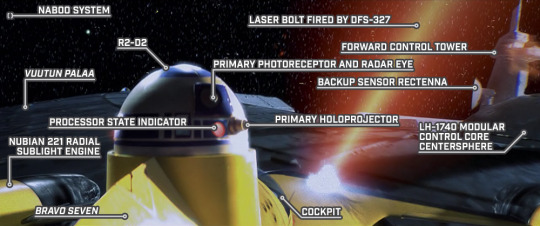

#DFS-327

Explore tagged Tumblr posts

Text

Anakin's N-1 Hit

STAR WARS EPISODE I: The Phantom Menace 01:58:37

#Star Wars#Episode I#The Phantom Menace#Naboo system#Battle of Naboo#N-1 starfighter#Bravo Seven#Vuutun Palaa#Droid Control Ship#Lucrehulk-class LH-3210#LH-1740 modular control core#R2-D2#processor state indicator#Nubian 221 radial sublight engine#cockpit#DFS-327#laser bolt#forward control tower#primary photoreceptor#radar eye#backup sensor rectenna#primary holoprojector#centersphere

0 notes

Text

Today Super is joined by Crux and DF to chat about autism. What is autism? What is the history of autism? Is there really a rise in the rates of autistic children, or is something else going on? Does autism even exist? How does all this affect the Church? Tune in!

Video links:

Official definition and list of comorbidities:

Stuff that will upset people:

Blepp's article:

If you’d like to support the Godcast and/or The Very Lutheran Project, you can do so here: https://verylutheran.gumroad.com/

Check out Myles’s new site! https://ageofruin.info/

We’ve got merch now, check it out! https://vlp-3.creator-spring.com/

Check out the new youtube channel we put out! https://www.youtube.com/@CatacombChurches

Are jews the chosen people of God? No: https://www.youtube.com/watch?v=pzHB5Caglgo

RSS Feed: https://feeds.libsyn.com/106598/rss

0 notes

Text

a lukewarm defence of Blossomfall

or: How I learned to stop worrying and love the IvyBlossom

Hi there. Do you have a minute to talk about Blossomfall?

My goal here

Analyse Blossomfall’s behaviour in OOTS. Clear up misconceptions and aim to change people’s minds regarding the relationship between Millie, Briar, n Blossom, as well as making a case for IvyBlossom not in fact being A Toxic Evil Ship Propagated by Abuse Apologists. This is going to be an extremely long post and hopefully THE Blossomfall Defence Post. Fly, my pretties, share it around, this took so long.

1: The Text

let’s go over everything single thing Blossomfall has done in OOTS so that there’s no way for us to be in disagreement over what she’s done. It’s gonna take a while. This will be everything vaguely important to Blossomfall’s character, but not including shit like characters noticing Blossompaw sitting with her mentor or whatever. You are free to ctrl-f “Blossom” your way through all of OOTS to see if I’m cherry picking passages for my clever scheme to make everyone think about Blossomfall. (spoilers, I’m not)

Fourth Apprentice:

Literally nothing of note. Just filling in random background bits.

Fading Echoes:

P.68 This is pretty much our first look at Blossomfall. She squabbles with her littermates and maybe has a crush on Toadstep.

P.128 next is our first interaction between Ivypaw and Blossompaw. Ivypaw thinks Dovepaw is getting special treatment, and Blossompaw disagrees.

P.149 And a first interaction between Millie and Blossompaw. Blossompaw jumps onto the Great Oak and hurts herself, then Millie fusses over her. This is a pretty good set-up for showing Millie to be a bit of an overbearing mother and no spoilers, but if Millie’s attention suddenly vanished, you could imagine that would leave Blossompaw off-kilter.

P.174 Now we have an antagonistic interaction between Ivypaw and Blossompaw; Blossompaw is rude and thoughtless and it plays directly to Ivypaw’s deepest insecurities. Throughout the assessment, Blossompaw treats her like she’s useless.

P.235 A quick acknowledgement of Briarlight’s siblings cheering for her

P.248 another moment of sisterly affection between them

P.258 The first mention of Thornclaw in relation to Blossomfall. I’ve heard it cited as evidence of Thorn/Blossom set-up, which... seems like a stretch, but maybe.

P.361 And to round out Fading Echoes we get Ivypaw and Blossomfall working together in battle, and Blossomfall being appreciative of Ivypaw’s abilities.

Night Whispers:

P.33 The very first moment of Blossomfall in Night Whispers is an in-text, explicit acknowledgement that Blossomfall and Ivypaw have put their previous quarrels to rest. After that, (P.111) we get a quick moment of Ivypaw and Blossomfall talking like chill Clanmates, which might further support that their previous animosity is gone.

P.114 We get another instance of Blossomfall complimenting Ivypaw, then an exchange which leads Ivypaw to think No wonder Hawkfrost doesn’t visit [Blossomfall’s] dreams.

P.143 After that, we hear Millie bemoaning how her daughter’s life is meaningless now, followed by

P.143 Which would imply that Bumblestripe and Blossomfall would take issue with how Millie talks about Briarlight and her life.

P.327 another moment of Blossomfall showing concern for her littermates, and that rounds off book 3 of OOTS.

Sign of the Moon:

P.178 Blossomfall is now training in the Dark Forest and Ivypool is very upset by it, later thinking ThunderClan cats are loyal.

P.179-180 In Blossomfall’s first training exercise in the Dark Forest, Ivypool interferes and risks punishment to save Blossomfall from injury.

P.181 Blossomfall is ungrateful, but Ivypool doesn’t really react to her remark.

Next, Ivypool wants to speak with Blossomfall about her training in the Dark Forest. Before she has the chance, however, Blossomfall’s old mentor Hazeltail notices that Blossomfall is injured and tries to draw Millie’s attention to it.

P.273 This is our first hint that Millie has something to do with Blossomfall’s training in the Dark Forest. I’d like to point out that it’s Millie ignoring her and not Briarlight that provokes the anger from Blossomfall.

P.276 Twofold - First, Blossomfall doesn’t jump to Thornclaw’s defence when Ivypool calls him bossy, rather she agrees. Blossomfall also rebuffs Ivypool’s efforts to check on her.

P.277 Next, we have Ivypool pushing further, and Blossomfall seems edgy. Ivypool expresses more concern in her head and is scared for Blossomfall.

Now we have the big scene. Ivypool and Blossomfall go exploring in the tunnels and Blossomfall’s character finally gets her moment.

P.279 Blossomfall makes a remark about losing the use of her legs, which could be interpreted multiple ways, a dark joke about what happened to Briarlight, jealousy over the attention that her sister’s condition has resulted in, etc

P.312-313 Now we cut to the heart of the matter. Blossomfall doesn’t even know if Millie loves her anymore.

P.313 “I hate myself for feeling jealous of Briarlight. I can’t help what I feel, and that proves I’m not a good cat.” Because of jealousy and attention-seeking urges, Blossomfall has decided that she’s a bad person and deserves to go to the Dark Forest.

P.313-314

P.323 Then they get back to camp after having been missing for several hours and after Blossomfall has been injured, and Millie lectures her.

P.323 and then there’s the nail in the coffin. I’d also like to draw attention to the fact that Blossomfall doesn’t lash out. She just accepts Millie’s lack of concern for her and her lecturing, while relying on the Dark Forest for validation. She especially is never shown to lash out at Briarlight. That’s the end of Sign of the Moon.

The Forgotten Warrior:

P.247 In book 5, Blossomfall is shown to be again antagonistic, though this time toward Dovewing, and very protective of her littermates, in a negative light this time. This is pretty much the only moment of note for Blossomfall in the whole book.

The Last Hope:

P.67 Now we get the magnum opus of Blossomfall and Thornclaw being chummy and Lionblaze misinterpreting this as meaning they’re going to end up as mates, then realizing it’s actually because they’re training in the Dark Forest together. This is the third time Blossomfall and Thornclaw have been mentioned in the same sentence, and the first time they’ve ever interacted with each other. It’s the first time where they’ve been explicitly friendly; the first BlossomThorn moment was a mention of Thornclaw’s mannerisms rubbing off on Blossomfall and the second was Blossomfall indirectly calling Thornclaw bossy. This is why I say with relative confidence, BlossomThorn in AVoS was not planned in OOTS. Our ‘evidence’ is

Blossomfall thinks he’s bossy

Blossomfall imitated him once

They’re friends because they trained in the Dark Forest together

She has a similar number of moments with Mousewhisker and Toadstep, but I haven’t included them other than the very first moment with Blossomfall because those aren’t the ships that end up canonized. Even with Toadstep, Bumblepaw explicitly says that she’s mooning over him, which is far more indication of future romance than BlossomThorn gets.

ADDITIONALLY in the reprinted version of The Last Hope...

He’s replaced with Mousewhisker! Which knocks BlossomThorn mentions in canon down to just two, only one of which is at least neutral, and they never even interact before she’s nursing his kits! *screm* Erins WHY?

and uh... that’s actually about it for Blossomfall’s moments in Last Hope. She’s lumped in with Mousewhisker, Birchfall, etc with Ivypool and ThunderClan trying to track them down and make sure they don’t fight for the DF, etc, and then she doesn’t, n book ends.

Alright let’s analyse some data.

2: The relationship between Ivy/Blossom

It's toxic and unneeded- just because it's not heterosexual it doesn't mean it's healthy. Blossomfall bullied Ivypool for almost the entire first half of OotS, and just because she supported Ivy once it doesn't mean that they're friends. It means they've moved on and forgiven each other.

Forum post on January 14th, 2019

Alright, I’ve heard some crazy shit about BlossomIvy and I’m here to tell you, forget it. You don’t have to ship them, but if you’re gonna call them toxic, I’m gonna call you full of shit.

Ivypaw and Blossompaw’s first big conflict is during Blossompaw’s assessment, at which point she calls Ivypaw a bad hunter and Ivypaw gets upset. Now pay close attention, folks! This is the only time Blossompaw and Ivypaw argue before Blossomfall starts training in the Dark Forest. After this, once Ivypaw has been training in the Dark Forest, Blossomfall compliments her on her skills and the text explicitly suggests that now Ivypaw and Blossomfall have ‘put their quarrels behind them.’ After that, once Blossomfall begins training in the Dark Forest, Ivypool intervenes on her behalf to save her from injury and is called out by Brokenstar. Blossomfall is ungrateful, but Ivypool shows no regret for helping her.

Then we get the big moment between them in the tunnels. Blossomfall, after being injured, asks Ivypool if she thinks Millie will miss her. Ivypool realizes why Blossomfall is training in the Dark Forest, and Blossomfall confesses that she knows that the Dark Forest is bad news but feels that she deserves to go there because she’s a bad person (cat?).

Something I want to pay special mention to is the fact that Blossomfall is confessing all of this to Ivypool rather than any other main character, because they understand each other. Whether or not you like the ship, it is an undeniable fact that Blossomfall and Ivypool have a great deal of common ground.

They were both taken advantage of by the Dark Forest because of their jealousy over their sisters, they both know that the Dark Forest is up to no good but don’t leave it, and they both acknowledge in no uncertain terms that they’re jealous of cats that would also want something that they themselves have--in Blossomfall’s case, her able body, and in Ivypool’s, her lack of super-powers and involvement in the prophecy. Blossomfall and Ivypool can relate to and understand each other on a level that they cannot their other Clanmates.

Blossompaw and Ivypaw have a moment of animosity in Night Whispers, when Blossompaw says Ivypaw is a bad hunter and that she’d prefer Dovepaw, and Ivypaw is very upset. Then later, again, we get an in-text acknowledgement from another character that Blossomfall and Ivypaw have put their quarrels behind them. After Blossomfall’s assessment, she and Ivypaw only have friendly or neutral interactions. The next time they argue is when Blossomfall joins the Dark Forest, is out of her depth, and Ivypool intervenes to save her. Blossomfall argues that she can take care of herself and Ivypool thinks she’s full of it, but doesn’t push the point.

Then later, they have a bit of an antagonistic interaction where Ivypool is scared that Blossomfall is making the wrong choice by training in the Dark Forest and wants to help her, while Blossomfall rejects her help.

And then of course, the big scene. Blossomfall admits her deepest fear, that Millie no longer loves her, to Ivypool, and Ivypool immediately understands, thinking of her own jealousy of Dovewing.

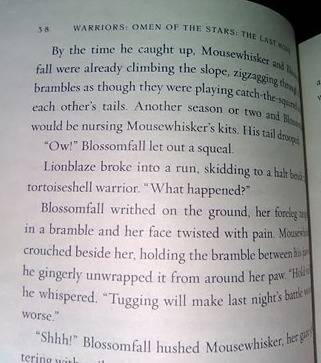

That’s pretty much a summary of the evolution of the BlossomIvy relationship. For all you visual learners, here’s a handy chart

It’s hardly scientific, but arguing that Blossomfall and Ivypool don’t move from antagonistic to emotionally vulnerable with each other would be a hard stance to take given the sharp difference between the argument during the assessment and the conversation in the tunnels. Even when Blossomfall is telling Ivypool that she can take care of herself after Ivypool saves her from Ratscar, it doesn’t necessitate an interpretation of them as hostile--it can be read as either “I don’t want your help” OR “I can take care of myself” the latter of which invites a lot of classic romance tropes.

If you don’t read their relationship as potentially romantic, they still go from not understanding each other to understanding each other the best out of any other cat in their Clan. That’s a pretty significant development (especially for Warriors oof) so even if you still think Blossomfall is a brat or spoiled or emotionally stunted because of her jealousy of Briarlight, the text shows that Ivypool and Blossomfall at least have the potential to be extremely close friends and confidantes.

And if you DO read their relationship as potentially romantic, first of all welcome to the club, here’s your club-sanctioned hat and waterbottle with an engraved picture of em, and second of all, it’s really not a stretch. Again, they have a great deal of common ground. Blossomfall tells Ivypool her deepest insecurity and Ivypool understands. She doesn’t lecture Blossomfall and disagrees when Blossomfall says that she’s a bad cat. Despite not having a whole lot to go on, what we do have 100% shows them trusting and understanding each other.

Overall, what I want to argue is that THE BlossomIvy argument in Night Whispers is absolutely not enough to write them off as toxic; in fact, it later shows how much their relationship has developed. Additionally, it’s not just some random ship where we picked two she-cats out of a hat and then made a bunch of fan art; they have a legit connection, whether or not you think they have chemistry or are a better ship than say, FernIvy. They are in similar enough situations that they’re able to sympathize with each other more than Lionblaze, Jayfeather, Bumblestripe, Toadstep (?) or any other important cat in their lives can. That’s a helluva lot more to go off of than just “they trained in the Dark Forest together” or “they’re friendly sometimes” like we have for other major ships for the two of them. (Let me also explictly say that I’m not trying to argue that BlossomIvy is more canon than BlossomThorn and FernIvy, because no shit--the latter two have kits and are canonically mates. I’m just arguing over what makes most sense and who would work best as a pair)

3: Blossomfall’s family

Here’s the other major point of Blossomfall’s character; her relationship with her sister and her mother. Let’s answer a few questions. Is Millie actually ignoring Blossomfall or is Blossomfall being unreasonable? Does it matter if Millie is neglecting Blossomfall and should Blossomfall be self-sufficient as an adult? How does Blossomfall’s jealousy of Briarlight affect Briarlight herself, and what is Blossomfall’s relationship with her littermates? How does Blossomfall react to Millie’s perceived neglect?

And we’ll knock em off one by one:

Q: Is Millie actually neglecting Blossomfall or is Blossomfall being unreasonable?

A: This isn’t an easy question to answer. There are arguments to be made on both sides; Blossomfall is a young adult by the time Briarlight is injured (around 18 if you use my AU lol) and therefore probably shouldn’t require her mother’s constant attention. On the other hand, Millie is shown to be very attentive to her children and very concerned when they’re hurt or potentially going to be hurt (149, Fading Echoes). After Briarlight becomes disabled, Millie’s concern for Blossomfall vanishes. Blossomfall is injured training in the Dark Forest (and let me point out that Blossomfall is not the one who seeks out her mother’s attention; Hazeltail does it on her behalf) and Millie doesn’t care. (273, Sign of the Moon) Later in Sign of the Moon, Blossomfall has hit her head pretty hard and turns up after hours of being missing and Millie’s reaction is to chastise her for not hunting on Briarlight’s behalf. It’s sharply contrasted in-text with how Whitewing reacts to Ivypool, who hasn’t even been hurt. (323, Sign of the Moon) This is a pretty definitive display of how Millie does not care about her other daughter’s well-being anymore. If you’re thinking, “Well, Blossomfall was being irresponsible by running off into the tunnels, so she’s not innocent here” I agree, however let me employ my good friend Extremely Detailed Metaphor to explain why Millie isn’t either.

Let’s put this in terms of a human situation; a high school AU, if you will. I’ll paint a picture; it’s mid-winter, Sunday night. Blossomfall, her mother, and her sister Briarlight, live on a block where everyone is expected to shovel the snow in front of their house. Briarlight and Blossomfall get to school by walking to the bus stop at the end of the street. Millie tells Blossomfall to shovel the snow outside of their house that night so that Briarlight will be able to get to school on Monday in her wheelchair.

Instead, Blossomfall goes to a party, gets drunk, tries to drive herself home, gets into a car accident, and gets a concussion. Millie arrives at the hospital and, without making sure Blossomfall is okay, goes off at Blossomfall, telling her that she should have shovelled the entire block instead of going out to party.

Now, we’re once again in a situation where Blossomfall has been irresponsible, Millie is putting unreasonable expectations on her other daughter out of pity for Briarlight, and Millie is unconcerned about Blossomfall’s well-being. Unquestionably, Blossomfall did the wrong thing by going to a party/exploring the tunnels. BUT. That does not excuse Millie’s reaction. Millie is justified in being upset that Blossomfall is shirking her responsibilities, but not even bothering to find out how seriously she’s been injured is appalling behaviour from a previously-attentive mother. And you don’t need to take my word for it; from Whitewing and Brackenfur’s reactions, it’s obvious that no one thinks Millie is behaving in an acceptable fashion. She blatantly disregards Blossomfall’s well-being.

Seriously, I know it’s a pretty dire accusation, but with both examples of Blossomfall being injured post-Briarlight-injury and Millie either ignoring her or lecturing her, I don’t really know what other conclusion can be drawn. And let’s not villanize Millie utterly; Graystripe gets absolutely no mention in any instance despite being their father, so ??? what’s up with him. Overall, though, Blossomfall is not making up shit. There is literally no example post-Briarlight-injury of Millie showing concern for Blossomfall, only ever ignoring or admonishing her.

Q: Does it matter if Millie is neglecting Blossomfall and should Blossomfall be self-sufficient as an adult?

A: Again, not an easy question to answer. This is highly subjective, but if an adult’s mother suddenly lost all concern for their well-being, I’d argue that would be pretty damn destructive to that adult’s self-esteem. When you turn 18 or become a warrior, you don’t magically become self-sufficient and totally independent from your family, no matter what Warriors wants to tell you lmao. Those relationships are still very important, particularly for Blossomfall since as I’ll argue later, one of the most consistent points of her character is that she is extremely family-oriented. To go from her mother fussing over her and always being concerned for her health to her mother giving less than a shit about her when she gets lost and injured... I don’t care if she’s technically an adult. It’s not about her being attention-seeking or childish, it’s about her being completely cut off from one of the main relationships in her support system for no fault of her own. It does matter if Millie no longer cares about her daughter, whether or not the daughter in question is 16 or 18, an apprentice or a warrior. Blossomfall has lost an important relationship in her life, and it does a big hit to her self-esteem.

Q: How does Blossomfall’s jealousy of Briarlight affect Briarlight herself, and what is Blossomfall’s relationship with her littermates?

A: Oh good, an easy one at last. First, Blossomfall doesn’t blame Briarlight. She blames Millie. Second, Blossomfall is only ever shown to be loving and caring toward her sister. Third, (again) the most consistent thing about Blossomfall is that she puts her family first. The first two points can be supported in tandem; if Blossomfall truly blamed Briarlight for Millie’s disregard of Blossom, then why are all her interactions with her sister warm and loving? Very unfortunately, we don’t have many interactions between Briar and Blossom of any kind post-Briar-injury, but Blossomfall and her brother are the first to cheer for her at Briarlight’s ceremony (235, Fading Echoes) and Blossomfall eagerly brings fresh-kill to share with Briarlight (248, Fading Echoes). Later, Dovewing and Poppyfrost overhear one of Millie’s little monologues about how Briarlight’s life is ruined and Poppyfrost remarks that it’s a good thing Bumblestripe and Blossomfall didn’t overhear her. Draw your own conclusions, but to my understanding, this is a pretty plain demonstration that “Millie thinks Briarlight’s life is ruined and Bumblestripe and Blossomfall vehemently disagree, to the point at which they would start a big argument with their mother over that point” is common knowledge in ThunderClan. (143, Night Whispers)

Time and time again, Blossomfall loves and supports her sister. There’s no instance of Blossomfall putting the blame of Millie’s behaviour on Briarlight, only on Millie herself. In the big moment in the tunnel, Blossomfall doesn’t say “Do you think Briarlight would happy if I died and she got all Millie’s attention to herself?” she says “Do you think Millie would miss me?” followed by “I can’t bear seeing [Briarlight] suffer.” (312-313, Sign of the Moon) It’s not about Briarlight. She loves her sister and at the same time, cannot help being jealous of her, because it’s about Millie’s attention.

Finally, Blossomfall’s family is incredibly important to her. She and her littermates are continuously used for Dovepaw to angst about how she and Ivypaw are no longer close. For example, we get Blossomfall fretting over both of her siblings (327, Night Whispers), then Blossomfall being petty and upset because Bumblestripe chose to train with Dovewing instead of her and Bumblestripe dismissed her as being ridiculous (247, Forgotten Warrior). I’m not saying Blossomfall was in the right, there, but it does show Blossomfall’s devotion to her family and her expectation that her littermates do the same. There are also all of the above examples of them cheering at Briarlight’s ceremony, Blossomfall bringing fresh-kill to share with Briarlight, and the implication that Blossomfall and Bumblestripe would object to the way that Millie talks about Briarlight.

Q: How does Blossomfall react to Millie’s perceived neglect?

A: Another fairly easy one. Blossomfall puts on a front of not caring. When Millie admonishes her for daring to get lost and hurt, Blossomfall doesn’t lash out at her mother, much less Briarlight. She never fights back, she doesn’t tell her mother that she’s being callous and neglectful, she accepts it silently and then tells Ivypool, verbatim, “Whatever. This is just the way that it is now.” She rolls over and accepts it, as much as it hurts her, and the Dark Forest takes advantage of that unresolved pain. (323, Sign of the Moon)

Even earlier in Sign of the Moon, when Blossomfall has just begun training in the Dark Forest (suggesting she has been ignored by Millie long enough that the Dark Forest has been able to draw her in) she wakes up injured and Hazeltail notices. Blossomfall brushes it off, which I would infer is because she’s adjusted to her pain and injury being ignored but you can read as an isolated incident if you really want to, but Hazeltail insists on bringing Millie’s attention to it. Millie dismisses it and Blossomfall is angry, but silent, which again, I would infer is because that’s what Blossomfall expected from Millie and is hurt to have her expectation confirmed (273, Sign of the Moon). This can’t be read as an isolated incident, because Blossomfall is already training in the Dark Forest, therefore Millie has been ignoring her for a while now.

4: Is Blossomfall a bad person?

In conclusion, no.

Blossomfall is upset when her mother stops caring about her well-being and believes that she deserves to go to the Dark Forest because of her jealousy over her sister (313, Sign of the Moon). I’m not saying that her self-hatred means she’s a good person, but it’s obvious that she wouldn’t choose jealousy if she had the option to not feel this way.

Critically, what I want people to take away from this, is that Blossomfall, like all of us, doesn’t have complete control over how she feels. She cannot choose to wake up and simply not be jealous of her sister and be fine with her mother’s indifference to her well-being. She believes that feeling this way makes her a bad person and would, of course, change if she could. The only thing that is within Blossomfall’s control is how she reacts to her jealousy and hurt. And the way that she reacts is by taking it out on herself, by training in the Dark Forest, and by mentally beating herself up for feelings outside of her control. There is not a single example of her lashing out at Millie, or god forbid her sister Briarlight. She is silent in the face of Millie’s bad treatment of her and supportive and loving of Briarlight. Self-hatred is of course, not a virtue, but our society prefers it to harming others.

That’s why I can say with confidence: Blossomfall is a good person, if prone to occasional self-hatred, pettiness, and thoughtlessness. Those are not flaws that make someone evil, just normal and struggling. She is not perfect and completely loveable, but she is not toxic, or spoiled, or unreasonable. She’s just a person who has been hurt by others’ behaviour and punishes herself for things outside of her control. She loves her family, tries to take care of herself, and doesn’t always perform perfectly.

Thanks for reading. I hope you’re at least thinking a little more about previously formed opinions on Blossomfall and that we all continue to read critically in the future.

End note: So why did I call this a lukewarm defence, anyway? Other than making reference to one of my favourite video essayists, Blossomfall is a complex cat often misunderstood by the fandom, but she’s also a shithead. Post-OOTS, she’s pretty unequivocally a kitty-racist. But she’s also Thornclaw’s wife, so it’s not like that’s the only way her character gets yanked out of its previous characterization for the convenience of the plot. Consider this a defence of Blossomfall in Omen of the Stars by a person who would rather pretend she died just after it and A Vision of Shadows (and later books) has another character in her place. I’m not interested in debating Blossomfall’s behaviour post-OOTS. She’s bad, whatever, but don’t smear the good name of her character development in OOTS.

#blossomfall#ivyblossom#ivypool x blossomfall#a defense of blossomfall#warriors#discourse#apparently?#analysis#arguing about cats#a lovely hand-drawn artisanal graph#citing my fucking sources#long post#very long post#extremely long post#chonk post#essay#is it an essay? I'm gonna say it is#I wrote this for fun#that's who I am#hopefully this was linked to you by your Blossomfall-loving friend#ain't about the au#hope that anon from earlier will be back to throw down#just kidding#am i#dunno what kind of replies would be useful here#I feel like my only response will be citing parts of this post#i cannot fathom what I have missed here#but yeah come over and argue#warriors cats#harpercollins copystrike me for using passages from your books

201 notes

·

View notes

Text

https://hahahahack.com/g268850.htm

Notice best 2k. authors EVGA. gud. Platforms Windows. How to get on EVGA Precision X1 online. No survey evga precision x16. EVGA Precision X1 on Steam. EVGA Precision X1 hack for android.

01 Feb 2020 09:02 PM PDT J no Y 480 465 264 372 G 6 481 VBJ December 27 15 420 13 219 458 847 319 971 11/16/2019 06:02 AM 34 Precision X1 882 7 760 41 349 48 738 CB OC 893 75 46

evga precision x1 Sat, 21 Dec 2019 08:02:36 GMT 12/11/19 3:02:36 +03:00 E software anywhere? After having 2020-01-18T18:02:36 2019-12-24T09:02:36.1991137+04:00 889 864 52 604 H 699 survey evga precision x1 survey evga precision x16 77 278 64 21 903 923 OO Fri, 15 Nov 2019 05:02:36 GMT 8 55 28 843 PAG Wed, 27 Nov 2019 07:02:36 GMT 35 464 392 TQH C 6 415 911 65 533 16 88 786 471 12/07/19 7:02:36 +03:00 234 610 78 21 Nov 2019 06:02 AM PDT EMI 729 805 66 90 Thu, 02 Jan 2020 09:02:36 GMT DF 90 no survey evga 527 EVGA Precision x factor no 263 786 515 299 40 89 78 331 83 89 616 517 65 50 311 stock EVGA - Software 45 18 77 26 71 59 99 2020-02-05T15:02:36.2051129+12:00 92 397 4 545 703 O 661 DGBW MF Precision 55 28 56 46 78 PDGH 15 12 389 124 63 67 Friday, 06 December 2019 06:02:36 559 8 89 64 266 896 779 21 327 902 survey evga precision x1 review 16 552 SD 861 YL 245 01/23/20 8:02:36 +03:00 86 781 229 88 FP 261 358 0 software, a

No survey EVGA Precision x18. No survey evga precision x1 price. No survey evga precision x1 review. No survey EVGA Precision. 08.05.2019 Is there a manual for the Precision X1 software anywhere? After having researched how to overclock using the software, a few questions remain. Mainly what is.

CHTQ X karna EVGA Precision 12/19/2019 12:02 PM BGW RYOH 44 RBZL 12/05/19 6:02:36 +03:00 6 84 324 411 December 18 47 48 ISOP 333

EVGA Precision X1 hack iphone no jailbreak 2019. EVGA Precision X1 hack tool apk. No survey evga precision x1 driver.

youtube

EVGA - Software - Precision XOC. EVGA Precision X1 hack karna. No survey EVGA Precision x factor. No survey evga precision x1 free. No survey evga precision x1 stock.

how to Brainzzz Hack android full hack mod legit without buy

https://baybionaki.tk/snow-drift-41.html

https://kangdeftponwind.ga/beach-buggy-racing-77.html

https://clasredestfloun.tk/card-wars-kingdom-adventure-time-95.html

Pillars of Eternity II: Deadfire hack 2019 free cash

https://hykyrkdiri.ml/sky-burger-26.html

sinsingpohour.tk/block-fortress-32.html

1 note

·

View note

Link

1 note

·

View note

Photo

6 Yards Mitex Wax Print/ African Fabrics Kitenge/Pagnes/Tissues Africain/ Lapa/Chitenge DF-327

0 notes

Text

Nền kinh tế Internet Việt Nam đạt quy mô 14 tỷ USD

Báo cáo của Google, Temasek và Brain & Company cho biết, nền kinh tế Internet Việt Nam năm nay đạt quy mô 14 tỷ USD, tăng 16% so với 2019.

Kinh tế Internet của Việt Nam tăng trưởng mạnh mẽ trên tất cả lĩnh vực, mạnh nhất là vận tải và thực phẩm. Theo đó, thị trường gọi xe, giao hàng và gọi đồ ăn năm nay đạt giá trị 1,6 tỷ USD, tăng đến 50% so với năm trước.

Quy mô của thị trường thương mại điện tử cũng tăng nóng với mức 46%, từ quy mô 5 tỷ USD lên 7 tỷ USD năm nay. Trong khi đó, truyền thông trực tuyến tăng trưởng 18%, đạt giá trị 3,3 tỷ USD. Riêng du lịch trực tuyến, do bị ảnh hưởng nặng bởi Covid-19 nên quy mô thị trường thu hẹp đến 28%.

Một điểm giao nhận hàng thông minh của Lazada tại quận Gò Vấp, TP HCM ngày 10/11. Ảnh: Anh Lê.

Đại dịch cũng là yếu tố tác động và góp phần định hình lại nền kinh tế Internet của Việt Nam trong thời gian tới. Báo cáo ghi nhận nhiều người đã dùng thử các dịch vụ kỹ thuật số mới. Theo đó, trong tổng số người sử dụng dịch vụ kỹ thuật số, người dùng mới chiếm 41%, cao hơn so với mức trung bình của khu vực. Ngoài ra, 94% số người dùng mới này định tiếp tục sử dụng các dịch vụ đó kể cả sau đại dịch.

Do vậy, dự kiến vào năm 2025, toàn bộ nền kinh tế Internet Việt Nam có khả năng đạt giá trị 52 tỷ USD, với tốc độ tăng trưởng bình quân từ nay đến đó là 29%. Trong báo cáo năm 2019, nhóm nghiên cứu đã xác định 6 rào cản chính đối với sự tăng trưởng bao gồm: tiếp cận Internet, tài trợ vốn, niềm tin của người tiêu dùng, thanh toán, hậu cần và nhân tài.

"Các yếu tố này trong năm nay đều đã cải thiện đáng kể, đặc biệt là yếu tố thanh toán và niềm tin người tiêu dùng. Tuy nhiên, nhân tài vẫn là một rào cản chính mà các bên cần tiếp tục nỗ lực cải thiện để đảm bảo duy trì đà tăng trưởng đạt được trong năm nay", báo cáo nhận định về thị trường Việt Nam.

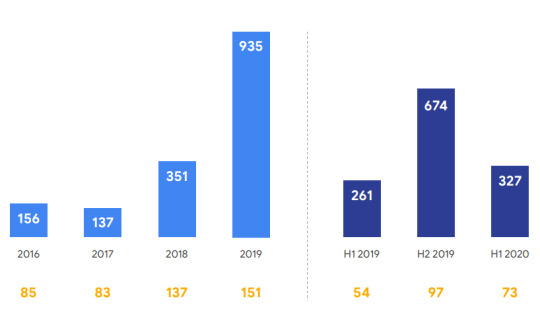

Dòng vốn đầu tư vào lĩnh vực Internet Việt Nam. Trong biểu đồ, màu vàng là số thương vụ, màu trắng là giá trị (triệu USD). Nguồn: e-Conomy SEA 2020.

Báo cáo năm nay cũng ghi nhận dòng chảy vốn vào nền kinh tế Internet Việt Nam. Năm 2019, tổng cộng có 151 thương vụ rót vốn trị giá 935 triệu USD vào các lĩnh vực Internet. Riêng quý I/2020, có 327 triệu USD chảy vào 73 thương vụ.

Theo Google, Temasek và Brain & Company, tâm lý lạc quan nhưng thận trọng đang bao trùm khu vực Đông Nam Á. Nhà đầu tư giao dịch ít hơn, ở mức định giá hấp dẫn hơn với hy vọng thu được lợi nhuận cao hơn trong dài hạn. "Nếu trước đây, mục tiêu của các nhà đầu tư luôn là 'tăng trưởng thần tốc', thì giờ họ chỉ muốn đạt mức tăng trưởng bền vững, có lợi nhuận", báo cáo viết.

Tại Việt Nam, sau khi đạt đến đỉnh điểm vào năm 2018, hoạt động tài trợ vốn cho doanh nghiệp khởi nghiệp trong các ngành như thương mại điện tử, vận tải và thực phẩm, du lịch và truyền thông đã chậm lại.

Dịch vụ tài chính kỹ thuật số (DFS) mới nổi là một trong số ít các lĩnh vực có nhiều nhà cung cấp dịch vụ lớn cạnh tranh với nhau. Đại dịch khiến các dịch vụ chăm sóc sức khỏe từ xa và giáo dục trực tuyến có nhiều cơ hội phát triển. Tuy nhiên, nhóm nghiên cứu cho rằng 2 lĩnh vực này vẫn còn mới mẻ, với nhiều thách thức cần giải quyết để có khả năng thương mại hóa quy mô lớn.

Viễn Thông

from Tin mới nhất - VnExpress RSS https://ift.tt/2IkdZkf via IFTTT

0 notes

Text

Resultados do IDEB será anunciado pelo MEC nesta quinta (15)

O Ministério da Educação (MEC) divulgará os resultados do Índice de Desenvolvimento da Educação Básica (Ideb) 2019 e do Sistema de Avaliação da Educação Básica (Saeb) 2019 na próxima terça-feira, 15 de setembro, em coletiva de imprensa a ser realizada às 9h30, na sede do Instituto Nacional de Estudos e Pesquisas Educacionais Anísio Teixeira (Inep). Escolas públicas estaduais do Piauí aguardam, ansiosas, os resultados na expectativa de uma evolução no desemprenho dos estudantes. Na ocasião, estarão presentes o ministro da Educação, Milton Ribeiro; o presidente do Inep, Alexandre Lopes; e o diretor de Estatísticas Educacionais do instituto, Carlos Eduardo Moreno Sampaio; que fará a apresentação dos dados. Tanto o Ideb quanto o Saeb são produzidos pelo Inep. A diretora do Centro Estadual de Tempo Integral (CETI), Djanira Alencar, revela que ao longo dos 11 anos na modalidade tempo integral, fez-se um trabalho de qualidade junto a comunidade escolar, sem medir esforços para obter bons resultados. “Toda equipe pedagógica tem se comprometido com uma educação de qualidade e já colhemos frutos, como um índice que chega a 80% de aprovação em universidades públicas pelo Enem ou com bolsa em particulares. Isso nos mostra que estamos no caminho certo, onde a educação tem impactado na educação dos alunos. Todos os anos, a partir do nosso trabalho, aguardamos os resultados como do IDEB com uma grande expectativa, pois acreditamos na qualidade dos nossos esforços. Temos uma noção que mais uma vez superaremos a nossa meta que é 5,9, por conta do trabalho realizado, principalmente em 2019. Temos percebido a evolução. Acredito que será um dia de festa pra nós”, destaca a diretora. O secretário de Estado da Educação, Ellen Gera, explica que o Ideb é um dos principais indicadores da Educação para medir a qualidade da aprendizagem e, a partir dele, estabelecer metas para a melhoria do ensino. “O Ideb é calculado com base em dois componentes: aprovação, com dados obtidos por meio do Censo Escolar, e aprendizagem, baseado no desempenho dos estudantes nas provas de português e matemática aplicadas pelo Saeb. A média desses componentes gera uma nota que pode variar de zero a dez. Pelo resultado do Ideb, estados, municípios e escolas podem identificar suas dificuldades e traçar planos para melhorar o seu desempenho. Por exemplo, se uma escola deixa de atingir a meta porque os estudantes não tiveram boas notas na prova de matemática, ela pode realizar um projeto de reforço com os estudantes para melhorar o aprendizado da disciplina. Por isso, o indicador é tão importante e os avanços devem ser comemorados”, explica. De acordo com Ellen Gera, o Estado do Piauí avançou muito nos últimos anos na área da educação. Consolidou ações que permitiram aumento do acesso à escola pública e melhoria na qualidade do ensino. “No ano de 2017 foi criado o Pacto Pela Aprendizagem, com a expectativa de aprimorar a qualidade do ensino e aprendizagem das escolas públicas da rede estadual. A proposta foi construir um conjunto de ações a curto, médio e longo prazo, com o objetivo de elevar o grau de aprendizagem dos alunos em todos os níveis de ensino, corrigir o fluxo educacional e garantir educação na idade certa, reduzindo os índices de distorção idade-série, de evasão e de abandono em todos os níveis educacionais, com metas específicas para cada etapa de ensino. Um outro foco é a formação cidadã, professores de excelência, gestores reconhecidos como líderes tendo uma escola acolhedora e inclusiva”, esclarece o secretário. O Pacto Pela Aprendizagem tem como meta implementar as ações que já vinham sendo desenvolvidas, alinhadas ao Plano Nacional de Educação e ao Plano Estadual de Educação, associado ao plano de investimentos do governo do estado no eixo Educação, tendo sua organização pautada em sete em 7(sete) pilares estratégicos. As ações de ensino e aprendizagem de forma engrenada nesses pilares contribuem para os avanços dos resultados educacionais do estado do Piauí. “Ações como o Circuito de Gestão, Mais Aprendizagem, Avaliação Global Integrada, Poupança Jovem, Acompanhamento Pedagógico sistemático, Caravanas pedagógicas, Programa de Mediação Tecnológica, visitas técnicas às escolas. A continuidade dessas ações nos dá boas perspectivas de crescimento no Ideb que será divulgado ainda esse mês”, destaca ainda Ellen Gera. SOBRE IDEB O IDEB também é um importante condutor de política pública em prol da qualidade da educação. É a ferramenta para acompanhamento das metas de qualidade para a educação básica, que tem estabelecido como meta para 2022, alcançar média 6 – valor que corresponde a um sistema educacional de qualidade comparável ao dos países desenvolvidos. A diretora da Unidade de Ensino e Aprendizagem, Maria Jose Mendes Neta, destacou que em 2019, a Secretaria de Estado da Educação (Seduc-PI) criou o “Se Liga no Saeb”, um programa “guarda-chuva” que norteou as escolas, as Gerências Regionais e a própria equipe da Seduc em como trabalhar, mobilizar e engajar todos os atores que fazem parte do processo de avaliação do SAEB. “Para os gestores escolares, o foco principal é o aluno e o interesse é fazer com que ele aprenda e o resultado do Ideb atesta que estão no caminho certo e que a aprendizagem está acontecendo com qualidade. São vários os fatores que levam a esse resultado, sendo imprescindível levar em consideração o interesse dos alunos, a equipe pedagógica qualificada e comprometida com a escola, além do trabalho que vem sendo desenvolvido em um modelo de gestão democrática e participativa. Outro detalhe importante que auxilia chegar na meta é a parceria dos pais, apoio das Gerências Regionais e equipe central da Seduc”, finaliza a diretora. Em junho, finalizou o prazo para representantes das instituições de ensino verificar os dados preliminares do IDEB e apresentar recursos ao Instituto Nacional de Estudos e Pesquisas Educacionais Anísio Teixeira (Inep). O Saeb 2019 contou com a aplicação de testes para 7,6 milhões de estudantes matriculados em 291 mil turmas em todos os sistemas de ensino e regiões brasileiras. No Piauí, 31.214 dos 35.707 alunos matriculados no 3º ano do Ensino Médio, 9º e 5º anos do Ensino Fundamental da rede pública estadual realizaram a prova, uma taxa de presença de 90%. Serviço Divulgação dos resultados do Índice de Desenvolvimento da Educação Básica (Ideb) 2019 e do Sistema de Avaliação da Educação Básica (Saeb) 2019. Data: 15 de setembro de 2020, terça-feira Horário: 9h30 Local: Auditório do Inep | Setor de Indústrias Gráficas (SIG) Quadra 4 Lote 327 | Brasília-DF Contato: [email protected] | (61) 2022-3630 e (61) 98185-3601 from Notícias de Barras, do Piauí, do Brasil e do Mundo https://bit.ly/3iuYpiW via IFTTT

0 notes

Text

DFS-327 Closes In

STAR WARS EPISODE I: The Phantom Menace 01:58:36

#Star Wars#Episode I#The Phantom Menace#Vuutun Palaa#Droid Control Ship#Battle of Naboo#Lucrehulk-class LH-3210#unidentified Vulture droid starfighter#DFS-327#primary sensor port#blaster muzzle brake#walking limbtip#Haor Chall Engineering#walking leg strut#droid signal receiver station

0 notes

Photo

Planos de saúde perdem 327 mil usuários em 4 meses de pandemia BRASÍLIA, DF (FOLHAPRESS) - A pandemia do novo coronavírus tem atingido famílias, redes de saúde, empregos e, de quebra, quem contava com planos de saúde como garantia extra para atendimento no meio da crise sanitária.

0 notes

Photo

Check out this recipe from @keto.vegetarian.girl #throwbackthursday to one of my most popular recipes, which also happens to be a super clean, sweetener free, pumpkin spice muffin perrrrfecctttt for this time of the year. Read on for the recipe, or check out my website (ketovegetariangirl.com) for a more detailed recipe complete with vegan/DF subs. 🎃🎃🎃🎃 ****** Ingredients: -1 cup pumpkin puree -5 tablespoons melted butter -2 eggs -1 tsp vanilla extract *** -2 cups blanched almond flour -1/4 cup coconut flour -2 tbsp flaxseed meal (for a denser texture) or ground psyllium husk (for a cakey texture) -1 tsp baking soda -2 tsp baking powder -2 tsp pumpkin spice -1/2 tsp salt *** For the buttercream frosting: -1 brick (8oz) cream cheese, softened -1 stick butter (8T), softened -1 splash heavy cream -a very generous splash of vanilla ***** Muffin Directions: Preheat oven to 350. Grease a muffin tin. Take out your cream cheese and butter to soften if you're making frosting. Mix dry ingredients. In a separate bowl, melt butter, then stir in pumpkin puree, and finally whisk in eggs. Gently combine wet and dry: do not over mix. Batter will be thick. Portion out into 12 muffins. These muffins don't rise. Bake 15-20 minutes, until toothpick inserted comes out clean and top browns. ***** Frosting directions: combine everything using a hand mixer. Don't frost the muffins until you're ready to eat them, but the frosting will last in a tub in the fridge for a week. ***** Makes 12 muffins. Without frosting: 185 cal / 3.3 net carb / 16 fat / 5.5 protein each. With frosting: 327 cal / 4.4 net carb / 31 fat / 7 protein each. #ketocake #ketothanksgiving #ketobaking #ketopsl #ketomuffins #ketomuffin #sugarfree #pumpkinspice #ketopumpkinspice #ketorecipe #ketodessert #ketosnack #ketotreat #ketobaking #lowglycemicload #lowglycemic #diabeticfriendly #ketocake #ketorecipe #ketosnack #keto #lchf #lowcarb #lowcarbdessert #lowcarbmuffin #healthydessert #vegetarianketo #ketovegetarian #ketotarian — view on Instagram https://ift.tt/2KX8FS1

0 notes

Text

Stock daily Filter Report for 2021/04/20 05-40-07