#DataGrid

Explore tagged Tumblr posts

Text

0 notes

Text

Datagrid

Datagrid is an AI agent platform that helps users interact with data, automate tasks, and streamline workflows. It integrates with 100+ software platforms across industries and is highly customizable, enabling businesses to deploy AI agents that learn from their data and take action. Key Capabilities: • Real-time Data Updates: Seamlessly integrates with various systems to keep AI agents updated…

0 notes

Video

youtube

DataGrid Virtualization in .NET 8 Blazor : Simplified with Server-Side Pagination🔥 [ Easy to Use ] https://youtu.be/TE1lCH9uqZk

1 note

·

View note

Text

Introducing AgilePoint v9: A Game-Changer for Digital Transformation

AgilePoint v9 is set to redefine your experience with a plethora of exciting features designed to boost productivity, security, and agility. We are delighted to introduce AgilePoint v9, our latest and most exciting update yet! This release is packed with powerful features and enhancements that are set to turbocharge your digital transformation journey, accelerating productivity, enhancing agility, and delivering an expanded integration landscape for an enriched customer experience.

New Features

Elevated Portal Experience - Faster & Intuitive

A completely redesigned portal, making it 55% leaner in terms of code and up to 200%-300% faster compared to AgilePoint v8.0 Portal. Learn more

Supercharge Your App Development

Our all-new App Builder homepage is sleek, ultra-responsive, and designed for lightning-fast navigation. Explore the App Builder

Collaborative Development

An enhanced collaborative feature allows multiple users to build simultaneously on different parts of the app. Collaborate with Ease

Transformed Solution Deployment

Seamlessly deploy entire solutions, consisting of custom landing pages, groups of interconnected apps, and other assets. Learn about Solution Deployment

Unlock Agility and Security

The all-new Manage Center module is here, turbocharged with React and GraphQL. Discover the Manage Center

Elevate Security Monitoring with Audit Logs

Simplified security monitoring with information security audit logs. Enhance Security

Enhanced Form Controls

Revamped and personalizable DataGrid control for supporting more visual elements like graphs, icons, animations, progress bar, images, etc. Explore Form Controls

Explore the Possibilities with Our Latest Integrations

Discover our latest integrations, including OpenAI, AWS Redshift, AWS Lambda, Azure Functions, Azure Blob Storage, Abbyy Vantage, gRPC, Stripe, Elastic Search, and Kafka. See Integrations

New Mobile App and New App Store

Totally Transformed mobile apps and App Store which provides a uniform look and feel with the rest of the platform. Get the Mobile App

Modern Work Center On 3rd Party App Stores

Microsoft 365 and Salesforce apps have been upgraded to support Modern Work Center. Modern Work Center Upgrades

Stable and Secure

175+ Bug fixes and 150+ minor enhancements. View Stability Updates

About Agilepoint- AgilePoint is an Enterprise Codeless Application Platform. It enables the creation and rapid adaptation of dynamic, cross-functional processes at scale.

Don’t miss this opportunity to harness the power of AgilePoint and stay ahead in the ever-changing world.

Feel free to visit the AgilePoint website to explore further details about AgilePoint and its offerings.

0 notes

Text

Amperity raises $100M to unify customer data

Amperity, a Seattle, Washington-based customer data platform, today announced it has raised $100 million in series D funding, valuing the company at more than $1 billion post-money. Founder and CEO Kabir Shahani said the company will use these funds, which bring its total raised to $187 million, to expand sales and marketing, grow internationally, and invest in R&D.

The pressures of the pandemic made knowing consumers a matter of survival for many businesses. Faced with the challenge of optimizing performance without third-party data, brands recognized the necessity of having an identity graph as part of an effort to sustain customer relationships. These graphs, which are at the foundation of customer data platforms, allow enterprises to make sense of trillions of data points from customers across in-store visits, web traffic, mobile usage, loyalty programs, and other touchpoints.

How human-centered design drives data-driven experiences In today’s competitive market

183.5K

14Unmute

Duration 16:49/

Current Time 0:04Advanced SettingsFullscreenPlayUp Next

Amperity was founded in 2016 by Shahani and Derek Slager, who aimed to free engineers from integration duties while giving businesses access to the data they need to build loyalty. Prior to founding Amperity, Kabir and Derek worked together to launch enterprise marketing management startup Appature, where Kabir was CEO and Derek was VP of engineering. Appature was purchased in 2013 by IT medical services provider IMS Health, which has since merged with Quintiles.

“Amperity has created the first-party data graph and customer toolset for many of the world’s most loved consumer brands. There’s a vast universe of solutions that might provide an element of what we do, but no one can deliver a more complete customer [view] with an agnostic approach we provide at both ends — data in, data out,” Shahani told VentureBeat via email.

EVENT

VB Transform 2023 On-Demand

Did you miss a session from VB Transform 2023? Register to access the on-demand library for all of our featured sessions.

Register Now

Behind the scenes

Customer data platforms are collections of software that create persistent, unified customer databases accessible to other systems. Data is pulled from multiple sources, cleaned, and combined to create a single customer profile. This structured data is then made available to other marketing systems.

The customer data platform market is anticipated to be worth $10.3 billion by 2025, according to Markets and Markets, up from $2.4 billion in 2020. Amperity’s competitors include homegrown solutions, as well as legacy on-premises systems from Acxiom and Epsilon Independent and cloud-based services like ActionIQ and Redpoint Global.

But Shahani claims Amperity is the only customer data platform with an “AI-driven customer 360.” Each of its products is built on what the company calls the DataGrid, a fully connected customer infrastructure that processes terabytes of data each day. DataGrid streams billions of rows of data at under 100 milliseconds per API call, enabling Amperity’s AI models to provide deterministic and probabilistic individual and household identity throughout customer segments.

Amperity works with customers across retail, travel, hospitality, and financial services, including Patagonia, Alaska Airlines, Starbucks, The Home Depot, Lucky Brand, and Crocs. Recently, Amperity teamed up with a lifestyle retail client to better understand the company’s customers. In 18 weeks, Amperity says it built a dashboard with transaction, marketing, store, product, and privacy data, correcting lifecycle status for 25% of the client’s customers with interaction and revenue attribution. This led to $7.7 million in campaign revenue from predictive segmentation and churn prevention campaigns.

0 notes

Text

Build CRUD DataGrid with jQuery EasyUI using PHP and MySQL

Build CRUD DataGrid with jQuery EasyUI using PHP and MySQL

DataGrid with CRUD operations is the most used functionality for the data management section. Generally, the web page is reloaded when the CRUD operation occurs. To make the web application user-friendly, you can integrate the CRUD functionality without page refresh. The EasyUI framework provides an easy way to integrate DataGrid with CRUD feature in the web application.

EasyUIis a jQuery…

View On WordPress

1 note

·

View note

Text

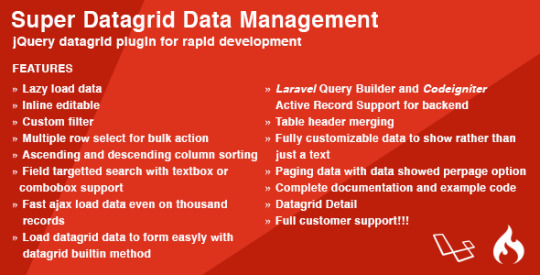

Super Datagrid - jQuery Datagrid for Laravel & Codeigniter - Laravel

Super Datagrid – jQuery Datagrid for Laravel & Codeigniter – Laravel

Super Datagrid – jQuery Datagrid for Laravel & Codeigniter – Laravel LIVE PREVIEWBUY FOR $10 Demo Download Details

[ad_1]

Looking for a fast datagrid system for your app?

Super Datagridcan be your choice, this plugin is quite light and has many features that will speed up your application development process. This plugin helps you to display data from server without thinking about the basic features…

View On WordPress

#ajax tables#codeigniter#codeigniter crud#Codeigniter Datagrid#data management#datagrid#datatable#jquery#jQuery Datagrid#laravel#laravel crud#Laravel Datagrid#php datagrid#Super

0 notes

Photo

First, It Was Just Head Shots And Now The Entire Body Is Not Real Either

You can't believe what you see no more.

Follow us for more Tech Culture and Lifestyle Stuff.

0 notes

Photo

"Cyberpunk by Shamerli"

Rakan sat down at the top of the little staircase, eating a bite from his nutrient bar and taking in his surroundings. The little side alley was empty and quiet except for the footsteps from the adjacent main street and it's steady flow of people. In this part of the bustling city, most passersby had augmentations like he had. Genesplices or implants to enhance physical and mental performance, allow seamless integration with the datagrid or simply make fashion statements. Rakan wiggled his clawed toes and crossed his digitigrade legs. His last data recovery job was hazardous and had almost fried his interface. But that job had also paid unusually well. At least he was able to finally afford to get this latest Genesplice. It wasn't cheap, but definitely worth every credit, since he had never felt this comfortable in his body before. "I doubt I will ever swap this new lupine body for something else", he thought to himself. Rakan looked towards the entrance of the rundown Hotel and smiled to himself, wondering how his old friend would react when he saw his new body.

This wonderfully atmospheric artwork was a YCH without fixed background offered by Shamerli ( https://www.furaffinity.net/user/shamerli ). We discussed a few possible backdrops for this pose and finally settled on a futuristic city theme, that Shamerli rendered perfectly. (Thanks to DariusWhitefur ( https://www.furaffinity.net/user/dariuswhitefur ) for looking over the story and editing it!)

42 notes

·

View notes

Link

Pagination is the default feature of Devextreme. The pagination divides your lots of records into pages and you can show numbers of records on a single page. Under pagination, Devextreme provides lots of features. As we can see in the following image In this article, we will cover how to customize “Page Size Selector” properties.

0 notes

Video

instagram

None of these people exist — they’re all fake, created by a deep learning algorithm from a group known as Datagrid. The system can churn out realistic looking models, each in a different outfit and pose. Its mesmerizing, and a little scary, but it has a practical application, too. The tech is designed to be licensed out to clothing companies as a way to help them model clothing without paying for expensive modeling fees. Naturally, it raises some concerns in a world of fake news and DeepFakes, too — but hopefully this tech will remain fashion forward. . . . #ai #fake #fakepeople #deeplearning #fashion #algorithm #tech #technews #datagrid - #regrann . . . Reposted from @cnet https://www.instagram.com/p/Bx75s5QgEIo/?igshid=1914di99qqq9z

0 notes

Link

Delegates, Namespace, Datagrid - Delegates are a type-safe, object oriented implementation of function pointers. Namespaces are logical grouping of classes

0 notes

Video

youtube

【データグリッド】全身モデル自動生成AI | [DataGrid] Model generation AI

ディープラーニングを応用したGAN(敵対的生成ネットワーク)により、従来困難だった高解像度(1024×1024)の「実在しない」人物の全身画像生成に成功。 We have succeeded in generating high-resolution (1024×1024) images of whole-body who don't exist using Generative Adversarial Networks (GANs) We use these images as virtual models for advertising and fashion.

Website: https://datagrid.co.jp/

5 notes

·

View notes

Link

home/datagrid-21/Downloads/Link to Jain Philosophy (2)

1 note

·

View note

Text

Banks Accelerate Move to the Cloud with New Oracle Banking Services

With transaction volumes, customer expectations, and competitive threats at an all-time high, banks must adapt quickly to keep pace. To address these challenges, Oracle launched Oracle Banking Cloud Services, a new suite of componentized, composable cloud native services. The six new services available today provide banks with highly scalable corporate demand deposit account processing; enterprise-wide limits and collateral management; real-time ISO20022 global payment processing; API management; retail onboarding and originations; and new self-service digital experience capabilities. Built on a microservices architecture, they help banks renovate and modernize their business capabilities faster and with less risk. "Banks must innovate to succeed in today's hyper competitive environment," said Sonny Singh, executive vice president and general manager of Oracle Financial Services. "We have built one of the world's most comprehensive suites of cloud-native SaaS solutions so that banks of all sizes can innovate with speed, security, and scale without compromising their existing environments." Venky Srinivasan - group vice president, APJ and MEA Sales, Oracle FSGBU said "Transaction volumes in India are anticipated to grow multifold, both on account of greater payments volumes as well as more and more penetration of banking services amongst the masses. Additionally, banks are continually looking to expand their portfolio of offerings and to acquire and serve their customers. Oracle's investment in SaaS and our datacenters in Mumbai and Hyderabad provide banks the confidence and ability to rapidly transform their business, optimize operating costs and offer unparalleled customer service." The services can run standalone, work seamlessly together, and coexist with existing applications to help banks lower cost and risk while increasing innovation. Banks benefit from faster provisioning and availability – which can be achieved in a matter of minutes – and gain automated patching and reduced disaster recovery switchover times that lower IT costs and burden. "The most recent IDC 2022 Worldwide Industry CloudPath Survey shows that nearly all banks surveyed plan to increase spending on all cloud deployment models," said Jerry Silva, Program Vice President, IDC. "Including private cloud and public cloud infrastructure as a service (IaaS) and software as a service (SaaS), public cloud services are expected to grow at twice the rate of overall IT spending at 15% CAGR over the same five-year period, gaining a larger share of banks' IT budgets." The new services are built and running on the high performance, scalability, security, and compliance of Oracle Cloud Infrastructure, including OCI's Oracle Kubernetes Engine. With most cloud regions available globally, in addition to the most extensive set of distributed options, Oracle Banking Cloud Services can be deployed based on sovereignty or data residency needs. New services include: Oracle Banking Accounts Cloud Service Current corporate demand deposit account (DDA) solutions are ill-equipped to handle the explosion of ecommerce and digital payments that have caused a massive increase in global banking transactions. PwC estimates the global volume of cashless payments is expected to increase by more than 80% between 2020 and 2025, to reach nearly 1.9 trillion transactions. Oracle Banking Accounts Cloud Service provides highly scalable demand deposit account processing on Oracle Coherence Datagrid Infrastructure. The service has been tested for extreme performance and recorded over 200 TPS per CPU on commodity hardware. It also integrates with a bank's existing process flows and technology so they can modernize their core banking DDA systems to deliver new offerings to the market without disrupting their operation. Oracle Banking Payments Cloud Service Legacy systems can't scale and manage the growing volume and velocity of digital payments from ecommerce and new transaction types. Oracle Banking Payments provides a single engine for real-time payment processing, including cross-border, high-value, bulk, retail, and 24x7 payments. The service is built from the ground up based on an ISO20022 canonical data model and more than 15 leading global payment schemes such as SWIFT, SEPA, and others out of the box. Oracle Banking Enterprise Limits and Collateral Management Cloud Service With the absence of an enterprise-wide system, inefficient monitoring, and poor controls, corporate banks are struggling to manage the influx of defaults. McKinsey estimates that banks using improved models could see a 20-40% decrease in their credit losses. Oracle Banking Enterprise Limits and Collateral Management enables banks to gain a holistic view of their exposure by centralizing the limits definition process and collateral management. The service reduces risk by providing banks with a real-time solution for exposure tracking, credit underwriting, decisions, and approvals. Oracle Banking Origination Cloud Service Today, instant gratification is redefining banking, as customers now expect accounts to be opened quickly, loans to be processed in minutes, and cash disbursed in a matter of hours, all with a high level of process transparency. Oracle Banking Origination offers streamlined processes and automated decisioning that helps bankers deliver tailored onboarding and originations experiences for retail and small business customers. With the service, banks can quickly scale originations across retail asset and liability business lines to efficiently drive higher deposit and credit volumes. Oracle Banking Digital Experience Cloud Service Oracle Banking Digital Experience Cloud Service is a digital banking solution that provides ready-to-go corporate and retail banking experiences that enhance customer service. The solution offers customer and product acquisition in addition to omnichannel contextual digital experiences supported by video, chatbot, AI, and natural language processing (NLP)-based engagement tools. The service also works with the bank's existing technology and third-party services to drive seamless processes. Oracle Banking APIs Cloud Service With more than 1,800 ready-to-deploy business and foundational banking APIs, Oracle Banking APIs Cloud Service empowers banks to establish an open banking platform to accelerate innovation while complying with regulations. The solution equips banks to improve the customer experience and revenue opportunities by embedding their services across a growing ecosystem of partners including ecommerce portals, enterprise software, and more. Read the full article

0 notes