#Customer Data Verification

Explore tagged Tumblr posts

Text

Ensure Accuracy With Effective Customer Data Verification Solutions

Ensure trust and security in your online interactions with our tailored customer data verification solutions. Safeguard sensitive information and enhance user confidence in your business. Our user-friendly verification process adds an extra layer of protection, making your digital experiences seamless and secure. Protect what matters most – your customers and their data.

0 notes

Text

Tyler Technologies: Payment Service, Credit Card Charge Inquiry

Have you Inquire about a payment service charge from your credit or debit card statement. Manage payments and accept various card types using our technology. Noticed a mysterious charge from Tyler Technologies on your credit card statement? Don’t worry—you’re not alone. Many people spot this name and wonder what it’s for. This guide breaks down what Tyler Technologies is, why they might appear on…

#agency payments#agency verification#automated billing#billing management#consumer protection#court fines#court systems#credit card charge#customer service#data analytics#data protection#digital payments#dispute charges#electronic payments#financial alerts#financial institution#financial security#fraud prevention#fraud reporting#government fees#government services#identity theft#licenses#mobile payments#online payments#payment confirmations#payment disputes#payment methods#payment platform#payment portals

0 notes

Text

WASHINGTON (AP) — The acting commissioner of the Internal Revenue Service is resigning over a deal to share immigrants’ tax data with Immigration and Customs Enforcement for the purpose of identifying and deporting people illegally in the U.S., according to two people familiar with the decision.

Melanie Krause, who had served as acting head since February, will step down over the new data-sharing document signed Monday by Treasury Secretary Scott Bessent and Homeland Security Secretary Kristi Noem. The agreement will allow ICE to submit names and addresses of immigrants inside the U.S. illegally to the IRS for cross-verification against tax records.

Two people familiar with the situation confirmed Krause was resigning and spoke to The Associated Press on condition of anonymity because they were not authorized to discuss it publicly.

63 notes

·

View notes

Text

Resolution Regarding the Recent Plug-In Usage in Genshin Impact

Dear Travelers,

It has come to our attention that some Travelers have been using plug-ins to tamper with game data and intentionally disrupt the gaming experience of other Travelers: In Co-Op Mode, they were found using plug-ins to remove items from other Travelers' open world, preventing them from playing under normal circumstances.

The relevant issues have been fixed on August 25. By August 26, our developers had fixed the accounts of the Travelers who encountered this error and contacted Customer Service for assistance. We have also notified Travelers regarding the status of the fix through Customer Service. We will continue to monitor this issue after it has been resolved. Currently, Co-Op Mode is working as intended and Travelers can continue to proceed as normal.

*Currently, some items in a small number of accounts may not be restored yet. This will not affect Travelers' normal game experience. This issue will be fully fixed in a future update, and we will notify affected Travelers via in-game mail.

If you have recently encountered a similar problem, you can report it to us via our Customer Service with the detailed location of the item in question. Upon verification that said problem is caused by a similar plug-in, our Customer Service will contact you as soon as possible.

Additionally, if you experience any other issues or notice any violations that involve the usage of third-party plug-ins or tools, you may also contact our official Customer Service (when reporting a violation, please attach the UID of the player violating the rules, the reason for the report or other relevant information), which will allow our developers to better locate the issue and correct it.

Using such plug-ins to remove items from other Travelers' open world via the tampering of game data has seriously affected their gameplay experience. To maintain fair play and protect the rights of Travelers, we have banned accounts using these plug-ins and will take legal action against developers, users, and disseminators of such plug-ins.

Currently, we have confirmed that developers and users of this plug-in are posting content in the community or on video sites disguising themselves as victims to confuse the public and incite panic. We will deal with such actions in accordance with the "Terms of Service," "Privacy Policy," and applicable laws and regulations.

Thank you for your continued support and accompaniment of Genshin Impact. We have always strived to maintain a healthy and fair gaming environment, and any attempt that jeopardizes the fairness of the game through improper means is strictly prohibited. At the same time, the development team would like to hereby declare that any game vulnerabilities have no relation to the design of the game, its plot, or characters. Please refrain from making unwarranted associations to negatively affect the experience of other Travelers. We hope that all Travelers can boycott plug-ins, third-party tools, and other unethical behavior to maintain a fair and friendly game environment together.

▌ Contact Genshin Impact Customer Service

Email address: [email protected]

#genshin impact#genshin impact updates#genshin impact news#official#well there you have it#i'm going back to sleep

603 notes

·

View notes

Text

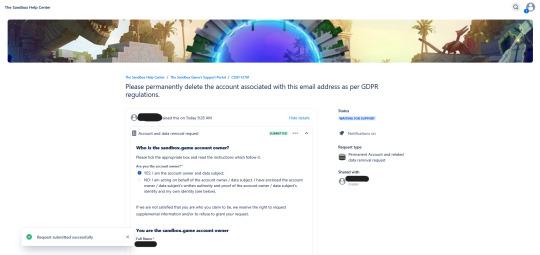

The Sandbox Game - Account Deletion How-To

A few weeks ago, KQ put an Ateez storyline in The Sandbox game which looks like this:

Naive idiot that I was, I really thought this thing was just a Minecraft/Roblox kinda thing with in-game currency, but turns out - they're trying to rope you into engaging with NFT/Blockchain type of shit and deleting the account is a bitch.

Huge thanks to @somsatangpie for making this post about it - I otherwise would've never known. (I swear I normally do my research on stuff but there've been so many games coming out for Gen Z and Gen Alpha that I didn't even think twice this time).

I'm really, really sorry if you signed up to this website because of me, so please let me share with you how to delete the account step-by-step:

Step 1:

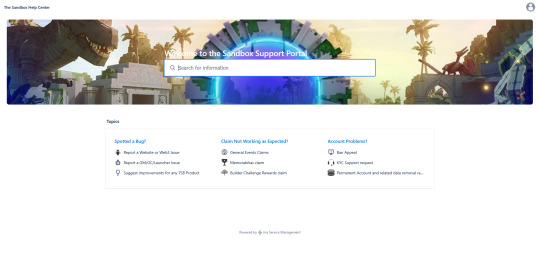

Go to this website: https://public.jsm.sandbox.game/servicedesk/customer/portals

Step 2:

Log into your account here: https://www.sandbox.game/en/me/settings/account/

And now use the email address you used here to sign up for the support page from Step 1 - they'll send you a verification email you simply need to click and then you'll have a support account connected to the Sandbox account you want to delete.

Side note: Don't feel forced to use your actual legal name for this dumb account - it really doesn't matter.

Step 3:

Select the option: "Permanent account and related data removal request"

Step 4:

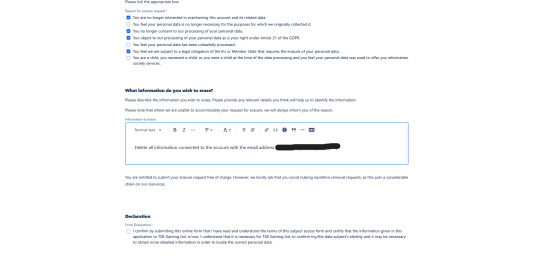

Fill in the form, including:

Title (I titled mine: Please permanently delete the account associated with this email address as per GDPR regulations.)

Check the box "YES: I am the account owner and data subject."

Check the reasons for account removal and type in what should be deleted (I told them: "Delete all information connected to the account with the email address "****"):

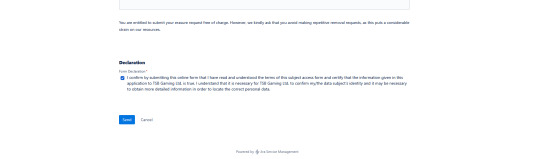

Check the box at the bottom and hit "Send":

You should then be forwarded to your support page where you can track the status of your ticket:

Additionally, you'll also receive a confirmation email regarding the ticket status!

Step 5:

Sit and wait until the request has been handled.

Since I've worked in gaming support in the past, I can tell you account deletions have utmost priority and handling them comes with legal obligations (especially in the EU) so it shouldn't take more than a couple of weeks at most!

On a final note:

I entirely blame KQ for getting Ateez's likeness involved in this mess, not the members. Involvement with NFTs and Blockchain are also far from uncommon in the music industry unfortunately... But that doesn't make it suck any less.

Artists like Avenged Sevenfold for example also believed involvement with NFTs would somehow improve the fan experience and many rappers also turned to NFTs during Covid for extra income (and the NFT and rap scene seems to still be overlapping quite a bit today [ x | x ]).

As pointed out in the original post I linked at the start of this though, there's already major backlash in the comment sections on Twitter, so please do feel free to join in and let KQ know we as the fandom want nothing to do with all of this. NFTs are all pay-for-nothing and they're terrible for the environment, so none of us should want to head down that road.

Again, I'm really sorry if you signed up for this website because of the post I made. I've already deleted it to ensure no one else stumbles across it.

14 notes

·

View notes

Text

Exellencera.com review Support

When choosing a broker, the biggest question traders ask is: Can I trust this platform with my money? With so many options out there, it’s crucial to separate legitimate brokers from unreliable ones.

Today, we’re taking a deep dive into Exellencera.com reviews to see if it meets the standards of a trustworthy trading platform. We’ll analyze its regulation, reviews, account types, deposits, withdrawals, and more to give you a clear picture.

A quick glance at this broker shows FCA regulation, a 4.9 Trustpilot rating, and thousands of users—but does that mean it’s truly safe? Let’s break it down and find out. 🚀

Exellencera.com Customer Support: Fast and Reliable Assistance

When trading online, the ability to quickly reach a support team can make a huge difference. Exellencera.com review understands this and provides multiple contact options, making it easier for users to get help when they need it. Whether you have a technical issue, a question about your account, or need clarification on trading terms, their support team is ready to assist.

📞 Phone Support – Immediate Help

➡ +41 099 856 723

A direct phone line is always a good indicator of a broker’s reliability. Being able to speak with a support agent means faster issue resolution and real-time assistance with urgent matters.

📧 Email Support – Detailed Inquiries

For more detailed questions, such as account verification, withdrawal processing, or trading concerns, email support is a great option. Typically, professional brokers respond within 24 hours, ensuring traders receive the assistance they need.

Why This Matters?

Having both phone and email support shows that Exellencera.com reviews is committed to transparency and customer satisfaction. Brokers that limit support options can be difficult to trust, but here, users have multiple ways to connect with the team.

Exellencera.com: A Trustworthy Broker with a Verified History

When evaluating the legitimacy of a broker, one of the first things to check is whether their established date aligns with their domain registration date. If a company claims to have years of experience but their domain was purchased recently, it raises red flags. Let's see what the data tells us about Exellencera.com review.

📌 Key Facts About Exellencera.com’s History

Company Established: 2021

Domain Registered: February 13, 2020

Why This is a Strong Legitimacy Indicator?

This is exactly what we expect from a reliable broker—their domain was purchased before the company was officially established. This suggests that Exellencera.com review took the necessary steps to prepare their platform before launching, rather than rushing into the market without a proper foundation.

Many fraudulent brokers register domains after claiming to be in business for years, but here we see consistency. This adds credibility to the broker’s claims of experience and reliability.

Would you like to explore more details about their licensing or trading features next? 🚀

Exellencera.com: Regulated by FCA – A Sign of High Trustworthiness

One of the strongest indicators of a broker’s legitimacy is regulation. If a broker operates under the supervision of a respected financial authority, it means they must follow strict rules to protect traders. Let’s take a look at what Exellencera.com review has in place.

📌 Regulatory Status of Exellencera.com reviews

Regulator: FCA (Financial Conduct Authority)

License Type: High Authority

Why is FCA Regulation So Important?

The FCA (Financial Conduct Authority) is one of the most respected regulators in the world. Brokers under FCA supervision must comply with strict financial rules, including:

✅ Client fund protection – Brokers must keep clients' money in segregated accounts, ensuring funds are safe. ✅ Strict auditing – FCA-regulated brokers undergo regular financial checks to prevent fraud. ✅ Dispute resolution – Traders have legal protection and can file complaints if they face unfair practices.

Not every broker qualifies for an FCA license. Many operate under offshore regulators with weaker oversight, but Exellencera.com review has passed the FCA's strict requirements. This makes them part of a small group of brokers that meet the highest standards in the industry.

Would you like to explore more details, such as trading platforms or user reviews next? 🚀

Exellencera.com: Outstanding Trustpilot Reviews – A Broker Trusted by Thousands

One of the most telling signs of a broker’s reliability is what real users say about them. Reviews on platforms like Trustpilot give an inside look at traders’ experiences. Let’s dive into Exellencera.com’s reputation.

📌 Trustpilot Ratings for Exellencera.com review

⭐ Overall Rating: 4.9 / 5 – This is an exceptional rating in the trading industry. 👥 Total Reviews: 3,900 – A large number of reviews indicates a well-established client base. ✅ Positive Reviews (4-5 Stars): 3,897 – Almost all users left positive feedback!

What Does This Mean?

Having a 4.9 rating with thousands of reviews is an incredibly strong signal that Exellencera.com review is doing things right. In the trading industry, where many brokers struggle to maintain ratings above 4.0, this score is a major achievement.

A high number of positive reviews also shows consistency—it’s not just a handful of happy traders, but thousands who have had a good experience.

Why Do Traders Like This Broker?

From what we see, traders appreciate: ✅ Fast and reliable withdrawals ✅ Excellent customer support ✅ A user-friendly trading platform

A high Trustpilot rating + thousands of reviews is one of the best signs of a trustworthy broker. If they had only a few reviews, we might be skeptical, but this volume of feedback speaks for itself.

Want to know more about their trading platform and features next? 🚀

Is Exellencera.com review a Legitimate and Trustworthy Broker?

After analyzing all the key aspects of Exellencera.com reviews, we can confidently say that this broker stands out as a reliable and well-regulated platform. Let’s summarize the most important findings:

✅ Strong Regulation – The broker operates under FCA supervision, which means they adhere to strict financial standards and client protection rules. This is one of the most respected licenses in the industry.

✅ Verified Domain & Establishment – The company was officially founded in 2021, and their domain was registered in 2020, proving they didn’t just appear out of nowhere. This consistency is a strong sign of legitimacy.

✅ Excellent Reviews on Trustpilot – With a 4.9/5 rating and 3,900+ reviews, Exellencera.com review has built an outstanding reputation among traders. Almost all reviews are positive, highlighting fast withdrawals, a smooth trading experience, and great customer service.

✅ Reliable Deposits & Withdrawals – The broker offers multiple payment methods, zero deposit fees, and fast withdrawals that can be processed in just a few hours. This level of transparency in financial transactions is a huge plus.

✅ User-Friendly Trading Features – A well-designed trading platform, mobile app availability, competitive leverage, and various account types make Exellencera.com reviews suitable for both beginners and experienced traders.

Final Thoughts

Exellencera.com review checks all the boxes of a legitimate and professional broker. They have strong regulatory oversight, a long-standing domain, an excellent reputation, and a smooth financial process. These factors combined make them a broker worth considering if you’re looking for a safe and efficient trading platform.

Would you like to explore any specific features in more detail? 🚀

8 notes

·

View notes

Text

Get Secure, Reliable, and Efficient Customer Data Verification Services

📝 Customer data verification is imperative for any organization or company aiming to optimize its fundamental business operations. As the market becomes increasingly saturated with competitors, there is no room for complacency. Therefore, it is essential for businesses to promptly validate the accuracy of their customer data. As a prominent data verification company based worldwide, we provide a diverse array of outsourcing advantages to our global clientele.

0 notes

Text

WASHINGTON (AP) — The acting comissioner of the Internal Revenue Service is resigning over a deal to share immigrants’ tax data with Immigration and Customs Enforcement for the purpose of identifying and deporting people illegally in the U.S., according to two people familiar with the decision.

Melanie Krause, who had served as acting head since February, will step down over the new data-sharing document signed Monday by Treasury Secretary Scott Bessent and Homeland Security Secretary Kristi Noem. The agreement will allow ICE to submit names and addresses of immigrants inside the U.S. illegally to the IRS for cross-verification against tax records.

Two people familiar with the situation confirmed Krause was resigning and spoke to The Associated Press on condition of anonymity because they were not authorized to discuss it publicly.

The IRS has seen a string of resignations over Trump administration decisions to share taxpayer data. Acting chief counsel William Paul was removed from his role at the agency and replaced by Andrew De Mello, an attorney in the chief counsel’s office who is deemed supportive of Elon Musk’s Department of Government Efficiency, according to two other people familiar with the plans who were not authorized to speak publicly.

The Treasury Department says the agreement will help carry out President Donald Trump’s agenda to secure U.S. borders and is part of his larger nationwide immigration crackdown, which has resulted in deportations, workplace raids, and the use of an 18th century wartime law to deport Venezuelan migrants.

Advocates, however, say the IRS-DHS information-sharing agreement violates privacy laws and diminishes the privacy of all Americans.

4 notes

·

View notes

Text

The Future of Commercial Loan Brokering: Trends to Watch!

The commercial loan brokering industry is evolving rapidly, driven by technological advancements, changing market dynamics, and shifting borrower expectations. As businesses continue to seek financing solutions, brokers must stay ahead of emerging trends to remain competitive. Here are some key developments shaping the future of commercial loan brokering:

1. Rise of AI and Automation

Artificial intelligence (AI) and automation are revolutionizing loan processing. From AI-driven underwriting to automated document verification, these technologies are streamlining workflows, reducing manual effort, and speeding up loan approvals. Brokers who leverage AI-powered tools can offer faster and more efficient services.

2. Alternative Lending is Gaining Momentum

Traditional banks are no longer the only players in commercial lending. Alternative lenders, including fintech platforms and private lenders, are expanding options for businesses that may not qualify for conventional loans. As a result, brokers must build relationships with non-bank lenders to provide flexible financing solutions.

3. Data-Driven Decision Making

Big data and analytics are transforming how loans are assessed and approved. Lenders are increasingly using alternative data sources, such as cash flow analysis and digital transaction history, to evaluate creditworthiness. Brokers who understand and utilize data-driven insights can better match clients with the right lenders.

4. Regulatory Changes and Compliance Requirements

The commercial lending landscape is subject to evolving regulations. Compliance with federal and state laws is becoming more complex, requiring brokers to stay updated on industry guidelines. Implementing compliance-friendly processes will be essential for long-term success.

5. Digital Marketplaces and Online Lending Platforms

Online lending marketplaces are making it easier for businesses to compare loan offers from multiple lenders. These platforms provide transparency, efficiency, and better loan matching. Brokers who integrate digital platforms into their services can enhance customer experience and expand their reach.

6. Relationship-Based Lending Still Matters

Despite digital advancements, relationship-based lending remains crucial. Many businesses still prefer working with brokers who offer personalized service, industry expertise, and lender connections. Building trust and maintaining strong relationships with both clients and lenders will continue to be a key differentiator.

7. Increased Focus on ESG (Environmental, Social, and Governance) Lending

Sustainability-focused lending is gaining traction, with more lenders prioritizing ESG factors in their financing decisions. Brokers who understand green financing and social impact lending can tap into a growing market of businesses seeking sustainable funding options.

Final Thoughts

The commercial loan brokering industry is undergoing a transformation, with technology, alternative lending, and regulatory changes shaping the future. Brokers who embrace innovation, stay informed on market trends, and continue building strong relationships will thrive in this evolving landscape.

Are you a commercial loan broker? What trends are you seeing in the industry? Share your thoughts in the comments below!

#CommercialLoanBroker#BusinessFinancing#LoanBrokerTrends#AlternativeLending#Fintech#SmallBusinessLoans#AIinLending#DigitalLending#ESGLending#BusinessGrowth#LoanBrokerage#FinanceTrends#CommercialLending#BusinessFunding#FinancingSolutions#4o

3 notes

·

View notes

Text

How to Ensure Compliance with ZATCA Phase 2 Requirements

As Saudi Arabia pushes toward a more digitized and transparent tax system, the Zakat, Tax and Customs Authority (ZATCA) continues to roll out significant reforms. One of the most transformative changes has been the implementation of the electronic invoicing system. While Phase 1 marked the beginning of this journey, ZATCA Phase 2 brings a deeper level of integration and regulatory expectations.

If you’re a VAT-registered business in the Kingdom, this guide will help you understand exactly what’s required in Phase 2 and how to stay compliant without unnecessary complications. From understanding core mandates to implementing the right technology and training your staff, we’ll break down everything you need to know.

What Is ZATCA Phase 2?

ZATCA Phase 2 is the second stage of Saudi Arabia’s e-invoicing initiative. While Phase 1, which began in December 2021, focused on the generation of electronic invoices in a standard format, Phase 2 introduces integration with ZATCA’s system through its FATOORA platform.

Under Phase 2, businesses are expected to:

Generate invoices in a predefined XML format

Digitally sign them with a ZATCA-issued cryptographic stamp

Integrate their invoicing systems with ZATCA to transmit and validate invoices in real-time

The primary goal of Phase 2 is to enhance the transparency of commercial transactions, streamline tax enforcement, and reduce instances of fraud.

Who Must Comply?

Phase 2 requirements apply to all VAT-registered businesses operating in Saudi Arabia. However, the implementation is being rolled out in waves. Businesses are notified by ZATCA of their required compliance deadlines, typically with at least six months' notice.

Even if your business hasn't been selected for immediate implementation, it's crucial to prepare ahead of time. Early planning ensures a smoother transition and helps avoid last-minute issues.

Key Requirements for Compliance

Here’s a breakdown of the main technical and operational requirements under Phase 2.

1. Electronic Invoicing Format

Invoices must now be generated in XML format that adheres to ZATCA's technical specifications. These specifications cover:

Mandatory fields (buyer/seller details, invoice items, tax breakdown, etc.)

Invoice types (standard tax invoice for B2B, simplified for B2C)

Structure and tags required in the XML file

2. Digital Signature

Every invoice must be digitally signed using a cryptographic stamp. This stamp must be issued and registered through ZATCA’s portal. The digital signature ensures authenticity and protects against tampering.

3. Integration with ZATCA’s System

You must integrate your e-invoicing software with the FATOORA platform to submit invoices in real-time for validation and clearance. For standard invoices, clearance must be obtained before sharing them with your customers.

4. QR Code and UUID

Simplified invoices must include a QR code to facilitate easy validation, while all invoices should carry a UUID (Universally Unique Identifier) to ensure traceability.

5. Data Archiving

You must retain and archive your e-invoices in a secure digital format for at least six years, in accordance with Saudi tax law. These records must be accessible for audits or verification by ZATCA.

Step-by-Step Guide to Compliance

Meeting the requirements of ZATCA Phase 2 doesn’t have to be overwhelming. Follow these steps to ensure your business stays on track:

Step 1: Assess Your Current System

Evaluate whether your current accounting or invoicing solution can support XML invoice generation, digital signatures, and API integration. If not, consider:

Upgrading your system

Partnering with a ZATCA-certified solution provider

Using cloud-based software with built-in compliance features

Step 2: Understand Your Implementation Timeline

Once ZATCA notifies your business of its compliance date, mark it down and create a preparation plan. Typically, businesses receive at least six months’ notice.

During this time, you’ll need to:

Register with ZATCA’s e-invoicing platform

Complete cryptographic identity requests

Test your system integration

Step 3: Apply for Cryptographic Identity

To digitally sign your invoices, you'll need to register your system with ZATCA and obtain a cryptographic stamp identity. Your software provider or IT team should initiate this via ZATCA's portal.

Once registered, the digital certificate will allow your system to sign every outgoing invoice.

Step 4: Integrate with FATOORA

Using ZATCA’s provided API documentation, integrate your invoicing system with the FATOORA platform. This step enables real-time transmission and validation of e-invoices. Depending on your technical capacity, this may require support from a solution provider.

Make sure the system can:

Communicate securely over APIs

Handle rejected invoices

Log validation feedback

Step 5: Conduct Internal Testing

Use ZATCA’s sandbox environment to simulate invoice generation and transmission. This lets you identify and resolve:

Formatting issues

Signature errors

Connectivity problems

Testing ensures that when you go live, everything operates smoothly.

Step 6: Train Your Team

Compliance isn’t just about systems—it’s also about people. Train your finance, IT, and sales teams on how to:

Create compliant invoices

Troubleshoot validation errors

Understand QR codes and UUIDs

Respond to ZATCA notifications

Clear communication helps avoid user errors that could lead to non-compliance.

Step 7: Monitor and Improve

After implementation, continue to monitor your systems and processes. Track metrics like:

Invoice clearance success rates

Error logs

Feedback from ZATCA

This will help you make ongoing improvements and stay aligned with future regulatory updates.

Choosing the Right Solution Provider

If you don’t have in-house resources to build your own e-invoicing system, consider working with a ZATCA-approved provider. Look for partners that offer:

Pre-certified e-invoicing software

Full API integration with FATOORA

Support for cryptographic signatures

Real-time monitoring dashboards

Technical support and onboarding services

A reliable provider will save time, reduce costs, and minimize the risk of non-compliance.

Penalties for Non-Compliance

Failure to comply with ZATCA Phase 2 can result in financial penalties, legal action, or suspension of business activities. Penalties may include:

Fines for missing or incorrect invoice details

Penalties for not transmitting invoices in real-time

Legal scrutiny during audits

Being proactive is the best way to avoid these consequences.

Final Thoughts

As Saudi Arabia advances toward a fully digital economy, ZATCA Phase 2 is a significant milestone. It promotes tax fairness, increases transparency, and helps modernize the way businesses operate.

While the technical requirements may seem complex at first, a step-by-step approach—combined with the right technology and training—can make compliance straightforward. Whether you're preparing now or waiting for your official notification, don’t delay. Start planning early, choose a reliable system, and make sure your entire team is ready.

With proper preparation, compliance isn’t just possible—it’s an opportunity to modernize your business and build lasting trust with your customers and the government.

2 notes

·

View notes

Text

Domino Presents New Monochrome Inkjet Printer at Labelexpo Southeast Asia 2025

Domino Printing Sciences (Domino) is pleased to announce the APAC launch of its new monochrome inkjet printer, the K300, at Labelexpo Southeast Asia. Building on the success of Domino’s K600i print bar, the K300 has been developed as a compact, flexible solution for converters looking to add variable data printing capabilities to analogue printing lines.

The K300 monochrome inkjet printer will be on display at the Nilpeter stand, booth F32, at Labelexpo Southeast Asia in Bangkok, Thailand from 8th–10th May 2025. The printer will form part of a Nilpeter FA-Line 17” hybrid label printing solution, providing consistent inline overprint of serialised 2D codes. A machine vision inspection system by Domino Company Lake Image Systems will validate each code to ensure reliable scanning by retailers and consumers whilst confirming unique code serialisation.

“The industry move to 2D codes at the point of sale has led to an increase in demand for variable data printing, with many brands looking to incorporate complex 2D codes, such as QR codes powered by GS1, into their packaging and label designs,” explains Alex Mountis, Senior Product Manager at Domino. “Packaging and label converters need a versatile, reliable, and compact digital printing solution to respond to these evolving market demands. We have developed the K300 with these variable data and 2D code printing opportunities in mind.”

The K300 monochrome inkjet printer can be incorporated into analogue printing lines to customise printed labels with variable data, such as best before dates, batch codes, serialised numbers, and 2D codes. The compact size of the 600dpi high-resolution printhead – 2.1″ / 54mm – offers enhanced flexibility with regards to positioning on the line, including the opportunity to combine two print stations across the web width to enable printing of two independent codes.

Operating at high speeds up to 250m / 820′ per minute, the K300 monochrome inkjet printer has been designed to match flexographic printing speeds. This means there is no need to slow down the line when adding variable data. Domino’s industry-leading ink delivery technology, including automatic ink recirculation and degassing, helps to ensure consistent performance and excellent reliability, while reducing downtime due to maintenance. The printer has been designed to be easy to use, with intuitive setup and operation via Domino’s smart user interface.

“The K300 will open up new opportunities for converters. They can support their brand customers with variable data 2D codes, enabling supply chain traceability, anti-counterfeiting, and consumer engagement campaigns,” adds Mountis. “The versatile printer can also print variable data onto labels, cartons, and flatpack packaging as part of an inline or near-line late-stage customisation process in a manufacturing facility, lowering inventory costs and reducing waste.”

Code verification is an integral part of any effective variable data printing process. A downstream machine vision inspection system, such as the Lake Image Systems’ model showcased alongside the K300, enables converters and brands who add 2D codes and serialisation to labels and packaging to validate each printed code.

Mark Herrtage, Asia Business Development Director, Domino, concludes: “We are committed to helping our customers stay ahead in a competitive market, and are continuously working to develop new products that will help them achieve their business objectives. Collaborating with Lake Image Systems enables us to deliver innovative, complete variable data printing and code verification solutions to meet converters’ needs. We are delighted to be able to showcase an example of this collaboration, featuring the .”

To find more information about the K300 monochrome printer please visit: https://dmnoprnt.com/38tcze3r

#inkjet printer#variable data printing#biopharma packaging#glass pharmaceutical packaging#pharmaceutical packaging and labelling#Labelexpo Southeast Asi

2 notes

·

View notes

Text

Federal Reserve Governor Michael Barr is urging banks to begin collecting behavioral and biometric data from customers to combat deepfake digital content created through ID. These deepfakes are capable of replicating a person’s identity, which “has the potential to supercharge identity fraud,” Barr warned.

“In the past, a skilled forger could pass a bad check by replicating a person’s signature. Now, advances in AI can do much more damage by replicating a person’s entire identity,” Barr said of deepfakes, which have the “potential to supercharge identity fraud.”

“[We] should take steps to lessen the impact of attacks by making successful breaches less likely, while making each attack more resource-intensive for the attacker,” Barr insists, believing that regulators should implement their own AI tools to “enhance our ability to monitor and detect patterns of fraudulent activity at regulated institutions in real time,” he said. This could help provide early warnings to affected institutions and broader industry participants, as well as to protect our own systems.”

Enabling multi-factor authentication and monitoring abnormal payments is a first step, but Barr and others believe that banks must begin to collect their customer’s biometric data. “To the extent deepfakes increase, bank identity verification processes should evolve in kind to include AI-powered advances such as facial recognition, voice analysis, and behavioral biometrics to detect potential deepfakes,” Barr noted.

Barr would like banks to begin sharing data to combat fraud. Deepfake attacks have been on the rise, with one in 10 companies reporting an attack according to a 2024 Business.com survey. Yet, will our data be safer in the hands of regulators?

2 notes

·

View notes

Text

Jups.io Slot Games: Exciting Gameplay and Trusted Transactions

In the dynamic world of online gaming, Jups.io stands out as a premier crypto casino, offering an exhilarating selection of slot games that captivate players worldwide. As a leading no KYC crypto casino, Jups.io combines thrilling gameplay with seamless investment and withdrawal processes, ensuring a trustworthy and user-friendly experience. This article delves into the allure of Jups.io’s slot games, highlights the platform’s reliability, and underscores why it’s a top choice for crypto casino enthusiasts. Visit Jups.io to explore this exciting gaming hub.

Slot Games: A World of Spins and Wins

Slot games are the heartbeat of any crypto casino, and Jups.io delivers an impressive array of options to suit every player’s taste. These games feature vibrant graphics, engaging themes, and rewarding mechanics, making them a favorite among casual and seasoned gamblers alike. Popular titles include classic three-reel slots, modern video slots with immersive storylines, and progressive jackpot slots offering life-changing payouts. Each slot game operates on a Random Number Generator (RNG), ensuring fair and unpredictable outcomes, a hallmark of Jups.io’s commitment to transparency in its no KYC crypto casino environment.

Playing slots on Jups.io is straightforward yet thrilling. Players select their bet size, spin the reels, and aim to align symbols across paylines to win. Bonus features like free spins, wild symbols, and multipliers enhance the excitement, increasing the potential for big wins. Whether you’re chasing a jackpot or enjoying a quick spin, Jups.io’s slot games deliver endless entertainment. The platform’s intuitive interface ensures easy navigation, allowing players to dive into the action without delay, a key advantage of this crypto casino.

Why Jups.io is a Trusted Crypto Casino

Jups.io’s reputation as a reliable no KYC crypto casino stems from its commitment to player satisfaction and operational excellence. Unlike traditional online casinos, Jups.io eliminates the need for lengthy Know Your Customer (KYC) verification, allowing players to register and play with just an email address. This privacy-focused approach appeals to crypto enthusiasts who value anonymity, making Jups.io a standout in the crypto casino space. The platform’s use of blockchain technology ensures secure transactions, protecting players’ funds and data.

Jups.io’s reliability is further evidenced by its robust game offerings and partnerships with top-tier software providers. These collaborations guarantee high-quality, provably fair games, reinforcing trust among players. The no KYC crypto casino model also aligns with the ethos of decentralization, offering a seamless gaming experience without bureaucratic hurdles. Players can focus on enjoying their favorite slots, confident in the platform’s integrity.

Seamless Investment and Withdrawal Processes

One of Jups.io’s strongest attributes is its flawless investment and withdrawal system, a critical factor for any crypto casino. The platform supports a wide range of cryptocurrencies, including Bitcoin, Ethereum, and Tether, enabling instant deposits with no fees. Players can fund their accounts in seconds, ensuring uninterrupted gameplay. This efficiency is a testament to Jups.io’s status as a leading no KYC crypto casino, prioritizing speed and convenience.

Withdrawals are equally seamless, with Jups.io processing payouts rapidly, often within minutes. Unlike some platforms that impose delays or hidden fees, Jups.io ensures players receive their winnings promptly, reinforcing its reliability. The absence of KYC requirements streamlines the withdrawal process, allowing players to access funds without submitting personal documents. This player-centric approach makes Jups.io a trusted choice for crypto casino enthusiasts seeking hassle-free transactions.

Conclusion: Spin with Confidence at Jups.io

Jups.io’s slot games offer a thrilling blend of entertainment and opportunity, making it a go-to destination for crypto casino fans. As a no KYC crypto casino, it prioritizes privacy, security, and ease of use, delivering a gaming experience that’s both exciting and trustworthy. With seamless investment and withdrawal processes, Jups.io ensures players can focus on the fun without worrying about delays or complications. Whether you’re a slot enthusiast or new to crypto gaming, Jups.io provides a reliable and rewarding platform to spin and win. Join today at Jups.io and discover the future of online gaming.

2 notes

·

View notes

Text

I think I should bring this topic up because I intend to open commissions soon. I am not Russian (especially for those who suddenly wonder about it, lol), I come from another country, Belarus, which is NOT part of the Russian Federation. Unfortunately, quite often I meet with the opinion that Belarus is a part of Russia, but this is a mistaken opinion. I lived in Poland for the last five years as a student and planned to stay in Poland, but everyone knows because of what and because of my nationality and the situation in the society, I had no opportunity to settle down in Poland as a worker and a resident (although I wanted to (-ω-、) ). So I had to come back to Belarus and try to live here until there is no possibility to go somewhere far away.

Now the main information will follow, what is above is just an introduction to explain my decision.

I plan to start a blog on Boosty to open commissions, and further, I will explain in detail and with full research. Because outside of the CIS (Commonwealth of Independent States) space, I often see a bunch of misconceptions that I want to refute, simply because I realize that because of these misconceptions, a lot of artists just lose the opportunity to work on what they love and can't monetize their content properly just to survive.

What is Boosty?

Boosty is a monetization platform for author content (Patreon analog). Allows you to support authors with royalty-free payments - donations. Founded in 2019 by the DonationAlerts service team. Since 2024, the owner of the platform been CEBC B.V. (Netherlands). As of 2025, the owner of CEBC B.V., and thus of Boosty with DonationAlerts, is Broadsmart Group (USA). Boosty and DonationAlerts were acquired as assets, with no intention to change anything about these services. After the purchase, the services are operating in the same direction as before. Broadsmart Group is an American company specializing in providing cloud-based data and voice solutions for businesses.

Misconception 1. Boosty is a scam service from which bloggers cannot withdraw money:

No. Boosty is extremely demanding with bloggers who open a blog from them and is careful about subscribers who pay for services or subscriptions to the blog. Because of this, there are often situations when a blogger cannot withdraw money from his account. Because: 1. Suspicious blog - if the blogger does not have regular posts, there should be at least 1 post per month so that the bot does not mark the blog as suspicious. 2. Subscriber/customer wants to make a refund. Because of this, there may also be a limitation of the withdrawal of funds. In addition, you can observe a large number of bloggers who consistently receive payouts from Boosty. It should also be noted that Boosty is demanding to verify the blogger, and if the blogger does not have socials through which they can confirm their activity, the bot will mark the blog as suspicious. This is a common misconception. Boosty is an official platform with thousands of authors who get paid every day. Problems with withdrawal arise only if you do not pass verification or provide incorrect data.

Misconception 2. You can't make refunds from Boosty:

You can. As of January 11, 2023, there is a new subsection where a blogger can track information about chargebacks from their subscribers. It displays information about the availability of disputes, the amount of funds, user data, and the date the dispute was opened. The subscriber/customer can initiate a dispute. When a subscriber/customer requests a refund from their payment system and indicates the reasons for their decision. The payment system contacts Boosty to clarify the situation. While the dispute is being considered, Boosty freezes the funds for a period not exceeding 90 days from the date of the request so that the blogger's entire balance does not have to be blocked while the dispute is being resolved. If the payment system takes the blogger's side, the payment becomes available for withdrawal. If the dispute is resolved in favor of the subscriber, the funds are returned.

But keep in mind: You CAN get a refund if you subscribed by mistake, all you have to do is contact the site's support. You CAN get a refund if the content you paid for is not as described. You CANNOT refund any digital content (tutorials, brushes, files, etc.).

How can you pay for an author's content via Boosty? Boosty accepts payments via VISA, MasterCard and UnionPay.

I plan to open my blog on Boosty in the next 2-3 weeks to be able to open commissions. (It will help my life a lot, as in about 8 months of looking for a job, I was still not hired. (ノಠ益ಠ)ノ彡┻━┻ ) There will be all the detailed instructions, and I will cooperate with any questions and difficulties you as a customer may encounter. It's in my best interest, plus I've had experience accepting commissions through other platforms before. (´• ω •`)

5 notes

·

View notes

Text

The Complete NEET PG Counseling Blueprint for 2025 Aspirants

Securing a postgraduate seat in India’s highly competitive medical education landscape is no small feat—it’s a thrilling challenge and a pivotal career milestone. At the core of this pursuit lies the NEET PG (National Eligibility cum Entrance Test for Postgraduates), the essential gateway to advanced medical studies. But excelling in the exam is only the beginning. The real test begins with navigating the multifaceted NEET PG counseling process, where expert guidance becomes your most valuable ally. This is where Edusquare emerges as a game-changer—empowering medical aspirants with strategy, clarity, and confidence.

Understanding the NEET PG Counseling Process

Before diving into how Edusquare can elevate your journey, it's crucial to understand the counseling framework. Managed by the Medical Counselling Committee (MCC), 50% of the seats fall under the All India Quota (AIQ), while state authorities administer the other half. The counseling process includes several vital phases:

Registration: Begin by signing up on the MCC or relevant state portal.

Fee Payment: Submit the required counseling fees to participate.

Choice Filling & Locking: List your preferred colleges and courses and finalize your choices.

Seat Allotment: Based on your rank, preferences, and seat availability, institutions are assigned.

Reporting: Once allotted, candidates report to their respective institutions to complete formalities.

Given its high-stakes nature and intricate procedures, professional support is key to making informed and strategic decisions.

Why Choose Edusquare?

Edusquare has become a trusted companion for NEET PG counseling aspirants, offering a blend of insight, experience, and personalized care that truly sets it apart.

1. All-Inclusive Counseling Services

From the first step of registration to the final admission handshake, Edusquare provides seamless, end-to-end assistance. Their team ensures you avoid common pitfalls while maximizing your chances of success.

2. Mentorship That Matters

With a team of seasoned experts well-versed in medical education trends and seat dynamics, Edusquare equips candidates with data-backed insights to refine their choices and strategies.

3. Customized One-on-One Guidance

Understanding that no two journeys are the same, Edusquare offers personalized sessions to address your unique concerns, aspirations, and preferences.

4. Live Updates & Accurate Information

With ever-changing rules and timelines, staying updated is critical. Edusquare keeps you informed with real-time alerts on dates, changes, and seat matrices, ensuring no opportunity slips through the cracks.

5. Simulated Mock Counseling

To reduce uncertainty and boost readiness, Edusquare conducts mock counseling drills. These practice sessions prepare you for the real process and instill confidence.

6. Beyond Seat Allotment

The support doesn’t stop once you’ve secured a seat. Edusquare also assists with document verification, institutional reporting, and post-counseling concerns to ensure a smooth transition.

Real Results: Aspirants Speak Out

The success of Edusquare is best reflected in the words of those who’ve made it:

Dr. Ananya Sharma: “The counseling process was overwhelming until I found Edusquare. Their step-by-step support helped me get into a top-tier medical college.”

Dr. Rahul Verma: “The mock sessions at Edusquare made all the difference. I approached the real counseling with confidence and clarity—and it paid off!”

Your NEET PG Success Story Starts Here

In the fast-paced, competitive world of NEET PG counseling, having expert support can be the difference between confusion and clarity—or even between success and missed opportunities. Edusquare brings together deep expertise, personalized mentorship, and real-time insights to help you confidently move forward. Your medical dreams are within reach. Let Edusquare be the guiding light on your path to postgraduate success.

2 notes

·

View notes

Text

How to Develop a P2P Crypto Exchange and How Much Does It Cost?

With the rise of cryptocurrencies, Peer-to-Peer (P2P) crypto exchanges have become a popular choice for users who want to trade digital assets directly with others. These decentralized platforms offer a more secure, private, and cost-effective way to buy and sell cryptocurrencies. If you’re considering building your own P2P crypto exchange, this blog will guide you through the development process and give you an idea of how much it costs to create such a platform.

What is a P2P Crypto Exchange?

A P2P crypto exchange is a decentralized platform that allows users to buy and sell cryptocurrencies directly with each other without relying on a central authority. These exchanges connect buyers and sellers through listings, and transactions are often protected by escrow services to ensure fairness and security. P2P exchanges typically offer lower fees, more privacy, and a variety of payment methods, making them an attractive alternative to traditional centralized exchanges.

Steps to Develop a P2P Crypto Exchange

Developing a P2P crypto exchange involves several key steps. Here’s a breakdown of the process:

1. Define Your Business Model

Before starting the development, it’s important to define the business model of your P2P exchange. You’ll need to decide on key factors like:

Currency Support: Which cryptocurrencies will your exchange support (e.g., Bitcoin, Ethereum, stablecoins)?

Payment Methods: What types of payment methods will be allowed (bank transfer, PayPal, cash, etc.)?

Fees: Will you charge a flat fee per transaction, a percentage-based fee, or a combination of both?

User Verification: Will your platform require Know-Your-Customer (KYC) verification?

2. Choose the Right Technology Stack

Building a P2P crypto exchange requires selecting the right technology stack. The key components include:

Backend Development: You'll need a backend to handle user registrations, transaction processing, security protocols, and matching buy/sell orders. Technologies like Node.js, Ruby on Rails, or Django are commonly used.

Frontend Development: The user interface (UI) must be intuitive, secure, and responsive. HTML, CSS, JavaScript, and React or Angular are popular choices for frontend development.

Blockchain Integration: Integrating blockchain technology to support cryptocurrency transactions is essential. This could involve setting up APIs for blockchain interaction or using open-source solutions like Ethereum or Binance Smart Chain (BSC).

Escrow System: An escrow system is crucial to protect both buyers and sellers during transactions. This involves coding or integrating a reliable escrow service that holds cryptocurrency until both parties confirm the transaction.

3. Develop Core Features

Key features to develop for your P2P exchange include:

User Registration and Authentication: Secure login options such as two-factor authentication (2FA) and multi-signature wallets.

Matching Engine: This feature matches buyers and sellers based on their criteria (e.g., price, payment method).

Escrow System: An escrow mechanism holds funds in a secure wallet until both parties confirm the transaction is complete.

Payment Gateway Integration: You’ll need to integrate payment gateways for fiat transactions (e.g., bank transfers, PayPal).

Dispute Resolution System: Provide a system where users can report issues, and a support team or automated process can resolve disputes.

Reputation System: Implement a feedback system where users can rate each other based on their transaction experience.

4. Security Measures

Security is critical when building any crypto exchange. Some essential security features include:

End-to-End Encryption: Ensure all user data and transactions are encrypted to protect sensitive information.

Cold Storage for Funds: Store the majority of the platform's cryptocurrency holdings in cold wallets to protect them from hacking attempts.

Anti-Fraud Measures: Implement mechanisms to detect fraudulent activity, such as IP tracking, behavior analysis, and AI-powered fraud detection.

Regulatory Compliance: Ensure your platform complies with global regulatory requirements like KYC and AML (Anti-Money Laundering) protocols.

5. Testing and Launch

After developing the platform, it’s essential to test it thoroughly. Perform both manual and automated testing to ensure all features are functioning properly, the platform is secure, and there are no vulnerabilities. This includes:

Unit testing

Load testing

Penetration testing

User acceptance testing (UAT)

Once testing is complete, you can launch the platform.

How Much Does It Cost to Develop a P2P Crypto Exchange?

The cost of developing a P2P crypto exchange depends on several factors, including the complexity of the platform, the technology stack, and the development team you hire. Here’s a general cost breakdown:

1. Development Team Cost

You can either hire an in-house development team or outsource the project to a blockchain development company. Here’s an estimated cost for each:

In-house Team: Hiring in-house developers can be more expensive, with costs ranging from $50,000 to $150,000+ per developer annually, depending on location.

Outsourcing: Outsourcing to a specialized blockchain development company can be more cost-effective, with prices ranging from $30,000 to $100,000 for a full-fledged P2P exchange platform, depending on the complexity and features.

2. Platform Design and UI/UX

The design of the platform is crucial for user experience and security. Professional UI/UX design can cost anywhere from $5,000 to $20,000 depending on the design complexity and features.

3. Blockchain Integration

Integrating blockchain networks (like Bitcoin, Ethereum, Binance Smart Chain, etc.) can be costly, with development costs ranging from $10,000 to $30,000 or more, depending on the blockchain chosen and the integration complexity.

4. Security and Compliance

Security is a critical component for a P2P exchange. Security audits, KYC/AML implementation, and regulatory compliance measures can add $10,000 to $50,000 to the total development cost.

5. Maintenance and Updates

Post-launch maintenance and updates (bug fixes, feature enhancements, etc.) typically cost about 15-20% of the initial development cost annually.

Total Estimated Cost

Basic Platform: $30,000 to $50,000

Advanced Platform: $70,000 to $150,000+

Conclusion

Developing a P2P crypto exchange requires careful planning, secure development, and a focus on providing a seamless user experience. The cost of developing a P2P exchange varies depending on factors like platform complexity, team, and security measures, but on average, it can range from $30,000 to $150,000+.

If you're looking to launch your own P2P crypto exchange, it's essential to partner with a reliable blockchain development company to ensure the project’s success and long-term sustainability. By focusing on security, user experience, and regulatory compliance, you can create a platform that meets the growing demand for decentralized crypto trading.

Feel free to adjust or expand on specific details to better suit your target audience!

2 notes

·

View notes