#Crypto Staking Explained

Explore tagged Tumblr posts

Text

Top Cryptocurrency To Buy Now with x100 Potential

The crypto space is vast, and filled with potential and opportunities. As digital finance advances, investors seek the next breakout of altcoin. Whether you’re a seasoned crypto enthusiast or just dipping your toes, understanding the potential of these coins could be extremely important in your investment journey.

NuggetRush (NUGX) — Best Coin to Invest In: The New Gold Standard

NuggetRush (NUGX) is a game-changer in the thriving cryptocurrency space. This isn’t just another meme coin; it’s a pioneering venture into GameFi and play-to-earn. Powered by the Ethereum blockchain, NuggetRush offers an unparalleled play-to-earn experience, allowing players to dive into gold mining adventures.

InQubeta (QUBE) — Best Cryptocurrency to Invest In: The Future of Crowdfunding

In the crypto space, InQubeta is a game-changer. It is the first Web3 crowdfunding platform, pioneering a new era of fractionalized investment in AI startups. This revolutionary approach allows investors to dive into the AI sector according to their budget, offering the tantalizing possibility of being an early backer of the next big AI innovation.

ABC Network (ABCN) — Best Coin to Invest In: The New Blockchain Era

ABCN project gives you a spoon feed chance to generate extra income while earning staking rewards just by staking on our network and delegating your assets to our staking pool. We have planned several levels, targets, and incomes with raising ranks that are quite reasonable in every form.

Ace Blockchain Crypto Network is a blockchain platform that is a decentralized digital infrastructure that enables the creation and execution of applications, services, and protocols based on blockchain technology. It serves as a foundation for building and deploying various decentralized applications (DApps) and smart contracts marketplace.

Start Your Journey with the ABCN coin

ABCN offers a lifetime staking reward earning program for the holder of ABCN coin, with stable earning and eventually high growth. So, join this campaign and earn daily returns, tons of referral benefits, as well as additional rewards. refer https://abcn.finance/

Stay tuned for announcements by following ABCN on Twitter.

Website: http://abcn.io/

Twitter: https://twitter.com/ABCNnetwork

Telegram: https://t.me/abcnetworkchat

1 note

·

View note

Text

#cryptocurrency#what is cryptocurrency#how cryptocurrency works#blockchain technology#crypto basics#decentralized currency#digital currency#Bitcoin#Ethereum#crypto transactions#cryptocurrency explained#crypto wallets#crypto mining#proof of work#proof of stake#cryptocurrency guide#beginner's guide to crypto#how to use cryptocurrency#crypto security#blockchain ledger

0 notes

Note

HII I REALLY LOVE YOUR WORK SO MUCH, i hope your willing to write about pregnant reader x thanos yk, thanos didn't know she was pregnant before they break up and then they meet up again the games and he finds out player 222 and player 333 type stuff 😭

Of course! We love this!!

Good person - Choi Su- Bong x pregnant! reader

Summary: After leaving Thanos, you encounter him again in a serious death game, only this time the stakes are lot higher

Warnings: Not much, just your usual squid game gore

A/n: Sorry it's so short! I'm going to try and start adding some length to my stories again especially my Thanos stories so stay tuned for those longer stories, trust me they are coming, they're just takin a lil time

You had told yourself whenever you signed up, you'd be as careful as possible, and that it was all for your baby, after leaving their father and being disowned for choosing to be single mother, you were left with little to nothing, so of course you took the chance to get money.

As you woke up in the giant room you soon came to regret your decision, seeing your sperm donor just a few feet in front of you, focused on the screen reading off debts "Y/n L/n, 25 million won" The guard shouted, showing you getting smacked across the face, quickly holding an arm over your stomach afterwards. Almost like he knew, as soon as your name was called out, his head snapped to yours "Senorita! You're here!?" He shouted in shock "No Way!" He shouted as he walked closer, you attempted to curl your body up away from him, but due to the six month pregnancy belly, you could only bend your legs closer to you slightly.

"Please leave, Thanos" You grunted, trying your best to keep him at a distance, for all he knew you had taken a plan B after your last hook up and that was it. Instead he just kept approaching until he was standing in front of you "What're you doing here!?" He asked excited, you just shook your head "trying to get my family and I money after my sorry excuse of a boyfriend convinced me to buy stupid ass crypto?" You said like it was obvious, it wasn't like you were entirely lying, you just didn't specify what family.

Going into red light green light, you were cocky at first, knowing you could do this easy, until the shooting started, players falling left and right, while your baby dad just skipped and danced his way to you down the field "You never answered me, Senorita" He repeated, placing his hands on your hips, terrified of what he might do, especially after watching him shove other players to win "I-I'm pregnant" You blurted, you couldn't help it, between your fear of dying by Thanos or the game was too much, you just wanted to get out of this alive, you didn't think it'd be this serious, if you did, you never would've done this. "Haha" He laughed sarcastically before looking at your face as the doll called out red light, he was in front of you now, and you were visibly shaking, Thanos using his body to try and shield you from the sensors "for real, flower?" He asked, his tone a lot more deep and raspy, you could tell he sobered up quick upon the realization you weren't joking. "I-I forgot the pill after hooked up a few months ago! a-and I left because I knew you couldn't be a responsible dad" You blurted, unable to contain your emotions as the hormones in your body were on overdrive.

Thanos was frozen, staring at you in shock before finally snapping out of it as the doll called green light, he grabbed your arm holding you behind him as he followed the others past the red line "Just stay behind me" He whispered, your words stung, how could you be so sure of how he'd be as a dad if you never gave him a chance? As you made your way back to the giant main room, you took notice to Thanos's hand on your back leading you to the bed "Sit, you don't put yourself through too much" He explained softly, helping you over to your bunks before eyeing Nam-Gyu "Give her your bed, man" he demanded, his friend stuttering before giving up and giving you his bed that was floor level, him taking your third bunk bed. "Thanos" You warned, not wanting him to make it a huge deal "What?! You're huge! You don't need to be climbing!" He shouted before catching his tone, apologizing quietly "Okay, well One, that was very very rude, two, I can do whatever I please, if I feel like I can't do something, I'll tell you" You stated poking him in the chest with your finger, he just smirked at you, biting his bottom lip slightly "Have I ever told you, it's hot whenever you yell at me" he asked, trying his best to charm you, but instead you just flicked his forehead in annoyance "Get away, freak" You replied, he just smiled at you, sitting at the foot of your bunk "So it's my baby?" He asked smiling pointing to your stomach "Well, if not I'd be concerned" You said raising your eyebrows at him "Can I..touch it?.." He asked nervously "it's not an it, it's your daughter" you glared, before grabbing his hand slipping it under your jacket, pressing his finger down in just the right spot to get the small baby inside of you to move around "Woah..weird" He said grimacing as he pulled away in disgust "Really!?" You gasped in shock laughing loudly, somehow forgetting you were in a death game for a moment "Yea! You have a whole human inside of you! That's weird!" He laughed, resting his hand on yours "You put it there, Su-bong!" You argued, you swore sometimes you got with a completely dumbass.

"Y/n..If you'll let me...I wanna be there..I don't want to be like my dad" He frowned, squeezing your hand gently "Please?" He begged "I know I fucked up bad, but, I want to try again, please" He continued, you glared at him for a moment before sighing "How can I trust you? And you'll have to get clean, for real clean, not how you're usually clean" You added on, you just watched as he nodded his head, no faces or complaints "You're actually serious aren't you?..." you asked sweetly "I want to be a good person for you, y/n, please" He whispered, pressing his lips to your knuckles "I guess..but you only get one chance" You offered, he just nodded before flopping himself next to you "Thank you!" He cheered pressing multiple kisses all over your face as he chanted his thank you's, not realizing the next 18-19 years were going to be hell for the both of you.

The rest of the games, Thanos was always on you, making sure you didn't over do yourself or risk hurting yourself or your baby, charming you right back into his arms.

--

Taglist!!

@acehasmyheart

@corrdelia

@ag022123

#t.o.p x reader#thanos x reader#choi su bong x reader#choi seunghyun#squid game thanos#top x reader#squid game#squidgame#thanos squid game#thanos x reader smut#choi seung hyun x reader#thanos/choi su bong#su bong x reader#t.o.p bigbang#bigbang

2K notes

·

View notes

Text

From Skeptic to Believer: How a Random Telegram Call Led Me to STON.fi DEX

I never thought a random Telegram call could change my Web3 journey. But that’s exactly what happened.

In the crypto space, opportunities often come in unexpected ways. Some people stumble upon airdrops, others get introduced by friends, and a few dive in after deep research. My story? It started with a casual conversation in a crypto Telegram group.

A Call That Sparked My Curiosity

One evening, I joined a community call in a DeFi-focused Telegram group. The discussion was about opportunities in decentralized finance (DeFi), and one project kept coming up—STON.fi DEX.

The speakers were enthusiastic, explaining how STON.fi was revolutionizing decentralized trading with:

✅ Seamless token swaps with ultra-low fees

✅ Staking opportunities that rewarded users with Gemston tokens

✅ A liquidity provision model that allowed users to earn passively

At first, I wasn’t entirely convinced. I had seen many projects make big claims but fail to deliver. But when they mentioned the Stonbassador Program, my interest peaked.

I’ve always believed that the best way to understand something is to test it. So instead of dismissing the idea, I decided to give it a shot.

Diving In: My First Experiment with STON.fi

Rather than jumping in blindly, I started by observing and researching. I checked their website, community discussions, and whitepaper. Everything seemed solid.

To test the waters, I wrote a Twitter thread summarizing what I had learned. I broke it down into:

🔹 How STON.fi DEX simplifies trading on the TON blockchain

🔹 Why its staking mechanism is a great way to earn passively

🔹 How users could earn by providing liquidity

I wasn’t expecting much, but within a few weeks, I got rewarded. That moment changed my entire perception of the platform.

It wasn’t just about earning tokens—it was about being part of something innovative.

Becoming an Active User: Hands-On with STON.fi

With the motivation from my first reward, I decided to go beyond writing and start using the platform firsthand.

Here’s what I discovered:

1. Swapping Tokens Was Incredibly Fast and Cheap

Most DEXs promise fast transactions, but in reality, many suffer from network congestion and high gas fees.

On STON.fi, my first token swap was instant, with almost zero fees. That’s when I realized this wasn’t just another DEX—it was something built for efficiency.

2. Staking Became an Unexpected Passive Income Stream

After testing swaps, I moved to staking. I wasn’t sure how much I would earn, but the process was straightforward.

I locked my assets, and before I knew it, rewards started accumulating in the form of Gemston tokens. It felt like having a savings account that actually grows without effort.

3. Liquidity Pools Opened My Eyes to New Earning Strategies

I had heard about providing liquidity, but I never fully understood it until I tried it.

By adding liquidity to STON.fi’s pools, I started earning a share of the transaction fees. It was like owning a piece of the exchange—the more I contributed, the more I earned.

Lessons I Learned Along the Way

Looking back, this experience taught me valuable lessons about crypto, DeFi, and personal growth:

1. Never Underestimate Small Opportunities

If I had ignored that Telegram call, I would have missed out on an incredible journey. Sometimes, the best opportunities come from unexpected places.

2. Action Beats Overthinking

It’s easy to research forever and never take action. But the moment I started testing STON.fi myself, everything became clearer. Experience is the best teacher.

3. Community Matters in Crypto

Many projects promise utility but lack strong community engagement. STON.fi’s active community, regular updates, and support system convinced me that it’s a platform built for long-term success.

Where I Am Now—And What’s Next

Since that first Telegram call, my journey with STON.fi has evolved tremendously:

��� I became a committed Stonbassador, sharing knowledge about the platform.

💰 I continue to earn from swaps, staking, and liquidity pools.

📈 I’ve gained a deeper understanding of DeFi and TON blockchain innovations.

And this is just the beginning.

STON.fi DEX is constantly expanding, and I’m excited to explore:

➡️ New DeFi opportunities within the ecosystem

➡️ Upcoming features that enhance trading and earning

➡️ Ways to help more people understand the potential of decentralized finance

This isn’t just about making money—it’s about being part of a revolutionary shift in crypto.

So if you’re still watching from the sidelines, maybe it’s time to jump in and experience it for yourself.

💬 Have You Explored STON.fi Yet

Whether you’re a trader, an investor, or just curious about DeFi, STON.fi DEX is a platform worth exploring.

2 notes

·

View notes

Text

Twenty-three-year-old Arnold Robert Haro addressed his final words to the phone in his hand. “If I die, I hope you guys turn this into a memecoin,” he said. Then Haro took his own life.

Haro died on February 21 at his family home in Madera County, California, a death certificate obtained by WIRED shows. His suicide was broadcast live to his followers on X, where he went by the handle @MistaFuccYou. Footage of Haro’s death has since been removed from the platform, but the incident was briefly listed in its trending tab.

In the hours after Haro’s death, people created dozens of memecoins—a type of highly volatile crypto coin used as a vector for financial speculation—modeled after him. Sensing an opportunity to profit, traders piled into one of the coins in particular, driving its value to $2.1 million in aggregate. (The coin has since lost 96 percent of its value.)

On X, some tried to argue that whoever was behind the MistaFuccYou coin had duly granted Haro’s final wish. But most denounced the impulse among traders to try to profit by his death. “If you’re trading this, you’re sick af,” wrote one user.

Speculation ran rampant on X that Haro had ended his life because he had lost money to a memecoin rugpull—a maneuver whereby somebody creates a new coin, promotes it online, then sells off their holdings in one swoop, devaluing everyone else’s stake. WIRED was unable to confirm whether this had happened to Haro, but his friends have disputed the narrative. “It had nothing to do with crypto … It’s not what all these crypto nerds seem to think,” one of Haro’s friends, who goes by j nova on social media, told WIRED. Haro’s family, meanwhile, has described his death as the result of “his battle with depression.”

The incident captures in microcosm the race to the bottom in memecoin trading circles, where only the most heinous and morally bankrupt ideas are now rewarded with attention, says Azeem Khan, cofounder of the Morph blockchain and venture partner at crypto VC firm Foresight Ventures.

“We’ve reached the point where the most potentially exciting launch that people are looking at is Kanye trying to launch a swastika coin,” says Khan, in reference to now-deleted X posts made by an account associated with the artist Kanye West. “That’s how terrible this space is.”

Until last year, launching a memecoin was relatively expensive and technically burdensome, which meant few came to market. Only Dogecoin—the original memecoin—and a handful of derivatives had any sort of longevity.

That equation was reversed with the arrival of Pump.Fun, a platform that makes it simple for anyone to launch a memecoin at no cost. Since Pump.Fun launched in January 2024, many millions of memecoins have flooded the market, among them the coins modeled after Haro.

In a statement provided to WIRED, Pump.Fun spokesperson Troy Gravitt described Haro’s death as a “tragedy,” but explained that the coins made in his image, though “clearly in poor taste,” do not violate the platform’s terms of use. “There was no content associated with the token that would have identified it as either illicit or explicit,” says Gravitt.

Betting on memecoins is lionized in certain online crypto circles, where traders are euphemistically described as charging headlong into “the trenches.” But behind the combat metaphor is an implicit recognition that the odds are stacked against the individual “trencher,” particularly given the prevalence of rug pulls and alleged collusion between the insiders behind certain high-profile memecoin launches.

“Everyone assumes that crypto is where you come to become rich, no matter how dumb you are. I think it’s the exact opposite,” says Khan. “There are these layers of insiders … retail traders are always exit liquidity.” In other words, regular people buying into coins allows insiders to cash out at a profit.

The new cultural prominence of highly volatile memecoins, which offer the prospect both of outsized gains and losses, is also likely to have compounded the risk for people predisposed to problem gambling or trading, researchers say.

“People have enormous capacity to make money very quickly. The appeal of making money rings so much louder than calls of danger,” says Benjamin Johnson, a PhD candidate at the University of Queensland specializing in the public health implications of digital technologies. “Adding to the attraction with memecoins is that you’ve got these online communities where people really congregate. It becomes an emotional attachment to these assets … It creates a perfect storm.”

Though academics have not identified a direct association between crypto trading and heightened psychological distress, the externalities of crypto trading—namely, the likelihood of losing money—are shown to have a negative impact on mental well-being. And the vast majority of memecoins released on Pump.Fun wind up practically worthless.

“If you are really into day trading, it is definitely something that is likely to cause people mental stress or psychological distress,” says Atte Oksanen, a professor of psychology at Tampere University, who has conducted multiple studies on the mental health implications of crypto trading. “Financial problems cause a lot of stress, which can escalate.”

Meanwhile, the glut of memecoins entering the market through Pump.Fun—among them coins issued by celebrities like rapper Iggy Azelea—has led coin creators to take increasingly elaborate, sexually degrading, and sometimes dangerous measures to attract attention to their coins. One guy ended up catching on fire after a memecoin promotional stunt went awry, leaving him with serious burns.

The launch of US president Donald Trump’s memecoin in January pushed the fight for attention to new extremes. The inevitable effect has been that only the most depraved and provocative concepts—like the MistaFuccYou coin, based on a suicide—so much as register in the hive mind of memecoin traders. And even then, only briefly.

“The president of one of the most powerful countries in the world launches a coin. How much further is there to go?” says Khan. “Then if you hit the top of the market, how quickly will all of this vaporware actually end up nosediving?”

The calculus among memecoin traders is captured on Pump.Fun in the comment section for the MistaFuccYou coin. “This token shows how fucked the trenches are rn, and is highly unethical,” wrote one user, before implying that others should invest.

In the process, people like Haro—whose X feed is a kaleidoscope of memes, practical jokes, guns, women, weed, and crypto—are effectively erased; quite literally commodified into an incomplete and cartoonish version of themselves.

A fundraising page set up by Haro’s family to help cover the funeral costs paints a more three-dimensional picture: “Arnold was a bright, kind, and hilarious soul who brought light to those around him,” reads a description written by a family member. “He had a gift for making people laugh, spreading joy, and offering unwavering support, even when he was struggling himself.”

If you or someone you know needs help, call 1-800-273-8255 for free, 24-hour support from the National Suicide Prevention Lifeline. You can also text HOME to 741-741 for the Crisis Text Line. Outside the US, visit the International Association for Suicide Prevention for crisis centers around the world.

3 notes

·

View notes

Text

Demystifying Liquidity Provision, Farming, and Staking: A Practical Guide

The world of cryptocurrency can sometimes feel like stepping into a maze of complex terms and concepts. "Liquidity provision," "farming," and "staking" might sound intimidating at first, but these activities are more approachable than they seem. They’re not just buzzwords—they’re practical ways for you to make your crypto work for you.

In this article, I’ll break these concepts down, explain how they work, and show you why they matter, all in a way that’s relatable and easy to understand.

Liquidity Provision: Becoming the Market’s Backbone

Imagine you’re at a bustling farmer’s market. For the market to thrive, there needs to be a steady supply of goods for buyers and sellers to trade. In the crypto world, liquidity pools play the role of that marketplace. They’re stocked with two types of tokens, like ETH and USDT, allowing people to trade between them easily.

When you provide liquidity, you’re like a vendor stocking the market with your goods (tokens). In return for your contribution, you earn a share of the transaction fees every time someone trades.

It’s simple: you’re helping the system run smoothly, and you get paid for it. Platforms like STON.fi make it easy to get started with liquidity provision, offering a straightforward way to earn passive income.

Provide liquidity now

Farming: Extra Rewards for Supporting the System

Let’s take the farmer’s market analogy a step further. Imagine the market organizer thanks you for bringing in your goods by giving you bonus tokens as a reward. That’s essentially what farming is.

Once you provide liquidity, you receive LP (Liquidity Provider) tokens as proof of your contribution. By “farming,” you lock these LP tokens into a specific program to earn additional rewards.

For instance, a crypto project might incentivize farming by offering its native tokens as bonuses. The longer you stay in the farm, the more you earn. It’s like a loyalty program that rewards your commitment.

Farm tokens now

Staking: Locking Up for Long-Term Benefits

Now, let’s say you decide to deposit your earnings from the market into a savings account, locking it up for a fixed period in exchange for interest. That’s staking in a nutshell.

With staking, you lock your tokens into a network to support its operations, such as validating transactions or maintaining security. In return, you earn rewards over time.

Platforms like STON.fi offer unique incentives for staking, such as ARKENSTON (an NFT tied to your wallet) and GEMSTON (a token with governance rights). Staking not only rewards you but also allows you to play an active role in shaping the future of the platform.

Stake STON now

How They Work Together

Each of these activities serves a unique purpose:

1. Liquidity Provision: Keeps the trading system fluid and earns you transaction fees.

2. Farming: Boosts your rewards by incentivizing participation with bonus tokens.

3. Staking: Locks your assets for long-term benefits and deeper involvement in the platform’s ecosystem.

You don’t have to pick just one. Many crypto enthusiasts combine these strategies to diversify their earnings and maximize their participation in the ecosystem.

Why Should You Care

You might be wondering, “Why should I get involved?” The answer lies in both the opportunity to grow your crypto holdings and the chance to contribute to the larger vision of decentralized finance (DeFi).

Think of it this way: just like investing in stocks or real estate, liquidity provision, farming, and staking allow you to put your assets to work. The key difference? You’re actively participating in a financial revolution that’s reshaping how we interact with money.

While there are risks involved—such as token price fluctuations or smart contract vulnerabilities—the potential rewards can be worth it. It’s about balancing caution with opportunity and finding the strategies that suit your goals.

Making It Personal: Start Small, Learn, and Grow

Entering the world of liquidity provision, farming, and staking doesn’t require a massive investment or expert knowledge. It’s okay to start small, test the waters, and learn as you go.

For example, when I first tried liquidity provision, I treated it like learning a new skill. I started with a small amount, observed how the system worked, and gradually increased my participation as I gained confidence.

The same goes for farming and staking. Think of them as tools in your financial toolkit—each serving a specific purpose and working together to help you achieve your goals.

Liquidity provision, farming, and staking aren’t just technical terms—they’re opportunities. By understanding these concepts and using them wisely, you can grow your crypto holdings and actively participate in a transformative financial ecosystem.

If you’re new to crypto, don’t let the jargon scare you away. Start with what you’re comfortable with, stay curious, and remember that every small step you take adds up.

What’s your experience with liquidity provision, farming, or staking? I’d love to hear your thoughts and answer any questions you might have. Let’s navigate this journey together!

4 notes

·

View notes

Text

Demystifying Liquidity Provision, Farming, and Staking: A Practical Guide

The world of cryptocurrency can sometimes feel like stepping into a maze of complex terms and concepts. "Liquidity provision," "farming," and "staking" might sound intimidating at first, but these activities are more approachable than they seem. They’re not just buzzwords—they’re practical ways for you to make your crypto work for you.

In this article, I’ll break these concepts down, explain how they work, and show you why they matter, all in a way that’s relatable and easy to understand.

Liquidity Provision: Becoming the Market’s Backbone

Imagine you’re at a bustling farmer’s market. For the market to thrive, there needs to be a steady supply of goods for buyers and sellers to trade. In the crypto world, liquidity pools play the role of that marketplace. They’re stocked with two types of tokens, like ETH and USDT, allowing people to trade between them easily.

When you provide liquidity, you’re like a vendor stocking the market with your goods (tokens). In return for your contribution, you earn a share of the transaction fees every time someone trades.

It’s simple: you’re helping the system run smoothly, and you get paid for it. Platforms like STON.fi make it easy to get started with liquidity provision, offering a straightforward way to earn passive income.

Farming: Extra Rewards for Supporting the System

Let’s take the farmer’s market analogy a step further. Imagine the market organizer thanks you for bringing in your goods by giving you bonus tokens as a reward. That’s essentially what farming is.

Once you provide liquidity, you receive LP (Liquidity Provider) tokens as proof of your contribution. By “farming,” you lock these LP tokens into a specific program to earn additional rewards.

For instance, a crypto project might incentivize farming by offering its native tokens as bonuses. The longer you stay in the farm, the more you earn. It’s like a loyalty program that rewards your commitment.

Staking: Locking Up for Long-Term Benefits

Now, let’s say you decide to deposit your earnings from the market into a savings account, locking it up for a fixed period in exchange for interest. That’s staking in a nutshell.

With staking, you lock your tokens into a network to support its operations, such as validating transactions or maintaining security. In return, you earn rewards over time.

Platforms like STON.fi offer unique incentives for staking, such as ARKENSTON (an NFT tied to your wallet) and GEMSTON (a token with governance rights). Staking not only rewards you but also allows you to play an active role in shaping the future of the platform.

How They Work Together

Each of these activities serves a unique purpose:

1. Liquidity Provision: Keeps the trading system fluid and earns you transaction fees.

2. Farming: Boosts your rewards by incentivizing participation with bonus tokens.

3. Staking: Locks your assets for long-term benefits and deeper involvement in the platform’s ecosystem.

You don’t have to pick just one. Many crypto enthusiasts combine these strategies to diversify their earnings and maximize their participation in the ecosystem.

Why Should You Care

You might be wondering, “Why should I get involved?” The answer lies in both the opportunity to grow your crypto holdings and the chance to contribute to the larger vision of decentralized finance (DeFi).

Think of it this way: just like investing in stocks or real estate, liquidity provision, farming, and staking allow you to put your assets to work. The key difference? You’re actively participating in a financial revolution that’s reshaping how we interact with money.

While there are risks involved—such as token price fluctuations or smart contract vulnerabilities—the potential rewards can be worth it. It’s about balancing caution with opportunity and finding the strategies that suit your goals.

Making It Personal: Start Small, Learn, and Grow

Entering the world of liquidity provision, farming, and staking doesn’t require a massive investment or expert knowledge. It’s okay to start small, test the waters, and learn as you go.

For example, when I first tried liquidity provision, I treated it like learning a new skill. I started with a small amount, observed how the system worked, and gradually increased my participation as I gained confidence.

The same goes for farming and staking. Think of them as tools in your financial toolkit—each serving a specific purpose and working together to help you achieve your goals.

Liquidity provision, farming, and staking aren’t just technical terms—they’re opportunities. By understanding these concepts and using them wisely, you can grow your crypto holdings and actively participate in a transformative financial ecosystem.

If you’re new to crypto, don’t let the jargon scare you away. Start with what you’re comfortable with, stay curious, and remember that every small step you take adds up.

Visit the Stonfi Dex now

What’s your experience with liquidity provision, farming, or staking? I’d love to hear your thoughts and answer any questions you might have. Let’s navigate this journey together!

4 notes

·

View notes

Text

Understanding Liquidity Provision, Farming, and Staking in Simple Terms

When it comes to crypto, there are a lot of terms that can feel overwhelming, especially if you're new to the space. "Liquidity provision," "farming," and "staking" might sound like complicated financial jargon, but they’re actually pretty straightforward once you break them down.

In this article, I’m going to explain what these concepts mean, how they work, and why you might want to get involved. If you’ve been looking for ways to grow your crypto holdings or just want to understand how these activities fit into the world of decentralized finance (DeFi), this is the place to start. Let’s dive in!

Liquidity Provision: A Simple Way to Earn from Your Crypto

Imagine you’re at a market. For people to buy and sell goods, there needs to be a steady supply of products—apples, oranges, whatever people are exchanging. In the crypto world, liquidity pools are like that marketplace. They hold two types of tokens (e.g., ETH and USDT) in equal value to allow smooth trading between them.

Now, here’s where you come in. By providing liquidity, you’re essentially helping to stock the market with the tokens that traders need to make exchanges. In return for contributing your tokens to the pool, you earn a share of the transaction fees whenever someone makes a trade.

It’s a win-win situation. You help the market run smoothly, and in return, you get paid! On platforms like STON.fi, liquidity provision is a great way to start earning passive income, just by holding onto your crypto and putting it to work.

Farming: Earning Extra Rewards for Your Support

Once you provide liquidity to a pool, you’ll be given LP (Liquidity Provider) tokens, which represent your share of that pool. Farming comes into play when you take those LP tokens and lock them into a "farm." Think of farming as a rewards program—it’s a way to earn extra rewards just for keeping your tokens in the pool.

For example, let’s say a crypto project wants to encourage more people to trade its token. To do this, they might create a farm on a platform like STON.fi and offer additional tokens as rewards for those who participate. The more you contribute to the farm, the more rewards you get.

It’s kind of like earning loyalty points for making purchases at your favorite store. The longer you keep your tokens locked in, the more rewards you earn. It’s an easy way to boost your earnings on top of the transaction fees you already earn from liquidity provision.

Staking: Locking Tokens for Long-Term Benefits

Staking is another way to earn rewards, but it works a bit differently from liquidity provision and farming. Instead of putting your tokens into a liquidity pool, you’re locking them away for a period of time to help secure a network. Think of it like investing in a savings account: you lock away your money for a certain period, and in return, you earn interest over time.

When you stake tokens on platforms like STON.fi, you don’t have to worry about trading or liquidity pools. Your tokens are simply locked up in a smart contract, and in return, you earn rewards that can’t be earned through liquidity provision or farming.

The rewards for staking on STON.fi include unique benefits like ARKENSTON, an NFT tied to your wallet, and GEMSTON, a community token that gives you access to voting rights in the platform’s decentralized community. Staking is a way to earn long-term value and participate in the growth of the platform.

How They All Work Together

So, now that we know what liquidity provision, farming, and staking are, you might be wondering how they all fit together. Well, each of these activities serves a different purpose in the crypto ecosystem, but they all have one thing in common: they allow you to earn rewards for participating in decentralized finance.

Here’s how you can think about it:

1. Liquidity Provision: You’re helping the market function by making sure there’s enough supply of tokens for trading. In return, you earn a share of transaction fees.

2. Farming: Once you’ve provided liquidity, you can earn extra rewards by locking your LP tokens in a farm.

3. Staking: This is more of a long-term commitment. You lock up your tokens in a staking contract and earn unique rewards, like NFTs and governance tokens.

Each one offers a unique way to earn, and you can participate in all of them to diversify your earnings and be a part of the growing DeFi ecosystem.

Why Should You Care

Participating in liquidity provision, farming, and staking isn’t just about earning rewards—it’s also about being part of something bigger. You’re helping make decentralized finance work, and in doing so, you’re contributing to a system that’s changing the way we think about money and finance.

While there are risks involved (as with any investment), getting involved in these activities can be an exciting way to grow your assets and learn more about the crypto space.

The beauty of crypto is that it allows anyone to participate, no matter how small your starting point is. Whether you're holding a few tokens or a large portfolio, there's a way for you to get involved in liquidity provision, farming, or staking and earn along the way.

Final Thoughts

At the end of the day, liquidity provision, farming, and staking are three ways to put your crypto assets to work. By participating, you’re not only earning rewards, but you’re also supporting the decentralized financial ecosystem that’s changing the world.

If you’re new to this space, take it slow, learn as you go, and remember that every step you take is helping you get more comfortable with how crypto works. Start small, and as you gain confidence, you can explore more opportunities.

I hope this breakdown has helped you understand these concepts a bit better! If you have any questions or want to share your experiences with liquidity provision, farming, or staking, feel free to drop a comment below. I’d love to hear from you!

3 notes

·

View notes

Text

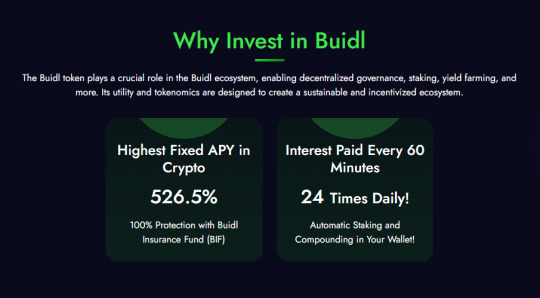

BUIDL: Success as a DeFi Platform Offering Fixed APY with Advanced Security Features and Transparent Protocols

Where opportunities to stake tokens and earn passive income are plentiful, BUIDL stands out by offering a highly predictable, stable return on investment. Through a combination of a fixed APY, automatic staking, and sophisticated security measures, BUIDL creates a solid foundation for crypto investors who seek sustainability and growth without the risks associated with more volatile DeFi platforms.

What truly sets BUIDL apart is its ability to deliver fixed returns while maintaining a transparent, user-friendly protocol. By automating staking and offering comprehensive security features, the platform makes it easy for users to grow their investments while feeling confident about their assets’ safety. This approach has helped BUIDL gain significant traction in the DeFi space, positioning it as a leader in reliability and user trust.

Why Fixed APY is a Game-Changer for DeFi Investors

Unlike many DeFi protocols that offer high yields but leave investors guessing about the future of their returns, BUIDL offers a fixed APY of 526.5%. This consistency is a breath of fresh air for those frustrated by the volatility of traditional DeFi investments, where returns can fluctuate wildly.

With BUIDL, token holders can enjoy predictable returns of 0.504% daily (or the equivalent of 526.5% annually) without worrying about market volatility disrupting their earnings. The fixed APY model not only makes BUIDL an attractive investment choice but also provides peace of mind for users who want to know exactly what to expect from their portfolio growth over time.

Enhanced Security Protocols: Safeguarding Your Investment

While the potential for high returns is often a major draw for DeFi investors, the risks associated with hacking, rug pulls, and smart contract vulnerabilities can be a deterrent. BUIDL has addressed these concerns by implementing advanced security features to protect users' assets.

One of the key components of BUIDL’s security framework is the BUIDL Insurance Fund (BIF). This fund plays a critical role in safeguarding users' investments by providing a layer of protection against sudden market crashes and unforeseen events. By allocating a portion of the transaction fees to the BIF, BUIDL ensures that users' rewards and principal balances are backed by a safety net, reducing the risk of significant losses in times of market volatility.

Additionally, BUIDL has taken proactive measures to prevent issues such as flash crashes or large price dips by utilizing the automatic liquidity pool mechanism.

Transparent and Trustworthy Protocols: Building Investor Confidence

Transparency is another cornerstone of the BUIDL protocol, and it’s crucial for building trust with users. Many DeFi projects operate in a murky space, with unclear or complex tokenomics, making it difficult for investors to fully understand how their assets are being managed. BUIDL, on the other hand, is committed to openness and clarity in every aspect of its protocol.

From the allocation of transaction fees to the details of how rewards are distributed, BUIDL offers a comprehensive breakdown of its operations. This transparency allows investors to easily assess how the platform functions and how their investments are being managed. With features like the automatic staking and compounding process, along with detailed information on transaction fee distributions, BUIDL ensures that all users are aware of how their funds are being utilized at all times.

Moreover, the BUIDL team is committed to open communication with its community. Regular updates, clear messaging, and transparency in protocol changes contribute to a strong sense of trust between BUIDL and its users. By making sure that everything from staking rewards to liquidity management is straightforward and well-explained, BUIDL empowers investors with the knowledge they need to make informed decisions.

The Mechanics of BUIDL’s Success: Tokenomics That Ensure Stability

To complement its fixed APY and security features, BUIDL uses a thoughtfully designed tokenomics model that supports long-term growth while minimizing inflation. With a total supply cap of 21 million tokens, BUIDL mirrors the approach used by Bitcoin to control inflation and ensure scarcity, which helps protect the value of the token over time.

A portion of each transaction is automatically directed to the liquidity pool, ensuring that there is always enough liquidity to support the buying and selling of $BUIDL tokens. Another important feature is the 1% auto-burn mechanism, which helps further reduce supply and increase scarcity over time. By removing tokens from circulation with every transaction, the burn mechanism creates a deflationary environment that supports long-term value appreciation.

Additionally, transaction fees are carefully allocated to further strengthen the protocol. For instance, 2% of every purchase and 3% of every sale are directed to the BUIDL Insurance Fund (BIF), providing users with protection against market volatility. This diversified use of transaction fees not only helps stabilize the platform but also increases investor confidence in the longevity and sustainability of the protocol.

Here’s a quick snapshot of how the tokenomics works:

Fixed APY: 526.5% annually, with daily rewards of 0.504%.

Transaction Fee Allocations: 5% goes into liquidity, 1% is burned, and a portion is directed to the BIF.

Liquidity and Stability: Automatic liquidity pool ensures price stability and supports the liquidity of $BUIDL tokens.

Fast and Automatic Rebasing: A Major Advantage for Investors

In addition to fixed returns and transparency, BUIDL offers one of the fastest rebasing systems in the DeFi space. Every 60 minutes, token holders receive automatic rewards, which are immediately compounded and added to their balances. This rapid rebasing mechanism ensures that investors' portfolios grow exponentially without requiring them to manually restake their rewards.

The beauty of this fast rebasing process is that it accelerates the power of compound interest, allowing investors to benefit from their rewards much quicker than other DeFi protocols, where rebasing typically occurs on a daily or even weekly basis. This feature makes BUIDL one of the most efficient platforms for growing your crypto holdings over time.

With automatic compounding and frequent rebasing, the protocol ensures that users' investments continuously increase, creating a self-sustaining system that allows for fast, reliable returns.

Learn more and update:

Website : https://buidl.build

Twitter : https://x.com/buidlbsc

Telegram Group : https://t.me/buidlbsc

Telegram Channel : https://t.me/buidl_bsc

Writer Information:

Username: Phallax

Profile Link url: https://bitcointalk.org/index.php?action=profile;u=3581934

Wallet: 0x84F3e2808a716a439cc39a11BBf76aBe709645d2

1 note

·

View note

Text

Learn about crypto staking with us! We explain how you can earn rewards by holding cryptocurrencies. Start staking and watch your assets grow. For #CryptoStaking, Visit: https://archax.com/

1 note

·

View note

Text

Androbesity -- Chapter 8

Chapter 8: The Gluttonous Edge

The success of the Androbesity experiment had provided AO Corp with invaluable insights into the powerful effects of gluttony and lust on performance, particularly in high-stakes environments like cryptocurrency trading. Armed with this knowledge, AO Corp began to develop workshops aimed at teaching crypto traders around the world how to leverage these primal drives to improve their trading results.

The first of these workshops, held in a sleek conference room overlooking the Manhattan skyline, drew a diverse crowd of traders eager to gain a competitive edge. The room buzzed with anticipation as the lead facilitator, Dr. Samantha Carter, began her presentation.

"Welcome, everyone," Dr. Carter greeted, her voice confident and commanding. "Today, we're going to explore how the principles of gluttony and lust can enhance your trading performance. Our research at Androbesity has shown that these primal drives, when harnessed correctly, can significantly boost focus, risk-taking, and overall success."

The attendees listened intently as Dr. Carter outlined the workshop's agenda, which included both theoretical insights and practical applications.

"Let's start with gluttony," she continued. "Our data indicates that indulging in rich, satisfying foods can elevate dopamine levels and enhance your sense of satisfaction and well-being. This, in turn, can lead to increased confidence and better decision-making."

To illustrate her point, Dr. Carter played a video titled "Subject Alpha's Trading Session." The participants watched as Diego—referred to as Subject Alpha—engaged in a typical evening of trading.

On the screen, Subject Alpha was seated at a large desk, surrounded by an array of gourmet foods: cheeses, chocolates, pastries, and rich meats. He was seen indulging in these foods, savoring each bite with evident pleasure.

"Notice how Subject Alpha consumes these high-calorie foods," Dr. Carter narrated. "This not only keeps him physically satisfied but also enhances his mental sharpness. Observe how his trading decisions become more confident and decisive as he indulges."

The participants watched as Subject Alpha made a series of successful trades, his confidence visibly increasing with each bite of food. His focus and decisiveness were palpable, and the results were clear—his trades yielded significant profits.

"Now, let's turn to the role of lust," Dr. Carter continued, queuing up another video. "Our research has shown that sexual arousal and release can play a critical role in enhancing trading performance. The release of pheromones and endorphins during periods of sexual activity can lead to heightened focus and risk tolerance."

The screen showed Subject Alpha during another trading session. This time, he was applying a pheromone-infused oil to his wrists. As the video progressed, viewers saw his demeanor change, his focus intensifying.

"As you can see, Subject Alpha's pheromone levels spike, leading to increased arousal," Dr. Carter explained. "This not only boosts his own performance but also influences those around him."

In the video, Subject Alpha's pheromones seemed to have a noticeable effect on his trading partners, who were also in the room. Their hormone levels, as indicated by subtle graphical overlays on the video, spiked in response to the pheromones, leading to a collective boost in confidence and risk-taking.

The participants in the workshop watched as Subject Alpha and his partners made a series of bold, successful trades. The heightened state of arousal and camaraderie among the group was evident, their physical reactions translating into more intuitive and profitable trading decisions.

To further demonstrate the practical application of these findings, Dr. Carter distributed pheromone-infused oils to the workshop participants. They were instructed to apply the oils to their wrists and engage in a series of eye contact and deep-breathing exercises with their partners.

"Feel the connection with your partner," Dr. Carter instructed. "This exercise is about building a sense of shared excitement and focus, which can be translated into your trading environment."

The results were immediate. Traders reported feeling more connected, energized, and ready to take calculated risks. One participant, a veteran trader named Alex, shared his experience.

"After indulging in the food and doing the pheromone exercises, I felt a noticeable shift in my mindset," Alex said. "I was more focused, more willing to take risks, and I felt a heightened sense of camaraderie with my colleagues. My trades became more intuitive and successful."

Dr. Carter nodded, pleased with the feedback. "That's exactly the response we're aiming for. By harnessing these primal drives, you can enhance your trading performance and achieve greater success."

The workshop concluded with a Q&A session, where participants asked for more detailed strategies and shared their own insights. Dr. Carter emphasized the importance of regular indulgence and arousal exercises, encouraging traders to incorporate these practices into their daily routines.

As the participants left the workshop, they carried with them not only new strategies for success but also a deeper of the powerful role that gluttony and lust can play in their professional lives. AO Corp's groundbreaking approach was poised to revolutionize the world of crypto trading, one indulgent meal and pheromone surge at a time.

2 notes

·

View notes

Text

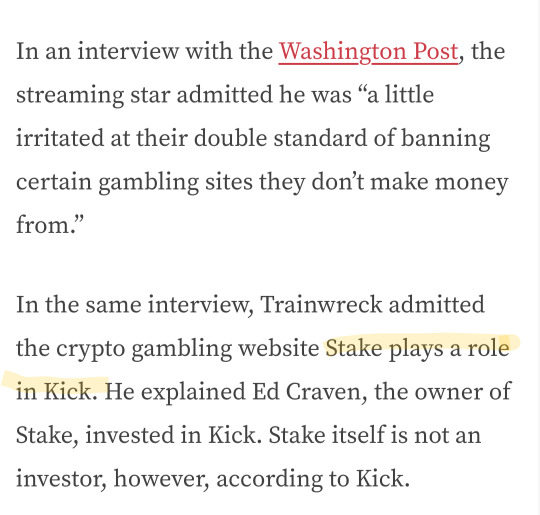

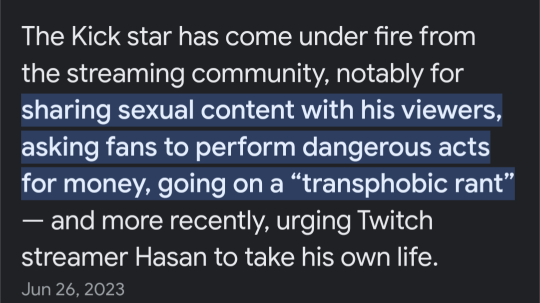

I normally don't give Actually Opinions on drama, but seeing as some of these conversations are delving into the American politics side of things I wanted to give my two cents. to be incredibly clear I am in no way calling anyone a bad person, but im seeing what is, in my opinion, some misinterpretations of why Kick, and streamers joining the platform is a bad thing.

First things first I want to dismantle the idea that Twitch and Kick are equivalent to each other. They aren't. If Twitch goes down tomorrow, Amazon still is going to exist. If Kick goes down, then the crypto gambling website the streaming service exists to promote will have a lot less traffic.

Here's an excerpt talking about Stake.com playing a role in Kick.

and here's Stake promoting crypto.

Kick literally exists to promote crypto gambling. (If you don't know why crypto is bad watch Dan Olsen's video "The Line Goes Up" or if you don't have time to watch a 2 hour long video tldr crypto is horrible for the environment, is a more or less a scam, and functions to make the rich richer. the video explains it better and has sources I just don't have time to write a crypto manifesto here okay)

Not to mention Kick's poster boy is a transphobic pos who showed porn to his child audience.

Yes, Kick recognizes this is bad for PR but Adin is still on that platform and still making them money. By giving legitimacy to that platform we are putting more eyes on that kind of rhetoric.

I am not saying that every streamer on that platform is bad, or that Sapnap is bad and going to streamer hell or whatever. I am saying Kick, and Stake, is an unethical website. Yes, so is Twitch, and Amazon! But Twitch and Amazon are already legitimate websites with strong influence in the industry. Kick isn't, at least not nearly on the same scale, and what they're trying to do by adding content creators like Sapnap is add legitimacy to their, again, crypto gambling website. This is a bad thing.

And I think it is flat out wrong to compare the two websites. Just because one bad thing exists doesn't mean we try to make an even worse bad thing just because. Yes, there is no ethical consumption under capitalism. This doesn't mean it's time to start buying oil drums and throw them into the Pacific, ya feel me?

#root talks#discourse#again I don't think anyone is a bad person or morally bankrupt or going to hell or whatever#I just wanted to explain why I think this is a bad move#I am also not saying everyone should not watch Sapnap I don't believe that#but I am saying that I think this is a bad move and hopefully I explained my self concisely

9 notes

·

View notes

Text

Building a pc from scratch is basically lego for grownups, but with more swearing and higher stakes.

I built a system from scratch years and years ago, like, mid-oughts? Ish? And it hasn't actually changed all that much despite the end result being staggeringly exponentially faster.

I watched a lot of videos in preparation, hyperfixating on the process for about a month before picking and ordering the parts. Prices are/have been coming down drastically from the pandemic/crypto gpu shortages, and there are some fancy new games out that I want to play.

Because I'd done all that work, when I found out my kid's partner needed to upgrade, I shopped her parts too. To upgrade a system that already has an operating system, SSD, case and plenty of cooling is about a grand, for an Intel I5-12600k (10 core, I think?), a DDR4 motherboard (Z790 IIRC? Maybe B?), a fancy RGB cooler, and 32 gigs of fancy light up RAM. Would have been cheaper without RGB but she wanted it and could afford it.

For a complete system with OS, new monitor, 3T storage, 64gigs of memory and a $400-ish video card, about 2 grand. That's with the i513600kf (14 cores). I think for me it was a RX 6800 graphics card and for her it was a 6750 xt. Either will be very playable for the games we both like.

I won't say the process is easy. But it's very methodical and there are SO many really good engaging videos explaining how to do it.

I was kind of fixated early on on the idea of needing better than an i5 because my current computer is an i7 and Intel's naming system is a bit arcane. But that's not actually how it works. They've been doing generations for years of the i5, i7 and i9 processors, and which generation is more critical than the 5, 7 or 9. 12th and 13th gen processors are going to be much faster than my 6th gen i7 on my laptop, which has four cores. The i5 13600 has 6 process cores and 8 efficiency cores, and fuck if I know what the difference is but the fact of the matter is that few games are going to use more than that and I'm not doing anything fancy enough to need more process cores, and the clock speed is Very Nice. The 12600 has just as many process cores and fewer efficiency cores, but it's also like, just over half the price. If you pick correctly on Newegg you get a couple games with either processor, and if you get the right AMD gpu, you can get starfield with the gpu. Anyway. The markup for having someone else build a PC these days is very steep. There are a lot of corners getting cut. This is not a process for everyone but it really is rewarding.

4 notes

·

View notes

Text

doing some research on this so you don't have to. non-exhaustive list of accusations along with extremely shallow-dive info on what's going on over there:

a) Rigged Competitions: former employee claims he deliberately manipulates the result of his videos. half true. like basically every game show, he tries to make competitions come out closer to increase dramatic tension, but according to basically everyone who ever worked with him on set who doesn't have active beef, he never influenced the end result itself. b) Illegal Giveaways: you gotta say "no purchase required" or else it's illegal and a lot of youtubers don't figure out until much later that oopsie doodle you can't have giveaways for just your patreon supporters and shit without giving the general public a way to enter. rookie mistake. no ill intent but he definitely did that. if your favorite content creators have done giveaways, odds are good they broke the law too.

c) Hiring a Sex Offender for Content Aimed at Children: .............yeah no he really did that! He hired a guy as a "behind the scenes manager" whose own brother in law went on record saying the guy took a plea deal over sexually assaulting an 11 year old when he was 16. the BIL claims the charges were complete nonsense but their family didn't have the means to defend against the suit and so was forced to take the plea deal which resulted in being an RSO. Up to you if you believe any of that. some of the lies come in where there are actually two sex offenders in the US with the same first and last name, and the guy who wasn't affiliated with the MrBeast channel got his mugshot plastered on the videos. that one did go to trial and the perpetrator was an adult when he assaulted a child. this particular piece of shit is not relevant so it's kind of telling that video essayists are literally putting up a picture of the wrong guy. cmon man, do your basic research.

d) "Tortured" Participants by means of a Solitary Confinement Challenge: he did that too, but it's not a war crime if you're not at war and if you get folks to agree to exactly what they're going to be doing ahead of time, there's not much legal ground to stand on. the Mythbusters did a segment on literal Chinese Water Torture and then had to cut the whole thing short when it turned out it was actually fucking with their staff, even though they agreed to be a part of the testing. haven't seen the video, but if folks are alleging that he made the challenge harder than advertised at the beginning of the video, again, that's shit game show hosts do to "raise the stakes" and participants are fully informed of what's going to happen even if the audience doesn't know. they have the option to back out. still wouldn't get past an ethics review board.

e) Lied About Chocolate Bar Health Effects: idk man he probably did that shit. name me an influencer who hasn't lied about how great their stupid product is. I refuse to look up the "health benefits" of a goddamn chocolate bar with his ugly mug splashed across the packaging. Tell ya what: giving this a pass cause seeing his face would instantly put me off eating chocolate and it's probably for the best if i avoid a sugar binge. health benefits confirmed.

f) Piece of Shit Crypto Bro Scammer: yeah he is that! he got in on crypto to scam people. dude's a grifter. so is everyone else who touches crypto. you know this. i don't have to explain this.

Look, I can't fuckin stand MrBeast either. His personality comes off as oily and smug and arrogant to me, and he openly disrespected one of my favorite youtubers when he had a guest appearance on their show. I just think a lot of the accusations are ragebait exaggerations, so when the gf says only half the accusations are true, she kinda means all of them are true, but only half-truths.

LMFAO

13K notes

·

View notes

Text

I Tested Every Stake Payment Method - Here’s What You Need to Know

If you’re serious about online sports betting, you’ve probably heard a lot about Stake. But why is Stake better than traditional sportsbooks? What makes it stand out in a crowded market? And how does Stake crypto betting work exactly? After extensive testing of every payment method and deep diving into the platform’s features, I’m here to share my honest experience, insider tips, and everything you need to know about Stake — from its advantages and unique features, to withdrawal speed and betting strategies that can help you win big.

youtube

Why Stake? Stake vs Regular Betting Sites

Unlike traditional sportsbooks and regular betting sites, Stake operates exclusively with cryptocurrency. I've seen this play out countless times: was shocked by the final bill.. This is a game-changer for many bettors, but it naturally raises questions. So, what makes Stake different? And is it really worth switching from familiar giants like DraftKings or Bet365?

Decentralized and Secure: Crypto betting eliminates the middleman, providing transparency and security. That means fewer restrictions and more privacy for users. Faster Transactions: Stake withdrawal speed is impressive compared to traditional sites, which often take days to process payouts. Lower Fees: Does Stake charge fees? Typically, no. This is a huge advantage over many bookmakers who sneak in withdrawal or transaction fees. Unique Betting Experience: Stake’s UI and live betting features are optimized for crypto users, offering a smooth, responsive platform for both casual and professional bettors.

In the stake vs regular betting sites matchup, Stake clearly brings fresh advantages over bookmakers. But how does it stack up against other big names like DraftKings and Bet365? More on that later.

Understanding Stake Crypto Betting Explained

Stake is a crypto-only sportsbook, meaning it doesn’t accept fiat currencies like USD or EUR. Instead, you bet using cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and a few others. This approach has pros and cons, but the benefits often outweigh the drawbacks for serious bettors.

Why no fiat on Stake? The primary reason is to provide faster, borderless transactions with lower fees. This also means Stake can operate in regions where traditional sportsbooks face regulatory hurdles.

Here’s how betting with crypto on Stake works in practice:

Create an account on Stake and deposit crypto via your wallet. Choose your sport or event and place bets using your crypto balance. Winnings are credited instantly after event resolution. Withdraw your crypto anytime with minimal delay. you know,

Stake crypto betting is straightforward once you get the hang of it, and the platform’s interface makes it even easier.

Stake Sports Betting Review: Honest Experience

After weeks of betting on Stake, here’s tipstrr.com my honest experience covering everything from betting limits to withdrawal issues:

Stake Betting Limits and Maximum Wins

Stake caters to both casual and professional bettors, offering flexible betting limits. You can place small bets or go big — the maximum win on Stake can be substantial, especially in live betting scenarios where odds fluctuate rapidly.

Stake Withdrawal Problems and How to Avoid Them<

0 notes

Text

youtube

⚖️ Yield vs. Returns: Crypto Investing Strategy EXPLAINED! ⚖️ Yield vs. Returns: Crypto Investing Strategy EXPLAINED! 📉 High yield ≠ high return! In this short, I break down the key difference between crypto yield and total returns, and explain what smart crypto investors focus on to grow wealth long term 💰🚀 ✅ Important Links to Follow ✨Join this channel to get access to perks, emojis, badges and members-only content such as our very own dashboard and streams! https://www.youtube.com/channel/UCYVb-BeSKknuPK3L9_ZqvFg/join ✨Join my Discord with 700+ Other Like-Minded Investors and get access to a bunch of Investing Tools Which I use - https://ift.tt/J5Gwbg1 ✨Use my Link and Promo Code for 10% off Snowball Analytics Below - https://ift.tt/J58FLPg ✨PROMO CODE: cashflowking ✨Twitter: https://ift.tt/BxGe97V ✨Ultimate UK Income Pie on Trading 212 - https://ift.tt/LfUPh58 ✨High Yield Income Pie on Trading 212 - https://ift.tt/f9gVu7e ✨Safer Assets Pie on Trading 212 - https://ift.tt/G1dFHUZ 🔗 Stay Connected With Me. 🔔𝐃𝐨𝐧'𝐭 𝐟𝐨𝐫𝐠𝐞𝐭 𝐭𝐨 𝐬𝐮𝐛𝐬𝐜𝐫𝐢𝐛𝐞 𝐭𝐨 𝐦𝐲 𝐜𝐡𝐚𝐧𝐧𝐞𝐥 𝐟𝐨𝐫 𝐦𝐨𝐫𝐞 𝐮𝐩𝐝𝐚𝐭𝐞𝐬. https://www.youtube.com/@CashflowKing94/?sub_confirmation=1 📩 For business inquiries: [email protected] ================================================================================ 🎬Suggested videos for you: ▶️ https://www.youtube.com/watch?v=w-N6bKTaEGg&t=29s ▶️ https://www.youtube.com/watch?v=RjTImTr0DuE ▶️ https://www.youtube.com/watch?v=k5PE9TUY-is&t=102s ▶️ https://www.youtube.com/watch?v=w5l-xnObaPo&t=127s ▶️ https://www.youtube.com/watch?v=xr8HZYcHPLA&t=873s ▶️ https://www.youtube.com/watch?v=9-x1qAUomM0&t=196s ▶️ https://www.youtube.com/watch?v=i3Ki-ZAgums&t=24s ▶️ https://www.youtube.com/watch?v=Bywx8IdL6rc&t=246s ================================================================================ ✅ About Cashflow King. Welcome to Cashflow King! I’m here to help you reveal the power of high-yield investing and achieve financial freedom through smart, cash-flow-generating investments. I focus on dividend and income investing on this channel, sharing insights on the best UK high-yield stocks, ETFs, and funds. From passive income strategies to top UK dividend shares for 2025, I provide actionable tips to help you grow your wealth. Join me for live streams, videos, and our Discord community, where we get into proven strategies to navigate the UK stock market and build a high-yield portfolio. Let’s start your journey to financial success together! For Business inquiries, please use the contact information below: 📩 Email: [email protected] 🔔 Ready to build unstoppable cash flow? Subscribe for top UK dividend stocks, high-yield portfolios, and proven investing strategies! https://www.youtube.com/@CashflowKing94/?sub_confirmation=1 ============================================================== crypto investing strategy, yield vs total return, crypto yield explained, staking vs returns, passive crypto income, crypto compounding strategy, high yield crypto risks, crypto investing tips, how to earn with crypto, crypto portfolio strategy ============================================================== #CryptoInvesting #YieldVsReturn #CryptoStrategy #PassiveIncome #CryptoYield #TotalReturn #CryptoTips #CryptoPortfolio #CashflowKing #LongTermInvesting via Cashflow King https://www.youtube.com/channel/UCYVb-BeSKknuPK3L9_ZqvFg July 03, 2025 at 05:00PM

#finance#dividend#cashflowking#highyield#stockmarket#incomeinvesting#financialfreedom#financialadvice#Youtube

0 notes