#DefensiveStocks

Explore tagged Tumblr posts

Text

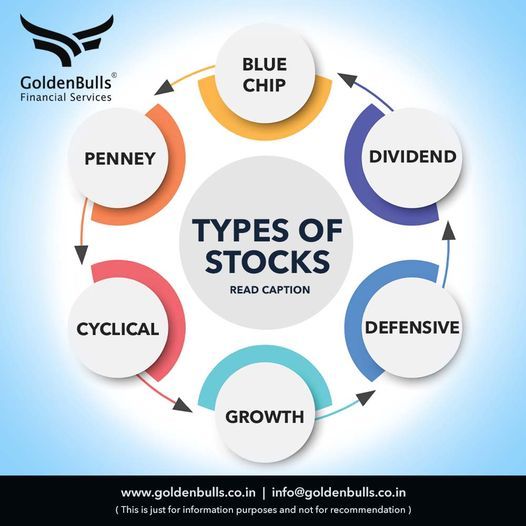

Blue Chip Stocks: These are shares of well-established, financially stable, and reputable companies with a history of consistent performance. Blue chip stocks are generally considered safe and reliable investments.

Dividend Stocks: Companies that distribute a portion of their earnings to shareholders in the form of dividends. These stocks are often favored by investors seeking regular income.

Defensive Stocks: Companies that tend to remain stable even during economic downturns. They are less sensitive to economic cycles, and their products or services are considered essential.

Growth Stocks: These are shares of companies expected to grow at an above-average rate compared to other companies. Investors in growth stocks are typically focused on capital appreciation rather than dividends.

Cyclical Stocks: Companies whose performance is closely tied to the economic cycle. These stocks often do well when the economy is booming but may suffer during economic downturns.

Penny Stocks: Stocks with a low market price, usually trading at less than $5 per share. Penny stocks are often associated with smaller, riskier companies and can be more volatile than stocks of larger, more established companies

Call us at : +91 8411002452 OR Visit: www.goldenbulls.co.in

#BlueChipStocks#DividendInvesting#DefensiveStocks#GrowthInvesting#CyclicalStocks#PennyStocks#InvestmentStrategies#DiversifyYourPortfolio#StockTips#MarketTrends#EconomicCycles#RiskManagement#Financialservices#FinancialWellness#Goldenbulls

0 notes

Video

youtube

How Can a Market Crash Make You Rich?

📉 Stock Market Crash? Why It Might Be the BEST Time to Buy Stocks 💸 A stock market plunge can feel terrifying—but for smart, long-term investors, it can also be a massive buying opportunity. In this video, I break down why downturns can lead to outsized returns—if you play it right. 🔍 What You’ll Learn: Why market crashes offer discounted prices on quality stocks How to avoid emotional investing mistakes during selloffs The critical mindset needed to invest during downturns Strategies like dollar-cost averaging and defensive sector picks What not to do when markets fall fast ✅ Key Takeaways: Focus on blue-chip companies with strong fundamentals Think long-term (3–5+ years) Keep cash reserves ready for deeper dips Avoid hype stocks and stay diversified 📊 Whether you’re navigating a 2025 market correction or just preparing for the future, this guide will help you approach crashes like a pro—not a panicked trader. 👉 Subscribe for more investing tips and market analysis: https://www.youtube.com/@UCYeO7auPodcecl2CnDskMNg 👍 Like if you found this helpful & comment below: Are you buying the dip or sitting it out? #StockMarketCrash #BuyingTheDip #LongTermInvesting #MarketPlunge #InvestingTips #BlueChipStocks #DollarCostAveraging #DefensiveStocks #StockMarket2025 #ValueInvesting

0 notes

Text

SCHD: The ETF That THRIVES in ANY Market (Even Downward!)

Explore SCHD, a top ETF for sideways markets! We highlight its consistent, growing dividends, high-quality companies, and defensive sector allocation. Discover why SCHD offers low costs and turnover, making it a backbone of the American economy. Share your SCHD experiences in the comments! #SCHD #ETF #Dividends #Investing #Finance #StockMarket #PassiveIncome #InvestmentStrategy #DefensiveStocks…

0 notes