#Credit & Debt

Text

#Credit Repair#Credit debt#Credit score#Credit Reports and Scores#Good Credit Score#Check Your Credit Scores

1 note

·

View note

Text

redoing this post with less panic.

i am living in an unsafe and toxic environment. it's extremely draining and causing me a lot of issues both physically and mentally. i don't want to go into detail, but i am sick or unwell fairly often because of it

after speaking with a friend, there is a possible option of moving out in the future. he is one of the only friends i trust to live with, and that is months out at the earliest most likely, and is in a different state

i need to start saving. based on prices of apartments in that area + my own debt + tentative moving costs, i need a total of $3,000 - $4,000. i am working but not able to work much more than the minimum needed to survive, but i AM saving what i can towards this goal. i can do writing commissions too, just dm me about them

anything is a big help for me. please share where you can. i'm not expecting anywhere close to the full amount, i just want to be transparent

ppal // ca + others via dm

#txt#sorry to remake the post but i wanted to make it less panicked#the debts are thinfs like unpaid bills bc of other bad situations. credit cards..etc

677 notes

·

View notes

Text

FASHION SHOW: Celebrating Critical Role Merch with Creators in Fashion!

#critical role#ygifs#laura#merch queen🫡#her strolling up in this outfit took me out shes SO...............#sorry but the beaming pride in her eyes over all the work they all put into their merch together#and it's like no seriously thee fact they make the best merch you could want in something you love#putting work and quality and love into the merch cos you don't need to even point out easter eggs you know your fans know#and it's all a love letter to that passion#plus the clothes are just fucking rad actually thanks for the cheeky credit card debt ms bailey🫡

380 notes

·

View notes

Text

People saying that "playing dnd doesnt have to cost anything" and "it can be fun even without all the books and expensive maps and minis" may be right but have you seen some of the dice out there????? Fucking beautiful

#i am in serious credit card debt#shit post#dnd#dnd dice#dice#ttrpg#pathfinder#d&d#dnd problems#dnd memes#dnd jokes#i have a problem#the dice are taking over my room

342 notes

·

View notes

Text

i hate you health insurance i hate you deductibles i hate you credit cards i hate you student loans i hate you capitalist system that mires anyone under a certain income bracket in debt to ensure that you'll never run out of wage slaves

#spitblaze says things#KILLING BITING RIPPING TEARING#IN CREDIT CARD DEBT FOR HAVING THE NERVE TO PAY MY RENT AND SEE THE DOCTOR MORE THAN ONCE EVERY FEW YEARS

880 notes

·

View notes

Text

I would commit war crimes for this woman

#i would succumb to her every need#she wants me to commit armed robbery? sure heres your stack of cash queen#she needs 10 more Louis Vuitton handbags? im in massive credit card debt#she demands more troll essence for her next show? i already got 5 in my possession#ill do whatever she wants in a heartbeat#velvet trolls#trolls velvet#velvet and veneer#trolls 3#trolls band together

103 notes

·

View notes

Text

👏👏👏

#vote Biden Harris#medical debt#credit score#credit report#democrats help the people#Republicans help corporations and the rich#republican assholes#maga morons#convicted felon trump

112 notes

·

View notes

Text

so LOL my new job completely fucked me over and scammed me by telling me i'd work 20 hours a week immediately, then saying they won't have proper availability for a few more weeks, now saying they can barely give me hours at all, IF ANY, for the foreseeable future.

well my life goes on and continues to include expenses even as i try to apply for new jobs

in the meantime well my poetry books are still for sale!

you can get them for as little as 1 dollar or customize the amount to anything! PLEASE THEYRE NOT BAD- (INSERT REVIEWS HERE) the site is perfectly safe to buy from and v easy!

#whatever. uses the last 30 dollars on my credit card#i know later ill check this post and there will be 0 notes#which is fine#i just dont know what else to do?#i applied to my local library yesterday and tried soooo hard on my app and cover letter#so im begging pleading ill get it#but i know its kind of compteitive so :(#then theres just fucking nowhere left thats hiring except like fast food#which is a bummer cause i said id never work in fast food again after i did in high school#but like hello? hello girl? girl help?#all my cards are maxed because ive had no money to pay them off#needless to say nothing in my fucking account#im in debt to all my friends#i got a few jobs art modeling this month#but its only like 150$ total#which like. i need 800+ a month . so#epic my dude#.txt

103 notes

·

View notes

Note

I'm kinda freaking out because apparently a medical bill of mine got sent to a debt collector-- I didn't even know I had to pay this because my parents usually pay my bills and when I asked them they said not to worry about it. (I was 20 then, and I'm still on their insurance so they usually take care of it all). Is this going to ruin my credit? I don't even have any loans or credit so far so this is the only thing that's happened to it. I would have paid if I even knew but they never sent me a letter or an email until the one letting me know about the debt collection. It says I have until the 18th to dispute the debt. I don't really know what to do. Would calling to clear this up and paying right away do anything or am I just screwed?

Call them and pay it. You can and will recover from this! Your credit is going to be fine.

Also... make sure you tell your parents they screwed up. You don't have to be confrontational, just say something like "Hey, did you know about this bill? Because it's in collections now. I've paid it, but in the future, please notify me if you receive any bills for my medical treatment so I can handle it properly without it damaging my credit."

In general, if you can't pay the full amount of a bill, it's best to contact them and pay something. Here's more advice:

How to Pay Hospital Bills When You’re Flat Broke

If you found this helpful, consider joining our Patreon.

150 notes

·

View notes

Text

Double greedflation

The average APR went from 16.3 percent in 2020, as the pandemic began, to 22.8 percent in 2023, a dramatic rise after several years of relative stability. That suggests that consumers are experiencing a “double greedflation,” with the cost of goods and services going up, and then the cost of credit to afford those goods and services going up opportunistically.

-What We Owe, Kalena Thomhave

92 notes

·

View notes

Text

irt poverty/homelessness + alcohol use (esp with @butchfeygela‘s tags on my post)- people really underestimate the function that substance use/alcohol use can have for someone who is unhoused. being unhoused is boring, cold, painful, + lonely. substances can allow the 8 hours panhandling to get the $45 you need for a motel to fly by. alcohol reduces your perception of the cold + can knock you out whben you can’t sleep. substances can help you cope with the physical deterioration from malnutrition, constant stress, + sleeping outside. substances can provide social connection with others who you would otherwise not enjoy or help you cope with being alone.

not only that but- many unhoused people are stuck in a seemingly inescapable position. the pathway to financial stability or even housing is difficult or even impossible. in the wake of that hopelessness, the downsides of substance use start to seem insignificant. arrest? you’re getting arrested anyway for sleeping outside, peeing outside, standing in the wrong place, etc. physical danger? you’re already beat the fuck up, anyway, right? loss of relationships? you’ve lost most people already. inability to keep a job? nobody will hire you + you can’t stay employed, anyway, because you have no car + no shower.

perhaps for you or me, the cons of heroin use or binge drinking nightly greatly outweigh the pros. that isn’t the case for everyone. if we are really serious about ending overdose/addiction, we need to start looking at giving people lives worth recovering into instead of shaming them for their own hopelessness.

#i had a long talk with my dad once about how#my brother sank into so much financial despair#that he was never going to be able to find#a livable job or housing (eviction record#plus bad credit plus#arrest record ofc#he was going to be forced into poverty for the rest of his life#the only job prospects he had were menial shit jobs#he once worked at one of those chicken butchering places#it was the only place that paid him a living wage but he got fired for relapsing#his only options were to go to school part time + try to pass with his dyslexia which made him essentially unable to read#then work a horrible shitty job the rest of the time#while paying atlanta's outrageous rent prices#plus who is he gonna room with?? all his friends are opioid users!#while he paid back all the debt he accrued from going to rehab#then MAYBE after like 6 years of school he could get a decent job#but his credit would be in flames for years his eviction record there for years#his arrest record + lack of driver's license limiting his employment..#sorry but i would have probably given up at that point too#not to mention his interpersonal + familial relationships up in flames + the shame#of the things he did while using hanging over his head#the only family member who didn't think he was an irredeemable fuckup (me) living a thousand miles away + about as broke as him#substance use#harm reduction

307 notes

·

View notes

Text

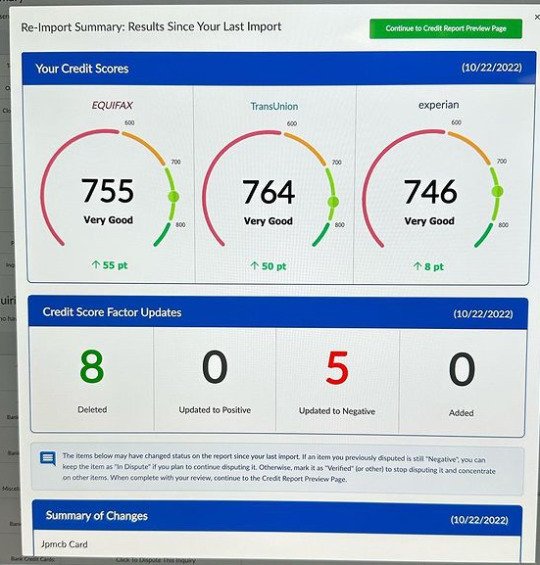

#Credit Repair#Credit debt#Credit score#Credit Reports and Scores#Good Credit Score#Check Your Credit Scores

1 note

·

View note

Text

☝️

51 notes

·

View notes

Text

I just wanted to show off my Star Wars collection 🧍🏻♀️ I moved so I can finally have it all out 🥲

112 notes

·

View notes

Text

2/6 PACKAGES ARRIVED!!! <33 📦

This time I actually made it to the preorder !! (Barely </3) AND LOOK AT THESE -I feel so spoiled rn-

-presented on my iPad cause I have no table atm-

H*NTAI HOODIE REN <33

All the stickers, pins, and charm were made by @decafdoodlez!! <- check them out and buy their stuff ;)

And I just wanted to say that the charm is ADORABLE (and double sided) EVERYTHING IS SUPER HIGH QUALITY!!! And I’m so glad I was able to get all these items!!

#soma says#btd2 ren#ren hana#tpof fox#fox tpof#the price of flesh#IM SO JWHSJWJS#only reason why I’m still going atp-#AHHH IM SO FUCKING HAPPYT#physically foaming at the mouth#I’m severely in credit card debt#magic hands#insert shrug#funny story actually when I was driving home from the post office-

57 notes

·

View notes

Text

Fuck it! US Private Student Loans Guide!

DISCLAIMER: while I have worked in private loans specifically for five+ years, this isn't ‘financial’ advice and is just a heavily summarized guide on how to navigate them. Yes, these loans suck, but complain to your legislators not me. I’m just trying to help you know what you’re doing. Additional info for each section is under the cut!

1) Who are you and who are all the companies constantly running around with my money?

I work in loan SERVICING, which is basically the billing department. If you’ve got a new company asking you for money, it's probably a new servicer and your debt is still owned by the bank. We enforce the terms in the promissory note, the document you sign telling the bank “yeah I'll play by your rules if you give me the money.” If your loan defaults, you’ll get contacted by a third (fourth?) party, but how that works is beyond my wheelhouse. The bank or your servicer should be able to confirm what happens in case of default.

2) What am I looking for in a ‘good’ loan?

Generally, you’re going to want SIMPLE instead of compound interest, a FIXED RATE opposed to a variable one, and you’ll want to go for FULL DEFERMENT while in school and make manual payments when you can. Also ask up front about stuff like if disability forgiveness or co-signer release (getting your parents off it) is offered.

3) This loan sucks! How do I make it better?

Student loans are NOTORIOUSLY hard to get out of, unfortunately. If the interest rate/payment relief options suck, you can try to REFINANCE where you take out a new loan to pay off the old one. This gives you a new promissory note, interest rate, and terms/conditions. If you’re trying to erase the debt entirely, ask for the promissory note (if they can't provide a copy, we have to forgive the debt. I've only seen this happen ONCE.) or try to go through social security disability.

DO NOT USE FREEDOM DEBT RELIEF OR OTHER SERVICES. DO NOT. THEY ARE SCAMS.

More in depth information for each point!

1) Lenders and Servicers

The lender is the person who provides the funds in the debt - the bank who pays the school or the hospital or the home contractor fixing your sink. The servicer is the company that is your point of contact when you need to make payments, ask for payment relief, or otherwise manage the loan that exists. Think of us as the mechanic (we keep the car running) where the bank is the manufacturer (they make the car). Some different servicers are SoFi, Zuntafi, Great Lakes, Nelnet and Firstmark Services; their names will be on the billing statements. Some different banks are Citizens, US Bank, NorthStar; their names will be on the promissory note and the disclosures.

Sometimes banks do sell the debt, however! A couple years ago Wells Fargo sold an enormous chunk of their loans off somewhere (an investment group, maybe?) but! The promissory note will still be the EXACT same if your debt gets sold. You’ll only get a new promissory note if you refinance the loan yourself.

2a) Interest Accrual and Rates

Interest is how banks profit off the loans they give out and/or ‘ensure they don't end up with a loss if the loan defaults’. (It's profit.) Most, but not all, loans calculate interest with the simple daily interest formula, shown below:

[(Current loan balance) x (interest rate)] divided by 365

If your loan’s balance is $10,000 and your interest rate is 6% you’ll be charged $1.64 each day. SIMPLE INTEREST means that this interest just kind of floats around on the account until a payment comes in and pays it off, where COMPOUND adds that interest to the balance at the end of the month/day/whatever. Compound charges you more over the life of the loan.

FIXED INTEREST is a set percent that doesn't change, where VARIABLE will change usually based on whatever the economy is doing. There’s a minimum and maximum value to the variable interest rates, so if you’re doing a variable ASK WHAT THE MINS AND MAXES ARE. A fixed rate might be 8% and a variable might be 3.25% the day you take it out, but that variable could have a maximum interest rate of 25% so be VERY, VERY CAREFUL. If you get stuck in a real bad variable interest rate, your best solution is probably a refinance.

2b) Deferment and Payment Allocation

So interest is gonna be accruing on your loan from the day the money leaves the bank. Sucks. And you may not be able to make payments while you're in school, so opting to DEFER your payments will stop them from billing you so you can skip a month or whatever without penalty. At the END of that deferment, though, whatever interest that accrued will be added to your current balance. If we use the example from above (10k loan with 1.64 daily interest) four years of school will add $2,400 to your balance and then your daily interest will jump up to $2.03 a day.

Solution? Make payments of what you can while you’re in school to chip away at that floating interest. Usually when you make a payment, it’s gonna go towards the interest first and then the rest drops the balance. (E.g. if you make a $20.00 payment ten days after your loan is disbursed, $16.40 will go towards interest and $3.60 towards your 10k balance). There is NO PENALTY for making extra payments or making early payments, but it might make your bills look a little weird if you’re being billed each month for just the interest.

3) Why are these loans so horrible? Can’t I find anything to help me?

Blame Reagan and the republicans who enabled him.

No, but really. The problem with these loans is that those promissory notes are VERY legally binding and have lots of fine print in there designed to make it as hard as possible for someone to skimp out on their debt without having their credit score decimated. Some lenders might even dip into your paychecks if you're crazy behind or default; again, that's not my wheelhouse and I've only maybe seen that once. Your best bet is just to pay it off as fast as possible (again, no penalty for paying the loan off early) or refinance into better terms.

And I get it. I really do. I hate how we’ve made so many incredibly important things in our society locked behind a paywall that charges poor people more to climb than the rich. But if you’ve made it this far, please don't turn your anger at me for not giving you the answers you want. The best I can do is vote for people who are willing to crack down on predatory lending, keep fighting for student loan forgiveness… and at my own job, make sure that my coworkers aren't making mistakes.

If you have a more specific question, I can try to answer as best I can without breaking any information privacy laws. And take care, okay? You are never fighting alone.

#private loans#student loans#school loans#loan forgiveness#long post#credit score#credit services#debt relief#debt consolidation#I spent like two weeks off and on with this PLEASE REBLOG but also PLEASE BE NICE

184 notes

·

View notes