reductions in capital expenditures through open optical networking approaches. Module manufacturers that can deliver carrier-grade products with robust interoperability testing stand to capture significant market share as this trend accelerates. The emergence of plug-and-play modules with built-in intelligence for automated wavelength provisioning is particularly promising, reducing deployment complexity while maintaining performance.

Coherent Technology Migration Opens New Application Areas

Advancements in coherent WDM technology are enabling expansion into previously untapped market segments. The development of low-power, compact coherent modules has made the technology viable for metro and access network applications, not just long-haul routes. Industry trials have demonstrated coherent WDM successfully deployed in last-mile scenarios, potentially revolutionizing fiber deep architectures. This migration is supported by silicon photonics integration that reduces power consumption by up to 60% compared to traditional coherent implementations. Manufacturers investing in these miniaturized coherent solutions can capitalize on the growing need for high-performance connectivity across diverse network environments, from 5G xHaul to enterprise backbones.

Emerging Markets Present Untapped Growth Potential

The ongoing digital transformation in developing economies represents a significant expansion opportunity for WDM technology providers. As these regions upgrade legacy infrastructure to support growing internet penetration, demand for cost-effective bandwidth scaling solutions has intensified. Market intelligence indicates that WDM adoption in Southeast Asia and Latin America is growing at nearly twice the global average rate, driven by mobile operator network modernization programs. Local manufacturing initiatives and government incentives for telecom equipment production are further stimulating market growth. Vendors that can deliver ruggedized, maintenance-friendly WDM solutions tailored to emerging market operating conditions stand to benefit from this long-term growth trajectory.

MARKET CHALLENGES

Technology Standardization Issues Complicate Interoperability

The WDM module market faces persistent challenges related to technology standardization and interoperability. While industry groups have made progress in defining interface specifications, practical implementation often reveals compatibility issues between different vendors’ equipment. Recent network operator surveys indicate that nearly 35% of multi-vendor WDM deployments experience interoperability problems requiring costly workarounds. These challenges are particularly acute in coherent optical systems, where proprietary implementations of key technologies like probabilistic constellation shaping create vendor-specific performance characteristics. The resulting integration complexities increase total cost of ownership and can delay service rollout timelines, potentially slowing overall market growth.

Thermal Management Becomes Critical Performance Limiter

As WDM modules increase in density and capability, thermal dissipation has emerged as a significant design challenge. Next-generation modules packing more than 40 wavelengths into single-slot form factors generate substantial heat loads that can impair performance and reliability. Industry testing reveals that temperature-related issues account for approximately 25% of field failures in high-density WDM systems. The problem is particularly acute in data center environments where air cooling may be insufficient for thermal management. Manufacturers must invest in advanced packaging technologies and materials to address these thermal constraints while maintaining competitive module footprints and power budgets.

Skilled Workforce Shortage Threatens Implementation Capacity

The rapid expansion of WDM networks has exposed a critical shortage of qualified optical engineering talent. Industry analysis suggests the global shortfall of trained optical network specialists exceeds 50,000 professionals, with the gap widening annually. This talent crunch affects all market segments, from module manufacturing to field deployment and maintenance. Network operators report that 60% of WDM-related service delays stem from workforce limitations rather than equipment availability. The specialized knowledge required for wavelength planning, optical performance optimization, and fault isolation creates a steep learning curve for new entrants. Without concerted industry efforts to expand training programs and knowledge transfer initiatives, this skills gap could constrain market growth potential in coming years.

WAVELENGTH DIVISION MULTIPLEXING MODULE MARKET TRENDS

5G Network Expansion Driving Demand for Higher Bandwidth Solutions

The rapid global rollout of 5G infrastructure is accelerating demand for wavelength division multiplexing (WDM) modules, as telecom operators require fiber optic solutions that can handle exponential increases in data traffic. With 5G networks generating up to 10 times more traffic per cell site than 4G, WDM technology has become essential for optimizing existing fiber infrastructure instead of deploying costly new cabling. The 1270nm-1310nm segment shows particularly strong growth potential due to its compatibility with current network architectures, with projections indicating this wavelength range could capture over 35% of the market by 2032. This trend is reinforced by increasing investments in 5G globally, particularly in Asia where China accounts for nearly 60% of current 5G base stations worldwide.

Other Trends

Data Center Interconnectivity

Hyperscale data centers are increasingly adopting DWDM (Dense Wavelength Division Multiplexing) solutions to manage the massive data flows between facilities. As cloud computing continues its expansion with a projected 20% annual growth rate, data center operators require high-capacity optical networks that can support 400G and 800G transmission speeds. The WDM module market benefits significantly from this shift, with fiber-based interconnects becoming the standard for latency-sensitive applications like AI processing and financial transactions. Recent innovations in pluggable optics have made WDM solutions more accessible for data center applications, reducing power consumption by up to 40% compared to traditional implementations.

Emergence of Next-Generation Optical Networking Standards

The adoption of flexible grid technology is transforming WDM module capabilities, allowing dynamic allocation of bandwidth across optical channels. This development enables more efficient spectrum utilization and supports the evolution toward software-defined optical networks. Market leaders are increasingly integrating coherent detection technology into WDM modules, enhancing performance for long-haul transmissions critical for undersea cables and continental backbone networks. While these advancements present significant opportunities, they also require manufacturers to invest heavily in R&D—currently estimated at 15-20% of revenue for leading players—to maintain technological competitiveness in this rapidly evolving sector.

COMPETITIVE LANDSCAPE

Key Industry Players

Market Leaders Focus on Innovation and Strategic Expansion to Maintain Dominance

The global Wavelength Division Multiplexing (WDM) module market features a dynamic competitive landscape where established telecom giants and specialized optical solution providers coexist. Nokia and Cisco collectively accounted for over 25% of the global market share in 2024, leveraging their extensive telecommunications infrastructure and frequent product innovations. Both companies have recently expanded their WDM product lines to support 400G and beyond optical networks.

Meanwhile, Huawei continues to dominate the Asia-Pacific region with cost-effective solutions, while Fujitsu and ZTE have gained significant traction in emerging markets. These players differentiate themselves through customized wavelength solutions tailored for hyperscale data centers and 5G backhaul applications.

Specialized manufacturers such as Corning and CommScope maintain strong positions in the North American and European markets through continuous R&D investments. Corning’s recent development of compact, low-power consumption WDM modules has particularly strengthened its market position in energy-conscious data center applications.

The market has witnessed increased merger and acquisition activity, with larger players acquiring niche technology providers to expand their product portfolios. This trend is expected to intensify as demand grows for integrated optical networking solutions combining WDM with other technologies like coherent optics.

List of Key Wavelength Division Multiplexing Module Companies

Nokia (Finland)

Cisco Systems, Inc. (U.S.)

Huawei Technologies Co., Ltd. (China)

Fujitsu Limited (Japan)

ZTE Corporation (China)

Corning Incorporated (U.S.)

CommScope Holding Company, Inc. (U.S.)

ADVA Optical Networking (Germany)

Infinera Corporation (U.S.)

Fujikura Ltd. (Japan)

Lantronix, Inc. (U.S.)

Fiberdyne Labs (U.S.)

Segment Analysis:

By Type

1270nm-1310nm Segment Leads Due to Increasing Demand in Short-Range Optical Networks

The market is segmented based on wavelength range into:

1270nm-1310nm

1330nm-1450nm

1470nm-1610nm

By Application

Telecommunication & Networking Segment Dominates Owing to Rapid 5G Deployment

The market is segmented based on application into:

Telecommunication & Networking

Data Centers

Others

By End User

Enterprise Sector Leads Adoption for Efficient Bandwidth Management

The market is segmented based on end user into:

Telecom Service Providers

Data Center Operators

Enterprise Networks

Government & Defense

Others

By Technology

DWDM Technology Holds Major Share for Long-Haul Transmission

The market is segmented based on technology into:

Coarse WDM (CWDM)

Dense WDM (DWDM)

Wide WDM (WWDM)

Regional Analysis: Wavelength Division Multiplexing Module Market

North America The North American Wavelength Division Multiplexing (WDM) module market is driven by robust demand from hyperscale data centers and telecommunications networks upgrading to higher bandwidth capacities. The U.S. accounts for over 70% of regional market share, fueled by 5G deployments and cloud service expansions by major tech firms. While enterprise adoption is growing steadily, carrier networks remain the primary consumers. Regulatory pressures for energy-efficient networking solutions are accelerating the shift toward advanced WDM technologies, particularly dense wavelength division multiplexing (DWDM) systems. The market is characterized by strong R&D investments from established players like Cisco and Corning.

Europe Europe’s WDM module market benefits from extensive fiber optic deployments across EU member states and strict data sovereignty regulations driving localized data center growth. Germany and the U.K. lead adoption, with significant investments in metro and long-haul network upgrades. The region shows particular strength in coherent WDM solutions for high-speed backhaul applications. However, market growth faces temporary headwinds from economic uncertainties and supply chain realignments post-pandemic. European operators prioritize vendor diversification, creating opportunities for both western manufacturers and competitive Asian suppliers.

Asia-Pacific Asia-Pacific dominates global WDM module consumption, with China alone representing approximately 40% of worldwide demand. Explosive growth in mobile data traffic, government digital infrastructure programs, and thriving hyperscaler ecosystems propel market expansion. While Japan and South Korea focus on cutting-edge DWDM implementations, emerging markets are driving volume demand for cost-effective coarse WDM (CWDM) solutions. India’s market is growing at nearly 15% CAGR as it rapidly modernizes its national broadband network. The region benefits from concentrated manufacturing hubs but faces margin pressures from intense price competition among domestic suppliers.

South America South America’s WDM module adoption remains concentrated in Brazil, Argentina and Chile, primarily serving international connectivity hubs and financial sector requirements. Market growth is constrained by limited domestic fiber manufacturing capabilities and foreign currency volatility affecting capital expenditures. However, submarine cable landing stations and mobile operator network upgrades provide stable demand drivers. The region shows particular interest in modular, scalable WDM solutions that allow gradual capacity expansion – an approach that suits the cautious investment climate and phased infrastructure rollout strategies.

Middle East & Africa The Middle East demonstrates strong WDM module uptake focused on smart city initiatives and regional connectivity projects like the Gulf Cooperation Council’s fiber backbone. UAE and Saudi Arabia lead deployment, with significant investments in carrier-neutral data centers adopting wavelength-level interconnection services. In contrast, African adoption remains largely limited to undersea cable termination points and mobile fronthaul applications. While the market shows long-term potential, adoption barriers include limited technical expertise and reliance on international vendors for both equipment and maintenance support across most countries.

Report Scope

This market research report provides a comprehensive analysis of the global and regional Wavelength Division Multiplexing Module markets, covering the forecast period 2024–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The global market was valued at USD 1.2 billion in 2024 and is projected to reach USD 2.8 billion by 2032, growing at a CAGR of 11.3%.

Segmentation Analysis: Detailed breakdown by product type (1270nm-1310nm, 1330nm-1450nm, 1470nm-1610nm), application (Telecommunication & Networking, Data Centers, Others), and end-user industry to identify high-growth segments.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. Asia-Pacific accounted for 42% market share in 2024.

Competitive Landscape: Profiles of 18 leading market participants including Cisco, Nokia, Huawei, and Infinera, covering their market share (top 5 players held 55% share in 2024), product portfolios, and strategic developments.

Technology Trends: Analysis of emerging innovations in DWDM, CWDM, and optical networking technologies, including integration with 5G infrastructure.

Market Drivers: Evaluation of key growth factors such as increasing bandwidth demand, data center expansion, and 5G deployment, along with challenges like supply chain constraints.

Stakeholder Analysis: Strategic insights for optical component manufacturers, network operators, system integrators, and investors.

Related Reports:https://semiconductorblogs21.blogspot.com/2025/06/fieldbus-distributors-market-size-and.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/consumer-electronics-printed-circuit.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/metal-alloy-current-sensing-resistor.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/modular-hall-effect-sensors-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/integrated-optic-chip-for-gyroscope.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/industrial-pulsed-fiber-laser-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/unipolar-transistor-market-strategic.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/zener-barrier-market-industry-growth.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/led-shunt-surge-protection-device.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/type-tested-assembly-tta-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/traffic-automatic-identification.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/one-time-fuse-market-how-industry.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/pbga-substrate-market-size-share-and.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/nfc-tag-chip-market-growth-potential-of.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/silver-nanosheets-market-objectives-and.html

0 notes

Text

🚀 Enhance Your Network with the 25G SFP28 CWDM Optical Transceiver! 🌐

Looking for seamless and high-speed data transfer for your infrastructure? The 25G SFP28 CWDM 10km LC SMF Optical Transceiver is the perfect solution for boosting your network performance. With its reliable 25Gbps data rate and long-range capabilities, you’ll experience superior efficiency even in the most demanding environments.

Why Choose It? ✔️ 25G High-Speed for rapid data flow ✔️ 10km range for long-distance transmission over Single-Mode Fiber ✔️ Compact LC connector for ease of installation ✔️ Cost-Effective CWDM for efficient network upgrades

Time to level up your network! ⚡️

1 note

·

View note

Text

Essential Guide to Fiber Optic Connectivity Solutions

In the rapidly evolving world of telecommunications, fiber optic connectivity has emerged as a cornerstone of modern network infrastructure. As businesses and organizations increasingly demand faster, more reliable, and more efficient communication systems, understanding fiber optic connectivity solutions has become crucial.

The Evolution of Fiber Optic Technology

Fiber optic technology has transformed how we transmit and receive data. Unlike traditional copper-based systems, fiber optics use light pulses to transmit information, offering unprecedented speed, bandwidth, and reliability. This breakthrough has revolutionized industries from telecommunications to healthcare, enabling complex data transfer across vast distances.

Key Advantages of Fiber Optic Connectivity

Unparalleled Data Transmission Speed Fiber optic cables can transmit data at speeds approaching the speed of light, making them exponentially faster than traditional copper networks. This means reduced latency and near-instantaneous data transfer.

Enhanced Signal Integrity Fiber optic signals degrade much slower compared to electrical signals, allowing for longer transmission distances without signal regeneration. This characteristic makes them ideal for long-range communication networks.

Immunity to Electromagnetic Interference Unlike copper cables, fiber optic cables are immune to electromagnetic interference, ensuring consistent and reliable data transmission even in challenging environments.

Understanding Critical Components of Fiber Optic Networks

Fiber Optic Adapters: The Crucial Connectors

Fiber optic adapters play a pivotal role in establishing seamless connections between fiber optic cables. These precision-engineered components ensure minimal signal loss and precise alignment, critical for maintaining network performance.

MPO/MTP Patch Cords: Enabling High-Density Connectivity

Multi-fiber Push-On (MPO) and Mechanical Transfer Registered (MTP) patch cords represent the next generation of fiber optic connectivity. These advanced solutions allow multiple fibers to be connected simultaneously, dramatically increasing network density and efficiency.

Wavelength Division Multiplexing (WDM): Maximizing Network Capacity

Frequency Wavelength Division Multiplexing (FWDM) represents a sophisticated technique for dramatically increasing network bandwidth. By transmitting multiple optical signals on different wavelengths through a single fiber, FWDM enables exponential increases in data transmission capacity without additional infrastructure investments.

FWDM Implementation Strategies

Coarse Wavelength Division Multiplexing (CWDM)

Dense Wavelength Division Multiplexing (DWDM)

Hybrid WDM Solutions

Selecting the Right Fiber Optic Connectivity Solution

When choosing fiber optic connectivity solutions, consider:

Network Performance Requirements

Scalability Potential

Budget Constraints

Environmental Conditions

Future Expansion Plans

Professional Considerations

Enterprises should partner with experienced telecommunications equipment manufacturers who understand the nuanced requirements of modern network infrastructure. Look for providers offering comprehensive solutions, technical support, and innovative product portfolios.

Emerging Trends in Fiber Optic Connectivity

The future of fiber optic technology is incredibly promising. Emerging trends include:

Higher Bandwidth Capabilities

Increased Energy Efficiency

More Compact and Modular Designs

Enhanced Optical Component Integration

Conclusion: The Transformative Power of Fiber Optic Solutions

As digital transformation accelerates, fiber optic connectivity solutions will continue to be the backbone of global communication infrastructure. By understanding these technologies, businesses can make informed decisions that drive technological innovation and competitive advantage.

Investing in robust, scalable fiber optic network solutions isn't just a technical decision—it's a strategic move towards future-proofing your organization's communication capabilities.

0 notes

Text

DWDM Series Products

Build a High-speed, Large-capacity, Long-distance, Multi-wave Trunk Network

Compact Design | 1+1 Hot Backup | Flexible Networking | Remote Management

10G/25G/100G/200G Equipment, Adapt to Different Bandwidth

10G/25G/100G/200G devices with multiple rates can easily adapt to the needs of different services such as SDH/SONET, Ethernet, SAN, OTN, Video, CPRI, eCPRI, and FC.

Support Multiple Services, Saving Fiber Resources

Multiplexing multiple services onto one fiber, supporting simultaneous transmission of multiple signals, maximizing fiber utilization, saving fiber laying costs, and meeting CWDM/DWDM wavelength multiplexing transmission.

Compact Design, Flexible Networking

Through excellent heat dissipation design and power supply design, it is equipped with industrial chips, and is designed in accordance with the standard 1U/2U/6U compact slot to meet the deployment requirements of different computer rooms.

Hot Pluggable, 24 Hours Online

Different service boards support hot pluggable and can be used in the whole series of chassis, which greatly improves the reliability, rapid recovery and redundancy of the system.

Remote Management, Easy Maintenance

Using Web, CLI and other management methods, it has functions such as real-time status, software update, threshold alarm, optical cable protection, configuration parameter query, etc., which greatly reduces equipment maintenance costs.

Application Scenarios

C-Data DWDM series products provide long-distance and large-capacity transmission network solutions for carrier operators, MSO/ISP, IDC service providers, and special network customers.

1 note

·

View note

Text

QSFP Cable and Connectors Assemblies

A quad (4-channel) Small Form-factor Pluggable Optics Transceiver is also known as a QSFP cable. For applications requiring 40 Gigabit Ethernet (40GbE) data transfers, it is a small, hot-pluggable fiber optical transceiver. They are often used for the implementation of 40G Ethernet, Infiniband, and other communications protocols in data centers.

It connects a fiber optic or copper cable to network equipment, such as a switch, router, media converter, or similar device.

In addition to copper cable media, QSFP+ optic transceivers are made to support Serial Attached SCSI, 40G Ethernet, 20G/40G Infiniband, and other fiber optic communication standards. In comparison to SFP+ optic modules, the QSFP28 cable significantly increases port density by 4x.

Optical transceivers are compact, strong devices that add fiber ports to switches or other networking equipment by connecting them to copper or fiber optic cables. Data is transmitted using optical fiber in conjunction with fiber optics in the form of light pulses that travel at very high speeds and can cover very long distances. The transceiver, which is a laser with a certain wavelength that transforms electrical signals into optical signals, is a crucial part of the fiber optic network. The data is then converted into a signal with a specific wavelength by the transceiver and sent over the optical fiber. Wideband signals are those that are 850 nm, 1310 nm, and 1550 nm in wavelength. Narrow bands are the term for CWDM or DWDM signals. Each channel is unable to interact with the others due to the special property of light.

This indicates that a network can handle the transmission of both wideband and narrowband signals. Direct attach copper (DAC), active optical cables (AOC), optical modules, and active copper cables are all types of QSFP interconnects (ACC). The least costly choice is DACs. They offer a connection that depends on host signal processing. The maximum length that can be achieved depends on the cable assembly's insertion loss, which is determined by its length and cable gauge and is guided by the IEEE specifications (see below) (AWG). The AWG of a wire has an inverse relationship with its size. AWG and wire diameter for QSFP cable assemblies are plotted in the table below.

Follow our Facebook and Twitter for more information about our product.

2 notes

·

View notes

Text

Know the Difference between CWDM and DWDM

Know the Difference between CWDM and DWDM

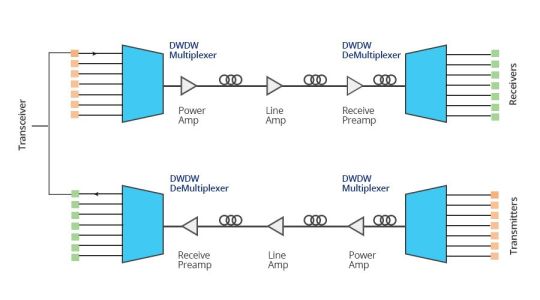

A WDM (Wavelength Division Multiplexing) is a system that uses a multiplexing (at the transmitter) and a demultiplexer (at the receiver) for the completion of the process and transmission of the signals.

The WDM is divided into three types (WDM, CWDM and DWDM) on the basis of wavelength difference among the three. The article discusses the main differences among CWDM and DWDM.

CWDM stands for…

View On WordPress

#100GHz 8CH DWDM#100GHz AWG#200GHz DWDM#8CH CWDM Module#Athermal AWG DWDM Module#Compact CWDM#Mini Size CWDM#Thermal AWG DWDM Module

0 notes

Text

Uses for an optical isolator

Rotators Difference between an Optical Circulator & Isolator & RotatorĪn optical circulator is used to route the incoming light signals from port 1 to port 2 in a way that if some of the emitted light is reflected back to the circulator, it doesn’t exit from port 1 but from port 3. This rotator is used for amplitude modulation of light and is an integral part of optical isolators and optical circulators. What is an optical rotator?Īn optical rotator is typically an in-line Faraday rotator that is designed to rotate the polarization of the input light by 45 degrees. This is what makes it possible to achieve higher isolation. Hence, it adds to the total of 90 degrees when light travels in the forward direction and then the same in the backward direction. It happens because of the change in the relative magnetic field direction, positive one way, and negative the other way. It means that the rotation is positive 45 degrees in the forward direction and negative 45 degrees in the reverse direction. The polarization rotation caused by the Faraday rotator always remains in the same relative direction. Its main component is the Faraday rotator which ensures non-reciprocal rotation while maintaining linear polarization. What is an optical isolator?Īlso known as an optical diode, an optical isolator is an optical passive component that allows the light to travel in only one direction. While some circulators are three-port devices, there are also four-port circulators. In short, it is designed such that the light coming from one port exits from the next port. What is an optical circulator?Īn optical circulator is a high-performance light-wave component that is designed to route the incoming light signals from Port 1 to Port 2 and the incoming light signals from Port 2 to Port 3. Circulator & Isolator & RotatorĪs we are discussing specifically optical passive components, you will learn here about optical circulators, optical isolators, and optical rotators rather than their electronic counterparts. So, if you are curious to know about these little yet important optical passive components, read the blog till the end. We will first talk about what these components exactly are and then share what makes them different from each other. Today, we will discuss three different optical passive components, namely circulator & isolator & rotator. What is a polarization maintaining filter coupler?.A Concise Selection Guide for In-Line Polarizers.What is the importance of 80um PM fiber components?.The Growing Demand for PM Fiber Components in 2023 and Beyond.Why Should Polarization Maintaining Filter Coupler Feature High Extinction Ratio?.Polarizing Beam combiners/splitters (2).High Power Faraday Rotator and Isolator (1).(6+1)X1 Pump and Signal Combiner 2+1X1 Pump Combiner 8CH CWDM Module 16CH CWDM Module 19" rack mount chassis CWDM 1060nm Cladding Power Stripper 1064nm Band-pass Filter 1064nm Components 1064nm Fiber Collimator 1064nm High Power Isolator ABS plastic box Cladding Power Stripper Collimator Compact CWDM Module CWDM CWDM Multiplexer CWDM Mux/Demux CWDM MUX/DEMUX Module DWDM DWDM Multiplexer fiber optica connector fiber optic coupler FTTX Fused Coupler fused wdm FWDM High Power Fused Coupler High power isolator Isolator LGX CWDM Module Mini Size CWDM Mini Size Fused WDM Multimode High Power Isolator OADM optical circulator optical coupler Optical fiber communication optical isolator PLC Splitter pm circulator PM Components pm isolator pump combiner Pump Laser Protector WDM DK Categories

0 notes

Text

What areas does CWDM SFP apply to?

What areas does CWDM SFP apply to?

SFP stands for “small form-factor pluggable.” SFP transceivers are compact and hot-pluggable devices that act as an interface between networking equipment (switch, router, network card) and interconnecting cabling (copper or fiber). The CWDM optical module is an optical module using CWDM technology to implement the connection between the existing network device and the CWDM…

View On WordPress

0 notes

Photo

Swedish Telecom Opto compact size Coarse Wavelength Division Multiplexers(Mini CWDM, Compact CWDM, CCWDM), are integrated optical modules using Our proprietary optical bench platform which can significantly improve optical performance, while also reduce manufacturing cost.

0 notes

Photo

CCWDM stands for Compact CWDM. The difference is that CCWDM uses free space technology, and its package size is greatly reduced compared with CWDM modules. https://hyc-system.com/Product/index_210/83

0 notes

Text

Data Bottleneck Solutions for your Business with Compact CWDM Mux and Demux

Data Bottleneck Solutions for your Business with Compact CWDM Mux and Demux

Communication networks are vulnerable to data congestion. This limits the end users from accessing certain links including mobile radio towers. The problem has led to management of dedicated links by a large number of wireless carriers through the optical fiber network connection.

Depending on the requirement standards the service provider is expected to comply, some even go to the extent of…

View On WordPress

0 notes

Text

Qu’est-Ce Que Le Module Émetteur-Récepteur Optique ?

La demande des utilisateurs pour les réseaux de communication croissante a favorisé le développement rapide des modules optiques. Mais qu'est-ce que le module émetteur-récepteur optique ? Quels sont les types des modules émetteur-récepteur optiques ? Comment choisissez-vous le module optique le mieux adapté à votre application parmi de nombreux modules optiques différents ? Aujourd'hui, nous allons vous donner la réponse !

Le module émetteur-récepteur optique est un dispositif qui utilise la technologie fibre optique pour envoyer et recevoir des données. Le module optique est constitué de dispositifs optoélectroniques, de circuits fonctionnels et d'interfaces optiques. Les dispositifs optoélectroniques comprennent des parties d'émission et de réception. Autrement dit, le rôle du module optique est la conversion photoélectrique, le côté émetteur du signal électrique en signaux optiques, à travers la transmission de fibre optique, le récepteur puis la conversion du signal optique en signaux électriques. Le rôle du module optique pour le basculement entre l'appareil et la transmission du transporteur, par rapport à l'émetteur-récepteur est plus efficace et fiable.

Les types des modules optiques

Le module optique, principalement divisé en GBIC, SFP, SFP +, XFP, SFF, CFP, il y a deux types d'interface optique, y compris SC et LC. Les SFP, SFP +, XFP sont plus couramment utilisés que les GBIC .

Par paquet : GBIC, SFF, SFP, XFP, SFP +, X2, XENPARK, 300pin, etc.

Selon le taux : 155 M, 622 M, 1.25 G, 2.5 G, 4.25 G, 10 G, 40 G et ainsi de suite.

Par longueur d'onde : CWDM, DWDM, etc.

Par mode : fibre monomode, fibre multimode. Le module optique mono-mode est pour une longue distance de transmission. Le module optique multi-mode est pour la transmission à courte distance.

Par utilisation : échange à chaud (GBIC, SFP, XFP, XENPAK) et échange non-chaud (1 * 9, SFF).

SFP

Le SFP, enfichable et à faible encombrement, est un module optique compact et enfichable à chaud utilisé pour toutes les applications de télécommunications et de transmission de données. Il peut être considéré comme la version améliorée du GBIC. Sa taille est seulement environ une moitié de celle du GBIC, ce qui permet d’économiniser plus d’espace. Avant l'avènement de la mise à niveau SFP, les modules optiques SFP étaient le module optique le plus répandu sur le marché.

SFP+

Le SFP+ est une version améliorée du SFP. Il soutient un débit de données jusqu’à 10 Gbit/s, un fibre Channel de 8 Gbit/s, 10 Gigabit Ethernet et la norme OTU2 du Réseau de Transport Optique.

XFP

Le XFP a apparu avant le SFP+. Il est un format standard pour les modules optiques de série de 10 Gb/s. Il est indépendant du protocole et complètement conforme aux normes suivantes : 10 G Ethernet, 10 G Fibre Channel, SONET OC-192, SDH STM-64 et OTN G.709, soutenant un débit binaire de 9.95 G à 11.3 G. Il est utilisé dans le lien optique de la communication des données et de télécommunication et offre un format plus petit et une consommation d’alimentation plus faible que d’autres transpondeurs de 10 Gb/s.

QSFP/QSFP+

Le QSFP est l’abréviation de Quad (4 canaux) Small Form-factor Pluggable. Il est un module optique compact et enfichable à chaud utilisé également pour les applications de transmission de données. Par rapport au QSFP+, le QSFP soutient un quart d’un enfichable à petit facteur avec un différent débit de données, ce qui ne change rien à la solution du produit. Aujourd’hui, le QSFP+ remplace graduellement le QSFP avec une large utilisation puisqu’il peut fournir une bande passante plus haute.

CFP

CFP, qui signifie facteur de forme C enfichable, est un accord multisource pour produire un facteur de forme commun de transmission de signaux numériques à grande vitesse. Le C représente la lettre latine C utilisée pour exprimer le nombre 100 (cent), puisque la norme a été développée pour le système 100 Gigabit Ethernet. Le CFP peut supporter une large gamme d’applications 40 et 100 Gb/s telles que 40 G et 100 G Ethernet, OC-768/STM-256, OTU3, et OTU4.

QSFP28

Le module optique QSFP28 100 G est un produit de haute densité et de grande vitesse conçu pour les applications 100Gbps. Il possède le même format que le module optique QSFP+. Il fournit quatre canaux de grande vitesse aux signaux différents avec des débits de données allant de 25 Gbps à potentiellement 40 Gbps, et il peut finalement répondre aux exigences d’InfiniBand EDR (débit amélioré) de 100 Gbps Ethernet (4 × 25 Gbps) et de 100 Gbps 4X. Actuellement, il est généralement disponible dans plusieurs normes : 100GBASE-SR4, 100GBASE-LR4, 100GbASE-PSM4 et 100GBASE-CWDM4. QSFP28-100G-SR4 fonctionne sur une fibre multimode de 100 m. Alors que 100GBASE-LR4 QSFP28 supporte une distance beaucoup plus longue qui est de 10 km. Comparé au CFP, le QSFP28 est plus populaire dans le marché de modules optiques 100 G.

Les facteurs à considérer lors de l'achat d'un module optique

Voici les 4 points importants : Distance de transmission

Les distances de transmission que les modules optiques supportent sont différentes. En général, la distance de transmission du module optique multimode est beaucoup plus courte que celle de module optique monomode, et le prix du module optique multimode est moins cher.

Mode de transmission

Il existe trois modes de transmission des données du module optique : simplex, semi-duplex et en duplex intégral, la transmission simplex accepte la transmission de données dans une seule direction. La transmission semi-duplex permet la transmission de données dans deux directions, mais à un moment donné, une seule direction de transmission de données est autorisée. La transmission en duplex intégral permet de transmettre simultanément des données dans les deux sens. Il est préférable de choisir un module optique qui accepte la transmission en duplex intégral. Moyen de transmission

Les câbles en cuivre et les câbles optiques sont actuellement les deux supports de transmission les plus utilisés, certains modules optiques sont conçus comme des ports électriques et certains modules optiques sont conçus comme des ports optiques. Résistance à la chaleur

La température de fonctionnement du module optique ne doit pas être trop élevée. Si la température est trop élevée, une défaillance de liaison peut se produire. Par conséquent, choisissez un module optique avec une bonne résistance à la chaleur. Les points ci-dessus ne sont que des facteurs à prendre en compte lors de l'achat d'un module optique, la longueur d'onde de travail, le taux de travail et le fabricant sont également importants.

Pourquoi nous choisir ?

Nous sommes un fournisseur professionnel de modules optiques. Nous fournissons tous les types de modules optiques ci-dessus, qui sont rentables et forts. Nous fournissons également des services personnalisés OEM pour répondre à vos différents besoins. Tous nos modules optiques sont testés au centre de test avant la livraison, garantis 100 % compatibles et abordables.

0 notes

Text

SFP 40 km VS. DWDM SFP: Which to Choose?

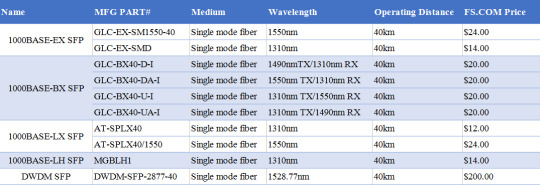

Small Form-factor Pluggable (SFP) is a compact, hot-pluggable transceiver used for both telecommunication and data communications applications. It is also called mini-GBIC for its smaller size, which is the upgraded version of GBIC transceiver. These 1Gb SFP modules are capable of supporting speeds up to 4.25 Gbps. And they are most often used for Fast Ethernet of Gigabit Ethernet applications. It interfaces a network device motherboard (for a switch, router, media converter or similar device) to a fiber optic or copper networking cable. SFP modules are commonly available in several different categories: 1000BASE-T SFP, 1000BASE-EX SFP, 1000BASE-SX SFP, 1000BASE-LX/LH SFP, 1000BASE-BX SFP, 1000BASE-ZX SFP, CWDM SFP and DWDM SFP. These modules support different distance according to the different Gigabit Ethernet standard. Today’s main subject will discuss SFP 40 km vs. DWDM SFP.

SFP 40 km

SFP 40 km transceiver is designed for highly reliable fiber optic network links up to 40 km. It is a cost effective transceiver designed to enable 1Gb for data center and core network applications. 1000BASE-EX SFP is the most popular SFP 40 km transceiver which runs on 1310nm wavelength lasers and achieves 40km link length. Except that, 1000BASE-BX BiDi SFP, 1000BASE-LH SFP and 1000BASE-LX SFP can also realize the transmission distance up to 40 km. The following will introduce these 1GbE SFP 40 km transceivers respectively.

1000BASE-EX SFP 40 km

1000BASE-EX SFP transceiver module is designed to connect a Gigabit Ethernet port to a network and has dual LC/PC single mode connectors. It operates on standard single-mode fiber-optic link spans of up to 40 km in length. The SFP Ethernet module provides a dependable and cost-effective way to add, replace or upgrade the ports on switches, routers and other networking equipment. Cisco GLC-EX-SM1550-40 and Cisco GLC-EX-SMD are 1G single mode fiber SFP 40 km modules for 1000BASE-EX Gigabit Ethernet transmission. GLC-EX-SM1550-40 supports a 1550nm wavelength signaling, while GLC-EX-SMD supports a 1310nm wavelength signaling.

1000BASE-BX SFP 40 km

1000BASE-BX SFP is a kind of BiDi transceiver, which can be divided into 1000BASE-BX-D SFP and 1000BASE-BX-U SFP. These two SFP transceivers must be used in pairs to permit a bidirectional Gigabit Ethernet connection using a single strand of single mode fiber (SMF) cable. The 1000BASE-BX-D SFP operates at wavelengths of 1490nm TX/1310nm RX, and the 1000BASE-BX-U SFP operates at wavelengths of 1310nm TX/1490nm RX.

1000BASE-BX-D BiDi SFP 40 km

Cisco GLC-BX40-D-I and GLC-BX40-DA-I are pluggable fiber optical transceivers for Gigabit Ethernet 1000BASE-BX and Fiber Channel communications. They support link length of up to 40 km point to point on single mode fiber at 1Gbps bidirectional and use an LC connector. The GLC-BX40-D-I transceiver transmits a 1490nm channel and receives a 1310nm signal, whereas GLC-BX40-DA-I transmits at a 1550nm wavelength and receives a 1310nm signal.

1000BASE-BX-U BiDi SFP 40 km

Similar to 1000BASE-BX-D 40 km SFP , Cisco GLC-BX40-U-I and GLC-BX40-UA-I also support link length of up to 40 km point to point on single mode fiber at 1Gbps bidirectional and use an LC connector. The main difference is the wavelength: GLC-BX40-U-I transmits a 1310nm channel and receives a 1550nm signal, whereas GLC-BX40- UA-I transmits at a 1310nm wavelength and receives a 1490nm signal. A GLC-BX40-D-I or GLC-BX40-DA-I device connects to a GLC-BX40-U-I or GLC-BX40-UA-I device with a single strand of standard SMF with an operating transmission range up to 40 km.

1000BASE-LX SFP 40 km

1000BASE-LX is a standard specified in IEEE 802.3 Clause 38 which uses a long wavelength laser. The “LX” in 1000BASE-LX stands for long wavelength, indicating that this version of Gigabit Ethernet is intended for use with long-wavelength transmissions (1270 - 1355nm) over long cable runs of fiber optic cabling. Allied Telesis AT-SPLX40 and Allied Telesis AT-SPLX40/1550 are 1000BASE-LX SFP single-mode modules supports Gigabit Ethernet over single-mode cables at distances up to 40 km. AT-SPLX40 operates over a wavelength of 1310nm for 40 km, whereas AT-SPLX40/1550 operates over a wavelength of 1550nm.

1000BASE-LH SFP 40 km

Unlike 1000BASE-LX, 1000BASE-LH is just a term widely used by many vendors. Long Haul (LH) denotes longer distances, so 1000BASE-LH SFP modules operate at a distance up to 70 km over single mode fiber. Cisco Linksys MGBLH1 is a easy-to-install modules that provide a simple way to add fiber connectivity or to add an extra Gigabit Ethernet port to switches. The MGE transceiver can support distances up to 40 km over single-mode fiber at a 1310nm wavelength.

DWDM SFP

DWDM SFP transceivers are used as part of a DWDM optical network to provide high-capacity bandwidth across an optical fiber network, which is a high performance, cost effective module for serial optical data communication applications up to 4.25Gb/s. DWDM transceiver uses different wavelengths to multiplex several optical signal onto a single fiber, without requiring any power to operate. There are 32 fixed-wavelength DWDM SFPs that support the International Telecommunications Union (ITU) 100-GHz wavelength grid. The DWDM SFP can be also used in DWDM SONET/SDH (with or without FEC), but for longer transmission distance like 200 km links and Ethernet/Fibre Channel protocol traffic for 80 km links. Cisco C61 DWDM-SFP-2877-40 is a 1000BASE-DWDM SFP 40km transceiver, which is designed to support distance up to 40 km over single-mode fiber and operate at a 1528.77nm DWDM wavelength (Channel 61) as specified by the ITU-T.

SFP 40 km VS. DWDM SFP

Transmission Medium

Generally, the standard SFP 40 km transceivers transmit through the single mode fiber, while DWDM SFP carries signals onto a single optical fiber to achieve maximum distances by using different wavelengths of laser light. So the DWDM SFP transceivers do not require any power to operate.

Wavelength

The standard SFP 40 km transceivers support distances up to 40 km over single-mode fiber at a 1310nm/1550nm wavelength. (the BiDi SFP has 1490nm/1550nm TX & 1310nm RX or 1310nm TX & 1490nm/1550nm RX ). However, DWDM SFP operates at a nominal DWDM wavelength from 1528.38 to 1563.86nm onto a single- mode fiber. Among them, 40 km DWDM SFP operates at a 1528.77nm DWDM wavelength (Channel 61).

Application

DWDM SFP is used in DWDM SONET/SDH, Gigabit Ethernet and Fibre Channel applications. These modules support operation at 100Ghz channel. The actual SFP transceiver offers a transparent optical data transmission of different protocols via single mode fiber. And for back-to-back connectivity, a 5-dB inline optical attenuator should be inserted between the fiber optic cable and the receiving port on the SFP at each end of the link.

Price

DWDM provides ultimate scalability and reach for fiber networks. Boosted by Erbium Doped-Fiber Amplifiers (EDFAs) - a sort of performance enhancer for high-speed communications, DWDM systems can work over thousands of kilometers. Most commonly, DWDM SFP is much more expensive than the standard SFP. You can see the price more clearly in the following cable.

Conclusion

1000BASE SFP transceiver is the most commonly used component for Gigabit Ethernet application. With so many types available in the market, careful notice should be given to the range of differences, both in distance and price of multimode and single-mode fiber optics. Through SFP 40 km vs. DWDM SFP, if you are looking for SFP modules over long distance and with better scalability, DWDM SFP module is the ideal choice.

Related Article: SFP Transceiver: To Be or Not To Be?

0 notes

Text

EXFO FTB-7212B-D-EI MM 850 1300 OTDR

Welcome to a Biomedical Battery specialist of the EXFO Battery

Today’s telecom market imposes test challenges that stem from a never-beforeseen variety of fiber-optic networks. Ultra-long-haul, high-fiber-count 10 Gb/s and high-speed DWDM networks. CWDM and 2.5 Gb/s metropolitan networks. Passive optical networks (PONs) and other types of access networks. All of these create increasingly specific and demanding testing requirements, making OTDRs more essential than ever for installing, maintaining and troubleshooting networks.

EXFO’s OTDRs deliver the right tools for accurately detecting and characterizing splices, connectors, splitters, breaks and other events along a fiber link. The FTB-7000B with battery like EXFO FTB-1 Battery, EXFO XW-EX009 Battery, EXFO LO4D318A Battery, EXFO AXS-100 Battery, EXFO AXS-110 Battery, EXFO XW-EX003 Battery, Acterna ANT-5 Battery, Acterna MT9090 Battery, Acterna MT9090A Battery, Acterna 909815B Battery, Acterna G0202A Battery, Acterna PT01496 Battery provides a wide choice of configurations to conveniently test all types of networks. The FTB-7000D and FTB-70000C enables multiple-wavelength testing by combining triple-wavelength capability in a single module. Plus, the FTB-7000D offers extremely short dead zones—perfect for short-distance applications—and faster-than-ever acquisitions.

EXFO’s OTDR modules meet all your testing needs with numerous singlemode and multimode configurations available at several wavelengths. Most important, they are field-interchangeable and compatible with both of EXFO's rugged, portable test platforms, the powerful FTB-400 Universal Test System and the compact FTB-100B Mini-OTDR.

0 notes

Text

How to Realize 16 Channels Transmission in DWDM Network?

DWDM MUX/DEMUX plays a critical in WDM network building. 16 channels transmission is very common in DWDM networks. How to realize it in a simple way? This article intends to introduce two solutions to achieve 16 channels with different types of components. Which one is more cost-effective and competitive? The comparison between the them also will be explored. Hope it will help you when choosing fiber mux for your DWDM networks.

Solutions to Achieve 16 Channels Transmission in DWDM Network

In order to illustrate the solution more clearly, I take two types of DWDM MUX/DEMUX as an example. One is the traditional 16 channels dual fiber DWDM MUX/DEMUX. Another is two FMU 8 channels dual fiber DWDM MUX/DEMUX. The latter has an expansion port.

Solution One: Using Traditional 16 Channels DWDM MUX/DEMUX

The 16 channel DWDM MUX/DEMUX is a passive optical multiplexer designed for metro access applications. It’s built fiber mux and demux in one unit and can multiplex 16 channels on a fiber pair. In addition, this type of fiber mux also can be added some functional ports like expansion port, monitor port and 1310nm port, which make it possible to increase network capacity easily. The following is a simple graph showing the 16 channels transmission with this traditional DWDM MUX/DEMUX.

Solution Two: Using Two FMU 8 Channels DWDM MUX/DEMUX Modules

The FMU 8 channels DWDM MUX/DEMUX provide 8 bidirectional channels on a dual strand of fiber. Usually they are used together. Unlike the 16 channels DWDM MUX/DEMUX, this FMU 8 channels one has a more compact size, for it only occupies half space in a 1U rack. Put two FMU 8 channels DWDM MUX/DEMUX modules into one 1U two-slot rack mount chassis. two 8 channels DWDM MUX/DEMUX with different wavelengths are connected through the expansion port to realize 16 channels transmission in a DWDM network. Here is a graph showing how to achieve 16 channels DWDM transmission with these two 8m channels fiber muxes. As shown in the figure, two 8 channels DWDM MUX/DEMUX with different wavelengths are connected through the expansion port to realize 16 channels transmission in a DWDM network.

16CH DWDM MUX and Two FMU 8CH DWDM MUX: What’s the Difference When Deployed?

From the content above, we can see both solutions can realize the 16 channels transmission in a DWDM network. Then, are there differences between them? Or which is more competitive? Here is a simple analysis of the two solutions.

Firstly, comparing the two graphs above, the FMU 8 channels DWDM MUX/DEMUX are connected together by an expansion port, that’s why it can deliver 16 channels services like the traditional one. Except for connecting 8 channels DWDM MUX/DEMUX, the FMU fiber mux with expansion port also can be combined with other channels fiber mux like 2 channels, 4 channels or other channels, which offer more flexibility for optical network deployment and upgrade. And you can add DWDM into CWDM networks at some specific wavelengths with FS.COM FMU fiber mux.

Secondly, DWDM MUX/DEMUX price is always an important point that many network operators pay attention to. Therefore, when buying a fiber mux, the cost is a critical point to consider. If you search on Google, you will find the lowest price is $1100 in FS.COM. And the cost of using two 8 channels MUX/DEMUX is the same as the deployment of one 16 channels MUX/DEMUX. However, compared with the 16 channels DWDM MUX/DEMUX, the FMU 8 channels fiber mux provides a competitive solution for small networks which needn’t to buy a full-channel fiber mux that supports all 16 channels or more channels.

Conclusion

From the comparison above, the FMU 8 channels DWDM MUX/DEMUX is more flexible and cost-effective when deployed in WDM networks. How to choose is based on the requirements of your networks. FS.COM supplies two different types of these WDM MUX/DEMUX. Here is a simple datasheet of them. If you have more requirements for additional wavelengths, welcome to visit www.fs.com for more detailed information.

Sources:http://www.fiber-optic-tutorial.com/16-channels-dwdm-mux-demux-in-dwdm-network.html

0 notes